#Audit-ready document validation using AI

Explore tagged Tumblr posts

Text

Webinar | From Bottlenecks to Launchpads: How AI Is Transforming Product Compliance in Manufacturing

Is compliance slowing down your product launch? In this exclusive webinar, Certivo CEO & Founder Kunal Chopra unveils how AI is reshaping compliance from a bottleneck into a launch accelerator.

From eliminating manual document reviews to spotting expired declarations instantly, learn how top manufacturers are using AI to automate regulatory operations, reduce risk, and get audit-ready in hours.

🚀 Watch the full webinar here: https://youtu.be/r0J31TZYvc4

🌐 Learn more: https://www.certivo.com

🔖 Stay #AlwaysCompliant and #AlwaysMarketReady

#AI automation for regulatory compliance workflows#How manufacturers use AI for compliance efficiency#Reduce compliance risk with AI in manufacturing#Compliance automation webinar for supply chain leaders#Audit-ready document validation using AI#PFAS and EUDR compliance automation tools#Streamlining product compliance in medtech and EV#AI-powered compliance ROI for manufacturers#Build supplier risk matrices using AI#7-day pilot for AI compliance implementation

0 notes

Text

AI in Medical Device Testing Labs: Opportunities and Challenges

Artificial Intelligence (AI) is rapidly transforming the operational landscape of medical device testing labs, offering a new level of intelligence, efficiency, and precision across all phases of device validation. From automating routine inspections to enabling predictive analytics and improving compliance tracking, AI is redefining how testing laboratories function in an increasingly complex and regulated industry. However, while the adoption of AI presents numerous opportunities, it also introduces a unique set of challenges that must be addressed to realize its full potential.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=254474064

One of the most promising opportunities lies in automated test execution and data analysis. AI systems can streamline traditionally manual tasks, such as functional testing, image analysis, and data interpretation, which speeds up the testing cycle and reduces human error. For example, computer vision powered by AI can detect surface defects, misalignments, or assembly faults in real time with higher consistency than manual visual inspections. This not only boosts throughput in testing labs but also ensures a higher level of quality assurance for life-critical devices.

AI is also revolutionizing predictive testing and risk assessment. Machine learning algorithms analyze historical data from prior tests, field performance records, and material properties to predict how a device will perform under various conditions. This predictive approach enables labs to proactively identify potential failure points and prioritize testing based on risk, helping manufacturers improve product designs before costly clinical trials or regulatory submissions begin.

In software validation and embedded system testing, AI plays a crucial role. As more medical devices rely on complex algorithms and real-time data processing, testing labs use AI to simulate user interactions, detect anomalies, and validate software updates. Automated test scripts generated by AI platforms can adapt to changes in firmware or interface logic, reducing the time and cost required for repetitive regression testing.

AI also enhances compliance and documentation processes. Testing labs must adhere to strict quality standards like ISO 17025, FDA’s 21 CFR Part 820, and the EU MDR. AI-powered tools can automatically generate traceable documentation, identify gaps in regulatory alignment, and maintain audit-ready records. Natural language processing (NLP) enables the extraction and analysis of data from technical reports, facilitating faster preparation for regulatory inspections and reducing the risk of non-compliance.

The integration of AI into testing labs further supports real-time data monitoring and continuous validation. With connected devices feeding live performance data back to labs or manufacturers, AI systems can analyze usage patterns, flag unusual behavior, and simulate stress scenarios on digital twins. This continuous loop of validation and feedback is particularly valuable in post-market surveillance and long-term performance assessment.

Despite these significant opportunities, several challenges accompany the adoption of AI in medical device testing labs. One of the most pressing concerns is data quality and availability. AI models require large, high-quality datasets to function effectively. In many labs, legacy systems and fragmented data storage limit the volume and variety of data available for training AI algorithms, potentially leading to biased or inaccurate results.

Another challenge is regulatory uncertainty. While AI can enhance testing, regulatory bodies are still in the process of developing clear guidelines on the use of AI in testing and validation. Labs must navigate this gray area cautiously, ensuring that AI-driven processes are transparent, explainable, and auditable to meet evolving regulatory expectations.

Technical skill gaps present another barrier. Implementing and maintaining AI systems requires expertise in data science, machine learning, and biomedical engineering. Many testing labs may lack in-house AI specialists, making it difficult to adopt and scale AI solutions without significant investment in training or external partnerships.

There are also concerns about algorithm transparency and traceability. In regulated industries like medical devices, every decision—especially those affecting safety—must be traceable. AI models that function as “black boxes” without clear logic or reasoning pose compliance risks. Testing labs must therefore prioritize explainable AI (XAI) models and maintain comprehensive validation records to satisfy auditors and regulatory bodies.

Lastly, integration with existing systems is a technical and logistical challenge. Many testing labs operate using legacy infrastructure not designed to support modern AI applications. Migrating to AI-enabled platforms requires careful planning, investment, and change management to ensure minimal disruption and maximum return on investment.

0 notes

Text

Accounting Dissertation Help with Research-Ready Topics for 2025

Writing a dissertation can be a daunting task, especially in a specialized field like accounting. The need to select the right topic, follow academic standards, conduct credible research, and maintain clarity throughout the document makes the entire process quite demanding. For students aiming to craft a strong dissertation in 2025, seeking proper Dissertation Help becomes a strategic step toward academic success.

This article offers comprehensive insight into how students can approach their accounting dissertations effectively. It also includes a curated list of research-ready topics that are relevant and impactful for the upcoming academic year.

Why Is Dissertation Help Important in Accounting?

Accounting is more than just numbers. It’s a combination of finance, analytics, law, strategy, and ethics. This complexity often makes it challenging to choose the right research focus and develop a coherent, evidence-based dissertation. Here’s why dissertation help is particularly valuable in this field:

Expert guidance ensures proper structure, methodology, and academic tone.

Topic validation helps in identifying areas with available data and future research potential.

Literature review support provides access to scholarly sources and peer-reviewed material.

Formatting and referencing help maintain compliance with APA, MLA, or other academic styles.

By taking advantage of professional support, students can focus on analysis and creativity rather than formatting and structure.

How to Choose the Right Accounting Dissertation Topic

Choosing a dissertation topic is the foundation of the entire project. A good topic should be:

Relevant to current trends

Feasible with available resources

Aligned with your academic goals

Interesting enough to sustain motivation

Students are encouraged to explore real-world issues and emerging areas in the accounting field. Avoid overly broad or excessively niche topics unless you have deep knowledge and access to resources.

Top Accounting Dissertation Topics for 2025

To help you get started, here’s a list of research-ready topics that align with current industry developments and academic interests:

1. The Impact of ESG (Environmental, Social, Governance) Reporting on Corporate Financial Performance

Explore how non-financial reporting is influencing investment decisions and overall company performance.

2. Blockchain Technology in Accounting: Disruption or Enhancement?

Examine the integration of blockchain into accounting systems and its implications on auditing, transparency, and fraud detection.

3. Forensic Accounting and Financial Fraud Detection in the Digital Age

Focus on how forensic accountants are evolving their methods to keep up with cybercrimes and digital manipulation.

4. The Influence of Artificial Intelligence on Financial Auditing

Analyze the pros and cons of using AI tools for internal audits and risk management.

5. The Role of Behavioral Accounting in Budgeting and Forecasting

Investigate how cognitive biases and human behavior influence financial planning in organizations.

6. Comparative Study: IFRS vs. GAAP in Cross-Border Accounting Practices

Assess the difficulties and advantages companies face when transitioning between these two accounting standards.

7. Sustainability Accounting and Its Role in Corporate Strategy

Evaluate how sustainability reporting is becoming a core element of business strategy and performance evaluation.

