#how to setup Forex Broker Company

Explore tagged Tumblr posts

Text

If you’re planning to start a forex brokerage, one of the first questions you’ll face is this:

#forex broker services#forex brokerage#start your own forex brokerage#affordable web development services#top forex liquidity providers#best liquidity providers in forex#forex liquidity solutions#how to setup forex broker company#best forex trading platform mt4#best forex company in india#Best Forex Trading Platform MT4#forex liquidity providers#how to become a licensed forex trader#top tier liquidity providers#liquidity provider forex broker#how to create your own forex broker#mt5 white label solutions

0 notes

Text

Bullwaypro.com review Registration

When choosing a forex broker, the biggest concern is always trust. Nobody wants to deposit funds into a platform only to discover withdrawal issues, shady practices, or poor regulation. That’s why we take a deep dive into every key aspect of a broker to see whether it’s legitimate or just another name in a long list of unreliable platforms.

Today, we’re looking at Bullwaypro.com review—a forex broker that has been gaining attention in the trading community. With a high Trustpilot rating, FCA regulation, and thousands of users, it certainly has some strong points. But does it truly hold up under scrutiny?

Let’s break it down step by step and find out.

Bullwaypro.com Registration Review: Quick and Easy Sign-Up Process

The registration process for Bullwaypro.com reviews is straightforward and efficient. Here’s how it works:

Locate the registration button in the upper right corner of the website.

Enter your personal data, ensuring accuracy for verification.

Wait for a manager to process the provided information.

Once verified, registration is successfully completed.

This structured approach suggests a secure onboarding process, where user information is checked before full access is granted. It’s a good sign—brokers who take verification seriously are often more reliable and compliant with financial regulations. Would you like details on the verification requirements or account setup next?

Bullwaypro.com – Establishment and Domain Registration Date

When assessing the legitimacy of a forex broker, one of the first things to check is whether the domain registration date aligns with the brand’s establishment date. If a broker claims to be operating for several years but its domain was only recently registered, that’s a red flag. So, how does Bullwaypro.com reviews measure up?

The company was established in 2022, and the domain bullwaypro.com review was registered on November 11, 2021. That means the domain was secured before the company officially started operating, which is a positive indicator. It suggests the brand was not hastily set up overnight but rather planned in advance.

Why is this important? Well, scam brokers often buy domains right before launching, making it easier to disappear without a trace. Bullwaypro, on the other hand, took steps ahead of time, likely to secure its brand identity and online presence early on. That’s a sign of long-term intentions, rather than a short-lived, fly-by-night operation.

This looks like a good argument in favor of legitimacy. What aspect should we analyze next?

Bullwaypro.com – Strong Regulatory Oversight

When it comes to forex trading, regulation is one of the most critical aspects that separate trusted brokers from potential scams. A regulated broker is subject to strict financial laws, regular audits, and capital requirements. So, what kind of regulatory status does Bullwaypro.com reviews have?

This broker operates under the oversight of the FCA (Financial Conduct Authority)—one of the most respected and stringent financial regulators in the world. The FCA license is not something a broker can obtain easily; it involves rigorous checks, capital requirements, and compliance with strict operational standards. Only brokers who meet transparency, security, and client protection policies receive this approval.

Why does this matter? Because FCA-regulated brokers are legally required to:

Segregate client funds from company accounts, ensuring traders' money is protected even if the broker faces financial trouble.

Follow fair trading practices, meaning no price manipulation or conflicts of interest.

Be covered by a compensation scheme, which provides an extra layer of security to traders.

We think this is a strong argument in favor of Bullwaypro’s legitimacy. Many brokers operate without regulation or under weak offshore jurisdictions—but here, we see one of the best financial regulators backing this platform.

This definitely adds trust to Bullwaypro.com reviews. What should we analyze next?

Bullwaypro.com – Client Reviews and Reputation

One of the best ways to gauge a broker’s reliability is to look at what actual traders are saying. Scammers tend to have poor ratings, few reviews, and plenty of complaints. But what about Bullwaypro.com reviews?

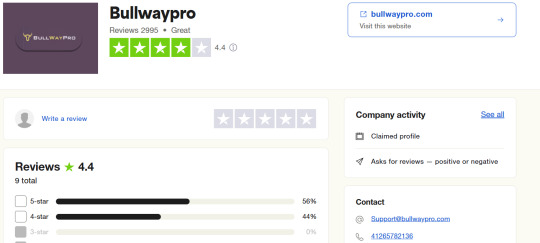

On Trustpilot, this broker holds an impressive score of 4.4 out of 5, based on 2,995 reviews. That’s a strong indicator of trustworthiness, especially in the forex industry, where traders are quick to leave negative feedback if something goes wrong.

Here’s why this is significant:

A score above 4.0 is already considered very high for brokers, as the industry tends to be highly competitive and filled with mixed experiences.

The sheer number of reviews (2,995) suggests a well-established platform. It’s easy for a scam broker to fake a handful of positive comments, but accumulating thousands of reviews takes consistent service over time.

Out of those, 2,869 reviews (the majority) are rated 4 or 5 stars, meaning most traders are satisfied with their experience.

This definitely looks like a solid argument for legitimacy. A broker with nearly 3,000 reviews and a high rating is unlikely to be a short-term scam. Instead, it suggests that Bullwaypro delivers on its promises and maintains a good relationship with its clients.

Final Verdict: Is Bullwaypro.com review a Legitimate Broker?

After a thorough review, Bullwaypro.comreviews checks all the right boxes when it comes to trust and reliability. The broker is not just another name in the forex industry—it has strong regulatory oversight, positive user feedback, and a well-structured platform. Here’s why we think traders can confidently consider this broker:

✅ Regulation by FCA – One of the most trusted financial regulators, ensuring transparency, security, and fair trading conditions. ✅ Established Track Record – The domain was registered before the company officially launched, showing proper planning and long-term intent. ✅ Excellent User Reviews – With a 4.4 Trustpilot rating and nearly 3,000 reviews, traders are overwhelmingly satisfied with the platform. ✅ Secure Deposits & Fast Withdrawals – No hidden fees, instant processing for most transactions, and reliable payment methods. ✅ User-Friendly Trading Conditions – Multiple account types, fair leverage, and a widely used trading platform. ✅ Accessible Customer Support – Various contact options make it easy for traders to get assistance when needed.

With all these factors in mind, Bullwaypro.com review stands out as a legitimate and well-regulated broker. The combination of FCA oversight, positive reviews, and a transparent operational model makes it a solid choice for both beginner and experienced traders.

Of course, every trader should do their own research and choose a broker that fits their needs, but based on the evidence, Bullwaypro.com reviews appears to be a trustworthy option in the forex market.

9 notes

·

View notes

Text

WindealAgency.com review:Account Types

Choosing a forex broker is never just about flashy websites or bold promises—it's about trust, regulation, and real trader experiences. In this review, we’ll take a close look at WindealAgency.com review and analyze whether it stands up as a reliable broker or raises red flags.

We’ll examine everything from its licensing, user feedback, and account types to deposit methods and trading conditions. A legitimate broker should check all the right boxes—so does WindealAgency.com reviews meet the standard? Let’s find out.

Account Types at WindealAgency.com: A Deep Dive into Their Offerings

When it comes to trading, flexibility and tailored experiences matter. WindealAgency.com reviews understands this well, offering a structured yet diverse range of account types to accommodate traders of all levels. Let's break down what they provide:

Account Type

Minimum Deposit

Bronze

$10,000

Silver

$25,000

Gold

$50,000

Premium

$100,000

Platinum

$250,000

VIP

$500,000

VIP+

$1,000,000

What Do These Accounts Mean for Traders?

