#CoinSecurity

Explore tagged Tumblr posts

Text

Crypto Wallets Unveiled: Mastering the Art of Coin Security! | Crypto Elite

youtube

Unlock the secrets of cryptocurrency wallets in this video! These indispensable tools are crucial for managing and safeguarding your digital assets. With diverse forms and unique features, each wallet comes with its own set of security considerations. Demystify crypto wallets, ensuring you master the art of keeping your coins safe. Stay informed and fortify your crypto journey with insights from Crypto Elite! . Here's a breakdown of different types of cryptocurrency wallets and tips for keeping your coins safe:

0 notes

Text

Lighton Master breaks silence on the death of Michelle Tarthchkhenberg "the devastating"

Lighton Myster broke her silence on the Michelle coinsecurity corridor in February. © CW Network/Evere Group Lighton Master takes Michelle’s death of “destroyed” For the first time. “She was a great and talented person, and everyone loved her,” the actress said in a new interview, two months after the death of “Gossip Girl”. “It is very sad for everyone who knows it,” 39 years old Flant magazine…

0 notes

Text

The Cryptocurrency Market: Trends, Key Players, and Future Outlook

The global Cryptocurrency Market has revolutionized the financial landscape, offering new possibilities for transactions, investments, and decentralized financial systems. With its volatility, rapid growth, and transformative potential, the cryptocurrency market is attracting the attention of both institutional and retail investors alike. As of 2023, the market is valued at USD 4.25 billion, and it's projected to grow at a moderate pace over the next few years. In this blog, we explore the current size, projected growth, key market players, segmentations, and the future of the cryptocurrency market.

1. Cryptocurrency Market Overview (2023-2030)

The cryptocurrency market has been on a significant growth trajectory, fueled by innovations in blockchain technology, increasing global adoption, and the rise of digital currencies like Bitcoin and Ethereum. In 2023, the global cryptocurrency market size is valued at approximately USD 4.25 billion, and by 2024, it is expected to reach USD 4.35 billion. By 2030, the market is anticipated to grow to USD 5.03 billion, with a compound annual growth rate (CAGR) of 2.47% from 2024 to 2030.

Key Growth Drivers:

Increased Adoption: With more businesses and consumers accepting cryptocurrencies, there is a growing acceptance of digital currencies in everyday transactions.

Blockchain Innovation: Technological advancements in blockchain are improving security, scalability, and efficiency, driving more adoption of cryptocurrencies.

Institutional Investment: Institutional investors, hedge funds, and corporations are beginning to invest in cryptocurrencies as part of their portfolios, lending credibility to the market.

Regulatory Clarity: As governments and regulators around the world work to establish clear frameworks for cryptocurrencies, more people are gaining confidence in investing in digital assets.

Decentralized Finance (DeFi): The rise of decentralized finance platforms, which offer lending, borrowing, and trading services using cryptocurrencies, is propelling further growth in the space.

2. Market Size and Forecast

The cryptocurrency market’s growth is modest compared to other technology sectors, but it still shows positive potential. From USD 4.25 billion in 2023, it is projected to grow at a steady pace, reaching USD 4.35 billion by 2024. By 2030, the market is forecast to expand to USD 5.03 billion.

Cryptocurrency Market Size (USD Billion)

YearMarket Size (USD Billion)20234.2520244.3520305.03

This growth, at a CAGR of 2.47%, reflects a cautious optimism around cryptocurrency adoption, where growth is expected to be stable but not as explosive as in the earlier years. This is due to factors such as market maturity, increased regulatory scrutiny, and a potential consolidation phase in the industry.

3. Key Market Players

The cryptocurrency market consists of a variety of players, including cryptocurrency exchanges, wallets, and payment processors. Some of the prominent players shaping the cryptocurrency landscape include:

ZEB IT Service

Coinsecure

Coinbase

Bitstamp

Litecoin

Poloniex

BitFury Group

Unocoin Technologies Private

Ripple

OKEX Fintech Company

Bitfinex

These companies offer services such as cryptocurrency trading, wallet management, exchange platforms, and investment tools. They play a critical role in facilitating the flow of digital assets and enhancing the liquidity of the market. Among them, Coinbase is one of the most prominent names, acting as a gateway for retail investors to enter the crypto space. Ripple and Litecoin are also notable for their contributions to the ecosystem through innovative solutions like cross-border payments and faster transaction processing times.

4. Market Segmentation

The cryptocurrency market can be segmented by type, applications, and regions, each offering unique growth opportunities and challenges.

By Type

Bitcoin (BTC): As the first and most widely recognized cryptocurrency, Bitcoin remains the dominant player in the market. It is primarily used for investment purposes and as a store of value, often referred to as "digital gold."

Ether (ETH): Ether, the native cryptocurrency of the Ethereum blockchain, is used for a variety of applications, including decentralized applications (DApps) and smart contracts. It has experienced significant growth, driven by the rise of decentralized finance (DeFi) platforms.

Litecoin (LTC): Litecoin, often referred to as the silver to Bitcoin’s gold, is designed to be a faster and cheaper alternative for transactions. It remains a popular choice for peer-to-peer transfers and transactions.

Other: This category includes a wide range of other cryptocurrencies like Ripple (XRP), Cardano (ADA), Solana (SOL), and more, which focus on different use cases such as privacy, smart contracts, and faster transaction speeds.

By Applications

Transaction: Cryptocurrencies are increasingly being used for peer-to-peer transactions, cross-border payments, and even purchasing goods and services. Digital wallets and exchange platforms make it easier for individuals to use cryptocurrencies as a form of payment.

Investment: Many investors view cryptocurrencies as an asset class to diversify their portfolios, similar to stocks or commodities. Cryptocurrencies like Bitcoin and Ether are popular choices for investment, both for short-term trading and long-term holdings.

Other: This segment includes the growing use of cryptocurrencies in decentralized finance (DeFi), smart contracts, non-fungible tokens (NFTs), and other blockchain-based innovations.

By Region

North America: North America is a key market for cryptocurrency, driven by increasing adoption of Bitcoin and Ether, especially in the U.S. Investors in North America are also influenced by the evolving regulatory landscape, which continues to shape the future of cryptocurrency in the region.

Europe: Europe is seeing growing acceptance of cryptocurrencies, with some countries, such as Switzerland, leading the way with favorable regulations. European investors are particularly interested in blockchain technology and DeFi platforms.

Asia Pacific: Asia is a major player in the cryptocurrency space, particularly with countries like China, South Korea, and Japan actively adopting digital currencies. However, regulatory challenges in countries like China have led to a shift in the market’s dynamics, with other nations emerging as leaders in crypto innovation.

Latin America: Latin American countries such as Brazil and Argentina are experiencing increasing adoption of cryptocurrencies due to economic instability, with cryptocurrencies being used as an alternative store of value and for remittances.

Middle East & Africa: The Middle East and Africa region is witnessing increasing interest in cryptocurrencies, particularly in countries like the UAE, which has been working to establish itself as a hub for blockchain and digital assets.

5. Market Trends and Innovations

1. Rise of DeFi and Smart Contracts

Decentralized Finance (DeFi) platforms, which use cryptocurrencies to offer services like lending, borrowing, and trading without intermediaries, have been gaining momentum. These platforms are built primarily on the Ethereum blockchain, using Ether as the primary asset for smart contracts. The growth of DeFi is expected to drive increased demand for cryptocurrencies, particularly Ether.

