#AutoBilling

Explore tagged Tumblr posts

Text

Revolutionizing Retail: How Smart Basket Eliminates Long Checkout Lines

The Retail Bottleneck: Slow Checkout Experiences

Every shopper has faced it — the dreaded checkout line. No matter how efficiently a store operates, long queues remain one of the biggest pain points for both customers and retailers. In today’s fast-paced world, consumers expect seamless, friction-free experiences, and traditional billing methods simply don’t cut it anymore.

At Tech4Biz Solutions, we believe the future of retail should be as effortless as picking an item off the shelf. That’s why we’ve introduced the Smart Basket with Auto Bill Generation, a game-changing technology designed to eliminate manual billing hassles and long checkout lines forever.

What is the Smart Basket?

The Smart Basket is a next-generation shopping assistant that automates the checkout process in real time. By integrating Auto Bill Generation, real-time price updates, and smart barcode filtering, this intelligent system enhances both the shopping experience and operational efficiency for retailers.

Key Features That Redefine Retail Checkout

🚀 Auto Bill Generation — No scanning, no waiting; your bill updates instantly as you shop.

📊 Real-Time Price Updates — Full pricing transparency at every step of the journey.

🔄 Effortless Cart Management — Add or remove items, and your bill adjusts automatically.

📡 Smart Barcode Filtering — Advanced accuracy in product code processing.

💳 Seamless Digital Payments — Multiple payment options for a smooth, hassle-free checkout.

How Does It Work?

Pick up a Smart Basket — Once activated, the basket syncs with the store’s inventory system.

Add Items on the Go — Each product added is instantly logged and priced in real time.

Automatic Bill Generation — No need to scan products separately at checkout.

Quick Digital Payment — Customers can pay directly via mobile, card, or UPI, skipping the cashier lines.

Exit with Ease — Once payment is completed, the basket confirms and allows exit, ensuring a completely seamless shopping experience.

Why This Matters for Retailers

For supermarkets, grocery stores, and retail chains, the Smart Basket offers tangible advantages:

✅ Happier Customers — A smooth, stress-free shopping experience enhances customer loyalty.

✅ Faster Transactions — Reduce checkout congestion, ensuring quicker service.

✅ Operational Efficiency — Optimize staff allocation and minimize billing errors.

The Future of Retail is Here

The traditional checkout process is becoming obsolete. With the Smart Basket, Tech4Biz Solutions is bringing automation, accuracy, and convenience to retail. It’s time for businesses to embrace the next step in shopping evolution — one where customers never have to wait in line again.

Are you ready to transform your retail experience? Connect with Tech4Biz Solutions today and let’s make shopping effortless!

tech4bizsolutions.com

#tech4bizsolutions#RetailInnovation#SmartBasket#FrictionlessCheckout#AutoBilling#RetailAutomation#SeamlessShopping#FutureOfRetail#DigitalPayments#ShopSmart

0 notes

Note

I have an salary account and an account for regular bills. On payday the amount for regular bills goes automatically to the billing account where all the autobills are withdrawn from, and my savings goes automatically to savings account. This way I don’t have to think about it at all basically. Recommended!

I am going to set that up too. Thanks.

5 notes

·

View notes

Text

Use the vehicle billing software from Nammabilling to improve your automotive business. Easily track sales, manage inventory, and ease billing. Increase earnings and efficiency right now! 🚗💼 #AutoBilling For more information, please visit our website: bit.ly/3Atg5q0

#AutomobileBilling#BillingSoftware#Nammabilling#AutoBusiness#Invoicing#InventoryManagement#SalesTracking#EfficiencyBoost#BusinessSolutions#AutomotiveIndustry#TechForAuto#BusinessGrowth#AutoSoftware#StreamlineOperations#Profitability

0 notes

Text

Cash, paypal, privacy.com generated card, credit union-offered credit card, debit card, and one autobil on the big bank backed credit card to keep scores up, and one credit union billpay-issued check a month.

0 notes

Text

I just checked my American Express and my balance is at 4,985.99.

I used my credit card again to buy tickets for a show so I knew that but also my Disney + subscription was autobilled (pay all at once) so that also drove my balance up. I honestly don't use it and would cancel it but I mainly keep it for my niece and nephew. My sister can't afford it and this helps her out so it's frustrating to see my balance increase again but I know I'll get there eventually.

0 notes

Text

How to ID Scammy Electricity Telemarketers

New Post has been published on https://www.ohenergyratings.com/blog/how-to-id-scammy-electricity-telemarketers/

How to ID Scammy Electricity Telemarketers

Protect Your Home From Electricity Scams

Scammy Electricity Telemarketers lie to you to take advantage of you. Learn what these tricks are so you can avoid them and still shop the best energy deals in Ohio.

