#Advantages of integrating utility payments API

Explore tagged Tumblr posts

Text

Payments with convienient API & benefits of integrating utility payments API

Fingope provides a convenient API with utiltity payments by which you can pay bills on time & some benefits of integrating utility payments. FOR MORE INFO.

#Advantages of integrating utility payments API#Paying bills on correct duration of time#Quickly deals payments with helpful API

0 notes

Text

How Fintech is Disrupting the NBFC Sector

The financial services sector in India is undergoing a massive transformation, and at the heart of this disruption is Fintech—technology-driven innovation reshaping how financial services are delivered. One of the most significant areas being revolutionized is the Non-Banking Financial Company (NBFC) sector. With the rise of digital platforms and data-driven solutions, fintech is fundamentally altering the landscape for traditional NBFCs.

In this blog, we explore how fintech is disrupting the NBFC ecosystem and how aspiring businesses can take advantage of this shift through NBFC Registration in India and NBFC License online.

The Role of NBFCs in India

NBFCs play a crucial role in India’s financial system by offering loans, credit facilities, asset financing, and investment products—especially to underserved and semi-urban populations. Unlike traditional banks, NBFCs are more flexible and responsive, making them ideal for small businesses and individuals who may lack access to formal banking services.

Fintech Disruption: What's Changing?

1. Digital Lending Platforms

Fintech startups are redefining how credit is evaluated and disbursed. With AI-powered credit scoring, paperless KYC, and real-time loan approvals, digital lending platforms are replacing traditional, time-consuming methods used by NBFCs.

2. Data-Driven Risk Assessment

Fintech tools analyze alternative data—like utility payments, mobile usage, and social media behavior—to evaluate borrower credibility. This approach enhances risk assessment for NBFCs and opens lending to previously excluded segments.

3. Automation and Lower Operational Costs

By integrating cloud-based systems, APIs, and mobile platforms, fintech reduces operational costs, allowing NBFCs to scale faster and serve customers more efficiently.

4. Improved Customer Experience

Fintech enhances customer onboarding with instant loan applications, transparent terms, and 24/7 digital access. NBFCs that integrate fintech can deliver superior service to today’s tech-savvy consumers.

Why Startups Should Leverage Fintech to Launch NBFCs

The fintech revolution creates a favorable environment for new entrants in the NBFC space. Startups looking to tap into lending, digital finance, or micro-credit services can now do so more effectively by obtaining an NBFC License from RBI in India.

How to Get NBFC Registration in India

To launch an NBFC, businesses must obtain proper licensing and meet RBI regulations. Here’s a simplified process:

Company Incorporation First, register a company under the Companies Act, 2013.

Minimum Net Owned Fund (NOF) Ensure a minimum NOF of ₹2 crores.

Application to RBI Submit your application for NBFC License in India through the RBI portal.

Approval and Compliance After due diligence, RBI grants the license, and your NBFC must adhere to continuous compliance obligations.

Opting for NBFC Registration online in India simplifies the process by allowing businesses to complete documentation, tracking, and communication digitally.

Why You Need an NBFC Registration Consultant

The regulatory landscape is complex, and one minor error in documentation can lead to delays or rejection. Partnering with a trusted NBFC Registration Consultant in India ensures that your application process is smooth, compliant, and successful.

Professional NBFC registration consultants offer services like:

Documentation and legal drafting

Compliance with RBI norms

Business model planning and financial forecasting

End-to-end application filing

Assistance in securing NBFC license online

Conclusion

The NBFC sector is being rapidly transformed by fintech innovation, and forward-thinking entrepreneurs are leveraging this shift to build agile, customer-centric financial solutions. If you're planning to enter the lending or digital finance space, there's never been a better time to get started with Online NBFC Registration in India.

#NBFC Registration in India#NBFC License in India#NBFC Registration online in India#Online NBFC Registration in India#NBFC Registration Consultant in India#NBFC registration online#NBFC registration consultant#NBFC license online#NBFC license from rbi in India

0 notes

Text

Fintech As A Service Market Emerging Opportunities and Forecast 2023–2030

The global fintech as a service market size was estimated at USD 266.56 billion in 2022 and is projected to reach USD 949.49 billion by 2030, growing at a CAGR of 17.5% from 2023 to 2030. One of the primary factors fueling this growth is the increasing demand from both consumers and businesses for seamless, user-friendly digital financial services that offer convenience, speed, and enhanced user experience.

In response to these shifting expectations, many traditional financial institutions are recognizing the urgent need to modernize their service offerings. To stay competitive and relevant, they are forming strategic partnerships with FaaS providers, integrating cutting-edge fintech capabilities into their existing infrastructures. These collaborations allow them to deliver enhanced digital experiences without undergoing a complete technological overhaul.

Another major contributor to market growth is the widespread adoption of open banking frameworks and application programming interfaces (APIs). These innovations have fundamentally transformed how financial data is accessed and shared, creating an environment that supports innovation and interoperability. FaaS providers utilize APIs to deliver modular, flexible, and customizable solutions, enabling banks and financial institutions to quickly introduce new features and services with minimal development time and reduced cost.

In addition to flexibility, cost-efficiency and scalability are central advantages of the FaaS model. Many traditional financial organizations continue to rely on legacy systems, which are often costly to maintain and upgrade. In contrast, FaaS solutions are typically cloud-based, allowing institutions to significantly reduce infrastructure expenses and scale operations more easily, unburdened by the limitations of physical infrastructure.

Moreover, the market is being shaped by evolving regulatory landscapes and growing compliance demands. Financial institutions are facing increasingly complex regulations, requiring advanced tools for risk management, reporting, and data security. Fintech-as-a-Service providers are addressing this challenge by offering compliance-ready platforms equipped with automated regulatory tools that help organizations navigate and meet these requirements more effectively and efficiently.

Key Market Trends & Insights:

• In 2022, North America emerged as the leading region in the Fintech-as-a-Service (FaaS) market, contributing to over 34.0% of the global revenue. This dominance can be attributed to the region’s strong digital infrastructure, early adoption of financial technologies, and a high concentration of key fintech companies and financial institutions embracing FaaS solutions to modernize their offerings.

• Meanwhile, the Asia Pacific region is anticipated to register the highest compound annual growth rate (CAGR) over the forecast period. The surge in digital transformation, rising smartphone penetration, and increasing support from governments for open banking and digital financial inclusion are key factors fueling the region’s accelerated growth in the FaaS market.

• By type, the payment segment led the market in 2022, accounting for a revenue share of more than 40.0%. This reflects the growing demand for streamlined, secure, and flexible digital payment solutions among consumers and businesses, especially with the rising popularity of online shopping, mobile wallets, and contactless payment technologies.

• From a technology standpoint, the blockchain segment dominated the market in 2022, contributing to more than 28.0% of the global revenue. Blockchain’s capabilities in enhancing transaction transparency, security, and speed have positioned it as a core technology in the fintech ecosystem, especially in areas like cross-border payments, identity verification, and smart contracts.

• In terms of application, the compliance and regulatory support segment held the leading position in 2022, representing over 31.0% of the global revenue share. This reflects the increasing need for financial institutions to meet complex regulatory requirements. FaaS providers are addressing this demand by offering advanced tools that automate compliance processes, support risk management, and ensure adherence to evolving financial regulations.

Order a free sample PDF of the Fintech as a Service Market Intelligence Study, published by Grand View Research.

