#CreditStacking

Explore tagged Tumblr posts

Text

#findyourpurpose#credit score#0percentfunding#CreditStacking#BetOnYourself#betonyourself#FreedomPath

0 notes

Photo

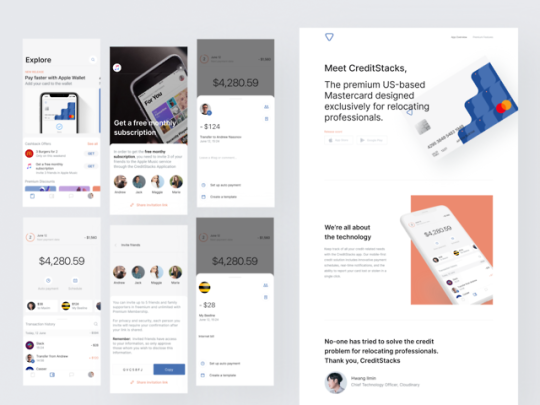

CreditStacks - Fintech Application and Branding by Artem Buryak - Web Design & Web Development

7 notes

·

View notes

Photo

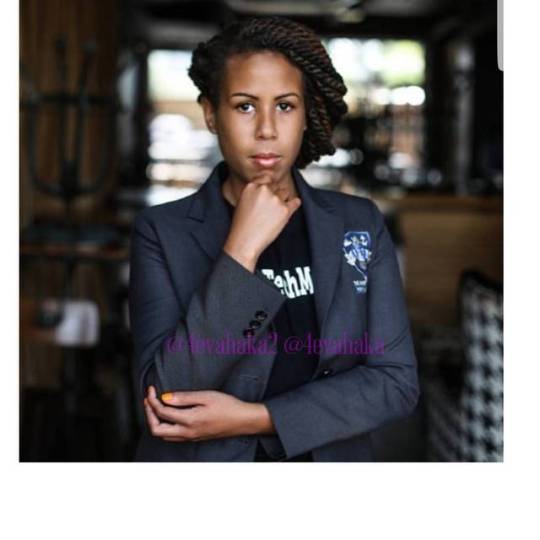

@AngelRich27, the woman who #Forbes is calling "The Next #SteveJobs." #AngelRich, a #HBCUGrad from #HamptonUniversity, developed an #App called "#CreditStacker" that #Teaches # #Budgeting, #Saving, #Investing, #CreditManagement, #Banking, #CarFinancing and much more. Formerly of #Prudential, #Rich earned the company $6BILLION in revenue and her reward; BUT was only given a #Bonus of #30THOUSANDDollars and an offer to pay for an #MBA at the #WhartonSchoolOfBusiness. She left #Prudential and started her OWN BUSINESS #TheWealthFactory, #WashingtonDC based firm that designs #FinancialLiteracy and #WorkforceDevelopmentEducationTechnologyGames." With the start of her new venture, #Rich released a #Book "#TheBlackDollar" revealing why there is a #FinancialGap between #BlackAmericans and #WhiteAmericans. #Rich is being #Endorsed by: #MichelleObama #DepartmentofEducation, #JPMorganChase and more, but her validation hit an all time high after #CreditStacker was #Downloaded #20K times since it's launch two weeks ago. The #App is #FREE! #4evahaka #4evahaka2 @angelrich27 @_hamptonu @hupiratenation @hamptonalumni @nphc_rockhill @_tjfoundation

#hbcugrad#30thousanddollars#teaches#book#mba#downloaded#prudential#20k#departmentofeducation#michelleobama#free#blackamericans#creditmanagement#stevejobs#endorsed#rich#creditstacker#4evahaka#washingtondc#financialliteracy#whartonschoolofbusiness#saving#investing#budgeting#whiteamericans#workforcedevelopmenteducationtechnologygames#forbes#angelrich#theblackdollar#bonus

1 note

·

View note

Photo

#AngelRich is goals! #creditstacker #credit #finance #apps #blackgirlmagic #lifestyleblogger

1 note

·

View note

Photo

Make sure that all of you go download #creditstacker now. It’s a mobile game app that teaches you about credit. Credit is important for building wealth. Shoutout to @angelrich27 for creating something so needed #blackowned #wealthy #phwealthy #money #wealthbuilding #money101 #creditstacker #games #education #growmoney #invest #buyblack #breakthecycle #knowyourmoney https://www.instagram.com/phwealthy/p/Bvc4QLknOOE/?utm_source=ig_tumblr_share&igshid=161xvy4xf27iz

#creditstacker#blackowned#wealthy#phwealthy#money#wealthbuilding#money101#games#education#growmoney#invest#buyblack#breakthecycle#knowyourmoney

0 notes

Text

CreditStacks: A Credit Card for Professionals Coming to the U.S

When moving to the U.S. for work, professionals from other countries often struggle to find financial products that they qualify for, especially when it comes to credit cards. That’s because regardless of the income they’ll earn here or the financial health of the company they’re joining, they’ll still lack a U.S. credit history and likely also a Social Security number — both of which are typically required by many traditional U.S. card issuers. CreditStacks has created a credit card that the company hopes will help solve this problem. The credit card doesn’t rely on traditional credit factors to vet applicants. It doesn’t earn rewards, but it saves cardholders money on fees while helping them build a credit history in the U.S.

