#HS.125

Explore tagged Tumblr posts

Text

Hawker in the setting sun at Scottsdale

#Hawker Siddeley#HS.125#Hawker#Siddeley#Scottsdale#SDL#airport#bizjet#Business jet#executive aircraft#plane#aviation

6 notes

·

View notes

Text

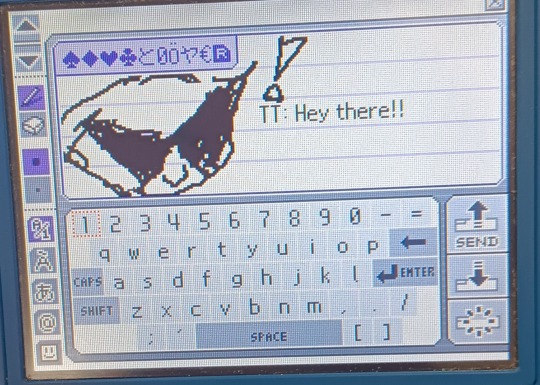

Day 125

He's so excited to see you

#homestuck#dirk strider#adj. dailys#homestuck dirk#hs dirk#day 125#pictochat#this was my friends dsi

19 notes

·

View notes

Note

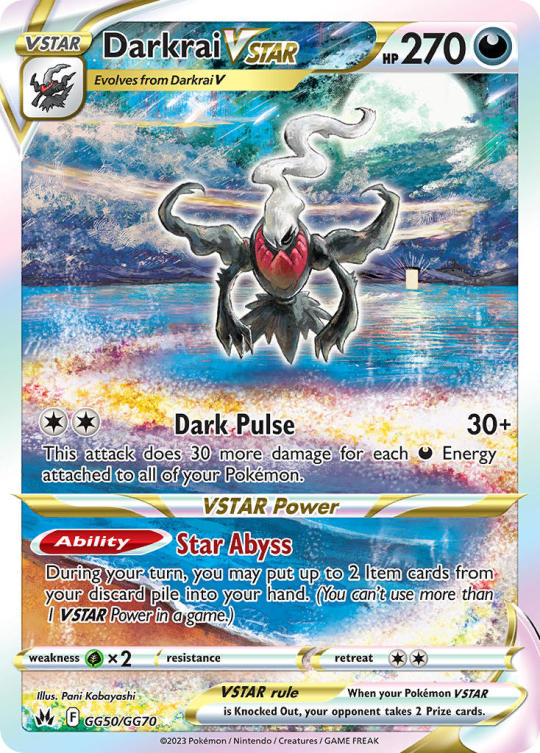

If you're still ranking pokemon tcg art, could you do darkrai?

decided gen 4 was due a turn next and skimmed through all the gen 4 requests i've had, decided to pick whichever mon had my favourite cards.

it wasn't even close. darkrai has some MAGNIFICENT cards oh my god

FULL TCG RANKINGS MASTERPOST

10. Umbreon & Darkrai GX (illus. Mitsuhiro Arita, Sun & Moon - Unified Minds 125/236)

9. Darkrai (illus. 5ban Graphics, Black & White Promo #73)

8. Darkrai (illus. Naoki Saitou, Sun & Moon - Ultra Prism 77/156)

7. Darkrai (illus. nagimiso, Sword & Shield - Darkness Ablaze 105/189)

6. Darkrai (illus. kawayoo, X & Y Promo #114)

5. Umbreon & Darkrai GX (illus. so-taro, Sun & Moon Promo #241)

4. Darkrai (illus. Uta, Sword & Shield - Fusion Strike 167/264)

3. Darkrai VSTAR (illus. Poni Kobayashi, Crown Zenith GG50/GG70)

2. Darkrai EX (illus. Oswaldo KATO, Pokemon TCG Pocket - Spacetime Smackdown 202/155)

1. Darkrai & Cresselia Legend (illus. Shinji Higuchi & Noriko Takaya, HS Triumphant 99 & 100/102)

90 notes

·

View notes

Text

1975 ad for Matchbox Kits featuring the Hawker Siddeley HS 125, the Sd-Kfz 234/2 Puma armoured car and the Sd-Kfz 124 Wespe (Wasp) self-propelled gun.

7 notes

·

View notes

Note

hello! i LOVE your stuff! sorry if this info is easily accessible, but what camera do you use for your photography?

specifically for pictures like this https://fruitstickerr.tumblr.com/post/732246307160408064/silly-guys-on-my-phone-%F0%96%A6%B9

thank you!!

Hi!! sorry for only getting to this now, i've been on vacation the past week and only opened tumblr now!

no worries about asking, it's a digicam from the early 2010s, the canon ixus 125 hs!

10 notes

·

View notes

Text

Know Your Body: Essential Biochemistry Tests Explained

🧪 1. Liver Function Tests (LFT)

Used to assess liver health and function:

ALT (Alanine Transaminase)

AST (Aspartate Transaminase)

ALP (Alkaline Phosphatase)

GGT (Gamma-glutamyl Transferase)

Total Bilirubin

Direct (Conjugated) Bilirubin

Albumin

Total Protein

🧪 2. Kidney Function Tests (Renal Panel)

Evaluate kidney function and electrolyte balance:

Urea (BUN - Blood Urea Nitrogen)

Creatinine

Uric Acid

Electrolytes:

Sodium (Na⁺)

Potassium (K⁺)

Chloride (Cl⁻)

Bicarbonate (HCO₃⁻)

Calcium (Ca²⁺)

Phosphorus (PO₄³⁻)

Magnesium (Mg²⁺)

🧪 3. Blood Glucose and Diabetes Tests

Detect and monitor blood sugar levels:

Fasting Blood Sugar (FBS)

Random Blood Sugar (RBS)

Postprandial Blood Sugar (PPBS)

HbA1c (Glycated Hemoglobin)

Oral Glucose Tolerance Test (OGTT)

🧪 4. Lipid Profile

Evaluates heart disease risk:

Total Cholesterol

HDL (High-Density Lipoprotein)

LDL (Low-Density Lipoprotein)

Triglycerides

VLDL (Very Low-Density Lipoprotein)

🧪 5. Thyroid Function Tests (TFT)

Check thyroid gland performance:

TSH (Thyroid Stimulating Hormone)

Free T3 (Triiodothyronine)

Free T4 (Thyroxine)

🧪 6. Cardiac Markers

Help diagnose heart attack and heart diseases:

Troponin I/T

CK-MB (Creatine Kinase-MB)

LDH (Lactate Dehydrogenase)

BNP / NT-proBNP

🧪 7. Pancreatic Function Tests

Assess pancreatic health:

Serum Amylase

Serum Lipase

🧪 8. Bone Profile

Important for bone health:

Calcium (Total & Ionized)

Phosphorus

Vitamin D (25-OH Vitamin D)

Parathyroid Hormone (PTH)

Alkaline Phosphatase (ALP)

🧪 9. Protein and Nutritional Tests

Evaluate nutritional and protein status:

Serum Albumin

Serum Globulin

Total Protein

Prealbumin

Ferritin

Vitamin B12

Folate

🧪 10. Hormone Tests

For reproductive and endocrine health:

Insulin

Cortisol

Testosterone

Estrogen (Estradiol)

FSH (Follicle-Stimulating Hormone)

LH (Luteinizing Hormone)

Prolactin

Progesterone

DHEA-S

🧪 11. Tumor Markers

Screen for or monitor cancer:

AFP (Alpha-Fetoprotein)

CEA (Carcinoembryonic Antigen)

CA-125 (Ovarian cancer)

CA 19-9 (Pancreatic cancer)

PSA (Prostate-Specific Antigen)

Beta-hCG

🧪 12. Others

CRP (C-Reactive Protein)

hs-CRP (High sensitivity CRP)

ESR (Erythrocyte Sedimentation Rate)

Lactate (for sepsis/anaerobic metabolism)

All Human Biochemistry Tests Explained – Get Yours Done at BloodTestDhaka.com in Dhaka, Bangladesh

0 notes

Text

Mudança climática está estragando os alimentos mais rapidamente; veja como evitar

News https://portal.esgagenda.com/mudanca-climatica-esta-estragando-os-alimentos-mais-rapidamente-veja-como-evitar/

Mudança climática está estragando os alimentos mais rapidamente; veja como evitar

Escrito en MEIO AMBIENTE E SUSTENTABILIDADE el 28/4/2025 · 11:15 hs

Pesquisadores alertam que o aquecimento global está facilitando a contaminação dos alimentos por bactérias e outros germes, colocando em risco a saúde de milhões de pessoas todos os anos.

O aumento do calor, das inundações e das secas frequentes está acelerando a deterioração dos alimentos e ampliando o risco de surtos de doenças transmitidas pela comida. A OMS estima que 600 milhões de pessoas adoecem por esse motivo a cada ano, com 420 mil mortes — 125 mil delas entre crianças menores de cinco anos.

Estudos mostram que, a cada aumento de 1°C na temperatura, o risco de infecção por salmonela e campylobacter cresce 5%. Calor extremo acelera a multiplicação de bactérias em produtos perecíveis como carnes, laticínios e frutos do mar. A alta umidade também favorece o crescimento de patógenos em hortaliças consumidas cruas.

Leia também: Com 2ºC a mais, áreas inabitáveis podem alcançar o tamanho do Brasil

No México, uma pesquisa associou os surtos de salmonela a regiões com temperaturas acima de 35°C e alta precipitação. Outro estudo recente concluiu que as mudanças climáticas devem intensificar ainda mais as doenças causadas pela Salmonella enterica, que hoje já afeta cerca de 1,2 milhão de pessoas por ano apenas nos EUA.

Durante ondas de calor, alimentos prontos para consumo ficam ainda mais vulneráveis, alerta Hudaa Neetoo, professora associada da Universidade de Maurício. “Sem uma etapa final de aquecimento, microrganismos patogênicos podem atingir níveis suficientes para causar doenças”, explica.

Leia também: Chuvas e enchentes: Brasil tem 1 em cada 3 cidades sem sistema de drenagem

Inundações

As inundações, além de danificar plantações, levam esgoto e esterco para os campos, contaminando vegetais e frutas. A lavagem caseira, sozinha, não elimina todos os riscos. Em casos mais graves, patógenos podem penetrar nas raízes das plantas, tornando a descontaminação quase impossível.

O uso de águas residuais tratadas na irrigação, prática comum em áreas com escassez de água, também traz riscos. Martin Richter, do Instituto Federal Alemão de Avaliação de Riscos, lembra que até uma única cópia de um patógeno pode causar infecção. “Água doce deve ser priorizada para culturas consumidas cruas”, recomenda.

As recomendações incluem consumir alimentos frescos, armazená-los corretamente e evitar o reaproveitamento de sobras. Também é necessário investir em infraestrutura para resistir a eventos extremos, melhorar o monitoramento de doenças e desenvolver novas técnicas de descontaminação.

Especialistas destacam ainda a necessidade de mudar a percepção pública: “Muitos ainda acham que só o manuseio inadequado contamina os alimentos”, diz Hamad, da Universidade Benha, no Egito. “Poucos reconhecem que o clima tem impacto direto no que comemos e em nossa saúde.”

Leia também: Crise climática: 400 mil pessoas sofrem com inundações e tempestades mortais na Europa

*Com informações de Lives Science

Comunicar erro Encontrou um erro na matéria? Ajude-nos a melhorar

0 notes

Text

Buy Genuine Hero Spare Parts Online at Smart Parts Exports

When it comes to maintaining the production, safety, along with resilience of your Hero two-wheeler, make use of genuine Hero spare parts is required. Whether you own a Hero Splendor, Passion Pro, HF Deluxe, Glamour, or a part of another model, keeping your bike in top order is dependent on the classification of parts you use. That’s where Smart Parts Exports comes in — your one-stop shop to buy Hero Spare Parts Online at aggressive cost with international shipping.

Why Choose Genuine Hero Spare Parts?

Hero MotoCorp is one of the great two-wheelers in the world, known for reliability, fuel organization, and value for money. Nonetheless, even the best automobile stands to be involved in timely substitution of parts due to wear and tear.. Using genuine Hero spare parts ensures:

Long-lasting performance: OEM parts are designed specifically for Hero models.

Perfect compatibility: No guesswork or modifications needed.

Safety and durability: Tested for road safety and high-performance standards.

Maintained resale value: Bikes with original parts fetch better value.

At Smart Parts Exports, we offer only 100% genuine Hero spare parts, sourced directly from authorized suppliers in India.

Buy Hero Spare Parts Online – Easy, Fast, and Reliable

Gone are the days when you had to visit multiple local dealers or wait for weeks to get your required spare parts. Smart Parts Exports brings the entire range of Hero spare parts online. Whether you’re a retailer, distributor, mechanic, or a bike owner, you can conveniently order Hero parts from our website and get them delivered anywhere in the world.

Here’s how we make it simple:

Easy-to-navigate website: Our user-friendly platform makes having a look together with ordering smooth.

Detailed product listings: Including part numbers, specifications, and compatibility.

Secure payments: Multiple international payment options.

Global shipping: We deliver Hero parts across Africa, the Middle East, Asia, Europe, and more.

Trusted by exporters worldwide: We are a leading name in the auto parts export business from India.

Explore the Complete E Catalog Hero at Smart Parts Exports

To help you find the exact part you need, we offer a comprehensive e catalog Hero that lists thousands of parts by model and category. Whether you’re searching for:

Engine components

Brake and clutch parts

Electrical parts and wiring

Suspension and chassis parts

Body panels and accessories

Filters and cables

…you’ll find everything in our Hero spare parts e catalog. This digital catalog is updated regularly to include the latest part numbers and new model releases.

Hero Spare Parts Available for All Popular Models

We cover the full range of Hero motorcycles and scooters, including:

For Hero Motorcycles:

Splendor Plus / Super Splendor

Passion Pro / Passion XPro

HF Deluxe / HF 100

Glamour / Glamour Xtec

Xtreme 160R / Xtreme Sports

XPulse 200 / Xtreme 200S

For Hero Scooters:

Maestro Edge / Duet

Pleasure / Pleasure Plus

Destini 125 / Maestro Edge 125

Whether you need a replacement for a broken lever, a worn-out chain kit, a headlight, or a carburetor, Smart Parts Exports ensures fast access to Hero spare parts online in just a few clicks.

Advantages of Ordering from Smart Parts Exports

Bulk orders welcome – Perfect for dealers and importers.

Export documentation support – We help you with invoices, packing lists, and HS codes.

Real-time support – Chat with our team to identify the correct part for your Hero vehicle.

