#CMA Intermediate New Syllabus

Explore tagged Tumblr posts

Text

The Institute of Cost Accountants of India (ICMAI) has always been committed to ensuring that its curriculum remains relevant and reflective of the dynamic business environment. In pursuit of this goal.Get more information please read this blog:

0 notes

Text

CMA Final Registration Fees & Exam Date Dec 2025: Full Guide

Your 2025 Guide to CMA Final Registration, Fees & Exam Date

If you're aiming for the CMA Final exam in December 2025, your journey begins with a timely and accurate registration. Many students focus solely on syllabus preparation, but skipping or delaying registration can cost you an entire exam cycle. Understanding the CMA Final registration fees and timelines is essential if you want to sit for the exam without any last-minute roadblocks.

Let’s walk you through everything you need—from eligibility and documents to deadlines and the CMA Final exam date Dec 2025—so you can stay ahead.

Why You Shouldn’t Delay CMA Final Registration

The Institute of Cost Accountants of India (ICMAI) mandates that all candidates must register for the CMA Final level by 31st July 2025 to be eligible for the CMA Final exam date Dec 2025. Missing this deadline means you’ll only be eligible for the next session in June 2026.

Moreover, candidates who pass the Intermediate exam in June 2025 won’t be allowed to take the Final exam in December 2025. ICMAI enforces a required buffer between levels, ensuring students get adequate time for preparation and practical training.

Clearly, registering early gives you more than eligibility—it also offers extra time with official study material and training completion.

Eligibility Criteria for CMA Final 2025

Before paying the CMA Final registration fees, make sure you meet these key requirements:

You must have cleared the CMA Intermediate level.

Your ICMAI student registration should still be valid.

Completion of mandatory practical training is essential.

Failing to meet even one of these will result in your registration being rejected. Therefore, check your eligibility thoroughly before proceeding.

How to Complete Your CMA Final Registration in 2025

The registration process is simple if you follow the steps carefully. To make sure you don’t miss anything, follow this checklist:

Visit the Official ICMAI Website Head to the student section and log in or create a new account if needed.

Choose the CMA Final Course From the course list, select the Final level.

Fill in Your Details Provide personal information, educational background, and CMA Intermediate credentials.

Upload Documents

CMA Intermediate Pass Certificate

A valid government ID (Aadhar, PAN, etc.)

Pay CMA Final Registration Fees The one-time CMA Final registration fees is ₹25,000 for both Group 3 and Group 4. It must be paid online via debit card, credit card, or net banking.

Download the Confirmation Slip Save your receipt and confirmation page for future reference.

What the CMA Final Registration Fees Cover

The ₹25,000 CMA Final registration fees includes enrollment for both groups. You also receive the latest study material from ICMAI. This ensures you prepare with up-to-date content, a crucial factor for success.

There is no offline payment option, so be cautious and pay only through ICMAI’s official portal. Always double-check the payment status before logging out.

Exam Structure After Registration

After completing your registration and paying the CMA Final registration fees, the next phase is full-on preparation. The syllabus is divided into two groups:

Group 3

Corporate and Economic Laws

Strategic Financial Management

Direct Tax Laws and International Taxation

Strategic Cost Management

Group 4

Corporate Financial Reporting

Indirect Tax Laws and Practice

Cost and Management Audit

Strategic Performance Management

Each paper carries 100 marks and includes a mix of objective and descriptive questions. So, planning your study strategy early is key.

Don’t Forget the Exam Application Form

Paying the CMA Final registration fees does not automatically enroll you for the exam. A few months before the CMA Final exam date Dec 2025, ICMAI will release the exam application form. This step is equally important.

The form allows you to:

Choose your exam papers

Select your exam center

Confirm your attempt for December 2025

Failing to submit the application means you won’t be allowed to appear, regardless of registration status.

Key Dates to Mark on Your Calendar

CMA Final Registration Deadline: 31st July 2025

CMA Final Exam Date Dec 2025: Exact date to be announced

Exam Form Release: Likely around September 2025

Final Thoughts

Registering for the CMA Final exam is more than a formality—it's your ticket to moving closer toward your professional goals. From verifying eligibility to paying the CMA Final registration fees, each step is critical. Moreover, understanding the CMA Final exam date Dec 2025 allows you to plan effectively.

Act early, gather your documents, and don’t miss the deadline. Strategic planning now will lead to exam success later.

By staying informed and proactive, you're not just preparing for an exam—you're preparing for your future as a qualified Cost and Management Accountant.

0 notes

Text

Coimbatore's Best CMA Online Classes for Fundation, Inter & Final

Lakshara Academy is one of Coimbatore 's leading CMA Coaching institute for CMA Foundation, CMA Intermediate and CMA Final exams(new syllabus for ca). Watch premium online / Offline coaching sessions for CMA Foundation presented by our top faculty members. Enroll now! . Lakshara Academy is an extension of KS Academy.

Click to know more : https://ksacademy.co.in/cma-classes-Coimbatore.php

#CMA #CSCourse #ACCA #CFA #USCPA #CIA #CFP #ProfessionalCoaching #LaksharaAcademy #ExamPreparation

0 notes

Text

BEST CA COACHING IN DELHI

Mittal Commerce Classes

Best Classes in New Delhi: https://mccjpr.com/ca-coaching-in-new-delhi/

Mittal Commerce Classes was established in the year 1998 by CA Manoj Gupta (Mittal). Mittal Commerce Classes offer comprehensive and result-oriented training to aspiring Chartered Accountants. Our experienced and knowledgeable faculty helps the students to prepare for the various exams of CA. We provide CA online classes and study material to ensure that students can access the same anywhere, anytime. Our study material is curated by experienced professionals who have in-depth knowledge of the CA exam syllabus and knowledge of the CA exam syllabus.

