#Global Vehicle-To-Grid (V2G) System Market News

Explore tagged Tumblr posts

Text

The Global Vehicle-To-Grid (V2G) System Market is estimated to grow at a CAGR of around 24.52% during the forecast period, i.e., 2023-28. The market growth imputes to the increasing electric vehicles production, rising governmental efforts to establish EV charging networks, expanding requirements for smart grid systems, the flourishing utilization of renewable energy sources, etc. Governments across the globe such as India, the Netherlands, China, the USA, the UK, etc., are increasingly introducing several initiatives such as incentives, subsidies, and tax credits, for the massive development of EV charging infrastructures in recent years.

#Global Vehicle-To-Grid (V2G) System Market#Global Vehicle-To-Grid (V2G) System Market News#Global Vehicle-To-Grid (V2G) System Market growth#Global Vehicle-To-Grid (V2G) System Market share#Global Vehicle-To-Grid (V2G) System MarketSize

0 notes

Text

Global V2X Communications Market Outlook 2024–2032: Redefining Connected Mobility

The global vehicle-to-everything (V2X) communications market is accelerating as vehicles become more connected, intelligent, and autonomous. V2X refers to the comprehensive communication network where vehicles exchange data with each other (V2V), infrastructure (V2I), pedestrians (V2P), networks (V2N), the grid (V2G), and the cloud. This real-time exchange of information enhances traffic efficiency, road safety, emissions management, and autonomous driving capabilities.

As transportation systems evolve toward fully autonomous and smart city frameworks, V2X acts as a foundational technology that connects vehicles with their surrounding environments. With growing deployment of 5G, edge computing, and connected infrastructure, V2X is rapidly transitioning from experimental use cases to scalable deployments in urban corridors, highways, and logistics hubs.

Market Overview

The V2X market is developing in parallel with the automotive industry’s transformation toward automation, electrification, and connectivity. Governments, regulators, and automotive OEMs are investing in V2X infrastructure to reduce road accidents, optimize traffic flows, and prepare for autonomous vehicle integration.

Two primary communication technologies are shaping the market: Dedicated Short-Range Communication (DSRC) and Cellular V2X (C-V2X). DSRC uses 5.9 GHz frequency for direct vehicle communication, while C-V2X leverages cellular networks (4G and 5G) for broader data exchange with infrastructure and cloud platforms.

Click here to download a sample report

Key Market Drivers

Rise in Autonomous and Connected Vehicles V2X is essential for safe and efficient interaction among self-driving cars and with the environment.

Government Safety and Smart Mobility Mandates Several countries have introduced road safety regulations that promote V2X deployment in new vehicles.

Advancement in 5G and Edge Computing High-speed, low-latency networks are accelerating the deployment of cellular V2X across dense urban areas.

Growth in Smart Cities and Intelligent Infrastructure Integration of vehicles with smart traffic systems and real-time analytics platforms increases demand for V2X.

Environmental and Traffic Efficiency Goals V2X facilitates eco-routing, reduced idling, and traffic synchronization to lower fuel consumption and emissions.

Market Segmentation

By Communication Type:

Vehicle-to-Vehicle (V2V) Enables data exchange between vehicles to prevent collisions, enhance lane-changing, and coordinate platooning.

Vehicle-to-Infrastructure (V2I) Connects vehicles to traffic lights, road signs, toll booths, and parking systems.

Vehicle-to-Pedestrian (V2P) Enhances safety by alerting vehicles and pedestrians about potential proximity or crossing movements.

Vehicle-to-Network (V2N) Communicates with cloud services for navigation, updates, infotainment, and diagnostics.

Vehicle-to-Grid (V2G) Links electric vehicles with the power grid for optimized charging, energy feedback, and load balancing.

By Technology:

Dedicated Short-Range Communication (DSRC) Proven, latency-free communication designed specifically for automotive use.

Cellular V2X (C-V2X) Uses LTE and 5G infrastructure to offer greater range, throughput, and scalability.

By Application:

Automated Driving Supports Level 3–5 autonomous vehicles through real-time environmental awareness.

Traffic Management Reduces congestion via traffic signal optimization and dynamic rerouting.

Road Safety Alerts for hazards, emergency braking, blind spots, and intersection risks.

Infotainment and Fleet Management Supports vehicle monitoring, entertainment, and logistics coordination.

Regional Insights

North America

Leading in V2X standardization and trials, particularly in the U.S. and Canada. Government safety programs, autonomous vehicle pilots, and investments from tech companies support market growth.

Europe

Strong focus on cooperative intelligent transport systems (C-ITS). The EU mandates include equipping new vehicles with V2X capabilities for collision avoidance and traffic efficiency.

Asia-Pacific

Rapid urbanization and smart city development, especially in China, Japan, and South Korea. Government support and partnerships between automakers and telecoms are boosting C-V2X deployments.

Latin America

Slow but emerging interest. Smart transport infrastructure projects in Brazil and Mexico are testing V2X capabilities.

Middle East & Africa

Adoption driven by smart city developments in the UAE and Saudi Arabia. Infrastructure modernization is creating opportunities for V2X integration.

Competitive Landscape

The V2X market includes collaborations between automotive OEMs, telecom providers, semiconductor companies, infrastructure developers, and software platforms.

Key Competitive Strategies:

Cross-Industry Alliances Automakers partnering with telecom and cloud companies to deliver end-to-end V2X solutions.

Standardization and Protocol Development Industry efforts to harmonize communication protocols, security models, and data sharing rules.

Integration with Advanced Driver Assistance Systems (ADAS) Embedding V2X into ADAS to enhance decision-making and driver awareness.

Pilot Projects and City-Scale Trials Real-world testing of V2X in live traffic conditions to validate performance and scalability.

Edge and Cloud Platform Expansion Use of cloud-edge hybrid systems to process real-time vehicle data efficiently.

Technological & Product Trends

Shift from DSRC to C-V2X Cellular-based communication is gaining preference due to its broader coverage and scalability.

AI and Predictive Analytics Integration V2X data is used to anticipate traffic conditions, pedestrian movements, and vehicle behavior.

Secure V2X Protocols Cryptographic and blockchain-based solutions are emerging for data integrity and cyberattack prevention.

Interoperability Initiatives Focus on seamless integration across vehicle brands, infrastructure platforms, and geographic regions.

Integration with Autonomous Vehicle Stacks V2X becoming a core module in Level 3–5 autonomous driving systems.

Challenges and Restraints

Lack of Unified Global Standards DSRC and C-V2X are competing technologies with regional differences, causing integration delays.

High Infrastructure Cost Deployment of smart roadside units, 5G towers, and cloud connectivity requires significant investment.

Security and Privacy Concerns Real-time data transmission raises concerns about hacking, surveillance, and unauthorized access.

Slow Regulatory Approvals Government legislation and policy adaptation lag behind rapid technological advancements.

Adoption Hurdles Among Fleet Operators Small- and medium-sized fleet operators face challenges in upgrading to V2X-enabled platforms.

Future Outlook (2024–2032)

The V2X market is expected to grow significantly as:

Automakers embed V2X in next-generation vehicle platforms

5G infrastructure becomes more accessible and widespread

Smart cities evolve to include interconnected road systems

Traffic fatalities and emission reduction targets push policy mandates

Demand rises for real-time, low-latency communication in autonomous driving systems

By 2032, V2X will be central to not only vehicle automation but also to traffic governance, urban mobility, and integrated energy systems.

Conclusion

The global Vehicle-to-Everything (V2X) communications market represents a paradigm shift in how vehicles interact with the world around them. By enabling seamless data exchange between cars, infrastructure, and networks, V2X improves road safety, traffic efficiency, and supports the broader push toward autonomous and sustainable transportation.

0 notes

Text

Mahindra XUV900 Launch Date, Price, Specs & Latest News

Mahindra has been steadily climbing the ladder of innovation and design, and with the highly anticipated XUV 900, the Indian automotive giant is all set to enter the world of premium electric coupe SUVs. Touted as a futuristic blend of performance, luxury, and sustainability, the XUV 900 is more than just a car — it represents Mahindra's leap into the new generation of mobility.

