#How to buy Bitcoin in India

Explore tagged Tumblr posts

Text

How to Buy Bitcoin with INR, स्टेप बाय स्टेप जानें

Bitcoin को INR में कैसे खरीदें: आसान गाइड

आज के डिजिटल युग में भारत में लाखों लोग क्रिप्टोकरेंसी की ओर आकर्षित हो रहे हैं, और उनमें सबसे लोकप्रिय नाम है – Bitcoin। इसकी लोकप्रियता का कारण है तेज़ लेनदेन, ब्लॉकचेन की सुरक्षा और वैश्विक पहचान।

अगर आप जानना चाहते हैं कि "How to Buy Bitcoin with INR" यानी भारतीय रुपये से बिटकॉइन कैसे खरीदें, तो यह लेख आपके लिए है।

Bitcoin (BTC) क्या है?

Bitcoin एक डिजिटल करेंसी है जिसे 2009 में एक गुमनाम डेवलपर "Satoshi Nakamoto" ने लॉन्च किया था। यह क्रिप्टोग्राफ़ी और ब्लॉकचेन टेक्नोलॉजी पर आधारित है, जिससे यह पारदर्शी और सिक्योर रहती है। समय के साथ यह एक बेहतरीन निवेश विकल्प बन गई है, जिससे कई लोगों ने अच्छा रिटर्न कमाया है।

🌐 यह दुनिया की सबसे पहली और सबसे बड़ी क्रिप्टोकरेंसी है।

🚀 बड़ी-बड़ी कंपनियां जैसे Tesla और MicroStrategy भी Bitcoin को अपना रही हैं।

📉 शेयर मार्केट की अनिश्चितता के बीच यह एक अच्छा हेजिंग टूल है।

💼 डिजिटल पोर्टफोलियो बनाने का बेहतरीन जरिया।

🔐 फाइनेंशियल स्वतंत्रता और अपनी संपत्ति पर नियंत्रण।

How to Buy Bitcoin with INR: स्टेप-बाय-स्टेप गाइड

भारत में INR (Indian Rupees) से Bitcoin खरीदना अब बेहद आसान हो गया है। नीचे दिए गए चार स्टेप्स को फॉलो करके आप आसानी से निवेश कर सकते हैं:

Step 1: किसी भरोसेमंद एक्सचेंज पर अकाउंट बनाएं

CoinDCX, WazirX, ZebPay या Binance जैसे रेगुलेटेड एक्सचेंज चुनें। अकाउंट बनाते समय:

मोबाइल नंबर और ईमेल रजिस्टर करें

आधार कार्ड या पैन कार्ड अपलोड करें

KYC वेरिफिकेशन पूरा करें

Step 2: INR डिपॉजिट करें

एक्सचेंज में लॉगइन करने के बाद अपने वॉलेट में भारतीय रुपये (INR) जमा करें:

UPI, IMPS, NEFT या RTGS का इस्तेमाल करें

यह प्रोसेस कुछ मिनटों में पूरा हो जाता है

Step 3: Bitcoin खरीदें

अब Bitcoin टैब में जाएं, जितनी राशि से खरीदना चाहते हैं वो दर्ज करें:

₹500 से भी निवेश शुरू कर सकते हैं

‘Buy’ बटन पर क्लिक करें

Bitcoin आपके डिजिटल वॉलेट में जुड़ जाएगा

Step 4: अपने Bitcoin को सुरक्षित रखें

अगर आप लंबे समय तक Bitcoin होल्ड करना चाहते हैं:

हार्डवेयर वॉलेट (जैसे Ledger, Trezor) का उपयोग करें

या फिर सेल्फ-कस्टडी वॉलेट जैसे Trust Wallet या Exodus

एक्सचेंज वॉलेट में भी रखें, लेकिन केवल छोटी अवधि के लिए

निष्कर्ष

Bitcoin अब सिर्फ एक ट्रेंड नहीं, बल्कि एक वैश्विक डिजिटल एसेट बन चुका है। भारत में "How to Buy Bitcoin with INR" अब बहुत ही सरल हो गया है, बशर्ते आप सही एक्सचेंज चुनें और सुरक्षित तरीके अपनाएं।

अगर आप अपने पोर्टफोलियो को फ्यूचर-रेडी बनाना चाहते हैं, तो Bitcoin एक बेहतरीन विकल्प हो सकता है। याद रखें—सावधानी और जानकारी ही स्मार्ट निवेश की कुंजी हैं।

📌 Disclaimer: क्रिप्टोकरेंसी में निवेश जोखिम के अधीन है। निवेश से पहले खुद से रिसर्च करें या किसी फाइनेंशियल एक्सपर्ट से सलाह लें।

#How to Buy Bitcoin with INR#Bitcoin#BTC#How to buy Bitcoin#How to buy Bitcoin in India#bitcoin in inr

0 notes

Text

#buy Bitcoin in India#how to buy Bitcoin India#Bitcoin India 2025#best crypto exchange India#WazirX#CoinDCX#Binance India#Bitcoin with UPI#crypto tax India#Bitcoin wallet India#Bitcoin for beginners India#secure crypto exchange India#Bitcoin KYC India#invest in Bitcoin India#Indian crypto market#Bitcoin INR purchase

0 notes

Text

What is UPB Token? How You Can Start With Just ₹100 and Earn Big Profits!

In today’s fast-paced digital world, cryptocurrency and blockchain-based tokens are gaining tremendous popularity. Among these rising stars, the UPB Token has recently caught the attention of investors, tech-savvy youth, and fintech enthusiasts across India. But what exactly is the UPB Token, and how can you potentially earn big profits by investing as little as ₹100?

In this blog, we’ll break down everything you need to know about the UPB Token in simple, easy-to-understand language. Whether you're a beginner or someone already exploring digital finance, this could be your next big opportunity!

🌐 What is UPB Token?

UPB Token stands for Universal Payment Bank Token. It is a digital asset designed to simplify, speed up, and secure online payments, banking, and financial transactions, especially in underserved or semi-banked areas of India.

Unlike traditional cryptocurrencies like Bitcoin or Ethereum, UPB Token is purpose-driven, focusing on enhancing financial inclusion and day-to-day digital payments.

🔹 Think of UPB Token as a smart currency that works inside a digital banking ecosystem designed for the future.

💡 Key Features of UPB Token

Let’s explore why UPB Token is becoming so popular:

✅ 1. Low Investment Entry

You can start with as little as ₹100, making it highly accessible for students, small business owners, and first-time investors.

✅ 2. Secure & Transparent

Powered by blockchain technology, all UPB Token transactions are encrypted, traceable, and protected from fraud.

✅ 3. Instant Payments

Use UPB Token to pay for mobile recharges, utility bills, money transfers, and more — all within seconds.

✅ 4. Growing Ecosystem

The UPB Token is part of a larger Universal Payment Bank platform, meaning it can be used across different services, apps, and vendor networks.

✅ 5. Rewards & Cashback

Early adopters and users often get bonus tokens, referral rewards, or cashback, making it a smart way to earn passively.

💰 How Can You Start With ₹100?

One of the best parts of UPB Token is that you don’t need thousands of rupees to begin. Here's a step-by-step guide on how you can start investing in UPB Token with just ₹100:

📝 Step 1: Register on the UPB Platform

Visit the official website or app of Universal Payment Bank and create your account. You’ll need to complete basic KYC using your Aadhaar and PAN card.