Custom packaging – Safe and secure packing for international shipping.

Fast dispatch – We maintain ready stock of most fast-moving Hero spare parts.

Our commitment to quality and service makes us one of the top exporters of Hero spare parts online from India.

Stay Updated with Our E Catalog Hero and Blog

We believe in empowering our customers with information. That’s why we regularly update our e catalog Hero and blog with insights on part numbers, new model compatibility, maintenance tips, and more. If you’re unsure about the right part for your Hero bike or need help cross-referencing parts, our blog and support team are here to help.

Get Started with Smart Parts Exports Today

No matter where you are in the world, Smart Parts Exports brings the world of genuine Hero spare parts to your doorstep. Trusted by hundreds of importers, workshops, and retailers globally, we are your most reliable partner for Hero spare parts online.

Conclusion

When it comes to keeping your Hero motorcycle or scooter, find an answer for anything less than genuine Hero spare parts that can agree on protection, showing, and longevity. At Smart Parts Exports, we make it easy and reliable to buy Hero spare parts online, no matter where you are in the world. With our comprehensive e catalog Hero, global shipping, and expert support, you get the right parts at the right price—every time.

Choose Smart Parts Exports as your trusted export partner for all Hero two-wheeler spare parts. Experience fast service, authentic parts, and hassle-free international delivery—all from the comfort of your home or office.

Order genuine Hero spare parts online today and keep your Hero bike running like new.

0 notes

Photo

The recent imposition of a 125 per cent tariff increase on Chinese textile and apparel products by the United States marks a significant turning point in global trade dynamics. In textile and apparel products, the tariff is likely to disrupt China’s price advantage, with potential gains for Vietnam, Bangladesh, and other nations with established trade ties with the US.President Donald Trump’s recent decision to impose, effective April 10, a sweeping 125 per cent tariff on Chinese textile and apparel imports—compared to a mere 10 per cent duty on comparable goods from all other countries—has severely undermined China’s price competitiveness in the US market. This enormous tariff disparity makes Chinese products vastly more expensive than those of other suppliers, effectively pricing many Chinese goods out of contention. US importers are expected to respond by shifting orders to alternative sourcing markets to avoid the exorbitant costs, especially favouring suppliers in low-cost manufacturing countries with well-established trade ties to the United States.The imposition of a 125 per cent US tariff on Chinese apparel significantly undermines China's pricing advantage, causing importers to seek alternative sources. Countries like Vietnam, Bangladesh, and Indonesia stand to gain notably across multiple apparel categories. This trade shift presents substantial opportunities for nations with robust apparel manufacturing sectors and established trade with US. Figure 1 Source: TexProIn 2024, the United States imported apparel worth $72.99 billion from its top 15 exporting partners, accounting for approximately 87.2 per cent of its total apparel imports. China remained the leading exporter with $18.39 billion, representing 22 per cent of the market share, followed closely by Vietnam at $15.33 billion (18 per cent) and Bangladesh at $7.40 billion (9 per cent). India ranked fourth with $4.93 billion (6 per cent), showcasing its growing influence in the global apparel trade. Other significant contributors included Indonesia, Cambodia, and several Central American nations, reflecting the diversified sourcing strategy of the US apparel industry.Impact on apparel productsFibre2Fashion examines the potential impact on key apparel categories—such as jerseys, trousers, hosiery, and undergarments—among China’s top exports to the US. The imposition of steep tariffs on these products is likely to significantly drive up the cost of Chinese goods in the US market, undermining one of China’s main competitive advantages: low pricing. As China grapples with this substantial setback, countries with lower tariff exposure (around 10 per cent), robust manufacturing capabilities, and well-established trade relationships with the US are well positioned to gain from the resulting shift in sourcing strategies. Table 1: US’ top 15 apparel imports (6-digit HS code) from China, total export values, competitors, initial and new tariff rates and tariff comparison in % Source: TexProThe recent imposition of substantial tariffs by the United States on Chinese textile and apparel imports has significantly altered global trade dynamics, particularly affecting China’s competitiveness in the US market. This shift presents opportunities for other manufacturing countries to capture increased market share across various product categories. Below is an analysis of the impact on specific apparel segments:1. Hosiery (HS 611596) 2024 US Import Data: Total imports were valued at $1,532.77 million, with China contributing $1,095.28 million. Tariff Impact: An 849 per cent tariff increase on Chinese hosiery has made these products considerably more expensive. Beneficiary Countries: Vietnam, Pakistan, and El Salvador are poised to benefit. Vietnam, with its robust hosiery manufacturing infrastructure and competitive pricing, is particularly well positioned to capture a larger market share.2. Cotton Pullovers and Cardigans (HS 611020) 2024 US Import Data: Total imports stood at $7,411.20 million, with China accounting for $1,043.15 million. Tariff Impact: A 1,263 per cent tariff increase on Chinese imports creates opportunities for other suppliers. Beneficiary Countries: Vietnam, Cambodia, and Bangladesh are likely to gain. Vietnam’s established cotton garment industry positions it to capture a significant share, while Cambodia and Bangladesh offer cost advantages that appeal to US buyers.3. Man-Made Fibre Pullovers (HS 611030) 2024 US Import Data: Imports totalled $4,837.28 million, with China contributing $995.51 million. Tariff Impact: A 916 per cent tariff increase on Chinese products affects sourcing decisions. Beneficiary Countries: Vietnam, Honduras, and Indonesia stand to benefit. Vietnam’s strong synthetic garment manufacturing base makes it a primary alternative, while Honduras and El Salvador can also attract buyers seeking competitive pricing.4. Women’s Cotton Trousers and Shorts (HS 620462) 2024 US Import Data: Total