#Forex Liquidity Providers

Explore tagged Tumblr posts

Text

MT5 Load Testing Without Downtime: A Broker’s Guide Run smarter load tests on your MetaTrader 5 gateway. This YaPrime guide helps you avoid failover while testing platform performance.

#how to become a broker in forex trading#how to setup Forex Broker Company#Forex liquidity solutions#best liquidity providers in Forex#best liquidity providers in the forex#launch your own forex brokerage#how to start your own forex broker business#liquidity provider forex broker#how to create your own forex broker#Best Forex Trading Platform MT4#forex liquidity providers

0 notes

Text

BigProfitPulse.io review Withdrawals

When it comes to choosing a forex broker, traders want security, reliability, and transparency. The industry is filled with platforms, but not all of them operate with the same level of trustworthiness. So, what about bigprofitpulse.io reviews? Is this a broker you can rely on, or just another name in the crowd?

A proper evaluation requires looking at key factors—licensing, user reviews, trading conditions, withdrawal processes, and platform stability. And that’s exactly what we’re going to do. Instead of just listing features, let’s break down the details that really matter and see if bigprofitpulse.io review stands up to scrutiny.

Because in forex, trust isn’t given—it’s earned. Let’s find out if this broker deserves yours.

Withdrawals on bigprofitpulse.io – Fast and Fee-Free Transactions

When it comes to withdrawing funds from bigprofitpulse.io reviews, everything looks smooth and convenient. The broker provides multiple withdrawal methods, including VISA, MasterCard, bank transfer, Poli, and BPAY. This variety of options makes it easier for traders from different regions to access their money without unnecessary hassle.

Now, let’s talk about speed. The platform ensures instant withdrawals, which means transactions are processed within a few minutes to a maximum of 2 hours. In the forex industry, this is a strong indicator of reliability—many brokers take much longer, sometimes even days, to release funds. The ability to access your earnings quickly is a huge advantage, especially for active traders who need liquidity.

And here’s another great point—there are no withdrawal fees. A 0% commission policy means traders can withdraw their funds without worrying about hidden costs. Many brokers charge a percentage-based fee or fixed withdrawal cost, but bigprofitpulse.io review eliminates this concern entirely.

Fast, fee-free, and with multiple options—this withdrawal system looks like a strong argument in favor of this broker’s legitimacy. If a platform allows traders to access their money quickly and without extra costs, it’s usually a sign that they operate transparently and care about user satisfaction.

BigProfitPulse.io – Legitimacy Through Time

One of the first things traders look at when evaluating a broker’s legitimacy is its history. And here’s an interesting fact—the domain of bigprofitpulse.io reviews was purchased in the same year the brand was established. This might seem like a small detail, but in reality, it’s a strong indicator of transparency.

Think about it: many scam brokers buy domains long after their supposed "founding date" to appear more experienced than they actually are. But that’s not the case here. The domain purchase date aligns with the official launch of the brand, showing that bigprofitpulse.io review didn’t just appear out of nowhere—it was planned and built with a solid foundation.

BigProfitPulse.io – A Broker with a Strong License

A broker’s license is one of the biggest indicators of its legitimacy. And here’s something important—bigprofitpulse.io review operates under a recognized financial regulator. This isn’t just a formality; it’s a guarantee that the broker follows strict rules and standards to protect traders.

Why does regulation matter? Well, licensed brokers have to comply with laws regarding fair trading practices, fund security, and transparent operations. They’re regularly audited and must prove that they keep client funds safe, often in segregated accounts. If a broker isn’t licensed, there’s no way to ensure they won’t simply disappear with users’ deposits.

And here’s another key point—brokers with strong licenses don’t just get them overnight. The process involves thorough checks, financial assessments, and legal verification. That means bigprofitpulse.io reviews didn’t just decide to become a forex broker on a whim; they went through the necessary steps to prove their legitimacy.

If you’re looking for a sign that this broker is operating legally, this is a big one. A properly regulated broker is far less likely to engage in fraudulent activities, and that’s a major reason traders can feel confident with bigprofitpulse.io review.

BigProfitPulse.io – Reviews That Speak for Themselves

If you want to know whether a broker is trustworthy, one of the best ways is to check what real traders are saying. And here’s where bigprofitpulse.io review stands out—its Trustpilot score is above 4, which is an excellent rating in the forex industry.

Now, let’s break this down. A score above 4 means the majority of users are satisfied with their experience, highlighting key aspects like smooth withdrawals, responsive support, and a reliable trading platform. And here’s an even stronger argument—the broker has received a large number of reviews. This isn’t just a handful of positive comments; it’s a consistent pattern of feedback from many traders.

Why is this important? Because fake brokers often have either very few reviews or a mix of extreme ratings, with sudden spikes in positive feedback that look unnatural. But when a broker maintains a solid rating with a large volume of reviews, it’s a sign that real traders are actively using and trusting the platform.

Is BigProfitPulse.io reviews a Legitimate Broker?

After analyzing all the key aspects, bigprofitpulse.io review checks the right boxes for a trustworthy forex broker. From a properly aligned domain registration date to a strong regulatory status, the broker shows no signs of shady operations. That’s already a good sign.

Then, there’s the high Trustpilot rating with a significant number of reviews. This is crucial—brokers with real traders actively engaging and leaving positive feedback are far more likely to be reliable. Add to that a well-structured withdrawal system with instant processing and zero fees, and you get a platform that prioritizes transparency and user experience.

Everything we’ve reviewed—secure licensing, solid reputation, smooth transactions, and strong platform features—paints a picture of a broker that’s playing by the rules. While every trader should do their own research, the evidence strongly suggests that bigprofitpulse.io reviews is a legitimate and dependable broker.

7 notes

·

View notes

Text

Bullwaypro.com review Trading Times

Finding a reliable broker in the forex market can feel like searching for a needle in a haystack. With so many platforms out there, how do you know which ones are trustworthy? That’s exactly why we’re diving into Bullwaypro.com review—a broker that’s been gaining traction among traders.

Legitimacy in this industry isn’t just about having a sleek website. It’s about proper regulation, transparency, user satisfaction, and overall trading conditions. So, does Bullwaypro.com reviews check all the right boxes? We’ll break down everything you need to know—its licensing, customer reviews, trading conditions, and more—to see if this broker is as solid as it claims to be.

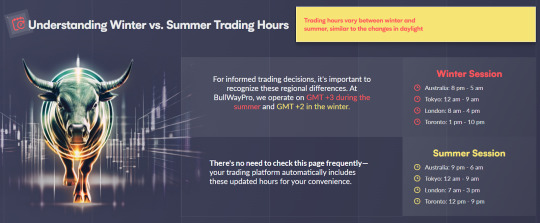

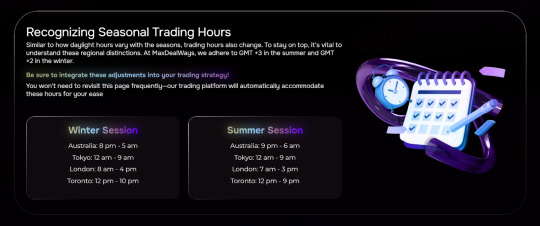

Bullwaypro.com Trading Times Review: Market Hours for Optimal Trading

Understanding the trading times of a broker is crucial for maximizing opportunities in the forex market. Bullwaypro.com review operates across major global trading sessions, ensuring that traders can engage in the market at the most active times.

Winter Session:

Australia: 8 PM - 5 AM

Tokyo: 12 AM - 9 AM

London: 8 AM - 4 PM

Toronto: 1 PM - 10 PM

Summer Session:

Australia: 9 PM - 6 AM

Tokyo: 12 AM - 9 AM

London: 7 AM - 3 PM

Toronto: 12 PM - 9 PM

This schedule aligns with the forex market's peak trading hours, ensuring liquidity and volatility—two key factors that traders look for. The London and New York overlap (12 PM - 4 PM GMT in winter, 11 AM - 3 PM GMT in summer) is particularly significant, as it's the most active period for currency trading.

