#Aadhaar Pan Card Link API

Explore tagged Tumblr posts

Text

Loan Against SIP & ELSS in 2025 – Get Funds in Minutes Without Breaking Investments

Fresh Start: Unlock the Power of Your Investments – Without Selling Them

In 2025, money problems can knock on your door anytime—be it a medical emergency, a wedding, a home renovation, or business needs. But what if you could unlock instant funds without disturbing your SIP or ELSS investments?

Yes, it’s possible! Thanks to the Loan Against Mutual Funds (LAMF) facility, you can borrow money by pledging your mutual fund units and get cash instantly, without selling a single unit.

Let’s dive deep into this digital loan revolution, understand the benefits, the process, and how you can apply for a loan against mutual funds online, especially when you need it the most.

What Is a Loan Against Mutual Funds (LAMF) in 2025?

A Loan Against Mutual Funds (LAMF) is a secured loan where you pledge your mutual fund investments—like equity mutual funds, debt funds, SIPs, or ELSS—as collateral. You don’t need to sell your units; you retain ownership and still enjoy market returns.

Banks and NBFCs provide instant loans against mutual funds online, typically through digital APIs (LAMF API), offering fast processing and minimal documentation.

Features of Loan Against Mutual Funds – 2025 Highlights

Note: Use an updated Loan Against Mutual Funds Eligibility Calculator to check how much loan you can get on your current holdings.

Why Choose a Loan Against SIP or ELSS Mutual Funds?

Let’s break down why more investors in India are choosing LAMF loans in 2025:

1. No Need to Sell Your Investments

You can get a loan on mutual funds without selling your ELSS, SIP, or equity units. Your long-term goals stay intact while you solve your short-term needs.

2. Fast Digital Processing

Thanks to the rise of mutual fund loan apps in India, you can apply digitally and get instant cash in your bank account—no physical visits, no hassles.

3. Low Interest Rates Compared to Personal Loans

The mutual fund loan interest rate in 2025 starts from as low as 9.5%*, making it more affordable than credit cards or personal loans.

4. Flexible Repayment

You can choose interest-only EMI, full repayment options, or even opt for overdraft-style accounts—perfect for short-term liquidity gaps.

Who Can Apply for a Loan Against a Mutual Fund Online?

To apply for a digital loan against a mutual fund, you need:

Valid and active mutual fund folio

KYC-verified PAN and Aadhaar

Investment in eligible AMCs

Age above 18 years

Indian resident status

How to Apply for a Loan Against Mutual Funds in 2025?

Here’s how you can apply for a LAMF loan via trusted apps like Investkraft Loan platform or bank portals:

Step-by-Step Process:

Choose a lender (bank/NBFC/mutual fund loan app like Investkraft)

Log in with PAN or an Aadhaar-linked MF account

Select mutual funds to pledge (ELSS, SIP, debt/equity)

Use their LAMF eligibility calculator to check the max loan value

Submit documents (minimal – KYC only)

The loan is disbursed instantly or within 24 hours

How Does a Loan Against a Mutual Fund Work?

Once you apply for LAMF, your chosen units are lien-marked (pledged) but not sold.

The lender holds the right to sell only if you default.

Until then, you continue earning market returns.

When you repay, the lien is removed and you regain full access to your investments.

Use Cases: When Should You Take a Mutual Fund Loan?

Loan Against Mutual Funds for Financial Needs – Urgent medical, travel, or short-term cash.

Loan Against Mutual Funds for Wedding – Plan your dream wedding without disturbing long-term wealth.

Loan Against Mutual Funds for Financial Planning – Bridge gaps in business, tuition fees, etc.

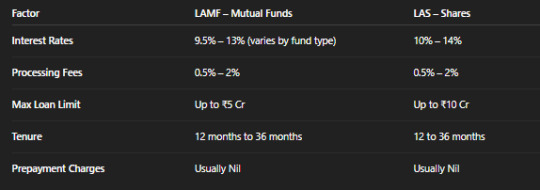

Mutual Fund Loan Interest Rate & Fees – 2025

Tip: Always compare loans against mutual funds processing fees and interest rates across multiple lenders before applying.

Digital Loan Against Mutual Fund – Peace of Mind in a Tap

Platforms like Investkraft Loan, Groww, Paytm Money, or even ICICI Direct now offer fully digital mutual fund loans. The digital loan against mutual fund trend is exploding in 2025 because of:

LAMF APIs are integrated directly with fund houses

Real-time pledge & approval system

Same-day credit disbursal

Transparent eligibility criteria & instant tracking

Comparison Table – Mutual Fund Loan vs Personal Loan

5 Most Asked FAQs on Loan Against Mutual Funds

1. Can I get a loan on mutual funds without selling them?

Yes! That’s the biggest benefit—you pledge but don’t sell, keeping your long-term growth on track.

2. What’s the maximum loan I can get on my SIP or ELSS?

Usually up to 50%-70% of your fund value. Use a loan against mutual funds eligibility calculator for exact figures.

3. How soon is the loan disbursed?

Most digital lenders offer instant loans against mutual fund disbursal within minutes to 24 hours.

4. Is my CIBIL score affected?

No, unless you default. Timely repayment even helps your credit score grow.

5. Which apps offer the best LAMF loan in 2025?

Some top apps include Investkraft Loan, Zerodha, Paytm Money, ICICI Direct, and Groww.

Final Thoughts – Don’t Break, Just Borrow!

In 2025, it’s smarter to borrow against your mutual funds than break them. Whether it’s your ELSS tax-saver fund or a 3-year SIP you don’t want to redeem, LAMF loans are your perfect bridge between long-term wealth and short-term needs.

So next time life throws you a financial curveball, don’t panic—just apply for a loan against mutual fund online and unlock the power of what you already own.

Ready to get started?

Use your PAN, check your eligibility, and get instant cash within hours—without selling even a rupee of your SIP or ELSS.

#loan against mutual funds#instant loan against mutual fund#loan against ELSS mutual funds#loan against SIP investment#loan against mutual fund online#Digital#get loan on mutual funds without selling#mutual fund loan interest rate 2025#how to get loan on mutual fund#mutual fund loan apps India#lamf#loan against mutual funds explained#digital loan against mutual fund#lamf eligibilty & documents#what is a loan against mutual fund#investkraft loan#lamf loan#how does a loan against mutual fund work#features of loan against mutual funds#lamf api#loan against mutual funds features#lamf eligibility#loan against mutual funds eligibility calculator#loan against mutual funds for financial needs#loan against mutual funds for wedding#loan against mutual funds eligibility and documents#apply for loan against mutual fund#how to apply loan against mutual funds#loan against mutual funds processing fees and interest rates#loan against mutual funds for financial planning

0 notes

Text

How WhatsApp API Is Transforming the Finance Industry?

In the ever-evolving financial landscape, staying connected with customers in real time is critical. With rising expectations for instant communication, personalized service, and security, financial institutions are rapidly turning to WhatsApp Business API as a trusted channel. Offering convenience, scalability, and security, WhatsApp API is revolutionizing how banks, NBFCs, insurance providers, and fintech firms engage with their audience.

Here’s how WhatsApp API is helping the finance industry thrive:

Real-Time Transaction Alerts & Notifications Customers expect prompt updates about their financial activities. With WhatsApp API, banks and financial service providers can send:

Account balance updates

Debit/credit transaction alerts

Loan EMI reminders

Credit card payment alerts

Example: A customer receives a WhatsApp message instantly after a debit card transaction, helping them track expenses and spot suspicious activity in real-time.

Customer Support and Query Resolution WhatsApp offers a two-way communication channel. Customers can initiate conversations for account queries, loan details, or complaint resolutions. AI chatbots or live agents can manage queries 24/7, reducing call center loads and improving service speed.

Example: A fintech app integrates WhatsApp API to assist users with forgotten UPI PINs, KYC updates, and service requests directly within the chat interface.

Document Collection and Verification Collecting customer documents for loan processing, account opening, or KYC is often a bottleneck. With WhatsApp API, institutions can securely request and receive documents like Aadhaar, PAN, salary slips, etc., via chat.

