#Inertial Navigation System Market

Explore tagged Tumblr posts

Text

Inertial Navigation System Market Size, Share, Exclusive Industry Report Insights by 2030

The global inertial navigation system market size was valued at USD 11.61 billion in 2022. The market is projected to grow from USD 12.29 billion in 2023 to USD 22.15 billion by 2030, exhibiting a CAGR of 8.77% during 2023-2030.

The Inertial Navigation System (INS) measures the relative position of a reference system point. These systems determine the location, attitude, and location of vehicles and other equipment. The INS market is expected to grow significantly during the forecast period owing to the increasing demand for miniaturized accelerometers and gyroscope sensors, emphasizing the development of next-generation navigation devices.

Fortune Business Insights™ mentioned this in a report titled "Inertial Navigation System Market, 2023-2030."

Informational Source:

Russia-Ukraine War Impact

Advanced Navigation Systems Prove Crucial in Wartime, Offering Precision and Flexibility

During wartime situations, there is a growing need for technologically advanced airborne systems, space-based navigation technology for enemy positioning precision, and the acquisition of Ship Inertial Navigation Systems (SINS). These conflicts have underscored the importance of multi-platform navigation solutions that disrupt accurate location data, with modern technology-based solutions providing lightweight, compact, and cost-effective systems suitable for both UAVs and vehicles, serving both aerial and ground applications.

List of Key Players Profiled in the Report:

General Electric Company (U.S.)

Gladiator Technologies (U.S)

Honeywell International Inc. (U.S.)

iXblue SAS (France)

Northrop Grumman Corporation (U.S.)

Parker Hannifin Corporation (U.S.)

Raytheon Technologies Corporation (U.S.)

Safran S.A (France)

Teledyne Technologies Incorporated (U.S.)

Thales Group (France)

Trimble Inc. (U.S.)

VectroNav Technologies LLC. (U.S.)

Segments:

Gyroscope Segment’s Augmented Growth due to Increased Demand for Compact and Efficient Devices

By component, the market is segmented into accelerometers, gyroscopes, and others. Due to the increasing demand for gyroscopes owing to its development of compact, cost-effective, and efficient devices, the gyroscope segment is expected to be the fastest-growing segment during the forecast period.

MEMS Segment Growth Driven by Increasing Demand for Compact and Intelligent Systems

By technology, the market is divided into mechanical gyro, ring laser gyro, fiber optics gyro, MEMS, and others. The MEMS segment is estimated to witness the fastest growth during the forecast period, owing to the rising demand for compact, intelligent, and efficient systems.

Airborne Segment Soars as Demand for Navigation Tech Rises

By platform, the market is classified into airborne, ground maritime, and space. The airborne segment is expected to experience the fastest growth during the forecast period, owing to the rising demand for navigation technology for airborne platform products.

Commercial Segment Takes Off with Growing Demand for Navigation Solutions

By end-user, the market is divided into commercial and military. The commercial segment is expected to grow significantly during the forecast period. The segment's growth is attributed to the navigation solutions’ growing demand in commercial platforms, including vehicles, helicopters, and aircraft.

Geographically, the market is studied across North America, Europe, Asia Pacific, and Rest of the World.

Report Coverage

The report offers:

Major growth drivers, restraining factors, opportunities, and potential challenges for the market.

Comprehensive insights into regional developments.

List of major industry players.

Key strategies adopted by the market players.

The latest industry developments include product launches, partnerships, mergers, and acquisitions.

Drivers & Restraints

INS Market Thrives on Technological Advancements and Growing Satellite Navigation Use

The growing technological developments in Micro-Electro-Mechanical-Systems (MEMS) and the rising use of satellite navigation are expected to drive market growth during the forecast period. The increasing availability of solid and minor components, navigation device developments, and aerospace businesses is estimated to drive the inertial navigation system market growth.

These systems require regular maintenance, leading to high procurement, maintenance cost, and operation and may hamper market growth during the forecast period.

Regional Insights

North America Dominates INS Market, Fueled by Military Investment and Tech Developers

North America held the largest inertial navigation system market share in 2022. The growth is attributed to the rising spending on advanced systems procurement for military solutions and the presence of several hardware and software developers across North America.

Europe is estimated to witness the fastest growth during the forecast period owing to the significant opportunities created by the Russia-Ukraine war for navigation devices.

Competitive Landscape

Major Players Drive Growth through Strategic Partnerships and Acquisitions

The inertial navigation system market has several players with strong brand and product portfolios. The rising adoption of different partnerships and acquisition strategies by major market players is expected to drive market growth during the forecast period.

Key Industry Development

March 2023 – The Inertial Labs GPS-Aided Inertial Navigation System launched INS-DM. It is an IP68-rated version of a new-generation, super-ruggedized, fully integrated system shielded from electromagnetic compatibility and electromagnetic interference (EMC/EMI). It combines an Inertial Navigation System (INS) with an Air Data Computer (ADC) to provide high-performance strapdown capabilities, enabling it to determine velocity, position, and absolute orientation.

0 notes

Text

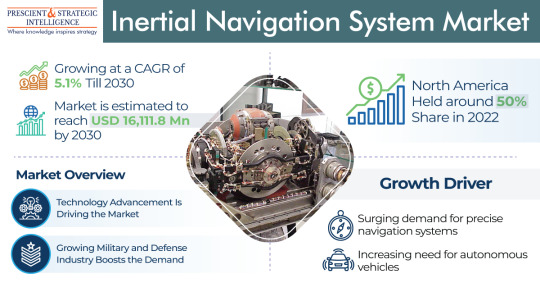

North America Is Dominating Inertial Navigation System Market

The inertial navigation system market generated revenue of USD 10,812.8 million in the past, which is expected to reach USD 16,111.8 million by 2030, advancing at a CAGR of 5.1%.

The market for inertial navigation systems is significantly driven by the defense industry. For precise navigation, location, and aiming in several defense applications, such as aircraft, submarines, missiles, and unmanned vehicles, INS technology is essential.

Many industries, including precision agriculture, geodesy, surveying, and geophysics, need accurate positioning and timing data. These applications benefit from the high accuracy and dependability provided by inertial navigation systems, which helps drive their expansion.

Accuracy, dependability, weight, power, size, cost-effectiveness, and other elements of such systems may all be improved, which will help a variety of industries like aerospace, military, and defense, among others. Microelectromechanical systems (MEMS) technical breakthroughs are also contributing to the market's growth. Manufacturers have developed more affordable, compact, low-power, and economical solutions thanks to the use of MEMS.

To receive free sample pages of this report@ https://www.psmarketresearch.com/market-analysis/inertial-navigation-system-market/report-sample

Additionally, the integration of several sensors, including barometers, magnetometers, and GPS, boosts the system's precision and dependability and results in more precise and secure navigation. Additionally, with the aid of modern MEMS-based sensors, enhanced sensor fusion algorithms, fiber optic gyroscopes, GNSS, and hybrid navigation systems, the competency and performance of inertial navigation systems are improving.

The forecast period is expected to have the biggest growth in the APAC market. This can be attributed to the expanding aviation sector in the area. Growing middle-class populations' preference for air travel has increased the demand for airplanes, which has increased the demand for inertial navigation systems in APAC.

Several APAC nations, including China, India, South Korea, and Japan, are raising their defense spending levels and modernizing their armed services. Military applications like armored vehicles, missiles, submarines, and precision-guided bombs rely heavily on inertial navigation systems. The APAC region's expanding defense capabilities and modernization initiatives have increased demand for INS.