The basics of CreditStacks CreditStacks started shipping credit cards to qualified customers in January 2018. The card is designed specifically for working professionals who are new to the U.S., which CEO Elnor Rozenrot says is a market that needs assistance. CreditStacks doesn’t rely on traditional factors like credit history or Social Security numbers to vet applicants. “When I came to the U.S., I couldn’t get a credit card, and it just drove me nuts,” said Rozenrot, who is from Israel. “I walked into a bank on my second day in the U.S., and they opened a bank account for me, but wouldn’t give me a credit card. Six months later, I got a card that only had a $300 credit line. I knew I wasn’t the only one, so I joined up with two other immigrants that had the same issue, and with a veteran U.S. banker, and we decided to figure out how to solve this problem once and for all.” Here’s a look at the card’s baseline benefits: No annual feeNo security depositA credit limit of up to $5,000An APR of 16.74% variable (as of March 2018)No penalty APRNo foreign transaction feeReporting to all three major U.S. credit bureaus: TransUnion, Equifax and ExperianTravel benefits, including a collision damage waiver for rental cars, insurance for lost or damaged luggage, travel accident insurance and trip cancellation/interruption reimbursementSafety benefits and other perks, including MasterCard ID Theft Protection, extended warranty and price protection What makes CreditStacks different CreditStacks offers some features that can be difficult to find elsewhere, including: No Social Security number needed to apply. Although applicants will have to report their Social Security number to CreditStacks once they receive one, that information isn’t required upfront. Instead, applicants will need to provide their passport, visa information and proof of income in the U.S. Potential customers can sign up to be on CreditStacks’ waitlist through the company’s website. Applicants will eventually have to get a Social Security number and report it to CreditStacks, but it isn’t required during the application process. No credit score required. Applicants who lack a U.S. credit history can still receive a credit card as long as they qualify in other ways. When vetting an applicant, the company looks at over 200 data points to determine the creditworthiness of the applicant, including debt-to-income ratio, whether they’ve been brought to the U.S. by an established company and whether there are any red flags in their online presence. Rozenrot declined to provide examples of what CreditStacks would consider an online red flag, but he noted that applicants who lack an online presence entirely might give the issuer pause.Fewer fees. CreditStacks doesn’t charge an annual fee, so you won’t pay to hold the card. Cardholders also avoid foreign transaction fees, meaning there aren’t extra charges to use the card internationally. There’s also no penalty APR, so the issuer won’t raise the interest rate if you pay late or miss a payment. And unlike secured credit cards, which require upfront collateral, you won’t owe a security deposit.Relatively high credit limit. Applicants may be eligible for up to $5,000 in credit. This is fairly high for someone new to credit in the U.S., although it’s possible to find even higher limits in this category. Secured credit cards, by comparison, tend to offer credit limits of only a few hundred dollars. To determine creditworthiness, CreditStacks looks at factors such as debt-to-income ratio and whether the applicant has been brought to the U.S. by an established company.Advance approval. The CreditStacks application process allows applicants to be approved up to 60 days before they move to the U.S. With other major credit card issuers, you may have to wait until you arrive in the U.S. before applying.Cell phone insurance. CreditStacks provides up to $600 in cell phone protection for cardholders who pay their monthly bill with the eligible CreditStacks card. This is a somewhat rare benefit for personal credit cards, and one that can be particularly helpful since CreditStacks’ cardholder account management system is mobile-only. Rozenrot says that a key component of CreditStacks’ mission is to provide guardrails that help customers manage their credit responsibly. For example, the company also plans to roll out an autopay feature that it hopes will help customers make their payments on time and not accumulate debt, so they can keep their credit utilization at the recommended 30% or less of their total credit limit. Potential drawbacks For newcomers to the U.S., CreditStacks can lower some of the barriers to entry for credit cards, while also keeping fees low as credit history is established. But it’s worth noting some of the card’s possible downsides: Approval process. CreditStacks has a waitlist of 8,000 people hoping to apply as of this writing. The timeline for approval is currently within two business days from a customer’s application, although Rozenrot said the company is working on improving that speed. Contrast that with an application for a secured card from a major issuer, which generally has no waitlist and will typically approve or deny an application within minutes.No rewards. You won’t earn any rewards with the card. If this is important to you, look for secured and unsecured cards that offer rewards that you can qualify for.Mobile-only account access. There’s a CreditStacks app, but you won’t be able to access your online account on a desktop computer. Rozenrot says the company wanted to be able to communicate with customers on a regular basis via push notifications and email to teach people how to work with the U.S. credit system. That’s part of what Rozenrot says is the company’s overall goal — to ease the path for working professionals who are making the transition to a different country. “The key part to remember is where we come from,” Rozenrot said. “It paints our approach to our customers. We wanted to make the card and experience that we wish we could have gotten.” Read the full article

0 notes

Text

CreditStacks: A Credit Card for Professionals Coming to the U.S

When moving to the U.S. for work, professionals from other countries often struggle to find financial products that they qualify for, especially when it comes to credit cards. That’s because regardless of the income they’ll earn here or the financial health of the company they’re joining, they’ll still lack a U.S. credit history and likely also a Social Security number — both of which are typically required by many traditional U.S. card issuers. CreditStacks has created a credit card that the company hopes will help solve this problem. The credit card doesn’t rely on traditional credit factors to vet applicants. It doesn’t earn rewards, but it saves cardholders money on fees while helping them build a credit history in the U.S.

