#Bluetooth mesh IoT

Explore tagged Tumblr posts

Text

MeshTek’s Smart IoT Framework: Building the Future of Connected Systems

MeshTek’s advanced IoT development service in action — where powerful software meets real-time automation. From smart connectivity to integrated mesh-based communication, the setup represents how businesses can monitor, manage, and optimize connected devices through a seamless, intelligent platform. The background workspace and digital overlays highlight MeshTek’s vision for scalable, secure, and low-latency IoT ecosystems designed for the modern world.

#MeshTek#IoT development service#Bluetooth mesh IoT#connected devices#smart automation#real-time IoT monitoring#low-latency communication#industrial IoT platform#smart infrastructure#scalable IoT systems#IoT software development#next-gen connectivity#AI-powered IoT#secure IoT network#edge computing solutions#smart business automation#intelligent IoT services#future-ready technology#MeshTek solutions#IoT mesh technology

0 notes

Text

Bluetooth Mesh Networking: The Future of Smart Connectivity

Bluetooth Mesh Networking enables seamless, large-scale device communication, making it ideal for smart homes, industrial automation, and commercial IoT applications. With its self-healing, low-power, and scalable architecture, Bluetooth Mesh ensures reliable and efficient data transfer across multiple devices.

Want to integrate Bluetooth Mesh Networking into your IoT solutions? Explore its potential today! 🚀

#iotnbo#iot#web development#iotsolutions#bluetooth#software development#iot development services#iot applications#iot platform#innovation

2 notes

·

View notes

Text

Smart Home Energy Management Device Market Size Driving Sustainability and Efficiency in Modern Homes

The Smart Home Energy Management Device Market Size is experiencing unprecedented growth, fueled by rising energy costs, increased environmental awareness, and widespread adoption of smart home technologies. According to Market Size Research Future, the global market is projected to grow from USD 2.7 billion in 2022 to USD 7.5 billion by 2030, expanding at a robust CAGR of 13.6% during the forecast period (2022–2030). These intelligent systems are emerging as a cornerstone of sustainable living, enabling households to monitor, control, and optimize their energy consumption with ease.

Market Size Overview

Smart home energy management devices (SHEMDs) refer to integrated solutions that allow homeowners to track real-time energy usage, automate appliance operation, and reduce electricity bills. These systems leverage Internet of Things (IoT) technology, wireless connectivity, and AI-driven analytics to manage everything from HVAC units and lighting to electric vehicle charging and solar power storage.

As governments introduce energy efficiency regulations and consumers demand greater control over their energy usage, the market for smart energy management devices is expanding rapidly across developed and emerging regions alike.

Enhanced Market Size Segmentation

To better analyze market dynamics, the Smart Home Energy Management Device Market Size can be segmented by:

By Component:

Hardware

Smart Meters

In-Home Displays

Load Controllers

Smart Thermostats

Software

Energy Analytics

User Interfaces

Control Applications

Services

Consulting

Installation & Integration

Maintenance

By Communication Technology:

Wi-Fi

Zigbee

Bluetooth

Z-Wave

Ethernet

By Application:

Lighting Control

HVAC Control

Energy Storage Management

Appliance Control

Solar Integration

Electric Vehicle Charging

By Region:

North America

Europe

Asia-Pacific

Middle East & Africa

Latin America

Market Size Trends

1. Rise of Energy-Aware Consumers

As consumers become increasingly eco-conscious, demand for smart meters and energy analytics platforms is growing. Users want granular control and insights into their energy usage to make informed decisions.

2. Integration with Renewable Energy

SHEMDs are becoming critical enablers for solar panel systems and residential energy storage units. They help balance loads, forecast usage, and integrate with grid services for energy sharing and trading.

3. Voice Assistant and AI Integration

Integration with voice assistants like Alexa, Google Assistant, and Siri is enhancing user engagement, enabling hands-free control of lights, temperature, and energy-saving modes.

4. Smart Grid Compatibility

These devices support real-time demand response, helping utilities reduce grid pressure during peak hours. The future of grid optimization will depend on millions of households participating via smart energy systems.

5. Rising Home Electrification

With growing adoption of electric vehicles and electric heating systems, smart energy management is crucial to prevent overloading, optimize consumption, and manage charging patterns.

Segment Insights

Hardware Holds the Largest Market Size Share

Smart thermostats, load controllers, and smart meters lead the hardware segment. These devices offer direct control and feedback mechanisms for household energy use and are widely adopted due to falling prices and user-friendly interfaces.

Wi-Fi Leads in Communication Technologies

Wi-Fi remains the dominant connectivity standard due to its compatibility with existing household infrastructure. However, Zigbee and Z-Wave are also gaining traction for their low power consumption and reliability in mesh networking.

HVAC and Lighting Dominate Applications

Heating, ventilation, and air conditioning (HVAC) systems consume a significant portion of residential energy. Smart thermostats and lighting systems that adapt to user behavior and occupancy are in high demand for both convenience and efficiency.

End-User Insights

Residential Sector

The primary driver of market growth, the residential sector is embracing energy management devices for cost savings, carbon footprint reduction, and comfort. Smart homes are evolving into self-regulating ecosystems, optimizing energy usage without human intervention.

Utilities and Energy Providers

Utilities are leveraging SHEMDs to enhance demand-side management programs. By working with customers through smart devices, they can reduce peak load stress and increase grid reliability.

Builders and Developers

Smart energy systems are increasingly integrated into new construction projects. Builders use these devices as a value-added feature, helping differentiate high-performance, sustainable housing.

Key Players

Leading technology firms and energy companies are investing in this growing market. Some key players include:

Schneider Electric SE

Honeywell International Inc.

General Electric Company

Panasonic Corporation

Johnson Controls

Nest Labs (Google LLC)

Eaton Corporation

Siemens AG

LG Electronics

Tata Power

These companies are driving innovation in user interface design, data analytics, and device interoperability, while expanding their global footprints through partnerships and acquisitions.

Future Outlook

The Smart Home Energy Management Device Market Size is at the heart of the global energy transformation. As homes become smarter and more interconnected, energy systems are transitioning from passive infrastructure to intelligent, self-regulating environments.

In the future, we can expect:

Increased interoperability between devices and platforms

Smarter load balancing with AI-based predictions

Participation in decentralized energy trading (peer-to-peer)

Seamless integration with electric vehicle and battery storage systems

With climate change policies accelerating and consumers embracing smart living, the potential for smart energy management in homes is enormous. What was once a luxury is quickly becoming a necessity in modern living.

