#IRS Audit Representation Service in New York

Explore tagged Tumblr posts

Text

How to Navigate Tax Trouble: A Complete Guide to Finding the Right Tax Fraud Attorney and Wage Garnishment Help

Introduction

Ever felt that panic when a letter from the IRS shows up unexpectedly? You’re not alone. Whether it’s unpaid taxes, frozen wages, or fraud allegations, tax troubles can feel like a snowball rolling downhill — growing larger and scarier by the minute. The good news? You’re not stuck. With help from a tax fraud attorney or wage garnishment attorney, you can take back control of your financial future.

Understanding Tax Fraud and Wage Garnishment

Tax fraud occurs when a person or business purposefully misrepresents financial information to the IRS. This could include underreporting income, inflating expenses, or hiding assets offshore. It’s a serious offense that can lead to audits, fines, and even jail time.

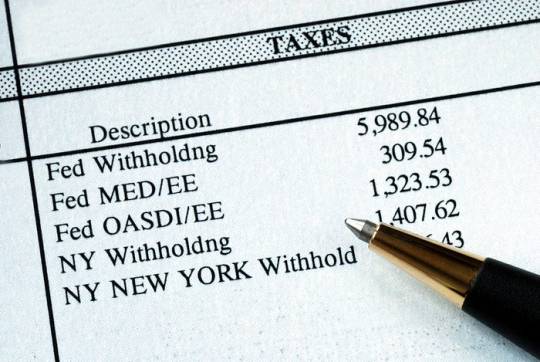

Wage garnishment happens when the IRS legally takes money directly from your paycheck to collect unpaid taxes. It’s more than just a nuisance — it can leave you scrambling to cover basic living expenses.

Signs You May Need a Tax Fraud Attorney

You might think only corporations or high-net-worth individuals need a tax fraud attorney, but in reality, even average earners can face tax fraud accusations. If you’ve received IRS notices, are being audited, or suspect you’re under investigation, legal help is essential. A good attorney can protect your rights, ensure you don’t incriminate yourself, and guide you toward a resolution that minimizes penalties.

What Exactly Is Wage Garnishment?

Role of a Wage Garnishment Attorney

A wage garnishment attorney acts as a barrier between you and aggressive collection efforts. They help halt garnishments by negotiating with the IRS or state tax agencies, filing motions, and setting up more manageable alternatives like installment agreements or Offers in Compromise. In situations where wage garnishment is already active, they may even be able to get some of your previously garnished wages returned, depending on the circumstances.

How IRS Wage Garnishment Attorneys Can Help You

These attorneys specialize in the fine print of IRS rules and are equipped to defend your paycheck. Their knowledge of IRS policies allows them to develop quick, strategic responses to wage garnishment and tax levies. By negotiating directly with tax agents, they often help reduce or remove garnishments, request hardship status for clients, or qualify them for settlement programs.

The Importance of Acting Quickly

Key Traits of the Best Tax Lawyers in New York

Finding the best tax lawyers in new york means looking beyond fancy offices. True experts share a few key qualities:

They have proven experience with tax disputes and IRS negotiations.

They communicate clearly, not in legalese.

They offer realistic expectations — not false promises.

Their clients speak highly of them, both online and off.

These traits often signal someone who’s prepared to represent your best interests with skill and integrity.

Services Offered by a New York Tax Law Firm

When you consult a new york tax law firm, you’re not just hiring one person — you’re gaining access to an entire team of legal and financial professionals. These firms handle:

Audit representation

IRS dispute resolution

Tax debt settlement

Wage garnishment appeals

Business and personal tax planning

Having a team with multiple specialties ensures that every angle of your tax issue is handled efficiently.

Common Tax Issues New Yorkers Face

Tax problems in New York can arise from many sources. Freelancers and gig workers often struggle with quarterly tax payments. Small businesses may misclassify employees. Even regular W-2 employees can find themselves in trouble due to overlooked side income, inaccurate deductions, or falling behind on payments. Combine that with state and city taxes, and it’s easy to see how things can spiral.

How to Choose the Right Tax Attorney

Choosing a tax attorney doesn’t have to be stressful. Start by identifying attorneys who specialize in tax law rather than general practice. Look for someone who explains things clearly, without pressure. If they offer a free consultation, use it to gauge how well they understand your situation and whether they propose a practical action plan.

Questions to Ask During Your Free Consultation

Make the most of your consultation by asking direct, relevant questions. A few to consider include:

Have you handled cases like mine before?

What are my chances of reducing penalties?

How quickly can you stop garnishment or collection?

What fees should I expect?

How do you typically communicate with clients?

These questions help you evaluate not just their expertise, but also their transparency and approachability.

Red Flags to Watch Out For

How Much Does a Tax Attorney Cost in NY?

In New York, tax attorney fees vary widely. For simple cases, you might pay a flat fee ranging from $1,000 to $3,000. More complex or ongoing cases could be charged hourly, typically between $250 and $600. Some firms require a retainer. While the cost may seem high, the financial relief they can secure often makes their services more than worth it.

What to Expect During the Legal Process

Once you hire a tax attorney, they’ll begin by assessing your situation in detail. Then, they’ll collect documentation, contact the IRS on your behalf, and begin negotiating. Depending on your case, this might involve filing forms for installment agreements, requesting hardship status, or submitting offers in compromise. You’ll stay informed throughout the process, with regular updates and strategic advice.

Preventing Future Tax Problems

The best defense against future IRS trouble is staying organized. Make sure you file your taxes on time, keep receipts and documentation, and update your financial records regularly. If you’re self-employed, use professional accounting software or hire a bookkeeper. For ongoing peace of mind, consider working with a tax attorney annually to review your filings and make sure you’re in compliance.

Conclusion

Tax issues can feel like you’re stuck in a storm with no umbrella. But the right legal help can shelter you from penalties, wage garnishments, and endless stress. Whether you’re facing a fraud investigation, IRS wage garnishment, or overwhelming back taxes, turning to a trusted tax fraud attorney, wage garnishment attorney, or irs wage garnishment attorneys is a smart and necessary move.

If you live in New York, your best option is to consult with experienced professionals from a New York tax law firm. With the best tax lawyers in New York on your side, you can face the IRS with confidence — and finally regain financial stability.

FAQs

1. What does a tax fraud attorney do?

A tax fraud attorney represents clients accused of intentionally misleading tax authorities. They provide legal defense during audits, investigations, and trials.

2. Can a wage garnishment attorney help stop paycheck deductions?

Yes. They negotiate with the IRS or state agencies to stop or reduce garnishments through settlements, exemptions, or payment plans.

3. How fast can IRS wage garnishment attorneys act?

Experienced attorneys can sometimes halt garnishments within a few days, depending on the case complexity and how quickly documentation is filed.

4. Do I need a tax attorney even if I’m not facing criminal charges?

Absolutely. Tax attorneys also help with audits, late filings, debt settlements, and other non-criminal but serious financial issues.

5. What’s the easiest way to find the best tax lawyers in New York?

Start with referrals, check online reviews, and look for firms that specialize in tax law. A free consultation can help you decide if they’re the right fit.

#Taxes#Tax Fraud#Tax Fraud Defense#Wages#Fraud#criminal tax lawyer new york#criminal tax lawyer#best payroll tax lawyer new york#best tax lawyer#new york#best tax lawyer nyc#irs lawyer nyc#legal advice#irs#tax law

0 notes

Text

Affordable CPA Firm in New York – Expert Services Without Breaking the Bank

Managing your finances or business accounting in a city like New York can be overwhelming—not to mention expensive. Between tax regulations, bookkeeping, and compliance requirements, individuals and small businesses alike often need professional guidance. The good news? You don’t have to spend a fortune to get expert help. If you're looking for a trusted, affordable CPA firm in New York, you’ve come to the right place.

📞 Call 888-517-6642 today for a free consultation with a licensed CPA near you.

Why Choose an Affordable CPA in New York?

