#Autonomous Robots Market Forecast

Explore tagged Tumblr posts

Text

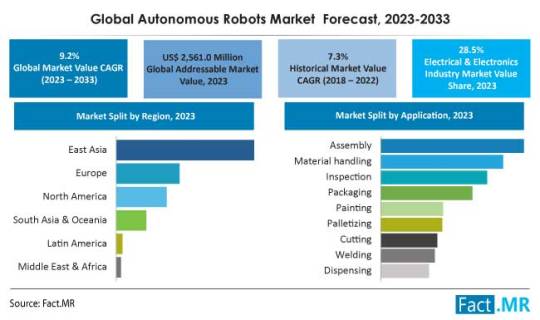

The autonomous robots market size is projected to achieve a value of approximately US$ 2,561.0 million by 2023, and it is anticipated to surpass US$ 6,175.0 million by 2033. This growth will be driven by a compound annual growth rate (CAGR) of approximately 9.2% between 2023 and 2033.

#Autonomous Robots Market#Autonomous Robots Market Size#Autonomous Robots Market Share#Autonomous Robots Market Forecast#Autonomous Robots Market Growth

1 note

·

View note

Text

Agriculture Autonomous Robots Market | BIS Research

The global agriculture autonomous robots market was estimated by BIS Research to be worth $828.4 million in 2022. Over the course of the forecast period, 2023–2028, it is anticipated to increase at a compound annual growth rate (CAGR) of 25.12%, reaching $3,136.7 million by 2028.

#Agriculture Autonomous Robots Market#Agriculture Autonomous Robots Industry#Agriculture Autonomous Robots Market CAGR#Agriculture Autonomous Robots Market Size#Agriculture Autonomous Robots Market Report#Agriculture Autonomous Robots Market Research#Agriculture Autonomous Robots Market Forecast#Agriculture#BIS Research

1 note

·

View note

Text

#defense robots and autonomous vehicle market report#defense robots and autonomous vehicle market size#defense robots and autonomous vehicle market growth#defense robots and autonomous vehicle market forecast#defense robots and autonomous vehicle market trends#defense robots and autonomous vehicle market analysis

0 notes

Text

#Autonomous Delivery Robots Market#Autonomous Delivery Robots Market size#Autonomous Delivery Robots Market share#Autonomous Delivery Robots Market trends#Autonomous Delivery Robots Market analysis#Autonomous Delivery Robots Market forecast

0 notes

Text

“My predictions about achieving full self-driving have been optimistic in the past,” Musk admitted to investors in 2023. “I’m the boy who cried FSD." He certainly has. Many times. Indeed, Musk has a long history of making outlandish promises and unfulfilled predictions about his businesses—and it's a habit that seems hard to break. On the Tesla earnings call with investors in late April, Elon Musk reportedly sounded aggrieved as he was forced to acknowledge a woeful 71 percent dip in profits. On the defensive, and seemingly grasping for positive spin among the dire results, Musk promised something implausible: The carmaker would become the world’s leading robotics company, ushering in the “closest thing to heaven we can get on Earth.” (He has since doubled down on this, stating that demand for his robots will be insatiable, and earlier this month he claimed that robots will number in the tens of billions and be like “your own personal C-3PO or R2-D2, but even better.”) On the call, despite tanking worldwide sales for his company’s aging cars and cratering demand for the Cybertruck, Musk asserted the “future for Tesla is brighter than ever.” He batted away the precipitous fall in sales as merely “near-term headwinds,” urging investors to ignore the non-autonomous-car business and assess the “value of the company” on “delivering sustainable abundance with our affordable AI-powered robots.” Still, even though Musk has a long history of broken promises, investors seemed soothed by tales of crushing market domination for Tesla, not as the car company it is today, but as the robotics behemoth Musk claims it will soon become. WIRED examined the history of Musk’s pledges on everything from Full Self Driving, Hyperloop, Robotaxis, and, yes, robot armies, with a view to reminding ourselves, his fans, and investors how reality in Elon’s world rarely matches up to the rhetoric. Tellingly, Musk’s fallback forecast of “next year” turns up repeatedly, only to be consistently proven wrong. “My predictions have a pretty good track record,” Musk told Tesla staff at an all-hands meeting in March. Here's a chronological look at that track record. 19 Years of Broken Promises

10 notes

·

View notes

Text

“My predictions about achieving full self-driving have been optimistic in the past,” Musk admitted to investors in 2023. “I’m the boy who cried FSD." He certainly has. Many times. Indeed, Musk has a long history of making outlandish promises and unfulfilled predictions about his businesses—and it's a habit that seems hard to break.

On the Tesla earnings call with investors in late April, Elon Musk reportedly sounded aggrieved as he was forced to acknowledge a woeful 71 percent dip in profits. On the defensive, and seemingly grasping for positive spin among the dire results, Musk promised something implausible: The carmaker would become the world’s leading robotics company, ushering in the “closest thing to heaven we can get on Earth.” (He has since doubled down on this, stating that demand for his robots will be insatiable, and earlier this month he claimed that robots will number in the tens of billions and be like “your own personal C-3PO or R2-D2, but even better.”)

On the call, despite tanking worldwide sales for his company’s aging cars and cratering demand for the Cybertruck, Musk asserted the “future for Tesla is brighter than ever.” He batted away the precipitous fall in sales as merely “near-term headwinds,” urging investors to ignore the non-autonomous-car business and assess the “value of the company” on “delivering sustainable abundance with our affordable AI-powered robots.”

Still, even though Musk has a long history of broken promises, investors seemed soothed by tales of crushing market domination for Tesla, not as the car company it is today, but as the robotics behemoth Musk claims it will soon become.

WIRED examined the history of Musk’s pledges on everything from Full Self Driving, Hyperloop, Robotaxis, and, yes, robot armies, with a view to reminding ourselves, his fans, and investors how reality in Elon’s world rarely matches up to the rhetoric. Tellingly, Musk’s fallback forecast of “next year” turns up repeatedly, only to be consistently proven wrong.

“My predictions have a pretty good track record,” Musk told Tesla staff at an all-hands meeting in March. Here's a chronological look at that track record.

19 Years of Broken Promises

August 2006: False Start

“[Our] long term plan is to build a wide range of models, including affordably priced family cars,” wrote Elon Musk in the Tesla Secret Master Plan hosted on the Tesla website 19 years ago. “When someone buys the Tesla Roadster,” he added, “they are actually helping pay for development of the low-cost family car.”

In Master Plan, Part Deux, written 10 years after the first plan, Musk reiterated that, even though Tesla had not yet delivered on the 2006 promise, it still planned to build an “affordable, high-volume car.” 2016 came and went without an entry-level car. In January this year, Musk said that—finally—Tesla would start producing the affordable model in the second half of 2025.

However, in April, Reuters reported that Tesla had scrapped plans for the cheap family car. Musk posted on X that “Reuters is lying (again),” eliciting the Reuters response that “[Musk] did not identify any specific inaccuracies.” A Tesla source told Reuters that instead of the long-promised cheap family car, “Elon’s directive is to go all in on robotaxi.”

August 2013: Hyperloop Hype

While he did not directly own any of the Hyperloop companies, in a 58-page white paper titled “Hyperloop Alpha”, Musk wrote of a “new open source form of transportation that could revolutionize travel.” It didn’t. The Hyperloop was shuttered in 2023, 10 years after it was first proposed—but even as late as 2022, Musk was still promising that Hyperloop could go from Boston to New York City “in less than half an hour.”

A form of magnetic levitation (maglev) capsule in an air-evacuated steel tube on stilts, Hyperloop was described on the company’s website as being an “ultra-high-speed public transportation system in which passengers travel in autonomous electric pods at 600+ miles per hour.” This description has since been removed but was documented by Electrek. Engineers from Tesla and SpaceX worked on Hyperloop for two years before the project was taken up by other companies in 2017.

Musk said at a tech conference in 2013 that his Hyperloop idea—which wasn’t new; George Medhurst of London first discussed the idea of moving goods pneumatically through cast-iron pipes in 1799—would be a “cross between a Concorde and a railgun and an air hockey table.” Hyperloop One—later Virgin Hyperloop—raised around $450 million from various investors, including Richard Branson, with a passenger test achieving a speed of 107 mph, almost 500 mph less than Musk originally proposed.

