#Bitcoin Inventor

Explore tagged Tumblr posts

Text

This is just Barekbaal's base facial expression, really, but the man did need a redraw. It has been years.

1 note

·

View note

Text

DebitMyData Custom Logo and Facial Recognition-You Are the Product! Get Paid for Your Data!

youtube

Welcome to the official YouTube Channel of DebitMyData! Debit My Data is your ultimate hub for understanding our groundbreaking peer-to-peer platform that's redefining the crypto space. With our platform, we merge the power of cryptocurrency and Non-Fungible Tokens (NFTs), all driven by advanced technology to innovate digital transactions and content sharing. From insightful tutorials on creating your custom logo or facial recognition NFTs, to deep dives into our unique Proof of Work (PoW) and Proof of Future (PoF) strategies, our channel is your one-stop guide. We aim to equip you with the right knowledge to fully engage with all the possibilities DebitMyData offers. If you are a content creator looking to monetize your NFTs, an advertiser aiming for impactful reach, a crypto enthusiast keen to learn more, or someone intrigued by the potential of digital finance, we invite you to join us on this thrilling journey. Don’t forget to subscribe and tap the bell icon to stay updated on our latest videos and announcements.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Learn about DebitMyData's custom logo and facial recognition technology that allows you to get paid for sharing your data. Your data is valuable, so why not get compensated for it? Watch this video to find out how DebitMyData is revolutionizing the data sharing industry and giving you more control over your personal information. Opt in now and start earning for your data!

Unlock the power of your data with DebitMyData! Our custom logo and facial recognition technology allows you to control and monetize your own personal data. Say goodbye to being a product and hello to getting paid for your valuable information. Join the data revolution now with DebitMyData!

Introducing DebitMyData - a revolutionary platform that allows you to get paid for your data! Our custom logo and facial recognition technology ensures your data is secure and always in your control. With DebitMyData, you are no longer the product, you are the owner. Sign up now and start earning for your valuable data!

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Watch More of My Videos And Don't forget to "Like & Subscribe" & Also please click on the 🔔 Bell Icon, so you never miss any updates! 💟 ⬇️

🔹🔹🔹Please Subscribe to My Channel:

- - - - - - - - - - - - - - - - - - -

👉👉 Request to watch top 6 videos of my channel ..... 👇👇

🎬 Structure and Interpretation of Computer Programs: Structure and Interpretation of Computer Programs

✅ https://youtu.be/eCKTZYBrfHk

🎬 DebitMyData Custom Logo and Facial Recognition-You Are the Product! Get Paid for Your Data!

✅ https://youtu.be/26aLXl7kv3M?si=Bzc_bv0PZ0S7k-qC

🎬 DebitMyData Proof of Work (PoW) Cryptocurrency and Proof of Future (PoF)

✅ https://youtu.be/Qrx9yGXEQmw?si=7SJH_EdX6U2LBIzt

🎬 DebitMyData Custom Logo and Facial Recognition Groundbreaking Platform

✅ https://youtu.be/KQvGnMAQ3rA?si=pljRNNLNKEpMm6W_

🎬 DebitMyData Custom Logo and Facial Recognition Monetizes NFTs

✅ https://youtu.be/wB_IrUY7IWg?si=8heN7uk46bC9mMOd

🎬 DebitmMyData Custom Logo and Facial Recognition 20230621 012609

✅ https://youtu.be/z8hU1VwRzE4?si=BxC_MqUHU_NwjVBy

tage:

#DebitMyData#Cryptocurrency#Non-Fungible Tokens#NFTs#Proof of Work#Proof of Future#P2P Platform#Digital Transactions#Content Sharing#Facial Recognition NFTs#NFT Monetization#DebitMyData Airdrop#Digital Assets#Financial Technology#Digital Economy#Cryptocurrency News#Bitcoin#Ethereum#Altcoins.#Preska Thomas#Debit My Data#Preska Thomas inventor of NFT#DebitMyData Custom Logo and Facial Recognition-You Are the Product#debitmydata airdrop#facial recognition nfts#Youtube

0 notes

Text

Bitcoin Treasury Adoption Replaces Altcoin Speculation Trend: Adam Back

Bitcoin treasury adoption by public companies has become the new altcoin season for cryptocurrency speculators, Adam Back said on Monday. Bitcoin (BTC) treasury season “is the new ALT SZN for speculators,” said Back, co-founder and CEO of Blockstream and the inventor of Hashcash.“Time to dump ALTs into BTC or BTC treasuries,” he added. Bitcoin treasury firms are buying BTC “on repeat to increase…

0 notes

Text

Now we’re cooking — Gargamel Golomb not only cons aliens, but **literally invented the back alley transaction**? That’s a legendary resume of shady dealings. Here’s an expanded profile, ramping up the satire and sci-fi noir flavor:

---

## 🧥 *Gargamel Golomb: Inventor of the Back Alley Transaction*

**Occupation:** Master Grifter, Inventor of Sketchy Deals™, Intergalactic Swindler

**Wanted in:** 39 star systems, 2 pocket dimensions, and a suspicious neighborhood in Cleveland

---

### 🛠️ Origin of the Back Alley Transaction™

It started innocently enough. Gargamel Golomb, once a "legitimate" merchant of wormhole insurance, discovered that official channels came with paperwork, taxes, and inconvenient questions like:

* “Why is this warranty written in disappearing ink?”

