#FinancialSector

Explore tagged Tumblr posts

Text

Finance Recruitment in Toronto: How to Attract the Best Candidates

Successful finance recruitment in Toronto goes beyond offering competitive salaries. It’s about crafting a compelling employer brand, understanding the needs of modern candidates, and leveraging the expertise of specialized recruitment agencies. Here’s how your organization can stand out and secure top-tier finance talent in a crowded market.

3 notes

·

View notes

Text

Globe Business drives financial sector’s digital transformation with The Breakthrough web series

2 notes

·

View notes

Text

An economy based on debt, where no one owns anything, cannot stand.

#history#economy#politics#american politics#us politics#uspol#political#Marxism#communism#socialism#DebtEconomy#FinancialSystem#EconomicPolicy#EconomicTheory#FinancialDebt#NationalDebt#EconomicCrisis#EconomicInequality#DebtCrisis#FinancialStability#DebtCycle#EconomicGrowth#FinancialSector#MonetaryPolicy#FiscalPolicy#GlobalEconomy#FinancialFreedom#EconomicDevelopment#EconomicJustice#EconomicReform

2 notes

·

View notes

Text

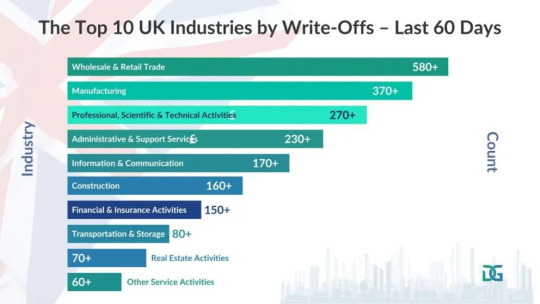

Top 10 Industries Affected by Write-Offs in the Last 60 Days

With a high volume of company write-offs now being reported, over the last 60 days, the UK business landscape has experienced significant financial disruptions, particularly in key industries. These aren’t isolated failures. They represent growing economic stress signals across sectors in which you may work, sell to, or invest in.

If you’ve ever asked:

“Which UK industries are most at risk right now?”

“Which UK industries are showing signs of financial distress?”

“What regions are facing the most business closures?”

“Where are the highest insolvency rates in the UK right now?”

This exclusive insight, powered by DataGardener’s UK business intelligence platform, pinpoints the sectors most impacted, regions most at risk, and the scale of insolvency trends threatening UK commercial stability.

What Are Write-Offs and Why Does It Matter?

In the business context, a write-off typically refers to a company’s failure to meet its financial obligations, often due to insolvency, liquidation, or default. Monitoring industry-level write-offs helps you:

Avoid high-risk partners or clients

Strengthen your risk management strategy.

Identify distressed sectors for investment or acquisition opportunities.

The Top 10 UK Industries by Write-Offs – Last 60 Days

Data Source: DataGardener (covering 5 million+ live UK companies)