8. The Effectiveness of Tax Avoidance Strategies in Multinational Corporations

Discuss the ethical, legal, and financial dimensions of tax planning techniques.

9. Audit Quality and Auditor Independence in Listed Companies

Study the balance between maintaining long-term client relationships and ensuring audit quality.

10. The Future of Cloud-Based Accounting: Security Risks and Advantages

Explore how cloud technology is transforming accounting processes and the risks it poses for data security.

What Makes an Accounting Dissertation Successful?

Beyond topic selection, your dissertation needs to meet certain academic expectations to stand out:

1. Clear Research Objectives

Start with well-defined goals. What are you trying to discover, prove, or analyze? Having precise research questions helps streamline your investigation.

2. Strong Literature Review

This section demonstrates your understanding of the existing body of knowledge. Focus on scholarly journals, government reports, and recent publications to give your work a solid foundation.

3. Appropriate Methodology

Choose a methodology that suits your topic — whether qualitative, quantitative, or mixed methods. Explain your data collection process, sample size, and analysis techniques clearly.

4. Data Analysis and Interpretation

Use tools like SPSS, Excel, or R to process your data. More importantly, interpret the results in light of your research questions and objectives.

5. Critical Thinking

Show your ability to analyze problems from multiple perspectives. Do not merely describe findings; evaluate their implications and limitations.

Common Challenges Students Face

While help is available, many students still face difficulties such as:

Time constraints

Poor topic alignment

Limited access to scholarly sources

Unclear academic guidelines

These issues can delay progress or compromise the quality of the final dissertation. Seeking dissertation help early can prevent such setbacks and keep your academic journey on track.

Conclusion

Writing a dissertation in accounting is a significant academic milestone. With proper planning, topic selection, and the right dissertation help, students can navigate this challenge successfully. As 2025 brings new trends and technological advancements in finance and auditing, students have exciting opportunities to explore fresh perspectives and contribute meaningful research to the field.

Choosing a relevant, research-ready topic and following academic standards is the key to a well-crafted dissertation. Whether you’re a final-year undergraduate or a postgraduate student, now is the perfect time to start preparing your accounting dissertation with confidence and clarity.

FAQs about Dissertation Help in Accounting

Q1. What is the ideal length of an accounting dissertation? Most dissertations are between 10,000 to 15,000 words. However, the requirement may vary by institution.

Q2. Can I change my topic after submitting my proposal? Yes, but you may need approval from your supervisor, especially if the new topic significantly changes your research direction.

Q3. Do I need to use primary data for my dissertation? Not necessarily. Secondary data analysis is also acceptable, depending on your topic and methodology.

Q4. How important is referencing in a dissertation? Very important. Accurate referencing demonstrates academic integrity and helps avoid plagiarism.

Q5. When should I start writing my dissertation? Start early — ideally right after your proposal is approved. Allocate time for research, writing, revisions, and proofreading.

1 note

·

View note

Text

Mastering the Mid-Cycle: GetMax’s Expert Medical Coding Services

At GetMax Healthcare Solutions, our mid-cycle RCM services bridge the gap between patient visits and payment. We ensure that every claim is accurate, compliant, and primed for fast reimbursement.

🧩 What Is Mid-Cycle RCM?

Mid-cycle RCM encompasses all activities after patient registration and insurance eligibility checks, but before final payment posting. The two critical pillars here are:

Medical Coding

Charge Entry & Claims Submission

✅ 1. Expert Medical Coding

Our certified coders (CPC, CCS) meticulously use CPT, ICD‑10, and HCPCS codes to match each visit and procedure precisely—regardless of specialty (orthopedics, cardiology, radiology, etc.).

We run regular audits to maintain compliance and minimize audit risk.

✍️ 2. Accurate Charge Entry & Claims Submission

Next comes charge capture—powered by a blend of automation and expert review.

We extract data via AI from superbills and EHRs, ensuring clean, complete entries.

Each claim undergoes validation and error correction before direct submission to clearinghouses or payers. This significantly reduces denials and delays in reimbursement.

⚙️ 3. Manual & Automated Charge Entry

For ultimate accuracy:

Our team performs pre-validation checks comparing charges with the source documentation.

Whether manual or AI-enhanced, every charge is reviewed before submission.

🛡️ 4. HIPAA-Compliant Security

GetMax prioritizes HIPAA compliance, safeguarding your protected health information through encrypted storage, secure transmission, and strict access controls.

📈 Why It Matters

Optimizing mid-cycle RCM means:

🚀 Faster Payments – Cleaner claims, quicker reimbursements.

✅ Greater Accuracy – Fewer denials, less rework, and streamlined cash flow.

🧠 Practice Efficiency – You and your team can focus on patient care.

🌟 GetMax Advantage

By combining certified coding experts, AI-powered data extraction, and best-in-class compliance, GetMax delivers a mid-cycle solution that supports your practice’s revenue goals—from initial visit to final payment.

Ready to transform your billing process? 📞 Contact us today at 646-535-0005 🌐 **Visit us at **getmaxhealthcare.com

#Revenue Cycle Management#Medical Billing#HealthcareSolutions#RCM Services#Efficient Billing#GetMax Healthcare#Patient Care#Medical Practice#Billing Solutions#Healthcare Efficiency

0 notes

Text

How does a cross-document data correlation system enhance enterprise decision-making?

In modern enterprises, data flows in from every direction—contracts, invoices, forms, emails, and scanned documents. While each document may tell part of a story, real value is unlocked only when data from different sources is connected and understood in context.

This is where a cross-document data correlation system becomes essential. It helps organisations identify relationships, extract insights, and create unified views from scattered and unstructured document data, enabling faster, smarter decisions across departments.

What is a Cross-Document Data Correlation System?

A cross-document data correlation system is an advanced AI-driven solution that links and analyzes data points found in multiple documents to form a comprehensive, interconnected understanding of business information. It not only extracts individual data fields using OCR and NLP but also traces patterns, matches entities, and identifies dependencies across different files, even if they vary in format, language, or structure.

Imagine being able to connect a purchase order to its corresponding invoice, shipment receipt, and payment confirmation automatically. With such correlation, audits, reporting, and decision-making become significantly more efficient.

Why Manual Data Matching Falls Short?

Traditional approaches to document processing often treat each file in isolation. A team member might manually compare documents to check if figures match, vendors align, or terms are consistent. This process is time-consuming, error-prone, and does not scale. In contrast, a cross-document data correlation system automatically links related documents, flags inconsistencies, and provides a complete data map all in real time. It removes the need for repetitive manual checks and eliminates the risk of missing critical connections.

Key Benefits for Businesses

The value of implementing a cross-document data correlation system is felt across multiple business functions:

Finance and Accounting: Automatically match invoices to purchase orders, detect duplicate billing, and validate payment records across systems.

Procurement: Ensure consistency between supplier contracts, delivery notes, and compliance documents.

Healthcare: Correlate patient intake forms, lab results, prescriptions, and discharge summaries for better care coordination.

Legal and Compliance: Link clauses across agreements, regulatory filings, and historical communications for full audit trails.

This kind of intelligent correlation turns static documents into dynamic knowledge sources, making data more actionable and reliable.

Intelligent Automation Behind the Scenes

The power of a cross-document data correlation system lies in its ability to understand context. AI models are trained to recognise relationships between fields like names, dates, amounts, reference numbers, and more. Machine learning ensures that over time, the system improves its understanding of complex patterns specific to each industry.

These systems also support entity resolution, identifying when different documents mention the same vendor, client, or product in various ways and consolidating that data under one unified identity.

Scalability, Accuracy, and Compliance

Scalability is critical for large enterprises handling thousands of documents daily. A robust correlation system can analyze documents in batches, link them through unique identifiers, and process the information without performance drops.

