#How Google Pay and PhonePe earn money

Explore tagged Tumblr posts

Text

How to Earn Money from Phonepe : 8 Best Innovative Ways

earn money from phonepe If you are wasting your precious time and want to utilize that with earning money then it will be very profitable for you. If you want to know How to earn money from Phonepe. Get all the answers in this article. In the digital age, smartphones have revolutionized the way we manage our finances and make transactions. PhonePe, a popular mobile wallet payment app in India,…

View On WordPress

#Can I earn through PhonePe#earn money from phonepe#How Google Pay and PhonePe earn money#PhonePe earn money app#phonepe earn money tricks#PhonePe free money Hack#phonepe reward 5000#PhonePe rewards transfer to account.#Scratch and win PhonePe cash#What is profit for PhonePe

0 notes

Text

PhonePe Refer and Earn: How to Earn Money by Referring Friends

PhonePe, one of India’s leading digital payment platforms, offers a fantastic "phonepe Refer and Earn" program that allows users to earn money by referring friends and family. This program is a great way to make extra cash while helping others discover the convenience of digital transactions.

What is PhonePe?

PhonePe is a UPI-based payment app that allows users to send and receive money, pay bills, recharge mobiles, and much more. With its seamless interface and wide range of services, PhonePe has become a popular choice for millions of users across India.

Highlights of the Refer and Earn Program

Earn Money: Get rewarded for every successful referral.

Easy Process: Simple steps to refer friends and earn rewards.

Instant Rewards: Receive your earnings as soon as your friend makes their first transaction.

How to Refer and Earn on PhonePe

Download the PhonePe App: If you haven't already, download the PhonePe app from the Google Play Store or Apple App Store.

Sign Up or Log In: Create a new account or log in to your existing PhonePe account.

Find Your Referral Code: Go to the "Refer and Earn" section in the app to find your unique referral code or referral link.

Share Your Referral Code: Share your referral code or link with friends and family via social media, messaging apps, or email.

Earn Rewards: Once your friend signs up using your referral code and makes their first transaction, you will receive a reward in your PhonePe wallet.

Benefits of Using PhonePe

Secure Transactions: PhonePe uses advanced security measures to ensure safe and secure transactions.

Wide Range of Services: Pay bills, recharge mobiles, book travel tickets, and more using the PhonePe app.

Easy to Use: User-friendly interface makes digital transactions simple and convenient.

Tips for Maximizing Your Earnings

Promote Actively: Share your referral code on social media, blogs, and with your contacts to reach a wider audience.

Explain the Benefits: Highlight the convenience and features of PhonePe to encourage others to sign up and use the app.

Follow Up: Remind your friends and family to complete their first transaction to ensure you receive your reward.

Common Questions About PhonePe Refer and Earn

How Much Can I Earn? The amount you earn per referral may vary based on ongoing promotions. Check the app for current offers.

When Do I Receive My Reward? Rewards are typically credited instantly once your friend completes their first transaction.

Is There a Limit to Referrals? Some promotions may have a cap on the number of referrals. Check the terms and conditions in the app.

Conclusion

PhonePe’s "Refer and Earn" program is an excellent opportunity to make extra money while promoting a reliable and convenient digital payment solution. By sharing your referral code, you help others experience the benefits of PhonePe and earn rewards in return. Download the PhonePe app today, start referring, and enjoy the perks of digital transactions!

0 notes

Text

How to Earn Money Online with Colour Prediction Games?

Do you appreciate making money? Do you get a kick out of the chance to tackle questions and riddles? Assuming this is the case, playing the Variety Expectation Game can be the best way for you to appreciate the two sides interests at the same time! How awesome is it that this game permits you to find more about yourself and your character highlights while likewise bringing in additional cash? Here, we'll make sense of what this game contains and express our feelings on whether offering it a chance could be advantageous. See more Color Prediction Game

How to Play Variety Forecast Games On the web?

By accurately assessing the shade of shapes that are framed arbitrarily, the player can dominate cash in this match. The player should accurately foresee the variety that will be shown. You relinquish focuses on the off chance that you are wrong. In the event that you foresee the following tone accurately, your focuses increment and you have the chance to build your profit. At the point when nobody can appropriately foresee the state of the accompanying round or when there is just a single player left, the game is finished. See more Colour Prediction Game

How to Sort Tones? The target of the game is to figure, from a bunch of five hued circles, which variety each circle will be the point at which it is uncovered. To do this, bunch the varieties into classes first, then pick the variety that you expect it to be. You get more cash the more right responses you get.

The most effective method to Acquire with Variety Expectation Game Profit On the web. Think about that you bet 50 rupees on red (the result will be either red or green). In the event that the result is red, you win and your bet will be worth 100 rupees; notwithstanding, assuming the variety is green, you will lose 50 rupees.

On the off chance that you bet 50 rupees on number 4 and win, you will get a 7X return or 350 rupees. furthermore, on the off chance that you bet on Violet, which infrequently shows up with red or green, you will benefit 4X or 200 rupees for a 50 rupee stake.

You can wage on one or the other variety or number, or you can bet on both variety and number, given that you make various orders for each.

How to Re-energize Your Wallet? To add cash to your Linacun32 wallet, you can utilize an assortment of installment strategies; the base sum is only 100 rupees.

As well as utilizing UPI applications like Google Pay and PhonePe, you can add cash utilizing a credit or check card. To win cash, re-energize immediately. Surmise the variety and the number.

How to Pull out Cash from a Variety Expectation Game? Cash can be removed Monday through Friday from 10 AM to 5 PM. Direct credit of the assets will be made to your Indian ledger.

Essentially go to MY>my bank>Add bank card and submit >my wallet and snap on withdrawal done, and the cash will be credited to your record inside a couple of days. Least and most extreme withdrawal sums are 31 and 50,000 individually. Withdrawal charges are 30 rupees for withdrawals of under 1500 rupees and 2% for withdrawals of more than 1500. Join the variety exchanging application and begin bringing in cash immediately on the grounds that pulling out is likewise bother free. Best Color Prediction

Variety Expectation for Android Brings in Cash. You can download the variety exchange application to your Android gadget and play this round of variety forecast exchanging straightforwardly from your portable internet browser. When you register utilizing the gave connection and sign into the exchanging framework, you will see the choice to download the application.

Variety speculating game for web income, Best believed variety exchanging game, best internet based number game to bring in cash, variety/number exchanging on the web installment confirmation, play and dominate red-green variety match on the web, play and dominate number match online variety exchange club, win go installment evidence, reference framework. Best Color Prediction online

Some Variety Forecast Games to Acquire On the web

RXCE Variety Expectation Utilize This Reference Code to Acquire ₹1000 Download RXCE Application in Apk Download RXCE Application 2.0. RXCE Variety Expectation the Most recent Rendition for Android. This application offers a wide assortment of games and variety expectations, all of which can possibly net you monetary rewards.

You can test your gaming information and abilities with this amazing match forecast programming and feel the surge of progress. One of the most supportive applications for individuals hoping to produce authentic cash is RXCE Apk. You ought to welcome companions to take a study, partake in games to acquire focuses or cash, etc.

Skyworld Live Application Skyworld is another top variety expectation administration that has been functional for a year with great reaction rates, fast cash appearance, and prompt withdrawals.

Sharing the skyworld live application with your companions is one more incredible method for raking in some serious cash. For one suggestion, the skyworld application will pay you 300 rupees.

A variety expectation application is Skyworld. This has a few tones proposed to you. Also, from that, you should pick one tone. assuming the last showcase is exclusively your picked variety.

Joymall Application Like RXCE and Skyworld application. Joymall application download is an expectation site That brings in cash by foreseeing The Tones Red And Green. The Joymall Application offers a direct client experience that is straightforward enough for anybody to use. One of the most accommodating applications is the Joymall Application. Application Joymall Procure Rs. 1000-Rs. 2000 by utilizing the Joymall Procuring Application. Win cash by playing Joymall.

Last Words We think you currently have a strong comprehension of variety forecast games and how to play them. The material gave is acceptable to depict this variety expectation games for your utilization. In the event that the data on variety expectation applications was really useful to you, if it's not too much trouble, leave a survey and let every one of your companions in on about it.

0 notes

Text

Top sports betting sites in India Offer instant withdrawal?

When you've discovered a promising betting site and had a successful run, the next exciting step is cashing out your winnings. Contrary to popular belief, withdrawing your earnings can be a bit challenging, especially if you're new to online betting. However, there are betting sites in India that offer instant withdrawal options, allowing you to enjoy your winnings promptly. Here, we'll introduce you to four such websites and discuss the withdrawal methods they provide for Indian customers, including UPI, Google Pay, PayTM, PhonePe, Internet Banking, Direct Bank Transfer, and even Cryptocurrency.

