#Client Trust

Explore tagged Tumblr posts

Text

Key Benefits of Plant and Equipment Insurance

Equipment is an important investment for your business, and protecting it with plant and equipment insurance can safeguard your financial well-being. This coverage not only shields you from potential losses due to theft or accidental damage but also ensures that your operations remain uninterrupted. By understanding the key benefits of this insurance, you can make an informed decision that enhances your business's resilience and longevity. Explore how this vital policy can offer you peace of mind while keeping your assets secure and your company running smoothly.

Understanding Plant and Equipment Insurance

Definition and Scope

Below, you'll find an overview of what Plant and Equipment Insurance entails. This type of insurance is designed to protect your machinery and equipment from unforeseen damages, theft, or loss during operation. It covers a wide range of equipment used in various industries, including construction, agriculture, and manufacturing, ensuring that you remain financially secure in the event of an accident or disaster. The policy typically encompasses imperative components such as repair costs, replacement values, and downtime expenses.

The scope of Plant and Equipment Insurance extends beyond basic coverage. It can also include specialized policies tailored to your specific needs, protecting not only the physical equipment but also the associated risks involved with operation and usage. By understanding the full extent of this insurance, you can ensure that your investments are safeguarded.

Types of Coverage

On your quest to find the right Plant and Equipment Insurance, you'll come across various types of coverage options. Depending on your business operations, you can choose from comprehensive coverage, which protects against a wide array of risks, or opt for specialized policies that focus on specific equipment types. Each coverage type is tailored to meet the unique requirements of your industry, providing flexibility in managing your assets and liabilities.Type of CoverageDescriptionComprehensive CoverageBroad protection against incidents like theft and damage.Accidental DamageCovers damages arising from unforeseen accidents.TheftProtection against theft of equipment and machinery.Loss of EarningsCompensates for earnings lost due to equipment downtime.Third-Party LiabilityCovers costs related to damage caused to third-party property.

Consequently, understanding the different types of coverage will help you make informed decisions about your insurance needs. Each option addresses specific risks and scenarios, ensuring that your business remains protected from potential financial setbacks. Some common types of coverage you may want to explore include:

Comprehensive coverage for full-range protection.

Accidental damage policies for unexpected incidents.

Theft coverage, imperative for safeguarding your investment.

Loss of earnings to buffer against downtime.

Third-party liability coverage to protect against external claims.

Any further inquiries about the specifics of these coverage types can help you better prepare your business for any potential obstacles you may face in the operational landscape.

Financial Protection

You understand the importance of having a safety net when it comes to your business operations, and financial protection is a key benefit of plant and equipment insurance. This coverage ensures that in the event of loss or damage, you are compensated for the repair or replacement of your equipment. By securing insurance, you create a reliable resource to mitigate the financial strain that could arise from unforeseen events such as accidents, theft, or natural disasters. This means you can focus on maintaining and growing your business rather than worrying about unexpected financial setbacks.

Risk Mitigation

Beside providing peace of mind, plant and equipment insurance is also a proactive approach to managing risks associated with your assets. The coverage acts as a buffer against potential hazards that could disrupt your operations, allowing you to maintain continuity and stability in your projects. By safeguarding your investments, you empower yourself to take on challenging tasks without the fear of catastrophic financial loss should an unfortunate incident occur.

Cost Management

Management of your finances becomes more manageable when you invest in plant and equipment insurance. With clearly defined coverage that outlines the limits and types of protection you receive, you can better plan your annual budget and allocate resources more effectively. This ensures that even in the face of unexpected expenses related to equipment failure, you are not derailed from your long-term financial goals. The ability to predict and manage these costs contributes significantly to the overall efficiency and success of your business operations.

Mitigation of expenses related to equipment repairs or replacements can lead to significant savings over time. By having insurance coverage, you can avoid the hefty out-of-pocket costs that can arise from accidents or damages. This not only keeps your finances stable but also provides you with the necessary funds to reinvest in your business or pursue new opportunities, further enhancing your potential for growth and success.

Asset Preservation

While investing in plant and equipment is a significant decision for your business, it is equally important to ensure that these assets are preserved over time. Asset preservation plays a vital role in maintaining the value of your equipment, which can directly affect your operational efficiency and profitability. By investing in plant and equipment insurance, you can protect your assets from unforeseen circumstances, allowing you to navigate challenges with greater ease and stability. This insurance not only covers financial losses but also helps you maintain the integrity and functionality of your valuable assets.

