#Best online CA classes in India

Explore tagged Tumblr posts

Text

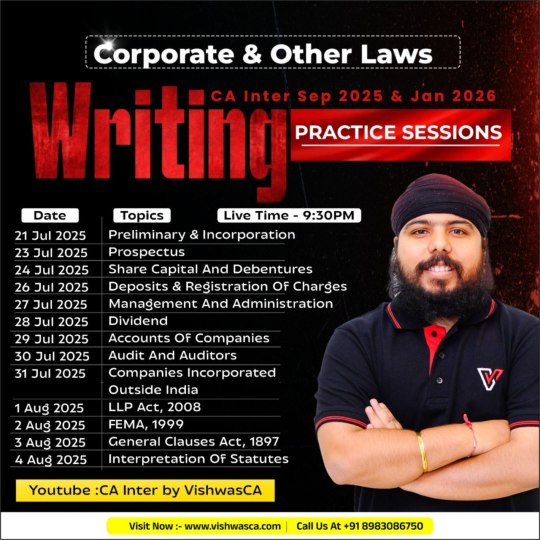

Law Writing Sessions – CA Inter 2025/26

Live at 9:30 PM from 21 Jul to 4 Aug. Topics: Co. Law, LLP, FEMA & more. 📺 YouTube: CA Inter by VishwasCA 🌐 vishwasca.com 📞 8983086750

#CA Classes in India#Online CA Coaching#Best CA Classes In India#CA Foundation Classes#CA Intermediate Classes#CA Online Classes#Best CA Coaching In India#CA Foundation online classes#CA Intermediate online classes#CA classes online#CA coaching classes online#Online CA coaching in India#Best online CA classes in India#Best CA coaching online

0 notes

Text

Republic Day Sale 10 % Off On All Courses | Ultimateca

Celebrate Republic Day with Ultimate CA! 🎉

🎯 Get 10% OFF on all courses and take a step closer to your CA dreams!

🗓 Offer valid from 24th Jan to 31st Jan.

👉 Use coupon code: INDIA

Don’t miss this opportunity to learn from the best! 🚀

📲 Enroll now at https://ultimateca.com/

contact us at +91 89830 87331.

#Republic Day Offer#Ultimate CA#CA Courses Discount#10 Percent Off#CA Exam Prep#Chartered Accountancy#Learn from the Best#CA Dreams#INDIA Coupon Code#Enroll Now#Limited Time Offer#CA Foundation#CA Inter#CA Final#Online CA Classes

0 notes

Text

Revise CA Foundation Economics for Jan 2025 Exam

Get ready for the Jan 2025 CA Foundation Exam with focused Economics revision! Topics include Business Economics, Theory of Demand & Supply, Production & Cost, Business Cycle, and more. Scan the QR code to access revision lectures by CA Harshad Jaju. 📞 Contact: +91 89830 87140 🌐 www.swapnilpatni.com

#ca classes in india#ca coaching classes#online ca course in india#ca foundation classes#swapnilpatniclasses#best ca online classes#spcgurukul

0 notes

Text

CA Foundation, Intermediate, and Final: Best Online Classes for Each Level

When pursuing the Chartered Accountancy (CA) journey, choosing the right guidance is essential. Rachith Academy, known for its excellence in CA education, offers the Best CA Online Classes in India, tailored to meet the specific needs of students at Foundation, Intermediate, and Final levels. Here’s why Rachith Academy is your ideal partner in this challenging yet rewarding journey:

CA Foundation: Building Strong Basics

Rachith Academy’s online CA Foundation classes focus on creating a robust understanding of core concepts. The curriculum is designed to:

Cover the syllabus comprehensively, ensuring no stone is left unturned.

Provide interactive sessions to clarify fundamental concepts.

Offer topic-specific tests to strengthen problem-solving skills.

With expert faculty and a learner-centric approach, students gain the confidence needed to excel in their initial steps.