Market Size & Forecast:

• 2022 Market Size: USD 266.56 Billion

• 2030 Projected Market Size: USD 949.49 Billion

• CAGR (2023-2030): 17.5%

• North America: Largest market in 2022

• Asia Pacific: Fastest growing market

Key Companies & Market Share Insights:

The fintech-as-a-service (FaaS) market is characterized by intense competition, largely due to the presence of several dominant players who actively strive to capture greater market share. These companies are adopting a variety of strategic approaches to strengthen their product portfolios and expand their reach. Among the key strategies being employed are strategic partnerships and collaborations, which enable market participants to combine expertise and resources, thereby accelerating innovation and market penetration.

A notable example of such collaboration occurred in March 2023, when PayPugs, a fintech company, joined forces with Muniy, a personal finance application, to launch a comprehensive global fintech-as-a-service solution. This innovative offering allows enterprises to seamlessly integrate a wide range of financial services into their existing product ecosystems. By doing so, it significantly enhances both the convenience and flexibility available to end customers, helping businesses meet evolving consumer demands with greater agility.

The strategic partnership between PayPugs and Muniy represents a powerful alliance within the fintech landscape, driving increased adoption of fintech services across key markets such as the UK and Europe. Beyond partnerships, market players are also investing heavily in research and development (R&D) initiatives, focusing on improving and expanding their product offerings to maintain competitive advantage and meet the growing expectations of a rapidly evolving customer base.

Key Players

• PayPal Holdings, Inc.

• Block, Inc.

• Mastercard Incorporated

• Envestnet, Inc.

• Upstart Holdings, Inc.

• Rapyd Financial Network Ltd.

• Solid Financial Technologies, Inc.

• Railsbank Technology Ltd.

• Synctera Inc.

• Braintree

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion:

The fintech-as-a-service market is experiencing rapid growth driven by increasing demand for seamless, scalable, and customizable digital financial solutions. Key factors fueling this expansion include the rising adoption of cloud-based platforms, open banking initiatives, and advancements in technologies such as blockchain and artificial intelligence. The market is highly competitive, with companies focusing on innovation, strategic partnerships, and regulatory compliance to enhance service offerings. As financial institutions continue to modernize their operations to meet evolving customer expectations, fintech-as-a-service solutions are becoming critical enablers for digital transformation across the global financial ecosystem.

#Fintech As A Service Market#Fintech As A Service Market Size#Fintech As A Service Market Share#Fintech As A Service Market Analysis

0 notes

Text

The forefront of the virtual currency marketplace: Profit maximization method using Bitrefill and Purse.io

In the modern business environment, monetization strategies using virtual currencies are opportunities for structural value creation that go beyond mere speculative investment. With the spread of digital assets, new business models that were difficult to realize with conventional payment systems are emerging one after another, and advanced companies are connecting these opportunities to monetization.

Table of contents

1. Building the foundation of the virtual currency marketplace strategy

・Monetization mechanism in the Bitrefill ecosystem

・Practical application of Purse.io arbitrage strategy

2. Business expansion through payment provider integration

・Strategic utilization of CoinGate and BitPay

・Establishing market advantages by introducing virtual currency payments

3. Advanced strategy for P2P platform monetization

・LocalBitcoins and Paxful brokerage business model

・Profit Opportunity Analysis of Decentralized Trading Systems

1. Building the foundation of the virtual currency marketplace strategy

・Monetization mechanism in the Bitrefill ecosystem

Bitrefill is not just a gift card sales platform, but an innovative ecosystem that converts cryptocurrency liquidity into real-world purchasing power. The core value of the platform lies in solving the "last mile problem" faced by digital asset holders and dramatically improving the practicality of cryptocurrencies.

From a strategic point of view, Bitrefill's monetization opportunities have a multi-layered structure. The first layer is a direct arbitrage opportunity, and it is possible to generate revenue using the difference between the gift card purchase price and the market price on the platform. You can build a continuous revenue stream by taking advantage of market price volatility and strategically buying and reselling gift cards from high-demand brands.

The second-tier revenue opportunity lies in the use of affiliate programs. Through the partnership system provided by Bitrefill, you can earn commission income from referrals. The key is to provide higher added value and build a sustainable revenue model by combining it with educational content and consulting services rather than a simple introduction.

The third layer includes the development of a unique service using Bitrefill's API. You can create revenue opportunities in the B2B market by building a virtual currency payment solution for businesses and an automated gift card distribution system.

・Practical application of Purse.io arbitrage strategy

Purse.io offers advanced arbitrage opportunities as a unique marketplace that connects the Amazon ecosystem and the cryptocurrency market. The platform's mechanism is established by matching users who want to buy Amazon products and users who want to sell Amazon gift cards in virtual currency.

It is important in strategic utilization to understand the asymmetry of supply and demand. The discount rate tends to be higher at certain times and product categories. By analyzing these patterns and optimizing trading timing with a data-driven approach, you can achieve stable returns.

A more advanced strategy is content marketing that utilizes the purchasing experience at Purse.io. You can create advertising revenue and sponsorship opportunities by creating detailed usage reports and case studies and posting them on blogs and YouTube channels. At this time, it is important to produce content that includes deeper insights, such as the evolution of financial technology and changes in consumer behavior, rather than just an experience.

It is also possible to provide market analysis services using Purse.io usage data. You can build a new revenue stream by analyzing the correlation between the cryptocurrency market and the traditional retail market and deploying reporting services for companies and investors.

2. Business expansion through payment provider integration

・Strategic utilization of CoinGate and BitPay

CoinGate and BitPay are payment providers with different strengths in the area of virtual currency payment infrastructure. The strategic use of both companies will make it possible to build a new business model that was difficult to achieve with conventional payment systems.

The feature of CoinGate is that it provides a comprehensive payment solution for a variety of virtual currencies. By utilizing the company's API, you can build a payment system that supports businesses of various sizes, from small to large. The important thing is not to introduce simple payment functions, but to focus on improving customer engagement using virtual currency payments and developing new customer bases.

From a strategic point of view, the use of CoinGate will greatly simplify the expansion into the global market. In traditional international payments, complex exchange processing and international remittance fees were barriers, but the introduction of virtual currency payments can solve these problems. In entering emerging markets, virtual currency payments are an important factor in providing a competitive advantage.

BitPay's strength lies in its comprehensive cryptocurrency payment solution for enterprises. The company's services go beyond simple payment processing, but also cover the functions necessary for corporate operations, such as integration with accounting systems, tax processing, and risk management. This inclusiveness can significantly reduce the technical and operational barriers when companies introduce virtual currency payments.

・Establishing market advantages by introducing virtual currency payments

The introduction of virtual currency payment is positioned as a means of establishing a strategic competitive advantage that goes beyond mere diversification of payment methods. This advantage is expressed in multiple dimensions.

First, it is the innovation of customer experience. Cryptocurrency payments significantly reduce friction in the traditional payment process. The effect is noticeable in international transactions and micropayments. This allows you to acquire a new customer base and improve the satisfaction of existing customers.

The second is to improve operational efficiency. Compared to traditional payment systems, virtual currency payments can significantly reduce the time to complete payment. This makes it possible to improve cash flow and reduce operating costs.

Third, it is the improvement of brand value as a symbol of innovation. The introduction of virtual currency payments is a signal that companies are innovative organizations that actively adopt the latest technologies. This will attract attention from technology-oriented customers and investors who value innovation.

The important thing in strategic implementation is to optimize the entire payment process rather than simply adding cryptocurrency payments to the existing business model. A comprehensive approach is required, including analyzing customer data, understanding payment patterns, and strengthening risk management.

