#Entrackr

Explore tagged Tumblr posts

Text

Indian Startup Funding and Acquisitions News [02 – 07 Sep]

During the week, 26 Indian startups raised around $421.29 million in funding. These deals count 4 growth-stage deals and 16 early-stage deals while 6 startups kept their transaction details undisclosed. Highlights:- 🚀26 startups 💰$420 Mn+ total funding 🌱22 early stage deals 🧑💻 5 key hirings 🤝 2 M&A 🚶2 layoffs (70 employees)

0 notes

Photo

Zomato initiates liquidation of Portugal-based subsidiary Zomato has initiated the liquidation proceedings of its wholly-owned subsidiary, Zomato Media Portugal, according to the disclosure made to the stock exchange. Zomato clarifies that its Portugal entity is not a material subsidiary and has no active business operations which will not affect the turnover/revenue of the company. ZM Portugal has a net worth Rs … Continue reading "Zomato initiates liquidation of Portugal-based subsidiary" The post Zomato initiates liquidation of Portugal-based subsidiary appeared first on Entrackr. https://entrackr.com/2023/07/zomato-initiates-liquidation-of-portugal-based-subsidiary/

0 notes

Text

ShareChat’s chief business officer Gaurav Jain steps down

ShareChat’s Chief Business Officer Gaurav Jain has decided to step down from his role, sources familiar with the matter told YourStory. . Entrackr was the first to report this development. During this transition, the homegrown social media platform has appointed Chief Financial Officer Manohar Charan to oversee business operations, according to the source with direct knowledge of the…

View On WordPress

0 notes

Text

Early Access Investing: How to Find Gems in the Unlisted Market

In recent years, India’s unlisted stock market has quietly gained traction among savvy investors looking for early access to high-growth companies. For those willing to do their research, this market offers a unique chance to invest in tomorrow’s big brands before the IPO buzz.

This approach is often called Early Access Investing, and it’s all about finding promising companies while they’re still private. Let’s break down how it works, and how you can spot potential winners in the unlisted space.

Why Early Access Investing?

Getting in early allows investors to buy shares at a lower valuation before market hype drives prices up. When the company grows or goes public, the potential upside can be significant. It’s the same principle venture capitalists use, but now it’s more accessible to retail and HNI investors.

How to Find Hidden Gems

Here are some practical tips for finding promising unlisted companies:

1. Track Upcoming IPOs

If a company is preparing to go public, chances are its unlisted shares are already being traded. Keep an eye on DRHP filings (Draft Red Herring Prospectus) on SEBI’s website or financial news platforms.

2. Follow Startups & Funding News

Use platforms like YourStory, Entrackr, and Tracxn to follow high-growth startups receiving investor funding. These companies often allow early investors to exit through the unlisted market.

3. Use Trusted Platforms

Websites like UnlistedZone, Planify, and Capitallinked offer access to unlisted shares and track prices, financials, and IPO plans. These platforms also share analyst reviews and insights.

4. Look for ESOP Opportunities

This opens a door for retail investors to purchase valuable shares directly from insiders.

5. Analyze Company Fundamentals

Before investing, check for:

Revenue and profit growth

Management team experience

Market share and industry potential

IPO timeline, if any

Risks to Keep in Mind

Low liquidity: It may take time to exit your position.

Lack of regular updates: These companies aren’t required to disclose financials publicly.

Regulatory and tax complexity: Different rules apply compared to listed stocks.

So while the rewards can be high, it’s important to invest carefully and selectively.

Conclusion

With the right research, timing, and patience, you can uncover hidden gems and potentially earn significant returns.

It’s not just about chasing IPO gains it’s about being ahead of the curve.

0 notes

Text

Fintech unicorn InCred poised to enter the realm of Insurtech with upcoming initiatives

InCred, the versatile fintech startup, is expanding its horizons into the insurance domain after obtaining approval to pursue a corporate insurance agency license from the Insurance Regulatory and Development Authority of India (IRDAI). The news was disclosed in a filing with the Registrar of Companies (RoC) and initially reported by Entrackr. This strategic leap comes as InCred Holdings Limited, the parent company of InCred Financial Services Ltd, recently secured commitments worth INR 500 Cr ($60 Mn) in its Series D Funding round. A global private equity fund, corporate treasuries, family offices, and UHNIs have expressed keen interest in joining this round, catapulting the startup into the coveted unicorn club.