imports were $4,011.92 million, with China supplying $674.59 million. Tariff Impact: A 1,606 per cent tariff increase on Chinese goods shifts demand. Beneficiary Countries: Bangladesh, Vietnam, and Pakistan are well positioned. Bangladesh’s low-cost manufacturing is particularly attractive, while Vietnam’s advanced production capabilities also make it a strong contender.5. Brassieres (HS 621210) 2024 US Import Data: Imports amounted to $2,119.78 million, with China providing $579.47 million. Tariff Impact: A 1,311 per cent tariff hike on Chinese brassieres alters market dynamics. Beneficiary Countries: Vietnam, Indonesia, and Sri Lanka are set to gain. Vietnam, already a leader in undergarments, is expected to see the most significant increase in demand, with Indonesia and Sri Lanka also capturing portions of the market.6. Synthetic Fibre Dresses (HS 620443) 2024 US Import Data: Total imports were $1,131.78 million, with China accounting for $511.95 million. Tariff Impact: A 1,115 per cent tariff increase on Chinese dresses impacts sourcing. Beneficiary Countries: Vietnam, India, and Indonesia are likely to benefit. Vietnam’s strong position in synthetic apparel makes it the prime beneficiary, while India and Indonesia offer competitive pricing that appeals to US importers.7. Gloves and Mittens (HS 611610) 2024 US Import Data: Imports totalled $852.01 million, with China supplying $502.45 million. Tariff Impact: A 1,261 per cent tariff hike on Chinese gloves and mittens affects cost structures. Beneficiary Countries: Sri Lanka, Vietnam, and Pakistan stand to gain. Sri Lanka’s specialised focus on glove manufacturing positions it to see the greatest increase in demand, while Vietnam and Pakistan offer efficient manufacturing processes that attract buyers.8. Women’s Overcoats (HS 620240) 2024 US Import Data: Total imports were $1,346.76 million, with China contributing $456.27 million. Tariff Impact: A 991 per cent tariff increase on Chinese overcoats shifts sourcing preferences. Beneficiary Countries: Vietnam, Bangladesh, and Indonesia are well positioned. Vietnam’s strong garment export sector is expected to dominate, while Bangladesh and Indonesia can capture market share due to their competitive prices.9. Nightdresses and Pyjamas (HS 610832) 2024 US Import Data: Imports amounted to $894.75 million, with China providing $446.52 million. Tariff Impact: An 881 per cent tariff hike on Chinese products influences market dynamics. Beneficiary Countries: Vietnam, Cambodia, and Sri Lanka are poised to benefit. Vietnam’s dominant position in sleepwear makes it the primary beneficiary, with Cambodia and Sri Lanka also positioned to capture additional demand.10. Men’s Overcoats (HS 620140) 2024 US Import Data: Total imports were valued at $1,466.97 million, with China supplying $440.03 million. Tariff Impact: A 991 per cent tariff increase on Chinese men's overcoats affects sourcing strategies. Beneficiary Countries: Vietnam, Bangladesh, and Indonesia stand to gain. Vietnam is poised to capture a significant share due to its established export network, while Bangladesh and Indonesia offer competitive alternatives.11. Sporting Apparel (HS 611430) 2024 US Import Data: The United States imported sporting apparel valued at approximately $1.02 billion, with China supplying about $404 million. Tariff Impact: The US has imposed a 599 per cent tariff increase on Chinese sporting apparel, significantly raising the cost of these imports. Potential Beneficiaries: Vietnam, Indonesia, and Cambodia are positioned to benefit from this development. Vietnam, with its efficient manufacturing capabilities and robust apparel sector, stands to gain the most. Indonesia and Cambodia may also capture market share in specific niches within the sporting apparel segment.12. Men’s Synthetic Trousers (HS 620343) 2024 US Import Data: The US imported men's synthetic trousers worth approximately $2.3 billion in 2024, with China accounting for around $377 million. Tariff Impact: A 1,190 per cent tariff increase on Chinese imports in this category has been implemented. Potential Beneficiaries: Bangladesh, Vietnam, and Indonesia are likely to benefit. Bangladesh, with its large-scale production capacity, is well positioned to capture a significant portion of the market. Vietnam and Indonesia also stand to gain due to their established manufacturing infrastructures and competitive pricing.13. Luxury Cashmere Garments (HS 611012) 2024 US Import Data: Luxury cashmere garment imports to the US were valued at approximately $512 million, with China supplying about $354 million. Tariff Impact: The US has imposed a 1,350 per cent tariff hike on Chinese luxury cashmere products. Potential Beneficiaries: Italy, Vietnam, and other European manufacturers are set to benefit. Italy, renowned for its luxury textiles and craftsmanship, is likely to see the most significant gain. Vietnam may also benefit from increased demand for mid-range cashmere products, leveraging its growing expertise in garment manufacturing.14. Felt and Nonwoven Garments (HS 621010) 2024 US Import Data: The US imported felt and nonwoven garments valued at approximately $913 million in 2024, with China contributing around $336 million. Tariff Impact: A 1,933 per cent tariff increase on Chinese imports in this category has been enacted. Potential Beneficiaries: Mexico, Honduras, and Vietnam are well positioned to absorb the shift in sourcing. Mexico, with its proximity to the US and favourable trade agreements, stands to gain significantly. Vietnam and Honduras can also benefit due to their established garment industries and competitive production costs.15. Cotton T-Shirts and Vests (HS 610910) 2024 US Import Data: In 2024, US imports of cotton T-shirts and vests totalled approximately $4.94 billion, with China supplying about $311 million. Tariff Impact: An 858 per cent tariff increase on Chinese products in this category has been imposed. Potential Beneficiaries: Vietnam, Bangladesh, and Honduras are poised to benefit. Vietnam, with its efficient supply chains and competitive pricing, is the key beneficiary. Bangladesh and Honduras are also expected to capture additional market share due to their cost-effective manufacturing capabilities and established export relationships with the US.These tariff adjustments are prompting US importers to diversify their sourcing strategies, leading to a realignment of global supply chains in the textile and apparel industry. Countries with competitive manufacturing sectors and favourable trade relations with the US are well positioned to capitalise on these changes. Fibre2Fashion News Desk (NS) Source link

