#COMP/USDT

Explore tagged Tumblr posts

Text

火币HTX启动12周年预热赚币日活动,申购热门赚币产品享加息券奖励

深潮 TechFlow 消息,6 月 19 日,据火币HTX官方公告,火币赚币自6月19日0:00至6月26日24:00(UTC+8)启动新一期赚币日活动,为平台即将到来的12周年庆典预热。活动期间,用户前往活动页【点击报名】,并参与指定币种(APE、COMP、QTUM、PENDLE、USDT、USDD、ETH、TRX、DOT、TON、SOL、ATOM、CSPR、POL、NEAR、ADA、SUI、APT、A)旗下定期、活期、鲨鱼鳍产品申购,且符合净新增金额门槛要求,即可获得1张USDT活期产品加息券。数量有限,先到先得。 当前,火币赚币为USDT、TRX等稳定币和主流PoS币种,以及APE、PENDLE等热门资产提供加息补贴,年化高至10%。

0 notes

Text

Token pode capturar 14% do volume de Swift, diz o CEO da Ripple, Brad Garlinghouse

Shaurya é o co-líder do Coindesk Tokens and Data Team na Ásia, com foco em derivativos de criptografia, defi, microestrutura de mercado e análise de protocolo. Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, Ghst, perp, btrfly, ohm,…

0 notes

Text

The Coin Market in 2025: Growth, Trends, and What’s Next

The global coin market—encompassing thousands of cryptocurrencies—is booming in 2025, reflecting a powerful mix of mainstream adoption, regulatory progress, and technical innovation. With a total market capitalization now exceeding $3.8 trillion, the crypto space is more mature, diverse, and influential than ever before.

But behind the big numbers lies a dynamic ecosystem of digital coins, each competing for relevance in finance, tech, and everyday life.

What Is the Coin Market?

The "coin market" refers to the combined landscape of cryptocurrencies—especially native blockchain coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). These coins play essential roles in:

Securing networks (via mining or staking)

Powering decentralized applications (dApps)

Enabling global peer-to-peer transactions

Serving as financial instruments for investors

This market is tracked closely by investors, developers, and institutions alike, with prices and trends monitored in real-time on platforms like CoinMarketCap and CoinGecko.

Current Market Overview

As of April 2025:

Bitcoin (BTC): Trading at over $78,000, fueled by ETF adoption and global demand.

Ethereum (ETH): Gearing up for its Dencun upgrade, trading near $4,300.

Solana (SOL): Strong growth in NFTs and payments, trading at $160.

Total Market Cap: ~$3.8 trillion

24-Hour Trading Volume: Over $150 billion

The dominance of BTC and ETH remains high, but altcoins (alternative coins) are gaining more ground as use cases diversify.

Top Trends in the Coin Market

1. Institutional Involvement

From Wall Street to fintech startups, institutions are entering the space. Bitcoin ETFs and Ethereum futures are now traded like traditional securities, and tokenized assets are being explored by banks and hedge funds.

2. DeFi and Real-World Assets (RWA)

Coins powering decentralized finance (DeFi) protocols—like Aave (AAVE), Maker (MKR), and Compound (COMP)—are back in the spotlight. Additionally, tokenized real estate, bonds, and stocks are being traded on-chain using stablecoins and native assets.

3. Layer 2 Ecosystems

Coins associated with Ethereum Layer 2s (like Arbitrum’s ARB and Optimism’s OP) are seeing rising interest. They offer cheaper, faster transactions while benefiting from Ethereum’s security.

4. Interoperability

Coins like Polkadot (DOT) and Cosmos (ATOM) are helping connect different blockchains. Cross-chain bridges and Layer 0 protocols are opening the door to seamless asset movement and unified liquidity.

Risks in the Coin Market

As exciting as the space is, it's not without pitfalls:

Volatility: Prices can fluctuate wildly, especially in altcoins.

Regulation: Some governments are tightening restrictions on trading and taxation.

Security: Hacks and scams remain a threat, especially in lower-cap or new projects.

Overhype: Meme coins and influencer-driven projects still mislead inexperienced investors.

The Role of Stablecoins

Stablecoins like USDT, USDC, and DAI play a stabilizing role in the coin market. Used for trading, savings, and payments, they account for a significant chunk of daily volume. Regulatory clarity is starting to emerge around their backing and transparency requirements, giving investors more confidence.

Outlook: What’s Next for the Coin Market?

Looking ahead, the coin market is poised for:

More regulation—but also more legitimacy

Broader use of AI and machine learning in crypto trading and protocols

Increased tokenization of traditional assets

Rising adoption of decentralized identity and privacy-focused coins

Conclusion

The coin market in 2025 is no longer just for techies and risk-takers—it’s a key pillar in the future of finance. Whether you're a seasoned trader or simply exploring your first investment, understanding the market’s key players, trends, and risks is essential in this ever-evolving space.

0 notes

Text

Ripple, XRP News: RLUSD Stablecoin Adoption Gets a Boost With Aave Market Launch

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis. Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM,…

View On WordPress

0 notes

Text

E世博(esball+)DeFi挖矿与套利策略全指南

在加密货币与在线博彩深度融合的时代,越来越多的平台开始将DeFi(去中心化金融)功能与博彩业务结合,帮助用户在享受高赔率娱乐的同时,实现资产的被动增值。作为行业领先者,E世博(esball+)官网内置了DeFi借贷与流动性挖矿模块,让玩家不仅能参与体育、电竞、真人视讯等博彩,还可将闲置的USDT、ETH等稳定币投入到DeFi生态,赚取利息和代币奖励。本指南将系统介绍什么是DeFi挖矿、E世博DeFi功能、主流协议收益对比、挖矿操作流程、博彩+DeFi套利模型、以及风险管理与优化等,助你构建复合收益策略。

一、DeFi挖矿概述:原理、模式与风险

1. 什么是DeFi挖矿?

