#FileITR

Explore tagged Tumblr posts

Text

#IncomeTaxReturns#FileITR#TaxFiling#IncomeTaxIndia#ITRGuide#TaxSeason#TaxTips#FileYourReturns#TaxFilingMadeEasy#IndianTaxSystem#ITR2024#Taxpayer#HowToFileITR#OnlineTaxFiling#IncomeTaxHelp#TaxBenefits#FinanceTips#MoneyManagement#IncomeTaxForm#FinancialYear

0 notes

Text

#ITR2024 #IncomeTaxIndia #TaxTipsIndia #FinanceForBeginners #ITRChecklist #TaxSeasonIndia #FileITR #PersonalFinanceIndia #IndianTaxpayer #MoneyManagement

0 notes

Text

Filing income tax return in India

Income Tax Return (ITR) filing is the process of submitting a report of an individual's income from one or more sources to the Income Tax Department. It includes details of total earnings and the taxes paid. This submission is formally known as Income Tax Return Filing or ITR Filing.

IncomeTaxReturn #ITRFiling #TaxCompliance #IndianTaxLaws #FileITR #TaxReturnIndia #IncomeDeclaration #ITRIndia #TaxDocumentation #FinancialCompliance

0 notes

Text

📊 Tax season got you feeling overwhelmed?

🤯 Let us handle the paperwork stress! Our ITR filing services are just ₹500 with guaranteed cashback/prizes(chance to win dubai trip). 📝 Your financial success begins today! 💰🌟

Use voucher code KSHIV90 for awailing services 💫✨️

#TaxSeason #FinancialFreedom #itr #fileitr #jobperson #business

0 notes

Text

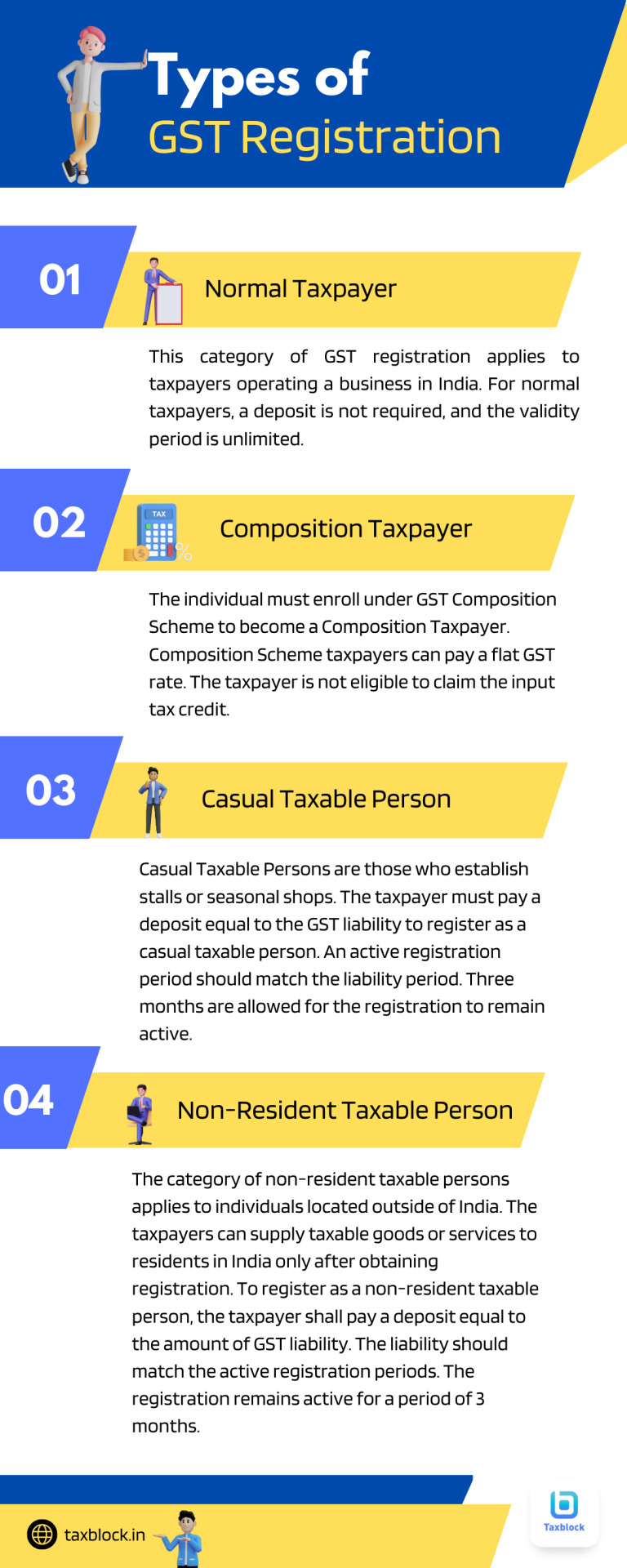

To know more visit our website.

Follow us for more.

