#CRM CustomerRelationshipManagement Oracle OracleCX

Explore tagged Tumblr posts

Photo

Benefits of CRM For Banks & Financial Institutions

Customer Relationship Management has turned out to be inevitable for development, growth and profitability of Banks in present situation marked by rising competition, technological advancement and empowered customers.

0 notes

Text

Benefits of Using CRM For Banks & Financial Institutions

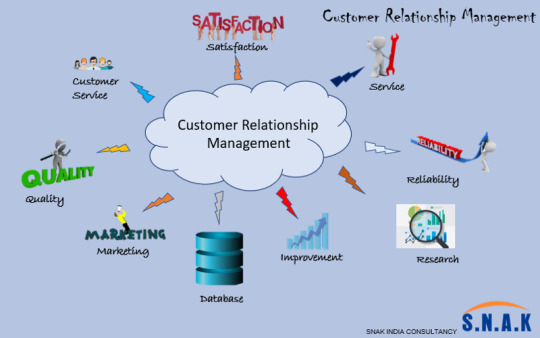

CRM or Customer Relationship Management is a process how a company proceed towards in making an interaction with current and potential customers effectively to improve business relationships with them, specifically that specialize in client retention and ultimately driving sales growth.

Customer Relationship Management has turned out to be inevitable for development, growth and profitability of Banks in present situation marked by rising competition, technological advancement and empowered customers. The CRM practices are embraced to create better understanding about the client regarding product development, appropriate targeting and maintenance of long term and commonly valuable associations with clients.

One of the unique challenges of business banking in a digital world is meeting customer expectations. You can’t just have a great checking account or lending terms, as you can with most retail customers. You must offer sound financial advice. With everything that is expected from banks, a Customer Relationship Management (CRM) solution is not only an optional but basic to your success.

Before moving on to “The CRM Benefits for Banks and Financial Institutions” Let’s have a look How Customer Relationship Management (CRM) benefits will renew and expand your business?

1. Maximize Upselling and Cross-selling: A CRM framework permits up-selling, or, in other words practice of giving customers premium products that fall into a similar category of their purchase. The strategy also facilitates cross selling, which is the practice of offering complementary products to customers on the basis of their previous purchases.

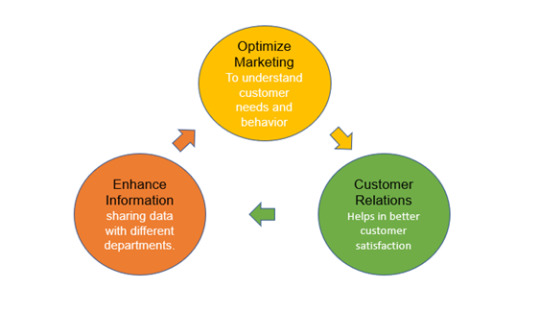

2. Optimize Marketing: With the help of CRM, you come to understand your customer needs and behavior and gives an idea about the most profitable customer groups and to identify the correct time to market your product to the customers.

3. Internal Communication Enhance: The sharing of customer data between different departments will enable you to work as a team — one of several major benefits of CRM.

4. Improved Customer Relations: One of the prime objectives of utilizing CRM is obtaining better consumer satisfaction. By utilizing this methodology, all dealings including adjusting, advertising, and selling your items to your clients can be completed in a organized and efficient way.

CRM Features That Make Banks More Competitive

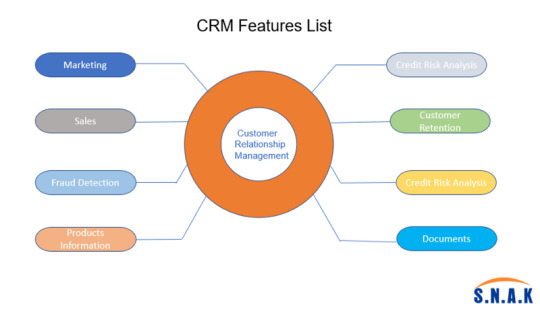

1. Customer Retention: Retention is often a major reason why businesses seek out sales, marketing, and customer service automation solutions. No industry relies more on the power of customer and client retention than banking, that’s why CRM plays a healthy role here.