Being in one of the most competitive and fast-paced cities in the world, New York residents and business owners need real value—not just flashy offices or overpriced billing. Our CPA firm combines top-tier expertise with reasonable pricing, ensuring you get the support you need without straining your budget.

Our Promise:

Transparent pricing – no hidden fees

Certified public accountants with years of experience

Personalized financial advice for individuals and small businesses

Flexible scheduling and remote services available

📊 Who We Help

We provide accounting and tax services for:

Small business owners in retail, hospitality, consulting, and other industries

Freelancers and gig workers (designers, developers, content creators)

Real estate investors and landlords

Startups and entrepreneurs

High net-worth individuals looking for tax optimization

Nonprofits and charitable organizations

💼 Our CPA Services

We’re a full-service CPA firm offering affordable solutions across the board:

✅ Tax Preparation & Planning

Personal & business tax returns (Federal, NY State, NYC)

Tax-saving strategies and quarterly estimates

IRS audit representation

✅ Bookkeeping & Accounting

Monthly bookkeeping packages

Bank reconciliation, invoicing, and accounts payable

Financial statements and reports

✅ Business Advisory

Entity formation (LLC, S-Corp, C-Corp)

Cash flow and budgeting analysis

Startup planning and financial modeling

✅ Payroll Services

Payroll processing and tax filings

W-2, 1099, and contractor management

Employee benefits tracking

🌟 What Sets Us Apart

Unlike many large firms that treat clients like just another file number, we offer:

1-on-1 Support with a Dedicated CPA

Flexible Payment Plans

Remote and In-Person Appointments

Industry-Specific Expertise

We believe everyone deserves quality financial support—no matter their income bracket or business size.

📍 Serving All 5 Boroughs (and Beyond)

Our affordable CPA services are available across New York City and the surrounding areas:

Manhattan

Brooklyn

Queens

The Bronx

Staten Island

Long Island & Westchester (remote services available)

💬 What Our Clients Say

“As a small business owner, I didn’t think I could afford a CPA in New York. These guys proved me wrong. They're professional, helpful, and didn’t nickel-and-dime me. Highly recommended.” — Rachel S., Owner of a Boutique in Brooklyn

“I was buried in tax problems from my side gigs and crypto investments. They sorted it out and even found me deductions I didn’t know I could claim.” — Kevin T., Freelancer in Manhattan

💡 Schedule a Free Consultation

Still unsure if a CPA is within your budget? Let’s talk. We’ll review your needs and provide a quote—no pressure, no obligation.

📞 Call us now at 888-517-6642 or schedule a consultation online. We’re here to make smart accounting affordable for every New Yorker.

FAQs

Q: How much does a CPA cost in NYC? A: Our rates are tailored to your needs, but we’re proud to offer some of the most competitive prices in the city. We offer flat-fee packages and hourly options depending on the service.

Q: Do you offer virtual services? A: Yes! We can work 100% remotely via secure portals and Zoom consultations.

Q: Are you certified and insured? A: Yes, all our CPAs are licensed and in good standing with the New York State Board of Public Accountancy.

Final Thoughts

Affordable doesn’t have to mean low quality. With the right CPA, you can streamline your finances, save on taxes, and make confident business decisions—without overspending. When you're ready to work with an experienced and budget-friendly CPA firm in New York, give us a call.

📞 Call 888-517-6642 now — your financial peace of mind is just one conversation away.

0 notes

Text

BergerCPAFirst: Your Reliable Accounting Partner Serving New Jersey and Manhattan

Accounting, bookkeeping, and tax obligations do not just happen once in a while or once a year, they require constant upkeep and attention to detail, as it can affect the growth of your business. We at BergerCPAFirst take the stress off your back with our proactive accounting, financial planning, and dependable tax services. Whether you are looking for an Accounting Firm in New Jersey, a Tax Accountant in Manhattan, or looking for Small Business Accounting Services in NJ, we have you completely covered.

A Leading Accounting Firm in New Jersey

Among New Jersey accounting firms, BergerCPAFirst has distinguished itself as a New Jersey-based full-service accounting firm. Our company employs licensed CPAs and financial experts who have decades of experience, meaning we offer much more than mere bookkeeping to our clients.

We offer:

Tax preparation and planning

Financial statement analysis

Payroll management

Audit Support and Representation

Retirement and Estate Planning.

Through combining state knowledge and a national framework, we help our clients along with their financial well-being by following all necessary compliance and regulatory policies at the local, state, and federal levels.

Custom Tailored Assistance from a Tax Accountant in Manhattan

Is there a reliable Tax Accountant in Manhattan that pays attention to the details of the NYC and NYS tax codes? Tax services on both personal and business level are provided by BergerCPAFirst in the Taxation Center of New York City. Easy access to the properly branded tax consulting services is available at our Manhattan office.

Our services cover:

Individual and corporate income tax returns

Preparation of multi-state returns

Tax planning for ultra high net worth individuals

IRS audit representation and audit services

We provide more than mere tax filing—we partner with you to create a comprehensive tax management plan that is effective throughout the year, minimizes liabilities, and guarantees tranquility.

Business Accounting Customized Services NJ

Accounting difficulties shouldn’t get combined with problems of running a business. This is the reason we offer tailored specialized small business accounting services in New Jersey for newly established firms, family businesses, and even more expanding enterprises.

Listed below are a few of the services we offer to assist small businesses:

Streamlined monthly bookkeeping

Cash flow and budgeting strategies

Comprehensive QuickBooks Setup and Support

Sales Tax Compliance and Filing

Payroll Processing and Reporting

From retail to real estate and even hospitality to professional services, we help businesses in all sectors. Our customized solutions enable you to focus on what matters – growing your company instead of wasting valuable time calculating numbers.

What Sets Us Apart From Other CPAs?

Certified & Experienced - With over two decades of serving clients across New Jersey and New York, we have built lasting trust.

Relationship Focused - We never treat accounting as a one-and-done transaction.

Cloud Technology - Secure online document storage and virtual tax preparation.

Specialized Knowledge - Nuanced industry insights and expertise you cannot get elsewhere.

Future Focused - We help you budget and plan for future goals instead of waiting for events to happen.

We make accounting as uncomplicated, straightforward and low-key as we can. Information is meant to empower, so we make sure that our clients are kept in the loop at all times.

Prepared to Begin?

If you are looking for dependable Small Business Accounting Services in NJ or a Tax Accountant in Manhattan, or even a full-service Accounting Firm in New Jersey, BergerCPAFirst will fulfill all your requirements in one place.

Contact Info :

Address : 505 Eighth Avenue, Suite 1402, New York, NY 10018

Phone : (212) 232-0222

0 notes

Text

The Best Tax Law Firms in New York

Introduction

Navigating the complexities of tax law can be daunting, especially in a bustling metropolis like New York. With its intricate tax codes and regulations, individuals and businesses alike often find themselves in need of professional guidance. This is where the best tax law firms in New York come into play, providing essential services to help clients manage their tax obligations effectively.

Why Choose a Tax Law Firm?

Tax law firms specialize in various aspects of taxation, including federal, state, and local tax laws. They offer a range of services from tax planning and compliance to representation in disputes with tax authorities. Here are a few reasons why engaging a reputable tax law firm is crucial:

Expertise: Tax attorneys possess specialized knowledge of tax laws and regulations that can significantly impact your financial decisions.

Representation: In the event of an audit or legal dispute with the IRS or state tax authorities, having an experienced attorney can make a substantial difference.

Strategic Planning: Tax law firms can help you devise strategies to minimize tax liabilities through effective planning.

Key Services Offered by Top Tax Law Firms

The best tax law firms in New York offer a comprehensive suite of services tailored to meet the diverse needs of their clients. These services typically include:

Tax Planning and Compliance: Ensuring that individuals and businesses comply with all relevant tax laws while minimizing their liabilities through strategic planning.

IRS Representation: Providing representation for clients facing audits, appeals, or collection actions from the IRS or state tax authorities.

Tax Controversy Resolution: Assisting clients in resolving disputes with tax agencies through negotiation or litigation.