Trending Report Highlights

Explore additional insights from high-growth technology and energy markets:

Geotechnical Instrumentation and Monitoring Market Size

Smartphone Application Processor Market Size

Hybrid Memory Cube (HMC) and High-Bandwidth Memory (HBM) Market Size

Failure Analysis Market Size

Laser Tracker Market Size

Machine Safety Market Size

GaAs Wafer Market Size

Voice Over Wireless LAN Market Size

Ingestible Sensor Market Size

Environmental Sensor Market Size

Multi-layer Security Market Size

Smart Smoke Detector Market Size

Interaction Sensor Market Size

0 notes

Text

Lighting Control Dimming Panel Market: Trends Driving Smart Building Innovations

MARKET INSIGHTS

The global Lighting Control Dimming Panel Market size was valued at US$ 2,890 million in 2024 and is projected to reach US$ 5,230 million by 2032, at a CAGR of 8.93% during the forecast period 2025-2032

Lighting control dimming panels are advanced electrical devices that regulate light intensity in commercial and industrial spaces. These systems enable precise control over lighting levels through centralized management, including features like programmable presets, automated scheduling, and integration with building management systems. Key product types include rack-mount and wall-mount configurations, serving different installation requirements.

The market growth is driven by increasing adoption of smart building technologies, stringent energy efficiency regulations, and rising demand for IoT-enabled lighting solutions. North America currently leads in market share (35%), while Asia-Pacific is projected to show the highest growth rate (10.2% CAGR) due to rapid urbanization. Major players like Eaton, Legrand, and Philips Lighting are investing in wireless dimming technologies, with the rack-mount segment expected to reach USD 1.9 billion by 2027.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand for Energy-Efficient Lighting Solutions Accelerates Market Expansion

The global push toward energy conservation is significantly boosting the lighting control dimming panel market. With commercial buildings accounting for nearly 40% of total energy consumption worldwide, smart lighting systems that incorporate dimming controls are becoming essential for achieving sustainability goals. Recent studies indicate that properly implemented lighting control strategies can reduce energy usage by 30-50% in commercial spaces. This substantial energy-saving potential is prompting widespread adoption across office buildings, retail spaces, and industrial facilities seeking to lower operational costs while meeting stringent environmental regulations.

Smart Building Integration Creates New Demand for Advanced Dimming Solutions

The rapid development of IoT-enabled smart building infrastructure presents significant growth opportunities for intelligent lighting control systems. Modern dimming panels now serve as critical components in building automation networks, capable of interfacing with occupancy sensors, daylight harvesting systems, and centralized management platforms. The global smart building market, projected to exceed $150 billion by 2026, directly benefits lighting control manufacturers. Building owners increasingly recognize that advanced dimming capabilities contribute not only to energy savings but also to occupant comfort and productivity—factors that are becoming key differentiators in commercial real estate.

Furthermore, integration with emerging technologies like Li-Fi (light fidelity) and advanced wireless protocols is expanding the functionality and appeal of modern dimming systems. Industry leaders are responding with innovative product launches—for example, recent introductions of DALI-2 and Bluetooth mesh compatible dimming panels demonstrate how manufacturers are evolving their offerings to meet the demands of next-generation smart buildings.

MARKET RESTRAINTS

High Installation Complexity and Costs Limit Widespread Adoption

Despite the clear benefits, several barriers restrain faster market growth. Retrofitting existing buildings with advanced dimming control systems often requires significant electrical infrastructure upgrades, with installation costs ranging from 30-50% higher than traditional lighting systems. This cost premium presents a substantial hurdle, particularly for small and mid-sized enterprises operating with constrained capital budgets. Additionally, the technical complexity of designing and commissioning sophisticated dimming networks demands specialized expertise that remains in short supply across many regions.

Other Challenges

Compatibility Issues with Legacy Systems The lighting control market faces ongoing challenges with backward compatibility, as many older dimming panels struggle to interface seamlessly with modern LED fixtures and smart control protocols. These interoperability issues frequently lead to performance limitations or require expensive workarounds, discouraging potential adopters from upgrading their systems.

Standardization Gaps The absence of universal communication standards across manufacturers creates additional barriers. While protocols like DALI and 0-10V have gained traction, proprietary systems still dominate certain market segments, potentially locking customers into single-vendor ecosystems and limiting future flexibility.

MARKET CHALLENGES

Cybersecurity Risks Emerge as Critical Concern for Connected Lighting Systems

As lighting control networks become increasingly connected to building IT infrastructure, they paradoxically expand both functionality and vulnerability. Recent analyses reveal that over 40% of commercial buildings using networked lighting controls have experienced at least attempted cybersecurity breaches. These threats range from simple unauthorized access attempts to sophisticated ransomware attacks that could disable entire lighting systems. Manufacturers face mounting pressure to implement enterprise-grade security protocols while maintaining the user-friendly operation that customers expect.

The industry must also address growing concerns about data privacy, as modern lighting systems can collect detailed usage patterns and occupant behavior data. Balancing the rich analytics capabilities that building operators demand with evolving global privacy regulations presents an ongoing challenge for solution providers.

MARKET OPPORTUNITIES

Wireless Control Solutions Open New Possibilities for Retrofit Applications

The development of reliable, high-performance wireless dimming technologies creates substantial opportunities in the massive retrofit market. Wireless solutions dramatically reduce installation complexity and costs compared to wired alternatives, particularly in historical buildings or structures where running new control wiring proves impractical. Industry projections suggest that wireless lighting controls could capture over 35% of the commercial dimming panel market within five years as these technologies mature.

Furthermore, emerging economies present significant untapped potential as their commercial construction activity expands rapidly. Countries implementing stringent new energy codes are particularly favorable markets, with lighting control requirements increasingly incorporated into national building standards. Forward-looking manufacturers are establishing localized production and distribution networks to capitalize on these growing regional opportunities while navigating varying regulatory environments.

LIGHTING CONTROL DIMMING PANEL MARKET TRENDS

Smart Building Integration Elevates Demand for Advanced Dimming Panels

The global lighting control dimming panel market, valued at several hundred million USD in 2024, is experiencing accelerated growth due to increasing smart building adoption. Modern dimming panels now feature IoT compatibility, allowing centralized lighting automation through building management systems. Studies indicate that smart lighting solutions can reduce energy consumption by 30-50% in commercial spaces, making them crucial for sustainability initiatives. Leading manufacturers are incorporating wireless protocols like Zigbee and DALI to enable seamless integration with smart ecosystems while maintaining granular brightness control.

Other Trends

Energy Efficiency Regulations Reshape Product Development

Stringent global energy codes are compelling facility operators to upgrade outdated lighting controls. The rack-mount dimming panel segment, projected to grow at a notable CAGR through 2032, dominates industrial applications where precise multi-zone control is mandatory. Recent product certifications like Title 24 in California and EU Ecodesign Directive compliance have become key purchasing criteria, forcing manufacturers to innovate high-efficiency designs with power monitoring capabilities.