Satsport247:

Satsport247 is a well-established online betting site in India known for its diverse selection of sports betting options and user-friendly interface. What sets it apart is its lightning-fast 30-minute withdrawal guarantee for Indian players. If you're eager to receive your winnings quickly, Satsport247 is a top choice due to its extensive features and speedy withdrawal process.

SS Exchange:

SS Exchange offers a 90-minute withdrawal time, ensuring that you have swift access to your betting profits. While it secures third place in our rankings, SS Exchange stands out for its straightforward and innovative betting options. They prioritize customer data security and responsible gambling practices.

Satfair:

Satfair allows you to withdraw your winnings within 90 minutes of winning a bet. With over 150 games to choose from, Satfair provides ample opportunities for betting and cashing out your earnings promptly.

Betxhub247:

Betxhub247 is dedicated to offering fast withdrawals, which is a priority for many players. It operates 24/7, providing a wide range of betting options, quick withdrawals, a generous welcome bonus, and an exceptional sports betting experience.

How to Withdraw Your Money from These Betting Sites:

Account Verification: The first crucial step is to verify your betting account. No website will allow you to withdraw funds without proper verification. To verify your account, provide government-issued ID documents to the betting websites. Ensure that the information on your account matches the details on the documents. Verification typically takes up to 72 hours.

Withdrawal Process: Once your account is verified, you can proceed with withdrawing your winnings. Familiarize yourself with the minimum and maximum withdrawal limits set by the operator. Keep in mind that if you've utilized welcome bonuses, free bets, or other promotions, you may need to meet wagering requirements before withdrawing.

Canceling Withdrawals: Some operators permit you to cancel withdrawal requests. This can usually be done through your account settings or by contacting customer service. It's essential to understand this process in case you change your mind or wish to continue betting.

In summary, finding a betting site with fast withdrawal options is essential for an enjoyable betting experience. These recommended sites in India offer not only quick withdrawals but also a variety of sports betting options. Remember to follow the verification process, understand withdrawal limits, and meet any wagering requirements if applicable. With these steps in mind, you can enjoy your betting wins promptly and responsibly.

0 notes

Text

Rummy Loot Apk Download & Get 51 Bonus Free

Rummy Loot Apk Download, Rummy Loot Apk, Rummy Loot App Download — Guys a new Rummy App is launched, Named Rummy Loot it gives 41 rupees signup bonus for free to play rummy and other games. If you don’t know about Rummy Loot app, then this article can be very useful for you. Because in this post I am going to give you all the important information about Rummy Loot App.

RUMMY LOOT DOWNLOAD

Today mobile phone has become a amazing source of online income. There are many people who are making money sitting at home by using mobile phone through internet. If you are also looking for the ways of online income, Then this article can prove to be good for you. Because today we are going to share you Loot Rummy Game Application in this article.

About Rummy Loot App | Loot Rummy Apk Download | Rummy Loot, Teen Patti Loot

Rummy Loot is a type of Gaming Apps that have inside many types of Rummy and Teen Patti games including Dragon vs Tiger and Poker. You can win Real cash by playing all these games and can also transfer it directly to your bank account. Not only this if you want to make money without any investment then you can join Rummy Loot’s Refer and earn program & Make fast money.

How To Download Rummy Loot APK?

If you want to download & win money in Rummy Loot then you can use the given link below. By clicking on the Download Now link given by us, you can easily reach its official website, and download this application from there.

RUMMY LOOT DOWNLOAD

First Click on Download Button

Now Rummy Loot Site will open

Now install Rummy Loot APP

Rummy Loot is successfully installed.

Games in Rummy Loot Application

There are 20+ games that you can play on the Rummy Loot app. All the games have to be downloaded before you can start playing. These are some of the games that you can play and earn real money:

7 Up Down

Andar Bahar

Fruit Line

Teen Patti

IPL(NEW)

Rummy

3 Card Poker

Car Roulette

Dragon VS Tiger

Bacarrat

Zoo Roulette

Poker

Fishing rush

Get ₹51 Rummy Loot Apk Bonus

Download the Rummy Loot app and install it.

Open the app and click on the withdraw button.

Click on Bound.

Now enter your mobile number, password and verify your number with OTP.

₹40 will be credited to your account immediately.

Extra Referral Rewards in Rummy Loot:

For each referral that meets the following conditions, you will earn ₹80–100:

Recharges ₹1000, or more.

What is a Rummy Loot Agent?

If you want to make maximum money from this Rummy Loot app then you can become agent of this game. It is very easy to become Rummy loot agents.

If you want to become rummy loot’s agent then, you just have to click on Refer & Earn and copy the invite link and you have to share this link everywhere. If your refered person recharges 1000 rs then you will recieve extra bonus of 80rs and will recieve lifetime referal commisions untill your friend plays and win the game 😁. In this way you can easily Withdraw this received commission in your bank account or UPI app.

How To Become A VIP Member Rummy Loot App?

If you want to become a VIP member in Rummy Loot then you can also become a VIP member easily, for that first you have to go to VIP Option and after that you have to add at least 500 chips in the Rummy Loot app, after that your level will be upgraded then you too are VIP Member becomes. After that you can get the benefits of Bonus every day as well as Bonus every week, Bonus every month and Level Bonus.

Safe Option In Rummy Loot App?

Their is a safe option in Rummy Loot app, This is a amazing feature in Rummy Loot app. This will help you to not get loss. You can save your chips in safe folder and then take it out anytime you wish.

Add money with the Bank option in Rummy Loot Apk

First, select the amount you want to deposit in Rummy Loot app in the Deposit section

Open UPI app like Phonepe, Paytm, Google Pay etc. and select bank payment

copy all details in the payment page and paste them to UPI app

Make A selected payment.

After payment enters the app. In some time the payment will be added to the game Id.

Benefits of Bank Deposit

5% bonus on the first deposit

5.5% bonus on the second deposit

2.5% upto 6.5% re deposit using Bank card

How to Withdraw Money From Rummy Loot

The best thing I liked about Rummy Loot is that you can withdraw your winnings without submitting your identity proof (PAN, Aadhaar) or bank details. That’s right, there is no need to verify your account.

You can simply enter your UPI ID and withdraw your winnings.

Open the app and click Withdraw.

Enter your payment details.

Enter the amount you want to withdraw and tap Withdraw.

The withdrawal request will be reviewed first and then processed.

Rummy Loot Dragon vs Tiger Tricks

First of all add about 1000 chips in your account.

Place: 10 Chips Place: 30 Chips Place: 70 Chips Place: 150 Chips Place: 350 Chips Place: 800 Chips Place: 1700 Chips Place: 3600 Chips you can choose “Dragon” or “Tiger” to place a Place. Choose to Place “Tiger” Place amount: 10. If the Place on “Tiger” does not win, the Place amount is selected: 30. If the Place on “Tiger” does not win, choose the Place amount: 70. If the Place on “Tiger” does not win, choose the Place amount: 150. If Place “Tiger” has won, modify the investment amount; Place 10 again. If one of them, once you win, continue to choose 10 to Place again.

Rummy Loot Customer Support Details:

Rummy Loot Customer Care Number:- +91 9560892702

Rummy Loot Whatsapp Number:- +91 9560892702

DISCLAIMER — Friend this game involves financial risk. Therefore, with folded hands, all of you are requested to play this game at your own risk. And also if you are more than 18 years of age then only you play this game otherwise you are away from this game.

Note: इस गेम में वित्तीय जोखिम का एक तत्व शामिल है और इसकी लत लग सकती है। कृपया जिम्मेदारी से और अपने स्वयं के जोखिम पर ही इसे खेलें । पैसे जोड़ने से बचें, नुकसान के जिम्मेदार आप खुद होंगे |

Rummy Loot Apk Download (FAQ):

Read Also» Rummy Nabob Apk Download & Get ₹51 Bonus

Read Also» Rummy Most App Download | Get 51 Bonus | Rummy Most

How Much is Sign-Up Bonus in Rummy Loot

Sign Up Bonus Rs.41

How much commission do you get in Rummy Loot Apk?

30% Commission You Can Earn.

What Is The Minimum Withdraw Amount Of Rummy Loot?

The Minimum Withdraw Amount Is Rs.100.

What Is Rummy Loot Application?