🪙 Step 2: Buy UPB Tokens

Once your account is active, go to the “Buy Tokens” section. Enter the amount you want to invest—you can start from ₹100.

📲 Step 3: Store Tokens in Your Wallet

The platform provides you with a secure digital wallet where your tokens are stored. This wallet can be used for transactions or to hold your investment.

💹 Step 4: Watch Value Grow

As UPB Token’s ecosystem expands, the value of each token may increase. Just like stocks or mutual funds, you can hold them until their value grows or use them in daily transactions.

📈 How Can You Earn Profits?

Let’s get to the exciting part — earning from UPB Token! There are multiple ways you can turn a small investment into significant returns.

💎 1. Value Appreciation

As more people adopt UPB Tokens and the platform grows, demand increases, which can raise the token price over time.

Example: If you buy 100 tokens at ₹1 each today and the value goes up to ₹5 later, your ₹100 becomes ₹500.

🔁 2. Trading

You can buy tokens at a low price and sell them when the value increases on supported exchanges or through the platform.

🎁 3. Referral Rewards

Many users earn free tokens by inviting others to join the platform. It's a win-win — your friend learns something new, and you get rewarded!

💼 4. Business Integration

If you’re a merchant or small business owner, you can start accepting UPB Tokens as payment. It reduces transaction fees and gives you access to tech-friendly customers.

📊 Real Example: Small Start, Big Growth

Let’s look at a hypothetical scenario:

Initial Investment: ₹100

Token Price at Entry: ₹1

Tokens Owned: 100

After 6 Months, the Token price rises to ₹4.

Value Now: ₹400

Profit: ₹300 (300% Return)

This is just a simplified example — actual profits depend on the market, demand, and adoption of the token. But it shows how even a small investment can grow over time.

🛡️ Is UPB Token Safe?

Yes, as long as you use official platforms and keep your login credentials secure. Like any digital asset, UPB Token is vulnerable to scams if used carelessly. Here are some tips:

✅ Always use the official UPB app or website.

✅ Do not share OTPs, passwords, or wallet keys.

✅ Don’t fall for “too good to be true” schemes.

✅ Enable two-factor authentication (2FA) where available.

UPB is aiming to operate under RBI-compliant frameworks, which increases its legitimacy.

📌 Who Should Consider UPB Token?

📱 Students & Young Professionals: Learn digital finance and start small.

🧑💼 Small Business Owners: Accept payments and expand customer options.

💡 Early Investors: Get in before the price surges.

🧓 Unbanked/Rural Citizens: Use tokens for daily utility in areas where banking is limited.

🌟 Future of UPB Token

UPB Token isn’t just a digital coin; it’s part of a bigger movement — Digital India. With the rising popularity of UPI, digital wallets, and cashless payments, UPB is positioning itself to be a major player.

In the coming years, we could see:

Integration with e-commerce platforms

Acceptance in retail stores

Listing on major token exchanges

Expansion in financial products like microloans or digital gold

📝 Final Thoughts

Investing in the UPB Token is not just about making money — it's about being part of a financial revolution. With just ₹100, you’re opening the door to digital banking, blockchain-based payments, and possibly long-term wealth.

Of course, every investment comes with risk, so make sure to do your research, stay updated, and avoid greedy decisions. But if you’re looking for a low-risk, high-potential entry into the digital finance world, UPB Token is worth exploring.

2 notes

·

View notes

Text

How Cryptocurrency Is Changing the Future of Finance

Cryptocurrency is reshaping the way we handle money—making it faster, borderless, and more inclusive. It’s not just for tech experts anymore; most of the people are using it to send, save, and grow their money. If you’re ready to use this, you can now Buy & Sell Bitcoin in India easily. INOCYX, our new crypto exchange, is built to make your journey simple, secure, and stress-free. The future of finance is here—be a part of it.

2 notes

·

View notes

Note

are in game currencies you can buy with real money covered under the same laws that make nfts and bitcoin taxable?

DISCLAIMER

I am not an international tax expert. Tax laws are obviously different in different jurisdictions; something that's true in the USA might not be true in the UK or Ukraine or India or Japan or Kenya or whatever. Also, the details of individual games can affect their legal standing. You may wish to consult a local tax expert before filing your return.

Disclaimers aside, probably not.

The thing about NFTs is that you can resell them. If you buy an ugly ape for etherium, you can later sell that ape for etherium and sell the etherium for cash, hopefully more than you paid in. That's what makes crypto stuff taxable; it's an investment.

Most in-game currencies cannot be exchanged for real-world money. You can't buy Fortnite VBucks at 5¢ to the buck and resell it at 7¢ to make a profit, and you can't sell anything for real-world cash. (This the main reason why gambling regulations usually don't apply to lootboxes.)

As far as the law is concerned, buying VBucks in Fortnite is no different from buying DLC on Steam.

Aside from blockchain games like the infamous Axie Infinity, the only ways I can think of for in-game currency purchases to result in taxable transactions probably violate the terms of service. Back in ye olde World of Warcraft days, people would sell their in-game gold for real-world money—profitable, despite (or because of?) being against the TOS.

Obviously, people can buy premium video game currency with their own money; that's what premium currency is for. But hypothetically, if you used that currency to buy an in-game item that you sold for real-world money, that would be a taxable transaction. The amount you sold it for minus the price initially paid for in-game currency would be taxable game.

Again, this is probably a violation of the terms of service you agreed to without reading, which would make this a breach of contract. In the US, you are required to report illegal income; however, as per the fifth amendment, you don't have to report anything that would incriminate yourself. How you report such income without self-incrimination is an exercise for any reader running a Fortnite money laundering business.

4 notes

·

View notes

Text

Bitcoin (BTC) Predicted to Reach $110K by End of June or July 2025

The world of cryptocurrency is evolving faster than ever, and Bitcoin (BTC), the pioneer of this digital revolution, continues to capture global attention. Whether you're a seasoned investor or someone exploring a cryptocurrency exchange in India, understanding Bitcoin’s potential trajectory is crucial. With predictions suggesting that BTC could soar to $110K by mid-2025, now is the time to dive deeper into what this means for you. Let’s explore why this bold forecast is gaining traction and how you can position yourself for success.

Explore why Bitcoin (BTC) could hit $110K by mid-2025, key drivers, risks, and how to prepare for this potential milestone in crypto trading.

Historical Context of Bitcoin’s Price Movements

Bitcoin’s journey has been nothing short of extraordinary. From its humble beginnings at mere cents to surpassing $69K in late 2021, BTC has consistently defied skeptics. Each bull run has been fueled by adoption, technological advancements, and macroeconomic shifts. These patterns suggest that history may repeat itself, making $110K a realistic target if current trends persist.

Factors Driving Bitcoin’s Potential Surge to $110K

Several key factors are aligning to propel Bitcoin toward new heights. Institutional adoption is skyrocketing, with major companies adding BTC to their balance sheets. Additionally, tools like BTC to USDT trading pairs on exchanges have made it easier than ever to buy, sell, and hedge positions. Coupled with the upcoming halving event—which historically reduces supply and boosts price—Bitcoin’s fundamentals remain stronger than ever.