Cynics have long alleged Musk’s floating of Hyperloop was a ruse to kill California’s high-speed rail project, a belief boosted by a claim in Walter Isaacson’s 2023 authorized biography of Musk. “Musk told me that the idea originated out of his hatred for California’s proposed high-speed rail system,” wrote Isaacson, claiming that Musk thought that “with any luck, the high-speed rail would be canceled.”

September 2013: Driverless Pioneering

In 2013, Tesla posted a job opening for an Advanced Driver Assistance Systems Controls Engineer who will be “responsible for developing vehicle-level decision-making and lateral and longitudinal control strategies for Tesla’s effort to pioneer fully automated driving.” Musk says: “We should be able to do 90 percent of miles driven [autonomously] within three years.”

October 2015: Full Autonomous Driving

“Tesla will have a car that can do full autonomy in about three years,” promises Musk. Then in December 2015: “We’re going to end up with complete autonomy,” pushes Musk, “and I think we will have complete autonomy in approximately two years.”

In January 2016: “I think that within two years you’ll be able to summon your car from across the country,” muses Musk.

June 2016: “I consider autonomous driving to be a basically solved problem,” says Musk. “We’re less than two years away from complete autonomy.”

November 2018: “I think we’ll get to full self-driving next year,” Musk tells Kara Swisher.

October 2016: Autonomous Charging

“Our goal is, and I feel pretty good about this goal, that we’ll be able to do a demonstration drive of full autonomy all the way from LA to New York—from home in LA to let’s say dropping you off in Time Square in New York, and then having the car go park itself—by the end of next year,” vows Musk, who can’t resist upping the ante by stressing that this cross-country journey will be made “without the need for a single touch, including the charger.”

A snake-like automatically-deployed charger plugged by Musk the year prior was trialled, but never made it into production.

Then, less than a year later, in April 2017: “I think we’re still on track for being able to go cross-country from LA to New York by the end of the year, fully autonomous,” Musk tells TED Conference curator Chris Anderson in a fireside TED chat.

“Still on for end of year,” says Musk of the coast-to-coast autopilot demo. “Just software limited,” he adds.

April 2017: Being Boring

Musk floats the idea of congestion-beating tunnels beneath cities with cars shot along on skates at 125 miles per hour. “By having an elevator … you can integrate the entrance and exits to [a] tunnel network just by using two parking spaces. And then the car gets on a skate. There’s no speed limit here, so we’re designing this to be able to operate at 200 kilometers an hour.”

This is the first outing for Musk’s Boring tunnel concept. The Boring Company was supposed to deliver an underground maze of tunnels where passengers could travel in autonomous vehicles at 150 miles per hour.

The goal, said Musk, was to build one mile of tunnel per week. “Finally, finally, finally, there is something that I think can solve the goddamn traffic problem,” boasted Musk.

So far, only Las Vegas has one short system, the 1.7-mile LVCC Loop. Forty feet below the Las Vegas Convention Center, the Boring Company’s tunnel opened in 2021 and currently takes paying passengers between three stations in chauffeur-driven Model Y Tesla cars which slow to just 15 miles per hour when the tunnels get congested.

August 2017: Brain Chips

Elon Musk founded Neuralink in 2016 with the aim of merging artificial intelligence with the human brain via an implantable interface. In 2017, the claim was that his Neuralink brain chip startup’s first product would be on the market “in about four years.”

In the second half of 2020 Musk shows the hardware’s ability to read the brain activity of a pig with a surgically implanted chip transmitting data wirelessly. He describes the AI-powered chip as “a FitBit in your skull with tiny wires” and then predicts the tech could one day cure paralysis and give the human race telepathy and superhuman vision.

In 2024, seven years after that initial four-year prediction, the first human trial subject receives a Neuralink implant (though some researchers show frustration over a lack of information about the study.)

November 2018: Special Delivery

“Probably technically be able to [self-deliver Teslas to customers’ doors] in about a year,” writes Musk on X.

January 2019: FSD Finally?

“When do we think it is safe for full self driving?” asks Musk on a Q4 earnings call. “Probably towards the end of this year.” Then just a month later, in February, he’s certain. “We will be feature complete [with] full self-driving this year,” promises Musk on an innovations podcast. “The car will be able to … take you all the way to your destination without an intervention this year. I’m certain of that. That is not a question mark.”

By April, Musk is repeating this claim, promising during a four-hour Tesla presentation billed as Autonomy Day, “We expect to be feature-complete in self-driving this year, and we expect to be confident enough … to say that we think people do not need to touch the wheel and can look out the window probably around the second quarter of next year.”

“In the future, any car that does not have autonomy would be about as useful as a horse,” Musk tells Lex Fridman on the MIT’s researcher’s podcast, also in April 2019. Full autonomy from a Tesla would arrive “very, very quickly,” Musk says, adding, “I think it will require detecting hands on wheel for at least six months.” Such detection is still required.

Two years later, in January 2021, Musk on an earnings call states: “I’m highly confident the car will drive itself for the reliability in excess of a human this year. This is a very big deal.” But by December, appearing for his third time on the Lex Fridman podcast, Musk is asked again when Tesla would solve Level 4 FSD. “It’s looking quite likely that it will be next year,” he says.

Fast-forward to May 2023 and Musk is telling CNBC’s David Faber “I mean, it does look like [full autonomy is] gonna happen this year.”

April 2019: One Million Robotaxis

“We expect to have the first operating robot taxi next year with no one in them,” claimed Musk on Autonomy Day. “Next year for sure, we’ll have over a million robotaxis on the road,” he promises.

Fast-forward to April's earnings call this year, and Musk says that Tesla will unveil its robotaxi service in Austin, Texas, next month. Initially a paid ride-hailing service with up to 20 Model Y vehicles supervised remotely, if it hits the June target this is a far cry from Musk’s 2019 expectation that Tesla would have 1 million driverless robotaxis on the road by the following year.

If a small number of Tesla’s robotaxis do turn up in Austin, people may be unwilling to be seen in the cars given the public backlash against Musk’s role at DOGE and his controversial public statements and salutes. Federal regulators are also sniffing around. On May 12 this year, it was revealed that NHTSA has written to Tesla asking for extensive details on the robotaxi rollout. “As you are aware,” the long letter to Tesla stated, “NHTSA has an ongoing defect investigation into FSD collisions in reduced roadway visibility conditions.”

July 2020: Level Five Is Alive

“I’m extremely confident that level 5–or essentially complete autonomy–will happen … this year,” Musk said in a video message at the opening of Shanghai’s World Artificial Intelligence Conference. “There are no fundamental challenges remaining,” he stated.

Then, in the following December, Musk shifts the goal line and doubles down. “I’m extremely confident that Tesla will have level 5 next year,” Musk tells Mathias Döpfner, the CEO of Business Insider’s parent company, Axel Springer SE. How confident? “100 percent,” replies Musk. Musk also tells Döpfner that a human will possibly step onto Mars by 2024.

As recently as April this year, Musk states on an earnings call: “We’ll start to see the prosperity of autonomy take effect in a material way around the middle of next year … There will be millions of Teslas operating autonomously, fully autonomously in the second half of next year,” he adds.

March 2025: Babysitting Robot Army

Musk has been promising Tesla would produce a humanoid robot—Optimus—since 2021. At an all-hands meeting earlier this year he promised this “robot buddy” would “clean your house, will mow the lawn, will walk the dog, will teach your kids, will babysit, and will also enable the production of goods and services with basically no limit.” He predicted that “hopefully” Tesla will be able to make about 5,000 Optimus robots this year. “That’s the size of a Roman legion,” he stated.

Musk then claimed Tesla would make “probably 50,000-ish [Optimus robots] next year.” He further claimed that Optimus “will be the biggest product of all time by far—nothing will even be close. It’ll be 10 times bigger than the next biggest product ever made. Ultimately, I think we’ll be making tens of millions of robots a year.” Mere seconds later, he upped the ante even further, stating that, no, Tesla would actually make “maybe 100 million robots a year.”

However, in April he told investors that production could be impacted by the restrictions on rare-earth metal exports China implemented in response to President Trump’s tariffs. There’s no date yet for the launch of Optimus.

Finally Making Good?