Rummy Loot App Is A Gaming Application. In This App, You Can Play Many Games Like Dragon Vs Tiger, 7 UP Down, Etc.

What is the maximum money I can earn by referring friends?

There is no such limit. So you can earn unlimited money from your referrals.

How to increase VIP level in Rummy Loot app?

It automatically increases as you deposit money in Rummy Loot app.

What is the maximum withdrawal amount in Rummy Loot?

Their is not such a limit, You can withdraw all amount you win or earn in Rummy Loot App.

Conclusion:

Rummy Loot is a real cash gaming platform where users can play online with other players. inside which you earn money by playing different types of games

If you’ve any thoughts on the Rummy Loot Apk Download, then feel free to drop them in the below comment box. Keep visiting our website: Metmoney.in for new updates on Rummy-Games.

I hope you like this post so please share it on your social media handles & Friends. Thanks for reading this article till the end.

1 note

·

View note

Text

One Stop Online Betting Destination In India

Step into Cricplayers

Cricplayers is home to some of the best gaming products which include sports betting, online casino, Live casino and one of the best online betting games for all game lovers. Enjoy a variety of promotions and bonuses up to 100% daily with Cricplayers. First of all, Cricplayers is one of the most user-friendly online betting sites in India, making it easy for both beginners and advanced players to place their bets with zero investment.

Why Cricplayers is one stop betting destination

· Very user-friendly. Great for beginners!

· Cricplayers on of the best website for online betting in India

· Deposit with your UPI, PhonePe, Bank Transfer, etc

· Customer support hard to reach

· Limited number of promotions available

· One of the world's most trusted gambling sites

· Get your money withdraw in your account.

· Recently launched a unique and entertaining sportsbook for casual Indian sports bettors.

· Relatively small selection of live casino tables, according to comfort.

· The sports betting service is still new and limited in scope and size

Sport betting India

Indian loves betting in sports, as well as playing casino. Betting on sport in must loved game from ancient time. People loves playing and betting online. Here are few games, on which peoples loves to spend their betting.

Cricket betting in India

Cricket has the potential to unite the entire population together, because is loved by all groups of people. It is fun to play, fun to watch, and it is fun to bet on as well! Cricket is not only popular in India but in many countries around the world, but Indians are mad for cricket at another level . As a cricket better player, you will have plenty of options when it comes to choosing a great cricket betting site then you have Cricplayers.

These are some of our betting options, in which you must try, and set a betting mark

· Ipl 2021

· World cup 2021

· T20 Mens world cup

Football Betting

Football is one of the most popular sports in the world as well as most loved game in India as well, so if you’re looking for football betting sites, you are at right place. Cricplayers is a bunch of your entire requirement.

Although most football betting sites are focused on European football, a good football betting site should allow you to bet on leagues from all over the world, including India, so Cricplayers provide you all that.

Other great features to look out on Cricplayers are: football live streaming, football betting and many more.

Deposit bonus live casino

You can easily deposit your bonus using any payment method.

How to deposit bonus on Cricplayers

Another great benefit of Cricplayers is that they make it incredibly straightforward for Indian players to deposit & withdraw money.

Here is a small selection of the many deposit methods you can use on circplayers:

· UPI

· Online Bank Transfer

· Paytm

· PhonePe

· Google Pay

· And many more

In other words, every player from India should find it easy to deposit money on Cricplayers without getting stuck!

Betting sites with best odds

Getting the best odds is essential in sports betting. Getting low odds is like getting ripped off, but Cricplayers is quite good in all that.

You are basically overpaying for a service that you could get at a cheaper price if you were playing with a different bookmaker with Cricplayers.

How to register with Cricplayers, and step into it.

Don’t waste your time anymore, signup with Cricplayers by using valid credentials and earn signup amount of Rs 100 as a sign up amount.

https://www.cricplayers.com/hi-in/home

0 notes

Text

PhonePe Refer and Earn: How to Earn Money by Referring Friends

PhonePe, one of India’s leading digital payment platforms, offers a fantastic "Phonepe Refer and Earn" program that allows users to earn money by referring friends and family. This program is a great way to make extra cash while helping others discover the convenience of digital transactions.

What is PhonePe?

PhonePe is a UPI-based payment app that allows users to send and receive money, pay bills, recharge mobiles, and much more. With its seamless interface and wide range of services, PhonePe has become a popular choice for millions of users across India.

Highlights of the Refer and Earn Program

Earn Money: Get rewarded for every successful referral.

Easy Process: Simple steps to refer friends and earn rewards.

Instant Rewards: Receive your earnings as soon as your friend makes their first transaction.

How to Refer and Earn on PhonePe

Download the PhonePe App: If you haven't already, download the PhonePe app from the Google Play Store or Apple App Store.

Sign Up or Log In: Create a new account or log in to your existing PhonePe account.

Find Your Referral Code: Go to the "Refer and Earn" section in the app to find your unique referral code or referral link.

Share Your Referral Code: Share your referral code or link with friends and family via social media, messaging apps, or email.

Earn Rewards: Once your friend signs up using your referral code and makes their first transaction, you will receive a reward in your PhonePe wallet.

Benefits of Using PhonePe

Secure Transactions: PhonePe uses advanced security measures to ensure safe and secure transactions.

Wide Range of Services: Pay bills, recharge mobiles, book travel tickets, and more using the PhonePe app.

Easy to Use: User-friendly interface makes digital transactions simple and convenient.

Tips for Maximizing Your Earnings

Promote Actively: Share your referral code on social media, blogs, and with your contacts to reach a wider audience.

Explain the Benefits: Highlight the convenience and features of PhonePe to encourage others to sign up and use the app.

Follow Up: Remind your friends and family to complete their first transaction to ensure you receive your reward.

Common Questions About PhonePe Refer and Earn

How Much Can I Earn? The amount you earn per referral may vary based on ongoing promotions. Check the app for current offers.

When Do I Receive My Reward? Rewards are typically credited instantly once your friend completes their first transaction.

Is There a Limit to Referrals? Some promotions may have a cap on the number of referrals. Check the terms and conditions in the app.

Conclusion

PhonePe’s "Refer and Earn" program is an excellent opportunity to make extra money while promoting a reliable and convenient digital payment solution. By sharing your referral code, you help others experience the benefits of PhonePe and earn rewards in return. Download the PhonePe app today, start referring, and enjoy the perks of digital transactions!

0 notes

Text

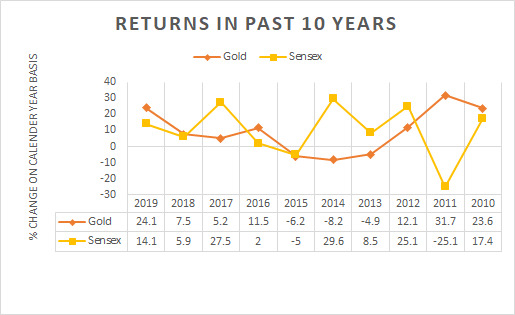

This Akshaya Tritiya think beyond Gold | GoldenPi

Digital Gold | Gold ETF | Sovereign Gold Bonds | Bonds

Indians love gold. The gold produced in India cannot meet the demand. Hence India imports tons of gold every year. In the FY 2019, 983,000kg of gold. This precious metal is irreplaceable. Rather than consumption, if you want to buy gold for investment purposes, then here are few gold investment options.

Gold Investment Options in India

Digital Gold

It is a digital form of gold issued by Minerals Trading Corporation of India.The investor can buy or sell digital gold via an agent on an online platform. Investors can convert the digital gold into physical gold and receive the delivery. You can buy digital gold via mobile apps such as Google Pay, Paytm, and PhonePe.

You can start investing in digital gold with Rs. 1 also. And that is why people go for digital gold. If you have to buy physical gold, you need to buy at least one gram of it. One gram of gold charges around Rs. 5000. They can be brought and sold easily online. Maintenance cost and GST together will charge you 6%. Hence effective returns will be less by 6% than gold returns. Most digital apps allow you to hold digital gold for a limited number of years (mostly 7 years). After that, you need to take physical delivery of the digital gold or sell the units. The more significant concern here is that there is no regulatory body to control the digital gold business.

How can one make money by investing in Bonds?

Gold ETFs:

Gold ETFs are commodity-based securities that invest in gold companies or gold refineries. They follow the gold index on the National Stock Exchange. These are low-risk investments present in both dematerialized and paper form. Every one unit of Gold ETF represents one gram of 24 carat gold. Gold ETFs are listed on the NSE, and Asset Management Company takes the responsibility of trading them online.