Estate and Gift Tax Planning: Helping clients navigate the complexities of estate and gift taxes to ensure that their assets are protected and transferred according to their wishes.

International Taxation: Advising businesses engaged in international operations on compliance with U.S. tax laws and treaties.

What to Look for in a Tax Law Firm

When searching for the best tax law firms in New York, consider the following factors:

Experience: Look for firms with a proven track record in handling cases similar to yours. Experienced attorneys are more likely to understand the nuances of your specific situation.

Reputation: Research client reviews and testimonials to gauge the firm’s reputation within the community. Recognition from legal publications can also be an indicator of excellence.

Personalized Service: Choose a firm that prioritizes client relationships and offers personalized attention to ensure that your unique needs are met.

Transparent Fees: Understanding the fee structure upfront can prevent any surprises later on. Look for firms that provide clear information about their billing practices.

Understanding Tax Law Needs

Tax law encompasses a wide range of issues, including compliance, planning, and disputes with tax authorities. Whether you are facing an audit, need help with estate planning, or are involved in a tax dispute, having a knowledgeable attorney by your side can make all the difference. The best tax law firms in New York offer comprehensive services tailored to meet diverse client needs.

Conclusion

Choosing the right tax law firm is essential for anyone looking to navigate the complex world of taxation in New York. By selecting a firm with the right expertise, reputation, and personalized service, you can ensure that your tax matters are handled effectively and efficiently. Whether you need assistance with compliance, representation during an audit, or strategic planning for future obligations, the best tax law firms in New York are equipped to provide the support you need.In today’s ever-changing regulatory environment, having a knowledgeable partner by your side can make all the difference. Take the time to research and consult with potential firms to find one that aligns with your needs and goals.

0 notes

Link

0 notes

Text

Big Apple Collections Attorneys

If your personal damage stems from an vehicle accident, or when you have been struck by a car as a bicyclist or pedestrian, New York’s no-fault laws will come into play. New York law supplies that driver, passenger, bicyclist, and pedestrian injuries shall be coated by the vehicle’s insurance coverage, up to the coverage limits, no matter who was at fault for the accident. If the automobile is uninsured or underinsured and all or some of your accidents usually are not coated, you may then be capable of turn to your personal insurance or a member of the family’s insurance coverage for extra coverage. New York’s personal damage legal guidelines govern how and when a declare should be filed, relying on the kind of accident and the injuries sustained. In basic, to prove a private damage claim, you should prove that you just had been injured because of the defendant’s wrongful conduct. Although a personal harm lawyer is in the best place to debate the information of your case and relevant legal guidelines, see below for some New York personal injury law basics.

The content material of the location on no account creates an attorney-consumer relationship. I assist clients prepare their Last Wills whether easy or complicated.

We’ve efficiently recovered greater than $1 Billion in settlements and awards. There’s a cause why we’re among the most revered personal injury attorneys in New York, NY. The cost of a private harm lawyer can vary broadly primarily based on your case, your injuries, and your circumstances.

Legal.io supplies software program providers to legal professionals and legal service organizations and through such software provides access to authorized service choices at the course of website guests. Legal.io isn't a legislation agency, doesn't provide lawyer referral providers and does not provide any authorized representation. We do not endorse or suggest any lawyer who makes use of the software. Lawyers who use the Legal.io software program pay to make use of the software companies and to advertise their authorized providers and can also receive credit for giving assist pro bono or to clients of average means. Use of the Legal.io software program providers Edwin Urrutia is subject to our Terms of Use. Our skilled attorneys can guide you through numerous legal challenges related to your rights underneath state and federal employment legal guidelines.

We can assist you with just about all employment regulation issues, together with wrongful termination, wage and hour violations, hostile work surroundings, discrimination, retaliation, harassment and extra. The LII Lawyer Directory contains legal professionals who've claimed their profiles and are actively in search of purchasers. The materials on this web site is for informational purposes solely; guests shouldn't rely on the data as advice or as a session, but should seek the advice of a lawyer about their particular authorized issues.

It is necessary to do not forget that whilst you may really feel that the individual responsible for your injuries deserves punitive damages, that the court is very conservative in making these determinations. A knowledgeable personal injury legal professional can let you understand in case your case may qualify for punitive damages. The nature of common damages could make them hard to quantify, but an skilled personal damage lawyer might help you perceive the overall damages situation as it might apply to your case. Our practice extends all through New York State and in the Federal courts. The firm is led by New York attorney Bernard D’Orazio, who is AV® rated as “Preeminent” in Litigation and Collections by Martindale-Hubbell. Connors And Sullivan Attorneys At Law, PLLC, has been efficiently Edwin Urrutia representing purchasers in IRS and New York State tax audits, tax collection instances, penalty abatement resolutions and tax appeals for more than 25 years.

Without a Will, State legislation determines who inherits your property. A Health Care Proxy, Living Will and Power of Attorney are all an necessary a part of an property plan and I work with my shoppers to put these papers in place. There are many complexities that may have an effect on an property plan. An essential factor to plan an estate is to obtain kinship and asset data. I fully evaluation these issues with shoppers in order that any future probate or estate administration issues may be alleviated. Missing or unknown relations can create kinship points that can delay probate or intestate administration. Also there are lots of assets that a Will doesn't management such as those who move by operation of law like joint property.

I explore these matters with clients in order that the property plan reflects a client’s intentions and desires. Estate taxes should be thought of in addition to an individual's kinship. Some conditions might require the creation of a Living Trust to supply lengthy-term protection from incapacity or to keep away from the probate course of.

Contact me to talk about making a plan that may benefit each you and people you want to defend and profit. Jules Haas is a New York legal professional who has more than 35 years expertise. He is understood for his dedication to reaching the desired results on behalf of his shoppers as quick and effectively as possible. This category of damages is less common in personal harm cases, but courts can award punitive damages in effort to financially reprimand offenders in instances of extraordinarily immoral or reckless behavior.

1 note

·

View note

Text

Understanding Criminal Tax Defense: How the Right Legal Help Can Protect You

Why Tax Issues Can Turn Criminal

Most people think tax problems only involve money, like unpaid taxes or mistakes on returns. But sometimes, the government believes a person or business broke the law on purpose. When that happens, you need more than just an accountant — you need a New York tax defense attorney who understands the legal system and how to protect you.

From filing false returns to underreporting income, tax offenses can carry serious consequences. If you’ve received a notice from the IRS or New York Department of Taxation and Finance, now is the time to act.

How Legal Representation Helps in Criminal Tax Cases

Whether you’re facing an audit or have been contacted by investigators, working with a skilled criminal tax attorney NYC is a smart move. These professionals know how to analyze records, deal with tax agents, and respond to accusations. A strong legal strategy can lead to reduced charges — or even having the case dropped.

Sometimes, tax issues also involve commercial matters like rental agreements. If your business has received property-related incentives, understanding lease incentive tax treatment is important. Misreporting these benefits can lead to costly errors or audits.

Handling New York State Sales Tax Investigations

Business owners in New York face complex tax regulations, especially when it comes to sales tax. If you’re under audit, consulting a criminal tax attorney New York who understands both business law and tax codes is vital.

In many cases, people also need help from a New York State sales tax attorney who can assist with audit defense, correcting errors, and communicating with tax agencies. Legal professionals in this area ensure that you respond properly and avoid escalating the situation.

Sometimes, businesses receive notices from state tax agents, and that’s when a sales tax attorney New York business owners can count on becomes crucial. Ignoring these issues can result in fines — or worse, criminal prosecution.

Fortunately, New York Sales Tax attorneys are trained to spot red flags and handle the problem before it turns into a major legal issue. If the problem has already reached that level, hiring one of the many experienced New York sales tax lawyers may protect your business from further harm.

What If the IRS Is Involved?

If the Internal Revenue Service is investigating you, you’ll want an IRS lawyer NYC representing your side. These attorneys know how the IRS operates and can help you avoid mistakes that lead to criminal charges.