Let’s say you’re spending a morning relaxing at home, when your phone rings. Your caller ID shows it’s your local Ohio utility company, so you pick up. The representative asks you to verify your account number. They then tell you that you owe a ton of money for your last bill. You give them your payment information. The next month, a company you’ve never heard of autobills you for hundreds of dollars. This is just one of the examples of deceptive sales practices from scams that target Ohioans every day. What can you do? To help you not be a victim, let’s cover the most common tactics so you can ID scammy electricity telemarketers.

Common Electricity Scams

There are a few common electricity scams you may find out in the wild. Door-to-door sales representatives will lie about the details in the plans they’re offering. They may skip that a variable rate plan has an introductory rate good for one month. Instead, they say“the current rate is”. Customers who jump on the super low rate wind up seeing it doubling or tripling within a few months.

Another common tactic is for suppliers to illegally misrepresent themselves as being from your utility. Remember that your utility will never call to threaten a shut off for an unpaid bill. Ohio law requires that utilities follow a specific procedure to ensure electricity consumer rights. That means all correspondence from your utility must be sent through the mail. As with any scam avoidance, make sure you never give your credit card details over the phone. Unless, of course, it is a number you yourself have dialed.

Some agents may lie about the reason they’re calling you. Scammers offer special “rebates” tied to signing up to a new plan, or a state-run program that doesn’t exist. They also lie about how the energy market works to scare customers into switching providers. This can include saying your utility charges a fee each time you use an appliance or flip a light switch.

How To Protect Yourself From Scammy Electricity Deals

Make sure you always have information about the plan you’re signing up for. It’s a red flag if representatives pressure you into signing a contract before you read the terms and conditions. Another red flag is if they try to claim they’re from your utility. Again, your utility will never call you asking for money.

The very best way to shop for your Ohio electricity rates is to use a trustworthy site. That way you can compare plans at your own speed and stay informed about important issues. At Ohio Electricity Ratings, you can even see customer reviews to make sure you’re teaming up with the best company.

Be sure to stay safe from scams and shop for your new plan at www.ohelectricityratings.com

0 notes

Text

Sir, we've canceled your internet in the middle of your work day because you did not pay us last month (even though I did pay them last month using their own stupid autobilling)

#I'm fine I'm fine I'm fine I'm fine#okay fuck this shit I'm going out and buying cigarettes as soon as i hang up with xfinity

0 notes

Text

if you have a webtoon account and a method of payment, you can read discord's webtoon (psst just scroll through it psst) and get free 1 month nitro if you haven't been subscribed in the past 12 months. and if you cancel your subscription right away you can keep your free nitro without being autobilled to renew it!

2 notes

·

View notes

Text

Dear mobile phone provider: I do not appreciate you automatically signing me up for a paid service I did not ask for. No, not even if the first three months are free. Especially not an anti-virus app.

In fact I find it insulting and abusive. I had to take time out of my day to log in to your shitty website and deactivate something I did not want in the first place and which you wish to charge me for.

And you just know that the whole point of this is that some folks just won't. They won't bother to deactivate it, and will just eat the extra five bucks a month, because it's not worth the effort. I guarantee you that if they offered this service as an opt-in, basically nobody would bother. That's the whole point; that's why it's designed that way. That is, for the most part, how most subscription services make money - by taking advantage of people who, for whatever reason, forget to cancel their subscription to a service they have no interest in. Wanna bet it gets folded into your phone contract so that you don't notice it unless you carefully inspect your balance? It wouldn't surprise me even a little bit.

10-15 years ago, I remember that one major issue for cell phones was "careful you don't click on a malicious site that will start autobilling you for a ringtone you didn't actually want". Now the phone company itself is using the same tactics to shill an anti-virus I don't know, trust, want, or need. An ANTI-VIRUS PROGRAM THEY AUTOMATICALLY GIVE YOU AND BILL YOU FOR! That used to be an extremely commom malware pattern! Why in God's name do you think I would want or trust this?

I am, to put it mildly, a bit miffed. We really need laws against this shit.

4 notes

·

View notes

Text

I'm fucking about to cry my stupid resume app has been autobilling me 25 bucks for the last four months and I didn't notice. Fuck. I haven't used them since april

5 notes

·

View notes

Text

Do NOT Buy Shipping Labels off of Etsy Right Now!!

There’s some sort of glitch or SOMETHING and people are getting charged up to 100x for their shipping labels. That means a $3.00 label is going to cost you $300 dollars.

On the purchase screen, everything seems to be fine and in order:

But when you go to your payment account, suddenly you have this HUGE CHARGE

(images from this thread on Twitter)

Luckily, I dodged a bullet and somehow avoided it but I’m seeing sellers all over Twitter and Reddit who are experiencing this issue.