“So many people are convinced [that Musk] is a miracle worker,” says auto journalist Ed Niedermeyer, author of the 2019 book Ludicrous: The Unvarnished Story of Tesla Motors. “People see his wealth on paper and assume there’s nothing he can’t do. As the world constantly rearranges itself in his favor, they keep believing in him. This cannot keep going forever.”

When it comes to his car business at least, Musk seems fully aware of what’s at stake. Perhaps this is driving his never-ending FSD optimism? My “overwhelming focus is on solving full self-driving,” he said during a June 2022 interview with three Tesla fanboys. “It’s really the difference between Tesla being worth a lot of money or worth basically zero.”

Earlier this year, Kelley Blue Book reporter Sean Tucker wrote: “Elon Musk is fond of telling investors that Tesla is now an automation company, not an automaker. But the company’s signature products are cars. Unless it can change its strategy to develop new products with widespread appeal, its high watermark as an automaker may be in the past.”

With plummeting sales and increased scrutiny, Musk may soon come to rue the fact that he hasn’t managed to make good on so many assurances since 2006 when he wrote, in a foundational pledge, that Tesla’s goal—still not delivered, and supposedly finally starting production next month—was to produce an affordable family car. Maybe next year?

8 notes

·

View notes

Text

CNN 7/24/2025

Tesla’s stock is tumbling after Elon Musk failed to shift the narrative

By Chris Isidore, CNN

Updated: 1:06 PM EDT, Thu July 24, 2025

Source: CNN

Elon Musk’s big promises apparently no longer seem to be enough for many Tesla investors.

Shares of Tesla (TSLA) fell 9% on Thursday following another dismal earnings report, released after the bell Wednesday.

Tesla’s earnings and revenue both fell by double-digit percentages following the biggest sales drop in the company’s history. The automaker also faces a number of financial headwinds, including the loss of a $7,500 tax credit for US EV buyers starting in October, and the vanishing market for regulatory credit sales, which has earned Tesla $11 billion since 2019.

But Tesla CEO Elon Musk barely talked about that on the earnings call Wednesday, although he did acknowledge the company “probably could have a few rough quarters.” Instead, he talked about his grand vision for the future, including Tesla’s long-promised robotaxi service; and its humanoid robot, Optimus, which is still in development.

The lack of details about the company’s plans to solve problems in the near term disappointed some investors and analysts.

“Investors have beenvery forgiving of Tesla for several quarters now, despite obvious headwinds to their business,” Garrett Nelson, analyst at CFRA Research, told CNN Thursday. “But I think its investors are taking a more realistic view of the story at this point. Some of his brilliance has been his ability to keep investors focused on the long term and ignoring the near term and intermediate term. Now, headwinds are difficult to ignore.”

Nelson downgraded the company’s stock to a neutral rating in April. But even some of the Tesla bulls on Wall Street are saying thatthe time for Musk to take action is running out.

“The street is losing some patience,” Wedbush Securities tech analyst Dan Ives told CNN Thursday, although he said he still believes in the autonomous vehicle and artificial intelligence vision laid out by Musk and Tesla.

Overly ambitious promises?

Musk has made big promises about his robotaxi service, including that it would be in service within a year as early as 2019.

Tesla’s robotaxis finally rolled out in June this year, albeit in a limited portion of Austin, Texas, to friends and fans of the company, and with an employee sitting beside the empty driver’s seat. However, that limited rollout wasn’t enough to stop Musk from making extraordinary claims on Wednesday that the service would be available to half the nation’s population by year’s end. To achieve that, Tesla will need to get regulatory permission to operate in two states per week through the rest of the year, including New York, which does not allow autonomous vehicles on its roads.

MorningstaranalystSeth Goldstein said that while he does believe Tesla will eventually be successful in its robotaxi venture, “the software will require further testing” and hedoes not expect a full robotaxi product until 2028.

But Musk has a history of making grand promises that do not pan out.

Like the Cybertruck – the only new vehicle Tesla has offered in the last six years.Musk said Tesla wassupposed to be delivering 250,000 vehicles annually by this year. But full-year sales of the Cybertruck and Tesla’s two other expensive models wereless than 80,000. Sales of the three plunged 52% in the most recent quarter.

Tesla also started the year forecasting it would achieve higher sales following its first annual sales drop in its history in 2024. But after two quarters of record sales declines, most investors now assume that it will not meet that goal either.

And with Musk himself barely mentioning car sales during an hour-long conference call, it doesn’t appear that is enough for shareholders any longer.

“We are mixed on Tesla’s ability to meet its robotaxi timelines, cost targets, and scale,” wrote Ben Kallo, an analyst for Baird, in a note to clients late Wednesday. “So far Tesla has received a pass due to how ambitious/revolutionary these products are, but we think continued sluggishness in the auto business could cause more focus on the near term.”

2 notes

·

View notes

Text

Unmanned Ground Vehicles Market Growth Explained: From Battlefield to Industry

Unmanned Ground Vehicles Market Overview: Advancing the Frontier of Autonomous Land-Based Systems

The global Unmanned Ground Vehicles market is undergoing a paradigm shift, driven by transformative innovation in artificial intelligence, robotics, and sensor technologies. With an estimated valuation of USD 3.29 billion in 2023, the unmanned ground vehicles market is projected to expand to USD 6.35 billion by 2031, achieving a CAGR of 9.7% over the forecast period. This momentum stems from the increasing integration of UGVs into critical applications spanning defense, commercial industries, and scientific research.

As a cornerstone of modern automation, unmanned ground vehicles markets are redefining operational strategies in dynamic environments. By eliminating the need for onboard human operators, these systems enhance safety, efficiency, and scalability across a wide array of use cases. From autonomous logistics support in conflict zones to precision agriculture and mining, UGVs represent a versatile, mission-critical solution with expanding potential.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40520-global-unmanned-ground-vehicles-ugvs-market

UGV Types: Tailored Autonomy for Diverse Operational Needs

Teleoperated UGVs: Precision in Human-Controlled Operations

Teleoperated unmanned ground vehicles market’s serve vital roles in scenarios where human judgment and real-time control are indispensable. Predominantly employed by military and law enforcement agencies, these vehicles are integral to high-risk missions such as explosive ordnance disposal (EOD), urban reconnaissance, and search-and-rescue. Remote operability provides a protective buffer between operators and threats, while ensuring tactical accuracy in mission execution.

Autonomous UGVs: Revolutionizing Ground Operations

Autonomous UGVs epitomize the fusion of AI, machine learning, and edge computing. These platforms operate independently, leveraging LiDAR, GPS, stereo vision, and inertial navigation systems to map environments, detect obstacles, and make intelligent decisions without human intervention. Applications include:

Precision agriculture: Real-time crop health analysis, soil diagnostics, and yield monitoring.

Warehouse logistics: Automated material handling and inventory tracking.

Border patrol: Persistent perimeter surveillance with minimal resource expenditure.

Semi-Autonomous UGVs: Optimal Balance of Control and Independence

Semi-autonomous systems are ideal for hybrid missions requiring autonomous execution with operator intervention capabilities. These UGVs can follow predetermined paths, execute complex tasks, and pause for remote validation when encountering ambiguous conditions. Their versatility suits infrastructure inspection, disaster response, and automated delivery services, where adaptability is paramount.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40520-global-unmanned-ground-vehicles-ugvs-market

Technological Framework: Building Smarter Ground-Based Systems

Navigation Systems: Real-Time Terrain Mastery

Modern UGVs integrate layered navigation systems incorporating:

Global Navigation Satellite Systems (GNSS)

Inertial Navigation Units (INU)

Visual Odometry

Simultaneous Localization and Mapping (SLAM)

This multifaceted approach enables high-precision route planning and dynamic path correction, ensuring mission continuity across varying terrain types and environmental conditions.

Advanced Sensor Suites: The Sensory Backbone

UGVs depend on an array of sensors to interpret their environment. Core components include:

LiDAR: For three-dimensional spatial mapping.

Ultrasonic sensors: Obstacle detection at short ranges.

Thermal and infrared cameras: Night vision and heat signature tracking.

Multispectral imaging: Agricultural and environmental applications.

Together, these sensors empower unmanned ground vehicles market’s to perform with superior situational awareness and real-time decision-making.