Should your case involve the state’s jurisdiction, a New York sales tax lawyer can work to resolve your situation at the state level while coordinating your defense with federal authorities.

Choosing the Right Legal Help

Finding the best representation matters. If you’re looking for experienced professionals, consider one of the top tax attorneys New York offers. They’ve handled serious investigations and helped clients reach favorable outcomes.

You should also consider hiring the best tax attorney NYC if you are dealing with both civil penalties and criminal exposure. The most experienced lawyers often have the insight and negotiation skills to resolve matters quietly and efficiently.

When the stakes are high, you may specifically need the best criminal tax attorney available. These attorneys understand the risks you face — including jail time and financial ruin — and will fight to protect your future.

In all these cases, having a strong criminal tax defense can reduce or eliminate penalties. Your lawyer can evaluate records, question accusations, and push for alternatives like settlements or deferred prosecution agreements.

The more quickly you get a criminal tax lawyer involved, the more options you have for resolving the matter without going to trial.

Federal Charges Require Specialized Help

When the government investigates crimes like tax fraud, false statements, or conspiracy, you’ll need a federal tax crime defense attorney. These cases are handled by U.S. attorneys and IRS special agents and may involve grand juries or federal courts.

Your defense attorney can guide you through interviews, protect your rights, and help control how your case unfolds.

Stopping Wage Garnishment Before It Hurts

If you’ve already received notice that the IRS or state will garnish your wages, don’t panic. A wage garnishment defense attorney near me can help stop or reduce the garnishment. They may negotiate a payment plan, challenge the amount owed, or seek hardship relief to give you breathing room.

Acting quickly can protect your income and prevent more aggressive collection actions like bank levies or property seizures.

Final Thoughts

Frequently Asked Questions (FAQ)

Q1: When should I contact a criminal tax attorney? You should contact a criminal tax attorney New York as soon as you receive a letter from the IRS or state tax agency, especially if it mentions audits, investigations, or possible fraud. Early legal guidance can prevent the situation from escalating.

Q2: Can a tax mistake really become a criminal issue? Yes. If tax authorities believe a mistake was intentional — like underreporting income or claiming false deductions — you may face criminal charges. A strong criminal tax defense is essential in such cases.

Q3: What’s the difference between a sales tax attorney and a criminal tax attorney? A sales tax attorney New York typically handles audits, collections, and compliance for businesses. A criminal tax lawyer New York, however, defends individuals or companies accused of tax crimes such as evasion or fraud.

Q4: What is lease incentive tax treatment, and why is it important? Lease incentive tax treatment involves how financial incentives provided in lease agreements are reported. Incorrect reporting can trigger audits or criminal investigations.

#Taxes#Criminal Tax Defense#Criminal#Legal Services#Payroll#criminal tax lawyer#best tax lawyer#criminal tax lawyer new york#best tax lawyer nyc#irs#new york#legal advice#best payroll tax lawyer new york#irs lawyer nyc#tax law

0 notes

Text

BergerCPAFirst: Your Trusted Tax Accountant in NJ & Manhattan

The right Tax Accountant near me NJ can help you maximize your deductions and comply with current tax laws. If you're located anywhere in New Jersey or Manhattan, BergerCPAFirst has expert tax and accounting services that cater to your every need.

Why Choose BergerCPAFirst?

Expert CPAs in Bergen CountyWhether you're an entrepreneur, a small business owner, or someone in need of professional tax advice, our highly qualified CPAs in Bergen County can assist you. Your financial needs are specific to you and so as a dedicated CPA firm in Bergen County, we offer tailored solutions.

Comprehensive Tax ServicesWhatever your need, personal tax preparation, corporate tax planning or even IRS audits; our highly qualified tax professionals are always ready and able to assist and ensure compliance with current laws. Our team of industry specialists proactively monitor the frequently changing IRS regulations to protect our clients.

Strategic Tax Planning for BusinessesWith our help, businesses in Manhattan and NJ can position themselves competitively by efficiently structuring their finances, minimizing their tax liabilities, and maximizing overall profitability.

Convenience and AccessibilityOur team can provide you with hands-on support whenever you need it due to the offices conveniently located in New Jersey and Manhattan. BergerCPAFirst is the perfect choice for someone looking for a Tax Accountant near me NJ.

Services We Offer

Personal & Business Tax Preparation

IRS Audit Representation

Bookkeeping & Payroll Services

Estate & Trust Planning

Financial Consulting

QuickBooks Assistance

Contact Us Today

Don’t let the upcoming tax season get the best of you. Contact BergerCPAFirst for all your accounting needs. Our team has years of experience so whether you need CPAs in Bergen County or a Tax Accountant Manhattan, you can be assured that you will receive the best service possible.

For stress-free tax and accounting services, please visit our website or schedule a consultation with us today.

Contact Info :

Address : 505 Eighth Avenue, Suite 1402, New York, NY 10018

Phone : (212) 232-0222

0 notes

Text

How to Navigate Payroll Tax Issues with Confidence

Introduction

Taxes can be a complex and stressful topic, especially for businesses handling payroll. Have you ever felt overwhelmed trying to comply with payroll tax laws or facing the possibility of an audit? You’re not alone. Many businesses encounter challenges with payroll tax issues, ranging from audits to garnishments. The good news is that there are experts ready to help, including the best payroll tax fraud lawyer and payroll tax attorney services available.

What is Payroll Tax Fraud?

Payroll tax fraud occurs when businesses intentionally misreport or fail to report payroll taxes to the IRS. This can include underreporting employee wages, misclassifying workers as independent contractors, or not remitting withheld taxes. It’s like trying to build a house on a shaky foundation — eventually, it’s bound to collapse. The consequences can include hefty fines, criminal charges, and even jail time.

Common Causes of Payroll Tax Issues

Payroll tax problems often arise from clerical errors, such as simple mistakes in calculations or record-keeping. Misclassification of workers is another common cause, where employees are treated as independent contractors to avoid payroll taxes. Cash flow problems, such as failing to remit taxes due to financial struggles, also contribute significantly. Addressing these issues proactively can prevent them from snowballing into bigger problems.

Signs You Need a Payroll Tax Fraud Lawyer

Not sure if you need legal help? Repeated IRS notices, facing a payroll tax audit, or legal actions like garnishment threats are clear indicators. A payroll tax fraud lawyer can provide the guidance and representation you need to navigate these challenges effectively.

Understanding Payroll Tax Audits

How a Payroll Tax Attorney Can Help

Hiring a payroll tax attorney can make all the difference. They represent you in communications with the IRS, negotiate settlements to reduce penalties or arrange payment plans, and provide expert advice on compliance and legal strategies. Their expertise ensures your interests are protected throughout the process.

The Role of an Attorney to Stop Garnishment

When the IRS starts garnishing your wages or bank accounts, it can feel like sinking in quicksand. An attorney to stop garnishment can file legal motions to halt garnishments, negotiate alternative resolutions with the IRS, and help you regain control of your finances. Their intervention can often provide immediate relief and a clear path forward.

Choosing the Best Tax Lawyers in New York

New York’s tax laws can be as complex as the city itself. Finding the best tax lawyers in New York involves evaluating their experience, reputation, and specialization. Look for professionals with years of handling payroll tax cases, positive client reviews, and proven expertise in payroll tax fraud and garnishments.

Tips to Avoid Payroll Tax Problems

Prevention is the best strategy when it comes to payroll taxes. By implementing sound practices, you can reduce the risk of issues.

Best Practices to Stay Compliant:

Use reliable payroll software to automate calculations.

Stay updated on tax laws and requirements.

Conduct regular internal audits of payroll records.

Consult a payroll tax attorney for proactive advice.

Benefits of Professional Tax Help

Why go it alone when you can have an expert by your side? Professional tax help offers peace of mind by ensuring your taxes are handled correctly. It saves you time, allowing you to focus on your business while experts handle the IRS. Moreover, it reduces risks by avoiding costly mistakes and penalties.