Equipment Replacement

Around the clock, you rely on your equipment to perform important tasks that keep your business running smoothly. However, accidents, theft, or equipment failures can happen unexpectedly, impacting your operations. Plant and equipment insurance ensures that you can replace damaged or stolen equipment quickly, minimizing downtime and enabling you to uphold your commitments to clients. Knowing that your equipment can be replaced without significant financial strain provides peace of mind and allows you to focus on growing your business.

Maintenance and Repair

With a solid plant and equipment insurance policy, you can also manage maintenance and repair costs associated with your assets. Regular maintenance is important to prolonging the life of your equipment and ensuring optimal performance. When accidents occur, having insurance will help cover the costs of repairs, allowing you to get your equipment back to working condition without out-of-pocket expenses that could affect your budget.

Understanding the full scope of maintenance and repair can empower you to make informed decisions regarding your equipment. Regular servicing, monitoring, and timely repairs not only keep your assets functioning effectively but also protect your investment. By including maintenance considerations in your insurance strategy, you can ensure your equipment remains operational for years to come, reducing the likelihood of more significant issues and ultimately safeguarding your financial interests.

Business Continuity

Keep your operations running smoothly with plant and equipment insurance, which can safeguard your business against unexpected disruptions. When equipment fails or gets damaged, it can lead to significant delays and financial losses. This insurance provides a financial safety net, allowing you to make necessary repairs or replacements quickly, ensuring that your business can bounce back effectively and continue its operations without lengthy interruptions.

Minimizing Downtime

For any business, downtime can be costly, and that’s where plant and equipment insurance shines. By covering the costs associated with equipment repair or replacement, you minimize the time your operations are halted. This quick recovery means you can resume your projects promptly, maintaining productivity and meeting deadlines. The assurance of financial support allows you to focus on your core activities rather than worrying about the financial impact of unexpected equipment failure.

Securing Projects

Around every job site, the stakes are high, and ensuring that you have reliable equipment is vital to securing projects. With plant and equipment insurance, you can confidently commit to project timelines and deliverables, knowing that you have a safety net should anything go wrong. This not only fosters trust with your clients but also allows you to target larger contracts that require stringent quality and reliability assurances.

With robust insurance coverage, you enhance your reputation as a dependable partner in your industry. This reliability can be a deciding factor when clients choose between competitors, significantly impacting your business's growth opportunities. Insurance helps you strategically position your business as a reliable entity, ready to take on projects of any scale without fear of unforeseen equipment mishaps interfering with your commitments.

Enhanced Credibility

Now, having plant and equipment insurance can significantly enhance your credibility in the marketplace. When clients see that you are properly insured, it sends a strong message that you take your business seriously and are committed to protecting both your assets and their interests. This commitment can set you apart from competitors who may not prioritize insurance, thereby fostering a sense of trust in your business practices. By showcasing your insurance status, you create a professional image that reassures clients they are working with a responsible and reliable contractor.

Building Client Trust

Any business owner understands the importance of building client trust. When you possess plant and equipment insurance, it provides an added layer of security for your clients. They have peace of mind knowing that should an unfortunate incident occur—be it damage to machinery or equipment failures—there’s a safety net in place. This investment in insurance not only protects your assets but also reinforces the notion that you care about the welfare of your clients and the successful completion of their projects. Establishing this level of trust can lead to long-term relationships and repeat business.

Competitive Advantage

The presence of plant and equipment insurance can also give you a competitive edge in your industry. While many businesses might overlook this imperative aspect, you can leverage the insurance as a distinguishing factor when bidding on projects or engaging with potential clients. Highlighting your insurance coverage shows that you are prepared for unforeseen circumstances, making your proposals more appealing when clients are evaluating their options. This proactive approach can lead to more job opportunities as clients prefer to partner with businesses that demonstrate reliability and responsibility.

Consequently, as businesses strive for excellence, having plant and equipment insurance not only positions you as a trustworthy choice but also enables you to navigate challenges with confidence. This forward-thinking strategy can set you apart in a crowded market, allowing you to secure contracts with clients who appreciate the extra layer of protection. By emphasizing your assessed risk management through insurance, you effectively elevate your brand's stature, increasing your chances of winning jobs and attaining long-lasting partnerships.

