#Accounting Software India

Explore tagged Tumblr posts

Text

Unlocking Efficiency with Link ID Assignment feature in RealBooks

In the dynamic world of business, keeping track of your financial data is essential. But with countless transactions occurring daily, maintaining accuracy and organization can feel like a constant struggle. Fortunately, RealBooks offers a powerful solution: the link ID assignment feature.

What is Link ID Assignment?

Link IDs are unique identifiers assigned to individual transactions. They act like labels, enabling categorization and tracking across different transactions and reports. Think of them as serial numbers for your transactions, offering a distinct reference point.

How Link IDs Simplify Your Life

1. Enhanced Tracking and Analysis: Say goodbye to sifting through endless data. Link IDs allow you to effortlessly track specific transactions across various ledgers and reports. This means you can identify trends, patterns, and anomalies with ease, gaining valuable insights into your financial health.

2. Error-Free Organization: Tired of duplicate entries and inconsistencies? Link IDs eliminate the confusion by ensuring each transaction has a unique identity. This promotes accuracy and organization in your financial records, boosting your confidence in data-driven decisions.

3. Effortless Exception Management: Not all transactions fit neatly into predefined categories. Link IDs come to the rescue by allowing you to assign them to a dedicated "exception" category. This keeps your main ledgers clean while still providing easy access to these transactions for analysis.

How to Leverage Link IDs in RealBooks:

To Use Link Transaction Feature first enable the feature from RealBooks Configuration option.

Go to Settings => Configuration => Accounts => General => Link Transaction

Click the Toggle button to enable the Link Transaction Feature.

Next, Enable Link id feature in Ledger

For ledger new Creation enable the toggle button available in right hand side of the screen.

For existing ledgers go to edit and enable it.

That’s it now just record entries and assign link ids in transaction page.

Take Control of Your Data

Whether you're a small business owner or a large organization, the link ID assignment feature in RealBooks empowers you to take control of your financial data. With increased accuracy, organization, and reporting capabilities, you gain the insights needed to make informed decisions and drive your business forward.

So, unleash the power of link IDs today and experience the difference in your financial management journey!

#accounting#online accounting software#accounting software#gst accounting software in india#accounting software india#cloud accounting software#gst accounting software#best accounting software for gst#cloud accounting#multi branch accounting software

0 notes

Text

Fundamentals of Forex Market (₹999)

Start your journey in currency trading with a comprehensive module covering forex basics, market dynamics, key terminology, and chart reading without getting overwhelmed. Ideal for beginners seeking clarity and direction.

#Best Trading App#Best Trading App in India#Trading Course app#Forex and Crypto Trading App#Forex Trading for Beginners#Price Action Trading Strategy#How to Learn Trading#Free Online Trading Courses#Stock Market Trading Courses#Trading On The Stock Market#Financial Markets In India#How to Learn Stock Market Trading#Currency Exchange Trading#Best Forex Trading Platforms in 2024#Price Action Trading#Open a Forex Trading Account#Basic to Advance Trading#Technical Analysis in Forex Trading#Best Technical Indicator for Trading#Basics of Indian Stock Market#Paper Trading Simulator#Bearish Candlestick Patterns#Best Charting Software in India#Smart Money Concepts (SMC)#Objectives of Fundamental Analysis#Financial Markets in India#Bullish Candlestick Patterns#Double Top Chart Pattern#Free Price Action Trading PDF#Ascending Triangle Pattern

0 notes

Text

Salesforce Service in India

#suitecommerce advanced implementation india#netsuite service provider india#customization#netsuite india#accounting software#erp application#best erp#erp#cloud erp#in house erp

0 notes

Text

Understanding HSN/SAC Codes for Indian Businesses

For any business working in the Goods and Services Tax regime in India, understanding HSN codes and SAC codes or applying them correctly is not merely a matter of fulfilling a legal requirement-it is an important aspect of ensuring bills are correctly prepared, that the right amount of tax is calculated, and GST has been properly complied with.

At first glance, these codes can appear complicated, but that is far from the truth-just like everything is based on common sense—these codes were developed with the intention that they provide uniformity and clarity in respect of classification of goods and services. Any other form of misclassification may have various consequences like levy of wrong tax, imposition of penalties, and reconciliation problems.

Tririd Biz, your trusted accounting and billing software in India, believes that GST compliance can be a little less challenging if it is clear upfront. This comprehensive guide will clarify HSN and SAC codes, show why these matters are of significance to your business, and even walk you through how our software makes managing HSN and SAC codes quite simple.