In this article, we’ll take a comprehensive look at what the Mahindra XUV 900 promises — from its expected features, design elements, platform, launch timeline, and price expectations, to its competition and market positioning. Whether you're an auto enthusiast or someone planning your next EV purchase, this deep dive into the XUV 900 will help you stay ahead of the curve.

What Is the XUV 900?

The Mahindra XUV 900 is expected to be the brand’s first electric coupe SUV. First teased at Mahindra’s Born Electric Vision event, the XUV 900 is a bold experiment that aims to combine sporty styling with EV capabilities. It’s not just another electric SUV — it’s a coupe-style vehicle with futuristic elements.

The XUV 900 will likely be built on Mahindra’s INGLO platform (Indian Global), which supports multiple body styles and powertrains. The vehicle will mark the brand’s flagship entry into the electric vehicle space, aimed at consumers looking for a luxury performance EV that doesn’t compromise on styling.

XUV 900 Design Language

Design is where the XUV 900 is expected to truly shine. It takes inspiration from Mahindra's Born Electric Concepts and will likely feature:

Futuristic LED lighting on the front and rear

A sloping roofline with coupe aesthetics

Aerodynamic body elements

High ground clearance typical of SUVs

Wide stance and aggressive grille pattern

The vehicle is being designed by the Mahindra Advanced Design Europe (MADE) studio in the UK, headed by renowned designer Pratap Bose. Given the European influence, the XUV 900 is likely to carry global styling cues with attention to detail, symmetry, and sophistication.

Interior Expectations

While the official interior has not yet been revealed, several key expectations include:

Panoramic sunroof

Minimalist dashboard

Large infotainment display

Digital instrument cluster

Ambient lighting

Premium upholstery

Touch-sensitive controls

High-end audio system

Comfort will likely be paramount in the XUV 900. As Mahindra aims to compete with premium EVs, expect ventilated seats, customizable mood lighting, and connected car features like remote diagnostics, live tracking, and voice-based controls.

Powertrain and Performance

Being an electric vehicle, the XUV 900 will draw power from high-capacity battery packs, possibly ranging between 60 kWh to 80 kWh, based on what we’ve seen from Mahindra’s INGLO-based prototypes.

Expected features include:

Dual-motor AWD configuration

Fast-charging capability (DC fast charging support)

Range estimation of 400–500 km on a single charge

0–100 km/h acceleration in under 6 seconds (for the higher-end variants)

The vehicle will also support multiple drive modes for eco, comfort, and sport driving, allowing users to customize performance as per driving conditions and preferences.

Advanced Technology Features

As a modern EV, the XUV 900 is expected to be loaded with next-gen features, such as:

ADAS (Advanced Driver Assistance Systems) including adaptive cruise control, lane keep assist, and emergency braking

Vehicle-to-Load (V2L) and Vehicle-to-Grid (V2G) technology

AR-enabled HUD (Heads-Up Display)

Over-the-Air (OTA) updates

360-degree camera

Wireless Apple CarPlay and Android Auto

Security will also be enhanced through facial recognition, biometric authentication, and e-SIM integration.

Expected Launch Timeline

As per Mahindra’s product roadmap, the XUV 900 is scheduled to arrive by late 2025 or early 2026. The car has already been spotted in concept form, and test mules may hit the road by mid-2025.

Mahindra has been strategically building EV production capacity, and the XUV 900 is likely to be one of the first cars to roll out from its new EV plant in Pune or Tamil Nadu, which will specialize in electric-only platforms.

Price Expectations

Being a flagship electric coupe SUV, the Mahindra XUV 900 won’t be cheap. The expected starting price could range from Rs 35 lakh to Rs 45 lakh (ex-showroom), depending on the variant and battery size.

Top-end variants with dual motors, maximum range, and ADAS features may go up to Rs 50–55 lakh, positioning it directly against vehicles like the Hyundai Ioniq 5, Kia EV6, and BYD Seal.

Competition in the Market

When launched, the XUV 900 will enter a space that’s currently niche in India — the electric coupe SUV segment. Its primary competitors will include:

Hyundai Ioniq 5

Kia EV6

BYD Seal

MG Marvel R (if launched in India)

Tata Curvv EV (expected by 2025)

Skoda Enyaq iV (future contender)

However, with Mahindra’s pricing strategy and strong domestic support, the XUV 900 might undercut some of its more expensive rivals and provide great value in terms of design and features.

Why the XUV 900 Matters for Mahindra

The XUV 900 is not just another electric car. It is Mahindra’s design and technology showcase — a product that aims to redefine what Indian carmakers can offer in the premium electric space. Here’s why it matters:

Brand Image: It will elevate Mahindra's image from a utility-focused automaker to a global EV brand.

First-Mover Advantage: It gives Mahindra a strong presence in the coupe SUV EV niche before Tata and other players catch up.

Export Potential: With global design, Mahindra could market the XUV 900 in international markets like Europe, Middle East, and Southeast Asia.

Platform Strategy: As part of the INGLO platform, it sets the stage for more EVs using the same base.

INGLO Platform Overview

The INGLO platform will be the backbone of Mahindra's future electric portfolio. Some of its key traits include:

Flat floor architecture allowing more cabin space

High energy-density batteries with fast charging support

Advanced cooling systems

Modular structure to accommodate multiple body styles

Active safety and passive safety systems

Low rolling resistance tires for better range

The XUV 900 will likely be the first car to showcase the full capability of this platform in its most advanced form.

Is India Ready for a Coupe SUV EV?

India’s EV infrastructure is improving. With better charging stations, government incentives, and increasing awareness, high-end EVs are finally finding takers. Urban areas like Delhi NCR, Mumbai, Bengaluru, and Hyderabad are seeing growing EV adoption.

The XUV 900, with its stylish design and premium placement, is aimed at early adopters, tech-savvy buyers, and EV enthusiasts who are looking for something more than just eco-friendly commuting.

As a status symbol with performance, the XUV 900 might be a turning point in Mahindra’s EV journey and in India’s overall EV ecosystem.

Customer Expectations from XUV 900

Buyers in this price segment have high expectations. Mahindra will need to deliver on several fronts:

Build quality and fit-finish

Reliable range and battery performance

Smooth, luxurious ride

Intuitive infotainment and connected features

Quick service and roadside assistance

Value-added ownership experiences

If Mahindra nails these, the XUV 900 could go on to become a trendsetter in its segment.

The Road Ahead

The Mahindra XUV 900 is an ambitious product that showcases what the future of Indian electric mobility could look like. As more consumers move toward sustainability without compromising luxury and design, the XUV 900 is positioned to fill that void.

It blends futuristic styling, advanced electric technology, and performance into a package that feels exciting and aspirational. If Mahindra executes the launch well, the XUV 900 may become a landmark vehicle in the company’s history — and for the Indian EV market at large.

FAQs on XUV 900

Q1. What is the Mahindra XUV 900? The XUV 900 is an upcoming electric coupe SUV from Mahindra, expected to be their flagship EV offering. It will feature a futuristic design, electric drivetrain, and premium features.

Q2. Is the XUV 900 electric or petrol? The XUV 900 will be a fully electric vehicle, based on Mahindra’s INGLO EV platform.

Q3. When will the XUV 900 launch in India? The launch is expected around late 2025 or early 2026.

Q4. What is the expected price of the XUV 900? The XUV 900 may be priced between Rs 35 lakh and Rs 55 lakh (ex-showroom), depending on the variant and battery configuration.

Q5. What are the key features of the XUV 900? Expected features include dual-motor setup, 400–500 km range, ADAS, panoramic sunroof, AR HUD, connected car tech, and fast-charging support.

Q6. Will the XUV 900 be available in petrol or diesel? No, the XUV 900 will be an electric-only model.

Q7. Is the XUV 900 a 7-seater SUV? No official confirmation is available yet, but based on the coupe styling, it’s more likely to be a 5-seater.

Q8. What platform will the XUV 900 be based on? The XUV 900 will be built on Mahindra’s new INGLO electric platform.

