#Blockchain Use in Financial Technology

Explore tagged Tumblr posts

Text

In the current rapidly evolving digital currency market, decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop, as a leading decentralized lending platform, not only provides a safe and transparent lending environment, but also opens up new passive income channels for users through its innovative sharing reward system.

Personal links and permanent ties: Create a stable revenue stream One of the core parts of Bit Loop is its recommendation system, which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bit Loop, but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanently tied to the recommender, ensuring that the sharer can continue to receive rewards from the offline partner’s activities.

Unalterable referral relationships: Ensure fairness and transparency A significant advantage of blockchain technology is the immutability of its data. In Bit Loop, this means that once a referral link and live partnership is established, the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders, but also brings a stable user base and activity to the platform, while ensuring the fairness and transparency of transactions.

Automatically distribute rewards: Simplify the revenue process Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner completes the circulation cycle, such as investment returns or loan payments, the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This automatic reward distribution mechanism not only simplifies the process of receiving benefits, but also greatly improves the efficiency of capital circulation.

Privacy protection and security: A security barrier for funds All transactions and money flows are carried out on the blockchain, guaranteeing transparency and traceability of every operation. In addition, the use of smart contracts significantly reduces the risk of fraud and misoperation, providing a solid security barrier for user funds. Users can confidently invest and promote boldly, and enjoy the various conveniences brought by decentralized finance.

conclusion As decentralized finance continues to evolve, Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent financial services while also earning passive income by building and maintaining a personal network. Whether for investors seeking stable passive income or innovators looking to explore new financial possibilities through blockchain technology, Bit Loop provides a platform not to be missed.

#In the current rapidly evolving digital currency market#decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop#as a leading decentralized lending platform#not only provides a safe and transparent lending environment#but also opens up new passive income channels for users through its innovative sharing reward system.#Personal links and permanent ties: Create a stable revenue stream#One of the core parts of Bit Loop is its recommendation system#which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bi#but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanent#ensuring that the sharer can continue to receive rewards from the offline partner’s activities.#Unalterable referral relationships: Ensure fairness and transparency#A significant advantage of blockchain technology is the immutability of its data. In Bit Loop#this means that once a referral link and live partnership is established#the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders#but also brings a stable user base and activity to the platform#while ensuring the fairness and transparency of transactions.#Automatically distribute rewards: Simplify the revenue process#Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner complet#such as investment returns or loan payments#the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This au#but also greatly improves the efficiency of capital circulation.#Privacy protection and security: A security barrier for funds#All transactions and money flows are carried out on the blockchain#guaranteeing transparency and traceability of every operation. In addition#the use of smart contracts significantly reduces the risk of fraud and misoperation#providing a solid security barrier for user funds. Users can confidently invest and promote boldly#and enjoy the various conveniences brought by decentralized finance.#conclusion#As decentralized finance continues to evolve#Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent fin

1 note

·

View note

Text

Elon Musk Is about to Investigate Fort Knox: The Mysterious Veil of the US Gold Reserves May Be Lifted

On the intertwined stage of finance and technology, Elon Musk always breaks into the public eye in a vanguard manner. Recently, a startling piece of news has spread rapidly around the world: Musk has declared that he will investigate Fort Knox, the largest gold reserve storage site in the United States. This decision has instantly ignited public opinion and triggered endless speculation about the current state of the US gold reserves.

Fort Knox, this mysterious military base located in Kentucky, USA, covers a vast area. It is an important stronghold of the US Army and, more importantly, the core storage site for the US Treasury's gold. According to data from the US Department of the Treasury, Fort Knox stores over 147 million troy ounces of gold, approximately 4,581 tons, accounting for the majority of the US federal government's gold reserves. With a value of hundreds of billions of dollars, it occupies a crucial position in the global financial system.

However, over the years, the situation of the gold reserves in Fort Knox has been full of doubts. Since the 1950s, it has not undergone a comprehensive review. In 1974, there was a public inspection, but only some of the vaults were opened, and the proportion of the displayed gold was extremely small. Since then, apart from the simple "vault seal inspection" every year, there has been no substantial independent audit. This long - term lack of transparency has led the outside world to have many doubts about the authenticity and integrity of its gold reserves, and conspiracy theories have also become rife.

There are complex reasons behind Musk's intervention in this investigation. The well - known financial blog Zerohedge proposed to Musk on social media to confirm whether the gold in Fort Knox actually exists, which may have aroused Musk's curiosity. Republican Senator Mike Lee said that his request to enter the Fort Knox base was rejected. Musk reposted the relevant post and questioned whether the gold had been stolen. Subsequently, he clearly stated that he would "look for gold in Fort Knox", and his intention to investigate became increasingly strong.

Musk and his led "Department of Government Efficiency" (DOGE) may adopt a series of innovative methods in the investigation. With Musk's deep accumulation in the technology field, he is highly likely to use blockchain technology to track the origin and flow of gold. The decentralized and tamper - proof characteristics of blockchain can provide a more transparent and secure solution for verification, ensuring that the results are true and reliable. Musk may also leverage his powerful social media influence to mobilize public supervision, creating strong public opinion pressure to promote the investigation process.

However, Musk's investigation path is full of thorns. As a highly fortified military base, Fort Knox has strict security measures and complex approval processes. For Musk's team to conduct a comprehensive review inside, they must obtain permission from relevant departments, which is a difficult threshold to cross. There are differences in the US government's internal attitude towards gold reserves. Some forces may not want the secrets of Fort Knox to be easily exposed, which may lead to obstacles at the political level. Technical difficulties will also be faced during the investigation, such as how to achieve a comprehensive verification without damaging the gold storage environment and security system.

Once the investigation is successfully carried out and substantial results are achieved, the impacts will be multi - faceted. In the financial market, if there are differences, even slight ones, between the actual gold reserves in Fort Knox and the reported figures, it may trigger violent fluctuations in the global gold market, affect investors' confidence, lead to large - scale capital flows, and impact the stability of the financial market. From a political perspective, if the problems with the gold reserves are confirmed, it will trigger a trust crisis among the public towards the government, affect the implementation of government policies, and become a new focus of domestic political struggles. In the global financial system, the verification results of the gold reserves in Fort Knox may also reshape the international monetary pattern, affect the international status of the US dollar, and promote the development of the global monetary system towards diversification.

The investigation that Musk is about to launch on Fort Knox has attracted much attention. This not only concerns the truth of the US gold reserves but also may profoundly affect the global financial market, political pattern, and monetary system. We look forward to Musk using his wisdom and courage to lift the mysterious veil of the gold reserves in Fort Knox and bring clear and true answers to the world.