Customization and Flexibility

Your plant and equipment insurance can be tailored to fit the unique demands of your business. This customization is vital as it allows you to create a policy that aligns with your operational risks, covering not just the tools and machinery you rely on but also any specialized equipment that may be critical to your work. This way, you're not paying for unnecessary coverage but rather for the specific protection that your assets require, ensuring you get the most value out of your insurance investment.

Tailored Policies

Customization goes beyond just selecting the right equipment with the appropriate coverage limits; it also enables you to incorporate additional endorsements or riders to your policy. Whether you need coverage for international transport, enhanced liability limits, or protection against specific perils, there are options available that can be integrated into your plan. This flexibility can provide peace of mind, knowing that your unique operational context is considered in your policy.

Adjusting Coverage as Needed

Tailored policies also grant you the ability to adjust your coverage as your business evolves. As you acquire new equipment or your projects expand in scope, your insurance can be adapted to reflect these changes. This responsiveness is important as it ensures that you’re continuously protected against risks associated with both growth and unforeseen circumstances. Having the option to modify your coverage allows you to stay agile and protected amidst the shifting dynamics of your industry.

Plus, this adaptability means that you can make informed decisions about your coverage based on seasonal needs or project-based demands. In times of expansion or economic fluctuation, adjusting your policy ensures that you're neither underinsured nor overpaying for unnecessary coverage. This flexibility not only supports a more proactive risk management approach but also helps you maintain operational efficiency while safeguarding your investments.

Final Words

Taking this into account, investing in plant and equipment insurance is a wise decision that can significantly safeguard your business operations. This type of coverage protects against potential losses from theft, damage, or unforeseen incidents, ensuring that your necessary machinery and equipment remain covered. By having this insurance in place, you can minimize financial disruptions and maintain peace of mind, allowing you to focus on the growth and success of your projects without the constant worry of unexpected setbacks.

Moreover, plant and equipment insurance not only offers direct protection but also demonstrates to clients and partners that you are a responsible and trustworthy business. With this assurance in place, you can enhance your reputation and potentially secure more contracts, knowing that you can deliver on your commitments reliably. As you weigh your insurance options, consider the key benefits that plant and equipment insurance offers to protect your investments and keep your operations running smoothly. Want to learn more or get a personalized quote? Check out this link: Insurify.

#Plant and Equipment Insurance#Equipment Protection#Business Asset Insurance#Machinery Coverage#Theft Protection#Accidental Damage Insurance#Loss of Earnings Coverage#Third-Party Liability#Risk Management#Business Continuity#Equipment Replacement#Maintenance and Repair#Customized Insurance Policies#Financial Protection#Operational Efficiency#Client Trust#Competitive Advantage#Insurance Flexibility#Construction Insurance#Industrial Equipment Insurance

0 notes

Text

0 notes

Text

The Essential Elements of a Successful Wealth Management Firm

A successful wealth management firm effectively combines expertise, strategy, and personalized service to help clients meet their financial goals. Key elements include a deep understanding of the market, personalized wealth plans, risk management, asset diversification, and strong client relationships. These firms must also have a forward-thinking approach, utilizing technology and providing transparent communication to ensure lasting success and trust.

#wealth firm#financial plan#risk control#asset growth#client trust#money advice#portfolio#investments#wealth coach#financial goals#risk management#tax strategy#market insight#estate plan#diversification#financial roadmap#retirement#wealth strategy#investment firm#growth planning#wealth advisor

0 notes

Text

i was extremely sleep deprived yesterday when i discovered the dragon survival mod which was LIFE CHANGING when you're on three hours of sleep so of course i made a whole custom forest dragon texture in one day about it. and. just for fun, some concept art i made for it:

#aka i was too tired to trust myself to speak coherently with clients or make commission work up to my standards. but i need to be productive#or ill die#my art#minecraft#mineblr#dragon#dragonsona#of sorts#forest dragon#earth dragon#lush cave#mods in the video tht are noticable btw: complimentary reimagined shaders. alex's mobs. ambient sounds 5. mizuno 16 craft resource pack.#and a really cool seed i found online :]#video#NOT my model but im going to tag it as#my model#since it's 3D work!! actual model made by blackaures who made the mod and also some SICK ass dragon art#also. patreon gets to see the other 3 pages of concept art i made for this later today! :] wink wink nudge. coughs#sorry i need to shill#um. anyways#no name for this dragon yet. i do know it steals livestock from too-small village/illager pens#to give them enriched lives in its expansive cave farm#i'd like to come back to this eventually and touch up the wing design since the glowing spots didnt really shake out