Q9. Will the XUV 900 support fast charging? Yes, fast charging is expected with DC support and 175 kW charging capabilities.

Q10. Which vehicles will compete with the XUV 900? The XUV 900 will compete with Hyundai Ioniq 5, Kia EV6, BYD Seal, and future Tata EVs like the Curvv EV.

0 notes

Text

Off-Highway Electric Vehicle Market Outlook: Trends, Growth, and Forecast (2025–2035)

What are off-highway electric vehicles?

Off-highway electric vehicles (OHEVs) are non-road vehicles powered by electric drivetrains designed for industrial applications such as construction, mining, and agriculture. These vehicles, including excavators, loaders, and haul trucks, operate in environments where traditional road-based electric vehicles are not feasible. OHEVs reduce emissions, noise, and maintenance costs compared to their diesel-powered counterparts, making them a sustainable alternative for industries seeking to meet environmental regulations and improve operational efficiency.

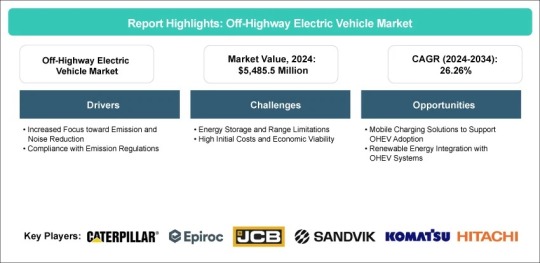

What is the expected CAGR of the off-highway electric vehicle market over the next decade?

The off-highway electric vehicle market is projected to grow at a robust CAGR of 26.26% from 2024 to 2034, driven by sustainability goals and technological advancements. It is expected to rise from $5,485.5 million in 2024 to $56,483.7 million by 2034.

What are the key trends in the off-highway electric vehicle market?

Key trends in the off-highway electric vehicle market include the increasing adoption of electric drivetrains in construction, mining, and agriculture, driven by stricter environmental regulations and sustainability goals. Innovations in battery technology, mobile charging solutions, and renewable energy integration are enhancing the viability of electric vehicles in remote areas. Additionally, regulatory pressure for reduced emissions and noise pollution is accelerating the shift toward electrification, while advancements in vehicle-to-grid (V2G) systems further support market growth.

Which regions are leading in the adoption of off-highway electric vehicles? • North America • Europe • Asia-Pacific • Rest-of-the-World

North America Region to Lead the Market.

Recent developments

In August 2024, Fortescue Metals partnered with Liebherr Mining to develop and validate a fully integrated autonomous haulage solution (AHS) at the Christmas Creek mine. This system, which includes a fleet management system, an onboard autonomy kit for the Liebherr T 264 truck, and a high-precision machine guidance system, will coordinate diverse autonomous vehicles. The initiative aims to support Fortescue Metal’s goal of zero Scope 1 and 2 emissions by 2030 and will eventually be available globally as part of Liebherr Group’s expanding technology portfolio.

In July 2024, Eleo, a Yanmar company, launched a new range of modular battery packs for off-highway applications. These packs are designed for low-volume, high-diversity vehicles and offer a scalable voltage range (50V to 720V) and up to 90 kW of continuous power, with flexible integration, easy serviceability, and industry-standard protocols.

In January 2024, Caterpillar partnered with CRH to introduce electric off-highway trucks, contributing to the decarbonization of the construction sector.

In December 2022, Nidec announced a $715 million investment to establish an electric motor manufacturing plant in Mexico, strengthening the region’s supply chain for electrified vehicles. In early 2022, John Deere expanded its battery production capacity by over 2 GWh through Kreisel Electric, reinforcing the push for electrified off-highway equipment.

Who are the major players in the off-highway electric vehicle market?

AB Volvo

PristenBully

Hitachi Construction Machinery Co., Ltd.

Caterpillar

CNH Industrial N.V.

Epiroc AB

Deere & Company

What strategies are existing market players adopting to strengthen their market position?

Existing market players are strengthening their positions by investing in advanced battery technologies, expanding electric vehicle offerings, and enhancing charging infrastructure. Strategic partnerships, such as collaborations for mobile charging solutions and renewable energy integration, are also being pursued. Additionally, companies are focusing on innovation to meet stricter emission regulations and reduce operational costs. These players aim to capture a larger share of the growing off-highway electric vehicle market by developing scalable, sustainable solutions and addressing infrastructure challenges.

Unlock Bespoke Analysis: Request Customized Insights to Fuel Your Success in the Market!

Want deep information on Automotive Vertical. Click Here!

Conclusion

The off-highway electric vehicle market is set for transformative growth, fueled by the global shift toward cleaner energy, regulatory pressures, and technological advancements in electrification. The market is growing quickly across industries like mining, construction, and agriculture as major players like AB Volvo, Caterpillar, and Hitachi Construction Machinery spur innovation. Electric off-highway vehicle adoption positions the market as a pillar of the future of heavy-duty transportation and industrial mobility by lowering long-term costs, improving operational efficiency, and supporting environmental goals.

#Off-Highway Electric Vehicle#Off-Highway Electric Vehicle Market#Off-Highway Electric Vehicle Industry#Off-Highway Electric Vehicle Report#automotive

0 notes

Text

How an EV Charging Station Finder App Development Company is Powering the Future of EV Charging Apps in 2025?

While the global cities work hard to fight against alarming pollution levels in 2024. Major metropolitan areas faced smog and carbon emissions play a vital part in climate change. The emergency of electric vehicles (EVs) is more urgent than ever, for the sake of transportation, which is the main culprit. To reduce pollution, governments close schools, order offices to put in place policies of work from home and enforce vehicle restrictions in high pollution zones. Such dictates the urgent need for the sustainable transportation.

For this reason, EV Charging Station Finder App Development Companiesies are the departments that play a major role in making this transition possible by creating smart EV charging software platforms that make the EV charging process easier and more convenient. The demand for charge station apps is high, with the EV market expected to reach $110 billion (source) by the year 2025. In this blog, we will delve into how smart charging solutions and smart charging solutions’ associated technology, Vehicle to Grid (V2G) technology, and more will transform the way EV chargers want to be charged using EV charging apps.

We are heading into a world of electric vehicles, we are ready for that electric revolution but are we ready for the charging revolution? Looking to buy cannabis seeds? EV adoption is growing and the supporting infrastructure must evolve as a result.

The Need for EV Charging Apps in 2025

Over the past few years, the EV industry has grown in leaps and bounds, to the extent where there will be 145 million EVs on the road by 2030. So the demand for electric charging station apps grows the more switchers opt for electric. To ensure smooth access, real-time availability tracking, and easy payment solutions for the users, the EV Charging Station Finder App Development company is now working on optimizing charging networks.

These apps are required, for at a given time, to ensure that drivers are aware of station locations, pricing and availability. Likewise, the increasing number of fast charging stations has meant that fast charging software platforms need to adopt smart technology to guarantee efficiency and fidelity. Are businesses changing fast enough in the EV industry? What will be the next generation of the charging solutions with new trends:

Key Trends in EV Charging Software Platforms

Clean energy has been pushed, and EV charging apps are becoming more developed. The biggest trend in the industry is the integration of renewable energy sources in the EV charging infrastructure. Solar and wind energy solutions are now becoming a part of charging station apps which helps in cutting down the carbon footprint and operational costs.

To stay competitive, EV charging software must embrace emerging trends and innovations. Below are the key developments transforming the industry:

Integration with Renewable Energy

EV charging stations are rapidly using solar and wind energy, reducing dependence on fossil fuels. The optimal plan technique has achieved significant decrease in voltage deviations and energy supply to integrate EV charging stations with hybrid winds and PV systems in multi-microgrids.

Real-time Charging Session Monitoring

Users can track charging progress and get updates on the availability of charging stations. Real -time notice in EV charging apps enhances user experience by providing immediate alert on the availability of station and perfection of the station, reduces uncertainty and reduces congestion.

AI-powered Route Planning

Wise navigation tools help drivers find the fastest and most convenient charging space. Advanced root planning algorithms consider factors such as battery range, charging station locations and energy consumption patterns, which ensure efficient and timely delivery.