For more details please visit our website: https://www.sbookmarking.com/story/fintech-unicorn-incred

0 notes

Text

This week's @Entrackr roundup highlights KiranaPro’s ONDC integration, alongside major startup funding, acquisitions & key market moves! 🔗 Read more: https://entrackr.com/report/weekly-funding-report/funding-and-acquisitions-in-indian-startup-this-week-feb-17-feb-22-8746227?utm_source=dlvr.it&utm_medium=tumblr #ONDC #Startups #Funding

0 notes

Text

Haber, a B2B robotics startup, announces a $38 million Series C round

Haber, a manufacturer of industrial robotics, raised Rs 317.2 crore (about $38 million) in its Haber robotics startup Series C funding, which was headed by Creaegis and included Accel India and BEENEXT Capital. The Pune-based company’s latest round of funding, the Haber robotics startup Series C funding, occurred following a three-year hiatus.

According to regulatory papers that Entrackr was able to access, the board of Haber has approved a special resolution to issue 100 equity shares and 457,572 Series C preference shares to raise the aforementioned amount in the Haber robotics startup Series C funding.

With Rs 200.35 crore, Creaegis was the round leader; BEENEXT and Accel contributed Rs 83.5 crore and Rs 33.4 crore, respectively, as part of the Haber robotics startup Series C funding.

The investment will help the business meet its other capital needs as well as its expansion and growth. Haber’s post-allotment valuation is roughly Rs 1,242 crore ($148 million), according to TheKredible, following the successful Haber robotics startup Series C funding.

Industrial robots with artificial intelligence (AI) capabilities are created by Haber to automate labor-intensive operations like sample collecting, measurement, analysis, and factory intervention. On its website, Haber claims to assist businesses in lowering the amount of chemicals, energy, and water used in industries like food and drink, agriculture, and oil and gas, further enhancing its appeal during the Haber robotics startup Series C funding.

So far, the company has funded approximately $65 million, including a $20 million Series B investment in November 2021 led by Ascent Capital and including Accel, Elevation, and BEENEXT, setting the stage for the Haber robotics startup Series C funding.

With an 18.1% ownership, Accel is the largest external stakeholder, followed by Elevation and Creaegis, both of whom participated in the Haber robotics startup Series C funding.

Haber reported a total revenue of Rs 82 crore and a loss of Rs 36.7 crore in FY23; FY24 data are not yet available. Its direct competitors include Altizon, Fero Labs, and Prosus-backed Detect Technologies, making the success of the Haber robotics startup Series C funding even more critical for its competitive edge.

Read More: Click Here

0 notes

Text

Exclusive: Infibeam entering UPI payments with new app RediffPay https://entrackr.com/2024/09/exclusive-infibeam-entering-upi-payments-with-new-app-rediffpay/

0 notes

Text

Rapido to turn cash flow positive next quarter by Aravind Sanka

In a recent interview, Sanka revealed that every segment of Rapido’s business is already generating positive EBITDA. “When we account for all the costs associated with each segment, including corporate expenses, every category is profitable. We are just a few months away from reaching overall cash flow positivity,” he explained.

Sanka also highlighted Rapido’s significant financial progress, noting that the company has doubled its gross merchandise value (GMV) annually while reducing losses by over 50%. Rapido’s GMV has now surpassed $1 billion.

The company is preparing to release its financial statements next month. Earlier this month, Rapido secured $200 million in a Series E funding round, which elevated its post-money valuation to $1.1 billion and earned it a spot in the unicorn club.

The new funding will be used to expand Rapido’s operations to an additional 250-300 cities over the next year. Currently, Rapido operates in over 100 cities across India. Sanka emphasized that the company aims to launch in new cities while deepening its presence in existing markets by introducing new services and addressing barriers to ride-sharing adoption.

Rapido has seen impressive growth, onboarding over six million users per month in the last quarter, indicating strong potential for further expansion. The company is also targeting growth in Tier II and III cities, particularly within the quick commerce sector, through partnerships with companies like Swiggy.

“We’re working on integrations with these partners and expect to launch most of them within the next quarter,” Sanka said.

In addition, Rapido is preparing for an IPO on Indian stock exchanges. While there is no fixed timeline for the filing, Sanka indicated that the company aims to be ready for a public listing within the next 18 months.

In a competitive landscape that includes global giants like Uber and Ola, Rapido has made notable strides. According to an Entrackr report from March 2024, Rapido has surpassed Ola in daily ride volume, handling 2.5 million orders per day and establishing itself as the largest in terms of daily rides.