How to Handle Payroll Tax Audits with Confidence

When to Seek Legal Assistance

Don’t wait until it’s too late. Seek help if you receive audit notifications, struggle with payroll tax compliance, or face legal actions like garnishments. Early intervention can often prevent more severe consequences.

Conclusion

Navigating payroll tax issues doesn’t have to be a nightmare. Whether you’re dealing with an audit, garnishments, or compliance challenges, there’s help available. By working with the best payroll tax fraud lawyer or payroll tax attorney, you can protect your business and move forward with confidence. Remember, the key to success is proactive planning and seeking expert guidance when needed.

FAQs about Payroll Tax Issues

What happens if I’m found guilty of payroll tax fraud?

You could face fines, criminal charges, and even imprisonment.

How long does a payroll tax audit take?

It varies but can last several months depending on the complexity.

Can an attorney stop IRS garnishments immediately?

Yes, they can file motions to halt garnishments and negotiate alternative resolutions.

Are payroll tax issues common?

Yes, especially for small businesses juggling multiple responsibilities.

How do I choose the best payroll tax attorney?

Look for experience, positive reviews, and specialization in payroll tax cases.

0 notes

Text

In today’s competitive market, you understand that your website is not just your digital presence but a portal to tell your brand’s story, showcase your products and services, and engage with visitors and convert them into investors.

That’s why you need a modern investor relations website developed by a thought leader with a successful track record that carries a team of industry-leading web designers and investor relations (IR) professionals. The right full-service IR tools and solutions provider can develop an IR platform with the following essential characteristics:

1. Excellent Design You need a world-class website that finds the perfect balance between creativity and functionality because your brand requires the best online representation. A good IR website must offer a superb digital experience with a visually appealing, clean, and intuitive interface that’s user-friendly and understands your target audience.

With the global smartphone penetration rate increasing annually, your IR partner should also optimize your website for mobile phones, tablets, and other devices.

ADVERTISEMENT 2. Value Proposition Give your investors a reason to stay on your website by offering easy access to critical information such as your stock symbol, events calendar, investor news, fact sheets, essential reports and insights, webcasts, resources, tool kits, etc.

Additionally, your website must load quickly. According to Google, over 50% of mobile users abandon websites that take over three seconds to load. A fast website will give potential investors another reason to stay.

3. Guaranteed Compliance Enhance investor confidence by developing a website designed to satisfy guidelines from key regulatory bodies:

European Union: Your IR website must meet General Data Protection Regulation (GDPR) compliance on data protection and privacy for your investors in Paris, Berlin, Brussels, Stockholm, Copenhagen, and other financial hotspots in the European Union (EU). And if your IR website satisfies GDPR compliance, there’s a fair chance that it may also meet UK data protection law for your clients in London. United States: Your IR website must meet the Securities and Exchange Commission (SEC) regulations for your clients in New York, Chicago, Atlanta, San Francisco, and other American cities. 4. Enterprise Security With cybercriminals launching increasingly sophisticated online attacks, your platform needs industry-leading around-the-clock security that delivers 99.9% uptime and keeps your data secure.

Look for a developer that guarantees a System and Organization Controls 2 (SOC-2) Type 2 certification. The SOC-2 Type 2 audit report is provided after an exhaustive and detailed evaluation and is an attestation to the credibility and security of your website.

5. Fully Integrated Analytics It would help if you had the right analytics tools to understand who is visiting your website, how long investors stay on your pages, and how visitors consume your brand’s story. With the correct metrics, you can make data-driven decisions to enhance your market reach, generate leads, and retain investors.

6. First-Rate Support Your platform must have first-rate support 24/7 from your IR tools and solutions provider, especially when traffic volume is high. The right provider understands that technical issues need to be addressed quickly in the busy world of investor relations.

These are six signs of an excellent investment relations website. A fast website with a cutting-edge and intuitive design that’s secure, compliant, and offers you a wealth of information about your market will help you hit your key performance indicators.

0 notes

Photo

IRS BACK TAX HELP - TAX RELIEF

If you live in Houston and find yourself in need of tax relief, don’t try to fight the IRS on your own. Take advantage of Advance Tax Relief trusted team of professionals to handle your case with the utmost dedication and see yourself back to financial freedom sooner than you thought imaginable.

Advance Tax Relief is proud to provide IRS back tax help to Houston and its nesting communities. From the museum district of Binz to the southwest neighborhood of Alief, Dallas to Austin, Texas to New York. Advance Tax Relief is America’s premier tax-service company here to solve all of your tax-related needs.

NEED HELP WITH IRS BACK TAXES, AUDIT REPRESENTATION OR SMALL BUSINESS TAX PREPARATION?

ADVANCE TAX RELIEF LLC www.advancetaxrelief.com BBB A+ RATED CALL (713)300-3965

Houston Hardships and Back Taxes

The term “back taxes” refers to taxes that were not paid when due. Houston taxpayers can face back taxes at local, Texas state, and U.S. federal levels. Unpaid back taxes can stir a number of consequences that soon demand tax relief help. First, it’s important to distinguish the difference between not filing and not paying your taxes, as the penalties are not the same.

Failure-to-File

If you don’t file your taxes – either deliberately or accidentally – you can face a failure-to-file penalty. In some cases, the consequence is less extreme. The IRS may simply file a substitute return on your behalf, resulting in you missing out on the refund that would have headed straight to your pocket. However, you might get picked up by the IRS radar if you have a sizeable (missing) income return or failed to file after consistently filing for years on end. Remember, the IRS has access W-2, 1099, or similar forms provided at the time of employment, and can therefore see any discrepancy between the income you earned and the income you reported (or in this case, failed to report).

If the IRS catches this, they can hit you with a hefty failure-to-file penalty. At a minimum, failing to file your tax return more than 60 days late will cost you a flat fee of $135 or 100 percent of the taxes you owe (whichever is less). On top of that base fee, you will incur a monthly charge of about 5 percent of the outstanding taxes you owe – remember, the IRS can already see what you made. You’ll incur this penalty for as many months as your taxes remain unfiled and unpaid, until capped at 25 percent.

Failure-to-Pay

This penalty exists for those who file their taxes, but are unable to pay the amount they owe. People find themselves unprepared to pay their tax bill for a variety of reasons. They might have substantial investments, or received a recent inheritance. In other cases, they might not have withheld enough tax from their income, opting instead for a bigger paycheck. In any case, if you are unable to pay your federal or state tax in Houston, you can face an imposed failure-to-pay penalty. This fee is charged at a rate of about 0.5 percent of your unpaid taxes for each outstanding month, up to 25 percent. Plus, you’ll still be responsible for the interest on the unpaid amount. The IRS cautions how much more costly the failure-to-file penalty is over the failure-to-pay (about ten times more expensive, in fact). The steep fee is their way of discouraging tax evasion – the illegal non-payment or underpayment of tax. For that reason, it’s always better to file your tax return, even if you know in advance you’ll be unable to pay.

There are a number of other ways taxpayers might accumulate debt and find themselves in need of IRS tax relief. Delinquent taxes might arise from:

Poor recordkeeping: In the case of an IRS audit, you’ll need detailed records of expenses and provide copies of documents to support your tax credits or write-offs. If you can’t substantiate your claim for a $50,000 pool, for example, you’ll be responsible for paying it back. Mixing business and personal expenses: Be very careful to keep your expenses separate, or you might have trouble explaining how a weekend in Vegas contributed to your business’s bottom line.

Deficient taxes: If you’re filing your taxes by yourself, a simple mistake such as leaving off an extra zero could result in a Notice of Deficiency, also known as a 90-day letter. This notice alerts the taxpayer of their delinquent taxes owed plus any penalties and interest, and allows 90 days to dispute the assessment.

Dishonored check: Whether intentional or not, if your bank doesn’t honor your check, you can face a penalty of 2 percent of the payment for checks made out to $1,250 or more. Be sure that there are sufficient funds to pay your bill when writing your check.

