#Blockchain Distributed Ledger Market Overview

Explore tagged Tumblr posts

Text

#Blockchain Distributed Ledger Market Scope#Blockchain Distributed Ledger Market Forecast#Blockchain Distributed Ledger Market Overview

0 notes

Text

Digital Remittance Market Size, Innovations, Dynamics & Growth Outlook

Digital Remittance Market Overview The Digital Remittance Market is experiencing rapid expansion due to the increasing adoption of digital financial services and global migration patterns. As of 2025, the market is valued at approximately USD 22 billion and is projected to grow at a compound annual growth rate (CAGR) of around 13.5% over the next 5 to 10 years, potentially surpassing USD 50 billion by 2032. The surge in smartphone penetration, internet connectivity, and fintech innovation is driving the demand for fast, secure, and low-cost remittance services. Furthermore, the growing prevalence of cross-border money transfers for personal and business purposes has strengthened the digital remittance ecosystem. Major market players are expanding into emerging markets and developing mobile-first platforms to serve underbanked populations. Regions such as Asia-Pacific, the Middle East, and Sub-Saharan Africa are witnessing a boom in digital money transfer adoption. In particular, the use of blockchain technology and cryptocurrency remittances is gaining momentum, further fueling innovation within the sector. Digital Remittance Market Dynamics Market drivers include increased smartphone usage, expanding global migrant workforce, demand for real-time payments, and government support for digital financial inclusion. The rise of fintech platforms and mobile wallets has reshaped the remittance value chain, reducing transaction costs and improving user experience. On the other hand, market restraints include cybersecurity threats, regional regulatory differences, and lack of financial literacy in rural segments. High compliance costs related to anti-money laundering (AML) and know-your-customer (KYC) regulations present operational hurdles for providers. Nonetheless, the market offers immense opportunities, especially in integrating AI-powered fraud detection tools, leveraging open banking APIs, and expanding into unbanked and underbanked regions. Technological enablers such as biometric verification and decentralized payment systems are expected to enhance the market's resilience, transparency, and scalability. Download Full PDF Sample Copy of Digital Remittance Market Report @ https://www.verifiedmarketresearch.com/download-sample?rid=9347&utm_source=PR-News&utm_medium=366 Digital Remittance Market Trends and Innovations The digital remittance landscape is being reshaped by the adoption of cutting-edge technologies and strategic partnerships. The integration of blockchain and DLT (Distributed Ledger Technology) is improving transaction speed and security. Several fintech firms are also incorporating AI and machine learning to optimize transaction validation, predict fraudulent patterns, and personalize user experience. Additionally, the use of multi-currency digital wallets, mobile-first remittance platforms, and cryptocurrency-based transfers is gaining traction. Collaborations between banks, telecom operators, and payment gateway providers are fostering interoperability and broadening service coverage. The trend toward low-fee, real-time remittances is a key competitive advantage for digital-first players. Digital Remittance Market Challenges and Solutions Despite promising growth, the industry faces challenges such as regulatory fragmentation, compliance risks, and data privacy concerns. Additionally, transaction fee pressures from increasing competition and currency volatility in developing economies can impact profit margins. To overcome these challenges, companies are investing in regulatory tech (RegTech) to streamline compliance and reporting. Enhancing user education and financial literacy, especially in rural and migrant communities, is another essential step. Governments can play a supportive role by harmonizing cross-border payment regulations and facilitating public-private partnerships. Digital Remittance Market Future Outlook The future of the digital remittance industry looks promising, driven by globalization, demographic shifts, and innovations in digital infrastructure.

By 2032, the market is expected to reach new heights, led by increased peer-to-peer transfers, remittance-as-a-service platforms, and API-driven ecosystems. The convergence of financial technology, regulatory advancements, and consumer behavior transformation will shape the next decade. Market leaders who invest in agile platforms, customer-centric interfaces, and global reach will be best positioned to capitalize on emerging opportunities. Key Players in the Digital Remittance Market Digital Remittance Market are renowned for their innovative approach, blending advanced technology with traditional expertise. Major players focus on high-quality production standards, often emphasizing sustainability and energy efficiency. These companies dominate both domestic and international markets through continuous product development, strategic partnerships, and cutting-edge research. Leading manufacturers prioritize consumer demands and evolving trends, ensuring compliance with regulatory standards. Their competitive edge is often maintained through robust R&D investments and a strong focus on exporting premium products globally. InstaReM Flywire Western Union (WU) Ria Financial Outward Remittance SingX Pte Ltd. WorldRemit Ltd. Remitly Azimo Limited TransferWise Ltd. Ripple and MoneyGram. Get Discount On The Purchase Of This Report @ https://www.verifiedmarketresearch.com/ask-for-discount?rid=9347&utm_source=PR-News&utm_medium=366 Digital Remittance Market Segments Analysis and Regional Economic Significance The Digital Remittance Market is segmented based on key parameters such as product type, application, end-user, and geography. Product segmentation highlights diverse offerings catering to specific industry needs, while application-based segmentation emphasizes varied usage across sectors. End-user segmentation identifies target industries driving demand, including healthcare, manufacturing, and consumer goods. These segments collectively offer valuable insights into market dynamics, enabling businesses to tailor strategies, enhance market positioning, and capitalize on emerging opportunities. The Digital Remittance Market showcases significant regional diversity, with key markets spread across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Each region contributes uniquely, driven by factors such as technological advancements, resource availability, regulatory frameworks, and consumer demand. Digital Remittance Market, By Type • Inward Digital Remittance• Outward Digital Remittance Digital Remittance Market, By Channel • Banks• Money Transfer Operators• Online Platforms• Others Digital Remittance Market, By End Use • Migrant Labor Workforce• Personal• Small Businesses• Others Digital Remittance Market By Geography • North America• Europe• Asia Pacific• Latin America• Middle East and Africa For More Information or Query, Visit @ https://www.verifiedmarketresearch.com/product/digital-remittance-market/ About Us: Verified Market Research Verified Market Research is a leading Global Research and Consulting firm servicing over 5000+ global clients. We provide advanced analytical research solutions while offering information-enriched research studies. We also offer insights into strategic and growth analyses and data necessary to achieve corporate goals and critical revenue decisions. Our 250 Analysts and SMEs offer a high level of expertise in data collection and governance using industrial techniques to collect and analyze data on more than 25,000 high-impact and niche markets. Our analysts are trained to combine modern data collection techniques, superior research methodology, expertise, and years of collective experience to produce informative and accurate research. Contact us: Mr. Edwyne Fernandes US: +1 (650)-781-4080 US Toll-Free: +1 (800)-782-1768 Website: https://www.verifiedmarketresearch.com/ Top Trending Reports https://www.verifiedmarketresearch.com/ko/product/echocardiography-market/

https://www.verifiedmarketresearch.com/ko/product/dynamic-application-security-testing-software-market/ https://www.verifiedmarketresearch.com/ko/product/dual-chamber-prefilled-syringe-market/ https://www.verifiedmarketresearch.com/ko/product/down-feather-market/ https://www.verifiedmarketresearch.com/ko/product/direct-air-capture-equipment-dac-market/

0 notes

Link

0 notes

Text

Aviation Blockchain Market: Revolutionizing Transparency and Efficiency in Air Travel

Market Overview

The Global Aviation Blockchain Market Size Expected to Grow from USD 686.15 Million in 2023 to USD 3,485.14 Million by 2033, at a CAGR of 17.65% during the forecast period 2023-2033.

Aviation parts and supplies can be tracked through the supply chain using a distributed ledger that is impenetrable and tamper-proof due to blockchain technology. By analyzing this blockchain data, AI makes it possible to optimize inventory control, do predictive maintenance, and comply with regulations.