#gst#gsttax#financialservices#fileitr#finance#infographic#company#financialfreedom#entrepreneur#business#fintech#financialplanning

0 notes

Text

#IncomeTaxExemption to #NorthEast, Hilly Area,#Laddakh & Ors.*

Are you from NorthEast India?

Do you know that your Tax Exemption is not Absolute?

How you have been interpreting Incometax exemption wrong this whole time?

Contact us to Learn More and Avoid Consequences.

#lexgenie#Incometax#Northeastern#Scheduletribe#Taxexemption#Nagaland#Assam#Manipur#Tripura#Arunachalpradesh#Megahalaya#Incometaxnotice#Penalty#Fileitr#Notfullyexempt

0 notes

Video

@filingmantra #fileitr #india #tax

0 notes

Photo

Filing Income Tax Return is a tedious task for first-time return filers.So, here are the few points that you should keep in your find while filing Income Tax Return.

https://tax2win.in/ #ITR #efiling #tax2win #31Aug2019 #FileITR

0 notes

Photo

#HelloTax app increases efficiency and effectiveness of the income tax return filing process.

#HelloTax #HelloTaxapp #ITR #fileITR #ITR201920 #fileITRanywhere#fileITRanytime

#Avail 20% discount by using Coupon Code: HT20(Condition Apply)

Visit us at : https://www.hellotax.co.in/

#hellotax#hellotaxmobileapp#ITR1920#fileITRanytime#fileITRanywhere#fileITRinjustRs125#Income tax return#ITR#CouponHT20

0 notes

Text

#IncomeTaxReturns#FileITR#TaxFiling#IncomeTaxIndia#ITRGuide#TaxSeason#TaxTips#FileYourReturns#TaxFilingMadeEasy#IndianTaxSystem#ITR2024#Taxpayer#HowToFileITR#OnlineTaxFiling#IncomeTaxHelp#TaxBenefits#FinanceTips#MoneyManagement#IncomeTaxForm#FinancialYear

0 notes

Text

Reduce Tax Liability using Section 80E

The deadline to file Income Tax Return for the Financial Year 2017-18 is 31st July 2018 and many of you must be wondering how to reduce your tax liability. We will tell you how you can reduce your tax liability by claiming deduction under Section 80E.

Download Click Here and use our Android App to file Income Tax Return

Tax benefits for Educational Loan or Foreign Education, can be claimed under Section 80E, this is what all you need to know about it: -

Download Click Here and use our IOS App to file your Income Tax Return

Who is eligible to claim tax deduction under Section 80E?

Only an individual taxpayer can claim this deduction, it is not available for HUFs or any other kind of taxpayer. A taxpayer can claim tax deduction under Section 80E, only when the education loan is taken for the higher education of self, spouse, children or someone for who the taxpayer is a legal guardian.

Filing Income Tax Return

From which Financial Institutions the taxpayer should take the loan?

The loan should be taken from any Bank/ financial institution or any approved charitable institutions. Loans taken from friends or relatives don’t qualify for the deduction under section 80E.

What is the deduction amount, that can be claimed under Section 80E?

The deduction amount that you can claim is the total EMI paid by you during the Financial Year. There is no limit on the maximum amount that is allowed as deduction. You need to obtain a certificate from your Bank, if you wish to claim deduction under Section 80E. Such certificate should segregate the principal and interest portion of the education loan paid by you during the financial year. The total interest paid will be allowed as deduction. No Tax benefit is allowed for the principal repayment of the loan.

Till when can I get this deduction?

The tax deduction for the interest on Educational loan starts from the year in which you start repaying the loan. It is available only for 8 years starting from the year in which you start repaying the loan or until the interest is fully repaid whichever is finishes earlier.

All India ITR Login | Start Filing Income Tax Return

0 notes

Text

e-file income tax returns and online income tax returns

Things to Know Before You File ITR in 2017

Getting income in your account every month is really too comforting, but filing the income tax returns for the same annually is quite a pain! However, if you know the easy ways to file your ITR accurately then there would be no pain in doing this. Income tax returns would not give you same excitement as claiming the income, but it is quite important and mandatory to file your returns.

Filing ITR doesn't always mean that you would be paying tax as most of the salaried people do pay their taxes in the form of TDS (Tax Deducted at Source). There are many tax exemptions offered later based on the investments, expenses, and even the salary heads. All these would result into return of excess tax paid in the form of TDS. You would be able to claim this tax returns only when you file ITR. Hence, even if you are not having regulatory obligations to pay the tax or file ITR, do it if you have a source of income. Remember, filing ITR does not always mean paying tax!

There are many ways to file ITR -

· Do it yourself - ITR can be done online by visiting our website http://www.trutax.in/ . You can file your returns for free on this website.

· Use income tax software online - Using ITR filing software is another free option you can explore, if you are not getting your income from multiple sources. Such option would work for relatively simple financial year that doesn't have different income heads, new addition to your income or property, or even to your life.