Tax Relief Solutions in Houston, Texas

For whatever reason you find yourself in need of IRS back tax help, refer to Advance Tax Relief as Houston’s trusted source for tax relief solutions. Being in debt with the federal government is not a fun place to be; it can result in tax liens, levies, garnished wages, and even arrest in extreme cases. Advance Tax Relief offers a number of relief solutions for those in Houston encumbered by IRS debt. Some forms of tax relief include:

Offers in Compromise (OIC)

Taxpayers very close to the threshold of financial hardship may qualify for an OIC. In this case, the IRS determines the maximum amount they would be able to get from a taxpayer without causing financial hardship, and the remainder is forgiven with the individual released from their liability.

Installment Agreement (IA)

IA is a method of debt resolution available to Houston residents that allows an individual to pay off their balance over a period of years, typically ranging from six months to ten years.

Stair Step Agreement

This form of IA is intended to allow taxpayers to finish payment on large expenses, such as a car loan, by more funds to that expense with small installments on the unpaid tax. Once the payment on the initial expense is complete, the taxpayer switches the entire payment over to the unpaid back taxes.

Streamline IA

Within this form of relief are strict guidelines that determine a taxpayer’s eligibility, but added benefits make the program worthwhile, and is ideal for taxpayers with disposable income and substantial assets. The amount owed must be less than or equal to $50,000 and repaid between 60-72 months.

Partial Pay IA

For those unable to pay their back taxes due to financial hardship, this IA calculates payments based on what the taxpayer can afford, and repayment can last as long as ten years (after ten years, the Statute of Limitations is imposed, and the IRS can no longer collect on past debt).

Conditional Expense IA

This version of tax relief allows individuals to address their tax debt problems while continuing to pay for a long-term monthly bill and/or expense. A more accommodating IA, this agreement allows taxpayers to continue their current lifestyle without disruption from tax debt.

Not sure how you can resolve your tax debt?

ADVANCE TAX RELIEF CAN HELP YOU DETERMINE WHICH SOLUTION IS RIGHT FOR YOU.

CONTACT US TODAY

Currently Not Collectible Status

If you’re struggling with extreme hardship, you could potentially be relieved of all of your IRS debt. The IRS cannot attempt to garnish wages or collect your debt while your account is placed on CNC status.

Penalty Abatement

Abatement does not apply to interest, but it may apply to penalties if the taxpayer meets a given requirement. Penalties may be abated if the taxpayer has a reasonable cause for not filing their taxes (such as sickness, a family death, or major life event), files an Administrative Waiver and First Time Penalty Abatement form, is an injured spouse, or falls under statutory exception.

Advance Tax Tax Relief Help

For those in Houston struggling to repay their debt and need IRS back tax help, Advance Tax Relief is here to assist. Our team is trained to negotiate with the IRS on your behalf and promises to fight for your right as a taxpayer. We offer a meticulous tax resolution service that involves pouring over IRS records and documents to have a complete understanding of your financial situation. As your Power of Attorney, we’ll communicate with the IRS on your behalf, eliminating your need to engage with stressful or intimidating government agents.

Advance Tax Relief assigns each client to an extremely dedicated team of practitioners and researchers who work together to create the best tax relief solution specific to your unique circumstances. Our goal is to not only fix your current debt situation and get you back on track, but provide you with ample information to assure you never face such troubles again in the future.

We’re happy to service the Houston area in addition to the hundreds of clients nationwide whose $50+ million debt we’ve resolved. Don’t spend another day drowning in debt; contact Advance Tax Relief to see how we can help you regain control of your finances. The consultation is free – give us a call today.

GET TAX RELIEF HELP TODAY

If you think that you may need help filing your 2018/2019 tax return and past due tax returns, you may want to partner with a reputable tax relief company who can help you get the max refund and reduce your chances for an IRS AUDIT.

Advance Tax Relief is headquartered in Houston, TX with a branch office in Los Angeles, CA. We help many individuals just like you solve a wide variety of IRS and State tax issues, including penalty waivers, wage garnishments, bank levy, tax audit representation, back tax return preparation, small business form 941 tax issues, the IRS Fresh Start Initiative, Offer In Compromise and much more. Our Top Tax Attorneys, Accountants and Tax Experts are standing by ready to help you resolve or settle your IRS back tax problems.

Advance Tax Relief is rated one of the best tax relief companies nationwide.

#TaxDebtProblems #FilingBackTaxes #TaxReliefPrograms #IRSDebtForgivenes #TaxAttorneysNearMe #IRSLawyer #TaxReliefFirms #OfferInCompromise #TaxResolution #LocalTaxAttorney #HelpFilingBackTaxes #TaxDebtSettlement #TaxReliefAttorneys #IRSHelp #TaxRELIEF #TaxAttorneys #AuditHelp #BackTaxes #OfferInCompromise #WageGarnishmentHelp #AuditReliefHelp #SmallBusinessTAXES

0 notes

Text

IRS Lawyer NYC: Best Tax Law Firms & Criminal Tax Attorneys Near You

Introduction

Qualities That Set Top Legal Professionals Apart

In a city as competitive as New York, finding the best tax lawyer nyc means looking for someone with both experience and a record of success. A top-tier attorney will provide detailed advice on IRS procedures, represent you in audits, and fight aggressively if criminal charges are on the table. It’s important to choose a lawyer who is responsive, transparent, and knowledgeable about both state and federal tax regulations.

For clients with more complex legal needs, turning to one of the best tax law firms nyc is often a wise move. These firms typically employ a multidisciplinary team that includes not only tax attorneys but also CPAs and enrolled agents. This team approach allows clients to benefit from a well-rounded defense strategy during audits, investigations, or litigation.

Comprehensive Legal Help

There is no shortage of talent when it comes to the best tax law firms in new york, many of which specialize in helping high-net-worth individuals, business owners, and investors. These firms understand the nuances of IRS procedures, New York State tax law, and cross-border compliance, giving their clients a competitive edge in resolving disputes. Having access to a firm with such wide-ranging expertise ensures no part of your financial picture is left unexamined.

Knowing When to Seek Help

Many people wait too long before seeking help, unsure of whether their issue merits legal involvement. That’s why scheduling a tax lawyer nyc consultation is so important. During this initial meeting, an attorney will review your situation, advise you on your risk, and recommend a course of action. These consultations are often the first step toward resolving tax debts, negotiating settlements, or avoiding criminal charges altogether.

Businesses, especially those operating in retail, hospitality, and e-commerce, are frequent targets of audits. Sales tax audit lawyers are skilled in defending companies against accusations of underpayment or improper recordkeeping. If you’ve received a notice, engaging one of these lawyers early can help minimize disruption to your business and prevent long-term financial damage.

Handling Criminal Tax Issues

If you are under criminal investigation or suspect you might be soon, searching for a criminal tax defense attorney near me is critical. These cases can involve charges of fraud, tax evasion, or knowingly submitting false returns — offenses that carry severe penalties, including imprisonment. A criminal tax defense attorney can work proactively, communicating with IRS agents and building a defense before charges are filed.

If you’re unsure where to begin, a quick search for criminal tax lawyers near me can help you find legal professionals experienced in IRS criminal investigations. These lawyers understand how to interpret investigative actions, review financial records, and challenge procedural missteps that might impact your case. Their goal is to protect your rights while navigating the complexities of federal law.

Local Support That Makes a Difference

People facing legal action often search for a criminal tax lawyer near me because they need immediate, accessible support. Having a local lawyer who understands both the federal system and New York’s tax laws ensures faster response times and more personalized legal service. Whether it’s attending court hearings or reviewing physical records, working with a local attorney streamlines the process and builds trust.

When dealing with legal consequences, many also seek a criminal tax attorney near me for reassurance and representation. These professionals provide more than legal support — they offer a roadmap to recovery. Whether you’re working toward a plea deal, facing court proceedings, or trying to clear your name, having a nearby expert can be both strategically and emotionally valuable.

A Full-Service Approach

In many cases, individuals and businesses find that working with a new york tax law firm offers comprehensive support. These firms can manage multiple aspects of a tax case — from unfiled returns and back taxes to compliance strategies and criminal defense. Having one team handle all the moving parts allows for better communication and a unified legal strategy.

