#Accounting and Financial Services

Explore tagged Tumblr posts

Text

Getting Around the Swiss Financial Scene: Accounting and Financial Services Designed For People and Companies

Renowned for its stunning scenery and stable economy, Switzerland has drawn people and companies looking for financial success. It may be difficult to navigate this Alpine nation's complex financial system, however. Visit: Getting Around the Swiss Financial Scene: Accounting and Financial Services Designed For People and Companies

1 note

·

View note

Text

What was everybody's nightly random brain spiral this fine evening (it's 5am)?

Mine was spending 3+hrs deep diving into researching the US military nuclear naval officer program due to a recruitment email I got in my school email (I'm an engineering major rn) despite the fact that I knew realistically I have too many medical conditions to qualify.

At the end of my brain spiral, I found an official document listing every disqualifying medical condition and I disqualify on a MINIMUM of 4 separate accounts from that list. I was literally WEEPING in laughter. The absolute delulu and audacity I had thinking my chronically-ill ass could even CONSIDER this.

Anyways that's how my evening went.

#cherry rambles#us military#hear me out#their nupoc program is SO financially appealing#and im fascinated by life on the sea#dont get me wrong its bloody grueling af and i basically sweeped the entire usnavy subreddit for all the first-hand accounts i could get#and the nuclear sectors i was looking at was more maintenance and supervision of nuclear power plants and stuff#not nuclear warfare 💀#and the career opportunities post-service in engineering/trade was rlly appealing#im atp in life where i just wanna try out random and novel experiences and opportunities bc why tf not#give up the next 5-6 years of my life to the military in exchange for life-long financial stability and fascinating experiences#with a sprinkle of trauma probably#BUT ITS FINE#IM TOO SICK LMAOOOOO#I DIDNT EVEN READ THE WHOLE DOCUMENTED MEDICAL LIST#BUT I HAD AT LEAST 4 CONDITIONS ON THAT LIST LMAOOOO

7 notes

·

View notes

Text

Chime Mobile Banking: A Better Way to Bank

In today’s fast-paced world, who has time to wait in line at a traditional bank or deal with outdated services? Enter Chime, the mobile banking solution designed for the modern lifestyle. With Chime, you can manage your money with ease, anywhere, anytime—right from your phone. Here’s why millions are switching to Chime:

No Hidden Fees—Ever

Most traditional banks hit you with fees left and right. Maintenance fees, minimum balance fees, overdraft fees—it adds up quickly. But with Chime, you’ll never pay a monthly fee or a fee for minimum balances. Plus, there’s no foreign transaction fees, so you can travel the world worry-free. Say goodbye to hidden fees and hello to real savings.

Get Paid Up to Two Days Early

Waiting for payday can be stressful, especially when bills are due. Chime makes payday something to look forward to by giving you access to your direct deposit up to two days early. Whether it's your paycheck or government benefits, Chime puts your money in your hands faster so you can pay bills, save, or treat yourself sooner.

Fee-Free Overdrafts

We've all been there—an unexpected purchase puts your account in the negative, and your bank slaps you with an overdraft fee. Chime’s SpotMe feature lets you overdraft up to $200 with no fees. It’s simple, straightforward, and designed to give you peace of mind when you need it most.

A Seamless Digital Experience

Chime isn’t just a bank—it’s an all-in-one financial tool. The user-friendly app lets you easily track your spending, deposit checks, transfer money, and receive instant notifications for transactions. With 24/7 access, your finances are always at your fingertips. Need to find an ATM? Chime has over 60,000 fee-free ATMs in its network, more than most traditional banks.

Save Effortlessly

Chime’s Automatic Savings feature helps you build your savings effortlessly. Every time you use your Chime card, we’ll round up your purchase to the nearest dollar and transfer the difference into your Savings Account. It’s a painless way to grow your savings over time. Plus, you can set up automatic transfers to reach your financial goals even faster.

Security You Can Count On

With FDIC insurance up to $250,000, Chime ensures that your money is safe and secure. Our state-of-the-art security measures protect your account, while features like instant transaction alerts and the ability to instantly block your card provide peace of mind.

Join the Chime Revolution Today

Traditional banks are outdated and expensive, but Chime is the future of banking. With no hidden fees, early paydays, and powerful tools to help you manage your money, it’s no wonder Chime is trusted by millions of people nationwide. Ready to upgrade your banking experience? Follow the link below to download the Chime app and open your account in just minutes—all from your phone.

