#CustomsDeclarations

Explore tagged Tumblr posts

Text

Customs Declarations: A Comprehensive Guide for UK Businesses

The customs declarations process is a crucial aspect of international trade for businesses operating in the United Kingdom. Whether importing goods from overseas or exporting to global markets, businesses must comply with customs regulations to ensure smooth trade operations. Understanding the intricacies of customs declarations can help businesses avoid delays, penalties, and unnecessary expenses.

In this comprehensive guide, we will explore everything UK businesses need to know about customs declarations, including what they are, why they are important, how to complete them, and best practices for compliance.

What Are Customs Declarations?

A customs declaration is an official document submitted to customs authorities detailing goods being imported or exported. This declaration provides crucial information, including the type of goods, their origin, their value, and applicable duties or taxes.

In the UK, customs declarations must be submitted to HM Revenue and Customs (HMRC) via the Customs Declaration Service (CDS). These declarations are necessary for clearing goods through customs and ensuring compliance with trade laws.

Why Are Customs Declarations Important?

Properly completing and submitting customs declarations is essential for several reasons:

Legal Compliance: Ensures businesses adhere to UK and international trade laws.

Taxation & Duties: Determines the correct amount of import duty and VAT to be paid.

Supply Chain Efficiency: Reduces delays at ports and borders.

Security & Safety: Helps prevent the movement of illegal or restricted goods.

Trade Statistics: Assists in collecting valuable trade data for government analysis.

When Are Customs Declarations Required?

Imports into the UK:

Businesses importing goods into the UK must complete an import customs declaration before goods are cleared by UK customs. This declaration includes information on the shipment, its value, country of origin, and applicable duties.

Exports from the UK:

UK businesses exporting goods must complete an export customs declaration to ensure compliance with destination country regulations. This declaration helps in determining whether any restrictions or additional checks apply.

How to Complete a Customs Declaration

Submitting customs declarations correctly is vital to avoid delays and penalties. Here’s a step-by-step process for UK businesses:

Gather Required Information:

Commodity code of goods

Country of origin

Value of goods

Applicable duties and VAT

Transport details

Importer and exporter details

Register for a GB EORI Number: UK businesses must have an Economic Operator Registration and Identification (EORI) number to submit customs declarations.

Use the Customs Declaration Service (CDS):

Businesses must submit declarations through CDS, which has replaced the previous CHIEF system.

CDS allows for electronic submissions and tracking of customs declarations.

Determine the Right Customs Procedure Codes (CPCs):

CPCs help customs authorities determine the purpose of the goods and applicable duties.

Submit the Declaration Electronically:

Declarations can be filed through a customs broker, freight forwarder, or customs software.

Pay Any Applicable Duties or Taxes:

HMRC will calculate the duties and VAT based on the declaration details.

Receive Clearance Confirmation:

Once approved, goods can proceed through customs.

Common Mistakes to Avoid in Customs Declarations

Many UK businesses face issues due to incorrect customs declarations. Some common mistakes include:

Incorrect Commodity Codes: Using the wrong code can result in incorrect duty payments.

Incomplete Documentation: Missing information can lead to customs delays.

Late Submissions: Failing to submit the declaration on time may result in penalties.

Incorrect Valuation of Goods: Underreporting or overreporting the value can cause compliance issues.

Ignoring Customs Procedures: Some goods require additional permits or licenses.

Best Practices for Smooth Customs Declarations

To ensure seamless customs declarations, UK businesses should:

Stay Updated with UK Customs Regulations: Rules and tariffs change frequently, so staying informed is crucial.

Work with Customs Brokers: Hiring a professional broker can reduce errors and speed up the declaration process.

Automate the Process: Use customs software for error-free electronic submissions.

Train Staff in Customs Compliance: Educating employees on trade compliance can minimize errors.

Use Trusted Freight Forwarders: Reliable freight services help in accurate documentation and compliance.

Changes in Customs Declarations Post-Brexit

Since Brexit, UK businesses trading with the EU must now complete customs declarations, a process that was not required when the UK was part of the EU Customs Union.

Key Brexit-Related Changes:

Import and Export Declarations: Required for all UK-EU trade.

Rules of Origin Requirements: Determines tariff applicability.

Customs Duty and VAT: Businesses must handle customs duty and VAT for EU trade.

How Customs Declarations Affect UK Businesses

Businesses must adapt to the new post-Brexit landscape, ensuring compliance to avoid additional costs and delays. The need for customs declarations has led many businesses to seek professional customs declaration services for efficiency.

Conclusion

The customs declarations process is a critical part of UK trade, ensuring compliance with import and export regulations. UK businesses must familiarize themselves with customs procedures, use the right documentation, and leverage professional services to navigate this complex process.

For businesses looking for expert assistance in handling customs declarations, working with a trusted service provider such as Customs Declarations UK can simplify the process and ensure smooth trade operations.

Author Profile:

(David Hawk)

David Hawk is an Expert in Customs Declarations Services having 7+ years of experience in this industry.

#CustomsDeclarations#UKTrade#ImportExport#HMRC#CustomsCompliance#TradeRegulations#SupplyChain#EORI#PostBrexitTrade#CustomsBroker

0 notes

Text

Understanding Export Declarations: A Comprehensive Guide

In the realm of international trade, export declarations play a pivotal role in facilitating the movement of goods across borders. These declarations serve as essential documents required by governments to monitor and regulate the exportation of goods from one country to another. Understanding export declarations is crucial for businesses engaged in global trade as compliance with regulatory requirements is essential for smooth operations and avoiding penalties. In this comprehensive guide, we delve into the intricacies of export declarations, their significance, and the key elements involved.