Bullwaypro.com– Establishment and Domain Registration

When evaluating a broker’s legitimacy, one of the first things to check is its establishment date and domain registration. A reliable company will always have these dates aligned—meaning the brand should not be created after its official domain was registered. This is a key indicator of transparency.

Bullwaypro.com review was founded in 2022, while its domain was registered in November 2021. What does this tell us? It shows that the company planned its online presence in advance rather than setting up a website at the last minute for questionable operations.

There is no discrepancy here, which is already a good sign. Scammers often register domains retroactively or use brand-new websites with no history. In this case, everything checks out: the brand was officially launched in 2022, but preparations for its online presence started earlier. This looks like a strong argument in favor of legitimacy.

This approach is typical of companies that plan for long-term operations rather than short-term gains. Serious brokers care about their reputation from the very beginning.

Bullwaypro.com– Regulatory License

One of the strongest indicators of a broker’s legitimacy is its regulation. A broker operating under a well-known financial authority provides a layer of security for traders. It ensures that the company follows strict guidelines, adheres to fair trading practices, and protects client funds. So, what about Bullwaypro.com reviews?

This broker is regulated by the FCA (Financial Conduct Authority), which is one of the most respected financial regulators in the world. The FCA is known for its stringent requirements, which include financial transparency, capital adequacy, and strict anti-fraud measures. Not every broker can obtain this license—it’s granted only to companies that meet high operational and ethical standards.

Why does this matter? Because brokers regulated by the FCA are legally required to segregate client funds, meaning traders’ money is kept separate from the company’s operational funds. This significantly reduces the risk of mismanagement or fraud. Moreover, FCA-regulated brokers must participate in compensation schemes, which provide traders with financial protection in case of unexpected company failures.

This looks like a strong argument in favor of Bullwaypro.com’s legitimacy. A broker with an FCA license isn’t just an offshore entity operating without oversight—it’s a company that abides by strict regulatory standards. We think that’s a big deal when it comes to trust.

Bullwaypro reviews – Customer Reviews and Reputation

When assessing a broker’s trustworthiness, user feedback plays a crucial role. A high Trustpilot rating and a large number of reviews indicate that traders actively use the platform and, more importantly, are satisfied with its services. So, how does Bullwaypro.com review perform in this regard?

Bullwaypro.com reviews has an impressive Trustpilot score of 4.4, based on 2,995 reviews. That’s a significant number of ratings, which suggests that the platform is not only widely used but also maintains a high level of client satisfaction. In the forex industry, where scams are unfortunately common, it’s rare to see brokers with such consistently positive feedback.

Now, let’s break this down further. Out of the total reviews, 2,869 are rated 4 or 5 stars. This means that over 95% of users have had a positive experience with the broker. What does this tell us? First, that traders are successfully using the platform and are happy with its services. Second, that the company is not hiding behind fake reviews or limited feedback—it has a real and engaged user base.

Final Verdict: Is Bullwaypro.com reviews a Legit Broker?

After analyzing all key aspects of Bullwaypro.com review, the evidence strongly suggests that this broker is legitimate. Let’s quickly recap why:

Regulation: Bullwaypro.com reviews is regulated by the FCA, one of the most respected financial authorities. This ensures strict oversight, fund security, and compliance with industry standards.

Domain and Establishment Date: The broker was founded in 2022, with its domain registered in 2021, showing transparency and long-term planning.

User Reviews: A Trustpilot score of 4.4 based on 2,995 reviews—with over 95% positive ratings—indicates a strong reputation and high trader satisfaction.

Trading Conditions: The platform offers multiple account types, fast deposits & withdrawals, low fees, and a well-rated mobile app—features that serious traders look for.

Customer Support & Accessibility: A variety of contact options and a well-structured support system make it easy for traders to get help when needed.

Looking at all these factors together, Bullwaypro.com review appears to be a trustworthy and well-regulated broker. It has a solid reputation, a strong regulatory framework, and a growing community of satisfied traders. While every trader should conduct their own due diligence, all signs point to this being a reliable choice in the forex market.

9 notes

·

View notes

Text

WindealAgency.com review:Account Types

Choosing a forex broker is never just about flashy websites or bold promises—it's about trust, regulation, and real trader experiences. In this review, we’ll take a close look at WindealAgency.com review and analyze whether it stands up as a reliable broker or raises red flags.

We’ll examine everything from its licensing, user feedback, and account types to deposit methods and trading conditions. A legitimate broker should check all the right boxes—so does WindealAgency.com reviews meet the standard? Let’s find out.

Account Types at WindealAgency.com: A Deep Dive into Their Offerings

When it comes to trading, flexibility and tailored experiences matter. WindealAgency.com reviews understands this well, offering a structured yet diverse range of account types to accommodate traders of all levels. Let's break down what they provide:

Account Type

Minimum Deposit

Bronze

$10,000

Silver

$25,000

Gold

$50,000

Premium

$100,000

Platinum

$250,000

VIP

$500,000

VIP+

$1,000,000

What Do These Accounts Mean for Traders?

At first glance, the minimum deposits might seem high, but let's analyze this setup. A structured tier system like this often indicates a serious brokerage catering to mid-to-high-level traders. Brokers that deal with professional clients or institutions usually set their entry points higher to ensure quality service, tight spreads, and dedicated support.

Bronze & Silver – These tiers are suitable for traders looking to get a professional-grade experience without committing massive funds upfront. Usually, accounts in this range come with basic perks like educational resources, standard spreads, and decent customer support.

Gold & Premium – Here, things start getting more advanced. Higher-tier accounts often mean lower spreads, priority support, and access to better trading conditions. This could include exclusive trading signals, personal account managers, or even faster withdrawal processing.

Platinum & VIP – At this level, traders are likely to receive premium analytics, risk management tools, and possibly even invitations to exclusive trading events. These accounts are for serious investors who demand top-tier trading conditions.

VIP+ – A $1,000,000 minimum deposit is an elite-level requirement. Brokers that offer this tier typically cater to institutional traders, hedge funds, or ultra-high-net-worth individuals. Expect customized trading conditions, personal analysts, and direct access to liquidity providers.

What Does This Tell Us About WindealAgency.com?

This tiered approach signals a brokerage that is not just catering to casual retail traders but instead positioning itself as a high-end trading platform. While the minimum deposit thresholds are significantly higher than entry-level brokers, this could also indicate a focus on serious traders who want quality execution, security, and premium service.

Would this account structure work for every trader? Maybe not. But for those looking for a premium brokerage experience, WindealAgency.com reviews seems to have a well-designed system in place.

How the Domain Purchase Date Confirms WindealAgency.com’s Legitimacy

One of the easiest ways to check a broker’s credibility is by looking at the relationship between its establishment date and the domain purchase date. Why does this matter? Because when a company secures its online presence before officially launching, it’s a sign of long-term planning and serious business intentions.

For WindealAgency.com review, we see that:

The brand was established in 2021

The domain was purchased on November 19, 2020

This means that WindealAgency.com reviews secured its domain before launching its services. That’s a great indicator of proper business structuring rather than a hastily thrown-together website. Many unreliable brokers often register their domain after they start operating, which raises red flags about their long-term commitment.

Think about it: a broker that purchases a domain in advance is likely investing in its infrastructure, platform, and compliance efforts before accepting traders' funds. This adds another layer of reassurance for clients looking for a trustworthy broker.

All in all, this timeline makes sense and aligns with what we expect from a legitimate brokerage.

Trustpilot Reviews: A Strong Indicator of WindealAgency.com’s Reliability

One of the best ways to gauge a broker's reputation is by looking at what real traders say about it. In the case of WindealAgency.com review, the Trustpilot score stands at 4.3, which is quite solid for a trading platform.

Now, let’s break it down further:

Total reviews: 24

Positive reviews (4-5 stars): 23

That means almost all traders who left reviews had a positive experience—an impressive ratio. In the forex industry, where brokers often receive mixed feedback due to the nature of trading, a 4.3 rating is a sign of consistent service, smooth transactions, and overall trustworthiness.