At first glance, the minimum deposits might seem high, but let's analyze this setup. A structured tier system like this often indicates a serious brokerage catering to mid-to-high-level traders. Brokers that deal with professional clients or institutions usually set their entry points higher to ensure quality service, tight spreads, and dedicated support.

Bronze & Silver – These tiers are suitable for traders looking to get a professional-grade experience without committing massive funds upfront. Usually, accounts in this range come with basic perks like educational resources, standard spreads, and decent customer support.

Gold & Premium – Here, things start getting more advanced. Higher-tier accounts often mean lower spreads, priority support, and access to better trading conditions. This could include exclusive trading signals, personal account managers, or even faster withdrawal processing.

Platinum & VIP – At this level, traders are likely to receive premium analytics, risk management tools, and possibly even invitations to exclusive trading events. These accounts are for serious investors who demand top-tier trading conditions.

VIP+ – A $1,000,000 minimum deposit is an elite-level requirement. Brokers that offer this tier typically cater to institutional traders, hedge funds, or ultra-high-net-worth individuals. Expect customized trading conditions, personal analysts, and direct access to liquidity providers.

What Does This Tell Us About WindealAgency.com?

This tiered approach signals a brokerage that is not just catering to casual retail traders but instead positioning itself as a high-end trading platform. While the minimum deposit thresholds are significantly higher than entry-level brokers, this could also indicate a focus on serious traders who want quality execution, security, and premium service.

Would this account structure work for every trader? Maybe not. But for those looking for a premium brokerage experience, WindealAgency.com reviews seems to have a well-designed system in place.

How the Domain Purchase Date Confirms WindealAgency.com’s Legitimacy

One of the easiest ways to check a broker’s credibility is by looking at the relationship between its establishment date and the domain purchase date. Why does this matter? Because when a company secures its online presence before officially launching, it’s a sign of long-term planning and serious business intentions.

For WindealAgency.com review, we see that:

The brand was established in 2021

The domain was purchased on November 19, 2020

This means that WindealAgency.com reviews secured its domain before launching its services. That’s a great indicator of proper business structuring rather than a hastily thrown-together website. Many unreliable brokers often register their domain after they start operating, which raises red flags about their long-term commitment.

Think about it: a broker that purchases a domain in advance is likely investing in its infrastructure, platform, and compliance efforts before accepting traders' funds. This adds another layer of reassurance for clients looking for a trustworthy broker.

All in all, this timeline makes sense and aligns with what we expect from a legitimate brokerage.

Trustpilot Reviews: A Strong Indicator of WindealAgency.com’s Reliability

One of the best ways to gauge a broker's reputation is by looking at what real traders say about it. In the case of WindealAgency.com review, the Trustpilot score stands at 4.3, which is quite solid for a trading platform.

Now, let’s break it down further:

Total reviews: 24

Positive reviews (4-5 stars): 23

That means almost all traders who left reviews had a positive experience—an impressive ratio. In the forex industry, where brokers often receive mixed feedback due to the nature of trading, a 4.3 rating is a sign of consistent service, smooth transactions, and overall trustworthiness.

But here’s where it gets interesting. A low review count can sometimes raise questions, but the fact that 23 out of 24 reviews are positive suggests that the broker’s clients are genuinely satisfied. If there were major issues like withdrawal problems, platform failures, or shady practices, we would expect to see a much lower rating and a higher percentage of negative reviews.

Regulation & Licensing: A Key Factor in WindealAgency.com’s Legitimacy

One of the strongest indicators of a broker’s trustworthiness is its regulatory status. WindealAgency.com review operates under the FCA (Financial Conduct Authority), which is known as one of the most respected financial regulators in the world.

Now, why is this important?

The FCA is a high-authority regulator, meaning brokers under its supervision must adhere to strict financial and operational guidelines.

It enforces transparency, fund protection, and fair trading practices, ensuring that traders are not exposed to fraudulent activities.

Brokers regulated by the FCA must separate client funds from company funds, reducing the risk of financial mishandling.

Some brokers operate under weak or offshore regulations, which often make it difficult for traders to recover funds in case of disputes. But WindealAgency.com being under the FCA umbrella automatically puts it in a category of trusted financial institutions.

So, what does this tell us? If a broker has gone through the rigorous FCA licensing process, it’s not a fly-by-night operation. Instead, it’s a platform that prioritizes legal compliance and trader security—two things that matter the most in the forex industry.

Is WindealAgency.com review a Legitimate Broker?

After carefully analyzing all the key aspects of WindealAgency.com reviews, the picture looks quite clear. This broker checks all the major boxes of legitimacy, making it a strong contender in the forex trading industry.

Regulation & Security: Being FCA-regulated, WindealAgency.com review operates under one of the strictest financial authorities, ensuring fund protection and transparency—a huge green flag.

Domain & Establishment: The fact that they secured their domain before launching the brand speaks volumes about their long-term vision and professionalism.

User Reviews: A 4.3 Trustpilot rating with an overwhelmingly positive response from traders indicates that real users have had a good experience.

Account Types: The structured tier system suggests that this broker caters to serious traders who value premium conditions and a high-end trading experience.

Looking at these factors, we think WindealAgency.com reviews can be trusted. It’s not just another unregulated, short-lived broker—it has the credentials, the reviews, and the structure of a serious financial platform.

7 notes

·

View notes

Text

MaxDeAlways.com review Withdrawals

Fast & Fee-Free Withdrawals at MaxDeAlways.com

When it comes to withdrawing funds from MaxDeAlways.com review, traders can breathe easy. The platform offers SWIFT as the withdrawal method, which is widely recognized for secure and efficient international transactions. That alone tells us something—this broker is catering to serious traders who need reliable banking options.

Now, let's talk speed. The withdrawal time is instant, typically ranging from just a few minutes to a maximum of 2 hours. That’s incredibly fast for this industry, where some brokers take days to process transactions. A speedy withdrawal system signals that the company is financially stable and isn’t holding onto client funds unnecessarily.

And the best part? Zero commission on withdrawals. Many platforms charge hidden fees, but here, what you earn is what you get. This suggests a trader-friendly approach—something that trustworthy brokers tend to prioritize.

MaxDeAlways.com review is Regulated by a Top-Tier Authority

One of the most critical aspects of a broker’s legitimacy is its regulation. And here, MaxDeAlways.com review doesn’t disappoint—it operates under the supervision of the Financial Conduct Authority (FCA). This isn’t just any regulator; the FCA is known worldwide for its strict rules, rigorous oversight, and high standards. Brokers under FCA regulation must maintain transparent operations, segregate client funds, and ensure financial stability.

Now, let’s add another layer of trust. The broker holds a "High Authority" license, which further confirms its credibility. This level of regulation is not handed out to just anyone—it’s reserved for companies that meet strict financial and operational criteria. If a broker has an FCA license, it means they’ve been vetted thoroughly, and that’s a solid sign of reliability.

So, what does this mean for traders? Safety, transparency, and legal protection. When you trade with MaxDeAlways.com reviews, you’re dealing with a company that’s held to the highest standards in the financial industry.

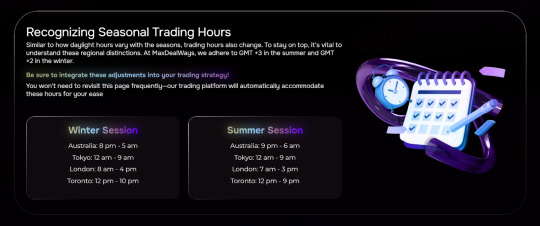

Trading Hours at MaxDeAlways.com – Global Market Access Around the Clock

One of the best things about trading is that the markets never really sleep, and MaxDeAlways.com review ensures traders can access opportunities at any time. The platform follows a structured global trading schedule, covering all major financial centers.