#Inertial Navigation System Market#Size of Inertial Navigation System Market#Demand for Inertial Navigation System Market#Trends in Inertial Navigation System Market

0 notes

Text

Understanding About the Uses of Inertial Navigation Systems

Whether, you are traveling in a commercial aircraft, military transport or even a self-driving car, there are good chances that an inertial navigation system will have an important role to play in the journey from one point to the other. The contemporary inertial navigation systems are tremendously reliable and affordable for a number of emerging applications What Exactly is INS? An INS has an…

View On WordPress

#Inertial Navigation System Market#Inertial Navigation System Market Growth#Inertial Navigation System Market Outlook#Inertial Navigation System Market Research Report#Inertial Navigation System Market Share#Inertial Navigation System Market Size#Inertial Navigation System Market Trends

0 notes

Text

The global inertial navigation system market size reached USD 12.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.28% during 2025-2033.

0 notes

Text

Unmanned Ground Vehicles Market Growth Explained: From Battlefield to Industry

Unmanned Ground Vehicles Market Overview: Advancing the Frontier of Autonomous Land-Based Systems

The global Unmanned Ground Vehicles market is undergoing a paradigm shift, driven by transformative innovation in artificial intelligence, robotics, and sensor technologies. With an estimated valuation of USD 3.29 billion in 2023, the unmanned ground vehicles market is projected to expand to USD 6.35 billion by 2031, achieving a CAGR of 9.7% over the forecast period. This momentum stems from the increasing integration of UGVs into critical applications spanning defense, commercial industries, and scientific research.

As a cornerstone of modern automation, unmanned ground vehicles markets are redefining operational strategies in dynamic environments. By eliminating the need for onboard human operators, these systems enhance safety, efficiency, and scalability across a wide array of use cases. From autonomous logistics support in conflict zones to precision agriculture and mining, UGVs represent a versatile, mission-critical solution with expanding potential.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40520-global-unmanned-ground-vehicles-ugvs-market

UGV Types: Tailored Autonomy for Diverse Operational Needs

Teleoperated UGVs: Precision in Human-Controlled Operations

Teleoperated unmanned ground vehicles market’s serve vital roles in scenarios where human judgment and real-time control are indispensable. Predominantly employed by military and law enforcement agencies, these vehicles are integral to high-risk missions such as explosive ordnance disposal (EOD), urban reconnaissance, and search-and-rescue. Remote operability provides a protective buffer between operators and threats, while ensuring tactical accuracy in mission execution.

Autonomous UGVs: Revolutionizing Ground Operations

Autonomous UGVs epitomize the fusion of AI, machine learning, and edge computing. These platforms operate independently, leveraging LiDAR, GPS, stereo vision, and inertial navigation systems to map environments, detect obstacles, and make intelligent decisions without human intervention. Applications include:

Precision agriculture: Real-time crop health analysis, soil diagnostics, and yield monitoring.

Warehouse logistics: Automated material handling and inventory tracking.

Border patrol: Persistent perimeter surveillance with minimal resource expenditure.

Semi-Autonomous UGVs: Optimal Balance of Control and Independence

Semi-autonomous systems are ideal for hybrid missions requiring autonomous execution with operator intervention capabilities. These UGVs can follow predetermined paths, execute complex tasks, and pause for remote validation when encountering ambiguous conditions. Their versatility suits infrastructure inspection, disaster response, and automated delivery services, where adaptability is paramount.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40520-global-unmanned-ground-vehicles-ugvs-market

Technological Framework: Building Smarter Ground-Based Systems

Navigation Systems: Real-Time Terrain Mastery

Modern UGVs integrate layered navigation systems incorporating:

Global Navigation Satellite Systems (GNSS)

Inertial Navigation Units (INU)

Visual Odometry

Simultaneous Localization and Mapping (SLAM)

This multifaceted approach enables high-precision route planning and dynamic path correction, ensuring mission continuity across varying terrain types and environmental conditions.

Advanced Sensor Suites: The Sensory Backbone

UGVs depend on an array of sensors to interpret their environment. Core components include:

LiDAR: For three-dimensional spatial mapping.

Ultrasonic sensors: Obstacle detection at short ranges.

Thermal and infrared cameras: Night vision and heat signature tracking.

Multispectral imaging: Agricultural and environmental applications.

Together, these sensors empower unmanned ground vehicles market’s to perform with superior situational awareness and real-time decision-making.

Communication Systems: Seamless Command and Data Exchange

Effective UGV operation relies on uninterrupted connectivity. Communication architectures include:

RF (Radio Frequency) transmission for close-range operations.

Cellular (4G/5G) and satellite links for beyond-line-of-sight control.

Encrypted military-grade communication protocols to safeguard mission-critical data.

These systems ensure continuous dialogue between unmanned ground vehicles market’s and control centers, essential for high-stakes missions.

Artificial Intelligence (AI): Cognitive Autonomy

AI is the nucleus of next-generation UGV intelligence. From object recognition and predictive analytics to anomaly detection and mission adaptation, AI frameworks enable:

Behavioral learning for new terrain or threat patterns.

Collaborative swarm robotics where UGVs function as a coordinated unit.

Autonomous decision trees that trigger responses based on complex input variables.

Unmanned Ground Vehicles Market Segmentation by End User

Government and Military: Strategic Force Multipliers

UGVs are critical to defense modernization initiatives, delivering cost-effective force protection, logistical autonomy, and increased tactical reach. Applications include:

C-IED missions

Tactical ISR (Intelligence, Surveillance, Reconnaissance)

Autonomous convoy support

Hazardous materials (HAZMAT) handling

Private Sector: Driving Industrial Autonomy

Commercial adoption of unmanned ground vehicles market’s is accelerating, especially in:

Agriculture: Real-time agronomic monitoring and robotic farming.

Mining and construction: Autonomous excavation, transport, and safety inspection.

Retail and logistics: Last-mile delivery and warehouse automation.

These implementations reduce manual labor, enhance productivity, and streamline resource management.

Research Institutions: Accelerating Innovation

UGVs are central to robotics and AI research, with universities and R&D labs leveraging platforms to test:

Navigation algorithms

Sensor fusion models

Machine learning enhancements

Ethical frameworks for autonomous systems

Collaborative R&D across academia and industry fosters robust innovation and propels UGV capabilities forward.

Regional Unmanned Ground Vehicles Market Analysis

North America: The Epicenter of Defense-Grade UGV Development

Dominated by the United States Department of Defense and industry leaders such as Lockheed Martin and General Dynamics, North America is a pioneer in deploying and scaling UGV technologies. Investments in smart battlefield systems and border security continue to drive demand.

Europe: Dual-Use Innovations in Civil and Military Sectors

European nations, particularly Germany, France, and the UK, are integrating UGVs into both military and public safety operations. EU-funded initiatives are catalyzing development in automated policing, firefighting, and environmental monitoring.

Asia-Pacific: Emerging Powerhouse with Diverse Use Cases

Led by China, India, and South Korea, the Asia-Pacific region is rapidly advancing in agricultural robotics, smart cities, and military modernization. Government-backed programs and private innovation hubs are pushing domestic manufacturing and deployment of UGVs at scale.

Middle East and Africa: Strategic Adoption in Security and Infrastructure

UGVs are being integrated into border surveillance, oil and gas pipeline inspection, and urban safety across key regions such as the UAE, Saudi Arabia, and South Africa, where rugged environments and security risks necessitate unmanned solutions.