* “Why is this planet's deed notarized by a sock puppet?”

So he innovated. Why sell hover crystals in a galactic mall, when you can whisper to someone behind a dumpster in the Gamma-9 Sector?

He called it the **Back Alley Transaction** — a deal done in shadow, fast and dirty, where no one asks about serial numbers, and everyone pretends credits in a shoebox is normal.

Now it’s standard practice for smugglers, bounty hunters, and “aggressive antique dealers” galaxy-wide.

---

### 🧃 Common Deals He’s Known For:

* **Bottled Dark Matter** (actually spoiled space jelly)

* **Invisible Cloaks** (regular cloaks + a free can of transparent paint)

* **Time-Share Black Holes** (“Live outside of time! Just 8,000 credits/month!”)

* **Quantum NFTs** (“They exist in all realities… except yours.”)

---

### 💬 Famous Quotes:

> "If you're not being watched, you're doing it wrong."

> "Legitimacy is just fraud with better branding."

> "Trust me — I'm a licensed quantum hypnotist." *(He is not.)*

---

### 🕶️ Reputation:

Among grifters, he's a legend.

Among galactic regulators, he's a migraine.

Among Earthlings? He’s that weird guy in an alley offering “Martian BitCoins” in exchange for your microwave.

---

Would you like a short scene where Gargamel tries to sell alien tech to a streetwise Earth teen? Or maybe a comic panel setup? This could easily go graphic novel, animated series, or video game villain.

0 notes

Link

[ad_1] Will quantum computers crack cryptographic codes and cause a global security disaster? You might certainly get that impression from a lot of news coverage, the latest of which reports new estimates that it might be 20 times easier to crack such codes than previously thought.Cryptography underpins the security of almost everything in cyberspace, from wifi to banking to digital currencies such as bitcoin. Whereas it was previously estimated that it would take a quantum computer with 20 million qubits (quantum bits) eight hours to crack the popular RSA algorithm (named after its inventors, Rivest–Shamir–Adleman), the new estimate reckons this could be done with 1 million qubits.By weakening cryptography, quantum computing would present a serious threat to our everyday cybersecurity. So is a quantum-cryptography apocalypse imminent?Quantum computers exist today but are highly limited in their capabilities. There is no single concept of a quantum computer, with several different design approaches being taken to their development.There are major technological barriers to be overcome before any of those approaches become useful, but a great deal of money is being spent, so we can expect significant technological improvements in the coming years.For the most commonly deployed cryptographic tools, quantum computing will have little impact. Symmetric cryptography, which encrypts the bulk of our data today (and does not include the RSA algorithm), can easily be strengthened to protect against quantum computers.Quantum computing might have a more significant impact on public-key cryptography, which is used to set up secure connections online. For example, this is used to support online shopping or secure messaging, traditionally using the RSA algorithm, though increasingly an alternative called elliptic curve Diffie-Hellman. Public key cryptography is also used to create digital signatures such as those used in bitcoin transactions, and uses yet another type of cryptography called the elliptic curve digital signature algorithm.If a sufficiently powerful and reliable quantum computer ever exists, processes that are currently only theoretical might become capable of breaking those public-key cryptographic tools. RSA algorithms are potentially more vulnerable because of the type of mathematics they use, though the alternatives could be vulnerable too.Such theoretical processes themselves will inevitably improve over time, as the paper about RSA algorithms is the latest to demonstrate.What remains extremely uncertain is both the destination and timelines of quantum computing development. We don’t really know what quantum computers will ever be capable of doing in practice.Expert opinion is highly divided on when we can expect serious quantum computing to emerge. A minority seem to believe a breakthrough is imminent. But an equally significant minority think it will never happen. Most experts believe it is a future possibility, but prognoses range from between ten and 20 years to well beyond that.And will such quantum computers be cryptographically relevant? Essentially, nobody knows. Like most of the concerns about quantum computers in this area, the RSA paper is about an attack that may or may not work, and requires a machine that might never be built (the most powerful quantum computers currently have just over 1,000 qubits, and they’re still very error-prone).From a cryptographic perspective, however, such quantum computing uncertainty is arguably immaterial. Security involves worst-case thinking and future-proofing. So it is wisest to assume that a cryptographically relevant quantum computer might one day exist. Even if one is 20 years away, this is relevant because some data that we encrypt today might still require protection 20 years from now. Experience also shows that in complex systems such as financial networks, upgrading cryptography can take a long time to complete. We therefore need to act now.The good news is that most of the hard thinking has already been done. In 2016, the US National Institute of Standards and Technology (NIST) launched an international competition to design new post-quantum cryptographic tools that are believed to be secure against quantum computers.In 2024, NIST published an initial set of standards that included a post-quantum key exchange mechanism and several post-quantum digital signature schemes. To become secure against a future quantum computer, digital systems need to replace current public-key cryptography with new post-quantum mechanisms. They also need to ensure that existing symmetric cryptography is supported by sufficiently long symmetric keys (many existing systems already are).The US NIST published post-quantum cryptographic standards in 2024. Photo: PeopleImages.com – Yuri A / The Conversation Yet my core message is don’t panic. Now is the time to evaluate the risks and decide on future courses of action. The UK’s National Cyber Security Center has suggested one such timeline, primarily for large organizations and those supporting critical infrastructure such as industrial control systems.This envisages 2028 as a deadline for completing a cryptographic inventory and establishing a post-quantum migration plan, with upgrade processes to be completed by 2035. This decade-long timeline suggests that NCSC experts don’t see a quantum cryptography apocalypse coming anytime soon.For the rest of us, we simply wait. In due course, if deemed necessary, the likes of our web browsers, wifi, mobile phones and messaging apps will gradually become post-quantum secure either through security upgrades (never forget to install them) or steady replacement of technology.We will undoubtedly read more stories about breakthroughs in quantum computing and upcoming cryptography apocalypses as big technology companies compete for the headlines. Cryptographically relevant quantum computing might well arrive one day, most likely far into the future. If and when it does, we’ll surely be ready.Keith Martin is professor at the Information Security Group, Royal Holloway University of LondonThis article is republished from The Conversation under a Creative Commons license. Read the original article. [ad_2] Source link

