#FinancialSupport

Explore tagged Tumblr posts

Text

Lend a Helping Hand: Fulfill the Supreme Court's Directive with Qard-e-Hasana

Introduction

In times of need, the true strength of a community shines through. The Heera Group, a respected business entity, now faces a significant challenge and calls upon its members and well-wishers to lend a helping hand. This blog post explores the concept of Qard-e-Hasana and how it can be used to fulfill the Supreme Court's directive while supporting the Heera Group.

Understanding the Supreme Court's Directive

The Supreme Court of India has issued a directive requiring the Heera Group to deposit ₹25 Crores within a 90-day period, starting from March 6, 2025. This court order is non-negotiable and must be fulfilled, even if it means resorting to borrowing. The gravity of this situation calls for immediate action and support from those who have benefited from the Heera Group or believe in the principles of fairness and justice.

What is Qard-e-Hasana?

Qard-e-Hasana is a unique Islamic financial concept that translates to "beautiful loan" or "benevolent loan." It is an interest-free loan given solely for the purpose of helping those in need and pleasing Allah. This form of financial assistance is deeply rooted in Islamic teachings and is considered a highly virtuous act.

Key features of Qard-e-Hasana:

Interest-free

Given with the intention of helping others

Repayment terms are flexible and based on the borrower's ability

Encouraged as a means of earning spiritual rewards

The Islamic Perspective on Qard-e-Hasana

The concept of Qard-e-Hasana is deeply embedded in Islamic teachings and is mentioned several times in the Holy Quran. One such reference is found in Surah Al-Baqarah:

"Who is it that will lend to Allah a goodly loan so that He may multiply it for him many times over?" (Surah Al-Baqarah 2:245)

This verse emphasizes the spiritual rewards associated with providing interest-free loans to those in need. The act of giving Qard-e-Hasana is seen as lending to Allah Himself, with the promise of manifold returns in this life and the Hereafter.

Prophet Muhammad (ﷺ) also encouraged this practice, as evidenced by the following hadith:

"Whoever relieves a believer's distress, Allah will relieve his distress on the Day of Judgment." (Sahih Muslim)

This hadith highlights the reciprocal nature of good deeds and the far-reaching impact of helping others in their time of need.

Why Your Support Matters

Supporting the Heera Group through Qard-e-Hasana is not just a financial transaction; it's a demonstration of community solidarity and an act of faith. Here's why your contribution is crucial:

Meeting the Court's Deadline: The ₹25 Crores must be deposited within the strict 90-day timeframe set by the Supreme Court. Your timely support can help meet this critical deadline.

Protecting Heera Group's Assets: By helping to fulfill this financial obligation, you're contributing to the protection of Heera Group's assets and ensuring its business continuity.

Reciprocating Past Benefits: If you've benefited from Heera Group in the past, this is an opportunity to give back and show your appreciation.

Earning Spiritual Rewards: Participating in Qard-e-Hasana, especially during the blessed month of Ramadan, can bring immense spiritual rewards and blessings.

Strengthening Community Bonds: Your support demonstrates the power of community unity in times of need, strengthening the bonds between Heera Group and its stakeholders.

How to Contribute

Contributing to this noble cause is straightforward. You can deposit your Qard-e-Hasana directly to the official Heera Group account using the following details:

Account Name: Heera Jewellers

Bank: HDFC, Mehdipatnam

Account Number: 03658630000054

IFSC Code: HDFC0000365

When making your contribution, please ensure that you:

Use a reliable and secure method of transfer

Double-check the account details before confirming the transaction

Keep a record of your transaction for future reference

The Impact of Your Contribution

By participating in this Qard-e-Hasana initiative, you're not just helping Heera Group meet a legal obligation; you're making a lasting impact in multiple ways:

Legal Compliance: Your contribution helps Heera Group comply with the Supreme Court's directive, maintaining its legal standing.

Business Continuity: Supporting Heera Group in this challenging time ensures that it can continue its operations, benefiting employees, stakeholders, and the wider community.

Economic Stability: By helping a significant business entity like Heera Group, you're contributing to the overall economic stability of the region.

Spiritual Growth: Engaging in Qard-e-Hasana is an opportunity for personal spiritual growth and earning rewards from Allah.

Community Strength: Your act of support reinforces the strength and unity of the community, setting a positive example for others.

Frequently Asked Questions

Q: Is Qard-e-Hasana a donation or a loan?

A: Qard-e-Hasana is an interest-free loan, not a donation. The principal amount is expected to be repaid when the borrower is able.

Q: How will Heera Group repay the Qard-e-Hasana?

A: Heera Group is committed to repaying all Qard-e-Hasana contributions as soon as its financial situation stabilizes. Specific repayment terms will be communicated to contributors.

Q: Is there a minimum or maximum amount for Qard-e-Hasana contributions?

A: There is no set minimum or maximum. Contributors are encouraged to give what they can comfortably afford.