Retrofit Solutions Gain Traction in Commercial Renovations

As businesses seek to modernize existing infrastructure without costly rewiring, plug-and-play dimming panel retrofits now account for over 40% of commercial sector sales. Modular wall-mount units with legacy phase-cut compatibility are particularly popular in hospitality and retail environments where lighting ambiance directly impacts customer experience. The market has responded with hybrid panels supporting both 0-10V analog and digital control protocols to ease transitional upgrades from conventional systems to networked architectures.

North America Leads in Adoption While Asia-Pacific Shows Highest Growth Potential

Currently representing the largest regional market share, North American dimming panel deployments benefit from mature smart building penetration and rigorous energy standards. However, Asia-Pacific is forecast for the fastest growth as megacity developments in China and India incorporate intelligent lighting as standard infrastructure. Notably, the Chinese market is projected to reach significant valuation by 2032, driven by government mandates for energy-efficient public buildings and rapid commercial construction activity.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Leaders Focus on Smart Solutions to Drive Adoption

The global lighting control dimming panel market is moderately consolidated, with key multinational players holding significant shares while regional competitors continue to gain traction. Legrand and EATON currently dominate the competitive landscape, collectively accounting for nearly 30% of market revenue in 2024. Their leadership stems from comprehensive product portfolios encompassing both rack-mount and wall-mount solutions, along with established distribution networks across commercial and industrial segments.

Philips Lighting (now Signify) and Osram remain formidable competitors, leveraging their heritage in lighting technology to deliver integrated dimming solutions. These companies have particularly strengthened their positions through strategic acquisitions – Philips’ acquisition of Cooper Lighting in 2020 expanded its North American footprint, while Osram’s merger with ams strengthened its smart lighting capabilities.

Meanwhile, Nortek and ABB are expanding market presence through product innovations in IoT-enabled dimming systems. Nortek’s recent 2023 product launch featuring cloud-connected dimming panels demonstrates how companies are evolving beyond traditional lighting control. Similarly, ABB’s Cylon® range incorporates powerful analytics alongside dimming functionality, addressing growing demand for data-driven building management.

The competitive intensity is expected to rise as companies accelerate R&D investments in wireless and programmable dimming solutions. Digital Lumens and LightwaveRF are emerging as agile innovators, with their focus on AI-powered dimming algorithms appealing to tech-forward commercial clients. However, strict energy efficiency regulations across Europe and North America create both challenges and opportunities – companies that quickly adapt to evolving standards will gain competitive advantage.

List of Key Lighting Control Dimming Panel Manufacturers

Nortek (U.S.)

EATON (Ireland)

Legrand (France)

Hubbell Control Solutions (HCS) (U.S.)

GE (U.S.)

LynTec (U.S.)

Philips Lighting (Netherlands)

Osram (Germany)

Digital Lumens (U.S.)

Lightwaverf (U.K.)

ABB (Switzerland)

Segment Analysis:

By Type

Rack-mount Segment Leads the Market Due to High Demand Across Large-scale Installations

The market is segmented based on type into:

Rack-mount

Subtypes: Centralized control panels, Modular dimming panels

Wall-mount

Subtypes: Single-gang dimmers, Multi-gang dimmers

Others

By Application

Commercial Segment Dominates Owning to Extensive Adoption in Smart Buildings

The market is segmented based on application into:

Industrial

Commercial

Residential

Others

By Technology

Digital Dimming Controls Gain Traction Due to IoT Integration Capabilities

The market is segmented based on technology into:

Analog dimming

Digital dimming

Hybrid systems

By Component

Control Modules Hold Largest Share as Core Operation Units

The market is segmented based on component into:

Dimming modules

Control interfaces

Communication devices

Sensors

Others

Regional Analysis: Lighting Control Dimming Panel Market

North America The North American market for lighting control dimming panels is driven by stringent energy efficiency regulations and the increasing adoption of smart building technologies. The U.S. holds the largest share, supported by commercial real estate development and government initiatives like upgraded ASHRAE 90.1 standards. The region shows strong demand for integrated rack-mount systems, particularly in corporate offices and hospitality sectors, with manufacturers like EATON and Hubbell Control Solutions (HCS) leading innovation. While Canada’s market is smaller, its focus on sustainable infrastructure projects creates stable demand. However, high initial costs remain a barrier for small enterprises.

Europe Europe’s market thrives on sustainability mandates, including the EU’s Energy Performance of Buildings Directive (EPBD), which mandates smart lighting in new constructions. Germany and France dominate, leveraging industrial automation and green building certifications. The UK’s retrofit market for heritage buildings presents unique opportunities for discreet wall-mount panels. Scandinavian countries prioritize adaptive lighting in smart cities, fostering partnerships with companies like ABB and Philips Lighting. Challenges include fragmented standards across Eastern Europe, where adoption trails Western counterparts despite lower costs.

Asia-Pacific As the fastest-growing region, Asia-Pacific benefits from massive urban development and government-led smart city projects. China accounts for over 40% of regional demand, driven by industrial automation and commercial construction. Japan focuses on precision-controlled systems for healthcare and manufacturing, while India’s market expands through metro rail projects and IT parks. Though cost sensitivity favors basic dimming solutions, vendors like Osram and Legrand are introducing localized, budget-friendly IoT-enabled panels. Infrastructure gaps in Southeast Asia, however, slow widespread deployment.

South America The market here is nascent but growing, with Brazil leading due to modernization of retail and hospitality sectors. Argentina shows potential in theatrical and studio lighting controls, albeit with reliance on imports. Economic instability and currency fluctuations hinder large-scale investments, causing clients to prioritize multi-functional panels with longer lifespans. Local players struggle against global brands’ dominance, though partnerships with regional distributors are improving accessibility. Chile and Colombia exhibit gradual uptake in commercial projects, supported by renewable energy integration.

Middle East & Africa The GCC nations, particularly the UAE and Saudi Arabia, drive demand via mega-projects like NEOM and Expo-linked developments, where smart lighting is integral. High-end hospitality and retail sectors prefer customizable rack-mount systems from international suppliers. Africa’s market is uneven—South Africa leads with industrial applications, while elsewhere, basic wall-mount panels suffice for small businesses. Despite funding challenges, IoT adoption in smart cities and solar-hybrid systems offer long-term opportunities. Local assembly initiatives aim to reduce reliance on imports, though technical expertise gaps persist.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Lighting Control Dimming Panel markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments.

Segmentation Analysis: Detailed breakdown by product type (rack-mount, wall-mount), application (industrial, commercial), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with country-level analysis.

Competitive Landscape: Profiles of leading manufacturers including Nortek, EATON, Legrand, Hubbell Control Solutions, GE, and their product strategies, R&D focus, and recent developments.

Technology Trends: Assessment of smart lighting integration, IoT connectivity, energy efficiency innovations, and evolving industry standards like DALI-2.