3. Advanced strategy for P2P platform monetization

・LocalBitcoins and Paxful brokerage business model

As a P2P (peer-to-peer) cryptocurrency trading platform, LocalBitcoins and Paxful offer a different value proposition from traditional centralized exchanges. The core value of both platforms is to enable direct transactions between individuals beyond geographical constraints and differences in regulatory environments.

The important thing in the strategic use of LocalBitcoins is the identification of arbitrage opportunities using regional price differences. Bitcoin price differences between different regions and countries are caused by factors such as the regulatory environment, economic conditions, and supply and demand balance. By analyzing these price differences and executing transactions at the right time, you can generate continuous profits.

However, market-making activities can be cited as an advanced strategy that goes beyond simple price difference trading. You can earn money from the spread by offering both buy and sell orders in low-liquid areas and time zones. A deep understanding of market trends and risk management skills are essential to the success of this strategy.

The feature of Paxful is that it supports a variety of payment methods. We support more than 300 payment methods, including bank transfers, credit cards, gift cards, and electronic money. This diversity creates an arbitrage opportunity that utilizes the price difference between different payment methods.

From a strategic point of view, it is important to understand the risk profile of each payment method for success at Paxful. While high-risk payment methods provide high returns, they require proper risk management. By optimizing the balance between risk and return, you can build a sustainable revenue model.

・Profit Opportunity Analysis of Decentralized Trading Systems

Decentralized trading systems (DEX) are developing rapidly as a new paradigm in cryptocurrency trading. The decentralized platform represented by Bisq (formerly Bitsquare) eliminates centralized administrators and realizes complete peer-to-peer transactions.

The revenue opportunities of distributed systems are fundamentally different from conventional centralized platforms. First, there is a profit from providing liquidity. On a decentralized exchange, you can earn a part of the transaction fee as a revenue by participating in a liquidity pool. This revenue model is similar to deposit interest in traditional banking operations, but may provide a higher rate of return.

Secondly, the expansion of arbitrage opportunities. Distributed platforms have a different price formation mechanism from centralized exchanges, creating arbitrage opportunities that take advantage of the price difference between the two. To take advantage of this opportunity, you need the technical ability to monitor multiple platforms at the same time and execute transactions instantly.

Third, there is revenue from the use of protocol tokens. Many decentralized platforms issue their own governance tokens, and by holding these tokens, you can earn a portion of the platform's revenue. From a long-term perspective, acquiring tokens from a high-growth platform at an early stage may lead to significant profits.

Technical understanding and the ability to adapt to new financial mechanisms are important in the strategic use of distributed systems. A different thinking pattern from the traditional centralized system is required, and continuous learning and experimentation are the key to success.

In addition, it is possible to develop educational business using the power of the community in a distributed system. By having a deep knowledge of new technologies and protocols, you can generate revenue through the production of educational content, consulting services, and holding seminars. The rapid development of decentralized finance (DeFi) has led to a rapid increase in demand for these knowledge.

As a more advanced strategy, there is a portfolio approach that combines multiple distributed platforms. By understanding the characteristics of different platforms and building a trading strategy that takes advantage of their respective strengths, you can maximize profits while distributing risks. This approach requires advanced technical knowledge and market analysis skills, but if successful, the profit potential will be very high.

1. Strategic importance of risk management and regulatory response

4-1. Sustainable revenue model by building a compliance system

In the virtual currency business, risk management and regulatory compliance are not just obligations, but strategic elements for establishing competitive advantage. By building an appropriate compliance system, you can gain the trust of the market and achieve long-term revenue growth.

Cryptocurrency-related laws and regulations in Japan are among the strictest in the world. Under a complex regulatory framework such as the Funds Settlement Act, the Crime Proceeds Transfer Prevention Act, and the Financial Instruments and Exchange Act, businesses need to build a high degree of compliance. It is important to see these regulatory requirements not just as a cost, but as an opportunity to improve reliability and build barriers to entry in the market.

The implementation of Know Your Customer (KYC) and Anti-Money Laundering (AML) is a particularly important factor. By implementing these processes efficiently, you can build a good relationship with regulators while improving the customer experience. The introduction of an automated system using advanced technology enables monitoring with higher accuracy while reducing compliance costs.

A strategic approach is also required for tax processing. Tax processing related to virtual currency transactions is complex, and proper record management and the establishment of a filing system are essential. By accumulating expertise in this field, we can create new revenue opportunities such as providing tax consulting services for customers and developing tax processing systems for companies.

In order to respond to changes in the international regulatory environment, it is also important to establish a compliance strategy with a view to business development in multiple jurisdictions. By understanding the differences in regulatory requirements of each country and building a business model that adapts to each, you can establish a competitive advantage in the global market.

4-2. Long-term value creation through security investment

Security investment is one of the most important strategic investments in the virtual currency business. By building an appropriate security system, you can gain the trust of customers and achieve long-term value creation.

The implementation of a multi-signary wallet is one of the basic security measures. By eliminating a single point of failure and ensuring the safety of transactions through multiple approval processes, customer assets can be protected. As a more advanced measure, a higher level of security can be achieved by introducing a hardware security module (HSM) and building a cold storage system.

From the perspective of cybersecurity, it is essential to establish a continuous threat monitoring and response system. By introducing an abnormal detection system using AI technology, it is possible to detect attack patterns that are difficult to detect with conventional methods at an early stage. This allows you to maintain the availability of the system while minimizing damage.

Security investment is positioned as an investment that establishes a competitive advantage, not just a cost. By maintaining a high level of security, you will be able to gain the trust of institutional investors and large customers and handle larger trading volumes. This will create an increase in fee income and opportunities to provide premium services.

Regular security audits are also an important factor. By receiving an objective evaluation from a third-party organization, you can continuously improve your security system. By publishing the audit results, we can show transparency to the market and further deepen the trust from customers.

1. Building a future-oriented revenue model

5-1. New value creation through DeFi protocol integration

The rapid development of decentralized finance (DeFi) protocols has created new revenue opportunities that were difficult to achieve in traditional financial systems. By strategically integrating these protocols, innovative value creation is possible.

Yield farming is one of the representative revenue opportunities in the DeFi ecosystem. By participating in the liquidity pool, you can earn a portion of the transaction fee as revenue. The important thing is to build an optimization strategy that combines multiple protocols beyond simple liquidity provision. You can take advantage of the yield differences between different protocols to maximize profits while distributing risks.

The use of the lending protocol is also an important source of revenue. By combining major protocols such as Compound, Aave, and MakerDAO, you can earn stable interest income. As a more advanced strategy, you can achieve higher rates of return by optimizing collateral efficiency and a portfolio approach that combines multiple assets.

The development of the derivative protocol has enabled a new strategy that achieves both risk hedging and profit maximization. By using options trading, futures trading, and synthetic assets, market volatility can be converted into profit opportunities. The success of these strategies requires a high level of financial knowledge and technical understanding, but if successful, the revenue potential will be very high.

5-2. NFT and metaverse economy monetization strategy

With the development of Non-Fungible Token (NFT) and the metaverse economy, new value creation models for digital assets are emerging. Monetization strategies using these technologies have the potential to significantly change the traditional business model.

Operating the NFT marketplace is one of the new revenue opportunities. By mediating NFT transactions in various fields such as art, music, games, and sports, you can earn transaction fee income. What's important is to specialize in a specific niche market and provide services deeply rooted in that community.

With the development of the creator economy, a new revenue model using NFT is being created. By building a platform where creators such as artists, musicians, and writers can directly connect with fans and sell their works, efficient revenue distribution by eliminating traditional intermediaries is possible.

Economic activities within the metaverse are also important revenue opportunities. It is possible to create new value by reproducing real-world economic activities in digital space, such as developing virtual land, selling virtual products, and holding virtual events. These activities require a variety of skills such as 3D design, game development, and community management, but if successful, the revenue potential will be very high.

