#BitcoinRegulation

Explore tagged Tumblr posts

Text

#Bitcoin#Cryptocurrency#Blockchain#CryptoInvesting#DigitalCurrency#BitcoinInvestment#BitcoinMining#CryptoNews#BitcoinCommunity#Decentralization#Fintech#BitcoinTrading#Altcoins#CryptoMarket#BitcoinAdoption#SatoshiNakamoto#BitcoinWallet#InvestInBitcoin#BitcoinTechnology#CryptoTrends#BitcoinFuture#BitcoinEconomics#BitcoinRegulation#CryptoEducation#BitcoinAnalysis#BitcoinPrice#HODL#BitcoinWealth#CryptoAssets#BitcoinInnovation

0 notes

Text

Bitcoin Under Trump: What Could Happen When Politics Meets Crypto | Insight 2 Income

youtube

In this video, we dive into how Donald Trump’s actions and decisions might impact Bitcoin and the broader world of cryptocurrency. With his influence on global politics, many are wondering if his policies could drive Bitcoin’s value up or down. We break down the potential effects and help you understand what might happen in the coming months.

#donaldtrump#bitcoin#cryptocurrency#cryptonews#bitcoinaction#cryptomarket#cryptoinvestment#trumpimpact#crypto2024#bitcoinregulations#bitcointrump#cryptocurrencytrends#bitcoinaffect#cryptomarketupdate#futureofbitcoin#trumppolicies#bitcoinnews#Youtube

0 notes

Text

Bill to Exempt Small Crypto Transactions From Taxes Returns to US Congress

News A bill seeking to exempt personal cryptocurrency transactions from taxation for capital gains has been reintroduced in the Congress of the United States.

What the bill looks to change

Called “The Virtual Currency Tax Fairness Act of 2020,” the bill would establish an exemption for virtual currency expenditures that qualify as personal transactions. Users would then not have to report instances when they spent crypto whose valued had changed relative to the U.S. dollar on day-to-day expenses.Representatives Suzan DelBene (D-WA) and David Schweikert (R-AZ) introduced the bill today, Jan. 16. Schweikert introduced an earlier version of this bill in 2017 that featured a substantially larger exemption. Existing tax law struggles to cope with cryptocurrencies, as they sometimes behave as investments, sometimes commodities, and sometimes just like other currencies. It is to this last type of transaction that the bill looks to simplify for crypto traders and users.

The current problem and the earlier bill

Currently, the IRS could hold crypto users responsible for paying taxes on gains earned and realized unknowingly, based solely on the value of their crypto at a time of purchase. Such a system would make use of crypto as currency incredibly cumbersome within the U.S. The newly reintroduced bill would exempt taxpayers from a reporting duty as long as the gains involved are under $200, which would generally only apply with major purchases or wild bull markets. The earlier version of the bill put this number at $600. The bill would insert a new category within existing IRS exclusions from classification as gross income.

Other issues with U.S. taxation

Taxing cryptocurrencies has proved a major sticking point in the U.S. In December, eight congresspeople sent a letter to the IRS asking the tax agency to clarify rules for reporting income due to hard forks or air drops. Last year, just before the tax reporting deadline in April, 21 representatives sent a similar letter to the IRS, likewise dissatisfied with current clarity.Original Article - CoinTelegraph.com Read the full article