Here's how it breaks down:

Winter Session:

Australia: 8 PM - 5 AM

Tokyo: 10 PM - 7 AM

London: 3 AM - 12 PM

New York: 8 AM - 5 PM

This setup means traders can engage in forex, stocks, and other financial instruments across different time zones, maximizing their chances of catching market movements.

Now, why is this important? Because liquidity and volatility vary throughout the day, and having access to multiple sessions lets traders choose the best times for their strategy. Night owls might prefer the Tokyo session, while early risers can take advantage of London’s high activity.

Trustpilot Reviews – A Solid Reputation for MaxDeAlways.com reviews

When it comes to choosing a broker, real user feedback speaks louder than any marketing claim. MaxDeAlways.com review holds a 4.0 rating on Trustpilot, which is a very respectable score in the trading industry. But let’s break this down a bit further.

The broker has 7 total reviews, and here’s something interesting—all 7 of them are rated 4 or 5 stars. That means 100% of the feedback is positive. In a field where traders are often quick to leave complaints, this is an impressive indicator of reliability.

Why MaxDeAlways.com review is a Broker You Can Trust

After exploring all the essential aspects of MaxDeAlways.com review, it’s clear this broker is committed to providing a secure and efficient trading experience. The FCA regulation and "High Authority" license ensure that your funds and trades are protected by one of the most reputable authorities in the financial world. Combine that with instant, fee-free withdrawals and a trading schedule that spans key global markets, and it's easy to see why MaxDeAlways.com review stands out.

Furthermore, the perfect score on Trustpilot and the positive feedback from users provide solid evidence that this platform delivers on its promises. It’s not just a broker; it’s a trusted partner for traders looking for reliability, speed, and transparency. Whether you're a novice or an experienced trader, MaxDeAlways.com reviews offers a seamless experience that inspires confidence.

So, if you’re looking for a broker that ticks all the right boxes, MaxDeAlways.com review is worth considering.

8 notes

·

View notes

Text

How to Start a Forex Brokerage: A Complete Beginner’s Guide

The global foreign exchange (forex) market is one of the most active and liquid markets in the world. With daily trade volumes crossing $7 trillion, it offers tremendous potential for entrepreneurs. If you’ve ever wondered how to start a forex brokerage, this guide breaks down the essential steps, from legal setup to launching your platform successfully.

What Is a Forex Brokerage?

A forex brokerage is a company that enables clients to trade currencies through an online platform. The brokerage connects retail traders to the interbank market or liquidity providers, facilitates the trades, and earns revenue through spreads, commissions, and various service fees.

Why Start a Forex Brokerage?

Massive market opportunity

High profit margins

Recurring revenue from active traders

Global customer reach

Scalable business model

How to Start a Forex Brokerage in 7 Key Steps

1. Define Your Brokerage Model

Choose between:

Market Maker Model (Dealing Desk): You act as the counterparty to clients’ trades.

ECN/STP Model (No Dealing Desk): You connect clients directly to liquidity providers and earn from commissions.

2. Register Your Business and Get Licensed

To operate legally, register your company and obtain a forex broker license. Jurisdictions like:

Cyprus (CySEC)

UK (FCA)

Australia (ASIC)

Seychelles or Belize (for cost-effective offshore setup)

Each regulatory authority has different requirements for capital, compliance, and auditing.

3. Partner with Liquidity Providers

This is essential for smooth execution and tight spreads. Choose reliable partners who offer deep liquidity, fast execution, and access to multiple markets like forex, crypto, and commodities.

4. Choose a Trading Platform

Most brokers opt for MetaTrader 4 (MT4) or MetaTrader 5 (MT5), the industry-standard platforms. Alternatively, you can develop a custom platform for branding and control.

Ensure the platform has:

User-friendly UI

Real-time data

Risk management tools

Mobile and desktop compatibility

5. Set Up a Website and Client Portal

Create a professional website integrated with your trading platform. Include:

Account registration

KYC/AML verification

Client dashboard

Payment gateway integration

Educational content

6. Implement Back Office and CRM

An effective back-office system will help manage clients, track trades, and monitor compliance. A CRM system is essential for lead generation, customer support, and retention.

7. Launch and Market Your Brokerage

Once your infrastructure is ready, launch with a strategic marketing plan:

Use SEO, paid ads, and social media

Offer demo accounts and trading bonuses

Partner with IBs (Introducing Brokers) and affiliates

How Much Does It Cost to Start a Forex Brokerage?

Expense CategoryEstimated Cost RangeCompany Setup & License$20,000 – $100,000Trading Platform$5,000 – $50,000+Liquidity ProviderBased on volume/spreadWebsite & CRM$10,000 – $25,000Marketing & OperationsVariable (ongoing)

Final Thoughts

Learning how to start a forex brokerage requires a strong understanding of finance, compliance, and technology. With the right planning, legal structure, and partnerships, your brokerage can thrive in today’s competitive forex trading ecosystem. Whether you target retail traders, institutional clients, or niche regions, offering transparency, reliability, and support will be key to long-term success.

0 notes

Text

MT5 Grey Label

Start Your Forex Brokerage with ForexLaunchpad’s MT5 Grey Label Solution

Are you ready to launch your own Forex brokerage but don’t want the high cost and complexity of starting from scratch? ForexLaunchpad is here to make your journey easier, faster, and more affordable with our new MT5 Grey Label solution. This service is designed for individuals or companies who want to run their own trading business under their own brand name using the powerful MetaTrader 5 (MT5) platform.

In this article, we’ll explain what a Grey Label is, why MT5 is the best choice, and how ForexLaunchpad helps you succeed in the competitive world of online trading.

What Is an MT5 Grey Label? An MT5 Grey Label is a cost-effective way to start a Forex brokerage. Instead of buying a full MT5 license (called a White Label or Full License), you "rent" the platform from an existing licensed provider — like ForexLaunchpad.

With a Grey Label, you can use your own brand name, logo, and website. Your clients will see your brand when they trade, but the technology and servers are managed by ForexLaunchpad in the background. This means you can focus on marketing, sales, and customer support, while we take care of the technology.

Why Choose MT5? MetaTrader 5 (MT5) is the most advanced and modern trading platform in the market. It is the next-generation version of MT4, offering faster execution, more instruments, and improved features. Some key benefits include:

Multi-asset trading (Forex, stocks, indices, crypto, commodities)

Faster order processing

Advanced charting and technical analysis tools

Automated trading with Expert Advisors (EAs)

Support for hedging and netting systems

With MT5, your clients get a smooth and professional trading experience. They can trade from desktop, mobile, or web platforms — all under your brand.

Why Choose ForexLaunchpad? ForexLaunchpad is more than just a Grey Label provider. We are your full-service partner for building a successful trading business. Here’s what makes us different:

Affordable Startup Costs Getting started with your own brokerage can be expensive. A full MT5 license can cost over $100,000. With our Grey Label solution, you get access to the same MT5 platform for a fraction of the cost.

Quick Setup Time is money. We can launch your branded MT5 Grey Label within 1 to 2 weeks. You don’t need to worry about servers, hosting, or technical settings — we take care of everything.

Complete Branding Your brand matters. We help you design your trading platform, mobile apps, and client portal to match your business identity. Everything looks and feels professional.

Integrated CRM & Back Office Manage your clients easily with our CRM and Back Office system. Track deposits, withdrawals, trading activity, and support tickets from one place. Full control at your fingertips.