Ultra-fast Charging Networks

New high-power stations reduce to charging time, making EVS more practical for daily use. The plans are to roll out a network of hundreds of thousands of EV chargers, including thousands of public charging points, with ultra-fast chargers significantly higher charging speeds and reduce charging time.

Enhanced Payment and Billing Systems

Safe, contactless payment and blockchain technology are ensuring spontaneous transactions. Integrated payment apps and integration of RFID-based payment options streamlines transactions, while blockchain technology increases safety and transparency in billing systems.

These are progress towards a more reliable and user-friendly EV charging eco system. Thanks to these innovations, the future of the EV charging seems bright and far from intimidating as it allows convenience and efficiency to users as well. Let us carry on with these trends and together, towards a cleaner and smarter tomorrow.

Imagine an EV charging network that knows exactly when and where you need to charge. How can AI and smart technology make EV charging effortless?

Smart Charging Solutions & AI Integration

Smart charging solutions operated by AI and machine learning are optimized by EV charging experience. These solutions analyze the demand for electricity, charge station use, and user preferences to suggest optimal charging time, which balances the load on the grid.

Predictive maintenance in charging station apps also predicts issues before they turn into bigger problems and minimize downtime. Tesla and ChargePoint are already using AI driven charging optimization models that reduce cost and improve user experience and many more advanced companies use and plan to use these AI driven charging optimization models.

What if your EV could not only take energy but also give it back? Vehicle-to-Grid (V2G) technology is about to turn EVs into power sources.

Vehicle-to-Grid (V2G) Technology in Charging Station Apps

In this area of electric vehicle technology, one of the most daring innovations is Vehicle to Grid (V2G), which entails using EV’s to supply power but in turn also allowing them to relieve the grid of excess energy. The bidirectional charging contributes to stabilizing electricity demand and helping integrate renewable energy.

Current EV charging software platforms include V2G functionalities that let users benefit from selling their excess power when demand peaks. Research indicates V2G technology will decrease grid dependency to 20% during the period from 2020 to 2030 according to the study. The expanding V2G trend will lead to additional charging station apps integrating this technology to improve efficiency and user cost savings.

Would you switch to an EV if charging was as simple as parking your car? Innovations in user experience are making that a reality.

Innovations Enhancing User Experience

In future years the focus of the chargers will be wireless charging, ultra-fast charging and blockchain secured transactions for the purposes of reliability and security. Wireless charging will provide us EV charging without any physical connectors, thus thus making it more user friendly.

EV will bring revolution in processing transactions through blockchain technology, providing tampering proof transactions and will give a transparent billing. Blockchain integration is being incorporated by several EV charging station Finder app development companies so that users can enjoy a comfortable colleague for peer energy trading and safe user authentication.

What are the biggest obstacles to EV adoption? Understanding these challenges and finding solutions is important for a successful infection.

Challenges and Solutions for EV Charging Station Finder Apps

However, the EV charging infrastructure lags far behind, as it still has many challenges to overcome. To better adopt and employ EV Charging Station Finder Apps, these obstacles must be addressed so they are easily used and become widely adopted. Charging station availability is limited, interoperability of networks is an issue, and the concerns over data security are great.

Infrastructure Expansion

To support the growing adoption of EVS, governments as well as private firms will need to invest at more fast-charging stations. Charging infrastructure is also an element that further enhances the facility for EV owners, which attracts more and more people to switch to electric vehicles. However, because this expansion requires large investment and high-level strategic plans and coordination between various stakeholders such as policy makers, utilities and charging station managers, it is necessary to prepare logistics as soon as possible.Top of Form

Interoperability Issues

For an uninterrupted EV charging experience, interoperability between various charging networks is necessary. Such standardized communication protocols as OCPP (Open Charge Point Protocol) ensure communications free of issues across different networks. Many EV Charging Station Finder Apps can follow a common standard to offer users constant access to different charging stations, no matter of the network operator. This increases user confidence as well as convenience.

Data Privacy

To build the trust in EV charging software platform, it is necessary to implement robust encryption and user authentication methods. Since these apps have access to users' sensitive data such as payment information and location data, the users must ensure that data is privacy. To safeguard user data and prevent breaches, adopting advanced security measures such as encryption, two factor authentication, regular security audits can be taken.

How Businesses and Individuals Can Tap into the Growing EV Market

EV charging has a great future ahead of it, both in terms of growth and innovation. It allows businesses to invest in developing advanced EV charging software platforms, smart charging solutions, and working with renewable energy providers. EV adoption and efficient use of the charging station app can help people have a sustainable and eco-friendly future.

When dealing with such challenges and leveraging opportunities, the EV charging ecosystem can move to meet an increasing demand for electric vehicles. Innovation, collaboration and sustainability are the components of the key. Lets drive to a cleaner, smarter tomorrow.

Growth Opportunities and Innovation

Innovation in EV charging is running new trade opportunities and expanding access to both commercial and residential users. Businesses can attract customers with charging station apps, while residential solutions meet for EV adoption. Emerging EV charging software platforms, franchise models, and public-private partnership are accelerating the development of infrastructure, ensuring wide EV access.

Innovation in EV charging is opening new business opportunities and improving accessibility for both commercial and residential users. Here are some of the most promising areas for growth:

• Commercial and residential charging solutions: Businesses can install EV Chargers at commercial places like shopping malls, hotels, and offices to attract customers. Similarly, residential charging in apartments and gated communities complements the growing EV owner Aadhaar.

• Fleet and workplace charging: The electrification of corporate fleet and workplace charging provides a chance to attract conscious employees and reduce transportation costs.

• Franchise model: Introducing EV charging as a franchise opportunity allows entrepreneurs to install stations in underserved areas, expand access, and increase the development of infrastructure.

• Public-Private Partnership (PPPS): Cooperation between governments and private enterprises through subsidy, tax encouragement and grants can accelerate the deployment of charging stations, control financial obstacles.

• Emerging Business Model: Subscription services, mobile charging units, and flexible solutions such as on-demand charging make up for users when running new revenue streams for businesses.

These innovations are turning EV charging into a profitable and scalable industry, while ensuring widely adopting electric vehicles. As smart charging solutions and AI-operated technologies, business can adapt to energy use and reduce costs. The integration of the vehicle-to-grid technique further enhances grid stability, making EVS a major component of permanent energy ecosystem.

Wrap Up

The front runner’s company that helps to build a sustainable & connected future are noted to be EV Charging Station Finder App Development Companies. Patient development for AI, V2G and blockchain are predicted to be the driving force for creation of EV charging software platforms to generate faster, smarter and much more efficient charging solutions.

As the market grows, it will be necessary for a spontaneous EV experience to integrate renewable energy sources, ultra-fast charging and smart grid solutions. With correct innovations, EV charging station apps will play an important role in intensifying global changes in electric mobility. For specialist insights and state -of -the -art solutions, find out the services of telepathy in EV app development.

#EV Charging Station Finder App Development Company#ev charging app development company#app development company

0 notes

Text

Automotive DC-DC Converters Market Trends: Powering the Future of Mobility

The automotive industry is experiencing a rapid transformation, propelled by the global shift toward electric vehicles (EVs), advanced driver-assistance systems (ADAS), and smart vehicle architectures. A key enabler of this evolution is the automotive DC-DC converter, a component that plays a crucial role in managing and distributing power efficiently within modern vehicles. As the demand for electrification grows, the automotive DC-DC converters market is gaining significant momentum. This article explores the latest trends shaping this vital segment and how it’s influencing the broader automotive landscape.

1. Electrification Driving Market Demand

One of the most impactful trends in the automotive DC-DC converter market is the surge in vehicle electrification. As automakers transition from internal combustion engines (ICE) to hybrid and fully electric powertrains, the need for efficient voltage conversion systems has become essential. DC-DC converters facilitate power transfer between high-voltage (400V–800V) traction batteries and low-voltage (12V–48V) auxiliary systems, such as lighting, infotainment, and safety components.