If you’ve recently received notice from the IRS or New York State, do not delay. Whether you’re searching for a criminal tax defense attorney near me, a seasoned sales tax audit attorney, or want to explore your options through a tax lawyer nyc consultation, now is the time to take action.

Common Scenarios Requiring Legal Help

A few common situations where people turn to legal experts include:

Receiving a notice of audit or tax delinquency

Facing penalties for unpaid payroll or sales taxes

Being contacted by IRS Criminal Investigations

Having substantial unreported income

Needing to settle several years of back taxes

Final Thoughts

Navigating tax disputes is never easy, but you don’t have to do it alone. Whether you’re dealing with federal investigations or complex state audits, hiring the right legal team is crucial. From finding an irs lawyer nyc for audit representation to engaging with the best tax law firms in new york for complex cases, the right legal help can change the outcome of your case.

If you’re facing serious legal or financial consequences, don’t wait. Seek guidance from a criminal tax attorney near me, a trusted new york tax law firm, or experienced sales tax audit lawyers today. With the right support, you can resolve even the most daunting tax challenges and move forward with confidence.

FAQ

Q1: When should I hire an IRS lawyer in NYC? You should hire an irs lawyer nyc if you’re facing an IRS audit, owe back taxes, have unfiled returns, or are being investigated for potential fraud or evasion. Early legal representation helps protect your rights and minimize penalties.

Q2: What makes someone the best tax lawyer in NYC? The best tax lawyer nyc will have years of experience handling IRS disputes, strong negotiation skills, and a deep understanding of both federal and New York tax laws. They should also be responsive and offer transparent legal advice.

Q3: Do the best tax law firms in NYC handle both audits and criminal cases? Yes, the best tax law firms nyc and the best tax law firms in new york typically offer comprehensive services — from audit defense and back taxes to criminal tax investigations and court representation.

Q4: What does a sales tax audit attorney do? A sales tax audit attorney represents businesses during audits by the New York State Department of Taxation and Finance. They help organize records, respond to auditors, and reduce potential tax liabilities.

#New York#Irs#Small Business#Lawyers#Criminal Law#criminal tax lawyer#best tax lawyer#tax law#legal advice#best tax lawyer nyc#irs lawyer nyc#best payroll tax lawyer new york#criminal tax lawyer new york

0 notes

Text

Payroll Tax Challenges? Discover the Best Lawyers to Help You

Understanding Payroll Tax Compliance

What Are Payroll Taxes?

Common Payroll Tax Challenges

Late Payroll Tax Filings

Missing payroll tax deadlines can result in hefty penalties and interest, jeopardizing your business’s financial stability.

Unfiled Tax Returns New York

Failing to file tax returns can escalate quickly. Whether it’s an oversight or due to financial difficulties, unfiled tax returns new york often lead to audits, fines, and even legal action.

Employee Misclassification

Misclassifying employees as independent contractors is a common issue. This mistake can trigger IRS audits, leading to back taxes, penalties, and interest.

Why Payroll Tax Compliance Is Crucial

Financial Consequences

Payroll tax errors can lead to steep fines and accrued interest. Businesses struggling with unfiled tax returns in New York risk severe financial strain.

Legal Risks

In severe cases, payroll tax non-compliance may result in legal action, including criminal charges. Seeking advice from a criminal tax attorney new york is crucial to protect your rights.

Business Reputation

Compliance issues can tarnish your reputation with employees, customers, and stakeholders. A proactive approach demonstrates professionalism and integrity.

When to Consult a Tax Attorney

Signs You Need an IRS Lawyer NYC

Facing IRS audits, receiving penalty notices, or having unfiled tax returns? It’s time to consult an experienced irs lawyer nyc who can help you navigate these challenges and protect your assets.

How a Tax Attorney Can Assist

A tax attorney provides specialized services, including negotiating payment plans, settling disputes, and representing you in court. Their expertise ensures compliance and mitigates legal risks.

Finding the Best Tax Lawyer NYC

Qualities to Look For

The best tax lawyer nyc should have years of experience, a solid track record in handling payroll tax cases, and a deep understanding of local tax laws.

Reputation and Reviews

Check online reviews and testimonials to ensure the attorney has a strong reputation for resolving cases effectively and maintaining clear communication with clients.

Services Offered by New York Tax Defense Attorneys

Resolution of Payroll Tax Disputes

New york tax defense attorney specialize in resolving payroll tax disputes, whether through audits or negotiations with the IRS.

Filing Unfiled Tax Returns New York

Addressing unfiled tax returns is a key service. Attorneys help clients file past-due returns, minimizing penalties and negotiating payment terms when necessary.

Criminal Tax Defense

If you’re under investigation for tax evasion or fraud, a criminal tax attorney New York can build a strong defense, protecting you from severe penalties or jail time.

Steps to Resolve Payroll Tax Issues

Gather Necessary Documentation

Compile all relevant financial records, including payroll reports, tax filings, and IRS notices, to provide your attorney with a clear understanding of your case.

Consult a New York Tax Defense Attorney

Schedule a consultation to discuss your options. A skilled attorney will analyze your situation and develop a customized strategy to resolve your tax issues.

Address IRS Penalties Promptly

Benefits of Hiring a Tax Attorney

Expertise in Tax Law

Tax attorneys possess in-depth knowledge of complex tax regulations, enabling them to navigate legal challenges effectively.

Representation in Legal Matters

Whether dealing with IRS audits or criminal charges, an attorney ensures your rights are protected and provides expert representation in negotiations or court.

Peace of Mind

Knowing you have a qualified professional handling your tax issues allows you to focus on running your business without constant stress over legal repercussions.

Conclusion

Payroll tax challenges require immediate attention, especially in a high-stakes environment like New York City. Whether you’re dealing with unfiled tax returns, seeking help from a New York tax defense attorney, or needing a criminal tax attorney New York for serious legal issues, professional assistance is crucial. Don’t wait — address these issues now with the best tax lawyer NYC to safeguard your business and financial future.

FAQs

1. What does an IRS lawyer NYC do?

An IRS lawyer NYC assists clients in resolving disputes with the IRS, including audits, penalties, and unfiled tax returns.

2. How can a New York tax defense attorney help with payroll taxes?

They ensure compliance, resolve disputes, and negotiate favorable payment terms with tax authorities, protecting your business from penalties.

3. What happens if I have unfiled tax returns in New York?

Unfiled tax returns can lead to audits, penalties, and legal action. A tax attorney can help file overdue returns and minimize consequences.

4. Why should I hire a criminal tax attorney New York?

A criminal tax attorney specializes in defending against serious tax-related charges like evasion or fraud, helping you avoid severe penalties or imprisonment.

5. How do I find the best tax lawyer NYC?

Look for a lawyer with extensive experience, positive client reviews, and a strong track record in handling cases similar to yours.

0 notes

Link

When you see a legal advisor embroiled in ongoing legal battles, you can’t help but wonder…

If they’re the real deal, why can’t they defend themselves?

But LegalShield may finally have their act together. The question now is whether you can make any money with this MLM.

LegalShield was once a big, bad, publicly-traded company with a network marketing opportunity on the New York Stock Exchange…until they went private faster than a celebrity in rehab.

Judging from some of their past scandals and legal troubles, going private was definitely a smart move. But are they worth joining? We’ll let you decide.

FAQ

1. What does LegalShield sell? LegalShield gives access to affordable legal coverage to its members, no matter how traumatic or trivial the situation. They’re the No. 1 subscription-based provider of legal plans to families and small businesses across the U.S. and Canada.

2. What are LegalShield’s most popular products? LegalShield’s Personal Legal Plan costs about the same as a dinner out ($24.95/month) and gives you coverage for you, your spouse or partner, and your children. Included with your membership are advice, letters/phone calls on your behalf, legal document review, standard will preparation, 24/7 emergency assistance, and trial defense services. Another popular service is ID Shield, which protects your identity, including customized alerts, complete identity monitoring, credit scores, and unlimited consultation.