Switch to Chime today and experience the smarter, easier, and more affordable way to bank.

Download Chime Mobile App Now, And Earn $100! Terms apply.

#Chime#Mobile Banking#mobile banking account app#mobile banking application#mobile#iphone#ios#android#android apps#Chime Mobile Banking#banking mobile upi#banking app#online banking#banking#financial#finance#financial services

7 notes

·

View notes

Text

x

#401(k)#savings#tax-advantaged retirement#bipartisan legislation#wealth gap#federal budget#financial industry#lobbying#retirement security#tax law#retirement savings#bipartisan#wealth disparities#federal deficit#financial services industry#tax-advantaged accounts#tax breaks#Congress#lobbyists#Social Security#Medicare

18 notes

·

View notes

Text

Our Services | Professional Tax & Compliance Services

At E Accountax Manager, we provide expert financial and legal services to help businesses, startups, and NGOs navigate the complexities of tax compliance, registrations, and regulatory obligations. Whether you’re starting a new venture, managing an established business, or ensuring compliance for your organization, we offer end-to-end solutions tailored to your needs.

#tax services#NGO compliance services#Part Time CFO Services#business setup services#GST services#MSME compliance services#accounting solutions#financial advisory#E Accountax Manager services#business finance solutions#TCS#TDS Services#Our Services

2 notes

·

View notes

Text

Debt2Dreams

Welcome to Debt2Dreams Are you ready to take control of your finances and build wealth? Our channel is dedicated to helping you: • Master budgeting and save more money • Pay off debt and improve your credit score • Learn how to invest for beginners and beyond • Build passive income streams for long-term financial freedom • Develop a winning money mindset to achieve your goals

Whether you’re just starting your personal finance journey or looking for advanced money strategies, our videos break down complex topics into easy, actionable advice. Don’t let money hold you back from your dreams! Subscribe now for weekly personal finance tips, investment guides, and wealth-building strategies designed to help you live your best life.

Start your journey to financial freedom today!

2 notes

·

View notes

Text

Taxulo

As an established CFO and Tax firm, Taxulo provides quality tax and accounting services that maximize the value of your money. While headquartered in Santa Clara, Our company provides services to clients throughout the US. We offer convenient locations to visit or provide services on-site to meet your needs.

Contact Info:

Taxulo

Address: 3031 Tisch Way #10, San Jose, CA 95128

Phone: 888-316-2990

Website: https://taxulo.com/

Business Email: [email protected]

Influencer marketing services

Business Hours: Mon – Fri: 9 AM–5 PM

Follow us on: Facebook: https://www.facebook.com/TaxuloUSA Instagram: https://www.instagram.com/taxulousa/ Google Maps CID: https://www.google.com/maps?cid=14264812699456281482

#accounting services#tax preparation#tax planning#bookkeeping services#QuickBooks ProAdvisor#fractional CFO#small business accounting#tax compliance#financial consulting#payroll management#business growth strategies#San Jose CA

3 notes

·

View notes

Text

April 15 Tax Deadline Approaching? Here’s How to Prepare and File on Time

As the April 15 tax deadline approaches, CPAs, EAs, and accounting firms must ensure their clients are well-prepared for a smooth and timely filing process. With tax laws constantly evolving and last-minute filings increasing the risk of errors, having a structured approach can help prevent unnecessary penalties and ensure compliance.

To assist in this critical period, here are key strategies to prepare and file tax returns efficiently while optimizing deductions and mitigating common errors.

1. Gather Essential Documents Early

One of the primary reasons for tax return delays is missing documentation. Encourage clients to compile the necessary forms, including:

Income Statements: W-2s for employees, 1099s for independent contractors, and other income-related documents.

Expense Records: Receipts for deductible business expenses, home office costs, medical expenses, and charitable contributions.

Previous Tax Returns: Reviewing past filings ensures consistency and helps identify potential deductions or credits.

Investment and Retirement Contributions: 1099-INT, 1099-DIV, and Form 5498 for IRA contributions.

Having these documents ready early streamlines the filing process, reducing the likelihood of last-minute stress.

2. Leverage E-Filing for Speed and Accuracy

Encourage clients to opt for electronic filing (e-filing), which offers several advantages:

Reduces Errors: E-filing software performs automated calculations, minimizing the risk of human errors.

Provides Immediate Confirmation: Clients receive instant acknowledgment that their tax return has been submitted.

Faster Refunds: The IRS processes electronically filed return more quickly, especially if direct deposit is chosen.

