#INCOMETAXRETURNFILING

Explore tagged Tumblr posts

Text

Income Tax Return Filing for Last 3 Year

It not only helps you abide by the law but also ensures that you are contributing to the development of the nation. Under Section 139(8A) of the Income Tax Act, taxpayers have the option to file their income tax returns for the last three years.

#incometax#incometaxreturn#incometaxindia#ITRfiling#itreturn#ITfiling#incometaxreturnfiling#returnfiling

0 notes

Text

Filing GST annual returns is an essential part of any business’s compliance process in India. It not only helps businesses stay on the right side of the law but also promotes transparency, boosts credibility, and helps avoid penalties. However, many businesses overlook the importance of filing GST returns correctly and on time, which can lead to complications. This article explores why filing GST annual returns is vital and provides an overview of the process for various types of returns.

0 notes

Text

NSSKCA Tax Consultants: Your Trusted Partner for Tax Solutions in Hyderabad

NSSKCA Tax Consultants is a leading firm providing comprehensive tax advisory and consultancy services in Hyderabad. With a commitment to offering precise and timely tax solutions, NSSKCA serves individuals, small businesses, and large enterprises. Our firm’s expertise and personalized approach make us the go-to tax consultants in Hyderabad. In today’s dynamic and evolving tax landscape, managing tax compliance efficiently is crucial for businesses to thrive, and that’s where NSSKCA steps in.

Why Choose NSSKCA Tax Consultants?

Expertise in Local and National Tax Laws: Our in-depth knowledge of both local and national tax regulations ensures that your tax returns and financial statements are fully compliant with the law.

Comprehensive Services: We provide a wide range of services, including tax planning, filing, advisory, and audits, making us a one-stop solution for all your tax needs.

Proactive Tax Planning: NSSKCA offers proactive tax planning strategies to minimize liabilities and ensure maximum tax efficiency.

Experienced Professionals: Our team consists of highly qualified tax consultants, chartered accountants, and financial experts who bring years of experience to the table.

Client-Centric Approach: We prioritize our clients' needs, offering personalized services tailored to your specific financial situation.

Key Tax Services Offered by NSSKCA

1. Income Tax Filing

At NSSKCA, we assist individuals and businesses with timely and accurate income tax filing services in Hyderabad. Our team ensures that your returns are prepared and filed according to the latest tax laws, helping you avoid penalties and save money.

Timely Filing: Avoid last-minute rush and penalties by filing your taxes on time with our expert assistance.

Accurate Documentation: Ensure all necessary documentation is complete and in line with tax regulations.

2. GST Compliance and Filing

As GST (Goods and Services Tax) regulations continue to evolve, staying compliant can be challenging. NSSKCA provides comprehensive GST advisory and filing services to help businesses navigate the complexities of GST laws.

GST Registration: Assistance with registration under GST and filing of monthly, quarterly, and annual returns.

Compliance Audits: We conduct thorough audits to ensure GST compliance and identify areas for improvement.

GST Refunds and Adjustments: Maximize your GST benefits with proper refunds and adjustments.

3. Tax Advisory Services

NSSKCA's tax advisory services help businesses and individuals develop effective tax strategies that align with their financial goals. We work closely with our clients to provide sound advice on tax-saving opportunities, investment planning, and compliance.

Customized Tax Solutions: Tailored tax planning strategies that suit your financial goals.

Tax-Saving Strategies: Maximize deductions, credits, and incentives to reduce your overall tax liability.

4. Corporate Tax Services

For businesses, tax compliance can be a time-consuming and complex process. NSSKCA’s corporate tax services ensure that your business remains compliant with all tax regulations, including corporate income tax, transfer pricing, and more.

Tax Risk Management: Minimize risks related to tax disputes and litigation with expert guidance.

Tax Return Preparation: Accurate preparation of corporate tax returns based on the latest legal regulations.

5. Tax Audits and Assessments

We provide audit services to ensure your tax records and statements are in order and compliant with the law. NSSKCA offers support for tax assessments and representation before tax authorities in case of disputes.