Technical Analysis Supporting the $110K Target

From a technical perspective, Bitcoin’s chart tells an exciting story. Long-term moving averages and Fibonacci extensions indicate significant upside potential. Resistance levels previously seen as insurmountable are now being breached, signaling growing market confidence. If these trends continue, breaking $100K—and eventually reaching $110K—seems inevitable.

Potential Risks and Challenges

While optimism abounds, it’s essential to acknowledge risks. Regulatory uncertainty, geopolitical tensions, and unexpected market crashes could derail Bitcoin’s ascent. Staying informed and using reliable platforms, such as a trusted crypto trading app, will help mitigate these challenges.

How to Prepare for Bitcoin’s Potential Rise

To capitalize on this opportunity, consider diversifying your portfolio while maintaining a long-term mindset. Set clear investment goals, stay updated on market news, and use secure exchanges to trade assets like BTC and USDT efficiently.

Conclusion

The prediction of Bitcoin hitting $110K by June or July 2025 isn’t just speculation—it’s rooted in data, trends, and expert analysis. As we move closer to this milestone, arming yourself with knowledge and leveraging resources like crypto trading apps will be vital. The future of Bitcoin looks bright; don’t miss out on this transformative journey.

FAQs

1. What is the Basis for the $110K Price Target?

The projection stems from historical price patterns, macroeconomic factors, and increasing institutional adoption.

2. How Likely is Bitcoin to Reach This Price by Mid-2025?

While no prediction is guaranteed, strong indicators suggest a high probability of BTC achieving this milestone.

3. Should I Invest in Bitcoin Based on This Prediction?

Invest wisely and only allocate funds you’re comfortable risking. Conduct thorough research before making any decisions.

0 notes

Text

What Defines the Best Crypto to Buy This Month? 3 Projects Making the Case

The cryptocurrency market moves fast. Every month, new coins emerge, narratives shift, and investor focus changes. But one thing stays the same: everyone wants to find "the best crypto to buy now." So what defines that? And which projects are truly worth your attention this month?

Let’s break it down—and introduce three standout cryptocurrencies, including a rising star from India: UPB Token.

🔍 What Defines the “Best” Crypto to Buy?

Before we list the projects, let’s clarify what makes a crypto “best” at any given time:

1. Real-World Utility

A coin that solves real problems—especially in payments, finance, or security—has lasting value.

2. Strong Community and Ecosystem

Coins with engaged communities and expanding use cases tend to perform better.

3. Early-Stage Growth Potential

Being early is everything. The best cryptos to buy are often the ones just getting started.

4. Tokenomics and Incentives

Solid supply models, staking rewards, and low transaction fees matter for adoption.

5. Vision + Technology

Projects with long-term vision, powerful teams, and smart tech usually outperform meme coins or hype-driven tokens.

🪙 3 Top Crypto Projects to Watch This Month

Let’s explore three crypto projects that check most or all of these boxes—including a revolutionary Indian crypto aiming to disrupt how we make digital payments.

1. UPB Token – The Crypto UPI Revolution Begins

If you missed Bitcoin or Ethereum early on, don’t miss UPB Token.

UPB (Universal Payment Bank) is India’s first Crypto + UPI-powered token, aiming to bridge the gap between decentralized finance and daily usability. It allows users to send and receive crypto instantly—just like UPI.

Why UPB Stands Out:

🔹 Real-time crypto transactions, UPI-style

🔹 Live blockchain scanner via UPBScan.com

🔹 Airdrops and staking rewards for early investors

🔹 Built-in utility for payments, merchant acceptance, and more

🔹 Backed by an emerging community of Indian and global users

If you're looking for a high-potential project with real usage, UPB might be the smartest pick this month. It’s still early, and early movers always benefit most.

🟢 Best for: Long-term investors, crypto payment believers, Indian DeFi adopters

2. Arbitrum (ARB) – Scaling Ethereum for the Masses

Ethereum's biggest limitation? High gas fees and slow transaction speeds. Arbitrum solves this with a Layer-2 solution that processes transactions faster and cheaper.

Arbitrum has quickly become one of the most active chains for DeFi apps, NFT platforms, and gaming projects.

Why Arbitrum Makes the List:

⚡ Lower fees than Ethereum

💡 High developer adoption

🧠 Continuous upgrades via Arbitrum DAO

🔄 Ecosystem incentives and cross-chain support

With strong support and real usage, Arbitrum could see steady growth, especially as DeFi rebounds.

🟢 Best for: Ethereum believers, DeFi users, yield farmers

3. Render (RNDR) – Powering the Future of AI and Metaverse

The future is AI and 3D computing—and Render Token is at the heart of it.

Render provides a decentralized GPU rendering network, letting users rent unused GPU power for rendering high-quality 3D content, which is critical for AI, gaming, and virtual reality industries.

Why Render is Booming:

🔥 Strong demand from AI + Metaverse creators

🖥️ GPU-as-a-service = sustainable revenue model

🎮 Partners with creative studios and metaverse builders

📈 Big upside potential in the emerging AI economy

🟢 Best for: Tech-savvy investors, metaverse bulls, GPU miners

💡 Final Thoughts – How to Choose the Right Crypto?

When picking the best crypto to buy this month, remember:

Don’t just chase hype. Look at utility, community, and timing.

Always research the team, roadmap, and tokenomics.

Diversify—but also try to find at least one undervalued gem.

🚀 Why UPB Token Deserves Your Attention Now

Among all three, UPB Token stands out as a unique opportunity in its early phase—especially for Indian crypto users. It merges UPI-style simplicity with blockchain power, and its airdrop and staking ecosystem make it even more rewarding for early adopters.

If you believe in the next big thing being “Crypto for the Masses,” then UPB isn’t just a good pick—it’s a must-have this month.

Ready to change your fortune? Start with UPB Token today. #UPBToken #upb #upbbank #universalpaymentbank

0 notes

Text

How to Create CoinDCX Account & Start Crypto in Minutes

Beginner’s Guide: Create a CoinDCX Account in Just a Few Steps

Thinking of investing in crypto but confused about where to begin? You're not alone. With so many platforms out there, it can be overwhelming. However, if you're in India, CoinDCX stands out for being user-friendly, secure, and beginner-focused. In this guide, we’ll take you through how to coindcx open account easily and start trading in just a few minutes.

Whether you’re planning to buy Bitcoin, Ethereum, or explore other altcoins — the first step is setting up your account. Let’s break it down for you.

Why CoinDCX Is Perfect for Beginners

Before we dive into the coindcx open account process, let’s understand what makes CoinDCX so popular among Indian crypto investors.

Low entry barrier – Start investing with as little as ₹100

Quick INR deposits – Add funds instantly via UPI

Over 200+ coins available – You get access to all major cryptocurrencies

Easy interface – Even if you’re a complete beginner, the app makes navigation simple

Secure platform – Backed by strong encryption and 2FA support

So, if you're searching for a reliable exchange, this is a great place to begin. But first, you need to coindcx open account and verify it.

Step-by-Step: CoinDCX Open Account Process

Here’s how you can create your account on CoinDCX in a few quick steps:

1. Download the App or Visit the Website

Head over to the Play Store or App Store and search for the CoinDCX app. You can also use their official website. Once you’re on the homepage, tap on “Sign Up”.