Q: Can non-Muslims participate in Qard-e-Hasana?

A: Yes, while Qard-e-Hasana is an Islamic concept, anyone who wishes to provide interest-free financial support is welcome to participate.

Q: How can I ensure my contribution reaches Heera Group?

A: Always use the official bank account details provided by Heera Group and keep your transaction receipt as proof of contribution.

Conclusion

The call for Qard-e-Hasana to support Heera Group in fulfilling the Supreme Court's directive is more than a financial appeal; it's an opportunity to strengthen community bonds, practice faith-based principles, and make a meaningful impact. By lending a helping hand through Qard-e-Hasana, you're not just supporting a business entity; you're participating in a noble act that carries both worldly and spiritual significance.

As we navigate this challenging period, let's remember the power of unity and the blessings that come from helping others. Your contribution, no matter the size, can make a significant difference. Together, we can help Heera Group overcome this hurdle and emerge stronger, all while earning the pleasure of Allah and strengthening our community ties.

#heeragroup#qardehasana#supremecourt#islamicfinance#ramadan#charity#interestfreeloan#legalcompliance#businesscontinuity#muslimcharity#financialsupport#communityhelp#quranverses#hadith#heerajewellers#hdfcbank#mehdipatnam#legalaid#financialcontribution#islamiccharity

2 notes

·

View notes

Text

What Are the Best Personal Loan Options for Private Tutors?

Private tutors play a crucial role in shaping students' academic success. However, since tutoring is often considered a self-employed profession, securing a personal loan can be challenging. Unlike salaried employees, private tutors may not have a fixed monthly income or employer-backed financial documents, making it difficult to prove financial stability to lenders.

The good news is that many financial institutions offer personal loans tailored to the needs of self-employed professionals, including private tutors. In this article, we will explore the best personal loan options available, eligibility criteria, documentation requirements, and strategies to improve approval chances.

Why Do Private Tutors Need a Personal Loan?

As a private tutor, you may require a personal loan for various reasons, including:

Expanding your tutoring business (renting a classroom, purchasing study materials, or upgrading technology).

Covering unexpected personal expenses (medical emergencies, home repairs, or debt consolidation).

Investing in skill development (enrolling in advanced courses or certifications to enhance your teaching career).

Managing cash flow issues during low-income months.

Since private tutors may not always have a steady income, accessing a personal loan with flexible repayment options can be highly beneficial.

Best Personal Loan Options for Private Tutors

There are several lenders that provide personal loans to self-employed professionals, including private tutors. Below are some of the best options:

1. Banks Offering Personal Loans for Self-Employed Individuals

Many banks offer personal loans to self-employed individuals, including tutors, based on income proof and creditworthiness. Some top banks include:

HDFC Bank – Offers personal loans for self-employed individuals with minimal documentation.

ICICI Bank – Provides loans with flexible tenure and competitive interest rates.

Axis Bank – Offers loans based on bank statements and credit history.

State Bank of India (SBI) – Provides personal loans under special schemes for self-employed professionals.

2. Non-Banking Financial Companies (NBFCs)

NBFCs are more flexible in their lending criteria and may approve loans for private tutors who have difficulty meeting traditional bank requirements. Some NBFCs offering personal loans include:

Bajaj Finserv – Provides collateral-free loans with instant approval.

Tata Capital – Offers customized loan options for self-employed professionals.

Fullerton India – Provides personal loans with flexible documentation requirements.

3. Digital Lending Platforms

Fintech companies and digital lending platforms offer quick and easy personal loans to self-employed individuals. These platforms use alternative credit assessment methods, such as transaction history and digital footprints. Some top digital lenders include:

MoneyTap – Offers flexible credit lines for self-employed professionals.

KreditBee – Provides instant personal loans for self-employed individuals with minimal paperwork.

EarlySalary – Specializes in small-ticket personal loans with quick disbursal.

4. Government-Backed Loan Schemes

Some government schemes support self-employed professionals, including tutors, by offering financial assistance:

Mudra Loan Scheme (PMMY) – Provides small business loans for self-employed professionals, including educators.

Stand-Up India Scheme – Supports entrepreneurs and small business owners with financial aid.

Eligibility Criteria for Private Tutors Applying for a Personal Loan

While eligibility criteria may vary across lenders, most financial institutions consider the following factors when approving personal loans for private tutors:

Age – Typically between 21 to 60 years.

Income Stability – A steady income with at least 2-3 years of tutoring experience.

Credit Score – A credit score above 700 increases the chances of approval.

Debt-to-Income Ratio – A lower DTI ratio (below 40%) is preferred.

Business Continuity – Proof of tutoring services through invoices, student payments, or online platforms.

Documents Required for a Personal Loan

To secure a personal loan, private tutors must submit essential documents, such as:

Identity Proof – Aadhaar Card, PAN Card, Passport, or Voter ID.