The basics of CreditStacks CreditStacks started shipping credit cards to qualified customers in January 2018. The card is designed specifically for working professionals who are new to the U.S., which CEO Elnor Rozenrot says is a market that needs assistance. CreditStacks doesn’t rely on traditional factors like credit history or Social Security numbers to vet applicants. “When I came to the U.S., I couldn’t get a credit card, and it just drove me nuts,” said Rozenrot, who is from Israel. “I walked into a bank on my second day in the U.S., and they opened a bank account for me, but wouldn’t give me a credit card. Six months later, I got a card that only had a $300 credit line. I knew I wasn’t the only one, so I joined up with two other immigrants that had the same issue, and with a veteran U.S. banker, and we decided to figure out how to solve this problem once and for all.” Here’s a look at the card’s baseline benefits: No annual feeNo security depositA credit limit of up to $5,000An APR of 16.74% variable (as of March 2018)No penalty APRNo foreign transaction feeReporting to all three major U.S. credit bureaus: TransUnion, Equifax and ExperianTravel benefits, including a collision damage waiver for rental cars, insurance for lost or damaged luggage, travel accident insurance and trip cancellation/interruption reimbursementSafety benefits and other perks, including MasterCard ID Theft Protection, extended warranty and price protection What makes CreditStacks different CreditStacks offers some features that can be difficult to find elsewhere, including: No Social Security number needed to apply. Although applicants will have to report their Social Security number to CreditStacks once they receive one, that information isn’t required upfront. Instead, applicants will need to provide their passport, visa information and proof of income in the U.S. Potential customers can sign up to be on CreditStacks’ waitlist through the company’s website. Applicants will eventually have to get a Social Security number and report it to CreditStacks, but it isn’t required during the application process. No credit score required. Applicants who lack a U.S. credit history can still receive a credit card as long as they qualify in other ways. When vetting an applicant, the company looks at over 200 data points to determine the creditworthiness of the applicant, including debt-to-income ratio, whether they’ve been brought to the U.S. by an established company and whether there are any red flags in their online presence. Rozenrot declined to provide examples of what CreditStacks would consider an online red flag, but he noted that applicants who lack an online presence entirely might give the issuer pause.Fewer fees. CreditStacks doesn’t charge an annual fee, so you won’t pay to hold the card. Cardholders also avoid foreign transaction fees, meaning there aren’t extra charges to use the card internationally. There’s also no penalty APR, so the issuer won’t raise the interest rate if you pay late or miss a payment. And unlike secured credit cards, which require upfront collateral, you won’t owe a security deposit.Relatively high credit limit. Applicants may be eligible for up to $5,000 in credit. This is fairly high for someone new to credit in the U.S., although it’s possible to find even higher limits in this category. Secured credit cards, by comparison, tend to offer credit limits of only a few hundred dollars. To determine creditworthiness, CreditStacks looks at factors such as debt-to-income ratio and whether the applicant has been brought to the U.S. by an established company.Advance approval. The CreditStacks application process allows applicants to be approved up to 60 days before they move to the U.S. With other major credit card issuers, you may have to wait until you arrive in the U.S. before applying.Cell phone insurance. CreditStacks provides up to $600 in cell phone protection for cardholders who pay their monthly bill with the eligible CreditStacks card. This is a somewhat rare benefit for personal credit cards, and one that can be particularly helpful since CreditStacks’ cardholder account management system is mobile-only. Rozenrot says that a key component of CreditStacks’ mission is to provide guardrails that help customers manage their credit responsibly. For example, the company also plans to roll out an autopay feature that it hopes will help customers make their payments on time and not accumulate debt, so they can keep their credit utilization at the recommended 30% or less of their total credit limit. Potential drawbacks For newcomers to the U.S., CreditStacks can lower some of the barriers to entry for credit cards, while also keeping fees low as credit history is established. But it’s worth noting some of the card’s possible downsides: Approval process. CreditStacks has a waitlist of 8,000 people hoping to apply as of this writing. The timeline for approval is currently within two business days from a customer’s application, although Rozenrot said the company is working on improving that speed. Contrast that with an application for a secured card from a major issuer, which generally has no waitlist and will typically approve or deny an application within minutes.No rewards. You won’t earn any rewards with the card. If this is important to you, look for secured and unsecured cards that offer rewards that you can qualify for.Mobile-only account access. There’s a CreditStacks app, but you won’t be able to access your online account on a desktop computer. Rozenrot says the company wanted to be able to communicate with customers on a regular basis via push notifications and email to teach people how to work with the U.S. credit system. That’s part of what Rozenrot says is the company’s overall goal — to ease the path for working professionals who are making the transition to a different country. “The key part to remember is where we come from,” Rozenrot said. “It paints our approach to our customers. We wanted to make the card and experience that we wish we could have gotten.” Read the full article

0 notes

Text

Personal Charge Cards 2021: Top 5 No Credit Check Cards

Personal Charge Cards 2021: Top 5 No Credit Check Cards

Easy Loans 👉 http://buildinternetwealth.com/LOANSCOMBOFree Business Videos 👉 https://houstonmcmiller.net/

youtube

Choosing the right personal charge card when you have bad credit is challenging.

There are many companies that offer credit to people with bad credit, but they charge high interest rates and an upfront payment.

Nonetheless, I have discover 5 personal charge cards that work with people with no credit or bad credit.

Can I Really Get The Tomo Personal Charge Cards No Credit Check?

With the Tomo Credit Card, you don’t need a credit history or do they charge any fees.

Tomo uses a third party service provider called Plaid to integrate various bank accounts across the United States. Plaid handles the encrypting of all data and maintains the highest level of security. Tomo does not store any bank account login details and they will not be visible to Tomo employees at any point.

In order to give a credit limit, Tomo looks at your bank accounts and other factors to help determine your credit limit. In order to obtain the highest limit, we recommend that you connect all bank accounts or the account with the highest balance.

t’s actually a debit card that works like a credit card with a 21 day grace period. They also require you to link your bank account. “To sustain a card that doesn’t require a credit score, deposit, or fee of any kind, your bank balance becomes a primary input for our underwriting.

Will The Deserve Credit Card Approve Me With No Credit History?

The Deserve Edu card is designed for students with limited or no credit history, both in the U.S. and abroad.

You can qualify for the Deserve Edu without any established credit, because Deserve will check more than the typical creditworthiness factors when you apply.

This card is rare in that it doesn’t require an SSN to apply, meaning international students are free to apply (with some requirements). If you do get an SSN later on, you should provide it to Deserve so your card activity can help you build credit.

Unlike secured cards, which are often the best options for people with limited or no credit history, the Deserve Edu doesn’t require a security deposit to be approved and establish a credit limit.

How is the Surge Credit Card with No Credit Check Different Than Other Cards?

The Surge Mastercard® Credit Card is a legit credit card for people with bad credit, not a scam. It reports to the three major credit bureaus each month, which allows cardholders to build credit by paying on time and using only a portion of their credit limit.

Surge Mastercard is issued by Celtic Bank, which is owned by Continental Finance. This company specializes in issuing credit cards to consumers who have less-than-perfect credit.

To pre-qualified for it, there is no impact to your credit score and it reports to all 3 major credit bureaus.

As a matter of fact, you get free access to your Vantage 3.0 score from TransUnion*.

Is it possible to get approved for The Jasper Credit Card With No Credit Check or SSN?

*Jasper Legal Disclosure: ² No SSN is required to apply for applicants who are new to the U.S. and are in the country on a work visa. SSN is required within 60 days of card activation.…A Social Security number² is not needed to apply

A passport.