Market Drivers & Restraints: Evaluation of factors such as smart building adoption, energy regulations, retrofit demand, along with supply chain challenges and cost pressures.

Stakeholder Analysis: Strategic insights for lighting manufacturers, system integrators, facility managers, and investors regarding market opportunities.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/laser-diode-cover-glass-market-valued.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/q-switches-for-industrial-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ntc-smd-thermistor-market-emerging_19.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/lightning-rod-for-building-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/cpe-chip-market-analysis-cagr-of-121.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/line-array-detector-market-key-players.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/tape-heaters-market-industry-size-share.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/wavelength-division-multiplexing-module.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/electronic-spacer-market-report.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/5g-iot-chip-market-technology-trends.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/polarization-beam-combiner-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/amorphous-selenium-detector-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/output-mode-cleaners-market-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/digitally-controlled-attenuators-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/thin-double-sided-fpc-market-key.html

0 notes

Text

GPS Tracker Smart Dog Collar Market 2025-2032

MARKET INSIGHTS

The global GPS Tracker Smart Dog Collar Market size was valued at US$ 234 million in 2024 and is projected to reach US$ 445 million by 2032, at a CAGR of 9.2% during the forecast period 2025-2032.

GPS tracker smart dog collars are innovative wearable devices that enable pet owners to monitor their dogs’ real-time location, activity levels, and health metrics through integrated GPS and IoT technologies. These devices typically combine cellular connectivity, Bluetooth, and motion sensors to provide comprehensive pet tracking solutions. The market offers both limited scope (basic tracking) and unlimited scope (premium features like geofencing and health monitoring) variants.

The market growth is driven by increasing pet ownership rates and rising consumer spending on pet tech products. With 66% of U.S. households owning pets (American Pet Products Association) and the global pet industry reaching USD 261 billion in 2022, demand for advanced pet care solutions continues to surge. Technological advancements in battery life (up to 30 days in premium models) and improved location accuracy (within 10 feet radius) are further propelling market expansion. Key players like Garmin, Whistle Labs, and Tractive are continuously innovating with features such as LED safety lights and virtual leash alerts to capture market share in this competitive landscape.

Claim Your Free Sample Report-https://semiconductorinsight.com/download-sample-report/?product_id=97716

Key Industry Players

Smart Pet Tech Leaders Expand Market Presence Through Innovation and Strategic Partnerships

The global GPS tracker smart dog collar market is characterized by intense competition, with established electronics brands competing alongside specialized pet tech startups. The market exhibits a fragmented but consolidating structure, where larger players are increasingly acquiring innovative startups to expand their technological capabilities.

Garmin Ltd. emerges as a dominant player, leveraging its decades of GPS technology expertise from the wearable and automotive sectors. The company’s recent acquisition of commercial tracking technology has significantly enhanced its pet offering, particularly for high-end hunting and sporting dog applications.

Meanwhile, Tractive and Whistle Labs (acquired by Mars Petcare) have secured strong market positions through subscription-based tracking services that combine GPS with health monitoring features. Their growth strategy focuses on leveraging big data from pet activity patterns to offer predictive health insights.

Startups like Jiobit and Pawscout are disrupting the market with ultra-lightweight designs and community-based finding networks, particularly appealing to urban pet owners. These companies are investing heavily in Bluetooth mesh network technology to supplement traditional GPS in dense urban environments.

List of Key GPS Tracker Smart Dog Collar Companies Profiled

Garmin Ltd. (Switzerland)

Whistle Labs (U.S.)

Tractive GmbH (Austria)

Jiobit (U.S.)

SportDOG Brand (U.S.)

FitBark (U.S.)

Petfon (China)

Cube Tracker (U.S.)

Pawscout (U.S.)

Bartun (China)

Findster Technologies (Portugal)

Segment Analysis:

By Type

Unlimited Scope Segment Dominates Due to Advanced Features and Real-Time Tracking Capabilities

The market is segmented based on type into:

Limited Scope

Subtypes: Proximity tracking, Basic activity monitoring

Unlimited Scope

Subtypes: GPS + cellular tracking, Multi-network connectivity

Hybrid

Subtypes: Combined RF/GPS tracking, Bluetooth-assisted GPS

By Application

Pet Dog Segment Leads Due to Increasing Pet Humanization Trends

The market is segmented based on application into:

Sporting Dog

Hunting Dog

Pet Dog

Working Dog

Others

By Connectivity

Cellular-enabled Collars Gain Popularity for Their Remote Monitoring Capabilities

The market is segmented based on connectivity into:

Bluetooth

Wi-Fi

Cellular (3G/4G/LTE)

RF

Hybrid

By Price Range

Premium Segment Shows Strong Growth Due to Higher Feature Adoption

The market is segmented based on price range into:

Budget

Mid-range

Premium

Access Your Free Sample Report Now-https://semiconductorinsight.com/download-sample-report/?product_id=97716

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global GPS Tracker Smart Dog Collar Market?

-> GPS Tracker Smart Dog Collar Market size was valued at US$ 234 million in 2024 and is projected to reach US$ 445 million by 2032, at a CAGR of 9.2%.

Which companies lead the GPS Tracker Smart Dog Collar Market?

-> Key players include Garmin, Whistle Labs, Tractive, Jiobit, and FitBark, with Garmin holding approximately 18% market share in 2024.

What are the primary growth drivers?

-> Major drivers include increasing pet ownership (66% U.S. household penetration), rising pet care expenditure (global pet market reached USD 261 billion in 2022), and technological advancements in pet wearables.

Which region shows strongest growth potential?

-> Asia-Pacific is expected to grow at 12.8% CAGR through 2032, driven by increasing pet adoption in China and Japan, though North America remains the dominant market.

What are the emerging technology trends?

-> Emerging trends include multi-network connectivity (GPS+GLONASS+Galileo), extended battery life (up to 30 days), and integration with pet health monitoring systems.

About Semiconductor Insight:

Established in 2016, Semiconductor Insight specializes in providing comprehensive semiconductor industry research and analysis to support businesses in making well-informed decisions within this dynamic and fast-paced sector. From the beginning, we have been committed to delivering in-depth semiconductor market research, identifying key trends, opportunities, and challenges shaping the global semiconductor industry.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

Related Url-

0 notes

Text

Smart Lift Windows: The Architectural Interface of the IoT Era

Smart lift windows represent a profound integration of IoT technology with building facades. Their core value lies in achieving environmental adaptability through sensor networks, transforming windows into dynamic, responsive interfaces.

① Electric Actuation System: Dual Assurance of Precision and Safety

Brushless DC Motors: Offering torque precision down to 0.1 N·m, enabling seamless, stepless opening and closing from 1% to 100%.