2. Regulatory Developments

As governments around the world continue to develop regulatory frameworks for cryptocurrencies, this is expected to provide more clarity and foster greater institutional investment. Regulations will help reduce the risks associated with fraud, money laundering, and volatility, which could attract more investors to the space.

3. NFTs and the Tokenization of Assets

Non-Fungible Tokens (NFTs) have brought a new dimension to the cryptocurrency market. NFTs allow the tokenization of digital art, collectibles, and even real estate, making it possible to buy, sell, and trade unique assets on blockchain networks. This trend is expected to continue to evolve, attracting new participants to the cryptocurrency ecosystem.

4. Institutional Adoption

The growing participation of institutional investors, including hedge funds, asset managers, and even major corporations, is a significant trend in the cryptocurrency market. The entry of institutional players into the market adds legitimacy and stability, which can have long-term positive effects on market growth.

6. Key Challenges

1. Regulatory Uncertainty

Despite progress in many countries, cryptocurrency remains a largely unregulated space in many regions. This uncertainty creates risks for both investors and companies operating in the space. Clear and consistent regulations would help foster further growth and investment.

2. Volatility and Speculative Nature

Cryptocurrencies are known for their extreme price volatility, which can deter some investors from entering the market. Although some view this volatility as an opportunity, it presents a challenge for those looking for more stable investment options.

3. Security Risks

Cybersecurity concerns, such as hacking and phishing attacks, remain a significant challenge in the cryptocurrency market. Protecting assets and user data from cyber threats will continue to be a top priority for market participants.

7. Future Outlook

The cryptocurrency market, while still in its nascent stages compared to traditional financial markets, is poised for steady growth. By 2030, the market is projected to reach USD 5.03 billion, driven by innovations in blockchain technology, the rise of decentralized finance, and the increasing institutional adoption of digital assets. As more individuals and institutions embrace cryptocurrencies as an alternative asset class, the market will continue to evolve and expand.

Projected Market Value and Growth Rate: With a CAGR of 2.47%, the market's moderate growth reflects an ongoing trend towards adoption, innovation, and regulation. This steady growth offers investors an opportunity to gain exposure to a maturing market that has the potential to change the way we view money, assets, and financial transactions.

In conclusion, the cryptocurrency market is on the brink of further growth, with new innovations and market players leading the charge. As the landscape continues to evolve, so too will the opportunities and challenges for those involved in this dynamic sector. Whether for transactions, investments, or decentralized applications, the future of cryptocurrency looks bright, and its impact on the global financial system is only beginning to unfold.

Browse More:

Crowdsourced Testing Market Research

Incidents and a draw in the Madrid derby between Atlético and Real Madrid, marked by the throwing of objects

0 notes

Text

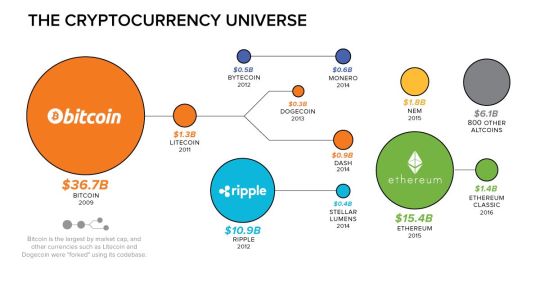

"From Bitcoin to Altcoins: Understanding the Diverse Landscape of Cryptocurrency Offerings."

The Cryptocurrency Market encompasses digital assets designed to function as a medium of exchange, store of value, and unit of account utilizing cryptographic techniques for secure transactions and decentralized control. Bitcoin, Ethereum, and a multitude of altcoins are among the most prominent cryptocurrencies in circulation, each operating on blockchain technology, a distributed ledger system that ensures transparency, immutability, and security.

The Cryptocurrency Market caters to a global audience of investors, traders, businesses, and consumers seeking alternatives to traditional fiat currencies, as well as opportunities for investment, speculation, and financial innovation. With the proliferation of cryptocurrencies and blockchain applications, the market has witnessed exponential growth, technological advancements, regulatory developments, and evolving consumer attitudes.

⏩𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬- https://introspectivemarketresearch.com/request/14538

Increasing Institutional Adoption and Mainstream Acceptance : A primary driver for the Cryptocurrency Market is the increasing institutional adoption and mainstream acceptance of digital assets as legitimate investment vehicles and financial instruments. Institutional investors, including hedge funds, asset managers, family offices, and corporations, are entering the cryptocurrency space, driven by the potential for high returns, portfolio diversification, and exposure to emerging asset classes.

Moreover, mainstream financial institutions, payment processors, and technology companies are embracing cryptocurrencies and blockchain technology, offering custodial services, trading platforms, and payment solutions to their clients. The institutionalization of cryptocurrency markets brings liquidity, stability, and credibility, attracting more investors and driving market growth.

Segments Covered :

By Type

Bitcoin (BTC)

Ether (ETH)

Litecoin (LTC)

Others

By Application

Transaction

Investment

Others

Key Market Deliverables :

Accurate growth rate of the global cryptocurrency market over the forecast period

Global cryptocurrency market size from 2021 to 2027

Leading manufacturing and software companies involved in the Market industry

Key current cryptocurrency industry trends will shape the market in the future

Major driving factors and opportunities in the target industry

Key niches at which players profiling with systematic plans, financials, and also recent advancements

Leading segments flourishing at the maximum growth rate while delivers experience a steady growth

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 : https://introspectivemarketresearch.com/inquiry/14538

Players Covered in Cryptocurrency :

Coinsecure

Bitstamp

Poloniex

BitFury Group

Unocoin Technologies Private

OKEX Fintech Company

Bitfinex and other major players.

About us :

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assist our clients grow and have a successful impact on the market. Our team at IMR is ready to assist our clients flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, specialized in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive, Chicago, Illinois 60616

USA Ph no: +1-773-382-1049

Email : [email protected]

#Cryptocurrency Market#Cryptocurrency#Crypto#currency#Cryptocurrency Market size#Cryptocurrency Market share#Cryptocurrency Market trends#Cryptocurrency Market analysis

0 notes

Photo

Ampleforth Raises $5M in 11 Seconds in Tokinex Exchange Offering/ Cryptocurrency exchange,CoinMarketCap,poloniex,bitfinex,bitmex,bittrex,bithumb,bitcoin price

Ampleforth has raised $4.9 million in 11 seconds in its AMPL token sale, according to an announcement on June 13. The initial exchange offering (IEO) was the first to take place on Ethfinex and Hong Kong-based crypto exchange Bitfinex’s Tokinex platform . An IEO is an alternative to an initial coin offering (ICO) in which a centralized exchange is responsible for vetting the token projects and investors, and then subsequently conducting the initial sale of the token. This IEO, ran by Tokinex, reportedly sold off 10% of Ampleforth’s total token supply, which will be available to its initial investors some time in the next few days. Ampleforth purports to be a token that is balanced around an equilibrium price target, but says that it does not qualify as a stablecoin, at least initially. The cryptocurrency is designed to periodically add or subtract tokens from an investor’s holdings in order to match exchange rate fluctuations, meaning that it has a correspondingly fluctuating market capitalization. This also means that this token is expected to have a low correlation with bitcoin (BTC) compared with other crypto assets, they say. The IEO platform Tokinex first launched back in May. Bitfinex and Ethfinex users can participate in IEOs using funds from their own exchange wallets. The platform also uses Know Your Customer (KYC) processes powered by the Blockpass mobile app for sales and IEOs hosted on the platform.

