#How to get a new Bitcoin address on the Cash app

Explore tagged Tumblr posts

Text

How To Get New Bitcoin Address On Cash App

How To Get New Bitcoin Address On Cash App – If you’re using Cash App to purchase Bitcoin, you would possibly be aware that the Bitcoin address supplied for receiving payments adjustments with every transaction. This is executed through Cash App for privacy and safety purposes. If you want to alternate your Bitcoin wallet deal with on Cash App, you need to delete your present address Cash App…

View On WordPress

#ash app bitcoin fees#cash app bitcoin fees#cashapp bitcoin#Changing Your Bitcoin Wallet Address on Cash App ...#How Do I Find My Cash App Bitcoin Address?#how to change bitcoin address on cash app#how to find your bitcoin wallet on cash app#How to get a new Bitcoin address on the Cash app#how to receive bitcoin on cash app#how to verify bitcoin on cash app#how to verify bitcoin on cash app 2023#how to withdraw bitcoin from cash app to bank account

0 notes

Text

Can Your Bitcoin Address Change on Cash App? Tips for Managing Your Wallet

As cryptocurrencies grow in popularity, platforms like Cash App have made it easier for everyday users to buy, sell, and send Bitcoin. Whether you’re new to crypto or a seasoned investor, you may have noticed that Cash App assigns you a unique Bitcoin wallet address. But what happens if you need a different address or wish to know whether a Cash App Bitcoin wallet address change is possible?

In this guide, we’ll take a deep dive into how the Cash App Bitcoin wallet works, whether you can change your Bitcoin address, and some essential tips for managing your Bitcoin transactions on the platform. We’ll also answer common questions about Bitcoin addresses on Cash App to help you understand how to keep your funds safe and transactions smooth.

Introduction: How Bitcoin Addresses Work on Cash App?

Cash App isn’t just a mobile payment app—it also offers crypto trading features, allowing users to send, receive, and store Bitcoin directly within the app. When you create a Bitcoin wallet on Cash App, the platform assigns a unique Bitcoin wallet address. This address acts like a digital identifier for your wallet, enabling other users or platforms to send Bitcoin to your account safely.

However, users often have questions about whether their Bitcoin address can be changed. Perhaps you are concerned about privacy, wondering if your wallet can have a new address to limit exposure of past transactions. Or maybe you want to reset the address for security reasons. This blog will explore how Bitcoin addresses on Cash App function and if you can request a Bitcoin wallet address change within the app.

Can I Change My Bitcoin Address on Cash App?

The answer to the question “Can I change my Bitcoin address on Cash App?” lies in how Bitcoin wallets are designed. Cash App automatically assigns a new Bitcoin address periodically for security reasons. So, the good news is that you don’t need to manually change your Bitcoin address because Cash App will provide new addresses on your behalf over time.

Bitcoin addresses on Cash App function similarly to how Bitcoin addresses work on most crypto platforms:

You can receive Bitcoin using the latest address assigned to your account.

Your previous Bitcoin addresses remain valid—so even if your address changes, funds sent to old addresses will still arrive in your wallet.

The platform may issue a new address whenever you perform certain activities, such as requesting a deposit address.

This dynamic address system ensures enhanced privacy for users by making it difficult for outsiders to trace a user’s entire transaction history based on one address.

How to View or Use Your Bitcoin Address on Cash App

If you’re using Cash App for Bitcoin transactions, it’s essential to know how to access your wallet address. Here’s how to find new Bitcoin wallet address on Cash App:

Open the Cash App on your phone.

Tap the Bitcoin (₿) icon at the bottom of the screen.

Select Deposit Bitcoin to display your current Bitcoin wallet address.

You’ll see both the alphanumeric address and a QR code that others can scan to send Bitcoin to your wallet.

This address can be used to receive Bitcoin from other wallets or platforms. Even though Cash App periodically updates your Bitcoin address, older addresses assigned to your account will still function for incoming transactions.

Why Does Cash App Change Bitcoin Addresses?

There are several reasons why Cash App assigns new Bitcoin addresses periodically. These changes are designed to enhance the security and privacy of your transactions:

Privacy Protection: Bitcoin addresses are public, meaning anyone can see all transactions associated with an address on the blockchain. By issuing new addresses periodically, Cash App helps prevent someone from easily tracking all your activity.

Security Enhancements: Using the same Bitcoin address repeatedly increases the chances of it being linked to fraudulent activities. Regular address changes lower these risks.

Compliance with Blockchain Standards: Bitcoin networks encourage wallet providers to use hierarchical deterministic (HD) wallets, which generate multiple addresses under a single wallet to enhance user security.

This automatic address update ensures that you don’t need to worry about changing your Bitcoin wallet address manually.

Can You Request a Specific Bitcoin Address Change?

Although Cash App generates new Bitcoin addresses regularly, there is no manual option for users to change the address on demand. The system is designed to automate this process, ensuring that each user’s account remains secure and compliant with blockchain standards.

If you have concerns about a previous Bitcoin address being compromised, you can still use the newest address generated by Cash App for future transactions. However, your old addresses will continue to receive Bitcoin without any issues.

Managing Multiple Bitcoin Transactions on Cash App

You don’t need to worry about managing different addresses yourself, as all Bitcoin received via old and new addresses will reflect in your Cash App Bitcoin balance. Here are some useful tips for seamless Bitcoin transactions on Cash App:

Use the latest Bitcoin address whenever requesting deposits from another wallet or exchange for added security.

Keep track of transaction confirmations on the Bitcoin blockchain to monitor the status of your incoming funds.

Make sure to verify the amount and recipient address before sending Bitcoin, as transactions on the blockchain are irreversible.

What Happens if You Share an Old Bitcoin Address?

If you’ve already shared an older Bitcoin address with someone, there’s no need to worry. Bitcoin sent to any valid address associated with your Cash App wallet will still arrive safely in your account.

Unlike some traditional payment systems, the blockchain ensures that all past addresses remain valid indefinitely, so even if your address changes, older ones will still work for receiving funds.

FAQ

Can I change my Bitcoin address on Cash App manually?

No, Cash App does not allow users to manually change their Bitcoin address. However, the platform periodically generates new addresses for your wallet to enhance security and privacy.

How often does Cash App change Bitcoin addresses?

There is no fixed schedule for Bitcoin address changes. Cash App issues new addresses automatically when needed, such as when you request a new deposit address.

Will my old Bitcoin address still work after a new one is assigned?

Yes, all old Bitcoin addresses linked to your Cash App wallet will remain valid and functional. Funds sent to any previous address will still arrive in your Bitcoin balance.

How do I find my Bitcoin wallet address on the Cash App?

To view Cash App Bitcoin wallet address, open the Cash App, tap the Bitcoin (₿) icon, and select Deposit Bitcoin. You’ll see your current address and QR code for deposits.

Why does the Cash App change Bitcoin addresses periodically?

Cash App updates Bitcoin addresses to protect user privacy, enhance security, and comply with blockchain best practices. Regular address changes prevent others from tracking your entire transaction history.

Can I have multiple Bitcoin addresses on Cash App?

Yes, Cash App assigns multiple addresses over time, but you don’t need to manage them separately. All addresses remain linked to your Bitcoin wallet and can receive funds.

#does cash app bitcoin address change#cash app bitcoin address change#how to change does cash app bitcoin address#how to get new cash app bitcoin address

2 notes

·

View notes

Text

How to Maximize Your Bitcoin Withdrawal on Cash App: A Complete Guide

If you're just getting started or have been using a Cash App for some time, you might be wondering: What is the maximum Bitcoin withdrawal limit? How can you increase your Cash App Bitcoin withdrawal limit? In this comprehensive blog post, we’ll break down all you need to know about Cash App's Bitcoin limits, including withdrawal, deposit, and purchase limits. Additionally, we’ll answer common questions that Cash App users have about their Bitcoin transactions, making sure you have all the information you need to manage your cryptocurrency investments more effectively.

What is the Cash App Bitcoin Withdrawal Limit?

To begin with, it’s important to understand the Cash App Bitcoin withdrawal limit. This refers to the maximum amount of Bitcoin you can withdraw from your Cash App account to an external wallet or bank account. As with most financial platforms, Cash App imposes a set of rules and limits to ensure security, prevent fraud, and comply with regulatory requirements.