Example: An NBFC sends a WhatsApp message requesting a customer to upload their latest bank statement for loan approval — all within the conversation thread.

Marketing and Lead Generation WhatsApp can be used (with opt-in consent) to share personalized offers, credit card deals, investment plans, insurance promotions, etc. It enhances conversion rates through interactive buttons and quick replies.

Example: A bank sends a customized message to pre-approved customers for a personal loan offer with “Apply Now” and “Talk to an Agent” buttons built into the chat.

Payment Reminders and Collections For finance companies, timely payments are vital. WhatsApp API allows for gentle, personalized reminders for EMI dues, insurance premium dates, or credit card bills — improving collection efficiency.

Example: An insurance company sends an automatic WhatsApp reminder with a payment link for monthly premiums, helping reduce churn.

Secure and Verified Communication WhatsApp API offers green tick verification and end-to-end encryption, making it a trusted channel for sensitive financial conversations. Customers are more likely to engage with messages from verified business accounts.

7. Loan Application Status and Onboarding WhatsApp API enables sending step-by-step loan status updates — from application received, under review, approved, disbursed — and even guides customers through onboarding and documentation.

Example: A customer who applied for a home loan receives WhatsApp updates at each stage — improving transparency and trust.

The WhatsApp Business API is no longer just a messaging tool — it’s a robust customer engagement platform that is driving real impact in the finance sector. Whether it’s delivering secure alerts, enabling two-way support, simplifying documentation, or automating marketing, WhatsApp empowers finance brands to provide timely, relevant, and humanized experiences.

At Dove Soft, we help financial institutions integrate WhatsApp API to drive smarter communication and better customer outcomes. Ready to revolutionize your customer experience? Let’s talk.

0 notes

Text

Understanding Permanent Account Number (PAN) in India

The Permanent Account Number (PAN) is a critical identification tool used primarily for financial and tax-related transactions in India. Issued by the Income Tax Department, PAN serves as a unique identifier for individuals and entities engaging in economic activities, ensuring transparency and compliance within the Indian tax system. This blog delves into the intricacies of PAN, its structure, the application process, its significance, and its various use cases.

Table of Contents

What is a PAN?

Decoding the Structure of PAN

How to Apply for PAN

Apply For PAN Online

Offline Application

How To Apply PAN Card Online Via Income-Tax Portal

How To Apply For a PAN Card Online Via NSDL Website?

How To Apply For PAN Card Online Via UTIITSL Website?

How to Update or Correct PAN Details?

Importance of PAN

Use Cases

1. Banking and Financial Services:

2. Real Estate:

3. Investments:

4. Government Services:

Verify PAN details via Instantpay PAN verification API

Benefits of Using the API:

Considering the Developer Hub

Conclusion

Frequently Asked Questions

1. How to change the name on the PAN card?

2. How to check PAN card status?

3. How to know the PAN card number?

4. How to check PAN card details?

5. How to get a PAN card if lost?

6. How to link Aadhaar and PAN card?

7. How to change the mobile number on the PAN card?

8. What is the use of a PAN card?

9. What is the area code on the PAN card?

10. How to verify a PAN card?

What is a PAN?

PAN, a permanent account number, is a unique 10-character alphanumeric identifier issued to Indian taxpayers. This identifier helps the government track financial transactions and prevent tax evasion. The PAN remains unchanged throughout the individual's or entity's lifetime, regardless of changes in name, address, or other personal details.

Decoding the Structure of PAN

The 10-character PAN consists of:

First Five Characters (Alphabets):

The first three characters are a random sequence of alphabets from A to Z.

The fourth character indicates the type of PAN holder:

A — AOP (Association of Persons)

B — BOI (Body of individuals)

C — Company

F — Firm

G — Government

H — HUF (Hindu Undivided Family)

L — Local authority

J — Artificial juridical person

P — Person (Individual)

T — Trust (AOP)

The fifth character is the first character of the PAN holder's last name or surname.

Following Four Characters (Numbers): These are a sequential set of numbers from 0001 to 9999.

Last Character (Alphabet): This is an alphabetic check digit used for verification.

How to Apply for PAN

The application process for obtaining a PAN is straightforward and can be completed online and offline. Here's a step-by-step guide:

Apply For PAN Online

Visit the Official Website: Navigate to the official website of NSDL (National Securities Depository Limited) or UTIITSL (UTI Infrastructure Technology And Services Limited).

Fill Out the Form: Select the appropriate form (Form 49A for Indian citizens and Form 49AA for foreign citizens) and fill in the required details.

Upload Documents: Upload proof of identity, proof of address, and proof of date of birth.

Payment: Make the payment to process the application.

Acknowledgment: An acknowledgment number will be provided upon successful submission, which can be used to track the application status.

Offline Application

Obtain the Form: Collect Form 49A or Form 49AA from any PAN service center.

Fill Out the Form: Complete the form with the required details.

Attach Documents: Attach copies of proof of identity, address, and date of birth.

Submit the Form: Submit the completed form and the documents to the nearest PAN service center.

Processing Fee: Pay the processing fee at the center.

Acknowledgment: Receive an acknowledgment receipt, which can be used to track the application status.

Learn More:

Identity Verification - How to Check PAN Aadhaar Linking Status with API

The Role of Aadhaar-PAN Linkage in Securing Identity & Compliance Across Industries

How To Apply PAN Card Online Via Income-Tax Portal

Step 1 - Apply for a new PAN card by visiting the Income Tax portal and clicking "Instant e-PAN"

Step 2- Select 'Get New e-PAN'

Step 3- Enter your Aadhaar number and click 'Continue' to proceed.

Step 4- The OTP validation page will appear. Tick the checkbox to accept the terms and conditions, then click 'Continue.'

Step 5- Enter the OTP sent to your Aadhaar-registered mobile number, check the box, and click 'Continue.'

Step 6 - You will see your details, such as your name and date of birth, as per your Aadhaar card. Click 'Validate Email' to verify your email address, check the box, and click 'Continue.'

Finally, you will receive an acknowledgment number and a confirmation message on your mobile number. Once your e-PAN is allotted, you will be notified via the same channel. Typically, the e-PAN card is generated within 10 minutes, and you can download it from the Income Tax portal.

If you require a physical copy of your PAN card, additional fees may apply, and you can request it through the reprint option.

The instant e-PAN card facility is available only to individual citizens above 18 years of age with a valid Aadhaar number and an Aadhaar-linked mobile number. This service is unavailable for NRIs, partnership firms, HUFs, companies, trusts, or other entities.

How To Apply For a PAN Card Online Via NSDL Website?

Step 1: Visit the NSDL website.

Step 2: Choose the application type: 'New PAN - Indian Citizen (Form 49A)' or 'New PAN - Foreign Citizen (Form 49AA)'.

Fill in the required details: select the applicable category and title, and enter your last name, first name, middle name, date of birth/incorporation, email, and mobile number.

Tick the checkbox, validate the captcha, and click 'Submit.'

Step 3: You will receive a Token Number on your email ID. Click the ‘Continue with PAN Application Form’ button.

Step 4: Carefully read the detailed instructions before completing the PAN card application form. Click here to view the PAN card application instructions.

Choose the mode of submission for your PAN card documents and indicate if you need a physical PAN card.

Complete the form by entering your details, contact information, and AO code, and upload the necessary documents

Step 5: The payment page will appear after submitting the PAN card application. Payment options include credit/debit cards, demand drafts, or net banking.

Upon successful payment, an acknowledgment will be displayed, which you can use to check your application status. This acknowledgment will also be sent to your email ID.

Note: If you choose the 'Forward application documents physically' option, you will need to print the acknowledgment and send it, along with the required documents, to the following address by post:

Income Tax PAN Services Unit 4th Floor, Sapphire Chambers Baner Road, Baner Pune - 411045

Once your application is processed and the PAN card is generated, it will be sent to your email or residential address within 15-20 days.

How To Apply For PAN Card Online Via UTIITSL Website?

