#CPA expensions

Explore tagged Tumblr posts

Text

How Much Does the 2024 CPA Exam Cost? Understanding the Fees and Expenses

The United States-based Course Certified Public Accountant (CPA) is a globally renowned credential that can pave your career in the finance and accounting fields. The AICPA (American Institute of Certified Public Accountants) structured and administered the CPA designation qualification exam. Note that, it is also called a US Chartered Accountant in India.

For whom this newsletter, if you have decided this CPA US as a path, then this newsletter will be an informative article for your enrollment plan with the CPA program.

Must To Know! CPA USA Course Details

US CPA Eligibility: From the United States, a credit-based system is continuing in India for taking the CPA exam and obtaining the license. As per the Indian academic system, the eligibility criteria are

Have to hold a bachelor’s degree in commerce from an accredited university or college.

Diversely for a total of 120 credit points, you may need 1 year of post-graduation coursework hours.

Plus 30 credit points are a must to apply for the license from AICPA. [120+30] CP = 150 credit points.

US CPA Course Structure: The US CPA has 4 papers (3 papers on core sections and 1 paper from 3 optional core-plus disciplines), namely:

Auditing and Attestation (AUD)

Financial Accounting and Reporting (FAR)

Regulation (REG)

By AICPA 2024 evolution, the Business Environment and Concepts (BEC) core section has been changed to three Core-Plus-Discipline Models:

Business Analytics and Reporting (BAR)

Information Systems and Controls (ISC)

Tax Compliance and Planning (TCP)

US CPA Exam Score and Duration: Your score in each section must be above 75 for your safer passing percentage, and as per the CPA 2024 extension, you now have a 30-month period to pass all the sections.

US CPA Exam Cost in India: Quotation by NorthStar Academy

The overall US CPA exam cost highly depends on the state where you evaluate your candidacy procedures, whether in the US or any other country. Here, the total CPA exam cost for an Indian student has been divided into various categories:

1️⃣ Evaluation Process and its Cost: The initial step is to assess whether you are eligible to proceed further with the US CPA exam process. In this step, you must upload your academic grade sheets and graduation details for evaluation to show that you are planning to apply for the CPA exam.

Evaluation Cost: The evaluation process will cost around $265 to begin the CPA program.

2️⃣ Training Fee: For well-coaching, study materials, and strategic exam study, choosing the best institute like NorthStar Academy is important to pass the CPA exam effectively.

Training Fee: The investment cost for CPA classes will be around 1 lakh rupees in India.

3️⃣ Examination Fee: If you get the permit from the evaluation phase, pay the registration fees and submit your academic transcripts to the board. After paying the CPA exam fees, you need to wait for the NTS (Notice to Schedule) ticket. And schedule your exam depending on the availability of the slot.

CPA Exam Fee: The US CPA exam cost plus the international testing fee will be around two lakh rupees in India.

4️⃣ Application Fee: It includes membership costs to obtain licensure from the respective state. By acquiring membership and licensure, you can access accounting bodies and valuable resources.

Licensure Fee: To pursue the application process, it will cost around $175 to be a licensed CPA cadet in India.

FAQs

1. How do avoid the international fee if you are in the United States?

In the United States, Indian candidates can apply for the US CPA exam in any of the five states: Alaska, Washington, Guam, Montana, and Pennsylvania.

2. In which countries can we expect to work after becoming a CPA cadet?

After completing of your US CPA certification successfully, you can expect to work in countries like the US, Canada, New Zealand, South Africa, and Australia.

3. Is it worth the investment in this US CPA career path in India?

Yes, it is truly worth doing US CPA after graduation to get multi-dimensional opportunities in different sectors like finance, consulting, tax services, auditing, and more. Now, Big 4s and MNCs prefer hiring qualified CPAs, so CPAs are in high demand in this capital market.