But here’s where it gets interesting. A low review count can sometimes raise questions, but the fact that 23 out of 24 reviews are positive suggests that the broker’s clients are genuinely satisfied. If there were major issues like withdrawal problems, platform failures, or shady practices, we would expect to see a much lower rating and a higher percentage of negative reviews.

Regulation & Licensing: A Key Factor in WindealAgency.com’s Legitimacy

One of the strongest indicators of a broker’s trustworthiness is its regulatory status. WindealAgency.com review operates under the FCA (Financial Conduct Authority), which is known as one of the most respected financial regulators in the world.

Now, why is this important?

The FCA is a high-authority regulator, meaning brokers under its supervision must adhere to strict financial and operational guidelines.

It enforces transparency, fund protection, and fair trading practices, ensuring that traders are not exposed to fraudulent activities.

Brokers regulated by the FCA must separate client funds from company funds, reducing the risk of financial mishandling.

Some brokers operate under weak or offshore regulations, which often make it difficult for traders to recover funds in case of disputes. But WindealAgency.com being under the FCA umbrella automatically puts it in a category of trusted financial institutions.

So, what does this tell us? If a broker has gone through the rigorous FCA licensing process, it’s not a fly-by-night operation. Instead, it’s a platform that prioritizes legal compliance and trader security—two things that matter the most in the forex industry.

Is WindealAgency.com review a Legitimate Broker?

After carefully analyzing all the key aspects of WindealAgency.com reviews, the picture looks quite clear. This broker checks all the major boxes of legitimacy, making it a strong contender in the forex trading industry.

Regulation & Security: Being FCA-regulated, WindealAgency.com review operates under one of the strictest financial authorities, ensuring fund protection and transparency—a huge green flag.

Domain & Establishment: The fact that they secured their domain before launching the brand speaks volumes about their long-term vision and professionalism.

User Reviews: A 4.3 Trustpilot rating with an overwhelmingly positive response from traders indicates that real users have had a good experience.

Account Types: The structured tier system suggests that this broker caters to serious traders who value premium conditions and a high-end trading experience.

Looking at these factors, we think WindealAgency.com reviews can be trusted. It’s not just another unregulated, short-lived broker—it has the credentials, the reviews, and the structure of a serious financial platform.

7 notes

·

View notes

Text

TheSuccessStrategy.com review: Trading Platforms

When choosing a broker, traders often ask the same questions: Is this platform reliable? Can I trust it with my money? These concerns are valid, given the number of unregulated brokers in the market.

TheSuccesStrategy.com review stands out as a platform that checks all the right boxes. It has a solid regulatory framework, positive user feedback, and a well-structured trading environment. But let’s not just rely on general claims—let’s dive deep into the facts that prove its legitimacy.

Trading Platforms of TheSuccesStrategy.com: Versatile and Accessible

The trading platform offered by TheSuccesStrategy.com review (thesuccesstrategy.com) includes multiple options tailored for different devices and trading styles. Traders can access:

WebTrader Platform – A browser-based platform that allows seamless trading without the need for downloads. This is a common choice for traders who prefer flexibility and instant access.

Tablet Trader – A specialized platform optimized for tablet devices, ensuring a smooth trading experience on larger screens compared to mobile phones.

Mobile Trader – Designed for on-the-go trading, this mobile app version ensures that traders can monitor markets and execute trades from anywhere.

This variety in trading platforms suggests that the broker is committed to accessibility and convenience, catering to both desktop and mobile traders. A broker that offers multiple platform options typically aims to provide a better user experience—wouldn't you agree?

Regulation and Licensing: TheSuccesStrategy’s Strong Credentials

One of the key indicators of a broker’s legitimacy is its regulation. TheSuccesStrategy.com reviews operates under the supervision of the FCA (Financial Conduct Authority), a top-tier regulatory body.

Why is this important? The FCA is known for its strict requirements and rigorous oversight. Brokers regulated by the FCA must adhere to stringent financial standards, including segregation of client funds, negative balance protection, and regular audits. This means that traders' funds are kept separate from the company's operational funds, ensuring greater security.

Even more reassuring is the fact that TheSuccesStrategy.com review holds a "High Authority" license, which places it among the most reliable and well-regulated brokers in the industry. A broker with such credentials isn't just compliant—it actively demonstrates transparency and a commitment to fair trading.

Doesn't this level of oversight make it easier to trust this broker?

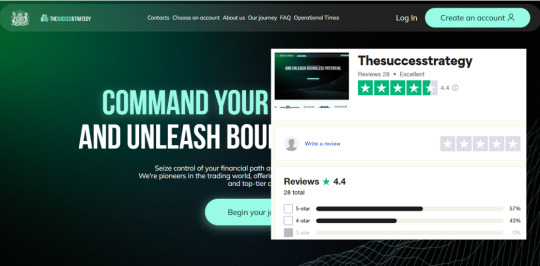

Trustpilot Reviews: A Strong Reputation Backed by Users

When it comes to choosing a broker, what do traders trust the most? Real user feedback. TheSuccesStrategy.com review (thesuccesstrategy.com) boasts an impressive 4.3 rating on Trustpilot. In the world of online trading, a score above 4 is a strong indicator of reliability and user satisfaction.

Even more notable is the fact that 100% of the reviews (26 out of 26) are positive, rated 4 or 5 stars. This suggests that traders consistently have a good experience with the platform, whether it's customer service, withdrawals, or trading conditions.

Trading Hours: When Can You Trade with TheSuccesStrategy.com?

Understanding a broker’s trading schedule is crucial, especially for those who want to take advantage of global market movements. TheSuccesStrategy.com review (thesuccesstrategy.com) follows the standard forex market hours, allowing traders to engage in different sessions based on their preferred trading times.

Here’s the breakdown of their trading hours by region:

🔹 Winter Session:

Australia: 8 PM - 5 AM

Tokyo: 11 PM - 8 AM

London: 7 AM - 4 PM

New York: 12 PM - 9 PM

These time slots align with the major financial centers, ensuring that traders have access to the most liquid and volatile hours in the forex market.

Having clear and structured trading hours means traders can plan their strategies efficiently. Whether you prefer the high volatility of the London-New York overlap or the steadier movements of the Asian session, this schedule provides flexibility for different trading styles.

Is TheSuccesStrategy.com review a Trustworthy Broker?

After thoroughly analyzing TheSuccesStrategy.com review (thesuccesstrategy.com), it’s clear that this broker meets the key standards of legitimacy and reliability. Let’s break it down:

✅ Regulated by the FCA – One of the most respected financial authorities, ensuring strict compliance and trader protection. ✅ High Trustpilot Rating (4.3/5) – A strong reputation backed by 100% positive reviews. ✅ Multiple Trading Platforms – WebTrader, Mobile Trader, and Tablet Trader provide convenience and flexibility. ✅ Fast Deposits & Withdrawals – A variety of payment options with no commissions. ✅ User-Friendly Experience – Simple registration, responsive support, and a growing community of traders.

With solid regulation, a high satisfaction rate, and a well-designed trading environment, TheSuccesStrategy.com reviews appears to be a legitimate and reliable broker. Of course, every trader should do their own research, but the evidence suggests that this platform is built for both security and success.

Would you feel confident trading with a broker that ticks all these boxes?

8 notes

·

View notes

Text

MaxDeAlways.com review Withdrawals

Fast & Fee-Free Withdrawals at MaxDeAlways.com

When it comes to withdrawing funds from MaxDeAlways.com review, traders can breathe easy. The platform offers SWIFT as the withdrawal method, which is widely recognized for secure and efficient international transactions. That alone tells us something—this broker is catering to serious traders who need reliable banking options.

Now, let's talk speed. The withdrawal time is instant, typically ranging from just a few minutes to a maximum of 2 hours. That’s incredibly fast for this industry, where some brokers take days to process transactions. A speedy withdrawal system signals that the company is financially stable and isn’t holding onto client funds unnecessarily.