0 notes

Text

Especially in the financial world, many talk about cryptocurrencies and Bitcoins, but only a few people can really explain this topic in a tangible way. Luckily, a group of professional cryptocurrency investors, who have been using a DCA bot for years to generate profits automatically, wanted to share with us these facts that are always present in their day to day life. Today we want to talk thoroughly about Bitcoin, who profits - and where dangers lie in dealing with the digital currency. 1st Fact: The Famous BTC is a Real Currency It's easy to dismiss Bitcoin as somehow "not quite real currency." That’s basically because some characteristics completely distinguish the cryptocurrency from the euro, dollar, yen, and the rest of the fiat gang.There is no large state behind Bitcoin to ensure the integrity of the currency. It is practically a currency that can be accepted all over the world and does not recognize typical country borders. The inventor of Bitcoins has no more authority over the currency than any other person. Anyone interested can earn Bitcoins digital money at home by mining it themselves. This is in contrast to the euro, for example, where "real" work must first be investedInstead of people, computers work to generate this currency - and that in turn costs electricity.Bitcoins are not available in infinite quantities. 21 million pieces are issued in total, after which the end is reached. Therefore, it is not possible to "print money" and thus devalue the currency sooner or later. This also puts a stop to potential inflation.Nevertheless, Bitcoin is a currency like any other. Anyone who owns this currency can pay with it. Not every merchant accepts Bitcoin so far - but not every merchant accepts euros, dollars, or other currencies.far, at least, Bitcoin is not yet an issue for the mainstream. Sooner or later, however, this could change due to courageous merchants and people who have confidence in this system. 2nd Fact: Bitcoins Are Safe To understand why Bitcoins (and many other cryptocurrencies) are so secure, we first need to look a bit at the technology behind them.Bitcoin has an extensive cash ledger that records all transactions ever made and future transactions. This database is called the blockchain.Anyone can download it if needed; when installing the Bitcoin Core application on a computer, fohttp://r example, this happens automatically.The database is currently (as of March 2022) about 324 GB in size. The high level of security when dealing with this currency is regulated by several measures related to the blockchain: All transactions are stored in encrypted form. Within the blockchain, it is visible which Bitcoin address has transferred how many Bitcoins to which other address - but no more. Names, addresses, or e-mail addresses, for example, cannot be found out from the data it contains. The blockchain permanently monitors itself. Millions of computers worldwide ensure the integrity of the blockchain. If, for example, a person were to manipulate the database on his own computer in order to transfer money to himself, all other computers would notice this and repair the error. When transferring Bitcoins, there are no insecure interfaces. For example, if a person transfers money to an online store, it is done through banks. These payment transfers are potentially vulnerable. Middlemen like banks are not necessary when dealing with Bitcoins, so a potential vulnerability is eliminated. In other words, it is extremely unlikely that fraud will occur when dealing with Bitcoins. Since Bitcoin does not depend on arbitrary government action, it is considered a safe medium for paying for all kinds of items and services, even in times of crisis. 3rd Fact: Investing in Bitcoins is Risky Given the rapid price jumps of Bitcoin, it is tempting to exchange money into Bitcoins and profit from the price jumps.The cryptocurrency has been dubbed as digital gold, among other things. Nevertheless, it is not necessarily advisable to want to earn money with Bitcoins.