For Cash App users, the Bitcoin withdrawal limit depends on your account’s verification status. In simple terms, unverified accounts have a lower Bitcoin withdrawal limit, while verified accounts can withdraw large amounts. To put this into perspective, here’s a breakdown of the Cash App Bitcoin withdrawal limits:

Unverified Accounts: Users who have not completed Cash App’s identity verification process can typically withdraw up to $2,000 worth of Bitcoin per day. These accounts are also subject to lower limits on the overall amount they can send, as Cash App requires verification for higher transactions.

Verified Accounts: After completing the Cash App’s verification process (which includes providing personal details such as your full name, date of birth, and the last four digits of your Social Security Number), users can access higher withdrawal limits. Verified accounts can withdraw up to $25,000 worth of Bitcoin per day, significantly increasing your ability to transfer larger amounts of Bitcoin to external wallets.

How to Increase Your Cash App Bitcoin Withdrawal Limit?

Many Cash App users want to know how they can increase their Bitcoin withdrawal limit to accommodate larger transactions. The good news is that this is possible, and it all comes down to completing the verification process. Here are the steps you’ll need to take to increase Cash App Bitcoin withdrawal limit:

Complete Identity Verification: The first step is to verify your identity on Cash App. This typically involves submitting some personal information, such as your name, date of birth, address, and Social Security Number (SSN). This step is essential for increasing your withdrawal limit to a higher threshold.

Verify Your Phone Number and Email: To ensure the security of your account, you must verify your phone number and email address. This process will further protect your account from unauthorized access and increase your trustworthiness in Cash App’s system.

Wait for Cash App to Approve Your Verification: After submitting your verification documents, Cash App will review them and, if everything checks out, approve your account for higher limits. This process can take anywhere from a few minutes to a few days, depending on their verification system’s load.

Once your account is fully verified, your Bitcoin withdrawal limit will be automatically increased, allowing you to withdraw up to $25,000 per day. If you encounter any issues during the verification process, be sure to contact Cash App’s customer support for assistance.

What are the Other Cash App Bitcoin Limits You Should Know?

Apart from the Bitcoin withdrawal limit, there are other important Cash App Bitcoin limits that users should be aware of. These include limits related to purchases, deposits, sending Bitcoin, and more.

1. Cash App Bitcoin Purchase Limit

The Cash App Bitcoin purchase limit refers to the maximum amount of Bitcoin you can buy through the app. Typically, the purchase limits are as follows:

Unverified Accounts: The purchase limit is usually around $10,000 worth of Bitcoin per week for unverified users.

Verified Accounts: Once your account is verified, you can increase your Bitcoin purchase limit to up to $50,000 per week.

2. Cash App Bitcoin Deposit Limit

Cash App also imposes a Bitcoin deposit limit, which is the maximum amount of Bitcoin you can deposit into your Cash App account from an external wallet or exchange. The deposit limit varies based on network congestion and other factors, but for the most part, it’s designed to be flexible to accommodate user needs. Cash App Bitcoin deposit limits are typically much higher than withdrawal limits, allowing users to deposit significant amounts of Bitcoin into their Cash App account without hitting a cap.

3. Cash App Bitcoin Sending Limit Per Week

Cash App also has a Bitcoin sending limit per week, which is the maximum amount of Bitcoin you can send from your Cash App account to an external wallet within seven days. Verified users can generally send up to $25,000 worth of Bitcoin per week, while unverified users face much lower limits.

4. Cash App Bitcoin Daily Purchase Limit

Similar to the Bitcoin withdrawal limit, there’s a Cash App Bitcoin daily purchase limit, which determines how much Bitcoin you can buy each day. For unverified users, the daily purchase limit is usually lower, often around $2,000 worth of Bitcoin per day. Once verified, users can typically purchase up to $10,000 worth of Bitcoin per day.

5. Cash App Bitcoin Monthly Withdrawal Limit

Some users may want to know about the monthly withdrawal limit for the Cash App Bitcoin. While Cash App does not impose a separate limit specifically for monthly withdrawals, the daily withdrawal limit of $25,000 effectively means you can withdraw up to $25,000 worth of Bitcoin each day, which adds up to a much higher withdrawal potential on a monthly basis.

Conclusion

Understanding the Cash App Bitcoin withdrawal limit is crucial for users who want to manage their cryptocurrency investments effectively. Whether you're withdrawing small amounts or looking to transfer large sums, knowing how to navigate the limits will help you plan your transactions accordingly. By completing the verification process, you can increase your withdrawal and purchase limits to ensure a smoother Bitcoin experience on the Cash App.

FAQs on the Bitcoin Withdrawal on Cash App

1. What is the Cash App Bitcoin withdrawal limit?

The Cash App Bitcoin withdrawal limit for unverified users is typically $2,000 per day, while verified users can withdraw up to $25,000 per day.

2. How can I increase my Cash App Bitcoin withdrawal limit?

To increase your Bitcoin withdrawal limit, complete the account verification process by submitting your details, including your full name, date of birth, and Social Security Number (SSN).

3. What is the Cash App Bitcoin purchase limit?

For unverified users, the Cash App Bitcoin purchase limit is typically $10,000 per week, while verified users can purchase up to $50,000 per week.

4. Can I withdraw more than the Cash App Bitcoin daily withdrawal limit in a week?

No, Cash App imposes a weekly limit on Bitcoin withdrawals. Even though your daily limit is $25,000, this limit applies over 7 days, meaning you cannot exceed the weekly cap.

2 notes

·

View notes

Text

The Hidden Cap: Daily, Weekly, and Monthly Cash App ATM Withdrawal Limits Explained

Cash App is a mobile-based payment service that enables users to send and receive funds with email address, phone number or $Cashtag (unique user identifier). Direct deposits from savings or checking into the Cash App balance can also be made. Cash App has ATM withdrawal limits of $310 per transactions and up to $1,000 over for a week. Cash App withdrawal limits have been put in place as security precautions. However, it is possible to increase ATM withdrawal limits on Cash App.

Verifying your identity and increasing the frequency of transactions are two effective methods to increase Cash App limit. Cash App verification requires information such as your full name, birth date and last four digits of your social security number. Moreover, for getting higher ATM withdrawal limits you can directly contact the customer support team.

What Is Cash App and Why It is So Popular?

Block, Inc. developed and launched the Cash App as a mobile peer-to-pee payment system in 2013. User can send and receive funds, invest in stocks or Bitcoin, making investments using the Cash Card that functions similarly to a debit card. Below mentioned are some of the reasons Cash App gained massive popularity:

Cash Card feature is the physical form enables users to utilize their cash app balance at shops or withdraw it from ATMs.

Unlike traditional banks, Cash App allows instantaneous transactions among its users.

Solutions Payroll and government benefits may be directly deposited to a Cash App account.

What are the Basics of Cash App ATM Withdrawals?

Cash App allows users to withdraw money using the Cash Card at an ATM. Once your Cash Card has been activated and ordered, you are able to utilize it at any ATM to withdraw funds from your balance on Cash App. Unlike traditional banking which has branches, ATM access is key in engaging with their money in the real world.

However, there may be limits and charges applicable depending on Cash App weekly, daily, or monthly withdrawal limits imposed on users. If you exceed these limits it could lead to declines in transactions at times when cash may be most needed.

What Are Daily ATM Withdrawal Limits on Cash App?

Cash App imposes a daily ATM withdrawal limit to reduce risk and encourage responsible use. At present, Cash App withdrawals can reach $1,000 within any 24-hour timeframe but each withdrawal transaction cannot exceed $310. You may make multiple transactions in one day to reach this total; however, the total cannot exceed $1,000 within any 24-hour timeframe.

Note that your 24-hour window does not coincide with a calendar day - instead it resets 24 hours from when you made your last withdrawal, such as taking one out at 2 PM on one day and 2 PM the following. This structure of rolling for Cash App daily withdrawal limit reset can be confusing to people expecting their limit reset at midnight each night.

What is the Cash App Weekly ATM Withdrawal Limits?