Visa information.

Proof of U.S. employment.

Even though, it’s designed for those moving or newly moved to the U.S., the Jasper Mastercard (re-branded from the CreditStacks Mastercard) provides a way to get your feet wet in the world of credit cards. With no credit scores required and some useful benefits and protections, it’s a helpful way to get a handhold in your new home.

Unfortunately, credit limit are maxed out at $5,000 for all approved applicants. However, the greate news is that that there are not any annual fees or any foreign transaction fees.

How Does The First Premier Bank Credit Card Me Build Credit?

First PREMIER is popular for its subprime credit card offerings, which cater to the poor-credit (credit scores below 650) consumer market. This means that those with low credit scores who would be turned down for unsecured credit from most mainstream issuers are more likely to qualify for a First PREMIER credit card.

It has an easy application process that won’t hurt your credit score. That’s a big difference from your typical credit card, which requires a hard pull. It does have a high ongoing APR at 24.90%, plus an annual fee ranging from $35 – $99.

Unforturnately, the First Premier Bank Platinum card was not a good credit card and it is no longer available to new applicants. It had a very high-interest rate, annual fee, monthly fee, high credit limit increase fee, honestly, there was a fee for just about everything. Get a Discover it Secured or a Capital One Secured instead.

Conclusion:

youtube

If you’re looking for new easy approval personal charge cards with bad credit or no ssn. In this blog, I share with you 5 new cards that work with people with challenging or limited credit.

If you’re in need of credit repair check out 3waycredit.com

0 notes

Text

Personal Charge Cards 2021: Top 5 No Credit Check Cards

Personal Charge Cards 2021: Top 5 No Credit Check Cards

Easy Loans 👉 http://buildinternetwealth.com/LOANSCOMBOFree Business Videos 👉 https://houstonmcmiller.net/

youtube

Choosing the right personal charge card when you have bad credit is challenging.

There are many companies that offer credit to people with bad credit, but they charge high interest rates and an upfront payment.

Nonetheless, I have discover 5 personal charge cards that work with people with no credit or bad credit.

Can I Really Get The Tomo Personal Charge Cards No Credit Check?

With the Tomo Credit Card, you don’t need a credit history or do they charge any fees.

Tomo uses a third party service provider called Plaid to integrate various bank accounts across the United States. Plaid handles the encrypting of all data and maintains the highest level of security. Tomo does not store any bank account login details and they will not be visible to Tomo employees at any point.

In order to give a credit limit, Tomo looks at your bank accounts and other factors to help determine your credit limit. In order to obtain the highest limit, we recommend that you connect all bank accounts or the account with the highest balance.

t’s actually a debit card that works like a credit card with a 21 day grace period. They also require you to link your bank account. “To sustain a card that doesn’t require a credit score, deposit, or fee of any kind, your bank balance becomes a primary input for our underwriting.

Will The Deserve Credit Card Approve Me With No Credit History?

The Deserve Edu card is designed for students with limited or no credit history, both in the U.S. and abroad.

You can qualify for the Deserve Edu without any established credit, because Deserve will check more than the typical creditworthiness factors when you apply.

This card is rare in that it doesn’t require an SSN to apply, meaning international students are free to apply (with some requirements). If you do get an SSN later on, you should provide it to Deserve so your card activity can help you build credit.

Unlike secured cards, which are often the best options for people with limited or no credit history, the Deserve Edu doesn’t require a security deposit to be approved and establish a credit limit.

How is the Surge Credit Card with No Credit Check Different Than Other Cards?

The Surge Mastercard® Credit Card is a legit credit card for people with bad credit, not a scam. It reports to the three major credit bureaus each month, which allows cardholders to build credit by paying on time and using only a portion of their credit limit.

Surge Mastercard is issued by Celtic Bank, which is owned by Continental Finance. This company specializes in issuing credit cards to consumers who have less-than-perfect credit.

To pre-qualified for it, there is no impact to your credit score and it reports to all 3 major credit bureaus.

As a matter of fact, you get free access to your Vantage 3.0 score from TransUnion*.

Is it possible to get approved for The Jasper Credit Card With No Credit Check or SSN?

*Jasper Legal Disclosure: ² No SSN is required to apply for applicants who are new to the U.S. and are in the country on a work visa. SSN is required within 60 days of card activation.…A Social Security number² is not needed to apply

A passport.

Visa information.

Proof of U.S. employment.

Even though, it’s designed for those moving or newly moved to the U.S., the Jasper Mastercard (re-branded from the CreditStacks Mastercard) provides a way to get your feet wet in the world of credit cards. With no credit scores required and some useful benefits and protections, it’s a helpful way to get a handhold in your new home.

Unfortunately, credit limit are maxed out at $5,000 for all approved applicants. However, the greate news is that that there are not any annual fees or any foreign transaction fees.

How Does The First Premier Bank Credit Card Me Build Credit?

First PREMIER is popular for its subprime credit card offerings, which cater to the poor-credit (credit scores below 650) consumer market. This means that those with low credit scores who would be turned down for unsecured credit from most mainstream issuers are more likely to qualify for a First PREMIER credit card.

It has an easy application process that won’t hurt your credit score. That’s a big difference from your typical credit card, which requires a hard pull. It does have a high ongoing APR at 24.90%, plus an annual fee ranging from $35 – $99.

Unforturnately, the First Premier Bank Platinum card was not a good credit card and it is no longer available to new applicants. It had a very high-interest rate, annual fee, monthly fee, high credit limit increase fee, honestly, there was a fee for just about everything. Get a Discover it Secured or a Capital One Secured instead.

Conclusion:

youtube

If you’re looking for new easy approval personal charge cards with bad credit or no ssn. In this blog, I share with you 5 new cards that work with people with challenging or limited credit.

If you’re in need of credit repair check out 3waycredit.com

0 notes

Text

Personal Charge Cards 2021: Top 5 No Credit Check Cards

Personal Charge Cards 2021: Top 5 No Credit Check Cards

Easy Loans 👉 http://buildinternetwealth.com/LOANSCOMBOFree Business Videos 👉 https://houstonmcmiller.net/

youtube

Choosing the right personal charge card when you have bad credit is challenging.

