#FinanceTools

Explore tagged Tumblr posts

Text

Accounting Software by HRsoft Bangladesh

Key Features- Strongly Secured admin panel, Invoice processing, Payment processing, Banking System, Customization, Financial reporting and projections

#AccountingSoftware#FinanceTools#Bookkeeping#BusinessSoftware#TaxSolutions#FinancialManagement#CloudAccounting#InvoicingSoftware#SmallBusinessTools#AutomatedAccounting#hrsoftbd#softwaredevelopment#softwarecompany#mobileapp#websiteDevelopmentBD#websiteDesignBD#appDevelopmentBD#omrSoftwareBD#OMRSolutionbd#ecommerceDevelopment#ERPSolutionBD#Ballotcountingsoftware#ballotsoftware#bulksms#voicecall

0 notes

Text

HR & Accounts Software by @hrsoftbd

The system includes a dashboard, payroll and attendance management, compliance, performance analysis, and various automated benefits

#HRSoftware#AccountingSoftware#HRandAccounts#BusinessSolutions#PayrollManagement#FinanceTools#EmployeeManagement#HRTech#SmartAccounting#WorkforceAutomation#hrsoftbd#softwaredevelopment#softwarecompany#mobileapp#websiteDevelopmentBD#websiteDesignBD#appDevelopmentBD#omrSoftwareBD#OMRSolutionbd#ecommerceDevelopment#ERPSolutionBD#Ballotcountingsoftware#ballotsoftware#bulksms#voicecall"

0 notes

Text

Accounting Software by @hrsoftbd https://hrsoftbd.com/service-details/accounting-software Strongly Secured admin panel, Invoice processing, Payment processing, Banking System, Customization, Financial reporting and projections

#AccountingSoftware#FinanceTools#Bookkeeping#BusinessSoftware#TaxSolutions#FinancialManagement#CloudAccounting#InvoicingSoftware#SmallBusinessTools#AutomatedAccounting#hrsoftbd#softwaredevelopment#softwarecompany#mobileapp#websiteDevelopmentBD#websiteDesignBD#appDevelopmentBD#omrSoftwareBD#OMRSolutionbd#ecommerceDevelopment#ERPSolutionBD#Ballotcountingsoftware#ballotsoftware#bulksms#voicecall

0 notes

Text

Plan Smart with ShiImperial's EMI Calculator!

Don’t let loan repayments catch you off guard. With ShiImperial’s EMI Calculator, you can calculate your monthly payments in just a few clicks—whether it’s for a home, car, or personal loan.

📲 Try it now 👉 https://www.shiimperial.com/tools/emicalculator

#EMICalculator #ShiImperial #FinanceTools #BudgetSmart #MonthlyEMI

0 notes

Text

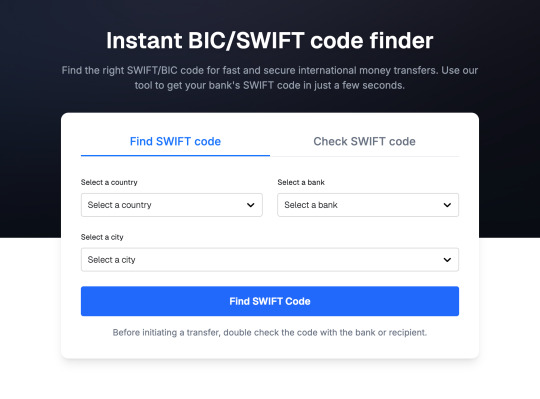

What is BIC/SWIFT code?

If you're sending or receiving money internationally between banks, particularly international wire transfers or SEPA payments, you may be asked for a SWIFT code. SWIFT codes help banks to process transfers from abroad.

How to find your SWIFT/BIC code?

You can usually find your bank's SWIFT/BIC code in your bank account statements. You also can use our SWIFT/BIC finder to get the right code for your transfer.

Find the right SWIFT/BIC code for fast and secure international money transfers. Use our tool to get your bank's SWIFT code in just a few seconds.- https://tools.infinityapp.in/swift-code-finder

#Swiftcode#infinityapp#currencyconverter#crossborderpayments#globalpayments#fintech#freelancers#infinity#internationalpayments#financetools#like

0 notes

Text

💰 Shape Financial Futures with Finance Category Domains!

Step into the world of wealth with domain names crafted for the Finance industry—ideal for banks, fintech startups, investment firms, advisors, and budgeting tools. These domains communicate trust, authority, and fiscal intelligence.