What are HSN Codes and SAC Codes?

Briefly:

HSN Code (Harmonized System of Nomenclature): These are internationally accepted classification codes for goods. The codes were evolved by the World Customs Organisation (WCO) to classify traded goods the world over systematically. In India, these codes are used in GST to assess the rate of tax applicable to different products.

Structure: While HSN codes remain international only till 6-digits, India in reality uses an HSN code of 2, 4, 6, or 8 digits depending on the turnover of the business. The more digits the code has, the finer the classification.

SAC Code (Service Accounting Code): In the same manner HSN is structured for goods, SAC codes are used to classify services. These codes are restricted to India and were developed by the Central Board of Indirect Taxes & Customs (CBIC) for service tax purposes, which were subsequently taken over by GST.

Structure: The SAC code is of 6 digits only; the initial two digits are '99' for services, and the next four digits specify the exact nature of service.

Why are HSN/SAC Codes Necessary for GST Compliance in India?

The primary reasons HSN/SAC codes are mandatory under GST are:

Uniform Classification: They ensure that goods and services are classified uniformly across India, preventing ambiguity and disputes regarding tax rates.

Tax Rate Determination: Every HSN/SAC code is linked to a specific GST rate. Using the correct code ensures you charge and pay the right amount of tax.

Invoice Generation: It is mandatory to mention the HSN/SAC code on GST-compliant invoices, especially for B2B transactions, if your turnover exceeds certain limits.

GST Return Filing: HSN/SAC-wise summary of outward supplies (sales) is required in GSTR-1, providing granular detail to the tax authorities.

Data Analysis & Policy Making: The government uses these codes to analyze trade data, understand consumption patterns, and formulate economic policies.

How Many Digits of HSN/SAC Code Do You Need to Use?

The number of digits you need to declare depends on your business's aggregate annual turnover in the preceding financial year:

For Goods (HSN):

Turnover up to ₹5 Crore: 4-digit HSN code (mandatory for B2B invoices)

Turnover exceeding ₹5 Crore: 6-digit HSN code (mandatory for all invoices)

Exports & Imports: 8-digit HSN code is generally required.

For Services (SAC):

All Turnovers: 6-digit SAC code is generally required.

(Always refer to the latest notifications from the GST portal for the most accurate and up-to-date requirements, as these thresholds can be revised.)

How to Find Your HSN/SAC Codes

Finding the right HSN/SAC code relevant to your goods or services is extremely important. Some good ways include:

GST Portal: The GST portal at times has search methods or links to official HSN/SAC code lists.

CBIC Website: Lists of HSN codes for goods and SAC codes for services are available on the Central Board of Indirect Taxes & Customs (CBIC) website.

Industry Associations: Your industry association might have compiled lists or issued guidelines for your particular industry.

Tax Consultants: A professional tax consultant will assist in determining the correct codes for your particular offerings.

Through Your Accounting Software: A good smart GST accounting software like Tririd Biz will take away a lot of these worries.

Common Mistakes to Avoid with HSN/SAC Codes

Using Wrong Codes: It is the commonest mistake, and these wrong codes can lead to wrong tax calculations, penalties, and problems for the customers in claiming ITC.

Not Updating Codes: As products or services change, or as GST rules change, always ensure your codes are up to date.

Ignoring Compulsory Requirements: Not mentioning the HSN/SAC code in the invoice, when it is required to do so, or putting in lesser digits than required, with respect to the turnover.

Confusing Goods with Services: Remember to use the HSN for goods and SAC for services.

Lack of Documentation: Failure to maintain documentation explaining the basis for assigning a certain HSN/SAC code, especially in the case of complex items.

How Tririd Biz Accounting & Billing Software Simplifies HSN/SAC Management

Managing HSN/SAC codes manually for every product and service can be tedious and error-prone, especially for businesses with diverse offerings. Tririd Biz is designed to take this burden off your shoulders:

Product/Service Master Data: Easily store and manage your products and services, each tagged with its correct HSN/SAC code and corresponding GST rate, within our software.

Automated Tax Calculation: When you create an invoice in Tririd Biz, the software automatically picks up the HSN/SAC code and applies the correct GST rate based on your master data. This minimizes manual errors.

Invoice Printing: Your GST-compliant invoices generated by Tririd Biz will automatically include the required HSN/SAC codes, ensuring you meet legal requirements.