In the case of Gold ETFs, the minimum investment is the price of one gram of gold. The maintenance cost is 0.5-0.1%. SEBI regulates them, and the physical gold brought is also audited regularly by the statutory bodies. The risk here is the volatility of the gold price. There is redemption, but you can sell them in the stock market at the current market price. And gains are taxable as per the tax slab.

Gold MF:

Gold MFs are funds that invest in multiple Gold ETFs. They are also called Fund of Funds. They are similar to Gold ETFs, but a professional fund manager manages Gold MFs.

The minimum investment amount is Rs. 100. They are readily available, and they are liquid in nature. The maintenance cost double the cost involved in gold ETFs. The maintenance charge is around 1.5 – 2.5 %. The effective gold returns from Gold MFs are 2.5 % lesser than the returns from physical gold. The gains from Gold MFs are taxable.

Sovereign Gold Bonds Schemes

SGBs are denominated in grams of gold. SGBs are derivative instruments issued by the RBI, where investors will own gold in a certificate format. They are available periodically. SGBs are issued by RBI once in a month or two. You can buy them from Stock Echange, selected banks, and Stock Holding Corporation of India. As the GOI backs them, they are safe to invest in, and they are insured. SGBs offer a fixed rate of interest of 2.5%. SGBs are tax-free if they hold them till maturity, i.e., eight years else, you will be taxed as per your tax slab. You cant redeem these bonds before five years. After the completion of 5 years, you can save them whenever RBI opens a window. RBI opens a redemption window twice a year. The dematerialized form of SGBs can be sold in secondary markets. SGBs are not very thriving in the secondary market; hence, the seller has to offer a good discount to sell these SGBs. SGBs are usually sold at the discount of 2% – 6%. You can take a loan on SGBs, and the loan amount varies from bank to bank.

Is physical gold safe?

Risks involved in physical gold are-

Making and designing charges

Storage expenses

GST of 3%

These charges may come up to 10%. And if you wish to sell physical, you need to produce origination and purity certificates. Else you need to sell at a discount.

Equity and gold prices both are volatile.

Digital Gold

Gold ETFs

Gold MF

SGBs

Bonds

Availability

Available Available Available Periodically Available Available

Liquidity

High Liquidity Medium Liquidity High LiquidityLow Liquidity Moderate Liquidity

Cost

3%0.5 – 0.1%1.5 – 2.5%NANA

Tax

3% GST Capital Gain Tax Capital Gain Tax Tax-free & early redemption taxable No TDS only Capital Gain Tax

Risk

No regulatory body Gold Price volatility Gold Price volatility No risk Low risk

Returns

Not fixed Linked to the gold price Not fixed Linked to the gold price Not fixed Linked to the gold price Fixed: Gold returns + 2.5%8-12% P.A.

(AAA rated)

Gold and equity both are volatile. Gold investments such as digital gold, Gold-ETFs, and Gold MFs attract the cost of maintenance, exit loads, and taxes. SGBs are profitable if you are determined to hold them for the whole eight years. In case you are looking for fixed income instruments that are liquid in nature. Then you can think of Bonds.

To know the perks of investing in Bonds, click here.

Bonds and Debentures

Bonds are debt securities issued by government bodies or corporates. The issuer can raise capital via bonds. The capital raised can be utilized for business operations or expansion. The bonds offer fixed interest paid regularly. And the investor gets the principal;l amount back on the maturity.

The advantages of the bonds are – As they are low-risk securities, they are relatively safer

They offer fixed income that can meet the financial requirements of the investors

They can be sold or brought at any point of time at the current market price without any exit load.

TDS is not deducted on bond gains.

To avail the Akshaya Tritiya offer. Invest today and earn a special yield.

0 notes

Text

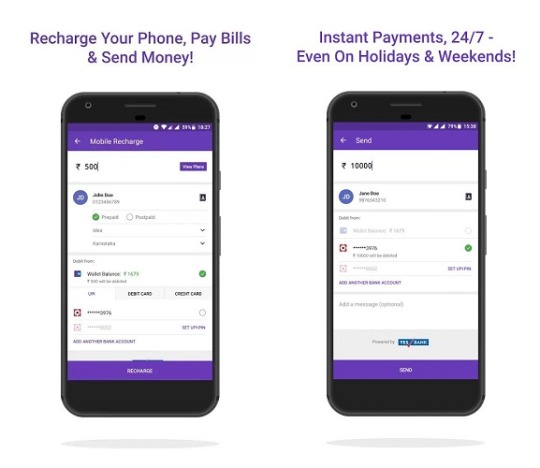

Best Mobile Payment Apps for 2021 that pays you Real Money

With the unstoppable rise of e-commerce, online businesses have seized the opportunity to become an important part of the global economy. Because these companies act like offline stores, they also need the same customer journeys - even faster and easier - to get their product to market. To make sure of that, they need to work with the best partners and have a satisfying inventory. This led the financial sector to also have an online presence. Banks have also created applications, websites, and online payment options to reach their customers through online businesses. This has led to a new era of partnerships. Payment gateways were also part of this revolution.

Life was made easy and stress-free with digital payment and recharge apps. They have given us the freedom to pay anytime, anywhere prepaid / postpaid mobile numbers, landlines, electricity, insurance, and gas bills.

Besides? These apps offer huge discounts and deals with every top-up, making them even more useful. This success can be measured by the large number of mobile recharge services that have grown in India in recent years.

New services are usually the ones that offer the most attractive deals. So if you are looking for mobile and bill payment apps that offer comprehensive and efficient solutions, this is where you need to put in some effort.

I have seen people buy loads of apps from Google PlayStore or Apple iStore. But there are also some free top-up apps available in stores that allow you to earn some top-up money to pay your bills. These are special apps designed to earn real money and rewards using a few simple steps / tricks. Yes that’s true All you have to do is install such a money earning app and do some very simple tasks like watching videos, solving a challenge or quiz etc. These are the best paid apps for earning money. And now is the right time for your smartphone which is really productive for you.

Nowadays, almost everyone is trying to do something different for their job so that they can earn money a parallel, such as a part-time job, stock market, work from home, data entry, investing, etc. But there are very simple and effective ways you can make you sit home. I managed to find some mobile applications available in the App Store that earn you free top-ups, paytm cash and many more rewards using your smartphone. allows for.

There is no point in using a “smartphone” if you are not using it “smartly”. I hope you agree with my statement. Most of you have an Android / iOS mobile device and now is the right time to use a smartphone to earn some money with it. Don’t worry, let me tell you how we can use your mobile smartly.

But today, I’m going to share with you the best money making apps I’ve personally tested, and help you earn some free recharge cash. You just need to install the apps and earn money with these latest apps. You can easily earn rewards by downloading the app and have unlimited free recharges by referring your social friends.

Top Online Recharge Apps to Earn Money

I personally tried and tested these apps and then divided them in our opinion to help you find out which app to try first. But I would advise you to try them all, you probably like all the apps. Some also help you get more rewards in less time. Most working and top-grossing mobile apps to earn real money and rewards:

BHIM – Making India Cashless

Nowadays people do all their transactions online through banking apps just to be “Cashless”. For this, BHIM app is developed by Govt. of India. And to go cashless, this app is the most beneficial, preferrable, secure, and helpful app to do all your banking transactions.

Not only you can do your transactions with this app but you also this app provides you various other services like interesting offers and discounts while doing transactions. This app is compatible with both Android and iOS. Make sure you have linked your mobile number with your bank account and the same is used for accessing BHIM.

There are some offers for first-time users so that everyone can take advantage of it. Every single day, you do some transactions using your bank account, but you can refer and earn money from this app instead of using this “cashless transaction facility”.

Khatriji – Utility Bill Payment & Online Recharge

By using Khatriji Website, you will get or earn money on Online recharge. you will earn while you refer a friend that can be shared to anyone and earn your referral reward points. Simply, doing online Recharge and Earn more with value added services like Utility Bill Payments, Mobile/DTH Recharge.

You can earn cash anytime and from anywhere, there are no complicated missions to visit places or wander around and best of all it’s an easy, quick and fun way to make easy money! Make money is the best online recharge website!

Empire ReEarn – Earn Money without Investment

Easiest Way to Earn Money. Your online prepaid recharge is just a click away with Empire ReEarn! Empire Re Earn is your one-stop shop solution for online recharge. For every prepaid recharge that you complete on Empire ReEarn, you may get special rewards that include cashback.

Empire ReEarn not only provide you easy accessibility, also ensure quick transactions. It is possible to complete a prepaid online recharge with us in less than 10 seconds.