South America: Gradual Integration Across Agriculture and Mining

In countries like Brazil and Chile, unmanned ground vehicles market’s are enhancing resource extraction and precision agriculture. Regional investment in automation is expected to grow in parallel with infrastructure modernization efforts.

Key Companies Shaping the Unmanned Ground Vehicles Market Ecosystem

Northrop Grumman Corporation

General Dynamics Corporation

BAE Systems

QinetiQ Group PLC

Textron Inc.

Oshkosh Corporation

Milrem Robotics

Kongsberg Defence & Aerospace

Teledyne FLIR LLC

Lockheed Martin Corporation

These firms are advancing UGV design, AI integration, sensor modularity, and battlefield-grade resilience, ensuring readiness for both present and future operational challenges.

The forecasted growth is underpinned by:

Rising geopolitical tensions driving military investments

Expanding commercial interest in automation

Cross-sector AI integration and sensor improvements

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40520-global-unmanned-ground-vehicles-ugvs-market

Conclusion: The Evolution of Autonomous Ground Mobility

The global unmanned ground vehicles market stands at the intersection of robotics, AI, and real-world application. As technological maturity converges with widespread need for unmanned solutions, the role of UGVs will extend far beyond today’s use cases. Governments, corporations, and innovators must align strategically to harness the full potential of these systems.

With global investments accelerating and AI-driven capabilities reaching new thresholds, Unmanned Ground Vehicles are not just an industrial trend—they are the vanguard of future operational dominance.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

1 note

·

View note

Text

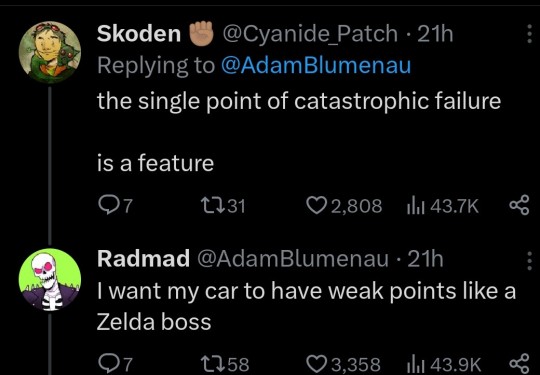

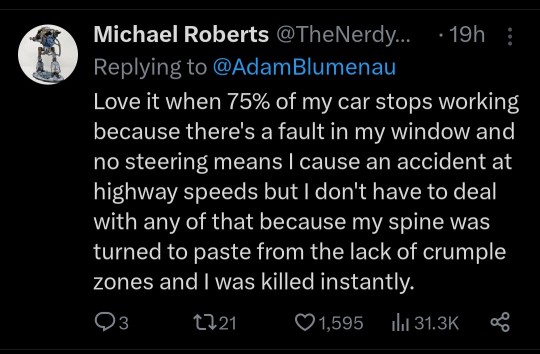

I was referencing the things put forth by OP, in order:

Huge wiring harnesses simplified: Cybertruck Guy and Radmad are both wrong, for different reasons.

Current industry standards don't have separate wires for each individual switch or control, either. They group several switches, lights, etc. that are nearby together, run them into a microcontroller, and put that controller on a vehicle bus. Currently that's usually a CAN (redundant, fault-tolerant) or LIN (neither, but much simpler) bus. This drastically simplifies wiring harnesses.

The main thing Tesla has done is change the DC voltage for that bus from 12 V to 48 V nominal. Since power is voltage times current, and wire thickness is dependent on current, this cuts about half the copper mass out of the power lines in the harness. The other (data) lines were already using smaller wires. The industry has been flirting with a 48V bus for around two decades by now; Tesla just went and did it and dealt with the engineering problems when they popped up. And this is a rare case where "they're a bunch of Silicon Valley nerds" may have helped: datacenters have been using 48V DC for in-rack power delivery for decades, so they had more familiarity with it than Detroit.

They've also adopted single-pair Ethernet (1000base-T1) for the high-speed entertainment data links. This technology has been in the industry since late 2016. It's usually integrated directly onto the custom ICs in ECUs. I remember another thread like this with a tweet where someone was complaining about the fragility of RJ-45 plugs and how that's disqualifying for a vehicle, and he's right, but single-pair Ethernet does not use those jacks; it's integrated into wiring harnesses with everything else.

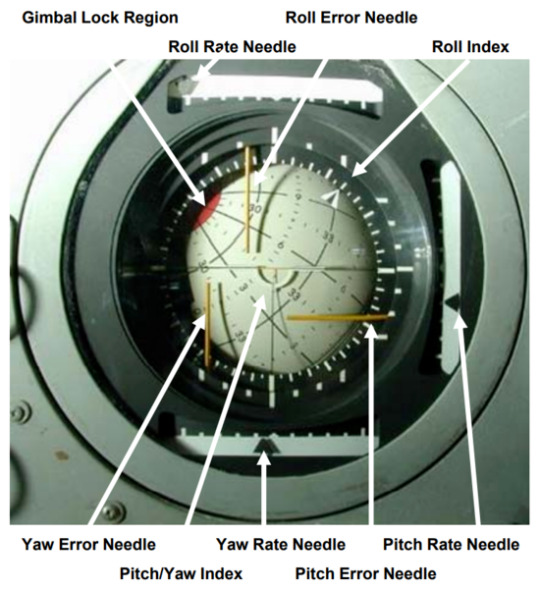

Astronauts laded on the moon with altitude markers hand etched on the window: That was a backup system dramatized by the Apollo 13 movie. They had an inertial navigation system, like aircraft do, as their primary navigation.

Oh, and it's attitude, not altitude. Very different concepts that folks should not mix up.

Can't get a rocket off the pad without blowing up: Neither could NASA their first few years. Meanwhile SpaceX had 98 successful orbital flights last year, and they can reuse their boosters (the record is 18 times). But that's way off topic.

Tesla Model Y broke: It's not news when non-Teslas lose power steering, apparently. And I've had cars that took many more than three appointments to fix. We can throw around anecdata all day.

Series wiring like Christmas lights: Come on, you've got no basis for that.

It's like the Titan sub: Sigh. Really?

Okay, now to the RDN link:

the vehicle’s angular design and stainless steel body could pose danger to other road users

Absolutely true. Also true of almost every luxury pickup truck on the market. One example:

I'm all for figuring out some kind of regulatory regime to rein this in. Or maybe a modification of liability rules and increased insurance coverage minimums.

“The big problem there is if they really make the skin of the vehicle very stiff by using thick stainless steel, then when people hit their heads on it, it’s going to cause more damage to them,”

True, but it's not that thick or stiff; the speaker was speculating. Other have pointed out that "we shot it with a Tommy gun" is a lousy test because the bullets are rather low velocity. If you watch the side impact crash test, you can see the side panels visibly flexing.

And right after that, an IIHS rep said, “IIHS hasn’t evaluated the Cybertruck. The discussions we’ve seen so far appear to be based on speculation. I would add that our experience with Tesla is that they aim for the highest safety ratings in IIHS tests. We have no reason to expect anything different with the Cybertruck.”

The biggest problem with Teslas, from insurance companies' perspectives, has been that airbag-deployed collisions tend to result in totaling the vehicle more often than in other cars. Occupant safety, on the other hand, seems to be better than average. We've seen people walk away from their Model 3s after they got T-boned by speeding pickups (60-ish MPH in a 30 zone). We know this from accident reconstruction and camera data.