Our Mission

We are focused on providing a platform that creates successful, disciplined, hardworking, progressive and prudent professionals helping in making a better and progressive society.

Our mission is to bring out the best from every student and to train them in the best possible way by providing educational facilities of the highest order.

Our vision

Education is the single most important tool that shapes mankind. Keeping this in mind was born a unique concept of the MCC Empire. MCC as a company (Educational Corporate) came into existence in 1998 with an intention and passion to provide result oriented quality education. The founders have the best of academic backgrounds. MCC made a huge success by delivering quality to the students. Motivated by a deep desire to ‘work towards perfection, greater efforts were made which resulted in enhancement of results.

Mittal Classes Unique Selling Proposition

We are glad to tell you about our unique selling proposition , we provide free demo classes , online classes and students opt online batch according to their comfort , you can access all recorded videos

You can check our blog section for CA preparation and study tips. https://mccjpr.com/blog/

Contact Details: +919929325016, +919314055518

Website link: https://mccjpr.com/

Services: Our services are CA , CMA and 11th &12th classes with foundation courses , intermediate courses and final coaching.

0 notes

Photo

Get google drive links for CA final old syllabus. Crack The paper has a team of well experienced faculties with expert know-how to crack the paper. Buy these links and pendrive today. For more information visit our educational portal.

#CA Foundation New Syllabus pendrive classes#Google drive lectures for CA foundation#Pendrive classes for Ca Inter New Syllabus#Best faculty for Ca Intermediate#online pendrive classes for CA Final course#Pendrive Classes for CA new syllabus by best faculty#Online pendrive classes for CA CMA CS Courses in India

0 notes

Video

youtube

CMA -NEW SYLLABUS 2022 JUNE Exam 2023 #cma

For every updates regarding CMA (ICWA) Exams, Exam Tips, etc., kindly Subscribe our Channel https://www.youtube.com/channel/UCdOVuBY_-IJKGHkFXqao9_A and press the Bell Icon so that you'll receive all the useful information then and there.

For further information, please call us @ +91 - 94 89 87 79 79 or visit us @ https://www.araeducation.in/ https://www.araeducation.in/cma-icwa-coaching-classes

https://www.araeducation.in/cma-foundation-coaching

https://www.araeducation.in/cma-intermediate-coaching

https://www.araeducation.in/cma-final-coaching #cmacoaching #icwacoaching #icwacoachingcoimbatore #cmafoundationcoaching #cmaintermediatecoaching #cmafinalcoaching #cmacoachingcoimbatore #cmaonlinecoaching #cmaofflinecoaching

2 notes

·

View notes

Text

A New doorway through CMA India with Lakshya CA Campus

These days, the CMA course is gaining popularity among commerce students, who want to pursue a career in the area of Cost and Management accounting. Students are curious about the CMA course subjects, CMA course syllabus, CMA course exam dates and CMA course career prospects. So, in this article, we are providing all the important course details for the CMA exam.

The CMA Course has gained huge recognition in recent times. A Qualified CMA finds great career opportunities in firms like big 4, government offices, etc. Hence, one must consider pursuing the CMA course. Here in this article on CMA Course details, you will get to know about Course eligibility, Registration details, and other deadlines that you should be aware of.

Over time we have seen that people tend to confuse between various terms like CMA, ICMAI, CWA, and ICWAI. So, to end all your confusion, the Institute of Cost & Works Accountants of India (ICWAI) has changed its name to The Institute of Cost Management Accountants of India (ICMAI). Also, the ICWA course has been renamed as the CMA course.

There is no difference between ICWAI and CMA, and they are the same. They are two different words used to describe one single thing. ICWAI stands for Institute of Cost and Work Accountant of India whereas CMA stands for Cost Management Accounting.

There are 3 stages in the ICWA course i.e,

CMA Foundation

CMA Intermediate

CMA Final

CMA Course Eligibility | Foundation Inter and Final | CMA Course DetailsEligibility criteria for CMA Foundation

A candidate should have passed Class 10 or equivalent from a recognized Board or Institution.

Passed Senior Secondary Examination under 10+2 scheme of a recognized Board or an Examination recognized by the Central Government as equivalent or has passed National Diploma in Commerce Examination held by the All India Council for Technical Education or any State Board of Technical Education under the authority of the said All India Council or the Diploma in Rural Service Examination conducted by the National Council of Higher Education.

Eligibility criteria for CMA Intermediate

A candidate should have passed Senior Secondary School Examination (10+2)and Foundation Course of the Institute of Cost Accountants of India.

Graduation in any discipline other than Fine Arts.

Foundation (Entry Level) Part I Examination of CAT of the Institute.

Foundation (Entry Level) Part I Examination and Competency Level Part II Examination of CAT of the Institute.

Passed Foundation of ICSI/Intermediate of ICAI by along with 10+2

Eligibility criteria for CMA Final

A candidate should have passed Senior Secondary School Examination (10+2)and Foundation Course of the Institute of Cost Accountants of India.

Graduation in any discipline other than Fine Arts.

Foundation (Entry Level) Part I Examination of CAT of the Institute.

Foundation (Entry Level) Part I Examination and Competency Level Part II Examination of CAT of the Institute.

Passed Foundation of ICSI/Intermediate of ICAI along with 10+2

In total, a student needs to complete 20 papers in the CMA Foundation, Inter, and Final exam.

As per existing provisions, a candidate can join the CMA Foundation Course and is offered provisional admission to the Course while pursuing 10+2. However, the student will be eligible to appear for Foundation Course after qualifying the 10+2 Examination. So, qualifying a 10+2 examination makes the student eligible to get converted from Provisional to Regular status. The conversion is done on the basis of submission of application along with the Pass Certificate/ Mark Sheets (qualifying) for Class 10+2.