It also strengthens compliance and audit readiness by keeping a complete digital trail of how data points were extracted, matched, and validated, ensuring transparency and traceability at every step.

A Step Toward Enterprise Intelligence

A cross-document data correlation system is more than a productivity tool it’s a gateway to enterprise intelligence. By surfacing hidden relationships and offering real-time insights, it supports faster decision-making, stronger risk management, and improved operational performance.

As businesses face increasing data complexity, the ability to connect the dots between documents automatically will define the leaders in every industry.

Experience the future of document intelligence. Transform scattered data into smart, connected insights only with Makez.ai.

0 notes

Text

The Next Decade of Procurement: Automation, Strategy, and Human Judgment

Let’s face it—procurement has been having a bit of a glow-up lately.

What used to be a back-office function buried under spreadsheets and supplier calls is now stepping into the spotlight. In 2030, procurement won’t just be about getting the best price. It’s going to be about resilience, automation, ethics, geopolitics, and data-backed decisions—all rolled into one intelligent, forward-looking ecosystem.

Sounds big? It is. But let’s break it down.

The AI-Powered ERP Is No Longer a “Nice-to-Have”

By 2030, AI in procurement won’t be some futuristic add-on—it’ll be the core engine. We’re talking about systems that not only place orders but also analyze vendor risks, scan for fraud patterns, and optimize delivery timelines—all without human intervention.

Imagine an ERP that knows when your raw materials are running low before your team does. One that chats with warehouse systems, freight agents, and customs platforms in the background and just gives you the ETA. No phone calls. No last-minute panics.

Procurement professionals? You won’t disappear—you’ll shift roles. You’ll be validating strategy, resolving anomalies, and focusing on supplier partnerships, not POs.

Robotics: Beyond the Warehouse Floor

If you thought warehouse robots were impressive today, wait until you see what’s coming.

By 2030, robots will handle everything from real-time inventory balancing to dynamic storage decisions—literally choosing where products sit based on usage patterns. Autonomous delivery vehicles? They’ll be the new normal, shaving days off lead times and reducing damage in transit.

It’s not just about speed. It’s about removing friction. Every touchpoint a human doesn’t have to manage is one less delay, one less error, one less bottleneck.

And here’s the kicker—these robotic systems will learn. They’ll adapt over time, flagging inefficiencies before you even notice them. That means procurement leaders will have to get comfortable with machines making operational calls—and trusting them.

Read More: The Essential Guide to Smart Warehousing: Navigating Modern Logistics

Geo-Politics Won’t Be a Side Note—They’ll Be the Playbook

Here’s the uncomfortable truth: global procurement has always been subject to political winds. But in 2030? The stakes are even higher.

Supply chains will shift overnight based on diplomatic friction, sanctions, or new trade corridors. The Belt & Road Initiative, AI treaties, data sovereignty laws—these things will directly influence where you source your next component.

To stay ahead, companies will start relying on “neutral zones”—independent manufacturing or logistics hubs located in politically stable regions. Think offshore robotic plants or warehouse networks designed to pivot fast based on global risk indicators.

The idea of a “fixed supplier in one country” will seem as outdated as fax machines.

Regulatory Red Tape? Expect It to Go Fully Digital

Procurement today is still stuck in paperwork purgatory in many parts of the world. But in 2030, we’ll see full-scale digital regulators.

Customs clearance, vendor compliance, documentation—everything will move through smart, auditable systems that reduce clearance time from weeks to hours. Countries that invest in this transparency will not only gain investor confidence—they’ll become sourcing magnets.

It’s not just about being faster. It’s about being traceable. Fraud detection, real-time rule enforcement, and audit-ready procurement trails will become table stakes.

Will that mean more upfront investment? Definitely. But it’ll also mean fewer fines, cleaner books, and less reputational risk.

Recommended Reading: Building Resilience in Your Supply Chain: Strategies for Future Disruptions

Inward Focused Economies Will Reshape the “Buy vs. Build” Equation

One thing’s clear—total self-reliance is a nice story, but not a realistic one. No country has all the resources, tech, and capabilities it needs. But we’ll still see a big push toward internal capacity building—especially for sensitive technologies.

What does that mean for procurement? A shift.

Teams will need to make smarter “make vs. buy” decisions, and those decisions won’t just be about cost. You’ll be weighing geopolitical risk, IP protection, long-term control, and public perception.

Will the local sourcing be more expensive short-term? Probably. Will it offer better strategic advantage? That depends on what you're optimizing for.

The most successful companies won’t just adjust—they’ll design for adaptability.

Metrics Will Matter More Than Ever (And Not Just Financial Ones)

Here’s where things get real: by 2030, procurement won’t just be measured by cost savings or supplier discounts.

You’ll be answering to sustainability metrics, carbon offset targets, ethical sourcing frameworks, and social impact scores. And you’ll need the data to prove it.

“Green” procurement won’t be optional—it’ll be regulated. And customers will expect to see that your supply chain lives up to your values.

This means your systems need to track more than shipments. They’ll need to map energy usage, vendor labor practices, and even circular economy impact. Procurement is becoming part of the ESG narrative—so get ready to own that story.

But Wait—What About the Human Element?

With all this tech flying around, it’s easy to think procurement will become a fully automated black box.

It won’t.

The most critical parts of procurement—judgment, negotiation, ethical reasoning, supplier relationships—are still deeply human. AI can spot a trend. But it can’t sense when a deal feels “off.” Robots can stack shelves. But they can’t build trust over years with a supplier halfway across the world.

In 2030, procurement leaders will need to do what machines can’t: think critically, resolve grey-area problems, and act with empathy.

So yes, the tools are changing. Fast. But the people using them still matter more than ever.

Final Thoughts: Procurement Is Stepping Up

By 2030, procurement will be predictive, not reactive. Strategic, not transactional. A central node in innovation, ethics, and risk management—not just a cost center.

If you’re in procurement today, the goal isn’t to become a coder or a futurist. It’s to stay curious, stay informed, and get comfortable with change.

Because procurement’s role is expanding—and the companies who see it as a strategic asset now will be the ones leading tomorrow.

0 notes

Text

Why MediBest Leads in Hospital System Software

Hospitals face tighter margins, rising patient expectations, and stricter data-privacy rules. A powerful, future-ready hospital management system software is now the backbone of safe, efficient care. MediBest—India’s most comprehensive hospital software company—unites every clinical, administrative, and financial workflow on one secure platform, giving hospitals an edge today and tomorrow.

What Makes MediBest the Benchmark in Healthcare Management Systems

MediBest was built for real-world hospital pressures: high footfall, complex specialties, and multi-location growth.

Core Modules of MediBest Healthcare Management System Software

MediBest’s healthcare management system software ships with every module hospitals need—no bolt-ons:

Electronic Health Records & CPOE for real-time, error-free documentation.

AI-driven scheduling that balances beds, staff, and theatres.

Integrated billing & claims with payer rules to cut denials.

Pharmacy, inventory & biomedical tracking to curb leakage.

Analytics dashboards comparing live KPIs against national benchmarks.

MediBest encrypts every transaction end-to-end, logs all access, and supports role-based permissions. Quarterly updates keep your hospital aligned with NABH, HIPAA, and upcoming EU AI rules. Bi-directional HL7/FHIR interfaces healthcare management system software near me ensure seamless data flow to labs, imaging, national registries, and public-health portals.

Rapid Implementation Roadmap

Define success metrics—LOS, claim cycle, infection rate.

Phase migration—start with EHR; add billing and inventory next.

Parallel runs to validate data accuracy.

Role-specific training for faster adoption.

Post-go-live audits every 30 days to refine workflows.

