#Fanless Computer

Explore tagged Tumblr posts

Text

Fanless Industrial Computer | Rugged, Quiet & Reliable

Looking for a robust, efficient computing solution? ValanoIPC’s Fanless Industrial Computer delivers quiet, rugged performance in a compact, maintenance‑free design. Built for demanding industrial environments, this computer is tailored to power your automation, monitoring, and data‑acquisition applications.

Why Choose a Fanless Industrial Computer?

Zero moving parts – no fans means significantly reduced failure points, enhanced reliability, and zero dust circulation.

Ultra‑quiet operation – perfect for noise‑sensitive environments such as control rooms, laboratories, and classrooms.

Industrial durability – rated for wide temperature ranges and equipped with shock‑ and vibration‑resistant components, it thrives in harsh conditions.

Compact & flexible – easily integrates into industrial racks, wall mounts, or small enclosures with versatile I/O options.

Key Features

Intel® J1900 Quad‑Core Processor Delivers smooth, multi‑threaded performance for typical industrial workloads—SCADA systems, OPC UA servers, PLC communications, kiosk control, and more.

Fanless Embedded Design Fully sealed chassis with no vents, ensuring protection against dust, moisture, and airborne contaminants. Ideal for food processing, packaging plants, factories, and outdoor automation.

Wide Temperature Endurance Operates reliably in extreme conditions (–20 °C to +60 °C standard, extended models up to –40 °C or +70 °C), making it a dependable choice across climates and weather.

Rich I/O Suite Offers multiple USB, COM, HDMI, Ethernet, and GPIO interfaces. Easily connect sensors, cameras, HMIs, and legacy peripherals. Dual LAN configuration supports network redundancy.

Flexible Storage & Expansion Supports mSATA and 2.5″ SSD drives, plus optional internal mini‑PCIe slots for Wi‑Fi, LTE, or additional I/O. Customize your system for edge‑AI, underwater monitoring, or energy solutions.

Ideal Use Cases

Industrial Automation – perfect for PLC supervisory control, data acquisition, and real‑time monitoring.

Smart IoT & Edge Computing – smoothly handles local AI inferencing, analytics, and MQTT/CoAP messaging.

Transportation & Surveillance – rugged and compact enough for trains, buses, tunnels, and security systems.

Medical & Laboratory – maintains sterile and quiet environments with silent, fan‑free operation.

Why ValanoIPC?

With decades in industrial computing, ValanoIPC designs reliable products purpose‑built for real‑world endurance. Our Fanless Industrial Computer series is fully configurable, CE/FCC certified, and comes with long‑term support and firmware updates—excellent value for life‑cycle management.

0 notes

Text

MediaTek Kompanio Ultra 910 for best Chromebook Performance

MediaTek Ultra 910

Maximising Chromebook Performance with Agentic AI

The MediaTek Kompanio Ultra redefines Chromebook Plus laptops with all-day battery life and the greatest Chromebooks ever. By automating procedures, optimising workflows, and allowing efficient, secure, and customised computing, agentic AI redefines on-device intelligence.

MediaTek Kompanio Ultra delivers unrivalled performance whether you're multitasking, generating content, playing raytraced games and streaming, or enjoying immersive entertainment.

Features of MediaTek Kompanio Ultra

An industry-leading all-big core architecture delivers flagship Chromebooks unmatched performance.

Arm Cortex-X925 with 3.62 GHz max.

Eight-core Cortex-X925, X4, and A720 processors

Single-threaded Arm Chromebooks with the best performance

Highest Power Efficiency

Large on-chip caches boost performance and power efficiency by storing more data near the CPU.

The fastest Chromebook memory: The powerful CPU, GPU, and NPU get more data rapidly with LPDDR5X-8533 memory support.

ChromeOS UX: We optimised speed to respond fast to switching applications during a virtual conference, following social media feeds, and making milliseconds count in in-game battle. Nowhere is better for you.

Because of its strong collaboration with Arm, MediaTek can provide the latest architectural developments to foreign markets first, and the MediaTek Kompanio Ultra processor delivers the latest Armv9.2 CPU advantage.

MediaTek's latest Armv9.2 architecture provides power efficiency, security, and faster computing.

Best in Class Power Efficiency: The Kompanio Ultra combines the 2nd generation TSMC 3nm technology with large on-chip caches and MediaTek's industry-leading power management to deliver better performance per milliwatt. The spectacular experiences of top Chromebooks are enhanced.

Best Lightweight and Thin Designs: MediaTek's brand partners can easily construct lightweight, thin, fanless, silent, and cool designs.

Leading NPU Performance: MediaTek's 8th-generation NPU gives the Kompanio Ultra an edge in industry-standard AI and generative AI benchmarks.

Prepared for AI agents

Superior on-device photo and video production

Maximum 50 TOPS AI results

ETHZ v6 leadership, Gen-AI models

CPU/GPU tasks are offloaded via NPU, speeding processing and saving energy.

Next-gen Generative AI technologies: MediaTek's investments in AI technologies and ecosystems ensure that Chromebooks running the MediaTek Kompanio Ultra provide the latest apps, services, and experiences.

Extended content support

Better LLM speculative speed help

Complete SLM+LLM AI model support

Assistance in several modes

11-core graphics processing unit: Arm's 5th-generation G925 GPU, used by the powerful 11-core graphics engine, improves traditional and raytraced graphics performance while using less power, producing better visual effects, and maintaining peak gameplay speeds longer.

The G925 GPU matches desktop PC-grade raytracing with increased opacity micromaps (OMM) to increase scene depths with subtle layering effects.

OMM-supported games' benefits:

Reduced geometry rendering

Visual enhancements without increasing model complexity

Natural-looking feathers, hair, and plants

4K Displays & Dedicated Audio: Multiple displays focus attention and streamline procedures, increasing efficiency. Task-specific displays simplify multitasking and reduce clutter. With support for up to three 4K monitors (internal and external), professionals have huge screen space for difficult tasks, while gamers and content makers have extra windows for chat, streaming, and real-time interactions.

DP MST supports two 4K external screens.

Custom processing optimises power use and improves audio quality. Low-power standby detects wake-up keywords, improving voice assistant response. This performance-energy efficiency balance improves smart device battery life, audio quality, and functionality.

Hi-Fi Audio DSP for low-power standby and sound effects

Support for up to Wi-Fi 7 and Bluetooth 6.0 provides extreme wireless speeds and signal range for the most efficient anyplace computing.

Wi-Fi 7 can reach 7.3Gbps.

Two-engine Bluetooth 6.0

#technology#technews#govindhtech#news#technologynews#processors#MediaTek Kompanio Ultra#Agentic AI#Chromebooks#MediaTek#MediaTek Kompanio#Kompanio Ultra#MediaTek Kompanio Ultra 910

2 notes

·

View notes

Text

Price: [price_with_discount] (as of [price_update_date] - Details) [ad_1] The Mercury Elite Pro is up to the task with its rugged, solid aluminum enclosure holding a high performance 3.5-inch 7200RPM hard drive with up to 16TB capacity. It can be used for a variety of personal and business needs including: Pro-level video editing projects Time Machine and File History backups of important business data and irreplaceable personal photos Consolidating files from multiple smaller drives to a single location for faster, more convenient access Migrating data from an existing machine to a new computer Expanding game storage of console gaming systems. Freeing up space on a computer's internal drive to improve performance. PURPOSEFULLY DESIGNED Offering an ideal blend of form and function, the Mercury Elite Pro’s fanless brushed aluminum chassis provides maximum heat dissipation to run quietly cool while the shock isolation design keeps the drive — and your data — safe and protected. It fits discreetly on any desktop with the included vertical orientation stand or place it horizontally with the included non-skid rubber feet and even stack multiple units to create a capacity “tower of power”. The Mercury Elite Pro isn’t just all work and no play. Besides saving and backing up computer data or functioning as a workhorse drive on set or in the edit suite, it can be used to watch videos, listen to music, and view pictures through your gaming console or directly attached to your Smart TV.2 We understand having confidence in gear reliability is paramount to all tech users. That’s why every Mercury Elite Pro pre-configured solution undergoes a multi-step performance certification prior to shipping. This ensures it arrives operating properly and immediately ready for demanding use. Top Tier Performance - Achieve real-world data transfer speeds of 252MB/s, perfect for professional video editing, backups, and data storage with this 2TB 3.5-inch hard drive enclosure. Versatile Compatibility - This 2TB SATA hard drive enclosure is Compatible with Mac, Windows, and Linux systems, as well as PlayStation, Xbox, and Smart TVs. Fast connectivity - The enclosure features USB 3.2 Gen 1 Type-B for up to 5Gb/s transfer speeds and supports both USB-C (Thunderbolt) and USB-A connections for flexibility. Flexible setup options - Position it vertically using the included stand or horizontally with non-skid feet, and stack multiple units for expanded storage. Includes - OWC Mercury Elite Pro 2TB External Storage Solution, USB 3.2 (5Gb/s) Type-B to Type-A Cable, External Power Supply, US Power Cable, Quick Start Guide, Assembly Manual & User Guide, 3-Year OWC Limited Warranty. [ad_2]