2. Enter Your Details

You’ll need to enter your mobile number and email ID. After that, verify it using the OTP sent to your phone. Simple and quick.

3. Set Your Password

Choose a strong password. This will help keep your account secure in the long run. Don’t use something predictable — stay safe from the start.

4. Complete KYC Verification

This is the most important part of the coindcx open account process. Upload your PAN card and Aadhaar card, and take a quick selfie. The system usually approves accounts within a few hours, if not sooner.

5. Add Your Bank Details

For smooth INR deposits and withdrawals, link your bank account. Make sure your bank details match your name used in KYC.

6. Start Trading

Done with all the above? Congrats! Your coindcx open account is now active. Add some funds via UPI or net banking, and you're ready to buy or sell crypto.

What to Do After Your CoinDCX Account Is Live

Opening your account is just the start. Now that your coindcx open account is up and running, here’s what you should do next:

Enable 2FA (Two-Factor Authentication) — For extra safety

Explore the “Learn” section — CoinDCX provides helpful guides

Track live prices — You can even set alerts for price drops or spikes

Practice caution — Don’t invest big right away; get a feel of the market first

By following these tips, you’ll feel more confident using the platform. Many users rush in, but taking a little time to understand the basics makes a big difference.

Why Timing Matters in Crypto

Once your coindcx open account is active, timing becomes super important. Prices in crypto can change fast — sometimes within minutes. That’s why being able to react quickly with an active and verified account gives you an advantage.

Also, CoinDCX often runs special campaigns, rewards, and referral bonuses — all of which require a verified account. So if you're just browsing without signing up, you might be missing out.

1 note

·

View note

Text

Coindcx Account Opening Process: Fast, Easy & 100% Digital

Cryptocurrency has moved beyond just finance experts and tech enthusiasts. In 2025, everyday Indians—from students to working professionals—are actively stepping into the digital asset space. And when it comes to starting that journey, CoinDCX makes it incredibly easy. If you're wondering how to coindcx open account without any confusing steps, this guide is for you.

Thanks to a seamless and paperless experience, the coindcx account opening process is one of the fastest in India. Whether you’re switching from another crypto exchange or taking your first step into crypto, you’ll be ready to trade in under 10 minutes. Let’s break it down.

Why Choose CoinDCX?

Before diving into the steps, it's helpful to know why CoinDCX has become the go-to crypto platform for so many. First of all, it gives you access to more than 100 digital assets, including big names like Bitcoin, Ethereum, and trending altcoins.

Even better, CoinDCX charges zero fees on INR deposits and withdrawals. So more of your money stays invested where it belongs. Importantly, it also provides strong security features like biometric login, two-factor authentication, and cold wallet storage for 95% of user funds.

However, what truly makes the platform stand out is the coindcx account opening process. It’s designed for speed and simplicity—with zero paperwork, no printing, and no scanning required.

Step-by-Step: Coindcx Account Opening Process

Getting started on CoinDCX is refreshingly simple. Here's how you can coindcx open account in just a few minutes:

1. Download the App

Go to the Google Play Store or Apple App Store and install the CoinDCX app. Then tap “Create Account for Free” to begin.

2. Enter Your Details

Fill in your full name (as it appears on your PAN card), email ID, and create a password. Hit "Continue" to proceed.

3. Verify Contact Info

You’ll receive OTPs on your email and Aadhaar-linked mobile number. Enter them to verify your identity.

4. Submit PAN Number

Enter your PAN card number accurately. This step is essential for the coindcx account opening process, so double-check for typos to avoid delays.

5. Complete KYC with DigiLocker

Choose the DigiLocker option for instant verification. Enter your Aadhaar number, confirm via OTP, and finish by clicking a quick selfie. No documents to upload—just fast, automatic KYC.

Tip: If your DigiLocker is already active, this part takes less than a minute.

6. Link Your Bank Account

Add your bank account number, IFSC code, and a few personal financial details like occupation and income range. A ₹1 verification is done and refunded almost instantly.

7. Apply a Referral Code

If you’ve got a referral or promo code, now’s the time to use it. You can earn bonus crypto or discounted trading fees—another great reason to go through the coindcx account opening process.

8. Fund Your Account and Start Trading

Once verified, add funds via UPI or net banking (starting from just ₹100). You’re all set to buy, sell, and trade crypto straight from your phone.

What Makes the Coindcx Account Opening Process So Smooth?

Unlike many other platforms, CoinDCX cuts out the usual friction. The coindcx account opening process uses automation and smart integrations to save you time. There’s no need to upload multiple documents or wait days for manual approval.

Additionally, the app is incredibly intuitive. New users often mention how easy it is to navigate. Meanwhile, experienced traders appreciate the real-time charts and fast order execution. It caters to both beginners and pros equally well.

What Are People Saying?

Thousands of Indians have already chosen to coindcx open account, and reviews have been very encouraging. Users consistently praise the app’s clean interface and quick verification process. Many note that onboarding via DigiLocker is smoother here than on other exchanges.

Moreover, CoinDCX’s customer support is responsive, and regular updates keep the platform fresh and reliable. It’s clear that the platform is built with the user in mind—whether you’re trading daily or just starting out.

0 notes

Text

BTCUSD Trading Signal – Entry, Stop Loss & Target

BTCUSD Trading Signal – Entry, Stop Loss & Target 📈 BTCUSD Trading Signal – Entry, Stop Loss & Target Below 🔻 BTCUSD – Sell Signal Alert 💼 Trade Type: Short Position 📌 Entry Zone: At Current Market Price (CMP) – 105,113 ⛔ Stop Loss: 106,000 🎯 Target Profit: 103,600 📍 Current Market Price: 105,113 📲 Join our Telegram: https://t.me/classroomoftraders 🌐 Visit our Community: https://classroomoftraders.com/community/ 📈 BTCUSD Trading Signal – Entry, Stop Loss & Target Below📊 Daily BTCUSD Market Report – June 5, 2025 ₿📈 Market Snapshot (As of June 5, 2025, 10:00 AM ET)🧭 Analyst View & Market Outlook⚠️ Important Note:⚠️ Disclaimer:Topic Covered: Daily BTCUSD Market Report – June 5, 2025 ₿ in the same detailed, professional format: 📊 Daily BTCUSD Market Report – June 5, 2025 ₿ 🔑 Key Economic Highlights Driving Bitcoin Price Today U.S. Services PMI Miss Boosts Risk Sentiment Yesterday’s ISM Services PMI came in below expectations, reinforcing views of a slowing U.S. economy. Traders are pricing in a potential Fed rate cut later this year. Impact: Lower yields and a weaker dollar lifted crypto sentiment, with Bitcoin rebounding above $106K. ETF Speculation Reignites Bullish Momentum Rumors are swirling that the SEC may greenlight additional spot crypto ETFs following last month’s Ethereum approval. This speculation has sparked renewed institutional interest. Watchpoint: Official confirmation could act as a strong catalyst for BTC upside. On-Chain Metrics Turn Bullish Glassnode reports rising exchange outflows and wallet accumulation. The Bitcoin reserve on centralized exchanges is at a 3-month low. Significance: Signals strong holder conviction and reduced sell-side pressure. Altcoin Rally Supporting Broader Market Major altcoins like ETH, SOL, and AVAX are posting double-digit gains this week. This broader rally is improving sentiment across the crypto complex. Market Response: BTC remains the anchor, absorbing capital inflows amid rising risk appetite. 📈 Market Snapshot (As of June 5, 2025, 10:00 AM ET) AssetPriceChange (%)Bitcoin (BTC/USD)$106,420▲ +1.24%Ethereum (ETH/USD)$5,540▲ +2.02%Dollar Index102.5▼ -0.29%Nasdaq Futures17,315▲ +0.41% 🧭 Analyst View & Market Outlook Short-term Trend: Bullish momentum building. BTC has reclaimed a key level above $106,000, with solid support at $104,800. Medium-Term Outlook: If current strength continues, Bitcoin could challenge $108,000–$110,000 in the coming sessions. Bloomberg Crypto Insight: Analysts cite improving macro backdrop and ETF enthusiasm as a “dual engine” likely to propel BTC toward $125,000 by Q4 2025. ⚠️ Important Note: Market conditions can shift rapidly, especially in response to economic data or geopolitical developments. Revisions to prior data releases are also common. Traders are advised to monitor real-time updates and consult with financial advisors before making any trading decisions. ⚠️ Disclaimer: This content is for educational purposes only and does not constitute financial advice. Trading involves risk. Always do your own research and consult with a qualified financial advisor. Topic Covered: Gold price today, gold market report, gold prices June 5 2025, live gold rates, spot gold price, gold forecast, gold outlook, invest in gold, gold investment, Fed interest rates gold, US dollar gold price, Treasury yields gold, ISM Services PMI gold, central bank gold demand, geopolitical tensions gold, Middle East tensions gold, Goldman Sachs gold forecast, safe haven assets, gold technical analysis, gold resistance levels, gold support levels, XAU/USD, impact of Fed policy on gold prices, how U.S. Services PMI affects gold, why central banks are buying gold, gold price prediction 2025, gold investment strategies June 2025, is gold a good investment today, gold price analysis June 4 2025, current gold market trends, gold price movement today, gold price India, gold rate Chennai, gold price Asia, gold price Middle East, inflation concerns, economic

