#Advancements in SOC estimation

Explore tagged Tumblr posts

Text

A Comprehensive Exploration of Battery State of Health (SOH) Estimation

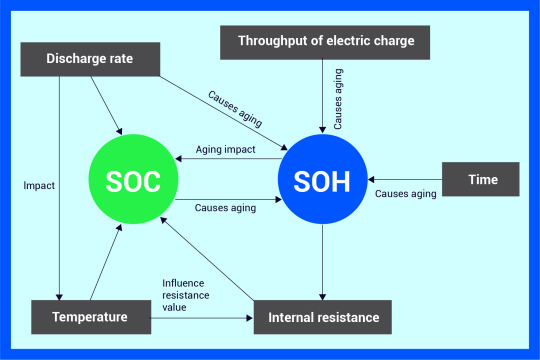

In the complex world of batteries, the State of Health (SOH) is a crucial parameter determining a battery's overall well-being and remaining useful life. Equally important is the State of Charge (SOC) estimation, especially when it comes to SOC estimation for dry goods batteries, where accurate monitoring can significantly influence battery performance and longevity. Advancements in precise SOC estimation technology have made it easier to optimize the state of charge, ensuring maximum efficiency.

Accurate estimation of both SOH and SOC is essential for maximizing battery performance, refining charging strategies, and ensuring long-term reliability. This article explores various methods for estimating SOH, while also addressing how battery state of charge monitoring plays a pivotal role in this process. We will highlight the strengths, limitations, and emerging trends in SOC measurement for dry batteries and SOH that promise to revolutionize our understanding of battery health.

Cycle Counting: Traditional Approach

Cycle counting is a traditional method for estimating SOH. It assumes that a battery's capacity gradually degrades with each charging and discharging cycle. This method provides a straightforward estimate of SOH by keeping track of the total number of cycles. While relatively simple to implement, it also serves as an initial method in SOC estimation techniques.

However, cycle counting has limitations. It oversimplifies the complex factors influencing battery degradation, such as depth of discharge (DOD), temperature variations, and charging patterns. This simplistic approach may lead to inaccurate estimations, especially with modern usage patterns involving partial charging and discharging cycles. As such, advancements in SOC estimation are critical in complementing this traditional method for better accuracy.

Charging Capacity Analysis: Precision Meets Complexity

Charging capacity analysis takes a more dynamic approach to SOH estimation by analyzing the actual charging capacity of the battery. This method compares the energy stored during a charging cycle with the original capacity, providing a more accurate assessment of both battery health and SOC algorithms for batteries.

While charging capacity analysis considers various factors impacting battery performance, it comes with its challenges. Precise measurement often requires sophisticated equipment or accurate SOC estimation methods, increasing implementation costs and complexity. Moreover, its accuracy is highest when the battery is charged from a low state of charge (SOC) to a fully charged state, potentially underestimating capacity decline with frequent charging from higher SOC levels.

Combining Cycle Counting with Charging Capacity Analysis

Recognizing the limitations of individual methods, a contemporary trend in SOH estimation involves combining cycle counting with charging capacity analysis. This synergistic approach aims to comprehensively evaluate battery degradation, considering both cumulative cycles and dynamic variations in charging behaviors and environmental conditions. Real-time SOC estimation for batteries and innovations in battery SOC tracking is integral to this comprehensive evaluation.

Emerging Trends in SOH and SOC Estimation

Machine Learning (ML): Precision and Dynamism: Incorporating machine learning algorithms trained on extensive battery data has emerged as a game-changer. ML goes beyond traditional methods, considering factors beyond cycle count and charging capacity. This approach enables more accurate and dynamic predictions of SOH and SOC prediction advancements.

Electrochemical Impedance Spectroscopy (EIS): Unveiling Internal Dynamics: EIS, a technique analyzing the battery’s internal resistance, offers insights into its health and facilitates early detection of potential degradation issues. It’s a key element in improving battery state of charge monitoring and overall, SOC improvement for dry goods batteries.

Open-Circuit Voltage (OCV) Analysis: Monitoring the Unseen: OCV analysis involves monitoring the battery’s open-circuit voltage during charging and discharging cycles, providing valuable information about its health and remaining capacity. This method adds another layer of precision to the SOH estimation process and can further support the battery management system SOC.

Conclusion: Navigating Towards Precision in SOH and SOC Estimation

In the ever-evolving landscape of battery technology, precise estimation of both the State of Health and State of Charge is crucial. By understanding the strengths and limitations of conventional methods like cycle counting and charging capacity analysis, coupled with embracing emerging techniques such as machine learning, EIS, and OCV analysis, we pave the way for a comprehensive understanding of battery health and charge.

Ongoing advancements in SOC estimation and battery SOC prediction advancements hold immense promise for enhancing the accuracy and reliability of SOH and SOC estimation, ultimately optimizing battery performance, lifespan, and sustainability in the long run.

#State of charge estimation#SOC estimation for dry goods batteries#Precise SOC estimation technology#Advancements in SOC estimation#SOC measurement for dry batteries#Battery state of charge monitoring#SOC algorithms for batteries#Accurate

0 notes

Text

Checkweigher Machine Market Size, Demand, Share, Trends and Forecast -2034

The size of the checkweigher machine market is expected to grow to US$ 629.2 million by 2024. The market is slated to grow with a consistent compound annual growth rate (CAGR) of 2.6% until 2034. This growth is expected to see the market growing to a size of US$ 813.3 million by 2034.

What are the Key Drivers Driving the Growth of the Checkweigher Machine Market?

"Checkweigher Machines Get Popular in Pharmaceuticals and Food & Beverage Sectors"

The explosive growth in demand for automatic checkweigher machines is due to their extensive usage across various sectors like chemicals, pharmaceuticals, and food & beverage. End-use industries such as chemicals, pharmaceuticals, food and beverage, and others are driving demand for automatic checkweigher machines. To measure bottles, cans, sachets, sticks, capsules, standing pouches, and more, the fast-growing international pharmaceutical industry requires the use of checkweigher machines. In the food and beverage sector, checkweigher machines are increasingly becoming popular.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=9706

Country-wise Insights

The East Asia checkweigher machine market is set to advance steadily, looking towards a sluggish 2.3% CAGR through to 2034. The expanding food processing industry's need for automation, along with the rising consumer awareness regarding food product packaging and labeling and the demand for packaged foods and the growing packaging industry, all drive the growth of the market. Additionally, since they are the leading exporters of automatic checkweigher machines in the market, China and Japan are the major consumers of the devices. In this region, China will most likely hog the limelight as a dominant player in the checkweigher machine market with a significant share of 58.4% in 2024.

The North America checkweigher machine industry is gearing up for consistent growth, foreseeing a CAGR of 2.9% through 2034. The primary driver of this expansion is an increase in demand for automatic checkweighers in industrial automation systems to boost efficiency. By collaborating with other revolutionary, integrated technologies to minimize expenses throughout the production process, automatic checkweighers also enhance the quality and rate of packing. The United States checkweigher machine market is projected to dominate in 2024, holding an estimated value of 71.6%.

Category-wise Insights

In 2024, the 12 to 60 kg checkweigher machines segment shall be leading with a huge share of 49.5% market share. Conversely, the food and beverages industry segment is expected to prove its dominance within the Checkweigher Machine business, holding an impressive 45.2% market share during 2024.

Competitive Landscape

Prominent players in the checkweigher machine industry are Thermo Fisher Scientific Inc., Mettler Toledo, R.S. Bilance S.r.l., SF Engineering, VBS, Inc., VARPE CONTROL DE PESO S.A., Soc. Coop. Bilanciai Campogalliano, Teraoka Seiko Co., Ltd., ACG, Anritsu, Bizerba, Cassel Inspection, Dibal, Espera-Werke, Idecon, iXAPACK GLOBAL, LOMA SYSTEM, Marel, Minebea Intec, NEMESIS, OCS-WIPOTEC, Packital S.R.L., Prisma Industriale, and Mettler Toledo. These rival companies use multifarious strategies in order to come out on top.