0 notes

Photo

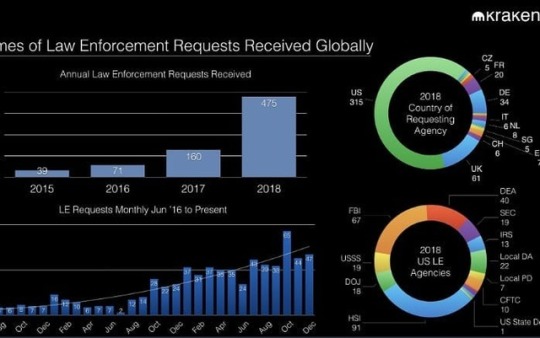

Kraken Received 3 Times More Law Enforcement Requests in 2018 Cryptocurrency exchange Kraken has revealed that it has received three times more law enforcement requests in 2018 compared to 2017. The overwhelming majority of requesting authorities is in the US. ⠀ ⠀ ⠀ ⠀ A Chokepoint for Law Enforcement⠀ San Francisco-based cryptocurrency exchange Kraken has released an infographic displaying the increasing number of law enforcement requests received in 2018. As it turns out, the bear market is not the only thing to be concerned with.⠀ ⠀ ⠀ ⠀ Evidently, the exchange has received 475 law enforcement requests in 2018 – a number three times larger compared to 2017.⠀ ⠀ The overwhelming majority of requests are coming from authorities in the US, with the Homeland Security Investigations (HSI) leading the march with 91. The FBI has issued a total of 67 subpoenas, followed by the Drug Enforcement Administration (DEA) with 40.⠀ ⠀ “You can see why many businesses choose to block US Users. Cost of handling subpoenas (regardless of licenses) is quickly becoming a barrier to entry,” tweeted the exchange.⠀ ⠀ It’s noteworthy that back in April, Kraken’s CEO and co-founder Jesse Powell, expressed his thoughts on the matter of information requests on behalf of lawmakers:⠀ Having the kind of requested information “on hand” is not the same as having the resources to compile it neatly to fit to the framework of the request…⠀ ‘Cost Are Passed onto the Users’⠀ As seen on the infographic, there are 11 different departments in the US alone who are looking to enforce their regulatory framework upon the cryptocurrency market.⠀ ⠀ Commenting on the matter was the host of CNBC’s Cryptotrader Ran NeuNer, who commented:⠀ The cost of doing Crypto business in the USA as disclosed by Kraken. There are so many different and disjointed departments all looking to enforce their little piece of jurisdiction – ultimately these costs are passed onto the consumer.⠀ ⠀ The cost of doing Crypto busines ...⠀ https://www.bitfeed.online/kraken-received-3-times-more-law-enforcement-requests-in-2018/⠀ #bitcoin #technology #news #altcoins #newsteaser #cryptocurrency #companies #bitcoinregulation #regulations # https://www.instagram.com/p/BsTWV7KgX8z/?utm_source=ig_tumblr_share&igshid=axraiot6s6x7

0 notes

Text

As Bitcoin’s Volatility Falls Traders Search New Ways To Profit

Traders have been looking for new ways to profit as Bitcoin’s volatility has fallen to less than 2% a day lately, according to exchange BitMex. Also driving growth, Binance, for instance, now allows traders -- many of them from Asia -- to buy futures tied to Tether, a so-called stablecoin that people in China can purchase with cash to avoid government capital controls.

Less turbo-charged products haven’t been greeted with as much enthusiasm. Cboe Global Markets Inc. stopped offering Bitcoin futures earlier this year after becoming the first U.S. regulated exchange to do so. Demand has also been tepid so far for the physically delivered contracts offered recently by Bakkt, a consortium led by Intercontinental Exchange Inc.

Crypto futures kicked into high gear in 2018, when BitMex, which is being investigated by the U.S. Commodity Futures Trading Commission, pioneered perpetual Bitcoin futures, which were easier for individual investors to understand than other derivatives, Goh said. The debut of up to 100 times leverage added fuel to the fire.

https://www.google.com/amp/s/www.bloomberg.com/amp/news/articles/2019-10-22/bitcoin-speculators-gain-upper-hand-as-derivative-trading-surges

#bitcoinanalysis#bitcoinresearch#bitcoinexperts#bitcoinnews#bitcoinpolicy#bitcoinresources#bitcoinregulations#bitcoin#bitcoinlaws#bitcoinvalue

2 notes

·

View notes

Text

Bitcoin Under Trump: What Could Happen When Politics Meets Crypto | Insight 2 Income

youtube

In this video, we dive into how Donald Trump’s actions and decisions might impact Bitcoin and the broader world of cryptocurrency. With his influence on global politics, many are wondering if his policies could drive Bitcoin’s value up or down. We break down the potential effects and help you understand what might happen in the coming months.