0 notes

Text

Night Operations at Quonset State Airport

7 notes

·

View notes

Photo

The recent imposition of a 125 per cent tariff increase on Chinese textile and apparel products by the United States marks a significant turning point in global trade dynamics. In textile and apparel products, the tariff is likely to disrupt China’s price advantage, with potential gains for Vietnam, Bangladesh, and other nations with established trade ties with the US.President Donald Trump’s recent decision to impose, effective April 10, a sweeping 125 per cent tariff on Chinese textile and apparel imports—compared to a mere 10 per cent duty on comparable goods from all other countries—has severely undermined China’s price competitiveness in the US market. This enormous tariff disparity makes Chinese products vastly more expensive than those of other suppliers, effectively pricing many Chinese goods out of contention. US importers are expected to respond by shifting orders to alternative sourcing markets to avoid the exorbitant costs, especially favouring suppliers in low-cost manufacturing countries with well-established trade ties to the United States.The imposition of a 125 per cent US tariff on Chinese apparel significantly undermines China's pricing advantage, causing importers to seek alternative sources. Countries like Vietnam, Bangladesh, and Indonesia stand to gain notably across multiple apparel categories. This trade shift presents substantial opportunities for nations with robust apparel manufacturing sectors and established trade with US. Figure 1 Source: TexProIn 2024, the United States imported apparel worth $72.99 billion from its top 15 exporting partners, accounting for approximately 87.2 per cent of its total apparel imports. China remained the leading exporter with $18.39 billion, representing 22 per cent of the market share, followed closely by Vietnam at $15.33 billion (18 per cent) and Bangladesh at $7.40 billion (9 per cent). India ranked fourth with $4.93 billion (6 per cent), showcasing its growing influence in the global apparel trade. Other significant contributors included Indonesia, Cambodia, and several Central American nations, reflecting the diversified sourcing strategy of the US apparel industry.Impact on apparel productsFibre2Fashion examines the potential impact on key apparel categories—such as jerseys, trousers, hosiery, and undergarments—among China’s top exports to the US. The imposition of steep tariffs on these products is likely to significantly drive up the cost of Chinese goods in the US market, undermining one of China’s main competitive advantages: low pricing. As China grapples with this substantial setback, countries with lower tariff exposure (around 10 per cent), robust manufacturing capabilities, and well-established trade relationships with the US are well positioned to gain from the resulting shift in sourcing strategies. Table 1: US’ top 15 apparel imports (6-digit HS code) from China, total export values, competitors, initial and new tariff rates and tariff comparison in % Source: TexProThe recent imposition of substantial tariffs by the United States on Chinese textile and apparel imports has significantly altered global trade dynamics, particularly affecting China’s competitiveness in the US market. This shift presents opportunities for other manufacturing countries to capture increased market share across various product categories. Below is an analysis of the impact on specific apparel segments:1. Hosiery (HS 611596) 2024 US Import Data: Total imports were valued at $1,532.77 million, with China contributing $1,095.28 million. Tariff Impact: An 849 per cent tariff increase on Chinese hosiery has made these products considerably more expensive. Beneficiary Countries: Vietnam, Pakistan, and El Salvador are poised to benefit. Vietnam, with its robust hosiery manufacturing infrastructure and competitive pricing, is particularly well positioned to capture a larger market share.2. Cotton Pullovers and Cardigans (HS 611020) 2024 US Import Data: Total imports stood at $7,411.20 million, with China accounting for $1,043.15 million. Tariff Impact: A 1,263 per cent tariff increase on Chinese imports creates opportunities for other suppliers. Beneficiary Countries: Vietnam, Cambodia, and Bangladesh are likely to gain. Vietnam’s established cotton garment industry positions it to capture a significant share, while Cambodia and Bangladesh offer cost advantages that appeal to US buyers.3. Man-Made Fibre Pullovers (HS 611030) 2024 US Import Data: Imports totalled $4,837.28 million, with China contributing $995.51 million. Tariff Impact: A 916 per cent tariff increase on Chinese products affects sourcing decisions. Beneficiary Countries: Vietnam, Honduras, and Indonesia stand to benefit. Vietnam’s strong synthetic garment manufacturing base makes it a primary alternative, while Honduras and El Salvador can also attract buyers seeking competitive pricing.4. Women’s Cotton Trousers and Shorts (HS 620462) 2024 US Import Data: Total imports were $4,011.92 million, with China supplying $674.59 million. Tariff Impact: A 1,606 per cent tariff increase on Chinese goods shifts demand. Beneficiary Countries: Bangladesh, Vietnam, and Pakistan are well positioned. Bangladesh’s low-cost manufacturing is particularly attractive, while Vietnam’s advanced production capabilities also make it a strong contender.5. Brassieres (HS 621210) 2024 US Import Data: Imports amounted to $2,119.78 million, with China providing $579.47 million. Tariff Impact: A 1,311 per cent tariff hike on Chinese brassieres alters market dynamics. Beneficiary Countries: Vietnam, Indonesia, and Sri Lanka are set to gain. Vietnam, already a leader in undergarments, is expected to see the most significant increase in demand, with Indonesia and Sri Lanka also capturing portions of the market.6. Synthetic Fibre Dresses (HS 620443) 2024 US Import Data: Total imports were $1,131.78 million, with China accounting for $511.95 million. Tariff Impact: A 1,115 per cent tariff increase on Chinese dresses impacts sourcing. Beneficiary Countries: Vietnam, India, and Indonesia are likely to benefit. Vietnam’s strong position in synthetic apparel makes it the prime beneficiary, while India and Indonesia offer competitive pricing that appeals to US importers.7. Gloves and Mittens (HS 611610) 2024 US Import Data: Imports totalled $852.01 million, with China supplying $502.45 million. Tariff Impact: A 1,261 per cent tariff hike on Chinese gloves and mittens affects cost structures. Beneficiary Countries: Sri Lanka, Vietnam, and Pakistan stand to gain. Sri Lanka’s specialised focus on glove manufacturing positions it to see the greatest increase in demand, while Vietnam and Pakistan offer efficient manufacturing processes that attract buyers.8. Women’s Overcoats (HS 620240) 2024 US Import Data: Total imports were $1,346.76 million, with China contributing $456.27 million. Tariff Impact: A 991 per cent tariff increase on Chinese overcoats shifts sourcing preferences. Beneficiary Countries: Vietnam, Bangladesh, and Indonesia are well positioned. Vietnam’s strong garment export sector is expected to dominate, while Bangladesh and Indonesia can capture market share due to their competitive prices.9. Nightdresses and Pyjamas (HS 610832) 2024 US Import Data: Imports amounted to $894.75 million, with China providing $446.52 million. Tariff Impact: An 881 per cent tariff hike on Chinese products influences market dynamics. Beneficiary Countries: Vietnam, Cambodia, and Sri Lanka are poised to benefit. Vietnam’s dominant position in sleepwear makes it the primary beneficiary, with Cambodia and Sri Lanka also positioned to capture additional demand.10. Men’s Overcoats (HS 620140) 2024 US Import Data: Total imports were valued at $1,466.97 million, with China supplying $440.03 million. Tariff Impact: A 991 per cent tariff increase on Chinese men's overcoats affects sourcing strategies. Beneficiary Countries: Vietnam, Bangladesh, and Indonesia stand to gain. Vietnam is poised to capture a significant share due to its established export network, while Bangladesh and Indonesia offer competitive alternatives.11. Sporting Apparel (HS 611430) 2024 US Import Data: The United States imported sporting apparel valued at approximately $1.02 billion, with China supplying about $404 million. Tariff Impact: The US has imposed a 599 per cent tariff increase on Chinese sporting apparel, significantly raising the cost of these imports. Potential Beneficiaries: Vietnam, Indonesia, and Cambodia are positioned to benefit from this development. Vietnam, with its efficient manufacturing capabilities and robust apparel sector, stands to gain the most. Indonesia and Cambodia may also capture market share in specific niches within the sporting apparel segment.12. Men’s Synthetic Trousers (HS 620343) 2024 US Import Data: The US imported men's synthetic trousers worth approximately $2.3 billion in 2024, with China accounting for around $377 million. Tariff Impact: A 1,190 per cent tariff increase on Chinese imports in this category has been implemented. Potential Beneficiaries: Bangladesh, Vietnam, and Indonesia are likely to benefit. Bangladesh, with its large-scale production capacity, is well positioned to capture a significant portion of the market. Vietnam and Indonesia also stand to gain due to their established manufacturing infrastructures and competitive pricing.13. Luxury Cashmere Garments (HS 611012) 2024 US Import Data: Luxury cashmere garment imports to the US were valued at approximately $512 million, with China supplying about $354 million. Tariff Impact: The US has imposed a 1,350 per cent tariff hike on Chinese luxury cashmere products. Potential Beneficiaries: Italy, Vietnam, and other European manufacturers are set to benefit. Italy, renowned for its luxury textiles and craftsmanship, is likely to see the most significant gain. Vietnam may also benefit from increased demand for mid-range cashmere products, leveraging its growing expertise in garment manufacturing.14. Felt and Nonwoven Garments (HS 621010) 2024 US Import Data: The US imported felt and nonwoven garments valued at approximately $913 million in 2024, with China contributing around $336 million. Tariff Impact: A 1,933 per cent tariff increase on Chinese imports in this category has been enacted. Potential Beneficiaries: Mexico, Honduras, and Vietnam are well positioned to absorb the shift in sourcing. Mexico, with its proximity to the US and favourable trade agreements, stands to gain significantly. Vietnam and Honduras can also benefit due to their established garment industries and competitive production costs.15. Cotton T-Shirts and Vests (HS 610910) 2024 US Import Data: In 2024, US imports of cotton T-shirts and vests totalled approximately $4.94 billion, with China supplying about $311 million. Tariff Impact: An 858 per cent tariff increase on Chinese products in this category has been imposed. Potential Beneficiaries: Vietnam, Bangladesh, and Honduras are poised to benefit. Vietnam, with its efficient supply chains and competitive pricing, is the key beneficiary. Bangladesh and Honduras are also expected to capture additional market share due to their cost-effective manufacturing capabilities and established export relationships with the US.These tariff adjustments are prompting US importers to diversify their sourcing strategies, leading to a realignment of global supply chains in the textile and apparel industry. Countries with competitive manufacturing sectors and favourable trade relations with the US are well positioned to capitalise on these changes. Fibre2Fashion News Desk (NS) Source link