With the global push for zero-emission vehicles and stricter emission norms, battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) are seeing exponential growth, directly fueling demand for high-performance DC-DC converters.

2. Shift Toward High-Voltage Architectures

Next-generation EVs are increasingly designed with high-voltage systems, ranging from 400V to 800V, to enable faster charging and improved efficiency. This shift is driving innovation in bidirectional DC-DC converters capable of handling wide voltage ranges and transferring power efficiently between subsystems.

High-voltage architectures reduce current requirements, minimize power loss, and reduce the weight and cost of cables and components. As a result, manufacturers are investing in modular and scalable DC-DC converter designs that can support diverse voltage platforms across vehicle models.

3. Integration with Onboard Power Electronics

Modern vehicles are becoming more electrically complex, with integrated electronic control units (ECUs), sensors, and processors that require stable and clean power. In response, DC-DC converters are being integrated into power electronics modules that include inverters, onboard chargers, and power distribution units.

This integration not only optimizes space but also enhances thermal management and improves system efficiency. The market is witnessing a rise in multi-functional converters that combine various power electronics functions into compact, lightweight packages, enabling more efficient vehicle designs.

4. Adoption of 48V Mild Hybrid Systems

Another significant trend is the adoption of 48V mild hybrid systems, especially in Europe and Asia. These systems provide a balance between cost and efficiency by offering regenerative braking, start-stop capabilities, and electric boost—without the need for a full battery pack.

DC-DC converters in these vehicles play a vital role in stepping down voltage from 48V to 12V to power traditional components. As automakers seek cost-effective paths to electrification, the demand for 48V DC-DC converters is expected to rise sharply over the next decade.

5. Emergence of Bidirectional DC-DC Converters

A rising trend in energy management is the use of bidirectional DC-DC converters, which allow power to flow both ways—enabling functionalities such as vehicle-to-grid (V2G) and vehicle-to-load (V2L). These technologies are critical for future energy ecosystems where electric vehicles act as mobile energy storage units.

Bidirectional converters are particularly relevant in commercial EVs and heavy-duty vehicles, where managing large energy loads and supporting grid interaction is a key priority. The development of smart grid-compatible converters is set to open new revenue streams and use cases for manufacturers.

6. Silicon Carbide (SiC) and GaN Technologies

The move toward wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN) is revolutionizing the DC-DC converter landscape. These materials offer superior efficiency, higher switching frequencies, reduced thermal losses, and smaller form factors compared to traditional silicon-based systems.

SiC and GaN-based converters are becoming increasingly common in premium EVs and high-performance applications. Although still more expensive, the long-term benefits in efficiency and size make them attractive for future vehicle platforms, and their adoption is expected to grow as costs come down.

7. Software-Defined Power Management

The rise of software-defined vehicles (SDVs) is bringing software intelligence to power systems. Automotive DC-DC converters are now being embedded with software controls that monitor thermal status, load requirements, and efficiency metrics in real-time.

Such smart converters can dynamically adjust voltage levels based on driving conditions, battery state, and power demand, optimizing energy use and extending vehicle range. This trend also supports predictive maintenance, reducing downtime and enhancing reliability.

8. Regulatory and Safety Standards Compliance

Compliance with automotive safety standards, such as ISO 26262 for functional safety and electromagnetic compatibility (EMC) regulations, is a growing trend. Manufacturers are investing in converters that meet rigorous safety certifications, particularly for ADAS-enabled and autonomous vehicles.

Moreover, regulations mandating high-voltage disconnects, fault isolation, and thermal monitoring are influencing the design of safer and more reliable DC-DC converters. Safety will remain a critical driver of innovation and differentiation in this space.

Conclusion

The automotive DC-DC converters market is undergoing a profound transformation, driven by electrification, digitalization, and changing mobility needs. With trends like high-voltage systems, wide-bandgap semiconductors, and software integration leading the charge, DC-DC converters are becoming smarter, more efficient, and more essential than ever before.

As the automotive world shifts toward sustainable and intelligent mobility, DC-DC converters will play a central role in shaping the vehicles of tomorrow—delivering not just power, but performance, safety, and efficiency.

0 notes

Text

AI-Driven Battery Management Systems Market 2025–2032: Trends, Opportunities, and Global Forecast

Market Dynamics Overview

The AI-driven battery management systems (BMS) market is picking up speed, mainly due to the rising demand for longer battery life, tighter safety standards, and the growing need for accurate readings of battery performance, such as state-of-charge (SOC) and state-of-health (SOH). With the increasing popularity of electric vehicles (EVs) and renewable energy systems, fast charging and advanced thermal management have become essential. AI plays a crucial role here. The market is also seeing a major shift from hardware-heavy BMS to software-defined systems, while digital twin technology is gaining traction for predictive modeling. Wireless BMS designs are also being used more widely, especially in EVs, to cut down weight. Additionally, performance-based licensing models are helping to push market growth further, especially in automotive and energy storage sectors.

Get Sample Copy @ https://www.meticulousresearch.com/download-sample-report/cp_id=6157?utm_source=Blog&utm_medium=Product&utm_campaign=SB&utm_content=21-04-2025

Key Market Drivers & Trends

Several trends are shaping the market. AI algorithms are now being used for advanced state estimation, helping ensure the safety and efficiency of battery operations. The growing reliance on digital twins for modeling battery performance allows for better prediction and monitoring. There’s also strong interest in wireless BMS technology, which reduces wiring and vehicle weight, improving overall efficiency. As EVs become more mainstream, these systems are increasingly expected to provide fast charging, long battery life, and consistent safety. Another notable trend is the move toward performance-based licensing and cloud-edge hybrid solutions that enable real-time responsiveness while continuously learning from large-scale data sources.

Key Challenges

While the outlook is positive, the industry still faces challenges. Developing and training AI models is expensive and requires large amounts of high-quality, standardized data—something that is still difficult to gather across various battery types. The challenge of deciding what processing should occur at the edge versus the cloud is ongoing, especially in time-sensitive applications. Older battery systems weren’t designed with AI in mind, so integrating new technologies into existing systems can be complex. Plus, companies still struggle with verifying the long-term accuracy and reliability of AI algorithms, making potential clients cautious about adoption.

Growth Opportunities

There are plenty of opportunities in the market. One is the reuse of EV batteries in second-life applications. Instead of recycling batteries at the end of their EV use, companies are finding ways to repurpose them for energy storage, which opens new revenue channels. Vehicle-to-grid (V2G) systems also present big opportunities, especially for utilities and grid operators. These require smart BMS capable of handling bidirectional energy flow. Battery-as-a-Service (BaaS) is another promising area—this model allows users to rent battery capacity while ensuring long-term maintenance and performance, cutting down upfront investment. BMS solutions that can handle multiple battery chemistries are also growing in demand, particularly in emerging markets, where various use cases are driving broader needs.

Market Segmentation Highlights

By Component

The Software and AI Solutions segment is set to lead in 2025 due to increasing use of predictive analytics and SOC, SOH, and remaining useful life (RUL) estimations. These software tools also manage thermal performance and cell balancing, helping systems run more efficiently and safely. Software is crucial for real-time insights, predictive maintenance, and decision-making across industries, especially in EVs and energy storage.

However, the Hardware segment is projected to grow faster through 2032. This is due to the increasing need for real-time, on-device data processing. AI-optimized processors are becoming essential, particularly for latency-sensitive applications like EVs and grid storage. In addition, smart sensors and real-time diagnostics are driving demand for advanced monitoring and control hardware.

By Services

In 2025, the Implementation & Integration Services segment is expected to dominate. This is because integrating AI into existing battery systems is complicated and requires deep technical expertise. Another important area is AI Model Training & Customization, which is seeing growth due to the need for custom-built algorithms tailored to specific battery types and use cases.

Still, the fastest-growing service area through 2032 will be Data Analytics Services. As businesses look to make better decisions using battery performance data, analytics services are helping turn raw data into actionable insights. This supports smarter maintenance, optimized performance, and better ROI across applications.