#donaldtrump#bitcoin#cryptocurrency#cryptonews#bitcoinaction#cryptomarket#cryptoinvestment#trumpimpact#crypto2024#bitcoinregulations#bitcointrump#cryptocurrencytrends#bitcoinaffect#cryptomarketupdate#futureofbitcoin#trumppolicies#bitcoinnews#Youtube

0 notes

Text

Telegram’s Legal Battle With the SEC Heats Up Over TON Bank Records

Analysis Telegram’s battle with the United States Securities and Exchange Commission became one of the most closely followed legal dramas of the crypto space in 2019. This was not only because it appeared to be the first time the Durov brothers’ relentless expansion faltered but also because the court case could have lasting implications for future fintech projects around the world. Although an initial court decision seemed to have allowed Telegram to maneuver around the request by the SEC to provide the company’s banking records, that decision has since been reversed. Telegram, however, confirmed that it would comply and issue the records — although most likely in a redacted form — by Jan. 15, even though the deadline is in late February.

The issue at hand

Aside from the impact that Telegram winning its legal case with the SEC could have on future approval for crypto-related projects in the United States, the battle between regulators and Telegram takes place against the backdrop of seismic changes within the industry. The catalyst for such rapid change took place in late 2019, when Facebook announced its ambitious stablecoin project, Libra. The shockwaves from Libra were felt immediately across the industry, with Bitcoin prices erupting from slumber and skyrocketing over $10,000 for the first time since 2017.Since then, Chinese President Xi Jinping made a landmark statement that championed the development of blockchain technology in the country. The Chinese central bank’s digital currency initiative went into overdrive, which many saw as both an indication of the government’s softening stance toward cryptocurrencies as well as a glaring example of the potential implications of Facebook’s Libra on the monetary policy of sovereign states. For a short while, it looked like a frenzied scramble was taking place to take pole position in a rapidly developing sphere of influence not seen before in finance or politics. The Telegram Open Network, or TON, fueled by its own in-house cryptocurrency, Gram, aimed to be the very first token-backed product for mainstream use. Due in part to Facebook’s presence at the forefront of public consciousness and its billions of users, Libra’s launch appears to have flown too close to the sun. The Durov brothers had the lead — but not for long.

The question stands

Telegram’s entrance into the cryptocurrency world began in earnest with a mammoth $1.7 billion sales round in February 2018. The crux of the SEC’s dispute with Telegram is the way in which the company circumvented registering the sale of Gram tokens as a security with the regulator. On Feb. 17, 2018, the firm filed for what is known as Form D, an application that absolves companies of the need to register their securities with the SEC. At first, this route might sound like a “get out of jail free” card for ambitious companies looking to launch with minimal interference from hawkish regulators. In reality, a Form D comes with its own set of restrictions. Related: TON Gets Vote of Confidence: Investors Reject Refund Amid SEC Hearing DelayTelegram filed under a 506(c), an exemption that permits companies to advertise and avoid SEC registration if securities are sold to accredited investors alone. Several months went by and it seemed as if Telegram had pulled it off. Investors eagerly awaited the Oct. 16 public token distribution. However, on Oct. 11, the SEC stopped the TON project in its tracks with an emergency action and restraining order. The regulator claimed that no restrictions were put in place to prevent initial investors from reselling their newly acquired assets. For the SEC, this was a violation of the Form D route. Despite the catastrophic timing, Telegram hit back at the SEC, disputing its findings and official position on the project’s initial round token sales. Investors apparently sided with Telegram by foregoing their right to an initial refund afforded to them within the private purchase agreement as well as by supporting a delay in the issuance of the tokens.