Issuing utility tokens is also one of the new revenue models. By issuing the tokens necessary to access certain features within the platform, you can earn revenue from the increase in value associated with the growth of the ecosystem. The design of token economics requires knowledge of game theory, behavioral economics, and system design, but properly designed tokens can achieve long-term value creation.

At the end

The monetization strategy using virtual currency provides innovative opportunities beyond the framework of the traditional financial system. By strategically utilizing platforms such as Bitrefill, Purse.io, CoinGate, and BitPay, you can build diverse revenue streams. The development of P2P platforms and decentralized trading systems has enabled a new form of financial brokerage business.

The key to success is to have a deep understanding of technical understanding and market trends, and to establish an appropriate risk management system. By adapting to changes in the regulatory environment and making continuous security investments, you can establish a sustainable competitive advantage.

The development of the DeFi protocol, NFT, and metaverse economy has created new revenue opportunities. By understanding these technologies early and using them strategically, you can build a next-generation business model. The key is to focus on real value creation beyond simple speculative transactions.

With the maturity of the virtual currency market, a more sophisticated business model and strategic thinking are required. The combination of technological innovation and financial theory makes it possible to create new forms of value that were previously difficult to achieve. By making proper use of these opportunities, you will be able to build a sustainable and profitable business.

0 notes

Text

Empowering Innovation Through Mobile Application Development

In today's hyper-connected world, mobile applications have become the cornerstone of digital transformation for businesses across industries. As smartphone usage continues to rise, companies are increasingly investing in mobile solutions to stay competitive, enhance user experience, and open up new revenue streams. Whether it's a startup building an MVP or an enterprise scaling digital capabilities, mobile app development plays a critical role in shaping modern customer engagement and operational efficiency.

The Evolution of Mobile Applications

Mobile app development has come a long way from its early days. What started as basic utility apps has evolved into complex platforms offering personalized experiences, real-time communication, and advanced integrations. Modern mobile applications are driven by powerful technologies such as AI, IoT, AR/VR, and 5G, all contributing to dynamic and intuitive digital experiences.

Businesses today demand more than just a functional app — they seek seamless performance, scalability, security, and engaging interfaces. This has led to the adoption of advanced frameworks and agile methodologies that ensure faster time-to-market and continuous improvement.

Why Mobile Apps Are Essential for Business Growth

1. Increased Customer Engagement Mobile apps allow businesses to maintain a direct line of communication with users, increasing customer interaction and brand loyalty. Push notifications, real-time updates, and personalized content help retain users and improve conversions.

2. Streamlined Operations From managing inventory to enabling digital payments and automating customer support, mobile apps streamline internal processes and improve productivity. Industries such as logistics, healthcare, education, and retail have greatly benefited from app-based solutions.

3. Data-Driven Insights Apps provide valuable insights into user behavior, preferences, and purchasing patterns. This data helps businesses make informed decisions, refine their strategies, and offer better products or services.

4. Competitive Advantage In a digital-first marketplace, having a mobile app sets businesses apart from competitors. A well-designed app enhances credibility and positions the brand as innovative and forward-thinking.

Latest Trends Shaping Mobile Application Development

Cross-Platform Development Frameworks like Flutter and React Native have made it possible to build apps for both iOS and Android with a single codebase, reducing development time and cost.

AI and Machine Learning Artificial intelligence is revolutionizing app functionality with features like chatbots, recommendation engines, facial recognition, and voice assistants.

Internet of Things (IoT) IoT-enabled apps are connecting everything from home appliances to industrial equipment, allowing users to monitor and control devices remotely.

5G Integration The rollout of 5G networks is enabling faster data transfer, high-quality streaming, and immersive experiences in AR and VR.

Enhanced App Security With rising concerns over data breaches and cyber threats, developers are incorporating advanced security protocols like biometric authentication, encryption, and secure APIs.

Cloud-Native Development Cloud-based mobile apps offer better scalability, flexibility, and integration with other platforms, making them ideal for businesses aiming to grow quickly.

The Process Behind a Successful Mobile App

Developing a successful mobile application involves a series of structured steps to ensure functionality, performance, and user satisfaction:

Discovery & Research – Understanding the business goals, target audience, and market trends.

Wireframing & UI/UX Design – Creating a visual blueprint and intuitive interface for the app.

Development – Coding the front-end and back-end, integrating APIs, and implementing core features.

Testing & QA – Running thorough tests for bugs, performance issues, and security vulnerabilities.

Deployment – Launching the app on app stores and preparing backend infrastructure.

Maintenance & Updates – Continuously improving the app based on feedback and technological changes.

Industries Benefiting from Mobile Application Development

Healthcare – Appointment booking, telemedicine, and remote monitoring through mobile apps are transforming patient care.

E-commerce – Online shopping, payment gateways, product recommendations, and loyalty programs are all made accessible through user-friendly apps.

Education – E-learning platforms, virtual classrooms, and content-sharing apps have made learning more interactive and accessible.

Finance – Mobile banking, digital wallets, and investment tools have empowered users to manage finances on the go.

Transportation – Ride-hailing, GPS tracking, and logistics management apps have optimized supply chains and user experiences.

Choosing the Right Mobile App Development Partner

When selecting a mobile app development partner, businesses should consider the following:

Technical Expertise: Look for experience in the latest frameworks and platforms.

Design Capability: The UI/UX must be engaging, accessible, and responsive.

Security Standards: Ensure the team follows industry-standard security practices.

Scalability: The app should be built to grow with your business.

Support & Maintenance: Ongoing support is essential for app updates, performance improvements, and bug fixes.

A reliable development team will act not just as a vendor, but as a technology partner that understands your vision and helps bring it to life with innovative solutions.

Conclusion

In an increasingly mobile-first world, investing in a powerful and intuitive mobile application is not just an option — it's a necessity. From enabling real-time customer interactions to streamlining business operations, mobile apps serve as the digital backbone of successful enterprises. As technology continues to evolve, businesses that embrace mobile solutions will stay ahead of the curve, unlock new growth opportunities, and deliver exceptional value to their users.

If you're ready to take the leap into mobile innovation, now is the time to explore the limitless potential of mobile application development in usa.

0 notes

Text

App Development Cost Estimator – Transparent Pricing Tool

App Development Cost Estimator – Transparent Pricing Tool

The mobile app development industry has experienced explosive growth, with businesses across all sectors recognizing the necessity of having a mobile presence. However, one of the biggest challenges entrepreneurs and companies face is understanding the true cost of app development. This uncertainty often leads to budget overruns, delayed launches, and strained relationships with development teams. Enter the app development cost estimator – a revolutionary tool that brings transparency to an otherwise opaque pricing landscape.

Understanding App Development Complexity

Mobile app development costs vary dramatically based on numerous factors. A simple utility app might cost between $10,000 to $50,000, while complex enterprise applications can exceed $500,000. The wide range stems from differences in functionality, platform choices, design complexity, integration requirements, and ongoing maintenance needs. Traditional pricing methods often leave clients guessing about final costs, making budget planning nearly impossible.

How Cost Estimators Work

Modern app development cost estimators utilize sophisticated algorithms that consider multiple variables to provide accurate pricing projections. These tools analyze feature requirements, technical complexity, design specifications, platform preferences, and development timelines. Users input their app requirements through intuitive interfaces, selecting features like user authentication, payment processing, social media integration, and backend complexity. The estimator then calculates development hours required for each component and applies current market rates to generate comprehensive cost breakdowns.