Audit Support: Assistance in preparing for and managing tax audits.

Dispute Resolution: Expert representation in tax disputes and assessment cases.

Why Timely Tax Planning is Important

Proper tax planning is essential to achieving financial efficiency. At NSSKCA, we emphasize the importance of proactive tax planning to help businesses and individuals make the most of tax-saving opportunities throughout the year. Delaying tax planning or filing can lead to unnecessary penalties and missed opportunities for deductions. NSSKCA offers year-round support to keep you ahead of deadlines and ensure that you’re making informed financial decisions.

How NSSKCA Can Help You

Personalized Service: Every client is different, and our personalized approach ensures that we address your unique tax challenges.

Dedicated Team: Our team of tax experts is available year-round to offer support and ensure timely compliance with tax deadlines.

Transparent Pricing: We provide transparent pricing, ensuring that you know exactly what you’re paying for with no hidden fees.

Conclusion

When it comes to tax consulting in Hyderabad, NSSKCA Tax Consultants stands out as a trusted and reliable partner. Whether you need help with income tax filing, GST compliance, or corporate tax services, we are here to guide you through every step of the tax process. Trust NSSKCA to take care of your tax needs, so you can focus on what you do best—growing your business.

Let NSSKCA Tax Consultants be your partner in tax success! Reach out to us today for expert tax advice and services.

0 notes

Text

Income Tax Return filing in Gurgaon | The Adya Financials

In Gurgaon, income tax return filing is a crucial annual task for residents and businesses alike. With numerous tax consultants and online platforms available, residents can navigate the process efficiently. Gurgaon's dynamic economy and tech-savvy populace often leverage digital solutions for seamless tax compliance.

0 notes

Text

LODGE WITH TAX OFFICE TAX RETURN 2025

taxreturn2025 #incometaxrefund #incometax #incometaxreturn #incometaxreturnfiling #incometaxindia #incometaxes

0 notes

Text

What is the purpose of an income tax return?

ITR is a tax return form used in India to disclose one's income and assets to the government's IT department. It comprises information regarding the personal and financial details of the taxpayers. ITRs are essentially a taxpayer's self-declaration of their earnings, assets, pending refunds, and taxes paid. While it is usually completed online, it is also possible for senior citizens to complete it manually.

Who is required to file a tax return?

An ITR is not required for everyone. Taxpayers can assess whether or not they need to file an ITR based on a variety of variables. The following are the elements:

An individual whose annual income exceeds the applicable taxable limit of 2.5 lakhs, 3 lakhs, or 5 lakhs.

An ITR must be filed by anyone who owns assets outside of India and earns income from them.

An individual who pays more than Rs. 1 lakh in power bills in a fiscal year is required to file an income tax return.

In a financial year, assesses who deposit more than 1 crore in one or more bank accounts must file an ITR.

If you spend more than $25,000 on international travel throughout the fiscal year, you must file an income tax return.

The Top Advantages of Electronically Filing Income Tax Returns on Time in India

Avoid Penalty

Individuals and corporations can save money by filing their ITRs on time. You may be charged a late fee of up to INR 5,000 if you file your ITR after the deadline. It is in addition to any other penalties that the Act may impose. In addition, you may be obliged to pay the penalty's interest.

Unintentional Claim

If you continue to file ITRs for yourself or your spouse, it will assist you in the event of an accident. Insurance companies demand proof of income to compute the amount of a claim, and if any returns are missing, particularly from the previous three years, the claim amount may be lowered or refused since the court views the ITR as the only evidence.

Furthermore, if a person dies in an automobile accident after completing income tax returns on a regular basis for the previous three years, the government is required to pay the deceased person's relatives. Compensation might be up to three times the deceased person's typical annual salary.

Evidence of Net Worth

The most reliable proof of your net worth or income is an ITR. Form 16, which is supplied by their employer and acts as proof of income, is beneficial to the salaried class. The ITR filing form, on the other hand, can be used as proof of income for self-employed people. It gives a detailed breakdown of these people's income and expenses for each fiscal year.