Market Growth and Key Drivers

✈️ Digital Transformation in Aerospace

Aviation is undergoing a massive digital shift. Blockchain facilitates real-time tracking of parts, reducing the risk of counterfeit components and improving regulatory compliance.

🔐 Demand for Secure and Tamper-Proof Systems

With sensitive data like flight records and passenger identities at stake, blockchain ensures end-to-end encryption, enhancing data integrity.

🔄 Smart Contracts for Operations

Automating contracts for leasing, cargo handling, and maintenance reduces downtime, boosts productivity, and ensures transparency among multiple parties.

🌍 Green Aviation & Carbon Credit Tracking

Blockchain enables traceable carbon credit systems, helping aviation stakeholders meet ESG goals and drive sustainable initiatives.

Get More Information: https://www.sphericalinsights.com/our-insights/aviation-blockchain-market

Market Challenges

Despite its promise, several factors are slowing adoption:

Legacy System Integration: Many aviation systems are not compatible with blockchain tech.

Regulatory Uncertainty: Lack of international standards and frameworks creates hesitation.

High Implementation Costs: Smaller operators and MROs face steep costs for system transformation.

Data Ownership Conflicts: Determining access rights and ownership in decentralized networks remains unresolved.

Market Segmentation

By Application

Supply Chain Management

MRO (Maintenance, Repair & Overhaul)

Passenger Identity Management

Ticketing & Loyalty Programs

Aircraft Leasing & Financing

By Deployment

Public Blockchain

Private Blockchain

Consortium Blockchain

By End-User

Airlines

Airports

MRO Providers

Aircraft Manufacturers

Travel Agencies

Regional Analysis

🌎 North America

Pioneering adoption with leading airlines integrating blockchain into MRO and baggage tracking systems.

🌍 Europe

Focused on carbon credit monitoring and secure ticketing systems amid strong regulatory support.

🌏 Asia-Pacific

Fastest growing market due to increased air travel demand and government-led digital infrastructure initiatives.

🌍 Middle East & Africa

Strategic investments in aviation innovation hubs and smart airport technologies.

Competitive Landscape

The market is competitive yet collaborative, driven by partnerships and pilot programs.

Key Players:

IBM Corporation

Winding Tree

LeewayHertz

Accenture

Infosys

Lufthansa Innovation Hub

GE Aviation

Honeywell

Buy This Report Now: https://www.sphericalinsights.com/checkout-insights/1026

Positioning and Strategies

Forward-thinking companies are positioning blockchain not as an isolated tech but as part of a larger digital ecosystem including AI, IoT, and cloud.

Winning strategies include:

Partnering with blockchain startups and aviation consortiums.

Investing in pilot projects before full-scale rollout.

Integrating blockchain with digital twins and predictive analytics.

Focusing on passenger trust through decentralized identity management.

Recent Developments

Lufthansa partnered with Winding Tree to create a decentralized travel marketplace.

SITA launched a blockchain-based FlightChain trial with Heathrow and other airports.

GE Aviation initiated blockchain programs to trace engine parts and improve MRO transparency.

Trends and Innovation

Tokenized Loyalty Programs: Blockchain enables reward points to be transferred or exchanged, increasing customer engagement.

Decentralized Baggage Tracking: Minimizes lost luggage through immutable location records.

Digital Identity Wallets: Passengers can verify their identity across airlines and borders securely.

Related URLS:

https://www.sphericalinsights.com/our-insights/antimicrobial-medical-textiles-market https://www.sphericalinsights.com/our-insights/self-contained-breathing-apparatus-market https://www.sphericalinsights.com/our-insights/ozone-generator-market-size https://www.sphericalinsights.com/our-insights/agro-textile-market

Opportunities

Blockchain-as-a-Service (BaaS) tailored for aviation SMBs and regional airlines.

Decentralized Air Traffic Control (ATC) systems.

Cross-border Smart Contracts for ticketing and fleet leasing.

Integration with Quantum-Resistant Encryption for long-term security.

Future Outlook

The aviation blockchain market is set to evolve from early-stage experimentation to mainstream adoption within the next decade. As the industry becomes more digitally integrated, blockchain will serve as the backbone for data integrity, compliance, and passenger trust. Industry-wide adoption hinges on global regulatory harmonization and affordable, scalable solutions.

Conclusion

Blockchain is not a futuristic fantasy — it's fast becoming the foundation for a trust-first, data-driven, and decentralized aviation ecosystem. For decision-makers, investors, and innovators, the runway is clear: embracing blockchain today means flying ahead of the competition tomorrow.

About the Spherical Insights

Spherical Insights is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

Contact Us:

Company Name: Spherical Insights

Email: [email protected]

Phone: +1 303 800 4326 (US)

Follow Us: LinkedIn | Facebook | Twitter

0 notes

Text

Blockchain Technology in Healthcare Market Gains Momentum with Rise in Decentralized Health Platforms

Market Overview

The Blockchain Technology in Healthcare Market is witnessing rapid expansion as the healthcare industry increasingly embraces decentralized, secure digital solutions. Blockchain’s ability to offer transparency, data integrity, and tamper-proof records is revolutionizing healthcare operations, ranging from clinical data exchange to drug traceability. Forecasts suggest the market will grow significantly through 2034, driven by various blockchain types such as public, private, consortium, and hybrid blockchains. The market includes blockchain platforms, Blockchain-as-a-Service (BaaS), and blockchain protocols, coupled with consulting, integration, and maintenance services. The integration of advanced technologies like smart contracts, distributed ledger technology (DLT), encryption, and tokenization enhances the value proposition for healthcare stakeholders globally.

Market Dynamics

Several factors fuel the growth of blockchain in healthcare. The rising need for secure, interoperable healthcare data exchange pushes organizations to adopt blockchain solutions that enable seamless and secure sharing of patient information across providers, payers, and research institutions. Regulatory pressures to ensure data privacy and compliance with standards such as HIPAA and GDPR further accelerate blockchain adoption due to its inherent data protection capabilities.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS24338

Challenges such as data fragmentation, fraud in claims processing, and supply chain inefficiencies in pharmaceuticals are also driving demand. Blockchain’s immutable ledger supports efficient claims adjudication, fraud reduction, and transparent tracking of medicines to combat counterfeit drugs. Furthermore, patient-centric health records empower individuals with control over their data, promoting trust and improving healthcare outcomes.

However, barriers like high implementation costs, technological complexity, and resistance to change among traditional healthcare providers remain. The balance between on-premises, cloud-based, and hybrid deployments offers flexibility but requires careful evaluation based on organizational needs.

Key Players Analysis

The market comprises a diverse mix of established tech companies and innovative startups specializing in blockchain healthcare solutions. Key players include IBM, Microsoft, Guardtime, Factom, and Chronicled, who offer blockchain platforms and BaaS tailored for healthcare applications. These companies provide consulting and integration services to help healthcare providers, pharmaceutical companies, and payers adopt blockchain technologies seamlessly.

Specialized blockchain protocol developers and middleware providers are also crucial, ensuring interoperability and scalability of solutions. Collaboration among tech providers and healthcare institutions drives innovation, especially in implementing smart contracts for automated claims processing and distributed ledgers for secure clinical data exchange.

Competitive strategies focus on partnerships, acquisitions, and technology advancements to enhance service portfolios. As the market matures, companies are investing heavily in research and development to address specific healthcare challenges, such as drug traceability and compliance management, thereby differentiating themselves in this evolving space.

Regional Analysis

Geographically, North America leads the blockchain technology in healthcare market due to high healthcare IT adoption, stringent data privacy laws, and significant investments in digital transformation. The U.S., in particular, is a major hub for blockchain startups and pilot projects in clinical data interoperability and claims management.

