#Cyclohexanone

Explore tagged Tumblr posts

Text

Cyclohexanone Prices, Trends & Forecasts | Provided by Procurement Resource

Cyclohexanone is a colourless to pale yellow liquid that is an organic molecule with a unique and pleasing peppermint-like odour. Its chemical structure includes a six-membered ring cyclic ketone, including a carbonyl group (-CO-).

Request for Real-Time Cyclohexanone Prices: https://procurementresource.com/resource-center/cyclohexanone-price-trends/pricerequest

The molecule is extremely reactive and combustible, fiercely reacting with strong acids and oxidising agents. It readily dissolves in organic solvents like ethanol, acetone, methanol, and ether.

Key Details About the Cyclohexanone Price Trends:

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on the Cyclohexanone price in its latest pricing dashboard. The detailed assessment deeply explores the facts about the product, price change over the weeks, months, and years, key players, industrial uses, and drivers propelling the market and price trends.

Each price record is linked to an easy-to-use graphing device dated back to 2014, which offers a series of functionalities; customization of price currencies and units and downloading of price information as excel files that can be used offline.

The cyclohexanone price trends, including India Cyclohexanone price, USA Cyclohexanone price, pricing database, and analysis can prove valuable for procurement managers, directors, and decision-makers to build up their strongly backed-up strategic insights to attain progress and profitability in the business.

Industrial Uses Impacting Cyclohexanone Price Trends:

Cyclohexanone is mainly employed as a solvent which facilitates the production of various compounds like caprolactam, adipic acid, and hexamethylenediamine, which are all used in nylon making. As the nylon market is witnessing rapid demand due to its application in end-use industries, like textile, automotive, and packaging, it will also boost demand for cyclohexanone. The chemical also works as a solvent to produce a few medicines, insecticides, and other chemical compounds. Other factors furthering the market expansion include a rising population, lifestyle changes and the increasing demand for food and agricultural goods.

Key Players:

BASF SE

OSTCHEM

Honeywell International Inc

UBE INDUSTRIES, LTD.

News & Recent Development

29th May 2023- The cyclohexanone benchmark price reached 9320.00 RMB/ton, from the previous 9510.00 RMB/ton declining by -2.00%. This decline was caused by weak feedstock benzene prices, frail demand, lower transaction focus, and high availability of product availability.

About Us:

Procurement Resource offers in-depth research on product pricing and market insights for more than 500 chemicals, commodities, and utilities updated daily, weekly, monthly, and annually. It is a cost-effective, one-stop solution for all your market research requirements, irrespective of which part of the value chain you represent.

We have a team of highly experienced analysts who perform comprehensive research to deliver our clients the newest and most up-to-date market reports, cost models, price analysis, benchmarking, and category insights, which help in streamlining the procurement process for our clientele. Our team tracks the prices and production costs of a wide variety of goods and commodities, hence, providing you with the latest and consistent data.

To get real-time facts and insights to help our customers, we work with a varied range of procurement teams across industries. At Procurement Resource, we support our clients, with up-to-date and pioneering practices in the industry, to understand procurement methods, supply chain, and industry trends, so that they can build strategies to achieve maximum growth.

Contact Us:

Company Name: Procurement Resource Contact Person: Chris Byrd Email: [email protected] Toll-Free Number: USA & Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500 Address: 30 North Gould Street, Sheridan, WY 82801, USA

1 note

·

View note

Text

Cyclohexanone Prices, News, Trend, Graph, Chart, Monitor and Forecast

Cyclohexanone is a crucial intermediate chemical used predominantly in the production of nylon, adipic acid, and caprolactam, making its market highly dependent on the performance of the textile and polymer industries. The pricing of cyclohexanone is influenced by multiple factors, including raw material costs, supply-demand dynamics, global trade policies, and macroeconomic conditions. The primary feedstock for cyclohexanone production is cyclohexane, which is derived from crude oil. Therefore, fluctuations in crude oil prices directly impact the cost structure of cyclohexanone manufacturers. When crude oil prices rise, the production costs of cyclohexane and subsequently cyclohexanone also increase, leading to a higher market price. Conversely, a decline in oil prices can provide cost relief to producers, resulting in lower market prices.

Supply chain disruptions, whether due to geopolitical tensions, natural disasters, or unexpected plant shutdowns, can also affect cyclohexanone prices. Any disruption in the supply of raw materials can lead to production bottlenecks, reducing the availability of cyclohexanone and driving up prices. Similarly, planned or unplanned shutdowns of major production facilities in key manufacturing regions, such as China, the United States, and Europe, can cause price fluctuations. In addition, regulatory changes impacting the chemical industry, such as environmental policies limiting emissions or increasing compliance costs, can also contribute to shifts in pricing trends. Stricter environmental regulations often require manufacturers to invest in cleaner production technologies, which may lead to increased production costs and, subsequently, higher product prices.