It can be utilized for a variety of things, including obtaining loans, obtaining insurance coverage, purchasing real estate and other valuable assets, and so on. If you need to provide proof of your income or net worth, the ITR is your only option.

Receiving a Refund

You must file tax returns if a refund of TDS deducted earlier is pending; otherwise, you will have to forego the refund. Some taxpayers may decide to put their money into fixed deposit accounts. On such investments, tax is deducted at source (TDS), which is over 10%.

You can save money on taxes on income from savings vehicles like term deposits if you file an ITR. You can also save money on your dividend income by filing an ITR. While these instruments are subject to taxation, ITR refunds can be used to reduce the amount of tax owed.

In a loan application, eligibility is important

ITR filing on a regular basis reveals stable income and that the individual has been paying taxes on time. Financial institutions use the applicant's prior year ITRs to approve loans and other credit lines such as overdrafts, bank credit cards, cash credits, and bill discounting alternatives. If you are unable to provide any documentation, including an ITR, that the lender/bank deems required, your house loan application may be denied.

Losses can be carried forward

Taxpayers must file a tax return by the due date to claim specified losses that may occur as a result of capital gains, a business, or losses under the Income from House Property head. For example, if you make a profit on the sale of mutual funds or stock, you can offset it by filing tax returns on time and claiming losses from past years.

The basic conclusion is that if tax returns are not submitted on time, unadjusted losses (with limited exceptions) cannot be rolled over to following years. As a result, you'll need to file a tax return to ensure that your losses are carried over and adjusted in the future.

Getting Tenders from the Government

Contractors may have a solid track record of obtaining significant projects in their field of business, whether it's a service or works contract, but if they don't file tax returns on time or at all, they could face serious implications that could harm their firm.

Contractors must not only file their forms on time, but they must also be exceedingly correct and audited (if necessary). This is very important when applying for a government contract. This work may be inspected by the tender scrutiny committee on occasion, and it is normal procedure to review the ITR for the previous five to seven years.

2 notes

·

View notes

Photo

#incometaxseason #incometaxreturnfiling #taxrefund #taxsavings #salariedemployee #capitalgains #housepropertyincome #rentalincome #businessincome #taxconsultant #taxgoal (at Karol Baag, New Delhi) https://www.instagram.com/p/BzFnkyIAF6W/?igshid=m5i2ig1r5ohm

#incometaxseason#incometaxreturnfiling#taxrefund#taxsavings#salariedemployee#capitalgains#housepropertyincome#rentalincome#businessincome#taxconsultant#taxgoal

1 note

·

View note

Text

A Comprehensive Guide: How to File Income Tax in India

In India, filing income tax returns is a critical financial obligation for both individuals and corporations. Seeking the advice of a trained professional, such as a chartered accounting business like CAnest, can be very beneficial in ensuring a smooth and correct filing procedure. We'll outline the procedures, required paperwork, and internet tools in this article's step-by-step guide to filing income taxes in India.

Step 1: Gather Essential Documents

Before proceeding with the filing process, it is essential to gather the necessary documents. These typically include:

1. PAN Card: Your Permanent Account Number (PAN) card is a unique identification number required for income tax filing.

2. Form 16: If you are a salaried individual, your employer will issue Form 16, which contains details of your salary, tax deductions, and TDS (Tax Deducted at Source).

3. Bank Statements: Collect your bank statements, as they will help you verify your income and transactions during the financial year.

4. Investment Proofs: Keep records of investments made under various tax-saving schemes, such as life insurance policies, provident fund contributions, and equity-linked savings schemes.