This provisional time period of his term of admission to the date of conversion to regular student status is now extended up to 36 (thirty-six) months instead of 6 (six) months.

(b) For joining Intermediate Course (while pursuing their Undergraduate studies)

As per existing provisions, a candidate who joins CMA Intermediate Course would be offered provisional admission to the Course while pursuing their undergraduate courses/studies. The student will be eligible to appear for the Intermediate Course only after qualifying the Graduation Examination. So, qualifying the Graduation examination makes the student eligible to get converted from Provisional to Regular status.

This provisional time period of his/her term of admission to the date of conversion to regular student status is now extended up to 18(eighteen) months instead of 6 (six) months.

However, students who would be joining Intermediate Course after qualifying CMA Foundation/CS Foundation/Intermediate by the Institute of Chartered Accountants of India shall be considered as Regular Students and shall be eligible to appear in the Intermediate Course Examination even during their pendency of undergraduate courses.

The CMA Course has gained huge recognition in recent times. A Qualified CMA finds great career opportunities in firms like big 4, government offices, etc. Hence, one must consider pursuing the CMA course. For further details, contact Lakshya CA Campus for proper guidance and counselling. Walk into a new pathway with Lakshya CA Campus and be a future CMA professional.

Impact of Covid-19 in the Indian…

CA is not Life. It’s just a part…

1 note

·

View note

Text

Best CA colleges near me

Sri Medha Educational Institution , the Top ca colleges in ap imparting quality education from Jr. Inter to CA & CMA Final under one roof with the motto of Igniting Intelligence & Delivering excellence.

Commerce is an evergreen stream for study in India, with the rapid growth of the Indian economy and an increasing number of foreign collaborations, it is promising better opportunities. The field of commerce will help you attain rewarding career avenues across multiple industries. Professional courses like Chartered Accountancy (CA), Company Secretary (CS), and Cost Management Accounting (CMA) are gateways to the ‘Big Five’ consultancies and MNCs, or careers as successful entrepreneurs and professionals.

Chartered Accountancy provides highly rewarding and challenging careers in every conceivable segment of trade, industry, commerce, government & non-government / non-profit sectors. A profession that imparts the best of Technical skills in financial and management areas and abilities necessary for deciding and acting upon high-pressure situations; Chartered Accountants today have occupied top management positions in public as well as private sectors. They also render professional services like accountants and management consultants. CAs today as a part of the top management team holds key positions in the corporate sector and government. Rapid changes taking place in the economy have further opened up new vistas of opportunities for Chartered Accountants.

There are three CA levels in the course:

CA Course Details

The CA course details contain all the information a student requires to pursue the Chartered Accountant course.

CA Foundation: The entry-level national examination that acts as the initial step to becoming a CA is the foundation course. The attempt at this examination is an offline method. The Chartered accountant exam is conducted biannually by the ICAI. The syllabus focuses on CA's application, comprehension, and knowledge aspects. Each paper is 100 marks with a 180 minutes duration.

CA Intermediate: To bridge the gap between the fundamentals of the CA course and the advanced CA course, students pursue the intermediate course. The course provides students with the knowledge of technology and essential skills required for becoming a CA. The intermediate subject is divided into two groups. After completing the CA foundation exam, aspirants can attempt the CA Intermediate Exam individually or together (subject groups).

CA Final: In the final CA final course, students must clear all the subjects in one go.

Related searches are:

Sri Medha Educational Institution, top 10 intermediate colleges in guntur, top 10 Degree colleges in guntur, ca colleges in guntur, cma colleges in guntur, ca coaching centres in guntur, cma coaching centres in guntur, ca academy in guntur, cma academy in guntur, best ca colleges in ap, best cma colleges in ap, top ca colleges in ap, top cma colleges in ap, best ca colleges near me, best cma colleges near me, ca inter institutes in ap, ca final institutes in ap, cma foundation institutes in ap, cma inter institutes in ap, cma final institutes in ap, Top commerce Colleges in Guntur, Top commerce Colleges in AP, Best commerce Colleges in Guntur, Best commerce Colleges in AP

For More Info: https://srimedha.com

or

Call us: 8886062692, 0863-2255891, 0866-2494581

# best ca colleges near me

# best cma colleges near me

# ca inter institutes in ap

# ca final institutes in ap

0 notes

Text

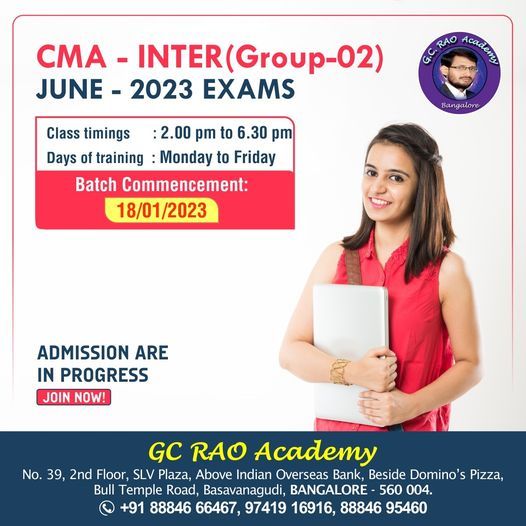

CMA Institutes in Bangalore

G.C RAO academy started in 2012 by Mr. G.C.Rao, A Young and Dynamic mentor to students aspiring to bring changes in commerce education in Karnataka. In a span of 11 years, produced No of qualified & semi-qualified CMA’s along with 33 ALL INDIA RANK HOLDERS.We offer coaching for both Regular classes for students and Weekend classes for working professionals

Contemporarily, the CMA course is acquiring monstrous prominence among trade understudies, particularly understudies who need to become showbiz royalty in their vocation in the field of Cost and Management Accounting. On the off chance that you are likewise inquisitive to realize about the course subtleties, keep perusing to figure out all relevant info about the CMA course in India.