0 notes

Text

i'm still not over the AI cover of FUCKING VOCALOID I SAW

#okay i didnt enable cpas lock on purpose but yeah sure that fits#cy posts#'oh but vocaloid are expensive' just pirate it#the voicebank you were using? her company doesn't exist anymore#one day i will do rana justice in a self proclaimed angel cover. i will baby dont worry

12 notes

·

View notes

Text

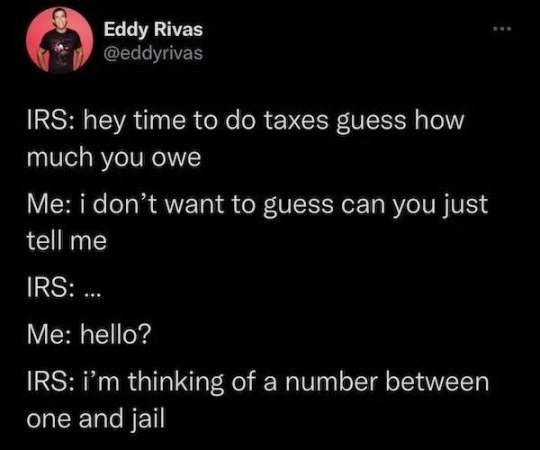

Finished my taxes (I think). Time to play a little ff7 as a treat

#by finished i mean i finished scraping together every possible expense and getting all the forms and stuff i needed#and handed it all over to my cpa just now#very frightened to find out what i owe this year#it could be pretty bad OTL#guess we'll see soon..#send strength

16 notes

·

View notes

Text

Streamlining Cash Flow Management with SAI CPA Services

Cash flow is the lifeblood of any business, and managing it effectively ensures stability and growth. At SAI CPA Services, our cash flow management services are designed to give businesses a clear view of their finances and actionable strategies to optimize cash flow.

Why Cash Flow Management Matters

Proper cash flow management helps you navigate expenses, meet obligations, and invest confidently in growth opportunities. Here’s how our services support your business:

Forecasting and Budgeting: We create cash flow forecasts tailored to your business, allowing you to anticipate incoming funds and make informed financial decisions.

Expense Tracking and Optimization: Our team analyzes your expenses, identifying areas to cut costs and improve efficiency.

Cash Flow Improvement Strategies: We develop actionable strategies to increase cash inflows, whether through better credit terms, financing options, or optimized billing practices.

How SAI CPA Services Can Help

SAI CPA Services provides expert cash flow management to keep your finances steady and your growth sustainable, giving you peace of mind to focus on the bigger picture.

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#SAICPAServices#cash flow#new jersey#expense tracking#financial stability#growth strategies#business finance#accounting#bookeeping#finance#business#financial planning#cpa

2 notes

·

View notes

Text

The tax system is an unnecessary hassle for anyone too poor to make hiring a personal CPA to find loopholes worth the expense.

#The tax system is an unnecessary hassle for anyone too poor to make hiring a personal CPA to find loopholes worth the expense.#irscompliance#irs audit#irsforms#irs1099form#irs#fuck the irs#cpa#loophole#expenses#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government

3 notes

·

View notes

Text

Had a really nice sleep, it was like 30 minutes sleep dreaming that I was going to the grand final, wake up, check bank balance hmm no I'm not, sleep for 30 minutes dreaming I got a ticket, wake up check bank balance yeah no sorry, sleep for 30 minutes RINSE AND REPEAT THE ENTIRE NIGHT

#i don't even care that much!!!!!#i don't need to go to some stupid combustible stadium with overpriced food and drink and climb 500 stairs to watch some silly sportsball#NO I DON'T CARE#also it's so expensive like please don't take $200 from me that's like four weeks of myki money#I'm so happy to be in the grand final that I'll watch the game anywhere#Collingwood always do a live site i think in 2018 it was $20 to watch at the AIA centre#with inflation it'll be a billion dollars but look it doesn't matter there are pubs there is home there is so many places to watch the game#i don't know why i have to depress myself waking up every 30 minutes to check my bank balance#also how is that depressing 'oh look i have money i can afford the next week's myki travel' THAT'S A GOOD THING#also grand finals are overrated#The record is $15#they show off the mark knight posters a day before the game and your mouth salivates and you're like I NEED ONE I'LL BUY IT AFTERWARDS#but then Maynard gets blocked and you're going home in tears on the train and you forget all about the poster and#and you just clutch your chemist warehouse cushion filled with random little goodies and cry for the next five weeks#in 2011 i didn't go - watched from home - and my mum came home with a chocolate footy and told me it was from Daisy#just cry and clutch Daisy's chocolate footy and cry and eat chocolate soaked with tears so it's all salty and#wait#no guys I'm fine#please don't make me go to therapy i don't have time i have to study for this CPA exam#i really am fine

6 notes

·

View notes

Text

Claimable & Non-Claimable Expenses for Medical Professionals

Intro:

Claimable & Non-Claimable Expenses for Medical Professionals

Navigating the world of tax deductions can be complex, especially for medical professionals. Understanding what you can and cannot claim is crucial for maximizing your tax benefits. Here’s a concise guide on claimable and non-claimable expenses, tailored for doctors, specialists, and other medical professionals.

