#Compound Interest

Explore tagged Tumblr posts

Text

How to Start Investing with Little Money: Easy Steps to Build Wealth for Beginners 💸✨

Hey, lovely readers! It’s Nada Azzouzi here, and today I’m breaking down how you can start investing—even with little money. If you’re new to the world of investing or think you need a large sum of money to begin, don’t worry! I’ll walk you through simple, easy steps you can start implementing today to build your wealth. 💪 Let’s get started! 🌱 Step 1: Start Small with Automation 💰 Tip number…

#compound interest#Consistent Investing#ETFs for Beginners#Financial Freedom#financial independence#Investing Apps#investing for beginners#investing tips#investment strategies#Learning to Invest#Low-Cost Index Funds#Micro-Investing#passive income#Personal Finance Tips#Reinvest Dividends#Robo-Advisors#Start Investing with Little Money#Wealth Building

4 notes

·

View notes

Text

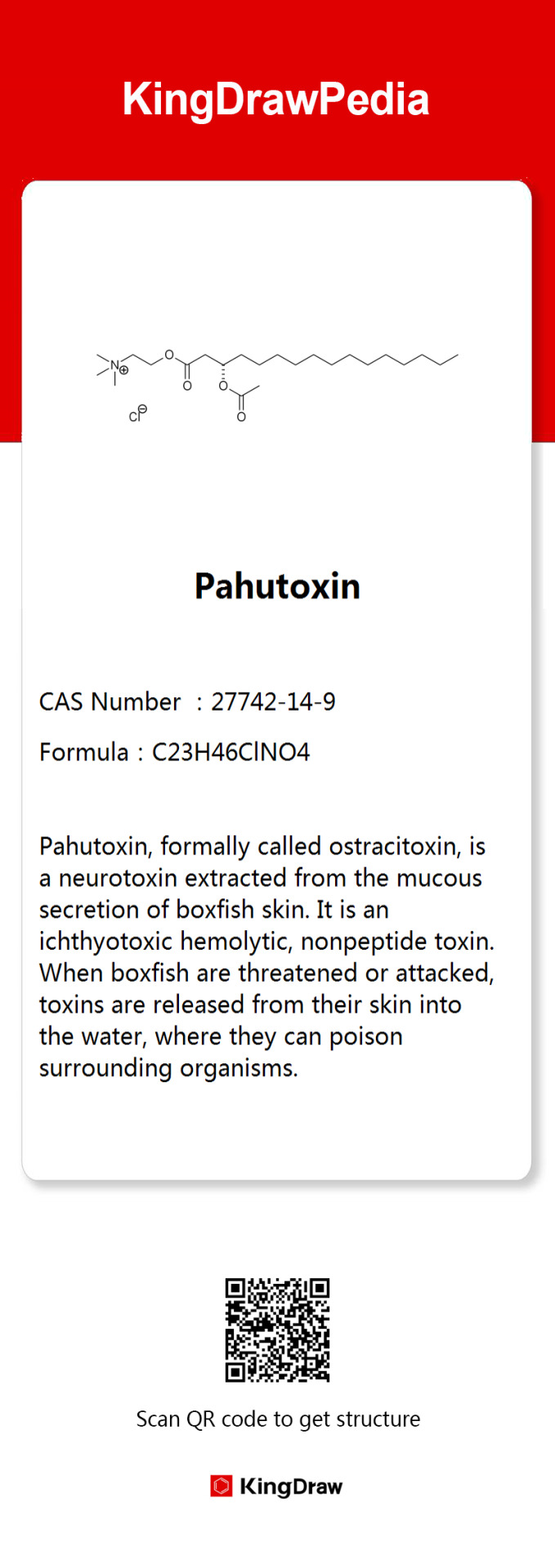

Chemistry behind Boxfish

The boxfish, found in tropical and temperate shallow reef areas, is a fish covered entirely in bony plates. Its body appears boxy with only its eyes, mouth, and fins movable, hence the name. Despite its cute appearance, the boxfish is a tough character in shallow seas. When threatened, it rapidly secretes a neurotoxin called pahutoxin, harming nearby organisms. In extreme cases, such as in confined aquariums, the high toxin concentration can even be fatal to the boxfish itself.

#chemistry#science#molecule#organicchemistry#boxfish#marine life#fishes#fishblr#sea creatures#compound interest#stem studyblr

52 notes

·

View notes

Text

youtube

#social security changes#shark tank guest shark#los angeles chargers#los angeles#guest interviews#usaid spending list#tommy robinson punches england fan#elon musk doge#doge elon musk#usaid spending#musk vs. congress#house gop updates#san diego chargers#daymond shark tank#compound interest#elon musk under fire#the dan bongino show#nations league england#pete sessions doge stance#elon musk doge controversy#blake moore on musk policies#Youtube

3 notes

·

View notes

Text

9 notes

·

View notes

Text

Mastering Personal Finance and Investing: Your Ultimate Guide to Financial Freedom

Introduction: Understanding the Importance of Personal Finance and Investing Personal Finance and Investing: Your Path to Financial Freedom Importance of Personal Finance and Investing for Wealth Creation The Basics of Personal Finance: Budgeting, Saving, and Debt Management Mastering the Basics: Budgeting, Saving, and Debt Management Budgeting Tips for Effective Personal Finance…

View On WordPress

#personal finance#financial planning#money management#budgeting#savings#debt management#investing#wealth creation#retirement planning#401(k)#IRA#stock market#real estate investing#compound interest#tax planning#financial freedom#financial education#money tips#financial goals#investment strategies#financial literacy#wealth management#financial advice#financial independence#money mindset#financial success

25 notes

·

View notes

Text

<— Unit 23 — Unit 24: G & D — Unit 25 —>

Unit 24: Growth & Decay

Part 1 —>

Review: Basic exponential

Basics

b^+ functions

Key point: (0,1)

Common pivot point

Important to know when shifting

.

Discrete Compound Interest

Related terms:

Quarterly = compounded 4 times per year

Semiannually = compounded 2 times year

Biannually = compounded 2 times per year

Continuous Growth

Compound Continuous interest

Page 63

#aapc1u24#exponential growth#exponential decay#exponential function#exponential functions#graphing exponential functions#discrete compound interest#compound interest#continuous compound interest#continuous growth

2 notes

·

View notes

Text

The Snowball Effect

10 notes

·

View notes

Text

When you say you “want” something, you’re saying it’s not here.

Dwell in gratitude and appreciation and all will flow.

Needing nothing really does attract everything.

FEEL genuinely grateful.

In order to receive, you have to give. It’s cool to receive, not gonna deny that, but the real satisfaction comes from giving. :)

#zero point energy#grateful heart#creator appreciation#5d consciousness#awakening#spirituality#expand your consciousness#feel good#feel great#to give is to receive#do good#give thanks#volunteer#service to others#unconditional love#needing nothing attracts everything#satisfaction#contentment#compound interest#cause and effect#karma

6 notes

·

View notes

Text

The FIRE Movement: A Comprehensive Guide to Financial Independence and Early Retirement

Introduction In recent years, a revolutionary concept has emerged in the realm of personal finance, captivating the imagination of young adults worldwide. Known as the FIRE movement, which stands for Financial Independence, Retire Early, this philosophy offers more than just financial advice—it proposes a radical shift in lifestyle. This in-depth guide explores the intricacies of the FIRE…

View On WordPress

#asset allocation#budgeting tips#Compound interest#early retirement#financial autonomy#financial freedom#financial independence#Financial planning#FIRE movement#frugality#lifestyle choices#lifestyle inflation#living below means#passive income#personal finance#retire early#retirement planning#Risk management#savings strategies#side hustles#smart investing#Wealth Management

6 notes

·

View notes

Text

Unlock Financial Wisdom with "Rich Dad Poor Dad": A Life-Changing Read

Written by Delvin Hey there, fellow bookworms and aspiring wealth builders! Today, I want to share with you one of my all-time favorite books that had a profound impact on my financial mindset: “Rich Dad Poor Dad” by Robert Kiyosaki. This book holds a special place in my heart as it was not only one of the first books I ever read but also the catalyst that sparked my journey towards financial…

View On WordPress

#Affiliate Marketing#assets vs liabilities#Compound Interest#dailyprompt#Financial#Financial Freedom#Financial Independence Retire Early#Financial Literacy#FIRE#Generational Wealth#knowledge#money#Money Management#Moneymaking#Motivational#Passive Income#Personal Finance#Real Estate#Rich Dad Poor Dad#Wealth

4 notes

·

View notes

Text

💰 HOW BANKS TURN YOUR DESPERATION INTO PROFIT

The interest rate scam that’s bleeding us dry 🩸

THE INTEREST RATE ROBBERY:

📊 THE SHOCKING NUMBERS:

Banks borrow money at 0.23% from the government

Students pay 2,540x higher rates (up to 69% in extreme cases)

Private loan rates: 5-15%+ depending on credit score

Federal rates: 5-7% (still way higher than what banks pay)

THE PROFIT MACHINE:

Bank's cost of money: $1,000 at 0.23% = $2.30 annual interest

Your loan: $1,000 at 6% = $60 annual interest

Bank's profit: $57.70 per $1,000 borrowed

Multiply this by TRILLIONS and you see the scam 🤑

WHY YOUR RATES ARE SO HIGH:

🎯 “Risk Assessment” (Translation: Discrimination):

No collateral = higher rates (your degree isn’t repossessable)

Young credit history = penalty rates

Need a co-signer? = Even your parents get trapped

First-generation college? = Premium rates because “risk”

💸 THE COMPOUND INTEREST TRAP:

Interest calculated daily

Capitalized interest (unpaid interest becomes principal)

Variable rates can increase anytime

No caps on total interest paid over loan lifetime

REAL TALK: THE MATH IS DESIGNED TO BREAK YOU

Example: $30,000 loan at 6.5% interest

Minimum payments over 10 years: $341/month

Total paid: $40,920

Interest paid: $10,920 (36% more than you borrowed!)

Miss payments? Here’s what happens:

Late fees: $5-50 per missed payment

Penalty APR: Can jump to 25%+

Capitalized interest: Your $30k becomes $35k, then $40k…

THE “FORBEARANCE” SCAM:

What they tell you: “Struggling? We can pause your payments!”

What actually happens:

⏸️ Payments stop

📈 Interest keeps growing

💀 Interest gets added to principal

🔄 Your debt INCREASES while you think you’re getting help

💸 Resume payments on a HIGHER balance

This isn’t help - it’s a debt expansion strategy ⚠️

WHY RATES STAY HIGH:

🏛️ Government Complicity:

Federal loans fund government operations

Student loan interest = government revenue

No incentive to lower rates that fund their budgets

🏦 Bank Addiction:

Risk-free profits (government backing)

Guaranteed payment (bankruptcy protection)

Lifetime customers (loans never go away)

THE UGLY TRUTH:

Your financial struggle is literally their business model. The longer you take to pay off loans, the more money they make. You’re not a customer - you’re a revenue stream.

Coming next: How they profit even more when you can’t pay at all 😈

Remember: If you’re drowning in interest, it’s not because you’re bad at math. It’s because the math was designed to drown you. 🌊

GOTO NEXT POST -> CLICK!

#student debt#interest rates#predatory lending#student loans#Bank Profits#Financial Exploitation#Loan Scam#compound interest#Student Loan Interest#financialliteracy#debt trap#banking industry#Student Debt Crisis#financial abuse#gen z

0 notes

Text

Unlocking the Bitter Truth: Denatonium Benzoate and Nintendo Switch

Denatonium benzoate, also known as 'bittering agent,' is the world's most bitter substance, with a bitterness 1000 times greater than quinine. Used in daily and industrial products to prevent accidental ingestion, it's even added to Nintendo Switch game cards for safety.

#bitter#nintendo switch#game cards#organic chemistry#chemistry#science#kingdraw#molecule#organicchemistry#dailychem#did u know#amazing facts#interesting stuff#compound interest

11 notes

·

View notes

Text

The Power of Compound Interest Explained Simply

Compound interest is often called the eighth wonder of the world—and for good reason. It's a powerful financial force that can help your money grow exponentially over time. But what exactly is it, and why does it matter? Read More..

0 notes

Text

Building Wealth in Your 20s: Simple Investment Strategies That Work 💰📈

Hey there, I’m Nada Azzouzi, and if you’re in your 20s, wondering how to get started on building wealth, you’re in the right place! The earlier you start investing, the more time your money has to grow. With a few simple strategies, you can set yourself up for financial success and enjoy the benefits of your hard work for years to come. 🌱💸 Let’s dive into how you can begin investing wisely…

#401k matching#beginner investing advice#building wealth in your 20s#compound interest#diversify your portfolio#employer-sponsored retirement accounts#Financial Freedom#financial success in your 20s#financial tips for millennials#fractional shares#how to grow wealth over time#how to invest in stocks#how to start investing in your 20s#investing basics#investing for young adults#investing in index funds#investment strategies for beginners#Low-Cost Index Funds#passive income#Personal Finance Tips#simple investment tips#start investing today#stock market for beginners#wealth-building strategies

0 notes

Text

12 Habits to Help You Reach Financial Freedom in 2025 and Beyond

Dreaming of financial freedom—where money works for you, not the other way around? In the USA, achieving financial independence is within reach if you adopt the right habits early. Whether you’re paying off debt, saving for retirement, or building passive income, these 12 habits to help you reach financial freedom will set you on the path to success. From budgeting to investing, this 2025 guide…

#401k savings#budgeting usa#Compound Interest#financial freedom usa#Financial goals#habits for financial independence#passive income usa#Personal finance tips#roth ira 2025#Wealth building

0 notes

Text

Bombay High Court: लोन डिफॉल्ट पर बैंकों को नहीं मिलेगा एलओसी जारी करने का अधिकार

Bombay High Court: बॉम्बे हाईकोर्ट ने हाल ही में एक ऐसा फैसला सूना दिया, जिसके बाद से बैंक सेक्टर में हाहाकार मच गया है। कोर्ट के फैसले के मुताबिक लोन डिफॉल्ट के मामलों अब कोई भी बैंक एलओसी जारी नहीं कर सकेगा। (Bombay High Court’s decision Banks will not get the right to issue LOC in case of loan default) मुंबई- आजकल लोन लेना एक सामान्य प्रक्रिया बन गई है। बैंक अपने ग्राहकों को कर्ज चुकाने के…

#Bank news#Big news#Bombay#Bombay High Court decision#Bombay High Court&039;s decision Banks will not get the right to issue LOC in case of loan default#Bombay news#Breaking news#Central government&039;s decision#compound interest#Fasttrack#fasttrack news#High Court decision on loan#Hindi news#Indian Fasttrack#Indian Fasttrack News#Interest on loan#Latest hindi news#Latest News#latest news update#loan default#loan from bank#lookout notice#Maharashtra big news#Maharashtra News#Mumbai News#News#News in Hindi#News updates#TODAY&039;S BIG NEWS#आज की बड़ी खबर

0 notes