Benefits of Transparent Pricing Tools

Transparency in app development pricing offers significant advantages for both clients and developers. Clients gain clarity about where their investment goes, enabling better decision-making about feature prioritization and budget allocation. This transparency builds trust and reduces the likelihood of scope creep during development. For development agencies, transparent pricing tools streamline the proposal process, reduce lengthy negotiations, and set realistic expectations from project inception.

Cost estimators also help identify potential cost-saving opportunities. By understanding the relative expense of different features, clients can make informed decisions about which functionalities are essential for their minimum viable product versus features that can be added in future iterations.

Key Features to Consider

Effective app development cost estimators should account for platform-specific requirements, distinguishing between iOS, Android, and cross-platform development costs. They should consider design complexity, from basic layouts to custom animations and user interface elements. Backend infrastructure requirements, including server costs, database management, and API integrations, significantly impact overall pricing and should be factored into estimates.

Additionally, modern estimators incorporate post-launch considerations such as maintenance costs, updates, and scaling requirements. These ongoing expenses often represent 20-30% of initial development costs annually but are frequently overlooked in traditional pricing models.

The Future of App Development Pricing

As the industry matures, transparent pricing tools are becoming standard practice among reputable development agencies. These tools not only improve client relationships but also help developers accurately scope projects and maintain profitability. The integration of artificial intelligence and machine learning into cost estimators promises even greater accuracy, with tools learning from completed projects to refine their predictions continuously.

For businesses considering mobile app development, utilizing transparent pricing tools represents a crucial first step in project planning. These estimators provide the foundation for informed decision-making, realistic budgeting, and successful app launches that meet both functional requirements and financial constraints.

0 notes

Text

Stripe vs PayPal

In the modern digital landscape, a dependable and effective payment processing system stands as a cornerstone for businesses across varying scales. Two frequently discussed options in this domain are Stripe and PayPal. While both platforms provide similar services, they boast distinctive features and advantages tailored to diverse business requisites. This comparative analysis aims to assist in determining the optimal payment processing platform, fitting for your business needs. Understanding Stripe and PayPal Stripe Overview Stripe serves as a payment service provider primarily focusing on online transactions, making it an optimal choice for businesses entrenched in the digital realm. Its robust API and developer-friendly tools empower businesses to craft tailored payment experiences. Enabling payment acceptance, vendor payments, invoice creation, and financial management, Stripe garners trust from major industry players like Amazon, Shopify, and Slack. PayPal Overview As a well-established payment processing platform, PayPal supports both online and in-person transactions. Renowned for its emphasis on security, PayPal offers a gamut of online payment solutions. It facilitates payment processing through ACH bank transfers, debit/credit cards, and even third-party platforms like Venmo. Its global recognition renders it a preferred choice for businesses of varied sizes. Key Features and Benefits Stripe's Features and Benefits Customizable Checkout Experience: Businesses can forge a completely tailored checkout experience that aligns with their brand using Stripe's potent API and tools like Stripe Elements. Global Acceptance: Supporting over 135 currencies, Stripe becomes an ideal choice for businesses catering to an international customer base. Multi-language support further aids in catering to diverse customer segments. Transparent Pricing: Following a per-transaction pricing model, Stripe offers transparent pricing sans monthly fees for the basic plan. Volume discounts are provided for higher transaction volumes. Developer-Friendly: With extensive documentation and round-the-clock customer support, Stripe's API and developer tools appeal to businesses possessing technical expertise. PayPal's Features and Benefits Established Reputation: PayPal's longstanding reputation for security measures and buyer protection policies instills confidence in both businesses and customers. Ease of Use: With a user-friendly interface and simplified integration, PayPal appeals to businesses lacking technical prowess. Pre-built solutions facilitate quick and easy payment acceptance. International Payment Support: Widely accepted globally and supporting payments in multiple currencies, PayPal aids businesses aiming to expand their global outreach. Extensive Customer Support: Offering 24/7 customer support via phone, email, and chat, coupled with a comprehensive knowledge base and community forum, PayPal ensures continual assistance. Pricing Comparison Stripe Pricing Online transactions: 2.9% + 30 cents per successful transaction. In-person transactions: 2.7% + 5 cents per transaction, with potential additional fees for certain features. PayPal Pricing Online transactions: 2.9% + 30 cents per successful transaction. Additional fees may apply for international transactions, currency conversions, and chargebacks. Tailored plans like PayPal Payments Pro offer enhanced features at a cost of $30 per month. User Experience and Customer Support Stripe's User Experience and Customer Support Stripe's developer-centric platform might necessitate technical proficiency for optimal utilization. While it provides extensive documentation and 24/7 customer support, some users might face challenges in navigating the dashboard. PayPal's User Experience and Customer Support Renowned for its intuitive interface and simple integration process, PayPal caters to businesses across technical spectrums. However, sporadic account freezes and related issues reported by some users might impact the overall user experience. Making the Right Choice for Your Business Choosing between Stripe and PayPal hinges on specific business requisites and priorities: Business Type: Online-oriented businesses valuing customization might favor Stripe, while those needing a user-friendly POS system might opt for PayPal or Square. International Transactions: While both support global transactions, Stripe offers wider currency support, enhancing flexibility in this aspect. Technical Expertise: Stripe caters to technical users, while PayPal is more accessible to businesses lacking technical proficiency. Pricing Structure: Considering transaction volumes and required features, comparing pricing models aids in choosing the most cost-effective solution. In summary, both Stripe and PayPal stand as reputable payment processing platforms, each with its distinct strengths. Stripe excels for businesses prioritizing customization and operating predominantly online, while PayPal offers a trusted, user-friendly solution suitable for businesses of varying sizes, emphasizing security. Evaluating your business needs, priorities, and the specific features of each platform aids in making an informed decision. Read the full article

0 notes

Text

How Essential Are Compatibility Testing Services for Fintech App Security?

There has been an increase in the utilization of smartphone apps, and the fintech sector has seen huge growth in recent years. Fintech apps offer a lot of advantages, ranging from access to financial data to streamlined investing options. However, with these benefits comes the need for testing to ensure that these apps are secure, trustworthy, and satisfy user requirements.

Fintech apps face unique challenges when it comes to testing. The main concern is to handle a huge amount of financial data and transactions. Therefore, security testing is necessary to prevent any kind of data breaches and unwanted fraud activities. Here comes another challenge: integrating fintech apps with APIs and payment gateways. This is where compatibility testing services come into the picture.

Compatibility testing service ensures that fintech apps work seamlessly across various devices, operating systems, browsers, and network environments. This type of testing helps identify and fix issues that could lead to poor user experiences. There are constant updates in mobile OS versions and devices, and maintaining compatibility is necessary for user retention. Moreover, compatibility testing can help you find vulnerabilities that only appear on a surface level.

In this way, it complements security testing and supports the overall integrity and trustworthiness of fintech applications.

The role of Compatibility Testing Services in Securing Fintech Apps

Do you know that a perfectly secure fintech app can fail if it does not work smoothly on your customer's device? We live in a digital world where users now expect a flawless experience. There are dozens of devices, operating systems, and screen sizes in use; a compatibility test is not a luxury, it’s a necessity. A glitch in one device can make or break a user's trust, especially when financial data is involved.

Mobile app performance testing ensures that your fintech app works seamlessly across platforms without compromising security. With this, outsourced testers uncover hidden issues that may never appear in a regular testing environment. Most importantly, this testing process helps protect users by ensuring every financial transaction runs smoothly, regardless of where or how it’s made. In the fintech space, trust is everything, and compatibility is the silent guardian behind it.