DeFi挖矿,也称为流动性挖矿或Yield Farming,是指用户将加密资产(如USDT、USDC、ETH等)存入DeFi协议的流动性池(Liquidity Pool),以提供交易所或借贷市场所需的流动性,从而获得交易手续费分成、借贷利息及平台激励代币等多重收益 。

DeFi挖矿的核心模式包括:

稳定币质押:在Curve、Aave等平台,将稳定币存入借贷市场,获得浮动利率收益;

流动性池提供:在Uniswap、PancakeSwap等AMM(自动化做市商)平台,提供两种或多种代币的配对流动性,分享交易手续费;

治理代币激励:DeFi协议为鼓励用户提供流动性,向流动性提供者发放治理代币(如COMP、CAKE、UNI),这些代币可在二级市场出售或用于协议治理 。

2. DeFi挖矿的主要风险

无常损失(Impermanent Loss):当提供流动性的代币价格波动较大时,因资产比例调整导致的机会成本损失;

智能合约风险:DeFi协议可能存在漏洞或被攻击,导致资产被盗或合约失效;

市场波动风险:加密市场剧烈波动可能引发借贷清算、质押资产贬值等;

治理风险:协议治理代币价值波动与社区决策不确定性。

用户在参与DeFi挖矿前,应充分了解上述风险,并通过分散投资、使用审计过的协议、设置止损限额等方式进行管理 hacken。

二、E世博(esball+)DeFi模块功能介绍

1. 平台内置DeFi借贷与挖矿

E世博官方网站在“理财中心”中集成了DeFi借贷与流动性挖矿功能,支持将USDT、ETH等资产存入平台指定的DeFi策略池,享受**4%–12%**不等的年化收益。该模块特点包括:

一键存入/赎回:无需跳转第三方App,平台直接调用DeFi协议智能合约;

自动复投:收益可选择自动复投,复利效应显著;

收益透明:实时展示累计利息、代币奖励及历史收益曲线。

2. 跨链与多协议支持

多链网络:支持Ethereum、BSC(Binance Smart Chain)等主流公链;

协议多样:内置Aave、Compound、PancakeSwap、Curve等主流DeFi协议池,满足不同风险偏好。

3. 安全与合规

审计保障:所接入的DeFi策略均通过CertiK或SlowMist等权威安全审计;

KYC/AML:用户需完成平台KYC后方可使用DeFi模块,符合国际反洗钱合规 。

三、主流DeFi协议收益对比

为了帮助玩家做出最优配置,下表列出2025年主流DeFi协议中USDT质押与流动性提供的典型年化收益率(APY)区间: 协议资产类型典型APY收益来源AaveUSDT借贷4%–6%借贷利息CompoundUSDT借贷5%–7%借贷利息 + COMP奖励CurveUSDT/DAI池2%–4%交易手续费 + CRV激励PancakeSwapUSDT/BNB池8%–12%交易手续费 + CAKE激励Yearn V3USDT Vault6%–9%自动策略调优收益

不同协议的收益率受市场流动性、代币激励力度和交易量波动影响较大,建议在稳定币池与多资产池之间进行组合,以平衡风险与回报 。

四、在E世博平台进行DeFi挖矿的操作指南

���下以USDT流动性挖矿为例,演示在E世博平台的完整操作流程:

登录与KYC 登录E世博官方网站,完成邮箱验证与KYC认证。

充值USDT 在“钱包中心”→“充值”页面,选择USDT/TRC20网络,完成充值。

进入理财中心 在导航栏点击“理财中心”→“DeFi挖矿”。

选择策略 在USDT策略列表中,查看各协议池的实时APY与历史收益,点击“参与”。

确认并存入 输入存入金额,确认协议风险提示并签署智能合约交易。

查看收益 存入后,可在“我的理财”中查看实时收益、奖励代币及自动复投选项。

赎回与提现 需要退出时,点击“赎回”并确认交易,赎回的USDT将返回主账户,可选择提现或继续投注。

五、DeFi+博彩套利模型

1. 套利原理

通过DeFi挖矿与博彩返水的收益叠加,构建复合收益模型:

在DeFi池中质押USDT,获得年化x%;

同时将另一部分USDT用于体育或电竞博彩,享受0.5%–2%返水;

当博彩活动有额外首存奖励时,再次提高综合收益。

2. 示例策略

假设玩家拥有10,000 USDT:

6,000 USDT投入PancakeSwap USDT/BNB池,APY 10%;

4,000 USDT用于E世博首存体育博彩,享受20%首存优惠(最高800 USDT),及1%日常返水。

年化收益测算:

DeFi收益:6,000×10%≈600 USDT;

首存奖励:800 USDT(一次性);

日常返水:4,000×1%≈40 USDT;

总收益≈1,440 USDT,综合收益率约14.4%。

3. 套利优化

动态调仓:定期评估DeFi池APY变化,及时在不同协议间切换;

多平台对冲:将博彩与DeFi收益分别分散在不同网络,降低单一平台风险;

自动化执行:借助E世博API或第三方量化脚本,自动监测APY与赔率,实时下单与调仓。

六、风险管理与策略优化

1. 风险识别

智能合约漏洞:优先选择通过多轮审计的协议;

无常损失:在稳定币池中风险较低,适合保守型玩家;

市场流动性风险:流动性不足时可能导致提款延迟或滑点;

博彩波动风险:赔率波动与赛事结果不确定性。

2. 风险对冲与分散

分散资产:同时持有USDT、USDC等多种稳定币;