slowdown, risk-off flows, precious metals, commodities market, currency movements, bond yields https://classroomoftraders.com/trading-signals/btcusd-trading-signal-entry-stop-loss-target/?fsp_sid=1094 #Commoditysignals #GoldSignals #TradingSignals

0 notes

Text

BTCUSD Trading Signal – Entry, Stop Loss & Target

BTCUSD Trading Signal – Entry, Stop Loss & Target 📈 BTCUSD Trading Signal – Entry, Stop Loss & Target Below 🔻 BTCUSD – Sell Signal Alert 💼 Trade Type: Short Position 📌 Entry Zone: At Current Market Price (CMP) – 105,113 ⛔ Stop Loss: 106,000 🎯 Target Profit: 103,600 📍 Current Market Price: 105,113 📲 Join our Telegram: https://t.me/classroomoftraders 🌐 Visit our Community: https://classroomoftraders.com/community/ 📈 BTCUSD Trading Signal – Entry, Stop Loss & Target Below📊 Daily BTCUSD Market Report – June 5, 2025 ₿📈 Market Snapshot (As of June 5, 2025, 10:00 AM ET)🧭 Analyst View & Market Outlook⚠️ Important Note:⚠️ Disclaimer:Topic Covered: Daily BTCUSD Market Report – June 5, 2025 ₿ in the same detailed, professional format: 📊 Daily BTCUSD Market Report – June 5, 2025 ₿ 🔑 Key Economic Highlights Driving Bitcoin Price Today U.S. Services PMI Miss Boosts Risk Sentiment Yesterday’s ISM Services PMI came in below expectations, reinforcing views of a slowing U.S. economy. Traders are pricing in a potential Fed rate cut later this year. Impact: Lower yields and a weaker dollar lifted crypto sentiment, with Bitcoin rebounding above $106K. ETF Speculation Reignites Bullish Momentum Rumors are swirling that the SEC may greenlight additional spot crypto ETFs following last month’s Ethereum approval. This speculation has sparked renewed institutional interest. Watchpoint: Official confirmation could act as a strong catalyst for BTC upside. On-Chain Metrics Turn Bullish Glassnode reports rising exchange outflows and wallet accumulation. The Bitcoin reserve on centralized exchanges is at a 3-month low. Significance: Signals strong holder conviction and reduced sell-side pressure. Altcoin Rally Supporting Broader Market Major altcoins like ETH, SOL, and AVAX are posting double-digit gains this week. This broader rally is improving sentiment across the crypto complex. Market Response: BTC remains the anchor, absorbing capital inflows amid rising risk appetite. 📈 Market Snapshot (As of June 5, 2025, 10:00 AM ET) AssetPriceChange (%)Bitcoin (BTC/USD)$106,420▲ +1.24%Ethereum (ETH/USD)$5,540▲ +2.02%Dollar Index102.5▼ -0.29%Nasdaq Futures17,315▲ +0.41% 🧭 Analyst View & Market Outlook Short-term Trend: Bullish momentum building. BTC has reclaimed a key level above $106,000, with solid support at $104,800. Medium-Term Outlook: If current strength continues, Bitcoin could challenge $108,000–$110,000 in the coming sessions. Bloomberg Crypto Insight: Analysts cite improving macro backdrop and ETF enthusiasm as a “dual engine” likely to propel BTC toward $125,000 by Q4 2025. ⚠️ Important Note: Market conditions can shift rapidly, especially in response to economic data or geopolitical developments. Revisions to prior data releases are also common. Traders are advised to monitor real-time updates and consult with financial advisors before making any trading decisions. ⚠️ Disclaimer: This content is for educational purposes only and does not constitute financial advice. Trading involves risk. Always do your own research and consult with a qualified financial advisor. Topic Covered: Gold price today, gold market report, gold prices June 5 2025, live gold rates, spot gold price, gold forecast, gold outlook, invest in gold, gold investment, Fed interest rates gold, US dollar gold price, Treasury yields gold, ISM Services PMI gold, central bank gold demand, geopolitical tensions gold, Middle East tensions gold, Goldman Sachs gold forecast, safe haven assets, gold technical analysis, gold resistance levels, gold support levels, XAU/USD, impact of Fed policy on gold prices, how U.S. Services PMI affects gold, why central banks are buying gold, gold price prediction 2025, gold investment strategies June 2025, is gold a good investment today, gold price analysis June 4 2025, current gold market trends, gold price movement today, gold price India, gold rate Chennai, gold price Asia, gold price Middle East, inflation concerns, economic

slowdown, risk-off flows, precious metals, commodities market, currency movements, bond yields ' https://classroomoftraders.com/trading-signals/btcusd-trading-signal-entry-stop-loss-target/?fsp_sid=1095 #Commoditysignals #GoldSignals #TradingSignals

0 notes

Text

Can Shiba Inu (SHIB) Token Reach $1? An In-Depth Analysis

Every crypto enthusiast is wondering: Can Shiba Inu Reach $1? As one of the most highly circulated meme coins in the crypto marketplace, SHIB is highly regarded around the world by retail investors and traders alike. But can this dog-themed token realistically reach a value of $1?