Claimable Expenses

Non-Claimable Expenses

Car Expenses🚙:

Car Expenses:

- Driving between different workplaces.

- Normal trips between home and work, even if you live far from your workplace or work outside normal hours.

- Use the logbook method or the cents-per-kilometer method to calculate your deduction.

Travel Expenses🛂:

Travel Expenses:

- Expenses incurred when traveling away from home overnight for work, including meals, accommodation, and incidentals.

- Private component of travel costs, even if there is a work-related component, like attending a seminar during a holiday.

- Must not have been reimbursed for these expenses by your employer.

Clothing and Laundry Expenses🆎:

Clothing and Laundry Expenses:

- Costs for protective clothing, compulsory uniforms, and specific footwear required for your job.

- Conventional clothing such as business attire, even if required by your employer.

Self-Education and Study Expenses📚:

Self-Education and Study Expenses:

- Courses directly related to your current job that maintain or improve your skills and knowledge, potentially leading to increased income.

- Courses that are only related in a general way or aimed at getting a new job.

Working from Home Expenses💻:

Working from Home Expenses:

- Expenses for items used for work, calculated using approved methods.

- Items provided by your employer or expenses reimbursed by them.

Other Work-Related Expenses💡:

Other Work-Related Expenses:

- Professional indemnity insurance, medical journal subscriptions, association membership fees, work-related phone and internet costs, medical equipment, and personal protective equipment like gloves and masks.

- Flu shots and other vaccinations, even if required for work.

How Amit Aggarwal Can Help

Amit Aggarwal, the Certified Practicing Accountant, can be a tremendous asset for medical professionals in tax planning and accounting. His expertise ensures you can maximize your deductions, engage in strategic tax planning, and make informed investment decisions. With Amit's guidance, you can navigate the complexities of tax laws, avoid common pitfalls, and ultimately save more money.

For expert advice tailored to your needs, consult with Amit Aggarwal. Click here to start maximizing your tax benefits today.

#tax benefits#tax accountant#tax planning#taxation#finance#wealth#cpa#australia#accounting services#tax services#accountant near me#finances#smsf#medical professionals#first responders#Australia Accounting#medical expenses

0 notes

Text

Outsourced bookkeeping services have emerged as a powerful tool for streamlining CPA practices, enabling professionals to focus on what truly matters: delivering exceptional financial advisory and consulting services. As the accounting landscape continues to evolve, embracing the advantages of outsourced bookkeeping can position CPA firms at the forefront of success.

#CPA Bookkeeping#Certified Public Accountant#Financial Accounting#Small Business Accounting#Tax Preparation#Financial Reporting#Ledger Management#Income Statement#Balance Sheet#Cash Flow Analysis#Expense Tracking#Payroll Services#Tax Compliance#Budgeting and Forecasting#Audit Support#Tax Planning#QuickBooks Accounting#Financial Statements#Tax Filing#Accounting Software

0 notes

Photo

IRS 2018 & 2019 Standard Mileage Rate Deductions for Business, Medical, Moving & Charity. Read more source: Falcon Expenses Blog

1 note

·

View note

Note

Any tips on saving money?

Track your income/expenses. Knowing your monthly cash flow + essential and discretionary spending is the only sound starting point toward setting your financial goals.

Evaluate your non-essential spending habits. Consider where this money is going, and whether these expenses add value/are necessary to your life (pleasure or peace of mind is an acceptable "necessity" if you're living within your means to be clear!).

Determine the money you have left over after you cover your essential expenses and most fulfill discretionary expenses. This amount is your "saving/investment" money.

Divide your leftover amount into 3 categories: Emergency fund, goal-oriented savings (like buying a desired luxury item/furniture, a down payment on a house, a vacation, etc.), and investments.

Put your savings in a high-yield savings account. If possible, have different accounts for each purpose, especially your emergency fund and savings for future purposes. You can also get a CD for a long-term savings goal.