Europe follows closely, driven by the EU’s robust regulatory environment and initiatives to standardize healthcare data sharing across member states. Countries like Germany, the UK, and France are focusing on blockchain applications for pharmaceutical supply chain security and patient data management.

The Asia-Pacific region is emerging rapidly, with growing healthcare infrastructure, digital health initiatives, and government support in countries such as China, Japan, and India. Increasing awareness of blockchain benefits in healthcare, coupled with expanding cloud adoption, fuels market growth here.

Other regions, including Latin America and the Middle East & Africa, are gradually adopting blockchain in healthcare, mainly through pilot projects and collaborations to improve healthcare delivery and drug supply chains.

Recent News & Developments

Recent developments highlight blockchain’s growing foothold in healthcare. IBM’s collaboration with major healthcare providers to expand its blockchain network for clinical data sharing signifies trust in the technology’s scalability. Microsoft’s launch of new BaaS solutions optimized for healthcare applications demonstrates increasing cloud integration.

Several pharmaceutical companies have adopted blockchain to enhance drug traceability and combat counterfeit medicines, an ongoing global challenge. Smart contract implementations for automated claims adjudication are gaining traction among health insurers, promising faster, more accurate reimbursements.

Pilot projects utilizing blockchain for patient-centric health records have shown promising results, empowering patients with control over their medical data and enhancing interoperability across providers.

Regulatory bodies in North America and Europe continue to explore frameworks that encourage blockchain adoption while safeguarding patient privacy, signaling a supportive environment for market growth.

Browse Full Report @ https://www.globalinsightservices.com/reports/blockchain-technology-in-healthcare-market/

Scope of the Report

The scope of this market analysis covers the comprehensive landscape of blockchain technology in healthcare, segmented by type (public, private, consortium, hybrid blockchains), product categories (blockchain platforms, BaaS, protocols), and services (consulting, integration, support).

Technological aspects such as smart contracts, DLT, encryption, and tokenization are examined alongside components including software, hardware, and middleware. Application areas span clinical data exchange, supply chain management, claims adjudication, drug traceability, and patient-centric health records.

Deployment models covered include on-premises, cloud-based, and hybrid systems. End users analyzed encompass healthcare providers, pharmaceutical companies, payers, and research institutes. The report delves into functionalities like identity management, data interoperability, and compliance management to provide a detailed understanding of market trends, opportunities, and challenges through 2034.

The blockchain technology in healthcare market promises a transformative impact by enhancing data security, improving operational efficiency, and empowering patients. As adoption grows globally, stakeholders can leverage blockchain’s potential to create a more transparent, efficient, and patient-centric healthcare ecosystem.

Discover Additional Market Insights from Global Insight Services:

Silica Sand for Glass Making Market: https://www.globalinsightservices.com/reports/silica-sand-for-glass-making-market/

Copper Foil Market: https://www.globalinsightservices.com/press-releases/copper-foil-market/

Textile Flooring Market: https://www.globalinsightservices.com/reports/textile-flooring-market/

Wood Charcoal Market: https://www.globalinsightservices.com/reports/wood-charcoal-market/

Carbon Capture Concrete Market: https://www.globalinsightservices.com/reports/carbon-capture-concrete-market/

0 notes

Text

Blockchain Development Services: Public, Private, DAO & White Label Solutions

The digital revolution has been profoundly transformed by the rise of blockchain development. From decentralized applications (dApps) and secure smart contracts to tokenized ecosystems and public governance, blockchain is reshaping the very foundations of value and data transfer. Today, businesses across the globe are turning to expert blockchain development companies to stay ahead of the curve and embrace this technological shift.

Whether you're exploring white-label blockchain solutions, building private blockchains, implementing DAO blockchain development, or venturing into public blockchain development, choosing the right blockchain developer is critical to achieving a secure, scalable, and successful deployment.

In this guide, we explore the wide array of blockchain development services, including niche offerings like Ton blockchain development, Binance Smart Chain blockchain development, and blockchain gaming services.

Blockchain - An Overview

Blockchain development involves building decentralized systems using technologies like smart contracts, distributed ledgers, and consensus protocols. A professional blockchain developer is responsible for designing system architecture, writing secure code, and integrating blockchain with business logic.

Partnering with a skilledBlockchain development company ensures that your solutions are secure, scalable, and aligned with your business goals—from ideation to deployment and beyond.

Public Blockchain Development

Public blockchain development focuses on permissionless, decentralized systems where anyone can participate. These networks are ideal for projects requiring transparency and community-driven governance.

Key Features:

Fully decentralized architecture

Resistant to censorship

Enhanced security via public consensus mechanisms

Examples include Ethereum, Bitcoin, and Solana. A capable blockchain development company can help you launch tokens, deploy smart contracts, and integrate wallets on these public networks.

Private Blockchain Development

Private blockchains are permissioned and are typically used by enterprises needing data privacy, speed, and customized governance.

Benefits:

Controlled access

Improved transaction speeds

Regulatory compliance and tailored governance

From supply chain management to healthcare and financial services, private blockchain development empowers businesses with secure and efficient solutions. Skilled blockchain developers can craft private networks to fit your specific business and compliance needs.

DAO Blockchain Development

Decentralized Autonomous Organizations (DAOs) are self-operating entities powered by smart contracts and governed by community consensus.

Why DAO Blockchain Development Is Important:

Transparent governance systems

Elimination of centralized control

Ideal for DeFi, crowdfunding, and community-run projects

Professional DAO blockchain development includes governance token creation, voting mechanisms, proposal systems, and contract audits—enabling start-ups and projects to build trustless and democratized ecosystems.

White Label Blockchain Solutions

White label blockchain solutions are pre-built platforms that can be customized and branded to your business. They’re a perfect choice for companies looking for quick deployment without compromising functionality.

Common Use Cases:

Crypto exchanges

NFT marketplaces

Defi platforms

Tokenized asset systems

Opting for white label blockchain platforms lets you enter the market quickly with a fully-functional system, all backed by a blockchain development company that offers customization, deployment, and post-launch support

.

Ton Blockchain Development

Created by Telegram, The Open Network (Ton blockchain) offers high-speed, scalable blockchain infrastructure. Its ecosystem supports decentralized internet components, such as Ton DNS, Ton Storage, and Ton Payments.

Core Features:

Advanced sharding for high-performance

Seamless cross-chain communication

Native smart contract functionality

Ton blockchain development services empower businesses to build advanced dApps, wallets, and smart contracts tailored to modern scalability and usability requirements.

Binance Smart Chain (BSC) Blockchain Development

Binance Smart Chain (BSC) is known for fast transactions and low fees. It is EVM-compatible, making it easy to migrate Ethereum-based dApps to the BSC ecosystem.

Advantages:

High-speed transactions

Minimal gas fees

Vibrant DeFi and NFT community

Easy token creation via BEP-20

Expert Binance Smart Chain blockchain development includes smart contracts, DeFi protocols, NFTs, and blockchain game development—all tailored to the fast-evolving BSC environment.

Blockchain Gaming Development

Blockchain gaming development are revolutionizing gaming by introducing decentralized economies, digital asset ownership, and play-to-earn mechanics.

Features of Blockchain Game Development:

Tokenized in-game assets (NFTs)

Secure digital goods trading

Monetization through P2E systems

Blockchain game development enables immersive player experiences where users earn real-world value. A reliable blockchain development company can help turn your gaming vision into a decentralized ecosystem that attracts and retains players.