There's a linked video in the article comparing the Tesla Cybertruck collision to a Dodge Ram 1500. There are several others like it on YouTube (I saw one that had six trucks in it, all synced up). They all have the same flaw: they're comparing different crash types. The Cybertruck is doing a full frontal crash, where you drive the vehicle into a solid, immovable wall, while the others are moderate overlap crashes, where the hood goes over the obstacle and only the left 1/3 of the vehicle is obstructed, so the engine can deflect to the sides instead of going into the firewall and then the passenger compartment. The Cybertruck, of course, does not have a large engine in that space; it's mostly cargo storage. And we can clearly see it crumpling and the front wheel moving outward instead of back into the passenger compartment, like practically all cars do now.

(Some folks like to point out how the rear wheel breaks away, too: this is expected because it's a steering wheel, since the Cybertruck has four-wheel steering, and uses the same suspension technology as the front, instead of connecting the rear wheels more directly to the rear axle like most vehicles. Not completely directly, though, like the Chevy Corvair's swing axles. In any case, kinetic energy breaking the rear wheels off like that is energy that isn't compromising the cabin.)

The article addresses the "lack" of crumple zones:

Samer Hamdar, a George Washington University auto safety professor, told Reuters that while a lack of crumple zones concerned him, there could be other factors that accounted for it. “There might be a possibility of shock-absorbent mechanism that will limit the fact that you have a limited crumple zone,” Hamdar said.

I'm not going to speculate about crumple zones beyond the above ("the cargo area collapses, taking some energy with it; we have to see if that's enough to call a crumple zone, but it's not nothing") until someone tears one down and documents it. But crumple zones aren't the only means of keeping kinetic energy out of the passengers.

The rest of the article goes back to concerns about pedestrian safety, which seem to be the main substantive concern, and is noted at the end of this video:

youtube

And again, pedestrian safety is an industry-wide problem. We need another Ralph Nader, but demonizing Tesla alone (god it's so easy, Elon is such an asshole) only gives cover to the rest of the industry. And none of the tweets in OP's post spoke of this.

42K notes

·

View notes

Text

Fibre Optic Gyroscope Market Drivers: Navigating Demand Across Aerospace & Defense

The fibre optic gyroscope market is experiencing robust growth due to its critical role in high-precision navigation systems. These gyroscopes, which use the interference of light to detect changes in orientation, have emerged as key components in aerospace, marine, robotics, and defense sectors. The ability to function without moving parts makes them more reliable and durable compared to mechanical gyroscopes. As global technological advancements continue to unfold, several market drivers are contributing to the expanded application and demand for fibre optic gyroscopes.

1. Rising Demand for Accurate Navigation in Defense Systems

One of the primary drivers for the fibre optic gyroscope market is its extensive use in defense and aerospace. Military operations increasingly require precise positioning and navigation, particularly in GPS-denied environments such as submarines, aircraft, or unmanned vehicles. Fibre optic gyroscopes are integrated into inertial navigation systems (INS) that operate independently of external signals. Their accuracy, reliability, and resistance to electromagnetic interference make them ideal for advanced weapon systems, guided missiles, and surveillance equipment.

With growing geopolitical tensions and increased investments in defense modernization programs, countries are focusing on strengthening their military capabilities. This has led to the rising adoption of next-generation gyroscopes across platforms such as tanks, drones, and fighter jets, significantly driving market demand.

2. Proliferation of Autonomous Vehicles and Robotics

The surge in autonomous vehicle development has introduced new opportunities for fibre optic gyroscope technology. Self-driving cars, drones, and unmanned underwater vehicles require precise motion sensing and orientation detection, especially in complex terrains and environments where GPS signals are weak or unavailable.

Fibre optic gyroscopes provide enhanced stability and control systems for these vehicles, enabling safer and more efficient navigation. Their high sensitivity and immunity to external disturbances allow them to be integrated seamlessly with AI-based systems and LiDAR technologies. As the demand for autonomous systems expands in both commercial and industrial sectors, the use of fibre optic gyroscopes is expected to see a parallel rise.

3. Advancements in Space Exploration and Satellite Technologies

The fibre optic gyroscope market is also benefitting from the resurgence in global space exploration initiatives. Satellites and spacecraft require highly reliable and precise attitude control systems, which are critical for orbit positioning and stabilization. Fibre optic gyroscopes offer the necessary durability and accuracy, making them a preferred choice for space agencies and private space enterprises.

With increasing satellite launches for communication, meteorology, and surveillance purposes, manufacturers are developing compact, lightweight gyroscopes with high performance to cater to this segment. The miniaturization of space-bound equipment further supports the adoption of advanced gyroscopic solutions.

4. Technological Advancements and Cost Reduction

Ongoing innovations in optical fiber technologies and laser sources have led to improvements in the performance of fibre optic gyroscopes. These advancements are enhancing sensitivity, reducing drift, and lowering manufacturing costs, thereby making the technology more accessible across new market verticals.

Manufacturers are increasingly developing smaller and cost-effective gyroscopes suitable for commercial UAVs, navigation systems in vehicles, and wearable technologies. The wider availability and improved scalability of such solutions are expected to drive adoption in consumer and industrial applications alike.

5. Integration with MEMS and Hybrid Sensor Technologies

Another significant driver is the integration of fibre optic gyroscopes with MEMS (Micro-Electro-Mechanical Systems) and other hybrid sensor technologies. While MEMS gyroscopes dominate the low-cost market, they often fall short in terms of precision and stability. Combining both technologies helps address performance gaps and broadens the use cases for navigation and inertial measurement systems.

This convergence allows for customized navigation solutions that are both cost-effective and precise, thereby opening doors in sectors such as agriculture, construction, mining, and even virtual reality.

6. Growing Investments in Infrastructure and Smart Systems

The global shift towards smart infrastructure and Industry 4.0 initiatives is also favoring the fibre optic gyroscope market. From intelligent transport systems to advanced surveying and mapping tools, the need for high-precision orientation data is crucial. These gyroscopes are being utilized in civil engineering applications like tunnel boring, dam construction, and seismic activity monitoring.

As urban planning evolves to incorporate smart mobility and automation, the demand for precision navigation tools like fibre optic gyroscopes will continue to rise.

Conclusion

Driven by defense needs, autonomous mobility, space exploration, and advancements in sensor technologies, the fibre optic gyroscope market is on a high-growth trajectory. These gyroscopes, known for their precision, reliability, and adaptability, are poised to revolutionize navigation and positioning applications across industries. As innovation continues and costs decline, their relevance and demand are expected to multiply, paving the way for expansive market development over the coming years.

0 notes

Text

Micro-Electro-Mechanical System (MEMS) Market Size Enabling Innovation Across Sectors with Miniature Marvels

The Micro-Electro-Mechanical System (MEMS) Market is redefining the future of electronic miniaturization, combining mechanical and electrical components at the microscale. From smartphones and wearables to automotive safety systems and industrial automation, MEMS technology is a silent yet powerful enabler of modern innovation.

Market Overview

MEMS devices integrate miniature sensors, actuators, and processors into compact systems that enhance performance, accuracy, and functionality. As industries pursue smarter, lighter, and more energy-efficient solutions, the demand for MEMS across applications like consumer electronics, medical devices, automotive safety, and industrial IoT has grown exponentially.

In recent years, advances in silicon micromachining and material science have accelerated the adoption of MEMS in complex environments, enabling real-time sensing, predictive maintenance, and enhanced human-machine interfaces. As AI, robotics, and edge computing evolve, MEMS are becoming critical building blocks for next-generation technologies.

Key Market Drivers

Proliferation of Smart Devices: MEMS sensors such as accelerometers, gyroscopes, and pressure sensors are embedded in smartphones, tablets, and wearables to support navigation, gaming, fitness tracking, and gesture recognition.