What is an Export Declaration?

An export declaration is a formal document submitted to the customs authorities of a country by an exporter or their authorized representative. It contains detailed information about the goods being exported, the parties involved in the transaction, and other relevant details required by regulatory bodies. Export declarations serve multiple purposes, including customs clearance, compliance with export regulations, statistical reporting, and security screening.

Significance of Export Declarations:

Customs Clearance: Export declarations provide customs authorities with essential information to verify the legality of exported goods, assess applicable duties and taxes, and ensure compliance with export regulations. Without proper documentation, shipments may face delays or even rejection at the border.

Trade Statistics: Governments utilize export declaration data to compile trade statistics, track trends in international trade, and formulate trade policies. Accurate and timely reporting through export declarations contributes to the transparency and reliability of trade statistics.

Security Screening: Export declarations play a crucial role in enhancing security measures by allowing authorities to screen shipments for potential risks, such as illegal goods, prohibited items, or goods subject to export controls. Compliance with export declaration requirements helps prevent illicit activities and protects national security interests.

Export Controls and Regulatory Compliance: Many countries have export control regulations in place to regulate the exportation of sensitive goods, technologies, or dual-use items that could pose risks to national security or violate international agreements. Export declarations assist in ensuring compliance with these regulations by providing detailed information about the nature and destination of exported goods.

Key Elements of Export Declarations:

Exporter Information: This includes the name, address, and contact details of the exporter or the exporting entity responsible for the shipment.

Consignee Information: Details of the party receiving the goods, including name, address, and contact information. In some cases, additional information such as the consignee's tax identification number or business registration number may be required.

Description of Goods: A comprehensive description of the goods being exported, including the quantity, weight, value, commodity code, and any applicable harmonized system (HS) code.

Export Documentation: Supporting documents such as commercial invoices, packing lists, certificates of origin, and export licenses may need to be submitted along with the export declaration, depending on the nature of the goods and destination country.

Transportation Details: Information regarding the mode of transportation, vessel or flight details, port of departure, and destination port.

Declaration of Value and Currency: Declaration of the value of the exported goods, along with the currency in which the transaction is conducted.

Regulatory Compliance: Declarations regarding compliance with export control regulations, sanctions, embargoes, or other regulatory requirements imposed by the exporting and importing countries.

Types of Export Declarations:

Standard Export Declaration (SED): Also known as the Electronic Export Information (EEI) in the United States, SED is the most common form of export declaration used for shipments of goods valued above a certain threshold. It is typically submitted electronically through customs' designated systems.

Simplified Export Declaration: This type of declaration is used for low-value shipments or shipments of non-restricted goods, where less detailed information is required compared to a standard export declaration.

Exemption Declarations: Some countries offer exemptions or simplified procedures for certain types of goods or transactions, such as temporary exports, personal effects, or goods intended for repair or return.

Conclusion:

Export declarations play a critical role in international trade by facilitating customs clearance, ensuring regulatory compliance, and enhancing security measures. Businesses engaged in exporting goods must understand the importance of accurate and timely reporting through export declarations to avoid disruptions in supply chains, regulatory penalties, and reputational damage. By adhering to export declaration requirements and staying informed about evolving export regulations, exporters can navigate the complexities of international trade successfully and contribute to global economic growth and stability. If you want to get services related to export declarations, Customs Declarations UK is helpful for you in this competitive market.

Top of FormAuthor Profile:

(David Hawk)

David Hawk is an Expert in Customs Declarations Services having 7+ years of experience in this industry.

#ExportDeclarations#InternationalTrade#CustomsCompliance#TradeDocumentation#ExportRegulations#GlobalTrade#CustomsClearance#TradeStatistics#ExportControls#SecurityScreening#RegulatoryCompliance#ExportDocumentation#TradeFacilitation#SupplyChainManagement#ExportProcesses#HarmonizedSystemCode#TradeEfficiency#GlobalLogistics#ExportServices#CustomsDeclarations

0 notes

Link

Proses Registrasi IMEI yang Disederhanakan Menurut PER-7/BC/2023

0 notes

Text

GACC Registration, or General Administration of Customs of China Registration, is a mandatory process for companies engaged in importing or exporting goods to or from China. It involves submitting detailed information about the company, its products, manufacturing processes, and compliance documentation to Chinese customs authorities. GACC Registration ensures that businesses comply with Chinese customs regulations, including product standards, labeling requirements, and import/export procedures. This registration is essential for gaining approval to move goods across Chinese borders smoothly and legally. Failure to obtain GACC Registration can result in delays, fines, or even the rejection of goods at customs checkpoints.