Cash App has both a daily limit and annual ATM withdraw limit in effect. This means each 7-day timeframe you are allowed to withdraw up to $1,000 total without any regard to daily limits. Once this limit has been reached it cannot be increased until one or more previous withdrawals within this seven-day timeframe have taken place again.

The Cash App weekly withdrawal limit is determined on an ongoing basis rather than being tied to any one specific week (such as Sunday through Saturday). If, for instance, you take out $300 on Tuesday it counts towards your limit until Tuesday; knowing when this resets and when new money can become accessible is crucial.

How Much Can You Withdraw Per Month on Cash App?

Cash App limits how much cash can be withdrawn from ATMs within 30 days. Every month, Cash App withdrawal limits of $1250 apply in addition to any weekly limits. Moreover, once you reach this monthly limit this morning, further withdrawals will not be possible until any transaction takes place outside of this 30-day window.

How to Increase Your Cash App Withdrawal Limits?

You need to get verified to increase Cash App withdrawal limits. Here is how to do it:

Steps to Verify: For best results, open the Cash app and examine its settings for your account.

Submit details such as your full name, date of birth and last four digits from your Social Security number (SSN).

Once verified, your withdrawal limits on Cash App will increase.

Are There ATM Fees with Cash App Withdrawals?

Yes, Cash App charges a $2.50 withdrawal fee at ATMs, with additional ATM operators’ fees depending on location and ATM used. But you could potentially be reimbursed for these charges with direct deposits of $300 into your Cash Account each month and eligible withdrawals of maximum three per day with up to $7 total reimbursements each month.

FAQ

What is the maximum amount I can withdraw from a Cash App ATM?

Your Cash App withdrawal limit per transaction is $310 per day or $1,250 total over 30 days.

How can I check how much I have withdrawn on Cash App?

To check the withdraw limit open the Cash App and navigate to its Activity Tab; once there, use this page to review your withdrawal history to keep an eye on how your funds have been utilized.

Does verifying my Cash App increase my ATM withdrawal limits?

Yes, by verifying your Cash App account, you can increase ATM withdrawal limits.

Are there fees for ATM withdrawals on Cash App?

Yes, Cash App charges $2.50 for every withdrawal made via their service, along with ATM operator fees that could incur.

1 note

·

View note

Text

How to Use a Verified Cash App Account

Live Contact Now Skype : Usaserviceshop Telegram :@Usaserviceshop Email: [email protected]

Are you new to Cash App and looking for guidance on how to use a verified account? Look no further! In this article, we will walk you through the steps to easily navigate and utilize all the features available with a verified Cash App account. Getting Started with Cash App First things first, you'll need to download the Cash App from the App Store or Google Play Store. Once you have the app installed on your device, create an account by entering your email address or phone number. Follow the prompts to set up your account and verify your identity to unlock all the features. Verifying Your Cash App Account To verify your Cash App account, you will need to provide some personal information such as your full name, date of birth, and social security number. This information is used to verify your identity and ensure the security of your account. Once you have provided this information, your account will be verified, and you can start using all the features of Cash App. Sending and Receiving Money One of the main features of Cash App is the ability to send and receive money with just a few taps on your phone. To send money, simply enter the amount you want to send and the recipient's information. To receive money, share your Cash App username or QR code with the sender. Money is transferred instantly between Cash App accounts, making it a quick and convenient way to handle transactions. Making Payments Cash App also allows you to make payments to retailers and businesses that accept Cash App payments. Simply scan the business's QR code or enter their Cash App tag to make a payment. You can also link your Cash App account to your debit card or bank account to easily transfer funds between accounts. Investing with Cash App In addition to sending and receiving money, Cash App also offers the ability to invest in stocks and Bitcoin. You can buy and sell stocks or Bitcoin directly from the app, making it easy to manage your investments on the go. Keep an eye on market trends and make informed decisions with real-time updates and investment tools available on Cash App. Cash App Card Cash App users can also request a Cash App card, which is a customizable debit card linked to your Cash App account. Use your Cash App card to make purchases at retailers that accept Visa or withdraw cash from ATMs. The Cash App card offers added convenience and flexibility for managing your finances. Stay Safe and Secure As with any online financial transaction, it's important to stay vigilant and protect your account information. Make sure to enable two-factor authentication on your Cash App account and never share your login credentials with anyone. If you suspect any unauthorized activity on your account, contact Cash App support immediately to resolve any issues. In conclusion, using a verified Cash App account is a convenient and secure way to manage your finances and make transactions on the go. By following the steps outlined in this article, you can make the most of all the features available with Cash App and enjoy a seamless user experience. So why wait? Start using your verified Cash App account today and experience the ease and convenience it has to offer!

1 note

·

View note

Text

Finance Profit Bot | Finance Profit Bot Reviews | Finance Profit Bot Trading App

Many people believe that trading online is a way to earn quick cash on the side or full-time. It's not that easy to succeed in this sector, though. Attaining success requires a significant amount of time and work. Indeed, some people achieve great success, but luck is usually the reason.

Open Your Finance Profit Bot Account Now

Selecting the appropriate trading platform is essential if you want a guaranteed probability of success. I'll be discussing a platform in this Finance Profit Bot review that can provide you the advantage you need to thrive in this cutthroat sector. To ensure you know what you are getting into, I will go over the state-of-the-art capabilities that this platform offers.

(1) What Is Finance Profit Bot?

A new cryptocurrency trading tool called Finance Profit Bot aims to make trading easier and assist users of all skill levels in making sizable profits. It gathers important data, such as price movements and historical asset information, and analyzes the vast cryptocurrency market using advanced technology, such as artificial intelligence and complex algorithms, to produce useful trade signals.

YouTube: https://www.youtube.com/watch?v=UFG_JUzc3Tw

Blogger: https://financeprofitbot.blogspot.com/

The site has an easy-to-use layout and a number of unique features, including support for numerous currencies, sophisticated tools and resources, a demo account with simulated funds, and effective banking choices. Finance Profit Bot links users with trustworthy brokers and uses SSL encryption to protect data and investments.

Trading Bot Name ╰┈➤ Finance Profit Bot Reviews

Bot Type ╰┈➤ Web-Based Trading Platform

Registration Process ╰┈➤ On The Official Website of Finance Profit Bot

Verification ╰┈➤ Yes

Registration Fee ╰┈➤ No Fee

Minimum Capital Required ╰┈➤ $250

Profit Withdrawal ╰┈➤ Any Time

Official Website Address ╰┈➤ Click Here

(2) How Does Finance Profit Bot Work?

The Finance Profit Bot is made with cutting-edge tools and technology to make trading easier overall. The software offers real-time updates and in-depth analytical data while continuously monitoring the cryptocurrency market around-the-clock. It assesses risk factors and lessens emotional decision-making, allowing you to spot trade opportunities with high profit potential.

Furthermore, Finance Profit Bot collaborates with licensed brokers to provide assistance in times of crisis or market decline. Users have the ability to alter the platform's functionality. To make sure the system meets their demands, traders can modify the settings and degree of support according to their trading objectives, experience, and risk tolerance. Additionally, Finance Profit Bot provides the choice of either automated or manual trading modes.

(3) Is Finance Profit Bot Platform A Scam or Not?

It is understandable that prospective consumers might be wary of automated trading solutions in a time when they are widely available. Our investigation of Finance Profit Bot Reviews has demonstrated that it is, in fact, a genuine trading instrument following extensive testing and assessment. Although it's crucial to remember that no trading bot can ensure profits because of the bitcoin market's inherent volatility, user feedback generally points to a generally favorable experience. Numerous users have expressed success in using the tool to better their trading tactics and financial results.

Click Here For Instant Access Limited-Time Only - This Offer Is Expiring Soon

Reviews from users point out a number of important features of Finance Profit Bot that support its legitimacy. The bot's user-friendly interface and effective trade execution are typically praised by users for easing the emotional burden that frequently comes with trading decisions. Furthermore, the platform's prompt customer service has been commended for assisting consumers in resolving any issues they may encounter. All of these elements work together to reinforce the idea that Finance Profit Bot is a trustworthy option for anyone wishing to trade cryptocurrencies automatically.

(4) Features Of Finance Profit Bot Reviews

One trading platform with a lot of special features is Finance Profit Bot. In this section, we will examine some of the key components of the cryptocurrency trading system.