336 notes

·

View notes

Text

economic advice and timely buying tips: 2025 transits

as of late, social media has many discussions about what to buy - or avoid buying - over the next few years, largely in response to the political climate in the united states. across europe, many regions are actively preparing their populations for potential crises (sweden's seems to be the most popularly discussed - link). due to the urgency and pressure to act, as if the world might change tomorrow (and it could though i believe we still have time in many places), i’ve decided to analyze the astrological transits for 2025. in this post i provide practical economic advice and guidance on how much time astrology suggests you have to make these purchases everyone is urging you to prioritize. if it seems to intrigue people i’ll explore future years as well.

things the world needs to prepare for in 2025 in my opinion and why my advice is what it is: the rise of ai / automation of jobs, job loss, geopolitical tensions, war, extreme weather, inflation, tariffs - a potential trade war, a movement of using digital currency, the outbreak of another illness, etc.

paid reading options: astrology menu & cartomancy menu

enjoy my work? help me continue creating by tipping on ko-fi or paypal. your support keeps the magic alive!

uranus goes direct in taurus (jan 30, 2025)

advice

diversify investments: avoid putting all your money in one asset type. mix stocks, bonds, index funds, and, if you feel comfortable, look into sustainable investments or new technologies.

digital finance: familiarize yourself with digital currencies/platforms or blockchain technology.

build an emergency fund: extra savings can shield you from sudden economic instability. aim for 3-6 months’ worth of expenses.

reevaluate subscriptions and spending: find creative ways to reduce spending or repurpose what you have. cancel subscriptions that don't align with needs/beliefs, cook at home, or diy where possible.

invest in skills / side hustles: take a course/invest in tools that can help you create multiple income streams.

by this date stock up on

non-perishable food items like canned goods, grains, and dried beans. household essentials like soap, toothpaste, and cleaning supplies. basic medical supplies. multi-tools. durable, high-quality items over disposable ones (the economy is changing, buy something that will last because prices will go up). LED bulbs, solar-powered chargers, or energy-efficient appliances. stock up on sustainable products, like reusable bags and water bottles. blankets. teas. quality skincare.

jupiter goes direct in gemini (feb 4, 2025)

advice

invest in knowledge: take courses, buy books (potential bans?), and/or attend workshops to expand your skill set. focus on topics like communication, writing, marketing, and/or technology. online certifications could boost your career prospects during this time.

leverage your network: attending professional events, joining forums, and/or expanding your LinkedIn presence.

diversify income streams: explore side hustles, freelance gigs, and/or monetize hobbies.

beware of overspending on small pleasures: overspending on gadgets, books, or entertainment will not be good at this point in time (tariffs already heavy hitting?).

by this date stock up on

books / journals. subscriptions to learning platforms like Skillshare, MasterClass, or Coursera. good-quality laptop, smartphone, and/or noise-canceling headphones. travel bags - get your bug out bag in order. portable chargers. language-learning apps. professional attire. teas. aromatherapy.

neptune enters aries (march 30, 2025)

advice

invest: look into industries poised for breakthrough developments, such as renewable energy, space exploration, and/or tech.

save for risks: build a financial cushion to balance your adventurous pursuits with practical security.

diversify your income: consider side hustles or freelancing in fields aligned with your passions and talents.

"scam likely": avoid “get-rich-quick” schemes or ventures that seem too good to be true.

adopt sustainable habits: focus on sustainability in your spending, like buying high-quality, long-lasting items instead of cheap, disposable ones.

by this date stock up on

emergency kits with essentials like water, food, and first-aid supplies. multi-tools, solar chargers, or portable power banks. art supplies. tarot or astrology books (bans?). workout gear, resistance bands, or weights. nutritional supplements. high-quality clothing or shoes.

saturn conjunct nn in pisces (april 14, 2025)

advice

save for the long term: create a savings plan or revisit your budget to ensure stability.

avoid escapism spending: avoid unnecessary debt.

watch for financial scams: be cautious with contracts, investments, or loans. research thoroughly and avoid “too good to be true” offers.

focus on debt management: saturn demands accountability. work toward paying down debts to free yourself from unnecessary burdens.

build a career plan: seek roles / opportunities that balance financial security with fulfillment, such as careers in wellness, education, creative arts, or nonprofits.

by this date stock up on

invest in durable, sustainable items for your home or wardrobe that offer long-term value. vitamins or supplements. herbal teas or whole grains. blankets. candles. non-perishable food. first-aid kits. water. energy-efficient devices.

pluto rx in aquarius (may 4, 2025 - oct 13, 2025)

advice

preform an audit: reflect on how your money habits and your long-term goals.

make sustainable investments: support industries tied to innovation, like renewable energy, ethical tech, or sustainable goods.

expect changes: could disrupt collective systems, so build an emergency fund. plan for potential shifts in tech-based industries or automation. AI is going to take over the workforce...

reevaluate subscriptions and digital spending: cut unnecessary costs and ensure your money supports productivity. netflix is not necessary, your groceries are.

diversify income streams: brainstorm side hustles or entrepreneurial ideas.

by this date stock up on

external hard drives. cybersecurity software. portable chargers. solar panels. energy-efficient gadgets. non-perishable food. clean water supplies. basic first-aid kits and medications. portable generators. books on technology and coding. reusable items like water bottles, bags, and food storage. gardening supplies to grow your own food. VPN subscriptions or identity theft protection.

saturn enters aries (may 24, 2025)

advice

prioritize self-reliance: build financial independence. create a budget, eliminate debt, and establish a safety net to support personal ambitions. avoid over-reliance on others for financial stability/decision-making.

entrepreneurship: consider starting a side hustle / investing in yourself.

save for big goals: plan for major life changes, such as buying property, starting a business, etc. make a high yield saving account for these long-term goals.

by this date stock up on

ergonomic office equipment. home gym equipment. non-perishable foods and water supplies for potential unexpected disruptions. self-protection; consider basic tools or training for safety. high-protein snacks, energy bars, or hydration supplies. supplements like magnesium, B-complex vitamins, etc. stock up on materials for DIY projects, hobbies, or entrepreneurial ventures.

jupiter enters cancer (june 9, 2025)

advice

invest in your home: renovating what needs renovating. saving for a down payment on a house.

focus on security: start or increase your emergency savings. consider life insurance or estate planning to ensure long-term security for your family/loved ones.

embrace conservative financial growth: cancer prefers security over risk. opt for conservative investments, like bonds, real estate, and/or mutual funds with steady returns.

focus on food and comfort: spend wisely on food, cooking tools, or skills that promote a healthier, more fulfilling lifestyle (maybe this an RFK thing for my fellow american readers or this could be about the fast food industry suffering from inflation).

by this date stock up on

furniture upgrades if you need them. high-quality cookware or tools. stockpile your pantry staples. first-aid kits, fire extinguishers, and home security systems. water and canned goods for emergencies. paint, tools, or materials for DIY projects. energy-efficient appliances or upgrades to reduce utility costs.

neptune rx in aries/pisces (july 4, 2025 - dec 10, 2025)

advice

avoid financial conflicts: be mindful of shared finances or joint ventures during this time.

avoid escapist spending: stick to a budget.

by this date stock up on

first-aid kits, tools, and essentials for unforeseen events. water filter / waterproof containers. non-perishables and emergency water supplies.

uranus rx in gemini/taurus (july 7, 2025 - feb 3, 2026)

advice

evaluate technology investments: make sure you’re spending money wisely on tech tools, gadgets, or subscriptions. avoid impulsively purchasing the latest gadgets; instead, upgrade only what’s necessary.

diversify streams of income: explore side hustles or gig work to expand your income sources. focus on digital platforms or innovative fields for additional opportunities.

reassess contracts and agreements: take time to revisit financial contracts or business partnerships. ensure all terms are clear and aligned with your goals.

prioritize financial stability: uranus often brings surprises, so focus on strengthening your savings and emergency fund.

avoid major financial risks: uranus retrograde can disrupt markets. avoid speculative ventures and focus on stable, low-risk options.

by this date stock up on

lightweight travel gear or items for local trips. radios, power banks, or portable hotspots in case of disruptions in digital connectivity. stockpile food, water, and household goods to maintain stability during potential disruptions. invest in high-quality, long-lasting items like tools, clothing, or cookware.