There are many companies that offer credit to people with bad credit, but they charge high interest rates and an upfront payment.

Nonetheless, I have discover 5 personal charge cards that work with people with no credit or bad credit.

Can I Really Get The Tomo Personal Charge Cards No Credit Check?

With the Tomo Credit Card, you don’t need a credit history or do they charge any fees.

Tomo uses a third party service provider called Plaid to integrate various bank accounts across the United States. Plaid handles the encrypting of all data and maintains the highest level of security. Tomo does not store any bank account login details and they will not be visible to Tomo employees at any point.

In order to give a credit limit, Tomo looks at your bank accounts and other factors to help determine your credit limit. In order to obtain the highest limit, we recommend that you connect all bank accounts or the account with the highest balance.

t’s actually a debit card that works like a credit card with a 21 day grace period. They also require you to link your bank account. “To sustain a card that doesn’t require a credit score, deposit, or fee of any kind, your bank balance becomes a primary input for our underwriting.

Will The Deserve Credit Card Approve Me With No Credit History?

The Deserve Edu card is designed for students with limited or no credit history, both in the U.S. and abroad.

You can qualify for the Deserve Edu without any established credit, because Deserve will check more than the typical creditworthiness factors when you apply.

This card is rare in that it doesn’t require an SSN to apply, meaning international students are free to apply (with some requirements). If you do get an SSN later on, you should provide it to Deserve so your card activity can help you build credit.

Unlike secured cards, which are often the best options for people with limited or no credit history, the Deserve Edu doesn’t require a security deposit to be approved and establish a credit limit.

How is the Surge Credit Card with No Credit Check Different Than Other Cards?

The Surge Mastercard® Credit Card is a legit credit card for people with bad credit, not a scam. It reports to the three major credit bureaus each month, which allows cardholders to build credit by paying on time and using only a portion of their credit limit.

Surge Mastercard is issued by Celtic Bank, which is owned by Continental Finance. This company specializes in issuing credit cards to consumers who have less-than-perfect credit.

To pre-qualified for it, there is no impact to your credit score and it reports to all 3 major credit bureaus.

As a matter of fact, you get free access to your Vantage 3.0 score from TransUnion*.

Is it possible to get approved for The Jasper Credit Card With No Credit Check or SSN?

*Jasper Legal Disclosure: ² No SSN is required to apply for applicants who are new to the U.S. and are in the country on a work visa. SSN is required within 60 days of card activation.…A Social Security number² is not needed to apply

A passport.

Visa information.

Proof of U.S. employment.

Even though, it’s designed for those moving or newly moved to the U.S., the Jasper Mastercard (re-branded from the CreditStacks Mastercard) provides a way to get your feet wet in the world of credit cards. With no credit scores required and some useful benefits and protections, it’s a helpful way to get a handhold in your new home.

Unfortunately, credit limit are maxed out at $5,000 for all approved applicants. However, the greate news is that that there are not any annual fees or any foreign transaction fees.

How Does The First Premier Bank Credit Card Me Build Credit?

First PREMIER is popular for its subprime credit card offerings, which cater to the poor-credit (credit scores below 650) consumer market. This means that those with low credit scores who would be turned down for unsecured credit from most mainstream issuers are more likely to qualify for a First PREMIER credit card.

It has an easy application process that won’t hurt your credit score. That’s a big difference from your typical credit card, which requires a hard pull. It does have a high ongoing APR at 24.90%, plus an annual fee ranging from $35 – $99.

Unforturnately, the First Premier Bank Platinum card was not a good credit card and it is no longer available to new applicants. It had a very high-interest rate, annual fee, monthly fee, high credit limit increase fee, honestly, there was a fee for just about everything. Get a Discover it Secured or a Capital One Secured instead.

Conclusion:

youtube

If you’re looking for new easy approval personal charge cards with bad credit or no ssn. In this blog, I share with you 5 new cards that work with people with challenging or limited credit.

If you’re in need of credit repair check out 3waycredit.com

0 notes

Text

Personal Charge Cards 2021: Top 5 No Credit Check Cards

Personal Charge Cards 2021: Top 5 No Credit Check Cards

Easy Loans 👉 http://buildinternetwealth.com/LOANSCOMBOFree Business Videos 👉 https://houstonmcmiller.net/

youtube

Choosing the right personal charge card when you have bad credit is challenging.

There are many companies that offer credit to people with bad credit, but they charge high interest rates and an upfront payment.

Nonetheless, I have discover 5 personal charge cards that work with people with no credit or bad credit.

Can I Really Get The Tomo Personal Charge Cards No Credit Check?

With the Tomo Credit Card, you don’t need a credit history or do they charge any fees.

Tomo uses a third party service provider called Plaid to integrate various bank accounts across the United States. Plaid handles the encrypting of all data and maintains the highest level of security. Tomo does not store any bank account login details and they will not be visible to Tomo employees at any point.

In order to give a credit limit, Tomo looks at your bank accounts and other factors to help determine your credit limit. In order to obtain the highest limit, we recommend that you connect all bank accounts or the account with the highest balance.

t’s actually a debit card that works like a credit card with a 21 day grace period. They also require you to link your bank account. “To sustain a card that doesn’t require a credit score, deposit, or fee of any kind, your bank balance becomes a primary input for our underwriting.

Will The Deserve Credit Card Approve Me With No Credit History?

The Deserve Edu card is designed for students with limited or no credit history, both in the U.S. and abroad.

You can qualify for the Deserve Edu without any established credit, because Deserve will check more than the typical creditworthiness factors when you apply.

This card is rare in that it doesn’t require an SSN to apply, meaning international students are free to apply (with some requirements). If you do get an SSN later on, you should provide it to Deserve so your card activity can help you build credit.

Unlike secured cards, which are often the best options for people with limited or no credit history, the Deserve Edu doesn’t require a security deposit to be approved and establish a credit limit.

How is the Surge Credit Card with No Credit Check Different Than Other Cards?