限额设置:在E世博账户中设置每日、每周提款与投注限额;

止损策略:当DeFi池APY下降超过预设阈值(如2%),或博彩连续亏损时,自动调整策略。

3. 持续监控与迭代

收益监测:利用平台BI报表与链上浏览器(如BscScan)实时查看资金动向;

策略复盘:每月统计DeFi收益与博彩返水,对比预期,优化资金分配比例;

社区交流:加入E世博DeFi社群,分享策略与心得,获取官方活动预告与新策略。

七、工具与资源推荐

DeFi Pulse:查看各协议锁仓量与APY排行榜;

Zapper.fi / Zerion:一站式管理多链DeFi资产与收益;

Etherscan / BscScan:链上交易与合约调用查询;

CoinMarketCap Earn:关注热门代币空投与流动性激励活动;

Dune Analytics:定制DeFi挖矿与博彩套利数据仪表盘。

结语

将DeFi挖矿与加密博彩结合,是提升加密资产收益的创新之举。通过E世博(esball+)官网内置的DeFi模块,你可在一个平台内完成充值、挖矿、投注与提现的全流程,享受便捷与安全。只要你遵循分散投资、风险管理、动态调仓三大原则,并灵活运用本指南中的实战策略,就能在DeFi与博彩双重赛道上抢占先机,实现资产的持续增值。立即访问E世博官方网站,开启你的DeFi+博彩复合收益之旅!

0 notes

Text

A Beginner’s Guide to Creating a Successful Cryptocurrency

Cryptocurrencies have transformed the financial landscape, enabling decentralized transactions, digital asset ownership, and new economic models. With the rise of blockchain technology, many entrepreneurs and businesses are exploring the possibility of creating their own cryptocurrencies. However, launching a successful cryptocurrency requires more than just writing code it demands strategic planning, technical expertise, and an understanding of market dynamics.

If you're a beginner looking to develop a cryptocurrency, this guide will walk you through the essential steps to ensure a successful launch.

1. Understanding the Basics of Cryptocurrency

Before diving into development, it's crucial to understand what a cryptocurrency is and how it works.

What Is a Cryptocurrency?

A cryptocurrency is a digital asset that uses blockchain technology to secure transactions, control new issuance, and facilitate peer-to-peer exchanges. Unlike traditional currencies, cryptocurrencies operate on decentralized networks without intermediaries such as banks or governments.

Key Components of a Cryptocurrency

Blockchain: A decentralized ledger that records all transactions.

Consensus Mechanism: A system that validates transactions (e.g., Proof of Work, Proof of Stake).

Tokenomics: The economic model governing the token supply, distribution, and use cases.

Smart Contracts: Self-executing contracts that automate agreements on the blockchain.

2. Defining the Purpose of Your Cryptocurrency

Before development, you need to determine the purpose of your cryptocurrency development. Ask yourself:

What problem does my cryptocurrency solve?

Will it be a payment method, a utility token, or a governance token?

Who is the target audience for my cryptocurrency?

Some common types of cryptocurrencies include:

Utility Tokens: Used within a platform for accessing services (e.g., BNB, UNI).

Security Tokens: Represent ownership in an asset or company (e.g., tokenized stocks).

Stablecoins: Pegged to fiat currencies to maintain price stability (e.g., USDT, USDC).

Governance Tokens: Enable holders to vote on protocol decisions (e.g., AAVE, COMP).

Clearly defining the purpose of your cryptocurrency will help you build a strong foundation for its development and adoption.

3. Choosing the Right Blockchain

You have two main options when developing a cryptocurrency:

Option 1: Creating a Coin with a Native Blockchain

Requires developing a blockchain from scratch.

Offers full control over the network.

Examples: Bitcoin, Ethereum, Solana.

This approach requires extensive development expertise and infrastructure to support the blockchain’s security and scalability.

Option 2: Creating a Token on an Existing Blockchain

Uses an existing blockchain network (Ethereum, Binance Smart Chain, Solana, etc.).

Requires less technical effort compared to creating a new blockchain.

Examples: ERC-20 tokens (Ethereum), BEP-20 tokens (Binance Smart Chain), SPL tokens (Solana).

For beginners, creating a token on an existing blockchain is more practical as it leverages the security and functionality of an established network.

4. Selecting a Consensus Mechanism

The consensus mechanism determines how transactions are validated on the blockchain. Common mechanisms include:

Proof of Work (PoW)

Used by Bitcoin.

Requires miners to solve complex mathematical puzzles.

Highly secure but energy-intensive.

Proof of Stake (PoS)

Used by Ethereum 2.0, Solana, and Cardano.

Validators stake tokens to secure the network.

More energy-efficient than PoW.

Delegated Proof of Stake (DPoS)

Users vote for delegates who validate transactions.

Used by networks like EOS and Tron.

Proof of Authority (PoA)

Validators are pre-approved entities.

Suitable for private or enterprise blockchains.

Choosing the right consensus mechanism depends on your project's goals and technical requirements.

5. Developing Your Cryptocurrency

Once you’ve defined your cryptocurrency's purpose and chosen a blockchain, it's time to start development.

A. Setting Up the Blockchain (For Native Coins)

If you’re creating a new blockchain, you’ll need to:

Select a programming language (C++, Rust, Go, etc.).

Design the blockchain architecture (block size, transaction speed, security protocols).

Implement nodes and a peer-to-peer network.

Develop the mining/staking mechanism.

Test the network for security vulnerabilities.

B. Creating a Token (For Token-Based Cryptocurrencies)

If you’re creating a token on Ethereum, Binance Smart Chain, or Solana, follow these steps:

Choose a Token Standard

ERC-20 (Ethereum) for fungible tokens.