AI-Backed Trading Signals: The cryptocurrency trading platform's ability to provide users with accurate insights and AI-backed trading signals is one of its primary strengths. The trading system is driven by cutting-edge technologies that provide you with real-time trading information by analyzing the cryptocurrency trading market.

Automated Trading: One element of the Finance Profit Bot cryptocurrency trading platform automates the entire trading procedure. If you choose this method, the trading platform will trade and act as your agent. All you need to do is stay logged into your account.

Privacy and Security: Finance Profit Bot offers strong privacy and security features. The trading system's website is SSL-encrypted to preserve your privacy, and it incorporates numerous safety features to ensure a safe trading environment.

(5) How To Start Using Finance Profit Bot App

The procedure to begin using Finance Profit Bot Platform is simple:

Sign Up: To establish an account, go to the official website and provide your basic information.

Verification: Following registration, a representative will assist and walk you through the verification process.

Initial Deposit: A $250 minimum deposit is required to start trading.

Automated Trading: With an 85% success record, the software makes trades using AI.

Withdraw Earnings: The platform's safe method makes it simple to take winnings out at any time.

(7) Finance Profit Bot Trading App- Cost, Minimum Deposit, and Profit

With only a €250 minimum investment needed to begin active trading, the Finance Profit Bot trading system seems to be fairly inexpensive. For account registration, upkeep, deposits, withdrawals, and other services, the platform doesn't charge any fees. User feedback supports the assertion that this minimal initial investment gives considerable earning possibilities.

Open Your Finance Profit Bot Account Now

Several users have claimed to have made significant gains in the first few weeks. Starting with smaller amounts is advised to provide a safe trading experience. You can progressively increase your investment as you learn more about Finance Profit Bot Crypto capabilities and improve your trading abilities.

(8) Finance Profit Bot User Reviews And Expert Ratings

Finance Profit Bot is a reliable cryptocurrency trading platform that is appropriate for traders of all skill levels, according to user reviews. Numerous clients have posted about their satisfying experiences on internet discussion boards, emphasizing the effective trading assistance that has enabled them to turn a profit.

Experts have also given Finance Profit Bot an outstanding grade of 4.7/5 after carefully assessing its performance. These professionals have verified the platform's dependability following a thorough examination of its features. Expert evaluations and user reviews both point to Finance Profit Bot as a reliable and strong trading platform.

(9) Final Verdict

A dependable and effective cryptocurrency trading platform that completely automates the trading process is Finance Profit Bot Trading App. It offers precise forecasts, real-time updates, and accurate trading insights thanks to AI, sophisticated algorithms, and VPS systems. Additionally, the approach eliminates emotional biases and lowers risks in trading judgments.

Click Here For Instant Access Limited-Time Only - This Offer Is Expiring Soon

Anybody, regardless of expertise level, can use this free platform. Before going live, users can adjust their trading parameters and the amount of help they require using Finance Profit Bot. Additionally, you have the option of trading manually or automatically. The majority of customers have given Finance Profit Bot positive reviews, and experts have given it an effectiveness rating of 4.7/5. These elements all suggest that Finance Profit Bot is a reliable platform that is worthwhile to use.

1 note

·

View note

Text

How to Transfer Crypto to Cash App: A Step-by-Step Guide

Transferring cryptocurrency to Cash App is a straightforward process that has become increasingly popular as Cash App expands its crypto features. Whether you’re a new or experienced crypto user, understanding how to move your funds efficiently and securely is essential. This guide explains how to transfer cryptocurrency to Cash App, answers common questions, and provides tips for smooth transactions.

Can You Send Cryptocurrency to Cash App?

Yes, Cash App allows users to send and receive Bitcoin, making it a versatile platform for cryptocurrency transactions. However, you can only send Bitcoin at this time. Other cryptocurrencies, such as Ethereum or Litecoin, are not yet supported. To send Bitcoin to Cash App, you need a verified account with a Bitcoin wallet address provided by Cash App.

How to Transfer Cryptocurrency to Cash App

Follow these steps to transfer Bitcoin to your Cash App wallet:

Open Cash App: Launch the Cash App on your device and log into your account.

Access Bitcoin Wallet: Tap the "Bitcoin" icon located at the bottom menu.

Generate Wallet Address: Select "Deposit Bitcoin" to generate your unique Cash App Bitcoin wallet address.

Copy the Wallet Address: Copy the address or scan the QR code provided by Cash App.

Initiate the Transfer: Go to the external wallet where your Bitcoin is stored.

Enter the Wallet Address: Paste the copied address or scan the QR code in the recipient field.

Set the Amount: Specify the amount of Bitcoin you want to transfer.

Confirm the Transaction: Review all details carefully and confirm the transaction.

Bitcoin transfers to Cash App typically take a few minutes to an hour, depending on blockchain network congestion.

How Do I Get My Money Out of Bitcoin on Cash App?

Cash App makes it easy to convert Bitcoin to cash. Here’s how to withdraw funds:

Sell Bitcoin:

Open the Bitcoin tab in Cash App.

Select “Sell” and enter the amount of Bitcoin you wish to sell.

Confirm the sale to convert your Bitcoin to USD.

Withdraw Cash:

Go to the home screen and select your Cash App balance.

Choose “Cash Out” and enter the amount you wish to transfer to your linked bank account.

Confirm the withdrawal and wait for the funds to appear in your bank account (standard deposits take 1–3 business days; instant deposits may incur fees).

Can I Receive Crypto on Cash App?

Yes, you can receive Bitcoin on Cash App. To do so, follow these steps:

Navigate to Bitcoin Tab: Open the Cash App and tap the Bitcoin icon.

Generate a Wallet Address: Select "Deposit Bitcoin" to create your unique receiving address.

Share Your Wallet Address: Provide the sender with your wallet address or QR code.

Wait for the Transfer: Once the sender initiates the transfer, Bitcoin will appear in your Cash App wallet after confirmation on the blockchain.

Cash App does not currently support receiving other cryptocurrencies besides Bitcoin.

How Much Crypto Can You Send on Cash App?

Cash App imposes certain limits on cryptocurrency transactions. These include:

Bitcoin Withdrawal Limit: You can send up to $2,000 worth of Bitcoin per day and $5,000 within a 7-day period.

Bitcoin Deposit Limit: There is no specific limit for deposits, but your sending wallet might impose restrictions.

Verification Requirements: Higher limits require account verification, which includes providing personal identification documents.

Tips for a Smooth Crypto Transfer to Cash App

Verify Your Account: Ensure your Cash App account is fully verified to access all Bitcoin features and higher transaction limits.

Double-Check Wallet Addresses: Entering the wrong wallet address can result in lost funds. Always double-check before confirming a transaction.

Be Aware of Fees: Cash App may charge fees for sending or receiving Bitcoin, depending on network conditions.

Monitor Network Congestion: During peak times, Bitcoin transfers may take longer. Plan your transfers accordingly.

Why Use Cash App for Cryptocurrency?

Cash App simplifies cryptocurrency transactions by integrating Bitcoin into its user-friendly interface. With options to buy, sell, send, and receive Bitcoin, it serves as a versatile tool for managing your cryptocurrency. Additionally, its integration with traditional banking makes it easy to convert crypto to cash.

Final Thoughts

Transfer cryptocurrency to Cash App is a convenient way to manage your Bitcoin holdings. By following the steps outlined above, you can securely transfer Bitcoin from an external wallet, convert it to cash, or send it to others. With its growing popularity and robust features, Cash App is a reliable choice for Bitcoin transactions.

0 notes

Text

Bitcoin Unveiled: A Complete Guide to Understanding and Harnessing its Potential

Introduction

What is Bitcoin?

Bitcoin is a type of digital money that you can send and receive over the internet. It was created in 2009 by someone (or a group) named Satoshi Nakamoto, whose real identity remains unknown.

Why Was Bitcoin Created?

Bitcoin was introduced as an alternative to traditional money and banking systems, especially after the financial crisis in 2008. It aims to be a decentralized form of currency that anyone can use.

Bitcoin in Simple Terms

Think of Bitcoin as cash for the internet. It’s not physical like dollars or euros, but you can use it to buy things, send money to friends, or hold it as an investment.