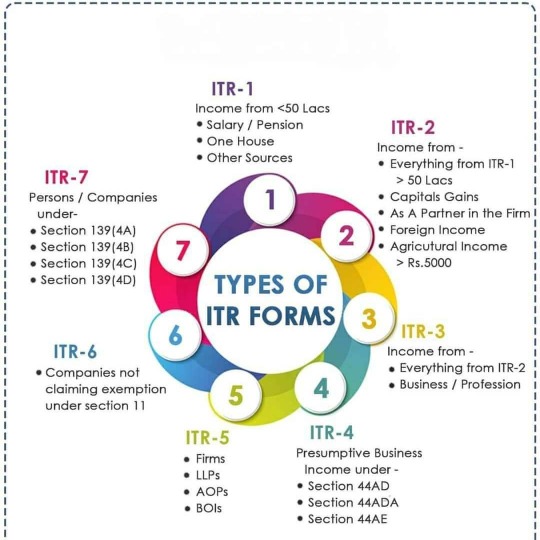

Step 2: Choose the Appropriate ITR Form

Next, determine the correct Income Tax Return (ITR) form to use. The appropriate form depends on your income sources and category. The different ITR forms cater to individuals, businesses, and specific income types. Seek professional advice from a chartered accountant to select the correct form based on your circumstances.

Step 3: Online or Offline Filing

India's income tax filing process offers two options: online and offline filing.

1. Online Filing: This is the most convenient and popular method. Visit the official income tax e-filing portal (incometaxindiaefiling.gov.in) and register yourself as a taxpayer. Complete the relevant ITR form, upload the required documents, and submit your return online.

2. Offline Filing: If you opt for offline filing, download the applicable ITR form from the official portal. Fill in the form manually, and submit it at the nearest Income Tax Office or authorized centers.

Step 4: Verify and Submit Returns

Regardless of the filing method, ensure you verify your returns. The most common methods of verification include:

1. Digital Signature Certificate (DSC): Obtain a DSC and sign your returns electronically. This is mandatory for certain categories of taxpayers.

2. Aadhaar OTP or EVC: Use your Aadhaar-linked mobile number to generate a One-Time Password (OTP) or EVC (Electronic Verification Code) for verification purposes.

Step 5: E-Verification or Physical Verification

After submitting your returns, you can choose either e-verification or physical verification.

1. E-Verification: Use any of the electronic verification methods mentioned in Step 4 to complete the verification process online.

2. Physical Verification: In case you choose physical verification, print your ITR-V (Income Tax Return - Verification) form generated after filing your returns. Sign the form and send it via regular or speed post to the Centralized Processing Center (CPC) within 120 days of e-filing.

Although submitting income tax returns in India may seem difficult, it can be made simple and trouble-free with the correct advice and assistance from a reputable chartered accounting business like CAnest. Do not forget to gather all required paperwork, select the appropriate ITR form, and decide whether to file electronically or manually. Verify your returns using digital signatures or OTP/EVC, then carry out the necessary steps for physical or electronic verification. You can efficiently complete your tax duties and ensure compliance with Indian tax rules by following these steps.

#IncomeTax#incometaxseason#incometaxes#incometaxtime#IncomeTaxRefund#IncomeTaxReturn#incometaxballers#incometaxreturnfiling#IncomeTaxMoney#incometaxmiami#incometaxspecials#incometaxeffect#incometaxseason2023#incometaxswag#incometaxballer#incometaxReturnFly#incometaxclapback#IncomeTaxPreparer#IncomeTaxPrep#incometaxloans#incometaxballin#IncomeTaxPreparation