0 notes

Text

Rugged and Reliable Industrial PCs by Pacetech Energy

In industrial environments where performance, durability, and reliability matter the most, a standard computer simply doesn’t make the cut. That’s why Pacetech Energy offers high-performance Industrial PCs (IPCs) that are designed to operate seamlessly in harsh conditions.

Whether you are running factory automation, machine control systems, or real-time data monitoring, Pacetech Energy’s Industrial PCs are built to handle it all with stability and speed.

Rugged Design for Harsh Conditions

Pacetech’s IPCs feature a rugged and compact fanless design, which ensures silent operation and minimal maintenance. With an operating temperature range of -20°C to 80°C and relative humidity tolerance from 5% to 95%, these systems are made for extreme environments — be it a hot manufacturing floor or a cold storage facility.

Their fanless architecture not only reduces the risk of internal dust build-up but also increases system longevity.

Powerful Performance

These IPCs are powered by Intel i5, 8th Generation processors, supported by 8GB RAM and 512GB SSD — offering lightning-fast boot-up and smooth multitasking. Whether you’re running heavy software applications or real-time monitoring tools, performance will never be an issue.

Flexible Connectivity

Connectivity is one of the key strengths of Pacetech Energy’s IPCs. They come equipped with:

2 Ethernet Ports for strong network redundancy

1 DP Port for high-resolution display support

4 USB Ports to connect multiple peripherals

5 RS-232 Serial COM Ports and 1 RS-485 Port for reliable data exchange with industrial machines and devices

This wide range of interfaces makes integration with existing systems seamless and hassle-free.

Why Choose Pacetech Energy?

Pacetech Energy not only delivers top-grade industrial PCs but also provides expert support from selection to setup. Their team understands industrial needs and ensures that every IPC matches the performance requirements of your environment.

If you’re looking for a compact, durable, and high-performing Industrial PC, then explore Pacetech’s full IPC product range today.

0 notes

Photo

Did you know that silence can be the ultimate upgrade for your PC? The Noctua NH-P1 is a game-changer for those who demand zero noise in their builds. Unlike traditional coolers, it operates fanless, relying solely on its massive heatsink made of copper and aluminum to keep your CPU cool. Perfect for quiet workstations or streaming setups, the NH-P1 offers strong thermal performance without any fan noise. If you're building a super silent system, this cooler is worth considering. It’s compatible with both Intel and AMD sockets and can handle high TDP levels with ease. Whether you’re customizing a home theater PC or a professional workstation, enjoying a noise-free environment boosts productivity and comfort. Are you ready to silence the noise and elevate your PC experience? Check out custom builds at GroovyComputers.ca to see how a fanless cooling solution could fit into your next setup. Visit https://groovycomputers.ca for custom computer builds and expert advice. #SilentPC #FanlessCooling #QuietBuild #CustomPC #PCBuilding #ComputerCooling #AquariumPC #BuildTips #PCMods #TechInnovation #Gamers #ContentCreators

0 notes

Text

Rugged Embedded Computers & EN50155 Ethernet Switches

These computers are compact, fanless, and power-efficient, with robust enclosures that ensure reliable operation in harsh conditions. Industries rely on them for automation, data acquisition, real-time processing, and edge computing applications.

Understanding EN50155 Ethernet Switches

An EN50155 Ethernet switch is a network switch that complies with the EN50155 standard, which defines the requirements for electronic equipment used on rolling stock in railway applications. These switches ensure stable and reliable communication even in the challenging environments of trains, metros, and industrial vehicles.

Key features include:

Wide operating temperature ranges

High resistance to shock and vibration

IP-rated enclosures for dust and water protection

Redundant power inputs

Long lifecycle and high MTBF (Mean Time Between Failures)

Key Factors Impacting Performance and Reliability

1. Environmental Tolerance

Both rugged embedded computers and EN50155 Ethernet switches are engineered to function in harsh environments. However, balancing temperature tolerance with power efficiency presents a challenge. While high processing power is desired, it may generate excessive heat, affecting stability.

2. Real-Time Communication

In sectors like railway and defense, real-time data exchange is critical. EN50155 Ethernet switches must support deterministic communication protocols and redundancy mechanisms to prevent network failure.

3. Space Constraints

Space-saving designs are essential in embedded environments. Embedded industrial-grade computers must be compact without sacrificing performance, which can sometimes limit expansion capabilities.

4. Long-Term Availability and Maintenance

Devices used in industrial and transportation sectors are expected to have long operational lifespans. Choosing components with extended support and easy maintenance options is crucial, but it may increase upfront costs.

5. Certifications and Compliance

Compliance with standards like EN50155, EN45545 (fire protection), and MIL-STD-810 (military-grade durability) is essential but often increases development time and cost.

Tradeoffs and Challenges

Performance vs. Power Consumption: High-performance processors consume more power and generate heat. Thermal management becomes a challenge in fanless rugged systems.

Durability vs. Cost: Enhancing durability with industrial-grade materials and certifications can significantly raise production costs.

Compact Design vs. Customizability: Smaller form factors limit the number of I/O ports or expansion slots available.

Network Redundancy vs. Complexity: EN50155 Ethernet switches may support redundancy protocols like RSTP or MRP, but these add complexity to network design and setup.

Making Informed Decisions

When selecting rugged embedded computers or EN50155 Ethernet switches, decision-makers must assess:

The environmental challenges of the deployment location

The criticality of data processing and communication speed

Lifecycle expectations and ease of maintenance

Compliance requirements for regulatory bodies

The right choice improves operational efficiency, minimizes downtime, and ensures long-term value.

Conclusion

As industries continue to adopt automation and intelligent systems, the importance of rugged embedded computers and EN50155 Ethernet switches will only grow. Understanding the balance between performance, durability, cost, and compliance is key to deploying the right solutions. Whether in a smart factory or a railway carriage, these technologies enable real-time control, data integrity, and system resilience all vital for future-ready infrastructure.

FAQs About Rugged Embedded Computers & EN50155 Ethernet Switches

1. What makes an embedded computer 'rugged'? A rugged embedded computer is designed to withstand extreme conditions such as high temperatures, shock, vibration, and dust. It uses industrial-grade components and sealed enclosures.

2. What is the EN50155 standard? EN50155 is a European standard that outlines the requirements for electronic equipment used in railway applications, including temperature range, shock/vibration resistance, EMC, and power supply conditions.

3. Where are EN50155 Ethernet switches typically used? These switches are primarily used in railway systems, metro stations, industrial vehicles, and other mobile environments where reliable communication is critical.

4. Can rugged embedded computers be used for AI or machine learning at the edge? Yes, many rugged embedded computers now come with GPUs or AI accelerators to perform edge computing tasks like image recognition or predictive maintenance.

5. How do I choose between a commercial-grade and industrial-grade embedded computer? If your application involves exposure to harsh conditions or requires 24/7 uptime, an industrial-grade (rugged) embedded computer is the better choice for long-term reliability and compliance.

