#Email Not Working in QuickBooks Desktop

Explore tagged Tumblr posts

Text

QuickBooks Premier Hosting: Everything You Need to Know for a Smarter Accounting Setup

Running QuickBooks Premier on a local desktop may have worked in the past, but today's businesses need more flexibility, stronger data security, and collaboration from anywhere. That’s where QuickBooks Premier hosting comes in.

In this blog, we’ll walk you through what QuickBooks Premier cloud hosting is, how it works, key benefits, what to look for in a QuickBooks hosting solution provider, and answer some frequently asked questions that people search on Google.

What Is QuickBooks Premier Hosting?

QuickBooks Premier Hosting is the process of running your desktop version of QuickBooks Premier on a virtual cloud server. Instead of accessing it from a single PC, you and your team can log in remotely via a secure internet connection from any device—PC, Mac, tablet, or mobile.

In short, it gives you the power of the desktop version, combined with the flexibility and security of the cloud.

How QuickBooks Premier Cloud Hosting Works – A Technical View

Here’s a behind-the-scenes breakdown of how it functions:

Virtual Server Setup: Your hosting provider sets up a secure cloud server (typically Windows Server OS) with fast SSD storage and scalable memory.

QuickBooks Installation: Your licensed QuickBooks Premier software is installed and configured on this server, optimized for performance and remote use.

User Access Configuration: Multiple users can be set up with custom permissions, allowing them to work on the same file in real time.

Secure Remote Access: Access is provided through Remote Desktop Protocol (RDP) or a web-based portal. Top-tier security features like multi-factor authentication and SSL encryption are standard.

Data Backup and Disaster Recovery: Daily automatic backups, geo-redundancy, and snapshot recovery options are built into the system.

Third-Party App Integration: You can integrate payroll, CRM, time-tracking, or Microsoft 365 applications, just as you would on a desktop version.

Key Benefits of QuickBooks Premier Hosting Service

Here’s what you gain by switching from local installs to QuickBooks Premier hosting solutions:

1. Remote Access from Anywhere

You’re no longer tied to the office. Log in from home, client locations, or on the go. It’s secure, fast, and reliable.

2. Seamless Collaboration

Work simultaneously with other users on the same file—no version conflicts, no emailing files back and forth.

3. Automated Updates & Maintenance

No more manual updates or IT headaches. Your hosting provider handles everything from software patches to OS upgrades.

4. High-Level Security

Your data is protected by advanced firewalls, encrypted connections, anti-virus tools, and secure Tier 3+ data centers.

5. Scalable Infrastructure

Add users, increase server capacity, or upgrade RAM as your needs grow. No need to reinvest in new hardware.

6. Disaster Recovery & Daily Backups

Top providers perform regular backups and include disaster recovery tools to avoid data loss in case of system failure.

How to Choose a QuickBooks Hosting Solution Provider

Not every provider delivers the same performance or support. Here's what you should look for: FeatureWhat to Look ForIntuit AuthorizationChoose an Intuit Authorized Hosting Provider (IAHP)Security ComplianceSOC 2, ISO 27001, or HIPAA compliance24/7 SupportLive chat, email, and phone support anytimeInfrastructureTier 3+ or Tier 4 data centers, SSD-based serversTrial PeriodMany providers offer free trials or demo environments

How to Get Started with QuickBooks Premier Cloud Hosting

Here’s how to move your software to the cloud the right way:

Step 1: Select a Trusted Provider

Do your research. Look at reviews, security certifications, and their experience with QuickBooks Premier hosting services.

Step 2: Share Your Licensing Info

You’ll need to share your license key, number of users, and any add-ons you use.

Step 3: Plan Your Migration

Choose a downtime window—like a weekend or late night—for the transition. A backup of your current files should be made before any changes.

Step 4: Cloud Setup & Configuration

The provider installs QuickBooks on a virtual server and transfers your files. They’ll configure multi-user access and performance settings.

Step 5: Testing and Go-Live

Test the hosted environment for accuracy—run reports, open files, test user access. Once everything works, you’re good to go live.

Step 6: Staff Onboarding & Support

Your provider typically offers onboarding documentation and live support to help your team adjust.

Frequently Asked Questions (FAQs)

Q1: Can I use QuickBooks Premier on the cloud?

Yes, QuickBooks Premier can be hosted on the cloud by a verified QuickBooks hosting solution provider. This lets you access it remotely with all desktop features intact.

Q2: What is the difference between QuickBooks Premier hosting and QuickBooks Online?

QuickBooks Online is a separate product with different features. Hosted QuickBooks Premier gives you the full functionality of the desktop version—just accessible via the cloud.

Q3: How secure is QuickBooks Premier hosting?

When hosted by a reputable provider, it's extremely secure. Look for features like end-to-end encryption, multi-factor authentication, and secure Tier 3+ data centers.

Q4: Is QuickBooks Premier cloud hosting good for accountants and CPAs?

Absolutely. It supports multi-user access, real-time collaboration, and integrates with tools commonly used by accounting professionals.

Q5: Can I integrate third-party apps with QuickBooks Premier hosting?

Yes. Most hosting providers support integration with tools like Microsoft 365, Bill.com, Avalara, TSheets, and more.

Q6: Do I need to buy QuickBooks again to host it?

No. If you already have a valid QuickBooks Premier license, you can use that on the hosted server. Just ensure it matches your hosting environment.

Q7: What happens if I want to cancel the hosting service?

You can cancel anytime, and most providers will help you download a backup of your data for local use. Always ask about cancellation policies upfront.

Final Thoughts

Switching to QuickBooks Premier cloud hosting gives you more freedom, better collaboration, and a secure environment to run your accounting operations. Whether you're a solo CPA or a multi-user financial team, the benefits of QuickBooks Premier hosting services are hard to ignore.

If you’re looking for a QuickBooks hosting solution provider that can handle the setup, backups, compliance, and support—so you can focus on your business—it might be time to make the move.

#quickbooks premier cloud hosting#quickbooks premier hosting#quickbooks premier hosting service#quickbooks hosting solution provider#quickbooks hosting solutions

0 notes

Text

5 Signs It's Time to Rethink Your Business Accounting Services

Running a small business is hard enough. Between keeping customers happy, managing staff, and planning for growth, who has time to chase numbers or double-check spreadsheets every week?

Here’s a question worth asking: Are your current accounting tools actually helping—or just holding you back?

Many small business owners find themselves stuck with outdated or overly complicated systems. And when those systems start costing time, money, or peace of mind, it’s a sign that something’s got to change. Modern Accounting Services offers more than just number-crunching—they streamline invoicing, payments, and payroll so owners can focus on what really matters: running the business.

When It All Feels Like Too Much

Let’s be honest. Traditional accounting setups often come with a heavy load—manual data entry, juggling between apps, or relying on software that feels like it belonged in 2008. Mistakes creep in, updates get missed, and things slip through the cracks. That kind of stress builds up fast, especially when there’s no clear picture of cash flow or upcoming expenses.

That’s where smarter, simpler tools come in. With platforms like Zil Money, small business owners gain a streamlined way to manage finances from a single, secure space. It’s user-friendly, works across devices, and is built to cut down the chaos that outdated accounting tools leave behind.

Sign #1: You are Still Chasing Invoices

The Problem: Clients take forever to pay, and you are stuck sending awkward reminder emails week after week.

The Fix: With Zil Money’s integrated invoicing system, businesses can create and send invoices instantly—by email or SMS. Payment tracking shows exactly when invoices are opened, paid, or overdue, which helps keep cash flow predictable and reduces delays.

Sign #2: Payroll Days Take All Day

The Problem: Running payroll is a full-day job that eats into productivity. Calculations, checks, and errors add unnecessary stress.

The Fix: Print payroll checks in batches or handle direct payments from a single dashboard. Zil Money makes it easy to manage wages—especially for businesses with part-time or seasonal staff—while keeping everything compliant and organized.