Step 1: Visit the utiitsl website

Step 2: Click 'Apply Now' under the 'PAN Card for Indian Citizen/NRI' or 'PAN Card for Foreign Citizen' tab.

Step 3: Choose the 'Apply for New PAN Card (Form 49A)' tab or the 'Apply for New PAN Card (Form 49AA)' tab.

Step 4: Choose how you will submit your documents. - Indicate your applicant status. - Select the PAN card mode. - Click the 'Submit' button.

Step 5: You will receive a reference number. Click ‘OK’.

Step 6: Enter the required details on the form, such as personal details, document details, contact and parent details, and address details. Upload the necessary documents and submit the form.

Step 7: Make the payment of the application fee. An acknowledgment will be displayed and sent to your email ID on successful payment.

Proceed to pay the application fee. Upon successful payment, an acknowledgment will be shown on the screen and sent to your email ID.

Important: If you choose the ‘Physical Mode’ option on the PAN card form, you must take a printout of the form, affix a photograph and signature, attach the documents to the form, and post them to the nearest UTIITSL office.

How to Update or Correct PAN Details?

You can apply for changes online if you need to update details in your existing PAN card, such as name or date of birth. The process is similar to applying for a new PAN card, and you must submit supporting documents for the requested changes. Here’s how you can proceed:

Visit the NSDL portal or UTIITSL website.

Select the application type "Changes or Corrections in existing PAN/ Reprint of PAN card."

Enter the details that require modification, upload the necessary documents, and click "Submit."

Pay the processing fee.

Your updated PAN card will be dispatched within 15 days.

For detailed steps to make corrections or update details in your PAN card, click here.

Advancements in technology have streamlined the PAN application process, eliminating the need to mail required documents to NSDL or UTIITSL offices physically. When opting for online document submission, documents can be conveniently uploaded and submitted electronically.

Importance of PAN

PAN is essential for various financial and non-financial transactions. Its importance can be highlighted in the following areas:

Income Tax Returns: PAN is mandatory for filing income tax returns in India. It helps the Income Tax Department track all taxable financial transactions.

Bank Accounts: PAN is required to open new bank accounts, including savings, current, and fixed deposit accounts.

High-Value Transactions: Transactions such as buying or selling property, vehicles, or investments exceeding a specified limit require PAN.

Credit and Loans: PAN is necessary to apply for loans or credit cards.

Investments: PAN is required to invest in mutual funds, stocks, and other financial instruments.

Foreign Travel: PAN is needed for transactions related to foreign travel, such as buying foreign currency.

Telephone Connections: PAN is required to obtain a new telephone or mobile phone connection.

Demat Accounts: A PAN is necessary for opening a d

Fixed Deposits: PAN is required to open fixed deposits with banks exceeding a specified limit.

Use Cases

PAN serves as a critical tool in various sectors:

1. Banking and Financial Services:

Account Opening: PAN is mandatory for opening bank accounts and demat accounts.

High-Value Transactions: Banks require PAN for deposits exceeding ₹50,000.

Loan Applications: PAN helps in assessing the applicant's creditworthiness.

2. Real Estate:

Property Transactions: PAN is mandatory for buying or selling property.

Rent Agreements: PAN is required for rental agreements exceeding a specified amount.

3. Investments:

Mutual Funds: PAN is needed to invest in mutual funds.

Stock Market: PAN is necessary for trading in the stock market.

4. Government Services:

Subsidies: PAN is used to track and provide subsidies.

Tax Payments: PAN is essential for paying taxes and receiving refunds.

Businesses today need reliable tools to streamline customer onboarding and ensure compliance with regulatory standards. Instantpay’s PAN Verification API offers an efficient solution to verify Permanent Account Number (PAN) details in real-time, directly from the official Income Tax Department database. This advanced API accelerates the onboarding process and enhances security and data accuracy, providing a seamless experience for businesses and customers alike. Here’s an in-depth look at how Instantpay’s PAN Verification API can revolutionize customer verification processes.

Verify PAN details via Instantpay PAN verification API

Instantpay offers a PAN Verification API that allows businesses to streamline customer onboarding and ensure regulatory compliance. Here's a deeper dive into how it works:

What it Does:

Authenticates PAN details: The API verifies the provided PAN number against the official Income Tax Department database.

Provides additional information: Beyond primary verification, Instantpay offers two API options:

PAN Verification: This returns essential details like the name on the PAN card, PAN status (active/deactivated), and Aadhaar seeding status (linked or not linked).

PAN Verification Plus: This advanced option provides a more comprehensive profile by adding details like address, date of birth, and gender.

Benefits of Using the API:

Faster Onboarding: Seamless verification eliminates the need for manual document checks, speeding up customer signup processes.

Enhanced Security: Verification helps prevent fraud by identifying fake or invalid PAN cards.

Improved Data Accuracy: Real-time data from the government database ensures accurate customer information in your systems.

Regulatory Compliance: The API helps businesses adhere to KYC (Know Your Customer) regulations that mandate customer identity verification.

Considering the Developer Hub

Instantpay's developer documentation provides valuable insights for using their PAN verification API.

Here's what you might find:

Detailed Documentation: Step-by-step guides explain the API's functionalities, request parameters, and response formats.

Code Samples: Examples in various programming languages demonstrate how to integrate the API into your code.

FAQs and Troubleshooting: The hub might address common issues and provide solutions for a smooth integration process.

With Instantpay's PAN verification API, businesses can significantly improve efficiency and ensure compliance with regulations.

Conclusion

The Permanent Account Number (PAN) is an integral part of the Indian financial system, ensuring transparency and accountability in financial transactions. Its unique structure, straightforward application process, and wide range of applications make it indispensable for individuals and entities. Whether opening a bank account, filing taxes, or making high-value investments, PAN is your key to financial integrity and compliance in India.

Understanding the significance of PAN and its various applications can help you navigate the financial domain more effectively, ensuring that your transactions are smooth and compliant with Indian regulations.

Frequently Asked Questions

1. How to change the name on the PAN card?

To change the name on your PAN card, follow these steps:

Visit the official NSDL website.

Select the option for 'PAN card correction' or 'Change/Correction in PAN data'.

Fill in the online application form with the necessary details.

Upload the required documents supporting the name change (e.g., marriage certificate, gazette notification, etc.).

Pay the applicable fee online.

Submit the application and note the acknowledgment number for tracking.

Send the printed acknowledgment form along with the required documents to the designated address mentioned on the website.

2. How to check PAN card status?

You can check the status of your PAN card application by following these steps:

Visit the official NSDL website.

Navigate to the 'Track PAN Status' section.

Enter your acknowledgment number or PAN number, along with the captcha code.

Click on 'Submit' to view the current status of your application.

3. How to know the PAN card number?

If you have lost or forgotten your PAN card number, you can retrieve it by:

Visiting the official Income Tax e-filing website.

Clicking on 'Know Your PAN'.

Enter your personal details such as name, date of birth, and mobile number.

Completing the OTP verification process.

Your PAN number will be displayed on the screen.

4. How to check PAN card details?

To check your PAN card details:

Visit the official Income Tax e-filing website.

Log in using your credentials or register if you are a new user.

After logging in, go to 'Profile Settings' and select 'My Profile'.

Your PAN card details will be displayed under the 'PAN Details' section.

5. How to get a PAN card if lost?

If your PAN card is lost, you can apply for a reprint by:

Visiting the NSDL website.

Selecting the option for 'Reprint of PAN card'.

Fill in the required details, including your PAN number and other personal information.

Paying the reprint fee online.

Submitting the application and noting the acknowledgment number.

The reprinted PAN card will be sent to your registered address.

6. How to link Aadhaar and PAN card?

To link your Aadhaar with your PAN card:

Visit the official Income Tax e-filing website.

Under the 'Quick Links' section, select 'Link Aadhaar'.

Enter your PAN, Aadhaar number, and name as per Aadhaar.

Complete the captcha verification and click on 'Link Aadhaar'.

If the details match, your PAN will be successfully linked with your Aadhaar.

7. How to change the mobile number on the PAN card?

To change the mobile number linked to your PAN card:

Visit the NSDL website.