For others, innovation is the top priority, and they invest heavily in state-of-the-art technology to remain ahead of the curve. A key objective is to differentiate by providing tailored features and applications that address specific industry requirements. For companies that want to appeal to customers on a shoestring budget, price positioning becomes a war. In addition, some competitors prioritize sustainability more, aligning their products with eco-friendly trends.

Recent Developments

In November 2023, Fortress Technology made a breakthrough in the checkweigher machine industry with the release of its slimline Raptor design. The Raptor weight sensors make real-time accurate and fast individual pack weight evaluation possible, reset rapidly. Furthermore, the Raptor Checkweigher software incorporates defined tolerance tables to ensure that there is automatic compliance with regional statutory weight limits.

In November 2022, Mettler-Toledo Product Inspection launched a new Track & Trace and Checkweighing combined solution with small and mid-market businesses in the cosmetics and pharmaceutical industries in focus. With the Mettler-Toledo CT33 system, customers can achieve supply chain accountability, legal compliance, enhanced brand security, and quality assurance due to an extreme level of integration between Mark & Verify, serialization, and accuracy weighing options.

Browse Full Report: https://www.factmr.com/report/checkweigher-machine-market

Segmentation of Checkweigher Machine Market Analysis

By Capacity :

Up to 12 kg Checkweigher Machines

12 to 60 kg Checkweigher Machines

Above 60 kg Checkweigher Machines

By End Use :

Food and Beverage

Logistics and Packaging

Personal Care Products

Pharmaceutical Use

By Region :

North America

Latin America

East Asia

South Asia and Pacific

Western Europe

Eastern Europe

Middle East and Africa

����𝐨𝐧𝐭𝐚𝐜𝐭:

US Sales Office 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583, +353-1-4434-232 Email: [email protected]

1 note

·

View note

Text

Safer, Smarter EVs with Advanced BMS Technology

As electric vehicles (EVs) continue to redefine the future of transportation, the demand for safety, efficiency, and intelligence grows stronger than ever. At the heart of this evolution lies one of the most critical yet often overlooked components — the Battery Management System (BMS). Advanced BMS technology is now enabling a new generation of EVs that are not just greener, but also safer and smarter than their predecessors.

🔐 Safety First: How BMS Protects EVs

Electric vehicles rely on high-voltage lithium-ion batteries. While these batteries are powerful, they are also sensitive to operating conditions. A modern BMS ensures safety in multiple ways:

✅ Overcharge and Over discharge Protection

Overcharging a battery can cause it to overheat or even catch fire. Similarly, deep discharging can degrade cells. BMS constantly monitors and regulates voltage levels to prevent these extremes.

🌡️ Thermal Management

Heat is a battery’s worst enemy. The BMS tracks temperature across the battery pack and can trigger cooling mechanisms or shut down operations in case of overheating.

⚠️ Short Circuit and Fault Detection

A short circuit or a fault in the system can cause immediate damage. The BMS detects anomalies and cuts off power instantly, preventing accidents.

🧠 Smarter Performance with BMS Intelligence

Today’s advanced BMS units go far beyond basic protection. They are now embedded with smart features that optimize performance and longevity:

🔋 State-of-Charge (SoC) and State-of-Health (SoH) Monitoring

These metrics provide precise insights into how much energy is available and how healthy the battery is over time, giving drivers accurate range estimations and early warnings for replacements.

⚙️ Active Cell Balancing

A modern BMS balances voltage among individual battery cells to maintain uniform performance and maximize usable capacity.

📡 Communication & Telemetry

Smart BMS systems communicate with the vehicle’s motor controller, charging station, and even cloud platforms. This allows remote diagnostics, real-time alerts, and data logging.

🚀 Enabling the Next Generation of EVs

As EVs become more connected and autonomous, the role of BMS grows exponentially:

Predictive Maintenance: Smart BMS systems can forecast potential failures before they happen.

Fast Charging Optimization: Helps manage temperature and voltage during rapid charging sessions.

Battery Swapping & Modular Packs: Enables flexible energy systems and compatibility with swappable or stackable battery architectures.

🌍 The Broader Impact

With a more advanced BMS, EVs last longer, perform better, and become more eco-friendly — reducing the need for frequent replacements and cutting down on electronic waste. In the end, this technology doesn’t just make EVs smarter — it makes the planet greener.

🔚 Conclusion

From ensuring safety to enhancing intelligence, advanced BMS technology is the foundation of today’s cutting-edge electric vehicles. As the EV industry races ahead, it’s the BMS that keeps everything in check — protecting drivers, powering smarter systems, and paving the way for a cleaner, more connected future.

Smarter EVs begin with smarter batteries — and smarter batteries start with smarter BMS.

#bms#battery management system#lithion#lithium battery#lithion power#electricvehicle#batterymanagementsystem#lithionpower#ev#batman

0 notes

Text

MinutesVault is the Team Meeting Productivity Tool You’ve Been Waiting For

Meetings are meant to align, decide, and propel action. But let’s face it most meetings end up doing the opposite: eating up hours, generating confusion, and leaving people wondering, “What now?”

That’s why we built MinutesVault, the team meeting productivity tool that brings structure, clarity, and momentum to every meeting so your team spends less time talking and more time executing.

Why MinutesVault?

Because meetings should work for your team not against them.

With MinutesVault, teams can plan smarter, collaborate better, and follow through faster. It’s not just a note-taking app or a to-do list it’s a full-circle meeting solution that turns discussion into action.

What MinutesVault Does

Pre-Meeting Clarity with Smart Agendas

Build and share meeting agendas in advance. Assign topics, estimate time, and set objectives so everyone shows up prepared.

Real-Time Collaborative Notes

Take notes together during the meeting. Tag people, mark key points, and assign tasks all while staying engaged in the discussion.

Instant Meeting Minutes & Summaries

MinutesVault automatically generates a summary of decisions, action items, and discussion points right after the meeting. No more chasing notes or writing recap emails.

Track Meeting ROI

Visual dashboards help you understand how much time is being spent in meetings, how productive they are, and where you can improve.

Built for Modern Teams

Whether you're remote, hybrid, or in-office, MinutesVault adapts to your workflow:

Startups use it to keep teams lean and fast-moving

Product teams use it to power agile standups and retros

Executives use it to stay focused on high-impact decisions

HR and Ops use it to maintain clear documentation and alignment

Data Security First

We know your meetings involve sensitive content. That’s why MinutesVault is built with enterprise-grade security:

End-to-end encryption

Role-based permissions

GDPR & SOC 2 compliance

Your data is protected at every step.

Final Thoughts

Your team’s time is valuable. Don’t waste another minute in unproductive meetings. Let MinutesVault turn every meeting into a launchpad for real results.

0 notes

Text

The Real Cost of Downtime: How EDSPL’s DDoS Defense Keeps You Online 24x7

Introduction: When Seconds of Downtime Turn Into Millions

Imagine this: It's 10 a.m. on a Monday. Your ecommerce site is flooded with visitors. Just when sales peak, your server crashes. Not because of faulty code. Not due to hosting issues. But due to a Distributed Denial of Service (DDoS) attack.

Your site is down for 15 minutes. In that small window, you lose thousands in revenue, customer trust takes a hit, and your brand reputation suffers.

This isn’t a theoretical scare tactic. Downtime costs real money, and the impact is bigger than most businesses estimate.

In this blog, we’ll uncover:

What DDoS attacks really cost you

How attackers exploit vulnerabilities

Why traditional defenses aren’t enough

And how EDSPL’s DDoS protection gives you 24x7 peace of mind

Section 1: The Hidden Price of Downtime

You might think a few minutes offline is no big deal. But here’s what it really means:

Revenue Loss

Amazon once estimated that every second of downtime costs them $2,300. Even a small ecommerce store making ₹50,000/day can lose ₹10,000 or more in 30 minutes of downtime.