Sign #3: You are Drowning in Logins and Spreadsheets

The Problem: You are flipping between tools—one for payroll, another for bills, a third for accounting—and your desktop looks like a cluttered puzzle.

The Fix: Zil Money connects with QuickBooks, Zoho, and Gusto, so everything syncs automatically. Invoices, payments, and reports are managed on one unified platform, reducing errors and saving time.

Sign #4: You are Always Double-Checking for Errors

The Problem: Every dollar that goes in or out has to be triple-checked. One mistake can throw off the books or delay vendor payments.

The Fix: All transactions, whether it’s paying a bill or issuing a refund, are stored and monitored in one high-security dashboard. Payments are traceable, and all records are automatically updated—making it easier to stay accurate and audit-ready.

Sign #5: You Can’t Work on the Go

The Problem: You are out of the office and can’t access your accounting tools—so tasks pile up until you're back at your desk.

The Fix: Zil Money works across Windows, Mac, Android, and iOS. Whether on a tablet during a lunch meeting or from a laptop at home, business owners can keep tabs on their finances in real time. The interface stays consistent across devices for a smooth experience every time.

A Better Way to Look at Business Finance

There’s a shift happening in how small businesses manage their money. Instead of outsourcing everything or using clunky systems that complicate daily operations, more business owners are opting for flexible platforms that do it all under one roof.

It’s not just about having access to data—it’s about having control. Better Accounting Services empower owners to make informed decisions, spot cash flow issues early, and stay ahead of deadlines without burnout. It’s a way to take ownership of the financial side of the business without feeling buried under it.

This kind of shift doesn't just save time—it builds confidence. With smoother systems in place, teams run better, vendors get paid faster, and growth doesn’t feel like guesswork. Technology can’t replace good business sense, but it can make running a business a lot less stressful.

Ready to Stop Stressing Over Spreadsheets?

Whether it’s missed payments, long payroll days, or too many tabs open—there’s a better way to manage business finances. Smarter accounting isn’t about doing more work. It’s about doing the right work more easily.

Explore what modern Accounting Services can do for your business—simplify, streamline, and take back control with Zil Money.

0 notes

Text

The Future of “I Do”: Exploring Wedding & Event Planning Software in 2025

Introduction to Wedding & Event Planning Software

Event planning has gone digital — and thank goodness. Wedding and event planning software provides a centralized hub to handle everything from guest lists to vendor bookings. These tools are designed not just for couples but also for professional planners, freelancers, and venue managers, making planning smarter and more efficient.

Why Traditional Planning Methods Fall Short

Let’s face it — sticky notes and hand-written checklists might have a nostalgic charm, but they don’t cut it anymore. When you’re dealing with dozens of vendors, hundreds of guests, and timelines that shift weekly, relying on pen and paper is a recipe for confusion. That’s where wedding planning software for wedding planners steps in, offering seamless, integrated alternatives.

Manual methods often lack flexibility, transparency, and collaboration. You can’t share a paper planner across time zones or auto-update a seating chart with a pencil. That’s why modern weddings require modern tools like online event planning software that everyone on the team can access.

How Wedding Planning Software Works

At its core, wedding and event planning software acts like a digital assistant. It brings all aspects of the planning process into one easy-to-use interface. You can monitor timelines, manage guest RSVPs, track your budget, and communicate with vendors without switching between apps or digging through emails. It’s a game-changer for anyone juggling multiple responsibilities — basically, everyone planning a wedding. Many of these tools also qualify as wedding event planning software, offering templates, calendars, and automation features.

Key Features to Look for in 2025

Some features are no longer luxuries — they’re necessities. In 2025, planners and clients alike will expect:

AI-powered scheduling that automatically suggests optimal dates and times.

Integrated vendor marketplaces for easy comparison and booking.

Mobile access, because nobody wants to be glued to a desktop.

Real-time budget updates to track expenses as they happen.

Drag-and-drop floor plans that make visualizing the layout simple.

Top Wedding Planning Software Innovators to Watch

Innovation in this space is booming, with several platforms setting new standards. These wedding planning software innovators are constantly upgrading their systems. Aisle Planner continues to impress with its sleek design and all-in-one functionality. HoneyBook remains a favorite among freelance wedding professionals due to its automation features. Meanwhile, Planning Pod and AllSeated provide powerful visual planning tools ideal for larger events or venues. These are the innovators driving change and shaping the industry.

Best Wedding and Event Planning Software 2024

Looking back at 2024, a few platforms stood out for their usability and robust feature sets. Zola and Joy catered to budget-conscious couples, providing powerful tools without a price tag. The Knot Pro enhanced vendor communication and client management, making it easier to stay on top of appointments and details. These tools were widely recognized as top-tier wedding and event planning software 2024.

Spotlight: Wedding & Event Planning Software USA

In the U.S., the demand for wedding software that offers more than just planning tools is rising fast. Planners and venues want built-in contract management, invoicing, CRM features, and integrations with other platforms like QuickBooks or Stripe. Tools like Eventbrite and Cvent, originally designed for corporate events, have started adapting for weddings too. They represent a new generation of wedding & event planning software USA.

Software for Wedding Coordinators & Venue Managers

The Rise of Online Event & Wedding Planning Software

Accessibility is king. With cloud-based platforms, couples and planners can collaborate from anywhere, whether they’re across the city or across the globe. Online event & wedding planning software like WedPlanner Pro and Joy offer real-time syncing, secure storage, and intuitive interfaces. Being online means updates are instant, mistakes are reduced, and everyone stays informed. The flexibility also makes these platforms suitable as wedding planner computer software.

All-in-One Event Planning Software: Worth the Hype?

All-in-one solutions promise to be the Swiss army knives of event planning — and many live up to the claim. They combine budgeting, scheduling, communications, design, and even guest interaction into one streamlined interface. This is ideal for planners managing multiple clients or complex events. All in one event planning software helps save time, reduce costs, and increase accuracy across the board.

Event Planning Business Software for Professionals

Planning Events Made Easy: Tools for Freelancers

Not every planner is part of a big agency. Freelancers need agile tools that fit within smaller budgets without sacrificing capability. This is where event planning software for wedding planners comes in. Tools like Asana and Trello help with task organization, while Google Workspace enables real-time collaboration. Canva is great for invites and mood boards. These options prove that even smaller operations can benefit from modern planning event software.

Innovative Wedding Venue Management Software

Venues are turning to technology to manage bookings, optimize layouts, and improve service delivery. Innovative Wedding Venue Management Software includes 3D modeling, automated staff scheduling, and client communications. Automating checklists, communications, and service schedules helps venues run smoother and provide better client experiences.

Wedding and Event Planning Software 2025: What’s Next?

As we look ahead, we can expect even more personalization and intelligence built into software. AI will suggest vendors, timelines, and even color palettes. Voice-command features and augmented reality previews may become common. Wedding and event planning software 2025 will be smarter, faster, and even more intuitive, making Event Planning with Innovative Management Software the new industry standard.

Conclusion: The Future is Software-Powered

FAQs

1. What is the best event planning software for wedding planners? Aisle Planner, Planning Pod, and HoneyBook are top picks offering tools for scheduling, budgeting, and vendor management.

2. Can I use wedding planning software for free? Yes. Tools like Joy and Zola offer free plans with essential features suitable for DIY planners.

3. What’s the difference between wedding planning and venue management software? Wedding planning software is for managing the entire event. Venue management software focuses on booking, logistics, and staff coordination.

4. Is online wedding software secure? Most modern platforms use strong encryption and follow best security practices, but always review the provider’s terms and data policies.

5. Will AI and AR become part of future event planning tools? Absolutely. AI is already being integrated for recommendations and automation, and AR is expected to become a major design tool by 2025.

0 notes

Text

“The Ultimate Guide to Application-Level Access Using RHosting”

In the evolving landscape of remote work and server access, security, precision, and control have become non-negotiable. Businesses no longer want to expose entire desktops or server environments to users who only need access to a single application.