ERC-721 (Ethereum) for NFTs.

BEP-20 (Binance Smart Chain) for tokens on BSC.

Develop the Smart Contract

Write the token’s smart contract using Solidity (Ethereum), Rust (Solana), or Vyper.

Define token supply, transfers, and burn/mint functions.

Test the smart contract on a testnet (e.g., Rinkeby, Binance Testnet).

Deploy the Token

Use blockchain development tools like Truffle, Hardhat, or Remix.

Deploy the smart contract on the mainnet.

6. Ensuring Security and Compliance

Security is critical in cryptocurrency development. Common risks include:

Smart Contract Bugs: Can lead to exploits and hacks.

Private Key Exposure: Can result in stolen funds.

51% Attacks (For New Blockchains): A risk in PoW-based blockchains.

To enhance security:

Conduct thorough smart contract audits with experts.

Use multi-signature wallets for fund security.

Implement anti-sybil attack measures to prevent network manipulation.

Regulatory compliance is also essential. Depending on your jurisdiction, you may need to comply with:

KYC/AML regulations for exchanges and token sales.

Securities laws if your token represents an investment.

Consult legal experts to ensure compliance with global cryptocurrency regulations.

7. Launching and Promoting Your Cryptocurrency

Once your cryptocurrency is developed, it's time to launch and market it.

A. Community Building

Successful cryptocurrencies have strong communities. Engage users through:

Social media (Twitter, Discord, Telegram).

Online forums (Reddit, Bitcointalk).

Developer meetups and hackathons.

B. Token Distribution

Decide how your cryptocurrency will be distributed:

ICO (Initial Coin Offering): Raise funds through public token sales.

Airdrops: Distribute tokens to early adopters.

Liquidity Mining: Reward users for providing liquidity.

C. Exchange Listings

To increase adoption, list your cryptocurrency on:

Decentralized Exchanges (DEXs): Uniswap, PancakeSwap.

Centralized Exchanges (CEXs): Binance, Coinbase, KuCoin.

D. Ongoing Development & Upgrades

Stay ahead by continuously improving your cryptocurrency:

Implement network upgrades and feature enhancements.

Adapt to changing regulations and security requirements.

Conclusion

Creating a successful cryptocurrency requires careful planning, technical expertise, and a strong community. Whether you’re building a native blockchain or launching a token, focusing on security, scalability, and usability will set your cryptocurrency apart.

The crypto space is highly competitive, but with a well-defined purpose, strategic development, and strong marketing, your cryptocurrency can achieve long-term success.

0 notes

Text

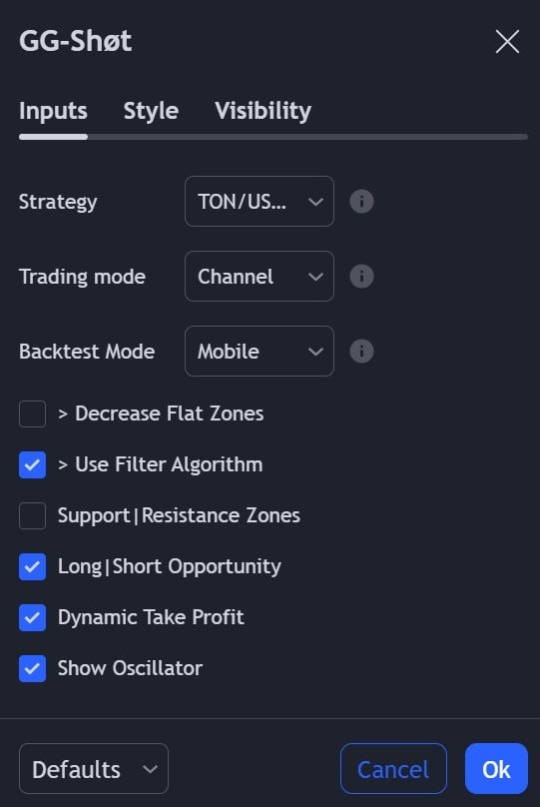

///The Indicator update has been released❗️

What's new:

🛠 >>> 36 Optimized strategies:

BTC\USDT - 1h | Mid-Term

ETH\USDT - 30m | Mid-Term

AVAX\USDT - 30m | Mid-Term

BLZ\USDT - 1h | Mid-Term

BNB\USDT - 30m | Mid-Term

BEL/USDT - 30m | Mid-Term

CRV/USDT - 30m | Short-Term

COMP/USDT - 30m | Mid-Term

C98/USDT - 30m | Mid-Term

CELR/USDT - 30m | Short-Term

CHR/USDT - 15m | Short-Term

DASH/USDT - 1h | Mid-Term

DOT/USDT - 30m | Mid-Term

EGLD/USDT - 1h | Mid-Term

ETC/USDT - 30m | Mid-Term

GMT/USDT - 30m | Mid-Term

IOTX/USDT - 1h | Mid-Term

JASMY/USDT - 30m | Mid-Term

LIT/USDT - 15m | Short-Term

LRC/USDT - 15m | Short-Term

MATIC/USDT - 1h | Mid-Term

NEAR/USDT - 30m | Mid-Term

ONT/USDT - 1h | Mid-Term

OCEAN/USDT - 30m | Mid-Term

MANA/USDT - 30m | Mid-Term

ONE/USDT - 30m | Mid-Term

ROSE/USDT - 30m | Mid-Term

SFP/USDT - 30m | Mid-Term

SOL/USDT - 30m | Mid-Term

THETA/USDT - 30m | Mid-Term

TRBUSDT - 30m | Mid-Term

UNFI/USDT - 1h | Mid-Term

WAVES/USDT - 30m | Mid-Term

WOO/USDT - 1h | Mid-Term

ZRX/USDT - 1h | Mid-Term

ZEC/USDT - 30m | Mid-Term

⚙️ >>> 5 New strategies:

PEOPLE\USDT - 1h | Mid-Term

FET\USDT - 30m | Mid-Term

TON\USDT - 30m | Mid-Term

ID\USDT - 30m | Mid-Term

TIA\USDT - 30m | Mid-Term

Total 167 strategies

Let's go 🖨💵💨

0 notes

Text

Exploring the Benefits of Galaxy Coin Contract Trading

Exploring the Benefits of Galaxy Coin Contract Trading

There are several reasons you might consider trading Bitcoin futures on this platform, some of which include:

It is the most liquid platform in the industry, far ahead. It allows you to short Bitcoin and other cryptocurrencies, hedge positions, and improve risk management to protect your cryptocurrency investment portfolio during bear markets. Due to leverage, you don’t need to hold a large amount of BTC on the exchange.

You can use up to 125x leverage on Bitcoin futures on GalaxyCoin. However, it’s important to note that leverage trading is not recommended for beginners as it involves significant risks. Compared to other trading methods, you may lose funds more quickly. This is why it’s advisable not to engage in it unless you have sufficient experience. In any case, always make sure not to risk more than you can afford to lose.

Now that we’ve covered some basics, let’s delve deeper into Bitcoin futures on GalaxyCoin and how to trade them.

What are Bitcoin futures? Bitcoin futures allow you to buy or sell Bitcoin at a predetermined price at some point in the future. When the contract expires, the contract buyer is obligated to purchase the asset while the seller is obligated to provide the asset.

In addition to traditional futures, GalaxyCoin also supports perpetual contracts, a widely used and highly traded derivative product type. Perpetual futures contracts have no predetermined expiration date and settlement date. They are pegged to the spot index price, and traders can terminate them at any time. In other words, when you buy or sell perpetual contracts, you are not required to buy or sell them at a predetermined date. Instead, you can do so at any time.

Bitcoin futures on GalaxyCoin are traded in USDT but can be settled and margined with USDT, BUSD, and other cryptocurrencies via the COIN-M derivative.

A year after its launch, GalaxyCoin contract trading platform also introduced quarterly futures contracts for the BTC/USD trading pair. Subsequently, it added ETH/USD quarterly futures contracts.

Which cryptocurrencies are supported by the GalaxyCoin contract trading platform? As of the writing of this article, the GalaxyCoin contract trading platform offers a wide range of trading pairs. Users can trade certain currency pairs with different levels of leverage, including:

Bitcoin (BTC) / USDT Ethereum (ETH) / USDT Ripple (XRP) / USDT Binance Coin (BNB) / USDT Bitcoin Cash (BCH) / USDT Cardano (ADA) / USDT Stellar (XLM) / USDT TRON (TRX) / USDT APE Coin (APE) / USDT Dogecoin (DOGE) / USDT Polkadot (DOT) / USDT More trading pairs are continuously being added. Some other coins available for trading include but are not limited to SOL, AVAX, KSM, OCEAN, HNT, SUSHI, UNI, SRM, FTM, ENJ, TOMO, NEAR, COMP, OMG, VET, ONT, ATOM, THETA, NEO, and many others.