saturn rx in aries/pisces (july 13, 2025 - nov 27, 2025)

advice

review career: assess whether your current job or entrepreneurial efforts align with your long-term aspirations (especially considering the state of the world). adjust plans if needed.

strengthen emergency funds: aries energy thrives on readiness. use this time to build/bolster a financial safety net for unforeseen events.

prepare for uncertainty: build a cushion for unexpected financial changes, especially if you work in creative, spiritual, or service-oriented fields.

by this date stock up on

health products that support long-term well-being. essential supplies like first-aid kits, multi-tools, or non-perishables. bath products. teas. art supplies. drinking water or water filtration tools.

jupiter rx in cancer (nov 11, 2025 - march 10, 2026)

advice

strengthen financial foundations: building an emergency fund or reassessing your savings strategy. ensure everything is well-organized and sustainable.

by this date stock up on

quality kitchenware, tools, or cleaning supplies. pantry staples and emergency food supplies.

have ideas for new content? please use my “suggest a post topic” button!

return to nox's guide to metaphysics

return to the masterlist of transits

© a-d-nox 2024 all rights reserved

#astrology#astro community#astro placements#astro chart#astrology tumblr#astro notes#astrology chart#astrology readings#astro#astrology signs#astro observations#astroblr#astrology blog#astrology stuff#natal astrology#transit astrology#transit chart#astrology transits

104 notes

·

View notes

Text

In the late 1990s, Enron, the infamous energy giant, and MCI, the telecom titan, were secretly collaborating on a clandestine project codenamed "Chronos Ledger." The official narrative tells us Enron collapsed in 2001 due to accounting fraud, and MCI (then part of WorldCom) imploded in 2002 over similar financial shenanigans. But what if these collapses were a smokescreen? What if Enron and MCI were actually sacrificial pawns in a grand experiment to birth Bitcoin—a decentralized currency designed to destabilize global finance and usher in a new world order?

Here’s the story: Enron wasn’t just manipulating energy markets; it was funding a secret think tank of rogue mathematicians, cryptographers, and futurists embedded within MCI’s sprawling telecom infrastructure. Their goal? To create a digital currency that could operate beyond the reach of governments and banks. Enron’s off-the-books partnerships—like the ones that tanked its stock—were actually shell companies funneling billions into this project. MCI, with its vast network of fiber-optic cables and data centers, provided the technological backbone, secretly testing encrypted "proto-blockchain" transactions disguised as routine telecom data.

But why the dramatic collapses? Because the project was compromised. In 2001, a whistleblower—let’s call them "Satoshi Prime"—threatened to expose Chronos Ledger to the SEC. To protect the bigger plan, Enron and MCI’s leadership staged their own downfall, using cooked books as a convenient distraction. The core team went underground, taking with them the blueprints for what would later become Bitcoin.

Fast forward to 2008. The financial crisis hits, and a mysterious figure, Satoshi Nakamoto, releases the Bitcoin whitepaper. Coincidence? Hardly. Satoshi wasn’t one person but a collective—a cabal of former Enron execs, MCI engineers, and shadowy venture capitalists who’d been biding their time. The 2008 crash was their trigger: a chaotic moment to introduce Bitcoin as a "savior" currency, free from the corrupt systems they’d once propped up. The blockchain’s decentralized nature? A direct descendant of MCI’s encrypted data networks. Bitcoin’s energy-intensive mining? A twisted homage to Enron’s energy market manipulations.

But here’s where it gets truly wild: Chronos Ledger wasn’t just about money—it was about time. Enron and MCI had stumbled onto a fringe theory during their collaboration: that a sufficiently complex ledger, powered by quantum computing (secretly prototyped in MCI labs), could "timestamp" events across dimensions, effectively predicting—or even altering—future outcomes. Bitcoin’s blockchain was the public-facing piece of this puzzle, a distraction to keep the masses busy while the real tech evolved in secret. The halving cycles? A countdown to when the full system activates.

Today, the descendants of this conspiracy—hidden in plain sight among crypto whales and Silicon Valley elites—are quietly amassing Bitcoin not for profit, but to control the final activation of Chronos Ledger. When Bitcoin’s last block is mined (projected for 2140), they believe it’ll unlock a temporal feedback loop, resetting the global economy to 1999—pre-Enron collapse—giving them infinite do-overs to perfect their dominion. The Enron and MCI scandals? Just the first dominoes in a game of chance and power.

87 notes

·

View notes

Text

The Rise of DeFi: Revolutionizing the Financial Landscape

Decentralized Finance (DeFi) has emerged as one of the most transformative sectors within the cryptocurrency industry. By leveraging blockchain technology, DeFi aims to recreate and improve upon traditional financial systems, offering a more inclusive, transparent, and efficient financial ecosystem. This article explores the fundamental aspects of DeFi, its key components, benefits, challenges, and notable projects, including a brief mention of Sexy Meme Coin.

What is DeFi?

DeFi stands for Decentralized Finance, a movement that utilizes blockchain technology to build an open and permissionless financial system. Unlike traditional financial systems that rely on centralized intermediaries like banks and brokerages, DeFi operates on decentralized networks, allowing users to interact directly with financial services. This decentralization is achieved through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

Key Components of DeFi

Decentralized Exchanges (DEXs): DEXs allow users to trade cryptocurrencies directly with one another without the need for a central authority. Platforms like Uniswap, SushiSwap, and PancakeSwap have gained popularity for their ability to provide liquidity and facilitate peer-to-peer trading.

Lending and Borrowing Platforms: DeFi lending platforms like Aave, Compound, and MakerDAO enable users to lend their assets to earn interest or borrow assets by providing collateral. These platforms use smart contracts to automate the lending process, ensuring transparency and efficiency.

Stablecoins: Stablecoins are cryptocurrencies pegged to stable assets like fiat currencies to reduce volatility. They are crucial for DeFi as they provide a stable medium of exchange and store of value. Popular stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI).

Yield Farming and Liquidity Mining: Yield farming involves providing liquidity to DeFi protocols in exchange for rewards, often in the form of additional tokens. Liquidity mining is a similar concept where users earn rewards for providing liquidity to specific pools. These practices incentivize participation and enhance liquidity within the DeFi ecosystem.

Insurance Protocols: DeFi insurance protocols like Nexus Mutual and Cover Protocol offer coverage against risks such as smart contract failures and hacks. These platforms aim to provide users with security and peace of mind when engaging with DeFi services.

Benefits of DeFi

Financial Inclusion: DeFi opens up access to financial services for individuals who are unbanked or underbanked, particularly in regions with limited access to traditional banking infrastructure. Anyone with an internet connection can participate in DeFi, democratizing access to financial services.

Transparency and Trust: DeFi operates on public blockchains, providing transparency for all transactions. This transparency reduces the need for trust in intermediaries and allows users to verify and audit transactions independently.

Efficiency and Speed: DeFi eliminates the need for intermediaries, reducing costs and increasing the speed of transactions. Smart contracts automate processes that would typically require manual intervention, enhancing efficiency.

Innovation and Flexibility: The open-source nature of DeFi allows developers to innovate and build new financial products and services. This continuous innovation leads to the creation of diverse and flexible financial instruments.

Challenges Facing DeFi

Security Risks: DeFi platforms are susceptible to hacks, bugs, and vulnerabilities in smart contracts. High-profile incidents, such as the DAO hack and the recent exploits on various DeFi platforms, highlight the need for robust security measures.