Address Proof – Utility bills, rental agreements, or passport.

Income Proof – Last 6-12 months' bank statements and Income Tax Returns (ITR) for the last 2 years.

Business Proof – Tutoring invoices, online course earnings, or student fee receipts.

Credit Report – A credit score report from agencies like CIBIL or Experian.

Providing accurate financial documentation improves loan approval chances.

Challenges Faced by Private Tutors in Securing a Personal Loan

1. Irregular Income

Since private tutors often have seasonal income variations, lenders may perceive them as high-risk borrowers.

2. Lack of Income Proof

Many tutors work on a cash basis, making it difficult to provide income proof such as salary slips or tax returns.

3. Lower Credit Score

Delays in bill payments or inconsistent financial records may lead to a lower credit score, affecting loan approval.

4. High-Interest Rates

Self-employed professionals often receive higher interest rates due to the absence of a fixed income.

How to Improve Personal Loan Approval Chances?

1. Maintain a High Credit Score

Pay credit card bills and existing loans on time.

Keep credit utilization below 30%.

Regularly monitor and improve your credit score.

2. Keep Financial Records Updated

Maintain proper income documentation through bank transfers and digital payments.

File Income Tax Returns (ITR) regularly.

3. Apply with a Co-Applicant or Guarantor

Adding a co-applicant (such as a spouse or family member with a stable income) increases approval chances.

A guarantor with a strong credit profile can boost credibility.

4. Opt for a Lower Loan Amount

Applying for a loan amount that aligns with income levels reduces the risk for lenders.

5. Choose the Right Lender

Compare banks, NBFCs, and fintech lenders before applying.

6. Consider a Secured Loan

If unsecured loans are difficult to obtain, applying for a secured loan (backed by collateral like property, gold, or fixed deposits) can be a better option.

Conclusion

Private tutors can qualify for personal loans despite not having a fixed salary. By choosing the right lender, maintaining a strong financial record, and improving credit scores, tutors can enhance their chances of loan approval. Banks, NBFCs, and digital lenders offer various personal loan options, each with unique benefits and eligibility criteria.

If you are a private tutor seeking financial support, compare different lenders, maintain proper documentation, and take proactive steps to strengthen your loan eligibility. A well-planned personal loan can help you expand your tutoring career, manage personal expenses, and secure your financial future.

#personal loan online#nbfc personal loan#fincrif#loan apps#bank#loan services#finance#personal loans#personal loan#personal laon#PersonalLoan#PrivateTutors#LoanForTutors#SelfEmployedLoan#TutoringBusiness#FinancialSupport#EducationLoan#LoanApproval#TutorFinances#UnsecuredLoan#LowInterestLoan#NBFCLoans#BankLoans#LoanEligibility#SelfEmployedFinance#TutorsLoanOptions#FlexibleLoan#PersonalLoanTips#InstantLoan#LoanWithoutSalarySlip

1 note

·

View note

Text

3 notes

·

View notes

Text

Fast Money Empowers Clients With Instant Cash Loan Solutions Today

At Fast Money, our instant cash loan service is designed to empower you with immediate access to funds through a seamless and transparent process. Offering flexible loan options and competitive interest rates, every application is managed swiftly by our professional team. Our commitment to clarity, trust, and quick processing ensures that you receive financial support when you need it most. Fast Money’s instant cash loan solution is your partner in navigating financial emergencies with ease and confidence. Begin your transformative journey with Fast Money today; contact us immediately to secure instant cash.

1 note

·

View note

Text

hi guys,

haven’t posted on here in a while. i’m posting today because i’m in extreme need of help with my rent.

i’m a vulnerable trans masc and i’m facing potential homelessness and i have set up a gofundme so if anyone is able to spare a bit of change to help me out, i’d really appreciate it.

i put some of my interests in the tags to hopefully find people with similar interests that might help me out :)

#gofundme#financialsupport#mine#transgender#please help#mental health#supernatural#the strokes#the sims 4#indie music#art#the 100#crochet#minecraft#beach house

6 notes

·

View notes

Text

Aging with Dignity: How To Apply for Attendance Allowance in the UK

Aging often involves navigating through various support systems. In the United Kingdom, one essential resource for seniors is the Attendance Allowance. This blog post aims to provide an exploration of the application process for Attendance Allowance, ensuring that older individuals and their families have the information they need to access the support they deserve. Understanding Attendance…

View On WordPress

#acasforms#AgeWithGrace#AgingWithDignity#AttendanceAllowance#CareForSeniors#citizenadvise#companieshouse#DignifiedAging#docue#eforms#ElderlyCare#expert#FinancialSupport#GovernmentBenefits#highquality#InclusiveSupport#lawdepot#legaltemplates#SeniorCitizens#SeniorSupport#templatenet#UKHealthcare#UKSeniors#UKSocialCare#WellbeingInOldAge

1 note

·

View note

Text

Hire the Best Accounting Firm Toronto on a Small Business Budget!