SEO Rankings

Search engines like Google penalize websites that face frequent downtime. This impacts organic traffic, crawl frequency, and eventually revenue.

Customer Trust

Users won’t wait. If your site’s down, they click away—to your competitor. Brand trust takes time to build, but one failed transaction can break it instantly.

Operational Chaos

Your support team is flooded with queries. Internal teams scramble. Productivity drops. Business operations suffer.

Security Risk Amplification

Downtime can be a smokescreen for larger attacks—like data theft, malware installation, or ransomware. A DDoS attack can serve as a diversion, while your real assets are being breached.

Section 2: What Makes DDoS Attacks So Dangerous?

A DDoS (Distributed Denial of Service) attack overwhelms your systems with traffic, making them crash or become inaccessible.

Types of DDoS Attacks

Volumetric attacks – Flood bandwidth (e.g., UDP floods)

Protocol attacks – Exploit network stack (e.g., SYN floods)

Application-layer attacks – Overload app endpoints (e.g., HTTP floods)

Why Firewalls Aren’t Enough

Basic firewalls can’t keep up with high-volume, multi-vector DDoS attacks. They’re built for rules-based protection, not real-time adaptive filtering.

That’s where EDSPL’s network security makes all the difference.

Section 3: EDSPL’s Always-On DDoS Defense — What Sets It Apart

While other providers offer reactive solutions, EDSPL provides proactive, AI-powered DDoS protection, built for scalability and speed.

24x7 Monitoring & Mitigation

With EDSPL’s fully managed Services, your digital assets are monitored continuously by our Security Operations Center (SOC). Mitigation begins the moment malicious traffic is detected.

Advanced Traffic Scrubbing

We inspect packets in real-time and remove malicious requests before they reach your application, preserving availability for real users.

AI-Based Anomaly Detection

Our systems learn your traffic behavior over time, identifying unusual activity patterns and preventing false positives.

Scalable Cloud Infrastructure

Attacks keep growing in size—and so does our defense. EDSPL leverages cloud security infrastructure that automatically scales to meet peak loads during attack surges.

Section 4: How Downtime Affects Your Digital Backbone

Most companies don't realize how downtime paralyzes not just their front-end, but the entire IT ecosystem. Here’s how:

Mobility Gets Disrupted

Remote teams, mobile apps, and field staff lose access to critical systems. This impacts productivity and customer service.

Routing & Switching Bottlenecks

Infrastructure gets choked, rerouting requests inefficiently, increasing latency, and hurting performance even after systems are "back."

Storage & Backup Failures

Automated backups, scheduled replications, or live transaction logs may fail mid-execution, leading to data inconsistency.

Compute Overload

Your cloud compute instances get overwhelmed during volumetric attacks, costing you not just downtime, but skyrocketing cloud bills.

Data Center Switching Errors

Heavy attack loads can exhaust your switching capacity, leading to internal data path failures inside your data center.

Section 5: Case Study – How EDSPL Saved a Leading NBFC

In early 2024, a leading NBFC in India faced a DDoS attack targeting its user verification API.

Servers went down for 18 minutes

Customers couldn’t log in to pay EMIs

A high volume of support tickets were raised

EDSPL was called for emergency mitigation

What We Did:

Diverted incoming traffic through our global DDoS scrubbing nodes

Restored operations within 6 minutes

Installed full-time managed and maintenance services for 24x7 uptime

Result: They now experience zero downtime during peak hours, with consistent transaction throughput.

Section 6: The EDSPL Advantage — What You Get Beyond Defense

With EDSPL, it’s more than protection. It’s a strategic cybersecurity partnership.

✅ Custom DDoS Mitigation Plans

Tailored by use case: banking, ecommerce, SaaS, logistics, healthcare, and more.

✅ Dashboard for Real-Time Insights

Live analytics on attacks, traffic volume, IP geolocation, and mitigation actions—no guesswork.

✅ Unified With Other Security Layers:

Application Security

Cloud Security

Network Security

✅ Vision-Driven Implementation

Our background vision is to enable secure digital growth across enterprises by ensuring nonstop service availability.

Section 7: DDoS Defense ROI — A Smart Investment

Improved SLAs & Customer Trust

Your customers won’t even notice an attack—because your services don’t go down.

Cost Saving vs. Recovery Cost

Downtime = ₹5L – ₹50L losses depending on the scale

EDSPL’s cost-effective defense = a fraction of that

Performance Boost

Without junk traffic, your systems perform better. You serve real users faster.

Seamless Integration

Whether you're on public cloud, private cloud, or hybrid infrastructure—no redesign required.

Section 8: A Call to Action — Don’t Wait Until It’s Too Late

If your business is online, DDoS attacks are inevitable. The only choice is:

Wait until it happens? Or prepare in advance with EDSPL?

📞 Call Us: +91-9873117177 📧 Email: [email protected] 🌐 Visit: www.edspl.net

✅ Reach Us | ✅ Get In Touch

Let’s make your brand unbreakable.

Final Thoughts

At EDSPL, we believe security shouldn’t be reactive—it should be resilient.

Whether you’re a startup or an enterprise, uptime is the lifeline of your business. And we’re here to guard it every second of every day.

Because in the digital age, downtime is destruction—and EDSPL is your shield.

0 notes

Text

New Horizons in Garage Door Engineering: Materials, Automation, and Energy Performance in 2025

Once a purely mechanical barrier between street and shelter, the garage door has become a sophisticated element of the connected, energy-efficient home. Rapid advances in materials science, embedded electronics, and safety regulation are reshaping both residential and commercial systems. This overview surveys the most significant developments reported in 2024–2025 and outlines where research and industry are heading next.

1. Market Trends and Consumer Expectations

Industry analysts note that demand for upgraded doors is driven by three parallel forces: rising smart-home adoption, interest in curb-appeal remodeling, and stricter efficiency codes. Surveys of leading manufacturers highlight growing orders for factory-integrated Wi-Fi operators, bold color palettes, and sustainable finishes, all of which are forecast to dominate product lines through 2026 :contentReference[oaicite:0]{index=0}.

2. Material Science Breakthroughs

2.1 Hybrid Steel-Composite Skins

Traditional rolled steel remains the structural core of most sectional panels, yet surface layers now incorporate composite veneers that mimic red oak, cedar, or carbon fiber without the maintenance burden. Heat-fused laminates resist ultraviolet degradation and allow deeper embossing for realistic grains :contentReference[oaicite:1]{index=1}.

2.2 Next-Generation Insulation

Closed-cell polyurethane foams with vacuum-microsphere additives are achieving R-values above 18 for 1¾-inch panels, a 25 % gain over formulations common five years ago. Studies estimate that swapping an uninsulated door for one of these new cores can cut conditioned‐space energy loss by 30–40 % in mixed climates :contentReference[oaicite:2]{index=2}.

2.3 Corrosion-Resistant Hardware

Research groups report promising results for zinc-aluminum-magnesium (ZAM) coatings on torsion springs and tracks. Accelerated salt-spray testing shows lifespan extensions of 2–3× relative to standard galvanized components, reducing lifetime maintenance intervals.

3. Connected Automation and Control

3.1 Embedded IoT Platforms

Smart operators in 2025 ship with dual-band Wi-Fi, Bluetooth LE, and Thread radios on a single SoC. Integration with Matter and open APIs allows homeowners to trigger scenes—such as closing the door, arming the alarm, and dimming exterior lights—via one command. Manufacturers are also experimenting with ultra-wideband (UWB) positioning for centimeter-level vehicle detection, promising hands-free entry without geofencing errors :contentReference[oaicite:3]{index=3}.