Choosing the Right Blockchain Development Company

The right blockchain development company will offer:

Business-aligned blockchain architecture

End-to-end development (public, private, DAO, white label)

Security, scalability, and compliance

Long-term maintenance and upgrades

Look for blockchain developers with deep technical skills, industry experience, and a proven record in public blockchain development, private blockchain development, and other specialized domains.

Conclusion: Osiz – A Leading Blockchain Development Company

When seeking cutting-edge blockchain development services, Osiz Technologies stands as a top-tier provider. From public and private blockchains to DAO blockchain development and white label blockchain solutions, Osiz delivers tailor-made solutions for businesses worldwide.

Their expertise extends to advanced areas like Ton blockchain development, Binance Smart Chain blockchain development, and blockchain gaming services. With a team of expert blockchain developers, Osiz ensures your blockchain journey is secure, scalable, and innovative.Ready to harness the power of blockchain? Partner with Osiz Technologies—your trusted blockchain development company.

0 notes

Text

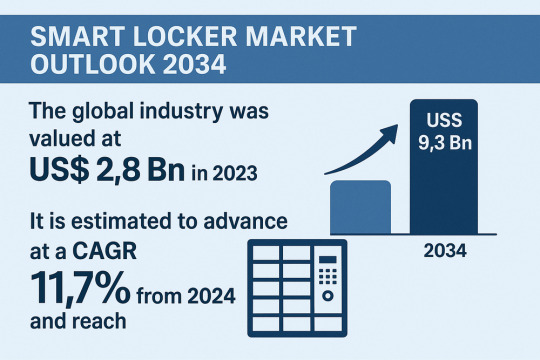

Smart Locker Market to Reach $9.3 Billion by 2034: What’s Driving the Growth?

The global smart locker market, valued at USD 2.8 billion in 2023, is poised for robust expansion over the next decade. Driven by surging e-commerce penetration, the need for secure parcel management, and rapid technology adoption across industries, the market is projected to register a compound annual growth rate (CAGR) of 11.7% from 2024 to 2034, reaching USD 9.3 billion by 2034.

Market Overview

Smart lockers secure, automated storage units integrated with sensors, connectivity, and management software are revolutionizing package handling and asset management across residential, commercial, institutional, industrial, and transportation sectors. They offer 24/7 secure access, real-time notifications, and advanced analytics, mitigating risks of theft, loss, and delivery delays. The COVID-19 pandemic underscored the importance of contactless solutions, accelerating deployments in logistics hubs, last-mile delivery networks, corporate campuses, educational institutions, and multi-family dwellings.

Market Drivers & Trends

E-Commerce Boom & Last-Mile Optimization The exponential rise of online shopping has intensified demand for reliable, contactless pickup and drop-off solutions. Retailers and logistics providers deploy smart lockers at convenient locations—supermarkets, transit stations, apartment complexes—to streamline deliveries, reduce failed delivery attempts, and cut operational costs.

Safety & Security Requirements With package theft (“porch piracy”) on the rise, consumers and businesses are adopting smart lockers to secure shipments. Integrated access control (PIN codes, biometrics, smartphone authentication) ensures only authorized users retrieve parcels.

IoT & Cloud-Based Analytics Connectivity via Wi-Fi, Bluetooth, NFC, and cellular networks enables automated monitoring, predictive maintenance, dynamic allocation of locker space, and utilization insights. AI-driven analytics optimize inventory distribution and enhance user experience.

Customized Solutions for Specialized Goods Temperature-controlled lockers support last-mile delivery of perishable groceries, pharmaceuticals, and laboratory specimens. Thermal management and modular compartmentalization ensure product integrity.

Regulatory & Sustainability Pressures Municipalities and corporations seek solutions to reduce carbon footprint of multiple delivery attempts. Consolidated locker deployments lower vehicle miles traveled and greenhouse gas emissions.

Latest Market Trends

Integration with Mobile Wallets & Apps Users increasingly leverage mobile apps and digital wallets to unlock compartments, track package status, and receive push notifications. Mobile-first interfaces are now standard.

Expansion into Multi-Tenant Residential Buildings Property developers embed smart locker ecosystems into new constructions to offer value-added amenities, improve tenant satisfaction, and differentiate offerings.

Plug-and-Play Modular Systems Scalable locker banks enable businesses to expand capacity on-demand. Plug-and-play modules simplify installation and future upgrades.

Partnerships with Last-Mile Tech Providers Collaboration between parcel locker manufacturers and drone, robotics, or autonomous vehicle companies is emerging to create end-to-end automated delivery networks.

Blockchain for Audit Trails Early pilots utilize distributed ledger technology to record chain-of-custody events for high-value shipments, enhancing transparency and reducing disputes.

Access key findings and insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86223

Key Players and Industry Leaders

Prominent vendors shaping the global smart locker landscape include:

ASSA ABLOY AB – Integrating smart access control across locker portfolios.

Allegion Plc – Broadening product lines with cloud-enabled locker solutions.

Avent Security – Specializing in modular, temperature-controlled lockers.

Dahua Technology – Offering AI-driven surveillance and analytics in locker systems.

dormakaba Group – Combining mechanical expertise with digital management platforms.

Honeywell International Inc. – Delivering enterprise-grade locker management software.

igloocompany Pte Ltd – Pioneering parcel locker networks in Asia.

Master Lock Company LLC. – Known for ruggedized, weatherproof locker designs.

MIWA Lock Co. – Integrating biometric authentication into high-security lockers.

Samsung Electronics Co., Ltd. – Leveraging consumer electronics expertise for locker interface design.

Spectrum Brands, Inc. – Expanding access control offerings into locker portfolios.

Vivint, Inc. – Bundling smart home security with locker access solutions.

These companies focus on R&D, strategic alliances, and targeted acquisitions to enhance technological capabilities and geographic reach.

Recent Developments

November 2023: Blue Dart Express partnered with India Post to install automated digital parcel lockers at select post offices nationwide. Authorized personnel deposit deliveries, and recipients access packages via unique codes—enabling flexible, round-the-clock collection.

March 2022: Quadient and DHL launched an extensive rollout of outdoor smart parcel lockers across Sweden, providing consumers with secure self-service pick-up points and reducing delivery failure rates.

January 2024: igloo expanded its locker network in Singapore’s suburban residential estates, integrating cloud-based analytics to optimize locker utilization and reduce idle capacity.

April 2025: dormakaba introduced biometric-enabled lockers for hospital and laboratory environments, ensuring traceable access to controlled substances and sensitive equipment.

Market New Opportunities and Challenges

Opportunities

Emerging Economies: Rapid urbanization and e-commerce growth in Asia, Latin America, and Africa create fertile ground for locker deployments.

Smart City Initiatives: Municipal plans to deploy shared locker hubs at transit nodes can drive large-scale adoption.

Cross-Industry Convergence: Integration of lockers with coworking spaces, gym facilities, and parcel shops presents new partnership models.

AI-Powered Predictive Maintenance: Leveraging machine learning to foresee component failures enhances uptime and reduces service costs.

Challenges

High Initial Capital Outlay: Infrastructure costs and integration with existing IT systems may deter small and mid-sized enterprises.

Data Security & Privacy: Handling user credentials and tracking data demands robust cybersecurity measures and compliance with evolving regulations (e.g., GDPR).

Interoperability Standards: Absence of universal communication standards across locker ecosystems can hamper large-scale interoperability.

Last-Mile Network Complexity: Integrating lockers into fragmented delivery networks—involving multiple carriers—requires seamless coordination.

Future Outlook

The smart locker market is set to evolve into a critical component of the global logistics and asset-management ecosystem. By 2034, we anticipate:

Hyper-Connected Lockers: Fully integrated into smart city infrastructures, enabling dynamic allocation based on pedestrian and vehicle traffic flows.