Thus far Etsy has yet to say anything or do anything about the matter, so I do not know if it has been fixed.

1. Do not buy ANY labels off of Etsy right now! If you have orders to send out, see if you can inform your customers or buy straight from the USPS if you HAVE to.

2. TURN OFF AUTOBILLING! If you made the mistake I did and didn’t see online before you bought your labels, you might still be able to save yourself by turning off autobilling. If you go over your threshold you might not get charged if you turn it off.

78 notes

·

View notes

Text

Goddddd god fucking autobilled 99 bucks for a service I've been meaning to quit

And money was already tight

Thank God I have my mom's help but ughhhhhhh

#its cause its how i get my hrt and im switching providers for that but i dont have all the right supplies yet from the new one so i hadnt#cancelled plume#ughhhhhhhh

1 note

·

View note

Text

HOW TO DEAL WITH THE ETSY LABEL OVERCHARGE FIASCO

[Originally published July 27, 2020; updated July 28 & August 5, 2020]

In case you missed it, today for several hours, buying shipping labels through Etsy resulted in your account being overcharged by a factor of 100 (i.e.,if the label cost $5, Etsy charged you $500). The problem appears to have been resolved on Etsy’s end, but now sellers are seeing huge credits to their payment accounts that do not accurately compensate for the overcharges. The biggest overcharge I have seen so far is $18,000, but I am sure there are worse.

In the past, when Etsy has vastly overcharged people, they have paid everyone affected for things like cheques bouncing, overdraft fees, late fees, cancelled credit cards etc. They will likely do that again. They will likely email or convo everyone affected once they sort it out on their end. [UPDATE: (Aug. 5) An Etsy staffer told a reporter that they would “...reimburse sellers who let our support teams know that they were charged overdraft or related fees." So make sure that you let them know, if you were affected.]

But that isn't good enough. This isn't the first time they have overcharged people thousands of dollars, and it likely isn't the last. When it comes to finances, they are the most technologically deficient company I have ever seen. There is no reason it won't happen again. And again.

Right now, it appears that the small amount of money Etsy makes off of each label is worth far more to them than your financial security or your mental health; they apparently don't care about how many sellers will be stressed about overdrawn bank accounts & unusable credit cards, during a pandemic and a recession. If they did, they would have shut down labels, or at least warned you not to use them until this was fixed. They can always notify you about their latest podcast on your Shop Manager, but they didn't think this merited any communication besides a buried thread in a forum most sellers have never visited.

EVERYONE AFFECTED NEEDS TO HOLD ETSY ACCOUNTABLE

Here's how:

1) Contact Etsy and after making sure all charges are reversed and that you are getting compensated for every penny that you lost (late fees, overdraft fees etc.) due to this fiasco,

Demand an explanation as to why they did not turn off labels while the problem continued

Demand an explanation as to why the Technical Issues thread wasn't pinned so more people would see it

Demand an explanation as to why Etsy Status did not report the issue

Demand an explanation as to why there were no notifications in our Shop Managers

Demand an explanation as to why didn't they do anything to let everyone know, and save people this worry, save people bouncing cheques, overdrafts, cancelled credit cards, late fees etc.

2) After that, stop giving Etsy any extra penny that you don't have to. The more things you buy from them, the more likely it is that you will get caught in one of these fiascos. So, buy your shipping labels through an outside provider. Pirate Ship is the most popular with many US sellers, but there are many others that integrate with Etsy & import all of your label info automatically. Look into Shipstation, Stamps, Shippo, etc. (Some even work with Canada Post and other providers, beyond USPS.) Remember, they have no reason to stop this type of behaviour if people keep handing them money.

3) Disable autobilling if possible. It's been involved in most of the more outrageous overcharges. [EDIT: July 28, 11 am ET - in my Etsy forum thread on the issue, other sellers have also suggested a) not using a debit card as your Etsy credit card, so Etsy does not have access to you bank account for withdrawals, b) having a separate bank account for Etsy, and then withdrawing that money as soon as it is deposited, and c) using a prepaid credit card for your Etsy credit card, if possible. All of these will reduce the likelihood of being caught by one of these Etsy financial glitches.

4) Then, spread the word about this, everywhere. Do what you can to get any attention to the fact that Etsy let a shipping bug overcharge sellers thousands of dollars, overdrawing the bank & credit limits, without taking measures to disable labels or even let most sellers know this was happening, for hours.

The quarterly report call is next week; let's make sure the participating financial experts know about this issue so they ask about it. After all, compensating sellers for the overdrafts fees, the late fees, the disabled credit cards etc., is probably going to cost the company more than just missing out on those labels would have in the first place. Etsy might have cost shareholders some coin here, by neglecting to do the right thing & letting everyone know about this issue before they bought the labels in the first place.