Select the option for 'PAN card correction'.

Fill in the online application form with the necessary details.

Enter the new mobile number in the relevant section.

Upload the required documents and pay the applicable fee.

Submit the application and send the printed acknowledgment form along with the necessary documents to the designated address.

8. What is the use of a PAN card?

A PAN card is used for various purposes including:

Filing income tax returns.

Opening a bank account.

Applying for loans and credit cards.

Making financial transactions above a specified limit.

Purchasing or selling property.

Investing in securities and mutual funds.

Receiving taxable salary or professional fees.

9. What is the area code on the PAN card?

The area code in a PAN card represents the geographical location associated with the PAN cardholder. It is part of the alphanumeric structure of the PAN card number and helps identify the jurisdiction under which the PAN was issued.

10. How to verify a PAN card?

To verify a PAN card:

Visit the official Income Tax e-filing website.

Navigate to the 'Verify Your PAN' section.

Enter the PAN number, full name, date of birth, and captcha code.

Click on 'Submit' to verify the PAN details.

The system will display the status of the PAN card and its authenticity.

0 notes

Link

If you are looking for Aadhaar Pan Card Link API service then Softcare Infotech is the best solution for you. Aadhaar pan card Link API lets help you to know the status of Aadhaar pan linking. As you know that Aadhaar PAN linking is the most important and necessary for individuals. If you have any query feel free to ask with us.

0 notes

Text

RPACPC Is The Best Identity Verification Platform in India

There are several identity verification platforms available in India, including Aadhaar, e-KYC, Digilocker, and RPACPC. Each platform has its unique features, capabilities, and effectiveness. Aadhaar is a biometric identification system that is widely used across India, while e-KYC provides a simple and easy way to verify identity electronically. Digilocker allows users to store and share digital copies of their documents, while RPACPC offers a GST verification API, 206AB Compliance Check, Pan Status, Pan Aadhaar Link for secure and reliable identity verification. When choosing an identity verification platform, it is essential to consider factors such as security, accuracy, and ease of use.

The Best Service Provided By RPACPC

GST verification API

GST verification API is a digital tool that enables businesses and individuals to verify the GST registration status of a particular business or entity. This API is typically provided by GST Suvidha Providers (GSPs) or other authorized entities and allows users to perform real-time verification of GST registration numbers. The API works by accessing the GST database and retrieving information on the registration status of the business or entity in question. This information can include details such as the registered name, address, and date of registration. The GST verification API is an important tool for businesses to verify the authenticity of their suppliers and partners, as well as for ensuring compliance with GST regulations.

206AB Compliance Check

206AB Compliance Check API is a digital tool that helps businesses and individuals to check their compliance with Section 206AB of the Income Tax Act. This section was introduced in the Finance Act of 2021 and requires specified persons, such as non-filers of income tax returns and those with high-value transactions, to pay a higher rate of tax. The API works by accessing the tax database and retrieving information on the compliance status of the specified persons. This information includes details such as the person's Permanent Account Number (PAN), income tax return filing history, and other relevant data. The 206AB Compliance Check API is an important tool for businesses to ensure compliance with the new tax regulations and avoid penalties.

Pan Status

Pan Status API is a digital tool that enables businesses and individuals to check the status of a PAN (Permanent Account Number) card. The PAN card is a unique identification number issued by the Indian government to taxpayers, and the Pan Status API allows users to verify the validity of a PAN number and check its current status. The API works by accessing the PAN database and retrieving information on the status of the PAN card, such as whether it is active, inactive, or canceled. The Pan Status API is an important tool for businesses to ensure the authenticity of their customers or partners and to prevent fraud in financial transactions.

Why Need an Identity Verification Platform in India

Identity verification platforms are essential in India for several reasons. Firstly, they help to combat identity theft and fraud by ensuring that the person or entity engaging in a transaction is who they claim to be. This is particularly important in financial transactions and e-commerce, where the risk of fraud is high. Secondly, identity verification platforms help to simplify the verification process for individuals and businesses, making it easier and more convenient to complete transactions. Finally, these platforms are often mandatory for compliance purposes, such as adhering to Know Your Customer (KYC) regulations in the financial sector. Overall, identity verification platforms play a critical role in promoting security, reducing fraud, and ensuring compliance in various sectors of the Indian economy.

Identity verification platforms in India typically include several key features that help to ensure the accuracy and security of the verification process. Some of these key features include:

Biometric authentication: This involves using a person's unique physical characteristics, such as fingerprints or facial recognition, to verify their identity.

Document verification: This involves verifying the authenticity of a person's identity documents, such as a passport or driving license.

Machine learning algorithms: These algorithms are used to analyze data and detect patterns that may indicate fraudulent activity.

Secure storage: The platform must ensure the secure storage of personal data to prevent unauthorized access and protect users' privacy.

Compliance with regulations: The platform must comply with relevant regulations, such as KYC norms, to ensure that the verification process is legally compliant.

User experience: The platform should provide a seamless and user-friendly experience for individuals and businesses, making it easy to complete the verification process.

Overall, these key features are essential in ensuring the accuracy, security, and compliance of identity verification platforms in India.

#Identity Verification Platform#Identity Verification#Identity Verification API#Identity Verification API Provider In India

0 notes

Text

5 Simple Tips to Keep Aadhaar Number and Information Safe

In India, the Aadhar card is the standard document of identification and residence. When filing an ITR, the government of India has ordered that each individual's Aadhar card be linked to their particular PAN (Income Tax Return). As a result, tax-related information will be available through Aadhar. Furthermore, the Aadhar Card must be linked to bank accounts in order for the government to gain access to individual financial information via this utility document.

Bharat Interface for Money (BHIM) and Aadhar Pay are two government and private money transfer programs that are related to Aadhar. If someone gains access to your Aadhar Card, he or she can now collect data from related/linked services. Furthermore, Aadhar contains biometric information such as iris and fingerprint data, which could be exploited if it falls into the wrong hands. As a result, it's a good idea to keep your Aadhar card safe. Here are five simple ways to keep your Aadhaar from being misused.

Do not post your Aadhaar number on any social media platforms:

Yes, social media is becoming a part of the air we breathe. We want the world to know how we live every second of our lives, yet there are some things that should not be revealed online, and your Aadhaar is one of them. Use your Aadhaar number in the same manner that you would not publish your credit card number or bank account information on a social networking platform.

Lock your biometrics on the UIDAI website.

Your biometric information is collected when you apply for Aadhaar. Your ten fingerprints are scanned, as well as both of your irises, and a photograph is taken.

Did you know that you can protect this data? No one will be able to access your biometric data once you've locked it. Any future misuse of your Aadhaar will be prevented by locking your biometrics.

Downloading your e-Aadhaar card on a system you don't trust is not recommended:

The UIDAI has made it incredibly simple to obtain your e-Aadhaar card at any time and from any location. If you don't have your Aadhaar card with you and need to provide a copy for authentication purposes, you may find it simple to download and submit it in a couple of minutes using any computer or laptop. It's possible that you'll neglect to remove it from the foreign system.

Yes, your downloaded Aadhaar card is password-protected, but hackers could bypass passwords to access your data. As a result, you should never download your Aadhaar on a system that you do not trust.

Do not provide your Aadhaar number over the phone.

Phishing scams, in which you receive a phone call from someone purporting to be from your bank, service provider, or online vendor, and they ask you for critical information that they intend to use without your permission, are becoming increasingly prevalent these days.

Because Aadhaar is a government-issued identification document, failing to keep it safe can result in your identity being compromised. Protect your Aadhaar information like you would do any other sensitive data.

To keep Aadhaar data safe, follow the Uidai security protocols.

The actual Aadhaar number, must not be stored in the database of any business, according to the rules of the Unique Identification Authority of India. The Core Banking System, APIs, e-KYC System etc. other than the Aadhar Data Vault.

The UIDAI has introduced an Aadhaar data vault, which is a centralized storage facility for all Aadhaar numbers collected by authorized agencies. The purpose of the Aadhaar data vault, according to the UIDAI, is to reduce the footprint of Aadhaar numbers within an organization's systems and environment, minimizing the danger of illegal access.