READ MORE

#business#news#marketing#ceo#Rapido cash flow#Rapido financials#Aravind Sanka#Cash flow positivity#Rapido forecast#CEO Rapido#Financial outlook#Rapido earnings#Cash flow report#Rapido performance

0 notes

Text

Unicommerce, an e-commerce SaaS platform, reported a 3% increase in revenue and a 22% rise in profit for Q1 FY25 compared to Q1 FY24. Revenue from operations grew to Rs 27.4 crore, while profit reached Rs 3.5 crore. This growth was supported by controlled expenditure, with the firm spending Rs 24.2 crore on employee benefits, server hosting, and other overheads. Unicommerce operates in multiple countries, including India, Indonesia, and UAE, offering integrated e-commerce enablement solutions. The company's IPO, launched in August 2024, was oversubscribed by 168 times, with shares currently trading at Rs 221.97, giving it a market capitalization of Rs 2,273 crore (around $274 million).

If you want to get complete information related to this topic click HERE.

0 notes

Text

Skin care brand Minimalist revenue balloons 8X with profit in last two fiscals - Entrackr

https://news.google.com/rss/articles/CBMirAFBVV95cUxPVUUtbDBkREdHRW9YMlhzSWpWUVllSm8yZ21Sa3ZGN09wMXliNG5nMExma2Z6V3d6U2FwZTJtQ0htU1Zpd2hObEw3UC1tWU96ckNEQXFDeURiZ1IyeW9YSndrd3hhczNtZzF6bUYzeW5pd3VOaVZxd2VqdGNWb2oza2lKYmlnakZJd2ViSlpPUlo0VzBtNThYeFhPdXNudzNwTjd0U05nam43ZGF1?oc=5&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

In a series of mass layoffs, a former employee stole a Bengaluru CEO’s passport, which included a US visa

The problems facing Bengaluru-based startup Saarthi AI don’t appear to be going away. In an attempt to turn a profit, the corporation carried out a large-scale layoff last year, and since March 2023, it has allegedly withheld the salaries of multiple employees.

The CEO of Saarthi AI now alleges that his passport, which had a US visa, was stolen by a former worker.

In July, Vishwa Nath Jha, the founder and CEO of Saarthi AI, informed news agency PTI that the company had to fire some staff to turn a profit. The layoffs were caused by “investor pressure,” he said.

A report that was released today in Entrackr gives the narrative a new angle. Speaking to the tech news website, Jha stated that he is unable to travel overseas to raise additional funding for the struggling company since a top employee seized his passport.

“Although I was able to obtain a new passport, I have not yet received my US visa. There’s a long line,” Jha remarked.

Discontent over unpaid salaries

He dismissed claims that employees’ salaries were being withheld. Jha stated that no salaries have been held back and called the allegations a tactic to damage the AI startup’s reputation. “We are looking to fill key positions as we negotiate deals with various banks and NBFCs,” he added.

However, the company’s current and former employees have a different tale to tell. The personnel of Saarthi AI was reduced to 40 employees due to the major layoffs that occurred in September of last year. About a dozen workers that Entrackr spoke with claimed they still hadn’t received their overdue salaries.Read More-https://voiceofentrepreneur.life/

0 notes

Text

UpGrad Secures Rs 287.5 Crore Debt Funding From EvolutionX To Fuel Growth

Leading Indian online education provider upGrad has received debt capital of Rs 287.5 crore (about $35 million) from growth-stage debt financing company EvolutionX Debt Capital, situated in Singapore. With this fresh round of funding, upGrad will be able to meet its operational needs, quicken its rate of expansion, and accomplish other company goals.

The announcement follows the approval of the issue of 28,75,000 debentures having a face value of Rs 1,000 apiece by upGrad’s board through the passage of a special resolution. By carefully increasing the total capital obtained to Rs 287.5 crore, this step strengthens Grad’s financial position. Entrackr disclosed the details in a report, referencing regulatory records obtained from the Registrar of Companies (RoC).

Strategic Allocation of Funds

Although the precise distribution of the funds is still unknown, upGrad has made clear the main areas that will be invested in. The company plans to use the debt financing to finance its expansion plans, reduce overhead, and meet critical business requirements. Using a multi-pronged strategy, upGrad can be sure that the funding is used intelligently to improve its entire market position and provide the groundwork for future growth.

A Legacy of Investment and Growth

UpGrad’s history has been distinguished by steady expansion and a reputation for drawing in well-known investors. As of March 2023, the corporation has raised over $700 million in investment, with a noteworthy $36.5 million coming from a right issue. Important players like Temasek, upGrad creator Ronnie Screwvala, and a group of other investors participated in this right issue.