Chartered Professional Accountant

BBS Chartered Professional Accountants stands as the premier choice for accounting services in Toronto, catering even to businesses operating within tight budgets. Our specialization lies in providing comprehensive accounting, bookkeeping, and tax solutions tailored explicitly to address the unique demands of small businesses in the Toronto area.

At BBS Accounting CPA, our dedicated team is committed to furnishing you with exceptional financial support and expertise, ensuring the robust financial growth of your small business. Here's what distinguishes us:

Comprehensive Accounting Services: We offer an extensive array of Accounting Services that encompass all facets of your financial needs. Whether it's bookkeeping management or tax preparation, we've got your back.

Customized Solutions: We recognize that small businesses grapple with distinct financial challenges and aspirations. Our services are meticulously tailored to align with your specific requirements, facilitating the realization of your financial goals.

Expert Proficiency: Our team comprises Chartered Professional Accountants (CPAs) armed with profound knowledge and experience in the field. We remain abreast of the latest tax regulations and accounting standards to furnish you with precise and compliant services.

Cost-Effective Solutions: We firmly believe that every small business should have access to top-tier accounting services. Hence, we proffer competitive rates that align with your budget, ensuring you receive unmatched value for your investment.

Local Insight: Being a Toronto-based firm, we possess an intimate understanding of the local business environment and regulatory landscape. This localized expertise empowers us to offer insights and strategies that can significantly benefit your business.

Dependability: Count on us to meet deadlines, deliver punctual financial reports, and be readily available when you require our assistance. We are unwavering in our commitment to bolster your business's success, taking your financial affairs with utmost seriousness.

Client-Centric Philosophy: Your contentment is paramount to us. We actively endeavor to cultivate enduring, robust relationships with our clients, and we stand ever-ready to address your queries and concerns.

Whether you're embarking on a new venture or seeking to streamline your financial operations, BBS Chartered Professional Accountants is your steadfast partner in Toronto. Let us shoulder the burden of number-crunching so you can channel your energies into what you excel at—nurturing the growth of your business. Contact us today to initiate a discussion about your accounting and financial needs with our proficient team.

#AccountingFirm#SmallBusiness#Toronto#CPA#AccountingServices#Bookkeeping#TaxServices#FinancialSupport#BudgetFriendly#CustomizedSolutions#Expertise#LocalKnowledge#FinancialCompliance#ClientSatisfaction#BusinessGrowth#FinancialManagement#ProfessionalAccountants#FullServiceAccounting#SmallBusinessBudget#BBSAccountingCPA

2 notes

·

View notes

Text

I swear I'm gonna reblog or donate❤️ Caught u😂 U swore👀❤️😂

A Couple Dream Was Burnt, But Hope Is Still Alive.

✅️Vetted by @gazavetters, my number verified on the list is ( #324 )✅️

Dear friends and family,

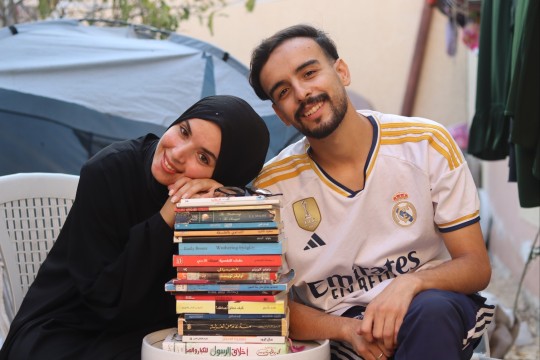

This is us Hadeel and Abed❤️

And this is our new link with 0 donations‼️

GFM has removed our previous link with no reason, and we lost all the donations😩

https://gofund.me/7d692896

Without any further ado, this is what happened to us, literally.⬇️

All of the above happened to us from the IDF and we lost our dreams, money and business equipment💔

Have you ever loved someone and wanted to live a perfect life with her or him but fate had another opinion for both of you?

Us? War has prepared a surprising plan for us💔

We are Hadeel and Abdelrahman, two gazan couple who, just like many others, dreamed of building a better life. For years, we poured our hearts and souls into our company, dreaming of a future full of possibility, independence, and success. But in an instant, everything was destroyed.

One phosphorus bomb took it all. Our tent, our belongings, our dreams—all turned to ashes.

But what hurt the most was not the loss of things, but the loss of our future.

While fleeing for our lives, we had to choose between saving our loved ones or saving our work. I chose my sister. And as I ran, I looked back at the burning remnants of everything we had worked for. My heart shattered.