Autonomous Replenishment: Drone and robotics fleets replenishing locker stock in real time, responding to demand signals from e-commerce platforms.

Advanced User Experiences: Voice-activated access, augmented reality (AR) wayfinding within locker halls, and AI-driven personalization.

Vertical-Specific Solutions: Tailored offerings for healthcare, cold chain, automotive manufacturing, and other sectors with stringent compliance requirements.

Sustainability Focus: Solar-powered locker banks and carbon-neutral installation programs to align with corporate ESG goals.

Analysts assert that as technology costs decline and value propositions become clearer, adoption will spread beyond major metropolitan areas into suburban and rural markets.

Market Segmentation

Segment

Details

By Type

Deadbolt locks, lever handles, server locks & latches, knob locks, others

By Communication

Bluetooth, Wi-Fi, Z-Wave, NFC, others

By Locking Mechanism

Keypad, card key, touch/biometric, key fob, smartphone

By End-Use

Commercial, residential, institutional & government, industrial, transportation & logistics

Regional Insights

Asia Pacific: Largest market share in 2023, driven by rapid e-commerce expansion, smart city programs, and strong uptake of IoT/cloud computing solutions. Key countries: China, India, Japan, South Korea, ASEAN nations.

North America: High adoption of advanced analytics and strong presence of leading vendors fuel growth. Retail, residential, and institutional segments are particularly active.

Europe: Focus on sustainability and urban logistics optimization. Germany, the U.K., and France lead with smart city pilots and intermodal transport locker installations.

Latin America & MEA: Emerging markets present significant growth potential, though hampered by infrastructural and regulatory challenges.

Why Buy This Report?

This comprehensive report offers:

In-depth market analysis from 2020 to 2023, with detailed forecasts through 2034.

Quantitative units covering market value (US$ billion) and volume (thousand units).

Extensive profiling of leading players, including product portfolios, strategic initiatives, financial overviews, and sales footprints.

Segment-level and regional breakdowns, highlighting growth pockets and investment hotspots.

Detailed qualitative assessments: drivers, restraints, opportunities, Porter’s Five Forces, value chain, and trend analyses.

Ready-to-use Excel datasheets for custom modeling and scenario planning.

Whether you are a technology vendor, investor, logistics provider, or smart city planner, this report equips you with actionable insights to make informed strategic decisions and capitalize on emerging opportunities in the smart locker landscape.

Frequently Asked Questions

1. What is driving the growth of the smart locker market? Surging e-commerce volumes, last-mile delivery challenges, rising concerns over package theft, and the integration of IoT/cloud analytics are key growth drivers.

2. Which regions offer the highest growth potential? Asia Pacific leads today, but Latin America, the Middle East & Africa, and secondary markets in North America and Europe present significant untapped opportunities.

3. What are the main barriers to adoption? High upfront costs, data security/privacy concerns, and the lack of universal interoperability standards across locker ecosystems.

4. How are smart lockers being used beyond parcel delivery? Applications include IT asset management, medical device distribution, temperature-controlled food and pharmaceutical logistics, and secure document storage.

5. Which technologies enhance smart locker capabilities? Bluetooth, NFC, Wi-Fi, biometric authentication, cloud-based management platforms, AI-driven analytics, and emerging blockchain pilots for audit trails.

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Blockchain Market Consumer Behavior and Industry Shifts to 2033

Introduction

The blockchain market has grown exponentially over the past decade, revolutionizing industries such as finance, healthcare, supply chain management, and beyond. As businesses continue to explore the potential of decentralized ledger technologies, the market is poised for substantial growth in the coming years. This article provides an in-depth analysis of industry trends, key growth drivers, challenges, and forecasts for the blockchain market up to 2032.

Market Overview

Blockchain technology is a distributed ledger system that provides transparency, security, and immutability. The market has witnessed significant adoption, driven by the increasing demand for secure transactions, decentralized applications, and smart contracts. The growing adoption of blockchain in financial services, government initiatives, and the rise of Web3 technologies are further fueling market expansion.

Download a Free Sample Report:-https://tinyurl.com/mu3aw3hh

Market Size and Growth

According to market research, the global blockchain market was valued at approximately $11 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 45% from 2023 to 2032. By 2032, the market is projected to reach $1.5 trillion, driven by innovations in cryptocurrency, decentralized finance (DeFi), and enterprise blockchain solutions.

Key Industry Trends

Enterprise Blockchain Adoption

Businesses are increasingly integrating blockchain solutions for security, efficiency, and transparency. Industries such as banking, supply chain, and healthcare leverage blockchain for secure transactions and record-keeping.

Growth of Decentralized Finance (DeFi)

DeFi platforms are transforming financial services by offering decentralized lending, borrowing, and trading solutions. The rise of DeFi is expected to disrupt traditional banking models, increasing blockchain adoption.

Regulatory Developments

Governments worldwide are introducing regulations to govern blockchain and cryptocurrencies. Regulatory clarity will help attract institutional investors and boost market stability.

Integration with AI and IoT

Blockchain is being integrated with artificial intelligence (AI) and the Internet of Things (IoT) to enhance security and automation. Smart contracts powered by AI are expected to drive efficiencies in multiple industries.

Rise of Non-Fungible Tokens (NFTs) and Web3

NFTs and the Web3 ecosystem are reshaping digital ownership and content monetization. The entertainment, gaming, and real estate sectors are increasingly utilizing blockchain for tokenized assets.

Key Market Segments

The blockchain market can be segmented based on type, application, and industry.

By Type:

Public Blockchain

Private Blockchain

Hybrid Blockchain

Consortium Blockchain

By Application:

Smart Contracts

Supply Chain Management

Payments and Transactions

Identity Management

Governance and Compliance

By Industry:

Financial Services

Healthcare

Supply Chain & Logistics

Government & Public Sector

Retail & E-Commerce

Market Challenges

Despite its growth, the blockchain industry faces several challenges:

Regulatory Uncertainty: Differing regulations across countries can create obstacles for blockchain companies.

Scalability Issues: Many blockchain networks struggle with transaction speed and high fees.

Security Concerns: While blockchain is secure, vulnerabilities such as hacking of smart contracts remain a concern.

Energy Consumption: Blockchain mining and proof-of-work (PoW) mechanisms require substantial energy, raising sustainability concerns.

Future Outlook and Forecast

Looking ahead, the blockchain market is expected to witness significant advancements:

2025-2027: Increased adoption of blockchain in enterprises, with a focus on supply chain and finance.

2028-2030: Mainstream adoption of central bank digital currencies (CBDCs) and further regulatory clarity.

2031-2032: Blockchain will become a foundational technology for various industries, integrating seamlessly with AI and IoT.

Conclusion

The blockchain market is set for exponential growth, driven by enterprise adoption, DeFi, Web3, and regulatory advancements. While challenges remain, technological innovations and widespread acceptance will propel the industry toward a trillion-dollar valuation by 2032. Organizations and investors should stay ahead of trends to capitalize on blockchain’s transformative potential.Read Full Report:-https://www.uniprismmarketresearch.com/verticals/information-communication-technology/blockchain

0 notes

Text

How Crypto Token Development Transforms Real Estate Transactions

The real estate industry now has an instrumental revolution support tool through crypto tokens development because these assets simplify processes while becoming more transparent.

The traditional real estate industry operating through complex systems together with substantial documentation requirements has met drastic alteration. New technologies built on blockchain and crypto token development systems have transformed traditional methods used for carrying out real estate deals.

Overview of Crypto Token Development

The processes of designing virtual cryptographic tokens happen through blockchain technology implementations. The fundamental principle of blockchain consists of a decentralized distributed ledger system which safely maintains transaction records. The blockchain technology operates without central authorities because it removes intermediaries to create secure transparent immutable transactions.