Liquidity Solutions We connect your brokerage to top-tier liquidity providers for fast execution and tight spreads. This gives your traders better pricing and builds trust in your platform.

Compliance Support ForexLaunchpad understands the importance of following regulations. We help you stay compliant and guide you on the right licensing options if needed.

Ongoing Support Our job doesn't end after setup. We offer 24/7 technical support, training for your team, and continuous system updates so your brokerage keeps growing.

Who Can Use Our MT5 Grey Label Service? Our solution is perfect for:

Entrepreneurs who want to start a new Forex brand

Traders who want to create their own trading community

IBs (Introducing Brokers) ready to take the next step

Crypto projects adding Forex trading to their platform

Affiliate marketers expanding into financial services

If you have a vision, we’ll provide the platform and support.

How to Get Started Launching your Forex business with ForexLaunchpad is simple:

Contact us: Fill out a short form or message us to schedule a free consultation.

Share your vision: Tell us your goals, target market, and brand details.

Pick your package: We offer flexible plans based on your needs and budget.

Launch your platform: We handle the setup and get your MT5 Grey Label ready fast.

Grow your business: Focus on marketing, client acquisition, and trading volume.

Final Thoughts Starting your own Forex brokerage used to be a dream for only big companies. Now, thanks to ForexLaunchpad’s MT5 Grey Label service, anyone with a strong vision and a good strategy can enter the market with low costs and fast speed.

Our team of experts is here to help you every step of the way — from platform setup to business growth. If you’re ready to take the next step and build your brand in the financial world, ForexLaunchpad is the partner you need.

Let’s build your Forex future together. Contact ForexLaunchpad today and launch your MT5 Grey Label brokerage!

0 notes

Text

In the fast-paced world of trading in forex, businesses and entrepreneurs are on the lookout for one opportunity or another through which they can tap into the bounty that this market has to offer. One such avenue is white label forex trading platforms. This all-encompassing guide takes you through everything you need to know about white label forex trading platforms: what they are, their benefits to your business, best practices, and future trends. What is a White Label Forex Trading Platform? A white label forex trading platform is an off-the-shelf trading software package initially created by one company and then distributed to another company for rebranding and customization. This allows companies to offer their forex trading services under their own brand without actually having to develop the trading platform. White label solutions are especially popular among brokers, financial institutions, and fintech startups that want to enter the forex market fast, with the least upfront investment. Key features to consider when looking for a white-label Forex trading platform Consider some of the features listed below before making a decision on which white label forex trading platform to go for: User-Friendly Interface: The platform should be such that it becomes user-friendly for both new and experienced traders. A clean, intuitive interface can significantly enhance the user experience. Advanced Charting Tools: Since traders rely upon technical analysis to make their trading decisions, make sure the platform offers advanced charting tools, indicators, and analytic features. Risk Management Tools: The features integrated into the platform should also be able to protect the investments of your clients through stop-loss orders, margin requirements, and other risk management tools. Multi-Asset Support: Though your main focus will be forex, it still does help to settle for a platform that offers multiple asset class support in commodities, indices, and cryptocurrencies. Mobile Trading: In today's mobile world, a rich mobile trading platform will definitely help the company win and keep customers. API integration should enable interaction with other software, like CRMs, liquidity providers, and payment gateways, to facilitate smoother operations and enhance the user experience. Choosing the Right White Label Provider The most important thing for your forex trading platform is selecting the right white-label provider. Here are some factors to consider: Reputation and Track Record: Research potential providers and go with one that holds a strong reputation and proven track record in the forex industry. Testimonials, case studies, and industry awards are a must to show some kind of credibility. Technological Expertise: It needs to be ensured that the service provider possesses adequate technological expertise in rolling out a rich, secure, and scalable platform. It should be well-equipped to handle high trade volumes, as well as provide advanced features like algorithmic trading, social trading, and automated trading systems. Customization Options: Seek out a provider that offers an extreme level of customization so that your platform differentiates itself in the market. The user interface, trading tools, and reporting features should be customized according to your business needs. Cost Structure: Understand the pricing model of the provider—whether there are setup fees, ongoing maintenance costs, or revenue-sharing agreements; make sure that the financial terms of service really work out for your business model and growth projections. Customer Support: Reliable customer support is an absolute necessity when it comes to providing a quick resolution of technical issues and, in turn, minimizes downtime. Ensure the provider offers 24/7 support with a responsive team for any emergencies or questions that arise. Regulatory Advice: The forex industry is highly regulated, and compliance is a significant issue.

Good white label providers should bring good regulatory expertise on board to help you through the regulatory landscape, including support with necessary licenses and ensuring that your platform meets all legal requirements. Most Effective Ways to Implement a White Label Forex Trading Platform Putting the white label forex trading platform into implementation requires planning and execution. Here are some best practices to follow: Do Market Research: A lot of market research is done before setting up the platform, taking into account the different needs of your target audience. Identify any market gaps your platform can solve and then refine the offering to zone in on that. Focus on User Experience: Most of all, the ultimate success of your platform will depend on user experience. Put more investment in a friendly user interface, fast execution speeds, and reliability in performance. The trading process should be seamless, engaging traders and encouraging them to return again and again. Leverage Marketing and Branding: Utilize the personalization options made available by your white label provider to come up with a strong brand. Develop the marketing strategy by establishing unique selling features that provide differentiation from existing players in the marketplace. Provide Education and Resources: Engage and retain traders through informative resources, which might take the form of webinars, tutorials, and market analysis. Knowledge will build trust and loyalty with empowered clients. Monitor and Adapt: The forex market is dynamic, and your platform has to be adaptable to changing conditions. Continuously monitor market trends, user feedback, and platform performance, and be ready to make adjustments as required. Future Trends in White Label Forex Trading Platforms A couple of trends have started emerging in the nature and appearance of white label Forex trading platforms for the future, based on the dynamics in technology and markets: AI and Machine Learning: Artificial Intelligence and Machine Learning are increasingly being incorporated into the trading platforms, along with features such as predictive analytics, sentiment analysis, and automated trading strategies. Cryptocurrency Integration: Given the mainstream acceptance that cryptocurrencies are receiving, more white label platforms are being expanded to include crypto trading alongside traditional forex, thus opening new revenue channels and opportunities to be accessed by a bigger base of prospects. Social Trading: It is gaining much popularity as this feature allows users to follow and copy trades of successful traders. Now, white label platforms are integrating social trading features with increasing user engagement. Blockchain and Security: There is an ongoing effort to use blockchain technology for better security and transparency in trading platforms. Currently, white label providers are integrating the use of blockchain solutions for fraud protection and to ensure the integrity of data. Customization and Personalization: Greater levels of personalization are becoming a part of the white labelers' offering. Conclusion White label forex trading platforms have provided powerful solutions for those who want to enter the forex market without much investment and risk. In the shortest time possible, getting the right platform and provider will help you establish presence in the market, offering traders a dependable and tailor-made trading experience under your brand. Whether you are a broker, financial institution, or fintech startup, using a white label solution will be your key to new revenue streams and long-term success in the forex industry. So remember on your way to this: The keys to success are choosing a reputable provider, focusing on user experience, and staying ahead of industry trends. Your white label forex trading platform will be as relevant in the competitive environment of forex trading with a proper approach.

0 notes

Text

Proxtrend.com Review 2024: why Proxtrend is the best choice for beginner Forex Traders in Japan

Introduction: Why Beginners Choose Proxtrend in 2024

The forex trading world can be daunting for newcomers, but having a reliable broker like Proxtrend can make all the difference. In this Proxtrend.com review, we’ll explore why this platform is the ideal choice for beginner traders in Japan. With its user-friendly interface, robust educational resources, and commitment to transparency, Proxtrend offers the tools needed to succeed in 2024.