This is a picture of the burning and remaining money:

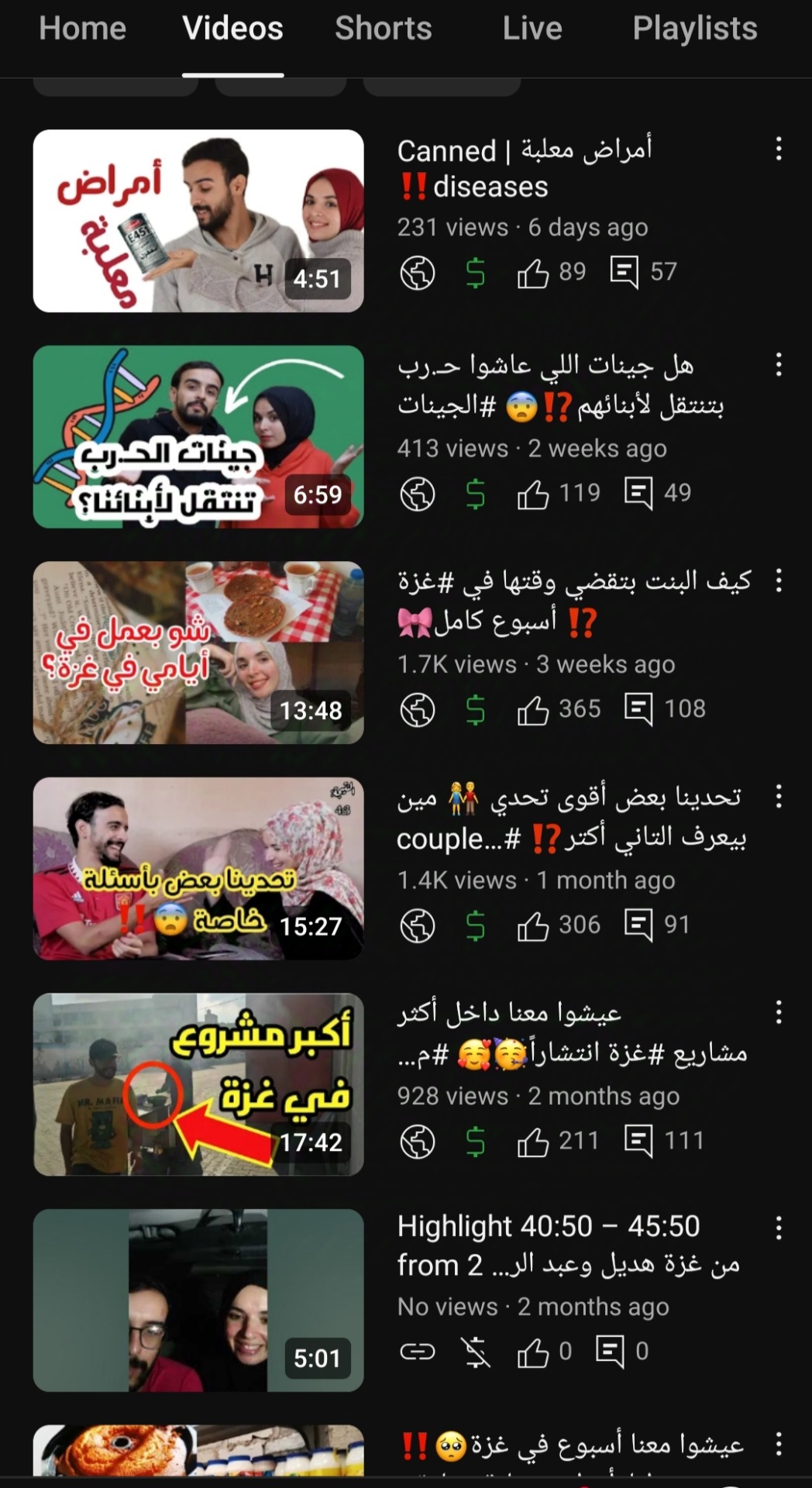

Now, we find ourselves rebuilding—not just our company, but our lives. The war took so much from us, but it hasn't taken our will to fight back. We decided to share our story through YouTube, showing the world what life is like in Gaza, and how we are trying to rise from the ashes.

We need your help to restore our hope, our business, and our lives.

Your money will help us to:

Travel out of #Gaza to rebuild our future.

Buy laptops, cameras, and equipment to continue our work.

Secure a safe place to stay and rebuild our lives outside #Gaza.

Support our families, who are also struggling to survive.

Reclaim our dreams and, someday, our wedding.

Even one Euro can make a huge difference in our lives.

You can be part of something meaningful. Your support will not only help us rebuild, but also allow us to keep helping others achieve their dreams, just as we once hoped to do. Together, we can make the impossible possible.

Our work place and equipment before war:

Thank you for being part of our journey.