Our aim is to give professional training to our students to crack their CMA exam with the best results possible. We boost our students' confidence while helping them prepare bet

GC Rao Academy is one of the leading CMA institutes in Karnataka with advanced courses that broaden minds and prepare students for their successful professions.

WHY GC RAO

10 Years of Excellence in the field of CMA coaching.

Produced 31 All INDIA RANKS in CMA Inter & Final including All India 6th Rank in Recent examinations.

Proven Track Record of producing excellent results which are best in class in CMA coaching industry.

Produced Hundreds of Qualified & Semi-Qualified CMA.

Exclusive coaching center for CMA from Foundation to Final under one roof.

Dedicated most experienced Faculty team.

Offers Coaching both Classroom as well as online classes to suits the requirements of all CMA Aspirants.

Offers coaching both Regular classes for students and Weekend classes for working professionals.

Noise free environment : Our New campus is strategically located which is free from heavy noise which disturb concentration of students.

Ease of transportation: Our new campus is easily accessible though Metro Rail, KS RTC and private Transport.

COVID Appropriate behavior: Strict Adherence to COVID control Measures as per Government norms.

Fully Sanitized premises (for every 2.5 hours).

Social Distancing – 3ft Distance among two students.

Hot Drinking water provision from 7am to 8 pm in Campus.

Fully Sanitized Hostel facilities for outstation students.

GC Rao Academy helps students to prepare for various professional and competitive exams like CMA at any time, anywhere, on any device. High-Quality CMA Intermediate Online Video Classes by the best faculty at the best possible cost. CMA Intermediate Online Video Classes covers the entire CMA syllabus of all CMA papers. Experienced and knowledgeable faculty design and teach lectures according to the latest teaching methodologies. We provide complete comprehensive study material, test series, doubt clarifying sessions, regular tests, mentoring sessions and much more. We provide CMA guidance from our best teachers through engaging video lectures and study materials.

Related Searches Are:

Best CMA Institutes Near Me,Best CMA Coaching Centers Near Me,Top CMA Institutes Near Me,Best cma coaching near me,Bangalore CMA institute,Best CMA Foundation Institutes in Bangalore,Best CMA Inter Institutes in Bangalore,Best CMA Final Institutes in Bangalore,CMA Institutes in Bangalore,Best CMA Institutes in Bangalore,Best CMA Coaching Centers in Bangalore

For More Info: https://posts.gle/9fSWPi

or Contact Us: +91-9741 916 916, +91-9742 676 156

#CMA Institutes in Bangalore

#Best CMA Institutes in Bangalore

#Best CMA Coaching Centers in Bangalore

#Best CMA Institutes Near Me

0 notes

Text

Commerce Courses After 12th Class in Chandigarh

Commerce Courses After 12th Class in Chandigarh: Now that you have completed your class 12 examinations, have you given any thoughts on what you want to do next? What are the courses after 12th you should pick?

If you are thinking of choosing a career in Commerce then we would say it’s a great option. In India, Commerce has grown enormous and is known for offering a huge scope of career options to pursue after class 12. It further gets wider with students realizing the significance of Commerce and the specialization courses related to it. These courses not only give you an opportunity to grow and make an illustrious career but also help you become the first-rate in your professional career. But the question which conflicts with you is ‘Which career option to choose?’ It is not a constraint that you need to have cleared your Higher Secondary from Commerce only. A Science or an Arts’ student can also chase these professional courses after class 12. As it is said that It’s not what you achieve, it’s what you overcome. That’s what defines your career”. All you require is dedication, hard-working spirit and self-confidence to face all the hustle coming your way. Now let me throw some light on some of the most distinguished and industry respected career choices you can opt for after class 12.

Top Courses After 12th Commerce with Mathematics

BCom (Honours)

BCom Accounting and Taxation

BCom Statistics

BCom in Management Accounting & International Finance

BCom in Accounting

BCom Applied Economics

BCom Banking & Finance

Top Courses After 12th Commerce without Mathematics

BCom (General)

BCom Business Administration

BCom Marketing

BCom Tourism & Travel Management

Following are some of the

main courses for commerce students to pursue after class 12th in Chandigarh

After pursuing 12th with commerce stream, you have to start your further education by choosing UG or Integrated UG courses like five years integrated BBA + MBA. To apply for admissions in UG courses, you must have completed 12th or analogous exams with commerce subjects from any recognized board. Following is the list of best courses after 12th commerce. Contrary to popular insight there are a huge range of options available for candidates who have completed class 12 in the commerce stream. Apart from professional and diploma courses, you can also choose our courses after 12 in commerce with or without maths as a subject. Go forward and take your pick of the best courses after 12th commerce. Courses enlisted below range from business to computers to hospitality.

Bachelor of Commerce ( B.Com )

It is the best undergraduate degree course after 12th commerce for those students who are interested in banking, finance, accounting, information system, computer,s etc. If you have passed with 12th in any stream then you can do it but it’s the most suitable for 12th commerce students. Advertising and Sales Management, Foreign Trade, E-Commerce, Taxation, Office Management, Computer Application etc are the specializations for B. Com. Bachelor of commerce is a 3 Years duration course. Eligibility Criteria of this course is 12th pass with 45-55% Admission Process of this course Direct / Entrance Exam, Group Discussion, Personal Interview

Bachelors of Commerce (Honours) or B.com (Hons)

This is B.com with a specialty in fields like Accountancy, management or economics etc. The industry demand for B.com (Honours) is better than a normal B.com course. The admission and eligibility criteria are the same for both and admission is generally based on merit, while some colleges take admission tests. Subjects taught are mostly the same, but in the honors course, one gets to study more adequately.