· Hire tax consultant online - In case of complexities, you can hire the tax consultant online as well. The online consultant will charge nominal fees for filing the returns, but reduce major hassles of tax filing.

· Hire the tax consultant in person - This is for those who may not want to go the online way. You may hire a tax consulting firm or the consultant in person. All you have to do is share your financial details like income, savings, and expenses with valid documents, while the rest is done by the consultant.

The above four ways of filing ITR may take care of all your ITR needs, however here are few important things you may know before you file ITR in 2017.

· What would be your assessment year?

This is the first thing that you need to select when it comes to filing returns, and here is where the confusion starts. Assessment Year (AY) is the year when you are filing the returns. Financial Year (FY) on other hand is the year when you earned the income. FY in India starts from 1st April to 31st March, so it spreads over two different calendar years. The Form 16 is prepared for the FY and then it is filed on the website for the AY. Example - For the income earned in FY 2016-2017, the AY would be 2017-2018.

· Tax Deducted at Source (TDS)

When everything has gone online, the information about TDS is also present online. You will have to view Form 26AS. The link to view this form is already present on our website.

ITR Forms

ITR Forms are also presented under different heads. The information about the ITR form and where it is applicable is clearly mentioned. One should select the form that suits his/her income specifications.

Look out for income tax deductions

Paying the tax is the skillful task and so is saving the same. There are various tax deductions available under different government investment schemes that you can use to save on your hard earned money being paid as tax. These savings can be made under following sections -

o Section 80C covering various forms of investments.

o Section 80CCC for the investments made under pension scheme.

o Section 80CCG for equity savings.

o Section 80D for medical insurance premium payment.

o Section 80DD for the medical treatment of dependent with some kind of disability.

o Section 8DDB for expenses incurred in medical treatment.

o Section 80E for interest payment on the loan taken to meet educational expenses.

o Section 80EE for loan interest payment on home loans.

o Section 80G for donations made to charitable trusts and some funds

o Section 80GG for the rent payment

o Section 80GGA for the donations towards rural development or scientific research.

o Section 80GGC for donations towards political parties.

o Section 80QQB on income made from book royalty.

o Section 80RRB for royalty income made from patents.

o Section 80TTA for interest earned out of savings deposits.

o Section 80U for person with disability.

ITR filing is not a rocket science. However, with little knowledge, more of accuracy, time investment, and online help, you can make it possible with proper savings without violating government regulations. Be a responsible citizen; file your ITR regularly on time!

�Ed @���Rn

0 notes

Text

📊 Tax season got you feeling overwhelmed?

🤯 Let us handle the paperwork stress! Our ITR filing services are just ₹500. 📝 Your financial success begins today! 💰🌟

Use voucher code KSHIV90 for awailing services 💫✨️

#TaxSeason #FinancialFreedom #itr #fileitr #jobperson #business

0 notes

Text

Improvements in electronic tax returns have cut filing time to 15 from 30 minutes | via @elijahtubayan, @ipcigaral http://bit.ly/fileITR pic.twitter.com/wRVjwQFhrW

Improvements in electronic tax returns have cut filing time to 15 from 30 minutes | via @elijahtubayan, @ipcigaral http://bit.ly/fileITR http://pic.twitter.com/wRVjwQFhrW

Improvements in electronic tax returns have cut filing time to 15 from 30 minutes | via @elijahtubayan, @ipcigaral http://bit.ly/fileITR pic.twitter.com/wRVjwQFhrW published first on http://ift.tt/2ljLF4B

0 notes

Photo

Amount refunded for the F.Y. 2017- 2018.Do file your return with Tax2Win and get maximum refunds. #Incometax #Refund #FileITR #Easyfilling #Taxseason #Tax2Win #Taxtime #Wintax

0 notes

Text

Form 16 and why is it important?

What is Form 16?

Form 16 is certificate that is issued to a taxpayer by his/her employer, when he/she deducts tax from the employee’s salary. It is an extremely important document, that is issued to you in accordance with the provisions of the Income Tax Act, 1961.

Download Click Here and use our Android App to file Income Tax Return

Form 16 contains the details related to Tax Deducted at Source or TDS on Salary by your employer along with the salary break up for a particular Financial Year. Form 16 can also be considered as a proof of the Tax Deducted at Source collected and deposited by the employer to the Government of India.

Download Click Here and use our IOS App to file your Income Tax Return

Who can issue Form 16?

As Income Tax Law anyone who has a TAN no and deducts TDS on salary must provide his/her employees Form 16. If your employer is not deducting TDS, then in that case he/she can refuse to issue Form 16.

Filing Income Tax Return

When is Form 16 issued?

The date to issue Form 16 is supposed to be 31st May of the year for which it is being issued to the employee. Last year this date was extended to 15 June 2017. If the employer fails to issue Form 16 by the assigned date, then in that case he/she will have to pay a penalty of Rs.100 per day, till the day this default continues.

All India ITR Login | Start Filing Income Tax Return

0 notes