This is our YouTube channel, please subscribe and have a look at our content❤️

https://youtube.com/@twogazans?si=-ZpyftxRxzNmSsGg

With love and gratitude,

Hadeel & Abdelrahman

1K notes

·

View notes

Text

From Complexity to Clarity: Bookkeeping Solutions for Chipping Campden SMEs

Managing business finances can often feel like navigating a maze. But with trusted Bookkeeping Chipping Campden services, small and medium enterprises gain control, clarity, and compliance. Whether you're juggling invoices, chasing payments, or reconciling statements, proper bookkeeping transforms chaos into strategy. Chipping Campden is home to a variety of growing businesses—from craft breweries to artisan markets—all of which need reliable financial support. Outsourcing bookkeeping means more than convenience—it’s about accurate records, cash flow visibility, and better decision-making. An experienced bookkeeper helps streamline daily operations, prepare for tax season, and reduce costly errors. With ongoing legislative changes, staying compliant is more critical than ever. Digital tools, customized reporting, and personalized service make expert bookkeeping not only accessible but indispensable. And when your books are handled by professionals who understand your local market, the results are immediate and impactful. Accurate data powers growth, ensures peace of mind, and builds business resilience. Make clarity your competitive edge with Accountancy Office—Chipping Campden’s bookkeeping specialists.

0 notes

Text

Youth Talent Search Examination (YTSE) 2026 – Your Dreams, Our Support!

Are you in Class 10th, 12th, or already passed and planning to continue your education? Worried about college or course fees? You're not alone — but here’s some good news! 💡

Introducing the Youth Talent Search Examination (YTSE) 2026, a nationwide scholarship program designed to support students like you. Whether you're aiming for engineering, medical, commerce, or arts – YTSE can help you get up to 100% scholarship for your higher education.

🔍 What is YTSE?

YTSE is a scholarship exam open to all students in 10th, 12th, or who have already passed. There’s no minimum marks or grade requirement – it’s based on your talent, not your past scores.

✅ Benefits of YTSE 2026:

Up to 100% Scholarship – study without financial burden

Open to all streams – Science, Commerce, Arts, etc.

No cutoff or percentage criteria

Easy online application

Support for students across India

📌 How to Apply:

It’s simple!

Visit www.ytse.org.in

Fill the form online

Submit your details

Appear for the scholarship exam

Secure your scholarship!

📧 For help, email at: [email protected]

🔥 Don’t let money stop your education. Let your talent lead the way! Apply now and grab this golden chance to build your future with full support.

#YTSE2026#ScholarshipIndia#YouthTalentSearch#ScholarshipExam#10thPassed#12thPassed#StudyFree#FinancialSupport#ScholarshipAfter12th#EducationMatters#StudentOpportunity#ytseScholarship#ApplyNow#HigherEducationIndia

1 note

·

View note

Text

Can Money Make You More Creative?

Let’s stop pretending artists don’t need money. Creativity flows stronger when you’re stable, supported, and in a good headspace. This isn’t about selling out — it’s about being free to create without surviving check to check. Respect the hustle. Respect the art.

#ArtistJourney#MusicIndustry#CreativeProcess#Inspiration#money#IndieArtist#ArtisticGrowth#CreativeEnergy#SupportArtists#MusicAndMoney#FinancialSupport

1 note

·

View note

Text

This infographic by Executive Financial Partners (EFP Financial Experts) breaks down the key reasons why financial support is essential for business growth. From establishing a solid financial foundation to enabling scalable expansion, it highlights how professional financial analysis and Atlanta bookkeeping services drive decision-making, build investor trust, and minimize risk. Perfect for small businesses seeking CFO-level insights.

#EFPFinancialExperts#FinancialSupport#AtlantaBookkeeping#SmallBusinessTips#BusinessGrowth#CFOservices#FinancialAnalysis#ExecutiveFinancialPartners#EntrepreneurTips#SmartFinance

1 note

·

View note

Text

Social Assistance in Canada: Financial Support Overview

Social assistance, or welfare, provides critical financial support for low-income Canadians facing hardship. EBSource details eligibility, benefits, and payment schedules across provinces, ranging from $537 monthly in New Brunswick to $1,901 for AISH in Alberta. Understanding these programs aids in effective financial planning.

0 notes

Text

युवा शक्ति का उत्थान: मुख्यमंत्री युवा योजना ऋण – Vibho Associates के साथ आपके सपनों को दें उड़ान

परिचय आज के भारत में युवा सिर्फ देश का भविष्य नहीं, बल्कि वर्तमान की सबसे बड़ी ताकत हैं। उनका जोश, ऊर्जा, और नवाचार का दृष्टिकोण देश को आत्मनिर्भरता की ओर ले जा सकता है। इसी सोच के साथ सरकार ने मुख्यमंत्री युवा योजना (CM Yuva Yojna) की शुरुआत की है, जो विशेष रूप से युवाओं को स्वरोजगार के लिए वित्तीय सहायता प्रदान करने के उद्देश्य से बनाई गई है। इस योजना को सफलतापूर्वक लागू करने और युवाओं तक पहुँचाने का कार्य ��र रहा है Vibho Associates, जो न केवल ऋण प्राप्ति में सहयोग करता है, बल्कि हर कदम पर मार्गदर्शन भी देता है।

मुख्यमंत्री युवा योजना क्या है?

