#billing software

Explore tagged Tumblr posts

Text

2 notes

·

View notes

Text

Procure-to-Pay (P2P) is a process

Procure-to-Pay (P2P) is a process that manages the purchase of goods and services in a business, from requesting items to making payments. Here are the key steps involved:

Identifying Needs: Recognising the requirement for goods or services.

Requisition Approval: Approval of purchase requests by relevant authorities.

Supplier Selection: Choosing suppliers based on price, quality, and delivery time.

Purchase Order Creation: Issuing a formal order to the supplier with details.

Receiving Goods/Services: Inspecting goods upon arrival to ensure accuracy.

Invoice Matching: Verifying the supplier’s invoice against the order and receipt.

Payment Approval: Reviewing and approving the payment.

Payment Execution: Processing payment to the supplier.

Record Keeping: Storing transaction records for compliance and future reference.

P2P helps businesses control costs, improve efficiency, and maintain compliance with policies. Automation of this process, through systems like SAP or Oracle, can further streamline operations.

2 notes

·

View notes

Text

Strong Business Starts Here: Smart Billing for Gyms & Fitness Clubs

Discover how Invoicera’s powerful billing software for Gyms & Fitness Clubs helps streamline payments and automate your workflow. From automated billing to customizable invoicing templates, manage memberships, sessions, and fees with ease.

This is the fitness club billing software your gym needs to boost efficiency and revenue. Watch now and take control with smarter gym billing software!

1 note

·

View note

Text

Ready to streamline your invoicing process?

In this video we introduce you to our powerful Invoice Temple app—your ultimate solution for creating professional invoices effortlessly.

Discover:

✅ How to use our free invoicing software to save time and boost efficiency.

✅ Tips for customizing your invoices to reflect your brand.

✅ Features that make invoicing simple and error-free.

Say goodbye to complicated invoicing and hello to smooth operations! Don’t forget to like, subscribe, and hit the notification bell for more tips and tricks.

Website: https://www.invoicetemple.com https://www.instagram.com/invoicetemple https://www.facebook.com/Invoicetemple Twitter: https://twitter.com/InvoiceTemple

#accounting#freeinvoice#freeinvoicegenerator#freeinvoicesoftware#branding#finance#billing software#startup#entrepreneur

2 notes

·

View notes

Text

A Successful Inventory and Billing Solution for Businesses in Saudi Arabia

One's inventory and bills can be the lifeline in a fast-paced, modern business environment within Saudi Arabia (KSA). Be it small or big enterprises, an efficient inventory and billing solution leads the way for the difference in the end. From tracking levels of stock towards generating perfect, accurate invoices, these tools enable your business to run seamlessly. Business houses in KSA prefer Tally Solutions as one of the top ones to gain complete solutions related to managing the inventory and requirements for billing.

Why inventory software is important to Saudi Arabian businesses:

Inventory software is something that cannot be avoided today as it really helps the business manage stock and optimize operations. Here are a few reasons why it becomes necessary for the businesses in Saudi Arabia:

It is real-time monitoring of the stock; thus, no overstocking and stockouts are encountered.

Improvement in the accuracy; here human errors can be completely removed, thus avoiding any kind of mismanagement of the inventory as well as missed orders.

Excess stocks are reduced so that holding costs are also low.

There is assurance the product will get delivered on the scheduled date with adequate inventory availability for customer fulfilment.

Tally Solutions is one of the leading companies, providing stockroom software across the globe including KSA.

Key Features:

Inventory Monitoring: Maintains records of various warehouses, such that stock of various items and places can easily be viewable at any time.

Barcoding and Scanning: This allows easy identification of products with barcode scanning for faster data entry.

Procurement and Sales Management: It reduces the procurement and sales process. Paperwork is eliminated, thus increasing efficiency.

Stock Valuation: It provides multiple methods of inventory valuation, including FIFO, LIFO, and Weighted Average.

Integration Capabilities: It successfully integrates with every other business application like accounting smoothly without any kinds of hurdles flowing data.

Benefits of billing software for businesses in Saudi Arabia:

Efficient Management of Invoices: The whole procedure of raising and managing the invoices is automatic for saving time and avoiding any errors.

GST Compliance: All the invoices will be as per the Saudi tax rules, and all compliance concerning VAT and other financial compliances will be taken care of.

Customization: It would allow businesses the potential to personalize their invoices in accordance with the brand identification of the businesses.

Real-time Reporting: It would give real-time financial reporting, thus reducing the complexity and increasing the productivity of tracing payments and handling accounts.