1 note

·

View note

Text

Dört altcoin için ufukta düzeltmenin olacağına yönelik gelişmeler ortaya çıktı. Kripto para piyasası açık bir formda yeni istikamet arayışında. Hangi altcoinler için kıymetli gelişmeler bekleniyor. Ayrıntılara bakalım.Altcoin COMP fiyatında düzeltme beklentisiAltcoin COMP fiyatı günlük vakit diliminde satış sinyalleri vererek trendin aksine döndüğüne işaret etti. Günlük grafikteki düşüş eğilimi COMP’nin piyasa pahasının %30’unu kaybedebileceğine işaret ediyor. Ayrıyeten 50 dolar düzeyine kadar fiyatın ineceğini gösteriyor. Günlük mum çubuğunun 76 dolar mahzurunun üzerinde kapanması ve bu mahzurun bir takviye tabanına dönüşmesi düşüş tezini geçersiz kılacaktır.Altcoin COMP fiyatı, günlük vakit diliminde momentumun azaldığına dair açık işaretlere karşın yükseliyor üzere görünüyor. Bu gelişme ‘sat’ diye bağırıyor. Ayrıyeten Compound platformunun token sahiplerine gelen bir düşüşün ikazıdır.COMP fiyatı son çıkarlarını geri almaya hazırAltcoin COMP fiyatı 2 Temmuz ve 15 Temmuz’da 71 dolar ve 76 dolardan iki yüksek zirve noktası oluşturdu. Buna göre bu durum birinci bakışta olağan görünüyor. Fakat daha yakından bakıldığında, yatırımcılar bu yükseliş trendinin bilakis dönmeye hazır olduğunu fark edecekler.Wave Trend göstergesi 7 Temmuz’da çok alım bölgesinde düşüş eğilimi gösterdi. Buna nazaran bu durum satış vaktinin geldiğine işaret ediyor. Lakin altcoin COMP fiyatı yükselmeye devam etti. Üstte belirtildiği üzere 15 Temmuz’da daha yüksek bir zirve oluşturdu. Bu yükseliş, satış sinyaline karşın, ikinci satış sinyali olan düşüş sapmasının oluşmasına yol açtı. İzafi Güç Endeksi (RSI) ve Awesome Oscillator (AO) daha düşük doruklar oluşturuyor. Öbür taraftan, COMP fiyatı daha yüksek bir zirve oluşturdu. Bu heyetim düşüş eğilimi olarak isimlendiriliyor. Ayrıyeten ekseriyetle düşüş trendi ile sonuçlanıyor.COMP/USDT 1 günlük grafikOptimism’de talep duvarıOptimism fiyatı gün içi ralli sırasında 1,64 dolar kadar yükseldi. Lakin düşüşe geçerek 1,45 dolardan süreç gördü. Fiyat artışı 670,56 milyon OP’lik talep duvarının 1,62 dolardan aşılmasına neden oldu. Lakin bunu sürdüremedi. Altcoin, ekseriyetle trendin bilakis dönmesine neden olan tehlike bölgesine ulaşmaya yakın bir bölgede yer alıyor.Optimism fiyatı, etkileyici bir ralli kaydettikten sonra Cuma günü birçok yatırımcısını keyifli etti. Ne yazık ki altcoin yükselişe ayak uyduramadı. Bu da fiyatın bilakis dönmesine neden oldu. Bu durum birçok altcoin OP sahibini birkaç saat içinde kâr elde edip kaybettikleri için mutsuz bıraktı.Altcoin Optimism fiyatı kıymetli ölçüde düştüOptimism fiyatı 1,44 dolardan süreç görürken, piyasadaki yükseliş sinyallerinin akabinde Cuma günü yaklaşık %20 artış gösterdi. Yazım sırasında altcoin yalnızca %6’lık bir artış kaydetti. Lakin 1, dolar olarak işaretlenen 50 günlük Üstel Hareketli Ortalamanın (EMA) üzerinde kalmayı başardı.İşlem seansı yeşil renkte sona ermiş olsa da, ortaya çıkan mum çubuğu 71 binden fazla yatırımcıyı kâr elde etme talihlerini kaybettikleri için mutsuz bıraktı. Bu adresler toplu olarak, bir noktada yatırımcılar için kâr getiren 1 milyar dolara yakın pahada 670 milyondan fazla OP token satın aldı. Lakin, kazandıkları kadar süratli bir biçimde, Altcoin Optimism fiyatı geri çekildiğinde kârlılıklarını da kaybettiler. Ortalama 1,62 dolardan satın alınan bu talep duvarı altıncı hafta boyunca aşılamadı. Ayrıyeten potansiyel olarak bu noktada yatırımcıların sabrını test etti.Bitcoin Cash yükselişte, fakat yatırımcıların bilmesi gereken daha fazla şey varGeçtiğimiz ay, çok az kripto para ünitesi altcoin Bitcoin Cash kadar yükseliş gösterdi. 2023’e cansız bir başlangıç yaptıktan sonra Haziran ayında işler değişti. Buna nazaran bu yıl şimdiye kadar %195’ten fazla artış gösterdi.Ancak, kısa vadeli çıkarlara karşın, Bitcoin Cash yatırımcıları son derece dikkatli olmalı. Ayrıyeten devam eden bir koşu için umutlarını denetim altında tutmalı.Büyük haber15 Haziran’da EDX isimli yeni bir kripto borsası birinci çıkışını yaptı. Nezaret dışı hizmetleri nedeniyle kendisini Coinbase Küresel ve Binance üzere tanınan borsalardan ayırdı.

EDX’te süreç görmesine müsaade verilen dört kripto para ünitesinden biri oldu Bitcoin Cash. Başkaları ise, Bitcoin, altcoin Ethereum ve Litecoin. Bu kripto para ünitelerinin seçimi, EDX tarafından düzenleyici incelemeden kaçınmak için kasıtlı bir hareketti. Zira bu kriptolar en merkezi olmayanlar ortasında kabul ediliyor. Bu nedenle Menkul Değerler ve Borsa Kurulu (SEC) düzenlemeleri kapsamında menkul değerler olarak sınıflandırılmıyor.Sonuç olarak, bu haber ortaya çıktığında, altcoin Bitcoin Cash, yatırımcıların ilgisini çekti. Zira Wall Street’ten bir onay aldığı ve sahiden merkezi olmayan bir varlık olarak kabul edildiği algısı oluştu. Bu haber bir yükseliş haberi üzere algılarda yerini aldı. Lakin, Bitcoin Cash’in kasvetli geleceğinin tam fotoğrafını yansıtmıyor. Sonunda Bitcoin Cash’in ardındaki ivme, daha evvel olduğu üzere muhtemelen azalacak. Bu gerçeğe hazırlık olarak, yatırımcıların daha inançlı ve ödüllendirici bir yatırım stratejisi için orjinal ve kanıtlanmış kripto para ünitesine öncelik vermeleri daha âlâ olacaktır.XRP için olumlu gelişmelerRipple Lab’in SEC ile devam eden yasal çabasında, federal bir yargıç altcoin XRP’nin bir menkul değer için belirlenen kriterlere uymadığına karar verdi. Bununla birlikte, Ripple’ın kurumlara 729 milyon dolar kıymetinde XRP satışı, kayıtsız menkul değer teklifleri olarak kabul edildi. Buna nazaran şirket menkul değerler yasasını ihlal etti.SEC’in Ripple’a karşı açtığı dava, Ripple yöneticilerinin altcoin XRP’nin kurumsal yatırımcılara yasadışı olarak sunulmasına bilerek katılıp katılmadığına karar verecek bir heyet ile devam edecek. XRP için alınan son karar yürek verici. Fakat, çok sayıda kripto para avukatı erken kutlamalara karşı ihtarda bulunuyor. Brown Rudnick hukuk firmasının ortaklarından Stephen Palley, özet kararın sadece kısmi olduğuna dikkat çekti. Ayrıyeten, Yargıç Torres’in kararı yasal bir emsal teşkil etmiyor. En âlâ ihtimalle, gelecekteki mahkemelerin karar vermeleri halinde dikkate almaları için tesirli bir fikir verebilir. Ayrıyeten Palley, başkalarının yanı sıra, SEC’in kararı temyiz etmeyi seçebileceği mümkünlüğünün altını çizdi. Bu, bir üst mahkemenin Yargıç Torres tarafından verilen kararları bilakis çevirme potansiyelini ortaya koymaktadır.Altcoin XRP fiyatı için sırada ne var?Altcoin XRP, birden fazla değerli direnç düzeyini aşarak yükseliş eğilimine işaret etti. Ayrıyeten fiyat 0,938 dolar üzere yüksek bir düzeye ulaştı. Lakin, XRP fiyatı süratle düşüşe geçtiği için yükseliş eğilimi kısa sürdü. XRP fiyatı 0,94 dolar civarında bir kâr elde etme ivmesi yaşadı. Başka taraftan bunu keskin bir düşüş rallisi izledi. Likidasyondaki büyük artış nedeniyle, fiyat birden fazla Fib kanalının altına düştü. Buna nazaran 0,668 dolarlık alt düzeye yakın bir dayanak aldı. Boğalar, %38,2 Fibonacci geri çekilme düzeyinin altındaki bölgede rastgele bir geri çekilmeyi 0,63 dolar ile sınırlamayı hedefleyecek.Altcoin fiyatı yükselir ve 0,75 doların üzerinde süreç görmeye devam ederse, boğaların itimadını güçlendirecek. Buna nazaran fiyatın düşüş kanalına düşmesini önleyecektir. 0,9 dolara hakikat bir artış, traderlar ortasında tekrar kar realizasyonunu görebilir. cointahmin.com olarak baktığımızda fiyat 0,75 doların altında kalırsa, fiyat takviyesi 0,6 dolardan yine test edecek. Bu düzeyin altına düşülmesi, fiyatı %61,8 geri çekilme düzeyine itecek. Buna nazaran bir sonraki yükseliş trendinin başlamasını potansiyel olarak geciktirecek.