मुख्यमंत्री युवा योजना एक सरकारी ऋण सहायता योजना है, जिसका उद्देश्य युवाओं को स्वरोजगार के लिए प्रेरित करना और उन्हें उनके व्यवसायिक सपनों को साकार करने के लिए आर्थिक सहायता प्रदान करना है। यह योजना विशेष रूप से बेरोजगार, शिक्षित युवाओं को ध्यान में रखकर बनाई गई है, जिससे वे अपने खुद के व्यवसाय या स्टार्टअप की शुरुआत कर सकें।

इस योजना की मुख्य विशेषताएं

सरल और त्वरित आवेदन प्रक्रिया Vibho Associates की मदद से आवेदन प्रक्रिया को बेहद आसान और पारदर्शी बनाया गया है, जिससे युवा बिना किसी बाधा के योजना का लाभ उठा सकते हैं।

कम ब्याज दर पर ऋण उपलब्ध योजना के तहत युवा कम ब्याज दर पर ऋण प्राप्त कर सकते हैं, जिससे व्यवसाय की शुरुआत में वित्तीय बोझ कम होता है।

प्रशिक्षण और मार्गदर्शन Vibho Associates न केवल ऋण दिलाने में सहयोग करता है, बल्कि व्यापार शुरू करने के लिए आवश्यक सलाह, प्रशिक्षण और योजना निर्माण में भी मार्गदर्शन करता है।

ऋण की राशि और उपयोग इस योजना के तहत ₹50,000 से लेकर ₹25 लाख तक का ऋण प्राप्त किया जा सकता है, जो व्यवसाय की प्रकृति और स्केल पर निर्भर करता है।

Vibho Associates – क्यों है ये योजना के साथ सबसे मजबूत साझेदार?

Vibho Associates एक भरोसेमंद संस्था है, जो युवाओं को सरकारी योजनाओं का लाभ दिलाने के लिए समर्पित रूप से कार्य कर रही है। उनका अनुभव, तकन��की समझ और प्रोफेशनल नेटवर्क युवाओं को सही दिशा में ले जाने में मदद करता है।

Vibho Associates के माध्यम से मिलने वाले लाभ:

✔ आसान डॉक्यूमेंटेशन प्रक्रिया

✔ विशेषज्ञों की मदद से व्यवसाय योजना बनवाना

✔ आवेदन की निगरानी और फॉलो-अप

✔ समय पर ऋण स्वीकृति सुनिश्चित करना

✔ ऋण प्राप्ति के बाद सहायता और परामर्श

कौन ले सकता है योजना का लाभ?

इस योजना का लाभ कोई भी ऐसा युवा ले सकता है जो:

भारत का नागरिक हो

आयु 18 से 45 वर्ष के बीच हो

न्यूनतम 10वीं कक्षा उत्तीर्ण हो

व्यवसाय शुरू करने की स्पष्ट योजना रखता हो

आवेदन की प्रक्रिया – आसान और पारदर्शी

Vibho Associates से संपर्क करें योजना की जानकारी और सहायता के लिए Vibho Associates के कार्यालय या वेबसाइट से संपर्क करें।

दस्तावेज़ तैयार करें – आधार कार्ड – निवास प्रमाण पत्र – शैक्षणिक प्रमाण पत्र – बैंक पासबुक – व्यवसाय योजना (Business Plan)

ऑनलाइन/ऑफलाइन आवेदन करें विशेषज्ञों की मदद से आवेदन प्रक्रिया को पूरा करें।

सत्यापन और स्वीकृति दस्तावेज़ों की जांच के बाद ऋण स्वीकृति प्रक्रिया शुरू होती है।

ऋण प्राप्त करें और व्यवसाय शुरू करें ऋण प्राप्त होते ही अपने सपनों का व्यवसाय शुरू करें और Vibho Associates से मार्गदर्शन लेते रहें।

मुख्यमंत्री युवा योजना कैसे बदलेगी युवा भारत का चेहरा?

बेरोजगारी में कमी स्वरोजगार को बढ़ावा देने से युवा खुद का रोजगार सृजित कर सकते हैं और दूसरों को भी काम दे सकते हैं।

स्टार्टअप और MSME को बढ़ावा नई सोच और तकनीक के साथ युवा अपने इनोवेटिव आइडिया को बिजनेस में बदल सकते हैं।

ग्रामीण भारत में विकास योजना का लाभ ग्रामीण क्षेत्रों में भी उपलब्ध है, जिससे गांवों में भी आर्थिक गतिविधियाँ बढ़ेंगी।

आत्मनिर्भर भारत का निर्माण जब युवा आत्मनिर्भर बनेंगे, तो देश भी आत्मनिर्भरता की दिशा में मजबूती से आगे बढ़ेगा।