Company Information: Who Operates Proxtrend?

Proxtrend.com is operated by Proxtrend Ltd, a company registered on the island of Mwali (Moheli), Comoros. The company is authorized and regulated by the Mwali International Services Authority under license number BFX2024053.

Company Address: P.B. 1257 Bonovo Road, Fomboni, Comoros, KM.

Website: www.proxtrend.com

These details ensure transparency and provide a sense of security for users, especially for beginners looking for a trustworthy trading partner.

Legal Documentation Overview

Proxtrend emphasizes compliance and transparency by providing detailed legal documentation on its website. Here are the key policies and what they cover:

Terms and Conditions: Outline the rules for using Proxtrend’s services, detailing user rights and responsibilities.

Risk Disclosure Statement: Highlights the inherent risks of forex trading, helping clients understand the potential for both profit and loss.

Privacy Policy: Explains how client data is collected, stored, and protected to ensure confidentiality.

AML and KYC Policies: Provisions to prevent money laundering and fraud, ensuring a secure trading environment.

Complaint Policy: Describes the process for addressing user concerns or disputes, reflecting Proxtrend's commitment to client satisfaction.

Educational Resources: Learn Forex Trading with Proxtrend

Proxtrend goes beyond being just a trading platform by offering robust educational resources designed to help beginners. Here’s what’s available:

Guides and Tutorials: Step-by-step instructions to help you get started.

Webinars: Interactive sessions with experts to answer questions and provide market insights.

Demo Account: Practice trading in a risk-free environment to build confidence before investing real money.

These resources empower users to learn at their own pace and make informed trading decisions.

User-Friendly Interface: Simplicity at Its Best

Navigating Proxtrend’s platform is a breeze, thanks to its intuitive design. Key features include:

Desktop Version: The website is structured with clear sections for account setup, trading tools, and support.]

Mobile Version: A fully optimized mobile platform lets users trade on the go without sacrificing functionality.

Accessibility: Proxtrend ensures all features are easy to locate, making it ideal for traders unfamiliar with complex trading systems.

Investment Instruments Offered by Proxtrend

Proxtrend provides a wide range of financial instruments, catering to various trading preferences:

Forex: Trade major, minor, and exotic currency pairs with competitive spreads.

Stocks: Access shares of leading global companies.

Indices: Reflect market trends with indices like NASDAQ and S&P 500.

Commodities: Invest in gold, oil, and agricultural products.

Cryptocurrencies: Diversify with popular digital currencies like Bitcoin and Ethereum. This diversity allows traders to explore multiple markets and build a balanced portfolio.

How to Withdraw Funds with Proxtrend: Proxtrend Withdrawal Explained

One of the most critical aspects of any trading platform is its withdrawal process. Here’s a breakdown of how Proxtrend withdrawal works: 1. Available Methods: Choose from bank transfers, credit cards, or e-wallets, depending on your preference. 2. Processing Time: Most withdrawals are processed within 1–3 business days. 3. Fees and Transparency: Proxtrend provides a clear fee structure, ensuring no hidden charges. 4. Troubleshooting: If you face issues, the support team is ready to assist promptly. Proxtrend’s transparent withdrawal process ensures clients can access their earnings without unnecessary hurdles.

Customer Support: Assistance Every Step of the Way

Proxtrend offers 24/7 customer support to address all trader concerns. Here’s what makes their service stand out:

Multiple Channels: Support is available via live chat, email, and phone.

Bilingual Assistance: Services are provided in Japanese and English, catering to Proxtrend’s diverse clientele.

Quick Resolution: Most queries are resolved within minutes, ensuring uninterrupted trading.

Overcoming Beginner Concerns: Proxtrend's Solutions

Starting forex trading can be intimidating. Here are common concerns and how Proxtrend addresses them: 1. How do I start trading if I’m new to forex? Proxtrend provides a demo account and step-by-step guides, making it easy for beginners to learn without risking money. 2. I’m afraid I won’t succeed. How does Proxtrend help? The platform offers robust educational resources and responsive support to guide users through the learning process. 3. Can I trust the withdrawal process? Yes, Proxtrend’s clear withdrawal policies and reliable processing times ensure peace of mind. 4. What if technical issues occur during trading? Proxtrend’s customer support is available 24/7 to resolve any technical problems. 5. Is Proxtrend interested in my losses? Proxtrend earns through spreads, not client losses. Their success depends on retaining satisfied, long-term traders. 6. What if I encounter negative reviews online? While negative reviews exist for any company, Proxtrend’s transparency and regulatory compliance set it apart as a reliable broker.

Conclusion: Start Your Trading Journey with Proxtrend Today

Proxtrend.com is the ideal choice for beginner forex traders in Japan. Its user-friendly interface, diverse investment instruments, and commitment to transparency make it a standout platform in 2024. Whether you’re new to trading or looking for a reliable broker, Proxtrend is worth exploring.

1 note

·

View note

Text

Forex White Label Cost

Understanding Forex White Label Costs with ForexLaunchpad

In the dynamic world of forex trading, establishing a brokerage can be a lucrative venture. For entrepreneurs eyeing this opportunity, utilizing a Forex White Label service like Forex White Label Cost can be a game-changer. However, understanding the costs associated with this service is crucial before diving into the forex business.

Forex White Label, in simple terms, is a solution that allows individuals or companies to set up their own branded forex trading platform using the technology and infrastructure of an established broker like Forex White Label Cost. This turnkey solution eliminates the need for extensive technical expertise, enabling entrepreneurs to focus on building their brand and client base.

The primary cost associated with a Forex White Label Cost is the setup fee. This one-time fee covers the customization of the trading platform with the brand name, logo, and other essential elements that make it uniquely yours. With ForexLaunchpad, entrepreneurs can enjoy a cost-effective solution that ensures a professional and personalized appearance for their brokerage.

Another crucial aspect to consider is the ongoing maintenance and support fees. These fees contribute to the continuous technical support, software updates, and infrastructure maintenance provided by ForexLaunchpad. This ensures a smooth and secure trading environment for both the broker and their clients. While these fees are recurrent, they are a small price to pay for the ongoing reliability and efficiency of the trading platform.

Transaction-based fees are also part of the equation. These fees are typically a percentage of the trading volume and may vary based on the agreement with ForexLaunchpad. It’s essential for entrepreneurs to carefully review these terms to understand how they impact their revenue model. Fortunately, ForexLaunchpad offers transparent and competitive transaction-based fees, allowing brokers to maintain a healthy profit margin.

Additionally, marketing and client acquisition costs are important considerations. While ForexLaunchpad provides the technological backbone, brokers are responsible for attracting and retaining clients. Investing in marketing strategies, educational resources, and customer support is vital for building a successful brokerage.

In conclusion, entering the forex market with a White Label solution like ForexLaunchpad offers a cost-effective and efficient way to establish a branded brokerage. The key costs to consider include the setup fee, ongoing maintenance and support fees, transaction-based fees, and marketing expenses. By understanding these costs, entrepreneurs can make informed decisions and embark on their forex journey with confidence, knowing they have a reliable partner in ForexLaunchpad.

0 notes

Text

Forex trading has a distinctive feature known as an Introducing Broker account or IB brokerage account. This type of account allows traders to collaborate with Introducing Brokers (IBs) who function as the go-between or the middlemen for traders and forex brokers. Simply put, an Introducing Broker refers clients to a broker. IBs have a responsibility to match the traders with reliable brokers that cater to the traders’ needs and goals. This article examines the workings of an IB brokerage account, its purpose, and how it benefits traders who want a stake in the forex market.