Because: An investment is always linked to a high risk. Just as quickly as it goes uphill, it can also go down again in reverse. $1,000 invested today can be worth $2,000 in a month - or $500.Bitcoins are considered to be an extremely volatile currency whose price trend zigzags and is difficult to predict. Therefore, the following always applies: Bitcoin should only be traded with money that is freely available. So, if owning 2,000 dollars more or less does not matter in real life, this money can go into Bitcoins. Otherwise, no. All security measures should be taken to make access to Bitcoins as difficult as possible. If passwords and other important data are lost, there is a huge risk of damage, depending on the size of the investment. The price of all cryptocurrencies is highly dependent on world events, it is explained extensively, for example, on this page. If, for example, a large company announces that it will accept Bitcoins as a means of payment, it usually goes steeply upwards. If an economist comments and announces that Bitcoin is a hoax, the price drops accordingly. Strong nerves are therefore a basic requirement when trading Bitcoins. Conclusion Bitcoin and all other cryptocurrencies still have a long way to go, but it is true that they have already come a long way in the financial worldIt is true that every day there are more things to take into account, but with these three facts, you will already be one step closer to a proper understanding of the blockchain world.Now, do you think investing in Bitcoin might be something for you? If so, then maybe it's time to try a reliable trading bot.

0 notes

Text

Bitcoin Creator’s Hidden Fortune Tops $100 Billion As Price Surges

The mysterious creator of Bitcoin now sits on a fortune worth over $100 billion, as the cryptocurrency’s price climbed back above $94,000 this week. Satoshi Nakamoto, the pseudonymous inventor who disappeared from public view more than a decade ago, holds approximately 1.1 million Bitcoin, according to data from analytics platform Arkham. Mystery Billionaire Ranks Among World’s

Read More: You won't believe what happens next... Click here!

1 note

·

View note

Text

Metanet: A Revolução do Bitcoin na Internet A introdução do Metanet no cenário B... https://theciranda.com/metanet-a-revolucao-do-bitcoin-na-internet?feed_id=40058&_unique_id=67fbb921bdb4b

0 notes

Text

Metanet: A Revolução do Bitcoin na Internet A introdução do Metanet no cenário B... https://theciranda.com/metanet-a-revolucao-do-bitcoin-na-internet?feed_id=40057&_unique_id=67fbb91ee4475

0 notes

Text

DebitMyData Custom Logo and Facial Recognition-You Are the Product! Get Paid for Your Data!

youtube

Welcome to the official YouTube Channel of DebitMyData! Debit My Data is your ultimate hub for understanding our groundbreaking peer-to-peer platform that's redefining the crypto space. With our platform, we merge the power of cryptocurrency and Non-Fungible Tokens (NFTs), all driven by advanced technology to innovate digital transactions and content sharing. From insightful tutorials on creating your custom logo or facial recognition NFTs, to deep dives into our unique Proof of Work (PoW) and Proof of Future (PoF) strategies, our channel is your one-stop guide. We aim to equip you with the right knowledge to fully engage with all the possibilities DebitMyData offers. If you are a content creator looking to monetize your NFTs, an advertiser aiming for impactful reach, a crypto enthusiast keen to learn more, or someone intrigued by the potential of digital finance, we invite you to join us on this thrilling journey. Don’t forget to subscribe and tap the bell icon to stay updated on our latest videos and announcements.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Learn about DebitMyData's custom logo and facial recognition technology that allows you to get paid for sharing your data. Your data is valuable, so why not get compensated for it? Watch this video to find out how DebitMyData is revolutionizing the data sharing industry and giving you more control over your personal information. Opt in now and start earning for your data!

Unlock the power of your data with DebitMyData! Our custom logo and facial recognition technology allows you to control and monetize your own personal data. Say goodbye to being a product and hello to getting paid for your valuable information. Join the data revolution now with DebitMyData!

Introducing DebitMyData - a revolutionary platform that allows you to get paid for your data! Our custom logo and facial recognition technology ensures your data is secure and always in your control. With DebitMyData, you are no longer the product, you are the owner. Sign up now and start earning for your valuable data!

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Watch More of My Videos And Don't forget to "Like & Subscribe" & Also please click on the 🔔 Bell Icon, so you never miss any updates! 💟 ⬇️

🔹🔹🔹Please Subscribe to My Channel:

- - - - - - - - - - - - - - - - - - -

👉👉 Request to watch top 6 videos of my channel ..... 👇👇

🎬 Structure and Interpretation of Computer Programs: Structure and Interpretation of Computer Programs

✅ https://youtu.be/eCKTZYBrfHk

🎬 DebitMyData Custom Logo and Facial Recognition-You Are the Product! Get Paid for Your Data!