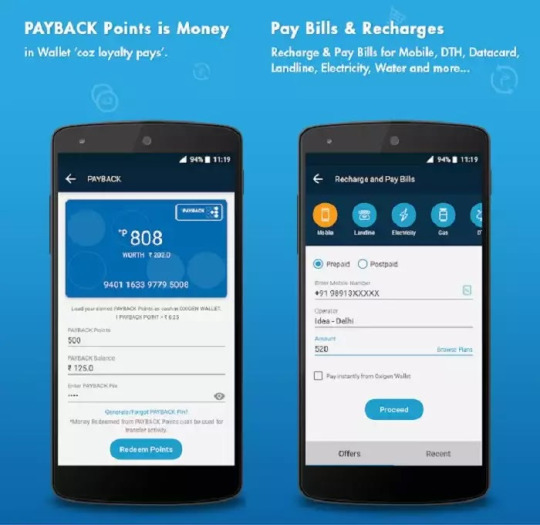

Oxygen – Bill Payment & Recharge, Wallet

Here is another big opportunity for you guys and I’m talking about the app named Oxigen Wallets. This is an app that provides you free Paytm cashback offers. Oxigen Wallet is one of the most loved & widely accepted mobile wallet apps. This app is designed to work with all of your payment methods.

Developers are frequently trying to give some amazing features and offer. This app is basically designed by USA country. That’s how you can make huge money by referring your USA friends.

Oxigen is giving Rs.200 FREE to all OLD and NEW users when they will refer their Indian-USA friends i.e. Indians who are living in USA right now. It’s very simple and easy, you will get Rs.200 mobile recharge on referring them on Oxigen USA mobile app. Oxigen is the one-stop solution for all your payment needs.

Cashbuddy – Paytm Cashbacks & Deals

Cashbuddy (or Databussy) is one of the biggest shopping cashback platforms over the internet. This app allows you to earn huge cashback and offers by shopping on Amazon, Flipkart, Jabong, Myntra, and over hundreds of other top shopping sites. You will see top trending brands and coupons for shopping. Earn cash on every action on Databuddy, which can be redeemed for mobile recharge.

You will also get coupons for Top Sales at Amazon like Prime day sale and great Indian festival sale, at Flipkart like Big Billion Days sale and many other sales like; Snapdeal unbox sale, Myntra, Ajio. Whatever you earn from all the deals that you will make, you can redeem cashback on Paytm, Amazon, and Flipkart, etc. Also, you can earn free cash by inviting your friends and family to try Casabuddy by sharing a link through WhatsApp, Facebook, Twitter, SMS, and Gmail.

Quite beneficial for first-time users of this app i.e. new users will get Rs.10 as a sign-up bonus and if you refer to your friends it will fives you Rs.10 more for each successful referral.

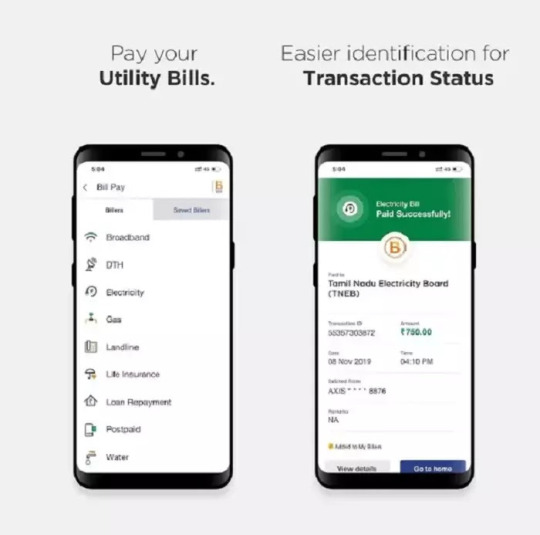

PhonePe

The PhonePe is the easiest solutions to mobile recharges and bill payments. It is a UPI-enabled app that can link directly to your bank account for transactions. The PhonePe app supports everyday payments of utility bills, mobile recharge, funds transfer to friends and family, request money, etc. and is quite simple to use.

Apart from this, the app also offers mobile-wallet service, multiple payment modes, and will often surprise you with offers like cash back and discounts. One can also earn handsome rewards from PhonePe by referring the app to others.

Unfortunately, the app doesn’t have the option to load money from your credit card in the wallet. You can pay your bills and do recharges using credit card, though.

Amazon Pay

Another payment is Amazon’s digital payment app. This is an integrated feature in your Amazon account. Using Amazon Pay you can add money to your account to pay for goods and services purchased from websites and mobile apps.

Amazon also partners with various services to promote its e-payments and offer discounts and cash back using pay balances. You can add up to Rs. 10,000 on Amazon Pay and use it to pay for food orders, movies and events, ebooks and more. There is also a monthly cashback offer on loading money in the wallet on Amazon. However, one thing missing from Amazon’s heavy artillery is the bill payment option.

Paytm

Paytm is the most popular and reliable app for online recharge and bill payment. Dynamic e-wallets and the UPI app provide payment, money transfer, shopping, recharge features, bill payment, and a myriad of other services including movie, bus and air tickets on its platform.

Paytm now has over 300 million users and is probably its biggest loss. Now, it has determined for itself once in the market that there are limited deals, discounts and cash back in the application.

Mobikwik

Mobikwik app is a hassle free mobile payment app for all your utility bills, mobile recharge and shopping. The app benefits from its e-wallet that can be used to pay at top merchants such as Big Basket, Book My Show, eBay, Myntra, Grofers, IRCTC, Domino’s Pizza, Shop Clues, Oyo Rooms and more.

Mobikwik wallet feature also comes with super cash-back offer. The app supports limited money transfers and it is literally impossible to use the entire super cashback.

Freecharge

Freecharge is one of the first online recharge and bill payment apps. Although it is now in a decreasing state, it offers several specific deals, among which users are notified via email. It has a simple and smooth process with various coupons, which can be used at your partner store to get discounts.

Freecharge has also started supporting merchant payments, which may not be as widely accepted as Paytm or MobiKwik, but are continuing progress.

PayZapp

PayZapp is an HDFC mobile platform e-recharge app offering for all. With PayZapp you can shop on partner apps on your mobile, buy movie tickets, groceries, compare and book flight tickets and hotels, shop online and get great discounts. The app can also be used to share money with anyone in your contact list or in your bank account, pay bills and recharge your mobile, DTH and data card and many more.

These are the main mobile payments widely used in India. While every app on its platform has charging and payment options, they differ from each other in one aspect. If you want to keep up to date with the latest offers and deals on various portals, you can also visit the Build Side Income.

So these are the most recent and updated apps that let you earn and recharge money for free, and some of them also save your money or mobile data. Go try them out and comment which app you like best and make more money together. Anyway, if you think something more promising is what I mentioned above and would like to suggest other things, don’t hesitate to use the comment section below. You can always contact me. Nice to hear from you and would like to share as much information as possible to help others.

Source : Earn Money With Payment Portals

#BHIM#BillPayments#Cashback#earnmoney#EmpireReEarn#khatriji#netbanking#online recharge#oxygen#paymentportals#skyomie#phonpe#paytm

0 notes

Text

Top 7 Refer And Earn Apps | Refer Your Friends | Earn Real Money Apps

Refer and Earn Money Apps Online

Sometimes Earn Money by Referring Apps isn’t as easy as the world makes it sound. A person may face difficulty in getting revenues out of odd jobs.

There are times when a person would look forward to some fantastic sources, through which s/he can earn money online.

But all a person needs is some sources which can help in earning money.

List of Best Apps for Earning Money in Online:

“Refer your Friends” and Earn Money

S.NoRefer and Earning AppsRewardsDownload

1.PaytmEarn Up to Rs. 50!

Download

2.Classic RummyEarn Up to Rs. 1500!

Download

3.Google PayEarn Up to Rs. 51!

Download

4.PhonepeEarn Up to Rs. 100!

Download

5.PayzAppEarn Up to Rs. 25!

Download

6.FreeChargeEarn Up to Rs. 30!

Download

7.Bhim ABBPEarn Up to Rs. 100!

Download

How to Refer and Earn Money Apps:

What If I tell you that there are some Mobile Applications, which you can refer to your friends and earn money online? The Best Apps for Earning Money in India.

Yes, you have heard it right! earn money by referring apps is the next big thing. The bigger your friend’s circle, the more money you can make!

You can invite all the friends you have to use a mobile app that will pay you for inviting your friends. Invite and earn is the new motto!