#GACCRegistration#CustomsCompliance#ImportExportChina#ChinaCustoms#InternationalTrade#CustomsClearance#TradeRegulations#ComplianceDocumentation#CustomsProcedures#CrossBorderTrade#ExportToChina#ImportFromChina#TradeFacilitation#GlobalSupplyChain#TradeCompliance#CustomsBroker#LogisticsManagement#CustomsDeclaration#TariffClassification#ExportDocumentation#ImportDocumentation#CustomsDuties#TradePolicy#TradeAgreements#CustomsBrokerage#TradeLogistics#CustomsProcesses#ExportCompliance#ImportCompliance#CustomsLaw

0 notes

Text

#ProFormaInvoice#CommercialInvoice#InternationalTrade#InvoicingGuide#BusinessDocumentation#ExportImport#CustomsDeclaration#DeliveryManagement#InvoiceDifferences#InstaDispatch#DeliverySoftware#TradeDocumentation#InvoiceTips#ExportingGoods#BusinessInvoices

0 notes

Text

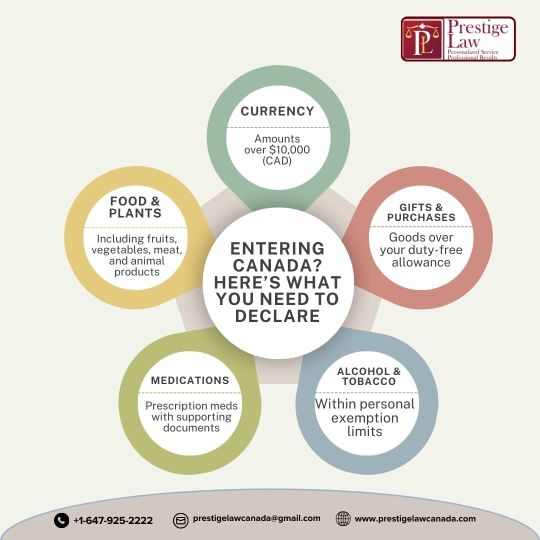

🛃 What to Declare When Entering Canada 🇨🇦 Planning your trip to Canada? Make sure you're informed about what items you need to declare at the border! 🔍 Here’s What You Should Know: Declare Items: Always declare items such as currency over CAD $10,000, food, plants, and animals. Illegal Items: Be aware of items prohibited from entry, including certain weapons, illegal drugs, and restricted goods. Duties and Taxes: Some items may be subject to taxes and duties, so check beforehand to avoid surprises. 🚫 Important: Failing to declare items can lead to serious consequences, including denial of entry. Stay informed and ensure a smooth entry into Canada! @zeeseansheikh Barrister, Solicitor & Notary Public Founding & Principal Lawyer 📞 Phone: +1 (647) 925-2222 🏢 Address: 100-100 Mural Street, Richmond Hill, ON L4B 1J3 📧 Email: [email protected] 🌐 Website: www.prestigelaw.ca 🌐 Alternate Website: www.prestigelawcanada.com #CanadaTravel #CustomsDeclaration #TravelTips #ExploreCanada #canadatrend

0 notes

Text

Customs Declaration Software Market

The report proves to be an effective tool that players can use to gain a competitive edge over their competitors and ensure lasting success in the global Customs Declaration Software market.

Get Free Research Report Sample PDF: https://cutt.ly/O0h2HNM

#customs#customsdeclarationsoftware#software#softwaremarket#declarationsoftware#cloudbased#onpremises#cloud#customsdeclaration#ictmedia#marketresearch#marketresearchers#marketresearchreport#statsmarketresearch#automotive

0 notes

Photo

Total Freight International - TFI offers more than 2 decades on experience in customs laws and procedures. We help you by guiding through the documentation procedures and ensure that you are compliant with the customs. Call one of our experts NOW! Visit us at www.tfiworld.com

#customsclearance#customsdeclaration#customsproceduresuae#dubaicustoms#customsregulations#3PL#logistics#internationalfreighforwarder#totalfreightinternational

0 notes

Photo

Customs Declaration

It is an official document that lists and gives details of goods that are being imported or exported. In legal terms, It is the act whereby a person indicates the wish to place goods under a given customs procedure.

It is the act whereby a person indicates the wish to place goods under a given customs procedure. This legal procedure is described in the Union Customs Code (UCC) Search for available translations of the preceding (Articles 5 (12) and 158 to 187).

The Files that traditionally accompany exported goods bear such information as the nature of the goods, their value, the consignee, and their ultimate destination. It shall be made using electronic data-processing techniques.

Required for statistical purposes, it accompanies all controlled goods being exported under the appropriate permit.

In general, it is the owner of the goods or a person acting on his behalf (a representative).

The person having control over the goods may also perform it. These persons may be individuals or companies, as well as in certain cases associations of persons.

Fresa Technologies www.fresatechnologies.com [email protected]

#fresa #freightsolutions #freightforwarding #FreightRate #billoflading #import #transport #tariffs #bestfreightforwardingsoftware #export #LeaderWinter2023 #LeaderSpring2023 #truck #airfreight #seafreight #oceanfreight #document #procedure #UCC #consignee #techniques #goods #Customs #Declaration #CustomsDeclaration

0 notes

Text

Customs Declarations: A Comprehensive Guide for UK Businesses

The customs declarations process is a crucial aspect of international trade for businesses operating in the United Kingdom. Whether importing goods from overseas or exporting to global markets, businesses must comply with customs regulations to ensure smooth trade operations. Understanding the intricacies of customs declarations can help businesses avoid delays, penalties, and unnecessary expenses.

In this comprehensive guide, we will explore everything UK businesses need to know about customs declarations, including what they are, why they are important, how to complete them, and best practices for compliance.

What Are Customs Declarations?

A customs declaration is an official document submitted to customs authorities detailing goods being imported or exported. This declaration provides crucial information, including the type of goods, their origin, their value, and applicable duties or taxes.

In the UK, customs declarations must be submitted to HM Revenue and Customs (HMRC) via the Customs Declaration Service (CDS). These declarations are necessary for clearing goods through customs and ensuring compliance with trade laws.

Why Are Customs Declarations Important?

Properly completing and submitting customs declarations is essential for several reasons:

Legal Compliance: Ensures businesses adhere to UK and international trade laws.