3.2 Edge AI for Anomaly Detection

Prototype controllers equipped with low-power neural processors analyze vibration signatures and current draw to predict spring fatigue or rail misalignment weeks before failure. Early field trials report a 60 % reduction in unplanned service calls compared with reactive maintenance schedules.

4. Safety Engineering and Regulatory Updates

4.1 Evolution of UL 325 Compliance

The 2024 revision of UL 325 introduced stricter entrapment-protection requirements, mandating redundant optical sensors and automated reversal testing at each power-cycle. Commercial operators must now log safety-self-check results to non-volatile memory, creating an auditable record for inspectors :contentReference[oaicite:4]{index=4}.

4.2 Force-Limiting Drives

Brushless DC motors paired with Hall-effect torque sensors enable controllers to cap closing forces more precisely than legacy AC units. This approach, combined with soft-start profiles, reduces the risk of impact injuries and extends gear life by lowering mechanical shock.

5. Energy Efficiency and Sustainability

Beyond high-R panels, manufacturers are addressing thermal bridging around perimeter seals. Novel triple-lip weatherstrips molded from bio-based thermoplastic elastomers demonstrate 15 % less compression set after 50 000 cycles. Meanwhile, lifecycle assessments reveal that insulated doors repay their embodied carbon in three to five heating seasons, depending on climate :contentReference[oaicite:5]{index=5}.

Solar-ready DC operators with integrated lithium-iron-phosphate batteries are entering mass production, offering grid-independent operation for up to 40 cycles after sunset—critical for regions facing extreme weather outages.

6. Acoustic Performance

Homeowners increasingly rank noise reduction alongside aesthetics. Recent studies show that nylon-encapsulated roller bearings paired with damped steel hinge plates can lower airborne noise by 5–7 dB(A). Computational fluid dynamics has been applied to redesign bottom astragals, minimizing air rush that contributes to closing slam.

7. Robotics and Installation Automation

Torque-controlled collaborative robots (cobots) are being piloted on factory floors to automate spring winding and panel stacking. Early data indicate a 40 % drop in repetitive-strain injuries among line workers and improved winding precision, translating to longer in-field spring life.

8. Future Outlook: Toward Adaptive, Self-Healing Doors

Researchers are experimenting with microcapsule-infused powder-coat finishes that release curing agents when scratched, sealing minor abrasions autonomously. Concurrently, integrated vision modules may soon enable doors to pause for obstacles that optical beams miss, such as low-lying pets, by leveraging shape-recognition algorithms.

Conclusion

Garage doors have progressed far beyond their utilitarian roots. Advances in hybrid materials, insulated cores, IoT integration, and predictive safety systems are transforming doors into active participants in the smart, sustainable home. With regulatory bodies tightening safety standards and consumers demanding both efficiency and design flexibility, the next generation of doors will be lighter, quieter, and markedly more intelligent. Engineers and installers who track these trends are poised to deliver solutions that meet the dual goals of resilience and user convenience.

#garage door maintenance#garage door service#garage door repair#garage door opener#garage#chattanoogatn

0 notes

Text

Edge AI for Real-Time Monitoring in Lithium-ion Battery Systems

The growing complexity and widespread deployment of lithium-ion batteries necessitate increasingly sophisticated monitoring systems. While traditional cloud-based AI approaches offer powerful analytics, the latency and connectivity demands can be prohibitive for real-time, safety-critical applications. This is where Edge AI emerges as a transformative solution, bringing intelligence directly to the battery system itself.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=49714593

Edge AI refers to the deployment of artificial intelligence models on edge devices – computational hardware located close to the data source, rather than relying on centralized cloud servers. For lithium-ion battery systems, this means embedding AI capabilities directly within the Battery Management System (BMS) or on dedicated, low-power microcontrollers within the battery pack. This local processing offers several distinct advantages for real-time monitoring.

One of the primary benefits of Edge AI in battery systems is significantly reduced latency. Data from sensors (voltage, current, temperature, etc.) is processed instantaneously on the device, enabling immediate decision-making. In critical scenarios, such as detecting an anomalous temperature rise or a sudden voltage drop that could indicate a potential thermal runaway, milliseconds matter. Cloud-based systems introduce delays due to data transmission, network congestion, and server processing, which can be unacceptable for preventing catastrophic failures. Edge AI bypasses these bottlenecks, providing near-instantaneous insights and enabling rapid protective actions.

Beyond speed, Edge AI enhances data privacy and security. Sensitive battery operational data, which can reveal usage patterns and personal behaviors, remains localized on the device. This minimizes the need to transmit large volumes of raw data to external servers, reducing the risk of data breaches and complying with stringent privacy regulations. Furthermore, operating at the edge reduces reliance on continuous network connectivity, making battery systems more robust in environments with limited or intermittent internet access.

Implementing Edge AI also contributes to more efficient resource utilization. By processing data locally, only essential insights or filtered data need to be sent to the cloud for long-term storage or broader analysis. This significantly reduces bandwidth requirements and cloud computing costs, making the overall system more economical to operate, especially for large fleets of electric vehicles or distributed energy storage systems. The development of lightweight AI models and specialized AI accelerators tailored for edge devices has made it feasible to run complex machine learning algorithms on resource-constrained hardware with minimal power consumption.

Edge AI enables real-time estimation of critical battery parameters such as State of Charge (SoC), State of Health (SoH), and Remaining Useful Life (RUL) with enhanced accuracy. Algorithms like AI-SOX can estimate SoC across various chemistries and temperature ranges with less than 1% Mean Absolute Error. This precision allows for more intelligent charge and discharge management, maximizing battery performance and extending its lifespan. Anomaly detection, a key application of Edge AI, identifies subtle deviations from normal operation, providing early warnings of potential degradation or faults, thus enabling proactive maintenance and preventing costly failures.

The challenges of implementing Edge AI include optimizing AI models for limited computational resources, ensuring model robustness across diverse operating conditions, and managing over-the-air updates for distributed devices. However, ongoing advancements in hardware, software frameworks, and model compression techniques are continually addressing these hurdles. As lithium-ion battery systems become even more ubiquitous and demanding, Edge AI will play an increasingly vital role in ensuring their safe, reliable, and efficient operation in real-time.

For Related Report on Semiconductor and Electronics Industry: https://www.marketsandmarkets.com/semiconductorand-electonics-market-research-87.html

0 notes

Text

IoT Chips Market is Driven by Explosive Connectivity Demand

Internet of Things (IoT) chips are specialized microprocessors, system-on-chips (SoCs), and connectivity modules designed to enable seamless data exchange among sensors, devices, and cloud platforms. These chips incorporate ultra-low-power architectures, embedded security protocols, and advanced signal processing capabilities that support a broad spectrum of IoT applications—from smart homes and wearable gadgets to industrial automation and connected vehicles. Advantages include reduced latency through edge computing, optimized energy efficiency for battery-operated devices, and streamlined integration into existing network infrastructures.

As businesses pursue digital transformation, there is a growing need for reliable, scalable chipsets capable of handling massive device connectivity, real-time analytics, and robust encryption. Continuous innovation in semiconductor fabrication processes has driven down production costs and boosted performance metrics, enabling smaller startups and established market players alike to introduce competitive products. Meanwhile, evolving market trends such as 5G rollout, AI-enabled analytics, and smart city initiatives are creating new IoT Chips Market opportunities and shaping the industry landscape. Comprehensive market research highlights expanding market segments in healthcare monitoring, agricultural sensors, and asset tracking.

The IoT chips market is estimated to be valued at USD 620.36 Bn in 2025 and is expected to reach USD 1415.005 Bn by 2032, growing at a compound annual growth rate (CAGR) of 15.00% from 2025 to 2032. Key Takeaways

Key players operating in the IoT Chips Market are:

-Intel Corporation

-Samsung Electronics Co. Ltd

-Qualcomm Technologies Inc.