Anti-Pinch Algorithms: Detecting obstructions via sudden current changes and triggering emergency braking within 0.3 seconds.

② Environmental Sensing Modules: From Reactive to Proactive Regulation

Rain Sensors: Automatically closing windows upon rain detection, with a response latency ≤2 seconds.

PM2.5 Sensors: Activating fresh air systems when air quality thresholds are exceeded, creating a closed-loop microenvironment.

③ Compatibility Design: Gateway to the Smart Home Ecosystem

Premium smart windows must support:

Multi-Protocol Interoperability: Compatibility with mainstream protocols like Zigbee, Wi-Fi, and Bluetooth Mesh.

Local Processing: Executing preset scenarios (e.g., "Away Mode") even during network outages.

Industry Trends:

According to Statista, the global smart window market is projected to reach $12.8 billion by 2027, with a compound annual growth rate (CAGR) exceeding 15%.

0 notes

Video

youtube

BluetoothAOA combined with BluetoothMesh lighting networking provides a ... Core IoT Bluetooth AOA high-precision positioning combined with Bluetooth Mesh lighting networking provides a fusion positioning solution #bleaoa #bluetooth aoa #蓝牙aoa Core IoT Bluetooth AOA high-precision positioning technology R & D The original factory provides base station hardware engine algorithms, as well as upstream and downstream software platforms for cooperative ecology supporting positioning end points and solutions, as well as industry application scenarios and business case sharing of partners.核芯物联蓝牙AOA高精度定位技术研发原厂提供基站硬件引擎算法,以及合作生态的上下游软件平台配套定位终端和解决方案以及合作伙伴的行业应用场景及商业案例分享。www.bleaoa.xyz wechat:18918935218

0 notes

Text

Mesh Networks: What is the matter with Zigbee?

Zigbee plays a key role in Matter, the new smart home standard aiming to unify IoT devices across ecosystems (Google, Apple, Amazon). Zigbee and Matter (formerly “Project CHIP” – Connected Home over IP) are closely connected because of their shared goal: device interoperability across brands and ecosystems. The same group that developed Zigbee is now spearheading Matter, meaning there is technical and strategic alignment between the two.

Matter uses Thread (another low-power mesh protocol) as its preferred transport layer. Since Zigbee and Thread both use the same IEEE 802.15.4 radio standard, they are technically compatible, making it easy for manufacturers to integrate legacy Zigbee products into Matter ecosystems.

#Communication#Compatible#Home automation#Hubs#Interoperability#Matter#Mesh Network#Scalability#Tools#Zigbee

0 notes

Text

Wi-Fi 6 Market Surge: Driving Forces, Emerging Trends, and Future Opportunities

Market Overview

The Wi-Fi 6 Market is experiencing rapid growth, driven by the increasing demand for high-speed internet connectivity and the rising adoption of Wi-Fi 6 devices for smart home applications. The growing investment in smart city projects is also creating significant growth opportunities for players operating in this market.

Get Sample Copy @ https://www.meticulousresearch.com/download-sample-report/cp_id=5238

Wi-Fi 6 Market Growth Drivers

Increasing Demand for High-speed Internet Connectivity

The growing number of connected devices such as smartphones, tablets, laptops, smart TVs, gaming consoles, and IoT devices has increased the need for high-speed internet connectivity. These devices require fast and reliable internet for activities such as video conferencing, streaming, online gaming, and cloud services. Businesses and individuals are increasingly relying on cloud-based storage, computing, and software applications, which require high-speed internet for smooth operation. Wi-Fi 6 technology addresses these needs by providing faster data transfer speeds, allowing users to experience smoother streaming, faster downloads, and improved online gaming performance.

Several companies are investing in Wi-Fi 6-ready broadband networks to meet this growing demand. For instance, in October 2024, Nokia Corporation (Finland) signed an agreement with Tata Play Broadband Private Limited (India) to launch a Wi-Fi 6-ready broadband network. Tata Play Fiber’s intelligent mesh Wi-Fi 6 solution provides high-speed internet coverage throughout the home, delivering a better user experience. Such developments are supporting the increasing adoption of Wi-Fi 6 technology and contributing to market growth.

Rising Adoption of Wi-Fi 6 Devices for Smart Home Applications

Smart homes have become more advanced with the integration of IoT devices, smart appliances, and high-definition video streaming. The increased bandwidth requirements of these devices have created a demand for faster and more reliable internet connectivity. Wi-Fi 6 technology meets these demands by offering higher data rates and improved efficiency, ensuring the smooth operation of multiple connected devices simultaneously. Wi-Fi 6 reduces latency and enhances network performance, which is essential for real-time smart home applications like video doorbells, smart lighting, and home security systems.

The adoption of Wi-Fi 6 for smart home applications is driven by its ability to support multiple devices, reduce latency, improve coverage, and enhance energy efficiency. In November 2022, Synology, Inc. (Taiwan) launched the WRX560, a Wi-Fi 6 router designed for smart homes. The WRX560 provides a combined throughput of up to 3,000 Mbps, enabling buffer-free streaming and faster downloads. Such product launches are contributing to the growing demand for Wi-Fi 6 technology in smart home applications.

Wi-Fi 6 Market Opportunities

Increasing Investments in Smart City Projects

Growing investments in smart city projects are driving the demand for Wi-Fi 6 technology, as it facilitates high-speed and high-bandwidth wireless broadband coverage in high-density environments. Wi-Fi 6 improves connectivity, efficiency, and performance in smart city applications through lower latency, enhanced responsiveness, better energy efficiency, and improved security.

Wi-Fi 6 technology supports high user density in indoor environments such as stadiums, convention centers, shopping malls, and school campuses. In February 2025, LitePoint Corporation (U.S.) collaborated with Morse Micro PTY. LTD. (Australia) and AzureWave Technologies, Inc. (Taiwan) to expand innovative use cases for Wi-Fi HaLow technology. LitePoint’s IQxel-MW 7G enables thorough validation of Wi-Fi HaLow chipsets, ensuring peak performance. The platform supports various wireless technologies, including Wi-Fi 6E/7 and Wi-Fi HaLow, as well as Bluetooth and cellular networks (2G/3G/4G/5G). These advancements are enhancing the adoption of Wi-Fi 6 technology in smart city projects, creating new growth opportunities for market players.

Wi-Fi 6 Market Analysis

By Device: Wireless Access Points Segment to Dominate

Based on device type, the Wi-Fi 6 market is segmented into mesh routers, wireless access points, home gateways, and wireless repeaters. In 2025, the wireless access points segment is projected to hold the largest market share of over 41.0%. The growing adoption of wireless access points is attributed to their ability to handle multiple connected devices without sacrificing performance. Wi-Fi 6 access points improve coverage, increase capacity, and provide enhanced security and efficiency.