Source : Medium

0 notes

Link

The digital payments scene in India is fiercely contested by a number of participants. Recently, one of India’s popular digital payments company – Paytm, wrote to the National Payments Corporate of India (NPCI), who govern digital payments regulations in our country, about Google Pay’s privacy policy.

Paytm wrote that “We would like to highlight a very important fact that Google Pay, which is an unregulated payments platform, has the scope of using their customers’ data for their monetary gains with complete disregard of the user’s need for privacy. The critical payments data collected by them is being processed and stored outside of India, which can have severe security implications in case of a data breach as their policy states that this data is also being disclosed with advertisers and third-parties”. Courtesy – Business Today, dated Sept 13.

Click here, to understand all about a personal loan in India

Paytm accused Google Pay of sharing their customer data with different affiliate companies for monetary gain. Various third party users also use the customer data to send out advertisements and hence misuse the information of trusted customers for monetary advantages. This is not the first time that Paytm has cried foul towards overseas companies violating customer data and privacy. Prior to this, Paytm had stated that, WhatsApp was killing United Payments Interface (UPI) by creating a walled garden.

The central government is still in the process of preparing a personal data protection bill which will mandate the storage of customer data related to digital payment companies in India. The draft regulations, issued in 2018 recommended that customer’s personal data originated within India cannot be stored outside of India. Google’s response to this was that it made use of a common Google account for managing all Google products. This allows the customer to manage or check on risk, spam, and fraud. Google clarified that it did not make use of any individual UPI transactions for monetization purposes (as per Google statement).

Since then, Google got its privacy policy tweaked. They have dropped the word ‘disclosure’ from its privacy clause.

Digital India 2.0

Through enhanced connectivity, widespread social media usage and internet outreach, we have gotten ourselves to think more about data protection in India. India, has also become a lucrative market for overseas companies to cash in on customer data. The following couple of years will get us more clarity on the regulations and its implementation.

Digital payments companies such as PhonePe, MobiKwik and Paytm have already backed the RBI’s decision to supervise the access of data stored with system providers. Till August 2018, close to 92 million customers transacted on Paytm through both their offline and online interface. G Pay, meanwhile has already recorded close to 22 million transactions up until now. India’s e-payments market pie is estimated to grow to close to 1 trillion dollars by 2023 (as per Credit Suisse). Close to 100 players in India (including 60 non-banking) have crowded the e-payments ecosystem.

But then, why does Loan Singh have to care about all this? Our customers are salaried millennials. Millennials have found digital wallets to make digital payments to be extremely convenient. A digital wallet is likened to a traditional leather wallet. It is a safer and convenient way to safeguard your money and cards. It stores your personal and financial information in a digitized form. It is an electronic platform that allows individuals to make electronic transactions. Digital wallets allow us to perform offline, as well as online, transactions to merchants who are registered with a digital wallet service provider.

We have seen these same salaried millennials struggle in getting fresh credit through traditional banks. Most of them are rejected a first time loan due to no prior credit history. This happens because banks do not find such individuals trustworthy or simply creditworthy. Loan Singh is ready to take that risk. Loan Singh is a digital lending platform that lets first-time salaried individuals apply for fresh credit even with no credit score. But to mitigate the risks of default, Loan Singh needs the latest 6 months’ bank statement, PAN card and Aadhaar card of the applicant.

Click here to know why Loan Singh is the best online loan website

Digital Wallet Payments

The working of a digital wallet is different from that of other card payments. A digital wallet makes use of a Near Field Communication (NFC) controller and antennae to enable mobile devices to send out account information to devices at payment counters. A secure smart card chip on the phone stores and allows access to the account information. All this can be executed via the installed digital wallet application on your smartphone. The communication is not restricted to NFC, but can also be done via web links, QR Code, SMS or even social media.

During the payment process, the shopper is authenticated. Then the shopper has access to the full features present on the digital wallet account. Merchants have to strongly consider their customer base while setting-up a digital wallet service because not everyone will be intending to make payments via digital wallets. In the world of digital wallets, there is not much difference between customers or merchants. It is just an accounting ledger convention wherein the payment from a customer to a merchant is just a database update (as all the money is flowing in the wallet itself). The working of a digital wallet is only effective if the API integration, for merchants, is done properly.

It requires effective security and permissions to access your information

The wallet can be used to purchase products online or offline

A password, QR code, an image or some authentication code is used for security

The digital wallet is linked to your bank account

Digital wallets allow currency conversions

Shoppers can also create an unverified digital wallet at the time of payment

It can also be used for authentication. For example: to verify the age while purchasing alcohol

Click here, to understand everything about credit score in India

Digital Wallet Benefits

The biggest advantage for customers is convenience – no need to carry cards or cash

Makes purchases easy with a ‘tap-to-pay’ approach

Enables automatic redemption of offers

Allows for enhanced security during transactions due to encryption

Faster processing of payments

Digital Wallets in India

You can get in-depth information regarding digital wallets online, but we have put up a brief listing of digital wallets being used in India. They are not listed in any particular order.

Airtel Money

Using this app allows users to easily recharge their Airtel prepaid account or pay their postpaid bills. This wallet can also be used to shop online if your wallet has cash loaded in it. Airtel Money is extremely safe and each transaction or payment can only be authorized via a secret 4-digit mPin.

Citrus Pay

One of the top digital wallets in India, the Citrus Pay wallet offers its customers’ payments options towards businesses. It is reported to have tied up with more than 12000 merchants with more than 12 million transactions a month.

Freecharge

Ask any young millennial and Freecharge is surely one of the apps installed on their smartphone. Freecharge provides an equivalent amount of coupons for every recharge made. This surely goes a long way in saving the amount spent on bills online. A reported 22 million plus users use Freecharge as a mobile payment solution. Freecharge also allows the user to donate money to a registered NGO. Its common e-wallet features include adding money using a credit card, debit card or net banking and instant payments. They also provide discounts to users on transactions.

ICICI Pockets

The ICICI Pockets e-wallet allows its users to connect to their respective bank account for mobile transactions. You can send/receive money, book tickets, recharge online, pay for online shopping and share gifts with friends. It is a fast, convenient and secure e-wallet for mobile transactions. Funds can also be transferred to email ID contacts or WhatsApp contacts.

Oxigen

Oxigen is a Fintech company founded in 2004 and is one of the major providers of digital payment in India. The Oxigen wallet is used for making purchases online and paying bills. Oxigen is considered to be a safe and secure digital wallet which asks a user to input a 6 digit OTP that is sent to the registered mobile number. It covers almost all major banks in India. It provides both online and offline modes. The offline mode allows payment to be made at physical stores such as CCD, Croma, BigBazaar, etc. Oxigen has also tied up with Goibibo, Indiatimes, KFC, eBay, Jabong, Justdial, etc.

Citi MasterPass

Another free digital wallet on the list, Citi MasterPass helps you move through an online shopping checkout process quicker.

Mobikwik

Mobikwik e-wallet payments system helps users to store money. They are used to recharge your phone, getting discounts on deals, pay bills, load money using a credit card, debit card, and net-banking; door-to-door cash collection and making third-party purchases.

Mobikwik has tied-up with close to 225000 merchants and has around 45 million customers.

HDFC PayZapp

HDFC PayZapp allows digital payments via one click. You can also compare hotel bookings and flight ticket pricings. You can even buy music and pay your bills via the PayZapp. All you need to do is connect your debit/credit card to the app.

Paytm

Launched in 2010, Paytm is currently the largest mobile wallet app in India. It allows payment of mobile bills, buying movie tickets, shopping online; transferring money directly to your bank or someone else’s bank account and paying for your Uber journey (with cash back).

Paytm is adopted by SME vendors, rickshaw drivers, and shopkeepers. Such is its reach. Paytm has also tied-up with brands such as LG, Nike, Onida, Sony, Lenovo, Panasonic, and more.