Get Real time Prices for Cyclohexanone: https://www.chemanalyst.com/Pricing-data/cyclohexanone-1136

The demand for cyclohexanone is closely tied to the performance of downstream industries, particularly the textile and automotive sectors. The growth of the nylon market, which is extensively used in the production of textiles, carpets, and industrial fabrics, plays a significant role in shaping the demand for cyclohexanone. A surge in demand from these industries can push cyclohexanone prices upward, whereas a slowdown can lead to lower pricing. Economic downturns or recessions often result in reduced consumer spending on textiles and automobiles, leading to weaker demand for nylon and subsequently impacting cyclohexanone prices negatively. On the other hand, economic expansion typically fuels industrial production, driving demand and supporting price increases.

Global trade policies and tariff regulations also play a crucial role in determining cyclohexanone pricing trends. Countries imposing trade restrictions, tariffs, or anti-dumping duties on cyclohexanone imports can significantly affect market dynamics. For instance, if a major importing country imposes tariffs on cyclohexanone from a key supplier, domestic prices may increase due to reduced competition. Conversely, the removal of trade barriers can encourage imports, leading to greater supply and potentially lowering prices. Currency fluctuations further complicate pricing dynamics. A weaker domestic currency in a major producing region can make exports more competitive, leading to increased demand and price hikes in international markets. Conversely, a stronger currency can make exports less competitive, potentially reducing demand and pressuring prices downward.

The role of regional markets in shaping cyclohexanone price trends cannot be understated. Asia-Pacific, particularly China and India, serves as a major production and consumption hub for cyclohexanone. The region’s rapid industrialization and expansion of the textile and automotive sectors continue to drive demand growth. In China, environmental regulations and production curbs have occasionally affected the availability of cyclohexanone, leading to price volatility. Meanwhile, Europe and North America have well-established cyclohexanone markets, with pricing influenced by domestic production capacities, regulatory frameworks, and import-export dynamics. The Middle East, with its access to abundant petrochemical feedstocks, is also emerging as a significant player in the global cyclohexanone market, contributing to competitive pricing trends.

Another important factor influencing cyclohexanone pricing is seasonal demand variation. Industrial activity often follows seasonal trends, with increased demand in certain periods leading to price surges. For example, the textile industry experiences higher production activity before peak shopping seasons, such as holidays and festivals, driving up the demand for nylon and indirectly boosting cyclohexanone prices. Conversely, during periods of lower industrial activity, demand wanes, leading to price declines. Additionally, the impact of global economic conditions, such as inflation rates, interest rates, and overall market sentiment, further shapes the trajectory of cyclohexanone prices. Inflationary pressures can increase production costs across the supply chain, from raw material procurement to logistics and transportation, ultimately raising market prices.

Technological advancements in production processes also play a crucial role in shaping cyclohexanone pricing trends. Innovations aimed at improving efficiency, reducing waste, and lowering energy consumption can help manufacturers cut costs and maintain competitive pricing. Companies investing in greener production methods, such as bio-based cyclohexanone synthesis, may also influence long-term pricing trends. The adoption of more sustainable production practices could lead to shifts in supply chain dynamics, potentially stabilizing prices while reducing environmental impact.

The outlook for cyclohexanone prices remains subject to ongoing market developments, including crude oil price movements, trade policies, and industrial demand shifts. Analysts closely monitor key indicators such as supply-demand balances, production capacities, and economic conditions to forecast future price trends. Businesses reliant on cyclohexanone must stay informed about these factors to make strategic procurement decisions and manage cost fluctuations effectively. While short-term price volatility is expected due to external shocks and market imbalances, long-term pricing trends will likely be shaped by fundamental supply-demand dynamics and industry advancements. As the global economy continues to evolve, market participants must remain agile in navigating price fluctuations and securing stable supply chains for cyclohexanone procurement.