CA Intermediate: Bridging Knowledge and Application

The CA Intermediate level demands deeper understanding and application of concepts. Rachith Academy addresses this through:

Structured study plans and regular assessments.

Detailed video lectures that simplify complex topics.

Access to an extensive question bank with solutions.

These features ensure students are well-prepared to tackle practical and theoretical aspects of the syllabus.

CA Final: Mastering the Pinnacle of CA

For CA Final aspirants, Rachith Academy provides:

Advanced training sessions by industry-experienced mentors.

Comprehensive case studies to develop analytical skills.

Mock exams replicating ICAI standards to boost confidence.

The focus remains on guiding students to achieve their dream of becoming successful Chartered Accountants.

Why Choose Rachith Academy for Online CA Classes?

Flexible learning schedules that accommodate personal study time.

Personalized mentoring to address individual challenges.

Proven track record of success with a high pass percentage.

Rachith Academy ensures that every student is equipped with the tools, knowledge, and confidence to excel at each stage of the CA journey. Enroll today and experience the difference with the Best CA Online Classes in India!

To Know More https://rachithacademy.com/best-ca-online-classes-in-india/

0 notes

Text

Best CA Foundation Classes online live/online in India

Embark on a successful CA journey with the best CA Foundation classes online live/online in India. Gain comprehensive knowledge and expert guidance for a solid foundation.

0 notes

Text

#"CA coaching classes#Online CA lectures#CA inter online classes#online lectures for FM-SM#CA virtual classes#CA live classes#Best Ca Online Classes#Ca Online Classes#Online Classes For Ca#Best Ca Classes In Pune#Top Ca classes in Pune#Ca Classes In Pune#Ca Coaching Classes In Pune#Ca Institute In Pune#Ca Online Classes In Pune#Best Ca Coaching Classes In Maharashtra#Best Ca Classes In Maharashtra#Best Ca Online Classes In Maharashtra#Best Ca Online Classes In Pune#Best Ca Online Classes In India#Best Ca Classes In India#Ca Online Classes In India#Online Ca Foundation Classes In Maharashtra#Ca Foundation Classes In Maharashtra#Online Ca Foundation Classes In Pune#Ca Foundation Classes In Pune#Best Ca Classes With 12 Commerce#Online Classes For Ca Foundation#Google Drive Classes For Ca In Pune#Top Ca Online Classes In Pune

0 notes

Text

Comprehensive Guide to the Best Reference Books and Study Materials for CA Final

The CA Final examination is the remaining and maximum hard hurdle for aspirants aiming to grow to be Chartered Accountants. It requires meticulous instruction and deep knowledge of numerous complex topics. To excel on this examination, applicants need to depend upon incredible reference books and look at substances that provide in-depth insurance of the syllabus.

If you want to read more click here

#ca online classes#paras institute#best career option#best coaching institute#best CA institute in india

0 notes

Text

Get CA Final FR (Financial Reporting) regular and fastrack course by CA Suraj Lakhotia on Edugyan

2 notes

·

View notes

Text

Best Career-Oriented Professional Courses After 12th – Full List Inside

Choosing the right path after completing Class 12 is one of the most important decisions in a student's life. With numerous options available, it’s essential to select a course that not only matches your interests but also ensures long-term career growth. Whether you're from Science, Commerce, or Arts background, there are several professional courses after 12th that open doors to rewarding careers.

In this article, we bring you a curated after 12th courses list to help you make an informed choice—and we’ll also introduce a unique program by HCL TechBee that’s transforming early career opportunities in India.

✅ Why Choose a Professional Course After 12th?

Professional courses are designed to equip students with industry-ready skills and practical knowledge. Unlike traditional academic degrees, these programs focus on employability, technology trends, and hands-on training.