Put your investments (in the USA at least) in the following buckets: Roth IRA (max it out), ALWAYS take your employer's full 401k match, HSA (if you have a high-deductible health insurance plan), and S&P 500 index funds/other evergreen mutual funds + blue-chip stocks.

Purchase fewer, higher-quality items. Know the sales seasons for each product category and shop around this calendar (down to the produce items in season). If possible, rent items when it makes sense.

Only say "yes" to plans/financial obligations that add value/pleasure to your life. Don't let yourself feel shortchanged financially or emotionally. It's never worth it, honestly.

Invest in your physical, mental, and financial health first. This can mean something different for everyone but it's important!

**I'm not a professional, just another young woman on the internet, so please take this advice accordingly. Please meet with a financial advisor/CPA for formal advice and personal financial planning.

Hope this helps xx

228 notes

·

View notes

Note

Juno, out of curiosity, what does an accountant DO? What does it mean to be one? Because I know there's math involved. I've heard it's very boring. But I don't know anything else and I'm curious because you're very good at putting things to words.

Okay first of all, I cannot express just how excited I got when I first saw this message. There is nothing I love more than talking about things I know about, and usually when my career is mentioned I don't get questions so much as immediate "Oh, bless you" and "I could never"s. Which- totally fair! For some people, accounting would be boring as all hell! But for a multitude of reasons, I adore it.

There are multiple types of accounting. The type most people tend to be more familiar with is that done by CPAs- CPAs, or Certified Public Accountants, are those that have done the lengthy and expensive process to be certified to handle other peoples' tax documents and submit taxes in their name, amongst other things. Yawn, taxes, right? Well, the thing with that is that there's a lot of little loopholes that tax accountants have to remain familiar with, because saving their clients a little more here or getting a little more back there can really add up, and can do a lot for people who, say, have enough money to afford to hire someone to do their taxes but not necessarily enough to be going hog wild with. Public accountants can work for large firms or by themselves, and also do things like preparing financial statements for businesses, auditing businesses to ensure all of their financial transactions are true and accurately reported to shareholders and clients, and consulting on how finances can be managed to maximize profit (money in - money out = profit, in very simple terms).

The type of accounting I do is private accounting! That basically just means that I work for a company in their in-house accounting/finance department. Private accounting tends to get split up into several different areas. My company has Payroll, Accounts Receivable, and Accounts Payable.

Payroll handles everyone's paychecks, PTO, ensuring the correct amount of taxes are withheld from individuals per their desires, and so on. Accounts Receivable handles money flow into the company- so when our company sells the product/service, our Accounts Receivable people are the ones who review the work, create the invoices, send the invoices to the clients, remind clients about overdue invoices, receive incoming payments via ACH (Automatic Clearing House- direct bank-to-bank deposits), Wire (Usually used for international transactions), or Check, and prepare statements that show how much revenue we are expected to gain in a period of time, or have gained in a period of time. This requires a lot of interfacing with clients and project managers.

My department is Accounts Payable. Accounts Payable does basically the other side of the coin from what Accounts Receivable does. We work mostly with vendors and our purchasing/receiving departments. We receive invoices from people and companies that have sold us products/services we need in order to make our own products/perform our services, enter them into our ERP (Enterprise Resource Planning, a system that integrates the departments in a company together- there are many different ERPs, and most people simply refer to their ERP as "the system" when talking internally to other employees of the same company that they work at, because saying the name of the system is redundant) using a set of codes that automatically places the costs into appropriate groups to be referenced for later financial reports, and run the payment processing to ensure that the vendors are being paid.

To break that down because I know that was a lot of words, here's some things I do in my day-to-day at work:

- Reconciliations, making sure two different statements match up: the most common one is Credit Card reconciliations, ensuring that there are appropriately coded entries in the system that match the payments made on our credit line in our bank.

- Invoice entry: this is basic data entry, for the most part. This can have two different forms, though

- Purchase Order Invoice entry: Invoices that are matched both to the service/product provided from the vendor and the purchase order created by our Purchasing/Receiving department. We ensure that the item, the quantity, and the price all match between our records, the purchase order, and the invoice, before we enter this.

- Hard Coded Invoice entry: Invoices that we enter manually due to there being no Purchase Order for them. This is often recurring services, like cleaning or repairs, that may happen too often or have prices vary too much for Purchase Orders to be practical.