0 notes

Text

The Advantages of Fanless Industrial PCs in Clean Room Settings

Clean room environments are critical in industries where airborne contaminants can compromise product quality or safety. Whether in semiconductor fabrication, pharmaceutical manufacturing, biotechnology labs, or aerospace component assembly, the integrity of the environment is paramount. One often overlooked yet essential component in maintaining this integrity is the computing hardware used in these spaces. Traditional PCs with fans introduce risks that can undermine the sterile or particle-controlled nature of clean rooms. Enter fanless industrial PCs—a revolutionary solution tailored for such sensitive applications.

The Nature of Clean Room Requirements

Clean rooms operate under stringent regulations to control particulate matter, humidity, temperature, and other variables. Classification systems like ISO 14644-1 define how many particles are permitted per cubic meter of air. Even a minor fluctuation can lead to contamination that disrupts operations or damages products. Equipment introduced into these environments must therefore be designed to minimize any particle emissions, vibrations, or thermal disruptions. Standard computers, with their mechanical cooling systems, are ill-suited for such settings.

Most conventional PCs rely on fans to dissipate heat generated by internal components. While effective at cooling, these fans can become liabilities in clean rooms. They draw in ambient air, which may contain microscopic contaminants, and then circulate it within and beyond the chassis. Over time, this airflow can stir up settled particles or introduce new contaminants into the sterile environment. Additionally, fan motors generate vibration and noise, both of which can interfere with precision equipment or testing. One way to avoid this issue is by using a Fanless Industrial PC, which eliminates the need for airflow while enhancing system stability and cleanliness.

Why Fanless Design Matters

Fanless industrial PCs address these challenges by utilizing passive cooling systems. These designs often involve heatsinks, conductive chassis materials, and optimized internal layouts to manage thermal loads without requiring airflow. The result is a completely sealed system that does not move air—and, by extension, does not move particles. This inherently reduces the risk of contamination, making fanless PCs ideal for use in clean rooms where every particle counts.

Beyond eliminating airborne contaminants, fanless PCs are typically housed in sealed enclosures that offer additional protections. These enclosures are resistant to dust, moisture, and chemical exposure, which are not uncommon in clean room processes. The lack of vents and moving parts means these systems can be sterilized or wiped down more easily without compromising internal components. This adds a layer of hygiene and reliability that traditional systems simply can't match. Among the most advanced solutions available today is the BEDROCK R8000, which delivers exceptional thermal performance in a fully enclosed, fanless chassis.

Enhanced Reliability and Longevity

One of the most compelling benefits of fanless industrial PCs is their durability. Without fans, there are fewer moving parts that can fail. This translates to longer operational lifespans and reduced maintenance needs—an essential advantage in environments where downtime is costly or logistically difficult. Sealed designs also prevent dust and debris from accumulating on internal components, preserving performance and minimizing thermal degradation over time.

When integrated into clean room workflows, fanless PCs contribute significantly to operational efficiency. Their silent operation ensures that they do not interfere with acoustic-sensitive equipment or create auditory distractions. Their thermal efficiency supports consistent performance even under continuous load. For industries where data acquisition, process control, and environmental monitoring are crucial, these PCs provide a dependable backbone without introducing new variables.

Many modern clean room facilities are now choosing fanless systems specifically designed for such environments. For instance, a high-quality fanless industrial PC offers not just fanless design but also a compact form factor, wide operating temperature range, and industrial-grade components. These features make them suitable for wall or panel mounting, freeing up workspace and further reducing contamination risks. They also support industrial protocols and real-time operating systems essential for precision control. Another excellent option for such requirements is the BEDROCK R8000, which combines ruggedness and computing power in one reliable platform.

Modular Efficiency Using i.MX8 SOM

The integration of modular components like the i.MX8 SOM brings additional versatility. This system-on-module platform allows for custom configurations that meet specific clean room demands, from processing power to connectivity. It also supports advanced graphical interfaces and machine learning applications, which are increasingly prevalent in automated lab environments. Its low power consumption and passive cooling features align perfectly with clean room standards.

Conclusion

Fanless industrial PCs are transforming the way sensitive industries approach computing within clean room environments. Their passive cooling systems, sealed enclosures, and robust performance make them an indispensable part of contamination-sensitive operations. These systems don't just improve environmental safety—they also enhance operational efficiency, reduce maintenance costs, and extend the lifespan of critical infrastructure.

Moreover, the flexibility of integrating components like the i.MX8 SOM allows industries to tailor computing solutions to highly specific clean room applications. Whether it's controlling laboratory automation, facilitating real-time data acquisition, or supporting machine learning models for diagnostics, fanless systems are more than up to the task.

As technologies like the BEDROCK R8000 and i.MX8 SOM continue to evolve, we can expect even more tailored solutions that marry high performance with environmental integrity. The growing demands of clean room industries—from semiconductor fabrication to biotechnology—require nothing less than uncompromised reliability and innovation. For industries where cleanliness isn't just preferred but mandatory, fanless PCs aren't just a smart choice—they're the only choice.

0 notes

Text

Unmanaged Gigabit Ethernet Switch Market - Detailed Analysis Of Current Industry Demand with Forecasts Growth

Unmanaged Gigabit Ethernet Switch Market, Trends, Business Strategies 2025-2032

The global Unmanaged Gigabit Ethernet Switch Market was valued at 513 million in 2024 and is projected to reach US$ 676 million by 2032, at a CAGR of 4.1% during the forecast period.

Unmanaged Gigabit Ethernet Switches are plug-and-play networking devices that enable high-speed data transfer between connected devices without requiring configuration. These switches operate at layer 2 of the OSI model, automatically negotiating speed and duplex settings while providing basic traffic management through MAC address learning. Common port configurations include 5-port, 8-port, 16-port, and 24-port variants, catering to different network size requirements.

The market growth is driven by increasing demand for cost-effective networking solutions in SMBs and home environments, coupled with rising adoption of IoT devices that require stable high-speed connections. While enterprise networks typically use managed switches, the simplicity and affordability of unmanaged switches make them ideal for small offices and residential applications. Recent advancements have focused on improving energy efficiency and heat dissipation in these devices, with leading manufacturers like Netgear and TP-Link introducing fanless designs for quieter operation in home environments.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://semiconductorinsight.com/download-sample-report/?product_id=103336

Segment Analysis:

By Type

5-Port to 8-Port Segment Holds Major Share Due to Optimal Balance of Cost and Performance

The market is segmented based on port configuration into:

Below 5-Port

5-Port to 8-Port

9-Port to 12-Port

Above 12-Port

By Application

Business Applications Drive Market Growth Through Widespread Enterprise Adoption

The market is segmented based on application into:

Household

Business

Subtypes: SMBs, Large Enterprises

Industrial

Education

By End User

IT & Telecom Sector Represents Significant Market Share Due to High Bandwidth Requirements

The market is segmented based on end-user industries into:

IT & Telecom

Healthcare

Manufacturing

Retail

Others

Regional Analysis: Unmanaged Gigabit Ethernet Switch Market

North America The North American unmanaged Gigabit Ethernet switch market is characterized by strong demand from small and mid-sized businesses and a well-established IT infrastructure. The United States dominates regional consumption, driven by increasing adoption of IoT devices, cloud computing, and remote work solutions. Enterprises favor these plug-and-play switches for their simplicity and cost-effectiveness in office environments, with 8-port to 10-port models being particularly popular for their balance of capacity and affordability. Additionally, the ongoing modernization of home networks in suburban areas has spurred residential adoption. However, the market faces pricing pressures from Asian manufacturers, compelling local brands to emphasize reliability and after-sales support as key differentiators.

Europe Europe’s market growth is bolstered by strict data protection regulations that necessitate reliable network hardware, even in unmanaged configurations. Germany and the UK lead in adoption rates, where businesses prioritize energy-efficient switches to align with EU sustainability directives. The market shows a preference for ruggedized industrial-grade switches in manufacturing hubs, while the hospitality sector favors compact models for space-constrained environments. A notable trend is the growing replacement of Fast Ethernet switches with Gigabit models, particularly in countries undertaking smart city initiatives. However, the presence of numerous local distributors creates a fragmented competitive landscape that challenges pricing stability across the region.