Vodafone MPesa

MPesa allows a secure, fast and convenient medium for making mobile transactions. It is a subsidiary of Vodafone M-Pesa Limited jointly operated with ICICI Bank. The wallet allows redemption or cash withdrawal for its users.

JioMoney

Sweeping the nation since 2016, Jio’s digital payment app – JioMoney, offers easy, fast and secure transactions. The app offers great discount and offers to its users. With more than 162 million reported subscribers, Jio provides the largest internet service in India. JioMoney can be used to make recharges online, book tickets online, transfer and receive money; and also pay for your cabs. It also offers massive discounts and deals on making the first transaction.

Chillr

Chillr has tied up with close to 55 banks across India. It easily allows management of multiple accounts from one digital wallet. You can make payments for recharging your mobile, book movie tickets online, receive and send money and also avail discounts on transactions.

State Bank Buddy

A product of State Bank of India, ‘Buddy’ is an online wallet that is available in 13 languages. Non-SBI account holders can also send money via Facebook to other bank accounts. It can also be used to book movie tickets and hotel reservations. The cash to wallet can be loaded using a credit card, debit card or net banking. You can also set reminders for due payments.

PayUMoney

A product of PayU India, PayUMoney is a payment gateway that allows merchants to collect payments from customers. The mode of payment can be credit cards, debit cards or via net banking. They also offer email invoicing and SMS notifications. It is a safe and secure platform and used across India by e-commerce websites.

PayUMoney is also introduced as a mobile wallet service. The wallet allows its users to perform online transactions. It also offers reward points for every transaction. It also provides a PayUMoney Buyer Protection which ensures the product reaches your designated address.

Juspay

Juspay Safe is a payment browser that allows users to make online payments fast with just 2 clicks.

LIME

Launched by Axis Bank in 2015, LIME was one of the first smartphone apps in India that integrated shopping, payments, integrated wallet, and banking. It also allows users to invest in a deposit and share your wallet.

Ola Money

Launched in 2015, Ola Money is a digital wallet offered by Ola. They are not just used towards making payments for Ola cab rides; you can also use them for purchasing groceries and booking flight tickets.

PayPOS

Launched in 2012, PayPOS is an app that allows small business owners to receive payments easily via debit cards or credit cards. They are also capable of processing electronic transactions.

Click here to read about Credit Bureaus and Free Credit Score Checks…

About Loan Singh

Loan Singh is a digital lending platform that prides in providing online personal loan or unsecured personal loan to salaried individuals. You can apply for quick funds as an easy emergency loan which is not a bank loan. We provide a loan with the best personal loan interest rates. The instant funds, or instant loans, are loans between Rs.50,000 and Rs.5,00,000 taken for purposes such as:

Home improvement loan/Home renovation loan

Marriage loan/ Wedding loan

Medical loan

Used vehicle loan

Consumer durable loan

Vacation loan

Debt consolidation loan

Credit card refinancing loan

Job relocation loan

Travel loan

Festival loan

Gold jewelry loan

Shopping loan

Lifestyle loan

You can calculate your easy EMIs using our personal loan EMI calculator. We accept bank statement, PAN, and Aadhaar for quick loan approval. A bad credit score or credit report errors can lead to personal loan rejection. The ‘Loan Singh Finance Blog’ is one of the best finance blogs in India. Loan Singh is a product of Seynse Technologies Pvt Ltd and is a partner to the Airtel Online Store.

Loan Singh’s Online Presence

Loan Singh is not an anonymous digital platform. We are present on almost all leading social media platforms. All you need to do is look for us. You can find us on Loan Singh Facebook, Loan Singh Twitter,Loan Singh YouTube, Loan Singh Pinterest, Loan Singh Instagram, Loan Singh LinkedIn, Loan Singh Blogarama, Loan Singh Google Review, Loan Singh Medium, Loan Singh Reddit, Loan Singh Tumblr, Loan Singh Scoop It, Loan Singh Storify, Loan Singh Digg and Loan Singh Blogger.

Click here to read about Credit Bureaus and Free Credit Score Checks…

Share this:

Click to share on Facebook (Opens in new window)

Click to share on Twitter (Opens in new window)

Click to share on Pinterest (Opens in new window)

Click to share on Google+ (Opens in new window)

Click to share on LinkedIn (Opens in new window)

Click to share on WhatsApp (Opens in new window)

Posted in

Editorial

Tagged

20000 salary loan

,

aadhaar based loan

,

aadhaar benefits india

,

Aadhaar loan

,

Advantages of personal loan

,

airtel emi

,

Airtel Online Store

,

airtel.in/onlinestore

,

apply for a consumer durable loan online

,

apply for a marriage loan online

,

apply for a quick online personal loan online

,

apply for travel loan online

,

applying for a wedding loan online

,

bank statement loan

,

best aadhaar loan website

,

best blogs

,

best camera in world

,

best consumer durable loan

,

best electronics loan india

,

best finance blog India

,

best home appliance loan india

,

best marriage loan in india

,

best personal loan blog india

,

best personal loan india is

,

bitcoin meaning

,

blog for personal growth

,

camera finance loan

,

camera loan

,

credit bureau meaning

,

credit card loan

,

credit report meaning

,

credit score meaning

,

cryptocurrency meaning

,

Dhanteras loan

,

digital loan

,

Digital Payments India

,

diwali loan

,

DSLR loan

,

e-payments india

,

early salary loan

,

fast loan first time credit

,

fastest loan service

,

first time applicant loan

,

first time loan boost score

,

gadget personal loan

,

honeymoon loan in india

,

how safe is aadhaar

,

how to apply for a personal loan for electronics

,

how to apply for a wedding loan with low interest rates

,

how to apply for an electronics personal loan

,

Independence day loan

,

indian rupee against dolla

,

instant personal loan

,

internet banking benefits

,

internet banking personal loan

,

is aadhaar safe

,

is aadhaar safe online

,

is loan singh real

,

kyc loan

,

kyc meaning

,

Loan Singh & Airtel – Eligibility to buy an iPhone on Airtel Online Store

,

loansingh review

,

loansingh.com

,

medical personal loan

,

navratri loan

,

net banking benefits

,

netbankng personal loan

,

new to credit personal loan

,

No More Document Hassle Personal Loan in Just 2 Documents

,

nokia 7 plus airt

,

nokia 7 plus airtel prepaid

,

online loan

,

oppo

,

oppo f9 pro airtel prepaid

,

oppo f9 pro loan

,

oppo phone loan

,

PAN based loan

,

PAN loan

,

personal finance loan

,

personal loan emi calculator

,

personal loan emi eligibility

,

personal loan faq

,

personal loan features

,

phone on emi

,

purpose of internet banking in loan

,

purpose of PAN in loan

,

quick and easy marriage loan

,

quick and easy travel loan

,

quick and easy wedding loan

,

role of know your customer

,

rupee fall

,

rupee versus dollar

,

seynse.com

,

smartphone personal loan

,

top finance blogs in India

,

travel blog

,

travel loan

,

Vivo loan

,

Vivo V11 Pro EMI

,

Vivo V11 Pro review

,

what Happens When You Face A Personal Loan Default

,

which is best credit card refinancing personal loan

,

which is best finance blog in india

,

which is best loan provider in india

,

which is best loan website india

,

which is best marriage personal loan india

,

which is best online shopping personal loan provider india

,

which is best personal loan website india

,

which is best smartphone personal loan provider india

,

which is the best consumer durable loan india

,

which is the best consumer durable loan interest rates

,

which is the best electronics loan website

,

which is the best personal loan for electronics

,

who gives fast personal loan in bangalore

,

who gives fast personal loan in chennai

,

who gives fast personal loan in goa

,

who gives fast personal loan in kolkata

,

who gives fast personal loan in mumbai

,

who gives fast personal loan in pune

,

Who is Loan Singh?