0 notes

Note

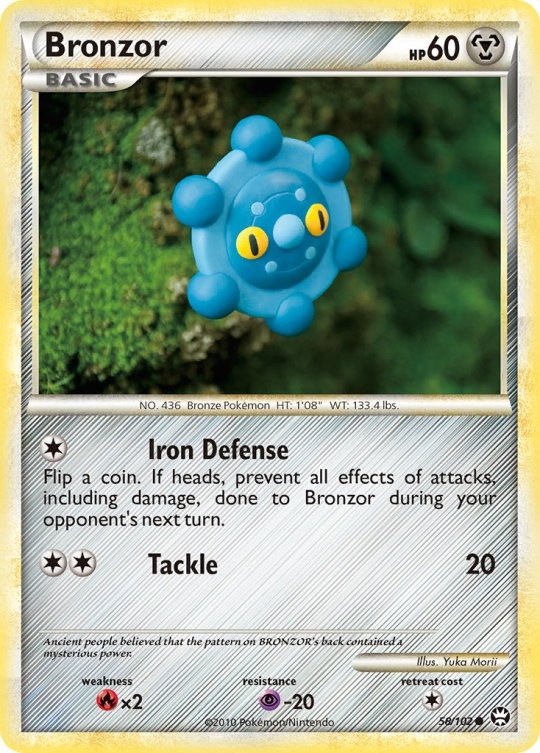

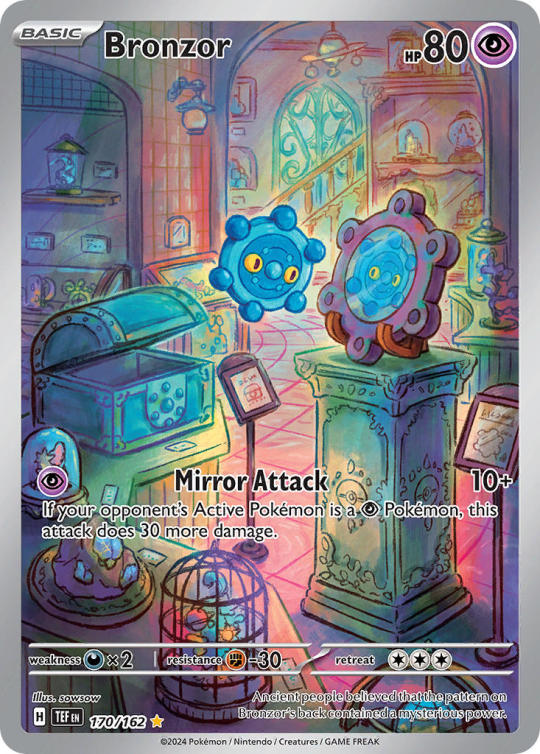

If you're still taking TCG ranking requests, may I humbly request Bronzong? I love that little bell.

Excellent pick! Big fan of these things, love Pokemon that have a vibe like they know ancient secrets or something. Did hate trying to figure out if they had Levitate or Heatproof back in gen 4, though.

FULL TCG RANKINGS MASTERPOST

10. Bronzong (illus. kawayoo, Scarlet & Violet - Surging Sparks 127/191)

9. Bronzor (illus. Nabatame Kazutaka, Scarlet & Violet - Surging Sparks 126/191)

8. Bronzong (illus. AKIRA EGAWA, Sword & Shield - Lost Origin 126/196)

7. Bronzor (illus. kawayoo, Platinum - Arceus 34/99)

6 (TIE). Bronzor/Bronzong (illus. Yuka Morii, HS Triumphant 15 & 58/102)