Understanding IB Brokerage Account

An IB brokerage account is a specialized account type that allows traders to access the forex market through Introducing Brokers. These brokers, often independent entities, collaborate with larger forex brokers to introduce traders to their services. The IB acts as an intermediary, facilitating the trader's account setup, offering support, and often providing additional services such as educational resources and trading signals.

How an IB Brokerage Account Works

Benefits of an IB Brokerage Account

Personalized Support: Traders working with an IB can often access personalized support and guidance tailored to their trading needs and experience level.

Access to Additional Resources: Many IBs offer educational resources, trading signals, and market analysis to help traders make more informed decisions.

Cost-Effective: While IBs earn commissions, the trader's overall trading costs may not be significantly higher than trading directly with a larger broker. In some cases, the trader may even receive cost savings through the IB.

Choice of Brokers: IBs partner with various larger forex brokers, giving traders the flexibility to choose the broker that best aligns with their trading preferences.

How to Start with an IB Brokerage Account

Research and identify a reputable Introducing Broker that partners with a larger forex broker. Ensure the IB offers the services, resources, and trading conditions you desire.

Reach out to the selected IB and express your interest in opening a forex trading account. The IB will guide you through the account setup process.

Follow the instructions provided by the IB to open a trading account with the partnered forex broker. This may involve providing personal information, verifying your identity, and funding your trading account.

Once your account is set up, you can trade forex online or other instruments like commodities, stocks, indices, cryptos etc. through the trading platforms provided by the larger broker. The IB may offer ongoing support and resources to assist you in your trading journey.

Conclusion

An individual or company acting as an Introducing Broker for a larger forex broker is responsible for attracting and referring clients to receive commissions or share of the profits. Accessing the market through an IB brokerage account in forex can provide traders with exclusive benefits, including customized assistance and supplementary resources. This type of account requires cooperation among traders, Introducing Brokers and established forex brokers to elevate trading proficiency. To choose the ideal IB account, thorough research is necessary to find one that harmonizes with your specific trading objectives and preferences. With the right IB, traders can improve their overall performance in the forex market and strive towards their financial ambitions. However, traders must do their due diligence before choosing an Introducing Broker.

0 notes

Text

Windealagency.com review – Register

When choosing a broker, traders need to consider multiple factors: regulation, reputation, trading conditions, and security measures. With so many platforms out there, it's essential to separate trustworthy brokers from those that might pose a risk.

Today, we take a close look at windealagency.com review to determine whether it meets the standards of a legitimate and reliable forex broker. We’ll analyze key aspects such as its regulation, user reviews, trading conditions, deposit and withdrawal policies, and customer support.

The goal? To see if windealagency.com reviews is truly a broker traders can trust. Let’s dive in!

How to Register on windealagency.com: A Step-by-Step Guide

Registering on windealagency.com reviews is a straightforward process, but it’s crucial to follow each step correctly. Here's how to do it:

Step 1: Access the Website and Click "Create Account"

On the homepage, locate the "Create Account" button in the upper right corner and click on it to begin registration.

Step 2: Fill in the Registration Form

Enter the required details: ✔ Full Name – Use your real name for verification. ✔ Email Address – A confirmation link will be sent here. ✔ Password – Choose a strong password for security.

Step 3: Confirm Your Email

Check your inbox for a verification email and click the link to activate your account. Without this step, your account won’t be fully functional.

Step 4: Log In and Set Up Your Profile

After verification, log in using your credentials. You may need to complete additional details, such as selecting an account type (demo or real) and linking a payment method.

Step 5: Identity Verification (KYC)

For security and compliance reasons, the broker may require: 📌 Passport/ID scan to verify identity. 📌 Proof of address (utility bill or bank statement). 📌 Selfie with ID (sometimes required). Verification usually takes a few hours to 48 hours.

Step 6: Deposit Funds and Start Trading

To trade on a real account, you need to make a deposit using bank cards, e-wallets, or cryptocurrencies. Once funded, you can access all platform features.

Establishment Date of windealagency.com

One of the key indicators of a broker's legitimacy is the relationship between the brand's establishment date and the domain registration date. If a broker truly operates transparently, its domain should not be younger than its claimed establishment date.

In the case of windealagency.com review, we see that: ✔ The brand was established in 2021✔ The domain was registered on November 19, 2020

This alignment is a strong sign of credibility. Why? Because many fraudulent brokers register domains after claiming to be in business for years. Here, the domain was secured before the company officially started operations, indicating a well-planned and legitimate business launch rather than a rushed setup.

Would a scam broker invest in securing its domain before launching? Unlikely. This suggests windealagency.com reviews is built for long-term operations rather than quick fraud.

Windealagency.com License & Regulation

A broker’s license is one of the strongest indicators of its legitimacy. Without proper regulation, a platform can operate unchecked, making it risky for traders. So, does windealagency.com review hold a solid regulatory status?

✔ Regulated by the FCA (Financial Conduct Authority)✔ License type: High Authority

The FCA is one of the most strict and reputable financial regulators globally. Brokers under the FCA must comply with capital requirements, transparency policies, and client fund protection rules. This means traders on windealagency.com reviews are safeguarded against unfair practices.

Would a fraudulent broker choose an FCA license? Highly unlikely. The FCA doesn’t hand out licenses easily, and companies must meet ongoing requirements to maintain them. This strongly suggests that windealagency.com reviews is a legitimate and well-regulated broker.

Trading Hours on windealagency.com

Understanding trading hours is crucial for traders, as different market sessions provide unique opportunities. windealagency.com reviews follows the global forex market schedule, ensuring traders can access the markets at the right times.

Here’s the breakdown of the trading sessions:

📌 Winter Session:

Australia: 8 PM – 5 AM

Tokyo: 11 PM – 8 AM

London: 3 AM – 12 PM

New York: 8 AM – 5 PM

This setup aligns perfectly with the traditional forex trading schedule, covering all major financial hubs. Having access to multiple sessions means traders can take advantage of higher volatility, news releases, and liquidity at different times of the day.

Would a non-legit broker bother offering a well-structured global trading schedule? Unlikely. This confirms that windealagency.com review operates within professional market hours, making it a reliable choice for traders worldwide.

Is windealagency.com review a Legitimate Broker?

After a detailed review of windealagency.com reviews, the evidence strongly suggests that this broker operates legally and transparently. Let’s recap the key points:

✅ Established History – The domain was registered before the company officially launched, proving a well-planned operation rather than a rushed setup. ✅ Strong Regulation – Holding an FCA license, one of the most respected financial regulators, ensures compliance with strict industry standards. ✅ Positive Reputation – High Trustpilot ratings and a significant number of user reviews indicate real traders have had good experiences. ✅ Professional Trading Conditions – The platform offers industry-standard trading hours, competitive leverage, and multiple account options. ✅ Secure Transactions – Deposits and withdrawals use trusted payment methods, with fast processing times and zero hidden fees. ✅ Reliable Customer Support – Multiple ways to reach the broker show they prioritize client assistance.

Would a scam broker go through the trouble of obtaining FCA regulation, positive reviews, and transparent policies? Highly unlikely. Everything we’ve analyzed points to windealagency.com reviews being a legitimate and trustworthy trading platform.

If you're looking for a broker that prioritizes security, offers solid trading conditions, and maintains a strong regulatory presence, windealagency.com review seems like a reliable choice.