Get Real time Prices for Cyclohexanone: https://www.chemanalyst.com/Pricing-data/cyclohexanone-1136

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Cyclohexanone#Cyclohexanone Price#Cyclohexanone Prices#India#united kingdom#united states#Germany#business#research#chemicals#Technology#Market Research#Canada#Japan#China

0 notes

Text

𝐄𝐮𝐫𝐨𝐩𝐞 𝐂𝐲𝐜𝐥𝐨𝐡𝐞𝐱𝐚𝐧𝐨𝐧𝐞 𝐌𝐚𝐫𝐤𝐞𝐭: 𝐊𝐞𝐲 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 & 𝐓𝐫𝐞𝐧𝐝𝐬-IndustryARC™

The Europe Cyclohexanone Market size is forecasted to reach US$1.2 billion by 2027, after growing at a CAGR of 4.5% during the forecast period 2022-2027.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞

Cyclohexanone (C₆H₁₁O) is a key industrial solvent and chemical intermediate with a wide range of applications in various industries. It is classified as a ketone due to its molecular structure, which consists of a six-carbon chain with a carbonyl group (C=O) attached to one of the carbons. Cyclohexanone is highly valued for its ability to dissolve a variety of substances and its role in the synthesis of key chemicals.

𝐊𝐞𝐲 𝐓𝐫𝐞𝐧𝐝𝐬

𝐑𝐢𝐬𝐢𝐧𝐠 𝐃𝐞𝐦𝐚𝐧𝐝 𝐢𝐧 𝐍𝐲𝐥𝐨𝐧 𝐏𝐫𝐨𝐝𝐮𝐜𝐭𝐢𝐨𝐧:

The Europe Cyclohexanone market is experiencing sustained growth, driven primarily by the increasing demand for nylon and its derivatives. As industries like automotive and textiles expand, the need for nylon-6 and nylon-6,6 is pushing up cyclohexanone consumption, especially in countries like Germany and France.

𝐒𝐮𝐬𝐭𝐚𝐢𝐧𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐚𝐧𝐝 𝐆𝐫𝐞𝐞𝐧 𝐂𝐡𝐞𝐦𝐢𝐬𝐭𝐫𝐲:

Environmental concerns are pushing manufacturers to adopt more sustainable practices. Bio-based cyclohexanone production is gaining traction as an eco-friendly alternative to traditional petroleum-based methods.

𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐞𝐝 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐂𝐨𝐚𝐭𝐢𝐧𝐠𝐬 𝐚𝐧𝐝 𝐀𝐝𝐡𝐞𝐬𝐢𝐯𝐞𝐬:

Cyclohexanone's role as a solvent in paints, coatings, and adhesives is expanding due to its excellent ability to dissolve a variety of resins. With the growth of the construction and automotive industries, demand for high-performance coatings and adhesives continues to rise.

𝐒𝐡𝐢𝐟𝐭 𝐓𝐨𝐰𝐚𝐫𝐝𝐬 𝐀𝐮𝐭𝐨𝐦𝐚𝐭𝐢𝐨𝐧 𝐚𝐧𝐝 𝐀𝐝𝐯𝐚𝐧𝐜𝐞𝐝 𝐌𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐢𝐧𝐠:

The Europe Cyclohexanone market is seeing a shift toward advanced manufacturing technologies and automation. This trend is improving production efficiency, reducing costs, and meeting the growing demand for high-quality cyclohexanone in various industrial sectors.

𝐄𝐱𝐩𝐚𝐧𝐝𝐢𝐧𝐠 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝐏𝐡𝐚𝐫𝐦𝐚𝐜𝐞𝐮𝐭𝐢𝐜𝐚𝐥𝐬 𝐚𝐧𝐝 𝐂𝐨𝐬𝐦𝐞𝐭𝐢𝐜𝐬:

Cyclohexanone's use in pharmaceuticals and cosmetics is increasing as demand for active ingredients and specialty fragrances grows. The compound is being utilized more in the formulation of certain pharmaceuticals and cosmetic products, which is opening new markets within the chemical industry.

0 notes

Text

Exploring Cyclohexanone (CYCLE) and China Ethyl Acetate Suppliers

Selecting the right CYCLE and Ethyl Acetate Suppliers in China entails careful consideration of several factors. Businesses should prioritize suppliers with a proven track record of reliability, adherence to quality standards, and commitment to sustainability. Conducting thorough due diligence, including site visits and audits, can provide valuable insights into suppliers’ capabilities and practices. For more details call us at 86-21-5997 0419.

0 notes

Text

Aldehydes react with Grignard reagents to give secondary alcohols (except formaldehyde (methanal), which gives primary alcohols), while ketones give tertiary alcohols (discussed in greater detail in section 21.5).

"Chemistry" 2e - Blackman, A., Bottle, S., Schmid, S., Mocerino, M., Wille, U.