Bitcoin leveraged trade at 100x leverage maximum, 100% profit at 1% price raise

Make a profit whether the bitcoin price rises or falls

BITSEVEN BITCOIN LEVERAGE TRADING YOU CAN TRUST

https://www.bitseven.com/en

#bitcoins mining#bitcoin mining pool#bitcoin cash news#coinsecure#cryptocurrency market#crypto#coindesk#tradingview#bitmex testnet#Cryptocurrency exchange

2 notes

·

View notes

Link

New reports are appearing, showing that Coinsecure is emailing some of its customers to tell them that they can start claiming their money back. This is despite the fact that the Indian cryptocurrency exchange hasn’t posted the update on its website as it usually does.

The last update, posted on April 29, says that authorities are slowing things down and making the compensation process difficult.

6 notes

·

View notes

Text

Update on IT Survey from Coinsecure

Press Release: 14 th December, 2017

Senior officials from the income tax department conducted a survey across our Delhi and Bangalore offices in an attempt to gauge and comprehend the state of Bitcoin in India.

The recent price surge created dramatic movement within their ranks to try and understand causes repercussions and taxability.

The broad sword of discussions was to understand Bitcoin and crypto currencies and their users.

The officials had requested data to try and analyse taxability of Bitcoin. Everything was extremely routine and all exchanges in India have gone through the same process cooperating and coordinating with the authorities.

While this will be a rude awakening for tax evaders across the system, we at Coinsecure have viewed this quite positively as we come closer to taxation laws and a recognised status for Bitcoin in India.

In the meantime, our operations have continued as normal and will continue to do so. Please do check with your tax consultants on viable options for your current trading volumes.

2 notes

·

View notes

Photo

Na czym polega kopanie bitcoinów?/ wydobycie bitcoinów, kopacz bitcoinów, dzisiejsza cena bitcoinów, kopanie bitcoinów, pula Bitcoinów

Wydobywanie, czy też kopanie bitcoinów to proces wytwarzania tej kryptowaluty. Terminu „kopanie” lub „wydobywanie” używa się z powodu tego, że tworzenie nowych bitcoinów przypomina pod pewnymi względami wydobywanie surowców np. złota. Wydobywanie bitcoinów odbywa się przy wykorzystaniu komputerów o dużej mocy obliczeniowej, które rozwiązują złożone problemy matematyczne. Są to problemy, których rozwiązanie jest na tyle złożone, że niemal niemożliwe jest ich rozwiązanie ręczne. Dlatego potrzebna jest moc obliczeniowa komputerów. Dzisiaj nie wystarczy zwykły komputer, tworzone są specjalne zestawy do kopania kryptowalut, które mają odpowiednio dobrane podzespoły zwiększające wydajność wydobywania kryptowalut. Ze względu na to dzisiaj wiele osób zainteresowanych wydobywaniem kryptowalut nie inwestuje w sprzęt na własną rękę, a korzysta z usług kopalni. To przedsiębiorstwa, które specjalizują się w wydobywaniu kryptowalut. Posiadają wielkie magazyny, które pełne są koparek kryptowalut, a osoby zainteresowane mogą „wykupić” część mocy obliczeniowej. Kryptowaluty kontra klasyczne waluty Większość klasycznych walut jest wspieranych i kontrolowanych przez organ centralny. Pozwala to zapobiec różnego rodzaju nadużyciom — organ centralny zajmuje się drukowaniem nowych pieniędzy, zajmuje się ściganiem fałszerzy. Organ centralny często kontroluje również transakcje cyfrowe. Dlatego dokonując płatności online lub kartą kredytową transakcje są sprawdzane, czy nie są oszustwem i czy nie są w żaden sposób podejrzane . Natomiast kryptowaluty nie są kontrolowane przez żaden organ centralny. Zamiast tego funkcję kontroli obiegu bitcoinów oraz tworzenia nowych kryptowalut pełnią wszystkie komputery współtworzące sieć bitcoin. Różnica jest taka, że informacje m.in. o wydobytych blokach są publiczne. Każdy może zdobyć informacje o nich na stronie internetowej blockchain.com. Większym wyzwaniem w przypadku walut fiat jest walka przeciwko ich podrabianiu. Papierowe banknoty mają wiele zabezpieczeń, które sprawiają, że nielegalne drukowanie banknotów jest trudne. Transakcje cyfrowe są monitorowane, co również utrudnia „dorobienie” fałszywych pieniędzy. W przypadku bitcoinów nie ma organu, który kontroluje dokonywane transakcje. Istnieje więc teoretycznie ryzyko, że osoba stworzy kopię bitcoina i wyśle ją drugiej osobie, a dla siebie zatrzyma oryginał. Rozwiązaniem problemu jest odpowiedni łańcuch bloków (ang. blockchain), który ma dowody kryptograficzne, co ma doprowadzić do uniknięcia możliwości fałszowania danych. Cały proces jest wieloetapowy i na każdym etapie wykorzystywane są zabezpieczenia kryptograficzne. Według niektórych złamanie zabezpieczeń Bitcoina byłoby zadaniem niemożliwym nawet dla superkomputerów. Kolejną warstwą zabezpieczeń jest to, że komputery podpięte do sieci blockchain przetrzymują dane obecne w blockchaine. Oznacza to, że nawet jeżeli jakiejś osobie udałoby się zmienić dane i wysłać je drugiej osobie to inni uczestnicy sieci z łatwością rozpoznaliby zmienioną kopię. Dzieje się tak, dzięki algorytmowi Proof of Work. Dlatego też Bitcoin jest walutą, która nie nadaje się do skopiowania. Został on zaprojektowany tak, żeby powstało maksymalnie 21 milionów Bitcoinów i gdy ten limit zostanie osiągnięty, to nie będzie możliwe wykonanie kolejnych bitcoinów. Jak działa kopanie bitcoinów? Wykopanie bitcoina wymaga rozwiązania złożonego problemu matematycznego. W praktyce można powiedzieć, że trzeba odgadnąć wartość docelową, która jest 64 cyfrową liczbą. Polega to na tym, że komputery wydobywające bitcoiny podają różne 64 cyfrowe liczby, aż uda im się znaleźć właściwą wartość. Gdy to zrobią, to udało im się wykopać bitcoina. Obecnie szansa, na trafienie wynosi mniej niż 1 do 6 bilionów. Na trudność wpływ ma m.in. moc obliczeniowa wszystkich komputerów próbujących wykopać bitcoina. Oznacza to, że im więcej osób próbuje to zrobić, tym trudniej jest wykonać bitcoina, a im mniej tym jest to łatwiejsze zadanie. Techniki kopania bitcoinów Początkowo do wykopywania Bitcoinów wykorzystywana była moc CPU, czyli procesorów. Dzięki temu tak naprawdę nie potrzeba było mocnego sprzętu — każdy mógł przy wykorzystaniu swojego komputera. Początkowo Satoshi Nakamoto, czyli twórca kryptowaluty był w stanie wykopać nawet ponad 200 BTC w ciągu jednego dnia przy wykorzystaniu zwykłego komputera. W początkowej fazie nie potrzeba było drogich koparek, wystarczył zwykły laptop albo komputer klasy PC. Dzisiaj do kopania wykorzystuje się karty graficzne, czyli GPU. Ich przewagą nad procesorami jest to, że są w stanie przetwarzać podobne zestawy informacji jednocześnie o wiele wydajniej niż procesory. A w przypadku kopania kryptowalut często przetwarzane są ogromne ilości obliczeń matematycznych w jednym momencie. Oczywiście należy pamiętać, że nawet wykorzystując GPU, potrzebne są też dodatkowe elementy wyposażenia takie jak płyta główna, pamięć RAM, zasilacz, czy też wcześniej wspomniany procesor — trzeba stworzyć działający komputer. Różnica polega w doborze komponentów — stawia się na najwydajniejsze karty graficzne, natomiast oszczędza się na pozostałych podzespołach. Dlatego często w koparkach można znaleźć karty graficzne za kilka tysięcy złotych każda i procesor, za kilkaset złotych. Jednakże nawet pomimo widocznej przewagi GPU nad CPU dzisiaj opracowano znacznie bardziej efektywną metodę kopania bitcoinów — ASIC (skrót od angielskiego Application Specific Integrated Circuit Chips). Jest to układ elektroniczny, który został stworzony na potrzeby wykonywania danej operacji matematycznej — jest znacznie wydajniejszy, jeżeli chodzi o tempo kopania bitcoinów od systemów stworzonych na podstawie GPU, przy tym pobiera mniej energii. Dlatego też wykopywanie przy wykorzystaniu tej metody jest bardziej opłacalne — daje większy zwrot z inwestycji. Rozwiązanie to ma jednak bardzo poważną wadę — nie ma możliwości wprowadzenia zmian na poziomie softwarowym, oznacza to, że na koparce ASIC do bitcoinów możesz kopać tylko i wyłącznie Bitcoiny. Podczas gdy na koparce opartej o GPU możesz w przyszłości kopać inną walutę, jeżeli stwierdzisz, że jest to bardziej opłacalne. Wspólne kopanie Jednocześnie kupno własnej koparki Bitcoinów to cena co najmniej kilku tysięcy złotych. Dodatkowo korzystając z koparki we własnym domu, trzeba mieć nad nią kontrolę — wiele osób nie będzie chciało zostawić włączonego sprzętu, gdy np. nie ma ich w domu. To z kolei zmniejszy wydajność, ponieważ koparka, zamiast działać 24/7 będzie działała krócej. Dlatego ciekawą opcją wydaje się kupienie mocy obliczeniowej od firmy, która zajmuje się profesjonalnie kopaniem kryptowalut. W tego typu przedsiębiorstwach najczęściej jest kilkaset kart graficznych i pracownicy kontrolują ich stan techniczny, dzięki czemu sprzęt pracuje 24/7. Inwestycje w tego typu rozwiązania mogą przybrać różne formy: Tylko opłata początkowa (na poczet np. zakupu kart graficznych). Tylko abonament (który pokrywa zużycie prądu oraz inne wydatki). Połączenie dwóch powyższych, czyli opłata początkowa + abonament. Dużą zaletą jest to, że twoja rola ogranicza się do wyłożenia pieniędzy — nie musisz zajmować się kwestiami technicznymi sprzętu, nie rosną Ci rachunki za prąd, nie ma problemów z wentylacją sprzętu, nie masz problemów ze sprzedażą sprzętu, gdy zakończysz kopanie bitcoinów. Z drugiej strony trzeba pamiętać o wadach. Pierwszą z nich jest możliwość oszustwa — kryptowaluty to popularny temat i wiele osób stara się go wykorzystać w nieuczciwy sposób. Kolejną wadą są zwykle mniejsze zyski przy tej samej inwestycji. Ceną jest również to, że nie masz kontroli nad procesem kopania — w przypadku systemu opartego o GPU sam decydujesz o tym, jaką walutę będziesz kopać, możesz dostosować wydobycie do tego, co jest najbardziej opłacalne, w przypadku „wspólnego” kopania najczęściej nie masz elastyczności.

BitSEVEN I : Giełda Handlowa, maksymalna dźwignia do 100x

Handluj bitcoinami i innymi kryptowalutami z maksymalną dźwignią do 100x. Szybka realizacja, niskie opłaty dostępne tylko na BitSEVEN.

https://www.bitseven.com/pl

#coinsecure#bitcointrade#coindesk#bittrex#handlarz bitcoinów#Coinsuper#Poloniex#cryptozoo news#wydobycie bitcoinów#bitcoin cash#bitcoin wiadomości

0 notes

Photo

Le Bitcoin rebondit alors que Binance et Visa annoncent un partenariat novateur/ échange de bitcoins,bitseven,Échange de crypto-monnaie

Bitseven.com - Les prix des crypto-monnaies ont augmenté mercredi en Asie. Les nouvelles selon lesquelles Visa (NYSE: V) et Coinbase ont formé un partenariat pour lancer une carte de crypto-monnaie ont retenu l'attention. Selon un rapport de Computer World, les deux sociétés lancent une nouvelle "carte Coinbase" qui serait rattachée au portefeuille crypto-monnaie du détenteur, permettant ainsi aux titulaires de "dépenser la crypto-monnaie aussi facilement que l’argent de leur banque". La carte permettrait également les retraits aux guichets automatiques, ont indiqué les rapports, notant qu'elle contournerait le processus de retrait fastidieux, qui prend souvent plus de 24 heures. «Les clients peuvent utiliser leur carte dans des millions de pays à travers le monde, en effectuant des paiements via une puce sans contact et un code PIN. Lorsque les clients utilisent leur carte Coinbase, nous convertissons instantanément la crypto en monnaie fiduciaire », a écrit le PDG de Coinbase UK, Zeeshan Feroze. Mercredi, Bitcoin a gagné 2,5% à 5 192,6$ à 09h20. L'Ethereum a progressé de 2,2% à 165,69$, XRP a augmenté de 1% à 0,32204$ et le Litecoin de 1,8% à 79,648$. Par ailleurs, Binance, une importante plateforme d'échange de crypto-monnaies, a annoncé un bénéfice de 78 millions de dollars au premier trimestre de cette année, en hausse de 66% en glissement trimestriel, selon le journal "The Block". L'article indique également qu'au quatrième trimestre de 2018, l'entreprise a réalisé un bénéfice net d'environ 47 millions de dollars. Binance Coin est actuellement la septième plus grande crypto-monnaie par capitalisation boursière.

BitSEVEN | Echange mercantile de Bitcoin Echangez avec un maximum de 100x de profit Echangez Bitcoin et autres cryptocurrences avec un maximum de 100x de profit Exécution rapide, frais bas, disponible seulement sur BitSEVEN

https://www.bitseven.com/fr

trading de bitcoin,kraken,bit,bitseven,Investir,Option QI,fcoin,okex,huobi,coinex,coinbene,Bithumb,Upbit,HitBTC,BitForex,FxPro,,poloniex,Trading de marge de change

#BtcTrader#Coin chambre#Indodax#Trader Local#coinsecure#bitbay#Bitcointalk#Cointelegraph#Blocktchain.info#bitcoin 2.0

0 notes

Text

DESI CRYPTO

For thousand years, physical tokens have been being used as means of payment (e.g. shells, gold coins, bank notes). In such a setting, a direct exchange of sellers’ goods and buyers’ tokens allows them to achieve an immediate and final settlement. This option is unavailable, when the two parties are not present in the same location (e.g. e-commerce), necessitating the usage of digital tokens. In a digital currency system, the means of payment is simply a string of bits. Cryptocurrencies such as Bitcoin are used as a digital means of payment in the absence of a trusted third party.

Cryptocurrency : Cryptocurrency is an integral part of the blockchain. Distributed ledger technology is built on the consensus algorithms regulating the creation of new blocks. All participants in the P2P network have to accept a block for it to be registered in the blockchain. There are several types of consensuses with PoW (proof-of-work), PoS (proof-of-stake), DPoS (delegated proof-of-stake), and PoA (proof-of-authority) among the most popular. Cryptocurrency is issued every time a new block is created and is used as a reward and incentive for blockchain participants taking part in the consensus mechanism and closing blocks, i.e. allocating their processing power, stakes of coins, and other resources to support the transparency and trust of blockchain and to verify new blocks.

Crypto Holders can transfer cryptocurrency assets between wallets and blockchain addresses, exchange it for fiat money, or participate in cryptocurrency trading. Everyone on the network can view transactions, while the identities of the people behind these public addresses remain anonymous, as they are encrypted by unique keys that connect an individual to an account. Cryptocurrencies can be divided into two large subcategories – coins and tokens. While they are both cryptocurrencies, there is a difference between a coin and a token.

Cryptocurrency in India:

As early as 2012, small scale Bitcoin transactions were already taking place within the country. These were still early days in the development of Bitcoin when only crypto hobbyists were interested in Bitcoin. By 2013, Bitcoin was beginning to gain a level of popularity that was spreading across many countries.

In a short space of time, cryptocurrency exchanges began to spring up within the country. Pioneers like BtcxIndia, Unocoin, and Coinsecure began oering cryptocurrency exchange and trading services in India. Over time, others like Zebpay, CoinDCX, and WazirX were added to the list.

Despite its vast population, India only contributes 2 million percent of the total global cryptocurrency market capitalization. The small role being played by such a large economy can be attributed to the high cryptocurrency prices & the RBI-led government crackdown. The general level of prices of cryptocurrencies in India is on the high side. Market rates are relatively higher by as much as 5 to 10 percent compared to the global average. This means that Indians can only get involved in peripheral participation in crypto trading as far as international crypto exchange platforms are concerned. Lack of large-scale mining facilities & strict government restrictions on international money flow also make it significantly dicult for Indians to transact with many of the large foreign crypto exchange platforms.

The Reserve Bank of India (RBI) has been consistent in warning citizens of the risk associated with cryptocurrencies. While the government of the country hasn’t banned cryptocurrencies, they haven’t exactly been endorsing it. The coming months will reveal the direction in which the crypto market will move as far as India is concerned.

Task at Hand:

Current situation - The government has banned all foreign crypto currencies in India. The cryptocurrency market and its potential gains has induced the Indian Government to introduce an Indian cryptocurrency independent to the Indian rupee. Your Task, as the Government agency responsible for the formation of the NEW GOVERNMENT BACKED UNPEGGED CRYPTOCURRENCY, is to create a formal proposal to the Government of India highlighting the below deliverables:

• Creation of a government backed un-pegged cryptocurrency

• Propose a phase wise 5 year plan by which you plan to regulate, promote, market and stabilize this market.

• Propose a long term plan to solve the problem of scalability of your currency

• Marketing strategies to : - Educate potential customers.

- Create a plan to encourage crypto mining

- Strategies to protect the crypto from cyber threats.

- Strategies to acquire and retain customers

- Conversion of other crypto users to your crypto

• Price at which ICO will be launched and details to list on exchanges

• Strategies to tackle and reduce market volatility

• Strategies to convince investors and government on safety of investment

• Forecasting schedule of your coin’s price for the next 5 years with expected 5 year CAGR

Deliverables:

Powerpoint presentation not exceeding 25 slides

Submission time - 9 am, 6th April 2021

2 notes

·

View notes

Text

Crypto Payment Gateway Bangalore - A Great Way For Merchants

A new crypto payment gateway has been launched in Bangalore. The gateway, called ‘Crypto Payment Gateway Bangalore’, is a joint venture between Indian IT firm Infosys and Singapore-based startup ZERO1. The aim of the gateway is to make it easier for businesses in India to accept cryptocurrency payments.

The gateway will allow businesses to accept payments in any major cryptocurrency, including Bitcoin, Ethereum, Litecoin, and Zcash. Payments will be processed instantly and converted into Indian rupees. The service will also offer a mobile app for customers to make payments with their smartphone.

The launch of Crypto Payment Gateway Bangalore comes at a time when the use of cryptocurrency is on the rise in India. According to a report by Google Trends, the search term ‘Bitcoin’ has seen a surge in interest over the past year.

The city of Bangalore in India is now home to a new crypto payment gateway. The gateway, which is the first of its kind in the country, will allow businesses to accept payments in various cryptocurrencies.

The move comes as part of the government's efforts to promote the use of digital currencies in the country. The gateway is seen as a way to make it easier for businesses to accept payments in cryptocurrencies, and to also encourage more people to use them.

The gateway will be operated by a company called Coinsecure, which is one of the leading cryptocurrency exchanges in India. It will allow businesses to accept payments in Bitcoin, Ethereum, Litecoin, and other major cryptocurrencies. The launch of the crypto payment gateway in Bangalore is a significant development for the cryptocurrency industry in India.

The company’s goal is to make it easy for businesses of all sizes to accept cryptocurrency payments. To that end, they’ve built a simple point-of-sale (POS) system that can be used by merchants with no prior experience with crypto. The company has also partnered with a number of banks and financial institutions to help them get started with the gateway.

The Dogecoin Payment Gateway Bangalore has been set up in the city of Bengaluru, and it allows merchants to accept dogecoin payments. This is not the first time that dogecoin has been used as a payment method in India. In 2015, a Bangalore-based startup called Unocoin launched a dogecoin-based payment gateway called “Dogetipbot”. However, the service was shut down after a few months due to lack of demand.

The Dogecoin Payment Gateway Bangalore is currently being used by a handful of merchants, including a cafe and a few online retailers. This makes them perfect for online payments and has no required middlemen.

As a result it is likely Dogecoin, the popular cryptocurrency, is now being accepted as a payment gateway in Bangalore, India. This is a big step for the currency, which has seen a lot of growth in recent years. The move will make it easier for people to use Dogecoin to pay for goods and services online.

This is good news for the many businesses in Bangalore that have been struggling to keep up with the demand for online payments. The Doge Payment Gateway will help them to accept payments from all over the world. It is also a great way for them to promote their business to a wider audience.

The Doge Payment Gateway Bangalore is easy to use and it is very secure. This will give businesses in Bangalore an edge over their competitors who are not using this payment gateway.to be a hit among the Indian cryptocurrency community.

LTC Payment Gateway Bangalore is a new payment gateway that allows businesses to make online payments using Litecoin. The gateway is designed to make it easy for businesses to accept payments in LTC, and also offers support for other popular cryptocurrencies. The LTC Payment Gateway Bangalore is currently in beta testing, and is expected to launch in the coming months. Businesses interested in accepting payments through the gateway can sign up for early access on the website. The LTC Payment Gateway Bangalore will be a valuable addition to the city's growing list of crypto-friendly businesses. With its ease of use and support for multiple currencies, the gateway has the potential to become a popular choice for businesses looking to accept digital payments.

Bitcoin Payment gateway launches in Bangalore with Infosys and Zero1. It is a free service for merchants and is designed to make it easier for people to use dogecoin to pay for goods and services online. The Bitcoin payment gateway Bangalore has been set up in the city of Bangalore to make crypto payments more easy. Bitcoin payment gateway Bangalore is a leading bitcoin payment service that helps businesses to accept bitcoin payments. The service provides a simple, easy-to-use platform for businesses to accept bitcoin payments.

Bitcoin payment gateway Bangalore is a free service that is designed to make it easier for people to use bitcoin to pay. It is free from any third party and is a peer to peer payment gateway that allows businesses to accept bitcoin payments. It is also the perfect solution for businesses who want to accept bitcoin and other cryptocurrency payments.

The BCH payment gateway Bangalore is one of the most popular payment gateways in India. It provides a user-friendly platform for sending and receiving payments for a variety of products and services. The gateway has been successfully used to process payments for businesses across India.

BCH payment gateway Bangalore is one of the most popular and well-known payment gateways in India. It offers a wide range of services, including online donations and remittance, as well as cross-border payments. The platform has been used by many businesses and individuals in India, and its popularity continues to grow.

The DeFi payment gateway Bangalore is a major player in the Indian payment ecosystem and offers a wide range of features for businesses.The company has developed an innovative platform that allows businesses to accept payments through DeFi. This makes it easy for customers to pay, without having to worry about multiple currencies or transferring money between different accounts.

#crypto Payment Gateway Bangalore#Doge Payment Gateway Bangalore#Ltc Payment Gateway Bangalore#bitcoin payment gateway Bangalore#Defi payment gateway Bangalore#BCH payment gateway Bangalore

0 notes

Text

What are the best Cryptocurrency

Introspective market research has released a new study that gives a comprehensive analysis of the Cryptocurrency industry as well as insights into the market’s major drivers. Different variables have been explored, including potential, size, development, technologies, demand, and the growth of high-profile players. The study is based on an examination of the basic statistics in the general Cryptocurrency market, as well as the key drivers fueling interest in its products and services.

The Cryptocurrency Market analysis paper will also address the variables influencing and developments in legislation in the Market on a national level, as well as the market’s present and future prospects. Furthermore,Market data such as volume, production, locations, distribution, pricing market research, input materials cost, and downstream and upstream industry analysis are important aspects used to estimate the Market situation for developing economies. A market research study on the Market was recently released. This strategic assessment research aims to provide a comprehensive picture of the Cryptocurrency Industry, considering current market realities as well as future market potential from 2022 to 2028. Geographics, applications, products, and other factors are used to segment the study

Get a free sample report on the Cryptocurrency market from 2022 to 2028

The worldwide Cryptocurrency market is expected to grow at a booming CAGR of 2022-2028, rising from USD billion in 2022 to USD billion in 2028. It also shows the importance of the Cryptocurrency market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The major players in the market are

ZEB IT Service, Coinsecure, Coinbase, Bitstamp, Litecoin, Poloniex, BitFury Group, Unocoin Technologies Private, Ripple, OKEX Fintech Company, Bitfinex

Cryptocurrency Market Segmentation

Introspective market research has segmented the Global Cryptocurrency Market On the basis of Type, Application, and Geography.

Cryptocurrency Market Segment by Types, Estimates, and Forecast by 2028

Bitcoin (BTC), Ether (ETH), Litecoin (LTC)

Cryptocurrency Market Segment by Applications, Estimates, and Forecast by 2028

Transaction, Investment

Regional Analysis

The base on geography, the world market of Cryptocurrency has been segmented as follows:

· North America includes the United States, Canada, and Mexico

· Europe includes Germany, France, UK, Italy, Spain, Russia, and the Rest of Europe

· South America includes Brazil, Argentina, Nigeria, Chile, and South America

· The Asia Pacific includes Japan, China, South Korea, Australia, India, Rest of Europe

Customization of the Report

https://introspectivemarketresearch.com/custom-research/14538

This Cryptocurrency Market report includes the estimation of market size for value (million USD) and volume (K Units). Both top-down and bottom-up approaches have been used to estimate and validate the market size of the Cryptocurrency market, and to estimate the size of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research, and their market shares have been determined through primary and secondary research. All percentage shares split, and breakdowns have been determined using secondary sources and verified primary sources.

COVID-19's Market Impact

The scope of this Cryptocurrency market study contains the fundamental overview, applications, classifications, and complex structures of the market. An accurate view of the global market can be displayed in a graphical fashion employing excellent graphics information. There’s also a list of specific elements that can have a big impact on market growth, one of which is the COVID-19.

#Cryptocurrency Market size#Cryptocurrency Market share#Cryptocurrency Market forecast#Cryptocurrency#Cryptocurrency indusrty#Cryptocurrency industry size

0 notes

Photo

Binance DEX: Navigating Country-Specific Cryptocurrency Trading Restrictions/ bitcoin margin trading,bitseven,bitcoin exchange

At the start of June 2019, reports emerged that Binance DEX’s website was blocking users with IP addresses from 29 countries. This news immediately caused confusion with some commentators, using it as an opportunity to reaffirm their stance that Binance DEX is not truly a decentralized exchange (DEX). However, as it turned out, the initial reports were somewhat inaccurate, as the geoblocking only applied to Binance.org — the website for the DEX platform. Traders could still access the DEX via some supported wallet apps, bypassing the need to go through the website to reach the DEX service. Responding to the issue, Changpeng Zhao, the CEO of Binance, advocated for the use of virtual private networks (VPNs) to bypass such restrictions. However, some commentators say using VPNs increases the burden for traders who might prefer to utilize other platforms that do not come with such encumbrances. Also, there is the little matter of VPNs being against the Binance DEX terms of service (ToS). From the perspective of United States-based traders, being geoblocked from Binance.org might see them move to U.S.-regulated trading avenues, which seem to be shrinking by that day. Back in May 2019, Poloniex had to block trading for its U.S. customers on nine cryptocurrency tokens, including ardor (ARDR), augur (REP) and NXT. 29 nations geoblocked from Binance.org Traders from the U.S. and 28 other countries will, as of July 1, 2019, be unable to access the Binance DEX platform via its website — Binance.org. This restriction, according to a pop-up that appears on the website, covers users whose IP addresses are from the affected countries. With the impending restriction, Binance has advised traders in the 29 countries to consider using wallet apps that support access to the DEX without having to go through the website. These wallets include Trust Wallet, Coinomi, Atomic Wallet and the Ledger hardware wallet, to mention a few. While the company does offer alternatives to traders in the geofenced countries, it provides yet another worry for traders in jurisdictions like the U.S., where trading avenues seem to be shrinking. The lack of clarity from U.S. regulators as to whether ICO tokens are to be considered as securities means that exchanges listing such tokens might have to blacklist American traders. Already, the Poloniex exchange announced back in May 2019 that U.S. traders would no longer be able to trade nine tokens on its platform. Announcing via Twitter on June 7, 2019, Bittrex, another cryptocurrency exchange, said it would be geofencing as many 32 assets from its U.S. customer base. The Seattle-based platform also identified regulatory uncertainties in the country as the reason for its decision. Just like Bittrex, it seems Binance is also seeing the results of trying to offer services to U.S.-based traders in this current regulatory landscape. As part of its Twitter announcement, Bittrex declared: “International markets provide the greatest opportunity for growth and the lowest risk of regulatory uncertainty. We will continue to advocate for laws and regulations that foster innovation.” Despite concerted efforts from many stakeholders, the country’s Securities and Exchange Commission (SEC) hasn’t loosened its strict stance on what constitutes a security with regard to cryptocurrencies. Some members of the country’s legislature are currently working on the modalities for a bill to provide an exemption for digital tokens from securities regulation. In the meantime, traders from the U.S. and all the other affected countries would have to try their hands on the suggested wallets. Some may yet switch to U.S.-regulated platforms, even if it means having fewer trading options. The other alternative for such traders is to use a VPN service to bypass IP restrictions. Even Zhao encouraged users to consider this, calling them a necessity in a tweet published on June 3, 2019: Binance DEX ToS: VPNs and the decentralization debate VPNs allow users to establish secure connections to a server, which can be useful for shielding one’s digital footprint from prying eyes. However, the most popular use case for VPNs is arguably to bypass geoblocked websites and other forms of internet censorship. Thus, it doesn’t appear out of order to consider using VPNs to circumvent such restrictions as imposed by Binance. However, there is a slight wrinkle, as the use of VPNs is prohibited in the Binance DEX ToS. Article 6.8 and 6.9 of the document under section 6, which deals with “prohibited uses,” reads: “You may not: [...] where you are a resident or national of a Prohibited Jurisdiction or a U.S. Person, access the Site or any Services using any virtual private network, proxy service, or any other third-party service, network, or product with the intent of disguising your IP address or location.” The Binance DEX document goes on to state that if the platform determines that a user has flouted such a rule, it reserve the right to address such prohibited use. So, why then would the likes of Zhao encourage the use of VPNs when they are clearly forbidden by the ToS? Cointelegraph reached out to Binance for clarification on the matter but is yet to receive any response as of press time. What happens when traders in the 29 countries who prefer to use VPNs rather than access the DEX via supported wallet apps begin doing so? Would they face any negative repercussions in the form of account suspensions or bans? Perhaps traders from the affected countries would do well to tread cautiously in this regard and maybe stick with platforms regulated in the country, or avail themselves by using one of the suggested wallet apps. Examining the ToS document also throws up some other issues, chief of which lies in article 2 — “liquidity and listing risk” under the “risk disclosure” portion. This particular portion of the ToS reads: “Markets for Digital Tokens have varying degrees of liquidity. Some are quite liquid while others may be thinner. Thin markets can amplify volatility. There is never a guarantee that there will be an active market for one to sell, buy, or trade Digital Tokens or products derived from or ancillary to them. Furthermore, any market for tokens may abruptly appear and vanish. Binance makes no representations or warranties about whether a Digital Token that may be traded on or through the Site may be traded on or through the Site any point in the future, if at all. Any Digital Token is subject to delisting without notice or consent.” The most important part from this is the final sentence, which says tokens can be “delisted without notice or consent.” Such a proviso hardly signals decentralization and calls into question the validity of the assertion that Binance DEX is truly decentralized. Presently, centralized platforms dominate the cryptocurrency exchange space. Some commentators point to the difficult user interface employed by decentralized platforms as part of the reason why they have yet to see widespread adoption. Cryptocurrency purists will, however, continue to advocate for decentralized exchanges for a number of reasons, such as their robust security and censorship resistance. A well-realized DEX network could also result in far cheaper trading than currently offered by their centralized counterparts due to the absence of any third party. One other major pain point of cryptocurrency trading is the increasing insistence on Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols by regulators in different jurisdictions, which Binance has seemingly been incorporating on its DEX platform. However, as DEX platforms usually do not support conversions to fiat currency, it should not be the case that such a proviso is relevant to their operations.

Bitcoin leveraged trade at 100x leverage maximum, 100% profit at 1% price raise

Make a profit whether the bitcoin price rises or falls

BITSEVEN BITCOIN LEVERAGE TRADING YOU CAN TRUST

https://www.bitseven.com/en

#negociecoins#99bitcoins#stock futures#bitcoin mining#stock market#bitcoin cash news#coinsecure#coincorner#cryptocurrency market#Binance#cryptozoo news

0 notes

Text

Dairy Herd Management Market Analysis 2021 by Recent Trends, Development, and Regional Growth Overview, 2027

The Final Report will cover the analysis of the Impact of Covid-19 on this industry.

Dairy herd management is a process that determines the productivity and health of dairy animals. Increase in herd size and demand for milk and other dairy products in different regions are the major factors that drive the market growth. Furthermore, dairy herd management is a cost-saving process as it implements techniques of smart farming. These factors fuel the market growth. Also, the increase in government initiatives toward dairy herd management in developing countries are among the key driving factors for the global dairy herd management market. However, factors such as campaigns that are against unethical practices with animals and the lack of professionals trained in dairy management impede the market growth.

The global Dairy Herd Management market provides qualitative and quantitative information on the growth rate, market segmentation, market size, future trends, and regional prospects. The research study represents a modern perspective aimed at securing the future potential of the Dairy Herd Management market. This report analyzes and evaluates the latest prospects for the new retail space, as well as the general and future market performance of Covid-19. In addition, this report provides a detailed overview of competition between some industries and others.

Dairy Herd Management Market is anticipated to reach USD 5.78 Billion by 2027, growing at a CAGR of 8.45% from 2021 to 2027.

Dairy Herd Management Market - Size, Competitive Landscape, and Segmentation Analysis:

Dairy Herd Management Market Reports provide a high-level overview of market segments by product type, applications, leading key players, and regions, as well as market statistics. The research insights focus on the impact of the Covid-19 epidemic on performance and offer a thorough examination of the current market and market dynamics. This crucial understanding of the report's objective can help you make better strategic decisions about investment markets by assessing elements that may affect current and future market circumstances. The leading key players in the Global and Regional market are summarized in a research to understand their future strategies for growth in the market.

The Major Players Covered in this Report:

ZEB IT Service

Coinsecure

Coinbase

Bitstamp

Litecoin

Poloniex

BitFury Group

Unocoin Technologies Private

Ripple

OKEX Fintech Company

Bitfinex

By Type, Dairy Herd Management has been segmented into:

· Hardware and Systems

· Standalone Software

· On-premise Software

· Web-based/Cloud-based Software

By Application, Dairy Herd Management has been segmented into:

· Reproduction Management

· Animal Comfort

· Calf Management

· Feeding Management

· Milk Harvesting

· Heat Stress Management

· Others

Market Segment by Regions and Countries Level Analysis:

· North America (U.S., Canada, Mexico)

· Europe (Germany, U.K., France, Italy, Russia, Spain, Rest of Europe)

· Asia-Pacific (China, India, Japan, Southeast Asia, Rest of APAC)

· Middle East & Africa (GCC Countries, South Africa, Rest of MEA)

· South America (Brazil, Argentina, Rest of South America)

Covid-19 Impact and Recovery Analysis on Industry:

We've kept track of Covid-19's direct impact on this market as well as its indirect impact on other industries. During the analysis period, the impact of the Covid-19 pandemic on the market is predicted to be significant. From a worldwide and regional viewpoint, this report examines the influence of the pandemic on the Dairy Herd Management industry. The study categorizes the Aerospace Carbon Fiber industry by type, application, and consumer sector to determine market size, market features, and market growth. It also includes a thorough examination of the factors that influenced market development before and after the Covid-19 pandemic. In addition, the research did a pest analysis in the sector to investigate major influencers and entrance obstacles.

#Dairy Herd Management Market#Dairy Herd Management#Dairy Herd Management Market size#Dairy Herd Management Market share#Dairy Herd Management Industry

0 notes

Text

THE GROWTH OF BITCOIN FROM 2008 TO PRESENT

Bitcoin, the best known and most widely used cryptocurrency, entered the global scene in October of 2008 when anonymous founder, Satoshi Nakamoto published a white paper entitled: ‘Bitcoin: A Peer-to-Peer Electronic Cash System’. The paper elaborated on methods to put in place a system of electronic transactions using peer-to-peer networks, without the need to rely on central authorities. Individuals who initially reviewed the white paper were eager to see this new technology come to fruition.

THE EARLY YEARS

The Bitcoin network was formed in January of 2009, with Satoshi Nakamato mining the first Bitcoin block. The value of the first 50 Bitcoin mined was negotiated on the bitcointalk forums. This was followed by the first notable transaction in digital currency, where 10,000 BTC were used to purchase two Papa John’s pizzas. In August 2010, a hard fork update to the Bitcoin protocol was introduced.

By 2011, the cryptocurrency had gained substantial ground. Wikileaks and some other organizations started accepting donations in Bitcoin. In September of that year, Bitcoin Magazine was founded. In July of 2011, Bitcoin’s first major bubble went from 1 USD up to 31 USD and then settled back down to 2 USD.

THE GROWTH STORY

In a testament to the growing popularity of Bitcoin, an episode in the third season of The Good Wife was centered on the digital currency. In October 2012, Bitcoin payment processor, BitPay, reported that over 1,000 merchants were now accepting the cryptocurrency as a mode of payment.

In February 2013, when the price of Bitcoin was at 22 USD per Bitcoin, payment processor and brokerage, Coinbase, reported to have sold $1 million USD worth of Bitcoin in a span of one month. The visibility of the cryptocurrency improved manifold when services such as Foodler and OkCupid recognized it as a legitimate mode of payment. In October, the world’s first Bitcoin ATM was launched in Vancouver, Canada, by Robocoin. This was a landmark milestone as it improved accessibility to the cryptocurrency, allowing users to buy and sell Bitcoin at a downtown coffee shop.

By the close of 2013, Bitcoin reached an all time high of 1,250 USD per Bitcoin and regulators and policy makers internationally started to take note that this was no longer a smaller internet currency but perhaps a global movement. One of the biggest highlights for the cryptocurrency in 2014 was Microsoft’s decision to accept payment in Bitcoin for Windows apps and Xbox. That same year, the American Red Cross started accepting donations in Bitcoin. By August 2015, a whopping 160,000 merchants had started accepting payment in Bitcoin. Perhaps for us, the largest milestone from 2014 to 2015, was the formation of Coinsecure and the launch of our exchange on January 1, 2015!

COINSECURE’S STORY

In the summer of 2014, Benson Samuel and Mohit Kalra came together to form the now leading Bitcoin exchange in India. At the time, there were only brokerage services and Mohit and Benson saw a need to have a real time exchange to cater to traders and every day customers. They also noted that there needed to be a way to bring in and hold liquidity in India. Coinsecure was formed and the team launched the first real time open order books exchange on January 1, 2015! Coinsecure is not just any exchange but offers an array of services to meet customer needs including: a merchant payment gateway, the first realtime trading app, a block explorer, and even a mock trading platform for users to test out how to buy and sell Bitcoin. The story has just begun for Coinsecure as we aim to bring Bitcoin to India and provide the best technology to do so!

THE PRESENT

By 2016, several governments recognized Bitcoin as a legitimate form of payment. The number of bitcoin ATMs doubled in a span of 18 months, with over 770 such ATMs installed worldwide.

As the world rang in 2017, the value of Bitcoin reached the 1,000 USD mark!

The growth story of this alternative form of money in less than a decade has been nothing short of phenomenal. In India, Bitcoin is just beginning to take off! We are excited to see what 2017 to 2018 will bring!

So why wait? Join the Bitcoin revolution today!

#Bitcoin#Coinsecure#BTC#INR#Blockchain#BTCNEWS#NEWSBTC#bitcoin price#cryptocurrency#digital money#future

2 notes

·

View notes

Photo

Rynek kryptowalut pozostaje “umiarkowanie byczy”, według indeksu SFOX/ bitcoin, żeton, moneta, Krypto, wymiana bitcoinów bitfinex, bitmex, bittrex, bithumb

Według najnowszego raportu za kwiecień 2019, indeks SFOX odczytuje obecnie rynek kryptowalut jako “umiarkowanie zwyżkowy”. Wskazuje na to wolumen i zmienność z ośmiu największych giełd kryptowalut dotyczący BTC, BCH, ETH, LTC, BSV oraz ETC. Utrzymuje się zatem sentyment z marca br., który wtedy był jedynie nieznacznie wyższy. Wartość indeksu SFOX Multi-Factor Market ustalana jest na podstawie autorskich, wymiernych wskaźników i sprowadza się do analizy trzech czynników rynkowych: dynamiki cen, nastrojów na rynku i dalszego rozwoju sektora. Indeks obliczany jest przy użyciu autorskiej formuły, która łączy dane ilościowe na temat ruchu wyszukiwania, transakcji blockchain i średnich ruchomych. Jedno duże zlecenie kupna przyczyniło się do wysokiej zmienności kryptowalut? Jak widać powyżej, indeks SFOX waha się od bardzo niedźwiedziego (-3) do bardzo byczego (+3). Analitycy z SFOX zauważają, że oczekujący raportu mogli spodziewać się wyższego odczytu, biorąc pod uwagę skok cen kryptowalut na początku kwietnia. Indeks pozostał jednak na poziomie „umiarkowanie byczym” już czwarty miesiąc z rzędu. Nie stało się tak bez powodu i w tym miejscu warto podkreślić następujące punkty: Napędzane przez fundamenty bycze sygnały, które widzieliśmy – dynamika cen, rozwój infrastruktury, zainteresowanie instytucji itp. – obecne są od kilku miesięcy. Rajd kryptowalut na początku kwietnia, pomimo wstrzyknięcia na rynek nowej zmienności, wydaje się być napędzany głównie przez jedno duże zlecenie kupna, a nie czynniki fundamentalne, a rynek wydaje się w znacznym stopniu znormalizowany na nowych poziomach po rajdzie. Sygnał sugerowany przez indeks SFOX jest pozytywny dla całego sektora. Co więcej, dane sugerują, że trwały wzrost jest niezależny od przejściowego zainteresowania rynku. Bitcoin (BTC) w kwietniu potwierdza dominujący wpływ na cały rynek Bitcoin (BTC) w kwietniu 2019 r. pokazał jaki wpływ ma na cały rynek kryptowalut. Wraz ze wzrostem notowań BTC na początku kwietnia, rajd pojawił się także na szerokim rynku. Notowania Bitcoina pomiędzy 1 a 3 kwietnia wzrosły o ponad 20%. Zobacz też: Brexit: Oddalają się szanse na kompromis. Kurs funta osuwa się kolejny dzień Domniemanym powodem wzrostów jest zlecenie kupna wielkości 20 tysięcy BTC zawarte przez anonimową stronę, które zachwiało równowagą podaży i popytu. Oliwy do ognia mogła dolać likwidacja pozycji na giełdzie Bitmex. Dodatkowo ruch wzrostowy mógł zostać następnie napędzony przez uczestników rynku, którzy nie chcieli przegapić wzrostów, o których głośno zrobiło się także w mediach

BitSEVEN I : Giełda Handlowa, maksymalna dźwignia do 100x

Handluj bitcoinami i innymi kryptowalutami z maksymalną dźwignią do 100x. Szybka realizacja, niskie opłaty dostępne tylko na BitSEVEN.

https://www.bitseven.com/pl

#Bitcointalk#Poloniex#Indodax#handlarz bitcoinów#gbp do usd#hitbtc#wiadomości o walucie bitcoin#coinsecure#kurs wymiany#cnbc premarket

0 notes