Asia-Pacific This region represents the fastest-growing market segment, with China accounting for over 40% of regional demand due to massive investments in digital infrastructure and local manufacturing capabilities. The proliferation of affordable, locally produced switches has driven widespread adoption across SMEs and educational institutions, though quality variations remain a concern. India’s market is expanding rapidly as telecom operators bundle switches with broadband packages, while Southeast Asian nations show increasing demand driven by growing startup ecosystems. Japan and South Korea maintain preference for premium brands with advanced features, creating a two-tier market structure across the region.

South America Market growth in South America is constrained by economic volatility but shows promise in Brazil and Chile where improving internet penetration fuels demand. The region exhibits strong price sensitivity, with 5-8 port switches dominating sales. A thriving gray market for networking equipment presents challenges for authorized distributors, while import-dependent countries struggle with inconsistent supply chains. Nevertheless, the expansion of fintech services and growing SMB sector are creating new opportunities, particularly in urban centers where businesses are upgrading from older networking equipment to support digital transformation efforts.

Middle East & Africa The MEA region demonstrates uneven growth patterns, with Gulf Cooperation Council countries leading adoption through smart city projects and commercial real estate developments. UAE and Saudi Arabia show preference for branded, feature-rich switches despite higher costs, while North African markets prioritize basic functionality at competitive prices. Sub-Saharan Africa’s growth is hindered by limited IT budgets and infrastructure gaps, though mobile network operators are driving demand for rugged switches in telecom towers. The market’s long-term potential remains substantial, particularly as regional governments increase investments in digital infrastructure and connectivity projects across major economic hubs.

List of Key Unmanaged Gigabit Ethernet Switch Companies Profiled

Netgear (U.S.)

TP-Link (China)

Antaira Technologies (U.S.)

PLANET Technology (Taiwan)

Zyxel (Taiwan)

Buffalo (Japan)

Linksys (U.S.)

TRENDnet (U.S.)

Tripp Lite (U.S.)

Dahua Technology (China)

Tenda (China)

D-Link (Taiwan)

EtherWAN (U.S.)

MERCUSYS Technologies (China)

EKS (Sweden)

StarTec (Germany)

Amped Wireless (U.S.)

3onedata (China)

ATOP (Taiwan)

Agatel (Russia)

H3C (China)

Aitech (Israel)

The exponential growth of Internet of Things (IoT) deployments is significantly driving the unmanaged Gigabit Ethernet switch market. With over 29 billion IoT devices projected to be connected globally by 2030, the demand for reliable and high-speed network connectivity solutions has surged. Unmanaged switches provide the perfect plug-and-play solution for IoT networks, offering seamless connectivity without complex configurations. Industries ranging from manufacturing to healthcare are adopting these switches to support their IoT infrastructure, as they enable efficient data transmission between devices while maintaining network reliability. The plug-and-play nature of unmanaged switches makes them particularly attractive for IoT applications where rapid deployment and minimal maintenance are critical requirements.

The global shift toward remote and hybrid work models has created substantial demand for reliable home networking solutions. Unmanaged Gigabit Ethernet switches have become essential components in home office setups, providing stable and high-speed connections for multiple devices. As approximately 40% of the global workforce continues to work remotely either full-time or in hybrid arrangements, the need for affordable and easy-to-use networking equipment has grown exponentially. These switches enable seamless connectivity for computers, printers, IP phones, and other office equipment without requiring advanced networking knowledge. Furthermore, the increasing adoption of cloud-based applications in professional settings has further amplified the need for high-performance networking hardware at the edge.

The rapid expansion of smart home technology and building automation systems presents significant growth opportunities for unmanaged Gigabit Ethernet switches. Modern smart homes often require reliable wired backbones to connect various automation components, security systems, and entertainment devices. The simplicity and reliability of unmanaged switches make them ideal for these applications, particularly in deployments where technical expertise may be limited. Building automation systems for small and medium commercial spaces are increasingly adopting these switches for their control networks, favoring their plug-and-play nature and cost-effectiveness compared to more complex managed solutions.

Additionally, the integration of energy-efficient designs and compact form factors specifically tailored for residential and light commercial installations is opening new market segments. Manufacturers who can develop switches with enhanced thermal management for confined spaces or specialized enclosures for harsh environments stand to gain significant market share.

Developing regions with growing IT infrastructure investments represent substantial untapped opportunities. As businesses in these markets modernize their operations and expand digital capabilities, the demand for affordable networking solutions increases. The lower total cost of ownership and minimal maintenance requirements of unmanaged switches make them particularly attractive for small businesses and educational institutions in these regions. Government initiatives to improve digital infrastructure and connectivity in rural areas are further driving demand for cost-effective networking hardware that can be deployed with limited technical expertise.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=103336

Key Questions Answered by the Unmanaged Gigabit Ethernet Switch Market Report:

What is the current market size of Global Unmanaged Gigabit Ethernet Switch Market?

Which key companies operate in Global Unmanaged Gigabit Ethernet Switch Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Browse More Reports:

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

Buy Apple Laptop in Dwarka – Premium Devices at Best Prices from Royal Computer

Are you looking to buy an Apple laptop in Dwarka? Whether you’re a creative professional, a student, or a business owner, owning a MacBook is a game-changer. Known for their sleek design, top-notch performance, and unmatched reliability, Apple laptops continue to be the preferred choice for individuals who want both style and power.

When it comes to finding genuine Apple laptops at the best prices, Royal Computer in Dwarka is your go-to destination. With expert guidance, genuine products, and excellent after-sales support, Royal Computer ensures you get a smooth and trustworthy buying experience.

Why Apple Laptops Are a Smart Investment

Apple laptops — particularly the MacBook Air and MacBook Pro — are more than just stylish devices. They’re powerful machines built to last and deliver outstanding performance. Here’s why many tech-savvy customers prefer Apple:

Superior Build Quality: Aluminum unibody construction makes Apple laptops lightweight yet durable.

Smooth macOS Experience: Apple’s operating system is intuitive, fast, and secure.

Powerful Performance: The new M1 and M2 chips provide blazing speed, making multitasking seamless.

Long Battery Life: MacBooks are known to last 10–18 hours on a single charge.

Retina Display: Crisp visuals and vibrant colors ideal for creative work, video editing, and daily use.

Whether you’re working from home, editing videos, or just browsing the web, Apple laptops offer a premium experience that’s hard to beat.

Why Buy Apple Laptop in Dwarka from Royal Computer?

If you’re in or around Dwarka and searching for a trusted place to purchase your Apple device, Royal Computer stands out as a reliable choice. Here’s what sets us apart:

1. Authorised & Trusted Reseller

Royal Computer ensures that every Apple laptop you buy is 100% genuine, sealed, and backed by official warranty and support.

2. Wide Range of Models Available

From the budget-friendly MacBook Air M1 to the powerhouse MacBook Pro M2 Max, you’ll find all the latest models in stock.

3. Expert Advice

Not sure which model suits your needs? Our team will help you compare features, storage options, and performance specs to make the right decision.

4. Best Prices & EMI Options

Looking for the best deal? Royal Computer offers competitive pricing and easy EMI plans to make your dream MacBook more affordable.

5. On-the-Spot Setup & Support

Need help setting up your MacBook? We provide initial setup support, including software installation, iCloud sync, and more.

Top-Selling Apple Laptops at Royal Computer

Here are a few popular models available at Royal Computer in Dwarka:

🔹 MacBook Air M1

Lightweight and powerful

Ideal for students and professionals

Long-lasting battery and Retina display

🔹 MacBook Air M2

Latest slim design

Enhanced performance with the M2 chip

Silent fanless operation

🔹 MacBook Pro 14” & 16” (M1 Pro / M2 Pro)

Designed for creators and developers

Amazing graphics and processing speed

Long battery life and powerful speakers

Location Advantage — Dwarka, Delhi

For residents of Dwarka and nearby areas like Uttam Nagar, Janakpuri, Palam, and West Delhi, Royal Computer offers easy access to the best Apple products without traveling far. You can walk in, compare models, ask questions, and leave with your brand-new MacBook — all on the same day.