For more info:

https://astarios.com/how-essential-are-compatibility-testing-services-for-fintech-app-security/

0 notes

Text

Loan Against Mutual Funds Online in 2025 – Fast Approval Without Selling Investments

In 2025, if you need urgent cash and own investments like mutual funds or shares, there's good news—you no longer need to sell your assets. Thanks to the rise of LAMF (Loan Against Mutual Funds) and LAS (Loan Against Shares), you can instantly apply for a digital loan without disturbing your portfolio. Whether it's for a wedding, education, travel, or medical emergency, you can unlock funds in minutes — no income proof, no selling, just swipe and go.

Let’s explore how a digital loan against mutual funds or shares works, who can apply, what the features, limits, eligibility, and more. This guide will clearly and naturally answer every user's question, utilizing all the important search keywords to help both readers and search engines trust and rank this content.

What is a Loan Against Mutual Fund (LAMF)?

A Loan Against Mutual Fund (LAMF) allows you to borrow money using your mutual fund units as collateral. Instead of redeeming your mutual funds, lenders provide you with a credit line or term loan based on the NAV (Net Asset Value) of your holdings.

Similarly, a Loan Against Shares (LAS) lets you pledge your equity shares and get funds instantly. The biggest advantage? You retain ownership and continue to earn returns, dividends, and capital gains while enjoying liquidity.

Top Features of Loan Against Mutual Funds & Shares (LAMF LAS)

How Does a Digital Loan Against Mutual Fund Work in 2025?

Log in to your Demat or Mutual Fund platform. Most AMCs and fintech apps now offer LAMF APIs directly integrated.

Select the funds to pledge. ELSS, debt, hybrid, and large-cap funds are typically eligible.

Get an instant offer based on NAV. The higher the NAV and fund stability, the better your loan terms.

E-sign documents and complete KYC online.

Loan is disbursed digitally – often within 30 minutes!

This is how a digital loan against mutual funds online saves you time, paperwork, and the stress of liquidating long-term wealth.

LAMF Eligibility & Documents – Who Can Apply in 2025?

Eligibility for Loan Against Mutual Funds (LAMF):

Age: 21 to 65 years

Must own eligible mutual fund units (ELSS, debt, hybrid, or equity)

Resident Indian with valid PAN & Aadhaar

Salary slip or ITR is not mandatory (many lenders skip this)

LAMF Documents Required:

PAN Card

Aadhaar or Passport/Voter ID

Mutual Fund Statement (CAS)

Cancelled Cheque (for loan disbursal)

Optional: Income proof for higher limits

You can also use a loan against mutual funds eligibility calculator available on most lending platforms to get your eligible amount instantly.

Top Use Cases – Why People Apply for a Loan Against Mutual Funds in 2025

Loan Against Mutual Funds for Wedding Expenses Don’t touch your SIPs or ELSS—get a short-term loan without penalty.

Loan Against Mutual Funds for Higher Education Quick and smart funding option without breaking your portfolio.

Loan Against Mutual Funds for Financial Planning Use for emergencies or opportunities while your investments grow.

Loan Against Mutual Funds for Financial Needs Medical emergencies, travel, family events, or even down payments.

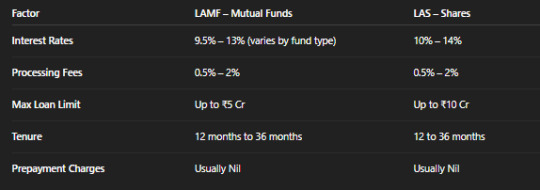

Interest Rates, Processing Fees & Limits – All You Need to Know

Digital loan platforms use LAMF APIs to instantly evaluate, process, and disburse loans, making the loan against mutual funds processing fees and interest rates transparent and user-friendly.

How to Apply for a Loan Against Mutual Funds Online – Step-by-Step (2025)

Visit a digital lending platform (like Groww, Zerodha, Paytm Money, or a Bank site)

Click on “Apply for Loan Against Mutual Fund.”

Enter PAN & link your MF folio or Demat

Select eligible funds (ELSS, debt, equity)

View the loan offer via the LAMF eligibility calculator

E-sign documents and submit KYC

Get instant disbursal to your linked bank account

Some fintech apps offer a loan against shares interest rates comparison to help you choose LAS vs LAMF smartly.

FAQs – Loan Against Mutual Funds or Shares in 2025

1. What is a loan against a mutual fund?

A Loan Against Mutual Fund (LAMF) allows you to borrow money without selling your investments by pledging them digitally.

2. Who can apply for a loan against mutual funds in India?

Any Indian citizen above 21 who holds mutual funds in their name can apply. Many platforms don’t require income proof or a high CIBIL.

3. Can I apply for a loan against ELSS mutual funds?

Yes, loan against ELSS is allowed, but with certain lock-in caveats. Many lenders accept ELSS if held for over 3 years.

4. How much can I borrow through LAMF?

Using a loan against mutual funds eligibility calculator, most users can obtain a loan of up to 70%-80% of their mutual fund's NAV.

5. Is LAS or LAMF better in 2025?

If you hold mutual funds, go for LAMF. If you own equity shares, LAS offers better liquidity options. Compare both using the Loan Against Securities Interest Rates before choosing.

Final Thoughts: Borrow Smart, Invest Smarter

In 2025, you no longer need to choose between growth and liquidity. With smart fintech platforms offering digital loans against mutual funds or shares, you get the best of both worlds — access to instant funds without selling your long-term assets.

Whether you’re planning a big event or tackling a financial emergency, LAMF or LAS ensures you get cash on tap with low documentation, transparent interest rates, and minimal stress. Just a few clicks, and you’re good to go — No Sell, Just Swipe.

#lamf#loan against mutual funds online#lamf eligibilty & documents#loan against elss#digital loan against mutual fund#how to apply loan against mutual funds#loan against mutual funds explained#features of loan against mutual funds#how does a loan against mutual fund work#loan against mutual funds faqs#lamf api#loan against mutual funds processing fees and interest rates#what is a loan against mutual fund#loan against mutual funds max limit#lamf eligibility#lamf loan#loan against mutual funds for wedding#loan against mutual funds eligibility calculator#loan against mutual funds for financial planning#apply for loan against mutual fund#loan against mutual funds for financial needs#loan against mutual funds features#loan against mutual funds for higher education#loan against mutual funds limit#loan against mutual funds eligibility and documents#digital loan against mutual funds interest rate#who can apply for loan against mutual funds#lamf documents#LAS#Loan Against Securities Interest Rates

0 notes

Text

The Role of Technology in On-Demand Clone App Development Company

In today's rapidly evolving digital landscape, on-demand clone apps have emerged as a powerful solution for entrepreneurs looking to capitalize on successful business models with minimal development time and cost. By leveraging existing frameworks and technologies, these apps allow businesses to quickly enter competitive markets and meet consumer demands effectively. The role of technology in the development of on-demand clone apps is pivotal, influencing every stage from initial concept through to deployment and beyond.

This article explores the key technologies that drive this innovative approach, the advantages they confer, the challenges faced by developers, and the future trends shaping the industry. As businesses increasingly turn to technology as a means of differentiation, understanding its impact on clone app development becomes essential for success in the modern marketplace.

Introduction to On-Demand Clone Apps

Definition and Overview

On-demand clone apps are like the bustling cafés of the tech world—everyone wants a seat at the table. These platforms replicate successful apps (think Uber or Airbnb) to offer similar services tailored to specific markets. They serve as a shortcut for budding entrepreneurs, allowing them to bypass the painstaking research and development stages. With cloning, you get a robust framework to kickstart your venture, while still having the flexibility to sprinkle your unique flavor.