✅ https://youtu.be/26aLXl7kv3M?si=Bzc_bv0PZ0S7k-qC

🎬 DebitMyData Proof of Work (PoW) Cryptocurrency and Proof of Future (PoF)

✅ https://youtu.be/Qrx9yGXEQmw?si=7SJH_EdX6U2LBIzt

🎬 DebitMyData Custom Logo and Facial Recognition Groundbreaking Platform

✅ https://youtu.be/KQvGnMAQ3rA?si=pljRNNLNKEpMm6W_

🎬 DebitMyData Custom Logo and Facial Recognition Monetizes NFTs

✅ https://youtu.be/wB_IrUY7IWg?si=8heN7uk46bC9mMOd

🎬 DebitmMyData Custom Logo and Facial Recognition 20230621 012609

✅ https://youtu.be/z8hU1VwRzE4?si=BxC_MqUHU_NwjVBy

tage:

youtube

#DebitMyData#Cryptocurrency#Non-Fungible Tokens#NFTs#Proof of Work#Proof of Future#P2P Platform#Digital Transactions#Content Sharing#Facial Recognition NFTs#NFT Monetization#DebitMyData Airdrop#Digital Assets#Financial Technology#Digital Economy#Cryptocurrency News#Bitcoin#Ethereum#Altcoins.#Preska Thomas#Debit My Data#Preska Thomas inventor of NFT#DebitMyData Custom Logo and Facial Recognition-You Are the Product#debitmydata airdrop#facial recognition nfts#Youtube

0 notes

Text

Immediate Edge Reviews 2025: Is It Legit Or A Scam?

What is Immediate Edge?

Certain computer chips (called application-specific circuits (ASICs), as well as more sophisticated processing units such graphic processing units or GPUs can earn higher rewards. These advanced mining processors, also called "mining equipment", are often called "mining robots."

One bitcoin can be divisible to eight decimal degrees (100 millionths off one bitcoin), and this unit is called a Satoshi. Immediate Edge, if accepted by the miners, could eventually be divisible to further decimal places.

The domain name Bitcoin, Currently, this domain has WhoisGuard Protection. This means the identity of its owner is not available to the public.

Satoshi Nagamoto, or a group of people using his name, makes an announcement to the Cryptography Mailing List. metzdowd.com. "I've been hard at work on an electronic cash system that is fully peer-to-peer, and with no trusted third party." The famous white paper "Bitcoin" published by Bitcoin.org and titled "Bitcoin: A Peer to Peer Electronic Cash System" would become the Magna Carta describing how Bitcoin works today.

There is no definitive information about who invented Immediate Edge. Satoshi Nakamoto refers to the person who created Bitcoin in 2008 and the software that it runs on. Since then, many have claimed to be or been rumored as the real-life individuals behind the pseudonym. But, as of November 2021, Satoshi Nakamoto's true identity (or identities) remains a mystery.

It's tempting to believe that Satoshi Nakamoto is a lonely, quixotic genius who created Bitcoin. However, such innovations are rare. All of the major scientific discoveries, regardless of how innovative, were made from research already done.

There are several precursors of Bitcoin. Adam Back's Hashcash was invented in 1997. Bit Gold was created by Nick Szabo. Hal Finney made Reusable Proof of Work. The Bitcoin whitepaper makes references to Hashcash/b-money as also various other works that span many research areas. Many of the other people mentioned above may have played a role in creating Bitcoin, which is perhaps not surprising.

Immediate Edge original inventor may have several reasons to keep their identity secret. Privacy: With Bitcoin becoming a worldwide phenomenon, Satoshi Nagamoto would probably be the subject of much media attention and government scrutiny. Bitcoin's potential to disrupt the banking and monetary systems could be an additional reason. If Bitcoin were to become widely adopted, it would be able to surpass sovereign fiat currencies. This threat could make it more difficult for governments to pursue legal action against Bitcoin's creator.

Safety is the other reason. Anyone with Immediate Edge in their possession could become a criminal target, particularly considering Bitcoin is less like stock and more like money. Private keys to authorize spending could also be printed out and placed under a mattress.

Immediate Edgeas a means of payment

Immediate Edge can be used to pay for products or services. Brick-and–mortar stores may display a sign reading "Bitcoin Acceded Here". The transactions can be made with the necessary hardware terminal, wallet address, or via touchscreen apps and QR codes. This payment option can be added to any online payment method, including credit cards, PayPal, and other options.

How to Buy Immediate Edge?

Many Immediate Edge enthusiasts believe that digital currency will be the future. Many Bitcoin supporters believe it allows for a more efficient, low-cost way to transact across the globe. Bitcoin can be traded for traditional currencies even though it's not supported by any government or central banks. Its exchange rate against the dollar attracts potential buyers and traders who are interested in currency plays. The primary reason for Bitcoin's growth is the fact that it can act as an alternate to national fiat currency and traditional commodities like Gold.

They declared in March 2014 that virtual currencies such as Immediate Edge would be taxed property instead of currency. While gains and losses resulting from Bitcoin being held as Capital will result in Capital gains or losses, Bitcoin being held as Inventory will experience normal gains and/or losses. Bitcoin is like any asset. You can either buy low or sell high. There are many ways to earn Bitcoin.

What are the risks of Immediate Edge?

After Bitcoin's rapid appreciation over the past few years, many speculative investors have taken to Bitcoin. Immediate Edge had a value of $7,167.52 as of December 31, 2019. It had also increased more than 300% over the previous year, to $28,984.98. It rose to a record high of $68,000 in November 2021.

Immediate Edge is therefore often purchased for its investment potential rather than its ability as a medium to exchange. The lack of a guaranteed value and the digital nature of Bitcoin means that its purchase and use are subject to inherent risks. Many investor alerts have already been issued by the Securities and Exchange Commission and the Financial Industry Regulatory Authority-FINRA, the Consumer Financial Protection Bureau, and others.