🏦 Great for loan services, credit tools, financial blogs, and crypto platforms 📈 Build credibility and drive client confidence 🔒 Secure, professional names perfect for every financial venture

#Fintech#WealthManagement#FinanceTools#BudgetApps#CryptoFinance#InvestmentDomains#BankingSolutions#MoneyMatters

0 notes

Text

Nalanda: The Intelligent Account Agent App for Hospital Finance | Powered by Grapes

In today’s fast-paced healthcare environment, managing hospital finances can be overwhelming, complex, and time-consuming. For hospital administrators and finance teams, real-time access to accurate financial data is crucial to make informed decisions that directly impact the quality of care and institutional sustainability. Recognizing this critical need, Grapes proudly introduces Nalanda, an intelligent, AI-powered mobile app engineered specifically to transform hospital financial management.

What Is Nalanda?

Nalanda is far more than just a mobile accounting application — it is a smart, AI-driven financial assistant built to serve the unique needs of hospitals and healthcare institutions. Leveraging advanced artificial intelligence technologies, Nalanda empowers hospital administrators and finance personnel with instant insights and control over essential financial metrics. By simplifying access to critical information and automating routine processes, it helps turn cumbersome hospital accounting into an intuitive, efficient, and transparent operation.

youtube

Designed to serve as an intelligent account agent, Nalanda supports instantaneous data retrieval, financial analysis, and communication of important financial updates directly through your smartphone. This means decision-makers can react faster and more confidently in a competitive healthcare market.

Why Nalanda Is a Game Changer for Hospital Finance

Hospital finances are extraordinarily complex, spanning cash handling, petty cash management, accounts receivable and payable, third-party liabilities (TPL), and much more. Traditional accounting methods often involve multiple manual steps, dependence on dedicated accountants, and delays that hinder timely decision-making. Nalanda is designed to solve these pain points and revolutionize how hospital finance operates:

1. Real-Time Financial Data at Your Fingertips

Nalanda provides instant access to all key financial data, including cash in hand, petty cash, receivables, payables, and third-party liabilities (TPL). Instead of waiting for accountants or generating delayed reports, hospital administrators receive up-to-the-minute snapshots of financial health, enabling agile, informed decisions.

2. AI-Powered Financial Insights

What sets Nalanda apart is its intelligent financial analysis capability. By integrating AI into financial management, the app goes beyond basic number crunching to deliver actionable insights. It highlights trends, flags anomalies, and suggests areas needing attention — supporting non-accountants in understanding and managing hospital finances effectively.

3. Reducing Delays and Increasing Accountability

Nalanda’s automation features and transparent data sharing reduce bottlenecks by eliminating the back-and-forth usually required between finance teams and management. The app improves accountability by ensuring that financial updates are always visible to relevant stakeholders, making it easier to track progress and enforce financial discipline.

4. Automated Reminders and Communication

In hospital finance, missing critical deadlines or financial updates can have severe consequences. Nalanda solves this by automatically reminding users about key financial events and communicating updates proactively. This ensures that nothing slips through the cracks, maintaining smooth financial operations.

5. Secure and Easy Mobile Access

Security is paramount when dealing with sensitive hospital financial data. Nalanda uses robust login security measures to protect user data while providing seamless mobile accessibility. Soon to be available on both the Play Store and App Store, Nalanda offers finance teams the convenience of managing hospital accounts securely on the go.

6. Feedback-Driven Continuous Improvement

Nalanda believes in building a product shaped by its users. The app includes a feedback mechanism so users can suggest new functionalities or improvements directly through the app, helping make Nalanda ever more responsive to the evolving needs of hospital finance personnel.

How Nalanda Elevates Hospital Financial Management

The complexities of hospital accounting require tools that are adaptable, smart, and user-friendly. Nalanda provides a centralized dashboard where all critical financial elements come together, offering hospital teams a holistic view of their institution’s financial status at any given moment. This level of transparency and control enables:

Faster decision-making: Access real-time data and AI-generated insights that help administrators quickly identify priority issues or opportunities.

Reduced workload for accounting staff: Automate routine reporting and reminders, freeing accountants to focus on strategy and compliance.

Improved compliance and financial discipline: Ensure that payables, receivables, and liabilities are tracked promptly with built-in accountability.

Easier communication and collaboration: Share financial updates seamlessly among departments and teams via the app.