The Basics of Blockchain Technology

What is Blockchain?

Blockchain is the technology that makes Bitcoin work. It’s a digital ledger or record book that keeps track of all Bitcoin transactions. This record book is shared across many computers worldwide.

How Does Blockchain Work?

Transactions are grouped into blocks. Each block is linked to the one before it, creating a chain. This chain of blocks ensures that every transaction is secure and transparent.

Decentralization Explained

Decentralization means that no single person or company controls Bitcoin. Instead, it is managed by many people (nodes) who keep copies of the blockchain and check transactions.

Nodes and Their Role

Nodes are computers that help run the Bitcoin network. They store the blockchain, verify transactions, and ensure everything is running smoothly and securely.

Mining: The Process of Creating Bitcoin

What is Bitcoin Mining?

Bitcoin mining is like digging for gold but digitally. Miners use computers to solve difficult math problems, which helps confirm transactions and add them to the blockchain.

Understanding Proof of Work

Proof of Work is the system that miners use. It involves solving complex problems that require a lot of computing power. This process makes it hard for anyone to cheat the system.

Rewards for Miners

When miners solve these problems, they get rewarded with new Bitcoins. This reward motivates them to keep the network secure and running.

What is the Halving Event?

The halving event happens roughly every four years. It cuts the reward miners get for adding new blocks in half, which helps control the number of new Bitcoins created over time.

Wallets and How to Use Bitcoin

What is a Bitcoin Wallet?

A Bitcoin wallet is like a digital wallet where you store your Bitcoins. It keeps track of your Bitcoins and lets you send or receive them.

Types of Bitcoin Wallets

There are different kinds of wallets: software wallets (apps on your computer or phone), hardware wallets (physical devices), and paper wallets (printed keys).

Keeping Your Wallet Secure

It’s crucial to protect your wallet. Use strong passwords, enable two-factor authentication, and keep your private keys safe and offline when possible.

How to Make Transactions

To send Bitcoin, you need the recipient's wallet address. You enter the amount you want to send, confirm the transaction, and it gets recorded on the blockchain.

Advantages of Using Bitcoin

Including Everyone Financially

Bitcoin can be used by anyone with internet access, which helps people who don’t have traditional bank accounts participate in the global economy.

Lowering Transaction Costs

Bitcoin transactions often cost less than traditional banking fees, especially for sending money internationally, saving users money.

Quick and Efficient Payments

Bitcoin payments can be processed quickly, no matter where you are in the world, making it ideal for international transactions.

Transparency and Trust

All Bitcoin transactions are visible on the blockchain. Once confirmed, they cannot be changed, which builds trust and security.

Security and Privacy

Bitcoin uses strong cryptography to secure transactions. While the transaction history is public, the identities behind the addresses are private.

Control Over Your Money

With Bitcoin, you have complete control over your money without needing permission from banks or governments. This gives you financial freedom.

A Safe Store of Value

Many people see Bitcoin as “digital gold” because it has a limited supply and can protect against inflation, making it a good store of value.

Challenges and Risks of Bitcoin

Price Volatility

Bitcoin prices can change quickly and dramatically. This makes it risky for people who want stable investments or money.

Regulatory Uncertainty

Different countries have different rules about Bitcoin, and these rules can change. This uncertainty can affect how Bitcoin is used and traded.

Security Issues

While the Bitcoin network is secure, users must protect their wallets from hackers and scams. If someone gets your private key, they can steal your Bitcoin.

Scaling Problems

Bitcoin’s network can get congested, causing slow transactions and high fees. Solutions like the Lightning Network are being developed to make it faster and cheaper.

Energy Consumption

Mining Bitcoin uses a lot of electricity, raising environmental concerns. Efforts are being made to use renewable energy and make mining more efficient.

How Bitcoin is Being Used

Businesses Accepting Bitcoin

More and more businesses are accepting Bitcoin for payments, including online shops, restaurants, and service providers.

Sending Money Abroad

Bitcoin is popular for remittances, as it allows people to send money across borders quickly and cheaply compared to traditional services.

Investing and Trading

People buy Bitcoin as an investment, hoping its value will increase. Others trade Bitcoin to make profits from its price changes.

Smart Contracts and Apps

While Bitcoin’s smart contracts are basic, other cryptocurrencies use advanced smart contracts for applications. Bitcoin’s role in this area is evolving.

The Future of Bitcoin

More People Using Bitcoin

As more people learn about Bitcoin, it’s likely to become more widely used. Improvements in user experience and infrastructure will help this growth.

Big Companies Getting Involved

Large financial institutions and companies are starting to invest in Bitcoin, which adds credibility and stability to the market.

Technological Improvements

New technologies, like the Lightning Network, are being developed to make Bitcoin transactions faster and cheaper.

Clearer Regulations

As governments create clearer rules for Bitcoin, it will become easier for people and businesses to use it legally and confidently.

Part of the Global Financial System

Bitcoin has the potential to become an important part of the world’s financial system, offering unique benefits like decentralization and a fixed supply.

Impact on Traditional Finance

Bitcoin is pushing traditional banks to innovate and explore new technologies, like blockchain, to stay competitive.

Empowering People Economically

Bitcoin can help people gain financial independence, especially in areas with unstable or limited banking services.

Staying Motivated and Informed

Embracing New Ideas

Using Bitcoin is about embracing innovation and the future of finance. It challenges old ways of thinking about money and transactions.

Control Over Your Finances

Bitcoin gives you control over your money without relying on banks or governments, providing financial freedom.

Helping the Unbanked

Bitcoin can provide financial services to millions of people who don’t have access to traditional banks, promoting economic growth.

Looking Ahead

The future of Bitcoin is full of possibilities. As technology and adoption grow, Bitcoin’s role in the economy will continue to expand.

Community and Collaboration

The Bitcoin community is diverse and active, with developers, investors, and enthusiasts working together to improve the ecosystem.

Long-Term Goals

Bitcoin represents a long-term vision for a decentralized and open financial system. Its success depends on widespread belief and participation.

Continual Learning

Understanding Bitcoin requires ongoing learning. Staying informed helps you make better decisions and contribute to the Bitcoin community.

Advancing Technology

Blockchain technology, which powers Bitcoin, has the potential to transform many industries beyond finance, including supply chain and healthcare.

Resilience of the Network

Bitcoin’s network is strong and resilient, able to withstand various challenges and continue operating securely.

Building a Better Future

Bitcoin aims to create a better financial system that is inclusive, transparent, and secure, offering a new way to think about money.

Conclusion

Reflecting on Bitcoin’s Journey

Bitcoin has evolved from a novel idea to a global phenomenon, influencing finance, technology, and society. Its journey continues to unfold.

The Promise of Bitcoin

Bitcoin holds the promise of a decentralized, secure, and inclusive financial future. Its potential is vast, driven by a dedicated community.

Embracing Bitcoin’s Potential

As we move forward, embracing Bitcoin and its technology can lead to new opportunities. Understanding and participating in the Bitcoin ecosystem is key to its growth and success.

Follow foe more content like this and if you want to learn blockchain from different platform then here are some suggesions:

0 notes

Text

What Is Bitcoin Mining and How Does it Work?

Anyone can try their hand at cryptocurrency mining today. While there are thousands of assets in circulation, BTC remains the most popular one – that’s why most miners opt for it. Bitcoin boasts a huge user base and an impressive market capitalization. Nearly all exchanges support it. The equipment for mining this coin is available in multiple varieties. All these factors make BTC an ideal choice.

In this article, we’ll address the question “What is Bitcoin mining?”. We’ll explain how this process occurs from the technological position. We’ll clarify the difference between several mining varieties and outline the potential risks of this activity. However, it’s necessary to admit that the multiple pros of BTC mining far outweigh its cons – that’s why we’ll also share a step-by-step plan on how to get started.

What Does Mining Bitcoin Mean?

The term “mining” denotes the process of gaining cryptocurrency. The Bitcoin emission is capped at 21 million units and is planned to end in the middle of the 22nd century. Until that moment, miners need to grant the generation of new coins by solving cryptographic puzzles.