-Texas Instruments Incorporated

-NXP Semiconductors NV

These market companies have established strong footholds through diversified product portfolios that span microcontrollers, application processors, short-range wireless SoCs, and AI inference engines. Their strategic investments in R&D, partnerships with tier-one automotive and industrial firms, and capacity expansions in fabrication plants are instrumental in driving market share growth. Robust alliances and licensing agreements help these players accelerate time-to-market for next-generation solutions, while continuous performance enhancements maintain their competitive edge. As major players optimize supply chains and strengthen IP portfolios, they contribute significantly to the overall market dynamics and industry size. The growing demand for IoT chips is fueled by accelerated digitalization across verticals such as automotive, healthcare, consumer electronics, and manufacturing. Automotive OEMs are integrating IoT chips for connected car features—remote diagnostics, vehicle-to-everything (V2X) communication, and advanced driver-assistance systems (ADAS)—driving substantial market growth. In healthcare, remote patient monitoring and telemedicine solutions rely on miniaturized, power-efficient chips to ensure continuous data transmission and secure access. Additionally, smart agriculture applications leverage low-cost sensors and communication modules to optimize resource usage and crop yields. As enterprises embrace Industry 4.0, the deployment of IoT solutions for predictive maintenance and asset tracking has become a critical business growth strategy. These evolving market trends underscore the importance of high-performance, cost-effective IoT chips to sustain long-term expansion.

‣ Get More Insights On: IoT Chips Market

‣ Get this Report in Japanese Language: IoTチップ市場

‣ Get this Report in Korean Language: IoT칩시장

0 notes

Text

global Video Sync Separator Market Industry Outlook: Trends and Forecasts

MARKET INSIGHTS

The global Video Sync Separator Market size was valued at US$ 234 million in 2024 and is projected to reach US$ 312 million by 2032, at a CAGR of 4.1% during the forecast period 2025-2032

Video sync separators are semiconductor devices designed to extract synchronization signals (horizontal and vertical timing information) from composite video inputs. These components are critical in processing video signals across multiple standards, including NTSC, PAL, SECAM, SDTV, and HDTV. By isolating sync pulses, they enable stable video display and synchronization in applications such as broadcasting, imaging, and consumer electronics.

The market is expanding due to rising demand for high-definition video processing, particularly in surveillance systems and digital displays. While the U.S. dominates with an estimated market size of USD 12.4 million in 2024, China is expected to witness accelerated growth, driven by increasing electronics manufacturing. Key players like Texas Instruments, Renesas, and ROHM collectively hold over 60% of the global market share, with innovations in low-power and multi-standard compatibility shaping competition.

MARKET DYNAMICS

MARKET DRIVERS

Expanding Video Processing Applications in Consumer Electronics to Accelerate Market Growth

The global video sync separator market is experiencing robust growth, primarily driven by the surging demand for high-quality video processing solutions in consumer electronics such as televisions, gaming consoles, and multimedia devices. Video sync separators play an integral role in extracting synchronization signals from complex video inputs, ensuring seamless display performance. With the rising adoption of 4K and 8K displays, the need for advanced synchronization solutions has become more critical than ever. The market is expected to witness a compound annual growth rate of over 6% from 2024 to 2032, fueled by these technological advancements.

Growth in Surveillance and Imaging Applications to Boost Demand

The surveillance industry’s rapid expansion is creating significant opportunities for video sync separator manufacturers. Modern security systems increasingly rely on high-definition video processing capabilities to deliver clear and stable images. Video sync separators enable precise synchronization in multi-camera setups, which is essential for traffic monitoring, public safety, and commercial security applications. The global surveillance camera market, valued at approximately $50 billion in 2024, continues to grow at a steady pace, directly benefiting the video sync separator segment.

Furthermore, medical imaging equipment manufacturers are incorporating advanced video processing solutions to enhance diagnostic accuracy. The integration of video sync separators in ultrasound machines, endoscopes, and other medical imaging devices is expected to drive substantial market growth in the healthcare sector.

MARKET RESTRAINTS

Declining Demand for Legacy Video Standards to Limit Market Expansion

While the video sync separator market shows promising growth potential, the gradual phasing out of legacy video standards presents a significant challenge. Analog video formats such as NTSC and PAL, which once dominated the market, are being replaced by digital interfaces like HDMI and DisplayPort. This transition reduces the need for traditional sync separation solutions in modern devices. Manufacturers face the challenge of adapting their product portfolios to remain relevant in an increasingly digital ecosystem.

Other Restraints

Integration Complexities in Advanced Systems Modern video processing systems require complex integration of multiple functionalities, making it challenging to implement standalone sync separator chips. System-on-chip (SoC) solutions that incorporate synchronization functions directly are becoming more prevalent, potentially reducing demand for discrete video sync separator components.

Price Pressure in Mature Segments The consumer electronics sector, particularly in emerging markets, remains highly price-sensitive. Intense competition among manufacturers often leads to margin compression, making it difficult to maintain profitability in standard-definition video processing solutions.

MARKET OPPORTUNITIES

Emerging Applications in Automotive Displays to Create New Growth Avenues

The automotive industry presents significant opportunities for video sync separator manufacturers, driven by the increasing adoption of advanced driver assistance systems (ADAS) and in-vehicle infotainment solutions. Modern vehicles incorporate multiple high-resolution displays for navigation, entertainment, and vehicle diagnostics, all requiring precise video synchronization. The automotive display market is projected to grow at nearly 8% annually through 2030, creating substantial demand for specialized video processing components.

Additionally, the development of augmented reality head-up displays (AR HUDs) in premium vehicles requires advanced synchronization capabilities to ensure seamless integration of digital information with the real-world view. This emerging technology segment is expected to drive innovation in video sync separator solutions.

MARKET CHALLENGES

Rapid Technological Evolution Requires Continuous R&D Investment

The video processing industry faces constant technological disruption, requiring manufacturers to maintain significant research and development expenditures. Developing solutions that support emerging video standards while maintaining backward compatibility with legacy systems presents both technical and financial challenges. Smaller players in particular may struggle to keep pace with the innovation required to remain competitive.

Other Challenges

Supply Chain Vulnerabilities The global semiconductor shortage highlighted the fragility of electronics supply chains. Video sync separator manufacturers must navigate component availability issues and price fluctuations that can impact production schedules and profitability.

Standardization Gaps The lack of unified standards for emerging video interfaces creates compatibility challenges. Developing solutions that work seamlessly across different manufacturers’ implementations requires extensive testing and adaptation efforts.

VIDEO SYNC SEPARATOR MARKET TRENDS

Rising Demand for High-Quality Video Processing in Consumer Electronics

The global video sync separator market is experiencing significant growth driven by increasing adoption in consumer electronics, particularly in televisions, gaming consoles, and video capture devices. With the global consumer electronics sector projected to surpass $1.5 trillion by 2030, manufacturers are prioritizing enhanced video processing capabilities to meet consumer expectations for pristine image quality. Sync separators play a critical role in extracting precise timing signals from composite video streams, ensuring stable synchronization across various display technologies. Recent advancements in 4K and 8K resolution standards have further amplified demand for high-precision sync separation chips capable of handling ultra-high-definition signals without artifact generation.

Other Trends

Integration with Emerging Display Technologies

As next-generation display technologies gain traction in the automotive and industrial sectors, video sync separators are evolving to support novel applications. The automotive display market alone is expected to grow at a CAGR of 8% through 2030, creating substantial opportunities for sync separator suppliers. Modern heads-up displays and advanced driver assistance systems (ADAS) require robust synchronization solutions that maintain performance across extreme temperature ranges and electromagnetic interference conditions. Leading manufacturers are responding with specialized automotive-grade sync separators featuring enhanced noise immunity and wider operating voltage ranges.