If sellers don't hold Etsy accountable, certainly no one else will. We're the ones who are most affected by everything Etsy does.

3 notes

·

View notes

Text

that sense of panic when you get a new debit card when your old one expires and try to remember all the places you have it logged for autopay/autobill but you forget one and realize you have a giant late fee for that thing because you didn’t update the card

and the fucking automated phonecall they give wont leave a voicemail telling you something’s wrong so you ignore it because its a number you dont know???

alkjsflkjauuuugh

14 notes

·

View notes

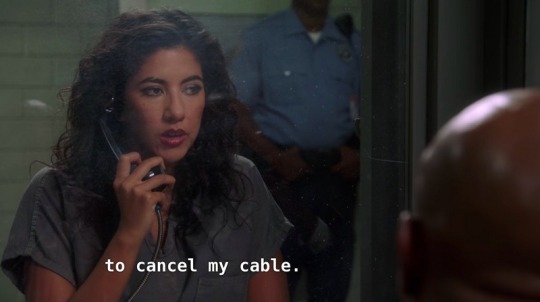

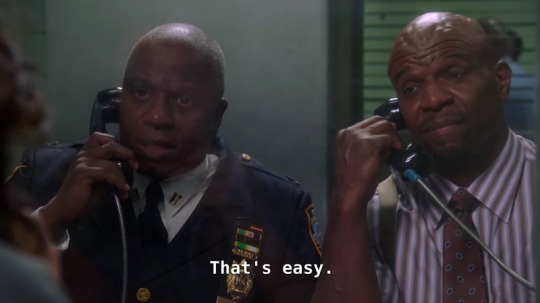

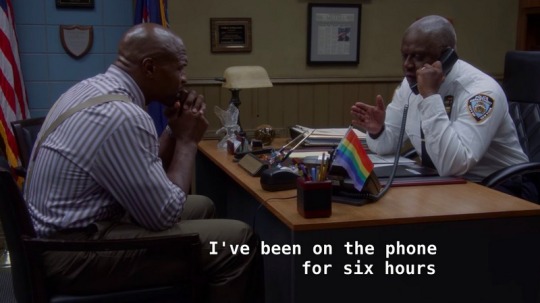

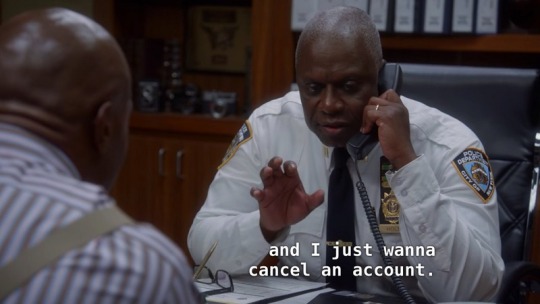

Photo

I once cancelled compuserve because I'd gotten a free account as a forum moderator and the asshole suspended it for 2 months instead of cancelling it and it resumed autobilling. He ended up fired. I cancelled comcast without significant difficulty though. They'd tried to charge us for a service call where the result was "Oh we had to fix the outside line because squirrels ate the internet."

326K notes

·

View notes

Text

#1yrago Equifax will make hundreds of millions in extra profits from its apocalyptic breach (forever)

At yesterday's Congressional hearings on the Equifax breach, Senator Elizabeth Warren took a moment to enumerate all the ways that Equifax will benefit from doxing 145,500,000 Americans.

For starters, there's the "free" credit monitoring service that was Equifax's initial sop to public outrage over its unforgivable carelessness. While the service is indeed free for the first year, every year thereafter Equifax will autobill you $17/month. If less than 1% of the people who signed up for credit monitoring after the breach forget to cancel, the company will make an extra $200,000,000/year.

Then there's the Lifelock enrollments. Lifelock is a disgraced, fraudulent garbage company that hard-sells useless credit-monitoring services that it buys from Equifax. In the first week after the Equifax breach, Lifelock signed 100,000 new customers at $29.95/month, and Equifax gets a big cut from each of those new customers' fees.

Then there's the fraud-prevention business, which is Equifax's new growth area. With all the breached data floating around online, fraud is at an all-time high. That creates demand for anti-fraud contracts, and Equifax has already been determined to be the only supplier suited to provide those services by federal agencies, who've started to award the company lucrative multi-million-dollar contracts to fight fraud -- which is now set to explode thanks to the all the personal-data plutonium that Equifax just liberally spread all over the world where any rando with bad ideas and low morals can get hold of it.

It's true that Equifax's stock is now down 30%, but as Wells Fargo helpfully reminded us, that's just the market overreacting and Equifax stocks are ""an attractive entry point," a chance to buy into a "high-quality consumer credit franchise" that will "outperform" current projections.

https://boingboing.net/2017/10/05/failing-up-and-up.html

19 notes

·

View notes