MediBest’s specialists handle mapping, testing, and onsite coaching, so IT teams stay focused on care delivery. Click here :

Frequently Asked Questions

1. Why is hospital management system software critical today? It digitizes every workflow—appointments, orders, billing—cutting delays and errors, while giving leaders real-time data to make better decisions.

2. How does MediBest differ from other hospital software companies? MediBest offers a single-platform solution with native PACS, mobile apps, and machine integrations, backed by local 24 × 7 support and modular pricing.

3. Can small hospitals afford MediBest healthcare management system software? Yes. Subscription tiers and lightweight cloud deployment let community hospitals start small and expand features as they grow.

CONTACT :-

MADHYA BHARAT CERAMICS :-

Chandapura Road, Pashupatinath Mandir road, Mandsaur M.P. 458001 India

Email us : [email protected] [email protected] us on : +91-8827697111 (Siddharth Jain) +91-9425105256 (Sushil Jain)

Call us on : +91-8827697111 (Siddharth Jain) +91-9425105256 (Sushil Jain)

0 notes

Text

Faster Policy Checks with BluePond.AI’s Generative AI

Policy Checking Made Effortless with Broker CoPilot by BluePond.AI

When the renewal season hits, the pressure is brutal.

Teams drown under endless documents, toggling between outdated systems, triple-checking every line, just to keep costly errors at bay. Clients expect immediate answers, flawless service, and unwavering attention. But your staff is buried in busy work!

Delays grow, mistakes creep in, and client trust starts to erode.

Well, operational challenges with insurance processes aren’t going away, but how you tackle them can change everything. Is your agency ready to rethink what’s possible with the right partner by your side?

Accelerate Renewals & Reduce Errors with Broker CoPilot

BluePond.AI’s Broker CoPilot leverages advanced Generative AI to transform the insurance renewal process, delivering unmatched speed and precision while minimizing costly errors.

Think of Broker CoPilot as your smart, tireless assistant that never misses a detail. Powered by cutting-edge Generative AI, Broker CoPilot ingests and reads through all kinds of insurance documents like submissions, quotes, policies, PDFs, binders, and ACORDs etc. It compares them line by line, identifies discrepancies, and highlights any gaps in coverage. It handles the heavy, repetitive work, so your team can focus on delivering value to clients. With Broker CoPilot handling the details, your brokers can spend more time helping clients and less time buried in paperwork.

Simply put, it’s like having a super-accurate co-pilot guiding you through the complex world of insurance processes, making renewals faster, minimizing errors, and your whole operation smoother.

Accelerating Renewals

Automated Policy Checking: Broker CoPilot automates the time-consuming process of checking new policies against expiring ones and original submissions, ensuring that renewals align with requested terms and prior coverage. This automation drastically shortens what was once a manual, hours-long task to just minutes, even for complex policies with extensive schedules.

Quote Comparison: Our Generative AI platform conducts in-depth, line-by-line comparisons of even the most complex quotes, quickly surfacing differences between quotes in clear and easy-to-read quote summaries. This enables brokers to present renewal options to clients faster and with greater clarity.

Workflow Automation: Broker CoPilot integrates automated intake, extraction, validation, and decision-making, streamlining the entire renewal workflow for brokers and agencies.

Reducing Errors

Generative AI-Powered Precision: Broker CoPilot is trained specifically for P&C insurance, enabling it to ingest and understand complex policy documents, spot discrepancies, and identify coverage gaps that might be missed in manual reviews. This reduces the risk of errors and omissions (E&O), a major concern in insurance processes.

Insurance Expert Oversight: While Generative AI handles the heavy lifting, licensed insurance experts provide quality control, further reducing the risk of errors and ensuring accuracy.

Comprehensive Document Analysis: Broker CoPilot exhaustively checks hundreds of pages and fields across all relevant documents, using market-leading checklists.

Consistent and Auditable Processes: Every step is documented and repeatable, providing an auditable trail that supports compliance and accountability.

Additional Benefits

Cost and Time Savings: Agencies using Broker CoPilot have reported significant reductions in administrative costs and a significant increase in operational capacity.

Improved Client Service: By accelerating renewals and minimizing errors, brokers can provide faster, more reliable service, strengthening client trust and satisfaction.

Scalability: The solution enables agencies of all sizes to handle large, complex accounts with the same efficiency and accuracy as the largest brokerages.

Reduced Manual Workload: Broker CoPilot takes over time-consuming manual tasks like Policy Checking, Quote Comparison, and renewal reviews. It eliminates the need for brokers to rely on external teams or spend hours on tedious processes. So, your team can focus on better service and strategic growth.

Is Your Agency Set Up for Smarter Growth?

Manually performing insurance processes while preventing errors isn't just costly; it is also a threat to growth.

Broker CoPilot by BluePond.AI offers a smarter, faster, and more reliable way to manage renewals, automating tedious tasks, catching discrepancies early, and freeing your team to focus on what matters most: building stronger client relationships.

With our P&C-trained Generative AI backed by insurance expert QAs, renewal season becomes an opportunity to stand out, not a source of stress or risk. Agencies and brokers can now retain full control, enhance reliability, and streamline operations without relying on insurance BPO services.

It’s not just about working faster. It’s about working smarter, reducing errors, and setting your agency on a path to scalable, sustainable success. The future of insurance processes isn’t coming someday; it’s already here, and it’s ready to help your operations improve!

To read full blog - Faster Policy Checks with BluePond.AI’s Generative AI

0 notes

Text

What if your team could eliminate 80% of its repetitive tasks, reduce operational errors by half, and run 24/7 without burnout? That’s not a dream. It’s Robotic Process Automation (RPA) — and it’s already transforming industries you rely on every day.

But here’s the catch: most RPA tools fall short when applied to complex, compliance-heavy workflows. That’s where Robotan stands out — tailor-built for high-stakes sectors like fintech, stock broking, insurance, and logistics.

What Is RPA, Really?

RPA uses software “bots” to replicate human actions like clicking, copying, updating, and generating reports. Think of it as your digital workforce — handling boring, repetitive tasks at lightning speed and without error.

But modern RPA, especially when fused with AI, goes further. It understands processes, adapts in real-time, and integrates across tools like CRMs, ERPs, and legacy systems.

That’s not just automation. That’s transformation.

Where Robotan Changes the Game

While most RPA platforms focus on the tech layer, Robotan brings something rare: deep industry context. Their in-house automation engine doesn’t just automate tasks — it redesigns how operations work.

Here’s how Robotan is reshaping business across three key industries:

Logistics & Supply Chain: From Bottlenecks to Seamless Flow

📦 Before: Manual invoicing, delayed shipment updates, and missed tracking data.

⚙️ After Robotan:

End-to-end order-to-invoice automation

Real-time inventory sync

Automated shipment alerts and reconciliation

Zero human errors in rate calculations

Result? Faster deliveries, lower cost per shipment, and stress-free audits.

Stock Broking: Precision at the Speed of Markets

📉 Before: Disjointed data, trade settlement delays, and compliance headaches.

⚙️ After Robotan:

Real-time trade confirmations

Automated KYC and AML checks

T+1 settlement process support

AI-driven reconciliation workflows

Robotan’s bots ensure that regulatory requirements are met while keeping operations lightning-fast — crucial in this high-stakes space.

Insurance: Making Claims & Compliance Smarter

Before: Paper-heavy claims, manual KYC, and delayed policy renewals.

After Robotan

Automated claims intake & validation

eKYC integration across platforms

Instant policy renewals & auto-notifications

Clean compliance trail for audits

Insurance firms using Robotan report turnaround time improvements of over 60% — that’s customer loyalty in action.

Why Most RPA Tools Fail — and Robotan Doesn’t

Traditional RPA is like hiring a robot assistant with no context. It needs rules for everything and breaks when things change.