Such puzzles are dubbed hashes. Each of them represents a string of 64 letters and numbers. The mining rig’s task is to guess the hash’s value. The owner of the machine that copes with the task earlier than others gets a cash reward. The mission of all the others consists in validating the generation of the new coin – that is, to prove that the process was not fraudulent. Such a mechanism is called Proof of Work.

After the last Bitcoin enters circulation, miners will remain relevant. They will be in charge of the tasks that they also deal with now:

Guarantee stability, security and smooth functioning of the blockchain

Facilitate the network expansion

Validate every single transaction that takes place within the chain and prevent duplicates

In exchange for their efforts, miners earn rewards. The reward per block decreases by 50% every four years, which is known as halving. Because of halving, solo mining has become unprofitable — but mining farms and pools still generate a handsome income.

How Does Bitcoin Mining Work?

Depending on how many people are engaged in it, mining falls into two categories:

Individual. You buy your rig and you alone bear the entire responsibility for it.

Industrial. Many people join forces and form a large pool of mining devices. Btc.com, Via BTC and F2pool can serve as well-known examples. When one machine from the set manages to solve a puzzle, each participant in the pool will get their share of the reward. The share will be proportional to the part of the computing power of the pool that belongs to the person.

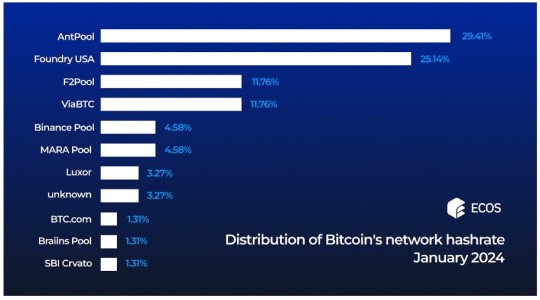

The largest pools in the world control around 70% of BTC network hashrate:

Depending on the equipment used, we can talk about:

CPU or GPU mining. It was relevant around a decade ago but not anymore. These devices lack the power to cope with the current complexity of calculations within the BTC network.

ASIC mining. Application-specific integrated circuits are purposefully built to serve exclusively this activity. They’re powerful and can deliver a substantial profit to their owners.

Mining farms. A farm is a complex that consists of multiple ASICs. Together, they have much better odds of handling cryptographic puzzles than a standalone device.

Cloud mining. Instead of buying the equipment, you rent it remotely. You can connect to the cloud through a website or mobile app. Currently, it’s the easiest and the most promising mining variety. Genesis Mining, EasyMiner and ECOS are among the most noteworthy providers.

Browser mining. You get rewards for using a specific browser to work online – such as Brave, for instance. Your profit will be tiny.

Hidden mining. It’s a nefarious activity. Someone infects your device with a virus and uses it for mining without your permission. It’s not you but a third party who gets the rewards – and you might fail to know about it.

If you’ve never mined crypto before, we recommend you should start with cloud mining. You won’t have to maintain your equipment yourself and think about where to place it. Farms and pools can shut down unexpectedly for reasons beyond their owners’ control – while clouds are much more adaptable and sustainable. All you have to do is manage the dashboard in the app to control your spendings and review the rewards that will be credited to you.

Hopefully, after reading this passage, you won’t need to ask anymore “How does mining Bitcoin work?”!

How to Calculate the Profitability of Mining?

In March 2024, the Bitcoin price broke its historical record by hitting the $70,000 mark. For miners, it was a very motivating piece of news. In the next few years, the BTC price should have good odds of climbing even higher, given the overall instability of the traditional financial system and the global economy. The more rigs you own or rent and the higher their computing power, the larger your income.

Apart from the profits, mining also involves expenses for:

Buying or renting the rig

Paying your energy bills

Paying taxes

To assess the upcoming spendings and profit, you can use a dedicated calculator. For instance, the ECOS one enables you to overview the computing power, reward and service fee per fixed time period.

The cheaper the electricity in the areas where your ASICs are located, the lower your expenses.

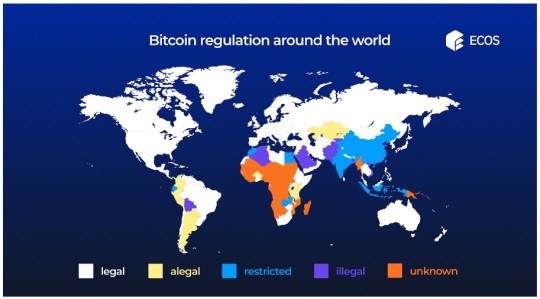

As for taxation, it’s very heterogeneous among different countries. In some territories, you’ll have to pay a tax on your block rewards. Others will charge you only for the fact of selling digital assets or making a profit on them. The rules that are valid today can change tomorrow because the international system of regulating the crypto sphere remains volatile.

It’s vital to pay attention to the legislation of the state where your ASICs will be located. It hardly makes sense to place them in a country where mining is illegal or unregulated yet – or where the political landscape can change drastically and the new party in power will edit the current mining-friendly laws. The optimal location will be a country whose political course is stable and whose government has proved its long-time loyalty to crypto mining.

Armenia is one of the top locations for Bitcoin mining in the world. Its government realizes well the importance of cryptocurrencies for the global community. To facilitate the development of businesses and the promotion of innovative technologies, the authorities create special economic zones. One of them is the ECOS Free Economic Zone, whose residents enjoy zero taxes and other benefits for a period of 25 years. They get access to advanced infrastructure, profile expertise, a convenient communication platform and the possibility of hiring foreign labor without restrictions. The Hrazdan Thermal Power Plant provides local miners with cheap electricity.

How to Start Bitcoin Mining

Today, private individuals tend to venture into mining for four reasons:

Make a profit

Invest in a promising asset

Keep up with the fast-paced technological progress

Contribute to the development of a decentralized financial system as an alternative to the conventional one that handles fiat money

Below, we’ll scrutinize the essential steps of starting mining at your home, in a garage or another location where you’ll be able to physically control your equipment. Then, we’ll switch to the basics of setting up cloud mining.

Step 1. Decide on the ASIC model

The more modern the ASIC model and the higher its hashing power, the faster you’ll be able to break even and the larger your profit. On the flip side, such devices consume large amounts of energy and emit loud noise. If you’re planning to place them in your home, consider those that are equipped with water-cooling systems – this new technology enables you to drive down the level of noise but at the same time drives up the ASIC’s price.

If your budget is limited, consider one of the most affordable models. Their hashrate is much lower but it can grant you a profit nevertheless. With modest upfront expenses, you’ll be able to assess whether this activity suits you or not.

Step 2. Set It Up

An ASIC is not a plug-and-play solution. You need to regularly fine-tune its settings, which requires technological expertise. If you lack profile knowledge, it might be wiser to outsource this task to professionals by joining a pool or trying cloud mining.

Step 3. Create a Bitcoin Wallet

You’ll need it to receive your earnings. There are two types of wallets:

Hot. It’s an app that you can download on your computer or smartphone, for free or at a price. Many apps are extremely user-friendly and boast visually appealing interfaces. On the flip side, as long as you store your assets online, hackers can try to steal them.

Cold. It’s a physical device that resembles a hard drive. You buy it as a one-off purchase and store it in a safe place, disconnected from the Internet. Cybercriminals would fail to attack a cold wallet – but this technology has other drawbacks. In the worst scenario, you might lose the device or damage it beyond repair.

Since BTC is the most in-demand crypto asset, the majority of the wallets support it. It shouldn’t be a problem for you to pick the one that best suits your needs.

Step 5. Follow the News

To make the most of mining, you should follow the news related to:

Bitcoin

Mining hardware, if you take care of it yourself

Legislation that regulates mining in the area where your rig is placed

Wallet to store your earnings

Miners exchange their experiences in multiple online communities – and you may want to join them too.

Setting Up Cloud Mining

It’s an alternative to buying and fine-tuning your own rig. The exact instructions can differ from one service provider to another. We’ll share the information with you, using the example of ECOS.

Sign up on the ECOS website or in its app. To complete the registration, it’s enough to make three clicks. There is no need to verify your identity with documents.

Activate demo mining. It’s not necessary to spend money from the onset. To get a notion of cloud mining, you can watch how it functions during a demo period. All the accruals that you’ll get during this time will be credited to you after you purchase a contract.