#book quote#chemistry#nonfiction#textbook#aldehydes#chemical reactions#grignard reagents#alcohol#formaldehyde#methanal#ketone#methylbutanal#phenylmagnesium bromide#cyclohexanone#ethylmagnesium bromide#methylphenylbutanol#ethylcyclohexanol#hydronium#magnesium#bromine

1 note

·

View note

Text

This recent screenshot between me and my boss that makes me laugh because it’s literally Sagebean

#im loosing it#sagebean is everywhere#they’re in my mind like a little paraiste help me#sagebean cannon actually btw#god hep me ugh#i should’ve become a hairstylist or something#id be the best walmart employee ever#valorant is ruining my brain#stupid fucking game#i found cyclohexanone in the fumehood and i was touching a bomb#0 reactivity label? better shake it!#very spicy snow globe#somebody call the fucking robot#we put it in a corner and let someone else deal with it

8 notes

·

View notes

Text

#cyclohexanone market size analysis 2025 to 2035#global demand forecast for cyclohexanone in nylon production#cyclohexanone industry trends and growth drivers 2030#cyclohexanone price trends and supply chain insights#impact of crude oil prices on cyclohexanone production cost.

0 notes

Text

Omg I work with methyl ethyl ketone every day, and I literally got some in my eyes last weekend. It felt like drinking booze through my eyeballs. So surreal.

Yknow when I'm looking for a first aid procedure when somebody gets an extremely strong solvent in their eyes, I'm also interested in learning what alternative solvents they should put in their eyes instead. Thanks, Google

#my posts#I also work with cyclohexanone#which is super corrosive. I really hope I don't get that in my eyeballs...

12 notes

·

View notes

Text

Dimethyl ether, carbon tetrachloride, sodium thiohydrate, pyridine, hydrogen bromide, barium hydroxide, barium sulfide, phenol, hydrochloric acid, dibromomethane, sodium hydroxide, n-butylene ether, 3-methylpyridine, bromoethane, aluminum trichloride solution, benzene, ethanethiol, octadecyl acetamide, acetonitrile, N N-diisopropylethylamine, hydrogen fluoride [anhydrous], potassium antimony tartrate, n-butylacetate, ethylene oxide, cyclohexane, potassium hydroxide, aluminum trichloride [anhydrous], 2-nitroanisole, 1, 2-dichloropropene, n-butanol, magnesium, O O ≤-diethylthiophosphoyl chloride, phenol solution, N-(phenylethyl-4-piperidine) propionamide citrate, ethyl acetate, 1,4-xylene, 2-aminopropane, isophthaloyl chloride, 2-chlorotoluene, cyclopentene, propionic acid, hydrofluoric acid, 2-butenaldehyde, 2-methylpentane, ethylamine, bromine, coal tar pitch, ethyl formate, ammonia solution [containing ammonia > 10%] 1-aminohydrin, 4-ethoxyphenylamine, diisopropylamine, sodium ethanolate, nitrifying asphalt, hydrazide hydrate [containing hydrazide ≤ 64%], dimethyl sulfate, acetic acid [content > 80%], acetaldehyde, 2-butylketone, aluminum borohydrate, phenylethanolnitrile, 2-chlorobenzoyl chloride, sodium hypochlorite solution [containing available chlorine > 5%], 2-aminophenol, chloroplatinic acid, barium chloride, tert-butylbenzene, tribromide, methyl sulfide, Diphosphate pentasulfide, diethylamine, chlorobenzene, n-butylbenzene, 1,3-xylene, hydrogen peroxide solution [content > 8%], terephthaloyl chloride, red phosphorus, tetramethyl ammonium hydroxide, methanol, propionaldehyde, 2-methoxyphenylamine, bleach powder, triethyl propropionate, 1-bromobutene, cyclohexanone, di-(tert-butylperoxy) phthalate [paste Content ≤ 52%], tetrahydrofuran, trichloroethylene, magnesium aluminum powder, formic acid, sodium ethanol ethanol solution, isopropyl ether, acetic acid solution [10% < content ≤ 80%], 2-methyl-1-propanol, diethyl carbonate, sodium aluminum hydroxide, 2-methylpyridine, n-butylamine, toluene, thiourea, magnesium alloy [flake, banded or striped Containing magnesium > 50%], methyl benzoate, hydrobromide, 4-methylpyridine, iodine monochloride, sodium sulfide, 3-bromo-1-propene, 2-propanol, potassium borohydroxide, triethylamine, ammonia, 4-nitro-2-aminophenol, 1, 2-epichlorohydrin, 1-propanol, cyclopentane chloride, n-propyl acetate, bromoacetic acid, zinc chloride solution, trichloromethane, 1-bromopropane, monoamine [anhydrous], perchloric anhydride acetic anhydride solution, 1-bromopropane Potassium hydroxide solution [content ≥ 30%], boric acid, sodium borohydrate, hydroacetic acid bromide solution, acrylic acid [stable], cyclopentane chloride, ammonium hydrogen sulfate, calcium hydroxide, 2-ethoxyaniline, dimethyl carbonate, sodium nitroso, monomethylamine solution, zinc chloride, hydrogen sulfide, trimethyl acetate, iodine trichloride, nitric acid, sodium hydroxide solution [content ≥ 30%], trimethyl orthoformate, hydrogen chloride [anhydrous], 4-methoxyaniline, sulfur, succinile, acetic anhydride, dipropylamine, methyl acetate, isopropylbenzene, propionyl chloride, ethyl formate, phosphorus pentoxide, formaldehyde solution, nitrogen trifluoride, acetone, ethanol [anhydrous], white phosphorus, 1, 2-xylene, 1, 3-dichloropropene, 1, 1, 1-dichloroethane, N N-diethylethanolamine, sulfuric acid, N, N-dimethyl formamide, methyl mercaptan, 4-chlorotoluene, 1, 2-dichloroethane, dichloromethane, succinyl chloride, 2, 3-dichloropropene, xylene isomer mixture, tartrate nicotine, cyclopentane, petroleum ether, bromocyclopentane Potassium perchlorate, potassium chlorate, aluminum powder, chromic acid, iron chloride, lead nitrate, magnesium powder, nickel chloride, nickel sulfate, perchloroethylene, phosphate, potassium dichromate, sodium dichromate, zinc nitrate