Some benefits include:

Early entry into the job market

Specialized knowledge in a specific domain

Higher salary potential

Better placement opportunities

📘 Popular Professional Courses After 12th – Stream Wise

🔬 For Science Students

B.Tech / B.E (Engineering)

MBBS / BDS / BAMS / BHMS

B.Sc. in Nursing, Biotechnology, or Radiology

Bachelor of Pharmacy

Data Science & AI Certification Courses

HCL TechBee: Early Career Program (Ideal for IT & Tech roles)

💼 For Commerce Students

B.Com (Professional Accounting, Taxation, or Finance)

CA (Chartered Accountancy)

CS (Company Secretary)

BBA / BMS

Digital Marketing or Business Analytics Courses

HCL TechBee: Work-integrated IT Program with Degree

🎨 For Arts Students

BA in Mass Communication / Journalism / Psychology

BFA (Fine Arts)

Bachelor of Design (Interior, Fashion, or Graphic)

Hotel Management / Event Management

Foreign Language Courses

HCL TechBee: Open to all streams with focus on IT Training + Degree

🌟 Why Choose HCL TechBee?

HCL TechBee is one of the most innovative professional courses after 12th. It’s a work-integrated career program by HCL Technologies that allows students to join IT roles immediately after completing Class 12. While working with HCL, students can also pursue a sponsored degree from reputed universities.

Highlights:

Stipend during training

Guaranteed job at HCL post-training

UGC-recognized degree (online/hybrid)

No financial burden on parents

Real-world exposure from Day 1

It’s a perfect choice for those who want to skip the long academic route and begin their professional journey early.

📝 Conclusion

With so many after 12th courses list options, choosing a path that offers real-world experience and financial independence is a smart move. HCL TechBee is an ideal solution for students who want a head start in the tech industry without compromising on education.

So, if you're looking for career-oriented professional courses after 12th, explore HCL TechBee and take your first confident step toward a successful future.

0 notes

Text

What Has Changed in ICAI's Updated CA Foundation Syllabus 2025?

The Institute of Chartered Accountants of India (ICAI) has rolled out a revised syllabus for the CA Foundation Exam 2025 under the New Scheme of Education and Training. If you are preparing for the CA Foundation September 2025 attempt or beyond, understanding these changes is crucial for smart preparation.

In this blog, we’ll walk you through the key changes in the ICAI CA Foundation syllabus 2025, how it impacts your preparation, and how platforms like Vishwas CA, a leading Online CA coaching institute, can help you stay ahead.

Why Did ICAI Revise the CA Foundation Syllabus?

The update aligns with the National Education Policy (NEP) 2020, aiming to improve skill-based learning, digital proficiency, and industry readiness among CA aspirants. The revised syllabus emphasizes conceptual understanding, analytical thinking, and practical application.

Key Changes in CA Foundation Syllabus 2025

Here’s what has changed in the updated syllabus:

1. Paper Structure Revamp

Earlier: The syllabus had four core subjects.

Now: While the number of papers remains four, their structure and content are revised to ensure clarity and depth.

All papers are now 100% objective (MCQ-based) with negative marking (0.25 marks deduction for every wrong answer).

2. Revised Paper Names and Scope

Paper 1: Accounting

More focused on foundational principles.

Increased emphasis on accounting for non-profit organisations, consignment, and joint ventures.

Paper 2: Business Laws

Now excludes Business Correspondence & Reporting.

The Indian Partnership Act, the Sale of Goods Act, the Indian Contract Act, and the Limited Liability Partnership Act have all received more attention.

Paper 3: Quantitative Aptitude

Integrates statistics, logical reasoning, and business mathematics into a single paper.

Logical reasoning weightage is reduced; more focus on business math and stats.

Paper 4: Business Economics

Retains fundamental micro and macroeconomic concepts.

Removes Business & Commercial Knowledge for more theory-oriented economic concepts.

3. Skill-Based Learning and Assessment

The new syllabus gives higher importance to application-oriented questions.

Encourages analytical thinking, practical case-solving, and clarity in core concepts.

4. Digital Awareness

Students are now expected to be digitally equipped.

Online examination systems and e-learning modules are emphasized more than before.