With all the advancements in technology, new eye-catching features keep coming out, refer and earn money apps are one of them.

Let’s have a look at some of the applications which you can refer to your friends and avail benefits such as cash!

“Earn Money by Referring Apps”

Paytm:

Paytm is a big name, which all of us would have heard. Paytm gives its users the option to ‘Best App for Earning Money In India’ on their platform.

Mobile recharges, movie tickets, etc., everything is available under the same hood. By referring the application to one of your friends, you can Earn Up to Rs. 50!

Invite your friends to earn money and promote the age of digital transaction at the same time.

Once your friend signs up through your referral link, he will have to recharge something within the next 30 days.

If he/she does so positively, then you will be credited with 50 rupees to your Paytm wallet. You can earn up to 1000 rupees a day! “Refer and Earn Paytm Cash”

That’s actually a lot of money and if you do it frequently, you can end up earning a lot. Invite all the people you know to make a ton of money.

Classic Rummy:

Even Classic Rummy is a delicious treat when it comes to referrals and earning money.

This Indian Rummy platform has a lot to offer you through their ‘refer and earn’ option.

Through their website, you will get to know that the rummy card game is a game of tactics and high-order thinking.

You can sign up on their platform and avail a lot of benefits by inviting your friends through referrals.

How to Earn Money by Classic Rummy App?

Download the Classic Rummy App,

Register for free online rummy,

Click on Refer Tab, for inviting your friends via WhatsApp, Hangouts and Messaging,

You can also play cash games and win more!

By using the referral code, you can invite any of your friends and win up to Rs. 1500 cash back! That is a huge reward for inviting your friends. Classic Rummy is one of the best app for earning money in India.

Not only can you enjoy the game itself, but also play online rummy with your friends and earn money on the go!

How many more benefits can any other platform provide? Download the app and start earning today. It’s an easy process. Check out their website for more details.

Play Online Rummy and Win Real Cash Daily!

Google Pay:

The great platform owned by Google provides you with good value for referrals! ‘Earn Money App Referral Code’

The procedure is very simple and similar to other platforms. Google pay is useful in online transactions that we make on a daily basis.

After signing up, you will have to send a referral link to one of your friends. Once he signs up through your link, you will get 51 rupees back through referrals.

Let’s say if ten of your high school friends sign up using your referral, then it will be a treat for you.

PhonePe:

Another great option in this list is PhonePe! If you have seen its advertisements, then you might be aware of this platform.

It is an application which is preferred for online transactions. By using the referral code, you can Earn Rs.100 in a single go.

You can refer it to as many people as you like!

PayZapp:

As good as the name sounds, even PayZapp offers a great deal if you refer it to your friends!

PayZapp is also a platform which makes the online payment process, convenient. They also make the process of ‘refer and earn’ convenient.

Through PayZapp, you can get Rs. 25, on every referral which you make!

If you have a long list of friends, then you can make a good lot of money out of the same! inviting them through “Earn Money by Referring App”

FreeCharge:

FreeCharge also makes up to this list, and you can use this application too, for earning money. You can earn around Rs. 30 per referral.

You will have to ask your friend that he uses your referral code, without fail during the time of transaction.

Among all other benefits, again referring it to your friends can be very beneficial!

Bhim ABBP:

Bhim ABBP is also very famous, and easy to use. When it comes to inviting your friends and making money by referring them to the app.

By referring this application to five of your friends, you can get around 100 rupees.

You will have to tell your friends that they use your contact number as their referral code, and then only it will work.

Not only will this platform make transactions easy for you, but it will also help you in earning money!

Final Thoughts: Refer and Earn Money Apps

These are some of the applications, which can help you in getting some money and making life easy for you. Did you ever think having many friends would pay you?

Now that you have gone through all the Money Earning Apps that can make you money for having friends, Go ahead and download these best apps for earning money in india.

0 notes

Text

How to Apply for IPO Using UPI ID?

As a wise investor, you want to buy a stock at the right price; essentially, because if you purchase the asset at the right price, then only you maximize your earnings by holding it for a long time and then eventually selling upon price rise. But how would you know the right price of a particular share? The best method to find that is via an Initial Public Offering (IPO).

When the shares of a private company are traded on the stock exchange for the first time, it is known as an IPO. You can participate in IPOs online using your Unified Payments Interface (UPI) ID. Yes, the same ID that you use to transfer funds and shop online can also be used for a new IPO application.

Here is all you need to know about IPO with UPI ID:

What is UPI?

UPI is an immediate, real-time payment platform developed by the National Payments Corporation of India (NCPI). UPI allows the transfer of funds between two bank accounts in no time. However, to use this facility, you need to create a UPI ID. You can use a UPI-enabled bank application or an authorised third-party app like BHIM app, PhonePe, Google Pay, Paytm, etc. to create your UPI ID.

How can you use your UPI ID to apply for IPOs online?

To make the IPOs online more secure, transparent and straightforward, the Securities Exchange Board of India (SEBI) has made it mandatory for retail investors to invest in new IPOs online through their UPI ID. You can select your UPI ID or instruct your broker to use this ID as the payment medium on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

You can use these steps below to apply for IPO with UPI ID:

Download any UPI 2.0 enabled application

Generate a UPI ID and mPIN for your bank account associated with your trading account

Login to your broker’s application and select an open or upcoming IPO

Opt for the IPO you wish to participate in

Read all terms and details of the IPO, including opening and closing dates, total issue, lot size, etc.

Enter the valid UPI ID associated bank account and subsequent trading account

Mention the number of stocks you wish to buy

If you want to buy at the cut-off price, tick the checkbox below. In case you wish for a different price, enter the new price

Read the full agreement and submit the document

Upon successful submission, a mandate request is sent to the UPI app

Once you accept the mandate received, your linked account will be blocked by the total funds required to purchase the number of lots specified in the application

If your IPO bid is successful, the blocked funds are deducted from your bank account, and your Demat account is credited with the number of shares

In case shares are not allotted, the blocked money is released on the date of new IPO allotment

SEBI launched the facility to apply for IPOs online using UPI ID in 2019 to make use of its increasing regional penetration and simple user interface. The introduction of UPI in the IPO arena has enhanced the reach of public offerings.

0 notes

Link

Get Best Deals and Offers online shopping, latest Coupons Online for top online shopping websites in India. Refer and earn cash, Mobile recharge tricks, Save money with largest Discount Vouchers and Promo Codes in Lootbazzar.com

You Can Also Get the latest updates on best online shopping deals, loot updates, refer and earn cash programs, Paytm, Amazon, Phonepe, google pay offers, and many more loot deals offer is here.

These match programs must not be bringing anyone enough to stop your daily life, they may also be a nice means to have a break and make some extra cash. You can apply it to some enjoyable cash or add it to your checking account.

Even if playing games to get the cash may seem such as a scam, the listing below contains valid possibilities for making dollars. There is a large number of tactics to earn, for example playing matches, answering trivia questions, taking surveys, etc.

Play Online Games & Earning From Home

You can find many apps that would get anyone income only for them. But Online Earning games are some of the more fun apps to use. If you look up you’re spending a while playing Candy Crush or Two Dots, try switching to certainly one of the options below. This way, you’ll make money online and have some mindless fun when you play.

The payouts vary for each program and therefore are everywhere from cents to a very few dollars at a time. Pick just a few selections against the checklist below and decide to try out them. You may even find a new preferred.

Swagbucks

You can find a number of ways to online earning while the Swagbucks App, and also games are only one of many options. You’ll become rewarded along with other”Swagbucks,” which proves to be redeemed for prizes or even gift cards to significant retailers like Starbucks, Amazon, Walmart therefore on.

One of the trendy means by which you can earn Swagbucks is by playing with absolutely free games one example is Swagasaurus operate or even Swag Memory. There is a daily limit on how many Swagbucks you can earn from each match, which means you might want to return every single day to maximize your earnings.

Mistplay

Mistplay calls itself a devotion app for players. You’re going to be capable to discover new games, play video games and get points for doing so.

Amazon

Visa

X Box

Starbucks

Google Play

I-tunes

And much more. The games anyone’s shown on Mistplay are decided on depending on your own gambling preferences and customs. What this means is Mistplay works difficult to select online games, anyone, like to learn.

HQ

Can you love displaying your trivia understanding? If that’s the circumstance, you need to truly give HQ a try. This fun, fastpaced trivia video game allows you to compete and win cash prizes. Players have 10 seconds to answer each multiple-choice problem.