That’s where RHosting’s application-level access becomes a game-changer.

Whether you're a startup aiming to keep things simple, or an enterprise needing airtight access control, this guide walks you through everything you need to know about leveraging application-level access through RHosting — and why it’s one of the smartest remote desktop strategies in 2025.

💡 What Is Application-Level Access?

Unlike traditional RDP (Remote Desktop Protocol) where users log in to a full Windows desktop environment, application-level access restricts the session to only the apps a user needs.

This means:

No desktop access

No access to server files or other users’ applications

Just the exact tool or software assigned

✅ Example: A remote accountant can open QuickBooks without ever seeing the server's desktop or folders.

🔐 Why Application-Level Access Matters

1. Enhanced Security

Limiting users to specific apps reduces the risk of:

Accidental data exposure

Unauthorized browsing

Malware or file deletion

2. Improved Productivity

Users see only what they need — no distractions, no clutter, no unnecessary tools.

3. Easier Compliance

Industries like healthcare, finance, and legal services can better meet compliance standards (HIPAA, GDPR, etc.) by limiting data exposure through isolated app access.

⚙️ How RHosting Makes It Easy

While some traditional RDP tools require complex configurations to achieve this kind of segmentation, RHosting offers a simple, intuitive control panel to set application-level access in minutes.

✅ Features:

Drag-and-drop app assignment

User-by-user customization

Instant activation — no reboot or re-login required

Audit logs to monitor usage and access patterns

🛠️ Step-by-Step: Setting Application Access in RHosting

Log into the RHosting control panel

Go to User Management

Select a user profile

Assign specific applications to the user

Save changes — and that’s it!

Your user now has remote access only to the apps you’ve designated — nothing more, nothing less.

💼 Who Should Use Application-Level Access?

Remote teams: Reduce security risks while ensuring remote workers stay focused

IT service providers: Offer isolated tools to clients or temporary contractors

Educational institutions: Give students access to specific learning tools or software

Finance & accounting firms: Allow secure access to tools like Tally, QuickBooks, or MS Excel

🚀 Real-World Example

A Mumbai-based marketing agency uses RHosting to give interns access only to Adobe Photoshop and a shared design folder — no admin tools, no emails, no server files. This setup increased data safety while streamlining workflow.

📊 Key Benefits Recap

BenefitHow RHosting DeliversSecurityApp-only access, user restrictionsControlAdmin-level customization per userComplianceData minimization, access auditingSimplicityNo need for complex GPO or Windows configsSpeedQuick setup and rollout

✅ Final Thoughts

In a digital-first world, less access means more control. With RHosting’s application-level access, you’re not just improving security — you’re designing a smarter, leaner, and more focused work environment.

Whether you're managing 5 users or 500, it’s time to rethink remote access — one app at a time.

0 notes

Text

Small and medium enterprises should be using tools to grow from strength to strength. That’s because – when used to their full potential – these tools can save time and money, leaving those two valuable resources available for other things the business needs. Here are a handful of essential tools you should consider if you want to grow your SME. QuickBooks Accounting Software First things first – if you’re not keeping an eye on your cash flow, your SME is likely to fail, even if you have active customers. So, you need to invest in a tool that will help you to track your income and outgoings, your profits and losses, as well as your accounts payable and payroll responsibilities. You can hire an accountant to do this for you, or take someone on in-house. If you choose the second option, make they have the right tools to do their job – lots of SMEs rate tools like QuickBooks for desktop or online, so be sure to check them out. QuickBooks Business Checks Similarly, QuickBooks offers other tools that SMEs should be using. Security is an incredibly relevant issue for small businesses right now, with cloud security risks, complicated regulation and compliance, and hackers posing some of the biggest threats. However, the security of ‘old-school’ elements of running a business – like using business checks – is an important thing to consider too. So, get hold of some of QuickBooks’ business checks to prevent anyone from tampering with the checks you’re making out, and print them directly from your accounting software to ensure everything is syncing up without needing to double up on the administrative work. Teamwork Teamwork is a tool you should be using if your SME is hiring more staff or taking on more projects. It’s a platform that allows you to plan out your tasks for the month, assign them to individuals, track the status of tasks and projects (including the time logged against each subtask), as well as chat to one another so that everyone is kept in the loop at all times. There are a number of different options and pricing plans, so take a look and see if it’s something that might benefit your SME. Hubspot Customer Relationship Manager As your SME continues to grow, you’re going to need an effective way of handling the relationships you make with your clients and customers. So, consider using something like Hubspot’s customer relationship manager. It allows you to create contacts and centralize all their details in one place, record conversations, and updates, sync their profiles with email addresses (so that you’re not switching between tabs), as well as create email templates. It’s an excellent sales pipeline tool too, and you can even align your marketing and sales work with your CRM so that your contacts, dashboards, reports, and pipelines are all in the same place. Google Analytics Another useful tool for your business is Google Analytics. This is especially true if you’re running an e-commerce business where traffic, heat maps, and referral sources are particularly important, but even if you’re not selling online, knowing what’s happening with your website can be very useful. For instance, it will show you who’s visiting your website (such as the demographic split, their age, and their location), as well as the pages they’re spending the most time on. MailChimp MailChimp is a marketing tool you should be using to encourage customers to buy your products or services. You can use it to design email templates and automate their distribution, meaning you’ll be sending customers to your website, social media channels or even phone line. Manage campaigns and see what’s working and choose the pricing plan that suits the stage your SME is at. What tools would you recommend? Are there any you’ve found to be particularly useful in running your business?

0 notes

Text

Enshittification - Intuit I started with quickbooks in 2000. Converted 5 to 6 at work. Cost about $125 for the program and $25/year for payroll form updates. Updated to 2002. Cruised. Around 2008 they demanded an update to continue payroll forms. And 2011, etc. Every three years. Needed to buy a complete copy while the price wandered up to $200. A couple years back they said they were improving the desktop version by making it annual subscription. Went to $400 per year, going up now to $500 per year. Payroll forms is also $500 per year. Each direct deposit adds up to $500 per year. So they send me a strongly worded email to watch out for fake software:

We want to alert you that there are unauthorized websites and resellers on ecommerce platforms that are selling fraudulent versions of QuickBooks Desktop software. Intuit no longer offers new subscriptions of QuickBooks Desktop Plus or QuickBooks Desktop Enhanced Payroll and no longer makes the non-subscription (sometimes referred to as Lifetime or perpetual license) versions of QuickBooks Desktop Pro, Premier, and Mac. Please note that existing QuickBooks Desktop Plus and Desktop Payroll subscribers, like yourself, can continue to renew their subscriptions to get security updates, product updates, and support. Hence desktop wanders off to the boneyard. They want folks to use the website software, which is mostly braindead. [ i tried it with a sample file, the graphics were awful ] And needs to get paid by the month. btw, I said very quietly during tax season, which is causing Intuit great pain with the new IRS DirectFile, a friend tells me that a copy of QB 2019 is still operating fine on desktop with no payroll.

1 note

·

View note

Text

Why QuickBooks Outshines Sage 50: The Go-To Choice for User-Friendly, Scalable, and Cloud-Based Accounting

Brandon, MB- November 28, 2024: Businesses often prefer QuickBooks over Sage 50 for several key reasons, particularly related to ease of use, cloud accessibility, integration options, and support for growth.

QuickBooks is designed with simplicity in mind, making it easy for users without an accounting background to navigate. Its intuitive layout allows business owners to manage tasks like invoicing, tracking expenses, and running payroll with minimal training. Sage 50, while robust, has a more traditional and complex interface that can be more challenging for beginners or those managing their own books.