Source: https://datagardener.com/blogs/write-offs/

0 notes

Text

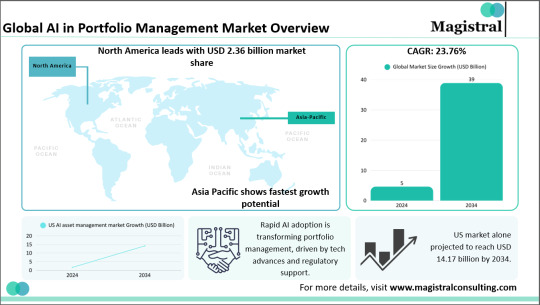

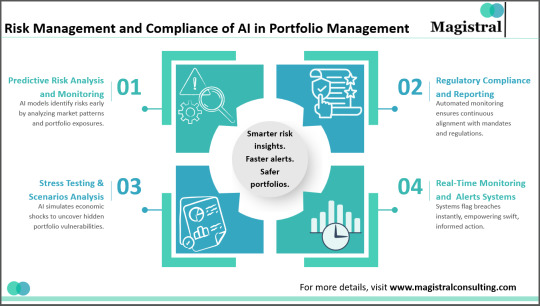

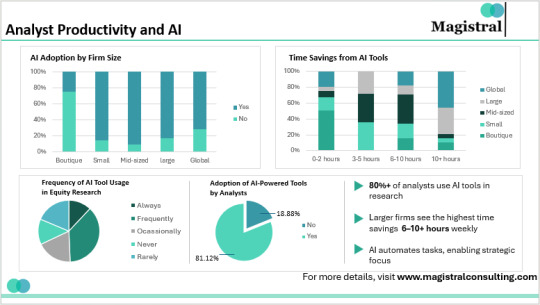

AI in Portfolio Management: Market Growth & Trends

#magistralconsulting#aicompliance#riskmanagement#portfoliomanagement#financialsector#financialmarket

0 notes

Text

#BankingJobs#FinanceHiring#TalentSolutions#MalaysiaJobs#HRSolutions#WorkforceStrategy#HiringMadeEasy#Recruitment#FinancialSector#FutureOfWork

0 notes

Text

youtube

Stock Market Daily Update - February 10, 2025 - InvestTalk Market Wrap

In today’s InvestTalk Market Wrap, the stock market closed on a positive note, though the financial sector went against the trend and finished in the red.

0 notes

Text

Best Bank Coaching in Mumbai - The Prayas India

The Prayas India offers exceptional banking coaching in Mumbai, with experienced mentors and innovative teaching methods that ensure success in competitive exams. Their comprehensive curriculum covers quantitative aptitude, reasoning, and current affairs, providing students with robust study materials and regular assessments. With a supportive learning environment and a track record of successful candidates, The Prayas India stands out as a premier institute for aspiring bankers in Mumbai, truly unmatched excellence.

#BankingCoaching#Mumbai#ThePrayasIndia#BankingExams#CoachingInstitute#BankPO#IBPS#SBI#RBI#CompetitiveExams#ExamPrep#StudyTips#Success#Motivation#Career#BankingJobs#FinancialSector#TestPrep#BankingCareer#FutureBankers

0 notes

Text

Indian Stock Market Sector Analysis - January 13, 2025

The Indian stock market experienced a significant downturn on January 13, 2025, with the BSE Sensex plummeting by 1,049 points to close at 76,330, and the Nifty ending down 345 points at 23,086. This broad-based decline affected all major sectors, raising questions about the underlying factors contributing to this market behavior.

Financial Sector: A House of Cards?

The financial sector, traditionally viewed as the backbone of economic growth, has recently shown signs of vulnerability. Major banks like HDFC Bank and ICICI Bank led the market decline, suggesting that the sector's perceived stability may be overstated. Concerns over slowing domestic earnings and the potential for fewer rate cuts by the Federal Reserve have further exacerbated the situation.

Source: Reuters

Real Estate: A Bubble Waiting to Burst?

The real estate sector faced a sharp decline, with the realty index dropping by 6.7%. This downturn raises questions about the sustainability of current property valuations and whether the sector is on the brink of a significant correction. Investors should critically assess the long-term viability of real estate investments in this climate.

Source: Moneycontrol

Oil & Gas: The End of an Era?

Oil and gas companies, including industry giant Reliance Industries, experienced losses, with the sector index down by 3-4%. This trend may indicate a broader shift away from fossil fuels, challenging the long-held dominance of oil and gas in the energy market. Investors might consider whether the era of oil and gas supremacy is nearing its end.

Source: Moneycontrol

Technology: Overhyped and Underperforming?

The technology sector, often hailed as the future of India's economy, did not escape the market downturn. Despite high valuations, tech companies have shown signs of slowing growth, prompting a reevaluation of their true market potential. Investors should question whether the tech sector's promise aligns with its performance.

Panic Selling: A Self-Fulfilling Prophecy?

The market's sharp decline was exacerbated by panic selling among investors, leading to a massive erosion of wealth. The total market capitalization of BSE-listed firms plunged by approximately ₹13 lakh crore, from ₹431.16 lakh crore on Friday to ₹418.29 lakh crore on Monday.

Source: The New Indian Express

Domestic Institutional Investors (DIIs): The Unsung Saviors?