Taxation & Duties: Determines the correct amount of import duty and VAT to be paid.

Supply Chain Efficiency: Reduces delays at ports and borders.

Security & Safety: Helps prevent the movement of illegal or restricted goods.

Trade Statistics: Assists in collecting valuable trade data for government analysis.

When Are Customs Declarations Required?

Imports into the UK:

Businesses importing goods into the UK must complete an import customs declaration before goods are cleared by UK customs. This declaration includes information on the shipment, its value, country of origin, and applicable duties.

Exports from the UK:

UK businesses exporting goods must complete an export customs declaration to ensure compliance with destination country regulations. This declaration helps in determining whether any restrictions or additional checks apply.

How to Complete a Customs Declaration

Submitting customs declarations correctly is vital to avoid delays and penalties. Here’s a step-by-step process for UK businesses:

Gather Required Information:

Commodity code of goods

Country of origin

Value of goods

Applicable duties and VAT

Transport details

Importer and exporter details

Register for a GB EORI Number: UK businesses must have an Economic Operator Registration and Identification (EORI) number to submit customs declarations.

Use the Customs Declaration Service (CDS):

Businesses must submit declarations through CDS, which has replaced the previous CHIEF system.

CDS allows for electronic submissions and tracking of customs declarations.

Determine the Right Customs Procedure Codes (CPCs):

CPCs help customs authorities determine the purpose of the goods and applicable duties.

Submit the Declaration Electronically:

Declarations can be filed through a customs broker, freight forwarder, or customs software.

Pay Any Applicable Duties or Taxes:

HMRC will calculate the duties and VAT based on the declaration details.

Receive Clearance Confirmation:

Once approved, goods can proceed through customs.

Common Mistakes to Avoid in Customs Declarations

Many UK businesses face issues due to incorrect customs declarations. Some common mistakes include:

Incorrect Commodity Codes: Using the wrong code can result in incorrect duty payments.

Incomplete Documentation: Missing information can lead to customs delays.

Late Submissions: Failing to submit the declaration on time may result in penalties.

Incorrect Valuation of Goods: Underreporting or overreporting the value can cause compliance issues.

Ignoring Customs Procedures: Some goods require additional permits or licenses.

Best Practices for Smooth Customs Declarations

To ensure seamless customs declarations, UK businesses should:

Stay Updated with UK Customs Regulations: Rules and tariffs change frequently, so staying informed is crucial.

Work with Customs Brokers: Hiring a professional broker can reduce errors and speed up the declaration process.

Automate the Process: Use customs software for error-free electronic submissions.

Train Staff in Customs Compliance: Educating employees on trade compliance can minimize errors.

Use Trusted Freight Forwarders: Reliable freight services help in accurate documentation and compliance.

Changes in Customs Declarations Post-Brexit

Since Brexit, UK businesses trading with the EU must now complete customs declarations, a process that was not required when the UK was part of the EU Customs Union.

Key Brexit-Related Changes:

Import and Export Declarations: Required for all UK-EU trade.

Rules of Origin Requirements: Determines tariff applicability.

Customs Duty and VAT: Businesses must handle customs duty and VAT for EU trade.

How Customs Declarations Affect UK Businesses

Businesses must adapt to the new post-Brexit landscape, ensuring compliance to avoid additional costs and delays. The need for customs declarations has led many businesses to seek professional customs declaration services for efficiency.

Conclusion

The customs declarations process is a critical part of UK trade, ensuring compliance with import and export regulations. UK businesses must familiarize themselves with customs procedures, use the right documentation, and leverage professional services to navigate this complex process.

For businesses looking for expert assistance in handling customs declarations, working with a trusted service provider such as Customs Declarations UK can simplify the process and ensure smooth trade operations.

Author Profile:

(David Hawk)

David Hawk is an Expert in Customs Declarations Services having 7+ years of experience in this industry.

#CustomsDeclarations#UKTrade#ImportExport#HMRC#CustomsCompliance#TradeRegulations#SupplyChain#EORI#PostBrexitTrade#CustomsBroker

0 notes

Text

UK Customs Declarations'

Customs declarations provide essential information about the commodities that are being transported across international borders, making them the cornerstone of regulatory compliance and efficiency in the global commerce scene. These declarations, which pay close attention to every detail, give customs officers crucial information that shapes the path of every cargo, from item characteristics to regulatory requirements. While inaccuracies in declarations can lead to delays, fines, or even the seizure of goods, accuracy in declarations is crucial as it affects tariffs, taxes, and compliance with trade laws. Businesses use cutting-edge technologies and services to effectively negotiate the complicated and ever-changing landscape of international trade, where regulations and paperwork requirements abound.

The Significance of Customs Declarations in Global Trade Compliance

Customs declarations are vital records that are crucial to both regulatory compliance and global trade. These declarations give customs officials vital information by serving as a thorough accounting of the commodities being imported or exported. A thorough declaration form that contains information about the items' type, quantity, value, origin, and Harmonized System (HS) code must be submitted as part of the procedure.

Ensuring Precision: The Importance of Accuracy in Customs Declarations

Since it establishes the proper tariffs, taxes, and regulatory obligations related to the shipping items, accuracy in customs declarations is crucial. This data is used by customs officers to evaluate and confirm that shipments comply with national and international trade regulations. Declarative errors or inaccuracies may lead to delays, penalties, or even the seizure of merchandise.