Get Full Report @ https://www.meticulousresearch.com/product/ai-driven-battery-management-systems-market 6157?utm_source=Blog&utm_medium=Product&utm_campaign=SB&utm_content=21-04-2025

By Application

Electric Vehicles are projected to hold the largest share in 2025, driven by the need for longer driving ranges, fast charging, and robust safety systems. Energy Storage Systems are also growing quickly, especially in utilities where they help manage peak demand, stabilize the grid, and integrate renewables.

But the fastest-growing application will be Data Centers. With higher power density and increasing energy demands, data centers need reliable battery backup systems. AI-powered BMS can provide real-time monitoring, predictive maintenance, and energy optimization, helping prevent downtime and reduce operational costs.

By Distribution Channel

Currently, the Direct Channel dominates, especially in applications requiring custom solutions and deep integration, such as EVs and aerospace. But the Indirect Channel is catching up quickly. As BMS technologies become more modular and easier to integrate, more solution providers and system integrators are helping deliver these products to industries like commercial storage and industrial facilities.

By End User

In 2025, Automotive Manufacturers are expected to be the largest end users. They’ve been early adopters of advanced BMS to support electric mobility at scale. Energy Companies follow, using AI-driven BMS to enhance the performance of grid-connected and renewable energy systems.

Data Centers are expected to show the highest growth, due to increasing energy costs and the need for zero power interruptions. Other growing sectors include Industrial Facilities and Telecommunications, where intelligent energy systems help maintain uptime and manage long-term energy costs.

By Geography

North America is projected to lead in market share in 2025, driven by strong EV adoption, regulatory support, and major investments in R&D. Europe follows closely, with similar trends in electrification and energy storage.

However, Asia Pacific—led by China, Japan, and South Korea—is growing the fastest. This is thanks to large-scale EV production, government backing for battery innovation, and aggressive deployments of storage technologies. Meanwhile, the Middle East & Africa is showing notable growth as countries there modernize their grid infrastructure and invest in renewable energy integration.

Competitive Landscape

The global AI-driven BMS market includes a mix of large battery manufacturers, semiconductor firms, and innovative software startups.

Established companies like CATL, LG Energy Solution, and Panasonic have a strong foothold thanks to their massive production capacity and integration of advanced software into their battery solutions. They benefit from long-term partnerships with OEMs and utility providers.

Tech-focused players like Tesla, TWAICE Technologies, and Siemens are leading with cutting-edge software capabilities. Tesla’s vertically integrated model and use of real-world driving data have set it apart. TWAICE is known for its analytics platform offering predictive maintenance, while Siemens leads in digital twin adoption for industrial uses.

The market is also seeing growing collaboration between battery makers and AI software firms. Semiconductor companies are investing heavily in processors optimized for BMS tasks, enabling cloud-to-edge integration and real-time local processing. As the market grows, issues like data ownership, algorithm transparency, and standardized performance metrics will be increasingly important.

Get Sample Copy @ https://www.meticulousresearch.com/download-sample-report/cp_id=6157?utm_source=Blog&utm_medium=Product&utm_campaign=SB&utm_content=21-04-2025

0 notes

Text

Automotive V2X Market Competitive Landscape and Strategic Insights to 2033

Introduction

The automotive industry is undergoing a significant transformation with the adoption of Vehicle-to-Everything (V2X) technology. V2X encompasses various communication systems that enable vehicles to interact with their surroundings, including other vehicles, infrastructure, pedestrians, and networks. This technology aims to enhance road safety, optimize traffic flow, and enable autonomous driving. The global automotive V2X market is rapidly growing, driven by advancements in connected vehicle technologies, the rise of smart transportation systems, and regulatory support for intelligent transportation solutions.

What is Automotive V2X?

Automotive V2X (Vehicle-to-Everything) is a communication system that allows vehicles to exchange real-time information with different entities. It comprises several components:

Vehicle-to-Vehicle (V2V): Enables communication between vehicles to share data on speed, location, and road conditions, reducing the risk of collisions.

Vehicle-to-Infrastructure (V2I): Facilitates communication between vehicles and traffic infrastructure, such as traffic lights, road signs, and toll stations, improving traffic management.

Vehicle-to-Pedestrian (V2P): Enhances pedestrian safety by alerting both vehicles and pedestrians about potential hazards.

Vehicle-to-Network (V2N): Connects vehicles to cloud-based services, enabling navigation, remote diagnostics, and entertainment.

Vehicle-to-Grid (V2G): Allows electric vehicles to interact with the power grid for energy distribution and demand response.

Download a Free Sample Report:-https://tinyurl.com/35cwf34k

Market Drivers

Several factors are fueling the growth of the automotive V2X market:

Rising Demand for Road Safety

With increasing traffic congestion and road accidents, governments and automotive manufacturers are focusing on V2X solutions to improve road safety. By enabling real-time data exchange, V2X helps prevent accidents and reduces fatalities.

Advancements in Connected and Autonomous Vehicles

The development of autonomous and connected vehicles heavily relies on V2X technology. Enhanced vehicle communication systems allow self-driving cars to make informed decisions, ensuring smooth and safe operation.

Government Regulations and Policies

Governments worldwide are promoting the adoption of V2X technology through regulations and infrastructure investments. For instance, the European Union and the U.S. Department of Transportation have introduced policies to mandate V2X implementation in new vehicles.

5G and Edge Computing Integration

The introduction of 5G networks and edge computing is accelerating V2X deployment. Low-latency, high-speed connectivity enhances real-time data exchange, making V2X more efficient and reliable.

Smart Cities and Intelligent Transportation Systems

V2X is a crucial component of smart city initiatives, enabling intelligent traffic management and reducing congestion. Governments are investing in smart infrastructure to integrate V2X solutions into urban mobility frameworks.

Market Challenges

Despite its potential, the automotive V2X market faces several challenges:

High Implementation Costs

Deploying V2X infrastructure requires significant investment in communication networks, roadside units, and vehicle integration, posing a challenge for widespread adoption.

Cybersecurity Risks

Since V2X systems rely on continuous data exchange, they are vulnerable to cyber threats. Ensuring robust cybersecurity measures is essential to prevent hacking and data breaches.

Interoperability Issues

Standardization and compatibility between different V2X technologies (such as DSRC and C-V2X) remain a challenge. Collaboration between stakeholders is crucial to establish universal standards.

Limited Infrastructure in Developing Regions

Developing economies may face difficulties in adopting V2X due to inadequate infrastructure and lack of investment in smart transportation systems.

Key Players in the Automotive V2X Market

The global automotive V2X market includes major technology companies, automotive manufacturers, and infrastructure providers. Some of the key players include:

Qualcomm Technologies, Inc.

Continental AG

Robert Bosch GmbH

Autotalks Ltd.

Denso Corporation

Infineon Technologies AG

Intel Corporation

Harman International

NXP Semiconductors

These companies are investing heavily in research and development to enhance V2X capabilities and drive market expansion.

Market Segmentation

The automotive V2X market is segmented based on communication type, connectivity technology, vehicle type, and region.

By Communication Type

V2V (Vehicle-to-Vehicle)

V2I (Vehicle-to-Infrastructure)

V2P (Vehicle-to-Pedestrian)

V2N (Vehicle-to-Network)

V2G (Vehicle-to-Grid)

By Connectivity Technology

Dedicated Short-Range Communications (DSRC)

Cellular V2X (C-V2X)

By Vehicle Type

Passenger Vehicles

Commercial Vehicles

By Region

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

Future Outlook

The future of the automotive V2X market is promising, with significant developments expected in the coming years. Some key trends include:

Increased Adoption of 5G and AI: The integration of 5G and artificial intelligence (AI) will enhance the efficiency of V2X communication, making it faster and more reliable.

Expansion of Smart Infrastructure: Governments will continue investing in smart transportation infrastructure to support V2X adoption.

Rise of Autonomous Vehicles: As self-driving technology advances, V2X will play a crucial role in enabling safe and efficient autonomous driving.

Growing Partnerships and Collaborations: Automakers, tech companies, and governments will collaborate to accelerate V2X implementation and standardization.