- Cleaning up old purchase orders: sometimes Purchase Orders are put in the system and then never fulfilled. Because this shows on financial statements as being a long-standing open commitment, it looks bad, so we have to periodically research these and find out if the vendor simply didn't send us the invoice, if the order was cancelled, or if something else is going on.

- Forensics! This is my personal favorite part of the job, where someone has massively borked something that is affecting my work, and so I go dig into it, sometimes going back as four or five years in records to find the origin point of the first mistake, and untangling the threads of what happened following that mistake to get us to where we are today. There's an entire field called Forensic Accounting that is basically just doing This but for other companies (it's a subset of auditing, and often is done via the IRS) and that's my dream position to be totally honest. I loooove the dopamine hit i get with solving the mystery and getting praised for doing so faster than anyone else has even begun to realize the problem to start with.

- Balancing Credits/Debits: This is more of a Main Accountant role thing, but the long and short of it is that every business has Assets, Liabilities, and Equity. Liabilities and Equity are what we put into the company/what we owe, and assets are what we have received/what we are owed. Anything that increases Assets or lowers Liabilities or Equity is a Debit. Anything that decreases Assets or raises Liabilities or Equity is a Credit. Every monetary change we process has to include an equal Debit and Credit. This is its own whole lecture, so if you wanna know more about double-entry accounting, let me know, but it's yawnsville for most people.

- Actually cutting checks or initiating bank payments to vendors for amounts we owe them.

- Vendor communication: I'm on the phones and email a lot with vendors who are wondering where their payment is, or why something was short-paid, or if I can change some of their info in our system, and so on and so on. Every job is customer service, unfortunately. I don't love it, but I do a lot less of it in private accounting than I would have to do in public accounting.

- Spreadsheets: I make so many spreadsheets I am a goddamn Excel wizard. I love spreadsheets. This isn't necessarily accounting-specific though, most people in Finance jobs love spreadsheets, or at least use them to make their lives easier. I make them just for fun, because I'm a giant fucking nerd who finds that kind of thing enjoyable lol. So if you ever need a spreadsheet made for anything, hit me up.

As for math, that's a pretty common misconception. While there is math, it is very rarely more complicated than "I paid $3 of the $8 I owe, now I owe $5" for me. There are some formulas you learn in school (Business Administration with a focus in Accounting is what I studied), but they're also pretty standard and rarely include more than like... basic algebra. Which. Thanks @ god because I flunked so hard out of pre-calc in college. I could not have done accounting if it really were all that math heavy.

Aaaand yeah! That's all I've got off the top of my head- if you have any more questions about it, do let me know, I'm happy to ramble on for hours, but I'm cutting it here so I don't start meandering on without direction lol.

45 notes

·

View notes

Text

Email chain below.

RE: Institute Gala

To: Mag. Inst. Employees- all

From: Alexander Sampson

Hello, Magnus Institute employees. I’ve received a lot of questions regarding the upcoming fundraising gala, and I figured it would be best to address them all here.

‘Do I have to attend?’

If Mr. Bouchard extended an invitation to you, yes, unless you have a prior engagement that he approves of.

‘Is it paid?’

No. There will, however, be food and a raffle.

‘Why isn’t it paid?’

I don’t know. That’s not my call.

‘What do I wear?’

Black tie attire. If you rent something, please send me the bill, as that qualifies as a business expense.

‘How long do I have to stay?’

Minimum 30 minutes. Please, for the love of everything sacred in this world, do not perform a mass exodus from the gala exactly thirty minutes after it starts.

‘What type of food will be there?’

There will be a catering service that provides the food. I’m not sure exactly what will be served. If you have allergies or dietary restrictions, please let Rosie know, as she’s in charge of the catering.

‘Will there be alcohol?’

Yes. Every guest receives one drink ticket for the bar. Do NOT give your ticket to somebody else. There is a one drink limit. We will not have a repeat of last year’s gala, Timothy Stoker.

‘Why are you, the accountant, answering these questions?’

I don’t know. I really don’t. This isn’t my job.

If you have any further questions, please reach out to me. Do not hit reply all to this email. I repeat, do NOT hit reply all to this email.