Automotive Innovation: The growing focus on autonomous driving and safety features (like airbag deployment, tire pressure monitoring, and lane detection) is driving demand for MEMS-based sensors in vehicles.

Healthcare & Biomedical Applications: MEMS are used in hearing aids, implantable devices, and lab-on-chip diagnostic platforms, making medical diagnostics more portable and less invasive.

Industrial Automation & IoT: In smart factories, MEMS sensors play a vital role in vibration monitoring, asset tracking, and environmental sensing to improve operational efficiency.

Market Segmentation

The MEMS market is segmented by:

Type: Sensors (Pressure, Inertial, Microphones), Actuators, Others

Material: Silicon, Polymers, Metal, Others

Application: Consumer Electronics, Automotive, Healthcare, Industrial, Aerospace & Defense, Telecommunications

Regional Outlook

North America: Leads in MEMS adoption across defense, medical devices, and consumer electronics, supported by a strong ecosystem of tech innovators and research institutions.

Asia-Pacific: Expected to witness the highest growth, driven by large-scale electronics manufacturing hubs in China, South Korea, and Japan, along with rising automotive production.

Europe: A strong contributor to industrial and automotive MEMS demand, with prominent players focused on R&D for high-precision sensors and actuators.

Leading Companies

Major players transforming the MEMS landscape include:

STMicroelectronics

Bosch Sensortec

Texas Instruments

Analog Devices Inc.

Broadcom Inc.

InvenSense (TDK)

NXP Semiconductors

Murata Manufacturing Co., Ltd.

These companies are investing in advanced packaging, miniaturization, and MEMS-on-CMOS integration to enhance product capabilities and cost-effectiveness.

Trending Report Highlights

Explore insights into adjacent and emerging markets shaping tech-driven industries:

Semiconductor Diode Market

Surveillance Digital Video Recorder Market

Transportation Lighting Market

Ultrasonic Gas Leak Detector Market

Wireless Flow Sensor Market

USB Flash Drives Market

Bakery Release Agents Market

Circular Waterproof Connector Market

Capacitor Bank Controllers Substation Automation Market

Robotic Waste Sorting Market

Electromagnetic Compatibility (EMC) Filtration Market

Flash Charger Adapter Market

PM2.5 Sensor Market

0 notes

Text

Triaxial MEMS Accelerometer Market - Latest Study with Future Growth, COVID-19 Analysis

Triaxial MEMS Accelerometer Market, Trends, Business Strategies 2025-2032

The global Triaxial MEMS Accelerometer Market was valued at 401 million in 2024 and is projected to reach US$ 492 million by 2032, at a CAGR of 3.0% during the forecast period.

Triaxial MEMS (Micro-Electro-Mechanical Systems) Accelerometers are advanced sensors that measure acceleration in three perpendicular axes (X, Y, and Z). These compact, high-precision devices enable accurate motion detection and vibration analysis across multiple industries. Their unique three-dimensional sensing capability makes them indispensable for applications requiring detailed movement tracking in complex environments.

The market growth is driven by increasing demand from automotive safety systems, wearable devices, and industrial IoT applications. The automotive sector accounts for approximately 35% of global demand, largely due to the mandatory inclusion of electronic stability control systems in vehicles. Meanwhile, consumer electronics adoption continues to rise, with smartphone manufacturers integrating these sensors for enhanced user experience features like screen rotation and gaming controls. Key players including STMicroelectronics and Bosch collectively hold over 60% of the market share, leveraging their semiconductor expertise to deliver increasingly miniaturized and energy-efficient solutions.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://semiconductorinsight.com/download-sample-report/?product_id=103302

Segment Analysis:

By Type

Capacitive Triaxial Accelerometer Segment Dominates Due to High Precision and Low Power Consumption

The market is segmented based on type into:

Capacitive Triaxial Accelerometer

Seismic Triaxial Accelerometer

By Application

Automotive Sector Leads Owing to Increasing Adoption in Advanced Driver Assistance Systems

The market is segmented based on application into:

Automotive

Consumer Electronics

Railway

Others

By Sensitivity Range

High-Range Sensors Gain Traction for Industrial Vibration Monitoring Applications

The market is segmented by sensitivity range into:

Low Range (<10g)

Medium Range (10g-100g)

High Range (>100g)

By End-User Industry

Industrial Automation Shows Significant Growth Potential Due to Industry 4.0 Adoption

The market is segmented by end-user industry into:

Automotive

Aerospace & Defense

Industrial Automation

Healthcare

Consumer Electronics

Regional Analysis: Triaxial MEMS Accelerometer Market

North America North America dominates the Triaxial MEMS Accelerometer market, accounting for approximately 35% of global revenue in 2024. The region’s strong position stems from robust demand in automotive safety systems and IoT applications. Major automotive OEMs integrate these sensors extensively for electronic stability control and rollover detection, driving growth. The U.S. remains at the forefront due to substantial defense spending on inertial navigation systems and strong R&D investments from key players like Analog Devices and STMicroelectronics. However, supply chain challenges and trade restrictions have impacted sensor imports, prompting localized manufacturing initiatives.

Europe Europe’s market thrives on stringent industrial automation standards and growing adoption in aerospace applications. Germany leads with its thriving automotive sector implementing advanced driver-assistance systems (ADAS), while France sees increased deployment in structural health monitoring for smart infrastructure projects. The EU’s focus on Industry 4.0 technologies is accelerating demand for industrial-grade MEMS accelerometers. Challenges include compliance with REACH regulations for sensor materials and competition from Asian manufacturers. Recent developments include collaborative R&D projects between academic institutions and sensor manufacturers to develop next-generation inertial measurement units.

Asia-Pacific As the fastest-growing regional market (projected 4.2% CAGR through 2032), Asia-Pacific benefits from massive consumer electronics production in China and automotive manufacturing expansion across Southeast Asia. China alone contributes over 60% of regional demand, driven by smartphone manufacturers and industrial robot production. India emerges as a key growth market with increasing defense and railway infrastructure modernization projects. While cost sensitivity remains a challenge, local manufacturers are developing competitively priced alternatives to Western and Japanese brands. The region also sees rising adoption in wearable health devices, particularly in South Korea and Japan.

South America Market growth in South America remains constrained by economic instability, though Brazil shows promise with its burgeoning automotive aftermarket and mining equipment sectors. Most demand stems from industrial vibration monitoring applications in oil and gas operations. Import dependency on sensors remains high (over 80%) due to limited local manufacturing capabilities. Recent trade agreements have improved access to Chinese and European sensor technologies, but adoption rates lag behind global averages. Infrastructure development projects in Argentina and Chile present growth opportunities for structural monitoring applications.

Middle East & Africa This region represents an emerging market with growth concentrated in oil-rich Gulf states. The UAE and Saudi Arabia lead in adopting MEMS sensors for industrial equipment condition monitoring in the energy sector. Africa’s market remains nascent, though mining operations in South Africa and infrastructure projects in Nigeria show increasing demand. Investment barriers include lack of technical expertise and high import duties. Recent partnerships between regional distributors and global manufacturers aim to improve market access. The Israel-based sensor startup ecosystem shows particular promise, with several companies developing innovative MEMS applications for defense and medical markets.

List of Key Triaxial MEMS Accelerometer Companies Profiled

STMicroelectronics (Switzerland)

Analog Devices, Inc. (U.S.)

Robert Bosch GmbH (Germany)

NXP Semiconductors (Netherlands)

Jewell Instruments (U.S.)