Pick and buy a contract. There are options for all types of users, from beginners to professionals. Plus, you can create a custom contract to 100% meet your goals.

Here is how the range of the ECOS plans looks, with their respective conditions:

ECOS lets you pay for the rented facilities with crypto or fiat money. Your income will be credited to you daily and you’ll be able to check it in the app. Other providers might have different conditions.

Downside of BTC Mining

Now that we’ve provided an exhaustive answer to the question “What is mining Bitcoin?”, let’s outline the shortcomings of this activity:

Low profits for solo miners. To earn money today, it’s necessary to join a pool or a cloud.

Volatile prices. If the BTC price drops, your income will decrease.

Legislative challenges. In some countries, crypto mining is illegal or not regulated yet. In others, it’s legal – but the political situation can change at any moment. It would be wise to engage in this activity only in the territories whose governments have confirmed their long-term approval of crypto.

Expensive electricity. To cut down your energy expenses, consider placing your equipment outside large cities, where electricity is affordable.

Damage to the environment. ASICs consume a lot of energy.

Necessity to fine-tune, maintain and update the equipment. You can entrust these tasks to professionals. They will make sure your rig operates without a hitch and is powerful enough by current standards to deliver a handsome profit.

Need of high upfront expenses. This drawback is relevant only for those who purchase physical ASICs – but not those who join a cloud.

0 notes

Text

Cash App Bitcoin Verification- Here are the Steps

Bitcoin, the world's leading cryptocurrency, has gained widespread popularity as a digital asset for investment and transactions. Cash App, a popular mobile payment platform, has made it easier than ever for users to buy, sell, and store Bitcoin directly within the app. However, before you can fully access the benefits of Bitcoin on Cash App, you'll need to verify your account. In this detailed guide, we'll walk you through the Cash App Bitcoin verification process, covering everything from enabling Bitcoin to troubleshooting common issues.

Understanding Bitcoin Verification on Cash App:

Verifying Bitcoin on Cash App involves enabling the Bitcoin functionality within the app and completing the necessary verification steps to ensure compliance with regulatory requirements. Once verified, you'll gain access to features such as buying, selling, and transferring Bitcoin seamlessly.

How to Enable Bitcoin on Cash App?

Enabling Bitcoin on Cash App is a simple process that can be completed directly within the app. Follow these steps mentioned on how to verify Bitcoin on Cash App:

Download Cash App: If you haven't already, download the Cash App from the App Store (for iOS devices) or Google Play Store (for Android devices).

Create an Account: Open the app and follow the prompts to create your Cash App account. Make sure to provide accurate information to expedite the verification process.

Navigate to Bitcoin Settings: Once your account is set up, navigate to the settings menu within the app. Look for the option labelled "Bitcoin" or "BTC" and tap on it to proceed.

Enable Bitcoin: Within the Bitcoin settings, you should see an option to enable Bitcoin functionality. Tap on this option to activate Bitcoin on your Cash App account.

Complete Verification: Depending on your region and regulatory requirements, you may need to complete additional verification steps to enable Bitcoin on Cash App. This may include providing identification documents such as a driver's licence or passport.

Wait for Verification: After enabling Bitcoin and completing the necessary verification steps, you'll need to wait for Cash App to verify your account. This process typically takes a few hours to a few days, depending on the volume of verification requests.

FAQs

Why is the Cash App Not Verifying My Bitcoin?

There could be several reasons why Cash App is not verifying your Bitcoin. Common issues include incomplete or inaccurate information provided during the verification process, technical glitches, or high verification volume. Double-check your information and contact Cash App support if you encounter any issues.

How Do I Enable Bitcoin Verification on Cash App?

To enable Cash App Bitcoin verification, navigate to the Bitcoin settings within the app and follow the prompts to allow Bitcoin to functionality. Complete any additional verification steps as required.

How Long Does Cash App Bitcoin Verification Take?

The verification process for Bitcoin on Cash App typically takes a few hours to a few days. However, verification times may vary depending on factors such as verification volume and regulatory requirements.

Conclusion:

Verifying Bitcoin on Cash App is a straightforward process that allows you to access the benefits of Bitcoin directly within the app. By following the steps outlined in this guide and addressing common FAQs, you can enable Bitcoin verification on Cash App with ease. Whether you're new to Bitcoin or a seasoned investor, Cash App provides a user-friendly platform for buying, selling, and storing Bitcoin securely. So why wait? Get started with Bitcoin on Cash App today and join the growing community of cryptocurrency enthusiasts.

#Cash App Bitcoin Verification#Cash App Bitcoin Verification Process#Cash App Bitcoin Verification pending#Cash App Bitcoin Verification failed#Cash App Bitcoin Verification denied#how to verify bitcoin on cash app#how to get bitcoin verified on cash app#how to enable Bitcoin verification on the Cash App

0 notes

Text

Increase Your Cash App Bitcoin Withdrawal Limits- Complete Guide 2024

As the popularity of Bitcoin continues to soar, many users turn to Cash App as a convenient platform to buy, sell, and hold cryptocurrency. However, there's one essential aspect that users often inquire about the Bitcoin withdrawal limit on Cash App. In this comprehensive guide, we will not only answer the burning question of "How to increase Bitcoin withdrawal limit on Cash App?" but also provide a detailed walkthrough of the process, share valuable insights, and address frequently asked questions.

Understanding the Cash App Bitcoin Withdrawal Limit

Before we delve into the process of increasing your Bitcoin withdrawal limit on Cash App, it's crucial to grasp why these limits exist. Withdrawal limits serve as a security measure, helping protect users from unauthorised or excessive withdrawals. However, they can sometimes pose restrictions that hinder your ability to transact freely.

Getting Started: Setting Up Cash App

To begin your journey toward increasing your Bitcoin withdrawal limit, you need to have a Cash App installed and your account set up. Please familiarise yourself with the app's interface to navigate it effectively.

What is the Initial Bitcoin Withdrawal Limit on Cash App?

By default, the Cash App imposes daily, weekly, and monthly withdrawal limits on Bitcoin transactions. These limits are set in place to ensure the safety and security of your transactions. Understanding your initial limits is crucial before attempting to increase them.

How to Increase Your Cash App Bitcoin Withdrawal Limit

Here is are the steps to increase Cash App Bitcoin withdrawal limit:

Step 1: Verify Your Account- The first step in increasing your withdrawal limit is to verify your Cash App account. This involves providing personal information and verifying your identity. The verification process is essential for unlocking higher limits.

Step 2: Provide Additional Information- In some cases, Cash App may require additional documentation or information to increase your withdrawal limit further. This could involve providing proof of income or linking a debit card to your account.

Step 3: Contact Cash App Support- If you require a substantial increase in your withdrawal limit, reaching out to Cash App support may be necessary. They can guide you through the process and provide personalised assistance.

Several factors influence your Bitcoin withdrawal limit on Cash App, including:

Different factors that can influence the Bitcoin withdrawal limit on Cash App:

Account verification level.

Transaction history and usage.

Additional information was provided to the Cash App.

Troubleshooting Cash App Bitcoin Withdrawal Limit Issues

If you encounter issues with your Cash App Bitcoin withdrawal limit, consider the following steps:

Verify your account.

Provide any requested additional information.

Contact Cash App support for personalised assistance.

Conclusion

Increasing your Bitcoin withdrawal limit on Cash App is a process that involves verifying your account, providing additional information, and potentially reaching out to support. By understanding the importance of withdrawal limits, following the steps outlined in this guide, and addressing common questions, you can navigate the process with confidence. Remember that these limits are in place to safeguard your financial security while enabling you to enjoy the benefits of Bitcoin on Cash App.

FAQs on Cash App Bitcoin Withdrawal Limit

Q1: What is the default Cash App Bitcoin withdrawal limit?

The default withdrawal limit varies based on your account and usage. Typically, new users have lower limits that can be increased with account verification.

Q2: How much can I increase my Cash App Bitcoin withdrawal limit?

The amount by which you can increase your limit depends on several factors, including your account verification level and the information you provide to Cash App.

Q3: How long does it take for Cash App to process a withdrawal limit increase request?

The processing time may vary, but it generally takes a few business days. Be patient and follow up with Cash App support if needed.

Q4: Can I reset my Cash App Bitcoin withdrawal limit?