The mesh routers segment is expected to register the highest compound annual growth rate (CAGR) during the forecast period. Mesh routers use multiple nodes to create a single, seamless Wi-Fi network, offering faster speeds and better performance compared to traditional routers. They also feature built-in support for smart home devices and smart home platform integration, driving their adoption in residential and commercial settings.

Get Full Report @ https://www.meticulousresearch.com/product/wifi-6-market-5238

By Commercial Use: Enterprises Segment to Lead

The Wi-Fi 6 market is segmented into enterprises and consumers based on commercial use. In 2025, the enterprises segment is expected to account for over 65.0% of the market. The increasing use of Wi-Fi 6 in enterprises is driven by the need to accommodate more connected devices while maintaining high performance. Wi-Fi 6 offers faster data transfer speeds and reduced latency, improving the efficiency of video conferencing, large file transfers, and cloud-based applications. Enterprises benefit from increased network capacity, improved efficiency, better coverage, and enhanced security.

The consumers segment is anticipated to register a higher CAGR during the forecast period. The growing adoption of Wi-Fi 6 in residential settings is driven by the increasing demand for better wireless performance, lower latency, and improved battery life for connected devices. Wi-Fi 6 reduces bandwidth congestion, enhances smart home functionality, and offers better energy efficiency.

By Application: Consumer Electronics Segment to Hold Largest Market Share

Based on application, the Wi-Fi 6 market is segmented into consumer electronics, AR/VR, retail, healthcare, manufacturing, smart cities, and other applications. In 2025, the consumer electronics segment is expected to hold over 32.0% of the market. Wi-Fi 6 technology is being increasingly used to enhance the performance of smartphones, tablets, laptops, smart TVs, and gaming consoles. Wi-Fi 6 networks provide faster speeds, lower latency, and better protection against unauthorized access, improving the user experience in crowded environments.

The smart cities segment is projected to register the highest CAGR during the forecast period. Wi-Fi 6 technology is being used in smart cities to connect a wide range of devices and infrastructure components, enabling real-time communication and data exchange. Wi-Fi 6 enhances security, reduces power consumption, and provides seamless connectivity, supporting traffic management, crowd monitoring, and environmental monitoring in smart cities.

Geographic Analysis

North America to Dominate the Wi-Fi 6 Market

In 2025, North America is expected to hold the largest market share of over 60.0%, driven by the increasing adoption of Wi-Fi-connected devices, rising demand for faster internet speeds, and government initiatives to promote Wi-Fi 6 technology. The presence of key market players such as Cisco Systems, Intel, and NETGEAR also contributes to the region's dominance.

The Asia-Pacific region is projected to register the highest CAGR of over 21.5% during the forecast period. The rising number of connected devices, increasing demand for public Wi-Fi 6 hotspots, growing smart city projects, and the expanding use of Wi-Fi 6 in enterprises are driving market growth in this region. Countries such as China, Japan, South Korea, and India are leading the adoption of Wi-Fi 6 technology.

Wi-Fi 6 Market: Key Companies

The Wi-Fi 6 market is highly competitive, with leading players focusing on product innovation, strategic partnerships, and geographic expansion to strengthen their market position. Major players include Cisco Systems, Inc. (U.S.), Cypress Semiconductor Corporation (U.S.), Aruba Networks (U.S.), D-Link Corporation (Taiwan), Marvell Technology, Inc. (U.S.), KAONMEDIA Co., Ltd. (Korea), Ruckus Wireless, Inc. (U.S.), Cambium Networks Corporation (U.S.), Linksys Holdings, Inc. (U.S.), AsusTek Computer Inc. (Taiwan), TP-Link Corporation Limited (China), NETGEAR, Inc. (U.S.), Intel Corporation (U.S.), Huawei Technologies Co., Ltd. (China), and Juniper Networks, Inc. (U.S.).

In January 2025, D-Link (Australia) launched the AQUILA PRO AI M30 AX3000 Dual-Band Wi-Fi 6 Mesh System, designed to address coverage, speed, and usability issues. Also, Altai Technologies Ltd. (Hong Kong) introduced the C260-S Outdoor Dual-Band Wi-Fi 6 Access Point, delivering reliable wireless connectivity in both indoor and outdoor environments with coverage of up to 600 meters.

Get Sample Copy @ https://www.meticulousresearch.com/download-sample-report/cp_id=5238

0 notes

Text

MeshTek’s Vision: Empowering IoT with Bluetooth Mesh Networking

MeshTek’s robust Bluetooth Mesh Networking ecosystem—seamlessly linking smart homes, wearables, industrial automation, and connected devices into one intelligent grid. It illustrates how MeshTek empowers secure, low-energy, and scalable communication across complex environments, enabling real-time control, optimized performance, and unmatched flexibility. Built to support everything from smart devices to enterprise-level automation, MeshTek’s platform is at the heart of next-gen IoT transformation.

#Bluetooth Mesh Networking#MeshTek#smart automation#connected devices#industrial IoT#IoT ecosystem#smart home network#IoT infrastructure#wearable integration#scalable IoT platform#low-energy communication#real-time control#IoT app development#MeshTek technology#intelligent automation

1 note

·

View note

Text

What is a Bluetooth Mesh Network, and how does it benefit IoT systems?

A Bluetooth Mesh Network is a decentralized communication network where multiple Bluetooth devices connect and relay messages to cover larger areas. This network is highly beneficial for IoT systems as it provides extended range, energy efficiency, and supports large-scale device communication, making it ideal for smart lighting, building automation, and industrial IoT solutions.

#BluetoothMesh#MeshNetwork#IoTPlatform#BLEMesh#IoTDevices#SmartSolutions#IoTInnovation#SmartHomeTech#WirelessNetworking#IoTSolutions#iot platform#iotnbo#software development#iot#bluetooth#iot applications#web development#iot development services#innovation

2 notes

·

View notes

Text

BLE Beacons Industry Enabling Smart Proximity-Based Ecosystems

The BLE Beacons Market Share is evolving rapidly as industries increasingly rely on proximity-based communication. BLE (Bluetooth Low Energy) beacons are crucial components in delivering context-aware services and real-time navigation. As the demand for indoor positioning, asset tracking, and personalized engagement rises, market leaders are consolidating their positions. In 2023, the global market reached USD 3.2 billion and is projected to exceed USD 8.7 billion by 2032, growing at a compound annual growth rate of 11.9.

Current Trends Defining the BLE Beacons Industry

The BLE beacons industry continues to evolve as its use cases diversify across commercial, industrial, and public domains. Prominent trends include:

Increased integration with mobile apps for customer engagement and location tracking

Wider adoption in hospitals, airports, and logistics hubs for navigation and monitoring

Surge in BLE 5.0 adoption to support higher range and broadcast capacity

Growth in demand for energy-efficient, low-cost IoT devices

Use of beacons in workplace safety and contact tracing applications

This evolution positions the industry as a key enabler of the connected environment.