Communication Systems: Seamless Command and Data Exchange

Effective UGV operation relies on uninterrupted connectivity. Communication architectures include:

RF (Radio Frequency) transmission for close-range operations.

Cellular (4G/5G) and satellite links for beyond-line-of-sight control.

Encrypted military-grade communication protocols to safeguard mission-critical data.

These systems ensure continuous dialogue between unmanned ground vehicles market’s and control centers, essential for high-stakes missions.

Artificial Intelligence (AI): Cognitive Autonomy

AI is the nucleus of next-generation UGV intelligence. From object recognition and predictive analytics to anomaly detection and mission adaptation, AI frameworks enable:

Behavioral learning for new terrain or threat patterns.

Collaborative swarm robotics where UGVs function as a coordinated unit.

Autonomous decision trees that trigger responses based on complex input variables.

Unmanned Ground Vehicles Market Segmentation by End User

Government and Military: Strategic Force Multipliers

UGVs are critical to defense modernization initiatives, delivering cost-effective force protection, logistical autonomy, and increased tactical reach. Applications include:

C-IED missions

Tactical ISR (Intelligence, Surveillance, Reconnaissance)

Autonomous convoy support

Hazardous materials (HAZMAT) handling

Private Sector: Driving Industrial Autonomy

Commercial adoption of unmanned ground vehicles market’s is accelerating, especially in:

Agriculture: Real-time agronomic monitoring and robotic farming.

Mining and construction: Autonomous excavation, transport, and safety inspection.

Retail and logistics: Last-mile delivery and warehouse automation.

These implementations reduce manual labor, enhance productivity, and streamline resource management.

Research Institutions: Accelerating Innovation

UGVs are central to robotics and AI research, with universities and R&D labs leveraging platforms to test:

Navigation algorithms

Sensor fusion models

Machine learning enhancements

Ethical frameworks for autonomous systems

Collaborative R&D across academia and industry fosters robust innovation and propels UGV capabilities forward.

Regional Unmanned Ground Vehicles Market Analysis

North America: The Epicenter of Defense-Grade UGV Development

Dominated by the United States Department of Defense and industry leaders such as Lockheed Martin and General Dynamics, North America is a pioneer in deploying and scaling UGV technologies. Investments in smart battlefield systems and border security continue to drive demand.

Europe: Dual-Use Innovations in Civil and Military Sectors

European nations, particularly Germany, France, and the UK, are integrating UGVs into both military and public safety operations. EU-funded initiatives are catalyzing development in automated policing, firefighting, and environmental monitoring.

Asia-Pacific: Emerging Powerhouse with Diverse Use Cases

Led by China, India, and South Korea, the Asia-Pacific region is rapidly advancing in agricultural robotics, smart cities, and military modernization. Government-backed programs and private innovation hubs are pushing domestic manufacturing and deployment of UGVs at scale.

Middle East and Africa: Strategic Adoption in Security and Infrastructure

UGVs are being integrated into border surveillance, oil and gas pipeline inspection, and urban safety across key regions such as the UAE, Saudi Arabia, and South Africa, where rugged environments and security risks necessitate unmanned solutions.

South America: Gradual Integration Across Agriculture and Mining

In countries like Brazil and Chile, unmanned ground vehicles market’s are enhancing resource extraction and precision agriculture. Regional investment in automation is expected to grow in parallel with infrastructure modernization efforts.

Key Companies Shaping the Unmanned Ground Vehicles Market Ecosystem

Northrop Grumman Corporation

General Dynamics Corporation

BAE Systems

QinetiQ Group PLC

Textron Inc.

Oshkosh Corporation

Milrem Robotics

Kongsberg Defence & Aerospace

Teledyne FLIR LLC

Lockheed Martin Corporation

These firms are advancing UGV design, AI integration, sensor modularity, and battlefield-grade resilience, ensuring readiness for both present and future operational challenges.

The forecasted growth is underpinned by:

Rising geopolitical tensions driving military investments

Expanding commercial interest in automation

Cross-sector AI integration and sensor improvements

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40520-global-unmanned-ground-vehicles-ugvs-market

Conclusion: The Evolution of Autonomous Ground Mobility

The global unmanned ground vehicles market stands at the intersection of robotics, AI, and real-world application. As technological maturity converges with widespread need for unmanned solutions, the role of UGVs will extend far beyond today’s use cases. Governments, corporations, and innovators must align strategically to harness the full potential of these systems.

With global investments accelerating and AI-driven capabilities reaching new thresholds, Unmanned Ground Vehicles are not just an industrial trend—they are the vanguard of future operational dominance.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

1 note

·

View note

Text

Aquatic Robot Market to Eyewitness Huge Growth by 2030

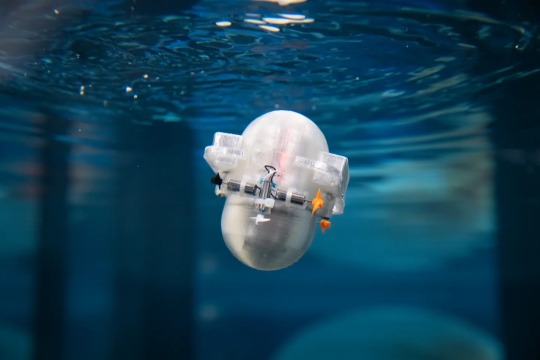

Latest business intelligence report released on Global Aquatic Robot Market, covers different industry elements and growth inclinations that helps in predicting market forecast. The report allows complete assessment of current and future scenario scaling top to bottom investigation about the market size, % share of key and emerging segment, major development, and technological advancements. Also, the statistical survey elaborates detailed commentary on changing market dynamics that includes market growth drivers, roadblocks and challenges, future opportunities, and influencing trends to better understand Aquatic Robot market outlook. List of Key Players Profiled in the study includes market overview, business strategies, financials, Development activities, Market Share and SWOT analysis: Atlas Maridan ApS. (Germany), Deep Ocean Engineering Inc. (United States), Bluefin Robotics Corporation (United States), ECA SA (France), International Submarine Engineering Ltd. (Canada), Inuktun Services Ltd. (Canada), Oceaneering International, Inc. (United States), Saab Seaeye (Sweden), Schilling Robotics, LLC (United States), Soil Machine Dynamics Ltd. (United Kingdom) Download Free Sample PDF Brochure (Including Full TOC, Table & Figures) @ https://www.advancemarketanalytics.com/sample-report/177845-global-aquatic-robot-market Brief Overview on Aquatic Robot: Aquatic robots are those that can sail, submerge, or crawl through water. They can be controlled remotely or autonomously. These robots have been regularly utilized for seafloor exploration in recent years. This technology has shown to be advantageous because it gives enhanced data at a lower cost. Because underwater robots are meant to function in tough settings where divers' health and accessibility are jeopardized, continuous ocean surveillance is extended to them. Maritime safety, marine biology, and underwater archaeology all use aquatic robots. They also contribute significantly to the expansion of the offshore industry. Two important factors affecting the market growth are the increased usage of advanced robotics technology in the oil and gas industry, as well as increased spending in defense industries across various countries. Key Market Trends: Growth in AUV Segment Opportunities: Adoption of aquatic robots in military & defense

Increased investments in R&D activities Market Growth Drivers: Growth in adoption of automated technology in oil & gas industry

Rise in awareness of the availability of advanced imaging system Challenges: Required highly skilled professional for maintenance Segmentation of the Global Aquatic Robot Market: by Type (Remotely Operated Vehicle (ROV), Autonomous Underwater Vehicles (AUV)), Application (Defense & Security, Commercial Exploration, Scientific Research, Others) Purchase this Report now by availing up to 10% Discount on various License Type along with free consultation. Limited period offer. Share your budget and Get Exclusive Discount @: https://www.advancemarketanalytics.com/request-discount/177845-global-aquatic-robot-market Geographically, the following regions together with the listed national/local markets are fully investigated: • APAC (Japan, China, South Korea, Australia, India, and Rest of APAC; Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka) • Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania) • North America (U.S., Canada, and Mexico) • South America (Brazil, Chile, Argentina, Rest of South America) • MEA (Saudi Arabia, UAE, South Africa)Furthermore, the years considered for the study are as follows: Historical data – 2017-2022 The base year for estimation – 2022 Estimated Year – 2023 Forecast period** – 2023 to 2028 [** unless otherwise stated] Browse Full in-depth TOC @: https://www.advancemarketanalytics.com/reports/177845-global-aquatic-robot-market