Dytran Instruments, Inc. (U.S.)

Kistler Group (Switzerland)

Dewesoft (Slovenia)

SkyMEMS Technology (China)

The automotive industry’s rapid integration of advanced driver assistance systems (ADAS) and electronic stability control is creating substantial demand for triaxial MEMS accelerometers. These sensors provide critical motion data for vehicle dynamics monitoring, with global ADAS market penetration exceeding 60% in new premium vehicles. Regulatory mandates for crash detection systems in major markets have further accelerated adoption – the European Union now requires emergency call (eCall) systems in all new vehicles, which utilize triaxial accelerometers for collision detection. Leading manufacturers are responding with automotive-grade sensors featuring improved shock resistance and operating temperature ranges up to 125°C.

Consumer electronics represents the fastest growing application segment for triaxial MEMS accelerometers, driven by the Internet of Things revolution. The global wearable device market is projected to exceed 1 billion annual shipments by 2026, with virtually all smartwatches and fitness trackers incorporating these sensors for activity tracking and gesture recognition. Smartphone manufacturers continue to push innovation boundaries – Apple’s latest iPhone utilizes a custom-designed high-g accelerometer capable of detecting crashes with 256G measurement range. This consumer demand is driving investments in miniaturization, with leading vendors now offering 3mm × 3mm × 1mm surface-mount packages that enable sleeker device designs.

Industry 4.0 initiatives are creating new opportunities for triaxial MEMS accelerometers in predictive maintenance and equipment monitoring. Manufacturing facilities increasingly deploy wireless sensor networks with MEMS-based vibration monitoring systems that can detect machinery faults weeks before failure. The global industrial sensors market is expected to grow at 8% CAGR through 2030, with MEMS devices capturing larger shares due to their cost-effectiveness. Recent advancements in MEMS fabrication have improved measurement stability to ±0.5% over temperature variations, making them viable replacements for traditional piezoelectric sensors in many industrial applications.

Civil infrastructure monitoring represents a high-growth frontier for triaxial MEMS accelerometers, with smart city initiatives globally driving demand. Wireless sensor networks featuring MEMS devices can monitor bridge vibrations, building sway, and pipeline integrity at a fraction of traditional system costs. The global structural health monitoring market is projected to grow at 16% CAGR through 2030, creating substantial opportunities for ruggedized MEMS solutions. Recent deployments in earthquake-prone regions demonstrate MEMS sensors achieving ±0.1% FS accuracy levels sufficient for many structural applications.

The integration of machine learning with MEMS-based vibration analysis is unlocking new predictive maintenance capabilities. Modern systems can now identify specific fault signatures in rotating equipment with over 95% accuracy using only triaxial accelerometer data. This technology shift is driving replacement of legacy monitoring systems across oil & gas, mining, and power generation industries. MEMS manufacturers collaborating with AI software startups stand to capture significant value in this high-margin market segment.

The healthcare sector presents untapped potential for specialized triaxial MEMS accelerometers capable of capturing subtle physiological movements. Emerging applications include Parkinson’s disease symptom monitoring, sleep apnea detection, and rehabilitation progress tracking. Medical-grade requirements for biocompatibility and long-term stability are pushing MEMS developers to innovate in materials science and low-power design. With the remote patient monitoring market expected to exceed $175 billion by 2030, medical applications could become the next major growth vector for high-performance accelerometers.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=103302

Key Questions Answered by the Triaxial MEMS Accelerometer Market Report:

What is the current market size of Global Triaxial MEMS Accelerometer Market?

Which key companies operate in Global Triaxial MEMS Accelerometer Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Browse More Reports:

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

LIDAR Mapping Trends and Innovations in the USA

The U.S. LIDAR market is experiencing significant growth, driven by the increasing demand for high precision mapping and surveying in industries such as construction, agriculture, and transportation. Advancements in LIDAR technology, including improved accuracy and reduced costs, have broadened its accessibility, facilitating its integration into various applications. Notably, the integration of LIDAR with drones and autonomous vehicles is propelling market expansion. Here’s a look at the top trends and innovations shaping the future of this tech.

Miniaturization and Cost Reduction

Historically, LIDAR systems were bulky and expensive, limiting their use to large scale industrial or government projects. However, a recent wave of innovation has seen the miniaturization of LIDAR sensors, making them more affordable and compact.

Advancements in Accuracy and Accessibility

Advancements in LIDAR technology, such as improved accuracy and reduced costs, have made it more accessible for a wide range of applications. These technological leaps mean that industries from real estate to agriculture can now tap into the precision of LIDAR without a massive investment. Moreover, LIDAR integration with drones and autonomous vehicles is driving market expansion, unlocking new possibilities in automation, logistics, and geospatial intelligence.

Drone-Based LIDAR Mapping

The integration of LIDAR with UAVs (unmanned aerial vehicles) is revolutionizing how we collect geospatial data. In forestry, agriculture, construction, and disaster response, drone-based LIDAR offers rapid, high-resolution mapping capabilities at a fraction of the time and cost of traditional methods. The FAA’s relaxed drone regulations in the USA have further fueled this growth, making airborne LIDAR mapping more accessible to smaller firms and public agencies.

AI-Powered LIDAR Data Processing

Artificial Intelligence and Machine Learning are now being used to enhance how we interpret LIDAR datasets. Advanced algorithms can automatically identify objects, classify land use, detect anomalies, and even predict changes over time. This trend is especially evident in smart city planning, where AI-driven LIDAR analysis is helping to monitor infrastructure, traffic flow, and urban growth with unprecedented accuracy.

LIDAR in Autonomous Navigation

Autonomous vehicles rely heavily on LIDAR to perceive their environment in real time. Tesla may be going all in on camera based vision, but many U.S. automakers and robotics startups continue to bet big on LIDAR as the foundation for safer self-driving systems. Innovations in sensor range, resolution, and integration with GPS and IMUs (Inertial Measurement Units) are making AVs more reliable and scalable.

Environmental and Climate Applications

With the increasing urgency around climate change, LIDAR is playing a key role in environmental monitoring and modeling. In the USA, researchers are using LIDAR to measure carbon stored in forests, track coastal erosion, and monitor glacier changes. The precision and frequency of LIDAR measurements make it indispensable for building accurate climate models and formulating data-driven environmental policies.

Integration with Other Geospatial Technologies

Another key trend is the merging of LIDAR with other mapping technologies like photogrammetry, satellite imagery, and GPS. This fusion enables multi-dimensional modeling and deeper insights, especially in complex projects such as underground utility mapping, urban digital twins, and construction progress tracking.

LIDAR mapping Services in USA is entering a golden age. As technology becomes more affordable, mobile, and intelligent, its use cases will continue to expand across sectors. From urban planners and engineers to conservationists and technologists, professionals are embracing LIDAR as an indispensable tool for spatial decision making.

Sven Carto, leading provider in the field is at the forefront of this transformation, delivering best solutions that empower industries to make smarter, data-driven decisions. Whether you’re a startup exploring drone surveying or a government agency mapping floodplains, staying ahead of these trends will be critical to harnessing the full power of LIDAR in 2025 and beyond.

0 notes

Text

RLG Technology to Drive $1.1 Billion Market by 2031, Fueled by Precision Navigation Needs

The global Ring Laser Gyroscope (RLG) market is poised for substantial growth over the next decade, driven by the burgeoning demand for advanced navigation systems across aerospace, defense, and consumer electronics sectors. Valued at US$ 796.8 million in 2022, the market is forecast to expand at a Compound Annual Growth Rate (CAGR) of 3.6%, reaching an estimated US$ 1.1 billion by 2031. The advancements in both technology and demand for more precise motion sensing systems are expected to shape the trajectory of this industry, with various stakeholders—including manufacturers, developers, and end-users—focusing on high-precision and reliable solutions.