The Surge Mastercard® Credit Card is a legit credit card for people with bad credit, not a scam. It reports to the three major credit bureaus each month, which allows cardholders to build credit by paying on time and using only a portion of their credit limit.

Surge Mastercard is issued by Celtic Bank, which is owned by Continental Finance. This company specializes in issuing credit cards to consumers who have less-than-perfect credit.

To pre-qualified for it, there is no impact to your credit score and it reports to all 3 major credit bureaus.

As a matter of fact, you get free access to your Vantage 3.0 score from TransUnion*.

Is it possible to get approved for The Jasper Credit Card With No Credit Check or SSN?

*Jasper Legal Disclosure: ² No SSN is required to apply for applicants who are new to the U.S. and are in the country on a work visa. SSN is required within 60 days of card activation.…A Social Security number² is not needed to apply

A passport.

Visa information.

Proof of U.S. employment.

Even though, it’s designed for those moving or newly moved to the U.S., the Jasper Mastercard (re-branded from the CreditStacks Mastercard) provides a way to get your feet wet in the world of credit cards. With no credit scores required and some useful benefits and protections, it’s a helpful way to get a handhold in your new home.

Unfortunately, credit limit are maxed out at $5,000 for all approved applicants. However, the greate news is that that there are not any annual fees or any foreign transaction fees.

How Does The First Premier Bank Credit Card Me Build Credit?

First PREMIER is popular for its subprime credit card offerings, which cater to the poor-credit (credit scores below 650) consumer market. This means that those with low credit scores who would be turned down for unsecured credit from most mainstream issuers are more likely to qualify for a First PREMIER credit card.

It has an easy application process that won’t hurt your credit score. That’s a big difference from your typical credit card, which requires a hard pull. It does have a high ongoing APR at 24.90%, plus an annual fee ranging from $35 – $99.

Unforturnately, the First Premier Bank Platinum card was not a good credit card and it is no longer available to new applicants. It had a very high-interest rate, annual fee, monthly fee, high credit limit increase fee, honestly, there was a fee for just about everything. Get a Discover it Secured or a Capital One Secured instead.

Conclusion:

youtube

If you’re looking for new easy approval personal charge cards with bad credit or no ssn. In this blog, I share with you 5 new cards that work with people with challenging or limited credit.

If you’re in need of credit repair check out 3waycredit.com

0 notes

Text

Personal Charge Cards 2021: Top 5 No Credit Check Cards

Personal Charge Cards 2021: Top 5 No Credit Check Cards

Easy Loans 👉 http://buildinternetwealth.com/LOANSCOMBOFree Business Videos 👉 https://houstonmcmiller.net/

youtube

Choosing the right personal charge card when you have bad credit is challenging.

There are many companies that offer credit to people with bad credit, but they charge high interest rates and an upfront payment.

Nonetheless, I have discover 5 personal charge cards that work with people with no credit or bad credit.

Can I Really Get The Tomo Personal Charge Cards No Credit Check?

With the Tomo Credit Card, you don’t need a credit history or do they charge any fees.

Tomo uses a third party service provider called Plaid to integrate various bank accounts across the United States. Plaid handles the encrypting of all data and maintains the highest level of security. Tomo does not store any bank account login details and they will not be visible to Tomo employees at any point.

In order to give a credit limit, Tomo looks at your bank accounts and other factors to help determine your credit limit. In order to obtain the highest limit, we recommend that you connect all bank accounts or the account with the highest balance.

t’s actually a debit card that works like a credit card with a 21 day grace period. They also require you to link your bank account. “To sustain a card that doesn’t require a credit score, deposit, or fee of any kind, your bank balance becomes a primary input for our underwriting.

Will The Deserve Credit Card Approve Me With No Credit History?

The Deserve Edu card is designed for students with limited or no credit history, both in the U.S. and abroad.

You can qualify for the Deserve Edu without any established credit, because Deserve will check more than the typical creditworthiness factors when you apply.

This card is rare in that it doesn’t require an SSN to apply, meaning international students are free to apply (with some requirements). If you do get an SSN later on, you should provide it to Deserve so your card activity can help you build credit.

Unlike secured cards, which are often the best options for people with limited or no credit history, the Deserve Edu doesn’t require a security deposit to be approved and establish a credit limit.

How is the Surge Credit Card with No Credit Check Different Than Other Cards?

The Surge Mastercard® Credit Card is a legit credit card for people with bad credit, not a scam. It reports to the three major credit bureaus each month, which allows cardholders to build credit by paying on time and using only a portion of their credit limit.

Surge Mastercard is issued by Celtic Bank, which is owned by Continental Finance. This company specializes in issuing credit cards to consumers who have less-than-perfect credit.

To pre-qualified for it, there is no impact to your credit score and it reports to all 3 major credit bureaus.

As a matter of fact, you get free access to your Vantage 3.0 score from TransUnion*.

Is it possible to get approved for The Jasper Credit Card With No Credit Check or SSN?

*Jasper Legal Disclosure: ² No SSN is required to apply for applicants who are new to the U.S. and are in the country on a work visa. SSN is required within 60 days of card activation.…A Social Security number² is not needed to apply

A passport.

Visa information.

Proof of U.S. employment.

Even though, it’s designed for those moving or newly moved to the U.S., the Jasper Mastercard (re-branded from the CreditStacks Mastercard) provides a way to get your feet wet in the world of credit cards. With no credit scores required and some useful benefits and protections, it’s a helpful way to get a handhold in your new home.

Unfortunately, credit limit are maxed out at $5,000 for all approved applicants. However, the greate news is that that there are not any annual fees or any foreign transaction fees.

How Does The First Premier Bank Credit Card Me Build Credit?

First PREMIER is popular for its subprime credit card offerings, which cater to the poor-credit (credit scores below 650) consumer market. This means that those with low credit scores who would be turned down for unsecured credit from most mainstream issuers are more likely to qualify for a First PREMIER credit card.

It has an easy application process that won’t hurt your credit score. That’s a big difference from your typical credit card, which requires a hard pull. It does have a high ongoing APR at 24.90%, plus an annual fee ranging from $35 – $99.