Bachelor of Law (LLB)

The study of law is absolutely one of the most pleasing career choices considering the job challenges and financial advantages. Over the last few decades, India INC has witnessed a steady rise in demand for law graduates in several professional fields. The study of law is becoming a career choice for millinery. Students were provided courses in civil, criminal, corporate, taxation, labor and election law. Today the collection has included new specializations involving space, cyber, intellectual property, and international laws. The prospect for law students is very good as they are now better issuing than those 10-15 years ago.

BCom Accounting and Taxation

Students who want to make a career in Banking and Insurance should take up BCom Accounting and Taxation. The course syllabus involves the Indian Tax System, Financial Accounting, Value Added Tax and Central Tax Procedure, Financial Accounting, Principles of Management and Business Communication.

BCom Statistics

BCom Statistics opens up various directions in Economic Research and Analysis. Civil Services, Data Analytics, Education, Consulting and Government Organisations are some of the popular career opportunities in this field. The course includes the study of Applied Information Economics, Applied Statistics, Biostatistics, Business Statistics, Data Analysis, Demography, etc.

BCom in Management Accounting & International Finance

BCom in Management Accounting & International Finance is a better option to choose at graduation level if one wishes to complete International Business at the Master's level. The course provides exposure to international business and US CMA (Certified Management Accountant).

BCom in Accounting

Those who wish to go for competitive exams and banking exams or take up Chartered Accountancy or Company Secretaryship must opt for BCom in Accounting. The course includes the Indian Financial System and Financial Market Operation, Financial Management, Cost & Management Accounting, Business Mathematics & Statistics, Economics, Principles of Marketing, Financial Accounting and Business Regulatory Framework.

Bachelors in Economics

Commerce students can pursue BSc. Economics Hons after plus two. The entire study area includes economic policies, analytical methods, and programs etc. Those who are interested in economics and aspire to specialize in the concept of the economic framework can opt for this course.

BCom Banking & Finance

BCom Banking & Finance course envelopes all the aspects of the BFSI industry such as Banking, Banking Law, Insurance Law, Insurance Risk & Insurance Regulations, Accounting, etc. After a degree in BCom Banking & Finance, one can go for careers such as Auditor, Analyst, Equity Manager, Wealth Manager, Account Manager, Stockbroker, Market Analyst, etc

Bachelor of Business Administration( BBA)

Bachelor of Business Administration or BBA is one of the most popular bachelor's degree courses after class 10+commerce. The BBA course is the entrance to many job chances in the fortunes of sectors like Marketing, Education, Finance, Sales, and Government to name just a few. Here are some essential highlights of the BBA program/degree that you should know about: The 3-year professional undergraduate course in Business Management is open to students from all three streams: Science, Arts and Commerce. The BBA course offers knowledge and training in management and leadership skills to prepare them for managerial roles and entrepreneurship. During the term of the course, candidates learn several aspects of business administration and management through classroom lectures and practical projects like internships.BBA can be completed in full-time as well as correspondence mode.

BCom Marketing

This specialization of BCom trains the student in techniques and methods of planning and managing marketing activities for a business organization. Career opportunities after BCom Marketing are many, as Marketing is one of the four pillars of any business company. Nowadays Marketing graduates are in high demand in every firm.

BCom Tourism & Travel Management

BCom Tourism & Travel Management is specific to the Tourism industry. This course trains students in theoretical and practical aspects of the industry. Apart from business operation and other entire commerce subjects, the students are taught financial bearing of tourism, impact on the world economy, environmental laws and regulations, customer-care and servicing, international travel laws and tourism management.

Chartered Accountancy (CA)

This is the most popular and sought after professional course for building a great and bright career in commerce. Chartered Accountancy unrolls the doors to bright career options as a Tax Consultant, an auditor, an advisor, a financial office. One can also opt for independent practice. However, CA is a very difficult and complex course hence requires very hard work and sincere efforts to qualify. Clearing the starting level might be easy but as one goes to the higher levels i.e. Intermediate (IPCC) and CA Finals, it gets extraordinarily tough. It is only through total resolution and compatible efforts that one can complete the program successfully. The new syllabus involves Foundation, Intermediate and Final levels. The Institute of Chartered Accountants of India (ICAI) provides this course and one can visit the official website www.icai.org to get more details on the course, eligibility conditions and admission procedure.

After Graduation you can pursue the following courses:

Master of Commerce students typically need one to two years to complete and may include a thesis project wherein the student will prove their understanding of key academic concepts and practical skills through an individual or group project. Master of Commerce courses are available on a full time or part-time study program. The Master of Commerce program lasts three semesters and inspires students to pursue their ideal career by encouraging them to tailor their course of study to a certain area of specialization. If you would like to learn more about how to gain the necessary qualifications to land great positions and develop your dream career in business, finance, accounting, marketing, human resources, or other area connected to Commerce, simply scroll down and find out how you can apply to a Master of Commerce degree program, today!

Top Post Graduate Course for Commerce Students

Master of Business Administration (MBA)

MBA is a postgraduate degree course which comes under the management catalog. The duration of this course is 2 years with a total of 4 semesters. Bachelor's degrees from an authorized university with a minimum of 50% or higher are eligible for this course. MBA subjects include disciplines such as- Human Resource, Management, Finance, Business, and Banking. MBA Jobs are in high demand in the business environment since it directly acts in the whole of the industry. One with brilliant communication and leadership quality along with innovative ideas can pick this course.

Company Secretary (CS)

Company Secretary (CS) is one of the fundamental posts in a company. He/she acts as a conscience seeker of the company. A certified Company Secretary is hired to handle the legal aspects of a firm. A CS is responsible for completing a company’s tax returns, keeping records, advising the board of directors, and ensuring that the company complies with legal and statutory regulations.

In India, The Institute of Company Secretaries of India (ICSI) is the only acknowledged professional body in India to develop and regulate the profession of Company Secretaries. The ICSI provides training and education to lakhs of aspiring Company Secretaries. Members. At present, there are more than 50,000 members and about 4,00,000 students on the rolls of ICSI.