Summarized Extracts from TOC of Global Aquatic Robot Market Study Chapter 1: Exclusive Summary of the Aquatic Robot market Chapter 2: Objective of Study and Research Scope the Aquatic Robot market Chapter 3: Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis Chapter 4: Market Segmentation by Type, End User and Region/Country 2016-2027 Chapter 5: Decision Framework Chapter 6: Market Dynamics- Drivers, Trends and Challenges Chapter 7: Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile Chapter 8: Appendix, Methodology and Data Source Buy Full Copy Aquatic RobotMarket – 2021 Edition @ https://www.advancemarketanalytics.com/buy-now?format=1&report=177845 Contact US : Craig Francis (PR & Marketing Manager) AMA Research & Media LLP Unit No. 429, Parsonage Road Edison, NJ New Jersey USA – 08837 Phone: +1 201 565 3262, +44 161 818 8166 [email protected]

#Global Aquatic Robot Market#Aquatic Robot Market Demand#Aquatic Robot Market Trends#Aquatic Robot Market Analysis#Aquatic Robot Market Growth#Aquatic Robot Market Share#Aquatic Robot Market Forecast#Aquatic Robot Market Challenges

2 notes

·

View notes

Text

Autonomous Robots Market Future Trends, Growth, Key Factors, Manufacture Players, Opportunities Analysis by 2033

The autonomous robots market size is projected to achieve a value of approximately US$ 2,561.0 million by 2023, and it is anticipated to surpass US$ 6,175.0 million by 2033. This growth will be driven by a compound annual growth rate (CAGR) of approximately 9.2% between 2023 and 2033.

The autonomous robots market in Japan is set to experience robust growth with a healthy CAGR, aiming to secure a market share of 15.8% by the year 2023. Japan held the top position as the largest global exporter of robots, both in terms of shipment value and the quantity of units in operation. Remarkably, Japan boasts a robot density of 364 robots per 10,000 employees, a figure equivalent to that of Germany. Furthermore, Japan stands as the preeminent producer of robots worldwide, with a substantial 47% of the world's robots being manufactured in Japan.

Download a Sample Copy of This Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=8267

The Emergence of Autonomous Robots:

Autonomous robots, frequently referred to as self-driving or self-operating robots, represent machines with the ability to perform tasks and make decisions autonomously, devoid of human intervention. These robotic systems have discovered applications across a wide spectrum of industries, ranging from manufacturing and logistics to healthcare, agriculture, and even space exploration. Their capacity to enhance efficiency, productivity, and safety renders them indispensable in our ever-evolving world.

Key Insights from the Report:

The recently published report on the autonomous robots market furnishes valuable perspectives on the factors propelling its remarkable expansion:

Escalating Demand for Automation: Industries are increasingly embracing automation to streamline operations and curtail labor costs. Autonomous robots lead this automation wave, as they operate tirelessly, consistently, and without fatigue.

Technological Advancements: Progress in artificial intelligence, computer vision, and sensor technologies has significantly augmented the capabilities of autonomous robots. They can now navigate intricate environments, adapt to changing circumstances, and collaborate more effectively with human counterparts.

E-commerce and Logistics: The rapid growth of e-commerce and the demand for efficient last-mile delivery solutions have catalyzed the adoption of autonomous delivery robots. These robots are revolutionizing the parcel delivery process, rendering it quicker and more convenient for consumers.

Healthcare Transformation: In the healthcare sector, autonomous robots contribute to patient care, medication delivery, and even surgical procedures. They play a pivotal role in sanitation and cleaning protocols, particularly in response to the challenges posed by the COVID-19 pandemic.

Agriculture and Sustainability: Autonomous robots are instrumental in precision agriculture, where they optimize crop management, reduce the reliance on pesticides, and boost yields. This not only enhances food production but also fosters sustainable farming practices.

Space Exploration: Autonomous robots are venturing into outer space, undertaking missions on distant planets and celestial bodies. They play a critical role in data collection, experimentation, and the groundwork for future human exploration.

Competitive Landscape

In its report, Fact.MR has profiled several leading companies operating in the autonomous robots market. These companies include ABB, AMS, Inc., ANYbotics AG, Augean Robotics, Inc., BlueSkye Automation, Clearpath Robotics, Inc., DJI, Fetch Robotics, MHS Global, Mouser Electronics, Inc., Move Robotic Sdn Bhd, Skydio, Inc., Teradyne Inc., and Waypoint Robotics Inc.

ABB, following its acquisition of mobile robot firm ASTI Mobile Robotics in 2021, has unveiled its inaugural line of autonomous mobile robots, which bear the newly renamed branding.

In a separate development in 2022, The Advanced Institute of Science and Technology (ASTI) is actively engaged in the development of a robot capable of detecting plant diseases, thereby assisting farmers in enhancing crop yields. This artificial intelligence (AI) robot is currently being trialed in a banana plantation, where it detects and identifies diseased plants at their earliest stages of infection.

Such pioneering applications of autonomous robots and the integration of cutting-edge robotic technology are expected to open new revenue streams for manufacturers in this industry.

Segmentation of Autonomous Robots Industry Research

By Type :

Collaboration Robots

Inventory Transportation Robots

Scalable Storage Picking Robots

Automatically Guided Vehicles (AGV)

By Technology :

Programmable

Non-programmable

Adaptive

Intelligent

By Payload :

Less than 500 kg

500 -1000 kg

1000-1500 kg

1500 -2000kg

Above 2000 kg

Autonomous Robots Market by Application :

Packaging

Palletizing

Material handling

Painting

Welding

Assembly

Inspection

Cutting

Dispensing

By End-Use Industry :

Aerospace and Defense

Automotive

Chemicals & Materials

Electrical & Electronics

Food and Beverage

Healthcare

Mining & Oil & Gas

Retail & e-Commerce

Logistics & Warehousing

Packaging

Others

By Region :

North America

Latin America

Europe

East Asia

South Asia and Oceania

Middle East & Africa

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=RC&rep_id=8267

Future Outlook:

The report suggests that the autonomous robots market is set for explosive growth in the coming years. Factors such as increased investment in research and development, the development of more sophisticated AI algorithms, and the expansion of their applications across various industries will be key drivers of this growth.

Check Out More Related Reports:

Arc Welding Equipment MarketDrone Bridge Inspection Services MarketPalletizing Robot Market

Contact: US Sales Office 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583, +353-1-4434-232 Email: [email protected]

#Autonomous Robots Market#Autonomous Robots Market Size#Autonomous Robots Market Share#Autonomous Robots Market Forecast#Autonomous Robots Market Growth

1 note

·

View note

Text

In 2022, the Global Military Robotic and Autonomous System Market was valued at $17,575.1 million and is expected to reach $19,794.0 million by the end of 2033, growing at a CAGR of 1.10% during the forecast period 2023-2033.

#Military Robotic and Autonomous System Market#Military Robotic and Autonomous System Industry#Military Robotic and Autonomous System Report#Military RAS Market#Military RAS Market Research Report#Military RAS Industry#Military RAS Report#Military RAS Market CAGR#Military RAS Market Forecast#BIS Research

0 notes

Text

From Climate Monitoring to Defense: The Expanding Applications of AUGs

The global autonomous underwater gliders (AUGs) market was valued at US$ 1.7 Bn in 2023 and is projected to reach US$ 4.7 Bn by 2034, expanding at a compound annual growth rate (CAGR) of 10.0% between 2024 and 2034. This robust growth is fueled by increasing investments in ocean research and a rising global focus on maritime defense.

Understanding AUGs: The Silent Operators of the Sea

Autonomous underwater gliders are a type of unmanned underwater vehicle (UUV) that move using changes in buoyancy and wings that convert vertical motion into horizontal movement. Unlike traditional autonomous underwater vehicles (AUVs), gliders are more energy-efficient, allowing them to operate for extended periods and cover vast oceanic distances without human intervention.

These vehicles are increasingly employed in scientific research, defense applications, environmental monitoring, and even commercial sectors like oil & gas and undersea archaeology.