GSTR-1 Summary: Tririd Biz helps in generating HSN/SAC-wise summaries for your GSTR-1, streamlining your return filing process.

Seamless Data Management: Update codes centrally, and the changes reflect across all relevant transactions, ensuring consistency.

By leveraging Tririd Biz, you can focus on growing your business, knowing that your GST billing and accounting are accurate and compliant with the latest HSN/SAC regulations.

Ensure Compliance, Embrace Simplicity

Understanding HSN/SAC codes is a fundamental aspect of GST compliance for Indian businesses. By dedicating time to correctly classify your goods and services and utilizing smart tools like Tririd Biz, you can ensure accuracy, avoid penalties, and simplify your entire GST filing process.

Ready to streamline your GST compliance with intelligent HSN/SAC management?

Get a Free Demo of Tririd Biz Today! Learn More About Tririd Biz GST Software Explore Tririd Biz Features

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

#Tririd Biz Accounting Software#HSN SAC codes India#GST codes for goods and services#Understanding HSN code#What is SAC code in GST#GST invoice HSN SAC

0 notes

Text

India Accounting Software Market Size, Share 2025-2033

India’s accounting software market reached a value of USD 639.99 Million in 2024 and is projected to grow to USD 1,416.62 Million by 2033, reflecting a CAGR of 9.20% during 2025–2033. The market is expanding rapidly due to the increasing use of automation, artificial intelligence (AI), and cloud-based platforms in financial operations.

#india accounting software market#accounting automation india#cloud accounting software india#ai in accounting india#msme accounting tools india

0 notes

Text

CA Client Management Software to Organize Your Practice

Organize your entire practice with feature-rich CA client management software. Designed for Chartered Accountants, it offers client profiles, task scheduling, document uploads, and deadline alerts—all in one centralized platform. With secure cloud storage and multi-user support, managing clients has never been easier. Enhance communication, improve client service, and streamline your accounting processes with software made specifically for CA professionals. Try a free demo and see the results yourself.

#CAofficemanagementsoftware#Best CA office management software#Chartered accountant software India#CA practice management tool#Office automation software for CA#Accounting firm management software#ca office#pl clients#pl client#client oms

0 notes

Text

India's No.1 Cloud-Based Imitation Jewellery Software – DoFort Jewellery ERP Software

DoFort Imitation Jewellery Software is a cloud-based platform designed specifically for businesses in the imitation and artificial jewellery sector. It facilitates the management of inventory, sales, accounting, customer relations, manufacturing processes, and billing, all from a single centralized interface. With features tailored to the industry, this software enables businesses to maintain organization, minimize errors, and grow effectively.

✅ Fully Cloud-based

✅ Tailored for the Indian imitation jewellery market

✅ Secure, scalable, and user-friendly

Benefits of Using DoFort Imitation Jewellery Software and Jewellery ERP Software in India

1. Complete Business Control:

DoFort's Imitation Jewellery Software and Jewellery ERP Software provide comprehensive management of your business operations, encompassing inventory, billing, manufacturing, accounting, and customer relationship management. You can eliminate the need to manage various systems or manual tasks, as everything is consolidated and accessible via a single dashboard. This integration facilitates quicker decision-making, enhances operational efficiency, and improves overall productivity within your jewellery enterprise.

2. Reduce Errors and Manual Work:

Errors in manual data entry related to inventory, billing, or accounting can adversely affect your business's financial standing and reputation. DoFort’s Jewellery ERP Software streamlines essential processes, including stock management, billing computations, and GST report creation, thereby minimizing errors and enhancing precision. This automation enables your team to concentrate on business expansion instead of spending time rectifying errors.

3. Improve Customer Experience:

In the imitation jewellery industry, providing prompt and tailored service is essential. DoFort’s Imitation Jewellery Software facilitates expedited billing, precise stock management, and tracking of customer loyalty. This allows for the identification of returning clients, the provision of loyalty incentives, the distribution of customized promotions, and the assurance of faster checkout processes — all contributing to an enhanced customer experience that fosters repeat patronage.

4. Boost Productivity:

Efficiency is paramount, particularly in the competitive landscape of the Indian imitation jewellery sector. With DoFort Jewellery ERP Software, your team can execute functions such as inventory management, invoicing, accounting, and order processing more swiftly and effectively. By automating routine tasks and offering real-time access to crucial data, your employees can enhance their productivity, which in turn leads to increased profitability for your enterprise.