1 note

·

View note

Text

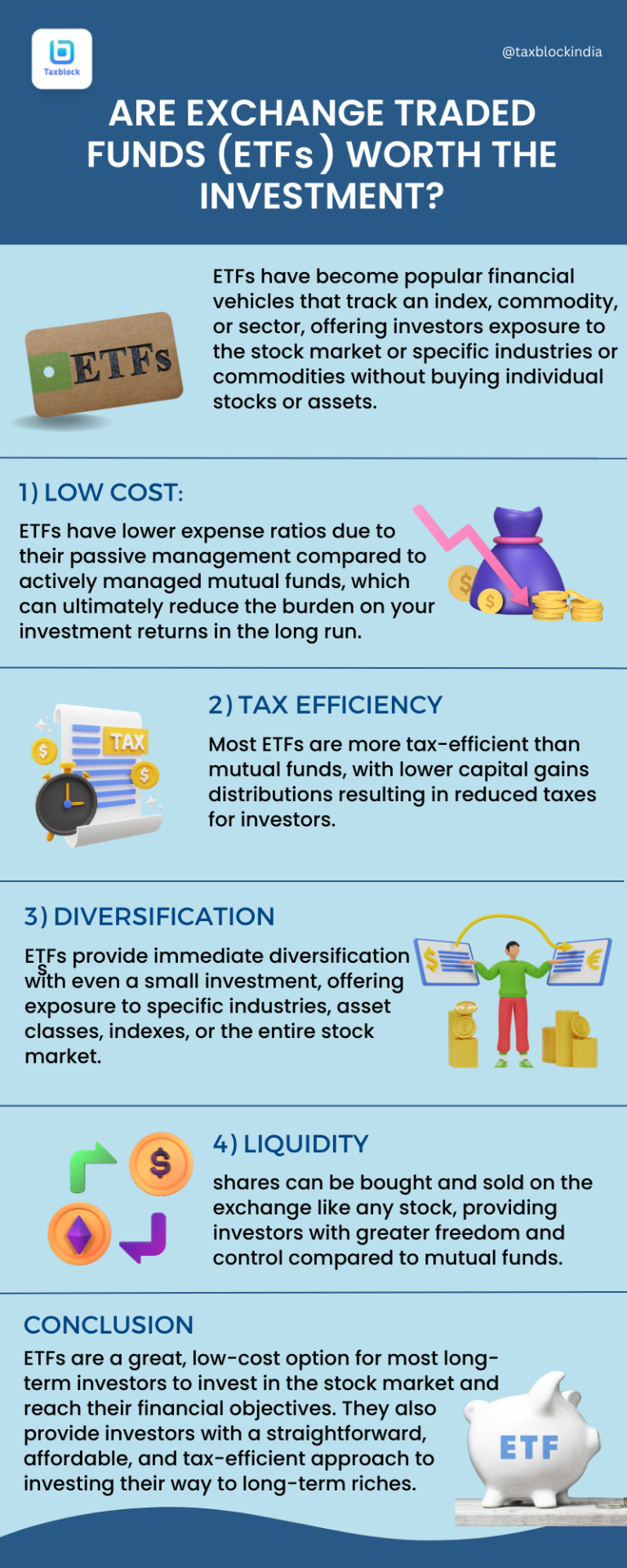

Follow us for more.....

Visit Our Website: taxblock.in

#incometaxseason#incometaxes#incometaxtime#IncomeTaxRefund#IncomeTaxReturn#incometaxballers#incometaxreturnfiling#IncomeTaxMoney#incometaxmiami#incometaxspecials#incometaxeffect#incometaxswag#IncomeTaxPrep#IncomeTaxPreparation#investment#investments#investmentproperty#investmentbanking#investmentproperties#InvestmentBanker#investmentopportunity#investmentrealestate#investmentph#investmentart#investmentgold#investmentadvisor#investmentbank#investmentmanagement#investmentclub#investmentadvice

0 notes

Text

#businesstaxconsultant#Incometaxaudit#Incometaxcalculation#IncomeTaxReturn#INCOMETAXRETURNFILING#taxconsultant#taxliability#caonweb#caservicesonline