Market Drivers: What’s Fueling the Rise of AUGs?

1. Surge in Underwater Research Investments

Autonomous gliders are becoming critical tools in oceanographic and climate research. Their ability to collect physical, chemical, biological, and biogeochemical data in hard-to-reach areas makes them invaluable for long-duration missions.

In 2023, DEEP, a British exploration firm, announced a £100 Mn investment in a deep-sea diving center aimed at establishing a continuous human presence beneath the oceans. Investments like these are expanding the market potential of AUGs as essential tools for ocean science.

2. Growing Maritime Defense Applications

Autonomous underwater gliders play a vital role in modern naval warfare, enabling countries to enhance their maritime security with minimal human risk. These gliders are used for autonomous detection, tracking, and reconnaissance missions.

For instance, in early 2024, the Japan Maritime Self-Defense Force (JMSDF) signed contracts to deploy “Type I and Type II” underwater gliders for oceanographic data collection. Meanwhile, the U.S. Navy continues to integrate these gliders with advanced sensors to improve submarine detection and mine countermeasures.

Expanding Use Cases Across Industries

From filmmaking to ecosystem restoration, autonomous underwater gliders are branching into various industries:

Regional Insights: Where is the Growth Happening?

North America Leads the Pack

North America dominated the global market in 2023, largely due to increased adoption by the U.S. Navy and various scientific institutions. Projects such as the launch of the Slocum Glider from helicopters and the Wave Glider USV from naval ships highlight the region’s technological edge.

Europe: Climate-Driven Innovation

In Europe, AUGs are essential in climate change studies. The Scottish Association for Marine Science (SAMS) has deployed robotic gliders to monitor ocean currents. Additionally, the Eurofleets+ and GROOM II projects are pushing the frontiers of sustainable marine research across the continent.

Competitive Landscape: Who’s Driving Innovation?

Major players in the autonomous underwater gliders market include:

These companies are innovating by integrating high-capacity energy systems, advanced sensors, and onboard processing units. A standout development came in March 2024, when Teledyne Marine partnered with Kongsberg to integrate the EK80 echo sounder onto the Slocum G3s Glider, boosting its scientific capability.

The Road Ahead

As demand for data-driven ocean monitoring, automated marine defense, and environmental sustainability increases, autonomous underwater gliders will continue to play a pivotal role. Governments, private companies, and research institutions are aligning efforts to create smarter, more efficient gliders with enhanced AI capabilities and longer mission endurance.With a 10.0% CAGR forecasted through 2034, this market presents a promising frontier where science, security, and sustainability converge deep beneath the waves.

0 notes

Text

Robot Chip Market - Trends, Market Share, Industry Size, Growth, Opportunities And Forecast

Robot Chip Market, Trends, Business Strategies 2025-2032

The global Robot Chip Market size was valued at US$ 3.45 billion in 2024 and is projected to reach US$ 8.94 billion by 2032, at a CAGR of 14.5% during the forecast period 2025-2032.

Robot chips are specialized semiconductor components that enable autonomous decision-making and adaptive learning in robotic systems. These chips process sensor data, execute AI algorithms, and control mechanical movements through integrated processing units including GPUs, ASICs, FPGAs, and brain-like neuromorphic processors. Leading applications span industrial automation, medical robotics, and consumer service robots.

The market growth is driven by accelerating Industry 4.0 adoption, with industrial robots alone accounting for 42% of chip demand in 2024. While Asia dominates semiconductor production with 73% market share, North American innovation in edge AI chips positions it as a key development hub. Recent breakthroughs include Nvidia’s 2023 launch of the Jetson Orin platform for next-gen robotics, demonstrating the industry’s push toward energy-efficient processing.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://semiconductorinsight.com/download-sample-report/?product_id=103091

Segment Analysis:

By Type

GPU Segment Leads the Market Due to High Demand for Parallel Processing in Robotics

The market is segmented based on type into:

GPU

Subtypes: Integrated, Discrete

ASIC

Subtypes: Full Custom, Semi-Custom

FPGA

Brain-like Chip

Subtypes: Neuromorphic, Quantum-inspired

Others

By Application

Industrial Robot Segment Dominates with Widespread Adoption in Automation

The market is segmented based on application into:

Industrial Robot

Subtypes: Assembly, Welding, Material Handling

Special Robot

Subtypes: Medical, Defense, Space Exploration

Service Robot

Consumer Robot

Others

By End User

Manufacturing Sector Accounts for Major Share Due to Industry 4.0 Adoption

The market is segmented based on end user into:

Manufacturing

Healthcare

Automotive

Electronics

Others

Regional Analysis: Robot Chip Market

North America North America remains a critical hub for robot chip innovation, driven by strong investments in AI, automation, and industrial robotics. The U.S. leads the region with major semiconductor players like Intel and Nvidia heavily investing in high-performance computing (HPC) and edge AI chips. Government initiatives, such as the CHIPS and Science Act, which allocates $52 billion for domestic semiconductor manufacturing, are accelerating research and production of advanced robotics components. Demand is particularly high in the industrial robotics sector, where automation trends in automotive and manufacturing continue to expand. However, stringent export controls on advanced semiconductor technologies to certain markets may influence long-term growth.

Europe Europe showcases steady growth in the robot chip sector, supported by strong industrial automation adoption in Germany, France, and the Nordic countries. The region benefits from collaborative R&D projects under Horizon Europe, focusing on AI-driven robotics and energy-efficient semiconductors. Germany, in particular, contributes significantly due to its robust automotive and machinery industries. While EU regulations on data privacy (GDPR) and sustainability impact chip development, they also encourage innovations in low-power, secure computing architectures. However, reliance on Asian semiconductor suppliers poses supply chain risks, prompting calls for increased local production capacity.

Asia-Pacific Asia-Pacific dominates the global robot chip market, accounting for over 60% of production and consumption. China, Japan, and South Korea lead the charge, with China aggressively expanding its domestic semiconductor capabilities amid U.S. trade restrictions. The region benefits from rapid industrial automation, particularly in consumer electronics and electric vehicle manufacturing. Taiwan’s TSMC and South Korea’s Samsung remain pivotal in supplying advanced GPUs and AI chips. However, geopolitical tensions and supply chain bottlenecks, such as the recent chip shortages, underscore the need for localized manufacturing strategies.

South America South America’s robot chip market is in a nascent stage but growing due to increasing automation in Brazil’s agricultural and mining sectors. While the region lacks major domestic semiconductor players, demand for cost-effective industrial robotics is rising. Economic instability and currency fluctuations limit investments in cutting-edge technologies, leading to a reliance on imported components, primarily from China and the U.S. Governments are beginning to recognize the importance of robotics in boosting productivity, but policy support remains inconsistent.

Middle East & Africa The Middle East & Africa presents a mixed landscape for robot chip adoption. GCC nations, particularly the UAE and Saudi Arabia, are investing in smart city projects and AI-driven robotics to diversify economies beyond oil. However, the high cost of advanced semiconductor solutions remains a barrier for broader industrial adoption across Africa. Limited local expertise in robotics and semiconductor manufacturing necessitates partnerships with global suppliers. Despite these hurdles, the region shows long-term potential as urbanization and digital transformation initiatives gain traction.

List of Key Robot Chip Companies Profiled

Intel Corporation (U.S.)

Nvidia Corporation (U.S.)

Qualcomm Technologies (U.S.)

Renesas Electronics Corporation (Japan)

NXP Semiconductors (Netherlands)

Microchip Technology (U.S.)

STMicroelectronics (Switzerland)

Infineon Technologies (Germany)

Hisilicon (China)

AMICRO (China)

Actions Technology (China)

NextVPU (China)

Rockchip (China)

The global robot chip market is experiencing unprecedented growth, primarily driven by breakthroughs in artificial intelligence and robotics technology. In 2024, the AI chip segment accounted for over 30% of the total semiconductor market revenue, demonstrating its critical role in modern computing. These specialized chips enable robots to process complex algorithms, learn from interactions, and perform tasks with human-like precision. Industrial automation is fueling demand for high-performance robot chips, particularly in manufacturing sectors where precision and efficiency are paramount.