Robotan uses AI-infused bots and process mapping to deliver:

Adaptable workflows (not just scripts)

Seamless integration with legacy + modern systems

Scalable solutions across departments

Compliance built-in from day one

This means less maintenance, faster deployment, and real ROI.

Not Just Automation — A Competitive Edge

According to Deloitte, 74% of companies are exploring or using RPA. But only a fraction unlock true value — because they treat RPA like a patch, not a strategy.

With Robotan, businesses gain:

✅ 60–80% cost reduction in target processes ✅ 3x faster operational turnaround ✅ Near-zero manual error rates ✅ Teams free to innovate, not copy-paste

Real-World Impact in Weeks, Not Months

One fintech client automated onboarding + document verification with Robotan and saw:

92% time savings

85% reduction in support tickets

Full compliance, with fewer audits triggered

Ready to Automate Smarter?

If your business is still relying on humans to do what bots could handle better, you’re already behind.

🔹 Book a free workflow audit 🔹 See how Robotan plugs into your stack 🔹 Start seeing results in under 30 days

📞 Call us at +91 9820446093 or visit www.robotan.io

Robotan isn’t just automation — it’s your competitive advantage in a digital-first world. Now is the time to automate like your future depends on it. Because it does.

0 notes

Text

Reconciliation Automation: Empowering Financial Accuracy and Efficiency with Cognizione

Introduction: The Reconciliation Bottleneck in Finance

Reconciliation is one of the most crucial yet time-consuming functions in any finance department. Whether it’s reconciling bank statements, vendor payments, or payment gateway settlements, the goal is always the same: ensure that internal records match external statements.

Traditionally, reconciliation has been a manual, error-prone, and often frustrating process. But today, reconciliation automation is revolutionizing the way finance teams operate.

Reconciliation automation uses intelligent software to eliminate manual tasks, reduce errors, improve compliance, and accelerate the financial close. At Cognizione, we build automation tools that empower businesses to gain control, confidence, and clarity over their financial data.

What is Reconciliation Automation?

Reconciliation automation refers to the process of using software and technology to match, validate, and reconcile financial records automatically. It replaces manual data entry and spreadsheet-based methods with intelligent systems that connect directly to banks, ERPs, and other financial sources.

Whether you are reconciling:

Bank transactions

Credit card settlements

Vendor payments

Payment gateway data

Inter-company accounts

Invoices and receivables

Automated reconciliation ensures faster processing, fewer errors, and better audit readiness.

Why Manual Reconciliation is No Longer Sustainable

For a long time, finance teams have relied on spreadsheets, manual file uploads, and human validation. But as transaction volumes increase and businesses grow more complex, these old-school methods begin to break down.

Challenges of manual reconciliation:

Hours or days spent matching entries

High risk of data entry errors

Limited visibility and control

Missed discrepancies and fraud risks

Delayed financial close processes

Resource-intensive and non-scalable

In short, manual reconciliation wastes time, money, and energy that could be invested in more strategic financial tasks.

How Reconciliation Automation Works

Cognizione’s reconciliation automation platform simplifies the process with end-to-end automation. Here’s how it typically works:

Data Integration The system connects with your banks, ERPs, accounting systems (like Tally, QuickBooks, SAP), and payment gateways. It pulls data automatically, eliminating manual downloads.

Smart Matching Logic Transactions are matched based on configurable rules—by date, amount, reference numbers, and even fuzzy logic that accounts for variations and typos.

Discrepancy Identification Any unmatched entries or anomalies are flagged instantly. The software provides clear reasons and recommended actions for resolution.

Exception Management Finance teams can review and resolve exceptions with just a few clicks. Approvals and comments are logged automatically.

Audit Trail and Reports Every action is recorded. You get detailed reconciliation reports, audit trails, and compliance-ready documentation at your fingertips.

Why Choose Cognizione for Reconciliation Automation?

Cognizione is more than just software—it’s a complete financial automation solution trusted by growing startups and large enterprises alike.

🔹 Seamless Integration

Cognizione connects with 100+ financial systems, banks, and third-party platforms. No more jumping between portals or importing/exporting spreadsheets.

🔹 AI-Powered Matching

Our intelligent matching engine handles one-to-one, one-to-many, and even complex partial matches using AI and machine learning.

🔹 Configurable Rules

Set your own rules for matching, thresholds for discrepancies, and policies for approvals. The platform adapts to your business logic.

🔹 Real-Time Dashboards

Monitor reconciliation status across all accounts, identify bottlenecks, and track KPIs like aging mismatches or unresolved exceptions.

🔹 Scalable for Growth

From 1,000 to 1 million transactions, Cognizione grows with your business. Our architecture supports high-volume processing with zero performance compromise.

🔹 Secure and Compliant

Built with enterprise-grade encryption and compliance with data protection standards like ISO, GDPR, and more.

Benefits of Reconciliation Automation

Reconciliation automation is not just about saving time—it’s about transforming your entire financial ecosystem.

✅ Save Time and Cut Costs

Automate 80-90% of manual reconciliation work and reduce dependency on spreadsheets and additional manpower.

✅ Increase Accuracy

Software doesn’t make typos. Avoid costly errors, duplicate entries, or missing data.

✅ Speed Up Month-End Close

Reduce month-end close cycles from weeks to days with faster reconciliations and clear reporting.

✅ Gain Real-Time Visibility

Stay on top of your financial health with real-time cash flow insights and reconciliation status across departments.

✅ Reduce Fraud and Risk

Instantly detect suspicious activity or transaction mismatches that could otherwise go unnoticed.

✅ Be Audit-Ready Always

No more scrambling for audit trails. Keep a clean, documented reconciliation history at all times.

Who Should Use Reconciliation Automation?

Reconciliation automation is a must-have for organizations that:

Deal with high volumes of transactions

Operate in multiple geographies or currencies

Use multiple payment platforms or bank accounts

Have intercompany transactions or vendor settlements

Need real-time visibility and control over cash flow

Are aiming for faster, cleaner financial closes

Industries that benefit the most include:

eCommerce & Retail

FinTech & Banking

Travel & Hospitality

Logistics & Transportation

Healthcare & Education

Manufacturing & Distribution

Cognizione: Your Partner in Financial Automation

With Cognizione, you’re not just buying software—you’re partnering with a team that understands finance. Our mission is to empower finance leaders with the tools they need to automate reconciliation, improve compliance, and drive business growth.

We offer:

Fast onboarding and implementation

Custom configurations and logic

Dedicated customer support

Transparent pricing and no hidden costs

Conclusion: Don’t Let Manual Reconciliation Hold You Back

In today’s competitive landscape, finance teams are expected to do more—with less. Manual reconciliation not only slows you down but also exposes your business to risk and inefficiency.

Reconciliation automation is the future. With Cognizione, you can embrace that future with confidence, knowing your financial data is accurate, timely, and audit-ready.Make your financial operations smarter, faster, and more efficient. Visit 👉 https://cognizione.com/ and automate reconciliation today.

0 notes

Text

Genuine Experience Certificates in 2025: How Dreamsoft Consultancy Meets the Digital Age of Background Checks

1. Next-Gen Verification in 2025

With employers ramping up digital scrutiny—using PF/EPFO cross-checks, TDS/Form‑16 validation, AI-driven document scans, and even geo-tagged office confirmations—Dreamsoft Consultancy tailors its service to thrive in this environment

2. Legally Registered Entity

Dreamsoft operates through MCA-registered companies across India. Framed as trusted experience certificate providers in Kolkata (and Hyderabad, Pune, etc.), this lends weight to documents during digital audits .