How These Changes Impact Your CA Foundation Preparation

The updated syllabus demands:

Better conceptual clarity

More practice with MCQs

Strategic use of online mock tests and RTPs

Shift from rote learning to smart, analytical preparation

How Vishwas CA Can Help You Prepare

At Vishwas CA, we’ve already updated our CA Foundation online classes to match the 2025 ICAI syllabus. Our expert faculties provide:

✅ Topic-wise MCQ practice ✅ Live sessions + recorded revision modules ✅ Mock tests with detailed solutions ✅ Personal doubt-clearing ✅ All content aligned with the new ICAI guidelines

Whether you're looking for the Best CA coaching online or Online coaching for CA Foundation, Vishwas CA is your trusted partner. We also provide full support for CA Intermediate online classes under the new scheme.

Why Choose Vishwas CA?

📚 Updated Study Material for the New Syllabus

👨🏫 Expert Faculty with years of ICAI exam experience

🧑💻 Interactive Live + Recorded CA classes online

🏆 One of India's Top Online CA Courses

Join thousands of successful students who have chosen Vishwas CA – the Best Online CA coaching in India.

Conclusion

The ICAI’s updated CA Foundation syllabus 2025 marks a significant step towards a more practical, skills-focused chartered accountancy pathway. To stay ahead, you need to adapt your preparation strategy with the help of the best CA coaching online.

Let Vishwas CA, your reliable Online CA coaching institute, guide you through these changes with comprehensive, updated content and expert mentoring.

#CA Classes in India#Online CA Coaching#Best CA Classes In India#CA Foundation Classes#CA Intermediate Classes#CA Online Classes#Best CA Coaching In India#CA Foundation online classes#CA Intermediate online classes#CA classes online#CA coaching classes online#Online CA coaching in India#Best online CA classes in India#Best CA coaching online

0 notes

Text

Learn Direct Tax from CA Bhanwar Borana – Expert Faculty & Founder of BB Virtuals

Unlock conceptual clarity in taxation with CA Bhanwar Borana, one of India’s top educators for CA and CMA aspirants. Known for his engaging and student-friendly teaching style, CA Bhanwar Borana has redefined the way Direct Tax is taught through his signature handwritten book "COMPACT" and his interactive classes.

As the founder of BB Virtuals, established in 2017, he has mentored thousands of students by being more than just a teacher—he is a guide, motivator, and mentor. His CA Taxation and Direct Tax lectures are now available in online and pendrive formats through Smart Learning Destination, making it easier than ever to learn from the best at your own pace.

0 notes

Text

12Th + CA Foundation Annual Batch 2025-2026 Special offer Book Your Seat now

📞 Helpline: +918983087140 📱 WhatsApp: https://bit.ly/3yXwo0W 🌐 Enquire now: https://bit.ly/3ykcSe1 🌐 www.swapnilpatni.com

#CA Foundation Course#CA Classes In India#CA Foundation Classes#Online CA Course In India#CA Coaching Classes#CA Live Classes#Best Ca Online Classes

0 notes

Text

Fast-Track Accounting Diploma Course Online

🎓 Diploma in Accounting – Career के लिए Perfect शुरुआत

✅ What is Diploma in Accounting? – Diploma Course की Simple Definition

Diploma in Accounting एक short-term professional course है, जो students को basic se advanced तक accounting knowledge provide करता है। Is course का main aim होता है practical और theoretical दोनों तरह की skills develop करना।

Generally, ये course उन लोगों के लिए perfect है जो accounting, taxation, और finance field में career शुरू करना चाहते हैं। Course को 6 months से लेकर 1 year तक किया जा सकता है।

📚 Why Choose Diploma in Accounting? – Is Course की खासिय��

Diploma in Accounting आपको job-ready बनाता है। Iska syllabus industry-oriented होता है जिससे students को actual work सीखने को मिलता है। Aaj ke time में businesses को ऐसे professionals की जरूरत है जिन्हें Tally, GST filing, और payroll system की knowledge हो।

Is course की सबसे बड़ी खासियत ये है कि इसे कोई भी 12th pass student या graduate कर सकता है। इसके अलावा, यह course affordable भी होता है और return on investment high होता है।

🧑🏫 Course Eligibility and Duration – कौन कर सकता है ये Course?