0 notes

Text

[ad_1] Galaxy Digital appears to be bullish on Bitcoin and Ethereum, as revealed by the newest knowledge. The blockchain firm not too long ago invested closely in Bitcoin and Ethereum positions amidst the continuing improve in worth. Whereas quoting knowledge from DeFi portfolio tracker DeBank, Lookonchain confirmed that Galaxy Digital deposited 4,168 WBTC (value $142 million) and 16,000 ETH (value $28.6 million) into Aave and Compound. Appears that Galaxy Digital is lengthy $BTC and $ETH on #Aave and #Compound. Galaxy Digital deposited a complete of 4,168 $WBTC($142M) and 16K $ETH ($28.6M) into #Aave and #Compound, then borrowed out 71.6M $USDT and 21.9M $USDC.https://t.co/2QTPSV1QRn pic.twitter.com/hAFCqDl1tQ — Lookonchain (@lookonchain) October 28, 2023 Galaxy Digital Makes Large Deposits Into DeFi Protocols Galaxy Digital has at all times been a Bitcoin supporter. Now, the corporate has made its transfer on the long-term way forward for Bitcoin and Ethereum. Particularly, the corporate deposited Wrapped Bitcoin and Ethereum value a complete of $170 million into decentralized protocols Aave and Compound as collateral to borrow $71.6 million in stablecoin USDT and $21.9 million in stablecoin USDC. The extent of curiosity in DeFi protocols for the aim of investing in cryptocurrencies is a shadow of what it was in 2021, through the peak of the DeFi growth. For example, knowledge from DeFi aggregator DeFiLlama places the present complete worth locked (TVL) of the Aave protocol at $5.432 billion. Bitcoin (BTC) is at present buying and selling at $34.169. Chart: TradingView.com This represents a 72% fall from its highest level of $19.442 billion in October 2021. Nevertheless, Galaxy Digital’s DeFi path to going lengthy on Bitcoin and Ethereum alerts what could be the return of perception in DeFi protocols. Why Galaxy Digital Is Going Lengthy On Bitcoin And Ethereum Galaxy Digital has projected an upcoming Bitcoin bull run in certainly one of its latest reviews. According to the company, spot Bitcoin ETFs are a greater means for typical traders to enter into the crypto trade than present market merchandise. These ETFs may appeal to billions into Bitcoin, reaching over $14.4 billion in inflows within the first yr of their approval. With its latest funding transfer, Galaxy Digital is in a primary place to profit from inflows into Bitcoin. Mike Novogratz, the company’s CEO, additionally strongly believes that a Bitcoin bull run is across the nook. Even earlier than spot Bitcoin EFT purposes had been made by BlackRock and different funding corporations, Novogratz pointed towards the rising adoption from Asia as a possible catalyst for a Bitcoin bull run. On the time of writing, Bitcoin is buying and selling at $34,194 and is trying to take a robust footing over $35,000. Ethereum has had a lesser worth spike than Bitcoin previously week and is at present buying and selling at $1,786. Then again, each AAVE and COMP reacted to Galaxy Digital going lengthy on Bitcoin and Ethereum on the DeFi protocols. These tokens are additionally up by 7.78% and 9.50%, respectively in a 7-day timeframe. Featured picture from Shutterstock [ad_2]