A distinguished group of names, including TOEFL, Artisan Partners, IIFL Finance, International Finance Corporation (IFC), Kaizenvest, 360 One Asset, and Unilazer, comprise upGrad’s investment base. This robust investor support is indicative of the industry’s faith in upGrad’s novel approach to education and its prospects for sustained success.

Read more: Marketing News, Advertising News, PR and Finance News, Digital News

0 notes

Text

Digital Marketing Strategy of Physics Walla

Digital Marketing Strategy of Physics Walla

Physics Walla Case Study to understand how Physicwalla created a 100 crore profit starting as a tutor in 2014.

Alakh Pandey aka Physicswalla was a college dropout, from a middle-class family who loved teaching.

He started teaching at a JEE coaching center and students just loved him.

To reach more students he started a YouTube channel in 2014. For a couple of years, he shared tutorials but it didn't move the needle.

In 2017 he decided to quit his job and focused his YouTube videos on teaching physics to ICSE students.

This was when his channel grew exponentially.

Marketing Strategy of Physicswallah

Do you know what is the USP of Physicswallah? His strength is his storytelling and his connection with his students.

Storytelling

Alakh Pandey has a great ability to teach via stories. He adds motivational stories, and real-life case studies and inspires students.

He can connect via stories.

Adding value to the customer

Customer aka the student is the most important person for Alakh. He always focused on his students and provided value.

Value addition has paid off big time for Physicswallah which has created a huge fan base.

Customer focus creates loyalty

Physicwallah is the star of EdTech. He is… He has numerous fan pages who constantly post content about him.

They share memes, and snippets from his classes, share his quotes, and are one of the primary reasons for his success.

Just a warning… do not ever try to get on his wrong side… it has been said that his students are so loyal… they have been known to create digital warfare against anyone who is known to have tried to discredit him…

This could be the single most important marketing strategy of Physicswala - a customer-focused approach.

Innovation

Physicswalla is a classic example of a company that has taken advantage of technology. They have launched apps, introduced referral systems, and have launched numerous courses and coaching centers.

They have welcomed funds and acquired companies to leverage their position the the EdTech industry.

Alakh Pandey has taken advantage of his fanbase and has risen above the crowd.

His ingenuity did not stop there. He went on to create an app that massed 300k downloads in just 7 days.

Rumor mills say it crashed the app store…

Let's talk about some marketing, and what exactly worked for Physicswalla.

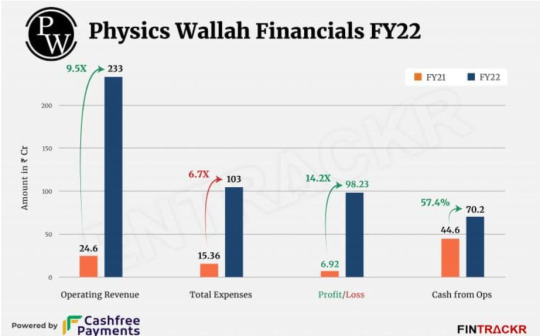

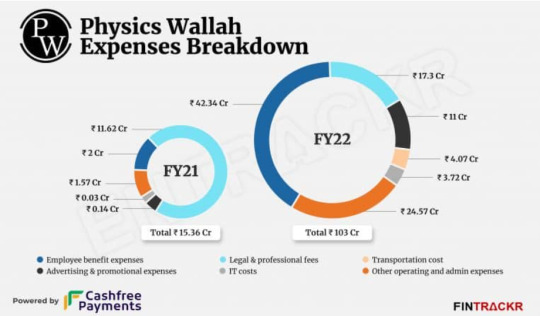

If you notice the financials of Physics Wallah you can see that they have generated a huge income.

Further drilling down, you will notice they have kept their advertising costs low… really minimal.

How did they manage to spend so less on advertisements and yet grow so big?

Financial as per entrackr

Let's break down how product pricing is decided.

Product pricing is decided majorly by

Production cost

Marketing Cost or COCA (cost of customer acquisition)

To increase your profits you need to lower the cost of customer acquisition.

The greater the cost of acquisition of a customer, the lower the profits.

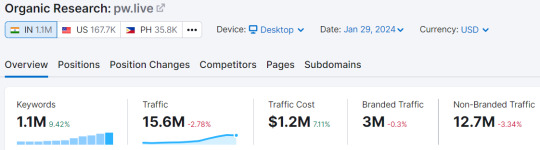

Digital Marketing Strategy of Physicswallah

Physicswalla is an example of how personal branding can make you successful.