1 note

·

View note

Text

1 note

·

View note

Text

Searching for reliable Erp software?

Look no further than Hamro SAN. Designed for businesses such as restaurants, hotels, cafes, supermarkets, and manufacturing houses, Hamro SAN offers comprehensive modules for order processing, point of sale, inventory management, and accounting. The software features zero configuration, end-to-end encryption, and a user-friendly dashboard. Additionally, Hamro SAN provides 24/7 customer support, training materials, and flexible pricing plans to enhance productivity and operational efficiency. Choose Hamro SAN for a seamless and secure business management solution.

https://hamrosan.com/about/

2 notes

·

View notes

Text

Transforming Quote-to-Cash Process for Businesses using BRIM

Acuiti Labs provides guidance to businesses on harnessing the power of SAP solutions for transforming business processes, particularly in the realms of billing, subscription, and usage-based operational models.

https://www.acuitilabs.com/

2 notes

·

View notes

Text

Annual Return filling- A complete guide

Introduction

From July 1, 2017, India's GST (Goods and Services Tax) has replaced various indirect taxes imposed by the state and federal governments. Every financial year, registered taxpayers must submit a complete GST annual return. According to the Goods and Services Tax Act, a yearly return must be filed with the government. GST aims to convert the entire nation into a single market.

If you are new to GST and eager to know how this new tax will affect you and your business, how to file annual returns, and other related topics, this section will help you understand the basics of annual return filing.

What is the GSTR-9?

GSTR 9 is a yearly return to be filed annually by taxpayers registered under GST and includes details regarding the outward and inward supplies made and received during the relevant financial year under different tax heads, i.e., CGST, SGST & IGST, and HSN codes. Although it is a complex process, this return helps in the extensive data reconciliation for 100% transparent disclosures. The last date to submit the GSTR 9 form is December 31 from the subsequent financial year.

Types of GSTR-9

There are four types of GSTR-9 annual returns under the GST law.

GSTR 9- It comprises registered taxpayers who file GSTR- GSTR-2, GSTR-3, and GSTR 3B

GSTR-9A- Registered and composite dealers come under this.

GSTR-9B- It includes e-commerce dealers

GSTR-9C- It is an audit form that has to be filed by all the companies with a turnover crossing ₹2 Crores in a financial year.

Who should file GSTR-9, the annual return?

All business dealers and owners registered under the GST system must file their GST returns using applicable forms, either online or offline. However, there are some exceptions, and the list includes:

The person who falls under the "Casual Taxable Person".

The person who is not a resident of India.

Any e-commerce website or portal collecting TCS.

Penalty of late filing ITR

Every taxpayer must submit the GSTR 9 form within the given time limit. If he fails to comply with that, there is a considerable GSTR 9 penalty amount of 200 INR per day. This late fee consists of CGST 100 INR per day and SGST 100 INR per day, and there is no late fee payment on IGST. The penalty amount will not exceed the taxpayer's quarter turnover.

How does Eazybills help you file GSTR-9?

Eazybills is an online accounting software that helps you manage your finances and file GST returns.

When you generate a GSTR-9 summary on the GSTN, the transaction details may differ from what you've recorded in your books of accounts. When this happens, you must manually reconcile the information, which can be tedious and error-prone. With Eazybills, you can connect to the GSTN and generate a GSTR-9 summary based on the transactions you've created, then fetch the GSTR-9 summary from the GSTN and compare them to see which fields need to be updated. Once done, you can file the updated summary to the GSTN. This reduces the amount of time you spend updating your returns.

Conclusion

When submitting GST returns, taxpayers encounter technical problems, lengthy processes, and ambiguous regulations.Follow Eazybills for the latest updates, news blogs, and articles related to business tips, income tax, GST, GSTR-9, and GST returns.

#billing software#gst billing software#best billing software#invoice software#free invoice software#invoicing software#free invoicing software#software for billing#GSTR-9

1 note

·

View note

Text

Best Restaurant Billing Software | DSO Software

Restaurant Billing Software helps you to efficiently manage your restaurant business with exciting features such as Ordering & POS Billing, reducing wastage and misuse and developing accountability. For more information, visit our website.

1 note

·

View note

Text

How to Automate Invoices with Billeasy

A Simple Guide for Businesses

Managing invoices manually can be time-consuming, error-prone, and frustrating—especially as your business grows. If you find yourself spending hours every week generating bills, sending reminders, or tracking payments, it’s time to switch to automation.