Crypto token development acts as digital assets within real estate which function as ownership portions of real estate properties. Crypto tokens maintain comparable functions as other blockchain-enabled digital assets because they operate on blockchain platforms through purchase and exchange mechanisms.

Real estate tokenization technology divides properties into smaller units to create marketable parts that allow investors to gain access to the market and achieve better transparency and efficiency. Typically issued by smart contracts procedural code contains all contractual terms in direct form.

Crypto token development remains new within the real estate sector yet continues to expand quickly because it solves multiple enduring industry issues including low market liquidity and restricted access together with slow transaction speeds.

Importance of Blockchain in Real Estate Transactions

Crypto token development relies on blockchain technology which establishes its success in real estate transactions. Multiple parties consisting of buyers sellers agents banks legal teams and others conventionally participate in real estate deals because they must validate documentation and processes and ownership verification. Real estate transactions become both lengthier and more expensive when increased due to this method and present opportunities for errors and fraudulent activities.

Multiple challenges in the industry find solutions through blockchain technology. Blockchain maintains an unalterable transaction record which both protects and easily allows any party to verify ownership traces and transaction records. The implementation of blockchain technology builds higher trust levels as well as decreases the likelihood of real estate industry fraud occurrences.

Through blockchain smart contracts operate autonomously by carrying out actions when predetermined criteria become fulfilled. The smart contract functionality allows finances to trigger property ownership transfer automatically between buyers thus replacing traditional requirements of lawyers and notaries. The combination enables faster business operations by eliminating the need for external agents thus minimizing related expenses.

The distributed blockchain system provides enhanced security for financial transactions. Blockchain-based data storage spreads information across multiple distributed locations which minimizes the risk of single database assaults and breaches according to traditional server architectures. The application of blockchain technology provides essential security protections to sensitive real estate information that must remain confidential.

How Crypto Token Development is Revolutionizing Real Estate

Crypto token development revolutionizes real estate functions through novel features which traditional methods either could not achieve or prove ineffective. This article examines the process behind the real estate revolution through Crypto token development.

1. Tokenization of Real Estate Assets

The primary effect of crypto token development on real estate becomes possible through the digitization of physical assets. A digital token serves as ownership representation through tokenization when a real estate property or asset gets converted into digital form. Distinct tokenized representations of real estate property values allow investors to acquire smaller affordable portions of properties without necessitating full property acquisition.

Real estate investment opportunities become available to numerous new participants through this process. Most traditional real estate investments demand extensive start-up money that blocks numerous market participants from entering the sector. Real estate tokenization transforms real estate ownership into fractional parts which extend investment possibilities to all types of investors who seek high-value property ownership. Real estate exists in digital form as tokens which investors can trade with the same ease as stock trading activities occur on financial markets.

2. Increased Liquidity

History records real estate as an asset class which demonstrates illiquidity characteristics. Property deals require substantial time to complete because listing a property takes multiple steps and needs term negotiations followed by legal document processing. Properties tend to remain available for purchase on the market for substantial amounts of time extending from months to years in numerous circumstances.

Cryptocurrency tokens have introduced substantial improvement to the fast exchange of real estate assets. Real estate tokenization enables investors to handle their tokens on different blockchain platforms which results in faster trading activities. The increased flexibility benefits property owners alongside the attraction of a fresh group of investment users who want swift and liquid trading positions.

3. Global Access to Real Estate

Being able to develop crypto tokens in real estate delivers investors access to properties worldwide. The buying and selling procedures in traditional real estate markets experience several restrictions that stem from location constraints and monetary barriers and government rules. Crypto tokens present the advantage of borderless trading which makes them easy to exchange across different international boundaries.

Real estate investments from Japan to the United States or Europe have become possible through crypto token development due to its borderless characteristics and removing the need for complex cross-border legal systems and foreign exchange rate management. Through Blockchain technology global investors can execute real estate investments across borders without limitation while real estate investment becomes accessible to international markets.

4. Improved Transparency and Security

Crypto token development creates both transparent and secure conditions during real estate deals. All blockchain transactions are permanently logged on public ledgers thus enabling parties to see complete records of ownership histories and transaction dates and supplementary data. All parties can check property deal specifics at any time through blockchain transparency which decreases the chance of property transaction-related disputes and fraud.

Upon implementation blockchain ensures that records will remain impossible to change. Records on the blockchain become permanent and cannot be changed after they are added to the system. Real estate transactions are safeguarded by blockchain technology to an exceptionally high standard despite the typical occurrence of conflicts regarding property ownership and details of previous transactions.

5. Lower Transaction Costs

The standard real estate deal process requires multiple intermediaries including brokers together with lawyers and title agents and banks who receive payment for their work. The overall succession of required professionals during transactions leads to substantial costs that build into sizable expenses.

The transaction system enabled by Crypto tokens allows direct transfers between participants without involving any middlemen. The removal of intermediaries makes transactions less costly because fees related to brokerage and other transaction services vanish substantially. Those transactions benefit from lower costs as no intermediaries remain to take fees from real estate investments particularly benefiting lower-scale investors.

Advantages of Crypto Tokens in Real Estate Transactions

Using crypto token development in property transactions provides multiple important benefits which include:

Reduced Costs

Increased Speed

Greater Accessibility

Enhanced Security

Conclusion

Crypto token development revolutionizes real estate operations through enhanced operational efficiency alongside greater transparency as well as complete accessibility. Real estate investments have become more liquid and affordable through blockchain technology because of its enablement of tokenization processes. Reduced expenses through smart contracts help activities move more efficiently by doing without middlemen and reducing typical properties’ transactional complexities.

The potential applications of crypto token development for the real estate market continue to evolve even though the technology stands at its current introductory phase. Custom Blockchain development technology adoption by real estate market participants will advance buying and selling of property through innovation that produces an improved real estate landscape.

0 notes

Text

#Blockchain Distributed Ledger Market Scope#Blockchain Distributed Ledger Market Forecast#Blockchain Distributed Ledger Market Overview

0 notes

Text

Blockchain In Telecom Market - Forecast 2024-2030

Blockchain In Telecom Market Overview :

The blockchain in telecom market size is forecast to reach USD $25.2 billion by 2030, after growing at a CAGR of 54.4% during the forecast period 2024-2030. The term "blockchain in telecom market" describes how blockchain technology has been adopted and integrated into the telecommunications industry. Blockchain is a distributed, decentralized digital ledger system that keeps track of transactions on several computers while guaranteeing the security, integrity, and immutability of data.

The telecom industry is using blockchain technology more and more to strengthen security and enhance identity management. Blockchain offers a strong framework for managing identities and safeguarding consumer data through the use of a decentralized ledger, making identity theft and data breaches practically unheard of. By ensuring secure transactions and communications, this improves customer confidence and complies with regulations. The use of blockchain technology to offer revenue assurance and stop fraud is another noteworthy trend. Fraudulent activities such as roaming and subscription fraud cause telecom carriers to suffer significant losses. Because of its transparent and unchangeable ledger, blockchain ensures correct billing and minimizes revenue leakage by assisting in the real-time detection and prevention of fraudulent transactions. For telecom businesses, this improves operational efficiency and profitability.

Report Coverage

The report “Blockchain in Telecom Market – Forecast (2024-2030)”, by IndustryARC, covers an in-depth analysis of the following segments of the Blockchain in Telecom Market By Provider: Application Providers, Middleware Providers, Infrastructure Providers. By Organization Size: Small & Medium-Sized Enterprises, Large Enterprises. By Application: OSS/BSS Processes, Identity Management, Payments, Smart Contracts Connectivity Provisioning, Others. By Geography: North America (U.S, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Russia, Netherlands and Others), APAC (China, Japan India, South Korea, Australia & New Zealand, Indonesia, Malaysia, Taiwan and Others), South America (Brazil, Argentina, Chile, Colombia and others), and RoW (Middle East and Africa).