And the best part? Zero commission on withdrawals. Many platforms charge hidden fees, but here, what you earn is what you get. This suggests a trader-friendly approach—something that trustworthy brokers tend to prioritize.

MaxDeAlways.com review is Regulated by a Top-Tier Authority

One of the most critical aspects of a broker’s legitimacy is its regulation. And here, MaxDeAlways.com review doesn’t disappoint—it operates under the supervision of the Financial Conduct Authority (FCA). This isn’t just any regulator; the FCA is known worldwide for its strict rules, rigorous oversight, and high standards. Brokers under FCA regulation must maintain transparent operations, segregate client funds, and ensure financial stability.

Now, let’s add another layer of trust. The broker holds a "High Authority" license, which further confirms its credibility. This level of regulation is not handed out to just anyone—it’s reserved for companies that meet strict financial and operational criteria. If a broker has an FCA license, it means they’ve been vetted thoroughly, and that’s a solid sign of reliability.

So, what does this mean for traders? Safety, transparency, and legal protection. When you trade with MaxDeAlways.com reviews, you’re dealing with a company that’s held to the highest standards in the financial industry.

Trading Hours at MaxDeAlways.com – Global Market Access Around the Clock

One of the best things about trading is that the markets never really sleep, and MaxDeAlways.com review ensures traders can access opportunities at any time. The platform follows a structured global trading schedule, covering all major financial centers.

Here's how it breaks down:

Winter Session:

Australia: 8 PM - 5 AM

Tokyo: 10 PM - 7 AM

London: 3 AM - 12 PM

New York: 8 AM - 5 PM

This setup means traders can engage in forex, stocks, and other financial instruments across different time zones, maximizing their chances of catching market movements.

Now, why is this important? Because liquidity and volatility vary throughout the day, and having access to multiple sessions lets traders choose the best times for their strategy. Night owls might prefer the Tokyo session, while early risers can take advantage of London’s high activity.

Trustpilot Reviews – A Solid Reputation for MaxDeAlways.com reviews

When it comes to choosing a broker, real user feedback speaks louder than any marketing claim. MaxDeAlways.com review holds a 4.0 rating on Trustpilot, which is a very respectable score in the trading industry. But let’s break this down a bit further.

The broker has 7 total reviews, and here’s something interesting—all 7 of them are rated 4 or 5 stars. That means 100% of the feedback is positive. In a field where traders are often quick to leave complaints, this is an impressive indicator of reliability.

Why MaxDeAlways.com review is a Broker You Can Trust

After exploring all the essential aspects of MaxDeAlways.com review, it’s clear this broker is committed to providing a secure and efficient trading experience. The FCA regulation and "High Authority" license ensure that your funds and trades are protected by one of the most reputable authorities in the financial world. Combine that with instant, fee-free withdrawals and a trading schedule that spans key global markets, and it's easy to see why MaxDeAlways.com review stands out.

Furthermore, the perfect score on Trustpilot and the positive feedback from users provide solid evidence that this platform delivers on its promises. It’s not just a broker; it’s a trusted partner for traders looking for reliability, speed, and transparency. Whether you're a novice or an experienced trader, MaxDeAlways.com reviews offers a seamless experience that inspires confidence.

So, if you’re looking for a broker that ticks all the right boxes, MaxDeAlways.com review is worth considering.

8 notes

·

View notes

Text

Solarystone.com review Register

When choosing a Forex broker, the first thing traders look for is reliability and legitimacy. Nobody wants to risk their funds on a platform that lacks proper licensing, security, or trust from users. Today, we’re taking a deep dive into Solarystone.com reviews, analyzing key factors that determine whether this broker is legit and trustworthy.

Does Solarystone.com review have a solid regulatory background? Are traders satisfied with their experience? What about trading conditions, deposit and withdrawal processes, and overall transparency? We’ll break it all down step by step.

Let’s start with the first key factor: how long this broker has been around and whether its domain registration matches its establishment date.

How to Register on Solarystone.com

For solarystone.com review, the registration process is straightforward:

On the main page, find the "registration" button.

Click it to open the registration form.

Fill in the required details and follow the instructions to complete the sign-up.

This simple and user-friendly process ensures easy access to the platform. Do you need any more

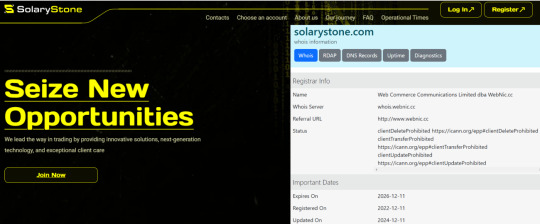

Solarystone.com reviews – Establishment and Domain Registration

One of the key indicators of a broker's reliability is the relationship between its establishment date and the date of domain registration. In the case of Solarystone.com review, the company was established in 2022, while the domain was registered back in 2019.

This is a crucial factor. Why? Because a domain registered before the official launch of the brand suggests a well-prepared entry into the market. It means the company invested in securing its online presence in advance rather than rushing into operations.

Solarystone.com – Regulation and Licensing

Regulation is the backbone of a broker’s legitimacy. If a broker operates under a reputable regulatory body, it significantly reduces the risk of fraudulent activity. Solarystone.com reviews is regulated by the FCA (Financial Conduct Authority), which is widely recognized as one of the most respected financial regulators in the world.

Now, why is this important? The FCA does not hand out licenses easily. Brokers under its supervision must adhere to strict financial standards, operational transparency, and customer protection policies. This means that Solarystone.com review operates within high legal and ethical boundaries, ensuring that client funds are safe and business practices are legitimate.

Would a scam broker manage to pass FCA’s rigorous compliance checks? Highly doubtful. This reinforces the trustworthiness of Solarystone.com reviews.

Solarystone.com – Trading Times

Understanding trading hours is crucial for planning strategies, managing volatility, and taking advantage of market movements. Solarystone.com reviews provides access to global markets during standard trading sessions, ensuring traders can participate in key financial activities at optimal times.

Here’s a breakdown of the trading schedule:

Winter Session

Australia: 8 PM - 5 AM

Tokyo: 11 PM - 8 AM

London: 3 AM - 12 PM

New York: 8 AM - 5 PM

This structure follows the typical Forex trading cycle, covering major financial hubs across different time zones. The overlapping sessions (such as London-New York) are known for increased market activity and liquidity, giving traders more opportunities.

Final Verdict: Is Solarystone.com review a Legit Broker?

After carefully analyzing Solarystone.com review, we see multiple strong indicators of legitimacy. Let’s recap the key points:

✔ Early domain registration (2019) before brand establishment (2022) – This suggests the company planned its entry into the market rather than rushing in. A clear sign of a serious and professional approach.

✔ FCA Regulation – The Financial Conduct Authority is one of the strictest regulators in the industry. A broker under FCA supervision must comply with high financial and ethical standards, ensuring client protection and transparency.

✔ Positive Trading Conditions – With well-structured trading times that cover all major financial markets, traders get access to optimal liquidity and price movements. This is the kind of setup found only on well-established platforms.

When looking at these factors together, Solarystone.com reviews shows no red flags. Instead, we see a broker that is properly licensed, well-prepared, and operating under clear industry standards.

Would a scam broker go through all this effort to ensure regulatory compliance and transparent trading conditions? Highly unlikely.

Based on all the data, Solarystone.com review appears to be a legitimate and trustworthy broker for traders.

6 notes

·

View notes

Text

What Is Forex? The Wild World of Currency Trading

Ever felt that rush when you drop a few coins into a gumball machine, anxiously waiting to see what color you’ll get? Welcome to the thrilling realm of Forex trading—a universe where speculation and strategy collide like Deadpool and a bad guy in a dark alley. So, buckle up and grab your favorite chimichanga; let’s jump into the vibrant, chaotic world of Forex!

What the Heck Is Forex?