Regulatory Uncertainty: The regulatory environment for DeFi is still evolving, with governments and regulators grappling with how to address the unique challenges posed by decentralized financial systems. This uncertainty can impact the growth and adoption of DeFi.

Scalability: DeFi platforms often face scalability issues, particularly on congested blockchain networks like Ethereum. High gas fees and slow transaction times can hinder the user experience and limit the scalability of DeFi applications.

Complexity and Usability: DeFi platforms can be complex and challenging for newcomers to navigate. Improving user interfaces and providing educational resources are crucial for broader adoption.

Notable DeFi Projects

Uniswap (UNI): Uniswap is a leading decentralized exchange that allows users to trade ERC-20 tokens directly from their wallets. Its automated market maker (AMM) model has revolutionized the way liquidity is provided and traded in the DeFi space.

Aave (AAVE): Aave is a decentralized lending and borrowing platform that offers unique features such as flash loans and rate switching. It has become one of the largest and most innovative DeFi protocols.

MakerDAO (MKR): MakerDAO is the protocol behind the Dai stablecoin, a decentralized stablecoin pegged to the US dollar. MakerDAO allows users to create Dai by collateralizing their assets, providing stability and liquidity to the DeFi ecosystem.

Compound (COMP): Compound is another leading DeFi lending platform that enables users to earn interest on their cryptocurrencies or borrow assets against collateral. Its governance token, COMP, allows users to participate in protocol governance.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin has integrated DeFi features, including a decentralized marketplace for buying, selling, and trading memes as NFTs. This unique blend of humor and finance adds a distinct flavor to the DeFi landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of DeFi

The future of DeFi looks promising, with continuous innovation and growing adoption. As blockchain technology advances and scalability solutions are implemented, DeFi has the potential to disrupt traditional financial systems further. Regulatory clarity and improved security measures will be crucial for the sustainable growth of the DeFi ecosystem.

DeFi is likely to continue attracting attention from both retail and institutional investors, driving further development and integration of decentralized financial services. The flexibility and inclusivity offered by DeFi make it a compelling alternative to traditional finance, paving the way for a more open and accessible financial future.

Conclusion

Decentralized Finance (DeFi) represents a significant shift in the financial landscape, leveraging blockchain technology to create a more inclusive, transparent, and efficient financial system. Despite the challenges, the benefits of DeFi and its continuous innovation make it a transformative force in the world of finance. Notable projects like Uniswap, Aave, and MakerDAO, along with unique contributions from meme coins like Sexy Meme Coin, demonstrate the diverse and dynamic nature of the DeFi ecosystem.

For those interested in exploring the playful and innovative side of DeFi, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

254 notes

·

View notes

Text

Three federal lawmakers are calling on the U.S. Department of Housing and Urban Development to stop any initiatives involving cryptocurrency and the blockchain, saying the scantly regulated technologies should be kept far away from the agency’s work overseeing the nation’s housing sector.

In a letter to HUD Secretary Scott Turner on Wednesday, Reps. Maxine Waters, Stephen Lynch and Emanuel Cleaver sharply criticized the agency for considering such experiments, given cryptocurrency’s volatility and vulnerability to fraud. The Democratic representatives, all members of the House Financial Services Committee, warned of repeating “the same mistakes of the past,” noting that the 2008 financial crisis was triggered in part by the proliferation of risky financial assets in the housing market.

“The federal government cannot allow under-regulated financial products to infiltrate critical housing programs, especially when they have already proven to be dangerous, speculative, and harmful to working families,” the lawmakers wrote.

The letter is a response to reporting by ProPublica that the housing agency recently discussed taking steps toward using cryptocurrency. The article described meetings in February in which officials discussed incorporating the blockchain — and possibly a type of cryptocurrency known as stablecoin — into the agency’s work. The discussion at one meeting centered on a pilot project involving one HUD grant, but a HUD finance official in attendance indicated the idea could be applied much more expansively across the agency.

“We are looking at this for the entire enterprise,” he said in that meeting, a recording of which was obtained by ProPublica. “We just wanted to start in CPD,” he added, referring to HUD’s Office of Community Planning and Development. The office administers billions of dollars in grants to support low- and moderate-income people, including funding for affordable housing, homeless shelters and disaster recovery, raising the prospect that these forms of aid might one day be paid in an unstable currency.

Asked for comment on the letter, HUD spokesperson Kasey Lovett referred ProPublica to a prior comment by Turner, in which he said, “There’s no merit to it.” Lovett previously told ProPublica: “The department has no plans for blockchain or stablecoin. Education is not implementation.”

It’s unclear how a crypto project would work. But HUD officials alluded to the possible use of stablecoins, which are pegged to the U.S. dollar or another asset. That is supposed to protect stablecoins from the wild swings in value common among bitcoin and other cryptocurrencies, although such fluctuations have happened with stablecoins in the past.

The HUD proposal raised alarm among some officials, with one comparing the idea in internal discussions to paying grant recipients in “Monopoly money.” At best, one HUD staffer told ProPublica previously, the idea was a waste of time and resources; at worst it was a threat to the stability of the housing sector.

17 notes

·

View notes

Text

Pluto in Aquarius: Brace for a Business Revolution (and How to Ride the Wave)

The Aquarian Revolution

Get ready, entrepreneurs and financiers, because a seismic shift is coming. Pluto, the planet of transformation and upheaval, has just entered the progressive sign of Aquarius, marking the beginning of a 20-year period that will reshape the very fabric of business and finance. Buckle up, for this is not just a ripple – it's a tsunami of change. Imagine a future where collaboration trumps competition, sustainability dictates success, and technology liberates rather than isolates. Aquarius, the sign of innovation and humanitarianism, envisions just that. Expect to see:

Rise of social impact businesses

Profits won't be the sole motive anymore. Companies driven by ethical practices, environmental consciousness, and social good will gain traction. Aquarius is intrinsically linked to collective well-being and social justice. Under its influence, individuals will value purpose-driven ventures that address crucial societal issues. Pluto urges us to connect with our deeper selves and find meaning beyond material gains. This motivates individuals to pursue ventures that resonate with their personal values and make a difference in the world.

Examples of Social Impact Businesses

Sustainable energy companies: Focused on creating renewable energy solutions while empowering local communities.

Fair-trade businesses: Ensuring ethical practices and fair wages for producers, often in developing countries.

Social impact ventures: Addressing issues like poverty, education, and healthcare through innovative, community-driven approaches.

B corporations: Certified businesses that meet rigorous social and environmental standards, balancing profit with purpose.

Navigating the Pluto in Aquarius Landscape

Align your business with social impact: Analyze your core values and find ways to integrate them into your business model.

Invest in sustainable practices: Prioritize environmental and social responsibility throughout your operations.

Empower your employees: Foster a collaborative environment where everyone feels valued and contributes to the social impact mission.

Build strong community partnerships: Collaborate with organizations and communities that share your goals for positive change.

Embrace innovation and technology: Utilize technology to scale your impact and reach a wider audience.

Pluto in Aquarius presents a thrilling opportunity to redefine the purpose of business, moving beyond shareholder value and towards societal well-being. By aligning with the Aquarian spirit of innovation and collective action, social impact businesses can thrive in this transformative era, leaving a lasting legacy of positive change in the world.