Market Demand and Trends

Today’s consumer landscape is moving at breakneck speed, and on-demand services are right at the forefront. From food delivery to ride-sharing, everyone is looking for convenience at their fingertips. According to market trends, demand for on-demand apps is expected to grow exponentially—think rocket ship levels of growth. With the rise of gig economy interests and an increasing number of startups diving into the fray, clone app development is hotter than ever. If you’re not convinced, just look at the latest app store charts; they’re practically waving flags of inspiration for the next big clone app.

Key Technologies Driving Clone App Development

Programming Languages and Frameworks

In the world of clone app development, programming languages and frameworks are like the secret sauce to your favorite dish—essential but often overlooked. For mobile apps, languages like Swift (for iOS) and Kotlin (for Android) dominate the scene. Meanwhile, frameworks like React Native and Flutter are making cross-platform development smoother than a hot knife through butter. Choosing the right tech stack is crucial; it's the foundation upon which your app's success will be built (no pressure!).

Cloud Computing and Hosting Solutions

Think of cloud computing as the superhero of the tech world. With its ability to provide infrastructure, great hosting solutions, and storage capabilities, your app can scale from zero to hero without breaking a sweat. Using platforms like AWS, Google Cloud, or Azure means your app doesn't have to worry about sudden traffic spikes (cue the collective sigh of relief from developers everywhere). With reliable cloud solutions, you ensure that your app is always up and running, even during the most chaotic peak hours.

APIs and Third-Party Integrations

APIs are like the Swiss Army knives of app development—they can do just about everything! Want to integrate payment gateways, social media logins, or geolocation features? There’s an API for that! By leveraging third-party services through APIs, developers can enhance functionality without the need to reinvent the wheel. It’s like having a cheat sheet for building a highly functional app without the stress of creating everything from scratch.

Advantages of Using Technology in Clone App Development

Speed and Efficiency

When it comes to app development, speed is the name of the game. Utilizing modern technology allows developers to whip up clones faster than you can say "market saturation." With pre-built templates and tools, developers can rapidly prototype and iterate, getting your app in the hands of users quicker than you can find out how to fix that broken coffee machine.

Cost-Effectiveness

Developing a clone app is generally less expensive than starting from the ground up. By using existing frameworks and leveraging technology, businesses can save time and money—allowing them to focus on marketing and user acquisition, rather than burning cash on development. It’s like having a great sale on those sneakers you’ve been eyeing—you get all the benefits without the hefty price tag!

Scalability and Flexibility

One of the glorious perks of modern technology is scalability. As your user base grows (let's hope it does—fingers crossed!), your app can adapt and expand seamlessly. With cloud computing and modular architecture, you can accommodate more users, new features, or even pivot your business strategy with ease. Plus, it means you won’t need a tech exorcism every time you want to make a change.

The Development Process: Integrating Technology Effectively

Planning and Prototyping

The development process begins with planning and prototyping—like laying out the blueprints before constructing a house. This phase involves figuring out what you want your app to be and sketching out its foundation. Utilizing wireframing tools and prototyping software can help turn those lofty ideas into tangible visuals, paving the way for a smoother development experience.

Development and Testing

Once you have your plan, it’s time to dive into development. This is where the magic happens—developers will code, design, and build your app. Alongside, rigorous testing is essential; think of it as a dress rehearsal before the big show. Ensuring that everything works seamlessly is crucial for user satisfaction. Bugs and glitches are less than ideal, and catching them early saves a lot of headaches later on.

Deployment and Maintenance

Finally, the moment of truth arrives—deployment! Your app is launched into the wild, but that’s not the end of the story. Maintenance is the unsung hero that keeps everything running smoothly. Regular updates, bug fixes, and user feedback incorporate a continual improvement cycle, ensuring your app remains relevant and functional amidst changing trends. Just like a pet, your app will need a little TLC to thrive—so don’t forget to feed it (with updates, of course).

Case Studies: Successful On-Demand Clone Apps

Notable Examples in Various Industries

In the world of on-demand clone apps, there’s no shortage of examples that make us say, “Why didn't I think of that?” From ride-hailing giants like Uber to food delivery heroes like DoorDash, businesses have embraced the clone app model to capitalize on proven concepts. For instance, in the travel industry, Airbnb-inspired clone apps have sprouted up, allowing homeowners to monetize their spaces while providing travelers unique stays. Even niche markets, like pet grooming or home cleaning, have seen successes with clone apps catering to those specific needs. The beauty of these examples lies in their ability to adapt these successful models, adding local flavors and unique twists to meet distinct customer demands.

Lessons Learned from Successful Implementations

But what can we learn from these success stories? First off, it’s crucial to understand your target audience. Many clone apps thrive simply because they’ve identified a gap in service or a particular pain point they can alleviate. Second, robust technology infrastructure is non-negotiable; without solid backend support, even the most innovative app will crumble faster than a house of cards. Lastly, effective marketing and user engagement strategies are critical. Remember, even the best-kept secrets need a little shouting from the rooftops to be noticed!

Challenges Faced in Technology Implementation

Technical Limitations

Let’s face it: technology isn’t always our best friend. Many entrepreneurs looking to launch an on-demand clone app face significant technical hurdles, ranging from integration issues to scalability challenges. Perhaps the backend system is slower than a snail on a lazy Sunday, or the app crashes every time it rains (thanks, Murphy’s Law). Overcoming these obstacles requires a solid tech team that knows the ins and outs of app development and can deliver a solution that doesn’t put users to sleep.

Market Competition

With great opportunity comes great competition. The on-demand clone app market is as crowded as a subway during rush hour. As new players enter the scene, differentiating your app becomes essential. What makes your clone app stand out in a sea of “me too” products? Perhaps it’s the unique features you offer or the exceptional user experience that keeps customers coming back for more. Being a trendsetter requires a constant pulse on market developments and a willingness to pivot when the competition heats up.

User Experience and Feedback

Ah, user feedback—the double-edged sword of the tech world. While it’s essential for growth, it can often feel like navigating a minefield. Users are fickle creatures, and their needs can change faster than you can say “update.” Gathering and responding to user feedback is a cornerstone of refining your app, but it also requires careful consideration of how to implement changes without alienating your loyal fans. Constantly iterating is key, but so is knowing when to stick to your guns.

Future Trends in On-Demand Clone App Development

Emerging Technologies to Watch

So, what’s the crystal ball showing for the future of on-demand clone apps? For starters, technologies like AI, ML, and blockchain are gaining traction. AI can enhance user experience through personalized recommendations, while ML helps analyze data for better decision-making. On the other hand, blockchain could revolutionize transaction security, paving the way for trust in a space that sometimes feels a bit… murky. Keeping an eye on these technologies could set your clone app apart from the rest.

Predictions for Market Growth

Market growth predictions for on-demand services are looking rosy—like a sunset over a quiet beach. As more consumers embrace the convenience of on-demand services, the market is expected to expand significantly in the coming years. The rise of remote work has also contributed, with more people looking for services that deliver directly to their homes. Entrepreneurs who jump on these trends early are likely to find themselves riding a wave of success rather than paddling against the current.

Conclusion

Summarizing Key Takeaways

In summary, the role of technology in on-demand clone app development cannot be overstated. Successful implementations hinge on understanding your audience, leveraging the right tech, and maintaining flexibility to adapt to feedback and competition. The landscape is constantly shifting, and those who can navigate the challenges will reap the rewards.