3K notes

·

View notes

Text

Was thinking about how even though ART threatened its life and terrified it the literal first time they met and even so ART is its best friend while gurathin is clearly cared about but will always get the label of “the client that murderbot Doesn’t Like” in a way that just feels different to me

And I genuinely don’t remember but… did gurathin ever apologize to murderbot??

Not for being suspicious or careful or whatever, but the way ART did. Bc in their first interaction, ART apologized not for threatening it, but for scaring it

Acknowledging that it has feelings and that ART’s actions had consequences that directly affected the wellbeing of murderbot and that murderbot had valid reasons for “sulking” or not wanting to engage with ART in that moment. Because ART scared it.

I think that waking up hurt and vulnerable and finding out that someone you didn’t trust dug inside your mind and dragged out your biggest secrets that, if known, you are certain will directly lead to your death. Well. I just think that would be incredibly scary is all

#murderbot diaries#murderbot#the murderbot diaries#don’t get me wrong I enjoy gurathin as a character#he and murderbot really are feral cats who did NOT get long enough sniffing each other under a door#and I respect gura’s suspicion bc damn. the group is so horribly trusting#and like. that could absolutely kill them#and sometimes u are okay with being the bad guy as long as the people you care about *live*#it does make me wonder if things would have gone very differently if they’d met one on one#where gurathin didn’t have anything to protect#the meeting with ART happened partially because ART didn’t have its crew to protect after all#but it makes me wonder if ARTs crew were there. idk. I still think it would have apologized for scaring it#and art didn’t apologize for the threat. bc art had to keep itself safe. but.#maybe it would have chosen a different way#idk#thinking a lot about that apology rn#has anyone ever apologized to murderbot before? not for like. a decision. but for the way it impacted murderbot specifically#gurathin is scared too but like. not by murderbot?#Gurathin is scared of things he thinks might happen or what murderbot might do#while murderbot is scared by something Gurathin did to it while it was vulnerable#like until that point murderbots actions had all been to try and keep its clients alive and its secret intact to keep itself alive#and even then when it came to its life and the crew? it chose theirs#and the repayment was an incredible violation of its privacy and more suspicion

140 notes

·

View notes

Text

mattodore for @mattodore ❣️

#artists on tumblr#digital art#oc#illustration#art#commission#my art#[ COVERED IN BLOOD ] HELLO#THIS TOOK ME ALL OF APRIL. HOW IS IT STILL APRIL#I RE-LINED THIS FIVE!!! TIMES!!! FIVE (5) 5️⃣#''GIRL HOW ARE YOU GOING TO TELL THEM YOU STRAIGHT-UP FORGOT HOW TO DRAW LOL???'' 🤪💀😭🆘#NOW THAT IT'S OVER I TOOK A LOOK AT THE TIMELAPSE. THE GENRE. IS COMEDY HORROR#WORTH IT...............#best and greatest client u should be so lucky if they commission u to draw their gorgeous gorgeous characters bc they have SO MUCH REF#thank u again for trusting me w them!!! it was an honor to do your bday commission!!! happy to make you happy!!! 🫡

166 notes

·

View notes

Text

nobody told me being a social worker was 90% collecting and hoarding resource pamphlets from every community agency i visit like a little pamphlet goblin bc god forbid i have a client who needs to know how to regulate their b12 level and my dumb ass didn't grab those free How to Regulate Your B12 Level pamphlets i saw at that clinic two fucking years ago

#i carry a large binder on all my calls#and it's literally just resource pamphlets business cards and referral forms i've collected over the years#but trust that if a client ever needs to know about their local pediatricians and what type of insurance they accept#i got a pamphlet for you baybeeeeee👌🏻😂

63 notes

·

View notes

Text

im doing a lot better now!