5. Stay GST and Compliance Ready:

Navigating tax regulations in India can be challenging, particularly for jewellery enterprises managing various categories and SKUs. DoFort’s Jewellery ERP Software is designed with Indian GST compliance as a priority. This software automates the recording of GST amounts, generates tax invoices, prepares GST reports, and facilitates precise return filings, thereby ensuring that your business stays fully compliant and ready for audits without requiring manual intervention.

6. Enhance Visibility:

DoFort Imitation Jewellery Software offers cloud-based access, enabling comprehensive visibility into your business operations at any time and from any location. You can monitor real-time inventory levels, observe sales trends, analyze customer behavior, and evaluate financial reports using your laptop or mobile device. Enhanced visibility translates to improved control, quicker resolution of issues, and more informed decision-making, which are crucial for businesses aiming to grow throughout India.

7. Increase Profitability:

By reducing manual errors, optimizing inventory, streamlining production processes, and enhancing customer service, you can naturally increase your profit margins. Implementing DoFort’s Jewellery ERP Software allows you to lower operational expenses, minimize manufacturing waste, and improve sales conversions, all of which contribute positively to your overall profitability.

8. Easy Multi-Store Management:

Are you considering expanding to new locations? DoFort Imitation Jewellery Software facilitates seamless multi-branch operations. It allows for the management of various stores or warehouses from a single centralized system, enabling the tracking of inventory movements, employee performance, customer interactions, and financial reports across all locations without the necessity for separate systems. This solution is ideal for expanding brands looking to grow across various cities and states in India.

9. Manufacturing Efficiency:

For businesses engaged in the in-house production of imitation jewellery, it is essential to oversee raw materials, production orders, and quality assurance. DoFort Jewellery ERP Software facilitates effective planning of manufacturing processes, enables monitoring of material consumption, tracks production schedules, manages costs, and reduces waste. Consequently, this leads to enhanced manufacturing efficiency, quicker turnaround times, and superior quality products delivered to customers.

10. Future-Proof Your Business:

The rapid advancement of technology is accompanied by increasing customer expectations. DoFort's cloud-based Imitation Jewellery Software and Jewellery ERP Software enable your business to maintain a competitive edge by embracing cutting-edge technology. With consistent software updates, improved security measures, data backup solutions, and mobile accessibility, you can manage and expand your jewellery business with confidence, free from concerns about obsolescence.

Conclusion:

In a sector where each customer interaction, every unit of inventory, and every currency unit is significant, DoFort’s Imitation Jewellery Software and Jewellery ERP Software provide a transformative benefit. By optimizing your operations and facilitating rapid growth while ensuring compliance, DoFort enables imitation jewellery enterprises in India to reach unprecedented levels of success. Transition to India's leading cloud-based imitation jewellery software today, Choose DoFort for a smarter, faster, and more profitable future.

#jewellery software#jewellery erp software#jewellery erp#jewellery billing software#jewellery accounting software#imitation jewellery software in india#jewellery erp system

0 notes

Text

India’s Trusted Jewellery Accounting Software

Say goodbye to generic tools! Jwelly ERP is tailor-made jewellery accounting software with GST, MIS, payroll, and custom reports for jewellery businesses. Discover the power at jwelly.com.

#jewellery software#jewellery billing software#jewellery management software in India#jewellery accounting software#jewellery showroom software#jewellery taging software

0 notes

Text

Empower Your Business with Smarter Tally Customization | Rajlaxmi Solutions

In an age where every second counts, your business tools should work for you—not the other way around. While Tally is already a trusted platform for accounting, the real magic happens when it’s customized to match your business's unique needs.

At Rajlaxmi Solutions, we help you unlock the full power of Tally by tailoring it to fit your exact workflow, industry, and operational goals.

⚡ Why Customizing Tally Makes All the Difference

Tally’s default features serve as a solid foundation—but every business has its own processes, challenges, and goals. Customizing Tally allows you to:

Eliminate repetitive manual work

Get reports that actually support decision-making

Stay compliant without the chaos

Streamline your entire financial ecosystem

In short? You stop working around your software and start working with it.

🔑 Key Benefits of Tally Customization

🔄 Process Automation

Minimize errors and save time with automated billing, voucher entries, and report generation—giving your team more time to focus on what really matters.

📈 Business-Specific Reports

Whether it’s inventory turnover, overdue receivables, or custom KPIs—get insights that truly reflect your business’s performance.