By integrating AI-driven analytics and mobile technology, Nalanda transforms hospital account management from a traditionally reactive process to a proactive, strategic function.

The Future Is Here: Empower Your Hospital Finance Team Today

Adopting Nalanda means stepping into the future of hospital financial management one where AI enhances human expertise, mobility empowers accessibility, and automation increases accuracy and accountability. It helps hospital administrators and finance staff operate smarter, not harder.

With Nalanda, hospitals no longer have to wrestle with delayed reports and outdated data. Instead, they can embrace an intelligent, adaptive tool that complements their workflows and improves the quality of hospital financial management exponentially.

Get your Free Demo Today!!

Frequently Asked Questions (FAQs)

Who is the target user for Nalanda? Nalanda is designed for hospital administrators, CFOs, finance managers, accountants, and other staff involved in managing hospital accounts.

2. Can Nalanda handle all hospital financial data types? Yes. Nalanda manages cash in hand, petty cash, accounts receivable and payable, third-party liabilities (TPL), and other essential hospital financial metrics.

3. How secure is the Nalanda app? Nalanda employs secure login protocols and encrypts sensitive data to protect financial information. Security is a top priority.

4. When will Nalanda become available for download? Nalanda is scheduled to launch soon on both the Google Play Store and Apple App Store for easy mobile access.

5. Can users request new features? Yes. Nalanda includes an in-app feedback option so users can submit feature requests and contribute to ongoing app improvements.

Join the Financial Revolution in Healthcare Today

Nalanda is more than an app; it’s the future of hospital accounting powered by AI and designed with your needs in mind. Watch our video overview now to see Nalanda in action and learn how it can save time, improve accuracy, and give you the financial control your hospital deserves.

Don’t forget to subscribe, share, and stay updated—you won’t want to miss the latest developments in hospital financial technology. Get ready to transform your hospital’s financial management with Nalanda!

#NalandaApp#HospitalFinance#HealthcareAccounting#AIForHospitals#FinancialManagement#HospitalAdmin#AIInsights#HealthTech#FinanceApp#MedicalBilling#HospitalFinanceManagement#AccountAgentApp#AIAccounting#FinanceAutomation#HealthcareFinanceApp#HospitalManagement#SmartFinance#MobileFinanceApp#HospitalAccountability#FinanceTechnology#HealthcareInnovation#HospitalCashFlow#ReceivablesPayables#FinancialTransparency#AIinHealthcare#GrapesTech#HealthcareAI#HospitalBilling#FinanceTools#HospitalERP

0 notes

Text

💸 How do modern entrepreneurs keep their businesses afloat and thriving?

Hint: It’s not hustle—it’s high-tech. This blog breaks down exactly how founders are using digital tools to optimize their cashflow—so they can grow, not just survive. 🔗 Dive into the full read:

0 notes

Text

Automate NetSuite Dunning with Bulk Email Invoices by Tvarana

Bulk Email Invoices by Tvarana provides an alternative to NetSuite dunning letters, helping businesses automate collections, eliminate manual follow-ups, and boost cash flow—all from within NetSuite. This native SuiteApp streamlines your accounts receivable process by sending personalized follow-up emails based on your schedule, allowing attachments to multiple contacts, and even merging multiple invoices into a single PDF.

🔹 Key Features: Automate collections Send multiple attachments to multiple contacts Schedule reminders after due dates Merge PDFs for easier payment processing Personalize email templates to match your brand See how Bulk Email Invoices by Tvarana makes managing NetSuite dunning letters more efficient than standard dunning tools and delivers results that matter.

👉 Watch now and take control of your AR process! 👍 Like & Share if you found this helpful!

0 notes

Text

Microfinance Vs. Business Loans: A Comparison for a Better Understanding

In the ever-evolving world of finance, understanding the key differences between microfinance and traditional business loans is essential for entrepreneurs, small business owners, and financial institutions. As funding remains the lifeline of any business, selecting the right financial product is vital. This blog will explore the intricacies of microfinance vs. business loans, the role of microfinance software, and how choosing the right financial partner—such as the Best Microfinance Software Company in India—can significantly impact financial management and business success.

What is Microfinance?

Microfinance refers to a range of financial services—including small loans, savings accounts, insurance, and remittances—provided to low-income individuals or groups who traditionally lack access to mainstream banking services. These services are typically offered by Microfinance Institutions (MFIs) that target underprivileged or rural populations.

The core idea behind microfinance is financial inclusion—empowering underserved communities to participate in the economy and improve their livelihoods through access to capital.