The IRS provides Free File for taxpayers earning $84,000 or less, enabling them to e-file at no cost.

3. Verify Personal and Financial Information

Even minor errors can lead to tax return rejections or processing delays. Double-check:

Social Security numbers for accuracy.

Legal names matching IRS and Social Security Administration records.

Bank details for direct deposit refunds.

Mistakes in these areas can delay refunds or result in notices from the IRS.

Read also:

Tax Planning for Individuals: The Proven Guide for 2025

4. Maximize Deductions and Credits

Help clients minimize their tax liability by ensuring they take full advantage of available deductions and credits:

Business Deductions: Home office expenses, business travel, professional development costs, and software subscriptions.

Education Credits: American Opportunity Credit and Lifetime Learning Credit for eligible education expenses.

Retirement Contributions: Maximizing IRA and 401(k) contributions can lower taxable income.

Health Savings Account (HSA) Contributions: Tax-deductible contributions can reduce taxable income.

Accurate record-keeping and documentation are essential to substantiate these claims in case of an IRS audit.

5. Avoid Common Filing Mistakes

Mistakes can result in audits, penalties, or delayed refunds. The most frequent errors include:

Math miscalculations or incorrect figures.

Incorrect filing status (e.g., filing as “Single” instead of “Head of Household” when eligible).

Failing to sign and date paper returns (electronic filings require a PIN instead).

Using professional tax software or consulting with a tax expert significantly reduces the likelihood of errors.

Read also:

Get Ready for Tax Season: Your Complete Preparation Checklist

6. Consider Filing an Extension if Needed

If a client cannot file their return by April 15, filing an extension can provide additional time to prepare:

Submit Form 4868: This application grants an automatic six-month extension until October 15.

Understand Tax Payments: An extension to files does not mean an extension to pay. Any taxes owed should be estimated and paid by April 15 to avoid interest and penalties.

While extensions offer flexibility, filing sooner helps clients avoid last-minute stress and potential IRS scrutiny.

7. Stay Informed About IRS Resources and Tax Law Changes

The IRS offers valuable resources to help taxpayers file accurately:

Interactive Tax Assistant for answering common tax law questions.

"Where’s My Refund?" tracking tool to monitor refund status.

Special assistance, including extended hours at select locations, to support last-minute filers (IRS newsroom).

Additionally, staying updated on recent tax changes ensures compliance and maximizes tax-saving opportunities.

8. Be Cautious of Tax Scams

With the rise of digital fraud, warn clients about common tax scams:

Phishing Emails and Phone Calls: The IRS does not initiate contact via email, text, or social media to request financial details.

Fake IRS Representatives: Scammers impersonate IRS agents to demand immediate payments. Always verify directly through the official IRS website.

Identity Theft: Encourage clients to use secure passwords and enable multi-factor authentication when accessing tax filing software.

Staying vigilant helps clients protect their financial data and prevent fraud.

9. Manage Tax Payments Wisely

For clients who owe taxes, planning for payments is essential:

Electronic Payment Options: IRS Direct Pay and Electronic Federal Tax Payment System (EFTPS) allow secure, instant payments.

Installment Agreements: If unable to pay in full, setting up a payment plan with the IRS can prevent further penalties.

Estimated Tax Payments: Self-employed individuals should make quarterly estimated payments to avoid underpayment penalties.

Proper tax planning reduces financial strain and ensures compliance.

Read also:

Relaxation Returns: How to Unwind After the Tax Season

10. Maintain Proper Records for Future Reference

Encourage clients to retain copies of tax returns and support documents for at least three years:

Helps resolve discrepancies with the IRS if questions arise.

Provides documentation for financial planning and loan applications.

Serves as a reference for next year’s filing.

Organized record-keeping simplifies future tax filings and ensures compliance with audit requirements.

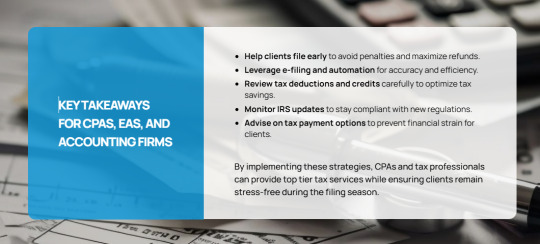

Final Thoughts: Partner with Experts for Hassle-Free Tax Filing

The tax season can be overwhelming for businesses and individuals alike. By adopting proactive filing strategies, leveraging available IRS resources, and staying vigilant against common pitfalls, CPAs, EAs, and accounting firms can help their clients navigate tax season with confidence.