That’s where Billeasy, a powerful billing software, makes your life easier. With its smart automation tools and Online Invoice Generator, you can streamline your entire invoicing process—saving time, improving accuracy, and getting paid faster.

In this blog, we’ll walk you through how to automate your invoices using Billeasy, step-by-step.

Why Automate Invoicing?

Before we dive in, let’s understand why invoice automation is a game changer:

✅ Saves Time – No more repetitive data entry

✅ Reduces Errors – Avoid mistakes in amounts, dates, or client info

✅ Faster Payments – Get paid quicker with timely invoices and reminders

✅ Improves Cash Flow – Stay on top of what’s due and when

✅ Better Recordkeeping – Keep everything organized and accessible

Now, let’s explore how Billeasy helps you do all of this effortlessly.

Step 1: Set Up Your Business Profile

After signing up for Billeasy, the first step is to complete your business profile. Add your company name, logo, GST details, and bank/payment information. This ensures your invoices look professional and include all required compliance fields.

Once saved, Billeasy automatically applies these details to every invoice you create—no need to re-enter them each time.

Step 2: Add Your Clients and Products

With Billeasy’s intuitive dashboard, you can quickly add customer information and your list of products or services. You can even set tax rates, item descriptions, and pricing. These saved entries help you generate invoices with just a few clicks.

This feature is especially helpful for businesses with recurring clients or fixed service packages.

Step 3: Use the Online Invoice Generator

Billeasy’s built-in Online Invoice Generator lets you create invoices in minutes. Choose your client, add products or services, select taxes, and hit “Generate.” The invoice is ready to go—professionally formatted and fully customizable.

Even better, the system supports automatic invoice numbering and date-stamping to keep things organized.

Step 4: Enable Auto-Reminders and Recurring Invoices

One of Billeasy’s most useful automation features is the ability to set up:

Recurring invoices for ongoing services (weekly, monthly, etc.)

Auto-reminders for upcoming or overdue payments

Once enabled, the system sends these out automatically via email or even WhatsApp (if integrated). No manual follow-up needed.

Step 5: Track Payments in Real Time

Billeasy’s billing software gives you a clear dashboard showing which invoices are paid, pending, or overdue. You can also link payment gateways, so clients can pay directly from the invoice. The system automatically updates the payment status, so you don’t have to chase or update it manually.

Bonus: Export Reports Anytime

Need a quick look at your earnings or taxes? Billeasy lets you generate financial reports instantly—perfect for tax filings, audits, or strategic planning. Everything stays synced and transparent.

Final Thoughts

Automating your invoicing process doesn’t just save time—it helps your business run smarter and smoother. With Billeasy’s easy-to-use billing software and powerful Online Invoice Generator, you can focus more on growth and less on paperwork.

Whether you're a freelancer, retailer, or small business owner, Billeasy is built to simplify your billing and keep your cash flow healthy.

Automate your billing, track payments, and grow faster with Billeasy — start your free trial now!

0 notes

Text

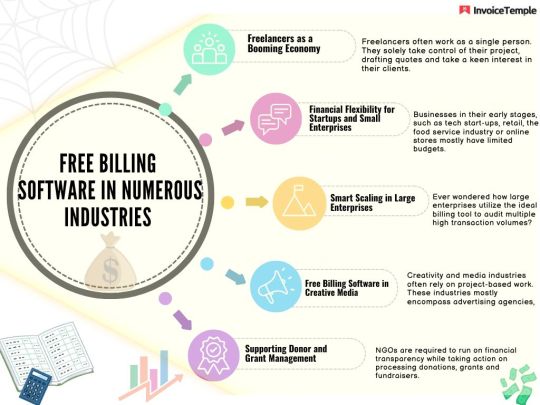

Free billing software for every industry! 🚀 From freelancers to large enterprises, InvoiceTemple supports your financial needs with ease. 💼 Visit www.invoicetemple.com to explore!

1 note

·

View note

Text

Simplify Business Finances with VAT-Ready Accounting Software in Saudi Arabia

Looking for accounting that fits Saudi business rules? This accounting software in Saudi Arabia is tailored to meet local compliance and operational needs. ✔️ VAT-compliant invoicing and reporting ✔️ Bilingual support for Arabic and English ✔️ Real-time financial insights and reports ✔️ Easy management of inventory, payroll, and banking ✔️ Scalable for businesses of every size

Run your accounts with accuracy, compliance, and complete peace of mind.