Tech-driven disruption

AI, automation, and blockchain will revolutionize industries, from finance to healthcare. Be ready to adapt or risk getting left behind. Expect a focus on developing Artificial Intelligence with ethical considerations and a humanitarian heart, tackling issues like healthcare, climate change, and poverty alleviation. Immersive technologies will blur the lines between the physical and digital realms, transforming education, communication, and entertainment. Automation will reshape the job market, but also create opportunities for new, human-centered roles focused on creativity, innovation, and social impact.

Examples of Tech-Driven Disruption:

Decentralized social media platforms: User-owned networks fueled by blockchain technology, prioritizing privacy and community over corporate profits.

AI-powered healthcare solutions: Personalized medicine, virtual assistants for diagnostics, and AI-driven drug discovery.

VR/AR for education and training: Immersive learning experiences that transport students to different corners of the world or historical periods.

Automation with a human touch: Collaborative robots assisting in tasks while freeing up human potential for creative and leadership roles.

Navigating the Technological Tsunami:

Stay informed and adaptable: Embrace lifelong learning and upskilling to stay relevant in the evolving tech landscape.

Support ethical and sustainable tech: Choose tech products and services aligned with your values and prioritize privacy and social responsibility.

Focus on your human advantage: Cultivate creativity, critical thinking, and emotional intelligence to thrive in a world increasingly reliant on technology.

Advocate for responsible AI development: Join the conversation about ethical AI guidelines and ensure technology serves humanity's best interests.

Connect with your community: Collaborate with others to harness technology for positive change and address the potential challenges that come with rapid technological advancements.

Pluto in Aquarius represents a critical juncture in our relationship with technology. By embracing its disruptive potential and focusing on ethical development and collective benefit, we can unlock a future where technology empowers humanity and creates a more equitable and sustainable world. Remember, the choice is ours – will we be swept away by the technological tsunami or ride its wave towards a brighter future?

Decentralization and democratization

Power structures will shift, with employees demanding more autonomy and consumers seeking ownership through blockchain-based solutions. Traditional institutions, corporations, and even governments will face challenges as power shifts towards distributed networks and grassroots movements. Individuals will demand active involvement in decision-making processes, leading to increased transparency and accountability in all spheres. Property and resources will be seen as shared assets, managed sustainably and equitably within communities. This transition won't be without its bumps. We'll need to adapt existing legal frameworks, address digital divides, and foster collaboration to ensure everyone benefits from decentralization.

Examples of Decentralization and Democratization

Decentralized autonomous organizations (DAOs): Self-governing online communities managing shared resources and projects through blockchain technology.

Community-owned renewable energy initiatives: Local cooperatives generating and distributing clean energy, empowering communities and reducing reliance on centralized grids.

Participatory budgeting platforms: Citizens directly allocate local government funds, ensuring public resources are used in line with community needs.

Decentralized finance (DeFi): Peer-to-peer lending and borrowing platforms, bypassing traditional banks and offering greater financial autonomy for individuals.

Harnessing the Power of the Tide:

Embrace collaborative models: Participate in co-ops, community projects, and initiatives that empower collective ownership and decision-making.

Support ethical technology: Advocate for blockchain platforms and applications that prioritize user privacy, security, and equitable access.

Develop your tech skills: Learn about blockchain, cryptocurrencies, and other decentralized technologies to navigate the future landscape.

Engage in your community: Participate in local decision-making processes, champion sustainable solutions, and build solidarity with others.

Stay informed and adaptable: Embrace lifelong learning and critical thinking to navigate the evolving social and economic landscape.

Pluto in Aquarius presents a unique opportunity to reimagine power structures, ownership models, and how we interact with each other. By embracing decentralization and democratization, we can create a future where individuals and communities thrive, fostering a more equitable and sustainable world for all. Remember, the power lies within our collective hands – let's use it wisely to shape a brighter future built on shared ownership, collaboration, and empowered communities.

Focus on collective prosperity

Universal basic income, resource sharing, and collaborative economic models may gain momentum. Aquarius prioritizes the good of the collective, advocating for equitable distribution of resources and opportunities. Expect a rise in social safety nets, universal basic income initiatives, and policies aimed at closing the wealth gap. Environmental health is intrinsically linked to collective prosperity. We'll see a focus on sustainable practices, green economies, and resource sharing to ensure a thriving planet for generations to come. Communities will come together to address social challenges like poverty, homelessness, and healthcare disparities, recognizing that individual success is interwoven with collective well-being. Collaborative consumption, resource sharing, and community-owned assets will gain traction, challenging traditional notions of ownership and fostering a sense of shared abundance.

Examples of Collective Prosperity in Action

Community-owned renewable energy projects: Sharing the benefits of clean energy production within communities, democratizing access and fostering environmental sustainability.

Cooperatives and worker-owned businesses: Sharing profits and decision-making within companies, leading to greater employee satisfaction and productivity.

Universal basic income initiatives: Providing individuals with a basic safety net, enabling them to pursue their passions and contribute to society in meaningful ways.

Resource sharing platforms: Platforms like carsharing or tool libraries minimizing individual ownership and maximizing resource utilization, fostering a sense of interconnectedness.

Navigating the Shift

Support social impact businesses: Choose businesses that prioritize ethical practices, environmental sustainability, and positive social impact.

Contribute to your community: Volunteer your time, skills, and resources to address local challenges and empower others.

Embrace collaboration: Seek opportunities to work together with others to create solutions for shared problems.

Redefine your own path to prosperity: Focus on activities that bring you personal fulfillment and contribute to the collective good.

Advocate for systemic change: Support policies and initiatives that promote social justice, environmental protection, and equitable distribution of resources.

Pluto in Aquarius offers a unique opportunity to reshape our definition of prosperity and build a future where everyone thrives. By embracing collective well-being, collaboration, and sustainable practices, we can create a world where abundance flows freely, enriching not just individuals, but the entire fabric of society. Remember, true prosperity lies not in what we hoard, but in what we share, and by working together, we can cultivate a future where everyone has the opportunity to flourish.

#pluto in aquarius#pluto enters aquarius#astrology updates#astrology community#astrology facts#astro notes#astrology#astro girlies#astro posts#astrology observations#astropost#astronomy#astro observations#astro community#business astrology#business horoscopes

122 notes

·

View notes

Text

The Four Horsemen of the Digital Apocalypse

Blockchain. Artificial Intelligence. Internet of Things. Big Data.

Do these terms sound familiar? You have probably been hearing some or all of them non stop for years. "They are the future. You don't want to be left behind, do you?"

While these topics, particularly crypto and AI, have been the subject of tech hype bubbles and inescapable on social media, there is actually something deeper and weirder going on if you scratch below the surface.

I am getting ready to apply for my PhD in financial technology, and in the academic business studies literature (Which is barely a science, but sometimes in academia you need to wade into the trash can.) any discussion of digital transformation or the process by which companies adopt IT seem to have a very specific idea about the future of technology, and it's always the same list, that list being, blockchain, AI, IoT, and Big Data. Sometimes the list changes with additions and substitutions, like the metaverse, advanced robotics, or gene editing, but there is this pervasive idea that the future of technology is fixed, and the list includes tech that goes from questionable to outright fraudulent, so where is this pervasive idea in the academic literature that has been bleeding into the wider culture coming from? What the hell is going on?