5. Bronzor (illus. Shinji Kanda, Scarlet & Violet - Obsidian Flames 144/197)

4. Bronzor (illus. Tomokazu Komiya, Sword & Shield - Lost Origin 125/196)

3. Bronzong (illus. Shinji Kanda, Sword & Shield - Astral Radiance 112/189)

2. Bronzong (illus. Hataya, Sword & Shield - Astral Radiance TG11/TG30)

1. Bronzor (illus. sowsow, Scarlet & Violet - Temporal Forces 160/162)

70 notes

·

View notes

Photo

The recent imposition of a 125 per cent tariff increase on Chinese textile and apparel products by the United States marks a significant turning point in global trade dynamics. In textile and apparel products, the tariff is likely to disrupt China’s price advantage, with potential gains for Vietnam, Bangladesh, and other nations with established trade ties with the US.President Donald Trump’s recent decision to impose, effective April 10, a sweeping 125 per cent tariff on Chinese textile and apparel imports—compared to a mere 10 per cent duty on comparable goods from all other countries—has severely undermined China’s price competitiveness in the US market. This enormous tariff disparity makes Chinese products vastly more expensive than those of other suppliers, effectively pricing many Chinese goods out of contention. US importers are expected to respond by shifting orders to alternative sourcing markets to avoid the exorbitant costs, especially favouring suppliers in low-cost manufacturing countries with well-established trade ties to the United States.The imposition of a 125 per cent US tariff on Chinese apparel significantly undermines China's pricing advantage, causing importers to seek alternative sources. Countries like Vietnam, Bangladesh, and Indonesia stand to gain notably across multiple apparel categories. This trade shift presents substantial opportunities for nations with robust apparel manufacturing sectors and established trade with US. Figure 1 Source: TexProIn 2024, the United States imported apparel worth $72.99 billion from its top 15 exporting partners, accounting for approximately 87.2 per cent of its total apparel imports. China remained the leading exporter with $18.39 billion, representing 22 per cent of the market share, followed closely by Vietnam at $15.33 billion (18 per cent) and Bangladesh at $7.40 billion (9 per cent). India ranked fourth with $4.93 billion (6 per cent), showcasing its growing influence in the global apparel trade. Other significant contributors included Indonesia, Cambodia, and several Central American nations, reflecting the diversified sourcing strategy of the US apparel industry.Impact on apparel productsFibre2Fashion examines the potential impact on key apparel categories—such as jerseys, trousers, hosiery, and undergarments—among China’s top exports to the US. The imposition of steep tariffs on these products is likely to significantly drive up the cost of Chinese goods in the US market, undermining one of China’s main competitive advantages: low pricing. As China grapples with this substantial setback, countries with lower tariff exposure (around 10 per cent), robust manufacturing capabilities, and well-established trade relationships with the US are well positioned to gain from the resulting shift in sourcing strategies. Table 1: US’ top 15 apparel imports (6-digit HS code) from China, total export values, competitors, initial and new tariff rates and tariff comparison in % Source: TexProThe recent imposition of substantial tariffs by the United States on Chinese textile and apparel imports has significantly altered global trade dynamics, particularly affecting China’s competitiveness in the US market. This shift presents opportunities for other manufacturing countries to capture increased market share across various product categories. Below is an analysis of the impact on specific apparel segments:1. Hosiery (HS 611596) 2024 US Import Data: Total imports were valued at $1,532.77 million, with China contributing $1,095.28 million. Tariff Impact: An 849 per cent tariff increase on Chinese hosiery has made these products considerably more expensive. Beneficiary Countries: Vietnam, Pakistan, and El Salvador are poised to benefit. Vietnam, with its robust hosiery manufacturing infrastructure and competitive pricing, is particularly well positioned to capture a larger market share.2. Cotton Pullovers and Cardigans (HS 611020) 2024 US Import Data: Total imports stood at $7,411.20 million, with China accounting for $1,043.15 million. Tariff Impact: A 1,263 per cent tariff increase on Chinese imports creates opportunities for other suppliers. Beneficiary Countries: Vietnam, Cambodia, and Bangladesh are likely to gain. Vietnam’s established cotton garment industry positions it to capture a significant share, while Cambodia and Bangladesh offer cost advantages that appeal to US buyers.3. Man-Made Fibre Pullovers (HS 611030) 2024 US Import Data: Imports totalled $4,837.28 million, with China contributing $995.51 million. Tariff Impact: A 916 per cent tariff increase on Chinese products affects sourcing decisions. Beneficiary Countries: Vietnam, Honduras, and Indonesia stand to benefit. Vietnam’s strong synthetic garment manufacturing base makes it a primary alternative, while Honduras and El Salvador can also attract buyers seeking competitive pricing.4. Women’s Cotton Trousers and Shorts (HS 620462) 2024 US Import Data: Total imports were $4,011.92 million, with China supplying $674.59 million. Tariff Impact: A 1,606 per cent tariff increase on Chinese goods shifts demand. Beneficiary Countries: Bangladesh, Vietnam, and Pakistan are well positioned. Bangladesh’s low-cost manufacturing is particularly attractive, while Vietnam’s advanced production capabilities also make it a strong contender.5. Brassieres (HS 621210) 2024 US Import Data: Imports amounted to $2,119.78 million, with China providing $579.47 million. Tariff Impact: A 1,311 per cent tariff hike on Chinese brassieres alters market dynamics. Beneficiary Countries: Vietnam, Indonesia, and Sri Lanka are set to gain. Vietnam, already a leader in undergarments, is expected to see the most significant increase in demand, with Indonesia and Sri Lanka also capturing portions of the market.6. Synthetic Fibre Dresses (HS 620443) 2024 US Import Data: Total imports were $1,131.78 million, with China accounting for $511.95 million. Tariff Impact: A 1,115 per cent tariff increase on Chinese dresses impacts sourcing. Beneficiary Countries: Vietnam, India, and Indonesia are likely to benefit. Vietnam’s strong position in synthetic apparel makes it the prime beneficiary, while India and Indonesia offer competitive pricing that appeals to US importers.7. Gloves and Mittens (HS 611610) 2024 US Import Data: Imports totalled $852.01 million, with China supplying $502.45 million. Tariff Impact: A 1,261 per cent tariff hike on Chinese gloves and mittens affects cost structures. Beneficiary Countries: Sri Lanka, Vietnam, and Pakistan stand to gain. Sri Lanka’s specialised focus on glove manufacturing positions it to see the greatest increase in demand, while Vietnam and Pakistan offer efficient manufacturing processes that attract buyers.8. Women’s Overcoats (HS 620240) 2024 US Import Data: Total imports were $1,346.76 million, with China contributing $456.27 million. Tariff Impact: A 991 per cent tariff increase on Chinese overcoats shifts sourcing preferences. Beneficiary Countries: Vietnam, Bangladesh, and Indonesia are well positioned. Vietnam’s strong garment export sector is expected to dominate, while Bangladesh and Indonesia can capture market share due to their competitive prices.9. Nightdresses and Pyjamas (HS 610832) 2024 US Import Data: Imports amounted to $894.75 million, with China providing $446.52 million. Tariff Impact: An 881 per cent tariff hike on Chinese products influences market dynamics. Beneficiary Countries: Vietnam, Cambodia, and Sri Lanka are poised to benefit. Vietnam’s dominant position in sleepwear makes it the primary beneficiary, with Cambodia and Sri Lanka also positioned to capture additional demand.10. Men’s Overcoats (HS 620140) 2024 US Import Data: Total imports were valued at $1,466.97 million, with China supplying $440.03 million. Tariff Impact: A 991 per cent tariff increase on Chinese men's overcoats affects sourcing strategies. Beneficiary Countries: Vietnam, Bangladesh, and Indonesia stand to gain. Vietnam is poised to capture a significant share due to its established export network, while Bangladesh and Indonesia offer competitive alternatives.11. Sporting Apparel (HS 611430) 2024 US Import Data: The United States imported sporting apparel valued at approximately $1.02 billion, with China supplying about $404 million. Tariff Impact: The US has imposed a 599 per cent tariff increase on Chinese sporting apparel, significantly raising the cost of these imports. Potential Beneficiaries: Vietnam, Indonesia, and Cambodia are positioned to benefit from this development. Vietnam, with its efficient manufacturing capabilities and robust apparel sector, stands to gain the most. Indonesia and Cambodia may also capture market share in specific niches within the sporting apparel segment.12. Men’s Synthetic Trousers (HS 620343) 2024 US Import Data: The US imported men's synthetic trousers worth approximately $2.3 billion in 2024, with China accounting for around $377 million. Tariff Impact: A 1,190 per cent tariff increase on Chinese imports in this category has been implemented. Potential Beneficiaries: Bangladesh, Vietnam, and Indonesia are likely to benefit. Bangladesh, with its large-scale production capacity, is well positioned to capture a significant portion of the market. Vietnam and Indonesia also stand to gain due to their established manufacturing infrastructures and competitive pricing.13. Luxury Cashmere Garments (HS 611012) 2024 US Import Data: Luxury cashmere garment imports to the US were valued at approximately $512 million, with China supplying about $354 million. Tariff Impact: The US has imposed a 1,350 per cent tariff hike on Chinese luxury cashmere products. Potential Beneficiaries: Italy, Vietnam, and other European manufacturers are set to benefit. Italy, renowned for its luxury textiles and craftsmanship, is likely to see the most significant gain. Vietnam may also benefit from increased demand for mid-range cashmere products, leveraging its growing expertise in garment manufacturing.14. Felt and Nonwoven Garments (HS 621010) 2024 US Import Data: The US imported felt and nonwoven garments valued at approximately $913 million in 2024, with China contributing around $336 million. Tariff Impact: A 1,933 per cent tariff increase on Chinese imports in this category has been enacted. Potential Beneficiaries: Mexico, Honduras, and Vietnam are well positioned to absorb the shift in sourcing. Mexico, with its proximity to the US and favourable trade agreements, stands to gain significantly. Vietnam and Honduras can also benefit due to their established garment industries and competitive production costs.15. Cotton T-Shirts and Vests (HS 610910) 2024 US Import Data: In 2024, US imports of cotton T-shirts and vests totalled approximately $4.94 billion, with China supplying about $311 million. Tariff Impact: An 858 per cent tariff increase on Chinese products in this category has been imposed. Potential Beneficiaries: Vietnam, Bangladesh, and Honduras are poised to benefit. Vietnam, with its efficient supply chains and competitive pricing, is the key beneficiary. Bangladesh and Honduras are also expected to capture additional market share due to their cost-effective manufacturing capabilities and established export relationships with the US.These tariff adjustments are prompting US importers to diversify their sourcing strategies, leading to a realignment of global supply chains in the textile and apparel industry. Countries with competitive manufacturing sectors and favourable trade relations with the US are well positioned to capitalise on these changes. Fibre2Fashion News Desk (NS) Source link