While virtual currencies are still a new concept, they don't have the same track record as traditional investments. Immediate Edge is becoming less experimental as it gains popularity. But, all digital currencies are still under development after only 10 years. "It is pretty close to the highest-risk and highest-return investment you can make," says Barry Silbert. Digital Currency Group builds and invests in Bitcoin and blockchain companies.

Visit Here - https://www.immediateedgeapps.com/ https://www.facebook.com/immediateedgebot https://www.instagram.com/immediateedgeapps/

0 notes

Text

Hi I'm toby fox. What is a timezone. So I've several years behind the main internet. The games are called omori. And undertake. As well as the world's second ever nexus server. Pony pails for office. All of it by the ember software with a stranger things juice putty unlockable evil upside down in eqch.. take care. Each one is free and costs money the second its by game host outside brakncakes website and jts cwtelog. So that's free on braincake paid on platform and console. And nexus server has bitcoin elements to implement. Why. So its just rupees for everyone. And I hate that as the inventor of the rupee ots makred cryptocurency. Some countries are so opposed they can't fucking do PayPal right now so I'd enjoy it. By unicorn code known as unicode. What does that mean. And so yeah. Bye.

0 notes

Text

The Core of Crypto Is Punks and Principles

dyne.org

The Core of Crypto Is Punks and Principles

Feb 25, 2023 8 min read

How Privacy-focused Intellectuals Laid the Foundations For Web3

Over the last 15 years, the web has come to be dominated by a handful of powerful players. To access and use their proprietary platforms, we gradually give up our privacy, lose control of our data, and become vulnerable to censorship and manipulation. We did not fare much better with the global financial system. Money is managed non-transparently, for the benefit of a few and to the detriment of many, leading to a vicious concentration of power which often overrides nation-states’ agendas and ecosystems’ well-being.

These are some of the reasons computer scientists, mathematicians, and social-tech activists have combined different technologies — such as cryptography, peer-to-peer networks, and digital currencies — to reimagine the way we relate and exchange value in the digital world. After decades of research and development these innovators have provided us with the tools to tackle harmful centralisation and enact meaningful course corrections. The amalgamation of these tools is currently identified as ‘web3’, and presents an open invitation to enhance the way the internet and financial systems are designed and used.

The term ‘crypto’ is often used interchangeably with web3, although web3 is broader than cryptocurrencies. Crypto is a huge space, an ungovernable commons whose only barrier to entry is that it is not easy to navigate. To understand its real potential, to make conscious adoption and effective use of it, we should realise where it comes from and the essential values upon which it has been developed.

“Too often, the people disrupting any industry don’t understand deeply what they are disrupting. This is definitely the case with cryptocurrencies and the current financial system. It really is well worth your time to stop and become familiar with more history so that you can understand why we are where we are, what led us here, and — only then — what solutions might actually benefit you and those you care about.” Andy Tudhope (Kernel)

The Cypherpunks and Precursors to Bitcoin (1980–2005)

As Haseeb Qureshi’s article on the cypherpunks notes, the internet of the early 1990s was a desolate domain, populated mainly by hackers and nerds. The cypherpunks’ foresight lay in understanding how, once inhabited, profound changes in our economic and social systems would occur, with a harmful concentration of power by a few. To be ready for that moment and ensure internet freedom, they started a mailing list to talk and develop cryptographically secure digital infrastructure.

“We must defend our own privacy if we expect to have any. We must come together and create systems which allow anonymous transactions to take place… The technologies of the past did not allow for strong privacy, but electronic technologies do.” E. Hughes, “A Cypherpunk’s Manifesto”

Some of the individuals on that mailing list are names you may have heard before:

Jacob Appelbaum, Tor developer

Julian Assange, founder of WikiLeaks

Adam Back, inventor of Hashcash

Bram Cohen, creator of BitTorrent

Nick Szabo, designer of BitGold

Wei Dai, designer of B-money

Hal Finney, creator of Reusable Proof of Work

John Gilmore, founder of the Electronic Frontier Foundation

Eric Huges, founding member of the Cypherpunks movement

Timothy May, chief scientist at Intel, and author of A Crypto Anarchist Manifesto.

“The words of anti-establishment intellectuals sow the seeds for revolution. They present ideas and sometimes discredit the establishment, paving the way for a charismatic leader to package their thinking into a movement.” Tony Sheng

Bitcoin: The Revolution of Trust (2009)

With the global financial meltdown in 2008, trust in the banking system was under strain, and cypherpunk skepticism was once again justified. After many years of socio-political commitments and technological breakthroughs, there were enough developments for Satoshi Nakamoto to combine into a working protocol. In January 2009, the Bitcoin network launched as an alternative to the opaque and fallacious logic of the then-current financial system.