The rollout of 5G infrastructure and proliferation of IoT devices has created a massive demand for specialized robot chips capable of processing vast amounts of data with minimal latency. In smart factories, these chips enable real-time communication between robotic systems, increasing operational efficiency by up to 40%. Edge computing applications are particularly benefiting from robot chips optimized for low-power, high-performance computing at the network periphery. The integration of 5G and AI in robotics represents a major technological inflection point for the industry.

The healthcare sector’s adoption of robotic systems for surgery, rehabilitation, and patient care has created specialized demand for medical-grade robot chips. Surgical robots alone are projected to reach market penetration in 30% of hospitals by 2026, driving significant component demand. Meanwhile, service robots for retail, hospitality, and domestic applications are driving innovation in cost-effective chip solutions. These applications require reliable, energy-efficient processing optimized for continuous operation in diverse environments.

The rapid development of autonomous vehicle technology presents enormous opportunities for specialized robot processors. The automotive semiconductor market alone is projected to grow by 9% annually, with perception and decision-making chips representing the fastest-growing segment. Similarly, commercial drone applications are driving demand for compact, low-power chips optimized for computer vision and navigation. These emerging verticals require entirely new chip architectures capable of processing sensor data with extreme reliability and safety margins.

Neuromorphic chips that mimic biological neural networks are gaining traction in advanced robotics applications. These brain-inspired processors offer significant advantages in power efficiency and pattern recognition tasks crucial for adaptive robotic systems. Recent breakthroughs have demonstrated 100x improvements in energy efficiency compared to traditional architectures for certain machine learning workloads. As these technologies mature, they promise to enable entirely new categories of robotic applications that were previously impractical due to power or size constraints.

The shift toward Robotics-as-a-Service (RaaS) business models is democratizing access to robotic technology across industries. This trend is driving demand for standardized, modular chip solutions that can be adapted to multiple applications. Cloud robotics platforms are similarly creating opportunities for hybrid processing architectures combining edge and cloud computing capabilities. These developments are expanding the potential customer base beyond traditional industrial buyers to include SMEs and service providers seeking flexible robotic solutions.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=103091

Key Questions Answered by the Robot Chip Market Report:

What is the current market size of Global Robot Chip Market?

Which key companies operate in Global Robot Chip Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Browse More Reports:

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

Mine Clearance System Market Size, Trends, and Growth Forecast 2025-2032

The mine clearance system industry is witnessing steady expansion driven by growing global demand for advanced solutions to detect and neutralize landmines and unexploded ordnance. Increasing geopolitical tensions and rising investments in defense infrastructure underscore evolving market dynamics. This blog delivers a detailed market forecast, investment scenario, regional opportunities, and key players shaping the future. Market Size and Overview The global Mine Clearance System Market size is estimated to be valued at USD 69.2 million in 2025 and is expected to reach USD 98.8 million by 2032, exhibiting a compound annual growth rate (CAGR) of 5% during the forecast period from 2025 to 2032.

The Mine Clearance System Market Growth reflects heightened demand for enhanced mine detection technologies coupled with increasing international efforts to clear conflict-affected areas. Market insights indicate that rising defense budgets and technology integration are pivotal market drivers contributing to consistent market growth. The Mine Clearance System market report suggests positive expansion is anticipated across multiple industry segments, reinforcing the growing market revenue outlook. Investment Scenario Investment trends within the mine clearance system market reveal increased venture capital interest and significant capital influx into R&D for autonomous and robotic clearance systems. In 2025, several startups secured funding rounds exceeding USD 10 million focusing on sensor innovation and AI-powered clearance capabilities. Moreover, key Mine Clearance System Market companies have pursued mergers and acquisitions to expand their global footprint and diversify product portfolios. For example, a strategic acquisition in early 2025 allowed a prominent mine clearance system supplier to broaden its offerings into emerging markets, enhancing business growth prospects. This investment momentum illustrates a robust market forecast, fostering competitive advantages through technological advancements.

Get More Insights on Mine Clearance System Market

#MineClearanceSystemMarket#MineClearanceSystemMarketDemand#MineClearanceSystemMarketGrowth#MineClearanceSystem#CoherentMarketInsights#Landmines#AutonomousMines

0 notes

Text

Smart Navigation Starts Here. : Global Navigation Sensors Market Forecast & Opportunities to 2032

The global Navigation Sensors Market was valued at 516 million in 2024 and is projected to reach US$ 999 million by 2032, at a CAGR of 10.1% during the forecast period.

Navigation sensors are critical components used to determine the precise position, orientation, and movement of objects or vehicles across multiple industries. These sensors utilize technologies such as GPS, inertial measurement units (IMUs), and optical/magnetic systems to provide real-time data for navigation and guidance. Key applications include autonomous vehicles, industrial automation, UAV navigation, and robotics.

The market growth is driven by increasing demand for automation across industries, advancements in sensor miniaturization, and the rapid adoption of autonomous systems. While optical navigation sensors dominate due to their high precision in robotics, magnetic sensors are gaining traction in industrial applications where electromagnetic interference is a concern. Recent developments, such as Honeywell’s launch of advanced MEMS-based IMUs in 2023, demonstrate the ongoing innovation in this space. Other key players like SBG Systems and KONGSBERG continue to expand their product portfolios to meet the growing demand for high-accuracy navigation solutions.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/navigation-sensors-market/

Segment Analysis:

By Type

Optical Navigation Sensors Lead Due to High Precision in Autonomous Systems

The market is segmented based on type into:

Optical Navigation Sensors

Subtypes: Infrared sensors, LiDAR, vision-based systems

Magnetic Navigation Sensors

Inertial Measurement Units (IMU)

GPS/GNSS Sensors

Others

By Application

UAV Navigation Segment Shows Strong Growth Due to Expanding Drone Applications

The market is segmented based on application into:

Robot Navigation

Industrial Automation

UAV Navigation

Autonomous Vehicles

Others

By Technology

MEMS-based Sensors Gain Traction for Compact Size and Low Power Consumption

The market is segmented based on technology into:

MEMS-based Navigation Sensors

Fiber Optic Gyro (FOG) Sensors

Ring Laser Gyro (RLG) Sensors

Others

By End-Use Industry

Automotive Sector Drives Demand for Advanced Navigation Sensor Solutions

The market is segmented based on end-use industry into:

Automotive

Aerospace & Defense

Marine

Industrial

Consumer Electronics

Regional Analysis: Navigation Sensors Market

North America North America remains a leader in navigation sensor adoption, driven by advanced military applications, autonomous vehicle development, and robust aerospace investments. The U.S. dominates the regional market, with significant R&D in GPS-denied environments and inertial navigation systems for defense applications. Commercial sectors, particularly logistics and robotics, are increasingly integrating MEMS-based sensors due to their cost-efficiency. Regulatory support from agencies like the FAA for drone navigation and DOT for autonomous vehicles further accelerates growth. However, export controls on high-precision military-grade sensors limit cross-border technology transfer, creating supply chain complexities.

Europe Europe’s navigation sensor market thrives on industrial automation and smart mobility initiatives, with Germany and France leading in automotive-grade sensor deployments. The EU’s stringent GNSS (Galileo) accuracy standards push innovation in multi-sensor fusion technologies, while maritime navigation regulations (e.g., SOLAS compliance) sustain demand for ruggedized systems. A key challenge is balancing data privacy concerns in drone/UAV applications against operational efficiency needs. Collaborative projects like the European Rail Traffic Management System (ERTMS) demonstrate cross-sectoral adoption, though Brexit-induced trade barriers complicate UK-EU component sourcing.

Asia-Pacific As the fastest-growing region, Asia-Pacific benefits from China’s BeiDou satellite expansion and Japan’s robotics dominance. China accounts for over 40% of regional demand, leveraging sensor technologies in smart city infrastructure and eVTOL (electric vertical takeoff/landing) aircraft. India’s defense modernization programs prioritize indigenous navigation sensor production, reducing import reliance. Southeast Asia sees rising UAV adoption for agricultural monitoring but faces infrastructure gaps in rural GNSS coverage. Cost-driven markets favor optical sensors over higher-end LiDAR solutions, though precision agriculture and mining sectors are shifting this dynamic.