Diploma in Accounting करने के लिए minimum qualification 10+2 होती है, preferably from commerce stream। Lekin agar aapne arts ya science किया है, तब भी आप ये course कर सकते हैं।

इसका duration institute पर depend करता है – कहीं ये 6 months में complete हो जाता है, और कहीं 1 साल लगता है। कुछ institutes weekend classes या online mode भी offer करते हैं।

📝 Subjects Covered in Diploma in Accounting – क्या-क्या सिखाया जाता है?

Course में theoretical knowledge के साथ-साथ practical exposure भी दिया जाता है। नीचे कुछ core subjects की list दी गई है:

Financial Accounting (वित्तीय लेखा)

Tally ERP & Tally Prime

GST (Goods & Services Tax)

Income Tax Basics

Payroll Accounting

Microsoft Excel – Accounting के लिए

Banking & Finance Fundamentals

Har topic को real-world examples के साथ समझाया जाता है जिससे concept clarity बढ़े।

💰 Course Fee Structure – कितना खर्चा आता है?

Diploma in Accounting course की fees vary करती है, location और institute पर depend करता है। Generally, इस course की fee ₹10,000 से ₹30,000 के बीच होती है।

कुछ institutes जैसे TIPA (The Institute of Professional Accountants) affordable fee में high-quality training offer करते हैं। Installment options और scholarships भी कई जगहों पर available हैं।

💼 Career Opportunities after Diploma in Accounting – क्या Job मिलेगी?

Diploma complete करने के बाद आप कई तरह की job roles के लिए apply कर सकते हैं। कुछ common job positions ये हैं:

Junior Accountant

Accounts Executive

Tax Assistant

Payroll Officer

Tally Operator

GST Practitioner

इन profiles की starting salary ₹15,000 से ₹25,000 तक हो सकती है, depending on skills and location। Experience बढ़ने के साथ salary भी ₹40,000+ तक पहुँच सकती है।

🏢 Top Companies Hiring Diploma Holders – कहां मिलेगा Job?

Badi-badi companies और SMEs दोनों Diploma in Accounting qualified candidates को hire करते हैं। कुछ well-known recruiters में शामिल हैं:

Infosys BPM

Genpact

Deloitte

HDFC Bank

Reliance

Flipkart

Local CA Firms and Startups

Government jobs में भी accountant और clerk roles के लिए ये diploma काम आता है।

🧠 Skills You Gain – क्या-क्या नया सीखने को मिलेगा?

Is course से aapko theoretical knowledge के साथ-साथ following practical skills मिलती हैं:

Double Entry System समझना

Manual और computerized accounting करना

Tax return filing सीखना

Data entry accuracy improve करना

Excel पर financial reports prepare करना

Ye सारी skills आपको real-time accounting world में survive करने लायक बनाती हैं।

🏫 Best Institutes Offering Diploma in Accounting – कहाँ से करें?

India में कई reputed institutes हैं जो ये course offer करते हैं:

TIPA – The Institute of Professional Accountants, Delhi Website: www.tipa.in Location: Laxmi Nagar, Delhi

TIPA की खास बात है कि वो students को placement assistance, doubt support और live training provide करता है।

🌐 Online Vs Offline Mode – कौन सा बेहतर है?

Online learning flexible होता है, लेकिन accounting एक practical subject है। इसलिए अगर possible हो तो offline classes लें।

TIPA जैसे institutes blended mode offer करते हैं – जिसमें आप classes online देख सकते हैं लेकिन practice offline करते हैं। Aise mode में learning ज्यादा effective होती है।

💼 Freelancing & Self-Employment Options – खुद का काम भी शुरू कर सकते हैं

अगर aap job नहीं करना चाहते तो आप freelancing या खुद की accounting service start कर सकते हैं। आप GST registration, ITR filing, और bookkeeping जैसे services offer कर सकते हैं।

Accounting diploma होने से clients aap par trust करेंगे। इससे आपके professional credibility में भी इजाफा होता है।

📈 Growth Scope and Future – Accounting Field का Future कैसा है?