To be able to specialist practice Company Secretaryship, an individual has to complete three levels of training and examination, set by the ICSI.

Financial management

In this course, you will learn the basics of financial accounting information. You will start your journey with a real overview of what financial accounting details are and the main financial statements. Then, You will learn how to code financial transactions in the financial accounting language. In the meantime, you will learn about the most essential concept in contemporary financial accounting: accrual accounting. You will then daringly analyze how the company recognizes revenues. Finally, you will complete the course with an analysis of accounting for short-term assets where you will go into detail on how firms account for accounts receivables and inventories.

Cost accounting

This course includes basic concepts of cost accounting and control. Course objectives are designed to Help the participants to become intelligent users of cost information for (a) Computing cost of product/ process/ project/ activity. (b) Controlling & managing the cost (c) Decision making like estimating, Make or buy, profit preparation. (d) Planning and Budgeting Cost accountants are responsible for the collection, adjustment, auditing, and scrutinizing of all financial information. The purpose of cost accounting is for budget preparation and profitability analysis. They collect the numbers which include data about planning systems, wages, bonuses, and operating policies into financial reports. The purpose of this is to help the management take decisions on the basis of this information.

0 notes

Text

Commonly Asked Q&As By The CA Aspirants (Part-2)

Why choose MEPL classes for the best CA classes in India?

Because MEPL classes follow Scientific Methodology to deliver the right knowledge to students keeping their level of understanding and requirements of the course in mind.

Because MEPL classes cover 100% syllabus Conceptually & Logically.

Because MEPL classes are the place where Quality matters over Quantity.

Because MEPL classes take a Limited Number of Students per batch, we look after the unique requirements of every student and guide accordingly.

Because MEPL classes conduct regular assessments and show the path of improvement to Every Student.

Because MEPL classes offer Enriching and Empowering learning experiences.

Because MEPL classes care for every student's success and maintain the record of Highest Pass Percentage at all Levels.

Can a student from any group in Intermediate (10+2) join CA?

A candidate becomes eligible to register for Intermediate only after passing (10+2) CA Foundation (introduced by ICAI as per the new scheme). Intermediate candidates become eligible after graduation and after this also they have to go under training for 9 months then they can give the ca inter exam (2nd level).

I heard passing CA is very tough? Is it true?

All the good things are tough to obtain in this world; if we consider ourselves are not determined; everything will look tough in this world. Yes, CA is definitely tough to pass, if you are not coached properly & conceptually. We at MEPL classes, make this learning a worthwhile exercise by providing the best CA classes In India so that your difficulties will be reduced.

As it is said: "The more difficult it is to reach your destination, the more you will remember the journey", hence make the right choice.

If I join other courses like engineering and medical, I have a fair chance of passing. What if I join CA and could not complete it?

We agree with you if you join engineering or medical, you have a fair chance of passing, one thing we should understand here is that engineering and medical are degrees with a specified period of learning, whereas CA is a professional course which you will only pass provided you put in your hard and sincere efforts towards learning the concepts and their usage in the financial world.

CA is not a degree. OK, if you don't pass CA, what then? There are various courses offered in the financial domain like CAT (Certified Accounting Technician), ATC (Accounting Technician Course), etc. Which you can enroll in and get job-oriented training. Apart from this, you have many courses such as CMA, CS which you can enroll and along with this, you can enroll for a correspondence degree.

And we are sure you be industry-ready if you equip yourself with the required skills if you got admitted to MEPL classes as it provides the best CS classes in India and the best CMA classes in India.

#best CA classes In India#Best CA Classes in Kolkata#best CMA classes in India#best CMA classes in Kolkata

0 notes

Text

CMA Amendments & Clarification for June 2019 Exams (Inter & Final)

CMA Amendments & Clarification for June 2019 Exams (Inter & Final)

9 Comments Juhi Gupta states 6 years ago Sir, Please notify the changes in December 2015. Juhi Gupta states 6 years ago Sir, Please notify the intermediate group 1 modifications of brand-new syllabus in December 2015 exam. Thanks & Regards Juhi susil nayak says 6 years ago Dear sir, I am student of CMA inter coming from old curriculum I.e2008, Caro is applicable for this examni.e June…

View On WordPress

0 notes

Text

Download CMA Inter Study Material 2019 (Syllabus 2016) - Revised Edition for June 2019

New Post has been published on https://finultimates.com/cma-inter-study-material/

Download CMA Inter Study Material 2019 (Syllabus 2016) - Revised Edition for June 2019

Download CMA Inter Study Material 2019 (Syllabus 2016) – Revised Edition for June 2019

CMA Inter Study Material 2019 (Syllabus 2016) – Latest Edition

Course – CMA Intermediate

Syllabus – Syllabus 2016

Publisher – Directorate of Studies, The Institute of Cost Accountants of India (ICAI),

Author – Directorate of Studies, ICAI

First Edition : January, 2018

Edition – March 2019

Applicable for June 2019 & December 2019

New Study Material, Paper 11 with GST & Paper 7 in accordance with Finance Act 2018)

Subjects in CMA Intermediate 2019 exams of Syllabus 2016

Group 1

Paper-5 Financial Accounting

Paper-6 Laws and Ethics

Paper-7 Direct Taxation

Paper-8 Cost Accounting

Group 2

Paper-9 Operations Management & Strategic Management

Paper-10 Cost & Management Accounting and Financial Management

Paper-11 Indirect Taxation (Including Customs Act)