2 notes

·

View notes

Text

Adipic Acid Prices Index: Trend, Chart, News, Graph, Demand, Forecast

The global adipic acid prices market has been witnessing significant fluctuations in recent months, influenced by feedstock costs, demand recovery trends, and changing supply dynamics. Adipic acid, a key raw material used in the production of nylon 6,6, polyurethane, plasticizers, and other industrial applications, is closely linked to the automotive, textile, and construction sectors, which collectively determine the overall consumption patterns. The prices of adipic acid are largely impacted by the volatility in the prices of its key feedstocks, including cyclohexanone and benzene, which are derived from crude oil. Rising crude oil prices tend to push feedstock costs higher, translating into upward pressure on adipic acid production costs, while any drop in energy and raw material prices generally exerts a bearish sentiment in the market. Additionally, supply-demand dynamics in major manufacturing hubs such as China, the United States, and Europe play a critical role in shaping the pricing landscape, with regional production levels, trade flows, and inventory positions being crucial determinants.

In recent times, Asia-Pacific, particularly China, has emerged as a dominant player in the adipic acid market, both in terms of production and consumption. With the country’s robust manufacturing sector and strong demand from downstream nylon 6,6 and polyurethane industries, Chinese prices often set the benchmark for global trade. However, the market in China has faced phases of price corrections due to fluctuating demand in the automotive and electronics industries, combined with intermittent oversupply situations. The slowdown in export demand from Europe and North America during certain months has also impacted Chinese export offers, leading to competitive pricing strategies among major suppliers. On the other hand, North American and European markets have been influenced by supply chain constraints, higher production costs, and strict environmental regulations that limit capacity expansion. Producers in these regions often rely on imports during tight supply situations, which makes them susceptible to global price trends and freight rate fluctuations.

Get Real time Prices for Adipic Acid: https://www.chemanalyst.com/Pricing-data/adipic-acid-1106

The demand for adipic acid remains largely dependent on the performance of its downstream industries, particularly nylon 6,6, which is extensively used in automotive components, electrical insulation, and industrial yarns. The automotive sector’s recovery post-pandemic initially provided strong support to adipic acid demand, resulting in price increases across several regions. However, in recent quarters, concerns over global economic slowdown, inflationary pressures, and reduced consumer spending have led to slower growth in vehicle production, which has somewhat dampened the demand for nylon and, consequently, adipic acid. Furthermore, the construction sector, another key consumer of polyurethane products derived from adipic acid, has shown mixed demand trends depending on regional economic activities. Markets like India and Southeast Asia have seen moderate growth due to ongoing infrastructure projects, while Europe has faced demand contraction due to high interest rates and economic uncertainties.