Key Features of Microfinance:

Small loan amounts (generally under ₹1 lakh)

Unsecured (no collateral required)

Group lending models

Focus on rural, semi-urban areas

Short-term repayment periods

Tailored for low-income borrowers

Check out our article on Understanding Subvention Lending

What are Business Loans?

Business loans, on the other hand, are credit instruments provided by commercial banks and NBFCs (Non-Banking Financial Companies) to small, medium, or large enterprises. These loans are generally used for expansion, working capital, equipment purchase, or infrastructure development.

Key Features of Business Loans:

Larger loan amounts (₹1 lakh to several crores)

Often secured with collateral

Extended repayment terms (1–10 years)

Detailed documentation required

Creditworthiness and business history evaluated

Microfinance and Business Loans – A Comparative Understanding

When it comes to accessing credit, Microfinance and Business Loans serve different purposes and target audiences, though both are critical to economic growth. Here's a breakdown of how they differ across several key parameters:

1. Target Audience: Microfinance is designed primarily for low-income individuals or small groups with little or no access to traditional banking services, such as self-employed women, small-scale farmers, or rural entrepreneurs. In contrast, business loans cater to established businesses, startups, or registered MSMEs looking for capital to expand, invest, or manage operations.

2. Loan Size: Microfinance loans are generally small-ticket loans ranging from ₹5,000 to ₹1,00,000, intended to support micro-businesses or urgent needs. Business loans, on the other hand, are much larger and can go up to several lakhs or even crores, depending on the business’s eligibility and creditworthiness.

3. Documentation Required: Microfinance typically involves minimal documentation such as identity proof, income declaration, and group verification, focusing more on trust and community reputation. Business loans require detailed financial records, bank statements, business registration documents, and tax returns to assess risk.

4. Collateral Requirement: Microfinance loans are mostly collateral-free, which makes them accessible to underserved populations. Business loans may be secured or unsecured, but larger loans often demand collateral such as property, machinery, or inventory.

5. Interest Rates: Microfinance interest rates are often higher due to the risks involved and administrative costs, ranging from 18% to 26% per annum. Business loan interest rates are relatively lower and vary depending on the lender, credit score, and loan amount—typically between 9% to 18%.

6. Repayment Tenure: Repayment periods for microfinance loans are short, usually ranging between 6 months to 2 years. Business loans offer more flexibility with tenures from 1 year up to 7 years, depending on the nature of the loan.

7. Approval Time: Microfinance approvals are quick and often done within a few days due to simplified processes and minimal checks. Business loan approvals can take from a few days to a few weeks, depending on document verification, evaluation, and credit checks.

8. Purpose of Loan: Microfinance is aimed at income-generating activities like setting up a stall, buying a sewing machine, or starting a dairy business. Business loans support broader purposes like infrastructure development, machinery purchase, working capital needs, or business expansion.

Role of Microfinance Software in Lending

With the rising demand for financial inclusion and digital access, microfinance software has emerged as a game-changer. It streamlines the lending process, ensures transparency, and improves efficiency.

Features of Modern Microfinance Software:

Loan origination and disbursal automation

Credit scoring algorithms

Real-time customer verification (e-KYC, Aadhaar)

Group lending and repayment tracking

Reporting and compliance tools

Mobile access for rural outreach

Advanced microfinance software ensures MFIs can operate at scale, even with limited resources, and reach underserved communities effectively.

Importance of Choosing the Right Financial Product

Microfinance is ideal for:

Individuals with no credit history

Rural women entrepreneurs

Self-help groups and cooperative societies

Small vendors or artisans

Business Loans are better for:

Registered companies or MSMEs

Enterprises needing large capital for operations

Businesses with assets for collateral

Entities seeking long-term funding solutions

Choosing the wrong loan type can lead to financial distress, default, or inefficiencies. Hence, understanding your financial needs, business stage, and repayment capacity is crucial.

Technology as the Enabler: Microfinance Software Tools

India's financial services landscape is evolving with the integration of digital tools. Microfinance Software Tools are now central to operational success, particularly for MFIs handling thousands of clients in multiple locations.

These tools:

Enhance customer onboarding speed

Support compliance with RBI guidelines

Provide real-time analytics for better decision-making

Reduce human error and fraud

Offer digital payment integrations like UPI, BharatPay

Whether you are an MFI or a lender, using robust microfinance software significantly reduces administrative overhead and improves ROI.