Amidst the turmoil, Domestic Institutional Investors (DIIs) emerged as net buyers, purchasing shares worth ₹8,066 crore. In contrast, Foreign Institutional Investors (FIIs) were net sellers, offloading shares worth ₹4,892 crore.

Source: Moneycontrol

Conclusion: A Market in Denial?

The across-the-board declines in the Indian stock market suggest that investors may need to reassess their assumptions about sector stability and growth potential. The traditional pillars of the economy are showing cracks, and sectors touted as future growth drivers are underperforming. This market behavior could indicate a broader denial of underlying economic challenges that need to be addressed.

In light of these developments, it's crucial for investors to conduct thorough due diligence and consider diversifying their portfolios to mitigate potential risks.

#IndianStockMarket#MarketAnalysis#StockMarketCrash#FinancialSector#RealEstateMarket#OilAndGasIndustry#TechnologySector#DIISupport#PanicSelling#InvestmentInsights#Sensex

0 notes

Text

Dow Jones Market Trends and Financial Sector Performance.

Explore the latest Dow Jones market trends, focusing on the financial sector's performance. Understand the factors influencing these trends and how they shape the broader market. Gain a clear understanding of the stability and growth potential within the Dow Jones Industrial Average.

Read more:

https://kalkinemedia.com/us/stocks/industrial

0 notes

Text

Brexit's Double-Edged Sword: Evaluating Scotland's Economic and Social Shifts

Navigating the Challenges and Opportunities of Brexit for Scotland Hello, dear readers! Today on "Perspectives Unbound", we delve into a topic of significant importance and timely relevance—Brexit, and its impact on Scotland's economy and society. As we navigate the post-Brexit landscape, it is crucial to evaluate the repercussions and prospects that this monumental change presents for our nation. Brexit has undoubtedly reshaped the economic and political framework of the UK, with Scotland facing unique challenges and opportunities in its wake. One of the most pressing issues is the access to the single market—a critical aspect for Scotland’s exporters, particularly in sectors like fisheries and agriculture that heavily relied on seamless trade with EU countries. However, beyond the challenges, Brexit also presents Scotland with a platform to redefine its economic identity and forge new global partnerships. With the power to negotiate and establish independent trade agreements, there is potential to enhance trade relationships beyond Europe, tapping into burgeoning markets in Asia and the Americas that offer vast opportunities for Scottish products and innovation. The financial sector, pivotal to Scotland’s economy, also faces a landscape transformed by Brexit. Edinburgh, a leading financial hub, must now adapt to serve not just a European context but a potentially wider audience. This shift could drive innovation in financial services, making Scotland a global fintech leader. Moreover, Brexit impacts on Scotland’s societal fabric extend to matters of immigration and labor markets. Scotland's approach to these issues will be critical in shaping its future, balancing economic needs with social inclusivity and diversity that enrich Scottish culture. As we look forward, the essential task for Scottish leaders and policymakers is to navigate these waters with a strategy that leverages new freedoms while mitigating risks. This includes fostering an environment conducive to business, innovation, and inclusive growth. Brexit is not merely a challenge; it's a canvas for reimagining Scotland’s global role. By embracing innovative policies and strategic global outreach, Scotland can not only navigate this change effectively but can emerge stronger, more dynamic, and more connected in the global economy. Thank you for joining today’s reflection on the complex yet promising future of Scotland post-Brexit. Warm regards, Alastair Majury *Perspectives Unbound* --- *Stay tuned to Perspectives Unbound for more analyses on how geopolitical changes influence Scotland's socio-economic landscape.*

#BrexitScotland#ScottishEconomy#GlobalPartnerships#TradeOpportunities#FinancialSector#FintechInnovation#ScottishExports#EconomicIdentity#GeopoliticalChanges#ScotlandGlobalRole#InclusiveGrowth#SocioEconomicImpact#PolicyMaking#NavigatingBrexit#ScotlandFuture

0 notes

Text

Toronto’s Premier Finance Recruiters: How They Can Help You Succeed

This blog will explore the benefits of working with a specialized finance recruitment agency, how it can support your hiring efforts, and why choosing the best finance recruitment agency in Toronto is essential to your company’s long-term success.