🔗 Third-Party Integration

Link Tally with other platforms like CRMs, payroll software, or e-commerce systems to keep everything synced in real-time.

🧾 Hassle-Free GST Compliance

Custom modules help you generate returns, e-invoices, and e-way bills with ease—ensuring accuracy and avoiding penalties.

��� Controlled User Access

Assign roles and permissions to different team members, enhancing security and accountability.

📊 What Our Clients Have Achieved

After switching to customized Tally setups, our clients have reported:

Up to 60% improvement in operational efficiency

Dramatic reduction in manual errors

Faster decision-making from real-time data

Greater ease in managing compliance and audits

👨💼 Why Partner with Rajlaxmi Solutions?

We don’t believe in cookie-cutter solutions. Our team takes the time to understand your business model, challenges, and growth goals. Then we create a customized Tally setup that feels like it was built just for you—because it was.

🚀 Ready to Upgrade How You Work?

Don’t let outdated systems slow you down. With Rajlaxmi Solutions, Tally becomes more than just accounting software—it becomes your business advantage.

📞 Get in touch today and explore how Tally customization can transform your business from the inside out.

#Tally Customization Services#Business Process Automation#Tally ERP Solutions#Customized Accounting Software#Rajlaxmi Solutions#Tally for Small Business#Finance Automation Tools#Workflow Optimization#ERP Integration#Business Software India

1 note

·

View note

Text

What is a Demat Account? Types, Benefits, Meaning and Working

Learn what a Demat account is, its benefits, types, opening process, and why brokers are essential for trading in India’s stock market. Open a Demat Account here.

Read more..

#Demat Account#Open Demat Account#Demat Account Online#Demat Account Opening#demat account charges#demat account login#Demat account app#Bigul Demat account#Demat Account Types#Demat Account Benefits#Demat Account Meaning#Demat Account Opening Process#Demat Account Working#Trading in India#Trading in Indian Stock Market#Stock Brokers#Online Demat Account Opening#Bigul Demat account app#Demat Account in India#algo trading#algo trading app#bigul#algo trading india#algo trading platform#algo trading strategies#bigul algo#free algo trading software#algorithm software for trading#finance#investment platform

0 notes

Text

Beyond Troubleshooting: RealBooks Support – Your Co-Pilot in Financial Excellence

In the dynamic world of business, accounting plays a crucial role in ensuring financial stability and growth. RealBooks, a leading provider of online accounting software in India, understands this importance and has built a robust support system to assist its users every step of the way.

The Human Touch

RealBooks knows that every problem you have is different, so we give you personalized attention. Our support team is made up of experts who are ready to help you with whatever you need. Whether you're a small business owner or a big company, our goal is to make sure you have the support you need when you need it.

Operating Hours

Our support service operates during standard business hours, ensuring that you have access to assistance when most needed. We believe in quality over quantity, focusing on delivering impactful solutions during the times you're actively engaged with your accounting processes.

How It Works

Reaching out for support is a breeze. Simply dial our helpline during operating hours, and you'll be connected with a knowledgeable support representative. Alternatively, if you prefer written communication, you can also reach us via email. Our team is ready to assist with everything from software navigation to troubleshooting.

Beyond Troubleshooting

RealBooks support goes beyond just resolving issues. We view each interaction as an opportunity to empower our users. Whether you need clarification on a feature, want guidance on best practices, or seek advice on optimizing your accounting processes, our team is here to help.

Continuous Improvement

Your feedback matters. We constantly strive to enhance our support services based on user experiences and evolving needs. By listening to your suggestions and concerns, we ensure that our support system grows and adapts alongside your business.

Instant Responses for Seamless Resolution

RealBooks understands that time is of the essence in business, and delays in resolving accounting issues can have significant consequences. That's why we prioritizes instant responses to customer inquiries. Whether you reach out through phone, email, or chat, you can expect a quick and helpful response from RealBooks' support team.

Having a strong support system is like having a compass for any business, regardless of its size or stage. RealBooks is here to help you navigate the ups and downs of your financial journey. We're committed to providing you with the support you need during our regular business hours. While we might not be available around the clock, our focus on excellence during operating hours ensures that you receive the support you deserve.

Remember, at RealBooks, success is not just a destination; it's a journey we navigate together.