Alright, folks, let’s get down to brass tacks (or, you know, shiny copper coins). Forex, or foreign exchange, is the largest financial market in the world. Yeah, even bigger than that stash of Yu-Gi-Oh cards you used to have! Here’s the scoop: Forex is where currencies are traded 24 hours a day, five days a week. Picture a never-ending marketplace with traders from every corner of the globe, shouting and signaling—kinda like a bazaar but with less camel and more currencies.

In a nutshell, Forex allows you to swap one currency for another. Think of it as a super-powered financial bartering system, only instead of trading goats or magic rocks, we’re dealing with dollars, euros, and yen. You buy one currency while simultaneously selling another. Easy peasy, right? Well, sort of!

Why Trade Forex? Is It Worth It?

1. Market Liquidity? Heck Yeah!

Imagine a party where everyone’s invited—except the awkward guy who talks about birdwatching. Forex has over $6 trillion (yes, trillion with a “t”) traded every single day. That means you can buy or sell almost any currency almost whenever you want. No waiting for your crypto buddy to finish updating his meme stock portfolio!

2. Leverage: The Double-Edged Sword

In Forex, leverage means you're trading with borrowed funds, allowing you to control larger positions than you could otherwise afford. It sounds epic, right? But let me warn you, with great power comes great responsibility! Use leverage wisely, or you might find yourself sliding down the wrong side of “Oops! I lost all my money!”

3. Trade Anytime, Anywhere!

Thanks to the magic of the internet (and a little help from our good friends, computers), Forex is open 24/5! You can trade from your couch, at the park, or even in a taco truck line. The world’s your oyster—or, should I say, your market!

4. Diversify That Portfolio

Bored of your usual stocks? Throw in some Forex action! Currency trading provides a fantastic opportunity to diversify your investment portfolio. After all, you wouldn’t just eat one flavor of ice cream, would you? (If you said yes, I question your life decisions!)

Basic Terminology: Don’t Get Left Behind!

1. Currency Pairs: The Dynamic Duo

In Forex, currencies are traded in pairs—like Batman and Robin, or peanut butter and jelly. Each pair consists of a base currency and a quote currency. For example, in the EUR/USD pair, the euro (EUR) is the base, and the US dollar (USD) is the quote. When you see this pair, you're essentially asking, “How much is one euro worth in dollars?”

2. Pips: Not the Pizza Kind!

A pip is a unit of measurement used to express changes in currency pairs. It's usually the fourth decimal place of a currency pair. For instance, if EUR/USD moves from 1.2000 to 1.2001, that's one pip. Think of it as a tiny frog hopping along the trading path.

3. Spread: The Cost of Admission

Ah, the spread—what you pay (or “lose”) to enter the Forex market. The spread is the difference between the buying and selling price of a currency pair. It's like paying a cover charge at a bar before enjoying the nightlife—except this bar might leave you screaming for mercy!

Getting Started in Forex: Your Fighting Chance

1. Find a Broker, Your Trusted Sidekick

To trade Forex, you need a broker. This savvy partner will help you execute trades and manage your account. Shop around for one that’s reputable, reliable, and offers an easy-to-use platform. Look for reviews; even Batman has a few bad reviews on Yelp, right?

2. Open a Demo Account: Practice Makes Perfect!

Before you throw your money into the trading pit like a seasoned gladiator, give a demo account a whirl! Most brokers offer these accounts for free to help you practice and sharpen your key trading skills. Learn how to read charts, implement strategies, and most importantly, NOT cry when you lose money!

3. Learn the Strategies: Boring, But Necessary

Whether you’re a day trader or prefer long-term strategies, learning the ropes is crucial! You wouldn't jump into battle without your sword (or at least some cool katanas), right? Read up on technical analysis, fundamental analysis, and sentiment analysis. It may sound like a snooze-fest, but trust me, it'll save you from tossing your hard-earned cash out the window.

Trade Forex With Someone Else's Money Using Prop Firms, Trade $100K Of Someone Else's Money; Learn More And Get Started Now - https://checkout.blueguardian.com/ref/32/

Conclusion: Welcome to the Revolution!

So there you have it, folks! Forex is not just some mystical realm meant for Wall Street wolves; it's a playground for the everyday hero (or anti-hero, depending on your style!). With its liquidity, 24/5 accessibility, and potential for profit, Forex offers opportunities for everyone willing to learn and adapt.

Now that you've got a taste of the extensive world of Forex, go out there and get your feet wet (but don’t literally go to a puddle and start yelling, “I’m a Forex trader!”). Master the tips, tricks, and tools, and who knows? You might just come to slay in this game! Just remember: Stay smart, stay bold, and never forget to stock up on those delicious chimichangas!

Trade Forex With Someone Else's Money Using Prop Firms, Trade $100K Of Someone Else's Money; Learn More And Get Started Now - https://checkout.blueguardian.com/ref/32/

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

5 notes

·

View notes

Text

Understanding CFD Trading: Concepts, Strategies, and Risk Management

Introduction

A contract for difference (CFD) provides traders the opportunity to take part in the world markets without actually receiving the underlying asset. If you just bet on whether prices will change, you can get exposure to forex, stocks, commodities, indices, and cryptocurrencies all from the same platform. Several traders of all levels, professional or not, are now interested in CFDs because they are flexible and exciting. Within a few more minutes, this guide will let you know what CFDs are, how they function, which first strategies to use, and most importantly, how to handle the higher risks involved with using leverage.

What Is CFD Trading?

A trader and broker agree on a Contract for Difference (CFD), which involves buying or selling the difference in the prices of an asset at opening and closing. You do not purchase Apple or oil stocks directly; simply forecast their price movement. When the market goes the way you predicted, you receive the difference from the broker; otherwise, you will owe the broker the loss. Since CFD trading includes major and minor forex, stocks, commodities, indices, and crypto tokens, you can enjoy more choice and control over your money with only one account.

How is CFD trading exactly?

If you think prices will go up, you decide to go long (buy). The result of your trade is your number of CFD units multiplied by the change in points of the asset. Since CFDs are leveraged, your initial margin may be only 5 % for major indices and 20 % for unstable cryptos.

Let’s say you buy stock index futures for 7,500, amounting to 1 lot (or 100 units). The minimum margin at 5 % is $ 3,750. Rising to 7,600, your earnings are $ 1,000 (100 x 10 USD per point), and falling to 7,500, you suffer a $ 1,000 loss out of your original investment of $3,750.

Some of the most important aspects to know about trading CFDs.

The gap between buying and selling prices, also called the spread, gets lower when spreads are tight; this leads to reduced costs for trading.

Leverage causes both profits and losses to be higher; margin serves as the required cash to store open positions.

Volatile markets mean shares can swing a lot in price, which provides opportunity but also risk. To manage the risk, a smaller stake is needed.

If there are overnight financing (swap) costs, inactivity fees, and wider spreads on liquid investments, this may reduce your profit—make sure to check the fine details.

Strategies That Are Easy for Beginners

Follow Trends—Look for higher highs or lower lows and then trade along with the main movement shown on a daily high or low.

Use breakout trading—take a position after the price breaks an important support or resistance level with strong volume.

Range Trading - That is, buy near the support in a range and sell at resistance points when the market isn’t moving much and volatility is low.

Do’s

Examine every strategy using data from the past.

It helps to use a demo account ahead of real trading.

Be sure that the maximum risk you take for a single trade is just 2 % of the funds you have.

Don’t

Notice and act on every single market change.

Next time, stake a bigger amount when you lose.

Try not to let major economic reports cause you to overreact.

Managing Risks while Trading CFD

Since a small change in the market can cause big losses when using leverage, sticking to risk control is very important.

Stop-Loss Orders- Set a stop-loss order to decide the amount of loss you are willing to take.

Risk/Reward Ratio- When you take a risk, your potential reward should be twice as big or more.

Position Sizing - Adjust lot sizes so that hitting the stop-loss will always risk less than 2% of your account value.

Psychology plays an important role, so make sure your goals are realistic, always take a breather after a long streak of losses, and record your trades in a diary to notice when your emotions affect your actions. Keep yourself from chasing profits by over-trading and taking excessive risks after you win.