कुछ प्रेरणादायक उदाहरण

राहुल (लखनऊ) – ITI करने के बाद नौकरी नहीं मिल रही थी। Vibho Associates की मदद से उसने ₹5 लाख का ऋण प्राप्त कर मोबाइल रिपेयरिंग शॉप खोली। आज वह 3 लोगों को नौकरी दे रहा है।

नेहा (भोपाल) – बेकरी व्यवसाय शुरू करने की इच्छा थी। मुख्यमंत्री युवा योजना के तहत ₹2 लाख का लोन मिला और Vibho Associates की मदद से उसने सफल व्यवसाय शुरू किया।

निष्कर्ष

CM Yuva Yojna सिर्फ एक योजना नहीं, बल्कि एक क्रांति है जो भारत के युवाओं को आर्थिक रूप से सक्षम बनाकर उन्हें अपने सपनों को साकार करने का अवसर देती है। Vibho Associates इस क्रांति का सारथी बनकर युवाओं को सही मार्गदर्शन, आवश्यक संसाधन और विश्वास प्रदान करता है।

अगर आप भी कुछ बड़ा करने का सपना देखते हैं, तो आज ही Vibho Associates से संपर्क करें और मुख्यमंत्री युवा योजना का लाभ लेकर अपने भविष्य को उज्ज्वल बनाएं।

"युवा बदलेंगे भारत की दिशा – Vibho Associates के साथ मिलकर उठाएं पहला कदम!"

#CMYuvaYojna#StartupIndia#YouthEmpowerment#Entrepreneurship#BusinessLoans#MSMEIndia#VibhoAssociates#GovernmentSchemes#FinancialSupport#SmallBusinessFunding

0 notes

Text

Personal Loan Interest Rates – What You Need to Know

When you're in need of quick financial support—whether it's for medical expenses, home renovation, travel, or managing existing debts—a personal loan can be a reliable solution. However, before you apply, it's important to understand how personal loan interest rates work and how they affect your repayment.

What Are Personal Loan Interest Rates?

Personal loan interest rates refer to the percentage charged by lenders on the amount you borrow. This rate plays a major role in determining your monthly EMI and the total cost of the loan. A lower interest rate means more affordable repayments over time, while a higher rate increases your financial burden.

Factors That Affect Personal Loan Interest Rates

Many factors influence the interest rate you're offered, including:

Your credit score – A good credit score (usually 750 and above) can help you secure a lower personal loan interest rate.

Income and job stability – Lenders prefer borrowers with stable income sources and employment history.

Loan amount and tenure – Higher loan amounts or longer repayment periods can sometimes affect the rate.

Relationship with the lender – Existing customers often enjoy better terms.

Understanding these factors can help you prepare better before applying.

How to Get the Lowest Personal Loan Interest Rates

Here are a few tips to ensure you get the most competitive rate:

Check your credit score before applying.

Compare personal loan interest rates from multiple lenders.

Avoid applying to too many places at once to prevent a negative credit impact.

Consider loans from NBFCs and digital platforms, which often have flexible terms.

Why Choosing the Right Consultant Matters

Navigating through different lenders and loan products can get confusing. That’s where having a reliable financial partner can make a difference. At Fundcera, we help you discover the most affordable personal loan interest rate available for your profile. With a 100% digital process and fast approval, you can get funding without the usual paperwork and delays.

Final Thoughts

Finding the right personal loan interest rate isn’t just about luck—it’s about being informed, comparing your options, and choosing the best offer available. Whether you're a salaried employee or a self-employed individual, make sure to prioritize low rates and flexible terms to manage your loan wisely.

#PersonalLoanInterestRates#LowestInterestRate#PersonalLoanIndia#Fundcera#LoanApproval#InstantLoan#QuickLoan#LoanConsultant#NBFCLoan#FinanceMadeEasy#DigitalLoan#EasyLoanProcess#LoanWithLowInterest#AffordableLoans#PersonalFinance#LoanHelp#GetLoanFast#FinancialSupport#LoanExperts#HassleFreeLoan

1 note

·

View note

Text

🚀 Upgrade Your Business with Powerful Machines! Looking to scale your production and efficiency? Get flexible machinery loans with faster approvals and minimal documentation from logintoloans.

✅ Quick Processing ✅ Easy Documentation ✅ Best-in-Class Loan Offers

📞 Call us now: 8885545255, 9966202433 🌐 Visit: www.logintoloans.com

#MachineryLoan#BusinessLoan#MSMEIndia#StartupIndia#LoanForBusiness#logintoloans#ManufacturingIndia#MakeInIndia#EquipmentFinance#SMEFinance#BusinessGrowth#LoanApproval#FinancialSupport#GrowYourBusiness#DigitalLoan#InstantLoanApproval#SmallBusinessSupport#LoanSolutions#business loan#carloan#financialfreedom#instantloan#mortgage loan#personal loan#home loan#loans#personalloan

0 notes