#accounting#online accounting software#accounting software#gst accounting software in india#accounting software india#cloud accounting software#gst accounting software#best accounting software for gst#cloud accounting#multi branch accounting software#freeaccountingsoftware#freeaccountingsoftwareinindia

0 notes

Text

Forex Basics and Profit Plan for Jaipur

Learn key forex concepts, develop a clear trading plan, manage risks, and start your profitable forex journey in Jaipur confidently.

SOCIAL MEDIA LINKS https://x.com/profithill21263https://www.youtube.com/@edu.profithillshttps://www.facebook.com/Edu.profithills/https://www.linkedin.com/company/edu-profithills/https://www.instagram.com/edu.profithills/?hl=enhttps://in.pinterest.com/profithillseducation/

#Best Trading App#Best Trading App in India#Trading Course app#Forex and Crypto Trading App#Forex Trading for Beginners#Price Action Trading Strategy#How to Learn Trading#Free Online Trading Courses#Stock Market Trading Courses#Trading On The Stock Market#Financial Markets In India#How to Learn Stock Market Trading#Currency Exchange Trading#Best Forex Trading Platforms in 2024#Price Action Trading#Open a Forex Trading Account#Basic to Advance Trading#Technical Analysis in Forex Trading#Best Technical Indicator for Trading#Basics of Indian Stock Market#Paper Trading Simulator#Bearish Candlestick Patterns#Best Charting Software in India#Smart Money Concepts (SMC)#Objectives of Fundamental Analysis#Financial Markets in India#Bullish Candlestick Patterns#Double Top Chart Pattern#Free Price Action Trading PDF#Ascending Triangle Pattern

0 notes

Text

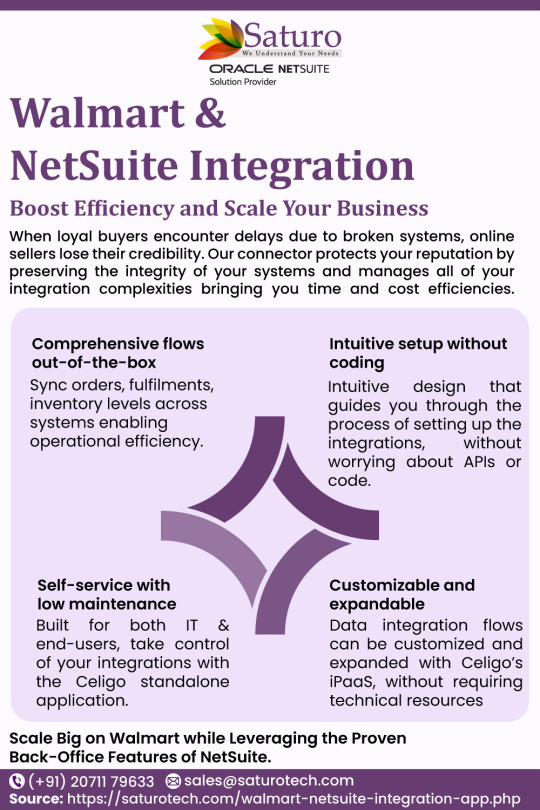

Walmart & Netsuite Intergation.

#netsuite service provider india#suitecommerce advanced implementation india#netsuite india#accounting software#customization#in house erp#best erp#erp application#erp#cloud erp

0 notes

Text

Budget-Friendly Billing Software in India at just ₹299!

Are you a small retailer, a service provider, or a large enterprise, then a billing software is essential to make operations smoother. With most billing software priced too high, businesses often find it hard to streamline their processes. That’s where Koka Books steps in, a customizable billing software available at an unbelievable price of just ₹299 per month!

Why Choose Koka Books?

Koka Books is a billing software tool designed for businesses across all industries from retail and healthcare to manufacturing and freelancing. It offers an easy-to-use platform that helps you generate invoices, track payments, and manage taxes effortlessly.

Affordable Pricing

Many billing software solutions in India charge thousands per year, making it hard for small businesses to manage expenses. Koka Books offers a powerful, feature-packed solution for just ₹299/month, ensuring that every business, regardless of size, can access affordable and efficient billing software.

At just ₹299, you get access to a premium billing software that eliminates the need for expensive accounting solutions. This budget-friendly option ensures that businesses can maintain accurate financial records without breaking the bank.

Key Features of Koka Books

Customizable Invoices

Create professional, branded invoices that align with your business identity. Add your company logo, colors, and custom fields to ensure each invoice reflects your unique style and requirements.