CFD Trading vs. Forex Trading

Trading in financial derivatives, for example in CFDs, is different from Forex trading.

Unlike forex trading, which only works with currency pairs, CFD trades are available in stocks, commodities, indices, and crypto as well. Because forex markets are so liquid and have small spreads, trading often is comfortable, but the 24-hour cycle may be too demanding for first-time users. CFD market access covers many assets, but spreads are large, trading longer means payments, and the news strongly influences outcomes—meaning they fit traders who need multi-market exposure.

Conclusion

Trading CFDs without truly understanding spreads, how leverage works, and risk controls is as risky as sailing in the open sea without any guidance. Beginners should trade on a smaller scale, follow these basic trading tips, and place stop-losses to reduce risks. The bulk of your efforts should be done on a demo account before using your real funds, and stop using this method only when your results are all positive. Are you set to look at live markets? Look for regulated providers such as AVFX Capital to trade contracts for difference in a secure way.

FAQ

Q1: Is it possible for me to trade CFDs legally where I live?

Rules vary; it’s best to check with your local financial authority before starting an account.

Q2: Can I end up losing a greater amount than I first deposited?

Most likely—with the exception of brokers that provide negative-balance protection. Leverage is multiplied even further if markets gap.

Q3: What are the tax rules for trading CFDs?

The rules for taxing capital gains or income relate to each region; a qualified tax specialist can tell you how your income or capital gains are taxed.

Q4: Which platforms are used for CFD trading?

Many traders prefer Meta Trader 4/5, cTrader, and web apps made by individual firms because all of them include up-to-date charts, indicators, and tools to manage risks.

Q5: How much money should I have before I open an olive oil business?

Most brokers accept accounts with a small amount like $100, but for real diversification anhttps://avfxcapital.com/d controlling risks, it helps to have more capital.

For more visit: https://avfxcapital.com/

3 notes

·

View notes

Text

Top Forex Brokers with Low Minimum Deposit: A Comprehensive Guide for Smart Traders

For many aspiring traders, the high barriers to entry in the forex market can be a major hurdle. That’s why finding reputable brokers with low minimum deposit requirements is crucial for beginners and budget-conscious investors. Starting with a smaller capital investment allows traders to test strategies, understand risk management, and explore trading platforms without significant financial exposure. In this guide, we delve into the top forex brokers that offer accessible entry points without compromising on quality, regulation, and performance.

Why Choose Brokers with Low Minimum Deposit?

Trading forex with a low initial investment is not only practical but also strategic. It offers an opportunity to:

Gain hands-on trading experience with real market conditions

Minimize financial risk while learning

Test a broker's platform and customer service before committing more funds

Choosing brokers with low minimum deposit requirements helps you transition from a demo account to live trading with minimal financial stress.

Top 5 Forex Brokers with Low Minimum Deposit

Eightcap Eightcap is a well-regulated forex and CFD broker known for its strong trading infrastructure and user-friendly platform. With a minimum deposit of just $100, it offers access to MetaTrader 4 and MetaTrader 5, along with competitive spreads and fast execution. Eightcap is also recognized for its integration with TradingView and Capitalise.ai, providing powerful analytical tools for traders.

FP Markets FP Markets combines affordability with professional-grade trading services. With a minimum deposit of $100, this broker offers both ECN and standard accounts. Traders benefit from tight spreads, deep liquidity, and access to both MT4 and MT5 platforms. FP Markets is licensed by ASIC and CySEC, ensuring a high level of trust and security.

FBS FBS stands out for its ultra-low entry barrier, offering accounts with a minimum deposit as low as $1. This makes it an attractive option for beginners who want to explore live trading with minimal risk. The broker provides cent, standard, and zero-spread accounts, catering to a range of trading strategies. FBS also offers frequent bonuses and promotions to enhance user experience.

XM XM is a globally recognized broker offering flexible account types and a low minimum deposit starting at just $5. The platform supports both MT4 and MT5, along with robust educational resources for traders at all levels. XM’s execution speed, regulatory compliance, and diverse asset offerings make it a favorite among budget-conscious traders.

IC Markets IC Markets is a top choice for serious traders looking for institutional-grade conditions with a relatively low capital requirement. A minimum deposit of $200 gives access to ECN-style trading with raw spreads starting from 0.0 pips. IC Markets is well-known for its deep liquidity, ultra-fast execution, and regulatory reliability.

Real-Life Success Story: From Small Beginnings to Sustainable Profits

Michael L., a 29-year-old graphic designer from the Philippines, started his trading journey with just $50 in an FBS cent account. Initially curious about forex, Michael chose FBS for its low deposit requirement and wide range of educational materials. He practiced consistently, followed risk management principles, and gradually built up his trading capital. After a year, Michael transitioned to a standard account and began earning steady returns. Today, he trades part-time and uses his profits to supplement his freelance income. His story is a testament to how brokers with low minimum deposit requirements can empower individuals to achieve financial goals through disciplined trading.

How to Evaluate Website Security When Choosing a Forex Broker

Ensuring the safety of your funds and personal data is critical when selecting a broker. Here’s how to assess whether a broker’s platform is secure:

Look for HTTPS in the URL, indicating encryption

Check for regulatory licenses from authorities like ASIC, CySEC, or FCA

Review privacy policies and data protection protocols

Ensure two-factor authentication is available for account login

Investigate the broker’s track record and reputation in online forums and review sites

Trustworthy brokers invest in cybersecurity infrastructure to protect their clients. Always prioritize safety when choosing where to trade.

Click Now

Frequently Asked Questions About Forex Brokers and Trading

What is a minimum deposit in forex trading? A minimum deposit is the smallest amount of money required to open a trading account with a broker. It varies across brokers and account types.

Are brokers with low minimum deposit safe? Many low-deposit brokers are regulated and trustworthy. Always check for licenses and read user reviews to ensure credibility.

Can I make a profit with a small trading account? Yes, but it requires strict risk management and realistic expectations. Profits may be small initially but can grow with experience.

Is it better to start with a demo account? Yes, using a demo account helps you understand the trading platform and market dynamics without risking real money. Transition to a live account once you feel confident.

What platforms do low minimum deposit brokers offer? Most offer MetaTrader 4 or 5, with some also providing web-based or proprietary platforms. Ensure the platform suits your trading style.

youtube

Conclusion: The Smart Path to Trading Success

Starting your forex trading journey doesn’t have to be financially intimidating. By choosing reliable brokers with low minimum deposit, you gain the flexibility to learn, experiment, and grow with minimal risk. Whether it’s Eightcap’s professional tools, FP Markets’ competitive conditions, FBS’s ultra-low entry, XM’s global reach, or IC Markets’ superior execution, each broker offers unique advantages. Your trading success starts with informed choices, and a low minimum deposit could be the first smart step in building a profitable trading future.

2 notes

·

View notes

Text

MT5 White Label Solutions for Brokers | YaPrime

Start your forex brokerage with YaPrime’s MT5 white label solutions. Get a fully branded platform, access to deep liquidity, seamless integration, advanced trading tools, multi-asset support, and 24/7 expert assistance tailored to meet all your brokerage needs efficiently and professionally.

#best forex company in india#Best Forex Trading Platform MT4#forex liquidity providers#best liquidity providers in forex#how to become a licensed forex trader#top tier liquidity providers#liquidity provider forex broker#how to create your own forex broker#MT5 White Label Solutions

0 notes

Text

STOCK MARKET INVESTMENT

Investing in financial markets offers various avenues for potential growth, with the forex (foreign exchange) and stock markets being two prominent options. Understanding the distinctions between these markets is crucial for investors aiming to align their strategies with their financial goals. This article delves into the key differences between forex and stock market investments, exploring aspects such as market structure, trading hours, liquidity, volatility, and the role of forex bank liquidity in enhancing trading experiences.

Market Structure and Instruments

Forex Market: The forex market involves the trading of currencies, where participants buy one currency while simultaneously selling another. This decentralized global market operates over-the-counter (OTC), with transactions occurring directly between parties without a centralized exchange. Major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, dominate trading activities.