Market Overview

Ring Laser Gyroscopes (RLGs) are vital components in the world of precision navigation and stabilization. These gyroscopes rely on optical principles and the interference of laser beams to measure angular velocity with extraordinary sensitivity and accuracy. Their role in inertial measurement units (IMUs), inertial navigation systems (INS), and various military applications is undeniable. They are used in aerospace, defense, and consumer electronics for applications that require accurate positioning and orientation data, such as autopilots, satellite guidance, and augmented reality (AR) systems.

In the ring laser gyroscope market, the adoption of cutting-edge technologies is paramount, with key players like Honeywell International Inc., Mitsubishi Precision Co., Ltd., and Northrop Grumman leading the way. The market is being propelled by a surge in aviation activity, the rise of consumer electronics, and technological advancements in precision navigation systems, including the integration of AI and machine learning to enhance gyroscope performance.

Market Drivers and Trends

The Ring Laser Gyroscope market is influenced by several drivers and trends:

Rapid Growth in the Aviation Sector The aviation industry continues to see exponential growth, with a marked increase in global air traffic. According to the International Air Transport Association (IATA), air traffic surged by 122.2% in September 2022 compared to the previous year. As more aircraft are deployed globally, there is a heightened demand for advanced navigation systems equipped with RLGs, which play a critical role in autopilot and flight control systems. Ring laser gyroscopes, known for their high reliability, are essential for maintaining accurate orientation and ensuring smooth flight operations, particularly in GPS-denied environments.

Consumer Electronics Expansion The consumer electronics sector is witnessing an unprecedented boom, driven by increased online entertainment consumption, gaming, and the growing trend of smart devices. RLGs are integral to devices such as smartphones, tablets, and smart televisions, which rely on precise motion sensing for applications like virtual navigation, augmented reality (AR), and 360-degree video processing. As demand for such devices soars, the market for ring laser gyroscopes is expanding, offering innovative navigation solutions.

Technological Advancements in Navigation Systems As the need for more advanced, accurate, and resilient navigation systems grows, manufacturers are embracing new technologies. RLGs are now being integrated with artificial intelligence (AI) and machine learning (ML) algorithms, ensuring real-time performance optimizations that were once unimaginable. This technological shift not only improves the gyroscope's efficiency but also allows for predictive calibration and self-correction during operation.

Key Players and Industry Leaders

Ericco Inertial System

Heppell Photonics

Honeywell International Inc.

Kearfott Corporation

Mitsubishi Precision Co., Ltd.

Northrop Grumman

Optics Blazers AG

Safran Electronics & Defense SAS

Teledyne CDL

Movella Inc.

Recent Developments in the Market

Honeywell’s eTALIN II 6000 (August 2023) Honeywell introduced its eTALIN II 6000 system, a groundbreaking development aimed at enhancing the performance of combat vehicles in GPS-denied environments. The product leverages advanced RLG technology, accelerometers, and embedded GPS to deliver cutting-edge off-road land navigation.

STMicroelectronics’ ASM330LHHX (May 2022) STMicroelectronics developed a compact inertial measurement unit (IMU) featuring a 3-axis accelerometer and 3-axis gyroscope, designed for smart driving and higher automation levels in automotive systems. This IMU incorporates machine learning (ML) algorithms to optimize system performance.

Market New Opportunities and Challenges

The market presents a host of opportunities for growth. The increasing reliance on precision navigation systems in both civil and military sectors is driving a surge in demand for RLG-based solutions. Innovations in the space industry, particularly with satellite positioning systems and spacecraft navigation, offer immense growth potential for ring laser gyroscopes.

However, challenges remain, such as high production costs, especially in the manufacturing of high-precision RLG systems, and the need for continuous research and development to stay ahead of technological trends. Moreover, the market faces intense competition, which necessitates constant innovation to meet the evolving demands of industries like aerospace, defense, and consumer electronics.

Market Segmentation

The global Ring Laser Gyroscope market is segmented as follows:

Number of Axes: Single Axis, Multi-Axis

Applications: Platform Stabilization, Missile Navigation, Aeronautics Navigation, Submarine Navigation

End-User:

Commercial: Air-based (Aircraft, Drones), Marine-based

Defense: Air-based (Aircraft, Drones), Marine-based, Spacecraft

Regions: North America, Europe, Asia Pacific, South America, Middle East & Africa

Regional Insights

North America holds the largest share of the ring laser gyroscope market. The rapid adoption of RLGs in military applications and the significant investments in the aerospace and defense sectors are major factors fueling market growth in this region. The United States, in particular, is witnessing a surge in tourism and air travel, which is driving demand for advanced navigation systems in commercial aircraft. With a projected increase in air traffic and defense spending, North America is set to maintain its dominance throughout the forecast period.

Why Buy This Report?

The Ring Laser Gyroscope Market report offers critical insights into the current and future market dynamics, providing a comprehensive analysis of the growth drivers, emerging opportunities, challenges, and technological advancements shaping the industry. Key stakeholders in aerospace, defense, and consumer electronics can leverage this report to make informed decisions, optimize their business strategies, and stay ahead of the competition in this fast-evolving market.

Additionally, this report includes detailed company profiles, market segmentation analysis, and a regional breakdown, allowing businesses to identify new growth areas, expand their product portfolios, and assess potential risks and opportunities in various geographical regions.

0 notes

Text

The global inertial navigation system market size reached US$ 11.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 18.9 Billion by 2032, exhibiting a growth rate (CAGR) of 5.6% during 2024-2032.

0 notes

Text

The global Inertial Navigation Systems (INS) industry is set to reach $13.5 billion by 2029, up from $10.3 billion in 2024, growing at a CAGR of 5.6%.

0 notes

Text

Is the MEMS Accelerometer & Gyroscope Market Set to Skyrocket? Here's What You Need to Know

Introduction

The global MEMS Accelerometer and Gyroscope Market is experiencing rapid growth, largely driven by the increasing demand for motion-sensing technology across various high-tech industries. This growth is evident in sectors such as consumer electronics, automotive, aerospace, and healthcare. MEMS sensors, which include accelerometers, gyroscopes, and Inertial Measurement Units (IMUs), are integral to technologies requiring precise motion detection, navigation, and stability control.

As we move further into the 21st century, the adoption of MEMS accelerometers and gyroscopes in advanced devices such as smartphones, wearables, autonomous vehicles, and drones is expanding the market's reach. From a technological perspective, MEMS sensors have become more efficient, smaller in size, and significantly more power-efficient, which contributes to the growth of this market.

The MEMS accelerometer and gyroscope market is projected to grow at a robust compound annual growth rate (CAGR) of 10.5% from 2025 to 2032, a clear indication of the potential and importance of MEMS technology across a wide range of industries.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40601-global-mems-accelerometer-and-gyroscope-market

Market Dynamics: Forces Shaping the MEMS Accelerometer and Gyroscope Market

Increasing Demand Across Key Industries

The primary driver of the MEMS accelerometer and gyroscope market's rapid expansion is the increasing demand for motion-sensing technology across a variety of industries:

Consumer Electronics: MEMS sensors are widely used in smartphones, wearables, and gaming devices. The increasing reliance on touch-based interfaces, augmented reality (AR), and virtual reality (VR) applications drives the demand for high-precision motion sensors.