The app normally takes the shape of the live match series, which broadcasts at 9 p.m. Eastern Time daily. There’s another show at 3 p.m. Eastern on weekdays in addition. You’ll need to answer 12 questions to be entered to win against the grand prize, which extends to the person who answers all of them accurately.

But if multiple folks answer all queries correctly, the prize is divided involving all respective winners. Occasionally, prizes can also be a lot higher up to $400,000.

The HQ app is accessible on Google Play and also in the I-tunes App store.

Inbox Dollars

In case anyone’s rather get cash compared to coins or rewards points, then check out InboxDollars. This absolutely free app provides an excellent collection of both the free and paid video games you could play with to make income. As opposed to other apps, you can get your earnings to get dollars.

You will find more than thirty free games you’ll perform. For example, word hunt, swimming pool, chase, sudoku, card games, and a lot more. The typical earnings for every activity include 25 cents to $5. Therefore it’s simple for the hard-earned money to rise.

Once you’re ready to cash out, you’ll take out the money and deposit it into your checking account or savings account. You can also consider a few of the alternative ways to earn income with InboxDollars, for example, surveys, internet searches, and much additional.

Lucktastic

Are you really addicted to scratch-off online games? Lucktastic is an absolutely free game that could help you satisfy that need and acquire funds without even buying physical tickets. Prizes may go up to $10,000. So you may have the prospect of earning some actual money.

Long Game

Though Extended matches is also a fun approach to pass enough moment. It can also assist you to reach your financial targets. Upcoming up, you may need to create a savings goal, just like the saving to get down a car cost. DOWNLOAD NOW

Then decide on how much anyone would like to be inserted to your own account each and every payday. Every time anyone adds money to your account. You’ll earn coins to learn games to get prizes.

All the money anyone’s putting into your in-app savings account proceeds for you. The account is currently FDIC-insured to get an added layer of protection and peace of mind.

Swag IQ

Can anyone adore the excitement of a reliable game show? Check out the absolutely free Swag IQ program for your opportunity to check your knowledge on a stay amusing game show. You can make cash only for playing with, and a grand decoration in case you answer all questions accurately.

DOWNLOAD NOW

In the true game series arrangement, anyone is offered a series of trivia questions along with multiple option responses for everyone. You have just 10 Seconds to go with your answer. Remember to generate a decision until the 10 seconds operate outside or anyone be out of this running to that grand prize.

Even in the event, you cannot allow it to be all the way into the very top, that you may earn Swag IQ’s digital currency for answering questions accurately. You can use it in order to receive an additional opportunity to get the grand decoration or decoration for cash or gift cards.

Bananatic

If anyone would like to become certainly one of the very first to play a new sport and give your input, consider Bananatic. This program is used by video game programmers for testing their newest matches and getting evaluations and hints about improvements.

It’s also a fun network of players that is able to satisfy each other through the program, discuss the matches, bugs, sport advancement, and thus on.

You’re able to redeem your winnings for digital articles, superior matches, and sometimes even gift cards.

GET IT NOW

Brain Battle

They do this by sharing a portion of the advertising profits along with the other lucky winner. You’ll find not any in-app buys without a paying to acquire.

Whatever you may need to do is downloading this absolutely free app and play any of the games to collect tickets. You should acquire a minimum of a single ticket to be entered into the money prize drawings. The amount of money is paid via a Paypal currency transfer.

Brain Fight can be obtained as part of their Google play store in Keep along with the I Tunes App-store.

Lucky Day

Experiencing that gaming Writer? Have a look at the Lucky Day app, that brings the casino into the hands of one’s hands. Select from a large number of casino games, including slots, slots raffles, scratch-offs, and also more. You have the occasion to gain real cash awards, like an everyday drawing for $100,000.

Even if you cannot wander off along with the grand prize, anyone still gets points that may be used on gift cards into popular merchants just like the Amazon. You also may make use of the tips to get into raffles, sweepstakes, and lottery drawings.

New scratch cards have been available every single day, which means you might want to come back and try your fortune again in case you didn’t win the earlier moment.

Want Lucky Day app CLICK HERE

Givling:-

In case you’re struggling with all of college student loan or mortgage debt, give the Givling app a try. You can play with totally free amusing video games to win – four and – five-digit cash payouts. You only get 10 seconds to answer each and every question, therefore there is absolutely no alternative to cheating by executing a fast online lookup.

If you play this game 10 times for 30 days. Then you will able to add $10,000 random drawing. Yet another means to find cash will be always to enroll in the financing queue to get student loans or mortgage obligations.

Your own goal should really be to make the journey at the surface of the lineup by completing selected actions for example getting together with all ads, engaging in sponsorship offers, etc. In this, if you can get to the very top, you have a shot at winning $50,000 to employ toward your own student loan.

CLICK HERE For Givling App

PCHGames

This program will be run through the Publisher’s Clearinghouse or even PCH to get brief. Proceed into PCHGames to access to scratch cards and instant win games at which you could win up to $2,500.

A few of these games available inside the program include Mahjong, slots, blackjack, and much a lot more. If you’re very blessed, that you’ll get awards up to $1million.

Aside from becoming blessed at a high decoration, you can also redeem the points for enjoyment memorabilia one example is gift cards as well as product. Enjoy this Online Earning Games.

Want PCHGames CLICK HERE

Big Time Cash

With more than 600 fun matches, the big style Cash app has something for everyone. When you play with every one of the games, you’ll amass tickets. Utilize them to get into the typical money prize foundations. The further tickets you could put at, the clearer your chance of success.

There aren’t any in-app upgrades or purchases. Since the program utilizes a portion of its advertising bucks to fund the prizes, the more people who join, the larger the payouts.

The Big Time Cash program is available as part of their Google Play Store along with iTunes App-store.

Pogo

The Pogo App includes a blend of both paid and free game options. You can find several different alternatives, from arcade online games to play card favorites.

The paid version enables you to enter tournaments and compete for more details. It provides an ad-free taking part in the adventure and offers the use of other games. Whereas in the free version you can able to play some games & win

Together with both variants, you could put in an everyday drawing to win $50. Moreover, you can actually score a $500 jackpot just for playing games. So keep playing.

Click Here For Pogo App

Blast

TheBlast App allows anyone to save lots of, get, and acquire cash for playing matches. To get started, you join with this absolutely free program to some checking account and allow it to transfer little sums into a high-yield Blast checking account.

You’ll get unique amounts by playing a wide range of matches or even completing missions. As an example, you are able to get 25 cents for linking candies and earn 5 cents coin for collecting or buy $1 for beating a particularly tough amount.

In addition, you earn practical experience details as part of their app for each assignment anyone complete and for each and every dollar you save. As anyone collects more points, anyone climbs the leaderboard for an opportunity to win one of 3 prizes. The first place wins $1,000, second place wins $50, and 3rd place has $25.

DOWNLOAD NOW

ALSO READ

Best Deals And Offers [Online Shopping] Website For Women

Online Mobile Recharge Tricks And Offers On [Amazon Pay]

0 notes

Text

google se paise kaise kamaye | How to earn money | गूगल से पैसे कमाए आसान तरीके से

Hello Freinds, आज मैंने इस पोस्ट में बात करने वाला हो google se paise kaise kamayeऔर किस तरीके से कमाए. इसके अलावा google pay के बारे में मैंने कई सारे जानकारी देने वाला हो जो आपको जानना बहुत ही जरुरी है. सबसे पहले आपको मैं बता देना चाहता हो की google pay से पैसे कमाना पूरी तरह से वैध और सुरक्षित है, इसमें किसी तरह की धोखेबाजी नहीं होती, क्योंकि यह google का ही प्रोडक्ट है. Google Pay Se Paise Kaise Kamaye यह जानने के पहले चलिए जानते है की google pay क्या है और यह कैसे काम करता है. Google Pay Kya Hai Google pay गूगल का एक पेमेंट एप्प है जो खास करके भारतीय लोगों के लिए बनाया गया है. यह एप्प online पेमेंट के लिए सबसे बेहतर और सुरक्षित है क्योंकि इसको गूगल इंडिया के द्वारा हैंडल किया जाता है. बैसे तो इन्टरनेट पर बहुत सारे ऑनलाइन पेमेंट एप्प्स मिल जाता है जैसे की Paytm, PhonePe आदि, लेकिन ये सभी एप्प्स से google pay सबसे बेस्ट है क्योंकि इसमें ऑनलाइन पेमेंट के लिए गूगल पूरी तरह से सिक्यूरिटी प्रोवाइड करती है और इसके साथ साथ लोगों को पैसे कमाने के लिए मोका भी देती है. आप google pay को इस्तेमाल करके अपना mobile रिचार्ज, DTH रिचार्ज, ऑनलाइन बुकिंग, और ऑनलाइन एक अकाउंट से दुसरे अकाउंट पर पैसे को ट्रान्सफर भी कर सकते है. Google pay का सबसे खास बात यह है की इसमें QR Code का एक ऑप्शन रहती है जिसके मदद से आप अपने आस पास का दूसरे किसी google pay यूजर को पैसे ट्रांसफर कर सकते है. Read the full article

0 notes

Text

PayQ Founder Shibabrata Bhaumik listed on Forbes

The coronavirus pandemic might help to achieve India’s stated goals of creating a less-cash economy and enhancing financial inclusion. Shoppers at even neighborhood stores now want contactless digital payments and that demand dovetails with what lenders want in lieu of working capital loans - digital invoices and online transaction records.