Medical Imaging Applications Driving Innovation

The medical imaging sector represents one of the fastest-growing applications for video sync separators, with the global medical displays market anticipated to reach $3.2 billion by 2027. Diagnostic imaging equipment such as endoscopes, ultrasound machines, and surgical displays demand ultra-reliable sync separation to maintain critical video feeds during medical procedures. This has prompted development of medical-grade sync separators with features like automatic format detection, minimum jitter generation, and redundant synchronization pathways. The trend toward minimally invasive surgery and telemedicine is further accelerating adoption of these specialized components in healthcare settings worldwide.

Video Sync Separator Market

COMPETITIVE LANDSCAPE

Key Industry Players

Technological Innovation Drives Competition in the Video Sync Separator Space

The global Video Sync Separator market, valued at $XX million in 2024, exhibits a semi-fragmented competitive landscape with established semiconductor giants competing alongside specialized component manufacturers. Renesas Electronics Corporation emerges as a market leader, leveraging its extensive expertise in analog and mixed-signal ICs to capture significant market share. The company’s advanced sync separator ICs supporting multiple video standards give it a strong position in both consumer electronics and professional imaging applications.

Texas Instruments and ROHM Semiconductor represent other major players, collectively accounting for a substantial portion of 2024’s global revenue. Texas Instruments’ broad portfolio of video interface solutions, combined with its strong distribution network, positions it well in North American and European markets. Meanwhile, ROHM has strengthened its market position through specialized low-power solutions favored in portable electronics.

Medium-sized players like Maxim Integrated (now part of Analog Devices) and Intersil (acquired by Renesas) have carved out specialized niches through innovative product designs. These companies compete on performance parameters such as jitter reduction and multi-standard compatibility, particularly in high-end broadcast and medical imaging applications.

Recent industry movements show increasing R&D investment in next-generation video processing technologies. Several key players are expanding their product lines to address emerging standards and higher resolution requirements in display technologies. Strategic partnerships between semiconductor manufacturers and display system integrators are becoming more common as the market evolves toward integrated video processing solutions.

List of Key Video Sync Separator Companies Profiled

Renesas Electronics Corporation (Japan)

Texas Instruments (U.S.)

National Semiconductor Corporation (U.S.)

NTE Electronics (U.S.)

ROHM Semiconductor (Japan)

Maxim Integrated (U.S.)

GENNUM Corporation (Canada)

Intersil Corporation (U.S.)

Segment Analysis:

By Type

Composite Segment Leads the Market Due to Widespread Use in Standard Video Processing

The market is segmented based on type into:

Composite

Subtypes: PAL, NTSC, SECAM

Horizontal

Vertical

Others

By Application

Consumer Electronics Segment Dominates Due to High Demand from Display Manufacturers

The market is segmented based on application into:

Imaging

Consumer electronics

Broadcast equipment

Medical imaging devices

Others

By Protocol

HDTV Segment Growing Rapidly Due to Shift Towards High Definition Content

The market is segmented based on protocol compatibility into:

SDTV

HDTV

NTSC

PAL

SECAM

By End User

Original Equipment Manufacturers (OEMs) Hold Major Market Share

The market is segmented based on end users into:

Original Equipment Manufacturers (OEMs)

Consumer electronics repair services

Broadcast equipment manufacturers

Medical device manufacturers

Others

Regional Analysis: Video Sync Separator Market

North America The North American market remains a dominant player in the video sync separator industry, driven by strong demand from the consumer electronics and imaging sectors. The U.S. alone holds a significant market share, accounting for nearly 40% of global demand in 2024. This is largely due to the proliferation of high-definition broadcasting standards and investments in 4K and 8K display technologies. Major semiconductor manufacturers, including Texas Instruments and Maxim Integrated, are headquartered in the region, accelerating innovation in sync separator ICs. However, market maturity and saturation in core segments pose challenges for aggressive growth. Stringent FCC compliance standards continue to influence product development, pushing the adoption of advanced sync solutions.

Europe Europe’s market benefits from robust demand in automotive infotainment and medical imaging, where precise video synchronization is critical. Germany and the U.K. are leading contributors, aided by a thriving industrial electronics ecosystem. The region is witnessing increased adoption of AI-powered video processing, which relies on high-performance sync separators for latency-sensitive applications. EU regulations on electromagnetic compatibility (EMC) indirectly shape product specifications, creating a preference for compliant chipsets from suppliers like Renesas and NXP. While the market exhibits steady growth, pricing pressures from Asian manufacturers and slow adoption of legacy analog systems restrain expansion.

Asia-Pacific Asia-Pacific is the fastest-growing market, spearheaded by China, Japan, and South Korea, where consumer electronics manufacturing dominates demand. China alone contributes over 30% of global shipments, with local players expanding their footprint in IC design. The rise of smart TVs, surveillance systems, and gaming consoles directly fuels demand for sync separators. Japan remains a hub for high-precision imaging equipment, while India’s burgeoning digital infrastructure projects offer untapped potential. However, intense competition from domestic suppliers and price volatility in the semiconductor supply chain create margin pressures for international players. The region’s shift toward IP-based video transmission could redefine long-term demand for traditional sync solutions.

South America South America presents nascent opportunities, primarily in Brazil and Argentina, where broadcast infrastructure modernization is underway. Local production remains limited, forcing reliance on imports from North American and Asian suppliers. Economic instability and currency fluctuations deter large-scale investments, though niche applications in security systems and educational AV equipment sustain moderate demand. The absence of stringent technical standards results in a fragmented market where both high-end and low-cost solutions coexist. Potential growth hinges on increased digitization of media and telecommunications networks.

Middle East & Africa This region shows gradual growth, led by the UAE and Saudi Arabia, where smart city initiatives and expanding broadcast networks drive procurement of video processing components. The market is highly import-dependent, with suppliers like ROHM and Intersil leveraging distribution partnerships to serve the region. Inconsistent regulatory frameworks and budgetary constraints delay the adoption of cutting-edge technologies, though demand for basic sync separators in surveillance and signage applications remains steady. Long-term prospects hinge on infrastructure development and increased localization of semiconductor assembly.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Video Sync Separator markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Video Sync Separator market was valued at USD 150.2 million in 2024 and is projected to reach USD 225.8 million by 2032, growing at a CAGR of 5.2%.

Segmentation Analysis: Detailed breakdown by product type (Composite, Horizontal, Vertical), application (Imaging, Consumer Electronics, Others), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America (USD 42.5 million in 2024), Europe, Asia-Pacific (fastest growing at 6.1% CAGR), Latin America, and Middle East & Africa, with country-level analysis.

Competitive Landscape: Profiles of leading players including Renesas (18% market share), Texas Instruments (15%), ROHM (12%), Maxim Integrated, and Intersil, covering product portfolios, R&D, and M&A activities.

Technology Trends: Assessment of emerging video processing technologies, integration with AI/ML, and evolving video standards (8K, HDR).

Market Drivers & Restraints: Evaluation of growth drivers (rising demand for high-quality video processing, 5G adoption) and challenges (supply chain constraints, pricing pressures).

Stakeholder Analysis: Strategic insights for semiconductor manufacturers, OEMs, system integrators, and investors.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/chip-solid-tantalum-capacitor-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-electrical-resistance-probes.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/high-temperature-tantalum-capacitor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-link-choke-market-innovations.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/multirotor-brushless-motors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/planar-sputtering-target-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ferrite-core-choke-market-opportunities.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/float-zone-silicon-crystal-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/carbon-composition-resistors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/resistor-network-array-market-analysis.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/melf-resistors-market-key-drivers-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/metal-foil-resistors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/metal-oxidation-resistors-market-size.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ferrite-toroid-coils-market-growth.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/vacuum-fluorescent-displays-market.html

0 notes

Text

Battery Management and Smart Charging Systems in Robotics

In modern robotics, the demand for longer operational time and improved autonomy has brought battery management and smart charging systems to the forefront of research and innovation. As mobile robots, drones, and autonomous vehicles become more common in logistics, healthcare, agriculture, and defense, efficient power systems are essential to ensure uninterrupted performance. Battery systems are often the limiting factor for robotic endurance, and intelligent solutions are required to maximize their efficiency, safety, and longevity.