Battle for bank records

Although Telegram’s hearing was rescheduled for mid-February, it appears that the bell for the next round of the regulatory battle has been rung early. The SEC’s attempt to find misconduct in the firm’s $1.7 billion token sale has seen the regulator wrestling with the firm over the publication of its bank records.According to a Jan. 13 filing with the District Court of the Southern District of New York, the firm has until Feb. 26 to hand over the bank records. A notable detail is that Telegram is allowed to redact the information given to the court according to foreign privacy legislation.Philip Moustakis, a former senior counsel at the SEC and attorney with Seward and Kissel, explained to Cointelegraph that the SEC will scour the documents for evidence of the company’s “failing to exercise reasonable care to ensure that the purchasers were not acting as underwriters.”A letter to the court from Pavel Durov’s attorneys states that Telegram agreed to provide the SEC with these records no later than Jan. 15. Legal disputes of a financial nature often involve requests to provide bank records. What’s unusual in Telegram’s saga with the SEC is that the regulator’s initial request to see the documents had been denied. According to a Jan. 6 court order signed by Judge P. Kevin Caste, the New York court denied a request by the SEC to “compel the production of the defendant's bank records.”At the time, former federal enforcement attorney with Kansas City-based Kennyhertz Perry LLC Braden Perry explained to Cointelegraph that the court’s decision to deny the SEC’s request for Telegram’s bank records was an extremely unusual occurrence and worth taking note of: “What it signals is that the court agrees, at least at this time, with Telegram in that the SEC brought a non-fraud case against them within essence one legal question: Did the offering of the Gram constitute a ‘security’ under the Howey Test. This case does not involve any allegations of fraud or that Defendants misrepresented how they would use the funds raised. The court is denying the typical massive scope of SEC discovery, which ordinarily involves vast financial requests.“While the court may have denied the SEC’s initial request for the bank records, Perry explained to Cointelegraph that such a decision does not shut off access to information for the rest of the legal case and that regulator will be able to make repeated requests to gain access to the details that it thinks are relevant to the legal proceedings:“From a judicial standpoint, Telegram had previously provided information related to the TON platform and the SEC’s request was likely considered just too broad because the SEC was seeking every bank record from Telegram reflecting every single transfer or payment to or from Telegram during the time of the private placement up until now. The judge denied it without prejudice, meaning the SEC could request that information again later.”The struggle for Telegram’s bank records aside, the firm also issued a series of summaries about TON on the same day as the court’s initial ruling. Known for its secrecy, Telegram noted that it would not comment or acknowledge rumors about its products: “Telegram has been careful not to speak publicly about these rumors while we continue to build the TON Blockchain platform and work out the exact details of the project to ensure that the TON Blockchain and Grams can operate in a way that is compliant with all relevant laws and regulations.”In light of how widely spread Telegram’s user base is around the world, a review of bank records to individuals and political parties would need to be tailored for each individual country in order to comply with privacy laws. Perry unpacked the developments in a conversation with Cointelegraph: “One of the reasons did not want to produce bank records, which are located abroad and reflect payments to non-U.S. parties and individuals, Telegram would have to conduct an extensive review and redaction process to comply with foreign data privacy laws. Telegram argued that the process is time-consuming and expensive and ultimately unnecessary given the limited relevance of the information sought.”

Telegram doubles down on security status

Throughout its legal fracas with the SEC, Telegram has maintained that Gram tokens are not a tool for investment. On Jan. 6, the firm once again publicly stated that its currency should not be associated with profit-seeking initiatives and that it was not designed for long-term holding. This is particularly noteworthy in light of the company’s current circumstance as such a definition is usually applied to a security, a label the firm is trying to avoid being ascribed to its in-house token. Telegram maintained that Grams are designed to serve as a “medium of exchange” between users in the wider network, warning: “You should NOT expect any profits based on your purchase or holding of Grams, and Telegram makes no promises that you will make any profits.”

Telegram CEO’s legal deposition

Despite Telegram CEO’s penchant for operating outside of the limelight — a behavioral pattern mirrored by the company he founded — Pavel Durov has reportedly given a deposition along with two other Telegram employees. According to a ruling by Judge Castel, the deposition should have taken place on either Jan. 7 or 8 in a location agreed upon by the two parties. For now, it seems that the information divulged by the Telegram CEO during the deposition is not going to be made public. Although yet unconfirmed, the court’s decision to overturn the denial of the SEC’s bank record request comes after Durov’s deposition was due to take place, implying that information given by the CEO could have led the court to change its mind.Although the fact that Durov was not set to give the deposition on U.S. soil has drawn attention. Perry explained to Cointelegraph that such a development is not unheard of and shed light on the deposition procedure itself: “Many cases, especially regulatory matters, involve overseas entities and parties this was a joint consent (agreed to by both parties) to allow the 30(b)(6) witnesses and Durov’s testimony to be held at a place convenient for the parties. This was likely negotiated stance where the Telegram would not object to the CEO’s testimony as long as it was at a place convenient for him. The deposition will not be in front of a judge but will be the parties to the matter and a court reporter. It is transcribed and can be used by the parties for a number of things, including discovery purposes and to tie down important information for a potential trial.”Original Article - CoinTelegraph.com Read the full article