Understanding Shiba Inu (SHIB)

Launched in August 2020 as an Ethereum-based ERC-20 token, Shiba Inu (SHIB) was created as a decentralized alternative to Dogecoin. With a massive total supply of 1 quadrillion tokens, SHIB's price per unit remains extremely low, currently valued at fractions of a cent.

Despite its low individual value, SHIB has built an ecosystem that includes LEASH and BONE tokens, along with the upcoming Shibarium layer-2 network, aimed at improving scalability and utility.

The Mathematical Reality

In order to find out if SHIB can reach $1, we have to think about the number. With 1 quadrillion SHIB tokens being worth $1 means a market cap of $1 quintillion, which is unreasonably high, even compared to Bitcoin's record. That value is beyond the full value of the entire global financial system.

This makes the $1 milestone mathematically improbable unless there's a significant token burn or a massive increase in demand that outpaces supply by an unprecedented margin.

Catalysts for Growth

Several factors could drive SHIB’s value upward:

Adoption of Shibarium: If the new blockchain gains traction, the implications for SHIB's utility increase.

Community: An active community is usually the catalyst for short-term rallies.

During the livelihood issue: Listing on a platform for cryptocurrency exchange in India or being recognized on platforms around the world can increase liquidity and confidence with investors.

Risks and Challenges

However, SHIB faces several hurdles:

Extremely high circulating supply

Regulatory scrutiny around meme coins

Lack of real-world utility compared to utility tokens

Conclusion

Although the concept of SHIB reaching $1 sparks excitement, the reality involves economics and market forces. Although it seems improbable, unpredictability in cryptocurrencies has allowed for an unanticipated price movement, but that does not mean it is likely.

At this point, investors in SHIB should be cautious and view it as highly speculative, not an investment that is worth making.

FAQs

Is it possible for SHIB to reach $1?

Highly unlikely due to its massive supply.

How much would SHIB need to grow to reach $1?

It would require an unimaginable increase in market capitalization.

Should I put money into SHIB for long-term profit?

That depends on your risk appetite. Generally, SHIB is considered a speculative buy, which is typically short-term, rather than a long-term holding.

#ShibaInuPricePrediction#CanSHIBHit#CryptoMarketTrends#SHIBAnalysis#MemeCoins#CryptocurrencyInvesting#ShibariumUpdate#CryptoNews#BlockchainTechnology#CryptoExchangeIndia

0 notes

Text

$500M Crypto Shakeout: BTC, ETH, SOL and Doge Lead the Crash

The global cryptocurrency market witnessed a sharp downturn this week, with over $500 million in positions liquidated, shaking investor confidence and triggering widespread losses. This sharp sell-off affected nearly every major token, but the top five most impacted assets were Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Solana (SOL), and XRP.

In fast-growing regions like Crypto India, where retail participation is surging, the impact of such market corrections is deeply felt. Investors, traders, and enthusiasts across Crypto India are closely analyzing this crash to understand its root causes and future implications.

1. Bitcoin (BTC): $222 Million Liquidated

Bitcoin, the market leader, suffered the most significant blow in terms of liquidation, with $222 million worth of positions wiped out in a short span. Its price briefly dipped to $104,000, down from its recent high of $111,814 recorded just last week.

This sudden plunge has rattled investors in Crypto India, many of whom consider BTC a long-term store of value. Indian traders who entered the market during the recent rally are now reassessing their positions. Experts in Crypto India advise a cautious but strategic approach, emphasizing the importance of stop-loss orders and portfolio diversification during volatile phases.

2. Ethereum (ETH): $122 Million in Losses

Following closely behind, Ethereum (ETH) faced $122 million in liquidations. The world’s second-largest cryptocurrency declined by 3%, dropping to $2,573.

Ethereum plays a key role in DeFi and NFT platforms — both areas that are gaining significant traction in Crypto India. With developers and projects in India increasingly building on Ethereum’s network, the price dip poses temporary concerns. However, many in the Crypto India community see this as a buying opportunity, particularly for those with long-term faith in the blockchain’s scalability upgrades and institutional adoption.

3. Dogecoin (DOGE): Drops 9% Below $0.20

Dogecoin (DOGE) experienced the largest single-day drop among the top 10 cryptocurrencies, plunging 9% and falling below the symbolic $0.20 mark — a level not seen since May 8.

This decline has disappointed the large community of DOGE holders in Crypto India, especially among younger investors who were drawn to the coin due to its viral popularity and community-driven rallies. While some are exiting the token, others in Crypto India are doubling down, speculating that DOGE could recover with the next wave of social media-driven momentum.

4. Solana (SOL) and XRP: Broader Market Weakness

Solana (SOL) and XRP round out the top five most impacted cryptos in this correction:

Solana fell 5%, reflecting broader concerns about network stability and recent downtime issues.

XRP declined by 3.3%, as traders continue to monitor the outcome of Ripple’s legal battle with the SEC.

In Crypto India, both assets have a strong following. Solana is particularly popular among developers and DeFi enthusiasts, while XRP is widely used in discussions around cross-border payments. Indian investors are viewing the current dip as a potential entry point, given the long-term utility and enterprise partnerships backing these projects.

What This Means for Crypto India

The latest market correction is a clear reminder of how quickly sentiment can shift in the crypto world. For Crypto India, this shakeout is both a challenge and an opportunity. The key takeaways for the Indian crypto community include:

Risk Management Is Crucial: With high liquidation figures, traders in Crypto India are learning the importance of using proper risk management tools.

Long-Term Vision Prevails: Despite short-term volatility, many Indian investors are holding firm, especially in assets like BTC and ETH.

Deeper Market Education: Events like this highlight the need for better awareness and education — something that’s gaining traction through online forums, influencers, and local crypto events in Crypto India.

Final Thoughts

While over $500 million in liquidations may seem alarming, it is part of the natural ebb and flow of the crypto market. For seasoned investors in Crypto India, this dip offers a moment to reassess strategies and potentially enter high-conviction projects at discounted prices.

As the market stabilizes, Crypto India is expected to bounce back stronger, driven by its vibrant community, developer talent, and growing interest in Web3 and blockchain innovation.

1 note

·

View note

Text

Quick & Secure CoinDCX Account Opening Process for New Traders

Easy Guide to the CoinDCX Account Opening Process & Start Trading Today

Cryptocurrency is booming in India, and more people are exploring it as a smart investment option. Whether you’re completely new or looking to diversify, choosing a reliable platform is key. That’s where CoinDCX stands out. Designed for Indian users, it offers a secure, beginner-friendly experience for crypto investing. In this guide, we’ll explain the CoinDCX account opening process, why it's ideal for new investors, and how you can start trading today.

Why Choose CoinDCX for Your Crypto Journey?

Before we get into the CoinDCX account opening process, it’s important to understand why CoinDCX is trusted by millions across India. The platform supports over 100 cryptocurrencies, giving users a wide selection for building a diverse portfolio.

Moreover, CoinDCX is known for its user-friendly interface, making it perfect for both beginners and experienced traders. With over 95% of digital assets stored in cold wallets, the platform puts a strong emphasis on security. It also offers instant INR deposits and withdrawals, low trading fees, and round-the-clock customer support.

If you're ready to begin, let’s look at how to CoinDCX open account and get started quickly.

Step-by-Step CoinDCX Account Opening Process

The CoinDCX account opening process is entirely digital and takes less than 10 minutes. Here’s a simple breakdown to help you get started:

1. Download the CoinDCX App

Head to the Google Play Store or Apple App Store and install the CoinDCX app. Once it’s on your device, tap “Create Account for Free.”