QuickBooks Online offers full cloud functionality, enabling users to access their accounts from any device with an internet connection. This flexibility is especially valuable for businesses with remote teams or multiple locations, allowing real-time collaboration and updates. Although Sage 50 offers a cloud-connected version, it remains primarily desktop-focused, which can limit accessibility and flexibility.

QuickBooks integrates with a vast array of third-party applications, including popular tools for CRM, time-tracking, e-commerce, and payroll, making it easier to connect and automate various business functions. Sage 50 has fewer integration options, which can limit customization and require manual data entry across platforms, slowing down operations.

As a cloud-based solution, QuickBooks Online manages software updates and data backups automatically, ensuring users are always working with the latest version and that data is securely stored. Sage 50 users often need to handle updates and backups manually, which can be time-consuming and increase the risk of data loss or using outdated features.

QuickBooks offers multiple pricing plans that cater to small startups as well as growing businesses, allowing companies to start with essential features and upgrade as their needs evolve. Sage 50, while offering tiered versions, can be more expensive for entry-level users, and it lacks the same scalability for businesses needing gradual increases in functionality.

QuickBooks provides a user-friendly, flexible, and scalable accounting solution with strong cloud capabilities and integration options. These features make it a preferred choice over Sage 50 for businesses seeking efficient, accessible, and growth-friendly accounting software.

About E-Tech

Founded in 2001, E-Tech is the leading file repair, data recovery, and data conversion services provider in the United States and Canada. The company works to stay up to date on the latest technology news, reviews, and more for their customers.

For media inquiries regarding E-Tech, individuals are encouraged to contact Media Relations Director, Melanie Ann via email at [email protected].

To learn more about the company, visit: www.e-tech.ca

Melanie Ann

Media Relations

E-Tech

136 11 th St

Brandon, MB R7A 4J4

www.e-tech.ca

0 notes

Text

QuickBooks Payroll Support

Quickbooks payroll support {+1-888-960-5414} an excellent service that helps professionals manage their payroll. This software allows you to accurately handle employee salaries, bonuses, and deductions.With QuickBooks Payroll Support, you can easily manage tax calculations and filing, saving both time and resources.If you encounter any issues, KickBooks' specialist team is always ready to help. The service is user-friendly and suitable for small to large businesses.With Quickbooks payroll support, you can manage your payroll work with greater efficiency and accuracy, helping you run your business better. Contact QuickBooks Desktop support via phone , chat, or email through their website. Alternatively, users can access community forums or consult help articles for self-service.

0 notes

Text

What you need to know about email issues in QuickBooks!

What you need to know about email issues in QuickBooks!

Dear users! in this blog, today we are going to discuss an error that bugs the users of QuickBooks from time to time. The error in question is email issues in QuickBooks. Here, in this article, we will concentrate more on what are the factors behind this error and what can we do to resolve the error. Read the entire article to know more. A note on Email issues in QuickBooks QuickBooks is…

View On WordPress

0 notes

Text

IT & Digital Support for Small Business: A Basic Guide

When you’re starting a small business, social enterprise, law firm, tech firm or just starting to scope your idea one of the first things you think about is technology. Before you can do almost anything else you need to think of the technology to run your services or organisation, equip your staff with the laptops and software they need, and get your business connected to the internet.

You also need to decide on suitable hosting and storage options, whether they’re in the cloud or in a server that sits in the back office. Depending on the nature of your business, you might invest in a separate telephony solution and the handsets to go with it.

And in many cases, after the initial setup is over, IT becomes an afterthought. Many small businesses operate their IT estate on a wing and a prayer, in the mistaken belief that all the IT support they need can be provided by the businesses that supply their hardware, software or services. As we’ll show in this guide, that’s a dangerous and unsustainable way to run your business.

The small business (start-up , social enterprise, legal firm and more) IT & digital stack

But first, some background. It’s a simple truth that small businesses are using more in terms of IT & digital technology than ever before. Some of that will be desktop solutions that sit in a server on your premises. A growing proportion will be cloud-based tools, platforms and applications that live in a distant data centre and are accessed via the internet. Wherever your IT & digital stack is housed, you’d be lost without it.

Quite simply, we all rely on our IT & digital systems more than ever, for communication and collaboration, productivity and business administration. Where would your business be without Zoom or Teams, Office 365, QuickBooks, Salesforce or 20 other applications we could mention? For that matter, where would it be without email or, if you sell online, your e-commerce platform?

The IT & digital stack has grown even more during the pandemic, because of the need to equip and connect remote workers and, in many cases, switch to online sales and customer service. With many businesses contemplating the long-term adoption of remote or semi-remote (hybrid) work, most of these emergency innovations are likely to remain in place.

Other trends will only increase the importance of IT & digital. The government is expecting more businesses to file accounts digitally, for example. Many businesses are already investing in Voice over IP (VoIP) communications in preparation for the ISDN switch off in 2025. A new generation of digital services based on cloud computing, big data, virtual reality and the Internet of Things (IOT) is emerging for the small business market.

Digital transformation is now a destination for most businesses, even if they’re travelling towards it at different speeds. But as they grow and adopt more digital services, they increase their risk. When you depend on technology for everything from sales and marketing to customer services and back-office operations, you can’t afford for it to be anything less than fully functional.

The cost of unsupported IT & digital estates

What happens when you don’t support your IT & digital real estate? Most obviously, it breaks. But it can also undermine your business in more insidious ways, many of which won’t be covered by a service provider’s SLA. When bottlenecks build up in your network, for example, data traffic slows down and productivity suffers. When your systems and software aren’t optimised for the way you work, you miss out on efficiency benefits and better ways of doing things.

If the worst comes to the worst and you suffer an IT outage, the results can be seriously expensive. Imagine the damage to your business if you had to spend a day offline. Alarmingly, recent statistics show that every hour of unplanned IT & digital downtime costs businesses over £50,000.

Even if these figures spike for larger enterprises, small businesses can still face significant damage. In a separate survey, more than a third of Small businesses stated they had lost customers and over 17% had lost revenue due to IT & digital downtime.

And then there’s security, the elephant in every boardroom. Hackers don’t care how small or new your business is. If there’s data to be mined from your servers, or a ransom to be extracted in return for unlocking your core functions, you’re a potential target.

Which is why the average cost of a cybersecurity breach to UK small businesses is currently around £3,000, a figure which doesn’t take into account costs associated with recovering from the attack or reputational damage.

A less obvious risk associated with relegating IT & digital to an afterthought is that you lose ground to your competitors. Too many small businesses are working with inefficient, legacy IT solutions because they don’t have time to survey the market and see what else is out there. That means they’re unaware of new or upcoming services and applications that could make their businesses better.

The different options of IT & digital support

So how do small businesses support their ever-expanding IT estates? In many cases, the founder or CEO or director does it themselves, which is obviously an unsatisfactory solution unless they happen to be a bona fide IT expert. If not, this option is tantamount to not having any IT support at all.

If they can afford it, many small businesses employ an IT manager and leave the smooth running of the IT estate entirely in their hands. That’s clearly better than having no IT support at all, but it’s also expecting a lot from a single individual who presumably doesn’t want to spend 24 hours a day at work.

As organisations get larger, they tend to employ IT teams. This is the ideal in-house solution, but it is far beyond the reach of most small businesses. IT professionals don’t come cheap, and cybersecurity experts are a rarity in small businesses.

In our experience very few small and medium sized businesses have the comprehensive support they need to keep IT infrastructure online, optimised and secure. In which case, third-party assistance is essential.

What is outsourced IT & digital support?

If you have no in-house support, or your small (often one person) team is stretched to the limit, you need external IT & digital support. We really can’t stress this enough. Trying to go it alone without the expertise to do so is a recipe for disaster.

A good third party IT support service can become your IT team, without the expense of employing your own. It can monitor and maintain your systems, update services and software, and advise you on your IT roadmap, effectively operating as an IT consultant. An outsourced IT service should always offer round-the-clock helpdesk support.