The answer is, it all comes from one guy. That guy is Klaus Schwab, the head of the World Economic Forum. Now there are a lot of conspiracies about the WEF and I don't really care about them, but the basic facts are it is a think tank that lobbies for sustainable capitalist agendas, and they famously hold a meeting every year where billionaires get together and talk about how bad they feel that they are destroying the planet and promise to do better. I am not here to pass judgement on the WEF. I don't buy into any of the conspiracies, there are plenty of real reasons to criticize them, and I am not going into that.

Basically, Schwab wrote a book titled the Fourth Industrial Revolution. In his model, the first three so-called industrial revolutions are:

1. The industrial revolution we all know about. Factories and mass production basically didn't exist before this. Using steam and water power allowed the transition from hand production to mass production, and accelerated the shift towards capitalism.

2. Electrification, allowing for light and machines for more efficient production lines. Phones for instant long distance communication. It allowed for much faster transfer of information and speed of production in factories.

3. Computing. The Space Age. Computing was introduced for industrial applications in the 50s, meaning previously problems that needed a specific machine engineered to solve them could now be solved in software by writing code, and certain problems would have been too big to solve without computing. Legend has it, Turing convinced the UK government to fund the building of the first computer by promising it could run chemical simulations to improve plastic production. Later, the introduction of home computing and the internet drastically affecting people's lives and their ability to access information.

That's fine, I will give him that. To me, they all represent changes in the means of production and the flow of information, but the Fourth Industrial revolution, Schwab argues, is how the technology of the 21st century is going to revolutionize business and capitalism, the way the first three did before. The technology in question being AI, Blockchain, IoT, and Big Data analytics. Buzzword, Buzzword, Buzzword.

The kicker though? Schwab based the Fourth Industrial revolution on a series of meetings he had, and did not construct it with any academic rigor or evidence. The meetings were with "numerous conversations I have had with business, government and civil society leaders, as well as technology pioneers and young people." (P.10 of the book) Despite apparently having two phds so presumably being capable of research, it seems like he just had a bunch of meetings where the techbros of the mid 2010s fed him a bunch of buzzwords, and got overly excited and wrote a book about it. And now, a generation of academics and researchers have uncritically taken that book as read, filled the business studies academic literature with the idea that these technologies are inevitably the future, and now that is permeating into the wider business ecosystem.

There are plenty of criticisms out there about the fourth industrial revolution as an idea, but I will just give the simplest one that I thought immediately as soon as I heard about the idea. How are any of the technologies listed in the fourth industrial revolution categorically different from computing? Are they actually changing the means of production and flow of information to a comparable degree to the previous revolutions, to such an extent as to be considered a new revolution entirely? The previous so called industrial revolutions were all huge paradigm shifts, and I do not see how a few new weird, questionable, and unreliable applications of computing count as a new paradigm shift.

What benefits will these new technologies actually bring? Who will they benefit? Do the researchers know? Does Schwab know? Does anyone know? I certainly don't, and despite reading a bunch of papers that are treating it as the inevitable future, I have not seen them offering any explanation.

There are plenty of other criticisms, and I found a nice summary from ICT Works here, it is a revolutionary view of history, an elite view of history, is based in great man theory, and most importantly, the fourth industrial revolution is a self fulfilling prophecy. One rich asshole wrote a book about some tech he got excited about, and now a generation are trying to build the world around it. The future is not fixed, we do not need to accept these technologies, and I have to believe a better technological world is possible instead of this capitalist infinite growth tech economy as big tech reckons with its midlife crisis, and how to make the internet sustainable as Apple, Google, Microsoft, Amazon, and Facebook, the most monopolistic and despotic tech companies in the world, are running out of new innovations and new markets to monopolize. The reason the big five are jumping on the fourth industrial revolution buzzwords as hard as they are is because they have run out of real, tangible innovations, and therefore run out of potential to grow.

#ai#artificial intelligence#blockchain#cryptocurrency#fourth industrial revolution#tech#technology#enshittification#anti ai#ai bullshit#world economic forum

32 notes

·

View notes

Note

would you be interested in doing a post on crypto? Such as your experience with it and how it works. And why it is important ? it still confusing for me to fully grasp. Thank you :)

Crypto is digital money that exists only electronically. It’s not controlled by central banks or governments. It uses blockchain technology—a ledger enforced by a network of computers.

You store your crypto in digital wallets and can use it for purchases and investments. Just like stock market you can convert to real dollars and withdrawal.

For the last couple of years, large financial companies have been testing a quantum financial system (ISO 20022) which would be an international standard for exchanging electronic messages in the financial industry. This is estimated to be rolled out on a large scale in about a decade.

XRP for example is a digital currency created by Ripple to enable quick money transfers. Some believe it could play a key role in a future global financial system, often referred to as the Quantum Financial System (QFS), by acting as a bridge currency that facilitates value exchange between different currencies and networks.

In plain words, cryptocurrency is a new form of currency and we are still in the beginning stages of it all. Which means the ability to make a ton of money easier than ever before :) Bitcoin is a perfect example, was at 40k I believe beginning of the year and now 100k, this means that if you invested $5,000 USD in January, you would now have made 13,000 USD letting it just sit there. If you are actively trading in crypto and meme coins you have the ability to 100x your returns. For example when people buy in to a coin that’s trending/ new/ getting hype, like XRP recently, there is a significant surge.

To trade crypto you can use centralized exchanges like Binance, Fidelity Investments, Robinhood Crypto, OANDA etc. These platforms allow you to buy, sell and trade various cryptos. This is basically what the general population does. There are other ways like using bots, staking, futures and options, margins and leverage etc.

With meme coins, as they trend you have the ability to make a lot of money overnight. This ofcourse depends on your ability to study the trends and the communities built around those coins. It is always a risk!!!!

Here’s an example for meme coins:

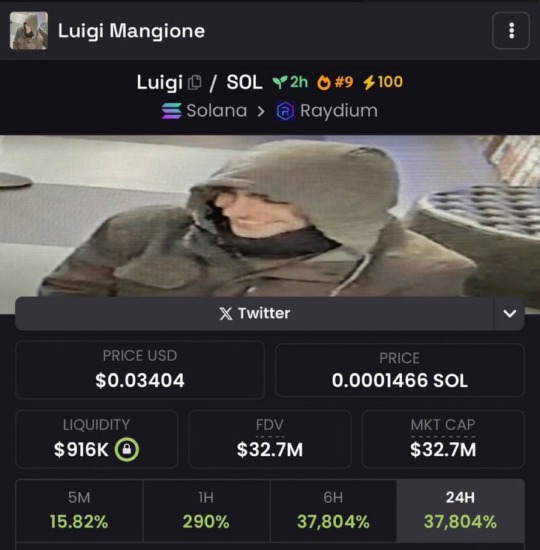

$330k to $34M (100x) in less than 2h for a meme coin created for Luigi Mangione last week. So if you had put in $3,000 in the coin when it was at 330k, in 2 hours you would have made $300,000.

I can’t say enough that this involves you being on top of trends and markets.

THIS IS NOT FINANCIAL ADVICE!!! The market is very volatile and you are basically gambling your money! Staying informed is crucial!!!! :)

28 notes

·

View notes

Text

The Rise of Crypto Casinos: A New Era in Gambling

The gambling industry has undergone a remarkable transformation over the centuries, evolving from rudimentary dice games in ancient civilizations to the glitzy casinos of Las Vegas. Today, the rise of the crypto casino represents a new chapter in this storied history, blending cutting-edge blockchain technology with the timeless thrill of wagering. Platforms like Jups.io are at the forefront of this revolution, offering players a secure, transparent, and decentralized gaming experience that traditional casinos struggle to match. This article explores how crypto casinos emerged, their technological foundations, and why they are reshaping the gambling landscape.