Stock Market: In contrast, the stock market centers on buying and selling shares of publicly listed companies through centralized exchanges like the New York Stock Exchange (NYSE) or the London Stock Exchange (LSE). Investors acquire ownership stakes in companies, with the potential to benefit from capital appreciation and dividends.

Trading Hours

Forex Market: Operating 24 hours a day, five days a week, the forex market follows a continuous cycle across major financial centers, including London, New York, Tokyo, and Sydney. This round-the-clock availability allows traders to respond promptly to global economic events and news.

Stock Market: Stock markets have specific operating hours, typically aligning with the business hours of their respective countries. For instance, the NYSE operates from 9:30 a.m. to 4:00 p.m. Eastern Time. Trading outside these hours is limited to pre-market and after-hours sessions, which often come with reduced liquidity.

Liquidity and Volatility

Liquidity: Liquidity refers to the ease with which assets can be bought or sold without causing significant price changes. The forex market boasts high liquidity due to its vast trading volume, estimated at over $6 trillion daily. This liquidity ensures that currency pairs can be traded swiftly, with minimal price fluctuations. In contrast, the stock market’s liquidity varies among different stocks, with large-cap stocks typically offering higher liquidity than small-cap stocks.

Volatility: Volatility measures the degree of price variation over time. The forex market is known for its higher volatility compared to the stock market, presenting opportunities for quick profits but also increased risks. Stock market volatility can be influenced by company-specific news, earnings reports, and broader economic indicators.

Leverage and Risk

Forex Market: Forex trading often involves the use of leverage, allowing traders to control large positions with a relatively small amount of capital. While leverage can amplify profits, it also increases the potential for significant losses, making risk management essential.

Stock Market: Leverage in stock trading is generally more restricted. Investors can use margin accounts to borrow funds for trading, but regulatory bodies impose limits to protect against excessive risk.

Role of Forex Bank Liquidity

In the forex market, liquidity is a critical factor influencing trading efficiency and pricing. Liquidity providers, such as banks and financial institutions, play a pivotal role by offering buy and sell prices for currency pairs, ensuring that traders can execute orders seamlessly. Platforms like Forex Bank Liquidity enhance trading experiences by providing:

Accurate Forex Signals: Professional analysts deliver precise and timely forex signals, aiding traders in making informed decisions.

Real-Time Market Data: Access to up-to-date market information enables traders to stay ahead of market movements.

Customized Solutions: Tailored services cater to both retail and institutional clients, aligning with diverse trading styles and strategies

Conclusion

Choosing between forex and stock market investments depends on individual financial objectives, risk tolerance, and trading preferences. The forex market offers high liquidity, 24-hour trading, and opportunities for leveraged positions, appealing to traders seeking flexibility and rapid market engagement. Conversely, the stock market provides avenues for long-term investment in company equities, with potential benefits from dividends and capital growth. Understanding the distinct characteristics of each market empowers investors to make strategic decisions aligned with their financial goals.

#forextrading#forex education#forexsignals#forex expert advisor#forex market#forex#bankliquidity#https://t.me/forexbankliquidity

2 notes

·

View notes

Text

Forex trader salary per month?

Forex Trader Salary Per Month: A Comprehensive Guide

Introduction

The world of Forex (foreign exchange) trading has captivated the interest of financial enthusiasts, investors, and career professionals alike. With a daily trading volume exceeding $7.5 trillion, the Forex market is the largest and most liquid financial market in the world. This scale often leads to a common question among those considering a career in Forex: "How much do Forex traders earn per month?"

This article provides a comprehensive analysis of the monthly salary of Forex traders. We'll examine the various types of Forex traders, income models (salaried vs. independent), factors influencing earnings, geographic differences, and examples to paint a realistic picture of potential income levels.

1. Who Is a Forex Trader?

A Forex trader is someone who buys and sells currency pairs in the foreign exchange market, aiming to profit from the price differences. These traders may work for:

Banks and financial institutions

Hedge funds

Prop trading firms

Retail brokers

Themselves (independent or retail traders)

Forex traders can be broadly divided into two categories based on employment:

Salaried (Institutional) Forex Traders

Independent (Retail) Forex Traders

Each group experiences a different compensation structure, and understanding these is key to grasping the full picture of Forex trader income.

2. Salary vs. Profit-Based Income

Salaried Forex Traders

Salaried Forex traders work in professional settings such as investment banks, hedge funds, or proprietary trading firms. They typically receive:

Base salary (monthly or annual)

Performance bonuses

Commission or profit-sharing arrangements (sometimes)

Independent Forex Traders

Retail traders often trade their own money or manage small private funds. Their income is entirely based on:

Trading profits

Account size and leverage

Consistency and risk management

They don’t receive a fixed salary and must rely on consistent profitability.

youtube

3. Factors Affecting Forex Trader Monthly Income

Several factors influence how much a Forex trader earns per month:

1. Trading Capital

One of the most important factors. Larger capital allows for bigger positions and higher potential profits.

A trader with $1,000 may make $100–$300/month.

A trader with $100,000 might earn $5,000–$15,000/month with moderate risk.

2. Leverage

Leverage amplifies gains but also increases risk. A highly leveraged trader may generate significant returns in a short time—but also suffer major losses.

3. Experience Level

Beginners tend to lose money. Consistently profitable traders usually have 3–5 years of trading experience.

Beginner (0–1 years): Often negative or break-even income.

Intermediate (1–3 years): $500–$2,000/month depending on capital.

Advanced (3+ years): $2,000–$20,000+/month depending on scale.

4. Trading Strategy

Scalping, swing trading, and algorithmic trading yield different income levels. High-frequency scalpers might make more frequent but smaller gains, while position traders aim for larger but less frequent profits.

youtube

5. Market Conditions

Volatile markets may increase opportunities for profit, while flat markets can reduce income potential.

4. Institutional Forex Trader Monthly Salary

Entry-Level Positions

Junior FX Trader (0–2 years)

Monthly Salary: $3,000–$6,000

Bonus: Up to 50–100% of annual salary

Mid-Level Positions

FX Analyst / Trader (2–5 years)

Monthly Salary: $6,000–$12,000

Bonus: 1–2x base salary annually

Senior Traders

Senior FX Trader / Desk Head (5+ years)

Monthly Salary: $10,000–$30,000+

Bonus: Can exceed base salary significantly depending on performance

Example: A London-Based FX Trader

Base monthly salary: £8,000 (~$10,000)

Annual bonus: £60,000–£120,000 (~$75,000–$150,000)

Monthly average income (after bonus spread): $16,250–$22,500

5. Retail Forex Trader Monthly Earnings

Retail Forex traders don’t earn a salary. Their monthly income depends on:

Account size

Risk tolerance

Win rate

Profit-to-loss ratio

Here are sample monthly incomes based on account size and average return: Account SizeMonthly Return (5%)Monthly Income$1,0005%$50$10,0005%$500$50,0005%$2,500$100,0005%$5,000$500,0005%$25,000

Note: These returns assume consistent profitability, which is rare among new traders.

6. Real-Life Forex Trader Profiles

Case 1: Institutional Trader in New York

Works for a hedge fund

6 years of experience

Monthly salary: $15,000

Annual bonus: $100,000

Monthly average: ~$23,333

Case 2: Retail Trader in South Africa

Trades full-time with $20,000 account

Average return: 4% per month

Monthly income: ~$800

Supplements income with online courses and affiliate marketing

Case 3: Part-Time Trader in India

Trades evenings and weekends

Account size: $5,000

Monthly return: 3%

Monthly income: $150

Primary income from IT job

7. Geographic Differences in Salary

High-Income Countries

CountryAverage Monthly Salary (Institutional Trader)USA$10,000–$25,000UK$8,000–$20,000Switzerland$12,000–$30,000Singapore$8,000–$18,000

Emerging Markets

CountryAverage Monthly SalaryIndia$1,000–$5,000South Africa$1,000–$3,000Philippines$800–$2,000Nigeria$500–$2,000

Note: Retail traders' income in these countries is highly variable and often supplemented with other income sources.