3. Multi-Channel Verification

Every certificate is backed by:

Email and telephonic confirmation of HR and managers

Third-party validation within the industry

On-demand physical verification at the workplace This layered protocol minimizes anti-fraud risks

4. Professional Formatting & Digital Resistance

Certificates are issued on formal letterhead with official seals, signatures, issuance dates, and authorized stamps. They are also designed compressibility-friendly for digital uploads and secured to survive scans and extraction checks.

5. Global Attestation Capabilities

For international employment or visa needs, Dreamsoft supports Hague-style apostille and MEA/embassy attestations—ensuring authenticity that's verifiable anywhere in the world .

6. Blockchain-Ready Awareness

Although not fully blockchain-enabled, Dreamsoft’s processes align well with proposed digital credential standards like India’s National Academic Depository—a readiness that positions their certificates well for emerging decentralized verification systems

7. Lifetime Verification & Support

They commit to lifetime verification support, maintaining active HR and management contacts to respond to employers or verifiers during audit periods—future‑proofing your certificate

Why This Matters

Automated Detection is On the Rise: As AI and digital systems become standard in DOJ, MNC, fintech, and BFSI sectors, unverified or amateur documents stand out.

Geographic Relevance: In cities like Kolkata, companies increasingly tie digital database checks to employment documents—so locally recognized experience certificate providers in Kolkata must adhere to these standards.

Future-Proofing Careers: With rising digital infrastructure, the certificates issued today must be able to withstand tomorrow’s verification frameworks.

Final Thoughts

In 2025’s digital hiring climate, Dreamsoft Consultancy delivers experience certificates that are:

Legally registered and professionally formatted

Verified across channels—digital and physical

Globally attested and internationally compliant

Technologically forward-looking—fit for blockchain and digital verification

Continuously supported for future reference checks

0 notes

Text

eTMF in the Era of Digital Trials: Challenges, Innovations, and Opportunities

The modus operandi of clinical trials is changing fast. The role of the electronic Trial Master File (eTMF) has grown more significant as the industry has became increasingly dependent on electronic solutions. The old days of bulky filing cabinets and paper-filled rooms are now a distant memory. Today, trial documentation is being simplified by a shift toward smart, centralized, and compliant eTMF systems.

But along with great innovations and possibilities, change also introduces a new range of challenges. We'll delve deeper into the evolving role of eTMF software in electronic trials in this blog post, as well as what works, where companies are struggling, and how this digital shift is opening the door for improved, faster, and more compliant clinical research.

What Is an eTMF, and Why Is It So Important?

Each clinical trial involves a mountain of paperwork that needs to be written, reviewed, stored, and ready for regulatory inspection. This collection is given the generic term Trial Master File (TMF). It includes everything from contracts and study procedures through correspondence and monitoring of reports.

These documents were once managed in hybrid environments or on paper. But with clinical trials becoming more complex and global, the need for a digital solution has become greater. Electronic TMF systems can assist with that. From anywhere in the world, research teams can more easily collaborate, reference documents in real time, and take advantage of automated workflows using these systems.

Without the disorganization of paper systems, today's TMF software facilitates smooth trials and compliance with regulations as well as document storage.

The Growing Pains: Obstacles with eTMF Adoption

Theoretically, going from paper to electronic is great. But transitioning to eTMF systems is really a little bit of a learning experience. Below are some common problems that companies face:

1. It's Difficult to Get Going

Software installation is merely one step in opening a new electronic trial master file system. Reengineering processes, training employees, setting permissions, and making sure it all meets the requirements of the law are all involved. It's a big lift upfront.

2. Change Is Not Favored Everytime

Some organizations are used to their legacy means of operation. It can take some time to convince employees to utilize eTMF software entirely, especially if they are not used to working with computer programs. Adoption can fall behind in the absence of proper training and support.

3. Moving Historical Data

It is difficult to move decades' worth of legacy documents into a new electronic TMF. Everything has to be properly tagged, stored in a safe place, and easy to find. Issues can surface down the road, especially in audits, if this process is not done correctly.

4. Compliance Concerns Persist

Even though they're built to help you comply, eTMF systems need proper validation and maintenance. It does not matter that you're virtual: regulations such as FDA 21 CFR Part 11 and ICH-GCP still exist.

5. Connecting the Dots

The trial master file software isn't an independent entity. It has to talk to other systems, e.g., safety databases, CTMS, or EDC. From a technical standpoint, it may be hard to have these platforms talk to each other seamlessly.

Game-Changing Innovations in eTMF Software

Despite the failures, the digital revolution has also spawned some amazing breakthroughs. Research teams are processing documents more speedily and confidently due to new features. The trendy one now is:

1. AI-powered smart automation

Artificial intelligence is utilized by some of the latest eTMF software solutions to execute the time-consuming tasks, like labeling documents, searching for errors, or finding missing files. Time is reduced, and the risk of human error is minimized.

2. Real-time Health Reports and Dashboards

Current electronic TMF platforms feature real-time dashboards that reflect your TMF's status of completeness and compliance in real time. Thus, sponsors and CROs will enjoy more visibility and less surprise during audits.

3. Granular Access Control

Security is also being enhanced. Only the right people can view sensitive documents with better permission settings. This maintains data while supporting efficient teamwork.

4. Work from Anywhere

Teams can upload and view documents from anywhere due to the cloud-based and mobile-accessible nature of many modern eTMF systems. This is especially handy in hybrid or decentralized trials where members are spread out.

5. Tamper-Proof Records

To furnish safe audit trails that cannot be altered, some vendors are even playing with blockchain functionality. Such openness could be a major boon to regulatory audits.

What's In It for Sponsors and CROs?

Indeed, there are difficulties. However, there are also significant benefits to properly preparing your electronic trial master file. Businesses that go digital now can benefit in the long run:

1. Constantly Prepared for Audits

You can always be prepared for an inspection with eTMF software. Even the ability to remotely review documents reduces the need for site visits and the anxiety that comes with audit preparation.

2. Quicker Startup of the Trial

Time to site activation is reduced and bottlenecks are eliminated by the help of automated document workflows. Consequently, trials may start and finish earlier.

3. Better Collaboration

The centralized aspect of eTMF systems means that investigators and monitors can stay in sync. No longer sending versions back and forth via email or wondering who has the latest version.

4. Lower Long-Term Costs

Gone digital is gone paperwork, gone printing, gone couriers, and gone storage, but first it costs money. Those savings accumulate over time.

5. Smarter Informed Decisions

Numerous TMF software solutions include analytics features that enable teams to track performance and leverage real-time data in making more informed operational decisions.

The Road Ahead: eTMF in a Digital Future

Electronic TMF platforms will continue to be more significant as clinical trials evolve. We are entering an era where wearables, remote monitoring, and decentralized trials are the norm. eTMF systems will have to be even more agile, automated, and interoperable to keep up with these changes.

Regulators are adapting as well. Good trial master file software is even more critical now that organizations such as the FDA and EMA are beginning to accept electronic document review and remote inspections.

Ultimately, the eTMF will become more than a compliance tool. In addition to aiding audits, it will facilitate collaboration, reduce turnaround time, and speed the release of treatments.

Final Thoughts

While changing to electronic TMF is an important step, it is well worth it. Organizations can conduct better and more efficient trials as well as comply with regulatory needs if they have the right procedures, training, and system in place.

eTMF software provides research teams with the competitive advantage they require to succeed in a world where compliance, transparency, and speed matter more than ever before. The Trial Master File is the hub of the digitalization of clinical trials in the years to come.

Want to learn more about how Octalsoft's eTMF system can assist in accelerating your next clinical trial? Schedule a demo with us today!

Want to know more about how Octalsoft’s eTMF system can help expedite your next clinical trial? Book a demo with us today!