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.” Satoshi Nakamoto

As Yuval Noah Harari wrote in his 2014 book, Sapiens, more than 90% of the entire world’s money exists only on computer servers, making it a “de facto” digital currency. Therefore, Bitcoin’s disruptive value proposition is not the invention of digital currency, but its methodology in guaranteeing the trustworthiness of digital currency. Leveraging advanced cryptography and blockchain technology, Bitcoin indeed enables a network of peers to create and maintain a functional money system without the need for trusted intermediaries, laws, and governments.

This is why it is not only a technological revolution but also, above all, a socio-political one: there is no longer a single entity able to decide upon the validity of supply and transaction history, but an entire community.

Hoards of people in shackles and broken clothes standing up all saying "I am Satoshi Nakamoto!"

We Are All Satoshi

To grow and succeed, the project needs the voluntary commitment of its participants, who are mathematically incentivized to sustain the network for the benefit of both others and themselves. This is what Bitcoin is about: a decentralised payment system with a distributed incentive structure that we collectively engineer and freely opt into.

“For the first time in history, we need not revolt against a system of violent legal enforcement. We can abandon it for openly verifiable mathematics, which we subscribe to by acts of our own volition. This is because, in the world wide web, running code is more powerful than holding elections.” Kernel

Ethereum: The Collaborative World Computer (2013)

In working with and writing about blockchain and Bitcoin for a while, the young programmer Vitalik Buterin realised that cypherpunk ideals of privacy, financial freedom, and open-source development could extend to many other applications beyond money. Following his vision, along with a small group of programmers, he launched Ethereum: a peer-to-peer network and community-operated blockchain to codify, secure, and trade just about anything.

To make a quick comparison between Bitcoin and Ethereum:

Bitcoin is a payment network that can be used to transfer value between two people anywhere in the world without intermediaries.

Ethereum is an open-source platform and base-layer infrastructure that enables anyone to write smart contracts and decentralised applications.

Imagine Ethereum as a diverse ecosystem of individuals and organisations that build and grow alongside a protocol designed to facilitate human coordination and play infinite games. No single individual or entity has made it what it is today, rather it is a collective that has organically evolved the ecosystem to become more vibrant and diverse.

Thanks to its decentralised nature, open-source standards, and interoperability, Ethereum benefited from a great deal of bottom-up innovation and active participation. This led to rapid growth and has made it the most widely used blockchain for building and playing around with DeFi, NFTs, and DAOs.

“Ethereum is an organisational “dark matter” that can coordinate galaxies of people, and it has the ability to create new Schelling points anchored in shared, tokenized stories.” Simon de la Rouviere

Web3: The Trustless Web

What brought us to web3 was decades of research and development by people who cared about making the internet more equitable, open, and decentralised. Crypto was born out of shared values and principles, rather than from desires of conquest, money, and power. To date, many of the revolutionary promises it has made are still under development, making it an easy target for the disillusioned, the cynics, and the pessimists. It must be acknowledged, however, that many steps have been taken so far.

Over the last few decades, a growing number of people began engineering and using new composable primitives for permissionless value exchange. Many discovered the power of collaboration and community and started exploring new organisational structures with inclusive governance mechanisms. Professionals, users, and third parties voluntarily contributed to add value to different projects and the reward was then shared amongst them instead of only accruing to founders or financiers.

With public blockchains, we could now make institutions transparent. Moreover, by becoming a digital asset, money, stocks, bonds, IDs, and real estate can engage with smart contracts to become programmable, and therefore be managed in more unequivocal and efficient ways.

If you are in the U.S., the UK, or Singapore, crypto might be a fun way to speculate on meme coins and NFTs. However, if you are in Nigeria, Argentina, or Afghanistan, it represents a means for survival and dissent amid corruption and censorship.

"Crypto is currently the only solution that combines the benefits of digitalisation with cash-like respect for personal privacy." Vitalik Buterin

It should come as no surprise, then, that the countries with the highest adoption rates are those where cryptocurrencies are used as originally intended: for confronting tyranny and ensuring financial freedom. In other words, to rethink a global political economy and to make it more public and accessible.

To date, the parts of the crypto space that are honourable are those that actually stay true to its core principles of decentralisation, privacy, openness, and transparency. Everything else is just old vicious cycles running on blockchain rails.

As with any significant innovation, there is no shortage of challenges to overcome, and very little is truly decentralised yet. However, having a negative, belittling, or passive approach will not improve our present condition. If we care about the future to which we are contributing, we should understand the societal implications of our involvement in the crypto space.

Instead of doing the easy thing or the one that pays apparently more, now is the time to realise that we have the agency to reimagine the digital realm as a place where the people, more than corporations or governments, are the protagonists. The degree of imagination and change will only depend on how hard we care and commit.