At Unison Globus, we specialize in providing outsourced tax preparation services tailored for North America-based accounting firms. Our expert team ensures accurate, timely, and compliant tax filings, freeing you to focus on strategic financial advising for your clients.

Looking for expert tax preparation and compliance solutions? Contact Unison Globus today to streamline your tax season and maximize your efficiency.

This blog was originally posted here:

https://unisonglobus.com/april-15-tax-deadline-approaching-heres-how-to-prepare-and-file-on-time/

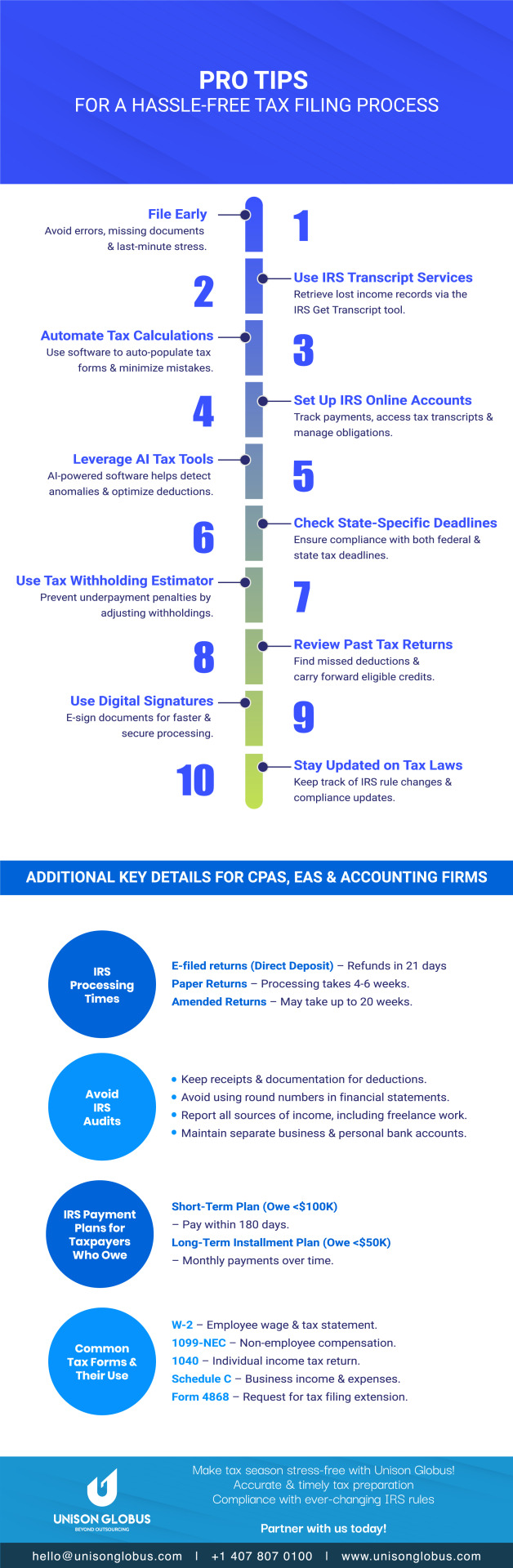

Infograp`hic

Pro Tips - For a Hassle-Free Tax Filing Process

#Tax filing tips#unison globus#Hassle-free tax filing#Tax preparation guide#Tax filing process#April 15 tax deadline#Tax season tips#how to file taxes#Tax filing checklist#Stress-free tax filing#tax deductions#tax services#tax preparation services#tax advisor#tax preparation#tax accountant#tax filing#tax planning#tax season#financial#Tax

1 note

·

View note

Text

Why Accurate Financial Statements Matter for Your Business

Accurate financial statements are the backbone of any successful business, providing insights into your company’s financial health and guiding decision-making. At SAI CPA Services, we offer expert financial statement preparation, ensuring your records are precise and reliable.

Why Accurate Financial Statements Matter

Accurate financial statements allow businesses to plan for the future, meet regulatory requirements, and demonstrate financial stability. Here’s how our services benefit your business:

Informed Decision-Making: Our financial statement services give you a clear understanding of your revenue, expenses, and overall financial position, enabling you to make informed business decisions.

Investor Confidence: Lenders and investors rely on accurate financial statements to evaluate your business’s health. A professionally prepared statement adds credibility and trust.

Regulatory Compliance: We ensure that your financial statements comply with all necessary accounting standards and regulations, avoiding penalties and ensuring transparency in your operations.