Environmental regulations and sustainability initiatives have also started influencing the adipic acid market. The production of adipic acid is associated with the release of nitrous oxide, a potent greenhouse gas, which has prompted manufacturers to invest in cleaner technologies and adopt eco-friendly production processes. While these green initiatives are crucial for long-term sustainability, they often add to production costs, which are eventually reflected in the price structure. Some producers are also exploring bio-based adipic acid alternatives, but commercial adoption remains limited due to higher production costs compared to conventional processes. This environmental compliance factor, especially stringent in Europe, keeps supply growth restricted, which may result in price firmness during periods of high demand.

Seasonal trends and inventory management strategies further contribute to adipic acid price movements. During peak manufacturing seasons, especially when the automotive and textile sectors ramp up production, demand tends to rise sharply, putting upward pressure on prices. Conversely, periods of inventory destocking, such as year-end or post-holiday slowdowns, often lead to price corrections as buyers refrain from bulk purchases. Trade policies, currency fluctuations, and freight rates also add to the volatility, especially for import-dependent regions. For instance, higher container freight costs during logistical disruptions can significantly increase landed prices in Europe and North America, even when the domestic demand remains stable.

In terms of market outlook, analysts expect adipic acid prices to remain moderately firm in the coming months, driven by a gradual recovery in industrial activities and stable feedstock trends. However, uncertainties surrounding crude oil prices, global economic performance, and geopolitical tensions continue to pose risks to market stability. If feedstock prices experience sustained upward momentum, production costs are likely to rise, which may push adipic acid prices higher. On the contrary, if economic headwinds persist, leading to slower downstream consumption, sellers might resort to competitive pricing to stimulate demand and clear inventories. In Asia, China is likely to maintain its strong influence on global trade, with any changes in its domestic demand and production rates directly affecting international offers. Meanwhile, Europe and North America may continue to experience moderate to firm pricing trends due to limited local production capacities and dependency on imports.

Overall, the adipic acid prices market is expected to be shaped by a combination of macroeconomic indicators, feedstock cost trends, and downstream demand patterns. With the automotive and construction sectors remaining key growth drivers, any significant rebound in these industries could support stronger pricing in the medium term. However, environmental compliance costs and ongoing investments in sustainable production methods may gradually increase the overall cost structure for producers, potentially keeping prices elevated in the long run. Market participants are therefore closely monitoring global trade flows, feedstock movements, and demand recovery signals to make informed procurement and production decisions, as the adipic acid market continues to navigate through evolving economic and regulatory landscapes.

Get Real time Prices for Adipic Acid: https://www.chemanalyst.com/Pricing-data/adipic-acid-1106

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Adipic Acid Price#Adipic Acid Prices#Adipic Acid Pricing#Adipic Acid News#Adipic Acid Price Monitor#Adipic Acid Database#Adipic Acid Price Chart

0 notes

Text

Navigating the Economics: Key Considerations for Cyclohexanone Production Cost

Cyclohexanone is a significant chemical intermediate used in various industries, especially in the production of nylon and as a solvent in paints and coatings. Understanding the production cost analysis of Cyclohexanone is crucial for businesses seeking insights into cost structures, market drivers, and procurement assessments.

Request For Free Sample: https://www.procurementresource.com/production-cost-report-store/cyclohexanone/request-sample

Introduction

The production cost analysis of Cyclohexanone involves intricate processes and assessments that influence the cost dynamics. Various factors come into play, from procurement resource assessment to market drivers, and these components significantly impact the overall cost structure of Cyclohexanone production.

Procurement Resource Assessment of Cyclohexanone Production Process

The procurement resource assessment is a critical aspect of Cyclohexanone production. This involves evaluating the raw materials, such as phenol and cyclohexane, and the methods used for their extraction or synthesis. Understanding the cost, availability, and quality of these resources is essential in determining the overall cost structure of Cyclohexanone production.

The assessment involves analyzing the sourcing strategies, supplier dynamics, market trends, and potential risks associated with raw material procurement. A comprehensive understanding of these factors is vital to optimize the production cost effectively.

Product Definition

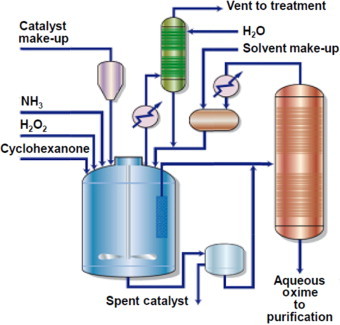

Cyclohexanone is a colorless oily liquid with a peppermint-like odor. It is an important precursor in the production of nylon and other materials. The chemical is predominantly produced through the oxidation of cyclohexane, catalyzed by air and metal catalysts. This process involves several stages, including hydroperoxidation, decomposition, and refining steps, which collectively define the Cyclohexanone production process.