What does that mean for your business? Well, it means you’re much less vulnerable to cyberattack, and the software and services you rely on are optimised to your needs. It means that, if something does go wrong, you should be back up and running in a much shorter time frame than would otherwise be the case.

IT & Digital support for small business from SI ICT

Of course, we would say all this. SI ICT is a third-party IT & digital service support provider, after all.

But think of all the times your internet connection drops out, downloads slow to snail pace, or video conferences stutter and stall. In our experience many small business owners don’t fully understand what is required every day to keep IT & digital systems fully protected and functioning normally. And why should you? That’s not your area of expertise.

But it is ours. That’s exactly where a good third-party provider comes in. At SI ICT we offer our technical services, and it means that effectively, we become your in-house IT support (albeit we mostly work remotely). You get a cost-effective IT support service that will proactively monitor, maintain and upgrade your systems and devices remotely, preventing issues before they happen. More for You covers everything a small business needs in terms of IT & digital support, including:

24/7/354 availability

Helpdesk support

On-site reactive visits

Proactive monitoring of servers and devices

Proactive consultancy

Backup services

IT roadmap

Account management

If you have some in-house IT support, but it’s stretched, we’ve got you covered too. With support your resource, we won’t do everything, but we’ll do the kinds of things that free up your IT & digital staff for more time-sensitive and customer-focused projects.

It’s not a prescriptive service, though. We’ll do whatever it takes to help your IT & digital team out. If they just need to talk through an issue or get an informed opinion on a new piece of kit, we’re there.

IT support for small business: a vital ingredient for business success

We hope to have demonstrated in this guide that IT & digital support isn’t a “nice to have” or something you can muddle along without. If you want your small business to thrive in the long term, you need secure, optimised and efficient digital systems and services, and keeping them that way takes time and expertise. If your IT & digital systems / applications go down, so does your business.

But in-house IT & digital support is expensive, and few small businesses can afford the in-house IT resource they need to cover an ever-expanding IT stack.

That’s why outsourced IT support is vital. A good provider can take over your IT support requirement lock, stock and barrel if you need them to. Alternatively, they can be the extra support your in-house team needs to make sure your systems are always in tip top condition. They should certainly be agile, giving you the right support at the right time for your business needs, not a one-size-fits-all solution that burdens you with bells and whistles you don’t need and shouldn’t have to pay for.

At Cloud and More, we don’t do off-the-shelf. We’ll work with you to understand where your business is now, where it wants to go, and the IT & digital support required to make sure your ambitions are fulfilled. Or to put it plainly, the level of IT & digital support you need is exactly the level of support we’ll give you.

For a consultation with SI ICT for IT & digital support services, please click here.

1 note

·

View note

Text

Business Accounting Software For Mac Free

Simple Bookkeeping Software For Mac

Free Business Accounting Software For Mac

Free Accounting App For Mac

Download Free Small Business Accounting Software For Mac

Best Accounting Software For Mac

Home Accounting Software For Mac

Business Accounting Software For Mac Free Download

Just because you’re a Mac person doesn’t mean you have to settle for less with your accounting software. Check out these 6 great options.

A few years ago, we published an article on the best accounting software options for Mac users. This is an update of that article, but here’s the thing: There’s no such thing as “accounting software for Mac” anymore.

Sure, there’s plenty of accounting software that you can use on your MacBook, MacBook Air, MacBook Pro, iMac, etc. But while there used to be Mac software and PC software, it’s now virtually all the same with the ever-increasing expansion of cloud-based software that works seamlessly in any browser.

In other words, you’d have a much harder time finding accounting software that doesn’t work on your Mac than a program that works only on Macs. In fact, with more than 100 million active Mac users, if you found an accounting program that somehow wasn’t compatible with Mac, that alone would be cause for alarm.

Cloud software is here to stay, and the market is only getting bigger. Gartner predicts that by 2022, 28% of enterprise IT spending will have shifted to cloud applications, up from 19% in 2018. (Full report available to Gartner clients.)

Less Accounting: Features and Functions: Another very easy to use free accounting software for Mac users. It is specifically meant for accountants or freelancers who are new to their work and are not much aware about accounting. Wave is a free, Canadian-made online software suite for managing small business finances. The free tools include accounting, invoicing, receipt scanning and personal finance, with features like unlimited bank connections, estimates/quotes, recurring invoices and accountant-approved (double-entry) reports. The Best Free Business Software app downloads for Mac: Microsoft Office 2011 Microsoft Office 2016 Preview Google Workspace Microsoft Excel 2016 Micro. MARG ERP 9+ Accounting Software. MARG ERP 9+ is widely acclaimed accounting software for. Osfinancials accounting and business processing software osFinancials is a free accounting package, easy to install Stock control and point of sales integrated with good support and plugins. Import from osCommerce, virtue-mart magento zenchart etc. Full reportdesigner reportman and all reports are made in reportman so can be adjusted to your needs.

6 user-friendly accounting software options for Mac

Rather than giving you a generic list of accounting software that works on Macs (which would basically just be our accounting software directory), I decided to determine which top factors users have for choosing Mac over PC and then find accounting software that best suits those users.

Macs are typically high-end machines with consistently strong reviews from users, so I included only accounting tools with an overall rating of 4.5/5 stars or higher in our directory (based on verified user ratings) and with at least 100 reviews.

In general, Macs are considered easier to use than PCs, so I’m including only products with an ease-of-use rating on our site of 4.5/5 or higher.

Finally, I included only products with a native iOS app with a user rating of 4/5 or better on the App Store, since Mac users typically use iPhones and iPads as well as their desktop or laptop computers.

With those factors in mind, here’s what I found, listed in order of rating and reviews from highest to lowest:

Jump to:

QuickBooks

FreshBooks

Accounting by Wave

Zoho Books

FreeAgent

Kashoo

1. QuickBooks

User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:14,700+

It’s no surprise that the big name in accounting software is available on Mac operating systems. QuickBooks has even had a desktop-only (not cloud-based) option available for Macs since at least the mid-1990s, making the company something of a pioneer for cross-platform functionality.

Now, any of QuickBooks’ cloud-based offerings will work fine on your Apple device, and Intuit even still offers a desktop version for Mac. The desktop version for Mac even has a few features designed specifically for Mac users:

QuickBooks for Mac 2020 takes advantage of the Mojave OS Dark Mode.

You can upload text searchable images with the iPhone scanner.

Documents can be automatically shared through iCloud.

Pros

Cons

QuickBooks is available on virtually every device, so whether your team has Macs, PCs, or smartphones, you know that everyone can use it together.QuickBooks has very attractive entry-level pricing, but it doubles after three months.With hundreds of integrations, QuickBooks is highly customizable.QuickBooks is an enormous company, and some reviewers find that the customer service isn’t as hands-on as they’d like.

How much does QuickBooks cost?

QuickBooks Online starts at $25/month. QuickBooks Desktop for Mac is a one-time payment of $299.

What about the iOS app?

The QuickBooks iOS app has a 4.7/5 rating on more than 100,000 reviews. It allows users to create invoices, manage expenses, and view reports.

The QuickBooks Online dashboard (Source)

2. FreshBooks

User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:3,000+

Designed specifically for small businesses and the self-employed, Toronto-based FreshBooks has been around for more than 15 years. FreshBooks also has Mac users in mind. They say that their easy-to-use accounting software works on any device—desktop, mobile, or tablet—and “plays nicely” with Mac.

Pros

Cons

Users rave over FreshBooks’ customer support, and the company stakes their reputation on it.If your company is rapidly growing—for example, if you plan on going public—you may quickly outgrow FreshBooks.Even though it’s targeted at smaller companies, FreshBooks has all the important accounting features you would need, so it can handle much more than lemonade stands.Freshbooks does a great job of keeping your books clean, but if you love forecasting and crunching numbers, it’s a little skimpy on the reporting side.

How much does FreshBooks cost?