Why Local Purchase is Better Than Online

While online shopping is convenient, buying a high-end device like an Apple laptop from a trusted local store in Dwarka offers:

Instant product delivery

In-person demonstration and comparison

Personalized service

No risk of receiving used or tampered devices

With Royal Computer, you also get hands-on support post-purchase — something e-commerce platforms can’t always guarantee.

Additional Services Offered by Royal Computer

Apple accessories (Magic Mouse, Apple Keyboard, Adapters, Covers)

Laptop bags and screen protectors

MacBook software installation (Final Cut Pro, MS Office, Adobe Suite)

MacBook servicing and upgrades

Trade-in options for old laptops

Final Thoughts

If you’re planning to buy an Apple laptop in Dwarka, make the smart choice by visiting Royal Computer. With a wide range of models, expert staff, and unbeatable after-sales service, we make sure your Apple experience is nothing short of excellent.

Step into our store today or call us for the latest deals and availability. At Royal Computer, we help you choose not just any laptop — but the right Apple laptop.

Visit Royal Computer — Dwarka’s Trusted Apple Laptop Store 📍 Location: [Dwarka] 🕒 Open All Days | Quick Demo | Easy EMI | After-Sales Support

#new laptops for sale in uttam nagar#laptop store near me#best cctv camera for shop in uttam nagar#buy apple laptop in dwarka#second-hand laptops for sale in dwarka#best deals on laptops near me

0 notes

Text

High-Performance Fanless Industrial Computer for Reliable 24/7 Operation | ValanoIPC

ValanoIPC presents the Fanless Industrial Computer IC06, built with the reliable Intel J1900 processor for high-performance industrial applications. Engineered with a rugged aluminum alloy chassis and a completely fanless design, this system ensures silent operation, reduced maintenance, and enhanced durability in harsh environments. Ideal for automation, manufacturing, and edge computing, the IC06 offers low power consumption and stable performance in 24/7 operations. With multiple I/O ports and wide operating temperature support, it meets the demands of diverse industrial setups. Trust ValanoIPC's Fanless Industrial Computer for long-lasting, efficient, and noiseless computing solutions. Discover cutting-edge industrial PC technology tailored for mission-critical environments. For more information, please feel free to contact us today at +86 13556025664 or email us at [email protected]. You can also visit us here: https://tinyurl.com/mry8ca5a

0 notes

Text

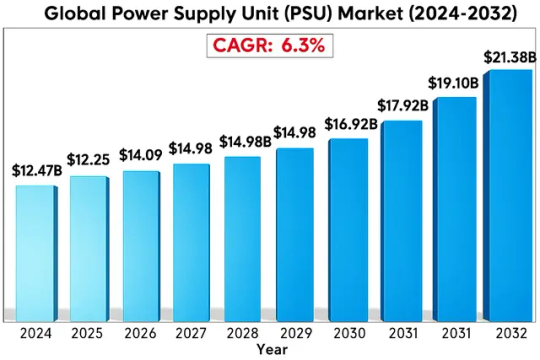

Global Power Supply Unit (PSU) Market : Forecast to 2032

Global Power Supply Unit (PSU) Market size was valued at US$ 12.47 billion in 2024 and is projected to reach US$ 21.38 billion by 2032, at a CAGR of 6.3% during the forecast period 2025-2032. This growth is driven by increasing demand for energy-efficient computing solutions and expansion of data centers worldwide.

A Power Supply Unit (PSU) is a critical hardware component that converts alternating current (AC) to direct current (DC) while regulating voltage for computer systems. Modern PSUs feature modular designs, 80 PLUS certification for energy efficiency, and advanced thermal management systems. The market offers two primary variants: AC power supplies (for general computing applications) and DC power supplies (specialized for industrial equipment and telecom infrastructure).

Key growth drivers include the rapid expansion of cloud computing infrastructure and increasing adoption of high-performance computing solutions. However, the market faces challenges from alternative power solutions and supply chain disruptions affecting semiconductor availability. Recent technological advancements focus on improving energy efficiency – with leading manufacturers like Corsair and Seasonic introducing PSUs achieving 94% conversion efficiency under Titanium certification standards. The competitive landscape features established players including Thermaltake, FSP Group, and Cooler Master, who collectively hold over 45% of the global market share through continuous product innovation and strategic partnerships with OEMs.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-power-supply-unit-psu-market/

Segment Analysis:

By Type

AC Power Supply Segment Leads the Market Owing to Widespread Adoption in Industrial Applications

The market is segmented based on type into:

AC Power Supply

DC Power Supply

By Application

PC Computers Segment Dominates Due to Increasing Demand for Gaming and High-Performance PCs

The market is segmented based on application into:

PC Computers

Mobile Devices

Industrial Equipment

Telecommunications

Others

By Power Rating

300W-500W Segment Holds Major Share for Mid-Range Computing Needs

The market is segmented based on power rating into:

Below 300W

300W-500W

500W-800W

Above 800W

By Form Factor

ATX Segment Dominates Compatibility With Standard Desktop Configurations

The market is segmented based on form factor into:

ATX

SFX

TFX

Flex ATX

Others

Regional Analysis: Global Power Supply Unit (PSU) Market

North America The North American PSU market is characterized by high technological adoption and stringent energy efficiency standards. The region’s mature PC gaming industry and data center expansion are key growth drivers, with the U.S. accounting for over 60% of regional demand. 80 PLUS certification requirements have pushed manufacturers toward modular, high-efficiency (90%+) units. However, market saturation in desktop PC segments has led vendors to focus on premium gaming PSUs and server-grade solutions. The Canadian market shows steady growth, fueled by increasing investments in hyperscale data centers.

Europe Europe’s PSU market is shaped by the EU Ecodesign Directive and energy labeling regulations, driving innovation in low-power consumption units. Germany and France lead in industrial and commercial applications, while the UK gaming sector sustains demand for high-wattage modular PSUs. The region has seen a 12% CAGR in server PSU demand, with increased cloud computing investments. A significant trend is the shift toward fanless and silent PSUs in residential and office environments. Eastern Europe presents emerging opportunities as PC component manufacturing expands to countries like Poland and Hungary.

Asia-Pacific As the largest and fastest-growing PSU market, Asia-Pacific benefits from concentrated electronics manufacturing in China, Taiwan, and South Korea. China’s DIY PC culture and esports boom have created a $2.1 billion PSU segment, while India shows the highest growth potential (18% YoY) due to increasing PC penetration. Japan maintains demand for high-reliability industrial PSUs, and Southeast Asian countries prioritize cost-effective solutions. The region faces challenges with counterfeit products but leads in OEM production, supplying 75% of global PSU units. Recent developments include GaN (Gallium Nitride) technology adoption among premium brands.

South America Market growth in South America is constrained by economic instability but shows pockets of opportunity in Brazil and Chile. The Brazilian gaming market, valued at $1.3 billion, drives demand for entry-level to mid-range PSUs. Argentina’s import restrictions have encouraged local assembly operations, though component quality remains inconsistent. A key trend is the growing second-hand PSU market, accounting for nearly 30% of transactions. Internet cafe expansions in Colombia and Peru provide steady commercial demand, while voltage stability issues necessitate robust surge protection features in consumer units.

Middle East & Africa This emerging market is bifurcated between high-end demand in GCC countries and price-sensitive segments across Africa. The UAE and Saudi Arabia show strong preference for branded 80 PLUS Gold/Platinum units, aligned with data center expansions. In contrast, African markets prioritize durability under unstable power conditions, making hybrid ATX units popular. South Africa leads in regional distribution, while North African countries see growing OEM partnerships. Challenges include counterfeit imports and low consumer awareness about efficiency ratings, though infrastructure development projects promise long-term growth.