Segment Insights

By Component

Hardware continues to dominate the industry, driven by the growing need for physical beacon units in retail, healthcare, and transport hubs.

Software solutions supporting beacon data analytics and campaign management are also expanding rapidly.

Managed services for deployment, integration, and maintenance are enhancing the commercial usability of beacon systems.

By Application Area

Indoor positioning systems account for the largest share, with retail and healthcare using BLE beacons to guide users through complex environments.

Asset tracking is rising in logistics and manufacturing, where location visibility is critical.

Proximity marketing remains a stronghold in shopping malls, stadiums, and airports.

By Technology

While BLE 4.0 and 4.2 dominate existing deployments, BLE 5.0 is increasing its share due to improved range, broadcast messaging, and mesh networking capabilities.

End-User Industry Insights

Retail and E-commerce

Retailers are leveraging BLE beacons to boost in-store engagement through push notifications, loyalty offers, and navigation — keeping them competitive with online platforms.

Healthcare

Hospitals and clinics use beacons to streamline workflows, manage staff and equipment, and enhance patient safety with location awareness.

Transportation

Beacons improve the travel experience by offering real-time wayfinding, boarding alerts, and contextual content at airports, train stations, and bus terminals.

Industrial and Logistics

BLE beacons enable automated inventory updates, real-time asset visibility, and optimized resource usage in warehouses and factories.

Events and Smart Venues

Stadiums, exhibitions, and conferences use beacons to manage crowds, deliver information, and support immersive attendee experiences.

Regional Industry Analysis

North America leads the industry with strong retail technology adoption and enterprise integration.

Europe is embracing BLE for transport, tourism, and healthcare systems.

Asia-Pacific is rapidly scaling deployments, especially in India and China, where smart city and digital retail initiatives are thriving.

Latin America and Middle East & Africa are emerging, with growth driven by infrastructure investments and public service modernization.

Major Players in the BLE Beacons Industry

The BLE beacons industry is shaped by key innovators and vendors that offer end-to-end solutions:

Kontakt.io

Estimote Inc

BlueCats

Gimbal Inc

Radius Networks

Aruba Networks (HPE)

Beaconinside GmbH

Accent Systems

Blue Sense Networks

Glimworm Beacons

These companies are driving advances in battery life, multi-beacon networking, and compatibility with smartphones and wearables.

Conclusion

The BLE beacons industry is witnessing robust growth as businesses and public institutions adopt proximity-based systems for enhanced interaction, tracking, and navigation. With continued innovation in hardware and software, along with expanding integration with IoT platforms, BLE beacons are shaping the future of smart environments.

Trending Report Highlights

Industrial Metrology Market

Gaming Monitors Market

Intrinsically Safe Equipment Market

Capacitor Market

AI Audio Video SoC Market

0 notes

Text

Unlock the Power of Bluetooth Mesh Networking for IoT

Bluetooth Mesh technology is revolutionizing the way devices communicate. Unlike traditional Bluetooth, which works on a point-to-point connection, Bluetooth Mesh creates a vast, scalable network of devices that communicate with one another seamlessly.

Key benefits include:

Scalability: Connect thousands of devices in one network without congestion.

Energy Efficiency: Devices operate on low power, making them ideal for IoT applications like sensors and wearables.

Security: Robust encryption and authentication features ensure your data stays safe.

Seamless Interoperability: Works across devices from different manufacturers, making integration easy.

Reliability: The mesh network structure ensures messages are sent across multiple paths, maintaining connection even when nodes are down.

From smart homes to industrial IoT, Bluetooth Mesh is set to power the future of connected devices.

0 notes

Text

The Ultimate Guide to Wireless & Networking: Trends, Tips, and Technologies

Introduction

In today’s fast-paced digital world, wireless and networking technologies are the backbone of connectivity. From enabling seamless communication to supporting IoT devices and smart homes, these systems have revolutionized the way we live and work. This guide dives deep into the fundamentals, trends, and advancements in wireless and networking, ensuring you stay ahead of the curve.

1. Understanding Wireless Networking

Wireless networking is the transmission of data without the use of cables or wires. Key components include:

Wi-Fi Technology: The cornerstone of modern connectivity. Learn how standards like Wi-Fi 6 and Wi-Fi 7 enhance speed and efficiency.

Bluetooth and Zigbee: Simplified communication for IoT devices.

Cellular Networks: The evolution from 3G to 5G and what lies ahead with 6G.

2. Types of Wireless Networks

Explore the different types of wireless networks:

WLAN (Wireless Local Area Network)

WPAN (Wireless Personal Area Network)

WWAN (Wireless Wide Area Network)

WMAN (Wireless Metropolitan Area Network)

3. Key Trends in Networking

Stay updated with the latest trends transforming the industry:

Mesh Networking: Enhancing home and office coverage.

IoT Integration: How wireless networks enable smart devices.

Network Automation: Using AI and ML to optimize performance.

Cloud Networking: Leveraging the cloud for scalability and flexibility.

4. Challenges in Wireless Networking

No system is without challenges. Common issues include:

Security Threats: Addressing risks like hacking and data breaches.

Signal Interference: Mitigating disruptions in high-density environments.

Scalability: Adapting to growing demands without compromising quality.

5. Tips for Building a Reliable Wireless Network

Choose the Right Equipment: Select routers and access points that fit your needs.

Optimize Placement: Position devices strategically to reduce dead zones.

Secure Your Network: Implement WPA3 encryption and strong passwords.

Regular Maintenance: Update firmware and monitor network health.

6. Future of Wireless and Networking

Wi-Fi 7 and Beyond: The next leap in wireless connectivity.

6G Networks: What ultra-low latency and high-speed data mean for the world.

Quantum Networking: Transforming encryption and communication.

Conclusion

Wireless and networking technologies are rapidly evolving, reshaping industries and personal lives alike. By understanding the fundamentals and staying informed about emerging trends, you can harness the full potential of these innovations.

0 notes

Text

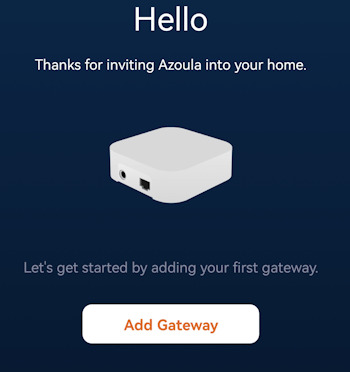

Effizientes Heimnetzwerk: Azoula ZigBee Gateway und Switch im Test

In diesem Beitrag möchte ich dir den ZigBee Gateway von der Firma Azoula vorstellen und im Detail zeigen, wie dieser eingerichtet wird. Zusätzlich wird noch ein smarter Schalter über ZigBee eingebunden und eine Lampe gesteuert. https://youtu.be/-MN1Ql-O7Ek Disclaimer: Für dieses Review habe ich das ZigBee Gateway sowie den smarten Schalter von der Firma Azoula kostenfrei zur Verfügung gestellt bekommen. Meine Meinung und Bewertung basieren jedoch ausschließlich auf meinen eigenen Erfahrungen und Eindrücken mit den Produkten.