Conclusion

The automotive V2X market is poised for significant growth, driven by advancements in connectivity, autonomous driving, and smart transportation systems. While challenges such as high implementation costs and cybersecurity concerns remain, ongoing technological developments and regulatory support will drive market expansion. As V2X continues to evolve, it will play a crucial role in shaping the future of mobility, making transportation safer, smarter, and more efficient.Read Full Report:-https://www.uniprismmarketresearch.com/verticals/automotive-transportation/automotive-v2x

0 notes

Text

Upcoming Third-Generation Nissan Leaf 2026: Here's Whats New

Introduction

The automotive industry is rapidly evolving, and Nissan is at the forefront of this transformation. With the anticipated launch of the third-generation Nissan Leaf in 2026, the future of electric vehicles (EVs) looks more promising than ever. This upcoming iteration of the Leaf is expected to set new benchmarks in technology, range, design, and sustainability, making it a formidable contender in the EV market.

Revolutionary Design and Aerodynamics

Nissan has always been a pioneer in electric mobility, and the 2026 Nissan Leaf is expected to showcase a bold, futuristic design. Leaked renders and early concept images suggest a more aerodynamic body with sleek LED lighting, a minimalist grille, and a modernized silhouette. The focus on aerodynamics will not only enhance aesthetics but also improve efficiency by reducing drag, leading to better range and performance.

Enhanced Battery and Range

One of the most crucial factors in an EV’s success is its range, and Nissan aims to make significant improvements in this area. The third-generation Leaf is rumored to feature a high-capacity battery, potentially exceeding 80 kWh, offering an estimated range of 300+ miles on a single charge. This leap in battery technology will make the Leaf more competitive with Tesla and other leading EV manufacturers.

Cutting-Edge Technology and Features

The 2026 Nissan Leaf is expected to come loaded with advanced technology. Some key highlights include:

Autonomous Driving Features: Nissan’s ProPILOT 2.0 is likely to be integrated, offering enhanced self-driving capabilities, improved lane-keeping, and adaptive cruise control.

Next-Gen Infotainment System: A revamped user interface with a larger touchscreen, AI-based voice commands, and seamless smartphone integration.

Vehicle-to-Grid (V2G) Capabilities: The new Leaf could support bidirectional charging, allowing users to power their homes using their car’s battery.

Sustainable Interior Materials: Nissan may introduce eco-friendly materials, such as recycled plastics and vegan leather, aligning with global sustainability efforts.

Improved Charging Infrastructure

Charging convenience is a significant factor influencing EV adoption. The third-gen Nissan Leaf is expected to support ultra-fast charging, enabling an 80% charge in under 30 minutes with a high-power DC charger. Nissan is also investing in expanding its global charging network, ensuring that Leaf owners have easy access to charging stations wherever they go.

Competitive Pricing and Market Positioning

Nissan has built a reputation for delivering affordable yet high-quality EVs. The 2026 Nissan Leaf is expected to remain competitively priced, making it accessible to a broader audience. With government incentives and the growing affordability of EVs, this model could attract both new and existing EV enthusiasts.

The Future of EVs with Nissan

The launch of the third-generation Nissan Leaf in 2026 is a testament to the automaker’s commitment to innovation and sustainability. With its improved range, cutting-edge features, and eco-friendly advancements, the new Leaf is poised to play a crucial role in the EV revolution.

As the automotive industry shifts towards an electrified future, the Nissan Leaf continues to be a trailblazer, proving that electric mobility is not just a trend but a long-term solution. Keep an eye out for more updates on the 2026 Nissan Leaf, as it could redefine the EV landscape for years to come.

0 notes

Text

Vehicle-to-Grid (V2G) Market to Expand at 31.5% CAGR Through 2032

Astute Analytica research report titled "Global Vehicle-to-Grid (V2G) Market Report 2024" presents an exhaustive analysis and strategic insights into the evolving landscape of the Vehicle-to-Grid (V2G) market. This report offers a deep dive into various facets of the market, including its size, projected growth, and the key trends that are currently shaping the industry. By providing a detailed examination of the market's framework, the report serves as an essential resource for stakeholders looking to navigate the complexities of this dynamic sector.

Global Vehicle-to-Grid (V2G) market was valued at US$ 308.0 million in 2023 and is projected to hit the market valuation of US$ 3,621.4 million by 2032 at a CAGR of 31.5% during the forecast period 2024–2032.

A Request of this Sample PDF File@- https://www.astuteanalytica.com/request-sample/vehicle-to-grid-v2g-market

Market Size and Growth Projections

According to the findings presented in the report, the global Vehicle-to-Grid (V2G) market is projected to achieve a valuation of US$ 3,621.4 million by 2032. This translates to a robust compound annual growth rate (CAGR) of 31.5% from 2025 to 2033, indicating significant market expansion. Notably, the market was valued at US$ 308.0 million in 2023, highlighting a consistent upward trajectory in its financial performance. Such growth can be attributed to various factors, including technological advancements, increasing digitalization, and rising demand for effective Vehicle-to-Grid (V2G) strategies in marketing.

Factors Influencing the Market

The report provides a thorough exploration of the internal and external factors that are anticipated to influence the Vehicle-to-Grid (V2G) market. On the external front, it assesses the market environment, competitive landscape, and broader economic and regulatory conditions. These elements are crucial as they can significantly impact the performance and sustainability of businesses operating in this space.

Internally, the report delves into the operational efficiencies, technological capabilities, and organizational structures that characterize the Vehicle-to-Grid (V2G) industry. By analyzing these internal dynamics, the report sheds light on how they contribute to the market's overall performance and competitive edge. Understanding these factors is vital for stakeholders seeking to optimize their strategies and enhance their market positions.

Market Segmentation and Analysis

In its quest for a granular understanding of the Vehicle-to-Grid (V2G) market, the report segments the industry into various categories. This segmentation facilitates a more detailed analysis of the dynamics within each segment, allowing stakeholders to identify specific growth opportunities and challenges. By breaking down the market, the report aids in crafting targeted strategies tailored to the unique characteristics of each segment.

By Vehicle Type

Battery Electric Vehicles (BEVs)

Plug-In Hybrid Electric Vehicles (PHEVs)

Fuel Cell Vehicles (FCVs)

By Solution Type

Hardware

Electric Vehicle Supply

Equipment (EVSE)

Smart Meters

V2G chargers

Software

V2G program administration

Dynamic load management system

Services

By Charging Type

Unidirectional

Bidirectional

By Application

Peak Power Sales

Spinning Reserves

Base Load Power

Others

By Region

North America

The U.S.

Canada

Mexico

Europe

Western Europe

U.K.

Germany

France

Spain

Italy

Rest of Western Europe

Eastern Europe

Poland

Russia

Rest of Eastern Europe

Asia Pacific

China

India

Japan

Australia & New Zealand

ASEAN

Rest of Asia Pacific

Middle East & Africa (MEA)

UAE

Saudi Arabia

South Africa

Rest of MEA

South America

Argentina

Brazil

Rest of South America

Geographical Segmentation

The report further segments the market into geographical regions, including North America, South America, Asia, Europe, Africa, and Others. Each region is examined with a focus on key countries, providing insights into the current market size and forecasts extending until 2033. This geographical breakdown is critical for understanding regional market dynamics and tailoring strategies to meet local demands effectively.

For Purchase Enquiry: https://www.astuteanalytica.com/industry-report/vehicle-to-grid-v2g-market

Competitive Landscape

A significant portion of the report is dedicated to analyzing the competitive landscape within the global Vehicle-to-Grid (V2G) market. This includes a comprehensive examination of leading Vehicle-to-Grid (V2G) product vendors, highlighting their latest developments and market shares in terms of shipment and revenue. By profiling these major players, the report offers valuable insights into their product portfolios, technological capabilities, and overall market positioning.

The report identifies key players in the Vehicle-to-Grid (V2G) market, providing a closer look at their contributions to the industry. This competitive profiling is essential for understanding the strengths and weaknesses of various companies, enabling stakeholders to make informed decisions and devise effective strategies in a crowded marketplace.

Nissan Motor Corporation

Mitsubishi Motors Corporation

NUVVE Corporation

ENGIE Group

OVO Energy Ltd.