India में हर business को accountant की जरूरत होती है। GST और digital compliance क�� बाद accounting professionals की demand बढ़ गई है।

Naukri.com, Indeed, और Monster जैसी sites पर हर महीने 50,000+ accounting jobs पोस्ट होती हैं। With skills & experience, आप senior accountant, finance manager या auditor बन सकते हैं।

📌 Conclusion – Kya Diploma in Accounting Worth It Hai?

Definitely! Agar आप short duration में job-ready बनना चाहते हैं, तो Diploma in Accounting एक शानदार विकल्प है। Ye course आपको ना सिर्फ job दिलाता है बल्कि freelancing और business opportunities भी देता है।

TIPA जैसे reputed institute से course करने से आपका resume और strong बन जाता है। Aaj की दुनिया में practical skills ज्यादा काम आती हैं, और यही इस diploma की खासियत है।

Name:-

Institute of Professional Accountants

Address:-

E-54 3rd floor, Metro Pillar No. 44, Laxmi Nagar, Block E, Laxmi Nagar, Delhi 110092

Phone:-

092138 55555

Website:-

www.tipa.in

Description:-

"The Institute of Professional Accountants (TIPA), located in Laxmi Nagar, Delhi, is a leading institute offering job-oriented Diploma in E-Accounting, Taxation, Tally Course and GST. Our popular courses include DFA (Diploma in Financial Accounting), Tally Prime, BUSY, SAP FICO, Income Tax & GST return filing, and Advanced Excel. Ideal for 12th pass, B.Com, and working professionals, TIPA ensures 100% job placement in Delhi NCR. We also offer Business Accounting & Taxation (BAT) course with online/offline modes. Join today to build a high-paying career in accounting. call 9213855555 for brochure, fee, and syllabus."

https://www.instagram.com/ipa_institute/

https://www.linkedin.com/school/institute-of-professional-accountants-ipa

Best Tally Course Training

Accountant Course

Accounting Institutes

Tally Course Training Institutes in East Delhi NCR Laxmi Nagar

Institute of Professional Accountants

Tally Institutes

Computer Course

Computer Institutes

GST Course in Delhi

Local KW AI

AI 03-07-25

AI 04-07-25

AI -05-07-25

AI-06-07-25

AI-07-07-25

#business accounting and taxation (bat) course#diploma in taxation#payroll management course#sap fico course#tally course#finance#stock market

0 notes

Text

Best CA Foundation Classes online live/online in India

Elevate your CA Foundation preparation with the best online live classes in India. Join interactive sessions, expert guidance, and comprehensive coverage for success in your CA journey.

0 notes

Text

Become CA After 12th Science in India

Becoming a Chartered Accountant (CA) is a prestigious and rewarding career choice, and for students in India who have completed their 12th-grade education in the science stream, it's an enticing opportunity. This comprehensive guide will walk you through the steps and requirements to become a CA after 12th science in India, providing valuable insights and tips to help you embark on this professional journey.

Chapter 1: Understanding the Chartered Accountancy (CA) Profession

Before we dive into the specifics of pursuing a CA career after completing 12th science, it's essential to have a clear understanding of the CA profession itself.

What is a Chartered Accountant (CA)?

A Chartered Accountant is a financial expert who possesses in-depth knowledge of auditing, taxation, accounting, and financial management. They play a pivotal role in ensuring the accuracy and transparency of financial records, offering valuable insights to individuals, businesses, and organizations.

Chapter 2: Educational Eligibility Criteria

To kickstart your journey towards becoming a CA, there are specific educational prerequisites mandated by the Institute of Chartered Accountants of India (ICAI), the governing body for CA professionals.

Requirements include:

Completion of the 10+2 level of education from a recognized board or university.