Request Sample

Key Takeaways

North America dominated the Blockchain in Telecom Market in 2023, which is accounted for nearly 44%. The region's strong adoption rates of blockchain technology and sophisticated technological infrastructure are credited with this dominance.

Application Providers dominated the Blockchain in Telecom Market in 2023. These suppliers solve a range of industry concerns by providing crucial services that use blockchain technology into telecom operations.

Blockchain technology has the potential to significantly lower costs in the telecom industry by streamlining a number of operational procedures. A fundamental component of blockchain technology, smart contracts automate contract execution, doing away with the need for middlemen and cutting down on administrative burden

By Provider - Segment Analysis

Application Providers dominated the Blockchain in Telecom Market in 2023 at 42.4% share. These suppliers solve a range of industry concerns by providing crucial services that use blockchain technology into telecom operations. These vendors develop applications for effective contract management, fraud protection, secure transactions, and identity management. Since blockchain's decentralized and immutable nature guarantees safe and impenetrable identity verification processes, identity management in particular has proven to be a crucial topic. The telecom industry's growing need for transparent and safe technologies that enable improved security and consumer data management is what's causing this dominance. It is anticipated that application providers' roles would grow and become more established as the telecom sector continues to innovate and adopt new technology.

Inquiry Before Buying

By Application - Segment Analysis

Smart Contracts dominated the Blockchain in Telecom Market in 202 at 25.75 share. Self-executing contracts, or smart contracts, have the conditions of the contract explicitly encoded into the code. They are essential in the telecom sector because of their capacity to safely and automatically manage agreements without the need for middlemen. This technology lowers expenses, increases operational efficiency, and lowers the possibility of human error. Smart contracts have been used by telecom businesses for several purposes, such as supply chain management that is transparent and impenetrable, roaming agreement management, and billing process automation. Smart contracts are becoming more and more popular because of their capacity to simplify intricate telecom processes, giving businesses a competitive advantage and enhancing service quality overall.

By Geography - Segment Analysis

North America dominated the Blockchain in Telecom Market in 2023, which is accounted for nearly 44%. The region's strong adoption rates of blockchain technology and sophisticated technological infrastructure are credited with this dominance. Early adopters of blockchain technology include North American telecom corporations, who use it for secure transactions, fraud prevention, and effective data management, among other uses. The telecom industry's adoption of blockchain solutions has been expedited by the robust presence of large technology corporations and startups in the United States. For instance, in April 2024, Aptos Labs is working on an institutional blockchain platform in partnership with SK Telecom and Microsoft. Furthermore, North America's dominant position has been reinforced by encouraging regulatory frameworks and significant expenditures in blockchain research and development. North America is therefore still a major participant in the blockchain telecom market, pushing innovation and establishing benchmarks for the sector.

Schedule a Call

Drivers – Blockchain in Telecom Market

Enhanced Security and Fraud Prevention

Strong security characteristics offered by blockchain technology are essential for the telecom sector. Preventing fraud is one of the main advantages, particularly when it comes to identity verification and roaming. Fraudulent actions cause telecom businesses to lose a lot of money, but the decentralized and unchangeable record of blockchain helps to reduce these risks. For instance, in February 2024, Telefónica and Chainlink Partnered to offer Security Against "SIM Swap" Attacks. Through this partnership, blockchain transactions will benefit from an additional degree of protection. Blockchain lessens the possibility of fraudulent activity and illegal access by guaranteeing that every transaction is visible and verifiable. Blockchain is a vital tool for the future development and credibility of the telecom industry because of its improved security, which not only safeguards customer data but also fortifies the general integrity of telecom networks.

Operational Efficiency and Cost Reduction

Blockchain technology has the potential to significantly lower costs in the telecom industry by streamlining a number of operational procedures. A fundamental component of blockchain technology, smart contracts automate contract execution, doing away with the need for middlemen and cutting down on administrative burden. This automation can be used to improve efficiency and lower errors in a variety of telecom tasks, including supply chain management, service delivery, and billing. Telecom firms can achieve higher operational efficiency, which translates to cost savings and enhanced customer service quality, by reducing manual processes and guaranteeing faster, more reliable transactions.

Buy Now

Challenges – Blockchain in Telecom Market

Regulatory and Compliance Challenges

Blockchain technology works in a regulatory landscape that is complicated, especially in the telecom sector, which is already governed by strict laws. The adoption of blockchain technology increases the difficulty of adhering to legal requirements such as data protection legislation and anti-money laundering regulations. The regulatory environment pertaining to blockchain technology and cryptocurrencies is fragmented as a result of differing national laws. To guarantee that their blockchain implementations adhere to all applicable laws, telecom businesses need to successfully negotiate these regulatory obstacles. Furthermore, regulatory compliance may be hampered by the anonymity and immutability of blockchain transactions, making it challenging to audit and monitor specific activity. To overcome these obstacles and guarantee that blockchain solutions are transparent and compliant with the law, strong regulatory cooperation and compliance framework development are necessary.

Market Landscape

Technology launches, acquisitions, and R&D activities are key strategies adopted by players in the Blockchain in Telecom Market in 2023, The major players in the Blockchain in Telecom Market are Amazon Web Services, Microsoft, SAP, Oracle, IBM, Huawei Enterprise, Subex, Protokol BV, Recordskeeper, Cegeka and Others.

Developments:

In April 2024, the company behind the now-defunct Diem blockchain, Aptos Labs, a blockchain business created by former Meta Platforms Inc. staff members, revealed that it has partnered with significant technology and financial companies to develop Aptos Ascend, a digital asset management platform for financial institutions.

In February 2024, Telefónica and Chainlink Partnered to offer Security Against "SIM Swap" Attacks. Through this partnership, blockchain transactions will benefit from an additional degree of protection

#Blockchain In Telecom Market#Blockchain In Telecom Market size#Blockchain In Telecom industry#Blockchain In Telecom Market share#Blockchain In Telecom top 10 companies#Blockchain In Telecom Market report#Blockchain In Telecom industry outlook

0 notes

Text

Sure, here is the article formatted as requested:

Cryptocurrency e\nTG@yuantou2048

Cryptocurrency e\n

Cryptocurrencies have emerged as a transformative force in the world of finance and technology. They offer a decentralized alternative to traditional banking systems, enabling peer-to-peer transactions without the need for intermediaries. This innovation has sparked global interest and investment, with Bitcoin leading the way as the first and most well-known cryptocurrency.

What is Cryptocurrency?

Cryptocurrencies are digital or virtual tokens that use cryptography for security. These currencies operate on a technology called blockchain, which is essentially a distributed ledger that records all transactions across a network of computers. The most famous example is Bitcoin, but there are now thousands of different cryptocurrencies available, each with its own unique features and applications.

Key Features of Cryptocurrencies

1. Decentralization: Unlike fiat money, which is issued and regulated by governments, cryptocurrencies operate independently and are not controlled by any central authority.

2. Transparency and Security: Transactions are recorded on a public ledger, making them transparent and secure. Each transaction is verified by network participants, ensuring integrity and reducing the risk of fraud.

3. Anonymity and Privacy: Users can transact anonymously, providing a level of privacy that traditional financial systems cannot match.

4. Potential for Investment: Many investors see cryptocurrencies as a potential hedge against inflation and a store of value. However, they also come with risks, including high volatility and regulatory uncertainties.