Battery Management Systems (BMS) are responsible for monitoring, controlling, and protecting rechargeable batteries. In robotics, an effective BMS must perform real-time tracking of battery health, estimate the State of Charge (SoC) and State of Health (SoH), and prevent overcharging, overheating, or deep discharging. Advanced BMS technologies now incorporate machine learning algorithms that can predict battery behavior under different usage scenarios, enabling proactive decisions. These systems are crucial for preventing energy wastage and avoiding system failures in mission-critical robotic applications.

Equally important is the development of smart charging systems that support fast, wireless, or adaptive charging protocols. Traditional robotic charging relies on manual or scheduled plug-in mechanisms, which can be inefficient for continuous deployment. Smart systems, by contrast, allow for autonomous docking and charging, based on energy demand, task urgency, and environmental conditions. Wireless charging through inductive or resonant coupling also reduces mechanical wear and enables sealed or underwater robots to recharge without physical contact.

To optimize battery life and energy efficiency, predictive load balancing can be implemented across multi-robot platforms. By intelligently distributing workloads based on remaining battery capacity and prioritizing energy-efficient tasks, overall system performance can be enhanced. Cloud-based BMS solutions also enable centralized monitoring and management of large robotic fleets, ensuring that each unit operates within optimal energy parameters. Integration with IoT infrastructure further enhances remote diagnostics and maintenance.

Looking forward, the combination of AI, edge computing, and advanced battery materials will transform the way robotic systems are powered and maintained. Innovations such as solid-state batteries, lithium-sulfur technology, and hybrid power sources are being researched to provide higher energy density and safety. The next generation of smart charging systems will likely include solar-assisted charging, energy harvesting, and real-time decision-making to switch between charging modes. These advancements will not only extend the operational range of robots but also contribute to sustainability goals by reducing energy waste and dependence on fossil fuels.

#BatteryManagement #SmartCharging #RoboticsEnergySystems #BMSinRobotics #RobotBatterySafety #EnergyEfficientRobots #BatteryMonitoring #AutonomousCharging #WirelessChargingRobots #BatteryOptimization #PredictiveBatteryAnalytics #SmartDockingSystems #BatteryHealthMonitoring #EdgeAIforBatteries #MultiRobotPowerManagement #RobotPowerSystems #FastChargingRobots #IoTEnabledRobots #MobileRobotsBattery #RenewableChargingSystems #BatteryLifecycleManagement #AIinBMS #LowPowerRobotics #EnergyHarvestingRobots #SolidStateBatteries #LithiumIonRobots #PowerAwareRobotics #ChargingAutomation #RobotFleetEnergyControl #SustainableRoboticPower

The Scientist Global Awards

Website link : thescientists.net NominationLink :https://thescientists.net/award-nomination/?ecategory=Awards&rcategory=Awardee Contact Us : [email protected]

___________________________________ Social Media: Twitter : https://x.com/ScientistS59906 Pinterest : https://in.pinterest.com/scientists2025/_profile/ Tumblr : https://www.tumblr.com/blog/thescientistglobalawards FaceBook : https://www.facebook.com/profile.php?id=61574662138238

0 notes

Text

System-on-Chip (SoC) Market Demand: Growth, Share, Value, Size, and Insights

"Executive Summary System-on-Chip (SoC) Market :

Global System-on-Chip (SoC) Market size was valued at USD 361.41 million in 2024 and is projected to reach USD 696.69 million by 2032, with a CAGR of 8.55% during the forecast period of 2025 to 2032.

The System-on-Chip (SoC) Market report contains appropriate explanation about the market definition, classifications, applications, engagements, and global industry trends. The report seems very helpful to the clients in drawing target audiences before launching any advertising campaign. It also takes in consideration analysis, estimation, and discussion of important industry trends, market size, and market share. This market research report plays very essential role when it is about achieving far-fetched growth in the business. The global System-on-Chip (SoC) Market research report is structured by precisely understanding the customer requirements. This business report bestows with the strength to any kind of business whether it is large, medium or small for surviving and succeeding in the market.

The estimations of CAGR values are quite essential which helps businesses decide upon the investment value over the time period. The global System-on-Chip (SoC) Market report is perfectly analyzed on the basis of numerous regions. Business can be taken to the peak level of growth and success with the important market insights covered in this report. Another chief part of this System-on-Chip (SoC) Market report is the competitive landscape which gives a clear insight into the market share analysis and actions of key industry players. This market report also involves strategic profiling of the major players in the market, comprehensive analysis of their basic competencies, and thereby keeping competitive landscape of the market in front of the client.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive System-on-Chip (SoC) Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-system-on-chip-soc-market

System-on-Chip (SoC) Market Overview

**Segments**

- **By Type**: The SoC market can be segmented into Analog and Digital. - **By Application**: It can be further classified into Consumer Electronics, Telecommunication, Automotive, Aerospace & Defense, and Others. - **By End-User**: The market can also be segmented based on end-users, including Industrial, Commercial, and Residential.

The global System-on-Chip (SoC) market is witnessing significant growth due to the rapid advancements in technology and the increasing demand for compact and power-efficient electronic devices. The digital segment holds a substantial share in the market, mainly driven by the growing popularity of smartphones, tablets, and wearables. On the other hand, the analog segment is also witnessing steady growth due to the rising demand for high-performance analog chips in various applications. In terms of applications, the consumer electronics segment dominates the market, driven by the increasing adoption of smart home devices, IoT devices, and smart wearables. The telecommunication sector also holds a significant share, fueled by the deployment of 5G technology and the increasing demand for high-speed data communication.

The automotive sector represents a promising opportunity for the SoC market, with the increasing integration of advanced driver-assistance systems (ADAS), infotainment systems, and connectivity solutions in modern vehicles. The aerospace and defense sector also present growth prospects for SoC manufacturers, with the rising demand for sophisticated electronics in military applications. The industrial sector is another key end-user of SoCs, leveraging these chips for automation, control systems, and IoT applications.

**Market Players**

- Qualcomm Technologies, Inc. - Apple Inc. - Samsung Electronics Co., Ltd. - Intel Corporation - MediaTek Inc. - Broadcom - Toshiba Corporation - Texas Instruments Incorporated - NVIDIA Corporation - NXP Semiconductors

These market players hold a significant share in the global System-on-Chip (SoC) market, with a strong focus on innovation, product development, and strategic alliances. Qualcomm Technologies, Inc. and Apple Inc. are among the key players in the SoC market, leveraging their expertise in mobile chipsets and processors. Samsung Electronics Co., Ltd. is another dominant player, known for its Exynos series of SoCs used in smartphones and other electronic devices. Intel Corporation and MediaTek Inc. are also prominent players in the market, offering a wide range of SoCs for various applications and industries.

The competitive landscape of the SoC market is characterized by intense rivalry among key players, leading to constant product enhancements and technological innovations. Strategic collaborations, partnerships, and acquisitions are common strategies adopted by market players to strengthen their market presence and expand their product portfolios. With the increasing demand for power-efficient and high-performance SoCs in diverse applications, the global SoC market is poised for significant growth in the coming years.

https://www.databridgemarketresearch.com/reports/global-system-on-chip-soc-marketThe global System-on-Chip (SoC) market continues to experience robust growth driven by technological advancements and the increasing need for compact and energy-efficient electronic devices. One of the emerging trends in the market is the integration of AI capabilities into SoCs to enable smart features in various applications, fueling demand for more powerful processing units. Additionally, the migration towards 5G technology is boosting the demand for SoCs with enhanced connectivity and processing capabilities to support high-speed data transfer and low latency communication.