How SAI CPA Services Can Help

At SAI CPA Services, we provide accurate and detailed financial statements to help your business stay on track. Our team ensures that your financial records are up-to-date, reliable, and compliant.

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#SAICPAServices#financial statements#business growth#financial services#accounting#accounting services#cpa#new jeresy#investor confidence#regulatory compliance services

2 notes

·

View notes

Text

Reliance Corporate Advisors (RCA) is a leading professional service firm in Nepal, offering legal services and financial advisory from top lawyers and Chartered Accountants.

INTELLECTUAL PROPERTY AND TRADEMARKS IN NEPAL: PASSING OFF

1. INTRODUCTION

1.1. A significant purpose of trademark registration is protection of your brand in a competitive marketplace whereby your registered trademark provides a unique and distinguished identity to your products or services.

1.2. Section 2(c) of the Patent, Design and Trademark Act, 2022 (1965) (the “PDT Act”) defines a trademark as a word, symbol, or picture or a combination thereof to be used by any firm, company or individual in its products or services to distinguish them with the product or service of others.

1.3. All trademarks registered as per the PDT Act are entitled to protection from passing off and infringement. Section 16(2) of the PDT Act explicitly prohibits the copying or unauthorized use of a registered trademark without ownership transformation or written permission pursuant to Section 21 D of the PDT Act.

1.4. Section 19 of the PDT Act imposes penalties for illegal passing off and infringement, including fines and confiscation of goods, based on the gravity of the offense.

1.5. The Trademark Directives, 2072 (2015) (the “Trademark Directives”) ensure further protection to registered trademarks which are as follows:

1.5.1. To freely use the trademarks registered in their name.

1.5.2. To prevent other firms or companies from using the same trademark without permission in a manner that may cause confusion through display, viewing, speaking, hearing or other presentation.

1.5.3. To grant permission for trademark use to other firms or companies under certain conditions for a specific duration.

2. PASSING OFF AS THREAT TO TRADEMARKS

2.1. The Department of Industries (the “DOI”), a quasi-judicial industrial property authority under the Ministry of Industry, Commerce, and Supplies in Nepal, is responsible for the regulation and protection of all registered trademarks.

2.2. Any allegations of trademark infringement or passing off can be brought before the legal division of DOI. DOI has the authority to conduct hearings and issue rulings akin to those of a District Court in the country. Moreover, if parties are dissatisfied with the DOI’s decision, they have the option to appeal such decision to the High Court and eventually to the Supreme Court of Nepal, if such appeal meets the criteria of law.

2.3. Despite statutory provisions and legal precedents upholding trademark rights, Nepal faces significant challenges with trademark infringements and passing off cases.

2.4. Passing off occurrences, especially with well-known trademarks, are increasing, posing a threat to consumer rights and intellectual property protections.

2.5. “Well-Known Mark” has been defined under Section 2(f) of the Trademark Directives as a mark specified by the Government of Nepal (“GoN”) to be well-known. Nevertheless, as of the present date, GoN has neither released nor clarified the criteria for recognizing a well-known mark. This leaves the definition open to interpretation by the courts and DOI; some instances of courts interpretation have been discussed in paragraph 5 below.

2.6. While case precedents protect well-known trademarks, the lack of clear legal provisions raises doubts and potentially deter multinational corporations from trusting brand protection in Nepal.

3. WHAT CONSTITUTES AS PASSING OFF?

3.1. A trademark passing off is said to have occurred when a party, typically a business or individual, misrepresents their goods or services in a way that creates confusion or deception amongst the consumers, leading them to believe that the goods or services are associated with another party’s established trademark.

3.2. Goodwill, built through consistent branding, production, and advertisement, is a crucial element in passing off cases. When another competitor passes off on this goodwill of another trademark, the consumers are the ones who must face the direct hit as they might end up with subpar products or services under the mistaken belief that they are associated with the legitimate brand.

3.3. Lord Langdale MR, in the case of Perry v Truefitt, said that “a man is not to sell his own goods under the pretence that they are the goods of another trader”.

3.4. From interpretation and as a matter of practice to establish passing off, certain key elements need to be present such as:

3.4.1. The existence of goodwill: Claimant has to showcase the goodwill or reputation that they have built around its brand through its consistent branding, production, supply, and advertisement in a particular market or amongst a niche of consumers.

3.4.2. Misrepresentation: A clear misrepresentation from the alleged infringing party has to be demonstrated, that could deceive or confuse consumers into believing that.