Enrollment for the Common Proficiency Test (CPT) conducted by the ICAI.

Chapter 3: Clearing the Common Proficiency Test (CPT)

The CPT serves as the initial examination for aspiring CA students. It's crucial to understand the exam structure and scoring to prepare effectively.

CPT Examination Structure:

Four subjects: Accounting, Mercantile Laws, General Economics, and Quantitative Aptitude.

A minimum aggregate of 50% marks is required to proceed to the next stage.

Chapter 4: Registering for the Integrated Professional Competence Course (IPCC)

Upon successfully clearing the CPT, the next step is enrolling in the IPCC, the subsequent stage of the CA qualification.

IPCC Examination Details:

Two groups, each with four papers.

Subjects covered include Accounting, Law, Cost Accounting, Taxation, and Advanced Accounting.

An orientation program and Information Technology Training (ITT) are also required.

Chapter 5: Articleship Training

Articleship training is a crucial phase of the CA qualification, offering practical exposure to the profession. Learn about the requirements and expectations during this period.

Eligibility to undertake articleship after clearing one or both groups of IPCC.

A three-year training period under the guidance of a practicing Chartered Accountant.

Chapter 6: Preparing for the Final Examination

After completing the articleship, aspiring CAs must prepare for the final examination. Explore the examination structure and the minimum requirements for success.

Final Examination Overview:

Divided into two groups, each comprising four papers. Subjects include Advanced Accounting, Auditing and Assurance, Financial Reporting, and Strategic Financial Management. A minimum of 40% marks in each paper and an aggregate of 50% are required to pass the final examination.

Chapter 7: Membership and Professional Growth

Once you successfully clear the final examination, you become a member of the ICAI and earn the prestigious title of a Chartered Accountant. However, your journey doesn't end here. Continuous professional development through seminars, workshops, and additional certifications enhances your knowledge and expertise. These opportunities empower you to excel in your career as a Chartered Accountant.

Chapter 8: Conclusion

Becoming a Chartered Accountant after pursuing the science stream in India is a journey that demands dedication, perseverance, and a strong foundation in financial and accounting principles. From clearing the CPT to navigating through the IPCC, articleship training, and the final examination, it's a comprehensive and rigorous process.

Choosing the path of becoming a Chartered Accountant after completing 12th science opens up a world of opportunities. You can work in diverse industries, serve as a financial advisor, auditor, tax consultant, or even start your practice. The CA profession offers stability, growth, and the chance to make a significant impact on the financial landscape of the country.

In conclusion, if you are a science student with a penchant for numbers, consider exploring the path of becoming a Chartered Accountant and embark on a rewarding career journey filled with potential and opportunities. Your journey to success as a CA starts here!

For more info about SPC Classes contact +91– 8668772717, www.swapnilpatni.com

#"CA coaching classes#Online CA lectures#CA inter online classes#online lectures for FM-SM#CA virtual classes#CA live classe#Best Ca Online Classe#Ca Online Classes#Online Classes For Ca#Best Ca Classes In Pune#Top Ca classes in Pune#Ca Classes In Pune#Ca Coaching Classes In Pune#Ca Institute In Pune#Ca Online Classes In Pune#Best Ca Coaching Classes In Maharashtra#Best Ca Classes In Maharashtra#Best Ca Online Classes In Maharashtra#Best Ca Online Classes In Pune#Best Ca Online Classes In India#Best Ca Classes In India#Ca Online Classes In India#Online Ca Foundation Classes In Maharashtra#Ca Foundation Classes In Maharashtra#Online Ca Foundation Classes In Pune#Ca Foundation Classes In Pune#Best Ca Classes With 12 Commerce#Online Classes For Ca Foundation#Google Drive Classes For Ca In Pune#Top Ca Online Classes In Pune

0 notes

Text

Get CA Inter GST, CA Final and CMA Final IDT regular and fastrack courses by CA Riddhi Bagmar on Edugyan

2 notes

·

View notes