Unforturnately, the First Premier Bank Platinum card was not a good credit card and it is no longer available to new applicants. It had a very high-interest rate, annual fee, monthly fee, high credit limit increase fee, honestly, there was a fee for just about everything. Get a Discover it Secured or a Capital One Secured instead.

Conclusion:

youtube

If you’re looking for new easy approval personal charge cards with bad credit or no ssn. In this blog, I share with you 5 new cards that work with people with challenging or limited credit.

If you’re in need of credit repair check out 3waycredit.com

0 notes

Text

Personal Charge Cards 2021: Top 5 No Credit Check Cards

Personal Charge Cards 2021: Top 5 No Credit Check Cards

Easy Loans 👉 http://buildinternetwealth.com/LOANSCOMBOFree Business Videos 👉 https://houstonmcmiller.net/

youtube

Choosing the right personal charge card when you have bad credit is challenging.

There are many companies that offer credit to people with bad credit, but they charge high interest rates and an upfront payment.

Nonetheless, I have discover 5 personal charge cards that work with people with no credit or bad credit.

Can I Really Get The Tomo Personal Charge Cards No Credit Check?

With the Tomo Credit Card, you don’t need a credit history or do they charge any fees.

Tomo uses a third party service provider called Plaid to integrate various bank accounts across the United States. Plaid handles the encrypting of all data and maintains the highest level of security. Tomo does not store any bank account login details and they will not be visible to Tomo employees at any point.

In order to give a credit limit, Tomo looks at your bank accounts and other factors to help determine your credit limit. In order to obtain the highest limit, we recommend that you connect all bank accounts or the account with the highest balance.

t’s actually a debit card that works like a credit card with a 21 day grace period. They also require you to link your bank account. “To sustain a card that doesn’t require a credit score, deposit, or fee of any kind, your bank balance becomes a primary input for our underwriting.

Will The Deserve Credit Card Approve Me With No Credit History?

The Deserve Edu card is designed for students with limited or no credit history, both in the U.S. and abroad.

You can qualify for the Deserve Edu without any established credit, because Deserve will check more than the typical creditworthiness factors when you apply.

This card is rare in that it doesn’t require an SSN to apply, meaning international students are free to apply (with some requirements). If you do get an SSN later on, you should provide it to Deserve so your card activity can help you build credit.

Unlike secured cards, which are often the best options for people with limited or no credit history, the Deserve Edu doesn’t require a security deposit to be approved and establish a credit limit.

How is the Surge Credit Card with No Credit Check Different Than Other Cards?

The Surge Mastercard® Credit Card is a legit credit card for people with bad credit, not a scam. It reports to the three major credit bureaus each month, which allows cardholders to build credit by paying on time and using only a portion of their credit limit.

Surge Mastercard is issued by Celtic Bank, which is owned by Continental Finance. This company specializes in issuing credit cards to consumers who have less-than-perfect credit.

To pre-qualified for it, there is no impact to your credit score and it reports to all 3 major credit bureaus.

As a matter of fact, you get free access to your Vantage 3.0 score from TransUnion*.

Is it possible to get approved for The Jasper Credit Card With No Credit Check or SSN?

*Jasper Legal Disclosure: ² No SSN is required to apply for applicants who are new to the U.S. and are in the country on a work visa. SSN is required within 60 days of card activation.…A Social Security number² is not needed to apply

A passport.

Visa information.

Proof of U.S. employment.

Even though, it’s designed for those moving or newly moved to the U.S., the Jasper Mastercard (re-branded from the CreditStacks Mastercard) provides a way to get your feet wet in the world of credit cards. With no credit scores required and some useful benefits and protections, it’s a helpful way to get a handhold in your new home.

Unfortunately, credit limit are maxed out at $5,000 for all approved applicants. However, the greate news is that that there are not any annual fees or any foreign transaction fees.

How Does The First Premier Bank Credit Card Me Build Credit?

First PREMIER is popular for its subprime credit card offerings, which cater to the poor-credit (credit scores below 650) consumer market. This means that those with low credit scores who would be turned down for unsecured credit from most mainstream issuers are more likely to qualify for a First PREMIER credit card.

It has an easy application process that won’t hurt your credit score. That’s a big difference from your typical credit card, which requires a hard pull. It does have a high ongoing APR at 24.90%, plus an annual fee ranging from $35 – $99.

Unforturnately, the First Premier Bank Platinum card was not a good credit card and it is no longer available to new applicants. It had a very high-interest rate, annual fee, monthly fee, high credit limit increase fee, honestly, there was a fee for just about everything. Get a Discover it Secured or a Capital One Secured instead.

Conclusion:

youtube

If you’re looking for new easy approval personal charge cards with bad credit or no ssn. In this blog, I share with you 5 new cards that work with people with challenging or limited credit.

If you’re in need of credit repair check out 3waycredit.com

0 notes

Text

Personal Charge Cards 2021: Top 5 No Credit Check Cards

Personal Charge Cards 2021: Top 5 No Credit Check Cards

Easy Loans 👉 http://buildinternetwealth.com/LOANSCOMBOFree Business Videos 👉 https://houstonmcmiller.net/

youtube

Choosing the right personal charge card when you have bad credit is challenging.

There are many companies that offer credit to people with bad credit, but they charge high interest rates and an upfront payment.

Nonetheless, I have discover 5 personal charge cards that work with people with no credit or bad credit.

Can I Really Get The Tomo Personal Charge Cards No Credit Check?

With the Tomo Credit Card, you don’t need a credit history or do they charge any fees.

Tomo uses a third party service provider called Plaid to integrate various bank accounts across the United States. Plaid handles the encrypting of all data and maintains the highest level of security. Tomo does not store any bank account login details and they will not be visible to Tomo employees at any point.

In order to give a credit limit, Tomo looks at your bank accounts and other factors to help determine your credit limit. In order to obtain the highest limit, we recommend that you connect all bank accounts or the account with the highest balance.

t’s actually a debit card that works like a credit card with a 21 day grace period. They also require you to link your bank account. “To sustain a card that doesn’t require a credit score, deposit, or fee of any kind, your bank balance becomes a primary input for our underwriting.