Navigating Complexity: Streamlining Customs Declarations in International Trade

The dynamic nature of international trade, where several nations have distinct laws and paperwork needs, adds to the complexity of customs declarations. Businesses frequently use cutting-edge software and customs brokerage services to manage this complexity and expedite the declaration procedure. These instruments aid in risk mitigation, regulatory standard compliance, and the seamless movement of products across international boundaries.

Promoting Efficiency and Collaboration: The Role of Effective Customs Declarations in Global Trade

Effective customs declarations improve supply chain visibility and traceability in addition to facilitating the smooth flow of products. They are essential to trade facilitation because they promote global collaboration and standardize documentation procedures, both of which promote economic progress. The expansion of international commerce necessitates the timely and precise filing of customs declarations, which are essential to the smooth operation of an efficient global trade ecosystem. If you are seeking for a Customs Declarations service, there are many solution and service providers in the market but Customs Declarations UK offers businesses streamlined customs processes, leading to efficiency gains and cost savings. With its advanced automation and compliance features, it ensures accurate declarations and minimizes the risk of errors, enhancing overall operational effectiveness in international trade.

Conclusion

Customs declarations serve as the bedrock of regulatory compliance and efficiency in the global trade landscape, offering vital insights into the goods traversing international borders. With meticulous attention to detail, these declarations provide customs officials with essential information, from item specifics to regulatory obligations, shaping the trajectory of each shipment. Accuracy in declarations is paramount, influencing tariffs, taxes, and adherence to trade regulations, while errors can result in delays, penalties, or even merchandise seizures. In the dynamic realm of international trade, where complexities abound due to diverse laws and documentation requirements, businesses leverage advanced tools and services to navigate this terrain efficiently. Streamlining customs declarations not only mitigates risks and ensures compliance but also promotes collaboration, standardizes procedures, and fosters economic progress on a global scale, underscoring their indispensable role in facilitating the seamless flow of goods across borders. As global commerce continues to evolve, the significance of customs declarations in upholding trade integrity and enabling efficient cross-border transactions remains undeniable, emphasizing the need for continued innovation and collaboration in this critical aspect of international trade compliance.

Author Profile:

(David Hawk)

David Hawk is an Expert in Customs Declarations Services having 7+ years of experience in this industry.

#CustomsDeclarations#GlobalTradeCompliance#InternationalBusiness#TradeLogistics#RegulatoryCompliance#CustomsAccuracy#SupplyChainEfficiency#TradeFacilitation#GlobalCommerce#CustomsProcesses#TradeCollaboration#CrossBorderTrade#CustomsAutomation#TradeTransparency#EconomicProgress

0 notes

Text

UK Customs Declarations

Customs declarations provide essential information about the commodities that are being transported across international borders, making them the cornerstone of regulatory compliance and efficiency in the global commerce scene. These declarations, which pay close attention to every detail, give customs officers crucial information that shapes the path of every cargo, from item characteristics to regulatory requirements. While inaccuracies in declarations can lead to delays, fines, or even the seizure of goods, accuracy in declarations is crucial as it affects tariffs, taxes, and compliance with trade laws. Businesses use cutting-edge technologies and services to effectively negotiate the complicated and ever-changing landscape of international trade, where regulations and paperwork requirements abound.

The Significance of Customs Declarations in Global Trade Compliance

Customs declarations are vital records that are crucial to both regulatory compliance and global trade. These declarations give customs officials vital information by serving as a thorough accounting of the commodities being imported or exported. A thorough declaration form that contains information about the items' type, quantity, value, origin, and Harmonized System (HS) code must be submitted as part of the procedure.

Ensuring Precision: The Importance of Accuracy in Customs Declarations

Since it establishes the proper tariffs, taxes, and regulatory obligations related to the shipping items, accuracy in customs declarations is crucial. This data is used by customs officers to evaluate and confirm that shipments comply with national and international trade regulations. Declarative errors or inaccuracies may lead to delays, penalties, or even the seizure of merchandise.

Navigating Complexity: Streamlining Customs Declarations in International Trade

The dynamic nature of international trade, where several nations have distinct laws and paperwork needs, adds to the complexity of customs declarations. Businesses frequently use cutting-edge software and customs brokerage services to manage this complexity and expedite the declaration procedure. These instruments aid in risk mitigation, regulatory standard compliance, and the seamless movement of products across international boundaries.

Promoting Efficiency and Collaboration: The Role of Effective Customs Declarations in Global Trade

Effective customs declarations improve supply chain visibility and traceability in addition to facilitating the smooth flow of products. They are essential to trade facilitation because they promote global collaboration and standardize documentation procedures, both of which promote economic progress. The expansion of international commerce necessitates the timely and precise filing of customs declarations, which are essential to the smooth operation of an efficient global trade ecosystem. If you are seeking for a Customs Declarations service, there are many solution and service providers in the market but Customs Declarations UK offers businesses streamlined customs processes, leading to efficiency gains and cost savings. With its advanced automation and compliance features, it ensures accurate declarations and minimizes the risk of errors, enhancing overall operational effectiveness in international trade.

Conclusion

Customs declarations serve as the bedrock of regulatory compliance and efficiency in the global trade landscape, offering vital insights into the goods traversing international borders. With meticulous attention to detail, these declarations provide customs officials with essential information, from item specifics to regulatory obligations, shaping the trajectory of each shipment. Accuracy in declarations is paramount, influencing tariffs, taxes, and adherence to trade regulations, while errors can result in delays, penalties, or even merchandise seizures. In the dynamic realm of international trade, where complexities abound due to diverse laws and documentation requirements, businesses leverage advanced tools and services to navigate this terrain efficiently. Streamlining customs declarations not only mitigates risks and ensures compliance but also promotes collaboration, standardizes procedures, and fosters economic progress on a global scale, underscoring their indispensable role in facilitating the seamless flow of goods across borders. As global commerce continues to evolve, the significance of customs declarations in upholding trade integrity and enabling efficient cross-border transactions remains undeniable, emphasizing the need for continued innovation and collaboration in this critical aspect of international trade compliance.