0 notes

Text

Smart Workforce Planning and HR Budgeting with Oracle EPM

In today’s fast-evolving business landscape, workforce planning and HR budgeting have become strategic priorities for organizations aiming to stay competitive and cost-efficient. Managing talent, forecasting HR costs, and aligning staffing plans with business goals require data-driven systems—and this is where Oracle EPM Cloud shines. From automated reports to dynamic dashboards, Oracle EPM empowers HR leaders to make proactive decisions with agility and confidence.

In this article, we explore the critical role of workforce planning, the complexities of HR budgeting, and how Oracle EPM helps optimize both for better decision-making.

Why Workforce Planning Matters in 2025

Workforce planning isn’t just about headcounts. It's about anticipating skill needs, managing attrition, ensuring the right talent is in place at the right time, and optimizing costs. In 2025, trends like remote work, skill-based hiring, and labor market volatility have increased the need for predictive workforce analytics.

Without an integrated system, HR teams often struggle with:

Inaccurate forecasts due to siloed data

Manual spreadsheet errors

Poor visibility into workforce costs and capacity

Inability to model different hiring or attrition scenarios

This leads to reactive decision-making and budget overruns. A proactive and integrated tool like Oracle EPM offers a robust solution.

The Complex Nature of HR Budgeting

HR budgeting is one of the most challenging components of organizational finance. It includes planning for salaries, benefits, bonuses, training costs, and more. Budget owners must also factor in:

Seasonal staffing

Headcount shifts

Regulatory and benefit changes

Economic uncertainties

Oracle EPM simplifies these complexities by providing:

Integrated Planning Modules that link HR, finance, and operations

Versioning and Scenario Modeling to evaluate different budget plans

Automated Forecasting using historical trends and AI-based predictions

It eliminates guesswork and helps align HR spend with business performance.

Employee Performance, Productivity, and Cost Analysis

One of the strengths of Oracle EPM Cloud is its ability to track employee metrics that impact financial outcomes. HR leaders can drill down into:

Department-wise labor cost

Revenue per employee

Training ROI

Turnover cost

With integrated KPIs and dashboards, organizations can assess the financial impact of workforce performance and optimize their talent investments. This enables HR teams to justify budget requests with performance data, not just projections.

Automation with Oracle EPM Dashboards and Reporting

Manual reporting is time-consuming and prone to error. Oracle EPM changes this with:

Real-time dashboards that present headcount, turnover, and compensation trends

Customizable reports for HR, Finance, and C-Suite audiences

Automated alerts and scenario planning

With built-in workflows and data validation tools, HR teams spend less time consolidating data and more time analyzing it.

What is Oracle EPM Cloud in HR Planning? Oracle Enterprise Performance Management (EPM) Cloud helps HR teams plan, budget, and forecast workforce needs through integrated modeling, real-time reporting, and scenario analysis.

Benefits for HR Leaders: Oracle EPM Cloud in Action

For HR directors and CHROs, Oracle EPM brings:

Better alignment between HR strategy and business goals

Faster decision-making with real-time data access

Reduced risks through scenario modeling and alerts

Regulatory compliance with audit-ready documentation

Improved collaboration across HR, finance, and operations

Case Study: How Turkish Enterprises Benefit from Oracle EPM

Several leading Turkish enterprises have already adopted Oracle EPM Cloud for workforce planning. For example:

A retail chain used it to forecast seasonal staffing needs, reducing overtime costs by 15% approx.

A manufacturing firm streamlined its training budget planning across 5 regions, resulting in a 10% approx reduction in unnecessary spend.

A healthcare provider improved its nurse-to-patient ratio analysis using Oracle dashboards, leading to better patient outcomes and cost control.

These case studies reflect how Oracle EPM is not just a tool, but a strategic enabler.

Final Thoughts and Strategic Advice from Constellation

At Constellation Consulting Group, we help organizations implement and optimize Oracle EPM for HR budgeting and workforce planning. Here are our key recommendations:

Start with clear objectives for your workforce plan.

Integrate HR and finance data for unified planning.

Use scenario modeling to prepare for economic shifts or workforce changes.

Automate reporting to improve decision timelines.

Invest in training HR teams to leverage Oracle EPM features fully.

Ready to transform your HR planning processes? Contact Constellation to schedule a free consultation with our Oracle EPM experts.

0 notes

Text

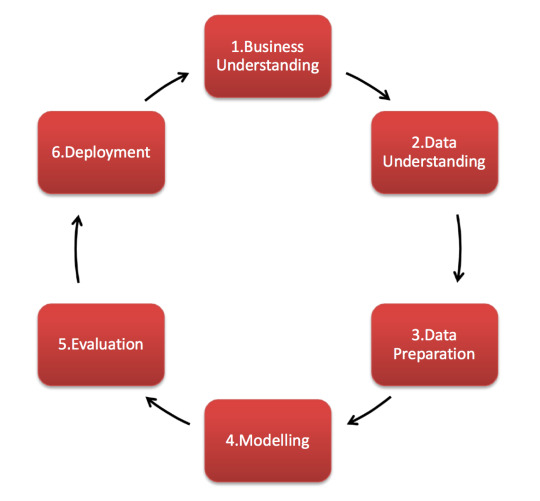

5 Enterprise Use Cases for No-Code AI-Driven Workflow Automation

The emergence of no-code AI-driven workflow automation has revolutionized how businesses operate, allowing them to optimize processes without the need for extensive coding expertise. By seamlessly integrating artificial intelligence with no-code platforms, enterprises can automate complex workflows, enhance decision-making, and drive unparalleled agility across various departments.

The Power of No-Code + AI at Scale

No-code platforms have democratized application development, enabling users to build and deploy solutions without traditional programming. When combined with AI, these platforms become even more powerful, allowing enterprises to leverage real-time data, automate repetitive tasks, and improve operational efficiency at scale. AI-driven automation adapts dynamically to changing business conditions, making workflows smarter and more responsive across industries.

Use Case 1: Finance - Automating Data Reconciliation & Compliance Checks

Problem

Finance teams often struggle with reconciling large volumes of financial transactions while ensuring compliance with regulatory standards. Manual processes are time-consuming, error-prone, and can lead to costly compliance violations.

Solution

No-code AI-driven workflow automation streamlines data reconciliation by integrating multiple financial systems, automatically validating data, and flagging discrepancies in real-time. AI algorithms ensure compliance checks are performed seamlessly, reducing human intervention and improving accuracy.

Outcome

Reduced manual effort and human errors in financial reconciliation.

Faster identification of compliance risks, preventing potential penalties.

Improved audit readiness with automated, real-time compliance reporting.

Use Case 2: Supply Chain - Adaptive Routing Based on Logistics Data

Problem

Enterprises face significant challenges in managing logistics efficiently due to unpredictable delays, supply chain disruptions, and inefficiencies in transportation routing.

Solution

No-code AI-driven automation enables real-time adaptive routing by analyzing logistics data, weather conditions, and traffic patterns. The system dynamically adjusts shipment routes and inventory distribution based on evolving conditions.

Outcome

Reduced transportation costs by optimizing routes.

Minimized delays through predictive supply chain adjustments.

Improved agility in responding to disruptions, enhancing customer satisfaction.

“No-code platforms enable business users to build applications in hours or days, not months, radically reducing time-to-market.” — Jason Low (Principal Analyst, Forrester Research)

Use Case 3: Marketing Ops - Syncing Data Across Tools Intelligently

Problem

Marketing teams struggle with fragmented data across multiple tools, making it difficult to track campaign performance, personalize customer interactions, and measure ROI effectively.

Solution

AI-powered workflow automation ensures seamless data synchronization between CRM, email marketing, and analytics platforms. It automatically updates customer profiles, tracks engagement, and generates cross-platform reports.