#accounting software online#billing software#business management software#vat return filing software

1 note

·

View note

Text

Top 10 Essential Features for School Billing Management Software

Handling school fees manually is labor-intensive, prone to mistakes, and outdated. As the demand for digital transformation in education increases, schools are increasingly adopting school billing management software to automate and streamline fee collection. However, with numerous options available, how can you select the most suitable one? Here is a compilation of the top 10 features that every school billing software should possess to assist your institution in saving time, minimizing errors, and enhancing the experience for both parents and staff.

1. Automated Invoicing and Fee Scheduling An effective system should automatically create and dispatch invoices based on fee structures, class assignments, or specific criteria. This functionality guarantees timely invoice delivery, thereby reducing delays and manual effort. 2. Online Payment Capabilities Parents seek convenience. The software should facilitate secure online fee payments through credit/debit cards, UPI, net banking, or digital wallets. This feature eliminates the necessity for in-person visits and enhances collection rates.

3. Adaptable Fee Structure

Each student has unique needs. Whether it involves scholarships, discounts, transportation fees, or extracurricular charges, the system must support customizable fee plans tailored for each student or group.

4. Real-Time Payment Monitoring

Monitor all payments as they occur. Real-time tracking enables school personnel to see who has made payments, who has not, and which amounts are outstanding—simplifying collections and follow-ups significantly.

5. Secure and Encrypted Platform Security is paramount.

Opt for a platform that provides data encryption, secure payment gateways, and role-based access control to safeguard sensitive financial and student data.

6. Parent and Student Portals

Facilitate access for parents and students to view fees, download receipts, and process payments. An intuitive dashboard or mobile application enhances user experience and minimizes inquiries directed to the administrative office. 7. Automatic Reminders and Notifications

Timely reminders can prevent missed payments. Your software ought to dispatch automated SMS, email, or app notifications regarding upcoming dues, overdue payments, and successful transactions.

8. Integration With School Management Systems

Your billing software must integrate with your current Student Information System (SIS) or Learning Management System (LMS) to eliminate redundancy and maintain synchronized data across various departments.

9. Reports and Analytics

Financial transparency is essential. Seek software that offers comprehensive reports on collections, outstanding fees, defaulters, and tailored analytics to assist you in making informed financial decisions.

10. Multi-User Access and Role Management

Various staff members require different access levels. The system should provide multi-user capabilities with administrative controls, ensuring data confidentiality and operational clarity.

✅ Final Thoughts

Investing in appropriate school billing management software can streamline fee collection, enhance cash flow, and deliver a seamless experience for both parents and school personnel.

By ensuring your system incorporates these top 10 features, you are positioning your institution for improved efficiency, transparency, and long-term success.

#BillingSoftware#CustomBillingSolutions#school billing software system#digital billing#online billing#school fee payment software#billing software

0 notes

Text

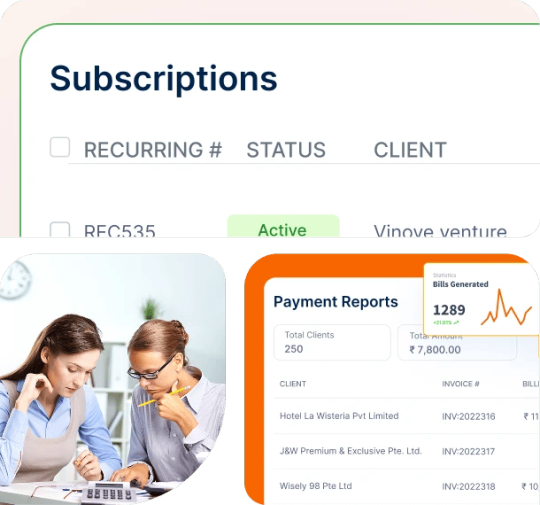

How the Best Recurring Billing Software Can Transform Your Subscription Business?

With the subscription economy booming, companies from various industries — SaaS, eCommerce, digital services, and professional consulting — are moving to recurring revenue streams. With this transition comes the necessity for effective, automated processes to handle subscriptions, invoices, and payments. This is where selecting the best recurring billing software plays a pivotal role.

Recurring billing, when done well, generates consistent revenue, increases cash flow, and increases customer retention. Manual billing or generic invoicing software, however, usually can’t keep pace with increasing subscription demands. That’s where advanced subscription billing software comes in — to automate the process, eliminate errors, and grow with your business.

What Is Recurring Billing Software?