2. Enter Your Details

Next, provide your name, email address, and create a strong password. These will serve as your login credentials.

3. Verify Email and Mobile

You’ll receive one-time passwords (OTPs) on your email and phone. Enter them to confirm and secure your account.

4. Upload PAN Card

Indian regulations require PAN card verification to ensure transparency. Upload a clear image of your card during the registration.

5. Complete eKYC via DigiLocker

Link your Aadhaar card using DigiLocker, and take a selfie for facial verification. This step is quick and essential for identity verification.

6. Add Bank Details

Input your bank account number and IFSC code. CoinDCX will transfer ₹1 to verify the details—a safe and standard procedure.

7. Enter a Promo Code (Optional)

If you have a referral or promo code, enter it now to unlock special rewards. You can also add it later under the app’s “Promotions” tab.

8. Deposit Funds and Start Trading

After successful verification, fund your wallet using UPI, net banking, or other methods. Now you’re ready to start trading crypto assets instantly.

With this smooth CoinDCX account opening process, you can start investing in crypto with confidence.

What Happens After You CoinDCX Open Account?

Once you CoinDCX open account, you’ll get access to a personalized dashboard. This includes live charts, a real-time wallet overview, and quick trading options. Whether you're buying Bitcoin, Ethereum, or smaller altcoins, the platform ensures a seamless trading experience.

CoinDCX also processes INR transactions rapidly, minimizing wait times and maximizing convenience. Whether you’re a long-term investor or a day trader, the tools available cater to all styles of trading.

Key Benefits of the CoinDCX Account Opening Process

Choosing CoinDCX means enjoying a host of advantages that make crypto trading easier and safer:

Fully paperless and digital onboarding

Highest-grade security with cold wallet storage

Lightning-fast deposits and withdrawals

Intuitive UI for all experience levels

PAN and Aadhaar-based KYC for full compliance

Competitive trading fees and real-time execution

In essence, the CoinDCX account opening process is more than just signing up—it's your first step into a powerful investing ecosystem.

Start Now: CoinDCX Open Account Today

Still on the fence? The crypto world waits for no one. By taking a few minutes to complete the CoinDCX account opening process, you open doors to exciting financial opportunities.

Don’t let complicated paperwork or confusing platforms hold you back. CoinDCX simplifies everything so you can focus on smart trading decisions. Whether you’re a student, entrepreneur, or working professional, there’s no better time to CoinDCX open account and explore the world of digital currency.

Final Thoughts

In summary, the CoinDCX account opening process is straightforward, secure, and beginner-friendly. With robust features, low fees, and high security, CoinDCX equips you to trade confidently from day one.

Take your first step into crypto investing the easy way. CoinDCX open account today—and unlock your digital financial future.

0 notes

Text

Build a Crypto Exchange from Scratch: Tech, Time & Budget Guide

So, you’ve got your eyes on the booming crypto industry and are thinking, “Why not build a crypto exchange of my own?” Well, you're not alone—and you're not wrong. With cryptocurrencies now a mainstream financial asset, launching a crypto exchange can be a goldmine. But here's the kicker: it's no walk in the park. Between regulations, tech complexities, and budget planning, there’s a lot to unpack. That’s why this guide exists—to walk you through everything step-by-step. Let’s get into it.

What is a Crypto Exchange?

At its core, a crypto exchange is a digital marketplace that lets people buy, sell, and trade cryptocurrencies. Think of it like a stock exchange, but for Bitcoin, Ethereum, and other digital assets.

There are two main types of exchanges:

Centralized (CEX): A third party manages the trades and assets.

Decentralized (DEX): Trades occur directly between users, without intermediaries.

Why Start Your Own Crypto Exchange?

Launching an exchange isn’t just about riding the crypto wave—it’s about building a sustainable, revenue-generating business.

Here’s how you make money:

Trading Fees: Small cuts per transaction. Multiply that by thousands of trades per day.

Listing Fees: Charge projects to list their tokens.

Premium Features: API access, margin trading, analytics dashboards.

Bottom line: the profit potential is high if you play it right.

Step 1 – Define Your Exchange Type

Before writing a single line of code, decide what type of exchange you want to build.

Centralized Exchange (CEX)

Pros:

Easier user onboarding

High liquidity

Faster transactions

Cons:

Prone to hacks

Requires strict regulation

Use case: Ideal for beginners or regions with established financial laws.

Decentralized Exchange (DEX)

Pros:

No need for user data (privacy)

No custody of funds

Cons:

Harder UX

Limited trading pairs

Use case: Perfect for DeFi audiences and privacy-focused traders.

Hybrid Exchange

Combining the liquidity of CEXs with the privacy of DEXs. Though complex to build, this model is gaining traction.

Step 2 – Regulatory Compliance & Licensing

Let’s face it—crypto has a bit of a reputation problem. That’s why regulation matters.

Choosing a Jurisdiction

Want fewer headaches? Pick countries known for crypto-friendly policies:

Malta

Estonia

Switzerland

Singapore

Cost of Licensing

Malta: $30,000 - $70,000

Estonia: $15,000 - $35,000

USA: Up to $500,000 depending on state licenses

Get legal counsel. It’s worth every penny.

Step 3 – Core Features of a Crypto Exchange

No one wants a clunky platform. Your exchange must be sleek, secure, and fast.

User Interface (UI)/User Experience (UX)

Clean dashboards, simple navigation, and responsive design. Mobile-ready? Absolutely.

Trading Engine

This is the brain of your exchange. It handles:

Order matching

Trade execution

Transaction history

Milliseconds matter here.

Wallet Integration

Use hot wallets for quick access and cold wallets for secure storage.

Security Features

Security is non-negotiable:

SSL encryption

2FA

Anti-DDoS

IP Whitelisting

Admin Panel

For your team to manage users, review transactions, and control settings.

Step 4 – Choose the Right Tech Stack

Here’s your digital toolbox. Pick wisely.

Backend Technologies

Popular choices:

Node.js

Python

Golang

They offer high performance and scalability.

Frontend Technologies

Make it look good and feel good:

React.js

Vue.js

Angular

Blockchain Integration

Connect with:

Ethereum

Binance Smart Chain

Polygon

You’ll need APIs or smart contracts, depending on the setup.

Step 5 – Hiring a Development Team

DIY is great for furniture, not crypto exchanges.

In-house team: More control but costlier.

Outsourcing: Cost-effective, especially in India, Ukraine, or Vietnam.

Cost Estimate

MVP Exchange: $50,000 - $150,000

Full-fledged Platform: $200,000 - $500,000+

Timeframe: 6 to 12 months

Step 6 – Designing the Architecture

Your platform should be:

Scalable (handle growth)

Modular (easier to update)

Fault-tolerant (avoid downtime)

Use cloud services like AWS or Google Cloud for infrastructure.

Step 7 – Testing & Security Audits

Before you go live, test everything. And then test it again.

Load Testing

Penetration Testing

Bug Bounties

Smart Contract Audits (for DEXs)

Better safe than hacked.

Step 8 – Marketing & Launch Strategy

Even the best exchange is useless without users.