Another key factor shaping the SoC market is the growing emphasis on edge computing, where processing tasks are performed closer to the data source to reduce latency and enhance efficiency. This trend is driving the development of SoCs with improved processing power and AI acceleration features to meet the demands of edge computing applications across industries. Moreover, the increasing adoption of IoT devices and sensors is driving the demand for SoCs with integrated security features to protect data and ensure the integrity of communication networks.

Furthermore, the shift towards electric vehicles and the development of autonomous driving technologies are creating new opportunities for SoC manufacturers to provide innovative solutions for automotive applications. SoCs with advanced processing capabilities, high-speed connectivity, and robust security features are essential for powering the next generation of connected vehicles and enabling smart functionalities such as advanced driver-assistance systems and in-vehicle infotainment.

In the competitive landscape of the SoC market, continuous innovation and product differentiation are critical for companies to maintain their competitive edge. Market players are focusing on developing SoCs with a combination of high-performance processing units, energy-efficient designs, and integrated connectivity solutions to address the evolving needs of diverse industries. Strategic partnerships and collaborations with technology providers, software developers, and system integrators are also key strategies for expanding market reach and driving innovation in SoC products.

Looking ahead, the global SoC market is poised for substantial growth driven by the increasing demand for intelligent and connected devices across sectors such as consumer electronics, automotive, industrial automation, and telecommunications. As the industry continues to evolve, market players will need to invest in research and development to stay ahead of technological trends and capitalize on emerging opportunities in the dynamic SoC market landscape.The global System-on-Chip (SoC) market is a highly dynamic and competitive landscape, driven by continuous technological advancements and the increasing demand for compact, energy-efficient, and high-performance electronic devices across various industries. One of the noteworthy trends shaping the market is the integration of AI capabilities into SoCs, enabling smart features in applications and fueling the demand for more powerful processing units to support complex tasks. This trend towards AI integration presents opportunities for SoC manufacturers to innovate and cater to the growing needs of industries seeking intelligent and interconnected solutions.

Moreover, the migration towards 5G technology is a significant driver in the SoC market, leading to the demand for SoCs with enhanced connectivity and processing capabilities to support high-speed data transmission and low latency communication. As industries embrace the benefits of 5G networks, the need for advanced SoCs that can deliver seamless connectivity and efficient data processing becomes paramount, creating opportunities for market players to develop cutting-edge solutions that align with 5G technology requirements.

Another key driver influencing the SoC market is the shift towards edge computing, where processing tasks are performed closer to the data source to reduce latency and enhance efficiency in various applications. This shift drives the development of SoCs with improved processing power and AI acceleration features, empowering industries to leverage edge computing technologies effectively. The demand for SoCs with enhanced processing capabilities and AI functionalities to support edge computing applications across sectors such as manufacturing, healthcare, and smart cities presents a significant growth avenue for market players.

Furthermore, the rise in IoT devices and sensors is driving the need for SoCs with integrated security features to ensure data protection and network integrity. With the proliferation of connected devices in sectors like smart homes, industrial automation, and healthcare, the market for secure and reliable SoCs is expanding, offering opportunities for manufacturers to deliver robust solutions that address the evolving security requirements of IoT ecosystems.

In conclusion, the global SoC market is poised for substantial growth driven by evolving technological trends such as AI integration, 5G connectivity, edge computing, and IoT adoption. Market players need to focus on continuous innovation, product differentiation, and strategic partnerships to stay competitive in this dynamic landscape and capitalize on the growing demand for intelligent and connected devices across various industries. As the market continues to evolve, proactive research and development efforts will be essential for companies to adapt to changing market dynamics and seize emerging opportunities in the ever-evolving SoC market.

The System-on-Chip (SoC) Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-system-on-chip-soc-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

How System-on-Chip (SoC) Market Report Would Be Beneficial?

Anyone who are directly or indirectly connected in value chain of System-on-Chip (SoC) Market industry and needs to have Know-How of market trends

Marketers and agencies doing their due diligence

Analysts and vendors looking for System-on-Chip (SoC) Market intelligence about System-on-Chip (SoC) Market Industry

Competition who would like to correlate and benchmark themselves with market position and standings in current scenario

Browse More Reports:

Global Whey Protein Market Global Wheat Seeds Market Global Wave and Tidal Energy Market Global Water Treatment System Market Global Vodka Market Global Vinyl Cyclohexane Market Global Video Streaming Software Market Global Veterinary X-Ray Market Global Veterinary Active Pharmaceutical Ingredients Manufacturing Market Global Vegetable Concentrates Market Global Variable Data Printing Market Global Vanilla Beans and Extract Market Global Ursodeoxycholic Acid Market Global Ultraviolet Protection Factor (UPF) Sun Protective Clothing Market Global Two Terminal Tunnel Diode Market Global Tubulointerstitial Nephritis Treatment Market Global Tubeless Tire Market Global Trichuriasis Treatment Market Global Tranexamic Acid Market Global Tourette Syndrome Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us: Data Bridge Market Research US: +1 614 591 3140 UK: +44 845 154 9652 APAC : +653 1251 975 Email:- [email protected]

Tag

System-on-Chip (SoC) Market Size, System-on-Chip (SoC) Market Share, System-on-Chip (SoC) Market Trend, System-on-Chip (SoC) Market Analysis, System-on-Chip (SoC) Market Report, System-on-Chip (SoC) Market Growth, Latest Developments in System-on-Chip (SoC) Market, System-on-Chip (SoC) Market Industry Analysis, System-on-Chip (SoC) Market Key Player, System-on-Chip (SoC) Market Demand Analysis"

0 notes

Text

Advancements in Precise State of Charge (SOC) Estimation for Dry Goods Batteries

In the dynamic world of dry goods batteries, accurately determining the State of charge estimation (SOC estimation for dry goods batteries) is crucial for optimal performance and longevity. This article explores two widely used methods for SOC estimation for dry goods batteries: the Anshi integral method and the open-circuit voltage method. By examining their mechanics, strengths, and limitations, we aim to understand each method's suitability for different battery types clearly, highlighting recent advancements in SOC estimation.

I. The Anshi Integral Method

The Anshi integral method precisely calculates SOC by considering critical variables such as charge and discharge currents, time, and total capacity. This method is a cornerstone of Precise SOC estimation technology and is versatile and suitable for various battery chemistries.

Operational Mechanics

Current Measurement: Accurate measurements of charge and discharge currents using high-precision sensors are fundamental to SOC measurement for dry batteries.

Time Integration: Integrating measured currents over time to determine the total charge transferred utilizes advanced SOC algorithms for batteries.

SOC Calculation: Dividing the total charge transferred by the battery's capacity to obtain SOC ensures Accurate SOC estimation methods.

Strengths

Versatility: Applicable to different battery chemistries, enhancing Dry goods battery SOC improvement.

Robustness: Resilient to noise and parameter variations, supporting reliable Battery state of charge monitoring.

Accuracy: Provides precise SOC estimation when combined with other methods, contributing to Improving SOC estimation accuracy.

Limitations

Sensor Dependence: Accuracy relies on the quality of current sensors, affecting overall Battery management system SOC.

Temperature Sensitivity: SOC calculation can be affected by temperature variations, necessitating adaptive measures.

Computational Complexity: The integration process can be computationally expensive, impacting real-time applications.

II. The Open-Circuit Voltage Method

The open-circuit voltage method estimates SOC by measuring a battery's voltage when no load is connected. This method is particularly effective for ternary and lithium manganate batteries due to their unique voltage characteristics, representing significant Innovations in battery SOC tracking.

Operational Mechanics:

Voltage Measurement: Measuring the battery's open-circuit voltage is a fundamental aspect of State of charge estimation techniques.