,

WHY LOAN SINGH IS THE BEST SOURCE FOR PERSONAL LOAN IN INDIA

,

www.loansingh.com

0 notes

Text

Loan Against Mutual Funds Online in 2025 – Fast Approval Without Selling Investments

In 2025, if you need urgent cash and own investments like mutual funds or shares, there's good news—you no longer need to sell your assets. Thanks to the rise of LAMF (Loan Against Mutual Funds) and LAS (Loan Against Shares), you can instantly apply for a digital loan without disturbing your portfolio. Whether it's for a wedding, education, travel, or medical emergency, you can unlock funds in minutes — no income proof, no selling, just swipe and go.

Let’s explore how a digital loan against mutual funds or shares works, who can apply, what the features, limits, eligibility, and more. This guide will clearly and naturally answer every user's question, utilizing all the important search keywords to help both readers and search engines trust and rank this content.

What is a Loan Against Mutual Fund (LAMF)?

A Loan Against Mutual Fund (LAMF) allows you to borrow money using your mutual fund units as collateral. Instead of redeeming your mutual funds, lenders provide you with a credit line or term loan based on the NAV (Net Asset Value) of your holdings.

Similarly, a Loan Against Shares (LAS) lets you pledge your equity shares and get funds instantly. The biggest advantage? You retain ownership and continue to earn returns, dividends, and capital gains while enjoying liquidity.

Top Features of Loan Against Mutual Funds & Shares (LAMF LAS)

How Does a Digital Loan Against Mutual Fund Work in 2025?

Log in to your Demat or Mutual Fund platform. Most AMCs and fintech apps now offer LAMF APIs directly integrated.

Select the funds to pledge. ELSS, debt, hybrid, and large-cap funds are typically eligible.

Get an instant offer based on NAV. The higher the NAV and fund stability, the better your loan terms.

E-sign documents and complete KYC online.

Loan is disbursed digitally – often within 30 minutes!

This is how a digital loan against mutual funds online saves you time, paperwork, and the stress of liquidating long-term wealth.

LAMF Eligibility & Documents – Who Can Apply in 2025?

Eligibility for Loan Against Mutual Funds (LAMF):

Age: 21 to 65 years

Must own eligible mutual fund units (ELSS, debt, hybrid, or equity)

Resident Indian with valid PAN & Aadhaar

Salary slip or ITR is not mandatory (many lenders skip this)

LAMF Documents Required:

PAN Card

Aadhaar or Passport/Voter ID

Mutual Fund Statement (CAS)

Cancelled Cheque (for loan disbursal)

Optional: Income proof for higher limits

You can also use a loan against mutual funds eligibility calculator available on most lending platforms to get your eligible amount instantly.

Top Use Cases – Why People Apply for a Loan Against Mutual Funds in 2025

Loan Against Mutual Funds for Wedding Expenses Don’t touch your SIPs or ELSS—get a short-term loan without penalty.

Loan Against Mutual Funds for Higher Education Quick and smart funding option without breaking your portfolio.

Loan Against Mutual Funds for Financial Planning Use for emergencies or opportunities while your investments grow.

Loan Against Mutual Funds for Financial Needs Medical emergencies, travel, family events, or even down payments.

Interest Rates, Processing Fees & Limits – All You Need to Know

Digital loan platforms use LAMF APIs to instantly evaluate, process, and disburse loans, making the loan against mutual funds processing fees and interest rates transparent and user-friendly.

How to Apply for a Loan Against Mutual Funds Online – Step-by-Step (2025)

Visit a digital lending platform (like Groww, Zerodha, Paytm Money, or a Bank site)

Click on “Apply for Loan Against Mutual Fund.”

Enter PAN & link your MF folio or Demat

Select eligible funds (ELSS, debt, equity)

View the loan offer via the LAMF eligibility calculator

E-sign documents and submit KYC

Get instant disbursal to your linked bank account

Some fintech apps offer a loan against shares interest rates comparison to help you choose LAS vs LAMF smartly.

FAQs – Loan Against Mutual Funds or Shares in 2025

1. What is a loan against a mutual fund?

A Loan Against Mutual Fund (LAMF) allows you to borrow money without selling your investments by pledging them digitally.

2. Who can apply for a loan against mutual funds in India?

Any Indian citizen above 21 who holds mutual funds in their name can apply. Many platforms don’t require income proof or a high CIBIL.

3. Can I apply for a loan against ELSS mutual funds?

Yes, loan against ELSS is allowed, but with certain lock-in caveats. Many lenders accept ELSS if held for over 3 years.

4. How much can I borrow through LAMF?

Using a loan against mutual funds eligibility calculator, most users can obtain a loan of up to 70%-80% of their mutual fund's NAV.

5. Is LAS or LAMF better in 2025?

If you hold mutual funds, go for LAMF. If you own equity shares, LAS offers better liquidity options. Compare both using the Loan Against Securities Interest Rates before choosing.

Final Thoughts: Borrow Smart, Invest Smarter

In 2025, you no longer need to choose between growth and liquidity. With smart fintech platforms offering digital loans against mutual funds or shares, you get the best of both worlds — access to instant funds without selling your long-term assets.

Whether you’re planning a big event or tackling a financial emergency, LAMF or LAS ensures you get cash on tap with low documentation, transparent interest rates, and minimal stress. Just a few clicks, and you’re good to go — No Sell, Just Swipe.

#lamf#loan against mutual funds online#lamf eligibilty & documents#loan against elss#digital loan against mutual fund#how to apply loan against mutual funds#loan against mutual funds explained#features of loan against mutual funds#how does a loan against mutual fund work#loan against mutual funds faqs#lamf api#loan against mutual funds processing fees and interest rates#what is a loan against mutual fund#loan against mutual funds max limit#lamf eligibility#lamf loan#loan against mutual funds for wedding#loan against mutual funds eligibility calculator#loan against mutual funds for financial planning#apply for loan against mutual fund#loan against mutual funds for financial needs#loan against mutual funds features#loan against mutual funds for higher education#loan against mutual funds limit#loan against mutual funds eligibility and documents#digital loan against mutual funds interest rate#who can apply for loan against mutual funds#lamf documents#LAS#Loan Against Securities Interest Rates

0 notes

Text

Identity Verification - How to Check PAN Aadhaar Linking Status with API

In the rapidly evolving digital landscape, the significance of robust identity verification cannot be overstated, particularly in contexts like financial services and online transactions. Aadhaar, India's unique identification project, stands at the forefront of this revolution, offering a streamlined, secure method for verifying identities.

The Aadhaar Linking Status enhances digital platform security, compliance, and user experience. It is a robust security measure that leverages biometric data and demographic information, ensuring that individual identities are accurately verified. This process significantly reduces the risk of identity fraud and unauthorized access.

Additionally, it ensures compliance with various regulatory requirements, particularly in financial services, by establishing a reliable method of identity verification. Aadhaar linking simplifies access to multiple services for users, offering a seamless and integrated experience across different digital platforms. This system streamlines processes, making transactions both safer and more user-friendly.

This blog aims to delve into the intricacies of Aadhaar Linking Status, exploring its role in enhancing security measures, ensuring compliance, simplifying user experiences in digital platforms, and our API's role in streamlining this process. We will uncover how Aadhaar Linking Status integrates digital identity verification into everyday transactions and services.

Significance of Aadhar-Pan Linking

Integrating Aadhaar with PAN is a significant move towards fortifying the financial infrastructure in India. This linkage transcends being merely a regulatory mandate; it represents a strategic shift towards a transparent and efficient financial ecosystem. By enabling the government to monitor and track taxable transactions effectively, it plays a crucial role in curbing tax evasion and promoting a more equitable tax system.

For individuals, linking Aadhaar with PAN is essential for uninterrupted access to various financial services, including bank account operations, investment activities, and income tax filings. Non-compliance with this requirement risks rendering the PAN card inoperative, potentially disrupting these essential financial activities.

How can I check my Aadhaar PAN link status online?

There are two primary methods available to ascertain the linkage statute: primary methods are online. These methods provide a straightforward and efficient means to verify the connection between your Aadhaar and PAN, ensuring compliance with regulatory requirements and facilitating seamless financial transactions.

Each method offers a user-friendly approach, allowing individuals to check their linkage status through reliable online platforms quickly.