#ace attorney#i love adrian :) i think abt her a lot#she's like 'you guys saved me and i feel a lot better now bc of you' like we didnt try accuse her of murder girl IM SO SORRYYYYYY#one thing i did rlly like abt her in 2-4#was like. phoenix's savior complex in putting all his faith and trust in his clients yea?#and well engarde betrayed that so it was like#this little sink of despair. but adrian ohh adrian she asks phoenix for help when everyone is at rock bottom and when it seems lost#and phoenix does. she becomes his new 'client' to redirect that faith towards#she's been through so much and was so so important to turning 2-4 on its head#IM GONNA GET YOU OUTTA HEEEEERRREEE#i was delighted to see her again when starting aa3 and so soon! im so happy for her. love her so much#definitely top 5 witnesses for me#she got her riza hawkeye fit on ...

163 notes

·

View notes

Text

This week I was in court, and one of the cases before me got dismissed because the cops didn't show.

(It may have been a murder case. Or else the murder one was a different case with the same attorneys; I was rereading notes for my own thing and not really paying attention.)

The defense attorney got up and gave a spiel about how we know they Risk Their Lives Every Day, but they signed to confirm they got the subpoena and we can't very well have a trial without them. The prosecutor just said "they Risk Their Lives Every Day." And then the judge was like "I know they Risk Their Lives Every Day, but we've already had one mistrial."

There isn't really a moral to the story, it was just really satisfying to hear "they risk their lives every day" not get them a free pass on everything.

Also, I guess those cops specifically don't see "enforcing the law" as an important part of their jobs.

#in theory I would like there to be real trials for alleged crimes especially serious ones#in practice idk if I trust this state to *have* real trials (especially since they apparently rigged the first one bad enough for mistrial)#(and didn't care enough to bother trying the second time)#so letting the accused off scot free sounds about right this time. cheers applause etc.#and then I saved my client's house. so; like; good day

46 notes

·

View notes

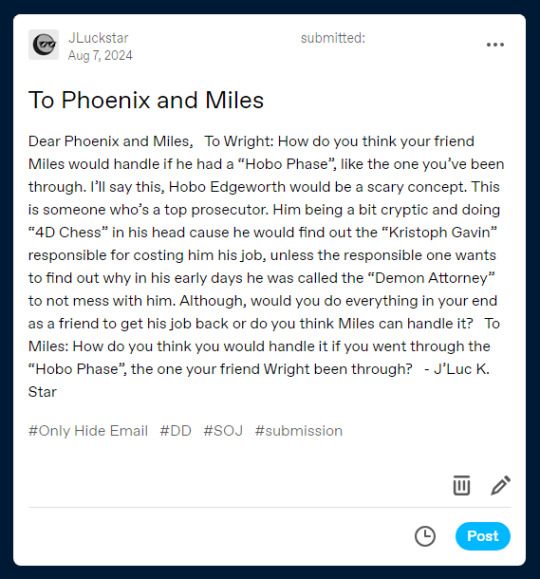

Text

Dear J'Luc K. Star,

The answer is that I wouldn't.

As much as I'd hate to throw this around or brag, but I suppose it is relevant but....

I have too much money to go through a "hobo phase." Money was one of the many problems Wright went through. No job. No Money. I, on the other hand, would live well with or without my job.

- Miles Edgeworth

#Anonymous#Miles Edgeworth#Phoenix Wright#Ace Attorney#Mod Commentary#Even if Edgeworth was raised by Badd or Shields; became a Defense Attorney and had Zak as a client he wouldn't have gone the way of Phoenix#AAI2 shows us exactly how Edgeworth would have handled his own version of how Phoenix was disbarred#I've said this before but I believe the reason Phoenix was jobless for 7 years was because he genuinely thought Kristoph was his friend#It wasn't until after Kristoph told Pheonix to his face that they were never friends that Phoenix exposed him. He trusted Kristoph too much#Edgeworth's trust has to be earned which is why he never trusted anyone in the PIC including Justine#If the roles were switched Edgeworth would have befriended Klavier; exposed Kristoph from the beginning and got his badge back in 3 hours#Phoenix would lose his badge; adopt Kay; Justine wouldn't be trusted and would be betrayed by Blaise

27 notes

·

View notes

Text

and creusa for a commission!