Paper-12 Company Accounts & Audit

Download CMA Inter Study Material for June & December 2019

CMA Study Material for June & December 2019 (Syllabus 2019) Download Links Paper-5 Financial Accounting (Revised Edition) Download Paper-6 Laws and Ethics (Revised Edition) Download Paper-7 Direct Taxation (Revised Edition) January 2019 Download Paper-8 Cost Accounting (New Edition) Download Paper-9 Operations Management & Strategic Management (Revised Edition- January 2019) Download Paper-10 Cost & Management Accounting and Financial Management (New Edition) Download Paper-11 Indirect Taxation (Including Customs Act) – March Edition Download Paper-12 Company Accounts & Audit (Revised Edition) Download

Applicable changes for CMA Inter June 2019 (Accountss, Tax & Law changes)

Applicability of Ind AS and AS in Intermediate – June 2019 Examination New

Amendments made in Finance Act, 2018 New

Supplementary Pension Fund Regulatory and Development Authority Act, 2013-June, 2019 Intermediate. New

List of Notified Sections June 2019 Examination New

Objectives of CMA Intermediate Study Material Syllabus 2016?

CMA Inter Study Material Syllabus 2016 is designed to nurture young business leaders of tomorrow who can convert the dream of ‘MAKE IN INDIA’ into reality by taking strategic management decisions effectively in both the National and International arena. The syllabus 2016 is based on International Standards set by IFAC (International Federation of Accountants) and IAESB (International Accounting Education Standards Board) and Initial Professional Development – Professional Skills (Revised) through IEG (International Educational Guidelines):

To create awareness and promote cost & management accounting education.

To achieve six skill sets – knowledge, comprehension, application, analysis, synthesis and evaluation.

Based on four knowledge pillars – management, strategy, regulatory function and financial reporting.

To inculcate skills for employability.

Increased emphasis on Accounting, Analysis, Reporting & Control, Strategy, Performance Measurement, Analysis, Reporting, Corporate & Allied Laws, Taxation, Ethics and Governance.

To extend all possible professional expertise to ensure transparency and governance as desired by the government.

#CMA#CMA Inter#CMA Inter Notes PDF#CMA Inter Study Material#CMA Inter Study Material June 2019#CMA Inter Syllabus 2016#CMA Intermediate#Download CMA Text Books#Download#Study Material

0 notes

Link

Direct Taxes A Ready Referencer for CA Final

Corporate and Economic Laws For CA Final New Syllabus By CA CS Munish Bhandari, Applicable For November 2018 Exams

CONTENTS:

APPOINTMENT AND QUALIFICATION OF DIRECTORSMEETINGS OF BOARD AND ITS POWERSAPPOINTMENT AND REMUNERATION OF MANAGERIAL PERSONNELINSPECTION INQUIRY AND INVESTIGATIONCOMPROMISE ARRANGEMENTS AND AMALGAMATIONPREVENTION OF OPPRESSION AND MISMANAGEMENTREGISTERED VALUERSREMOVAL OF NAMES OF COMPANIES FROM THE REGISTER OF COMPANIESWINDING UPCOMPANIES AUTHORISED TO REGISTER UNDER THE COMPANIES ACT 2013COMPANIES INCORPORATED OUTSIDE INDIA GOVERNMENT COMPANIESREGISTRATION OFFICES AND FEESNATIONAL COMPANY LAW TRIBUNAL AND APPELLATE TRIBUNALMISCELLANEOUS PROVISIONS OF THE COMPANIES ACT 2013PRODUCER COMPANIESCORPORATE SECRETARIAL PRACTICE THE FOREIGN CONTRIBUTION (REGULATION) ACT 2010THE ARBITRATION AND CONCILIATION ACT 1996 THE SECURITIES CONTRACTS(REGULATION) ACT 1956 AND THE SECURITIES CONTRACTS (REGULATION) RULES 1957THE SECURITIES AND EXCHANGE BOARD OF INDIA ACT 1992 AND SEBI (ICDR) REGULATIONS 2009THE SECURITIES AND EXCHANGE BOARD OF INDIA (LISTING OBLIGATION AND DISCLOSURE REQUIREMENT ) REGULATIONS 2015THE SECURITISATION AND RECONSTRUCTION OF FINANCIAL ASSETS AND ENFORCEMENT OF SECURITY INTEREST ACT 2002THE FOREIGN EXCHANGE MANAGEMENT ACT 1999THE PREVENTION OF MONEY LAUNDERING ACT 2002THE INSOLVENCY AND BANKRUPTCY CODE 2016

#CorporateAndEconomicLawsForCAFinal#Corporate And Economic Laws For CA Final New Syllabus#Corporate And Economic Laws#For CA Final New Syllabus#CA Final#CA CS Munish Bhandari#Munish Bhandari#Applicable For November 2018 Exams#Appointment And Qualification Of Directors#Corporate Secretarial Practice#Government Companies#CAFinalBooks#CA Intermediate#IPCC#CAIPCC#CMA#CMAFinal#CMAInter#CharteredAccountant#Chartered Accountant#Bestword#AcademicBooks#Academic Books#Professional Books#Online Bookstore#Buy Books Online#Buy Books Online in India

0 notes

Text

CA Inter Pendrive Classes & CA Intermediate Online Classes - SUBJECTS

1. CA Inter FM & Economics for Finance Video Lectures

FM & Economics for Finance video lectures: Takshila Learning Provide CA Inter Economics for Finance online and Offline mode by Expert Faculty, the Student can get Recorded Lectures for CA Inter as per Latest Syllabus of ICAI with use of PPTs and Live Examples from industries. CA Inter Economics For Finance is a Subjective Paper (40Marks).

These videos are enough for passing this exam and will let the student score excellent marks in your exams. We gave you a 1-year subscription for this course with unlimited views. Our package cover DVD/Pendrive + BOOK +Doubt Solving facility via Chat. Duration of these videos is 15 hours. Our classes are based on any time, anywhere, on any device.