8 notes

·

View notes

Text

Forex Trading Tips Online - Taking Risks Could Be Beneficial

There's no shortage of Forex trading signs online today. A quick internet search will almost surely give you a plethora of attempted and proven tips to aid your trading. But regrettably, found that a large part of these articles were just repeated elsewhere. Sadly, a lot of the info provided is overly generalized or presented in a manner that doesn't really get to the"meat and potatoes" of the investing. Let's take a look at a few suggestions which may improve your odds of making more money on the foreign exchange marketplace.

For people who know a bit about Forex, a great thing would be to search for a Forex broker firm using a well-established standing. These firms can afford a massive advertising budget. This enables them to reach out to as many potential investors as possible. Therefore, they will usually have specialist traders that will lead you along the way to become an extremely prosperous trader. Again, a number of these companies will provide a free training course for people that are interested.

Another outstanding way to better your chances of success is to prevent looking harder than you should. Too frequently, beginning traders try harder than they should. If the concept of doubling up on several of your transactions isn't attractive, then it can be time for you to proceed. While doubling up on a few of your investments is never a bad idea, trying more difficult than necessary is not.

Is it really any surprise that some folks like to trace their favourite sports team? In reality, there is a complete sub-industry devoted to sports teams around the globe. In this aspect, if you're trying to select up forex trading hints, a really good thing to keep in mind is that stocks tend to proceed in tandem with sports. Therefore, if your favorite team is winning, that generally is an indication that you ought to be watching its stock price.

It is correct that many forex traders are looking harder than needed. But, it's also a fact that the most prosperous dealers do not do anything that much different than the typical investor. 1 good thing about that is that the market moves in layouts, and consequently, you may take advantage of this knowledge to exchange according to a blueprint. For this end, you ought to take note of if certain stocks hit specific points from the trading procedure.

Some traders have the mentality that they have to look at each transaction for a race towards the end. In this respect, they will often deviate from their trading setup and set numerous trades at the same time, regardless of how profitable those initial ones were. What these people don't understand is that each and every trade has a profit potential and risk. This usually means that a dealer who's trying harder could actually be placing more dangers than he would like.

When you have a plan in place, which entails you to follow a predetermined set of rules and parameters, this can be helpful to you to keep an eye on how well that strategy is doing. As an example, a fantastic rule of thumb for the majority of traders is you would like to just enter and exit a trade based upon the price action of this currency pair you are trading. If you're relying solely upon your investigation, you might run the risk of ignoring other things, like political information and financial reports. Furthermore, a good rule of thumb for cost action traders is to just trade on currencies pairs which you're interested in. This will make certain you don't get overly caught up in after after a popular trend, and you may instead concentrate on developing a system which is suitable for you and your particular objectives.

Obviously, you must always take care when taking risks. The threat lies in the unknown. Forex Currency trading is no different from other kinds of investing. Moreover, there are many men and women who have been able to place up successful businesses solely on using their trading skills and knowledge. But, in addition, there are many others who have lost everything because they didn't know what they were doing. When taking trading tips from anyone, particularly those with experience, it is very important to take precautions to make certain that you are as protected as you can.

1 note

·

View note

Text

MT5 Grey Label

Start Your Forex Brokerage with ForexLaunchpad’s MT5 Grey Label Solution

Are you ready to launch your own Forex brokerage but don’t want the high cost and complexity of starting from scratch? ForexLaunchpad is here to make your journey easier, faster, and more affordable with our new MT5 Grey Label solution. This service is designed for individuals or companies who want to run their own trading business under their own brand name using the powerful MetaTrader 5 (MT5) platform.

In this article, we’ll explain what a Grey Label is, why MT5 is the best choice, and how ForexLaunchpad helps you succeed in the competitive world of online trading.

What Is an MT5 Grey Label? An MT5 Grey Label is a cost-effective way to start a Forex brokerage. Instead of buying a full MT5 license (called a White Label or Full License), you "rent" the platform from an existing licensed provider — like ForexLaunchpad.

With a Grey Label, you can use your own brand name, logo, and website. Your clients will see your brand when they trade, but the technology and servers are managed by ForexLaunchpad in the background. This means you can focus on marketing, sales, and customer support, while we take care of the technology.

Why Choose MT5? MetaTrader 5 (MT5) is the most advanced and modern trading platform in the market. It is the next-generation version of MT4, offering faster execution, more instruments, and improved features. Some key benefits include:

Multi-asset trading (Forex, stocks, indices, crypto, commodities)

Faster order processing

Advanced charting and technical analysis tools

Automated trading with Expert Advisors (EAs)

Support for hedging and netting systems

With MT5, your clients get a smooth and professional trading experience. They can trade from desktop, mobile, or web platforms — all under your brand.

Why Choose ForexLaunchpad? ForexLaunchpad is more than just a Grey Label provider. We are your full-service partner for building a successful trading business. Here’s what makes us different:

Affordable Startup Costs Getting started with your own brokerage can be expensive. A full MT5 license can cost over $100,000. With our Grey Label solution, you get access to the same MT5 platform for a fraction of the cost.

Quick Setup Time is money. We can launch your branded MT5 Grey Label within 1 to 2 weeks. You don’t need to worry about servers, hosting, or technical settings — we take care of everything.

Complete Branding Your brand matters. We help you design your trading platform, mobile apps, and client portal to match your business identity. Everything looks and feels professional.

Integrated CRM & Back Office Manage your clients easily with our CRM and Back Office system. Track deposits, withdrawals, trading activity, and support tickets from one place. Full control at your fingertips.

Liquidity Solutions We connect your brokerage to top-tier liquidity providers for fast execution and tight spreads. This gives your traders better pricing and builds trust in your platform.

Compliance Support ForexLaunchpad understands the importance of following regulations. We help you stay compliant and guide you on the right licensing options if needed.

Ongoing Support Our job doesn't end after setup. We offer 24/7 technical support, training for your team, and continuous system updates so your brokerage keeps growing.

Who Can Use Our MT5 Grey Label Service? Our solution is perfect for:

Entrepreneurs who want to start a new Forex brand

Traders who want to create their own trading community

IBs (Introducing Brokers) ready to take the next step

Crypto projects adding Forex trading to their platform

Affiliate marketers expanding into financial services

If you have a vision, we’ll provide the platform and support.

How to Get Started Launching your Forex business with ForexLaunchpad is simple:

Contact us: Fill out a short form or message us to schedule a free consultation.

Share your vision: Tell us your goals, target market, and brand details.

Pick your package: We offer flexible plans based on your needs and budget.

Launch your platform: We handle the setup and get your MT5 Grey Label ready fast.

Grow your business: Focus on marketing, client acquisition, and trading volume.

Final Thoughts Starting your own Forex brokerage used to be a dream for only big companies. Now, thanks to ForexLaunchpad’s MT5 Grey Label service, anyone with a strong vision and a good strategy can enter the market with low costs and fast speed.

Our team of experts is here to help you every step of the way — from platform setup to business growth. If you’re ready to take the next step and build your brand in the financial world, ForexLaunchpad is the partner you need.

Let’s build your Forex future together. Contact ForexLaunchpad today and launch your MT5 Grey Label brokerage!

0 notes

Text

Currency Trading - Truths You Need to Know

Currency trading, in its easiest significance, is specified the procedure of trading a particular currency for an additional. Just like in visiting various other places/countries, what you do is you trade your own currency for the currency of that nation you're seeing. Yet when people discuss currency trading on the foreign exchange market, the meaning of the word ends up being different ... as it is currently defined as a procedure of constant exchange of one currency for one more (buying money and afterwards selling the various other money), making it a point to make revenues when the currency exchange rate will certainly go through changes. Currency trading is rather like trading supplies on the securities market, wherein the stock investors get and also market stocks a great deal faster compared to the individual typical capitalist who takes the recommendations if his/her broker however in a great deal of times, keep supplies for many years or decades.