FreshBooks starts at $15 per month for five clients and goes up to $50 per month for 500 clients. *At the time of writing, FreshBooks has a fall sale of 60% off for six months on all plans.

What about the iOS app?

The FreshBooks app has a 4.8/5 rating on almost 8,000 reviews. It allows you to run invoices, record expenses, track time, and accept payments, all while you’re away from your computer.

The Invoices dashboard in FreshBooks (Source)

Simple Bookkeeping Software For Mac

3. Accounting by Wave

User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:800+

Accounting by Wave is one of the youngest tools on this list, having launched out of Toronto in 2010 before being acquired by H&R Block earlier this year. Its biggest differentiator is that it has a completely free version, as long as you don’t need to use it to accept payments or run payroll (those are optional, paid features).

So what makes Wave an attractive option specifically for Mac users? As mentioned, it’s free, so it’ll help you save for the next iPhone or MacBook upgrade. It also scores high for ease of use, making it fit in nicely with the intuitive Mac ecosystem.

Pros

Cons

It’s free without limitations on users or transactions as long as you don’t need to accept payments or run payroll.Wave is missing an audit trail feature, leaving it vulnerable to fraudulent employees.Wave offers above-average reporting features for a free tool.The free version offers only email support, and even if you pay for payments or payroll you still only get access to chat support (no phone support).

How much does Wave cost?

Wave is free. Payments are 2.9% + 30 cents per credit transaction, or 1% per bank transaction. Payroll starts at $20 per month plus $4 per employee.

What about the iOS app?

Invoice by Wave passes the user review test, clocking in at 4.6/5 with almost 2,000 reviews. It doesn’t completely replace the web version of Wave, but it does allow you to keep an eye on your business finances wherever you are. The biggest complaints that users have seem to be related to customer service, which is not unique to the app.

Recent transactions in Accounting by Wave (Source)

4. Zoho Books

User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:380+

If you’re looking for the peace of mind of an established, international company offering Mac-friendly accounting software and you’re trying to avoid QuickBooks for whatever reason, Zoho Books might be for you. Zoho has been releasing business software since 1996, and Zoho Books is specifically tailored for Mac users, as it is designed to work with iMessage, Apple Maps, Siri, and 3D Touch. It even has an app for the Apple Watch.

Pros

Cons

Zoho Books is one of the most user-friendly options out there. In fact, it placed fourth—better than any other option on this list—on our Top 20 Most User-Friendly accounting software report earlier this year.Zoho Books offers integrated payroll in California and Texas for now, but if you’re in any other state you’ll have to use a separate payroll app.Starting at $9 per month, Zoho Books is one of the best values in accounting software this side of Wave, which is free. And unlike Wave, Zoho has almost universally praised customer service.Zoho Books is optimized for use with Zoho’s customer relationship management system, Zoho CRM, so if you’re already using a different CRM, it won’t work as efficiently.

How much does Zoho Books cost?

Zoho Books starts at $9 per month or $90 per year for 50 contacts and two users and goes up to $29 per month or $290 per year for unlimited contacts, 10 users, and more features.

What about the iOS app?

As mentioned above, the Zoho Books iOS app takes full advantage of iOS-specific features such as messaging and voice assistant, and users love it, giving it a 4.7/5 rating on almost 150 reviews. While some accounting software apps have minimal features, allowing you to basically just check balances and view transactions, Zoho Books allows you to create and send invoices, manage expenses, track time, view reports, and share numbers with your accountant.

Managing invoices in Zoho Books (Source)

5. FreeAgent

User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:110+

FreeAgent accounting software is based in the U.K. and originally designed for British businesses, but they also have versions customized for U.S. and global businesses, and the software has full multicurrency support. Like any good cloud-based software, FreeAgent works like a breeze on the Mac platform, and its iOS app is a fan favorite.

Pros

Cons

Users are quite pleased with FreeAgent’s recurring invoice and receipt scanning features, which help take repetitive tasks out of small business accounting.FreeAgent is designed for small businesses, so if you’re growing fast, you could outgrow it relatively quickly.Users also have good things to say about FreeAgent’s customer service, which is available by email or phone.FreeAgent is 50% off for your first six months, but after that it’s $24 per month, which is a little high compared to other options on this list.

How much does FreeAgent cost?

FreeAgent has a flat-rate of $12 per month for everything (unlimited users and clients) for the first six months, then goes up to $24 per month after that.

What about the iOS app?

FreeAgent’s iOS app has an average rating of 4.7/5 on 20 reviews. It allows you to view your accounts, manage expenses by snapping pictures of receipts, create and send invoices, and track time.

The main dashboard in FreeAgent accounting for iPad (Source)

6. Kashoo

User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:110+

Once you’ve stopped giggling about the name, you’ll see that Kashoo is a comprehensive accounting tool that is easy to use right from the start on any web-connected device, including Macs. One of Kashoo’s standout features is their customer support: You get free phone and web support with your subscription, which is much easier than standing in line at the Genius Bar.

Pros

Cons

The free phone and web support is a real plus for those of us who like to have some expert guidance.Kashoo integrates with Square for payments and Paychex for payroll in the U.S. (and PaymentEvolution in Canada, where it’s based) but beyond that, it doesn’t have much to offer as far as customization.Kashoo has a flat rate, so you get every feature in the basic plan.Some users have reported issues syncing multiple bank accounts with Kashoo, so it’s a good thing they have easily accessible customer support.

How much does Kashoo cost?

Kashoo is $19.95 per month, or $16.58 per month if you pay for an entire year up front ($199).

What about the iOS app?

Kashoo’s iOS app has a 4.3/5 rating on more than 50 reviews. It allows Kashoo users to view reports, manage and send invoices, accept payments, and scan receipts.

The tax management interface in Kashoo (Source)

What’s your favorite accounting software for Mac?

Are you an accountant (either accidental or professional) and a power Mac user? If so, what’s your weapon of choice, whether it’s listed above or something else? (There are plenty of other options out there with iOS apps, as you can see by filtering for iOS deployment in our accounting software directory.)

I’d love to hear what you use and why you use it so I can recommend it to others. Just let me know in the comments or connect with me on Twitter @AndrewJosConrad.

Note: Listed pros and cons are derived from features listed on the product website and product user reviews on Gartner Digital Markets domains (Capterra, GetApp, and Software Advice). They do not represent the views of, nor constitute an endorsement by, Capterra or its affiliates.

Note:The applications selected in this article are examples to show a feature in context and are not intended as endorsements or recommendations. They have been obtained from sources believed to be reliable at the time of publication.

Looking for Accounting software? Check out Capterra's list of the best Accounting software solutions.

Financial management can be very complicated in you do not have a clear understanding of how much money you are getting and how much is the expenses. If you want to maintain proper financial records then you will be able to use certain Business Accounting Software. These ERP Accounting Software are free to use and most of the Legal Accounting Software will have advanced tools that can be used for making the process easier.

Related:

Account Edge Pro

This premium software from Acclivity Group LLC is a complete accounting solution for small business and management tool that will have all the information regarding sales, purchases, inventory, etc.

Manager

Free Business Accounting Software For Mac

This is a comprehensive free accounting software that has many features like general ledger, expense claims, estimates, quotes, credit notes, purchase orders, cash management, accounts receivable, accounts payable, etc.

Easy Books

This premium software can be used for tracking all the accounts, invoices, statements, and taxes. You can generate invoices in PDF format and email it to the customer and produce a full P&L and balance sheet.

Quickbooks

This premium software from Intuit Inc. will be useful for tracking expenses and sales, creating estimates, managing customers, creating professional looking invoices, managing payments and much more. It can be accessed from anywhere using multiple devices.