Automotive: The automotive industry is another major contributor to the growth of MEMS accelerometers and gyroscopes. These sensors are essential in advanced driver-assistance systems (ADAS), autonomous vehicles, and stability control systems, where accurate motion detection is crucial.

Aerospace: In aerospace applications, MEMS sensors are used in navigation systems, stability control, and flight systems for precision and reliability.

Healthcare: The healthcare industry has also seen an uptick in MEMS adoption, particularly in medical devices such as wearable health trackers, implantable devices, and diagnostic equipment.

The continued innovation in these sectors, alongside the integration of MEMS sensors into next-generation devices, will drive sustained growth in the coming years.

Get up to 30% Discount: https://www.statsandresearch.com/check-discount/40601-global-mems-accelerometer-and-gyroscope-market

Technological Advancements

Recent advancements in MEMS technology have significantly enhanced the functionality, miniaturization, and energy efficiency of sensors. The trend towards sensor fusion—integrating accelerometers, gyroscopes, and magnetometers into single units—has led to more versatile motion sensors. These sensors are capable of providing highly accurate real-time data processing for a variety of complex applications, including industrial automation, robotics, and AR/VR experiences.

Moreover, the growing demand for low-power MEMS sensors to support energy-efficient applications across industries such as wearables and automotive systems has spurred further innovation.

Rise of Emerging Technologies

The MEMS accelerometer and gyroscope market is also benefiting from the rise of emerging technologies, notably:

Internet of Things (IoT): MEMS sensors are key enablers in the development of smart devices and systems that form the backbone of IoT networks. Their compact size and low power consumption make them ideal for IoT devices in homes, factories, and healthcare settings.

Artificial Intelligence (AI): AI-powered systems require high-performance sensors that enable precise motion tracking, which is where MEMS technology plays a crucial role.

Autonomous Systems: Drones, autonomous vehicles, and robots rely heavily on MEMS sensors for navigation, motion detection, and flight control.

These emerging technologies continue to open up new applications for MEMS sensors and will drive future growth.

Challenges in the MEMS Accelerometer and Gyroscope Market

Despite the promising outlook, there are several challenges that could hinder the growth of the MEMS accelerometer and gyroscope market:

High Manufacturing Costs: MEMS technology can be expensive to produce due to the complexity of the fabrication process. This could make it challenging for smaller companies or developing markets to afford high-precision MEMS sensors.

Supply Chain Disruptions: The MEMS industry relies heavily on specific semiconductor materials and components, which makes it vulnerable to supply chain disruptions, especially in a global market where raw material prices fluctuate.

Calibration Complexity: High-precision MEMS sensors require intricate calibration processes, which can be resource-intensive and time-consuming.

However, technological advancements and efforts to streamline production and calibration are expected to mitigate these challenges over time.

MEMS Accelerometer and Gyroscope Market Segmentation: Detailed Breakdown

By Product Type

The MEMS accelerometer and gyroscope market can be segmented into several product categories, each contributing to the overall growth of the market:

MEMS Accelerometers: MEMS accelerometers hold the largest share of the market in 2024, valued at approximately USD 2.5 billion. These sensors are crucial in applications like automotive stability control, consumer electronics, and industrial automation. Their high accuracy, compact size, and integration capabilities make them indispensable in modern motion-sensing technologies.

MEMS Gyroscopes: MEMS gyroscopes, which measure rotational movement, are used in applications requiring precise orientation control, such as drones, robotics, and wearables.

MEMS Inertial Measurement Units (IMUs): IMUs, which integrate accelerometers and gyroscopes, are primarily used in more complex systems like drones, aerospace navigation, and robotics. They offer the advantage of multi-dimensional sensing, allowing for more accurate motion tracking in dynamic environments.

By Application

The MEMS accelerometer and gyroscope market can also be segmented by application, with several industries showing significant demand for motion-sensing technologies:

Consumer Electronics: As the leading application segment, consumer electronics accounted for over USD 3.0 billion in 2024. This includes smartphones, wearables, and gaming devices, all of which require high-precision motion sensors for features like touch detection, gaming controls, and fitness tracking.

Automotive: The automotive industry is increasingly adopting MEMS sensors, particularly in autonomous vehicles, ADAS, and vehicle navigation systems. With the growing focus on safety and self-driving technology, the automotive segment is expected to grow at a CAGR of 11.4% through 2032.

Aerospace & Defence: MEMS accelerometers and gyroscopes are used extensively in navigation systems for aircraft and spacecraft, offering enhanced accuracy in flight control and positioning.

By Region

The MEMS accelerometer and gyroscope market is geographically diverse, with significant regional growth patterns:

Asia-Pacific: Expected to dominate the MEMS market by 2024, Asia-Pacific's growth is largely attributed to the booming consumer electronics sector in countries like China, Japan, and South Korea. The region is projected to grow at the highest CAGR of 12.0% through 2032.

North America and Europe: Both regions show steady demand, driven by automotive, aerospace, and healthcare applications. The U.S. and European countries are significant players in the MEMS market, with robust research and development activities.

South America and Middle East: These regions are expected to experience slower growth but will see increasing adoption of MEMS technology as industrial automation and IoT applications expand.

Competitive Landscape: Key Players and Strategic Insights

The MEMS accelerometer and gyroscope market is highly competitive, with several key players pushing the boundaries of innovation to capture market share. These companies focus on advancing sensor accuracy, power efficiency, and miniaturization. Notable companies in the market include:

Robert Bosch GmbH: A leader in MEMS sensor technology, Bosch offers a wide range of accelerometers and gyroscopes for automotive, consumer electronics, and industrial applications.

STMicroelectronics N.V.: Known for its innovations in MEMS sensors, STMicroelectronics provides highly integrated solutions that cater to automotive, consumer electronics, and industrial markets.

Analog Devices: Specializes in high-precision MEMS sensors for a variety of applications, including aerospace, automotive, and healthcare.

Honeywell: A key player in the consumer electronics sector, Honeywell offers next-generation MEMS gyroscopes for applications in AR/VR and wearables.

These companies are continuously investing in R&D to introduce more cost-effective and high-performance MEMS sensors, positioning themselves for long-term growth in a rapidly evolving market.

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40601-global-mems-accelerometer-and-gyroscope-market

Conclusion

The MEMS accelerometer and gyroscope market is on a strong growth trajectory, driven by the increasing demand for motion-sensing technologies in various high-tech industries. With continued innovation in miniaturization, sensor fusion, and power efficiency, MEMS sensors are poised to play a crucial role in shaping the future of consumer electronics, automotive systems, healthcare devices, and beyond.

The increasing integration of MEMS sensors in emerging technologies such as AI, IoT, and autonomous systems ensures that this market will continue to experience robust growth through the next decade. As key players innovate and expand their offerings, the MEMS accelerometer and gyroscope market will remain a key enabler of technological advancement and digital transformation across industries.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

#MEMS Accelerometer and Gyroscope Market#MEMS sensors#accelerometer market#gyroscope market#MEMS technology#market trends#sensor market#MEMS accelerometer#MEMS gyroscope#sensor industry#wearable sensors#automotive sensors#MEMS applications#MEMS devices#motion sensors#sensor technology#market analysis#MEMS sensor market growth#IoT sensors#MEMS sensor applications#MEMS market forecast#MEMS sensor suppliers#MEMS accelerometer applications#MEMS gyroscope applications#MEMS market demand#MEMS in automotive#MEMS in wearable devices#MEMS market research

1 note

·

View note

Text

0 notes