3. How much does it cost to join LegalShield? It costs $99 plus any applicable state licensing fees to become a LegalShield associate. This gives you an Associate Start-Up Kit with brochures and applications so you can begin your business right away.

4. Is LegalShield a scam? No, LegalShield is a legitimate business with 1.7 million members in 50 states and 4 provinces. They have provider law firms across the United States and Canada, so the legal support you get comes from a lawyer who’s well acquainted with your local laws and regulations. What does feel scammy is the lack of full disclosure about becoming an Associate and how much you can earn. If it’s such a great opportunity, why aren’t they more forthcoming with information about how to join?

5. What is LegalShield’s BBB rating? A+

6. How long has LegalShield been in business? Since 1972

7. What is LegalShield’s revenue? $457 million

8. How many LegalShield distributors are there? 287,812

9. What lawsuits have been filed? In 2001, Wyoming came down on Pre-Paid Legal Services (which was LegalShield’s original name) for making income representations that were prohibited by Wyoming law. [1] The SEC also required them to stop counting commissions as assets instead of expenses. Complying with their ruling essentially cut their reported earnings by more than half. [2] In 2005, LegalShield lost a case related to deceptive advertising and fraud and paid $9.9 million in punitive damages. [3] In 2007, the FTC began investigating their marketing, saying it was misleading. Fortunately for LegalShield, in 2010 the investigation ended without any action. [4] In 2018, LC Technology International filed a proposed class action against Harvard Risk Management and LegalShield for sending unlawful, unsolicited fax messages as part of a pyramid sales scheme. [5]

10. Comparable companies: Market America, Life Leadership, Primerica

So should you join LegalShield?

I’m not a hater of the company at all, there’s definitely a market for legal advice and resources. But as far as passive income opportunities go, there are better options out there.

Click here for my #1 recommendation

Either way, here’s the full review on LegalShield.

Overview

LegalShield was founded in 1972 under the name Sportsman’s Motor Club in Ada, Oklahoma. A couple of years later, they changed their name to Pre-Paid Legal and went public, selling its shares on the New York Stock Exchange.

In 2011, the company was acquired by MidOcean Partners, a private equity firm worth $3.5 billion, for $650 million. They then went private and changed their name to LegalShield. In 2011, before they went private, they were raking in an annual revenue of $461 million. [6]

Back in 2001, they were hit twice by the law – first by the state of Wyoming for misrepresenting distributor earnings, and again by the SEC for counting commissions as assets to inflate their stock prices. They also faced legal troubles in Missouri that year. [7]

In 2009, they were subpoenaed by the SEC for various documents which were never sent over to the SEC despite multiple demands. After that, the FTC filed a complaint against LegalShield for multiple violations, including misleading representations. [8]

Jeff Bell is LegalShield’s new CEO, and this guy is no joke.

Bell got his MBA from none other than the Wharton School of Business back in 1989. He’s worked in key positions at Ford Motors, Chrysler, NBCUniversal, Advertising Age, where he won them their first-ever Online Marketer of the Year award in 2005, and Microsoft, where he oversaw the launch of Halo 3, among other major releases, as Vice President of Global. [9, 10]

He’s got decades of experience in marketing and advertising at some of the world’s biggest corporations, and he was named as LegalShield’s new leader in 2014. [11]

Hopefully, he can replicate his success in the world of multi-level marketing. This will be his first MLM, but maybe that’s a good thing. Maybe his credentials can fend off the FTC.

So maybe he can turn their rep around. However, in March of 2016, he made the decision to leave the Direct Selling Association, the regulatory body that pretty much ensures that an MLM is at least semi-legit (see the full MLM rankings here).

Bell claims their decision to leave the DSA is because the DSA actually isn’t enforcing its own Code of Ethics against other MLMs who are clearly breaking it, and thus is weakening the direct selling industry as a whole. Wouldn’t be the first time. [12]

As of January 2016, LegalShield membership began a steady increase, hitting 1,612,183 members before the end of the year. Now, they’re over 1.7 million members. Smells like a comeback.

How much does LegalShield cost?

At the time of writing this, it costs $99 for a New Associate Start-Up Kit, which includes online training, materials, sponsor support, a back office, and a few other perks.

Products

LegalShield sells legal services, in case their name didn’t tip you off. They claim to offer direct and affordable access to law firms.

They have a network of almost 7,000 independent attorneys throughout the United States and Canada who offer these services. For your monthly membership fee, which varies by state but usually comes out to just under $25/month, you get:

Legal Advice: If you ever need advice or consultation from a legal representative, you always have one at your service.

Legal Representation: In the case that you should need legal representation, you have their independent attorneys at your disposal.

Automotive Defense: Accident defense and moving violation assistance.

Familial and IRS Legal Services: This covers everything from divorce and name changes to IRS audits.

Considering legal advice can cost hundreds, and representation from an attorney can cost anywhere from $150-$500 per hour, it’s not a bad deal.

The company also now sells identity theft protection services starting at $9.95/month. The basic plan covers you and a spouse, and includes:

Credit report and credit score analysis

Credit restoration

Unlimited ID theft consultations

Minor protection

Credit monitoring and alerts

Honestly, if you have even a halfway decent bank or own a credit card, you probably already have access to all of these services for free.

Compensation Plan

You’re selling a monthly membership, and when you get a new customer, LegalShield pays you an advance for a year’s worth of that customer’s membership. Sounds great, right? Yeah, until that customer decides to cancel, and you have to pay back a huge chunk of that advance.

The compensation plan is nowhere to be found on their website, and the information you can find is very vague. It doesn’t list any specific commission rates.

There are four ways to earn:

Personal Sales

You make a percentage on each membership you sell, which varies by rank. This is roughly what you can make, according to rank:

Junior Associate: Up to 50%

Associate: Up to $75 on each sale

Senior Associate: Up to $100 on each sale

Manager: Up to $125 on each sale

Director: Up to $150 on each sale

Executive Director: Up to $182.50 on each sale

These numbers look generous, but remember, they are advances on 12 months of membership payments. Also, it’s very, very difficult to move up even past Junior Associate, let alone all the way to director levels.

Build a Team

Team commissions are offered in the form of bonuses for every membership they sell. Exact numbers are not specified.

Residual Income

After a membership that you’ve sold lasts a year, you make a monthly commission on each month they stay active. Whether or not this commission is the same as before isn’t stated, but this is basically number one rehashed.

Performance Club

Each time you sell memberships and recruit new associates, you earn points. If you earn enough (fat chance), you can start earning cash bonuses and prizes.

Recap

The company is not without their scandals. They’ve got a pretty colorful history, to say the least.

However, it seems that the worst might be over for them. They’ve survived dozens of legal battles, and since going private, they’ve only had one claim made against them. (It looks pretty frivolous; they’ll probably pull it out.) On top of that, they’re being run by a rock star CEO, and so far, he’s doing good things for the company.

That being said, the commission plan is vague, at best. It’s really not clear how much money you’d make as an associate. One thing that is clear – you’re probably not getting rich here.

I’ve been involved with network marketing for over ten years so I know what to look for when you consider a new opportunity.

After reviewing 200+ business opportunities and systems out there, here is the one I would recommend:

Click here for my #1 recommendation

0 notes

Text

LegalShield: Are their legal services really legal? [Review]

When you see a legal advisor embroiled in ongoing legal battles, you can’t help but wonder…

If they’re the real deal, why can’t they defend themselves?

But LegalShield may finally have their act together. The question now is whether you can make any money with this MLM.

LegalShield was once a big, bad, publicly-traded company with a network marketing opportunity on the New York Stock Exchange…until they went private faster than a celebrity in rehab.

Judging from some of their past scandals and legal troubles, going private was definitely a smart move. But are they worth joining? We’ll let you decide.

FAQ

1. What does LegalShield sell? LegalShield gives access to affordable legal coverage to its members, no matter how traumatic or trivial the situation. They’re the No. 1 subscription-based provider of legal plans to families and small businesses across the U.S. and Canada.