0 notes

Text

Arriflex 16SR II Rolleiflex 3.5 F Sony FX3 Кожаный ремень для камеры Sony NP-FZ100 — 4 шт. Sony CFexpress Type A Tough Series 320GB — 2 шт. DJI RS 4 Pro Sony FE 85mm f/1.4 GM Sony FE 50mm f/1.2 GM Sony FE 35mm f/1.4 GM Sony FE 24mm f/1.4 GM Sony FE 28–70mm f/2 GM PolarPro Chroma VNDPL 2–5 Gold Mist 82mm PolarPro Chroma VNDPL 6–9 Gold Mist 82mm Breakthrough Brass Step-Up Ring 72–82mm Breakthrough Brass Step-Up Ring 67–82mm Sony ECM-B1M Sanken COS-11D — 4 шт. Tentacle Track E — 4 шт. Sony URX-P41D MacBook Pro 16" M4 Max Silver EarPods SanDisk Pro-G40 SSD 4TB Sony HDR-CX220 Canon Digital IXUS 125 HS Roland SP-404 ZMF Auteur Classic Панель для терапии красным светом Разборные гантели 40 кг 2025

0 notes

Text

US Crude Oil Import Data: Top Crude Oil Importers in the US

The environment of US crude oil imports has changed significantly during the past decade. Crude oil imports are used to supply a major portion of the energy and crude oil needs of the United States. Imports account for over 40% of the US's total petroleum consumption, making them a vital component of the nation's energy balance. In 2023, the United States imported $172.42 billion worth of crude oil, a 16% reduction from the last year. According to US import data, the country imported 1.78 billion barrels of crude oil in the first three quarters of 2024, totaling $133.56 billion.

About 6.48 million barrels of crude oil were imported daily by the US in 2023, for a total quantity of 236.52 million barrels. Crude oil is the most imported commodity in the United States, which is the second-largest importer of the commodity globally, after China. This article will look at the top US crude oil importers and the latest trends and market research about US crude oil imports for 2023–2024.

Import Data and Trends of US Crude Oil Importers

The largest crude oil importers in the United States are ExxonMobil, Chevron Corp., and Valero Energy Corp.

Data from the US crude oil buyers and importers list shows that there are over 2000 verified crude oil importers and purchasers in the United States.

Sixty-six percent of all energy imports into the US are crude oil.

These importers purchase crude oil from more than 3100 suppliers worldwide.

There are now over 28,900 shipments of crude oil into the United States, based on USA shipment data.

The United States imports crude oil from over 100 countries, according to data on imports by country.

Crude oil has the 4-digit HS code 2709, which places it under the HS code 27 for worldwide trade and in the classification of mineral fuels.

USA Crude Oil Importers List: Database of Leading Crude Oil Importers in the US

According to US importer statistics and US crude oil import estimates for 2023–2024, these are the largest 10 American companies that import crude oil:

1. Valero Energy Corporation: Import Value: ~$25 billion

Total Import Quantity: ~230 million barrels

Import Shipments: Over 9,000 annually

Headquarters: San Antonio, Texas

2. Chevron Corporation: Import Value: ~$21 billion

Total Import Quantity: ~190 million barrels

Import Shipments: Over 8,000 annually

Headquarters: San Ramon, California

3. ExxonMobil: Import Value: ~$18 billion

Total Import Quantity: ~165 million barrels

Import Shipments: Over 7,000 annually

Headquarters: Irving, Texas

4. Marathon Petroleum Corporation: Import Value: ~$16 billion

Total Import Quantity: ~150 million barrels

Import Shipments: Over 6,500 annually

Headquarters: Findlay, Ohio

5. Phillips 66: Import Value: ~$14 billion

Total Import Quantity: ~125 million barrels

Import Shipments: Over 5,500 annually

Headquarters: Houston, Texas

6. Motiva Enterprises: Import Value: ~$12 billion

Total Import Quantity: ~110 million barrels

Import Shipments: Over 5,000 annually

Headquarters: Houston, Texas

7. Shell USA (formerly Shell Oil Company): Import Value: ~$10 billion

Total Import Quantity: ~100 million barrels

Import Shipments: Over 4,500 annually

Headquarters: Houston, Texas

8. Tesoro Corporation: Import Value: ~$8.5 billion

Total Import Quantity: ~80 million barrels

Import Shipments: Over 3,500 annually

Headquarters: San Antonio, Texas

9. BP America: Import Value: ~$7.2 billion

Total Import Quantity: ~70 million barrels

Import Shipments: Over 3,000 annually

Headquarters: Houston, Texas

10. HollyFrontier Corporation: Import Value: ~$6 billion

Total Import Quantity: ~60 million barrels

Import Shipments: Over 2,500 annually

Headquarters: Dallas, Texas

Imports of US Crude Oil by Country: US Crude Import Data by Country

The USA imports the majority of its crude oil from Saudi Arabia, Mexico, and Canada. About 3.8 million barrels of crude oil were imported daily from Canada to the United States in 2023, bringing the total import value to $97.18 billion. In total, 370.39 million cubic meters of crude oil were imported into the US. The top ten countries from which the United States imports crude oil in 2023 are:

1. Canada: $97.18 billion (56.4%)

2. Mexico: $20.35 billion (11.8%)

3. Saudi Arabia: $10.81 billion (6.3%)

4. Iraq: $6.01 billion (3.5%)

5. Brazil: $5.90 billion (3.4%)

6. Colombia: $5.59 billion (3.2%)

7. Nigeria: $4.73 billion (2.7%)

8. Ecuador: $3.95 billion (2.3%)

9. Venezuela: $3.45 billion (2%)

10. Guyana: $3.09 billion (1.8%)

Local Crude Oil Consumption in the United States

The USA is one of the biggest consumers of crude oil in the world, with a considerable percentage of its energy demands being met by crude oil and petroleum products. The nation's domestic crude oil consumption is driven by several industries, including shipping, residential, commercial, and industrial demands. The U.S. Energy Information Administration (EIA) recently released data showing that in 2023, the country's daily crude oil consumption exceeded 20 million barrels.

The United States trade policy and regulations on crude oil imports

The US government has implemented several policies and initiatives to manage environmental concerns, promote domestic production, and regulate imports of crude oil. The federal government can impose trade restrictions like tariffs and quotas to regulate imports of crude oil.

One of the main laws affecting the import of crude oil is the Renewable Fuel Standard (RFS), which mandates the use of biofuels such as ethanol and biodiesel in transportation fuels. This program aims to reduce the nation's dependency on imported crude oil and promote the growth of renewable energy sources.

The Environmental Protection Agency (EPA) plays a key role in regulating the crude oil industry by enforcing environmental laws and regulations. These regulations cover many subjects, including greenhouse gas emissions, pollution of the air and water, and the handling and disposal of hazardous materials.

Bottom Line

To sum up, US imports of crude oil are critical to ensuring the nation has a strong and consistent energy supply. Despite being a major producer of crude oil, it imports crude oil to meet its domestic needs. Identifying the impact of the crude oil import market will help policymakers make well-informed decisions to ensure energy security and prosperity in the years to come.

#CrudeOil#USImports#EnergyTrade#GlobalEconomy#usimport#USOIL#UScrudeoil#crudeoiltrading#oil#ImportData#oilimportdata

0 notes