#DefensiveStocks

Explore tagged Tumblr posts

Text

Cyclical vs. Defensive Sectors: Mastering Sector Rotation 🔄

Understanding financial markets means grasping sector performance. Sector rotation, a key asset allocation strategy, depends on recognizing how economic cycles impact different investment sectors. This analysis explores the crucial distinctions between cyclical sectors (sensitive to economic shifts) and defensive sectors (more stable during downturns), providing a solid framework for smarter investment decisions.

https://gwcindia.in/blog/cyclical-vs-defensive-sectors-a-sector-rotation-perspective/

#SectorRotation#CyclicalStocks#DefensiveStocks#EconomicCycles#InvestmentStrategy#MarketAnalysis#AssetAllocation#best stock market advisor#best stock advisor in india#best stocks to buy#investing stocks#best stock broker in india#investsmart#bse

1 note

·

View note

Text

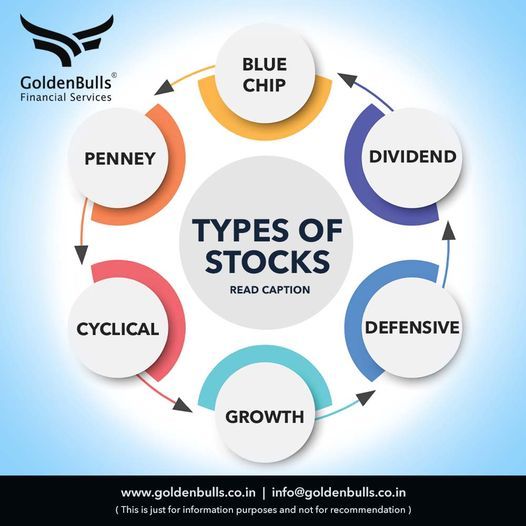

Blue Chip Stocks: These are shares of well-established, financially stable, and reputable companies with a history of consistent performance. Blue chip stocks are generally considered safe and reliable investments.

Dividend Stocks: Companies that distribute a portion of their earnings to shareholders in the form of dividends. These stocks are often favored by investors seeking regular income.

Defensive Stocks: Companies that tend to remain stable even during economic downturns. They are less sensitive to economic cycles, and their products or services are considered essential.

Growth Stocks: These are shares of companies expected to grow at an above-average rate compared to other companies. Investors in growth stocks are typically focused on capital appreciation rather than dividends.

Cyclical Stocks: Companies whose performance is closely tied to the economic cycle. These stocks often do well when the economy is booming but may suffer during economic downturns.

Penny Stocks: Stocks with a low market price, usually trading at less than $5 per share. Penny stocks are often associated with smaller, riskier companies and can be more volatile than stocks of larger, more established companies

Call us at : +91 8411002452 OR Visit: www.goldenbulls.co.in

#BlueChipStocks#DividendInvesting#DefensiveStocks#GrowthInvesting#CyclicalStocks#PennyStocks#InvestmentStrategies#DiversifyYourPortfolio#StockTips#MarketTrends#EconomicCycles#RiskManagement#Financialservices#FinancialWellness#Goldenbulls

0 notes

Video

youtube

How Can a Market Crash Make You Rich?

📉 Stock Market Crash? Why It Might Be the BEST Time to Buy Stocks 💸 A stock market plunge can feel terrifying—but for smart, long-term investors, it can also be a massive buying opportunity. In this video, I break down why downturns can lead to outsized returns—if you play it right. 🔍 What You’ll Learn: Why market crashes offer discounted prices on quality stocks How to avoid emotional investing mistakes during selloffs The critical mindset needed to invest during downturns Strategies like dollar-cost averaging and defensive sector picks What not to do when markets fall fast ✅ Key Takeaways: Focus on blue-chip companies with strong fundamentals Think long-term (3–5+ years) Keep cash reserves ready for deeper dips Avoid hype stocks and stay diversified 📊 Whether you’re navigating a 2025 market correction or just preparing for the future, this guide will help you approach crashes like a pro—not a panicked trader. 👉 Subscribe for more investing tips and market analysis: https://www.youtube.com/@UCYeO7auPodcecl2CnDskMNg 👍 Like if you found this helpful & comment below: Are you buying the dip or sitting it out? #StockMarketCrash #BuyingTheDip #LongTermInvesting #MarketPlunge #InvestingTips #BlueChipStocks #DollarCostAveraging #DefensiveStocks #StockMarket2025 #ValueInvesting

0 notes

Text

SCHD: The ETF That THRIVES in ANY Market (Even Downward!)

Explore SCHD, a top ETF for sideways markets! We highlight its consistent, growing dividends, high-quality companies, and defensive sector allocation. Discover why SCHD offers low costs and turnover, making it a backbone of the American economy. Share your SCHD experiences in the comments! #SCHD #ETF #Dividends #Investing #Finance #StockMarket #PassiveIncome #InvestmentStrategy #DefensiveStocks…

0 notes

Text

Stock market news today: Stocks flip to losses as comeback rally loses steam

1/8 The stock market rollercoaster continues! 🎢 After a glimmer of hope yesterday, stocks have turned bearish again, losing steam in today's trading session. Is this a blip in the recovery or a sign of more volatility ahead? #StockMarketUpdate #Stocks #Investing 2/8 The Dow Jones, S&P 500, and Nasdaq all dipped in early trading, dampening hopes of a sustained comeback rally. Investors are grappling with uncertainties around inflation, interest rates, and the global economic recovery. 📉 #MarketVolatility #EconomicRecovery 3/8 Amidst the red numbers, tech stocks and growth companies are facing renewed pressure, with some of the high-flying names experiencing notable declines. Is this a momentary setback or a potential shift in market sentiment? 🤔 #TechStocks #InvestmentStrategy 4/8 On the flip side, traditional value stocks and sectors like energy and financials are seeing fluctuations, reflecting the tug-of-war between growth and inflation concerns. It's a battleground out there, and investors are navigating choppy waters. ⚖️ #ValueStocks #Inflation 5/8 Still, there are bright spots. Some analysts point to the resilience of certain sectors, including healthcare and consumer staples, as defensive plays in the face of market turbulence. Are investors flocking to safety amidst the choppy market conditions? 🛡️ #DefensiveStocks 6/8 As the day unfolds, keep an eye on how market dynamics evolve. Will we see a late-day rebound, or are we in for further downside pressure? Stay informed, stay vigilant, and consider your investment decisions with a measured approach. 📈📉 #InvestingWisdom #StayInformed 7/8 In the midst of market fluctuations, remember the importance of a diversified portfolio and a long-term perspective. Volatility can create opportunities, and staying informed is key to navigating the ever-changing landscape of the stock market. 🌍💼 #Diversification #LongTerm 8/8 TL;DR: Stock market paused its attempted rebound, led by tech stocks feeling renewed pressure. Investors balancing fears of inflation and interest rates. Stay informed, keep a diversified portfolio, and approach volatility with a long-term perspective. 📊 #StockMarketUpdate #Investing

0 notes