3.4.3. The likelihood of confusion.

3.4.4. Actual or potential damage.

3.5. For instance, producing and selling a cold drink with its packaging, symbols, words, and colour combinations like that of Sprite, (a well-known trademarked soft drink product), with just a few tweaks and changes of letters or adding prefixes or suffixes on the mark construes as passing off.

4. WHAT ARE THE REMEDIES ONE CAN SEEK AGAINST PASSING OFF?

4.1. As a first rule of the thumb, to ensure the protection of a trademark, the crucial step is its registration with DOI. As outlined in Section 21B of the PDT Act, “The title to any patent, design or trademark registered in a foreign country shall not be valid in Nepal unless it is registered in Nepal by the concerned person.” This implies that trademarks registered in foreign jurisdictions, even those within the state parties of the Paris Convention for the Protection of Industrial Property, 1883 (the “Paris Convention”), will not enjoy protection in Nepal unless they are registered locally.

Note: Internationally, recognized well-known marks, as evidenced in case laws (discussed in paragraph 5, below), receive certain protection due to their widespread popularity. However, such protections cannot be guaranteed for well-known marks, if unregistered.

4.2. As per law, the DOI must facilitate the registration of trademarks from foreign countries without conducting elaborate inquiries if an application is filed along with relevant certificates of registration in the foreign country. This is in alignment with the provisions of the Paris Convention, as per Section 21C of the PDT Act.

4.3. However, as a matter of practice DOI conducts its regular investigation (as applicable for local trademarks) even if prior filing right is claimed as per the provision above.

4.4. After the registration of a trademark, if an entity attempts passing off an already registered trademark, an opposition claim can be filed at the Law Division of the DOI within 90 days of the publication of the mark in the Industrial Property Bulletin (“IP Bulletin”). This is in accordance with Section 21A(2) of the PDT Act.

4.5. Pursuant to Section 24(2) of the Trademark Directives, the opposition can also be filed in another language, provided that a notarized Nepali translation of the opposition claim is attached.

4.6. Upon the filing of the opposition, the DOI will refrain from issuing a trademark registration certificate for the opposed mark. The opposition will go through a similar process of litigation whereby the Parties will be called for hearings and the DOI will provide its decision on the opposed mark.

4.7. If either party is dissatisfied with the DOI’s decision, they have the option to appeal at the High Court within 35 days from the date of the decision.

4.8. On a different note, Section 25 of the Trademark Directives also provides administrative and judicial bodies for the enforcement of trademark rights. These are:

4.8.1. District Administration Office

4.8.2. Nepal Police

4.8.3. Customs Offices

4.9. These offices have been vested with the responsibility to work individually or collaboratively within their jurisdictions.

4.10. The collaborative efforts of the DOI and the mentioned administrative agencies can significantly enhance the protection of industrial property rights held by businesses, ensuring a healthy market environment for both consumers and competitors.

5. CASE LAWS RECOGNIZING THE PROTECTION OF WELL-KNOWN MARKS:

5.1. Kansai Nerolac Paints Limited v. Rukmani Chemical Industries Pvt. Ltd., NKP: 2077, Decision №10561.

5.1.1. Earlier, Rukmani Chemical Industries had registered the Kansai Nerolac Paint Nepal Pvt. Ltd. at the DOI, leading to the DOI prohibiting Kansai Nerolac Paints Limited, a Japanese multinational corporation, from using the Kansai Nerolac brand. Following an extensive legal battle in the DOI, High Court, and Supreme Court, the Supreme Court ruled in favour of Kansai Nerolac Paints Limited, establishing key principles:

5.1.1.1. “Deceptive similarity” is said to be constituted if a trademark or the words used are identical, or the trademark is displayed with modifications, such as the addition of prefix or suffix, creating a phonetic similarity with minimal dissimilarity and if presented in a similar manner at first glance.

5.1.1.2. Time limitation is not applicable for revoking the registration of a trademark if it is registered with bad faith or the registration process seems malafide.

5.1.1.3. Ownership and right over a trademark of a foreign company does not end only by virtue of the registration of such trademarks by a local company. Even after the registration of a mark copied from a well-known foreign mark by a local company, if the foreign company applies for registration of the mark at a later date, the registration in the name of the local company automatically ends.