Author Profile:

(David Hawk)

David Hawk is an Expert in Customs Declarations Services having 7+ years of experience in this industry.

#CustomsDeclarations#GlobalTradeCompliance#InternationalBusiness#TradeLogistics#RegulatoryCompliance#CustomsAccuracy#SupplyChainEfficiency#TradeFacilitation#GlobalCommerce#CustomsProcesses#TradeCollaboration#CrossBorderTrade#CustomsAutomation#TradeTransparency#EconomicProgress

0 notes

Text

Customs Declarations' Critical Role in Ensuring Global Trade Compliance

Customs declarations provide essential information about the commodities that are being transported across international borders, making them the cornerstone of regulatory compliance and efficiency in the global commerce scene. These declarations, which pay close attention to every detail, give customs officers crucial information that shapes the path of every cargo, from item characteristics to regulatory requirements. While inaccuracies in declarations can lead to delays, fines, or even the seizure of goods, accuracy in declarations is crucial as it affects tariffs, taxes, and compliance with trade laws. Businesses use cutting-edge technologies and services to effectively negotiate the complicated and ever-changing landscape of international trade, where regulations and paperwork requirements abound.

The Significance of Customs Declarations in Global Trade Compliance

Customs declarations are vital records that are crucial to both regulatory compliance and global trade. These declarations give customs officials vital information by serving as a thorough accounting of the commodities being imported or exported. A thorough declaration form that contains information about the items' type, quantity, value, origin, and Harmonized System (HS) code must be submitted as part of the procedure.

Ensuring Precision: The Importance of Accuracy in Customs Declarations

Since it establishes the proper tariffs, taxes, and regulatory obligations related to the shipping items, accuracy in customs declarations is crucial. This data is used by customs officers to evaluate and confirm that shipments comply with national and international trade regulations. Declarative errors or inaccuracies may lead to delays, penalties, or even the seizure of merchandise.

Navigating Complexity: Streamlining Customs Declarations in International Trade

The dynamic nature of international trade, where several nations have distinct laws and paperwork needs, adds to the complexity of customs declarations. Businesses frequently use cutting-edge software and customs brokerage services to manage this complexity and expedite the declaration procedure. These instruments aid in risk mitigation, regulatory standard compliance, and the seamless movement of products across international boundaries.

Promoting Efficiency and Collaboration: The Role of Effective Customs Declarations in Global Trade

Effective customs declarations improve supply chain visibility and traceability in addition to facilitating the smooth flow of products. They are essential to trade facilitation because they promote global collaboration and standardize documentation procedures, both of which promote economic progress. The expansion of international commerce necessitates the timely and precise filing of customs declarations, which are essential to the smooth operation of an efficient global trade ecosystem. If you are seeking for a Customs Declarations service, there are many solution and service providers in the market but Customs Declarations UK offers businesses streamlined customs processes, leading to efficiency gains and cost savings. With its advanced automation and compliance features, it ensures accurate declarations and minimizes the risk of errors, enhancing overall operational effectiveness in international trade.

Conclusion

Customs declarations serve as the bedrock of regulatory compliance and efficiency in the global trade landscape, offering vital insights into the goods traversing international borders. With meticulous attention to detail, these declarations provide customs officials with essential information, from item specifics to regulatory obligations, shaping the trajectory of each shipment. Accuracy in declarations is paramount, influencing tariffs, taxes, and adherence to trade regulations, while errors can result in delays, penalties, or even merchandise seizures. In the dynamic realm of international trade, where complexities abound due to diverse laws and documentation requirements, businesses leverage advanced tools and services to navigate this terrain efficiently. Streamlining customs declarations not only mitigates risks and ensures compliance but also promotes collaboration, standardizes procedures, and fosters economic progress on a global scale, underscoring their indispensable role in facilitating the seamless flow of goods across borders. As global commerce continues to evolve, the significance of customs declarations in upholding trade integrity and enabling efficient cross-border transactions remains undeniable, emphasizing the need for continued innovation and collaboration in this critical aspect of international trade compliance.

Author Profile:

(David Hawk)

David Hawk is an Expert in Customs Declarations Services having 7+ years of experience in this industry.

#CustomsDeclarations#GlobalTrade#TradeCompliance#SupplyChainManagement#InternationalTrade#RegulatoryCompliance#TradeFacilitation#CustomsProcesses#EfficientTrade#GlobalCommerce#ExportImport#TradeSolutions#BorderCompliance#SupplyChainEfficiency#TradeInnovation

0 notes

Text

Customs Declarations' Critical Role in Ensuring Global Trade Compliance Customs declarations provide essential information about the commodities that are being transported across international borders, making them the cornerstone of regulatory compliance and efficiency in the global commerce scene. These declarations, which pay close attention to every detail, give customs officers crucial information that shapes the path of every cargo, from item characteristics to regulatory requirements. While inaccuracies in declarations can lead to delays, fines, or even the seizure of goods, accuracy in declarations is crucial as it affects tariffs, taxes, and compliance with trade laws. Businesses use cutting-edge technologies and services to effectively negotiate the complicated and ever-changing landscape of international trade, where regulations and paperwork requirements abound.