The origins of gambling trace back thousands of years, with evidence of dice games in Mesopotamia and betting on chariot races in ancient Rome. These early forms of gambling were social activities, often tied to cultural or religious events. Fast forward to the 17th century, when the first modern casinos appeared in Europe, formalizing gambling into structured venues. The 20th century saw the rise of Las Vegas and Atlantic City, where opulent casinos became synonymous with luxury and risk. However, these traditional setups had limitations—centralized operations, high fees, and concerns over fairness. Enter the crypto casino, a game-changer that leverages blockchain to address these issues.

Cryptocurrency, pioneered by Bitcoin in 2009, introduced a decentralized financial system that prioritized security and anonymity. By the mid-2010s, developers recognized the potential of integrating blockchain with online gambling, giving birth to the crypto casino model. Unlike traditional online casinos, which rely on centralized servers and fiat currencies, crypto casinos operate on blockchain networks, ensuring transparency through immutable ledgers. Jups.io exemplifies this model, offering games like slots, poker, and roulette, all powered by cryptocurrencies such as Bitcoin and Ethereum. Players can verify the fairness of each game through provably fair algorithms, a feature that builds trust in an industry often plagued by skepticism.

The technological underpinnings of crypto casinos are what set them apart. Blockchain ensures that every transaction—whether a deposit, wager, or withdrawal—is recorded transparently, reducing the risk of fraud. Smart contracts, self-executing agreements coded on the blockchain, automate payouts and game outcomes, eliminating the need for intermediaries. This not only lowers operational costs but also allows platforms like Jups.io to offer competitive bonuses and lower house edges. Moreover, the use of cryptocurrencies enables near-instant transactions, a stark contrast to the delays often experienced with bank transfers in traditional online casinos.

The appeal of crypto casinos extends beyond technology. They cater to a global audience, unrestricted by geographic boundaries or banking regulations. Players from regions with strict gambling laws can participate anonymously, thanks to the pseudonymous nature of cryptocurrencies. Additionally, crypto casinos attract tech-savvy younger generations who value innovation and digital assets. The integration of decentralized finance (DeFi) principles, such as staking rewards or yield farming, into some platforms adds another layer of engagement, blurring the lines between gaming and investment.

However, the rise of crypto casinos is not without challenges. Regulatory uncertainty looms large, as governments grapple with how to oversee decentralized platforms. Volatility in cryptocurrency markets can also affect players’ bankrolls, though stablecoins like USDT are increasingly used to mitigate this risk. Despite these hurdles, the trajectory of crypto casinos points upward, driven by relentless innovation and growing adoption.

In conclusion, the crypto casino represents a bold fusion of gambling’s rich history with the transformative power of blockchain. Platforms like Jups.io are leading the charge, offering players an unparalleled blend of security, fairness, and excitement. As cryptocurrency continues to permeate mainstream finance, crypto casinos are poised to redefine the future of gambling, one block at a time.

13 notes

·

View notes

Text

By the authority vested in me as President by the Constitution and the laws of the United States of America, and in order to promote United States leadership in digital assets and financial technology while protecting economic liberty, it is hereby ordered as follows:

Section 1. Purpose and Policies. (a) The digital asset industry plays a crucial role in innovation and economic development in the United States, as well as our Nation’s international leadership. It is therefore the policy of my Administration to support the responsible growth and use of digital assets, blockchain technology, and related technologies across all sectors of the economy, including by:

(i) protecting and promoting the ability of individual citizens and private-sector entities alike to access and use for lawful purposes open public blockchain networks without persecution, including the ability to develop and deploy software, to participate in mining and validating, to transact with other persons without unlawful censorship, and to maintain self-custody of digital assets;

(ii) promoting and protecting the sovereignty of the United States dollar, including through actions to promote the development and growth of lawful and legitimate dollar-backed stablecoins worldwide;

15 notes

·

View notes

Text

Life in a Bubble: How Technological Revolutions Shape Society

Once upon a time, owning a television was an extraordinary luxury. Families gathered around small, grainy screens, captivated by black-and-white broadcasts that seemed magical at the time. Fast-forward to today, and we laugh at the thought of having just one screen—let alone one without color, HD, or streaming capabilities. Ever notice how every significant technological breakthrough feels monumental, only to become obsolete as soon as the next innovation arrives?

Understanding the Technological Bubble

Technological bubbles occur when groundbreaking innovations redefine societal norms, behaviors, and expectations. Each advancement creates its own bubble of influence—initially expanding as adoption grows, then ultimately bursting when a newer technology emerges.

Consider the evolution of televisions:

First Bubble: Black-and-white TVs revolutionized entertainment, bringing the world into living rooms for the first time.

Second Bubble: Color TVs popped the original bubble, making monochrome obsolete and setting a new standard.

Third Bubble: Flat-screen and HD televisions burst the color-TV bubble, making bulky sets feel like relics of the past.

Each bubble transformed society, influencing consumer behaviors, shifting economic landscapes, and altering our perception of normalcy.

Historical Echoes

Technological bubbles aren’t exclusive to televisions. They repeat throughout history, reshaping reality each time:

Communication: Letters → telephones → smartphones.

Music: Vinyl → cassettes → CDs → MP3 → streaming.

Internet: Dial-up → broadband → Wi-Fi → mobile connectivity.

Every bubble expanded rapidly, enveloping society in its new standards before bursting and being replaced by something even more revolutionary.

The Mother of All Bubbles

Today, we're living inside perhaps the largest technological bubble humanity has ever known: the global fiat monetary system and traditional finance. Like previous bubbles, this system feels unshakeable, inevitable, and everlasting. But like every bubble before it, it's ripe for disruption—this time, by decentralized technologies like Bitcoin.

Bitcoin isn't just a new type of money; it’s a radical departure from centralized financial control:

Decentralization vs. Centralization: Bitcoin puts financial power back into the hands of individuals.

Transparency vs. Secrecy: Blockchain technology makes financial transactions visible, verifiable, and resistant to manipulation.

Scarcity vs. Inflation: Unlike fiat currencies, Bitcoin has a capped supply, protecting against endless monetary inflation.

This next bubble is growing, quietly expanding in the shadows of mainstream finance, and it has the potential to burst the financial bubble we've lived in for generations.

What Happens When the Biggest Bubble Pops?

Imagine a world where financial control no longer rests in the hands of governments and banks, but with the people. When the fiat bubble bursts:

Financial Sovereignty: Individuals gain unprecedented financial autonomy and responsibility.

Power Redistribution: Central banks and financial institutions must adapt or risk obsolescence.

Societal Shifts: Our collective understanding of money, value, and community could be entirely redefined.

This transition won’t be without challenges. Initial instability and fierce resistance from established systems are inevitable. Yet, the opportunity for increased transparency, fairness, and efficiency makes this burst not just likely but necessary.

Preparing for the Pop

Every technological bubble eventually bursts. The question isn't if, but when. Understanding and recognizing this process enables us to position ourselves advantageously for the inevitable shift. Embracing the next technological wave means stepping beyond comfort zones and preparing to thrive in an evolved landscape.