Multi-Industry Support

Designed to meet the needs of various industries, including retail, wholesale, freelancing, and service-based businesses. Whether you sell products, offer services, or manage bulk orders, the software adapts to your workflow.

GST-Compliant Billing

Simplify your tax process with automated GST calculations, integrated tax slabs, and easy-to-generate tax reports. Ensure accurate invoicing and remain fully compliant with India’s GST regulations.

Payment Tracking

Track outstanding and completed payments in real-time. The system helps you manage cash flow efficiently by sending automated reminders for overdue payments.

Inventory Management

Monitor stock levels with ease and receive timely alerts when products are running low. This feature ensures you never face unexpected shortages and can plan purchases accordingly.

User-Friendly Interface

Designed for simplicity, the intuitive interface requires no accounting expertise. Users can create invoices, track expenses, and generate reports with minimal training.

Cloud-Based Access

Access your business data securely from any device with an internet connection. Whether you’re working from the office, home, or on the go, your information is always available and up to date.

Customizable for All Industries:

Unlike other billing software, KOKA Book is made to work for all kinds of businesses, including:

Retail & E-commerce – Quick and accurate invoice generation.

Healthcare & Pharmacies – Manage prescriptions and billing effortlessly.

Construction & Real Estate – Keep track of project payments and vendor invoices.

Logistics & Transportation – Generate freight invoices and track payments.

IT & Freelancers – Simplify client billing and track payments hassle-free.

Get Started Today!

Koka Books Budget-Friendly Billing Software is the perfect solution for businesses looking for a cost-effective, efficient, and scalable invoicing tool. At just ₹299 per month, you get a complete billing solution tailored to your industry’s needs.

Don’t let complex billing slow down your business. Upgrade to Koka Books today and experience seamless invoicing at an unbeatable price!

#billing software#accounting software#affordable#billing services#software#low cost#billing software in India

1 note

·

View note

Text

Client Management Software for CA Firms Made Easy

Simplify your workflow with efficient client management software for CA firms. This solution helps you handle client data, follow-ups, and document sharing all in one place. With built-in reminders, audit trail tracking, and CRM tools, you can maintain strong client relationships effortlessly. Ideal for busy Chartered Accountants, this software supports your daily operations and boosts productivity. Stay organized and focused on what matters most—serving your clients better.

#CAofficemanagementsoftware#Best CA office management software#Chartered accountant software India#CA practice management tool#Office automation software for CA#Accounting firm management software#ca office#pl clients#pl client#client oms

0 notes

Text

The Role of GST Billing Software in Enhancing Tax Filing Efficiency for Indian Startups

In recent years, the Goods and Services Tax (GST) has revolutionized the tax landscape in India, unifying multiple indirect taxes into a single framework. For Indian startups, the adoption of GST billing software has become a crucial factor in ensuring tax compliance and maximizing efficiency. Startups, often facing resource and time constraints, can benefit significantly from GST billing software. This article explores how GST billing software plays a key role in enhancing tax filing efficiency for Indian startups.

What is GST Billing Software?

GST billing software is an automated tool designed to help businesses generate GST-compliant invoices, calculate GST on transactions, maintain records, and file returns. The software ensures that businesses comply with GST regulations while also streamlining the entire process of tax-related documentation and filing. The benefits of GST billing software are particularly impactful for startups, where managing resources and time efficiently is essential for growth.

Key Benefits of GST Billing Software for Indian Startups

1. Automated GST Calculations

GST billing software automates the calculation of GST on sales and purchases, reducing the possibility of human error. Startups can rest assured that their GST calculations are accurate, which is critical when filing returns. Whether dealing with multiple tax rates (CGST, SGST, IGST) or exemptions, the software ensures that businesses comply with the latest tax laws.

2. GST-Compliant Invoice Generation

One of the primary features of GST billing software is its ability to generate GST-compliant invoices. These invoices follow the GST format, including details such as the GSTIN number, tax amount, and applicable tax rates. By automating the invoicing process, startups can ensure that they always issue accurate invoices, which is a key requirement for claiming input tax credit (ITC).

3. Streamlined GST Return Filing

GST filing can be complex, especially for startups that are still learning the ins and outs of tax compliance. GST billing software simplifies the process by automating the preparation of returns like GSTR-1, GSTR-3B, and other relevant forms. The software also integrates directly with the GST portal, enabling seamless filing with minimal manual effort. This ensures that startups don’t miss deadlines and avoid penalties for late or incorrect filings.