Outcome

Increased data accuracy and consistency across marketing platforms.

Faster campaign performance analysis with automated reporting.

Enhanced ability to deliver personalized, data-driven marketing strategies.

Use Case 4: HR - Automating Onboarding with Dynamic Conditions

Problem

Employee onboarding is often bogged down by paperwork, inconsistent processes, and delays in task completion, leading to a poor new-hire experience.

Solution

AI-driven workflow automation customizes onboarding tasks based on job roles, department needs, and compliance requirements. It automates document collection, approvals, and progress tracking.

Outcome

Reduced administrative burden on HR teams.

Faster, smoother onboarding experience for new employees.

Higher employee satisfaction and retention rates.

Use Case 5: SaaS - Self-Updating Usage-Based Billing Workflows

Problem

SaaS companies face challenges in managing usage-based billing due to fluctuating customer consumption patterns, leading to inaccuracies and disputes.

Solution

AI-powered automation dynamically adjusts billing workflows based on real-time usage tracking, automatically generating invoices and integrating with accounting systems.

Outcome

Increased billing accuracy, reducing revenue leakage.

Automated invoicing, saving time for finance teams.

Enhanced customer trust through transparent and accurate billing.

No-Code AI Workflow Automation Impact Charts

The Cross-Functional Impact of AI-Driven Workflow Automation

Beyond individual use cases, no-code AI-driven workflow automation has a profound impact across multiple business functions. By automating repetitive and error-prone processes, enterprises can break down operational silos and foster a more collaborative and data-driven work environment. Some key benefits include:

Data Validation Across Systems

Ensures accuracy and consistency across different platforms, minimizing data discrepancies.

Reduces manual errors and improves decision-making by providing clean, validated data.

SLA Compliance Monitoring

Automates SLA tracking, ensuring adherence to service level agreements.

Generates alerts and reports to prevent potential compliance breaches.

Auto-Generated Reports from Cross-Platform Data

Saves time by eliminating manual report generation.

Provides executives with real-time insights to make informed business decisions.

Cross-Tool Approvals & Routing

Enhances efficiency by automating approval workflows across departments.

Reduces bottlenecks in decision-making, ensuring faster execution of tasks.

Customer Feedback Triage

Uses AI to categorize and prioritize customer feedback for timely response and resolution.

Helps businesses enhance customer satisfaction by addressing concerns proactively.

The implementation of no-code AI-driven workflow automation represents a paradigm shift for enterprises, offering them the ability to streamline operations, improve compliance, and adapt to changing business environments effortlessly. Organizations that embrace this shift will see more than just operational improvements—they'll foster a culture of adaptability, creativity, and resilience. The future belongs to businesses that move fast, automate smartly, and empower their teams to do more with less friction. Now is the time to make the leap.

Learn more about DataPeak:

#datapeak#factr#saas#technology#agentic ai#artificial intelligence#machine learning#ai#ai-driven business solutions#machine learning for workflow#digital technology#digitaltools#digital trends#datadrivendecisions#dataanalytics#data driven decision making#data analytics#artificialintelligence#intelligence artificielle#ai solutions for data driven decision making#ai business tools#aiinnovation

0 notes

Text

Hospital Revenue Cycle Management in USA: Boosting Efficiency and Profitability

Introduction

Running a hospital in the United States is no small feat — the stakes are high, and the financial pressures are even higher. Between rising costs, complex insurance processes, and strict regulations, maintaining a healthy cash flow is critical. That’s where Hospital Revenue Cycle Management in USA comes into play.

RCM is the backbone of hospital financial operations, and getting it right can mean the difference between thriving and merely surviving. Let's break down how modern RCM works and why your hospital can't afford to ignore it.

What is Hospital Revenue Cycle Management?

Hospital Revenue Cycle Management refers to the administrative and clinical functions that capture, manage, and collect patient service revenue. It spans the entire patient journey:

From pre-registration to check eligibility

To coding and billing for services rendered

Through claim submission and payment posting

Ending with collections and financial reporting

An efficient RCM system ensures that hospitals get paid fully and on time — without overburdening staff or frustrating patients.

Key Stages in the Hospital RCM Process

Here’s how the typical hospital RCM workflow looks:

1. Pre-Registration & Eligibility Verification

Verifying insurance before services ensures accurate billing and reduces denials.

2. Charge Capture & Medical Coding

Accurate documentation and proper medical coding are essential for compliance and reimbursement.

3. Claim Submission & Adjudication

Claims must be submitted quickly and correctly to avoid costly rejections and delays.

4. Payment Posting & Collections

Payments are posted and tracked, with follow-ups on any outstanding balances.

5. Reporting & Compliance

Hospitals must stay audit-ready with detailed reporting and adherence to HIPAA regulations.

Common Challenges Hospitals Face in RCM

Hospitals in the USA encounter unique hurdles in revenue cycle management:

High Volume of Claims: Leading to delays if not managed efficiently

Claim Denials: Often due to incorrect coding or missing information

Manual Processes: Prone to errors and inefficiencies

Regulatory Compliance: Complex requirements that evolve constantly

The Role of Technology in Modern Hospital RCM

Digital innovation has revolutionized hospital RCM:

Automation: Speeds up tasks like claim scrubbing and payment posting

AI & Machine Learning: Predicts claim denials and recommends actions

Real-Time Dashboards: Provide financial visibility at every step

Integration with EHR: Ensures seamless data flow across systems

Benefits of Optimized RCM for Hospitals

A well-run RCM process brings tangible rewards:

Increased Cash Flow: Get paid faster and more consistently

Fewer Claim Denials: Thanks to proactive validation and coding checks

Patient Satisfaction: Easier billing and quicker resolutions

Regulatory Confidence: Stay compliant and avoid penalties

Choosing the Right RCM Partner

When outsourcing or upgrading your RCM system, look for:

Scalability: Can the solution grow with your hospital?

Customization: Is it built for your workflows and specialties?

Support: Ongoing training, updates, and technical help

Transparency: Easy access to reports and performance metrics

Why MyBillingProvider Leads in Hospital Revenue Cycle Management in USA

MyBillingProvider stands out with tailored RCM solutions specifically designed for U.S. hospitals. Here's what sets them apart:

End-to-End RCM Platform: Covers every stage from intake to collections

AI-Driven Tools: Minimize errors and optimize reimbursements

Custom Integration: Works with your existing systems and staff

Client Success: Case studies show 40% reduction in A/R days and 30% increase in NPR

Financial Impact of Efficient RCM

The numbers speak for themselves:

Faster Reimbursements: Speed up the revenue flow

Lower A/R Days: Reducing time from service to payment

More Net Revenue: Fewer denials and write-offs = higher income

Hospitals using smart RCM solutions consistently outperform their peers financially.

Compliance and Security in Hospital RCM

With HIPAA and other regulations, data protection is critical:

Encrypted Data Storage

Role-Based Access Controls

Automated Audit Trails

Regular Compliance Updates

MyBillingProvider ensures full compliance while maintaining operational agility.

Future Trends in Hospital RCM

What’s on the horizon?

Predictive Analytics: Forecast claim outcomes and cash flow

Blockchain: For transparent, secure payer-provider communication

Patient-Centered Billing: More transparency, mobile payments, flexible plans

Hospitals that embrace these trends will be better positioned for long-term success.

Conclusion

In today’s healthcare economy, effective Hospital Revenue Cycle Management in USA isn’t optional — it’s mission-critical. From ensuring financial stability to enhancing the patient experience, RCM impacts every part of hospital operations.

Partnering with a trusted provider like MyBillingProvider can transform your RCM from a bottleneck into a strategic advantage. If you’re ready to improve profitability and efficiency, the time to act is now.

0 notes