Recurring billing software is software that simplifies the process of billing customers on a regular basis — monthly, quarterly, yearly, or according to custom-defined schedules. These programs enable companies to keep track of customer subscriptions, send recurring bills, accept payments, apply taxes, and provide billing analytics — all through a single interface.

Whether you have dozens or thousands of clients, the proper subscription billing management software sends payments in a timely fashion, invoices correctly, and keeps customer information organized.

Why Recurring Subscription Billing Is Important?

A solid recurring subscription billing system is not only about receiving payments — it’s a key element of your customer experience. Reliable, proper billing ensures customer loyalty, trust, and fewer failed payments or revenue loss.

Following are some primary reasons why subscription-based companies need to spend on the finest recurring billing software:

Automated Invoicing

No more manual invoice creation. Streamline recurring invoices for all your subscribers with adjustable billing cycles and customizable designs.

Error-Free Payments

Avoid human errors, duplicate payments, or forgotten billing cycles with automated mechanisms that process payments accurately and on schedule.

Improved Cash Flow

With automated billing and accelerated payment cycles, companies can have predictable and stable revenue streams.

Streamlined Customer Experience

Customers are sent on-time invoices, accurate billing data, and are able to access self-service portals — making them happy overall.

Scalability

With your customer base expanding, a robust billing system is able to process thousands of transactions without raising overhead.

Key Features to Look for in Subscription Billing Software

When looking for the best recurring billing software, it is essential to select a solution with a blend of flexibility, automation, and control. Here’s what to seek:

Multiple Billing Cycles– Monthly, quarterly, yearly, or custom billing plans.

Automated Invoice Creation– Repeating invoices with professional templates and branding.

Payment Gateway Integration– Integration with multiple international gateways to accept payments everywhere.

Tax Management– Automatic taxation by regions and services.

Dunning Management– Auto-retries for declined payments and retry logic to reclaim revenue.

Customer Portals– Allow customers to manage subscriptions, view history, and change payment information.

Granular Reports– Real-time revenue, churn, and growth insights.

Custom Plans & Discounts– Support for creating dynamic pricing models with trial periods, coupons, and upgrades.

Invoicera: The Best Recurring Billing Platform for Thriving Businesses

In terms of recurring subscription billing management, Invoicera is among the top options for businesses of every size. With a focus on automation and adaptability, Invoicera streamlines subscription billing while providing robust features to maximize cash flow and customer experience.

Invoicera is more than a billing tool — it’s an end-to-end solution for recurring revenue management and maximizing client satisfaction.

Benefits of Recurring Billing Software Across Industries

Whether your business is in a particular industry or not, subscription billing software is a game-changer:

SaaS Companies: Scale through thousands of user subscriptions, upsell capabilities, and effortlessly.

Agencies & Consultants: Invoice clients on retainers or packages of services with automated monthly invoices.

E-commerce Businesses: Provide subscription boxes or product-based billing with little manual intervention.

Online Services: Gym memberships, course sites, digital libraries — all are improved by automated scheduled billing.

Best Practices for Implementing Recurring Billing Software

To make the most from your subscription billing management tool, do the following:

Define Your Billing Strategy

Select your billing cycles, price levels, and whether to have free trials, add-ons, or package deals.

Customize Templates & Communication

Tailor invoice layouts and automate client reminders for improved branding and transparency.

Integrate with Payment Gateways

Facilitate easy, quick, and safe payments by linking your desired payment gateways.

Test Before Scaling

Begin with a small group of clients, experiment with billing cycles and payment recovery logic, and hone your workflow.

Monitor Performance

Utilize native reports to track monthly recurring revenue (MRR), churn rate, and customer lifetime value (CLV).

Conclusion

With increasing demand for subscription services, the best recurring billing software is no longer a choice, but necessary for business sustainability and customer satisfaction. Handcrafting invoices is laborious, error-ridden, and untenable in the long run.

With tools like Invoicera, companies can automate their entire billing cycle, eliminate missed payments, and deliver a seamless experience to customers. Whether you’re a SaaS business, service business, or digital entrepreneur, take advantage of robust subscription billing software — your next step to scalable, predictable revenue.

Leave payment chasing behind and grow your business — automate your billing now with Invoicera.

0 notes

Text

Pandian calls it The Best Billing Software in Chennai — and we’re proud to deliver just that! With a user-friendly interface, reliable service, and excellent customer support, VarthagamSoft is built for businesses that expect more. Thank you, Pandian, for your kind words and trust!

0 notes