Aadhaar PAN card link status without logging into the Income Tax portal

Step 1: Check Income Tax e-filing portal.

Step 2: Head towards the ‘Quick Links’ heading, and click on the ‘Link Aadhaar Status’.

Step 3: Enter the ‘PAN number’ and ‘Aadhaar Number’ and click the ‘View Link Aadhaar Status’ button.

Upon successfully validating the Aadhaar-PAN linkage, users will receive a confirmation message. This message will indicate that the user's PAN is already linked to the provided Aadhaar number, confirming the successful completion of the linkage process. This notification serves as an assurance that the user's records are updated and in compliance with the necessary regulatory requirements.

When the Aadhaar-PAN linkage is being processed, users will receive a notification stating that their request for linking Aadhaar with PAN has been forwarded to the UIDAI for validation. This message prompts users to revisit the portal later and check their linkage status via the homepage's 'Link Aadhaar Status' option.

Conversely, suppose a user's Aadhaar is not linked with their PAN. In that case, an alert will appear indicating the absence of linkage and guiding the user to link their Aadhaar with their PAN through the 'Link Aadhaar' option.

Aadhaar PAN card link status by logging into the Income Tax portal

To check the Aadhaar-PAN linking status, follow these professional steps:

Access the Income Tax e-filing portal and log in.

Navigate to the 'Dashboard' on the homepage and select 'Link Aadhaar Status'.

Alternatively, visit 'My Profile' and choose 'Link Aadhaar Status'.

If your Aadhaar is already linked to your PAN, the system will display your Aadhaar number. In cases where Aadhaar is not merged with PAN, an option to connect will be presented. For requests pending validation by UIDAI, the status should be checked later.

Accessing Aadhaar-PAN Linking Status: Direct Online Portal

Here is the direct link to check the Aadhaar PAN card link status -

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/link-aadhaar-status

To ascertain the status of your Aadhaar-PAN linkage, input your PAN and Aadhaar numbers into the designated fields and select the 'View Link Aadhaar Status' option.

Upon doing so, the current status of your PAN-Aadhaar linkage will be displayed on your screen, providing you with the necessary information regarding the linkage process.

Verify the linkage status of your Aadhaar with PAN via SMS

Step 1 - Compose a message in the following format: UIDPAN [Your 12-digit Aadhaar Number] [Your 10-digit PAN Number].

Step 2 - Send this message to either 567678 or 56161.

Step 3 - Await a confirmation response from the government service.

If linked, a confirmation stating “Aadhaar is already associated with PAN [number] in ITD database” will be received. If not linked, you will receive a message indicating that “Aadhaar is not associated with PAN [number] in ITD database.” This service facilitates a convenient and efficient method for individuals to ensure their compliance with government regulations.

Link Aadhaar with a PAN card online

If your Aadhaar is not linked with your PAN card, initiating the linking process on the Income Tax website is imperative, which may involve a late penalty fee of Rs.1,000. You may refer to the detailed steps provided on the website for comprehensive guidance on paying the penalty and executing the Aadhaar-PAN linkage. Linking Aadhaar with PAN is streamlined for user convenience and can be summarized in a few key steps.

To link your Aadhaar with PAN card in a professional setting, follow these steps:

Access the Income Tax e-filing portal.

Select 'Link Aadhaar' under the 'Quick Links' section.

Input your PAN and Aadhaar numbers and click 'Validate'.

Proceed to 'e-Pay Tax' for payment.

Enter PAN and mobile number, then continue.

Under 'Income Tax', click 'Proceed'.

Complete the payment process.

Return to 'Link Aadhaar' under 'Quick Links'.

Re-enter PAN and Aadhaar details, then validate.

Add your Aadhaar number, mobile number, and OTP for final validation.

Your request will then be processed for validation by UIDAI. Alternatively, you can also visit a PAN card centre to submit a linking request form manually.

Fees for Aadhaar PAN card linking

The linkage of PAN with Aadhaar was complimentary until March 31, 2022. Post this date, up until June 30, 2022, a nominal penalty of Rs. 500 was applicable for linking. Subsequently, from July 1, 2022, the penalty amount for linking PAN with Aadhaar was revised to Rs. 1,000. It is imperative to pay this penalty for linking before June 30, 2023, to avoid the PAN card becoming inoperative starting July 1, 2023. This step ensures compliance with regulatory mandates and maintains the validity of the PAN card.

Who all should link Aadhaar with a PAN card?

Under Section 139AA of the Income Tax Act, all PAN cardholders must link their Aadhaar by June 30, 2023, with a stipulated penalty of Rs.1,000 for non-compliance, after which the PAN card will become inoperative. Exceptions to this requirement include non-resident Indians (NRIs), citizens above 80 years of age, and residents of Assam, Meghalaya, Jammu, and Kashmir. It is advised to verify your Aadhaar-PAN link status and ensure linkage by the specified deadline to maintain the operational level of your PAN card.

Now let’s understand Aadhaar-PAN linking status API

Aadhaar, a critical 12-digit identification number in India, necessitates using Aadhaar Verification API for reliable authentication. Given its importance in identification across various platforms, integrating Aadhaar API is crucial. At Instantpay, we offer specialised services to address the challenges of fraudulent Aadhaar use.

Our advanced methodology and robust algorithms are designed to validate Aadhaar details accurately, thereby supporting businesses and individuals in mitigating risks associated with counterfeit Aadhaar cardholders. Our verification process, which involves simply uploading Aadhaar data or a snapshot, ensures both efficiency and reliability in confirming Aadhaar credentials across India.

USP of Instantpay Aadhaar-PAN linking status API

The Aadhaar Verification API is meticulously developed using HTTP standard verbs and RESTful endpoints, ensuring high precision and intelligence in its architecture. This API is designed for optimal functionality and efficiency. Moreover, it incorporates comprehensive documentation, facilitating a seamless integration experience akin to a plug-and-play setup. This strategic approach ensures that the API performs effectively and integrates smoothly into various systems.

The API access is facilitated through HTTP requests directed to a specific version endpoint URL, utilising GET or POST methods for data retrieval. Each endpoint is secured with SSL-enabled HTTPS, ensuring data integrity and security. The API is structured with version control for methods, parameters, and other elements, requiring the inclusion of a version number in every call. Multiple versions with distinct endpoints are available.

Additionally, responses are systematically structured within a 'data' tag, typically including a status code, success flag, type, and address in each reaction, ensuring clarity and consistency in data delivery.

In the event of a failure, the API implements specific response codes for clarity and diagnostic purposes:

A 2xx series code indicates successful execution of the operation.

A 4xx series code signifies an error originating from the user's end.

These codes are crucial for identifying the nature of the issue and facilitating appropriate troubleshooting measures.

Industry Use Cases of Aadhaar Validation API

The Aadhaar Validation API is a powerful tool for verifying the authenticity of Aadhaar cards in India. Its applications go beyond simple identity verification, offering various benefits across various sectors. Here are some critical use cases for the Aadhaar Validation API in India:

[wptb id=2629]

Use Cases of Aadhaar Validation API

[wptb id=2641]

Digitalising Aadhaar verification through Instantpay's Aadhaar-linking status API unlocks significant benefits for institutions across diverse sectors. This innovative solution simplifies and expedites identity verification, offering immediate value in numerous scenarios.

Instantpay's API eliminates the complexities of implementing traditional UID verification methods. Removing tedious paperwork and manual processes offers a seamless and user-friendly experience for both institutions and individuals. The intuitive click-and-upload functionality significantly reduces friction and streamlines the verification process.

While immediate adoption of the API is highly encouraged, we recognise the importance of tailoring its integration to specific needs and workflows. Instantpay offers comprehensive support and guidance to ensure a smooth and efficient implementation, maximising the time and energy savings potential. By leveraging Instantpay's Aadhaar Verification API, institutions can unlock a new era of efficient, secure, and user-friendly identity validation, ultimately enhancing operational effectiveness and delivering excellent value to all stakeholders.

Frequently Asked Questions

Linking PAN with Aadhaar after the Deadline

Q: Can I link my PAN with my Aadhaar now?