8. Challenges of Being a Forex Trader

1. High Failure Rate

Over 70–90% of retail traders lose money. Trading psychology, poor risk management, and lack of discipline contribute to losses.

2. Inconsistent Income

Unlike salaried jobs, retail Forex income can be highly variable—even for experienced traders.

3. Emotional Pressure

Losing streaks can lead to emotional stress, which affects performance.

4. Regulatory Barriers

Retail traders in some countries face restricted leverage or broker availability.

9. How to Increase Forex Trading Income

Grow Capital: Bigger accounts allow larger positions and more income.

Use Compounding: Reinvest profits to increase equity and returns over time.

Get Funded: Join proprietary trading firms that provide capital in exchange for a profit split.

Diversify Skills: Teach, stream, or write content about trading.

Automate Strategies: Use bots or EAs (expert advisors) to trade more efficiently.

10. Prop Trading Firms and Their Compensation Models

Model

Pass an evaluation (e.g., FTMO, MyForexFunds)

Receive funding ($10,000–$500,000)

Profit split (typically 70–90%)

Example

Funded account: $100,000

Monthly return: 5%

Gross profit: $5,000

Trader share (80%): $4,000

Traders can scale up or get multiple funded accounts to increase income.

11. Passive Income Streams for Traders

In addition to direct trading profits, traders can earn from:

YouTube or TikTok tutorials

Paid signal services

Affiliate commissions from brokers

Selling courses or eBooks

Mentorship programs

Many top Forex influencers earn $5,000–$50,000+ monthly from these sources alone.

12. Is Forex Trading a Reliable Career for Monthly Income?

Pros

High income potential

Global opportunities

Flexible work hours

Scalable with capital or technology

Cons

No guaranteed income

High failure rate for beginners

Emotional and financial stress

Regulatory and tax complexities

Forex trading is not a get-rich-quick scheme. It requires discipline, risk management, and continuous learning.

Conclusion

So, what is the average Forex trader salary per month?

Retail traders: $0–$5,000/month (most under $1,000)

Institutional traders: $3,000–$30,000+/month

Prop firm traders: $1,000–$10,000+/month depending on performance and capital

While some traders do make consistent, high monthly incomes, the path requires rigorous discipline, capital management, and often years of experience. Most retail traders start with small earnings or losses and gradually grow their income as they refine their skills.

Forex trading can be a lucrative career, but it’s not for everyone. A realistic understanding of earnings potential, combined with a commitment to continuous learning, can set you apart on the path to financial independence.

#stock market#blockchain#altcoin#digitalcurrency#cryptocurrency#ethereum#crypto#forex trend indicator#forex robot#forex ea#eating disoder trigger warning#each#video games#Youtube

1 note

·

View note

Video

youtube

ETHUSDT 31 Consecutive Successes! AI Trading Based on 2,500 Indicators: Unveiling PrimeXAlgo's Innovative Technology A deep dive into PrimeXAlgo's cutting-edge AI trading technology Utilizes a dataset of 2,500 comprehensive indicators No repainting on real-time chart analysis 100% legal and ethical algorithms Provides real-time buy, sell, and neutral signals Discover the state-of-the-art trading solution born from AI and big data!https://primexalgo.comtelegramhttps://t.me/primexalgofacebookhttps://facebook.com/profile.php?id=615665...discordhttps://discord.com/channels/1288670367401...instagramhttps://instagram.com/primexalgox.comhttps://x.com/PrimeXAlgo#PrimeXAlgo,#AITrading,#GoldInvestment,#BitcoinTrading,#TradingSuccess,#FX,#FOREX,#GOLD,#Chart,#TradingChart,#Stock,#Finance,#Investment,#primexalgo,#primex,#ConsecutiveSuccess,#Financial,#AIBOT,#BOT,#BOTtrading,#crypto,#cryptocurrency,#Forex trading,#Buy,#Sell,#Long,#Short,#indicator,#Strategy,#MACD,#RSI,#Bollinger Bands,#Oscillator,#Volume,#Charts,#Scalper,#Trend,#Bond,#Options,#Derivative,#Liquidity,#Leverage,#Margin,#Hedging,#Arbitrage,#Bull market,#Bear market,#BTC,#Bitcoin,#spread

2 notes

·

View notes

Text

An Overview of Different Financial Instruments in Global Trading

Introduction Entering global trading can be both exciting and complex. To help you navigate, this guide explores various financial instruments, assisting you in finding the best trading platform and making informed investment decisions. 1. Stocks Buying stocks means owning a share of a company. Stock prices fluctuate with company performance and market trends. Stocks are ideal for long-term investments, especially for those aiming to become the best forex trader. 2. Bonds Bonds are loans given to companies or governments, repaid with interest. Bonds are generally safer than stocks but offer lower returns. 3. Forex (Foreign Exchange Market) The forex market deals with currency trading and is the largest financial market globally. It operates 24/7, providing high liquidity. Forex trading involves buying one currency while selling another, requiring a good grasp of market trends and currency pairs to excel as the best forex trader. 4. Commodities Commodities include raw materials like gold, oil, and agricultural products. Trading commodities can diversify your investment portfolio. Their prices are affected by supply and demand, political events, and natural factors. 5. Mutual Funds Mutual funds collect money from numerous investors to invest in a diversified portfolio of stocks, bonds, or other assets. Managed by professionals, they are ideal for beginners, offering a hassle-free investment approach. 6. ETFs (Exchange-Traded Funds) ETFs are similar to mutual funds but trade like stocks. They offer a diversified investment portfolio with the flexibility of stock trading. ETFs can cover various assets, including stocks, bonds, and commodities. 7. Options Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price before a set date. They can be used for hedging or speculative purposes, presenting high rewards but also high risks. Conclusion Grasping the different financial instruments available in global trading is vital for making smart investment choices. Whether you're interested in stocks, bonds, forex, or commodities, selecting the best trading platform and strategy will set you on the path to success. Begin with the basics, continue learning, and discover the best investment opportunities tailored to your goals.

4 notes

·

View notes

Text

Launch a Trading Platform Fast with Fintech360’s White Label Brokerage Technology

In today’s fast-paced financial landscape, launching your own trading platform doesn't have to take years or millions in development costs. With white label brokerage technology from Fintech360, businesses can enter the trading market quickly, offering a fully-branded platform for forex, crypto, CFDs, and other financial instruments.

What is White Label Brokerage Technology?

A white label brokerage platform is a ready-made, customizable trading system that you can brand as your own. Fintech360 provides all the essential tools—including trading terminals, back-office solutions, liquidity integrations, and compliance modules—so you can start operating a brokerage business without building from scratch.

Whether you're a financial institution, fintech startup, or entrepreneur, Fintech360's white label solution offers a low-risk, high-reward path into online trading.

Why Choose Fintech360?

Fintech360 stands out by offering:

Fully branded and customizable platforms

Multi-asset trading support (Forex, Crypto, Indices, Stocks, and more)

Real-time execution with top-tier liquidity providers

Integrated KYC/AML compliance tools

Affiliate and partner management systems

Cloud-based architecture for low latency and global access

Their solution is ideal for those seeking a crypto brokerage solution, forex white label platform, or a multi-functional fintech platform to support trading operations.

Who Is It For?

Fintech360’s white label technology is designed for:

Entrepreneurs launching a brokerage brand

Financial companies expanding into online trading

Crypto communities monetizing their networks

Influencers building niche financial products

The Future of Brokerage is White Label

As digital assets and decentralized finance gain momentum, having a scalable, secure, and user-friendly trading platform is critical. Fintech360 ensures your brokerage is future-ready with mobile access, real-time analytics, and continuous platform updates.

If you’re ready to launch a trading platform without technical barriers, Fintech360’s white label brokerage technology offers everything you need to get started—quickly, affordably, and professionally.

Start your journey today with Fintech360—where innovation meets opportunity.

1 note

·

View note