5.2. Virgin Enterprises Limited v. Virgin Mobile Pvt. Ltd., 12 June 2023, Department of Industries

5.2.1. An opposition was filed by Virgin Enterprises Limited (“Virgin Enterprises”), a member company of the Virgin Group against Virgin Mobile Pvt. Ltd., a local company for the ownership on the mark “VIRGIN (and logo)”. Virgin Enterprises had registered their mark in Class 9 and 38 whereas the local company Virgin Mobile Pvt. Ltd. (“Virgin Mobile”) was seeking to register the mark in Class 35.

5.2.2. The DOI rejected the application of Virgin Mobile based on the following:

5.2.2.1. The “VIRGIN” mark has been registered and used by Virgin Enterprises in Nepal and other countries and thus is a well-known mark belonging to Virgin Enterprises

5.2.2.2. The mark in question, “VIRGIN (and logo)” did not appear to be the original creation of Virgin Mobile.

5.2.2.3. Virgin Mobile filed the application in bad faith.

5.2.2.4. Allowing registration of the mark in the name of Virgin Mobile will adversely affect the goodwill of Virgin Enterprises and cause confusion among consumers.

5.2.3. The DOI also reiterated its position that a well-known mark shall receive protection not only in the class in which it has been registered but also in other classes as well as in non-competing goods and services where the well-known mark does not have registration.

5.3. Six Continents Hotel Inc. V Holiday Express Travels and Tours Pvt. Ltd., 10 July 2023, Department of Industries.

5.3.1. An opposition was filed at the DOI by Six Continents Hotel Inc. (“Six Continents”) for their trademark “HOLIDAY INN EXPRESS” registered in Class 43 in Nepal against a local company Holiday Express Travels and Tours Pvt. Ltd. (“Holiday Express”) which had filed to register its mark “HOLIDAY EXPRESS TRAVELS AND TOURS (and logo)” in Class 35.

5.3.2. Six Continents opposed this application claiming that “HOLIDAY INN” marks are globally well-known marks and the application was filed in bad faith and can confuse the public.

5.3.3. The DOI made the following determination in the given case:

5.3.3.1. HOLIDAY INN marks have been registered and are used by Six Continents in Nepal and other countries and thus are well-known marks belonging to Six Continents.

5.3.3.2. Holiday Express’s proposed mark does not seem to be its original creation and the application has been made in bad faith.

5.3.3.3. Allowing registration of the “HOLIDAY EXPRESS TRAVELS AND TOURS (and logo)” mark to Holiday Express Nepal can adversely affect the goodwill of Six Continents and therefore shall cause confusion among consumers.

For more details go to: https://reliancecs.co/

#law firm#legal services#financial services#financial consultant#chartered accountant#arbitration#advocate#intellectual property#disputeresolution#corporate law firm#corporate lawyers in nepal#legal advice

3 notes

·

View notes

Text

NSI Accounting: Reliable Financial Reporting You Can Trust

Ensure your financial statements are accurate and compliant with NSI Accounting. We deliver detailed financial reporting that provides a clear picture of your business’s financial health.

3 notes

·

View notes

Text

We are a leading financial services firm based in Thrissur, dedicated to providing our clients with the best financial solutions to meet their diverse needs. Our primary services include mutual fund distribution, insurance agency, and loans syndication. Our team of experts is highly skilled and experienced in handling all types of financial services. We are committed to delivering the best-in-class services to our clients and ensuring their financial goals are met with the utmost professionalism and expertise. At Neelsaj Financial Services Private Limited, we understand that every client is unique, and their financial requirements vary. Hence, we offer personalized services that are tailored to meet their specific needs. We ensure that our clients receive the highest level of support and assistance throughout their financial journey. Our core values include integrity, transparency, and customer-centricity. We believe in building long-term relationships with our clients and providing them with the best financial solutions that are aligned with their goals. Thank you for choosing Neelsaj Financial Services Private Limited as your trusted financial partner. We look forward to serving you with the best financial solutions and excellent service.

.

.

.

.

2 notes

·

View notes

Text

Our Software Development Virtual Assistant is knowledgeable in project management, software testing, documentation, and other areas. Professional business apps for iOS, Windows, and Android are developed by competent software and mobile application developers at Pankh Consultancy Pvt. Ltd. These are the services that design software according to a client's specifications. Contact Now ! +1 (646-795-6661)

#digital marketing virtual assistant#graphic designer virtual assistant#financial accounting virtual assistant#cost accounting virtual assistant#social media manager virtual assistant#seo specialist virtual assistant#ppc specialist virtual assistant#mobile development virtual assistant#software development virtual assistant#top-rated virtual assistants worldwide#virtual assistance services#virtual assistant

4 notes

·

View notes

Text

Website : https://en.intertaxtrade.com

Intertaxtrade, established in the Netherlands, excels in facilitating international business and assisting individuals in Europe with integrated solutions in tax, finance, and legal aspects. Registered with the Chamber of Commerce, they offer services like company management in the Netherlands, Dutch company accounting, tax intermediation, international tax planning, business law consulting, EU trademark and intellectual property registration, international trade advice, and GDPR compliance. Their expertise in financial and accounting services ensures clients have a clear financial overview, aiding in business success.