The multi currency, multinational payment processor PayQ, which is now active in India in a sandbox environment along with other leading UPI player have started to tap into the new customer trend who relies deeply on smartphone access for online payments. Financial companies are leveraging this opportunity to meet demand through digital media.

PayQ Founder Shibabrata Bhaumik is fond of Indian Financial regulators like RBI and SEBI who encourage the innovation in the Fintech space by allowing start-ups to experiment in ‘sandboxes’ that will offer them temporary regulatory protection especially during the pandemic stage.

As regulators like RBI and SEBI develop the framework for these sandboxes, UK-based fintech start-up PayQ now wants to be allowed into these sandboxes to get more comfortable with financial transactions for domestic as well as cross border transactions. Shibabrata’s Fintech start up PayQ, headquartered at London, which is growing at breakneck speed, is known for implementing block chain for Frictionless Payments and has surged $1.2 billion in the last financial year.

Shibabrata says, “As regulators and state governments here in India have set up sandboxes for Fintech companies and they are providing relaxation, we are working with them to open the sandboxes and operate within the guidelines.”

Sandboxes are regulatory safe havens created for Fintech start-ups to operate in. They allow live testing of new products or services on real customers in a controlled environment. If these experiments are successful and PayQ grows to a pre-determined scale, PayQ will soon exit the sandbox to operate in the open market under full regulatory supervision and will compete with the major UPI payment players like PhonePe and PayTm.

PayQ’s digital payment platform also includes digital billing to even geotagging, Shibabrata believes that merchant digitization business will boom when the lockdown eases. PayQ also deals with merchant account for high risk businesses like payment gateway for tech support, Merchant account for Pharmacy and aims to go beyond the traditional payment method to revolutionize the e-commerce industry.

Shibabrata announced small ticket credit to PayQ Merchants like Kirana Shops and small businesses. PayQ is the latest entrant to the club of Paytm, PhonePe and BharatPe, with the company announcing its ambitions to lend in a filing with local regulators. PayQ is unlikely to play for runners’ and players like Paytm and Phonepe will have to aggressively defend their crowns.

The CEO of PayQ, Shibabrata Bhaumik is a young first-generation entrepreneur, who has developed application programme interfaces (APIs) for India’s ambitious Unified Payments Interface (UPI). He says, “Working with the government is not so difficult. It has been an enriching experience. Your credibility depends on your delivery of performance. The payments landscape is going to change fundamentally”.

The game of entrepreneurship has changed substantially during COVID19 and players have to change. Founders have to be immersed in two things: the messiness of the problem and that of the new infrastructure.

While Paytm, Google Pay, Naspers-owned PayU and other players were aggressively trying to rope in small businesses on their platform, as B2B does not bleed the business, the big scramble is for over 60 million small businesses. PayQ and Shibabrata is trying to get them hooked to the PayQ payment gateway and then offering them a host of services, including loans, and easy payment acceptance and settlement to small businesses incuding Kirana shops and that would lead to an intense battle, where incumbents could face the heat.

Moreover, the PayQ’s entry to India comes at a very opportune time. During the lockdown, several questions have been raised about the readiness of the Indian grassroots system to allow its small businesses to participate in an end-to-end digital ecosystem that powers content, transactions and finally, payments and fulfillment. With this one move, PayQ have clearly sent out signals to take on the giants in the payments, content and ecommerce spaces, simultaneously.

PayQ’s entry portends well for India, as it is likely to bring more serious and diversified investors in the country, reducing its reliance on Chinese money. However the Indian consumer will be the final and the ultimate deal-seeker yet demands the best user experience at the lowest cost. Though PayQ has grown exponentially on adoption of new territory starting from United Kingdom to diversifying its merchant acquisition to European Union and then stepping to Asian Countries but its business models is still evolving. With economic growth slowing down and consumer demand in India tempered, Shibabrata Bhaumik’s PayQ is at an interesting crossroads.

Given all this snitching, the final test will be “how does PayQ appeal to the end user?”

In style and philosophy, Shibabrata Bhaumik, the 36-year-old founder and CEO of PayQ, is in the camp of the financial anarchists. He sits, jammed alongside Developers, Payment Technology Experts and Data Scientists, in a row of tiny desks resembling library carrels and he prefers to sit and work with the team around their desk not like a typical CEO with fancy cabin. He wears a black Business Tuxedo, Classic Red and Black Check Tie, black pants and gloss polished black formal shoes. He talks about a brave new world in which we are liberated from the shackles of giant banks and government-controlled money supplies. The CEO of PayQ, Shibabrata Bhaumik is a young first generation entrepreneur, who has developed application programme interfaces (APIs) for India’s ambitious Unified Payments Interface (UPI), it has been an enriching experience. “Working with the government is not so difficult,” he says. “Your credibility depends on your delivery of performance. The payments landscape is going to change fundamentally".

The multi currency, multi national payment processor PayQ, which is now active in India in a sandbox environment along with other leading UPI player have started to tap into the new customer trend who relies deeply on smartphone access for online payments. Financial companies are leveraging this opportunity to meet demand through digital media.

During an expansive interview, this usually reserved and the press-shy entrepreneur declares why he got into this business: “I wanted the world to have a global, open financial system that drove innovation and freedom.” In the following business model, though, Shibabrata fits in with the pinstriped financiers working down the block.

Born at Kolkata, India to an engineer Father, Shibabrata displayed an entrepreneurial streak as early as grade school. He recalls being hauled into the principal’s office on charges of operating a candy-reselling venture on the playground. The business flings continued with a scheme to resell used computers and, after he earned a master’s degree in 2006 in International Business, he started a web development business from India for overseas clients. Later, he also tried to do few export-import and bilateral trade exhibition business but didn’t turn out that great and lost a fortune and met racket of scammers from Agra, India in 2011 who defamed Shibabrata and his family and charged false allegations on him. However, the young entrepreneur didn’t loose his hope and his sprit was always positive against all odds.

In 2012, Shibabrata read the manifesto by a European Union Bank that proposed card payments of Visa, Mastercard & the future Fintech companies will have limitless possibilities and bitcoin as an underground currency. Its transactions are recorded on a ledger called the blockchain, maintained in duplicated computer files by a band of self-appointed guardians called nodes. Disputes about transactions and ground rules are resolved by majority vote. The nodes are kept honest, and troublemakers at bay, by requiring a participant in the network to engage in some arithmetic busywork before certifying a batch of transactions. A node that completes the arithmetic task is awarded a few new coins.

The busywork, called mining, did not interest Shibabrata. But he did see an opportunity in the business of safeguarding the keys to the coins and setting up transactions. Working weekends and late nights, Shibabrata and his Developing Team created a Payment gateway to process high volume transactions and connected the nodes with the acquiring bank and launched the first payment portal in 2014 later sold it an EU Bank.

Few Venture capitalists from Russia and Germany, showered 5 million USD on Shibabrta’s innovative approach in 2017 and motivated him to create PayQ, a unique high-risk merchant account company whish uses cryptocurrencies and blockchains to build transaction networks for corporations.

Crypto has been condemned as rat poison by Warren Buffett, as a fraud by Jamie Dimon and the mother of all scams by doomsday economist Nouriel Roubini. Where’s the payoff to the economy?

It’s coming, Bhaumik says. He posits a future in which thousands of startups use crypto to raise capital in a global marketplace no longer controlled by Wall Street firms. Within a decade, he predicts, the number of people participating in the blockchain economy will explode from 50 million to 1 billion. We are destined to enjoy a financial system that is “more global, more fair, more free and more efficient”.

New Source:

Forbes : https://www.forbesindia.com/article/brand-connect/uk-fintech-payq-uses-sandboxes-for-digital-loans-to-kiranas/59531/1