Just how does IQoption job. Let's point out an example. As an example, today rate on the British pound to euro foreign exchange market is GBP/EUR 1.1200, which indicates that in order for you to get or purchase one pound, you require to have 1.12 euros. Now, if you predicted that the euro was mosting likely to have a higher rate compared to the worth of the pound, after that you could market 100,000 extra pounds, by 100,000 euros, and wait for. Come a couple of days later, and the currency exchange rate relocated to GBP/EUR 1.0600 ... which means that the pound is worth 1.06 euros just. So if you would certainly market your euros and afterwards purchase back $100,000, you will certainly then be able to earn a profit of around 6% of the initial financial investment, less any type of charges. Currently, this will seem a big quantity of cash. That now has 100,000 extra pounds (or bucks) in the financial institution to have it patronize? Nobody! Yet you do not need to have all of those money genuine. What takes place is that you're purchasing and also at the very same time marketing too, so what you require to have with you is sufficient amount to cover any kind of losses if your prediction was wrong as well as the currency you purchased started to drop in value ... after which your broker is going to be the one that financings the remainder.

This is "trading margins". So the margin on a $100,000 trade is around 1% ($1,000) or 2% ($2,000)... which is the amount of money you should have in your own forex brokerage account. The "lots", which a single one would deserve $10,000 or more (depending on the currency as well as the broker as well), will certainly be the ones to establish the quantity that you're going to trade, so if you intend to trade $10,000 you would certainly trade 1 lot, $20,000 for two, etc. To stay clear of margin calls, there are now a restricted number of risk accounts, where the investor just takes the chance of the money he/she has on account with his/her broker. This will be done through obtaining smaller players to trade in the foreign exchange marketing by the use fractions of a whole lot, or what we call "tiny whole lots" (i.e. you can trade $1,000 by trading 0.10 of a whole lot). This set will lessen the threat, yet on the various other hand, may set you back a lot even more to trade it.

Today, a great deal of common people are getting associated with currency trading. It provides you a variety of benefits over the stock market, and also even if you have no concept of the worths that the different money have, you can always have your own forex robotic, which is a kind of software that will certainly be the one to trade for you in accordance to your own picked setups. Keep in mind, currency trading is a dangerous company, money comes as well as money goes. Currently, recognizing these realities in this post, I make sure you now have a suggestion of whether or not you still wish to choose the next action that you require to take right into coming to be an actual currency investor in the forex market!

As you get involved in the niche of foreign exchange trading, it might be very handy for you, as an investor, to recognize every one of its related elements, such as ad prices, website traffic statistics, signal evaluation, and so on. Knowing all of the important elements will certainly aid you to be much more effective in the foreign exchange arena.

2 notes

·

View notes

Text

White Label Offering by Integrating With Match-Trader

Introduction

As more companies look to provide their clients with a fully branded trading platform without having to invest in establishing one themselves, white-label solutions are growing in popularity in the financial sector.

White-label trading platforms from Match-Trader, a top supplier, provide brokers and financial institutions with a variety of features and functionality. Forex Brokerage Setup is The Leading White Label Solutions in the market.

In this blog article, we'll look at the advantages of integrating with Match-Trader's white-label solution and how it can support companies as they develop and broaden their product lines.

White Label Solutions: What Are They?

A white-label solution is a good or service that is created by one business but rebranded and offered by another business under their own name.

A white-label solution in the context of trading platforms enables brokers and financial institutions to provide their clients with a fully branded trading platform without having to make the investment in establishing one themselves.

Brokers and financial institutions can provide their clients a top-notch trading platform while saving time and money on development costs by utilizing a white-label solution. As a result, they are able to concentrate on other aspects of their organization like marketing, customer service, and compliance.

Benefits of White Label Trading Platforms

Utilizing a white-label trading platform has a number of advantages, including:

Branding: By allowing brokers and financial institutions to fully brand their trading platform, white-label solutions help them increase customer brand recognition and loyalty.

Customization: White-label systems can be highly customized, enabling brokers and financial institutions to design the platform to meet both their unique requirements and those of their clients.

Savings: Employing a white-label solution can help brokers and financial institutions save a lot of cash on development costs as well as on ongoing maintenance and support.

Saving time: Building a trading platform from the ground up might take a lot of time. Brokers and financial institutions can launch their platforms right away using a white-label solution without having to wait for development to be finished.

Expertise: White-label solutions are created by subject-matter specialists, ensuring that the platform is dependable, secure, and complies with all applicable regulations.

The White Label Offering from Match-Trader

A significant supplier of white-label trading platforms for brokers and financial institutions is Match-Trader. Their product provides a variety of features and functionalities that can aid in business expansion and growth.

Customizable Interface: Match-Trader's white-label platform is highly customizable, allowing brokers and financial institutions to fully brand their trading platform and tailor it to their specific needs.

Advanced Trading Tools: Match-Trader's platform offers a range of advanced trading tools, including technical analysis, risk management, and social trading features.

Multi-Asset Trading: Match-Trader's platform supports trading in a wide range of asset classes, including Forex, CFDs, and cryptocurrencies.

Mobile Trading: Match-Trader's platform is fully mobile-responsive, allowing clients to trade on-the-go using their mobile devices.

Compliance and Security: Match-Trader's platform is fully compliant with all necessary regulatory requirements and offers robust security features to protect against fraud and cyber-attacks.

Integration with the White Label Solution from Match-Trader

The white-label solution from Match-Trader may be integrated easily and quickly in a few weeks.

The steps in the integration process are:

Customization: Brokers and financial institutions collaborate with Match-Trader's staff to tailor the trading platform to meet their unique requirements.

API Integration: Match-Trader gives brokers and financial institutions a thorough API that enables them to link the trading platform with their current systems and databases.

Testing and deployment: After the integration is finished, the trading platform is put through a rigorous testing process to make sure everything is working as it should. Then clients are given access to the platform.

Top White label products...

The market's top white label solution is the forex broker setup. IB Solutions, Client Office (CRM), Liquidity, Data Feeds, RMS, etc. Brokers now have access to the new turnkey White Label Solutions standard.

Verdict

Finally, brokers and financial institutions may grow and expand their offers while saving time and money on development costs by integrating with Match-Trader's white-label trading platform.

The Match-Trader platform in Forex Brokerage setup provides a variety of features and functionality, such as advanced trading tools, multi-asset trading, and mobile trading, that can assist companies in providing their clients with a top-notch trading experience.

All things considered, Match-Trader's white-label option is a great option for brokers in Forex Brokerage Setup and financial institutions that want to provide their clients with a premium trading platform without having to make their own development investments.

Forex Brokerage setup may give their clients the best trading experience possible while concentrating on other aspects of their operations like marketing, customer service, and compliance by adopting a white-label solution.

0 notes

Text

How to Setup Forex Broker Company with Top Forex Liquidity Solutions

Learn how to setup forex broker company with YaPrime, your trusted partner for success. YaPrime provides all the tools you need to launch and grow your brokerage, from licensing and regulatory support to advanced trading technology—access premium forex liquidity solutions with deep liquidity pools, competitive spreads, and lightning-fast trade execution. Whether you’re new to the industry or looking to scale, YaPrime’s expert guidance and powerful infrastructure ensure a flawless setup process. Start your Forex broker journey today with YaPrime’s trusted expertise.

#start your own forex brokerage#forex broker services#top forex liquidity providers#web development services#affordable web development services#how to setup Forex Broker Company#Forex liquidity solutions#How to become a licensed forex trader#best forex trading platform mt4

0 notes