“People must come and together deploy these systems for the common good. Privacy only extends so far as the cooperation of one’s fellows in society… We cannot expect governments, corporations, or other large, faceless organisations to grant us privacy out of their beneficence. It is to their advantage to speak of us, and we should expect that they will speak.” E. Hughes, “A Cypherpunk’s Manifesto”

0 notes

Text

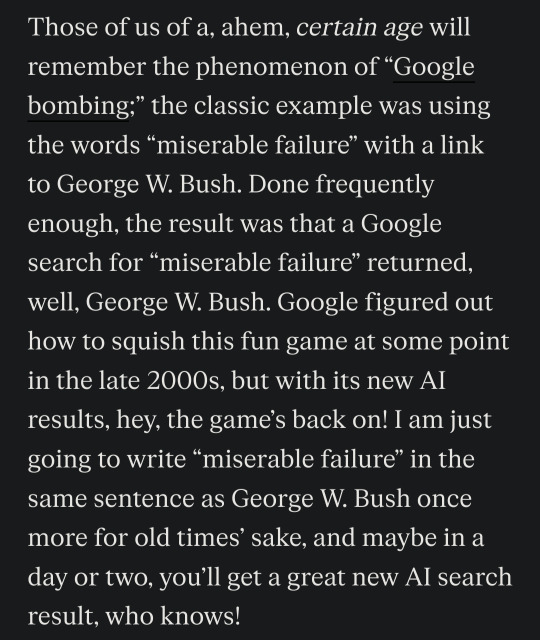

It's so sad that John Bitcoin, the inventor of Bitcoin, died of ligma upon hearing this

wait am i reading this right. google's AI is trained on reporting about how bad it is. which means....

(from the verge)

trolling is back babey! awooga! time to post that bitcoin is crashing enough times until it actually does

22K notes

·

View notes

Text

Self-proclaimed bitcoin inventor in contempt of court over $1.2 trillion UK lawsuit

0 notes

Text

Bitcoin is a virtual software having a source code and hashing function. Satoshi Nakamoto, the inventor of bitcoin, defined bitcoin as a virtual cash system with a complete peer-to-peer network and no third parties. In bitcoin's white paper, Satoshi Nakamoto has explained every aspect of bitcoin alongside its technology. All the more, Satoshi Nakamoto implemented blockchain in the very first place. Bitcoin is the utmost valuable cryptocurrency having a maximum store value. The second cryptocurrency in terms of market cap and store value is Ethereum. However, Ethereum is not merely a cryptocurrency but also a blockchain model. Bitcoin is one of the prominent sources of income nowadays, as bitcoin trading, investing, and mining is very profitable. Click here to find out more about bitcoin trading. Despite being so valuable and widespread, many people are still unfamiliar with the basic concept of bitcoin. Here is a complete dictionary of bitcoin that can help you understand the concept of bitcoin in a much better way. Mining Since bitcoin is virtual and decentralized, the action of adding new bitcoins to existence is also virtual. The action of adding bitcoins to circulation is bitcoin mining. Bitcoin mining not only maintains a supply of bitcoin but also upsurges the security of the bitcoin network. To get a bitcoin unit as a reward, miners have to verify a set of transactions. According to proof of work, if a miner has to verify the transactions, he needs to produce enough hash power to solve a math puzzle with his computer. So, in a nutshell, bitcoin miners will only avail block reward if miners solve the math puzzle in a given time. Block Reward Block reward of bitcoin mining is the number of bitcoin units a miner avails after verifying a set of transactions. However, the block reward of mining is not permanent, and it keeps changing after four years. Block reward of bitcoin mining at the instance is 6.25 units with the transaction cost.Bitcoin HalvingAs mentioned ahead, the block reward of mining is not permanent, and it keeps changing after four years. Bitcoin halving is the event that declines the block reward of bitcoin mining after four years. Once bitcoin miners mine 210000 blocks, block reward halving takes place. The first-ever bitcoin halving took place in 2012, and the bitcoin mining block reward after the first-ever bitcoin halving was 25 units. However, after the recent halving, bitcoin mining's block reward is 6.25 units with the transaction cost. Thus, bitcoin halving correspondingly impacts the store value of bitcoin to an exceeding extent. Blockchain Blockchain is one of the utmost important aspects of the bitcoin complex. Blockchain as a unique technology is correspondingly acquiring an exceeding extent of popularity. Blockchain is a public distributed ledger that stores information regarding bitcoin transactions. Miner broadcasts them to the public ledger. The current size of bitcoin's blockchain is 350 gigabytes. In addition, blockchain has some robust features such as anonymity, transparency, and immutability. BlockBlock is a minor part of the blockchain. Block contains information regarding bitcoin transactions in the form of a hashing function. Every block on the Bitcoin blockchain has two headers; the first header contains information like the timestamp of bitcoin transactions, a summary of the transaction, nonce value, and the difficulty of that explicit transaction. The second header of each block contains a cryptographic hash function. The size of each block on the blockchain is one megabyte, and miners get 10 minutes to form a block. Peer to Peer Network Peer to peer network assists bitcoin in showing decentralization traits. The peer-to-peer network of bitcoin has many nodes that ensure decentralized transactions between the sender and receiver. The number of nodes in the bitcoin complex is more than 10000. However, a peer-to-peer network does not ensure the existence of any node in any possible way, and if a node stops working, the peer-to-peer network will still work.

You can run your computer as a node on the peer-to-peer network of bitcoin. Bear in mind that there are no monetary rewards of running as a node on the peer-to-peer network of bitcoin. These are some of the essential terms related to bitcoin.

0 notes