The withdrawal limit can be increased, but it cannot be reset to zero. It's essential to understand your current limits and work on increasing them if necessary.

#cash app bitcoin withdrawal limit#increase cash app bitcoin withdrawal limit#cash app bitcoin purchase limit#cash app bitcoin limit#cash app bitcoin sending limit per week#cash app bitcoin daily withdrawal limit#cash app bitcoin deposit limit#cash app bitcoin daily purchase limit#cash app bitcoin daily sending limit#cash app bitcoin weekly limit#cash app bitcoin weekly limit reset#cash app bitcoin monthly withdrawal limit

0 notes

Text

Top 5 APPS to Sell Bitcoin in Nigeria 2024

Are you new to the crypto world or an old-time trader looking for a place to easily sell your bitcoins in Nigeria? This article is for you. Here, I will carefully explain how you can easily sell your bitcoins in Nigeria at the best rate. When choosing the best app for selling your bitcoin in Nigeria, consider comparing them based on fees, withdrawal methods, and associated costs. Here are some platforms you can checkout right away, although we strongly recommend Koyn for easy cashout and maximum security of your funds: Here are the Top 5 APPS to Sell Bitcoin in Nigeria 2024 Koyn: Koyn is one of the best apps in Nigeria where you can easily exchange your bitcoins for cash without any delay. Currently, it is the go-to app for anything bitcoin to naira in Nigeria. What is extraordinary about Koyn is that there are no fees and no additional charges. It is the number one choice for anyone that loves simplicity. Binance: Everyone knows binance right? Binance is a globally recognized crypto exchange that offers P2P for Nigerians. You can also sell your bitcoins here if you know how to navigate the P2P platform. Breet: This is an automated crypto-to-fiat mobile app that uses the OTC system, enabling you to convert your BTC to cash. NairaEx App: NairaEx is a nice Bitcoin exchange platform, supporting various payment methods, including bank transfers and cash deposits. Its mobile app facilitates smooth transactions, allowing you to buy and sell Bitcoins with ease. Paxful App: Paxful is a peer-to-peer Bitcoin marketplace that supports an extensive list of payment methods. With a user base of 200 million, Paxful’s app is a reliable choice for anyone looking to sell Bitcoins securely.

How to sell Bitcoin on Koyn

Selling bitcoin on Koyn is as easy as ABC. Here’s how you can get started: 1. Create a Koyn Account: Quickly Download the Koyn app and create an account. 2. Add Your Bank Account Details: To ensure a smooth transaction process, Quickly add your bank account details to your Koyn account. This step is essential for transferring the funds after your crypto sales. 3. Auto-Generated Wallet Addresses Depending on the crypto you plan to sell, Koyn will automatically generate unique wallet addresses within your account. These addresses are where the digital assets you want to sell will be sent. Each cryptocurrency you plan to sell will have its specific auto-generated wallet address 4. Initiate the Transaction: Send the cryptocurrency you wish to sell from your external wallet or exchange to the generated wallet address within Koyn. Wait for the network confirmation, which typically takes 15-30 minutes for three confirmations. 5. Automatic Conversion and Transfer: Once the transaction is confirmed, your crypto will be automatically converted to naira at the best available rate. The equivalent Naira amount will be instantly transferred to your wallet for withdrawal.

Why you should sell your crypto on Koyn

User-Friendly Interface: Koyn is designed with simplicity in mind. Whether you’re new to cryptocurrencies or an experienced trader, you’ll find the interface intuitive and easy to navigate. This ensures a hassle-free experience for selling Bitcoin. Top-Notch Security: Security is a paramount concern in the world of cryptocurrencies. We take security seriously and have robust measures in place to protect your money. Prompt Transactions: Time is of the essence when it comes to cryptocurrency trading. We ensure that your Bitcoin transactions are processed swiftly, allowing you to access your funds when you need them. Excellent Customer Support: Koyn’s dedicated customer support team is always ready to assist you with any queries or issues you may have. Our commitment to customer service sets us apart in the crypto space.

Conclusion

Koyn is the go-to app for selling Bitcoin in Nigeria. Its user-friendly interface, top-notch security, good rates, and excellent customer support make it the best choice for both beginners and experienced traders. So, if you’re looking to sell your Bitcoins in Nigeria, koyn is your answer. It is the best app for Bitcoin trading in Nigeria. Read the full article

0 notes

Text

How to transfer money from Cash App to PayPal

About Cash App

Cash App is a famous online payment mobile app that offers a free, rapid, and simple way to transfer and request assets online. Like a savings account, Cash App provides its customers a Cash Card to make online payments utilizing the assets accessible in their Cash App account. Furthermore, the Cash App lets users invest in Bitcoin and stocks.

About PayPal

PayPal is a well-known digital financial service platform that lets you receive and transfer assets or make payments via a safe online account. Simply put, PayPal is a virtual wallet where users can keep their assets as the PayPal balance. Also, you can add your cards, savings, and checking accounts.

Advertisement

PayPal lets you transfer assets to others using their mobile number or email addresses. The assets will reach their PayPal account in a few seconds. Also, you can utilize PayPal to pay for online purchases and in-store. When you make a purchase, PayPal provides you the purchase now & pay later option with PayPal Pay.

Is It Possible to Transfer Assets from Cash App to PayPal?

You can transact assets from Cash App to PayPal, but it’s not that easy. We tried utilizing different methods, like using the PayPal card as a transaction method on Cash App and utilizing the Cash App Cash Card to deposit assets on PayPal. Nothing works.

There are multiple methods to transact assets, from Cash App to PayPal. However, it will need patience and a bit of work. Let’s check out the possible ways in the guide.

How to Transfer Assets from Cash App to PayPal

To a certain extent, these are the only methods users have been able to transact assets from Cash App to PayPal. Let’s begin the process.

Method 1: Connect a Bank Account to Cash App and PayPal

This method is more clear and successful for transacting assets from Cash App to PayPal.

Connecting a Bank Account to Cash App

Launch the Cash App and hit the Profile tab.

Then, tap the Linked Banks button.

Next, hit Link Card > No Card.

After this, select your financial institution from the available list.

Follow the prompts.

Connecting a Bank Account to PayPal

Visit PayPal.com and sign in.

Hit Pay & Get Paid > Bank & Cards.

Then, choose the Link new bank option.

Next, pick your financial institution and sign into it.

Follow the prompts.

After connecting your desired savings account with Cash App and PayPal, you must follow these instructions to transfer assets to your savings account and then PayPal.

First, you should open the Cash App on your device.

On the homepage, hit the Asset tab.

Tap the Cash Out option.

Then, choose the amount you need to transact to your savings account and tap Cash Out.

Next, choose Standard if you have set up your savings account. Also, you can utilize Instant if you have set up the debit card of your savings account, but this has a fee. Now, wait for the assets to show in your account.

Once your assets reach your account, open the PayPal app.

After this, choose the Add Asset option under your PayPal balance.

Then, tap the From the bank or card tab.

Specify the desired amount to add and tap Next.

Next, choose how quickly you need the transaction to happen. You can select in three to five days and utilize the savings account you transact the assets to from the Cash App. Also, you can choose in seconds and pick the card connected to said savings account.

Finally, hit the Add Now tab once ready.

Methods 2: Use the Cash App Cash Card as a mode of Payment on PayPal

Users can use the Cash Card as a mode of payment on PayPal. When purchasing using PayPal, you can choose the Cash App Cash Card as your payment method.

Users who do not have a Cash Card can get it by opening the Cash App, tapping Cash Card > Get Cash Card, and following the prompts.

Now go through the steps below to add the Cash Card to PayPal:

To begin, open the PayPal app on your smartphone.

On the home screen, navigate and hit the Wallet tab.

Then, tap the + sign and choose the Debit or Credit Card option.

After this, specify the card details and tap Link Card.

PayPal can ask you to validate your identity. Follow the prompts to do so.

After adding the Cash Card to PayPal, you can utilize it as your payment method for the next PayPal purchase.

Method 3: Link the Cash App Bank Account to PayPal

Users can add their Cash App savings account to PayPal and transfer assets to their PayPal account from it. While Cash App isn’t a bank, it has partnering financial institutions that offer a savings account to its users.