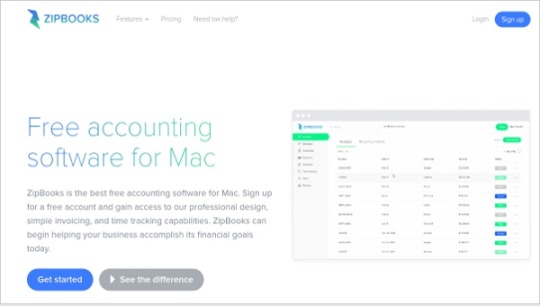

ZipBooks

This free accounting software from Zipbooks is used for its professional interface, simple invoicing and high-level time tracking abilities which will help businesses reach their financial goals. It has an intuitive user interface that can be used for all the aspects.

KashFlow

This premium software from KashFlow Software Ltd is an accounting software that can be used for organizing the company in a better way and managing all the financial aspects in one place.

Money Manager EX

This free and open source software from Money Manager EX has many features like account creation, currency conversions, tracking transactions, managing payee lists, repeating transactions, etc. Stocks, assets, budgets and attachments can be maintained in one place.

Express Accounts Accounting Software

Free Accounting App For Mac

This premium software from NCH software is a business accounting software that can be used by small businesses for documenting and reporting the incoming and outgoing cash flow including receipts, sales, purchases, and payments.

Wave

This free software from Accounting Inc. is secure and approved way of doing your accounting and invoicing. It is suitable for any freelancer, small business, consultant, and entrepreneur.

Sage Software

OSAS

Accountz

MoneyWorks

GNU Cash

Connected

Accounting Edge

Download Free Small Business Accounting Software For Mac

AcctVantage

Best Accounting Software For Mac

Xero – Most Popular Software

Home Accounting Software For Mac

This free software is very popular and it can be used by small business for managing all their financial tasks. Invoicing, bank reconciliation, bookkeeping and many more aspects can be maintained.

Business Accounting Software For Mac Free Download

How to install Accounting Software for Mac?

If you want to install any accounting software, then you should decide the software that you want by going through the reviews. The system requirements should be checked so that all the conditions like memory requirement, operating system, GUI requirement, etc. can be fulfilled. The readme text in the installation file can also be checked for this purpose. If it is a premium version, then the trial version can be used for learning about the features. The free version can be installed directly by using the links and following the instructions that are prompted on the screen. The software can be saved in any location and the language preferences can be set.

You will be able to track your sales and accounts receivable by using this software. Automatic records of recurring orders and invoices can be maintained and reports can be updated as and when an order comes in. You will be able to generate professional level quotes, invoices and sales orders.

Related Posts

1 note

·

View note

Text

My job is super-easy? Okay. YOU do it.

This is pretty long. Smartass TL;DR at the bottom.

I was telling a Buddy about this sub, and he related this story, I tell it to you with his permission.

Buddy is a very charismatic guy, great friend, and probably a great co-worker. He’s the type of guy that everyone is fond of. Easygoing, and seems to have a knack for personal relationships. Always remembers birthdays, if he hears that a band you like is coming to town he’ll text you the news, that sort of guy.

Buddy works for a company that services industrial machinery. It was a small operation, there was Buddy, GoodBoss, Owner, The Kid in the warehouse, a couple of Technicians, and some Office Ladies who handled administration. Buddy was the pivot man in the operation, he was the point of contact for the Technicians and had great relationships with the Clients and the Vendors who supplied the parts. He knew his job inside out, and everyone likes dealing with him. He gets things done.

Now the way this place worked was that the Technicians would send in their reports for the day after 4:00pm. Buddy would look them over, looking for “Rockets”, these were high-priority jobs that needed to be done ASAP, as opposed to routine maintenance issues. He would then email The Kid a list of parts to be picked. Buddy worked 9am to 5:30pm, and was on-call for emergencies. If a “rocket” came in after-hours, Buddy would email The Kid to add it to the morning order.

The Kid arrived for work at 7:00am, and would pick parts orders for the technicians. These would be picked up by a local courier at 9:00am, and taken to a depot. There were 2 major industrial areas in town, and the “depot” wasn’t more than a large mailbox in a post office in each area. The technicians could avoid city traffic by going directly to the depots, which were very close to the clients. The couriers would get these boxes to the depots about 9:30. Buddy would schedule a call for the technicians, and when they finished the first call, they would head around the corner to the depot to pick up their parts.

Things ran smoothly for years, and then GoodBoss decided he wanted to move on. He was grooming Buddy for the move up, and Buddy learned most of the managerial duties GoodBoss covered, in addition to his own duties, things like QuickBooks and scheduling, etc.

GoodBoss leaves, and Buddy takes over these responsibilities, again things run smoothly.

Until Owner tells Buddy that he’s getting a new supervisor. BadBoss. This guy came from a Sales background, had no experience in operations, and was basically there to help Owner bid on big jobs, but his title was Operations Director, and he was Buddy’s new boss.

Buddy was angry that he had been denied the chance to move up, which in a small operation, doesn’t happen often. Add to that the fact that BadBoss was a jerk, but not a dumb jerk, and quickly figured out that Buddy was a threat. And so the lines were drawn. BadBoss had it in for Buddy, and Buddy wasn’t taking any of his shit.

One day BadBoss comes in about 8:45 and sees Buddy shooting the shit in the coffee room with one of the Office Ladies, and lays into him. “Why aren’t you at your desk? I don’t pay you to stand around talking. Get to work.”

Buddy starts to protest that he’s actually at the office 15 minutes before his shift, but BadBoss cuts him off, “I don’t listen to bullshit excuses. I want you at your desk at 8am sharp, and I want you to send me an email every morning to prove it. Now get going.”

Buddy sends him an email, BCC to Owner, asking BadBoss to confirm that he wants Buddy working 8-4:30. There was also a previous email saying “no overtime”. BadBoss sends a tersely worded confirmation.

Now Buddy comes in just before 8am, sends an email right at 8, confirming he’s on duty, and BCC to Owner. But here’s the problem.

The Technicians send their reports in after 4pm. Buddy lets it be known on the down-low that closer to 4:30, the better. So the parts requests come in at 4:25, and Buddy leaves at 4:30. He doesn’t get a chance to review them until 8 the next morning. He sends the order pick to The Kid, who doesn’t have enough time to assemble the order before the courier comes at 9am.

So what used to be next-day service ends up taking an extra day. If a Technician requests a part on his Monday report, he gets it Wednesday, not Tuesday, the way things worked before.

The customers start to revolt, loudly and energetically. These are industrial production machines, and when a “rocket” is delayed, it means a machine is down for an entire extra day. The customers are losing production and they are NOT happy.

Buddy gets called into a meeting on a Thursday with Owner and BadBoss demanding to know what the hell is happening. BadBoss is in full form, and says that Buddy’s job is super easy, and these delays are unacceptable.

Buddy explains exactly why the delays are occurring, it’s all because BadBoss changed his hours. Owner gives BadBoss the stink-eye after confirming that he ordered the schedule change.

“Okay, fine.” BadBoss concedes. “You go back to your old hours, starting Monday”

“I won’t be here Monday,” replies Buddy.

“What are you talking about?”

“I am on holiday for 2 weeks. Didn’t you check the vacation schedule?”

BadBoss goes red in the face. “I never approved any holiday request from you. You are NOT on holiday.”

“Yes, I am. The request was approved by GoodBoss before you were hired. Do you want to see the emails?”

“I don’t give a shit. Your holidays are cancelled.”

“Sorry, but my brother is getting married, and I am in the wedding party. I fly out to The Dominican on Saturday. I will be back in 2 weeks.”

“Who have you trained to take over your duties?” asks Owner.

“Well, back in the day GoodBoss would cover. I guess it’s up to BadBoss to cover while I am gone.”

BadBoss is stuck. He can’t very well claim that Buddy’s job is super easy, and then claim later in the same meeting that he can’t do it.

Oh, my Lord. What a shitshow.