Thank you,

Alexander Sampson, CPA/CFE, he/him/his

17 notes

·

View notes

Note

{{ Hey, just stopping by because I'd LOVE to read a book about running a small business with disabilities and chronic illnesses in the equation!

I know one thing I struggle with Immensely is differentiating between when it's a Day to Push Through and Do the Work, versus when it's a Day to Rest. Recognizing when you're going too far and will be paying for it in the morning, versus when it's just the chronic pain being chronic pain. It's a balance three decades of Having Disabilities has yet to teach me, so maybe someone else can help with that.

Also, dealing with taxes. ;;; Even if it's just a compendium of outside resources that help you learn! I know this is heavily country/region dependent, but I'm sure I'm not the only one who desperately needs pointers!

Thank you! I'm glad it's something that would be helpful!!

Lemme tell you what, you've really boiled it down to one of the big eternal struggles right there. When to push through VS when to stop and rest.. Yeah it is REALLY hard to know especially in the moment. Like with hindsight it's easy to go "oh, I could've handled that fine and been done with it already for sure!" or "oh no, I went too far and I really should've tapped out". But in the moment? It takes a lot of self-awareness and clarity to not only realize it's time to check in and make a decision, but then also make that decision AND make peace with the decision.

I'll be thinking about that more and it's definitely the kind of thing I'd like to try to address!

One nugget of wisdom, that I'm still very much mentally tumbling right now, is just keeping in mind the concept of "equinimity". How can we keep a reliable core based in equanimity, regardless of the stress of a growing to-do list, or what's going on in this very chaotic world, or the physical pain that might be present that day? It's gonna be a different answer/approach for everyone, but there's surely something in there that anyone could apply in their own way..

As for taxes,, well... I did used to to my own taxes for a very long time. It's doable, but it really sucks. Tbh I'd highly recommend hiring a CPA to at least just handle yearly taxes the absolute first second you've got any business money on hand to do so. I could give some pointers on stuff like tracking income/expenses though! I still do that myself in a shitty spreadsheet and it's fine, haha.

#i tried quickbooks for a hot second and it was MORE work and frustration for waaaayyy too much money#a CPA for tax season tho#extremely extremely worth it#also if you're looking to become an LLC or anything else that will involve more legal headaches#times like that it's very worth paying someone that's already an expert rather than trying to learn it yourself#well anyways#this ended up really long! haha#thanks for giving me some more points to think about :]#ask#witch vamp

10 notes

·

View notes

Text

If you are on a high-deductible health plan (which is common on state marketplace health plans in America), you can set up a Health Savings Account with many banks. You put money into the account--and you get a tax break for doing this. And then you can use the money for certain medical expenses, and it's more than people think.

I am not a CPA, so def make sure with an accountant and/or your bank and/or your health plan.

But you can often get things like flu shots, PPE and even hand sanitizer, certain "feminine hygiene products" as they still put it (including period panties), some vaccines, mouth guards for grinding teeth, canes, crutches, eye tests, some prescriptions, and even some dental treatments.

So yeah, you have to have the money to put into your account (or your employer might offer it), and you get a tax break for making the contributions, and you can use the funds to pay for certain health care expenses.

Consult a tax person or your bank/credit union!

#america is a shithole#but like try to find bonuses and loopholes!#health savings accounts#finances#health care

6 notes

·

View notes

Text

that stupid low and middle income offset being taken away means that *i* have to pay tax as well wtffff who did this

#i usually get a refund every year#pffft#even with the CPA expenses#but just i'm only paying $100 in tax so it's fine i've had like $4000 in interest for the year apparently#didn't notice it was that much interest but whatever you say ATO prefill

0 notes

Quote

As an independent writer and publisher, I am the legal team. I am the fact-checking department. I am the editorial staff. I am the one responsible for triple-checking every single statement I make in the type of original reporting that I know carries a serious risk of baseless but ruinously expensive litigation regularly used to silence journalists, critics, and whistleblowers. I am the one deciding if that risk is worth taking, or if I should just shut up and write about something less risky. I am the one who ultimately could be financially ruined by such a lawsuit. I am the one in charge of weighing whether I should spring for the type of insurance that is standard fare for big outlets to protect themselves and their staff, but often prohibitively expensive for independent writers. I am the one putting on even more hats: risk manager, insurance broker, business consultant, CPA.

I am my own legal department: the promise and peril of “just go independent”

5 notes

·

View notes