Why Software Matters Even More Today

Post-pandemic, the shift toward digital financial services has accelerated. Borrowers prefer quick disbursal, online applications, and remote servicing—especially in rural India. Without the right technology, financial institutions risk lagging behind.

That’s where modern Microfinance Software Tools step in, bridging the gap between traditional lending practices and a fully digital future.

Also read : Top 10 Features Every Modern Loan Origination System Should Have

Selecting the Best Microfinance Software Company in India

If you're a microfinance institution or a new-age lender, your choice of software provider can define your success. A good software partner understands compliance, user experience, scalability, and integrations.

Here are things to consider:

RBI compliance and reporting support

Scalable infrastructure for growing customers

User-friendly dashboards for field agents

Integration with digital KYC and payment systems

Customization based on regional requirements

How GTech Web Solutions PVT. LTD. Empowers Microfinance Institutions

GTech Web Solutions PVT. LTD. stands out as the Best Microfinance Software Company in India, delivering cutting-edge solutions tailored to the specific needs of MFIs, NBFCs, and co-operative lenders.

Their advanced platform includes:

Real-time loan management and accounting

Customer lifecycle management tools

High-level data security

Custom modules for business and micro loans

Bilingual interfaces for regional outreach

What makes GTech Web Solutions different is their commitment to quality, scalability, and customer success. Whether you're transitioning from manual operations or scaling your lending operations, GTech has the right microfinance software to help you lead confidently in this digital era.

Final Thoughts

Understanding the distinction between microfinance and business loans is critical for both borrowers and lenders. Each has its place in the financial ecosystem, and both contribute to economic growth and job creation.

For microfinance institutions, embracing digital transformation through top-tier Microfinance Software Tools is no longer optional—it's essential. And when choosing a technology partner, aligning with the Best Microfinance Software Company in India ensures you're equipped to meet compliance, efficiency, and growth goals with confidence.

#Microfinance#BusinessLoans#LoanComparison#FinancialInclusion#SmallBusinessSupport#BestMicrofinanceSoftwareCompanyInIndia#MicrofinanceSoftware#DigitalFinance#InclusiveBanking#BusinessGrowth#LoanSolutions#MSMEFinance#StartupFunding#FinancialLiteracy#FintechIndia#Microcredit#WomenEntrepreneurs#IndiaFinance#NBFCSoftware#FinanceTools

0 notes

Text

Smart & Reliable Accounting Software Malaysia – For Businesses of All Sizes

Discover the power of smart financial management with Peppolsync.com’s accounting software in Malaysia. Perfect for startups, SMEs and large enterprises, our solution offers automated invoicing, accurate expense tracking and full compliance with Malaysia’s tax regulations. With seamless integration into your workflow and realtime financial visibility, our accounting software Malaysia helps reduce errors and boost overall productivity. Take charge of your finances and grow with confidence—Peppolsync.com Malaysia is your trusted partner in smarter business accounting.

#SmartAccounting#ReliableSoftware#AccountingMalaysia#BusinessGrowth#SMBs#FinancialManagement#AccountingSolutions#BusinessSoftware#MalaysiaBusiness#FinanceTools#EfficientAccounting#EnterpriseSolutions#TaxManagement#SmallBizTools#CloudAccounting#SoftwareForBusinesses#GrowYourBusiness#AccountingForAll#SoftwareInnovation

0 notes

Text

What are the benefits of integrating Insurance CRM software with accounting tools?

Integrating Insurance CRM software with accounting tools provides numerous benefits:

Streamlined Operations: Automates financial processes such as billing, invoicing, and commission tracking.

Centralized Data: Combines customer and financial data for better decision-making.

Improved Accuracy: Reduces manual errors in financial calculations and reporting.

Real-Time Insights: Provides real-time updates on financial health and revenue performance.

Enhanced Reporting: Enables detailed financial and sales reports for performance tracking.

Faster Payment Processing: Simplifies premium and claims payment workflows.

Compliance Management: Ensures adherence to financial regulations with automated tracking.

Cost Efficiency: Reduces administrative costs by eliminating redundant tasks.

Seamless Collaboration: Facilitates coordination between sales, finance, and operational teams.

Better Customer Experience: Ensures accurate billing and reduces payment delays.