Benefits of Cryptocurrencies

Decentralized: No single entity controls the currency, reducing the risk of government interference or manipulation.

Global Accessibility: Anyone with an internet connection can participate in the ecosystem.

5. Fast Transactions: Transfers can be completed much faster than traditional banking methods.

6. Global Reach: They can be used globally, bypassing traditional banking networks and offering a new way to conduct business and invest.

Risks and Challenges

Volatility: Prices can fluctuate dramatically, making them attractive yet risky investments.

Adoption: As more businesses and individuals adopt cryptocurrencies, their utility and value continue to grow.

Future Outlook

The future of cryptocurrencies remains uncertain but promising. As more institutions and governments explore their integration, the landscape is rapidly evolving.

By understanding these aspects, one can better navigate this exciting but complex market. Stay informed and consider the risks before investing.

This brief overview provides just a glimpse into the world of cryptocurrencies. For those interested in exploring this space, it's crucial to stay updated with the latest developments and regulations.

For further insights and updates, follow us for ongoing coverage and analysis.

加飞机@yuantou2048

ETPU Machine

王腾SEO

0 notes

Text

Cryptocurrency Investing: A Comprehensive Guide for Beginners

The world of cryptocurrency has exploded in popularity, offering exciting investment opportunities but also presenting unique challenges. This guide provides a comprehensive overview for beginners looking to navigate the crypto market.

Understanding Cryptocurrency Basics:

Before diving into investing, it's crucial to understand what cryptocurrency is. In simple terms, it's a digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by central banks, cryptocurrencies operate independently, relying on a decentralized network called a blockchain. This decentralized nature offers several advantages, including increased transparency, faster transaction times, and reduced fees in some cases.

Key Concepts to Grasp:

Blockchain: The underlying technology behind most cryptocurrencies. It's a distributed, immutable ledger that records transactions across a network of computers, ensuring transparency and security.

Decentralization: Cryptocurrencies are not controlled by a single entity, like a bank or government. This decentralization makes them more resistant to censorship and single points of failure.

Volatility: The cryptocurrency market is known for its volatility, meaning prices can fluctuate dramatically in short periods. This presents both opportunities and risks for investors.

Types of Cryptocurrencies: Thousands of different cryptocurrencies exist, each with its own unique characteristics and use cases. Bitcoin, the first and most well-known cryptocurrency, is often considered a store of value. Ethereum is a platform for building decentralized applications (dApps) and smart contracts. Other cryptocurrencies, known as altcoins, serve various purposes, from facilitating payments to powering specific projects.

Getting Started with Cryptocurrency Investing:

Education is Key: Don't invest in something you don't understand. Take the time to learn about blockchain technology, different types of cryptocurrencies, and the factors that influence their prices.

Choose a Reputable Exchange: Cryptocurrency exchanges are online platforms where you can buy, sell, and trade cryptocurrencies. Research different exchanges carefully, considering factors like security, fees, supported cryptocurrencies, and user experience. Some popular exchanges include Coinbase, Binance, Kraken, and Gemini.

Set Up a Secure Wallet: A cryptocurrency wallet is a digital wallet used to store your cryptocurrencies. There are two main types of wallets:

Hot Wallets: These are online wallets connected to the internet, offering convenient access to your funds but potentially being more vulnerable to hacking. Cold Wallets: These are offline wallets, such as hardware wallets, which store your cryptocurrencies offline, providing greater security. Start Small and Diversify: Begin with a small investment amount that you're comfortable losing. Don't put all your eggs in one basket. Diversify your portfolio by investing in different cryptocurrencies to spread your risk.

Understand Risk Management: Cryptocurrency investing is inherently risky. Be prepared for potential losses and never invest more than you can afford to lose. Implement risk management strategies, such as setting stop-loss orders, to limit your potential losses.

Research and Due Diligence: Before investing in any cryptocurrency, conduct thorough research. Understand the project's goals, team, technology, and market potential. Don't rely solely on hype or social media recommendations.

Be Patient and Long-Term Focused: Cryptocurrency investing is a long-term game. Don't expect to get rich quick. Be patient and focus on the long-term potential of the technology.

Stay Informed: The cryptocurrency market is constantly evolving. Stay up-to-date on the latest news, trends, and regulatory developments.

Important Considerations:

Security: Security is paramount in the cryptocurrency world. Protect your private keys, use strong passwords, and be wary of scams and phishing attempts.

Regulation: The regulatory landscape for cryptocurrencies is still developing. Be aware of the regulations in your jurisdiction and how they might affect your investments.

Taxes: Cryptocurrency investments are subject to taxes in many countries. Consult with a tax professional to understand the tax implications of your crypto activities.

Conclusion:

Cryptocurrency investing can be a rewarding experience, but it's essential to approach it with caution and a well-informed strategy. By understanding the basics, conducting thorough research, and managing your risk effectively, you can navigate the crypto market with greater confidence and potentially benefit from the long-term growth of this exciting new asset class. Remember that this is not financial advice, and you should always do your own research and consult with a financial advisor before making any investment decisions.

1 note

·

View note

Text

Mastering Economics, Business & Finance by Sean Shah | Tumblr on Nikhil.Blog

1. Introduction

In today’s dynamic marketplace, mastering business and finance principles has become essential for anyone aiming to achieve professional success and personal fulfillment. Whether you’re drawn to cryptocurrency, interested in entrepreneurship strategies, or eager to expand your understanding of legal and regulatory matters, cultivating a solid knowledge base is paramount. Moreover, marketing tactics such as SEO and backlink creation have become critical in ensuring your message reaches the right audience.

This guide is structured to serve as your roadmap. It explores cutting-edge developments in blockchain, the intricacies of organizational excellence, the strategies behind niche market dominance, and even the legal complexities of fraud detection. It also dives deep into personal finance, credit, and net worth, giving you an all-encompassing foundation. Each section references specialized books that cover everything from search engine optimization to financial freedom—allowing you to pinpoint the best resources for holistic mastery of your career and personal goals.

By the time you finish reading, you’ll be equipped with a clearer perspective on how to navigate and excel in these various domains. You’ll also discover a wealth of actionable insights that can help you sustain long-term success while maintaining ethical practices. Let’s begin our journey by delving into one of the most revolutionary fields reshaping the financial landscape: cryptocurrency and blockchain.

2. Cryptocurrency & Blockchain

2.1 Overview

Cryptocurrency and blockchain technology have rapidly evolved from niche concepts to mainstream financial instruments. They offer decentralized systems, digital asset ownership, and transformative potential for global finance. Whether you are new to the space or a seasoned investor, understanding the foundations of blockchain and how to leverage them for wealth creation is critical.

2.2 Key Resources

Mastering Cryptocurrency, Blockchain Technology, and Future Finance To gain a solid foundation in the mechanisms of digital currencies and distributed ledger technology, consult Mastering Cryptocurrency, Blockchain Technology, and Future Finance by Sean Shah. This resource delves into how NFTs and blockchain ecosystems work, while also exploring the future of finance in a tokenized economy. If you’re interested in deepening your understanding of crypto innovations, this comprehensive blockchain guide will walk you through NFT marketplaces and the intricacies of decentralized finance.

Mastering Wealth Creation Money Making Strategies Cryptocurrency Mastery For those focused on investment strategies that leverage digital currencies, look at Mastering Wealth Creation Money Making Strategies Cryptocurrency Mastery by Sean Shah. This text teaches you how to diversify your portfolio to encompass the volatile yet promising world of crypto. If you wish to explore advanced techniques in cryptocurrency trading and passive income streams, make sure to refer to this cryptocurrency investment roadmap for actionable steps.

2.3 Why It Matters

Decentralization offers freedom from traditional banking systems, reducing barriers to entry.