The Technicians requested, say, a front sensor for a BoomStomper Model 31. BadBoss would ask them for a part number, and the Technician would reply, “I don’t know, Buddy knows all the part numbers.” Then he would go to The Kid, and say he needs to send a sensor to the Technician, and The Kid would point to the racks, where all the parts were labelled by part numbers. “I need a part number if you want to add it to an order”.

Buddy had an exhaustive Excel folder with all kinds of parts lists in it on his desktop. He also had a massive collection of manufacturers binders on shelves behind his desk. The Excel folder was already named something obscure, BadBoss couldn’t find it, so BadBoss was forced to look parts up in the binders. No CTRL-F in Excel to find a part number for BadBoss.

Buddy had bookmarks on his Chrome browser for manufacturer’s and vendor’s websites. He removed all the bookmarks so BadBoss, if he wanted in to log into any of these sites, had to create his own login. Buddy’s were on LastPass, but BadBoss didn’t have the LastPass password.

Buddy was also the adept with computers, so he had been given the access to the phone system portal. He set it up so that any calls to his desk phone or work cell would get “I am on vacation, in my absence, please contact BadBoss at Extension 123.” And then the call would forward to BadBoss’s desk phone, and if unanswered, to his work cell. After hours emergency calls went directly to BadBoss’s work cell, and if unanswered, to his HOME phone.

Buddy set up his Outlook with an autoreply that said to contact BadBoss, and copied Owner in.

Then Buddy shut off his work phone and took two weeks off.

BadBoss found out in a hurry that Buddy’s job wasn’t so super-easy after all. He was getting calls from irate clients, Technicians with the wrong parts, and calls in the evening that he had no way to handle. Remember that they repaired industrial machinery, and some facilities were 24-hours.

When Buddy got back BadBoss was waiting for him by the door and went ballistic. It was a screaming match that drew everyone, even Owner, who literally had to step between them.

Finally Buddy just screamed, “Fuck this shit. I can’t work with this guy.” He turned to Owner and said, “You saw how this place ran when I was doing HIS job, and now you see what it’s like when he’s doing mine. I am going back home, right now, before I do something I regret. So you have a choice to make.

“I’ll come in tomorrow and clean out my desk if this asshole hasn’t cleaned out his first.”

When he arrived on Tuesday, all the staff were grinning and BadBoss’s office was empty. Owner called him into his office and told him that BadBoss was gone and Buddy could get back to work.

“Nope,” said Buddy. “His office is empty, and I want it. I want his job, I want his pay, I want his perks. I have been here for years and you know what I can do. Put me in charge.”

And that’s how Buddy got his promotion. Since then the company has grown, and Buddy has grown right with it. There are now branches in 3 cities, a huge staff, and Buddy is in charge of it all.

And he still reminds me when my favorite band is coming to town.

TL;DR Grow an attention span.

(source) (story by PJMurphy)

#prorevenge#by PJMurphy#pro revenge#revenge stories#pro revenge stories#pro#revenge#revenge story#last10

2K notes

·

View notes

Text

The Best Legal Tech Tools to Help Entrepreneurs to Manage Legal Processes

By: Amanda Ciccatelli

As we emerge from a global pandemic where working from home for many has become the new normal, smart entrepreneurs must leverage remote work and other technology to manage and scale their businesses.

Twenty years ago, the first dollar of startup revenue was likely not far from Founder Louis Lehot’s elite boutique law firm L2 Counsel in Silicon Valley. Since then, startups have globalized — with one co-founder at one end of the world, another at the other, R&D, sales and marketing all over. Technology businesses are inherently global, so they must operate in compliance with multiple jurisdictional statutes, rules, regulations, commercial contracts, licenses and more. Now more than ever, LegalTech tools will play a key role in running legal processes for your business.

Today, legal process points cause frustration for entrepreneurs everywhere — from harvesting and protecting IP rights, to storing and securing customer information, to negotiating and renewing contracts — the potential for human error is big. To alleviate this issue, LegalTech tools can enable safe, secure and private communication, document storage and management, e-signature and cloud-enabled contract management and AI tools.

We sat down with Louis Lehot who has represented hundreds of startups over the last 20 years, to discuss the best LegalTech tools to use for your business. Below is a list of the best LegalTech tools for collaboration, spend management, and contract review, according to Louis Lehot.

The Best LegalTech Tools for Collaboration:

Zoom has become the poster child for video-conferencing lately. With high quality images and audio, virtual backgrounds, audio calling, conference calls, screen sharing and scheduling, startups have flocked to this affordable technology.

“While it has had some security issues, and could be improved to allow for better recording and editing, it remains a piece of resistance for legal communications and collaboration,” he said.

Skype has been accelerating enterprise penetration since its acquisition by Microsoft, allowing for free web meetings, video conference and VOIP software. There is also an instant messaging feature, audio and video call features, mobile phones and landline calling, paid international calling, and conference call capabilities for up to 25 people.

Louis Lehot added, “During video sessions, users can share their screen, and other features include background blurring, voice and text translation, location sharing, and conversation searching.”

Microsoft Teams combines video conferencing with team collaboration tools, allowing MS Office users to conduct conference calls and share files, as well as join or initiate a group chat. He said, “The shared chat space and ability to break out into smaller groups can enable collaboration tools to share documents.”

However, deletion of messages is not enabled, there is no group calendar option, and the permission settings are not user-friendly.

RingCentral is a VOIP solution available in the cloud, featuring video and audio conferencing, desktop phone rentals, collaboration tools and integrations with other apps. According to Louis Lehot, it is known for quality voice and video communication, consistent interface across platforms, good performance, messaging and texting. But, generating reports takes about 24 hours and often contain inaccuracies, group calls are challenging, and there is no forwarding to an external number or group texting features as of this writing.

Google Hangouts provides a communication and extension of the Google collaboration platform to include messaging, voice, VoIP, and video call capabilities. Louis Lehot explained that users can “Hangout” to start a chat or video call, phone call using Wi-Fi or data, send text messages with a Google Voice or Google Fi phone number. “They sync across devices, and you can start a call on one device and switch to another. It’s free, can run on almost any platform, easy to set up, with a clean and intuitive interface,” added.

Cisco WebEx is a cloud-based phone system optimized for midsized and large enterprises. It presents essential business calling capabilities and removes complexity of managing a phone system infrastructure on premises. According to Louis Lehot, this tool has an easy interface, fast notifications to email, clear connections, easy to add users, mobile use, easy to switch between devices and collaboration with WebEx document sharing teaming. The only problem is that it can take 5–10 minutes to download the local client, so Louis Lehot advises that you make sure your other users have previously installed it.

The Best LegalTech Tools for Spend & Matter Management:

Clio, Practice Panther, Thomson Reuters (Serengeti), and other programs attempt to solve the problem of managing budgets, billing and time management. Clio and PracticePanther are web-based legal practice management software packages, principally for small law firms and solo practitioners, with case management, accounting and document storage functions.

SimpleLegal focuses on modern legal operations management that combines matter management, e-billing and spend management, vendor management, knowledge management and provides business insights through robust reporting and analytics.

“It is best for tracking expenses, creating, analyzing matters, reporting and analytics,” he said. “However, some wish that it had the functionalities of QuickBooks and out-of-the-box API integrations.”

Acuity Elm is a cloud-based enterprise legal spend management solution, providing business solutions to in-house counsel and legal ops teams of all sizes. Louis Lehot likes that it helps teams reduce spend, increase productivity and improve outcomes and transparency.

“It serves as a communication for clients and counsel to share and organize documents, as well as manage time entry, and it keep track of cases,” he explained. “But it is criticized for provoking tension between companies and counsel and being overly complex.”

The Best LegalTech Tools for Contract Review:

Contract Companion provides a proofreading tools that leverages AI to ensure documents meet quality standards, automatically identifies and reviews errors in real-time and quickly bacs back to higher-value activities.

He added, “It consistently demonstrates capabilities and work integrity and has time management tools designed to reduce time pressure and complete a precise review that is difficult to achieve manually.”