MARKET OPPORTUNITIES

Edge Computing Expansion Opens New Markets for Rugged PSUs

The rapid deployment of edge computing infrastructure presents significant opportunities for PSU manufacturers specializing in ruggedized, reliable power solutions. As computing moves closer to data sources, demand grows for PSUs capable of operating in harsh environments with minimal maintenance. This market segment is particularly attractive, with projected CAGR of 18% through 2030. Leading manufacturers are already introducing new product lines featuring extended temperature ranges and enhanced protection against power fluctuations.

Integration of Smart Monitoring Features Creates Value-Added Opportunities

The incorporation of IoT connectivity and predictive maintenance capabilities into PSU designs represents a growing revenue stream. Smart PSUs capable of monitoring load conditions, predicting failures, and optimizing power delivery are gaining traction in data center and industrial applications. These advanced units typically command 50-75% premium over conventional models while delivering significant operational savings through improved reliability and energy management.

POWER SUPPLY UNIT (PSU) MARKET TRENDS

Rising Demand for High-Efficiency Power Supplies

The global Power Supply Unit (PSU) market is witnessing a significant shift toward high-efficiency, low-power consumption solutions, driven by increasing energy regulations and consumer demand for sustainable technology. With the growing emphasis on 80 PLUS certification standards, manufacturers are prioritizing units with higher efficiency ratings, such as Titanium and Platinum, which offer over 90% efficiency under typical loads. Furthermore, advancements in semiconductor technologies, including gallium nitride (GaN) and silicon carbide (SiC), are enabling compact, lightweight power supplies with superior thermal management and reduced energy wastage. These innovations are particularly crucial for data centers and high-performance computing applications, where energy costs and heat dissipation are major concerns.

Other Trends

Modular and Semi-Modular PSU Adoption

The growing preference for modular and semi-modular power supplies is reshaping the market, especially among PC enthusiasts and system builders. Unlike traditional PSUs, modular variants allow users to detach unnecessary cables, improving airflow and reducing clutter in custom-built systems. This trend aligns with the increasing popularity of small-form-factor (SFF) PCs and gaming rigs, where cable management is critical for thermal performance and aesthetics. Additionally, the rise of RGB customization in high-end builds has spurred demand for PSUs with integrated lighting and digital monitoring features.

Expansion of AI and Data Center Applications

Artificial Intelligence (AI) workloads and hyperscale data centers are fueling demand for robust, scalable power supply solutions. As enterprises deploy more AI-driven infrastructure, the need for stable, high-wattage PSUs capable of sustaining continuous heavy loads has surged. The data center PSU market alone is projected to grow significantly, driven by cloud computing expansion and the rollout of 5G networks. Innovations such as digital power management and redundant power supply (RPS) configurations are becoming standard in enterprise environments, ensuring reliability and uptime for mission-critical operations. Furthermore, edge computing deployments are creating opportunities for compact, high-efficiency PSUs designed for distributed IT architectures.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading PSU Manufacturers Focus on Efficiency and Innovation to Capture Market Share

The global power supply unit (PSU) market features a diverse competitive landscape with both established electronics giants and specialized power solution providers vying for dominance. Seasonic and Corsair currently lead the premium segment, capturing nearly 28% of the high-wattage PSU market combined as of Q2 2024. Their success stems from patented modular designs and 80 PLUS Titanium certified products that achieve up to 96% energy efficiency.

The mid-range segment shows particularly fierce competition, with Cooler Master and Thermaltake leveraging strong distribution networks across Asia-Pacific and Europe. Both companies have recently expanded their product lines to address the growing demand for SFX-L form factors in compact gaming PCs.

Meanwhile, Taiwanese manufacturer FSP continues to dominate the OEM supply market, providing power solutions for 30% of major desktop brands. Their vertically integrated production capabilities allow competitive pricing while maintaining 80 PLUS Gold efficiency standards.

The competitive landscape continues to evolve with strategic movements from key players:

SilverStone Technology recently acquired a German power electronics firm to enhance their R&D capabilities

Antec partnered with NVIDIA to develop ATX 3.0 compatible power supplies ahead of competitors

XFX committed $120M to expand production capacity for their high-performance PSU line

List of Key Power Supply Unit Manufacturers Profiled

Seasonic (Taiwan)

Corsair (U.S.)

Cooler Master (Taiwan)

Thermaltake (Taiwan)

FSP Group (Taiwan)

SilverStone Technology (Taiwan)

Antec (U.S.)

XFX (Hong Kong)

New Japan Radio (Japan)

Gigabyte (Taiwan)

Learn more about Competitive Analysis, and Forecast of Global Power Supply Unit (PSU) Market : https://semiconductorinsight.com/download-sample-report/?product_id=95800

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Power Supply Unit (PSU) Market?

-> Power Supply Unit (PSU) Market size was valued at US$ 12.47 billion in 2024 and is projected to reach US$ 21.38 billion by 2032, at a CAGR of 6.3% during the forecast period 2025-2032.

Which key companies operate in Global PSU Market?

-> Key players include Corsair, Cooler Master, Seasonic, Thermaltake, FSP, Antec, and SilverStone Technology, among others.

What are the key growth drivers?

-> Key growth drivers include rising gaming PC demand, data center expansion, and increasing adoption of high-efficiency PSUs.

Which region dominates the market?

-> Asia-Pacific holds the largest market share (42%), driven by strong manufacturing presence in China and Taiwan.

What are the emerging trends?

-> Emerging trends include digital PSUs with monitoring capabilities, higher efficiency standards (80+ Titanium), and modular cable designs.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes

Text

MediaTek Kompanio 838 Top 8 tech features for Chromebooks

MediaTek Kompanio 838: Boosts Productivity and Provides Longer Battery Life in Chromebooks That Lead the Class

High performance computing is offered by the MediaTek Kompanio 838, which boosts productivity and improves multimedia, online surfing, and gaming. With the great battery life offered by this highly efficient 6nm processor, Chromebook designs that are thin and light will enable users, educators, and students to be genuinely mobile throughout the day.

Boost innovative thinking, learning, and productive work

The MediaTek Kompanio 838 is a major improvement over the lower-end Kompanio 500 series, offering exceptional performance and greater multitasking.

Due to a doubling of memory bandwidth over previous generations, the improved octa-core CPU with faster Arm “big core” processors and a highly capable tri-core graphics engine can handle significantly more data at a faster rate.

With compatibility for both DDR4 and LPDDR4X, OEMs can now design products with greater flexibility to satisfy market performance needs and BOM targets. Additionally, the highly integrated architecture offers the highest power efficiency available on the market for long-lasting batteries.

Up to 76% quicker visual performance

Increased performance in CPU-based benchmarks by up to 66%

Performance in web-based benchmarks was up to 60% better than that of the MediaTek Kompanio 500 series.

Superior Image Processing Unit for Cameras

The MediaTek Kompanio 838 equips Chromebooks with state-of-the-art dual camera technology and high quality imaging features. Photos and videos produced with the new MediaTek Imagiq 7 series ISP have more vibrant colours, especially in difficult lighting situations, thanks to improvements in HDR and low-light capture quality over the previous generation.

Improved AI on-Device

With unmatched power efficiency, the MediaTek Kompanio 838 with MediaTek NPU 650 offers entertainment that is more engaging and of higher quality. The MediaTek NPU can quickly complete complicated computations and is optimized for processing picture data efficiently.

Dual 4K Displays

For demos, presentations, movie nights, or just increased productivity with more visual real estate, premium Chromebooks with the highest quality screens may also output at the same resolution to a connected 4K smart TV or monitor thanks to support for 4K dual displays.

Perfect for 4K Media Streaming

With hardware-accelerated AV1 video decoding built right into the CPU, the MediaTek Kompanio 838 is now the perfect device for effortlessly streaming high-quality 4K video content without using up too much battery life.