#CustomsDeclarations#GlobalTrade#InternationalCommerce#TradeCompliance#RegulatoryCompliance#CustomsProcesses#TradeFacilitation#SupplyChainManagement#CustomsAutomation#CustomsBrokerage#AccurateDeclarations#EconomicGrowth#GlobalCollaboration#TradeRegulations#EfficientTrade#CrossBorderTrade#TradeInnovation#CustomsCompliance#HarmonizedSystemCode#TradeEfficiency

0 notes

Text

UK Safety and Security Declaration: A Complete Guide for Importers and Exporters

The UK Safety and Security Declaration is a crucial document for businesses involved in the import and export of goods to and from the United Kingdom. As global trade regulations continue to evolve, complying with customs requirements has become more critical than ever. This article provides a comprehensive guide on the UK Safety and Security Declaration, explaining what it is, why it is important, how to complete it, and best practices to ensure compliance.

What is a UK Safety and Security Declaration?

A UK Safety and Security Declaration is a mandatory customs document that provides essential information about goods being transported into or out of the United Kingdom. The declaration includes details about the cargo, transportation method, consignor and consignee, and supply chain participants. This information allows UK customs authorities to assess potential risks and enhance border security.

The UK Safety and Security Declaration is part of the Entry Summary Declaration (ENS) for imports and the Exit Summary Declaration (EXS) for exports. It aligns with international safety and security regulations, ensuring the UK maintains robust border controls while facilitating legitimate trade.

Why is the UK Safety and Security Declaration Important?

The UK Safety and Security Declaration serves several critical purposes in international trade and customs compliance:

Risk Management: The declaration helps customs authorities assess potential safety and security risks associated with incoming and outgoing goods.

Regulatory Compliance: Submitting the declaration ensures businesses adhere to UK customs regulations, avoiding fines and legal issues.

Supply Chain Transparency: It offers visibility into the supply chain, helping detect and prevent illegal activities such as smuggling or trafficking.

Efficient Customs Processing: Providing accurate information in the declaration streamlines customs clearance, reducing delays at the border.

Enhanced Border Security: The declaration supports the UK's border security measures by allowing authorities to perform risk assessments before goods arrive or depart.

When is a UK Safety and Security Declaration Required?

The UK Safety and Security Declaration is required for both imports and exports. The specific requirements vary depending on the mode of transport:

Maritime Transport: For deep-sea containerized cargo, the declaration must be submitted at least 24 hours before loading at the port of departure.

Short Sea Shipping: The declaration must be submitted at least 2 hours before arrival in the UK.

Air Transport: For long-haul flights, the declaration is required at least 4 hours before arrival. For short-haul flights, it should be submitted at the time of takeoff.

Road and Rail Transport: The declaration should be submitted at least 1 hour before arrival at the UK border.

Meeting these timelines is critical to avoid fines, delays, or potential refusal of goods at the border.

How to Complete a UK Safety and Security Declaration

Completing a UK Safety and Security Declaration involves several key steps:

Gather Necessary Information: Collect detailed information about the goods, including product descriptions, commodity codes, and transportation details.

Access the Customs Platform: Businesses must submit their declarations through the Import Control System (ICS) for imports or the Export Control System (ECS) for exports.

Fill in the Declaration Form: Enter all required information accurately, ensuring compliance with customs data standards.

Submit the Declaration: Send the completed declaration electronically through the appropriate customs system.

Monitor the Status: Stay informed of the declaration status and address any feedback or additional requirements from UK customs authorities.

Common Mistakes to Avoid

To avoid complications when submitting the UK Safety and Security Declaration, businesses should avoid the following mistakes:

Late Submissions: Ensure the declaration is submitted within the required timeframe based on the mode of transport.

Incomplete Information: Fill in all mandatory fields accurately.

Incorrect Commodity Codes: Double-check that the correct codes are used for the goods being transported.

Non-Compliance with Customs Requirements: Keep updated on the latest UK customs regulations to avoid potential fines.

Best Practices for Compliance

Use Customs Software: Automating the submission process using customs software can help reduce errors and ensure timely submissions.

Engage with Experts: Work with customs brokers or logistics professionals who specialize in UK Safety and Security Declarations.

Provide Staff Training: Ensure that employees responsible for customs declarations are well-trained and knowledgeable about current regulations.

Regular Audits: Conduct regular audits of your customs declaration processes to identify and rectify compliance gaps.

Conclusion

The UK Safety and Security Declaration is more than just a regulatory formality—it is a vital component of maintaining compliance with UK customs regulations and enhancing supply chain security. By understanding its requirements, completing it accurately, and following best practices, businesses can avoid costly delays and fines, ensuring smooth and efficient trade operations. Staying informed about regulatory changes and working with experienced professionals will further help businesses navigate the complexities of international trade with confidence. If you are in search of services related to UK Safety and Security Declaration, "Customs Declarations UK" is a highly recommended option for you.

Author Profile:

(David Hawk)

David Hawk is an Expert in Customs Declarations Services having 7+ years of experience in this industry.