#i don't think my client is on tumblr but hey! if you see this thank you for your patience and trust#i'm not too fond of this drawing as if there was something off but maybe it's just the fact that I've stared at it quite too much#aeneid#vergil tag#my art

44 notes

·

View notes

Text

The Essential Elements of a Successful Wealth Management Firm

Wealth management success involves much more than just sound investment and financial planning techniques. A truly successful wealth management firm demonstrates excellence across multiple dimensions, from technical expertise to client relationship management. Here's a comprehensive look at what defines excellence in this sophisticated financial service sector.

Client-Centric Philosophy and Personalized Approach

The crux of any successful wealth management company is to understand the needs of the individual and be able to adapt to them. Top portfolio management services differ themselves through customized strategies that fit with the unique financial goals, risk tolerance, and time horizons for each client. This perspective extends beyond pure risk analysis to include family dynamics, legacy planning, and lifestyle objectives.

Comprehensive Service Integration

The best wealth management companies have expertise in delivering comprehensive solutions to all aspects of their clients' financial lives. This includes the following:

Investment management and portfolio optimization

Tax planning and mitigation strategies

Estate planning and wealth transfer solutions

Risk management and insurance planning

Business succession planning

Philanthropic advisory services

Technical Expertise and Professional Development

As a successful wealth management firm, it holds very high standards for professional expertise. The best of firms assure that their advisors are earning advanced certifications, including CFP, CFA, or ChFC. Furthermore, a well-tailored training and education program keeps team members updated on the changing market trends, new tax law changes, and new and emerging wealth management strategies.

Clear Fee Structure and Communication

Transparency in pricing models distinguishes superior wealth management companies from their competitors. The best portfolio management services use transparent fee structures that align their interests with client success. Communication about fees, performance metrics, and strategic adjustments is regular and builds trust and demonstrates value.

Technology Integration and Security

Modern wealth management requires sophisticated technological infrastructure. Leading firms invest in:

Robust portfolio management and reporting systems

Secure client communication platforms

Advanced risk analysis tools

Cybersecurity to protect client's sensitive data

Robust Risk Management Framework

Successful wealth management companies have appropriate risk management programs in place, at the portfolio and operational levels. This involves:

Portfolio stress testing

Regular portfolio stress testing

Thorough due diligence on investments

Compliance monitoring systems

Business continuity planning

Track Record of Performance and Accountability

Although past performance is no guarantee of future results, excellent wealth management companies have long-term track records of success. They set up clear performance measures and report periodically against client objectives, adjusting their strategies as necessary.

Client Education and Empowerment

Elite wealth management firms place a priority on client education to enable them to make good decisions about their financial futures. This commitment to education is manifested through:

Regular market updates and economic insights

Educational seminars and workshops

Resource libraries and financial planning tools

Family wealth coaching programs

Culture of Innovation and Adaptation

The financial landscape is constantly changing, and wealth management companies must be ahead of the curve. Innovative firms have a culture of innovation while preserving proven wealth preservation strategies. They predict market changes and adjust their service offerings to meet the emerging needs of clients.

Quality of Client Experience

Excellent wealth management services go beyond financial acumen to provide excellent client experiences. This includes:

Responsive communication

Efficient onboarding processes

Regular review meetings

Proactive problem-solving

Coordination with other professional advisors

Accomplishing selection of the right wealth management firm requires careful review of these success factors. The highly successful firms demonstrate excellence in all those dimensions but stay focused on the client outcomes. With this definition, it can be easy to evaluate which wealth management company best fits the objectives and service expectations from your financier.

The hallmarks of success in wealth management continue to evolve, yet the fundamental commitment to client success remains constant. Top portfolio management services that epitomize these characteristics position themselves—and their clients—for long-term success in an ever more complex world of finance.

#wealth firm#financial plan#risk control#asset growth#client trust#money advice#portfolio#investments#wealth coach#financial goals#risk management#tax strategy#market insight#estate plan#diversification#financial roadmap#retirement#wealth strategy#investment firm#growth planning#wealth advisor

1 note

·

View note

Text

Why turnabout goodbyes was about Maya's self confidence and her seeing herself as whole.