Facebook : https://www.facebook.com/intertaxtrade

Instagram : https://www.instagram.com/intertaxtrade/

Linkedin : https://www.linkedin.com/in/ramosbrandao/

Keywords: company registration netherlands legal advice online comprehensive financial planning financial planning consultancy international business services international business expansion strategies gdpr compliance solutions international trade consulting european investment opportunities gdpr compliance consulting services in depth financial analysis gdpr compliance assistance cross border tax solutions netherlands business environment european union business law dutch accounting services tax intermediation solutions international tax planning advice eu trademark registration services investment guidance online business law consultancy corporate tax services netherlands financial analysis experts business immigration support startup legal assistance online european market entry consulting international financial reporting services business strategy netherlands tax authority communication support international business law expertise dutch commercial law advice global business strategy services european business consulting online international business services platform expert legal advice online efficient company registration netherlands reliable dutch accounting services strategic tax intermediation proactive international tax planning eu trademark registration support tailored investment guidance specialized business law consultancy dynamic international trade consulting holistic corporate tax services netherlands streamlined business immigration support online startup legal assistance strategic international business expansion european market entry planning innovative cross border tax solutions navigating the netherlands business environment european union business law insights accurate international financial reporting proven business strategy netherlands exclusive european investment opportunities seamless tax authority communication in depth dutch commercial law advice comprehensive global business strategy proactive european business consulting one stop international business services personalized financial planning solutions expert legal advice for businesses quick company registration in netherlands trustworthy dutch accounting services strategic tax intermediation solutions innovative international tax planning efficient eu trademark registration tailored investment guidance online business law consultancy expertise comprehensive corporate tax services netherlands thorough financial analysis support streamlined business immigration assistance navigating netherlands business environment european union business law guidance international financial reporting accuracy business strategy for netherlands market european investment opportunities insights efficient tax authority communication international business law excellence dutch commercial law proficiency global business strategy implementation european business consulting excellence comprehensive international business services proactive financial planning strategies expert legal advice on international matters

#company registration netherlands#legal advice online#comprehensive financial planning#financial planning consultancy#international business services#international business expansion strategies#gdpr compliance solutions#international trade consulting#european investment opportunities#gdpr compliance consulting services#in depth financial analysis#gdpr compliance assistance#cross border tax solutions#netherlands business environment#european union business law#dutch accounting services#tax intermediation solutions#international tax planning advice#eu trademark registration services#investment guidance online#business law consultancy

4 notes

·

View notes

Text

GST services Singapore

K.M.Ho & Co. offers Business financial audit, GST services Singapore, Public Accounting audit, GST accounting, Tax filing and return services with our top-rated audit firm for handling your business issues in Singapore at reliable prices.

#Business financial audit#Accounting audit#Audit firm singapore#Audit and tax services#Business audit#Tax audit services#Tax audit#Accounting audit services#Accounting audit firms#Tax services#Tax filing services#Tax return services#Public accountant singapore#Public accounting firm singapore#Accounting services singapore#Accounting firm services#GST accounting services#GST filing singapore#GST services singapore#GST return services

2 notes

·

View notes

Text

Understanding the Distinctions: Military Lending Act vs. Servicemembers Civil Relief Act

Written by Delvin The Military Lending Act (MLA) and the Servicemembers Civil Relief Act (SCRA) are two important pieces of legislation designed to protect military service members and their families. While both acts aim to provide financial safeguards, they address different aspects of military life. In this blog post, we’ll explore the differences between the MLA and the SCRA to help military…

View On WordPress

#Checking Accounts#Credit#Credit Cards#dailyprompt#Financial#Financial Freedom#Financial Literacy#Generational Wealth#knowledge#Military Lending Act#MLA#money#Money Management#Moneymaking#Overdraft Protection#Personal Loans#SCRA#Service Member Civil Relief Act#student loans#Wealth

2 notes

·

View notes