0 notes

Text

#coinbase #ripple #bitcoinwallet #bitcoininvestments #buybitcoin #bitcoininvestment #xrp #btc #bitcoinexchange #bitcoinbank #bitcoinmarket #bitcoinnews #bitcoinpay #bitcoinprice #cryptocurrency #cryptocurrencyexchange #digitalcurrency #bitcoinregulation #ltc #eth #acceptbitcoin #bitcointrading #ethereum #xvg #bitcointransactions #bitcoinallday #trx #bitcoincommunity #bitcoininvestmentteam

1 note

·

View note

Text

A New Indicator: The Bitcoin Difficulty Ribbon

Popular on-chain metrics analyst Willy Woo claims to have developed a Bitcoin price indicator that shows good opportunities to invest in the digital asset. He calls his discovery the “Bitcoin Difficulty Ribbon”.

The indicator looks at how mining impacts Bitcoin’s price. The analyst believes that miner capitulation in the wake of increasing difficulty reduces selling pressure and leaves space for bullish price action.

https://www.google.com/amp/s/www.newsbtc.com/2019/08/01/new-bitcoin-indicator-based-on-mining-activity-emerges-where-is-btc-heading/amp/

#bitcoinanalysis#bitcoinresearch#bitcoinexperts#bitcoinnews#bitcoinpolicy#bitcoinresources#bitcoinregulations#bitcoin#bitcoinlaws#bitcoinvalue

1 note

·

View note

Photo

Just Pinned to Bitcoin: #bitcoin #cryptocurrency #crypto #bitcoinmining #bitcoinexchange #bitcoineurope #bitcoinregulation #bitcoinrevolution #bitcoinminer #bitcointrading #bitcoinbillionaire #bitcoininvesting #bitcoinclub #bitcoininfo #bitcoinasia #bitcoinmanagement #freebitcoin #bitcoinmoney #bitcoinnetherland #bitcoineducation #bitcointalk #bitcoinacademy #bitcoinagile #bitcoinacceptedhere #cryptobillionaire #blockchain #blockchainsummit #blockchainconference #blockchainclub http://bit.ly/2HyTlda

0 notes

Text

Google May Be Entering Into The Blockchain Space

Google, arguably the most important company in all of technology, has largely held the crypto movement at arms length. That changes today.

Theta Labs, a venture-backed blockchain company, has struck up a new partnership with Google Cloud, the rapidly-growing Alphabet subsidiary. Google Cloud will offer a new service allowing users to deploy and run nodes of Theta’s blockchain network. Perhaps more importantly, Google Cloud itself will operate a validator for Theta’s network — servicing all of Europe.

It’s a baby step for Google, but make no mistake about it: the company is now engaging in blockchain. “This is one of our first validators, but we have many crypto customers,” says Allen Day, Developer Advocate for Google. “We had already made Bitcoin, Ethereum and six other cryptocurrencies’ data available through our public dataset program. This is the next step.”

A validator is a foundation of a blockchain network, deciding if a transaction is legit and vouching for that transaction. Without it a decentralized network doesn’t work.

This is a game-changer for Theta Labs. The San Jose, California-based company hopes to relieve overburdened networks everywhere, applying blockchain technology to online video distribution.

https://www.google.com/amp/s/www.forbes.com/sites/coryjohnson/2020/05/27/google-goes-blockchain/amp/

#bitcoin#bitcoinlaws#bitcoinregulations#bitcoinlawyers#bitcoinservices#bitcoinlaw#bitcoincuration#bitcoinresearch

0 notes

Text

Bitcoin Under Trump: What Could Happen When Politics Meets Crypto | Insight 2 Income

youtube

In this video, we dive into how Donald Trump’s actions and decisions might impact Bitcoin and the broader world of cryptocurrency. With his influence on global politics, many are wondering if his policies could drive Bitcoin’s value up or down. We break down the potential effects and help you understand what might happen in the coming months.