The Way Forward for Entrepreneurs

For entrepreneurs entering this vibrant space, the way forward is clear: embrace emerging technologies, listen to your users, and keep an eye on competitors. Innovation doesn’t just mean creating something new; sometimes, it’s about refining what’s already out there. With the right strategy, your on-demand clone app could be the next big thing—and perhaps, you’ll find yourself starring in your own success story! So, grab your smartphone, start brainstorming, and who knows what the future holds?

Technology plays a crucial role in the development of on-demand clone apps, offering businesses the tools and frameworks necessary to thrive in competitive markets. By understanding and harnessing the latest technological advancements, entrepreneurs can create efficient, scalable, and user-friendly applications that meet the needs of their target audience. As the industry continues to evolve, staying informed about emerging trends and challenges will be essential for those looking to succeed in the on-demand economy. Ultimately, the effective integration of technology in clone app development not only fosters innovation but also drives business growth and customer satisfaction.

Frequently Asked Questions (FAQ)

What are on-demand clone apps?

On-demand clone apps are applications that replicate the functionality of existing successful apps, allowing entrepreneurs to enter the market quickly and at a lower cost. These apps leverage established business models and technologies to provide similar services to users.

What technologies are commonly used in the development of clone apps?

Key technologies used in clone app development include programming languages like Java and Swift, frameworks such as React Native and Flutter, cloud computing solutions for hosting, and APIs for integrating third-party services.

What are the main advantages of developing a clone app?

The primary advantages of developing a clone app include reduced development time, cost-effectiveness, the ability to leverage proven business models, and the potential for rapid market entry, allowing businesses to capitalize on existing demand.

What challenges do developers face when creating clone apps?

Developers may face challenges such as technical limitations, market saturation with similar apps, ensuring a positive user experience, and keeping up with the fast-paced changes in technology and consumer preferences.

#ondemandappclone#ondemandcloneappdevelopmentcompany#cloneappdevelopmentcompany#ondemandserviceclones#ondemandserviceapp#appclone#fooddeliveryapp#gojekcloneapp

0 notes

Link

0 notes

Text

Streamlining Finances: How to Seamlessly Sync MINDBODY and QuickBooks Online

In today’s fast-paced digital business environment, managing operations and finances efficiently is vital for sustainable growth. For wellness businesses using MINDBODY to QuickBooks Online, ensuring accurate financial tracking and reporting is critical. This is where the ability toSync MINDBODY and QuickBooks Online becomes not just beneficial—but essential.

MINDBODY is a leading business management platform for the wellness industry, helping salons, spas, fitness centers, and health studios manage appointments, customer relationships, and sales. QuickBooks Online, on the other hand, is one of the most popular accounting solutions trusted by small and medium businesses globally. Integrating the two allows businesses to reduce administrative burdens, eliminate manual data entry errors, and maintain up-to-date financial records.

Why You Need to Sync MINDBODY and QuickBooks Online

Manually exporting sales data, processing invoices, and reconciling accounts between two systems can be time-consuming and error-prone. With the right tools, businesses can Sync MINDBODY and QuickBooks Online to automate this workflow, ensuring that each transaction in MINDBODY reflects accurately in QuickBooks.

Whether it's tracking revenue by service category, matching payments to invoices, or keeping tax records clean, syncing these two platforms saves time and helps maintain financial transparency. Automating this process minimizes human error, enhances productivity, and allows business owners to focus on delivering excellent customer service instead of spending hours reconciling books.

Understanding the Integration Process

The process to connect MINDBODY to QuickBooks Online involves using middleware or custom-built integrations. These tools enable data—such as customer details, payments, sales, and taxes—to flow seamlessly from MINDBODY into QuickBooks Online. Here’s what an effective integration process generally includes:

Authentication & API Setup: Secure login and authentication between both platforms.

Data Mapping: Ensuring that every data point (customer, invoice, payment) in MINDBODY corresponds accurately to its QuickBooks counterpart.

Real-Time Sync: Transactions are updated in real-time or at scheduled intervals, depending on the integration method chosen.

Error Handling & Reports: Any discrepancies or errors are logged for review, and synchronization reports are often available for audit trails.

Benefits of Connecting MINDBODY to QuickBooks

There are numerous benefits to syncing MINDBODY to QuickBooks. Here are the key advantages businesses experience:

Accurate Financial Records

With automation, every sale, tax, and refund is recorded accurately in QuickBooks Online, ensuring you have reliable financial statements for decision-making.

Time Savings

Eliminating the need for manual data entry allows your team to focus on strategic tasks rather than repetitive accounting chores.

Improved Tax Readiness

With accurate categorization of income and expenses, preparing for tax season becomes significantly easier.

Better Cash Flow Management

Real-time financial updates mean business owners always have a current view of their cash position, helping them make informed business decisions.

Enhanced Client Experience

With fewer administrative tasks, your team can invest more time in delivering exceptional service to your clients.

Common Challenges and How to Overcome Them

While the integration between MINDBODY to QuickBooks can be smooth with the right tools, there are some common challenges to be aware of:

Incorrect Mapping: Ensure that each service, product, or tax rate in MINDBODY has a corresponding account or item in QuickBooks.

Duplicate Entries: Avoid importing data manually while automatic syncing is turned on, as this can cause duplicates.

Reconciliation Errors: Periodically review and reconcile data to catch and resolve any discrepancies early.

Utilizing reliable third-party integration tools or working with a professional can help overcome these hurdles effectively.

Choosing the Right Integration Solution

There are several options in the market that allow you to Sync MINDBODY and QuickBooks, including standalone apps and API-driven platforms. When choosing the best solution, look for the following features:

Ease of Setup

Comprehensive Data Sync (customers, payments, invoices, refunds)

Ongoing Support and Maintenance

Customizable Mapping Options

Real-time Synchronization or Scheduled Sync Options

One business that found success with syncing their operations was Quote Stock Sell Pty Ltd, a firm that values efficiency and precision. By integrating their business tools with QuickBooks Online, they gained better financial oversight while reducing manual errors. Their commitment to streamlined workflows has made them a standout in their industry.

Best Practices for Maintaining a Healthy Integration

Once your systems are integrated, maintaining clean data becomes essential. Here are a few best practices:

Regularly review synced transactions to ensure accuracy.

Keep both MINDBODY and QuickBooks updated with the latest software versions.

Train staff on how the integration works to prevent accidental disruptions.

Work with an accountant or bookkeeper who understands both platforms.

Another great example is Quote Stock Sell Pty Ltd, which implemented consistent auditing practices after syncing their platforms. This helped them identify gaps in their reporting and resolve them swiftly, thus ensuring smoother operations across departments.

Conclusion

Integrating MINDBODY to QuickBooks Online is a strategic move for any business looking to streamline operations and improve financial reporting. By taking the time to Sync MINDBODY and QuickBooks Online, businesses can boost productivity, enhance accuracy, and make informed decisions with confidence.

Whether you're a small wellness studio or a growing franchise, optimizing your financial workflows through smart integration can be a game-changer. Make the shift today and experience the peace of mind that comes with reliable, automated bookkeeping.

0 notes

Text

Best Practices for API Integration in Next.js Apps

Modern web applications thrive on seamless, efficient, and secure API communication. Whether it's pulling data from a CMS, connecting with a payment gateway, or interacting with a cloud service, API integration is at the core of every high-performance Next.js app.

Next.js, with its server-side capabilities and built-in API routes, offers a flexible environment for creating and consuming APIs. But with flexibility comes the responsibility of integration best practices especially when dealing with sensitive data or mission-critical services.

Why Next.js Is Built for API-Driven Applications

Next.js offers both server-side and client-side rendering, making it ideal for hybrid API workflows. Developers can: