#Credit Management Custom Software

Explore tagged Tumblr posts

Text

Online Marketing Services - Wartiz Technologies

Wartiz Technologies offers comprehensive online marketing services designed to help businesses grow their digital presence. From SEO and SEM to social media management and content marketing, their expert team utilizes the latest strategies to boost brand visibility, drive traffic, and increase conversions. With a focus on data-driven results, Wartiz Technologies tailors campaigns to meet each client’s unique needs, ensuring maximum return on investment. Whether you're a startup or an established company, their innovative solutions can enhance your online reach and overall business performance. Partner with Wartiz Technologies for measurable success.

#Mobile Application Development#Credit Management Custom Software#Utility Billing Software#Website Development Services#IT Solution Services

2 notes

·

View notes

Text

Dealer App for Petrol Pump - Simplify Fuel Station Management with Petrosoft

Managing a petrol pump can be challenging without the right tools. That’s why Petrosoft offers a smart and easy-to-use Dealer App designed especially for petrol pump owners and managers. This app helps you handle all your daily operations from your mobile phone, saving time and effort.

With the Petrosoft Dealer App, you can track daily fuel sales, monitor stock levels, and view payment collections quickly. The app shows you clear reports about your pump's performance, helping you make better business decisions. Whether you are at the pump or away, you can keep an eye on everything in real time.

The Dealer App also allows you to manage credit customers, check due payments, and send reminders easily. You can see which customer has paid and who still needs to pay. This avoids confusion and makes your billing system simple and clear.

#petrol pump dealer app#fuel station management app#Petrosoft dealer app#petrol pump software#fuel station software#digital solution for petrol pump#petrol pump management system#fuel sales tracking app#petrol pump billing app#Petrosoft fuel app#credit customer management petrol pump#petrol pump automation software

0 notes

Text

Using Sims2Pack Clean Installer with The Sims 2: Legacy Collection (and Ultimate too!)

Bringing over a simple (and previously documented) tutorial on how to make Sims2Pack Clean Installer work with Sims 2 Legacy and UC. This is just an adapated version of SimsWiki's UC FAQ, so all credit goes to them. If you want a written step-by-step, please go to their website! STEP 1: Download Sims2Pack Clean Installer

Download (and install) Sims2Pack Clean Installer. This tutorial will be covering the installable version, but the NoInstall one probably works the same. STEP 2: Open the Sims2Pack Clean Installer configuration file

You will now go into the directory where you selected and installed Sims2Pack Clean Installer on. By default, it installs on the C:/ drive, so it is probably located at C:\Program Files (x86)\Sims2Pack Clean Installer. That may vary if you changed the directory.

Open the file called "S2PCI.ini". That is the configuration file that we will be altering. PS: You can use your computer's default Notepad for this, but software like Notepad++ can be easier to manage/edit.

STEP 3: Edit your Sims2Pack Clean Installer configuration to detect Sims 2 Legacy/UC

Where it says SaveGamePath="", you will add the directory where your game's Documents folder is in between the "", just like shown in the photo. - For The Sims 2: Legacy Collection, it is usually C:\Users\YourUserName\Documents\EA Games\The Sims 2 Legacy - For The Sims 2: Ultimate Collection, it is usually C:\Users\YourUserName\Documents\EA Games\The Sims 2™ Ultimate Collection

After that, simply save and replace the file. Depending on your computer settings, it might say it is not able to save. If this happens to you, simply save the edited S2PCI.ini on your desktop, then copy and paste the file inside the Sims2Pack Clean Installer folder and replace the original file (and it should always ask for you to replace the original file! check the tips below for clarification). It might ask for administrator permission, just click yes and proceed until the file is replaced with the one you just edited.

TIP: Not sure what your username is? Simple: on your File Explorer, go to Documents > EA Games > The Sims 2 Legacy (or Ultimate Collection) and click the bar. It will show the full path to the folder. Copy that path and follow the rest of this step. TIP 2: Make sure to save it as a .ini file and NOT a .txt one! If you are having difficulties with that, go to File > Save as on Notepad and select "All Files (*)" as file type. Make sure to also name it exactly as S2PCI.ini (it SHOULD ask you to replace the original file, if it did not, something is wrong. Try following the steps again making sure everything was properly followed!)

STEP 4: Install your Custom Content

The last step is to install your custom content. To make sure that Sims2Pack Clean Installer is working properly with the configuration file you edited, make sure that it shows the path written in the file when you press install. It should point to the game's Documents folder like the image above. Now that you showed the program where your Sims 2 Documents folder is, it should auto-detect where to put the files. Ta-da! Your Sims2Pack Clean Installer is done and working. Enjoy your Custom Content and Sims2Pack installing galore all you want <3

#ts2#sims2#ts2legacy#legacycollection#thesims2#the sims 2#the sims 2 legacy#sims 2#sims 2 legacy#ts2cc#sims2cc#s2cc

293 notes

·

View notes

Text

Microsoft pinky swears that THIS TIME they’ll make security a priority

One June 20, I'm live onstage in LOS ANGELES for a recording of the GO FACT YOURSELF podcast. On June 21, I'm doing an ONLINE READING for the LOCUS AWARDS at 16hPT. On June 22, I'll be in OAKLAND, CA for a panel and a keynote at the LOCUS AWARDS.

As the old saying goes, "When someone tells you who they are and you get fooled again, shame on you." That goes double for Microsoft, especially when it comes to security promises.

Microsoft is, was, always has been, and always will be a rotten company. At every turn, throughout their history, they have learned the wrong lessons, over and over again.

That starts from the very earliest days, when the company was still called "Micro-Soft." Young Bill Gates was given a sweetheart deal to supply the operating system for IBM's PC, thanks to his mother's connection. The nepo-baby enlisted his pal, Paul Allen (whom he'd later rip off for billions) and together, they bought someone else's OS (and took credit for creating it – AKA, the "Musk gambit").

Microsoft then proceeded to make a fortune by monopolizing the OS market through illegal, collusive arrangements with the PC clone industry – an industry that only existed because they could source third-party PC ROMs from Phoenix:

https://www.eff.org/deeplinks/2019/08/ibm-pc-compatible-how-adversarial-interoperability-saved-pcs-monopolization

Bill Gates didn't become one of the richest people on earth simply by emerging from a lucky orifice; he also owed his success to vigorous antitrust enforcement. The IBM PC was the company's first major initiative after it was targeted by the DOJ for a 12-year antitrust enforcement action. IBM tapped its vast monopoly profits to fight the DOJ, spending more on outside counsel to fight the DOJ antitrust division than the DOJ spent on all its antitrust lawyers, every year, for 12 years.

IBM's delaying tactic paid off. When Reagan took the White House, he let IBM off the hook. But the company was still seriously scarred by its ordeal, and when the PC project kicked off, the company kept the OS separate from the hardware (one of the DOJ's major issues with IBM's previous behavior was its vertical monopoly on hardware and software). IBM didn't hire Gates and Allen to provide it with DOS because it was incapable of writing a PC operating system: they did it to keep the DOJ from kicking down their door again.

The post-antitrust, gunshy IBM kept delivering dividends for Microsoft. When IBM turned a blind eye to the cloned PC-ROM and allowed companies like Compaq, Dell and Gateway to compete directly with Big Blue, this produced a whole cohort of customers for Microsoft – customers Microsoft could play off on each other, ensuring that every PC sold generated income for Microsoft, creating a wide moat around the OS business that kept other OS vendors out of the market. Why invest in making an OS when every hardware company already had an exclusive arrangement with Microsoft?

The IBM PC story teaches us two things: stronger antitrust enforcement spurs innovation and opens markets for scrappy startups to grow to big, important firms; as do weaker IP protections.

Microsoft learned the opposite: monopolies are wildly profitable; expansive IP protects monopolies; you can violate antitrust laws so long as you have enough monopoly profits rolling in to outspend the government until a Republican bootlicker takes the White House (Microsoft's antitrust ordeal ended after GW Bush stole the 2000 election and dropped the charges against them). Microsoft embodies the idea that you either die a rebel hero or live long enough to become the evil emperor you dethroned.

From the first, Microsoft has pursued three goals:

Get too big to fail;

Get too big to jail;

Get too big to care.

It has succeeded on all three counts. Much of Microsoft's enduring power comes from succeeded IBM as the company that mediocre IT managers can safely buy from without being blamed for the poor quality of Microsoft's products: "Nobody ever got fired for buying Microsoft" is 2024's answer to "Nobody ever got fired for buying IBM."

Microsoft's secret sauce is impunity. The PC companies that bundle Windows with their hardware are held blameless for the glaring defects in Windows. The IT managers who buy company-wide Windows licenses are likewise insulated from the rage of the workers who have to use Windows and other Microsoft products.

Microsoft doesn't have to care if you hate it because, for the most part, it's not selling to you. It's selling to a few decision-makers who can be wined and dined and flattered. And since we all have to use its products, developers have to target its platform if they want to sell us their software.

This rarified position has afforded Microsoft enormous freedom to roll out harebrained "features" that made things briefly attractive for some group of developers it was hoping to tempt into its sticky-trap. Remember when it put a Turing-complete scripting environment into Microsoft Office and unleashed a plague of macro viruses that wiped out years worth of work for entire businesses?

https://web.archive.org/web/20060325224147/http://www3.ca.com/securityadvisor/newsinfo/collateral.aspx?cid=33338

It wasn't just Office; Microsoft's operating systems have harbored festering swamps of godawful defects that were weaponized by trolls, script kiddies, and nation-states:

https://en.wikipedia.org/wiki/EternalBlue

Microsoft blamed everyone except themselves for these defects, claiming that their poor code quality was no worse than others, insisting that the bulging arsenal of Windows-specific malware was the result of being the juiciest target and thus the subject of the most malicious attention.

Even if you take them at their word here, that's still no excuse. Microsoft didn't slip and accidentally become an operating system monopolist. They relentlessly, deliberately, illegally pursued the goal of extinguishing every OS except their own. It's completely foreseeable that this dominance would make their products the subject of continuous attacks.

There's an implicit bargain that every monopolist makes: allow me to dominate my market and I will be a benevolent dictator who spends his windfall profits on maintaining product quality and security. Indeed, if we permit "wasteful competition" to erode the margins of operating system vendors, who will have a surplus sufficient to meet the security investment demands of the digital world?

But monopolists always violate this bargain. When faced with the decision to either invest in quality and security, or hand billions of dollars to their shareholders, they'll always take the latter. Why wouldn't they? Once they have a monopoly, they don't have to worry about losing customers to a competitor, so why invest in customer satisfaction? That's how Google can piss away $80b on a stock buyback and fire 12,000 technical employees at the same time as its flagship search product (with a 90% market-share) is turning into an unusable pile of shit:

https://pluralistic.net/2024/02/21/im-feeling-unlucky/#not-up-to-the-task

Microsoft reneged on this bargain from day one, and they never stopped. When the company moved Office to the cloud, it added an "analytics" suite that lets bosses spy on and stack-rank their employees ("Sorry, fella, Office365 says you're the slowest typist in the company, so you're fired"). Microsoft will also sell you internal data on the Office365 usage of your industry competitors (they'll sell your data to your competitors, too, natch). But most of all, Microsoft harvest, analyzes and sells this data for its own purposes:

https://pluralistic.net/2020/11/25/the-peoples-amazon/#clippys-revenge

Leave aside how creepy, gross and exploitative this is – it's also incredibly reckless. Microsoft is creating a two-way conduit into the majority of the world's businesses that insider threats, security services and hackers can exploit to spy on and wreck Microsoft's customers' business. You don't get more "too big to care" than this.

Or at least, not until now. Microsoft recently announced a product called "Recall" that would record every keystroke, click and screen element, nominally in the name of helping you figure out what you've done and either do it again, or go back and fix it. The problem here is that anyone who gains access to your system – your boss, a spy, a cop, a Microsoft insider, a stalker, an abusive partner or a hacker – now has access to everything, on a platter. Naturally, this system – which Microsoft billed as ultra-secure – was wildly insecure and after a series of blockbuster exploits, the company was forced to hit pause on the rollout:

https://arstechnica.com/gadgets/2024/06/microsoft-delays-data-scraping-recall-feature-again-commits-to-public-beta-test/

For years, Microsoft waged a war on the single most important security practice in software development: transparency. This is the company that branded the GPL Free Software license a "virus" and called open source "a cancer." The company argued that allowing public scrutiny of code would be a disaster because bad guys would spot and weaponize defects.

This is "security through obscurity" and it's an idea that was discredited nearly 500 years ago with the advent of the scientific method. The crux of that method: we are so good at bullshiting ourselves into thinking that our experiment was successful that the only way to make sure we know anything is to tell our enemies what we think we've proved so they can try to tear us down.

Or, as Bruce Schneier puts it: "Anyone can design a security system that you yourself can't think of a way of breaking. That doesn't mean it works, it just means that it works against people stupider than you."

And yet, Microsoft – whose made more widely and consequentially exploited software than anyone else in the history of the human race – claimed that free and open code was insecure, and spent millions on deceptive PR campaigns intended to discredit the scientific method in favor of a kind of software alchemy, in which every coder toils in secret, assuring themselves that drinking mercury is the secret to eternal life.

Access to source code isn't sufficient to make software secure – nothing about access to code guarantees that anyone will review that code and repair its defects. Indeed, there've been some high profile examples of "supply chain attacks" in the free/open source software world:

https://www.securityweek.com/supply-chain-attack-major-linux-distributions-impacted-by-xz-utils-backdoor/

But there's no good argument that this code would have been more secure if it had been harder for the good guys to spot its bugs. When it comes to secure code, transparency is an essential, but it's not a sufficency.

The architects of that campaign are genuinely awful people, and yet they're revered as heroes by Microsoft's current leadership. There's Steve "Linux Is Cancer" Ballmer, star of Propublica's IRS Files, where he is shown to be the king of "tax loss harvesting":

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

And also the most prominent example of the disgusting tax cheats practiced by rich sports-team owners:

https://pluralistic.net/2021/07/08/tuyul-apps/#economic-substance-doctrine

Microsoft may give lip service to open source these days (mostly through buying, stripmining and enclosing Github) but Ballmer's legacy lives on within the company, through its wildly illegal tax-evasion tactics:

https://pluralistic.net/2023/10/13/pour-encoragez-les-autres/#micros-tilde-one

But Ballmer is an angel compared to his boss, Bill Gates, last seen some paragraphs above, stealing the credit for MS DOS from Tim Paterson and billions of dollars from his co-founder Paul Allen. Gates is an odious creep who made billions through corrupt tech industry practices, then used them to wield influence over the world's politics and policy. The Gates Foundation (and Gates personally) invented vaccine apartheid, helped kill access to AIDS vaccines in Sub-Saharan Africa, then repeated the trick to keep covid vaccines out of reach of the Global South:

https://pluralistic.net/2021/04/13/public-interest-pharma/#gates-foundation

The Gates Foundation wants us to think of it as malaria-fighting heroes, but they're also the leaders of the war against public education, and have been key to the replacement of public schools with charter schools, where the poorest kids in America serve as experimental subjects for the failed pet theories of billionaire dilettantes:

https://www.ineteconomics.org/perspectives/blog/millionaire-driven-education-reform-has-failed-heres-what-works

(On a personal level, Gates is also a serial sexual abuser who harassed multiple subordinates into having sexual affairs with him:)

https://www.nytimes.com/2022/01/13/technology/microsoft-sexual-harassment-policy-review.html

The management culture of Microsoft started rotten and never improved. It's a company with corruption and monopoly in its blood, a firm that would always rather build market power to insulate itself from the consequences of making defective products than actually make good products. This is true of every division, from cloud computing:

https://pluralistic.net/2022/09/28/other-peoples-computers/#clouded-over

To gaming:

https://pluralistic.net/2023/04/27/convicted-monopolist/#microsquish

No one should ever trust Microsoft to do anything that benefits anyone except Microsoft. One of the low points in the otherwise wonderful surge of tech worker labor organizing was when the Communications Workers of America endorsed Microsoft's acquisition of Activision because Microsoft promised not to union-bust Activision employees. They lied:

https://80.lv/articles/qa-workers-contracted-by-microsoft-say-they-were-fired-for-trying-to-unionize/

Repeatedly:

https://www.reuters.com/technology/activision-fired-staff-using-strong-language-about-remote-work-policy-union-2023-03-01/

Why wouldn't they lie? They've never faced any consequences for lying in the past. Remember: the secret to Microsoft's billions is impunity.

Which brings me to Solarwinds. Solarwinds is an enterprise management tool that allows IT managers to see, patch and control the computers they oversee. Foreign spies hacked Solarwinds and accessed a variety of US federal agencies, including National Nuclear Security Administration (who oversee nuclear weapons stockpiles), the NIH, and the Treasury Department.

When the Solarwinds story broke, Microsoft strenuously denied that the Solarwinds hack relied on exploiting defects in Microsoft software. They said this to everyone: the press, the Pentagon, and Congress.

This was a lie. As Renee Dudley and Doris Burke reported for Propublica, the Solarwinds attack relied on defects in the SAML authentication system that Microsoft's own senior security staff had identified and repeatedly warned management about. Microsoft's leadership ignored these warnings, buried the research, prohibited anyone from warning Microsoft customers, and sidelined Andrew Harris, the researcher who discovered the defect:

https://www.propublica.org/article/microsoft-solarwinds-golden-saml-data-breach-russian-hackers

The single most consequential cyberattack on the US government was only possible because Microsoft decided not to fix a profound and dangerous bug in its code, and declined to warn anyone who relied on this defective software.

Yesterday, Microsoft president Brad Smith testified about this to Congress, and promised that the company would henceforth prioritize security over gimmicks like AI:

https://arstechnica.com/tech-policy/2024/06/microsoft-in-damage-control-mode-says-it-will-prioritize-security-over-ai/

Despite all the reasons to mistrust this promise, the company is hoping Congress will believe it. More importantly, it's hoping that the Pentagon will believe it, because the Pentagon is about to award billions in free no-bid military contract profits to Microsoft:

https://www.axios.com/2024/05/17/pentagon-weighs-microsoft-licensing-upgrades

You know what? I bet they'll sell this lie. It won't be the first time they've convinced Serious People in charge of billions of dollars and/or lives to ignore that all-important maxim, "When someone tells you who they are and you get fooled again, shame on you."

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/14/patch-tuesday/#fool-me-twice-we-dont-get-fooled-again

#pluralistic#microsoft#infosec#visual basic#ai#corruption#too big to care#patch tuesday#solar winds#monopolists bargain#eternal blue#transparency#open source#floss#oss#apts

278 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

January 18, 2025

Heather Cox Richardson

Jan 19, 2025

Shortly before midnight last night, the Federal Trade Commission (FTC) published its initial findings from a study it undertook last July when it asked eight large companies to turn over information about the data they collect about consumers, product sales, and how the surveillance the companies used affected consumer prices. The FTC focused on the middlemen hired by retailers. Those middlemen use algorithms to tweak and target prices to different markets.

The initial findings of the FTC using data from six of the eight companies show that those prices are not static. Middlemen can target prices to individuals using their location, browsing patterns, shopping history, and even the way they move a mouse over a webpage. They can also use that information to show higher-priced products first in web searches. The FTC found that the intermediaries—the middlemen—worked with at least 250 retailers.

“Initial staff findings show that retailers frequently use people’s personal information to set targeted, tailored prices for goods and services—from a person's location and demographics, down to their mouse movements on a webpage,” said FTC chair Lina Khan. “The FTC should continue to investigate surveillance pricing practices because Americans deserve to know how their private data is being used to set the prices they pay and whether firms are charging different people different prices for the same good or service.”

The FTC has asked for public comment on consumers’ experience with surveillance pricing.

FTC commissioner Andrew N. Ferguson, whom Trump has tapped to chair the commission in his incoming administration, dissented from the report.

Matt Stoller of the nonprofit American Economic Liberties Project, which is working “to address today’s crisis of concentrated economic power,” wrote that “[t]he antitrust enforcers (Lina Khan et al) went full Tony Montana on big business this week before Trump people took over.”

Stoller made a list. The FTC sued John Deere “for generating $6 billion by prohibiting farmers from being able to repair their own equipment,” released a report showing that pharmacy benefit managers had “inflated prices for specialty pharmaceuticals by more than $7 billion,” “sued corporate landlord Greystar, which owns 800,000 apartments, for misleading renters on junk fees,” and “forced health care private equity powerhouse Welsh Carson to stop monopolization of the anesthesia market.”

It sued Pepsi for conspiring to give Walmart exclusive discounts that made prices higher at smaller stores, “[l]eft a roadmap for parties who are worried about consolidation in AI by big tech by revealing a host of interlinked relationships among Google, Amazon and Microsoft and Anthropic and OpenAI,” said gig workers can’t be sued for antitrust violations when they try to organize, and forced game developer Cognosphere to pay a $20 million fine for marketing loot boxes to teens under 16 that hid the real costs and misled the teens.

The Consumer Financial Protection Bureau “sued Capital One for cheating consumers out of $2 billion by misleading consumers over savings accounts,” Stoller continued. It “forced Cash App purveyor Block…to give $120 million in refunds for fostering fraud on its platform and then refusing to offer customer support to affected consumers,” “sued Experian for refusing to give consumers a way to correct errors in credit reports,” ordered Equifax to pay $15 million to a victims’ fund for “failing to properly investigate errors on credit reports,” and ordered “Honda Finance to pay $12.8 million for reporting inaccurate information that smeared the credit reports of Honda and Acura drivers.”

The Antitrust Division of the Department of Justice sued “seven giant corporate landlords for rent-fixing, using the software and consulting firm RealPage,” Stoller went on. It “sued $600 billion private equity titan KKR for systemically misleading the government on more than a dozen acquisitions.”

“Honorary mention goes to [Secretary Pete Buttigieg] at the Department of Transportation for suing Southwest and fining Frontier for ‘chronically delayed flights,’” Stoller concluded. He added more results to the list in his newsletter BIG.

Meanwhile, last night, while the leaders in the cryptocurrency industry were at a ball in honor of President-elect Trump’s inauguration, Trump launched his own cryptocurrency. By morning he appeared to have made more than $25 billion, at least on paper. According to Eric Lipton at the New York Times, “ethics experts assailed [the business] as a blatant effort to cash in on the office he is about to occupy again.”

Adav Noti, executive director of the nonprofit Campaign Legal Center, told Lipton: “It is literally cashing in on the presidency—creating a financial instrument so people can transfer money to the president’s family in connection with his office. It is beyond unprecedented.” Cryptocurrency leaders worried that just as their industry seems on the verge of becoming mainstream, Trump’s obvious cashing-in would hurt its reputation. Venture capitalist Nick Tomaino posted: “Trump owning 80 percent and timing launch hours before inauguration is predatory and many will likely get hurt by it.”

Yesterday the European Commission, which is the executive arm of the European Union, asked X, the social media company owned by Trump-adjacent billionaire Elon Musk, to hand over internal documents about the company’s algorithms that give far-right posts and politicians more visibility than other political groups. The European Union has been investigating X since December 2023 out of concerns about how it deals with the spread of disinformation and illegal content. The European Union’s Digital Services Act regulates online platforms to prevent illegal and harmful activities, as well as the spread of disinformation.

Today in Washington, D.C., the National Mall was filled with thousands of people voicing their opposition to President-elect Trump and his policies. Online speculation has been rampant that Trump moved his inauguration indoors to avoid visual comparisons between today’s protesters and inaugural attendees. Brutally cold weather also descended on President Barack Obama’s 2009 inauguration, but a sea of attendees nonetheless filled the National Mall.

Trump has always understood the importance of visuals and has worked hard to project an image of an invincible leader. Moving the inauguration indoors takes away that image, though, and people who have spent thousands of dollars to travel to the capital to see his inauguration are now unhappy to discover they will be limited to watching his motorcade drive by them. On social media, one user posted: “MAGA doesn’t realize the symbolism of [Trump] moving the inauguration inside: The billionaires, millionaires and oligarchs will be at his side, while his loyal followers are left outside in the cold. Welcome to the next 4+ years.”

Trump is not as good at governing as he is at performance: his approach to crises is to blame Democrats for them. But he is about to take office with majorities in the House of Representatives and the Senate, putting responsibility for governance firmly into his hands.

Right off the bat, he has at least two major problems at hand.

Last night, Commissioner Tyler Harper of the Georgia Department of Agriculture suspended all “poultry exhibitions, shows, swaps, meets, and sales” until further notice after officials found Highly Pathogenic Avian Influenza, or bird flu, in a commercial flock. As birds die from the disease or are culled to prevent its spread, the cost of eggs is rising—just as Trump, who vowed to reduce grocery prices, takes office.

There have been 67 confirmed cases of the bird flu in the U.S. among humans who have caught the disease from birds. Most cases in humans are mild, but public health officials are watching the virus with concern because bird flu variants are unpredictable. On Friday, outgoing Health and Human Services secretary Xavier Becerra announced $590 million in funding to Moderna to help speed up production of a vaccine that covers the bird flu. Juliana Kim of NPR explained that this funding comes on top of $176 million that Health and Human Services awarded to Moderna last July.

The second major problem is financial. On Friday, Secretary of the Treasury Janet Yellen wrote to congressional leaders to warn them that the Treasury would hit the debt ceiling on January 21 and be forced to begin using extraordinary measures in order to pay outstanding obligations and prevent defaulting on the national debt. Those measures mean the Treasury will stop paying into certain federal retirement accounts as required by law, expecting to make up that difference later.

Yellen reminded congressional leaders: “The debt limit does not authorize new spending, but it creates a risk that the federal government might not be able to finance its existing legal obligations that Congresses and Presidents of both parties have made in the past.” She added, “I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.”

Both the avian flu and the limits of the debt ceiling must be managed, and managed quickly, and solutions will require expertise and political skill.

Rather than offering their solutions to these problems, the Trump team leaked that it intended to begin mass deportations on Tuesday morning in Chicago, choosing that city because it has large numbers of immigrants and because Trump’s people have been fighting with Chicago mayor Brandon Johnson, a Democrat. Michelle Hackman, Joe Barrett, and Paul Kiernan of the Wall Street Journal, who broke the story, reported that Trump’s people had prepared to amplify their efforts with the help of right-wing media.

But once the news leaked of the plan and undermined the “shock and awe” the administration wanted, Trump’s “border czar” Tom Homan said the team was reconsidering it.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Consumer Financial Protection Bureau#consumer protection#FTC#Letters From An American#heather cox richardson#shock and awe#immigration raids#debt ceiling#bird flu#protests#March on Washington

30 notes

·

View notes

Text

PC Storage System

The Pokémon Storage System was invented by Bill in 1995 with Lanette as a co-developer of the software, designed for people to be able to store more than six Pokémon in a global database where their Pokémon could be converted into raw data and safely kept somewhere they could be easily accessed through interacting with a PC or an otherwise capable link in order to access the database. It is capable of storing both Pokémon kept in Poké Balls and Pokémon eggs in their natural states.

The Pokémon Storage System is managed my multiple different people globally in order to troubleshoot, improve, and maintain it. Bill maintains it in Kanto and Johto.

Celio maintains it in the Sevii Islands and also runs the Pokémon Network Centre on One Island which is responsible for providing a method of facilitating global trading. He also helped develop the Global Terminal in Johto and Sinnoh for this same purpose.

Lanette maintains it in Hoenn and is primarily in charge of the user interface and enabling personal Trainer customization of the Box System with wallpapers and giving Trainers the ability to change the names of boxes and the like as well as streamlining the process and making the interface more user-friendly.

Bebe maintains it in Sinnoh and actually built it from scratch as a computer technician based on the previous designs of the system by Bill and Lanette, earning their respect, and developing a way to make it so that the system can be accessed by Trainers from anywhere without the need to access a PC.

Amanita maintains it in mainland Unova and developed it based on the previous designs of Bill, Lanette, and Bebe, introducing a new feature of a Battle Box where Trainers can store a team they use specifically for battling and making it so that Trainers start out with eight boxes available to them and that each time each box is storing at least one Pokémon, the capacity will increase by another eight boxes and then by another eight boxes once the same conditions are met again, making the total capacity of Unova’s PC Storage System seven-hundred-and-twenty Pokémon per Trainer.

Cassius maintains it in Kalos and despite being a capable computer technician, he has made no significant contributions to the operations or design of the PC Storage System. In fact, his sole role is keeping it maintained and was personally tasked by Bill himself to take on that role.

Molayne maintains it in Alola and runs the Hokulani Observatory and, like Cassius, makes no significant contributions to the operations or design of the PC Storage System and simply maintains it.

Brigette (Lanette’s older sister) and Grand Oak (relation to Professor Samuel Oak unclear) manage the PC Storage System everywhere else and in every other capacity, typically on a more global scale. They maintain a more centralized PC Storage System that acts as the bridge between all the others and the network that facilitates global trading. Brigette is credited with upgrading the Pokémon Storage System with the ability to hold fifteen-hundred Pokémon per Trainer, as well as the ability to select and move multiple Pokémon at once. She is also the developer of the Bank System, which acts as an online cloud where Pokémon can be transferred if their Trainers have to move regions and need to access them from the local PC Storage System in their target region and other similar purposes. Grand Oak, however, is more interested in completing a comprehensive National Pokédex by collecting the data from Pokédex holders all over the globe into one central database.

Taglist:

@earth-shaker / @little-miss-selfships / @xelyn-craft / @sarahs-malewives / @brahms-and-lances-wife

-

@ashes-of-a-yume / @cherry-bomb-ships / @kiawren / @kingofdorkville / @bugsband

Let me know if you'd like to be added or removed from my taglist :3

11 notes

·

View notes

Text

James Connolly Collection

This cc set is dedicated to James Connolly.

James Connolly (1868-1916) was the working class hero of the 1916 Easter Uprising. The only member of the Provisional Government of Ireland with actual military experience, as Commandant General of the Dublin Brigade of the Army of the Irish Republic continued to issue commands from the GPO while seriously wounded. James Connolly also led the Irish Citizens Army which was formed to protect workers during the 1913 lock-out. Connolly was invited to join forces with the Irish Brotherhood for the Easter Rising and he was named one of the Vice-Presidents of the Provisional Government of Ireland.

James Connolly came from extreme poverty and spent his life passionately fighting for the rights of workers and the poor against capitalists. James Connolly was active in the Socialist movements in Ireland and the United States.

James Connolly was executed at Kilmainham Jail on 12 May 1916, tied to a chair because his wounds did not allow for him to stand in front of the firing squad.

Song "James Connolly" by The Wolfe Tones https://youtu.be/iYH5h-5Dz40?si=pNuIwnJT7mMSFtEW

Lyrics: lyrics.lyricfind.com/lyrics/wolfe-tones-james-connolly

The cc is listed individually to allow you to pick and choose which items you would like. The flags in the post's primary screenshot can be found here. More cc related to the Easter Rising can be found here.

DOWNLOAD for FREE: SFS

OR at Patreon*

*You must be over 18 to access my Patreon page.

Creations by SexyIrish7

These cc objects were produced as selective clones using Sims 4 Studio.

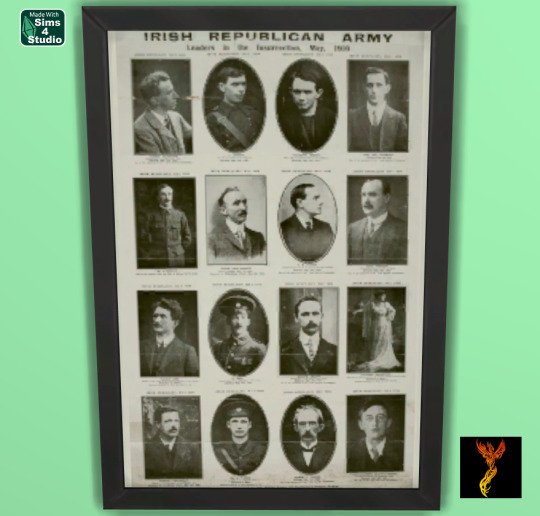

1916 Leaders:

Framed picture of the leaders of the 1916 Easter Rising.

Polygon Count: 50

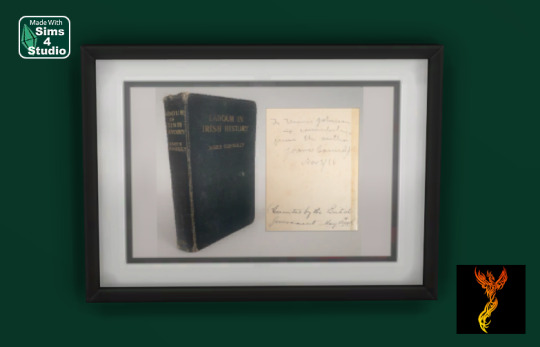

Autographed James Connolly:

Framed display of "Labour in Irish Society" by James Connolly, signed by author in March 1910.

Polygon Count: 50

Framed James Connolly Mural:

Pictured is James Connolly and "Big" Jim Larkin with Connolly's quote “Governments in capitalist society are but committees of the rich to manage the affairs of the capitalist class” from August 1914.Mural by Nik Purdy of BlowDesigns located on the Mall in Sligo City, County Sligo, Ireland

Polygon Count: 50

GPO Last Stand 1916:

Scene depicting 'The Last Stand' at the General Post Office, Dublin during the Easter Rising in 1916. The man with arms folded is Michael Nugent. He was one of the stretcher bearers for James Connolly. He was later jailed in Wales for nearly 2 years for his part in the Easter Rising. Bottom left is Doctor George Henry Mahony, from Cork City. He was a captured member of the British Army Medical Service. Photographer: Unknown Date: Circa 28 April 1916

Polygon Count: 494

James Connolly Memorial:

Framed picture of the James Connolly Memorial located on Beresford Place in Dublin, Ireland. The statue is cast in bronze. The statue was unveiled in 1996 on the 80th anniversary of his execution. Sculptor: Eamon O'Doherty

Polygon Count: 50

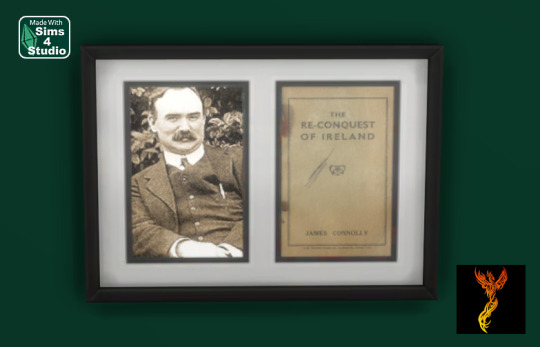

James Connolly Portrait:

Pictures of James Connolly from around 1900 and 1889

Polygon Count: 46

James Connolly Portrait Large:

Picture of James Connolly taken some time before 1916

Polygon Count: 94

Reconquest Ireland:

Display of original book cover of James Connolly's book "The Re-Conquest of Ireland"

Polygon Count: 50

All CC have:

*Ability to search catalog using search terms: sexyirish7 and si7

*Customized thumbnail

*******

CREDITS:

Software credits:

Sims 4 Studio v. 3.2.4.1 (Star): https://sims4studio.com

GIMP v. 2.10.34: https://www.gimp.org/

Inkscape v. 1.2: https://inkscape.org/

Thank you to the creators and moderators producing tutorials and answering questions!

*******

Image Credits:

1916 Leaders: Photo: National Library of Ireland, EPH F339 https://www.rte.ie/centuryireland/articles/how-the-rising-was-planned

Autographed James Connolly: https://www.whytes.ie/art/james-connolly-signed-and-inscribed-copy-of-his-book-labour-in-irish-history-1910/171294/

Framed James Connolly Mural: Photo: © 2024 Seosamh Mac Coılle via https://extramuralactivity.com/category/events-people/james-connolly/

GPO Last Stand 1916: Photographer: Unknown Date: Circa 28 April 1916 https://www.waterfordmuseum.ie/exhibit/web/DisplayPrintableImage/K039Sforwardslashki0g6MU/

James Connolly Memorial: https://www.rte.ie/archives/2018/0512/961209-james-connolly-commemoration/

James Connolly Portrait:

Swatches 1-3: Picture taken around 1900 https://en.wikiquote.org/wiki/File:Connolly.james.jpg

Swatches 4-6: Picture taken around 1889 https://avocagallery.ie/1916-rebel-back-story-james-connolly/

James Connolly Portrait Large: National Library of Ireland, EPH F339 https://www.rte.ie/centuryireland/articles/james-connolly

Reconquest Ireland:

Picture of James Connolly: https://www.1916rising.com/cms/wp-content/uploads/2016/10/James-Connolly.jpg

Original book cover: https://www.whytes.ie/art/connolly-james-the-re-conquest-of-ireland/149292/

*******

TOU:

Do not re-upload and claim as your own

Do not re-upload and hide behind a paywall

#irish cc#irish history#easter uprising#ireland#irish#rebellion#rebel#James Connolly#Irish Citizen Army#irish wall decor#the sims 4 cc#sims 4 cc#ts4 cc#sexyirish7

17 notes

·

View notes

Text

──────── REQUESTS: OPEN ✓

Net Restore: A project to retrieve and archive micro-media from various 2000s programs.

Started as a quick retrieval mission of the full emoticon index from Windows Live Messenger 2009, our media spelunking managed to access the entire resource sheet of several other Windows Live programs.

Our only goal is to recover this type of micro-media (emoticons, tiny logos, dividers, icons), very easily lost to discontinuations, ugly updates, and other corporate whims, and share them with people so they can be used.

Because that's why we make things, for them to be used and enjoyed.

All these images, being in their original quality and transparency, are able to be upscaled and reused, filtered, custom colored, etc. with total freedom.

Feel free to request edits in our inbox. If you are looking for a specific lost image, the more details you're able to give us (Software name, year, ideally a picture reference) the quicker we will get back to you.

No need to credit us for single image use, but please refer back to our page when sharing our .zips. (As a precaution for malware)

──────── TAGS:

#Barbie Girls #Windows Live Messenger #Windows Live Mail

#banners #borders #dividers #emoticons #graphics #icons

Friends :)

41 notes

·

View notes

Text

So this is what the Biden administration spent it's last week in office doing. It's important to know this isn't unusual activity for them. But this is all just in one week:

"Out With a Bang: Enforcers Go After John Deere, Private Equity Billionaires

https://www.thebignewsletter.com/p/out-with-a-bang-enforcers-go-after

At least for a few more days, laws are not suggestions. In the end days of strong enforcement, a flurry of litigation is met with a direct lawsuit by billionaires against Biden's Antitrust chief.

Matt Stoller

Jan 16, 2025

It’s less than a week until this era of antitrust ends. And while much of the news has been focused elsewhere, enforcers have engaged in a flurry of action, which will by legal necessity continue into the next administration. One case in particular angered some of the most powerful people on Wall Street, the partners of a $600 billion private equity firm called Kohlberg Kravis Roberts (KKR).

But before getting to that suit, here’s a partial list of some of the actions enforcers have taken in the last two weeks.

The Federal Trade Commission

Filed a monopolization claim against agricultural machine maker John Deere for generating $6 billion by prohibiting farmers from being able to repair their own equipment, a suit which Wired magazine calls a “tipping point” for the right to repair movement.

Released another report on pharmacy benefit managers, including that of UnitedHealth Group, showing that these companies inflated prices for specialty pharmaceuticals by more than $7 billion.

Sued Greystar, a large corporate landlord, for deceiving renters with falsely advertised low rents and not including mandatory junk fees in the price.

Issued a policy statement that gig workers can’t be prosecuted for antitrust violations when they try to organize, and along with the Antitrust Division, updated guidance on labor and antitrust.

Put out a series of orders prohibiting data brokers from selling sensitive location information.

Finalized changes to a rule barring third party targeted advertising to children without an explicit opt-in.

The Consumer Financial Protection Bureau

Went to court against Capital One for cheating consumers out of $2 billion by deceiving them on savings accounts and interest rates.

Fined cash app purveyor Block $175 million for fostering fraud on its platform and then refusing to offer customer support to affected consumers.

Proposed a rule to prohibit take-it-or-leave-it contracts from financial institutions that allow firms to de-bank users over how they express themselves or whether they seek redress for fraud.

Issued a report with recommendations on how states can update their laws to protect against junk fees and privacy abuses.

Sued credit reporting agency Experian for refusing to investigate consumer disputes and errors on credit reports.

Finalized a rule to remove medical debt from credit scores.

The Antitrust Division

Sued to block a merger of two leading business travel firms, American Express Global Business Travel Group and CWT Holdings.

Filed a complaint against seven giant corporate landlords for rent-fixing, using the software and consulting firm RealPage.

Got four guilty pleas in a bid-rigging conspiracy by IT vendors against the U.S. government, a guilty plea from an asphalt vendor company President, and convicted five defendants in a price-fixing scam on roofing contracts.

Issued a policy statement that non-disclosure agreements that deter individuals from reporting antitrust crimes are void, and that employers “using NDAs to obstruct or impede an investigation may also constitute separate federal criminal violations.”

Filed two amicus briefs with the FTC, one supporting Epic Games in its remedy against Google over app store monopolization, and the other supporting Elon Musk in his antitrust claims against OpenAI, Microsoft, and Reid Hoffman.

And honorary mention goes to the Department of Transportation for suing Southwest and fining Frontier for ‘chronically delayed flights.’"

It's worth reading the entire piece because the Biden people have also gone after KKR which is one of the biggest and most well-connected private equity firms. Remember when suddenly last year all the rich people who used to donate to both parties stopped giving money to Democrats? The billionaires coup against Biden was because of anti trust enforcement.

IF YOU'RE THINKING "GOSH I NEVER HEARD ABOUT ANY OF THIS BEFORE" I HOPE YOU CAN PUT TOGETHER THAT THE NEWS AND SOCIAL MEDIA PLATFORMS ARE ALL OWNED BY BILLIONAIRES WHO ARE VERY ANGRY ABOUT ALL OF THIS AND MAYBE THAT'S WHY YOU NEVER SAW ANYONE TALK ABOUT THE HUGE RESURGENCE OF ANTI TRUST WORK DONE BY BIDEN FOR THE LAST FOUR YEARS.

And no, Trump cannot magically make this all go away. The lawsuits will have to be played out and many of them have state level components that mean the feds can't just shut them down.

X

11 notes

·

View notes

Text

The Top 10 Hardest Things About Starting a Small Business (And How to Overcome Them)

Starting a small business is an exciting journey, but it is not all passion projects and overnight success. Whether you’re launching a sticker business, an online store, or a local shop, the process is filled with challenges, setbacks, and lessons you never saw coming.

From funding struggles to burnout, many entrepreneurs face unexpected obstacles that can make or break their business. But knowing what to expect—and how to overcome these hurdles—can help turn challenges into opportunities.

Here are the ten hardest things about starting a small business and how to tackle them successfully.

1. Finding the Right Business Idea

The Challenge:

You might have too many ideas, or you may not be able to think of a single good one. Choosing the right business idea is tough because:

• It needs to be profitable.

• It should align with your skills and passion.

• It has to have market demand, meaning people actually want to buy it.

How to Overcome It:

• Test your idea before going all in—survey potential customers or create a prototype.

• Research the competition—if no one is doing it, there may be a reason such as lack of demand.

• Solve a problem—successful businesses fill a gap in the market.

Your first business idea does not have to be your last. Many entrepreneurs pivot after learning what works.

2. Getting Funding for Your Business

The Challenge:

Most businesses need money to start, but where do you get it? Banks require strong credit, investors want proof of success, and using your own savings is risky.

How to Overcome It:

• Start small and test with low-cost products before expanding.

• Look for alternative funding such as crowdfunding, grants, or small business loans.

• Consider bootstrapping by reinvesting early profits instead of taking on debt.

Pre-selling your products is a smart way to generate cash flow before investing too much.

3. Learning Everything (Marketing, Sales, Accounting, and More)

The Challenge:

As a business owner, you wear all the hats—you are the marketer, accountant, customer service rep, and CEO all at once.

How to Overcome It:

• Learn the basics with free online courses on marketing, finance, and branding.

• Use business tools such as accounting software, AI for content creation, and social media planners.

• Outsource when possible by hiring freelancers for things you do not have time to master.

Focus on your strengths and outsource the rest once you can afford it.

4. Building a Customer Base from Scratch

The Challenge:

No customers means no sales. But how do you get people to trust a brand that just launched?

How to Overcome It:

• Leverage social media by consistently posting valuable content.

• Offer early discounts or freebies to incentivize first-time buyers.

• Encourage word-of-mouth by asking happy customers for reviews.

Building a strong brand identity, including a logo, website, and social proof, makes people more likely to buy from you.

5. Managing Time and Avoiding Burnout

The Challenge:

Most small business owners work much more than 40 hours a week—without a boss to set limits, it is easy to burn out.

How to Overcome It:

• Set a schedule and balance work time with personal time.

• Prioritize tasks by focusing on what moves the business forward.

• Take breaks because burnout leads to bad decisions and lower productivity.

You are more productive when well-rested. Take at least one day off per week to recharge.

6. Handling Self-Doubt and Fear of Failure

The Challenge:

Every entrepreneur asks themselves, “What if this fails?” Self-doubt can kill motivation before you even start.

How to Overcome It:

• Focus on progress, not perfection—you will learn as you go.

• Surround yourself with support by connecting with other business owners.

• Celebrate small wins—every sale is proof that you are on the right track.

Every successful business owner has failed before. The key is learning and pivoting when needed.

7. Dealing with Slow Sales and Unpredictable Income

The Challenge:

Some months are great, while others are painfully slow—especially in the beginning.

How to Overcome It:

• Have a backup fund by setting aside money during good months.

• Create multiple revenue streams by selling online, at markets, and on different platforms.

• Run promotions during slow periods, such as flash sales or limited-time discounts.

Focus on repeat customers because loyal customers spend more and shop often.

8. Standing Out in a Crowded Market

The Challenge:

No matter what business you start, there is competition. So how do you make people choose you over others?

How to Overcome It:

• Find your Unique Selling Proposition (USP)—what makes your brand different?

• Offer top-tier customer service because people remember great experiences.

• Build a personal brand so that people connect with you, not just your product.

Brand story matters—people buy from businesses they relate to.

9. Managing Inventory and Supply Chain Issues

The Challenge:

Whether you are selling physical products or digital goods, inventory management can be a headache—especially when suppliers have delays or price increases.

How to Overcome It:

• Start with small batches and do not overstock before testing demand.

• Work with reliable suppliers and always have a backup plan.

• Track inventory closely using software to avoid running out or over-ordering.

Having a pre-order system can help manage unexpected inventory shortages.

10. Staying Motivated When Things Get Hard

The Challenge:

Not every day will be exciting. Some days, you will want to quit. Motivation comes and goes, but consistency is key.

How to Overcome It:

• Remember your “why”—what made you start this business?

• Join entrepreneur communities because talking to other business owners helps.

• Set small goals by breaking big tasks into manageable wins.

Mindset is everything—keep pushing forward, even when it is tough.

Final Thoughts: Is Starting a Small Business Worth It?

Absolutely. Even though starting a business is hard, the freedom, creativity, and potential for success make it worth the effort. Every challenge you face is a learning opportunity that brings you closer to long-term success.

What is the hardest part of starting a business for you? Share your thoughts in the comments.

Looking for custom stickers for your small business? Check out BeaStickers.ca for high-quality, waterproof branding solutions.

7 notes

·

View notes

Text

Future of LLMs (or, "AI", as it is improperly called)

Posted a thread on bluesky and wanted to share it and expand on it here. I'm tangentially connected to the industry as someone who has worked in game dev, but I know people who work at more enterprise focused companies like Microsoft, Oracle, etc. I'm a developer who is highly AI-critical, but I'm also aware of where it stands in the tech world and thus I think I can share my perspective. I am by no means an expert, mind you, so take it all with a grain of salt, but I think that since so many creatives and artists are on this platform, it would be of interest here. Or maybe I'm just rambling, idk.

LLM art models ("AI art") will eventually crash and burn. Even if they win their legal battles (which if they do win, it will only be at great cost), AI art is a bad word almost universally. Even more than that, the business model hemmoraghes money. Every time someone generates art, the company loses money -- it's a very high energy process, and there's simply no way to monetize it without charging like a thousand dollars per generation. It's environmentally awful, but it's also expensive, and the sheer cost will mean they won't last without somehow bringing energy costs down. Maybe this could be doable if they weren't also being sued from every angle, but they just don't have infinite money.

Companies that are investing in "ai research" to find a use for LLMs in their company will, after years of research, come up with nothing. They will blame their devs and lay them off. The devs, worth noting, aren't necessarily to blame. I know an AI developer at meta (LLM, really, because again AI is not real), and the morale of that team is at an all time low. Their entire job is explaining patiently to product managers that no, what you're asking for isn't possible, nothing you want me to make can exist, we do not need to pivot to LLMs. The product managers tell them to try anyway. They write an LLM. It is unable to do what was asked for. "Hm let's try again" the product manager says. This cannot go on forever, not even for Meta. Worst part is, the dev who was more or less trying to fight against this will get the blame, while the product manager moves on to the next thing. Think like how NFTs suddenly disappeared, but then every company moved to AI. It will be annoying and people will lose jobs, but not the people responsible.

ChatGPT will probably go away as something public facing as the OpenAI foundation continues to be mismanaged. However, while ChatGPT as something people use to like, write scripts and stuff, will become less frequent as the public facing chatGPT becomes unmaintainable, internal chatGPT based LLMs will continue to exist.

This is the only sort of LLM that actually has any real practical use case. Basically, companies like Oracle, Microsoft, Meta etc license an AI company's model, usually ChatGPT.They are given more or less a version of ChatGPT they can then customize and train on their own internal data. These internal LLMs are then used by developers and others to assist with work. Not in the "write this for me" kind of way but in the "Find me this data" kind of way, or asking it how a piece of code works. "How does X software that Oracle makes do Y function, take me to that function" and things like that. Also asking it to write SQL queries and RegExes. Everyone I talk to who uses these intrernal LLMs talks about how that's like, the biggest thign they ask it to do, lol.

This still has some ethical problems. It's bad for the enivronment, but it's not being done in some datacenter in god knows where and vampiring off of a power grid -- it's running on the existing servers of these companies. Their power costs will go up, contributing to global warming, but it's profitable and actually useful, so companies won't care and only do token things like carbon credits or whatever. Still, it will be less of an impact than now, so there's something. As for training on internal data, I personally don't find this unethical, not in the same way as training off of external data. Training a language model to understand a C++ project and then asking it for help with that project is not quite the same thing as asking a bot that has scanned all of GitHub against the consent of developers and asking it to write an entire project for me, you know? It will still sometimes hallucinate and give bad results, but nowhere near as badly as the massive, public bots do since it's so specialized.

The only one I'm actually unsure and worried about is voice acting models, aka AI voices. It gets far less pushback than AI art (it should get more, but it's not as caustic to a brand as AI art is. I have seen people willing to overlook an AI voice in a youtube video, but will have negative feelings on AI art), as the public is less educated on voice acting as a profession. This has all the same ethical problems that AI art has, but I do not know if it has the same legal problems. It seems legally unclear who owns a voice when they voice act for a company; obviously, if a third party trains on your voice from a product you worked on, that company can sue them, but can you directly? If you own the work, then yes, you definitely can, but if you did a role for Disney and Disney then trains off of that... this is morally horrible, but legally, without stricter laws and contracts, they can get away with it.

In short, AI art does not make money outside of venture capital so it will not last forever. ChatGPT's main income source is selling specialized LLMs to companies, so the public facing ChatGPT is mostly like, a showcase product. As OpenAI the company continues to deathspiral, I see the company shutting down, and new companies (with some of the same people) popping up and pivoting to exclusively catering to enterprises as an enterprise solution. LLM models will become like, idk, SQL servers or whatever. Something the general public doesn't interact with directly but is everywhere in the industry. This will still have environmental implications, but LLMs are actually good at this, and the data theft problem disappears in most cases.

Again, this is just my general feeling, based on things I've heard from people in enterprise software or working on LLMs (often not because they signed up for it, but because the company is pivoting to it so i guess I write shitty LLMs now). I think artists will eventually be safe from AI but only after immense damages, I think writers will be similarly safe, but I'm worried for voice acting.

8 notes

·

View notes

Text

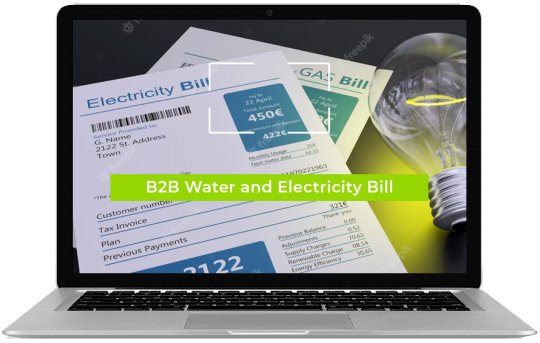

Utility Billing Software: Streamlining Operations for Utilities

In today’s fast-paced world, utilities such as water, electricity, gas, and waste management services are essential to every household and business. Managing billing and ensuring timely, accurate payments is critical to sustaining these operations. However, the traditional methods of utility billing are often inefficient, prone to human error, and time-consuming. That’s where utility billing software comes into play, offering an efficient and streamlined approach to handling these vital services.

At Wartiz Technologies, we understand the complexities faced by utility providers and are committed to transforming the way they operate. Our Utility Billing Software is designed to automate and simplify billing processes, ultimately improving accuracy, reducing operational costs, and enhancing customer satisfaction.

The Importance of Utility Billing Software

Utility billing involves much more than simply sending out invoices. It encompasses various critical tasks, including meter reading, consumption tracking, rate management, invoicing, payment processing, and customer support. Managing all these processes manually can result in delays, errors, and frustration for both utilities and customers.

Utility billing software, however, automates these processes, making it easier for service providers to manage large volumes of data, ensure timely billing, and track payments accurately. With such software, utilities can improve their internal efficiency, offer more flexibility to customers, and reduce the time spent on administrative tasks.

Key Features of Wartiz Technologies’ Utility Billing Software

Wartiz Technologies’ Utility Billing Software comes equipped with several features that cater to the unique needs of utility providers. Some of the key features include:

Automated Meter Reading Integration: Our software integrates with advanced meter reading systems, allowing for accurate tracking of utility usage. Automated readings reduce the risk of errors that occur when done manually, and they can be captured remotely, providing real-time data for billing.

Customizable Billing Rates: Every utility provider has different pricing structures, and our software allows for customized rate management. Whether it’s tiered pricing, flat rates, or variable rates based on consumption, our system ensures accurate calculation based on your specific pricing model.

Online Payment Gateway: Customers expect convenience in today’s digital world, and our software offers integrated online payment options. With secure payment gateways, customers can pay their bills instantly through various channels, including credit/debit cards, net banking, or mobile wallets.

Customer Management and Support: The software includes a comprehensive customer management system that helps utilities track customer accounts, monitor billing history, and provide support. Through this feature, utilities can address customer queries efficiently, improving overall customer satisfaction.

Reporting and Analytics: Real-time reporting and analytics are built into the software to provide utilities with insights into consumption patterns, payment trends, outstanding balances, and overall financial health. This data-driven approach empowers utilities to make informed decisions.

Scalability: Whether you serve hundreds or thousands of customers, our software is scalable to fit your needs. As your utility grows, the system can adapt to manage increasing data volumes without sacrificing performance.

Compliance and Security: Our solution is designed with the highest standards of security to ensure customer data is protected. Additionally, our software complies with industry regulations, ensuring utilities are always operating within legal frameworks.

Benefits of Using Utility Billing Software

Improved Accuracy and Efficiency: With automation, the chances of human error are drastically reduced, and billing cycles become faster, which ensures timely payments and improved cash flow.

Cost Savings: Reducing manual labor and administrative costs helps utility providers save on operational expenses, which can be reinvested into other areas of business development.

Customer Satisfaction: With accurate billing and convenient payment methods, customers are more likely to trust the utility service, leading to higher retention and fewer complaints.

Regulatory Compliance: Compliance with legal and regulatory requirements is simplified with automated features that ensure accurate data reporting.

Why Choose Wartiz Technologies for Your Utility Billing Software?

At Wartiz Technologies, we specialize in delivering innovative software solutions that cater to a wide range of industries, including utility providers. Our utility billing software is built with the latest technologies and designed with user-friendliness in mind. With our solution, utility providers can streamline their operations, reduce costs, and provide exceptional service to customers.

We offer personalized support, ensuring that our clients’ unique requirements are met. Our team works closely with your business to ensure seamless integration and smooth adoption of the system, resulting in minimal disruption to your operations.

Conclusion

Utility billing doesn’t have to be a complex, manual process. By adopting automated billing solutions, utility providers can transform their operations, reduce errors, and provide an improved experience for both their team and their customers. Wartiz Technologies Utility Billing Software offers a robust, scalable solution that addresses the unique needs of utilities while enhancing operational efficiency.

Let Wartiz Technologies help you streamline your utility billing processes, improve customer satisfaction, and ensure accurate and timely invoicing. Reach out to us today to learn more about how we can assist in transforming your utility business with our state-of-the-art billing software.

#Outsource Management Software#Credit Repair Management Software#Construction Management Custom Software#Mobile Application Development#Website Development Services#Digital Marketing Services#Ecommerce Website Development

1 note

·

View note

Text

Strengthening Microfinance Institutions Through Effective Training of Staff

The success of microfinance hinges on people, making the training of staff in microfinance sector one of the most strategic areas of investment. Microfinance institutions (MFIs) serve millions of financially excluded individuals, and the quality of service they deliver depends largely on the skills and knowledge of their staff. Whether dealing with small entrepreneurs, farmers, or women-led households, trained personnel are key to enabling financial inclusion, maintaining client trust, and ensuring long-term sustainability.

Why Training is Crucial in Microfinance

MFIs operate in diverse, often underserved areas, where staff are expected to educate, guide, and support clients through their financial journeys. Training ensures that they are equipped to handle this responsibility. Here’s why training matters:

Service Quality Improvement: Well-trained staff enhance client experiences by providing accurate information and empathetic support.

Credit Risk Management: Proper training in loan appraisal techniques helps reduce defaults and improves portfolio quality.

Technology Adaptation: Staff learn to use digital tools and software for faster, error-free operations.

Legal Compliance: Understanding the regulatory environment reduces risks of non-compliance.

Field Confidence: Trained employees are more confident and consistent in their approach, especially in rural outreach.

What Should Microfinance Staff Training Include?

A strong training framework covers not just technical skills but also interpersonal and ethical dimensions. Essential training topics include:

Loan Product Education: Understanding features, eligibility, interest structures, and repayment norms.

Client Communication: Teaching staff to listen actively, explain terms clearly, and maintain respectful client interactions.

Collections & Recovery: Managing follow-ups and guiding borrowers in repayment without coercion.

MIS and Digital Reporting Tools: Familiarity with software used for customer onboarding, data entry, and reporting.

Responsible Lending: Promoting ethical behavior and ensuring clients are not overburdened with loans.

Barriers to Training in the Microfinance Sector

Despite its importance, the implementation of training faces several hurdles:

Budgetary Constraints: Especially for smaller MFIs with limited resources.

Geographical Spread: Branches in remote areas are harder to reach with in-person sessions.

Language Diversity: Training material must be customized to suit regional dialects and literacy levels.

High Staff Turnover: Leads to frequent onboarding needs and training repetition.

Solutions include investing in mobile-based learning, multilingual video content, and local facilitators who understand regional contexts.

FAQs – Training of Staff in Microfinance Sector

Q1. How does training impact microfinance performance? It improves client satisfaction, reduces defaults, ensures compliance, and boosts employee retention.

Q2. What are cost-effective training methods? E-learning modules, mobile training apps, and peer-to-peer learning help cut costs without compromising quality.

Q3. Should training be one-time or ongoing? Training should be continuous, with regular refreshers and updates as policies or products change.

Q4. How do MFIs manage training across remote branches? They use a combination of digital training platforms and local trainers to ensure accessibility.

Conclusion

In the rapidly expanding world of financial inclusion, training of staff in microfinance sector is a powerful enabler of efficiency, ethics, and growth. Institutions that prioritize learning empower their employees to make smarter decisions, reduce risk, and build lasting relationships with clients. As the microfinance industry continues to scale and digitize, a trained and agile workforce will be the cornerstone of its success.

#Training of staff in microfinance sector#Microfinance employee training#Microfinance staff development#Financial inclusion training#Microfinance institutions India

2 notes

·

View notes

Text

Online Bookkeeping Services by Mercurius & Associates LLP

In today’s fast-paced digital economy, accurate and efficient financial management is crucial for every business. Whether you're a startup, small enterprise, or a growing company, keeping track of your finances is vital for sustainability and success. That’s where Mercurius & Associates LLP steps in with its online bookkeeping services — blending technology, expertise, and reliability to manage your books with precision.

Why Bookkeeping Matters

Bookkeeping is the foundation of any business’s financial health. It involves recording, classifying, and organizing all financial transactions so that businesses can:

Monitor their financial position

Ensure regulatory compliance

Make informed decisions

File accurate tax returns

Plan for growth and investment

Yet, many businesses struggle to keep up with bookkeeping due to time constraints, lack of in-house expertise, or outdated processes.

Benefits of Online Bookkeeping Services

Online bookkeeping is a game-changer for modern businesses. It offers:

Real-time access to financial data

Cloud-based solutions for anytime, anywhere access

Cost-effective services compared to in-house staff

Scalability as your business grows

Increased accuracy through automated tools

Secure data storage with regular backups

By outsourcing bookkeeping to professionals, businesses can focus more on core operations while ensuring their books are in order.

Why Choose Mercurius & Associates LLP?

At Mercurius & Associates LLP, we specialize in providing online bookkeeping services tailored to your business needs. Here’s what sets us apart:

1. Experienced Professionals

Our team comprises skilled accountants and finance experts who understand the nuances of bookkeeping across industries. We ensure compliance with Indian and international accounting standards.

2. Customized Solutions

We understand that no two businesses are the same. Our bookkeeping services are tailored to suit your industry, size, and specific requirements.

3. Technology-Driven Approach

We leverage cloud-based platforms like QuickBooks, Zoho Books, Xero, and Tally for seamless and accurate bookkeeping. Integration with your existing systems is quick and hassle-free.

4. Transparent Reporting

You receive regular financial reports that help you track performance, manage cash flow, and plan strategically. Our detailed reports include profit and loss statements, balance sheets, and cash flow summaries.

5. Data Security

We implement best-in-class data protection protocols to ensure your financial information is secure and confidential.

Services We Offer

Daily, weekly, or monthly transaction recording

Bank and credit card reconciliation

Accounts payable and receivable management

General ledger maintenance

Payroll processing support

GST return preparation and filing

Financial reporting and analysis

Industries We Serve

Our online bookkeeping services are ideal for:

Startups & Entrepreneurs

E-commerce Businesses

Healthcare Professionals

Legal Firms

Retail & Wholesale Businesses

IT & Software Companies

NGOs and Trusts

Get Started with Mercurius & Associates LLP

Outsourcing your bookkeeping doesn’t mean losing control. With Mercurius & Associates LLP, you gain a partner who brings clarity, accuracy, and efficiency to your financial operations.

Let us handle your books while you focus on growing your business.

📞 Contact us today to learn more about our online bookkeeping services or to request a free consultation.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#income tax#taxation#foreign companies registration in india#auditor#ap management services

2 notes

·

View notes

Text

🛡️ Cybersecurity and Fraud Prevention in Finance: How to Protect Your Financial Systems in 2025

In today’s digital-first financial world, cybersecurity and fraud prevention in finance are more critical than ever. With the rise of online banking, mobile payments, and digital assets, financial institutions face increasingly sophisticated cyber threats and fraud tactics.

🔍 Why Cybersecurity Is Crucial in the Finance Industry

The financial sector is one of the most targeted industries by cybercriminals due to its vast access to sensitive personal data and high-value transactions. From phishing and ransomware to account takeover and insider threats, the risk landscape continues to evolve.

Google Keyword: financial cyber threats

💣 The Cost of Poor Financial Cybersecurity

Average cost of a financial data breach: $5.9 million

70% of consumers will switch banks or services after a breach

Identity theft and digital fraud rates are up 34% YoY

Trending Search Term: banking data breaches 2025

✅ Top Strategies for Cybersecurity and Fraud Prevention in Finance

1. Adopt Multi-Layered Security Protocols

Layered security (also called “defense in depth”) uses a combination of firewalls, encryption, anti-virus software, and secure authentication to prevent unauthorized access.

Related Term: secure financial transactions

2. Leverage AI and Machine Learning for Fraud Detection

Artificial intelligence plays a key role in identifying unusual patterns and suspicious behavior in real-time. AI-powered fraud detection systems can:

Flag fraudulent transactions instantly

Analyze thousands of data points in seconds

Continuously learn and adapt to new fraud tactics

Keyword: AI in cybersecurity

3. Implement Real-Time Transaction Monitoring