Groupe Renault

Honda Motor Co., Ltd.

Hyundai Motor Company

Edison International.

DENSO Co.

Boulder Electric Vehicle

EV Grid

Hitachi

Next Energy

NRG Energy

OVO Energy Ltd.

Other Prominent Players

Download Sample PDF Report@- https://www.astuteanalytica.com/request-sample/vehicle-to-grid-v2g-market

About Astute Analytica:

Astute Analytica is a global analytics and advisory company that has built a solid reputation in a short period, thanks to the tangible outcomes we have delivered to our clients. We pride ourselves in generating unparalleled, in-depth, and uncannily accurate estimates and projections for our very demanding clients spread across different verticals. We have a long list of satisfied and repeat clients from a wide spectrum including technology, healthcare, chemicals, semiconductors, FMCG, and many more. These happy customers come to us from all across the globe.

They are able to make well-calibrated decisions and leverage highly lucrative opportunities while surmounting the fierce challenges all because we analyse for them the complex business environment, segment-wise existing and emerging possibilities, technology formations, growth estimates, and even the strategic choices available. In short, a complete package. All this is possible because we have a highly qualified, competent, and experienced team of professionals comprising business analysts, economists, consultants, and technology experts. In our list of priorities, you-our patron-come at the top. You can be sure of the best cost-effective, value-added package from us, should you decide to engage with us.

Get in touch with us

Phone number: +18884296757

Email: [email protected]

Visit our website: https://www.astuteanalytica.com/

0 notes

Text

Servotech Partners with France’s Watt & Well to Revolutionize India’s EV Charging Industry

In a major step toward strengthening India’s electric vehicle (EV) ecosystem, Servotech Renewable Power System Ltd. has announced a strategic collaboration with the France-based Watt & Well SAS. This partnership is set to drive the development and manufacturing of cutting-edge EV charger components in India, marking a significant milestone in the country’s push toward self-reliance in e-mobility infrastructure.

Servotech, a prominent player in the sustainable energy sector, has joined forces with Watt & Well, a leader in power electronics solutions catering to industries such as aerospace, oil and gas, renewables, and e-mobility. The agreement will see the two companies working closely to design and produce a state-of-the-art 30kW power module tailored for India’s rapidly expanding EV charging market. Additionally, they will explore the feasibility of developing a bidirectional power module for Vehicle-to-Grid (V2G) applications, an innovation that could reshape energy distribution in the country.

As part of the agreement, Servotech will take the lead in manufacturing these power modules in India, aligning with the government’s "Make in India" initiative. Watt & Well, on the other hand, will provide comprehensive technical support, ensuring that the products meet international quality standards while being optimized for local conditions. Furthermore, Servotech has secured exclusive rights to market and distribute these components across the Indian market, positioning itself at the forefront of the domestic EV charging industry.

Raman Bhatia, Founder and Managing Director of Servotech Renewable Power System Ltd., expressed his enthusiasm about the partnership, stating that the collaboration with Watt & Well would not only enhance Servotech’s product offerings but also contribute to the localization of advanced EV charging technology. He emphasized that reducing dependency on imports and fostering indigenous manufacturing would ultimately help India establish itself as a global hub for EV charger production.

Echoing this sentiment, Benoit Schmitt, CEO of Watt & Well SAS, highlighted the immense potential of India’s EV sector. He underscored the importance of local production in accelerating EV adoption and reiterated that this partnership would play a key role in supporting India’s clean energy goals. By leveraging their expertise in power electronics, Watt & Well aims to bring world-class technology to Indian consumers while bolstering the country’s manufacturing capabilities.

This partnership arrives at a crucial time, as India’s EV market continues to witness exponential growth, driven by favorable government policies, increasing consumer adoption, and a rising demand for reliable charging infrastructure. With Servotech’s established expertise in the electronics domain and Watt & Well’s technological prowess, this alliance is expected to set new benchmarks for EV charging solutions in India.

As the collaboration progresses, both companies are set to unveil innovative solutions that could redefine the Indian EV charging landscape. By focusing on advanced power modules and bidirectional charging technologies, they aim to address key challenges such as charging efficiency, infrastructure scalability, and energy sustainability.

With this landmark agreement, Servotech Renewable Power System Ltd. not only strengthens its position in the EV market but also takes a decisive step toward creating a self-sufficient and technologically advanced charging infrastructure in India.

0 notes

Text

Electric Mobility Market: The Charge Toward a Greener Future (2024-2033)

Electric Mobility Market : Electric mobility (e-mobility) is rapidly transforming the way we think about transportation, offering sustainable, cost-effective solutions that are crucial for reducing our carbon footprint. E-mobility encompasses a wide range of electric vehicles (EVs), including electric cars, bikes, scooters, buses, and trucks, all of which are powered by electricity rather than fossil fuels. As global concerns about climate change intensify, the shift towards e-mobility is seen as a critical step in achieving cleaner air, reducing greenhouse gas emissions, and promoting sustainable urban living. Governments and organizations worldwide are investing in EV infrastructure, such as charging stations and incentives, making electric mobility more accessible than ever.

To Request Sample Report: https://www.globalinsightservices.com/request-sample/?id=GIS21754 &utm_source=SnehaPatil&utm_medium=Article

The adoption of electric mobility is fueled by technological advancements in battery performance, energy efficiency, and charging speed. New innovations in battery technology, such as solid-state batteries, are extending the range of electric vehicles and reducing charging times, addressing some of the key challenges that previously hindered mass adoption. Additionally, electric vehicles are becoming more affordable, with an expanding range of options that cater to various consumer needs. Whether for personal use, public transportation, or commercial logistics, e-mobility is poised to revolutionize every sector of transportation.

As the demand for electric mobility continues to grow, the industry is driving new trends in sustainability, urban planning, and energy management. The rise of smart cities is closely tied to the integration of e-mobility, as advanced technologies like autonomous driving, vehicle-to-grid (V2G) systems, and renewable energy integration are reshaping the future of transportation. With the potential to not only reduce environmental impact but also improve the efficiency and convenience of urban transport, electric mobility is paving the way for a cleaner, greener, and more connected world.

#ElectricMobility #SustainableTransport #Evehicles #GreenEnergy #EVRevolution #ZeroEmissions #ElectricCars #SmartCities #CleanTransportation #BatteryTechnology #ElectricScooters #SustainableFuture #EVInfrastructure #GreenMobility #ElectricBikes #CarbonFreeTransport #FutureOfTransport #ElectricTrucks #RenewableEnergy #CleanTech

0 notes

Text

Driving the Future: Key Trends in the Automotive On-Board Charger Market

The Automotive On-board Charger Market is projected to be valued at USD 6.86 billion in 2024 and is anticipated to grow to USD 12.27 billion by 2029, with a compound annual growth rate (CAGR) of 13.24% over the forecast period (2024-2029).

The Automotive On-Board Charger (OBC) Market is experiencing robust growth, primarily driven by the rapid adoption of electric vehicles (EVs) across the globe. According to Mordor Intelligence, the increasing demand for sustainable transportation solutions is compelling automakers to innovate in battery charging technologies, positioning on-board chargers as a critical component in the evolving EV ecosystem.

Key Market Drivers:

Rising Electric Vehicle Sales: As governments globally push for stricter emission regulations and offer incentives to promote EV adoption, the market for on-board chargers is seeing significant demand growth. The rising popularity of plug-in hybrid vehicles (PHEVs) and battery electric vehicles (BEVs) further propels the market forward.

Technological Advancements: Innovations such as higher charging capacity and integration of bidirectional charging capabilities (V2G - Vehicle to Grid) are key trends in the market. Modern OBCs are becoming more efficient, compact, and cost-effective, making them appealing for automakers aiming to enhance vehicle performance.

Government Policies & Incentives: Governments around the world are offering subsidies and tax rebates for the purchase of EVs. Additionally, infrastructure improvements, such as expanding charging stations, complement the growth of the OBC market. In regions like Europe and China, stricter emissions standards are directly influencing the market's expansion.