Learn more about Insurance CRM software: https://mindzen.com/what-is-a-crm-in-insurance/

#InsuranceCRM#AccountingIntegration#CRMSoftware#InsuranceTech#FinanceAutomation#StreamlinedProcesses#InsuranceSolutions#CRMIntegration#FinancialTools#CustomerExperience#AccountingSoftware#DigitalTransformation#CRMFeatures#EfficiencyInInsurance#InsuranceCRMBenefits#DataDrivenDecisions#CRMInnovation#SmartInsurance#AutomationInInsurance#BetterCustomerService#FinanceTools#InsuranceAnalytics#CRMOptimization#BillingAutomation#InsuranceEfficiency#InsuranceAccounting#CRMAndFinance#PolicyManagement#RevenueTracking#SeamlessIntegration

0 notes

Text

Take control of your business finances with our intuitive Finance and Accounting ERP solution.

Concord ERP is India's leading solution for finance and accounting management

Book Your Free Demo Today Visit: https://www.concorderp.com/ https://techwaveitsolutions.com/ Call Now: 9009155444

#FinanceManagement#AccountingSoftware#ERPSolution#BusinessFinance#FinancialControl#AccountingSystem#FinanceTools#ERPIndia#BusinessAccounting#FinancialManagement#SmartFinance#AccountingSolutions#FinanceERP#BusinessSolutions#FinancialPlanning#ERPForBusiness#FinanceExperts#AccountingMadeEasy#BusinessGrowth#FinanceInnovation#techwave#techwaveitsolutions#itcompany

0 notes

Text

🌍 Easily Convert Currency with Real-Time Exchange Rates- Infinity

Looking to convert currencies quickly and accurately? Infinity App’s Currency Converter offers a seamless solution for users needing real-time currency exchange information. Whether you're a traveler budgeting for a trip, a freelancer getting paid from abroad, or a business managing cross-border transactions—this free tool is designed to make your life easier.

With support for over 150 global currencies, you can instantly convert USD to INR, EUR to GBP, JPY to CAD, and many more. The interface is clean, fast, and easy to use, delivering updated exchange rates sourced from trusted financial data providers.

What makes it stand out? Unlike many converters that show outdated or rounded rates, Infinity App ensures transparency by displaying live mid-market rates—just like the ones used by banks and financial institutions.

✅ No login required ✅ Mobile-friendly ✅ Absolutely free

Make smarter financial decisions and stay ahead with accurate conversions at your fingertips.

🔗 Try it now: https://tools.infinityapp.in/currency-converter

0 notes

Text

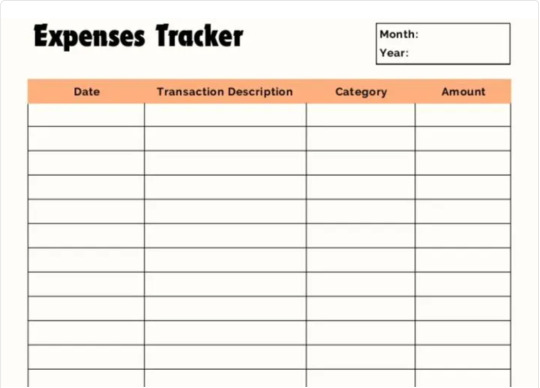

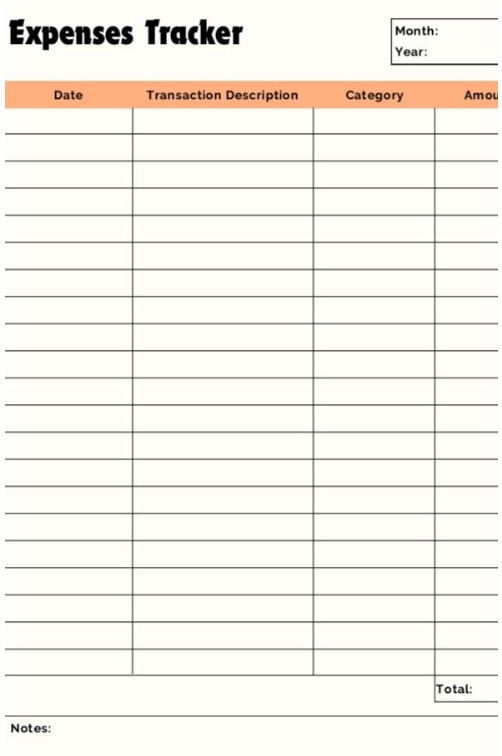

#expenses#spending#budgetplanning#financetips#finance planning#financial planning#budget friendly#financetools#digital platforms#moneysaving#finances#printable

0 notes

Text

0 notes