#financialsector#financerecruiters#Toronto#financerecruitmentagency#financerecruitment#recruiters#recruitmentfirm#recruitmentagency

1 note

·

View note

Text

youtube

India's Banking Dilemma: RBI to the Rescue? | SSEI

This podcast examines the implications of asset-liability mismatches, the pressure on net interest margins, and the necessity for a re-evaluation of the cash reserve ratio (CRR) in light of evolving financial landscapes.

#IndiaBanking#RBIMonetaryPolicy#BankingDilemma#FinancialSector#DepositStress#CreditGrowth#AssetLiabilityMismatch#CashReserveRatio#BankingPodcast#EconomicInsights#Finance#MutualFunds#NetInterestMargin#BankingReform#SSEI#Youtube

0 notes

Text

Retail Core Banking Systems Market - Revolutionizing Financial Services

The retail core banking system market is in the eye of a storm as financial institutions strive to keep pace with the dynamic demands of the modern consumer. This constitutes one of the major drivers for the retail core banking systems market: growing consumer demand for digital banking services. Customers want access to banking services 24/7 through various digital channels, from anywhere. This requirement has been accelerated because most of the traditional banking systems have legacy processes or systems in place. As such, financial institutions have begun to invest heavily in modern core banking systems that permit real-time processing, omnichannel capabilities, and improved user experiences. That allows banks to provide convenient personalized services to customers, who will retain and attract them in the market.

The other major factor driving the retail core banking systems market is regulation. There are strict regulations and standards that a financial institution follows concerning keeping security and integrity in customer data. Any regulation, be it the General Data Protection Regulation or the Payment Services Directive 2, dictates that banks have proper protection for data and provide secure payment services. Modern core banking systems are conceived with these regulations in mind, featuring state-of-the-art security and compliance features. These regulations permit banks to establish trust with their customers, avoiding costly fines and reputational damage.

Cloud computing is the new-minted disruptor in the retail core banking systems market. Cloud-based core banking solutions are highly scalable, flexible, and cost-effective; they help banks react to rapidly changing business needs. This eliminates the need for expensive on-premises infrastructure and associated maintenance costs. Besides, cloud-based systems facilitate access to real-time data that assists banks in making informed decisions and responding to customer needs in good timing. This is where the technology shift to cloud-based core banking systems happens. Many of these financial institutions are adopting a software-as-a-service model for enhanced operational efficiency and agility.

The outlook for the competitive landscape in the retail core banking systems market is changing. Established players innovate to maintain their respective positions in the market, while new entrants disrupt the market with cutting-edge technologies. On the other hand, banks are also increasingly collaborating or partnering with FinTech companies to drive innovation and spur the development of sophisticated core banking solutions. Such collaboration will enable banks to use the expertise of FinTech firms in furtherance of their digital transformation journey in an attempt to provide better services to clients.

Author Bio -

Akshay Thakur

Senior Market Research Expert at The Insight Partners

0 notes

Text

#beststartupstory#bss#entrepreneurs#dubai#CBUAE#ZeroBureaucracy#financialsector#UAE#governmentinitiative#KhaledMohammedBalama#serviceefficiency#digitaltransformation#economicgrowth#UAE2031

0 notes

Text

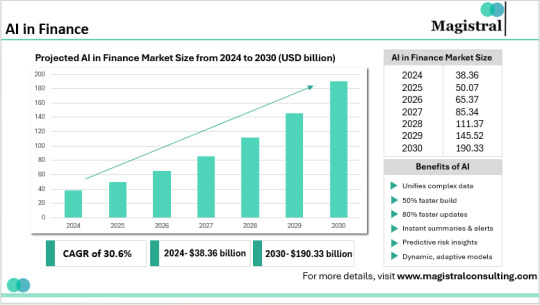

Equity Research AI: Transforming Financial Analysis

#magistralconsulting#aiinfinance#aimodel#financialmarket#privateequity#operationoutsourcing#financialsector

0 notes