ABOUT THE TEACHER

CA Gian Arora, He is a Chartered Accountant and has teaching experience of more than 5 years in Costing and Financial Management.

NEED ASSISTANCE IN BUYING / DEMO VIDEO FOR CA INTER FM & ECONOMICS FOR FINANCE? Call @

8800999280

/

8800999283

/

8800999284

https://www.takshilalearning.com/course/ca-inter-economics-for-finance-ca-video-lectures/

2. CA INTER Law Ethics and Communication Video Lectures

CA IPCC Law Ethics and Communication Video Lectures : Takshila Learning Provide CA IPCC Law Ethics and Communication (Old Syllabus) Classes in Offline mode by Expert Faculty, the Student can get Recorded Lectures for CA Inter as per Old Syllabus of ICAI with use of PPTs and Live Examples from industries.

CA IPCC Law, Ethics and Communication is a Subjective Paper. These videos are enough for passing this exam and will let the student score excellent marks in your exams. Duration of these videos is 140 hours. Our classes are based on any time, anywhere, on any device.

USPs of Our Classes

1. Proper Reasoning behind every topic is given. 2. Real/Daily life examples used to begin any topic and a particular topic is introduced. 3. Past knowledge of the student is connected with the current topic. 4. Thought-Provoking questions are asked to trigger the inquisitiveness of students. 5. Comprehensive coverage of all topics. 6. Students will not only Understand better but also Replicate in the exam/tests. 7. Practical implications of imparted knowledge are taught. 8. Sudhir Sachdeva Law Video lectures are a perfect replacement for Physical coaching.

About the Teacher

Sudhir Sachdeva has been serving as a Law teacher in the education industry for over 16 Years. He has taught well over 15,000 students of CA, CS, CMA and LL.b during his coaching journey. He is famous among students due to his simple, easy and super effective approach to teaching. Students love his flowcharts techniques of teaching and his way of explaining the most difficult concepts in a very simple way.His ability to give real-life examples relating to the topics of Law is a highlight of his law classes. Many of his Students have got full Marks in CA CPT and many students have been getting exemption in Law Subjects of Chartered Accountancy, Company Secretary and Cost and Management Accounting courses for many years. He always advises to all of his students to Work hard and stay focused as there are no shortcuts to success.

NEED ASSISTANCE IN BUYING / DEMO VIDEO FOR CA INTER FM & ECONOMICS FOR FINANCE? Call @

8800999280

/

8800999283

/

8800999284

https://www.takshilalearning.com/course/ca-ipcc-law-ethics-and-communication-video-lectures-old-syllabus/

3. CA INTER Cost Accounting and Financial Management video lectures

Takshila Learning Provide Best Cost Accounting and Financial Management video lectures (CA IPCC Group I-Paper-3) in Offline mode (Downloadable Link, Pendrive, and SD Card) by CMA Chander Dureja for Nov 2020 / May 2021 Attempt. The Student can solve their doubts through Whatsapp, on-call, and mail.

These Lectures for CA IPCC as per Old Syllabus of ICAI with use of PPTs and Live Examples from industries. Our Classes are a focus on Conceptual Clarity and more Practice as it is a Practical Subjects so for Students we created Test Series for Practice for Exam and let the student score excellent marks.

The course is divided into 80 Lectures( Duration of these videos is 140 hours) Our classes are based on any time, anywhere, on any device.

About the Teacher

CMA Chander Dureja is an expert in subjects related to Financial Management. He has taught thousands of students over the years and many toppers among them too. He is very popular among students because he is known to be a very vibrant and fun person in the classrooms. He received his CMA certificate in June 2006. He has been involved in the teaching field for the last 11 years. He has worked with the Institute of Cost Accountants of India for 3 years and was awarded the best faculty in 2013. His interest lies in learning more about the stock and derivative market, of which he is already quite knowledgeable.

NEED ASSISTANCE IN BUYING / DEMO VIDEO FOR CA INTER FM & ECONOMICS FOR FINANCE? Call @

8800999280

/

8800999283

/

8800999284

https://www.takshilalearning.com/course/ca-ipcc-cost-accounting-and-financial-management-online-classes/

4. CA Inter Taxation Video Lectures & online classes

CA Inter Taxation Video Lectures: Takshila Learning Provide Best CA Inter Taxation Video Lectures (CA Inter Group-I Paper-4) in Offline mode (Downloadable Link and Pendrive) by CA Ashish B. Deolasi for Nov 2020. This Course Cover Income Tax (60 Marks). The Student can solve their doubts through WhatsApp or via mail. These Lectures for CA Inter as per Old/New Syllabus of ICAI with use of PPT’s and Live Examples from industries. Our Classes are a focus on Conceptual Clarity and more Practice as it is Practical Subjects. The course duration for this course is 113 hours. Our classes are based on any time, anywhere, on any device.

About the Teacher

CA ASHISH B. DEOLASI is a renowned faculty in top most cities of India to have realized the changing time and moduled himself accordingly to bring the best quality lectures delivered by him to the doorsteps of students pursuing CA/ CS for the better accessibility in every corner of the country. He is endowed with the passion of winning as evinced through demonstrated excellence in Academics and Teaching Career. His primary focus is on enhancing student’s knowledge theoretically and practically as well as focused preparations to ensure success in the examinations and to achieve professional expertise. He thinks from a students point of view and his teaching style is such that even an average student develops an interest in taxation and score good marks in the exam Having taught over 4000 students in this field for the last 7 years, he understands the reason behind the failure of students to clear the exam in minimum time and advises learning pattern to change this situation.

NEED ASSISTANCE IN BUYING / DEMO VIDEO FOR CA INTER FM & ECONOMICS FOR FINANCE? Call @

8800999280

/

8800999283

/

8800999284

https://www.takshilalearning.com/course/ca-inter-direct-tax-video-lectures/

0 notes