ZigBee vs. Bluetooth

ZigBee und Bluetooth sind beide drahtlose Kommunikationsprotokolle, die für die Vernetzung von Geräten verwendet werden, aber sie haben einige wichtige Unterschiede: Zweck und Anwendung - ZigBee wurde ursprünglich für die Vernetzung von Geräten im Bereich des sogenannten "Internet der Dinge" (IoT) entwickelt. Es eignet sich gut für Anwendungen, bei denen eine geringe Datenrate, niedriger Stromverbrauch und lange Batterielaufzeit wichtig sind, wie z.B. Smart-Home-Geräte, Sensornetzwerke und industrielle Steuerungen. - Bluetooth wurde ursprünglich für die drahtlose Kommunikation zwischen mobilen Geräten wie Handys, Headsets und Computern entwickelt. Es bietet höhere Datenraten als ZigBee und wird oft für Audio-Streaming, Dateiübertragung und die Vernetzung von Peripheriegeräten verwendet. Datenrate - Bluetooth hat in der Regel eine höhere maximale Datenrate als ZigBee. Bluetooth kann Datenraten von mehreren Mbps erreichen, während ZigBee typischerweise Datenraten von bis zu 250 kbps bietet. Reichweite - ZigBee hat in der Regel eine größere Reichweite als Bluetooth. ZigBee kann je nach Umgebung und den verwendeten Frequenzbändern Reichweiten von bis zu mehreren hundert Metern bieten, während Bluetooth in der Regel auf Reichweiten von maximal etwa 10 Metern begrenzt ist. Allerdings hängt die Reichweite von beiden Protokollen stark von den Umgebungsbedingungen ab. Stromverbrauch - ZigBee wurde speziell für den Einsatz in batteriebetriebenen Geräten entwickelt und hat daher oft einen niedrigeren Stromverbrauch als Bluetooth. Dies ermöglicht längere Batterielaufzeiten für Geräte, die ZigBee verwenden. Topologie - ZigBee unterstützt Mesh-Netzwerktopologien, was bedeutet, dass ZigBee-Geräte untereinander kommunizieren können, um das Netzwerk zu erweitern und die Reichweite zu erhöhen. Bluetooth unterstützt diese Mesh-Topologie nicht nativ, obwohl Bluetooth 5.0 einige Funktionen bietet, die ähnliche Vorteile bieten können.

ZigBee Gateway von Azoula

Der mir vorliegende ZigBee Gateway von Azoula wird über ein RJ45 Netzwerkkabel mit dem lokalen Netzwerk verbunden (verfügt also nicht über WiFi). Ein Problem war lediglich das Netzteil, denn dieses war in meinem Fall nicht mit dem europäischen Netz kompatibel und ich musste mir einen Adapter besorgen. Dieser Adapter kostet aber lediglich 5 € (im Doppelpack) und somit ist das jetzt nicht die Welt. Lieferumfang - ZigBee Gateway, - Netzteil, - RJ45 Netzwerkkabel

Lieferumfang - Azoula ZigBee Gateway Wie erwähnt benötigte ich einen Adapter von US Buchse auf EU Stecker* für die Stromversorgung. Hinweis von mir: Die mit einem Sternchen (*) markierten Links sind Affiliate-Links. Wenn du über diese Links einkaufst, erhalte ich eine kleine Provision, die dazu beiträgt, diesen Blog zu unterstützen. Der Preis für dich bleibt dabei unverändert. Vielen Dank für deine Unterstützung! Anschluss des LAN Kabel an den ZigBee Gateway Das mitgelieferte LAN Kabel ist für meinen Anwendungsfall etwas zu kurz und daher verwende ich ein eigenes 3 m langes. Wenn das LAN Kabel eingesteckt ist, dann erkennst du eine aktive Verbindung daran, dass die kleine grüne LED blinkt. Die orange LED auf der anderen Seite signalisiert lediglich, dass die Leitung an sich aktiv ist.

Einrichten über Azoula Smart

Zur Einrichtung des Gateways benötigst du die App Azoula Smart, diese bekommst du für Android sowie iOS-Geräte in den einschlägigen Stores.

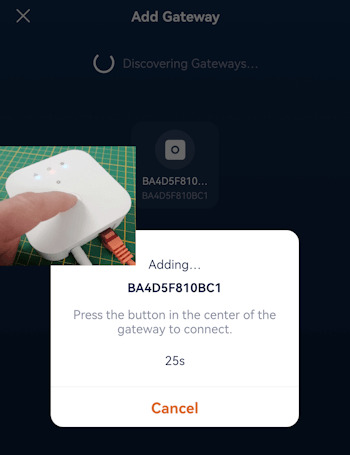

Bevor wir jedoch den ZigBee Gateway hinzufügen können, müssen wir einen Account anlegen, dafür benötigt man lediglich einen Benutzernamen, Passwort sowie eine E-Mail-Adresse. Ich gehe im nachfolgenden davon aus, dass du einen Account erfolgreich eingerichtet und dich eingeloggt hast. Im oben verlinkten YouTube Video zeige ich dir das ganze jedoch im Detail, falls du hier Unterstützung benötigst. Der ZigBee Gateway wird in drei einfachen Schritten über die App hinzugefügt. Wenn die App gestartet wird und noch kein Gateway hinzugefügt wurde, dann sollten wir nachfolgende Seite sehen, wo wir zunächst auf "Add Gateway" tippen.

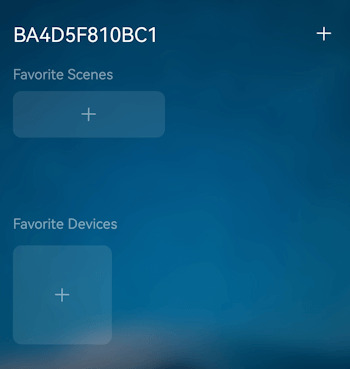

In meinem Fall wurde das Gerät sofort gefunden und ich musste zur Bestätigung die große Taste auf der Gehäuseoberseite betätigen. Damit ist die Einrichtung abgeschlossen und wir können nun weitere ZigBee Geräte hinzufügen. Wie du einen smarten Schalter integrierst und darüber eine Lampe steuerst, zeige ich dir im oben verlinkten YouTube Video.

Read the full article

0 notes