Lightning-fast, safe WiFi

Support with MediaTek Filogic Wi-Fi 6 and Wi-Fi 6E chipsets by the MediaTek Kompanio 838 allows for dual- and tri-band connectivity choices. This enables more dependable connections with 2×2 antennas, quicker speeds of up to 1.9Gbps, and improved security with WPA3.

Extended Battery Life

With the class-leading power efficiency of the highly integrated 6nm processor, Chromebook designers can now construct fanless, silent devices with true all-day battery life.

The MediaTek Kompanio 838 is an excellent tool for the classroom that increases productivity and offers fluid 4K multimedia and web surfing experiences. With the great battery life offered by this highly efficient processor, Chromebook designs that are small and light enable teachers and students to be genuinely mobile throughout the day. These are the top 8 internal tech elements that support more creative thinking, learning, and productive working.

Top 8 Kompanio 838 tech features

1) Improved Efficiency

The MediaTek Kompanio 838 boasts an octa-core CPU with Arm Cortex-A78 ‘large core’ processors, a powerful tri-core graphics engine, twice the memory bandwidth of previous generation platforms, and exceptional speed and enhanced multitasking.

2) HDR cameras that capture excellent low light images

With the improved HDR and low-light capture quality of its latest generation MediaTek Imagiq 7 series ISP, images and videos have more vibrant colours even in difficult lighting situations. For more options and product distinctiveness, product designers can even incorporate dual camera designs with various lenses or sensors.

3) High Definition Webcams

Manufacturers of devices can design 4K webcams to provide superb streaming quality, which enhances your credibility when participating in video conferences and working remotely. In remote learning scenarios, this capability enables students to view the entire classroom and additional information on slides.

4) Improvement of On-Device AI

With unmatched power efficiency, the MediaTek NPU 650, which is integrated into the processor, offers effective picture data processing for more interactive and superior multimedia.

5) Upgrade the workstation with two 4K monitors.

Chromebook manufacturers can now incorporate the greatest detail screens into their newest models and add an external display connection that can output at the same resolution thanks to support for not just one, but two 4K monitors. For demos, presentations, movie evenings, or just to enjoy a healthy dose of increased productivity due to the extra visual real estate, connect to a 4KTV, monitor, or projector.

6) Perfect for Media Streaming in 4K

Now that the MediaTek Kompanio 838 has hardware-accelerated AV1 video decoding built into the CPU, it’s perfect for effortlessly viewing high-quality 4K video streams with the least amount of battery waste.

7) Extended Battery Life

With its class-leading power efficiency and true all-day battery life, this processor—which is based on an advanced 6nm chip production process—allows Chromebook designers to create designs that are light, thin, and even fanless. It also gives users the confidence to leave their charger at home.

8) Lightning-fast, safe WiFi

Although not a component of the Kompanio 838 processor itself, the platform gives device manufacturers the choice to use MediaTek Filogic Wi-Fi 6 or Wi-Fi 6E chipsets, based on what the market demands. This makes it possible to have dual-band or tri-band connectivity options. Both provide dependable connections through 2×2 antenna, improved WPA 3 security, and throughput speeds of up to 1.9Gbps (when using Wi-Fi 6E).

Read more on Govindhtech.com

#Highperformancecomputing#MediaTekKompanio838#Kompanio500series#DDR4#Chromebooks#premiumChromebooks#monitor#news#technews#technology#technologynews#technologytrends#govindhtech

5 notes

·

View notes

Text

Price: [price_with_discount] (as of [price_update_date] - Details) [ad_1] The Avolusion PRO-5Y Series 10TB External Hard Drive (10-Terabyte) is the valuable hard drive upgrade kit that provides the best and easy solution to extend the storage capacity of your desktop/laptop instantly. Plug and play USB 3.0 interface provides a perfect portable storage solution for you to store and back up your game data, music, image, video and more. Avolusion PRO-5Y series external hard drive designed to work perfectly with your Windows operating system computer PC, laptop. Fully compatible with any device with Windows operating system. It comes with a quiet fanless design to keep your external hard drive running quietly. Avolusion PRO-5Y Series External Hard Drive Upgrade Kit features high-quality construction, advanced external interface technology, durable chassis, and state-of-the-art industrial design, assured to provide you with years of reliable performance. Features:

0 notes

Text

Fanless Embedded System Market: Regional Analysis and Insights 2025–2032

MARKET INSIGHTS

The global Fanless Embedded System Market size was valued at US$ 1,230 million in 2024 and is projected to reach US$ 2,340 million by 2032, at a CAGR of 9.67% during the forecast period 2025-2032.

Fanless Embedded Systems are compact computing solutions designed without cooling fans, making them ideal for harsh environments where dust, vibration, or extreme temperatures are concerns. These systems incorporate processors like Intel i7, i5, i3, and Celeron, packaged in rugged enclosures that dissipate heat through passive cooling techniques. The technology enables reliable operation in industrial automation, military applications, and outdoor installations where traditional PCs would fail.

The market growth is driven by increasing adoption in Industry 4.0 applications, stringent reliability requirements in aerospace/defense sectors, and rising demand for edge computing solutions. Energy efficiency regulations and the need for maintenance-free systems in remote locations further accelerate market expansion. Key players including Advantech, AAEON, and ADLINK dominate the landscape, collectively holding over 35% market share. Recent technological advancements focus on enhanced thermal management and AI-enabled processing capabilities for real-time analytics in industrial IoT deployments.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand for Rugged and Reliable Computing Solutions to Accelerate Market Expansion

The global fanless embedded system market is experiencing significant growth due to increasing demand for rugged, reliable computing solutions across industries. These systems eliminate moving parts, reducing failure rates in harsh environments where temperature extremes, dust, and vibration are common. The military and aerospace sector accounted for nearly 28% of total market revenue in 2024, as these applications require systems capable of withstanding extreme conditions while delivering uninterrupted performance. Fanless designs also minimize maintenance requirements, offering substantial total cost of ownership advantages over traditional systems.

Energy Efficiency Requirements Driving Adoption Across Multiple Verticals

Energy efficiency has become a critical factor in industrial and commercial computing deployments. Fanless embedded systems typically consume 30-40% less power than conventional cooled systems, making them ideal for energy-conscious applications. Data centers are increasingly adopting these solutions for edge computing deployments, where power savings directly translate to operational cost reductions. The global push toward sustainable computing practices further amplifies this trend, with regulations in many regions mandating stricter energy efficiency standards for industrial equipment.

Advancements in thermal management technologies have enabled fanless systems to support increasingly powerful processors without compromising reliability. Recent product launches demonstrate this capability, with several manufacturers now offering fanless solutions supporting high-performance Intel Core i7 processors previously considered unsuitable for passive cooling configurations.

Industrial IoT Expansion Creating New Application Opportunities

The rapid growth of Industrial Internet of Things (IIoT) implementations represents a major growth catalyst for the fanless embedded systems market. These systems serve as ideal platforms for edge computing nodes in smart factories, providing reliable processing power in environments where traditional computers would fail. Manufacturing automation deployments increased by approximately 22% year-over-year in 2024, driving corresponding demand for rugged computing solutions. The inherent reliability of fanless systems makes them particularly suitable for continuous operation scenarios common in industrial settings.

MARKET RESTRAINTS

Thermal Limitations Constrain Performance Capabilities

While fanless embedded systems offer numerous advantages, their thermal limitations present a significant market restraint. Passive cooling designs inherently limit the maximum processing power that can be reliably supported, creating challenges for applications requiring high-performance computing. This restriction becomes particularly apparent in artificial intelligence and machine learning deployments at the edge, where processor-intensive workloads often exceed the thermal budgets of current fanless solutions. Manufacturers continue to innovate in thermal management, but the fundamental physics of heat dissipation remains a persistent challenge.

Higher Initial Costs Compared to Conventional Systems

The specialized design and materials required for effective passive cooling result in fanless embedded systems carrying a substantial price premium over traditional cooled alternatives. Entry-level fanless solutions typically cost 25-35% more than comparable actively-cooled systems, creating adoption barriers in price-sensitive market segments. While the total cost of ownership often justifies this premium through reduced maintenance and longer service life, the higher upfront investment can deter budget-constrained organizations from selecting these solutions.