She has soo many lines the whole first game about apologizing for not being useful or not being able to be her sister (whether that be literally in the terms of channeling her or just being as strong and capable as Mia was) and Phoenix actually pisses me off with how much he kinda brushes her off until the tazing incident. Shitty ass 24 year old doesn't know how to take care of a teenager and how fragile they can be especially after the death of her SISTER

#Phoenix has rocks for brains soemtimes i swear#maya you're doing amazing sweetie#would it kill you to reassure her?#but also this probably shows his character of learning to trust people clients or friends#like they weren't necessarily instant besties but needed the whole first game to really trust each other

14 notes

·

View notes

Text

little update on my love life hsksjsk

i ghosted and then sb’ed the lawyer guy on ig bc turns out he’s friends with that one psycho man i met a few months ago. i think the latter i only mentioned meeting but never gave tea on the fallout here. it was all fun and games until it wasn’t. he basically tried to be alpha with me and i was not having it LOL but each time i blocked him in one place he found another means to reach me but his options were limited to begin with so eventually he gave up and stopped bothering me. but like, man. digging up all of my socials just to tell me things like “you’re so cold to me whenever we’re not together physically. far from the eye, far from the heart — is this your game?” was the last straw. NO SIR I AM A HORRID TEXTER i don’t play mind games 😭 i just kept blocking him without even bothering to give a reply, it probably pissed him off sm LOL which wasn’t my intention, i just thought there was no point in wasting my time and energy on a man like that, i didn’t even want to clear out the misunderstanding like hello i have a life and ur not my priority 😭 his petty male ego was def hurt, what a dick

so when i found out they were friends my brain went ultra dramatic, i thought maybe the lawyer guy was a setup from the very start and that it was a carefully crafted method by the psycho guy to approach me again. naturally i got paranoid and that story is now over, nothing weird’s happened after that, thankfully

and— you rmr the hq guy? yeah, we’re forced to keep a professional relationship rn bc he often visits the office for work related purposes. today he came. twice. first for work, and then — to bring me sweet treats 😭 out of the blue, like way after his business was done 😭 we hadn’t talked after what happened last time so what’s this now 😭 why can’t men read the room 😭

#— ai rambles#i allow myself to ghost ppl if we’re not that close yet and it just saves us both all the uncomfortable and unnecessary talk of#‘i’m not interested in you ok bye’#also men often mixing politeness with flirty intentions drives me crazy#last one is about the hq guy#like ur my client ofc i will not be an ass to you 😭#DURING A BUSINESS MEETING 😭😭😭😭 get a grip#thank you for the chocolates but 😭 what the hell 😭#ALSOOO#i ran into the lawyer guy after the ghosting and it was decent#we both said hi to each other and that was all#maybe i read too much into it and maybe he’s got no idea i once hooked up w the psycho guy who also happens to be his friend 😭#but what are the odds 😭#men like gossip more than women TRUST so i don’t think it was a pure coincidence…..i think he knew 😭#i have a hunch and i might be wrong but i feel more comfortable staying clear of him

24 notes

·

View notes

Text

worst day at work everrrrrrrrrrrrrrrrrr starting a go fund me to turn myself into a 2 dimensional art form to live inside the COD games forever

#rorysrants#i have had no breaks and missed my lunch period eNTIRELY#and so i go off queue to EAT LUNCH and IMMEDIATELY i get yelled at to 'please go back on queue and answer calls we have callers waiting 🥰'#“yeah i know but i was just on a call for an hour and a half and i missed lunch. may i go to lunch?”#“oh. well. um. let me check.”#let me check?? LET ME CHECK?????#“i guess you can go to lunch”#YOU GUESS?!?! YOU FUCKING GUESS??!!?!?!#like listen it is not my fault that you guys laid off a whole fucking TEAM of people whos job it is to ANSWER CALLS#and then you signed a new client to ANSWER CALLS FOR so theres more work with LESS FUCKING PEOPLE#and so now our productivity bs looks like dog shit and you're screaming at us to work harder SHUT UP !! THIS IS A HELL OF YOUR OWN MAKING#and BTW BITCHES if the fucking asshole ancient oligarch CEO named after a stupid fucking VIKING in his ugly ass modern mansion in BOSTON#wasn't WASTING MILLIONS OF DOLLARS taking other ceos from companies who are NOT EVEN OUR CLIENTS to fucking VEGAS#then maybe you could afford to pay us all a living wage and afford as many call reps as you actually need to fulfill the demand#but what the hell do i know i wasn't born with a trust fund or a dick

8 notes

·

View notes