0 notes

Text

In Budget 2023-24, the central government has shown pity for the common man. Only those earning more than 7 lakhs per annum are now liable to pay income tax. Those with an annual income of less than 7 lakhs have been exempted from income tax. It must be said that this is a huge burden for the average wage earner. The biggest mistake in the Indian taxation system is that the middle class people who are paying double the taxes than before due to the increase in the prices of petrol, diesel, gas.. have to pay income tax even on the little income they earn. Now this government has amended it. At least this time the income tax slab has been greatly increased. It should also be said that the central government has taken huge decisions in the new budget. As the reputation of India increases internationally, the number of people who want to visit India will increase. So it is a great thing that the central government has come up with the idea of bringing new plans for India tourism. The Center has introduced a new scheme called “Dekho Apna Desh”. And when the world is facing recession, the new reforms will strengthen Indian banking. As any transaction in the country is ultimately tied to the bank, this will lead to changes in other sectors. Allocations to agriculture sector have increased. Special provisions were made for women. At a time when the world is chasing electric vehicles, the reduction in taxes on lithium-ion batteries will give relief to the sector. However, it can be said that in this budget only decisions have been taken that benefit the common man. For More information http://bhalamedia.com/ncome-tax-exemption-limit-2023/

#incometaxseason#incometaxreturn#incometaxindia#incometaxes#incometaxrefund#incometaxreturnfiling#incometaxfiling#incometaxupdate#incometaxdepartment#incometaxreturns#incometaxballers#incometaxtime#incometaxupdates#incometaxpreparation#incometaxact#.#Created by Inflact Hashtags Generator

0 notes

Text

With the Employee Stock Option Plan, employers can offer shares to their employees. Eazystartups can seamlessly help you in this regard.

#OnlineTaxandAccountingServices#IncomeTaxFiling#IncomeTaxReturnFiling#IncomeTaxReturn#IncomeTaxReturnOnline#IncomeTax ReturnIndia#OnlineTaxFilingIndia

0 notes

Link

File ITR-1 Sahaj Form Online through IndiaFilings. Know about Documents for ITR-1 Sahaj Form, Eligibility Criteria for ITR-1 Sahaj Form & more on IndiaFilings.com

0 notes

Photo

#incomestreams #income #itrindia #incometaxfiling #incometaxrefund #incometaxreturnfiling #incometaxoffice #incometaxseason #incometips #incometaxofficer #incometax #incometaxact #incometaxpreparation #itr #incometaxdepartment #incometaxreturns #incometaxtime #incometaxpreparer #incometaxprep #incometaxcheck #incometaxes #incometaxreturn #incometaxmoney #incometaxinspector #incometaxballers #incometaxupdate #incometaxindia #incometaxupdates (at India : इंडिया) https://www.instagram.com/p/CW3tefyBgST/?utm_medium=tumblr

#incomestreams#income#itrindia#incometaxfiling#incometaxrefund#incometaxreturnfiling#incometaxoffice#incometaxseason#incometips#incometaxofficer#incometax#incometaxact#incometaxpreparation#itr#incometaxdepartment#incometaxreturns#incometaxtime#incometaxpreparer#incometaxprep#incometaxcheck#incometaxes#incometaxreturn#incometaxmoney#incometaxinspector#incometaxballers#incometaxupdate#incometaxindia#incometaxupdates

0 notes

Text

ARE YOU SHARE INVESTOR

investor #incometaxrefund #incometax #incometaxreturn #incometaxreturnfiling #incometaxindia

0 notes

Photo

Pay your Income tax ..! And help in India development..! #incometaxhouston #incometaxoffice #incometaxcheck #incometaxballers #incometaxballin #incometaxation #incometaxreturns #incometaxseason #incometaxtime #incometaxindia #incometaxsale #intags #incometaxact #incometaxrefund #incometaxmoney #incometaxreturn #incometaxreturnfiling #incometaxprep #incometaxes #incometaxdepartment #incometaxeffect #incometaxpreparation #incometaxballer #incometaxfiling #incometax (at Uttar Pradesh) https://www.instagram.com/p/CT1QU4dpDex/?utm_medium=tumblr

#incometaxhouston#incometaxoffice#incometaxcheck#incometaxballers#incometaxballin#incometaxation#incometaxreturns#incometaxseason#incometaxtime#incometaxindia#incometaxsale#intags#incometaxact#incometaxrefund#incometaxmoney#incometaxreturn#incometaxreturnfiling#incometaxprep#incometaxes#incometaxdepartment#incometaxeffect#incometaxpreparation#incometaxballer#incometaxfiling#incometax

0 notes