4. Time and Resource Efficiency

For startups, time and resources are limited. GST billing software can save valuable time by automating tasks such as invoicing, tax calculation, reconciliation, and filing. This reduces the administrative burden on startup teams, enabling them to focus on core business operations and growth strategies. The software also eliminates the need for manual entries and error-prone spreadsheets, reducing the chances of mistakes.

5. Real-Time Data Access and Reporting

GST billing software allows businesses to access real-time data, helping them stay on top of their financials. This includes tracking sales, purchases, and GST-related transactions. The software generates detailed reports on tax liabilities, input tax credits, and other key financial metrics. These insights help startups make informed decisions and maintain financial transparency, both of which are vital for securing funding or attracting investors.

6. GST Reconciliation Made Easy

GST billing software makes it easier to reconcile sales and purchase data. This feature ensures that the input tax credit (ITC) claimed by the business matches the tax paid on purchases. GST reconciliation can be a tedious task, but with automated software, discrepancies are flagged early, and businesses can correct them before filing returns. This ensures that no credits are missed, reducing tax liabilities and increasing the efficiency of the entire GST process.

7. Cost-Effective Solution

Many GST billing software options come with affordable pricing plans, making them accessible for startups operating on a tight budget. By using GST billing software, startups can avoid penalties associated with non-compliance or incorrect tax filings. Additionally, the software's ability to streamline tax filing and invoicing reduces the need for hiring dedicated accountants or tax professionals, further lowering operational costs.

How GST Billing Software Enhances Tax Filing Efficiency for Startups

1. Minimizes Errors and Ensures Accuracy

GST filing involves dealing with various tax rates and compliance requirements. Mistakes in tax calculations or filings can lead to penalties and legal issues. GST billing software reduces human error by automating the entire process, ensuring that all transactions are correctly accounted for and reported.

2. Reduces Compliance Risks

GST compliance is mandatory, and failing to comply with regulations can result in heavy penalties and fines. GST billing software ensures that startups remain compliant with the latest GST rules, automatically updating the software to reflect any changes in tax laws or requirements. This reduces the risk of non-compliance, which is especially critical for new businesses trying to establish themselves in the market.

3. Faster Filing and Submission

Filing GST returns manually can be time-consuming and prone to delays. GST billing software streamlines the filing process by automatically generating returns and submitting them directly to the GST portal. This ensures that startups can meet filing deadlines, avoiding penalties for late submissions.

4. Real-Time Updates on GST Liabilities

GST billing software tracks GST liabilities in real-time, providing startups with a clear view of how much tax they owe. This enables businesses to make timely payments and avoid late fees. Moreover, the software ensures that startups do not miss out on claiming input tax credit, which can significantly reduce tax liabilities.

5. Easy Integration with Other Tools

Most GST billing software can integrate with other accounting, inventory, and ERP software, creating a seamless flow of data across platforms. This integration helps startups streamline their entire financial workflow, from procurement to invoicing to tax filing, resulting in better operational efficiency.

Popular GST Billing Software for Startups in India

Several GST billing software options are tailored for startups in India. Here are a few of the most popular choices:

1. TallyPrime

TallyPrime is a trusted and comprehensive GST software, offering features like automatic tax calculation, multi-GST return filing, and seamless integration with GST portals.

2. Zoho Books

Zoho Books is an affordable GST-compliant accounting software that enables startups to create GST invoices, file returns, and track taxes. Its intuitive interface makes it an excellent choice for small businesses.

3. ClearTax

ClearTax is a user-friendly GST software designed for simplicity and accuracy. It helps businesses file returns, generate invoices, and track GST liabilities without any hassle.

4. QuickBooks

QuickBooks is another popular choice for startups, offering features like automated GST calculations, GST return filing, and real-time financial reporting.

5. Smaket Billing Software

Smaket offers GST-compliant invoicing and easy GST return filing. It provides customizable templates and is suitable for small startups looking for an efficient, cost-effective solution.

Conclusion

For Indian startups, the adoption of GST billing software is not just about compliance; it’s about increasing efficiency and freeing up valuable resources. By automating tax calculations, simplifying GST return filing, and improving data accuracy, startups can focus on scaling their operations and driving growth. With the right GST billing software, Indian startups can navigate the complexities of GST compliance with ease, ensuring a smoother and more successful business journey.

#accounting software#software#gst billing software#accounting#smaket#gst#billing#Startups#INDIA#ODISHA#BHUBANESWAR

0 notes