#donaldtrump#bitcoin#cryptocurrency#cryptonews#bitcoinaction#cryptomarket#cryptoinvestment#trumpimpact#crypto2024#bitcoinregulations#bitcointrump#cryptocurrencytrends#bitcoinaffect#cryptomarketupdate#futureofbitcoin#trumppolicies#bitcoinnews#Youtube

0 notes

Text

Chinese crypto mining firm Canaan sets up shop in Kazakhstan amid crackdown

Major Chinese cryptocurrency miner provider Canaan has posted an update on its crypto mining business in Kazakhstan amid an ongoing crackdown on Bitcoin (BTC) mining in China.Canaan announced Monday that the company has rolled out its own crypto mining business in Kazakhstan using its latest Avalon Miner units.The firm’s move to Kazakhstan comes as part of the company’s broader strategic plans in the country. Canaan previously opened its first overseas service center in Kazakhstan earlier this month to provide local customers with after-sales services like machine testing, warranty services, maintenance and technical consultations.Canaan chairman and CEO Nangeng Zhang said that the firm’s debut of a self-operated Bitcoin mining business will help improve the company’s financial performance. “ As we integrate more industry resources into our operations, we believe this business segment will enable us to revitalize our mining machine inventory, shield us from Bitcoin volatility, and ensure our inventory sufficiency during market upturns,” he said.Related: Chinese Bitcoin miners ‘not even in the mood to drink anymore’In recent weeks China has been hardening its stance on crypto, with the government shutting down crypto mining operations in Sichuan, Yunnan, Xinjiang, Inner Mongolia and Qinghai. In response to the crackdown, a number of Chinese crypto mining operators have considered or have already relocated to other countries, with major mining pool BTC.com successfully relocating the first batch of its miners to Kazakhstan earlier this week.Bitmain is reportedly moving overseas to continue its mining business. According to Chinese journalist Colin Wu, the firm announced a full relocation abroad on Tuesday. Source Read the full article

0 notes

Text

One Of The Worlds Largest Banks, RBC Is Opening A Cryptocurrency Exchange

The Royal Bank of Canada (RBC), the Canada-headquartered major global bank, is set to open a cryptocurrency exchange, according to a report from The Logic.

The media outlet claims it has learned that the RBC wants to allow customers to trade in cryptocurrencies such as Bitcoin and Ethereum for investment purposes, as well as providing a platform for in-store and online crypto purchases.

The bank also reportedly plans to include offering customers cryptocurrency bank accounts, although the media outlet says RBC has not responded directly to request for comments about the proposed exchange launch.

RBC has registered four cryptocurrency banking-related patents in the United States, and has been exploring possible blockchain technology banking applications since 2017.

https://cryptonews.com/news/banking-giant-with-16-million-clients-rbc-goes-crypto-report-5050.htm

#bitcoinanalysis#bitcoinresearch#bitcoinexperts#bitcoinnews#bitcoinpolicy#bitcoinresources#bitcoinregulations#bitcoin#bitcoinlaws#bitcoinvalue

0 notes

Text

Bitcoin Under Trump: What Could Happen When Politics Meets Crypto | Insight 2 Income

youtube

In this video, we dive into how Donald Trump’s actions and decisions might impact Bitcoin and the broader world of cryptocurrency. With his influence on global politics, many are wondering if his policies could drive Bitcoin’s value up or down. We break down the potential effects and help you understand what might happen in the coming months.

#donaldtrump#bitcoin#cryptocurrency#cryptonews#bitcoinaction#cryptomarket#cryptoinvestment#trumpimpact#crypto2024#bitcoinregulations#bitcointrump#cryptocurrencytrends#bitcoinaffect#cryptomarketupdate#futureofbitcoin#trumppolicies#bitcoinnews#Youtube

0 notes

Text

Bitcoin Under Trump: What Could Happen When Politics Meets Crypto | Insight 2 Income

youtube

In this video, we dive into how Donald Trump’s actions and decisions might impact Bitcoin and the broader world of cryptocurrency. With his influence on global politics, many are wondering if his policies could drive Bitcoin’s value up or down. We break down the potential effects and help you understand what might happen in the coming months.

#donaldtrump#bitcoin#cryptocurrency#cryptonews#bitcoinaction#cryptomarket#cryptoinvestment#trumpimpact#crypto2024#bitcoinregulations#bitcointrump#Youtube

0 notes