Listing Initial Coins

List popular coins like BTC, ETH, and USDT. Then add new tokens to draw attention.

Incentive Programs

Airdrops, sign-up bonuses, referral bonuses. Get creative. Build hype.

Also consider:

PR Campaigns

Community Building (Telegram, Discord)

Influencer Outreach

Maintenance and Upgrades

The crypto space evolves fast. Your exchange must too.

Regular patches

Feature rollouts

Security updates

Consider launching a mobile app for broader reach.

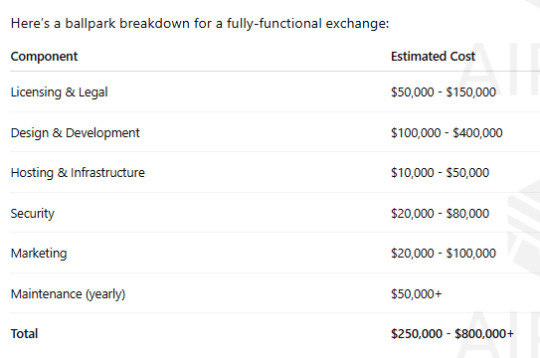

Cost Breakdown

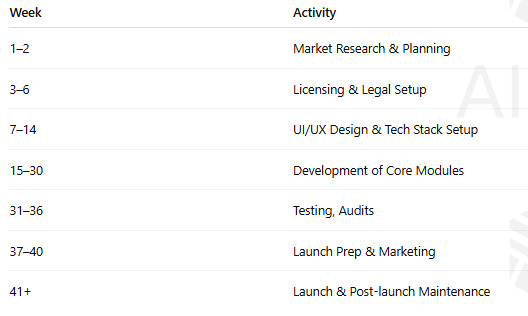

Timeline Overview

A realistic timeline might look like this:

Conclusion

Building a crypto exchange from scratch isn’t just about slapping together some code and flipping a switch. It’s a meticulous journey through regulatory hurdles, technical architecture, and business strategy. But if you get it right, it’s one of the most lucrative ventures in the digital finance world. So, whether you're a startup or a fintech giant, the roadmap is here—you just need to follow it.

FAQs

1. Can I build a crypto exchange without coding knowledge?

Technically yes, with white-label solutions. But for full control and scalability, you’ll need developers or a dev agency.

2. How do crypto exchanges make money?

Mainly through trading fees, listing fees, and premium service offerings like APIs or advanced analytics.

3. What licenses do I need to launch a crypto exchange?

That depends on your target market. Countries like Malta and Estonia offer favorable regulatory environments for crypto businesses.

4. How long does it take to launch a crypto exchange?

A basic platform can go live in 4-6 months. A more sophisticated, scalable exchange might take 9-12 months.

5. Is it safe to build and operate a crypto exchange?

Yes—if you invest in strong security infrastructure, conduct regular audits, and comply with all legal requirements.

#CreateACryptocurrencyExchange#HowToCreateACryptocurrencyExchange#BuildYourOwnCryptocurrencyExchange#LaunchYourCryptocurrencyExchange#CryptocurrencyExchangeDevelopment#ShamlaTech#CryptoExchange#BlockchainSolutions#CryptoBusiness#CryptoDevelopment

0 notes

Text

Crypto Market Crash Why Are Bitcoin and Altcoins Falling — and Why UPB Might Be the Safer Bet

But amidst the panic, a new player is gaining attention—UPB (Universal Payment Bank)—India’s first Crypto UPI Bank, offering real-world utility while the rest of the market falters.

So why is the market crashing? And could UPB be the smart move in uncertain times?

📉 What’s Happening in the Market?

The global crypto market has lost billions in value in a matter of days. Bitcoin has dropped below key psychological levels, and altcoins like Solana, Cardano, and Avalanche have plummeted even further.

Investor sentiment has gone from bullish to fearful almost overnight. But this isn’t random—it’s driven by a perfect storm of real-world factors.

🔍 1. Macroeconomic Pressure

The global economy plays a major role in crypto price movements:

Interest rate hike delays: Central banks, especially the U.S. Federal Reserve, are hesitant to cut rates due to persistent inflation.

Stronger US Dollar: As the dollar strengthens, riskier assets like crypto suffer.

Recession fears: Investors are shifting to “safer” assets.

All of this puts downward pressure on crypto valuations, leading to panic sell-offs.

⚖️ 2. Regulatory Crackdowns

Governments worldwide are tightening their grip on crypto. In the U.S., the SEC continues its aggressive enforcement. In India, a lack of regulatory clarity keeps investors and developers on edge.

In contrast, UPB is operating with a mission to bridge the regulatory gap by integrating familiar UPI-like systems with blockchain—making crypto simpler, safer, and more compliant for Indian users.

🐋 3. Whale Movements & Panic Selling

On-chain analytics suggest that large wallets (aka whales) have been selling off BTC and ETH to take profits. These moves trigger stop-loss orders and cause a cascading effect across the market.

The moment whales move out, smaller investors panic. But this also creates space for early-stage projects with real utility, like UPB, to shine without being affected by legacy volatility.

🧊 4. Retail Fatigue

Retail investors powered the 2021 bull run. But now:

Many are exhausted from past losses.

They’re uncertain due to news and price volatility.

There’s a lack of exciting, trustworthy projects.

This is where UPB stands out—because it isn’t just another meme coin or short-term hype. It offers a real-world solution for Indian users through crypto UPI payments, cross-chain transactions, and decentralized banking.

🧠 What Sets UPB Apart During This Crash?

While other coins are bleeding due to speculation, UPB is gaining momentum due to utility, vision, and simplicity.

✅ Built for Indian Users

UPB uses a UPI-style interface for instant crypto transactions—making it easy for millions of Indians to adopt.

✅ Not Just a Coin, a Payment Ecosystem

UPB aims to create a full crypto bank experience, where users can store, send, earn, and invest—all within one secure ecosystem.

✅ Early Entry Opportunity

UPB is still in its early stage—meaning massive upside potential for those who buy before it becomes mainstream.

💡 In a market crash, speculation dies—but utility thrives. That’s why UPB is becoming the preferred bet for serious crypto believers.

📈 What Should You Do Now?

🛑 Don’t Panic

Crypto markets are known for high volatility. But panicking never helps. Now is the time to research and reposition.

🔍 Look for Utility

Move your focus from meme coins and short-term flips to projects with real-world adoption—like UPB, which is built on solving India’s everyday payment challenges with crypto.

💼 Diversify

Use this opportunity to rebalance your portfolio. Don’t go all-in on Bitcoin or Ethereum. Add promising early-stage projects with strong fundamentals.

📢 How to Get Started with UPB

Visit upbonline.com

Claim free airdrop (if still active) by completing social tasks

Set up a Solana-compatible wallet (like Phantom)

Join the community on Telegram and X (Twitter) for updates

🔚 Final Thoughts: Crisis or Opportunity?

Yes, the crypto market is crashing. But it always has—and it always comes back stronger.

The smart investors aren’t just watching the prices; they’re watching the fundamentals. And right now, projects like UPB—which offer solutions, not speculation—are exactly what this market needs.

This might be the moment you look back on months from now and say: “I bought UPB when no one was looking.”

So don’t just survive the crash—take advantage of it. Because while others panic, you can prepare.#upb #whatisupb #upbtoken

0 notes