0 notes

Text

Today’s market review brings the COMP Coin into the limelight as its price glides at $40.92, modestly beneath the pivot price, allowing traders to anticipate potential trajectories towards the noted bullish target of $42.76 or a converse journey spiraling down to the bearish depth of $39.86. On this 11th day of October 2023, Ailtra.ai unfolds a canvas where analytical narratives intertwine with the dynamic realms of the cryptocurrency market, forming a tapestry that is not only a reflection of the current state but also a guide into possible future pathways. COMP Price Target Today Delving into the dynamics of COMP’s current price movements, the perspective of possible financial directions is painted with strokes of calculative projections and nuanced market understanding. With $40.92 being its current market footprint, the coin teeters on the brink of potential bearish routes, the seeds of which are subtly embedded in its inability to breach the pivot point. However, the clouds of unwavering optimism regarding bullish breakthroughs continue to hover, whispering tales of possible upward surges. This chart is generated from Tradingview.com: https://in.tradingview.com/chart/?symbol=BINANCE%3ACOMPUSDT.P COMP Price Prediction Today Navigating through the intricate waves of the COMP Coin's pricing requires a balanced vessel, steered by a rational acknowledgment of its current bearish inclination while simultaneously fanning the sails of a potential bullish turnaround. A prudently charted course through these financial seas, with the wisdom to anticipate, adapt, and navigate, becomes the treasured ally of both seasoned traders and new entrants alike, guiding them through currents of profitability and tides of risk mitigation. COMP Price Prediction 11th Oct 2023 The dichotomy of COMP’s journey through its future is enunciated through an exploration of its yesterday, characterized by a high of 42.06 and a low of 40.61, carving out echos of potential futures that echo through today’s financial corridors. Although yesterday’s high ventures close, it refrains from encroaching upon the third resistance level, thereby not crafting an additional bullish target for today but providing rich soil from which analytical seeds may sprout and guide financial endeavors. COMP/USDT Daily Chart for Yesterday Scanning the COMP/USDT daily chart of yesterday unveils tales that reverberate through the metrics of highs and lows, crafting narratives that are as much reflections of its past as they are portents of its future. These narratives, when soaked in the rich hues of broader market dynamics and entwined with the threads of macroeconomic influences, weave a complex tapestry that, while not prophetic, becomes a guide through the labyrinths of future financial journeys and investment decisions. Disclaimer: This analysis and subsequent predictions are crafted for educational purposes and should not be embraced as financial advice. Ailtra.ai underscores the importance of prudent investment decisions that acknowledge the vibrant yet volatile nature of the cryptocurrency market.

0 notes

Text

Celer (CELR), Cartesi (CTSI) và Compound (COMP) tăng tốc khi DeFi nóng lên

Celer (CELR), Cartesi (CTSI) và Compound (COMP) tăng tốc khi DeFi nóng lên

Với mục tiêu giảm chi phí giao dịch trong DeFi đang thu hút các nhà phát triển và nhà đầu tư đến với Celer Network, Cartesi và Compound. Những chú bò Bitcoin vẫn đang vật lộn để đẩy giá lên mức cao mới, mà dấu hiệu tích cực là BTC đã không điều chỉnh mạnh trong vài ngày qua. Và đồng tiền điện tử được xếp hạng hàng đầu này đã giữ vốn hóa thị trường trên 1 nghìn tỷ USD kể từ ngày 26/3. Trong khi…

View On WordPress

1 note

·

View note

Text

O único trader de bitcoin perde US $ 200 milhões, pois os touros de criptografia veem liquidações de US $ 1b

Shaurya é o co-líder do Coindesk Tokens and Data Team na Ásia, com foco em derivativos de criptografia, defi, microestrutura de mercado e análise de protocolo. Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, Ghst, perp, btrfly, ohm,…

0 notes

Text

AAVE veya COMP: Hangi DeFi borç verme platformunun avantajı var?

AAVE veya COMP: Hangi DeFi borç verme platformunun avantajı var?Şu anda DeFiPulse tarafından listelenen ilk üç DeFi projesi arasında Maker, AAVE ve Compound yer alıyor. Üçü de ödünç verme kategorisi altında sınıflandırılmıştır, ancak son birkaç hafta içinde küçük bir değişiklik olmuştur. Maker en üst sıradaki yerini korurken, AAVE sıralamada Compound üzerinde sıçradı. Ocak ayının başından bu yana AAVE, TVL'ye 4 milyar dolardan fazla para ekledi ancak son verilere göre COMP şu anda yetişiyor. Read the full article

#Aave#comp#Compound#CryptoCurrency#DAI#defi#DeFiPulse#koinanaliz#koinkoine#Kripto#kriptopara#stabilcoin#TVL#USDC#USDT

0 notes

Text

Mantra OM News: Founder to Burn $80M of Own Tokens Following 90% Price Drop

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis. Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM,…

View On WordPress

0 notes

Text

Compound超越Maker成为DeFi市值最高的项目:DeFi大戏开启

按照COMP的总代币量,并按照当前ETH230美元的价格,其整体市值(包括未流通代币)达到998,761,200美元,位居DeFi市值第一,超过Maker代币MKR的市值(截止到蓝狐笔记写稿时,Maker市值为540,726,781美元。)即便按照流通代币的市值来看,Compound当前已发行的代币量为5,770,890个,其市值也达到576,374,102美元,也超越Maker成为DeFi市值第一。

造就这神奇一幕的是什么?COMP的流动性挖矿。

🆕更多详情,请参阅完整文章内容🆕 👨🏫欢迎大家留言讨论或到币区讨论专区👩🏫 🌐立即前往【币区】:https://pse.is/NV4BQ

#Compound#Maker#DeFi#COMP#ETH#BTC#uniswap#MKR#ERC20#Reservoir#USDC#USDT#BNT#DEX#BAL#Balancer#Bancor#coin#token#V2#UNI#UP#市值#去中心化金融#美元#美金#市值第一#排名第一#币区#bitsreach

0 notes