Analysing the website traffic you will notice that branded search terms constitute a major source of traffic.

Personal Branding

Branded search is an indicator that you have done everything right. People are searching with your name and your company's name.

This also indicates how loyal their customers (students and parents) are. This also proves the rule of 7 of marketing.

Establishing Multiple touchpoints

Elmo Lewis from the advertising industry coined the term "Rule of Seven" in early 1927. It was coined as the rule of 7 and referred to as the effective frequency.

Rule of seven states that it takes 7 interactions with a brand, with an ad for a potential customer to be influenced.

Fun Fact - Elmo Lewis is the person who also coined the terms AIDA and USP.

What has all this to do with Physicswalla?

He has built a brand and generated trust. He has created multiple touchpoints which are essential to generating a steady stream of leads.

This in turn has helped him manage low advertisement costs.

You can find him on Instagram, Twitter, Facebook, and YouTube, and he even has a dedicated Telegram channel.

Multiple active touchpoints with a massive fan following to reach potential customers.

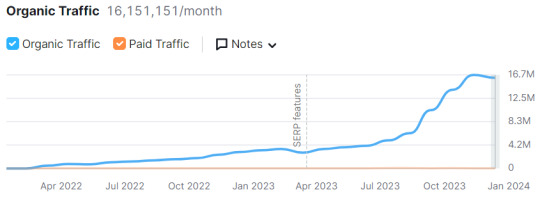

Organic Marketing

Analysing the traffic of Physicswalla you can't but notice how vast the organic traffic is.

The website alone generates approx 16 million visitors using over 1.1M keywords to find the site.

3M of this traffic is branded ( did I mention every month?).

Content Marketing

Content in the form of images, videos, memes,content shared by fans and blog posts have been one of their key sources of success.

Physicswalla is a company that has all the right ingredients of growth. Understanding their digital marketing strategy and implementing it in your venture will help you take your business to an all-new level.

Author

Latha is a Digital strategest and content marketer. You can find her on LinkedIn.

1 note

·

View note

Text

CyborgIntell seeks to simplify AI machine learning in order to improve business outcomes

India has the third largest fintech ecosystem in the world with The sector in India recorded a market size of $31 billion in 2021. The market has been steadily expanding due to the increase in digitization in the country. The recent entry of AI into the sector has further contributed to this growth.

Data as complex as it is of utmost importance especially to the BFSI market. The collection and correct usage of data can create a significant difference to the companies in the sector.

In order to help companies collect and process large amounts of data, help with the decision-making process and to assist companies to adopt AI technology; trio Suman Singh, Mohammed Nawas, and Amit Kumar founded CyborgIntell in 2019.

CyborgIntell is an enterprise AI software company for financial services, poised for simplifying AI & designed for better ROI. The company was set up to help companies take up AI using the company’s end-to-end Automated Data Science Machine Learning platform to accelerate the decision making process simpler and faster.

Co-founder and CEO Singh told Entrackr, “Our whole mission has been how we can simplify this AI and help our customer to generate a better ROI in a much faster, better and accurate manner.”

Among its key products are iTuring AutoML+ a zero-code auto AI that helps automate data science and machine learning, iTuring MLOps works along with the company’s DevOps platform and helps operationalize AI models for business impact, and iTuring Decision AI which helps organize the outputs of the predictive models and supplement them with policy driven rules.

Basically, iTuring cuts down turnaround time, aids in increasing efficiency, and assists in the delivery of new solutions, looking to increase a business’ ROI and save money by increasing precise and reliable business decisions.

The company has its headquarters in Bangalore, but it also operates offices in Johannesburg and Dallas. The platform licensing subscriptions generate the majority of the company’s revenue. It currently has around 40 active users.

A majority of CyborgIntell’s customer base consists of Tier-1 and Tier-2 banks, Tier-1 and Tier-2 insurance, digital lending, and housing finance companies.

The fintech company has received a total of $2 million in funding in its pre-series A funding round which saw participation from SenseAI, Pentathlon Ventures, and Ghosal Ventures.

The company is currently in discussions with fintech, insurance technology, and core banking solutions companies about developing analytical applications to extract value from their customer data through automation.

As part of its plans of expansion, the four-year-old company recently extended its operations to the US signing it a insurance company in North America. It further plans on expanding into new geographies within the North American market as well.

It currently faces competition from companies like Dataiku, DataRobot, and SAS. In order to get a stronger hold of the market globally as well, the company is also looking to tap into the Singapore, UAE, and Malaysia fintech markets.

0 notes