Market Drivers

Several factors drive the market for Cyclohexanone, influencing its production cost. Market demand, technological advancements, regulatory policies, and global economic conditions significantly impact the cost analysis. For instance, an increase in demand due to the growth of end-user industries, such as automotive or construction, can impact the overall production cost. Similarly, advancements in production technologies can alter cost structures, making the analysis dynamic and ever-evolving.

Key Considerations for Cyclohexanone Production Cost

When assessing the production cost of Cyclohexanone, several key considerations play a pivotal role:

Looking for an Exhaustive and Personalized Report

Seeking an exhaustive and personalized report for Cyclohexanone production cost analysis is crucial for businesses aiming to optimize their operations. Such a report should delve into specific factors relevant to your business model and market conditions. It should encompass detailed insights on procurement strategies, cost breakdowns, competitive analysis, and potential risks to facilitate informed decision-making.

In conclusion, comprehending the cost analysis of Cyclohexanone production involves a multifaceted approach that considers procurement, market drivers, and crucial cost considerations. Accessing a personalized and comprehensive report can significantly bolster your business strategies and decision-making processes. Understanding the nuances of Cyclohexanone production costs is instrumental in staying competitive and achieving operational excellence in the chemical industry.

1 note

·

View note

Text

Cyclohexanone Prices Trend | Pricing | News | Database | Chart

Cyclohexanone is a crucial intermediate in the production of various chemical products, primarily used in the manufacture of nylon precursors like adipic acid and caprolactam. As a result, fluctuations in cyclohexanone prices significantly impact related industries and the wider chemical market. The pricing dynamics of cyclohexanone are influenced by a myriad of factors, from raw material costs to demand patterns and broader economic conditions. To gain a deeper understanding of these variations, it is important to consider both recent price movements and historical trends within the context of raw material availability, production processes, and shifting market demands.

The production of cyclohexanone typically involves the oxidation of cyclohexane or the hydrogenation of phenol. Given this, any significant change in the cost or availability of raw materials such as cyclohexane and phenol exerts direct pressure on cyclohexanone prices. When crude oil prices spike, for instance, the cost of derivatives like cyclohexane often increases, which, in turn, can drive up cyclohexanone prices. Market players must closely monitor crude oil markets to anticipate potential price fluctuations that can cascade through the value chain. This dependence on upstream costs ties cyclohexanone pricing directly to global energy markets, which are themselves influenced by geopolitical tensions, production agreements among oil-producing countries, and shifts in energy policies aimed at reducing carbon emissions.

Get Real Time Prices for Cyclohexanone : https://www.chemanalyst.com/Pricing-data/cyclohexanone-1136

Global demand also plays a pivotal role in cyclohexanone price determination. With the bulk of cyclohexanone production being consumed by the nylon industry, changes in demand for nylon products have a pronounced effect on prices. A surge in demand for automotive parts, textiles, and consumer goods made from nylon often leads to increased cyclohexanone consumption, thereby supporting higher price levels. Conversely, economic downturns or weakened industrial output can lead to demand contractions, exerting downward pressure on prices. Notably, evolving consumer preferences and sustainability concerns are influencing demand for certain types of materials, including bio-based nylons, which could shift demand patterns for traditional cyclohexanone-derived products in the coming years.

Trade dynamics and regional supply-demand imbalances also add complexity to cyclohexanone pricing. Major cyclohexanone producers and consumers are concentrated in regions such as Asia-Pacific, North America, and Europe. The Asia-Pacific region, led by China, remains a key growth market due to its strong manufacturing sector and demand for nylon-based products. Trade policies, import tariffs, and regional economic conditions can create price disparities and lead to fluctuations in cyclohexanone prices globally. For example, if China imposes restrictions on cyclohexanone imports, local prices may rise due to reduced competition, while exporters may find themselves with excess supply, potentially causing prices to fall in other regions.

Regulatory frameworks concerning environmental protection and chemical safety are another important factor influencing cyclohexanone prices. Compliance with increasingly stringent regulations often leads to higher production costs, as companies must invest in cleaner technologies or more efficient processes. Moreover, any disruptions to the supply chain, whether due to plant shutdowns for maintenance, force majeure events, or unforeseen incidents, can lead to temporary supply shortages, driving up prices in the short term. On the other hand, technological advancements in cyclohexanone production, such as process optimization and improved catalyst efficiency, can lower production costs and exert downward pressure on market prices over the long term.