Will The Deserve Credit Card Approve Me With No Credit History?

The Deserve Edu card is designed for students with limited or no credit history, both in the U.S. and abroad.

You can qualify for the Deserve Edu without any established credit, because Deserve will check more than the typical creditworthiness factors when you apply.

This card is rare in that it doesn’t require an SSN to apply, meaning international students are free to apply (with some requirements). If you do get an SSN later on, you should provide it to Deserve so your card activity can help you build credit.

Unlike secured cards, which are often the best options for people with limited or no credit history, the Deserve Edu doesn’t require a security deposit to be approved and establish a credit limit.

How is the Surge Credit Card with No Credit Check Different Than Other Cards?

The Surge Mastercard® Credit Card is a legit credit card for people with bad credit, not a scam. It reports to the three major credit bureaus each month, which allows cardholders to build credit by paying on time and using only a portion of their credit limit.

Surge Mastercard is issued by Celtic Bank, which is owned by Continental Finance. This company specializes in issuing credit cards to consumers who have less-than-perfect credit.

To pre-qualified for it, there is no impact to your credit score and it reports to all 3 major credit bureaus.

As a matter of fact, you get free access to your Vantage 3.0 score from TransUnion*.

Is it possible to get approved for The Jasper Credit Card With No Credit Check or SSN?

*Jasper Legal Disclosure: ² No SSN is required to apply for applicants who are new to the U.S. and are in the country on a work visa. SSN is required within 60 days of card activation.…A Social Security number² is not needed to apply

A passport.

Visa information.

Proof of U.S. employment.

Even though, it’s designed for those moving or newly moved to the U.S., the Jasper Mastercard (re-branded from the CreditStacks Mastercard) provides a way to get your feet wet in the world of credit cards. With no credit scores required and some useful benefits and protections, it’s a helpful way to get a handhold in your new home.

Unfortunately, credit limit are maxed out at $5,000 for all approved applicants. However, the greate news is that that there are not any annual fees or any foreign transaction fees.

How Does The First Premier Bank Credit Card Me Build Credit?

First PREMIER is popular for its subprime credit card offerings, which cater to the poor-credit (credit scores below 650) consumer market. This means that those with low credit scores who would be turned down for unsecured credit from most mainstream issuers are more likely to qualify for a First PREMIER credit card.

It has an easy application process that won’t hurt your credit score. That’s a big difference from your typical credit card, which requires a hard pull. It does have a high ongoing APR at 24.90%, plus an annual fee ranging from $35 – $99.

Unforturnately, the First Premier Bank Platinum card was not a good credit card and it is no longer available to new applicants. It had a very high-interest rate, annual fee, monthly fee, high credit limit increase fee, honestly, there was a fee for just about everything. Get a Discover it Secured or a Capital One Secured instead.

Conclusion:

youtube

If you’re looking for new easy approval personal charge cards with bad credit or no ssn. In this blog, I share with you 5 new cards that work with people with challenging or limited credit.

If you’re in need of credit repair check out 3waycredit.com

0 notes

Photo

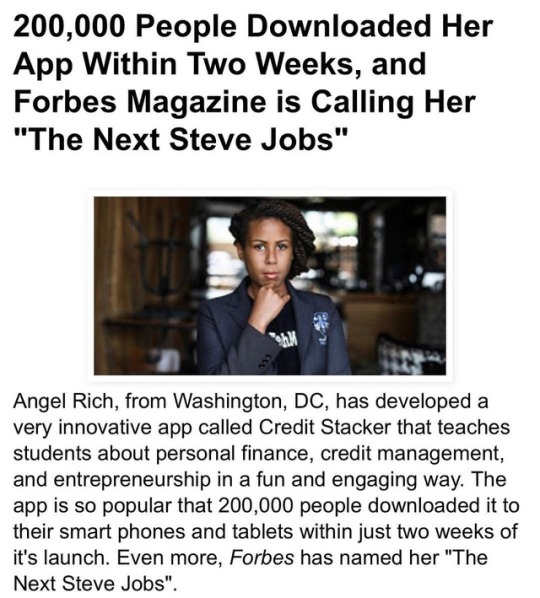

#AngelRich, from Washington, DC, has developed a very innovative app called Credit Stacker that teaches students about personal finance, credit management, and entrepreneurship in a fun and engaging way. The app is so popular that 200,000 people downloaded it to their smart phones and tablets within just two weeks of it's launch. Even more, Forbes has named her "The Next Steve Jobs". Remarkably, the app has been named the "best financial literacy product in the country" by the Office of Michelle Obama, the "best learning game in the country" by the Department of Education, and the "best solution in the world for reducing poverty" by JP Morgan Chase. It has won first place in several business competitions including the Industrial Bank Small Business Regional Competition, the Prudential Financial National Case Competition, and the Goldman Sachs Portfolio Challenge. All in all, Angel has one more than $50,000 in business grants. Her background Angel was raised in Washington, DC, and graduated from Hampton University. She also studied at the University of International Business and Economics in Beijing, China. After winning Prudential’s annual National Case competition for her marketing plan to reach millennials, she worked briefly as a global market research analyst for Prudential, where she conducted over 70 financial behavior modification studies. She says that during her time there, she helped the company generate more than $6 billion in revenue. She resigned, however in 2013, to start her own company, The Wealth Factory. Reaching her company goals Angel's ultimate goal with her company is (and has always been) to develop financial literacy edtech games that empower and educate both students and adults. And she has been very successful at doing this! In fact, her company has been so impressive that the National Alliance of Public Charter Schools named it the ninth best ed-tech company of 2015. Her company's #CreditStacker app is available in four languages and in 40 countries, and is quickly approaching 1 million downloads. Although the app is free for users to download, the revenue model is to generate money on the back-end - #regrann

0 notes

Text

CreditStacks Card Rebranding to Jasper, Expanding Its Target Audience

CreditStacks Card Rebranding to Jasper, Expanding Its Target Audience https://ift.tt/3cVebkn

0 notes