Price sensitivity varies significantly by region, with developing markets showing particular resistance to the premium pricing of fanless systems. This dynamic has slowed market penetration in cost-conscious economies, despite the long-term operational benefits these solutions provide.

MARKET CHALLENGES

Balancing Performance and Thermal Design Remains a Persistent Challenge

Manufacturers face ongoing challenges in developing fanless systems that meet escalating performance demands while maintaining reliable thermal characteristics. Processor manufacturers continue to push the envelope of computing power, but thermal output increases correspondingly. This creates a technological arms race where cooling solutions must evolve rapidly to keep pace with advancing silicon capabilities. The industry has made significant progress through innovations in heat pipe technology andadvanced thermal interface materials, but fundamental limitations remain.

Design Constraints in Compact Form Factors

The push toward miniaturization presents another significant challenge for fanless embedded system designers. Smaller form factors inherently limit available surface area for heat dissipation, requiring innovative approaches to thermal management. This challenge is particularly acute in applications such as transportation and mobile deployments, where space constraints are severe. Designers must carefully balance size, performance, and thermal characteristics, often making difficult compromises that impact the final product's capabilities.

Emerging solutions include advanced phase-change materials and three-dimensional heat spreaders, but these technologies often come with cost premiums that impact market competitiveness. The industry continues to seek cost-effective solutions that overcome these physical limitations without compromising reliability or affordability.

MARKET OPPORTUNITIES

Edge Computing Expansion Creates New Growth Horizons

The rapid growth of edge computing represents a substantial opportunity for fanless embedded system vendors. As computing resources migrate closer to data sources, demand increases for rugged, reliable systems capable of operating in diverse environments. The edge computing market is projected to grow at a compound annual rate exceeding 19% through 2032, creating corresponding demand for suitable hardware platforms. Fanless systems are particularly well-positioned to capitalize on this trend due to their reliability advantages in unattended installations.

5G Network Deployments Driving Demand for Rugged Infrastructure

Global 5G network expansion creates significant opportunities for fanless embedded systems in telecommunications infrastructure. These systems serve as ideal platforms for small cell deployments and network edge applications where environmental protection and reliability are paramount. The transition to network function virtualization (NFV) further amplifies this opportunity, as it requires computing resources at the network periphery. Telecommunications providers increasingly recognize the value proposition of fanless solutions for these distributed deployments.

Recent technological advancements have enabled fanless systems to meet the stringent performance requirements of 5G applications, opening new revenue streams for manufacturers. Vendors that can deliver solutions combining high performance with telecommunication-grade reliability stand to capture substantial market share in this rapidly growing segment.

Healthcare Digitization Creating New Application Areas

The healthcare sector's accelerating digitization presents expanding opportunities for fanless embedded systems. These solutions are increasingly adopted for medical imaging equipment, diagnostic devices, and patient monitoring systems where silent operation and contamination prevention are critical. The elimination of fans reduces airborne particle circulation, making these systems particularly suitable for sterile environments. Recent regulatory emphasis on healthcare facility noise reduction further strengthens the value proposition of fanless designs in medical applications.

FANLESS EMBEDDED SYSTEM MARKET TRENDS

Rising Demand for Energy-Efficient Computing Solutions to Drive Market Growth

The global fanless embedded system market is witnessing significant growth due to the increasing demand for energy-efficient and low-maintenance computing solutions across industries. These systems eliminate mechanical cooling components, reducing power consumption by approximately 15-30% compared to traditional embedded systems with active cooling. The industrial automation sector accounts for over 35% of fanless embedded system deployments, owing to their durability in harsh environments. Furthermore, advancements in thermal management technologies have enabled high-performance processors like Intel's i7 and i5 to operate reliably in fanless configurations, expanding their application scope.

Other Trends

Expansion of Edge Computing Infrastructure

Edge computing deployments are accelerating the adoption of fanless embedded systems as they require compact, reliable computing nodes in remote or unmanned locations. The global edge computing market, projected to grow at a CAGR of 32% through 2030, is driving demand for rugged fanless solutions that can operate 24/7 without maintenance. These systems are particularly valuable in data collection points for smart cities, oil and gas monitoring stations, and renewable energy installations where dust-proof and vibration-resistant characteristics are critical.

Military and Aerospace Applications Fueling Technological Innovation

The defense sector's transition to SWaP-optimized (Size, Weight, and Power) computing solutions is creating lucrative opportunities for fanless embedded system manufacturers. Military applications now represent approximately 25% of the high-end fanless system market, with demand for radiation-hardened and wide-temperature-range (-40°C to +85°C) configurations growing at 18% annually. Recent innovations include conduction-cooled designs that dissipate heat through chassis walls instead of fins, enabling operation in confined spaces such as unmanned aerial vehicles and armored vehicle electronics suites.

COMPETITIVE LANDSCAPE

Key Industry Players

Strategic Innovations and Product Expansions Drive Market Competition

The global fanless embedded system market is moderately fragmented, with key players competing through technological advancements, strategic alliances, and portfolio diversification. Advantech leads the market with a strong foothold in industrial automation and IoT solutions, leveraging its widespread distribution network and robust R&D capabilities. With a revenue share of approximately 18% in 2024, the company continues to dominate due to its high-performance systems catering to harsh environments.

AAEON and ADLINK collectively hold nearly 22% of the market share, driven by their focus on edge computing and AI-integrated fanless solutions. These companies are capitalizing on the growing demand for energy-efficient systems in data centers and military applications. Recent partnerships with chipset manufacturers have further strengthened their market position, enabling them to deliver customized solutions.

Meanwhile, mid-tier players like Neousys and Axiomtek are gaining traction through niche applications such as autonomous vehicles and smart grid systems. Their aggressive pricing strategies and compact form-factor designs are particularly appealing to SMEs in emerging markets. Both companies reported 12-15% year-on-year growth in 2024, outpacing the industry average.

Emerging competitors are challenging established players through vertical integration strategies. Acrosser recently expanded its manufacturing facilities in Southeast Asia to reduce lead times, while Sphinx Connect acquired a thermal management specialist to enhance its passive cooling technologies. Such moves are reshaping competitive dynamics as companies strive to address the critical challenge of heat dissipation in high-performance fanless systems.

List of Key Fanless Embedded System Companies Profiled

Advantech (Taiwan)

AAEON (Taiwan)

BCM Advanced Research (U.S.)

ADLINK (Taiwan)

Acnodes Corporation (U.S.)

Neousys (Taiwan)

Axiomtek (Taiwan)

Aiomtek (China)

Acrosser (Taiwan)

Sphinx Connect GmbH (Germany)

IEI Integration (Taiwan)

Segment Analysis:

By Type

i7 Segment Leads Due to High Processing Efficiency in Industrial Applications

The market is segmented based on type into:

i7

i5

i3

Celeron

Others

By Application

Industrial Automation Dominates Due to Ruggedness and Reliability Requirements

The market is segmented based on application into:

Energy and Power

Data Centers

Military and Aerospace

Education and Research

General Industrial

Others

By End User

Manufacturing Sector Leads with Growing Need for Industrial IoT Integration

The market is segmented based on end user into:

Manufacturing

Utilities

Transportation

Healthcare

Retail

By Power Consumption

Low Power Systems Gain Traction in Energy-Sensitive Applications

The market is segmented based on power consumption into:

Below 25W

25-50W

50-100W

Above 100W

Regional Analysis: Fanless Embedded System Market

North America The North American market for fanless embedded systems is driven by industrial automation, stringent reliability requirements in harsh environments, and high adoption in military applications. The U.S. accounts for over 85% of regional demand, with key sectors including defense, energy, and data centers. Technological leadership from companies like Advantech and AAEON, coupled with substantial R&D investments in IoT and edge computing, positions North America as an innovation hub. Government initiatives supporting Industry 4.0 adoption further accelerate market growth. However, higher manufacturing costs compared to Asia-Pacific remain a challenge for price-sensitive buyers.