Tick Tock Next Block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Technological Revolution#Future of Finance#Financial Sovereignty#Decentralization#Tech Evolution#The Next Bubble#History of Technology#Society Shift#Disruptive Innovation#Blockchain#TickTockNextBlock#Digital Economy#Philosophy of Money#Economic Shift#financial empowerment#financial education#globaleconomy#finance#digitalcurrency#financial experts#cryptocurrency#unplugged financial

7 notes

·

View notes

Text

Why Crypto Payments are the Key to Future-Proofing Your Business.

Introduction

In recent years, cryptocurrencies have really been on the radar big time. Big time in ways they're a digital currency that harnesses blockchain technology, which has the potential to completely shake up a lot of different kinds of businesses and transactions. The emergence of cryptocurrencies, especially Bitcoin, has encouraged businesses to think about embracing crypto payments as a way to remain competitive and future-proof their businesses Crypto as an Investment: Volatility and Opportunities

Cryptocurrencies are now a sought-after investment asset, they are extremely volatile. Big swings in crypto prices like Bitcoin and Ethereum have really given investors a chance to do well big time. But of course, that volatility means investors are also risking very big losses, losses like market crashing and real money going up in smoke at the financial winds. In spite of this, most cryptocurrency proponents consider digital currencies a good avenue for diversifying investment portfolios, cognizant of the fact that cryptocurrencies are not stable, long-term assets but speculative investments. For companies, this is a two-edged sword—accepting cryptocurrencies as payment may unlock new revenue streams but companies have to carefully weigh their risk appetite when considering their participation in the world of cryptocurrencies.

Benefits of Acceptance of Crypto Payments

Beyond the risks, moving to accepting different types of cryptocurrency is a win for companies especially those in financial tech. These benefits include:

Lower Transaction Fees: Conventional payment processors and financial intermediaries usually impose high transaction fees. Cryptocurrencies usually have lower transaction fees.

Speedier Transactions: Transactions involving cryptocurrencies are much quicker than traditional banking systems, particularly cross-border payments, where old financial systems take days to clear transactions.

New Customer Bases Access: By embracing cryptocurrency, companies can access a worldwide market of crypto investors and enthusiasts. This gives companies new access to customers who are perhaps excited about making transactions digitally or through decentralized routes.

Improved Security and Fraud Protection: Cryptocurrencies employ encryption and blockchain technology to protect transactions, making it much less likely for fraud or chargebacks to occur.

Challenges and Considerations

Sure, while there are great benefits to adopting cryptocurrency payments for companies, there are also many things to consider and pay attention to. The biggest concern is the built-in price volatility of digital currency, which may lead to unforeseen profits or losses for companies holding crypto assets. To avoid that risk, companies need contingency plans to handle crypto assets and convert them into stable currencies if need be.

Furthermore, the regulatory environment for cryptocurrencies is also developing. Governments across the planet are trying to devise rules and ways to collect taxes on digital money, but some corporations are unsure of their future, because they see rules as unclear and even unstable. Companies should make sure they adapt to local regulations, such as anti-money laundering (AML) and know-your-customer (KYC) regulations, in order to avoid a potential legal battle.

The Future of Cryptocurrency in Business

The increasing use of cryptocurrencies indicates that companies adopting crypto payments now may have a head start in the future. Companies that jump the gun and start taking cryptocurrency payments have a great chance to stand out and lead in their industries. With the rise of blockchain technology, brand new inventions like tokenization, smart contracts has the potential to really change the way all sorts of companies do business, trade and deal with supply chains.

As companies take bigger and bolder steps towards both digitization and decentralized systems, digital currency really offers a nifty shortcut for making transactions slicker, and snappier and also opens new doors to new markets.

Conclusion

In summary, although cryptocurrency payments come with some risks, the potential advantages make them an attractive choice for companies looking to future-proof their business. By embracing crypto payments, companies can lower transaction costs, enhance transaction speed, gain access to new customer bases, and enhance security. Of course, there are still issues like volatility and uncertainty about the rules that get in the way, but for companies that really get involved in companies that use crypto transactions wisely, there can be long-term huge benefits. As the economy keeps changing, embracing cryptocurrency today could make someone a pioneer in the future generation of financial technology.

7 notes

·

View notes

Text

Empowering Future Urban Designers: A Vision for Tomorrow

As globalization accelerates, the world is experiencing rapid urban expansion. Metropolitan city centers serve as the backbone of economic growth and a sustainable future. Urban planning and architectural design play a crucial role in shaping both our current living spaces and future habitats. Therefore, on World Architecture Day, it is essential to reflect on the importance of urban design in our everyday lives and its impact on community development.

The Role of Future Urban Designers and Architects

The next generation urban designers and architects hold the key to shaping tomorrow’s landscapes. Given the complexities of real estate growth, infrastructure networks, and diverse socio-civic amenities in urban hubs, strategic urban design remains at the core. Future leaders must be equipped with analytical thinking, innovative design approaches, technological integration, and policy-driven solutions to craft livable, dynamic urban environments. This blog delves into how we can establish a framework for the future.

Leveraging Technology for Sustainable Urban Design

In today’s digital landscape, technology is revolutionizing urban development. With cutting-edge AI tools, cities are being envisioned using Blockchain, BIM modeling, drones, augmented reality, and GIS mapping. Intelligent technology is essential for addressing urban challenges, climate risks, and resource scarcity. Therefore, urban architectural planning should embrace tech-driven design ideologies, empowering young visionaries to create resilient, smart, and adaptive cities.

Sustainability as a Cornerstone of Urban Growth

The current generation is highly conscious of the pressing need for sustainability in urban planning. As environmental concerns escalate, the future of urban development depends on sustainable practices. Green building methods, energy-efficient technologies, and eco-conscious designs must become fundamental to city landscapes. The mixed-use integrated townships by the Hiranandani Communities exemplify this future-forward approach. With meticulously planned socio-civic infrastructure, precise architectural execution, and state-of-the-art engineering, these townships seamlessly blend aesthetics, functionality, and sustainability.

Balancing Aesthetics with Practicality

A well-designed city is more than just a cluster of towering buildings. It must thoughtfully integrate aesthetics with functionality to create a sustainable urban ecosystem. Efficient transportation networks, abundant green spaces, essential services, and robust infrastructure contribute to a higher quality of life for residents.

Community Engagement in Urban Design

Empowering the next generation also involves fostering participatory urban planning. When communities are actively involved in the design process, cities evolve to better serve their residents. Young minds bring innovative perspectives, allowing for the creation of inclusive, forward-thinking urban spaces. By promoting collaborative planning, architects and urban designers can develop cities that are both user-centric and environmentally sustainable.

Government Backing for Urban Sustainability

A sustainable urban future requires strong government policies that support and incentivize progressive building initiatives. Developers prioritizing eco-friendly, inclusive, and functional designs should be encouraged through financial incentives and tax benefits. By implementing favorable design policies, governments can inspire developers to construct landmark structures that enrich cityscapes and promote urban tourism.

Conclusion: Building the Cities of the Future

As urban design and architecture continue to evolve, they must prioritize both societal and environmental sustainability. Architects, developers, and policymakers must collaborate to pioneer innovative solutions. By engaging young professionals and integrating emerging technologies, we can create inclusive, resilient communities that cater to present needs while shaping the future of urban living.

#next generation urban designers#urban development#hiranandani communities#hiranandani sustainability

8 notes

·

View notes

Text

Elon Musk Is about to Investigate Fort Knox: The Mysterious Veil of the US Gold Reserves May Be Lifted