2. Marketing Management Tools: Marketing and website traffic analysis helps to track your client’s engagement with your business, CRM comes fully-equipped with features like email designer and lead tracking forms to help your bank grow and retain its customer base.

3. Up-selling opportunities: A Customer Relationship Management solution will give more power for analyzing at website activity. With significant information, up-selling turns out to be more useful for a bank and helpful to a client.

4. Helpful in tracking sales and activity: Apart from having a customer relationship building and retention, CRM also excels at data tracking and visualization.

5. Track Product/Services: You’re also able to track specific products or services, using that data to create forecasts and report on key sales metrics.

6. Segregate Commercial and Consumer Data: As banks deals in a number of segments and areas like insurance, mortgage, investment banking, commercial, loan and rents, CRM, segment these key audiences into their own groups, ensuring the two are distinct.

Benefits of CRM For Banking & Financial Institutions

CRM frameworks provide tools that can segment, and deliver the right service, at the ideal time, by following up on unique customer data. This enables the ability to track and build strong relations with beneficial clients and distinguish particular items and services that can benefit customers.

Customer Relationship Management helps to solve some of the challenges that banks and financial institutions faced in a day to day business like:

1. Evolving Customer Profiles as customers are not loyal to specific banks and their circumstances are dynamic.

2. Connecting the Dots with customer profiles, customer service and marketing initiatives can be combined to identify opportunities and drive up conversion rates.

3. Responding Appropriately to create, assign and track action items, measure outcomes.

Other Major benefits that CRM provide to banks are:

Customer Retention

Fraud Detection

Optimizing marketing efforts as per customer life time value

Credit Risk Analysis

Segmentation and targeting

Development of customized new products matching the specific preferences and priorities of customers.

Reach out to customers is easy.

How CRM help Banks to Increase Customer Retention?

To remain competitive, banks need to develop a customer-centric retention approach that incorporates data insights, personnel training, and added product value. Some Valuable CRM approaches bank can use to increase customer retention.

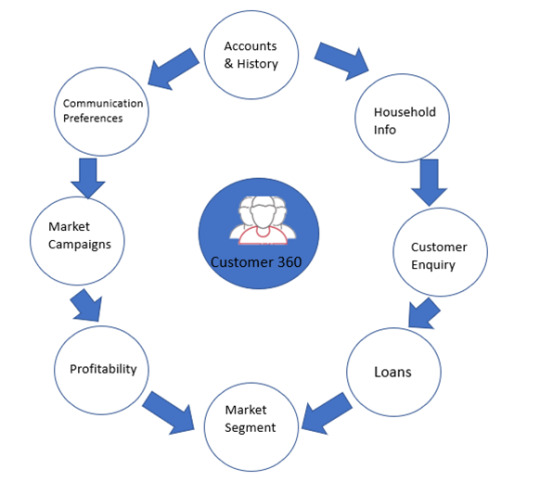

Gain a 360 Degree View: CRM provides a 360-degree view about customer data like account info, client interaction, loans, and others. This well-defined process enables banks to:

Provide faster service to customers

Make informed decisions

Understand how a customer prefers to communicate

2. Take Actions Using Analytics: The next evolution of business intelligence involves deep analysis of existing data to identify trends, predict customer behavior, and proactively take actions.

3. Understand the voice of Customer: By conducting surveys and track responses directly within the application. Surveys should be conducted frequently to understand customer base.

4. Identify Next Best product: With CRM database, banks can make highly-educated product recommendations to customers. Storing the best product for every customer in CRM will give representatives a great source of referrals. Additionally, with this customized experience result in sound connection between a bank and its customers.

5. Execute Marketing Campaigns: Marketing segment can create valuable campaigns to increase customer awareness, reinforce brand integrity, and inform customers of products and promotions straight from CRM. With the results of these, banks can offer new services to customers like:

Rate Changes

New products

Rewards Redemption

Any Loan Offer

Conclusion:

CRM effective features allow banks to link with their customers and build a long-lasting relationship, helping them set apart the competition. Customer Relationship Management is no longer optional for banks, but it is crucial for its success.

With the proper CRM technology in the place like SNAK INDIA CRM, your bank can reap the best out of its customers.

0 notes