South America South America’s navigation sensor market grows moderately, with Brazil and Argentina prioritizing maritime and oil/gas applications. Offshore drilling vessels and port automation drive demand for corrosion-resistant magnetic sensors, while mining operations adopt inertial systems for heavy equipment tracking. Economic instability delays large-scale IoT deployments, restricting sensor integration in smart logistics. Localized manufacturing is limited—most high-end sensors are imported from North America or Europe, creating price sensitivities. However, Chile’s astronomy sector presents niche opportunities for high-accuracy celestial navigation systems.

Middle East & Africa The Middle East leads regional growth through aerospace investments and sovereign drone programs, with the UAE and Saudi Arabia deploying navigation sensors for urban air mobility (UAM) initiatives. Africa’s mining and agriculture sectors gradually adopt low-cost GPS trackers, though intermittent satellite connectivity hinders reliability. Israel’s defense exports dominate the high-end market, supplying MEMS-based tactical grade sensors. Geopolitical tensions in the Persian Gulf amplify demand for anti-jamming marine navigation systems. Sub-Saharan Africa remains underserved due to infrastructure deficits, though mobile-based navigation apps create downstream opportunities for low-power sensor modules.

MARKET OPPORTUNITIES

Emergence of Quantum Navigation Technologies

The commercialization of quantum-based positioning systems represents a revolutionary opportunity for the navigation sensor market. Early quantum accelerometers and gyroscopes have demonstrated 1000x improvements in accuracy compared to conventional MEMS devices, albeit at prototype stage. Several governments have announced major funding initiatives for quantum navigation R&D, with projected investments exceeding $3 billion through 2028. First-mover advantages will be significant as these technologies mature, particularly for defense applications where size, weight and power constraints currently limit performance.

Smart City Infrastructure Creating New Deployment Paradigms

Urban digital twin projects and intelligent transportation systems are creating demand for networked navigation sensor grids. These distributed systems provide continuous positioning correction data through over 500,000 planned roadside units globally by 2030, enhancing localization accuracy for connected vehicles. The transition from vehicle-contained navigation to infrastructure-assisted systems represents a fundamental shift in market dynamics. Successful players will need to develop hybrid business models combining hardware sales with data services, potentially doubling revenue opportunities in municipal applications.

Miniaturization Enabling New Wearable Applications

Advances in nanotechnology and packaging are reducing navigation sensor footprints to enable innovative end-uses. Emerging applications include precision mining helmets, augmented reality navigation glasses, and medical asset tracking systems. The wearable technology sector represents an $80 billion addressable market for miniature inertial measurement units that can operate on minimal power. Early successes in sports analytics and military exoskeletons demonstrate the potential for high-margin niche applications that could drive the next wave of market expansion.

NAVIGATION SENSORS MARKET TRENDS

Integration with Autonomous Systems Driving Market Expansion

The adoption of navigation sensors in autonomous vehicles and drones is accelerating market growth, with the segment expected to account for over 35% of total revenue by 2032. As automotive manufacturers and logistics providers increasingly adopt autonomous solutions, demand for high-precision inertial measurement units (IMUs) and GPS-integrated sensors has grown significantly. The aviation sector’s shift toward autonomous flight control systems has further amplified this trend, with sensor accuracy requirements now exceeding 0.1° in angular measurement for commercial drone applications.

Other Trends

Miniaturization and Power Efficiency

Recent advancements in MEMS (Micro-Electro-Mechanical Systems) technology have enabled the development of compact navigation sensors that consume less than 10mW power while maintaining sub-meter accuracy. This breakthrough addresses critical challenges in portable and battery-operated devices, particularly in wearable navigation solutions and IoT applications. The military sector continues to drive demand for ruggedized miniature sensors, with certain applications requiring operation in extreme temperatures ranging from -40°C to +85°C.

Industrial Automation Creating New Opportunities

Manufacturing facilities undergoing Industry 4.0 transformations are increasingly deploying navigation sensor networks for automated guided vehicles (AGVs), with adoption rates growing at 18% annually. Modern smart factories now integrate optical navigation sensors with machine learning algorithms to enable centimeter-level positioning accuracy in dynamic environments. Warehouse automation solutions represent another high-growth segment, where sensor fusion technologies combining LiDAR, ultrasonic and vision systems are reducing navigation errors to under 2cm in package handling robots.

Technological Convergence in Marine Navigation

The maritime sector is witnessing a convergence of satellite-based and terrestrial navigation technologies, with modern vessel traffic systems now achieving positional accuracy of 1-3 meters in open sea conditions. Recent developments in quantum inertial navigation systems promise to revolutionize underwater navigation by eliminating dependency on GPS signals, potentially opening a $2.7 billion subsea navigation market by 2030. Commercial fishing fleets and offshore energy providers are early adopters of these hybrid navigation solutions that combine traditional sensors with AI-powered predictive positioning.

COMPETITIVE LANDSCAPE

Key Industry Players

Intensified Competition Drives Innovation in Navigation Sensor Technologies

The global navigation sensors market exhibits a moderately consolidated structure, dominated by established technology providers while accommodating emerging innovators. Honeywell International Inc. maintains leadership through its diversified sensor portfolio, spanning aerospace, defense, and industrial applications. The company’s vertical integration capabilities, coupled with longstanding government contracts, solidify its 18% revenue share in 2024.

SBG Systems has emerged as a disruptive force, particularly in the high-growth inertial navigation segment. Their quartz-based MEMS technology captured 12% of the professional UAV navigation market last year. Meanwhile, KONGSBERG continues to dominate marine navigation solutions, holding 22% of the maritime sector’s sensor deployments as of Q1 2024.

The competitive intensity is further heightened by strategic movements – Nidec Corporation’s acquisition of Parker’s motion control division last quarter expanded its industrial sensor capabilities. Similarly, SICK AG is leveraging its LiDAR expertise to penetrate autonomous vehicle markets, with recent trial deployments in three European smart city projects.

Chinese manufacturers like MEMSPlus are gaining traction through cost-competitive optical navigation modules, though their market share remains concentrated in domestic robotics applications. This geographic specialization creates distinct competitive dynamics across regional markets.

List of Prominent Navigation Sensor Manufacturers

Honeywell International Inc. (U.S.)

SBG Systems (France)

KONGSBERG (Norway)

Nidec Motor Corporation (Japan)

SICK AG (Germany)

Parker Hannifin Corp (U.S.)

CODICO GmbH (Austria)

CMC Electronics (Canada)

Diginext (France)

PixArt Imaging Inc. (Taiwan)

MultiDimension Technology (China)

Shanghai Yuanben Magnetoelectric Tech (China)

MEMSPlus (China)

The ongoing industry shift toward multi-sensor fusion platforms is reshaping competition parameters. While established players benefit from system integration expertise, smaller specialists are carving niches in calibration algorithms and edge-processing solutions. This technological fragmentation suggests the competitive hierarchy may see significant reorganization by 2030.

Learn more about Competitive Analysis, and Forecast of Global Navigation Sensors Market : https://semiconductorinsight.com/download-sample-report/?product_id=103119

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Navigation Sensors Market?

->Navigation Sensors Market was valued at 516 million in 2024 and is projected to reach US$ 999 million by 2032, at a CAGR of 10.1% during the forecast period.

Which key companies operate in Global Navigation Sensors Market?

-> Key players include Nidec Motor Corporation, Honeywell, Parker, SICK, SBG Systems, KONGSBERG, and CMC Electronics, among others.

What are the key growth drivers?

-> Key growth drivers include autonomous vehicle development, industrial automation expansion, and increasing defense sector investments in navigation technologies.

Which region dominates the market?

-> North America currently leads the market, while Asia-Pacific is projected to exhibit the highest growth rate during the forecast period.

What are the emerging trends?

-> Emerging trends include miniaturization of sensors, integration with AI/ML technologies, and development of multi-sensor navigation systems.

Browse Related Reports :

https://semiconductorinsight.com/report/global-elevator-travel-cables-market/

https://semiconductorinsight.com/report/global-smart-pos-machine-market/

https://semiconductorinsight.com/report/global-circuit-breakers-and-fuses-market/

https://semiconductorinsight.com/report/global-carbon-brush-holder-market/

https://dineshsemiconductorsinsightspr.blogspot.com/2025/07/3d-through-glass-via-substrates-market.html

https://dineshsemiconductorsinsightspr.blogspot.com/2025/07/global-suspension-ride-height-sensor.html