In recent years, cyclohexanone prices have experienced notable volatility, in part due to the economic impact of global events such as the COVID-19 pandemic. The pandemic led to disruptions across supply chains, shifts in consumer demand, and operational challenges for many industries, including chemicals. While some sectors experienced a sharp downturn, others saw demand recovery as economic activities resumed. These fluctuations were mirrored in cyclohexanone pricing as supply-demand dynamics recalibrated to the evolving market environment. The recovery has been uneven across regions, adding further layers of complexity to pricing.

Looking ahead, cyclohexanone prices are expected to be shaped by several key trends. A major influence will be the push toward sustainable and environmentally friendly production practices. As industries continue to focus on reducing their environmental impact, demand for more sustainable cyclohexanone production processes and alternative feedstocks may grow. This could lead to price premiums for sustainably produced cyclohexanone, but it may also create opportunities for companies to differentiate themselves through innovation. Additionally, macroeconomic factors such as interest rates, inflation, and global trade policies will continue to influence demand for nylon and related products, indirectly affecting cyclohexanone prices.

In summary, the cyclohexanone market is subject to a complex interplay of factors, including raw material costs, industrial demand, trade policies, regulatory changes, and technological advancements. Prices are influenced by global economic conditions, industry-specific demand patterns, and regional supply-demand balances. As the chemical industry continues to adapt to changing environmental and economic realities, market participants must navigate these dynamics to ensure competitive positioning and manage risks associated with cyclohexanone price fluctuations. The interplay of these elements highlights the need for continuous monitoring and strategic planning, allowing market participants to anticipate and respond effectively to changes in cyclohexanone pricing trends.

Welcome to ChemAnalyst App: https://www.chemanalyst.com/ChemAnalyst/ChemAnalystApp

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Cyclohexanone#Cyclohexanone Price#Cyclohexanone Prices#Cyclohexanone Pricing#Cyclohexanone News#Cyclohexanone Price Monitor

0 notes

Text

Duty caprolactam Grade powder Prices down in Mumbai Market

In Mumbai, the price of mid-industrial grade ε‑Caprolactam powder (≈99% purity) dropped from Rs.185/kg on July 14 to Rs.181/kg on July 15, reflecting a Rs.4/kg decline largely due to oversupply in local markets and weakening demand across Asia‑Pacific; Q1 2025 saw a 3.4% quarter-over-quarter price decline in APAC as producers maintained output despite soft benzene and cyclohexanone costs and sluggish downstream activity in textiles and automotive sectors. Caprolactam is the primary monomer for producing Nylon‑6, a high-performance engineering polymer valued for its mechanical strength, chemical resistance, and low friction, and is used to manufacture fibers, engineering plastics, automotive parts, gears, bearings, and medical devices including catheters and implant housings. On the global stage in July 2025, spot prices ranged from US\$1.39/kg in Northeast Asia to US\$1.96/kg in North America*, all significantly lower than Mumbai’s Rs.181/kg (\~US\$2.15), underscoring the relatively elevated cost in India . The global caprolactam market, valued at around USD 16.5–17.5 billion in 2024–25, is poised for robust growth (\~6% CAGR) as automotive, textile, and engineering plastics demand expands, yet persistent regional oversupply and subdued downstream procurement continue to pressure prices. Indian Producers, Gujarat State Fertilizers & Chemicals Limited (GSFC), Fertilisers and Chemicals Travancore (FACT). International Producers: BASF SE, Sinopec, AdvanSix Inc., UBE Corporation, DOMO Chemicals, Caprolactam Prices in India, Indian Caprolactam Prices, Indian Prices Caprolactam, IndianPetrochem.

0 notes

Text

Cyclohexanone and Ethyl Acetate Suppliers China

The combination of Cyclohexanone and Ethyl Acetate often proves to be a powerful duo in industrial processes. Their compatibility and complementary properties enhance the efficiency of various chemical reactions. Whether it's in the realm of adhesive production, pharmaceutical synthesis, or the creation of specialty chemicals, these compounds join forces to facilitate the seamless development of diverse products. For more details call us at +86-510-83223090.

0 notes

Text

The presence of the ketone is indicated by changing the suffix from -e to -one (section 2.3).

"Chemistry" 2e - Blackman, A., Bottle, S., Schmid, S., Mocerino, M., Wille, U.

#book quote#chemistry#nonfiction#textbook#ketone#suffix#nomenclature#methylhexanone#methyl cyclohexanone#acetophenone#benzophenone

0 notes