#UKSafetyAndSecurityDeclaration#CustomsDeclaration#UKCustoms#ImportExport#InternationalTrade#SupplyChainSecurity#CustomsCompliance#BorderSecurity#Logistics#Shipping#AirFreight#MaritimeTransport#RoadTransport#RailTransport#CustomsRegulations#TradeCompliance#RiskManagement#SupplyChainTransparency#CustomsProcessing#ExportControlSystem#ImportControlSystem#CommodityCodes#CustomsSoftware#CustomsBroker#LogisticsExperts#StaffTraining#RegulatoryCompliance#TradeOperations#GlobalTrade#CustomsClearance

0 notes

Text

UK Safety and Security Declaration: A Complete Guide for Importers and Exporters

The UK Safety and Security Declaration is a crucial document for businesses involved in the import and export of goods to and from the United Kingdom. As global trade regulations continue to evolve, complying with customs requirements has become more critical than ever. This article provides a comprehensive guide on the UK Safety and Security Declaration, explaining what it is, why it is important, how to complete it, and best practices to ensure compliance.

What is a UK Safety and Security Declaration?

A UK Safety and Security Declaration is a mandatory customs document that provides essential information about goods being transported into or out of the United Kingdom. The declaration includes details about the cargo, transportation method, consignor and consignee, and supply chain participants. This information allows UK customs authorities to assess potential risks and enhance border security.

The UK Safety and Security Declaration is part of the Entry Summary Declaration (ENS) for imports and the Exit Summary Declaration (EXS) for exports. It aligns with international safety and security regulations, ensuring the UK maintains robust border controls while facilitating legitimate trade.

Why is the UK Safety and Security Declaration Important?

The UK Safety and Security Declaration serves several critical purposes in international trade and customs compliance:

Risk Management: The declaration helps customs authorities assess potential safety and security risks associated with incoming and outgoing goods.

Regulatory Compliance: Submitting the declaration ensures businesses adhere to UK customs regulations, avoiding fines and legal issues.

Supply Chain Transparency: It offers visibility into the supply chain, helping detect and prevent illegal activities such as smuggling or trafficking.

Efficient Customs Processing: Providing accurate information in the declaration streamlines customs clearance, reducing delays at the border.

Enhanced Border Security: The declaration supports the UK's border security measures by allowing authorities to perform risk assessments before goods arrive or depart.

When is a UK Safety and Security Declaration Required?

The UK Safety and Security Declaration is required for both imports and exports. The specific requirements vary depending on the mode of transport:

Maritime Transport: For deep-sea containerized cargo, the declaration must be submitted at least 24 hours before loading at the port of departure.

Short Sea Shipping: The declaration must be submitted at least 2 hours before arrival in the UK.

Air Transport: For long-haul flights, the declaration is required at least 4 hours before arrival. For short-haul flights, it should be submitted at the time of takeoff.

Road and Rail Transport: The declaration should be submitted at least 1 hour before arrival at the UK border.

Meeting these timelines is critical to avoid fines, delays, or potential refusal of goods at the border.

How to Complete a UK Safety and Security Declaration

Completing a UK Safety and Security Declaration involves several key steps:

Gather Necessary Information: Collect detailed information about the goods, including product descriptions, commodity codes, and transportation details.

Access the Customs Platform: Businesses must submit their declarations through the Import Control System (ICS) for imports or the Export Control System (ECS) for exports.

Fill in the Declaration Form: Enter all required information accurately, ensuring compliance with customs data standards.

Submit the Declaration: Send the completed declaration electronically through the appropriate customs system.

Monitor the Status: Stay informed of the declaration status and address any feedback or additional requirements from UK customs authorities.

Common Mistakes to Avoid

To avoid complications when submitting the UK Safety and Security Declaration, businesses should avoid the following mistakes:

Late Submissions: Ensure the declaration is submitted within the required timeframe based on the mode of transport.

Incomplete Information: Fill in all mandatory fields accurately.

Incorrect Commodity Codes: Double-check that the correct codes are used for the goods being transported.

Non-Compliance with Customs Requirements: Keep updated on the latest UK customs regulations to avoid potential fines.

Best Practices for Compliance

Use Customs Software: Automating the submission process using customs software can help reduce errors and ensure timely submissions.

Engage with Experts: Work with customs brokers or logistics professionals who specialize in UK Safety and Security Declarations.

Provide Staff Training: Ensure that employees responsible for customs declarations are well-trained and knowledgeable about current regulations.

Regular Audits: Conduct regular audits of your customs declaration processes to identify and rectify compliance gaps.

Conclusion

The UK Safety and Security Declaration is more than just a regulatory formality—it is a vital component of maintaining compliance with UK customs regulations and enhancing supply chain security. By understanding its requirements, completing it accurately, and following best practices, businesses can avoid costly delays and fines, ensuring smooth and efficient trade operations. Staying informed about regulatory changes and working with experienced professionals will further help businesses navigate the complexities of international trade with confidence. If you are in search of services related to UK Safety and Security Declaration, "Customs Declarations UK" is a highly recommended option for you.

Author Profile:

(David Hawk)

David Hawk is an Expert in Customs Declarations Services having 7+ years of experience in this industry.

#UKSafetyAndSecurityDeclaration#CustomsDeclaration#UKCustoms#ImportExport#InternationalTrade#SupplyChainSecurity#CustomsCompliance#BorderSecurity#Logistics#Shipping#AirFreight#MaritimeTransport#RoadTransport#RailTransport#CustomsRegulations#TradeCompliance#RiskManagement#SupplyChainTransparency#CustomsProcessing#ExportControlSystem#ImportControlSystem#CommodityCodes#CustomsSoftware#CustomsBroker#LogisticsExperts#StaffTraining#RegulatoryCompliance#TradeOperations#GlobalTrade#CustomsClearance

0 notes