#Inflatables in Bakersfield

Explore tagged Tumblr posts

Text

Toddler inflatables Bakersfield | Blow up Slides in Bakersfield

We offer the highest quality inflatables and affordable Jumpers for rent. Best choice for quality Toddler inflatables and Blow Slides in Bakersfield

0 notes

Text

Foreclosure filings rose sharply in Q1 2025 – up 11 percent quarterly – with March alone seeing 35,890 filings. This reverses three straight quarters of decline, signaling renewed financial distress among homeowners.

High mortgage rates (above 6.5 percent) and inflation are squeezing homeowners, especially those with variable-rate loans. Refinancing is unaffordable for many who secured mortgages during low-rate periods.

Delaware, Illinois and Nevada had the highest foreclosure rates, while cities like Chicago, New York and Houston saw the most filings. Columbia (SC), Lakeland (FL), and Bakersfield (CA) topped metro-area foreclosure rates.

Federal policies, like extended relief for hurricane-affected FHA borrowers and the end of a veteran-assistance program, added complexity. Foreclosure timelines shortened to 671 days on average, with stark state variations (e.g., Louisiana's more than 2,000 days vs. Texas' roughly 100 days).

9 notes

·

View notes

Text

It sounds weird to say that carrots are having a moment, but social media has catapulted the humble root to a status resembling stardom. Anecdotal evidence suggests online carrot recipes trail in popularity only those for potatoes and brussels sprouts among vegetables, and Pinterest numbers support that: recipe searches for honey balsamic carrots on the platform are up 75% this year, while queries for roasted parmesan carrots skyrocketed 700%. Fresh carrots are an expanding $1.4 billion U.S. market, andAmericans are expected to consume 100 million pounds this Thanksgiving — roughly five ounces for every human being in the country.

At least 60% of those carrots are produced by just two companies, Bolthouse and Grimmway, both of which were acquired by buyout firms, in 2019 and 2020 respectively.

“There’s only two sources,” Adam Waglay, cofounder and co-CEO of Bolthouse owner Butterfly Equity, told Forbes. “We joke around — it’s kind of like the OPEC of carrots.”

Cartels are less funny for neighbors of the two producers in Southern California’s Cuyama Valley, who are calling for a boycott of Big Carrot over the amount of water their farms are sucking out of the ground. In 2022, Bolthouse and Grimmway together were responsible for 67%, or 9.6 billion gallons, of the area’s total water use. Local residents said they expect their wells to dry up if the carrot farms continue to use as much water as they do — Grimmway CEO Jeff Huckaby told Forbes his company has already reduced the amount of acreage it farms — and the two carrot producers have joined forces to defend their thirst in court. That worries local residents, who say they lack the deep pockets needed to wage a prolonged legal battle.

Cattle rancher Jake Furstenfeld places a boycott sign in New Cuyama, California in September.Marcio Jose Sanchez/AP Photo

Water fights like this can take years to resolve, and often become a way to delay cutbacks, Karrigan Bork, a professor at the University of California, Davis School of Law, told Forbes. “You see these rights again and again get trimmed back by the state or by courts,” Bork said. “In some cases, your savvy water users recognize that, and for them, just delaying that trimming back is a success, and the longer they can do that, the happier they will be.”

Price Concerns

Waglay uses the word “duopoly” to describe the two companies. Such market consolidationoften leads to higher prices, and the government has for years used increased consumer prices as an indicator of possible unfair competition. The U.S. Department of Agriculture declined to comment on any antitrust issues.

Since 2019, carrot producer prices have increased more than 40%, according to the U.S. Bureau of Labor Statistics, outpacing the 22% inflation in the U.S. economy.

Carrot Top

Prices are near their highest since 2019, when Bolthouse was acquired by a private equity firm. Grimmway changed hands a year later.

Huckaby, the Grimmway CEO, told Forbes that the costs of a number of inputs have gone up, too. Packaging, fertilizer and fuel prices have all risen at a higher rate than inflation, he said, and California’s minimum wage has increased 27% since 2018. At $15 an hour, it’s the second-highest in the country.

Still, the carrot business has been a lucrative play. Total U.S. production value has increased 34% since 2019.

Duopoly Origins

Bolthouse, founded in 1915 in Grant, Michigan, started selling carrots packed in cellophane bags in 1959. In the 1970s and 1980s, production was centered around Bakersfield, California. After Bakersfield farmer Mike Yurosek invented “baby carrots” in 1986, consumption soared.

In the 1990s, Bolthouse ballooned into the largest carrot operator, reportedly shipping some 80% of California’s carrots. It amounted to half the U.S. carrot market in 1992, followed by Grimmway, founded by brothers Bob and Rod Grimm in 1969, and Yurosek’s family-owned outfit. Grimmway eventually bought out Mike Yurosek & Son. The carrot crop is now the tenth-biggest commodity in California, where one-third of America’s vegetables are grown.

Today, the industry’s growth could be limited by dwindling water supplies in the drought-prone Cuyama Valley, 150 miles northwest of Los Angeles and 90 miles west of Bakersfield. But the companies behind the duopoly aren’t giving up without a fight.

Both businesses, which own their own manufacturing, are hitting a similar point in their ownership lifecycles. Private equity-backed businesses typically change hands every three to five years. In 2019, Butterfly Equity acquired Bolthouse from publicly traded Campbell Soup for $510 million in cash. A year later, Grimmway was acquired by Teays River Investments, a Zionsville, Indiana-based investment firm, for an undisclosed amount. That means both businesses are in the sweet spot of what most investors consider the hot time to unload an investment or take it public.

Los Angeles, California-based Butterfly has sold only one of its investments, an organic protein company called Orgain, acquired by Nestle Health Science in February 2022 after two years of Butterfly ownership. Grimmway is Teays River’s only current investment after exiting two others in 2019 and 2013. Teays River held those investments for eight years and one year, respectively.

Grimmway’s owner, which according to Pitchbook has $1.38 billion in assets under management, is backed by pension funds including the public employees of the states of Maine and Oregon, Texas teachers, the New York state Teamsters union and the Producer-Writers Guild of America.

Butterfly Equity, by comparison, has $4 billion in assets under management and is backed byexecutives of private equity giant KKR, where Waglay worked for eight years. The firm has done eight deals in the eight years since it launched. Butterfly also owns America’s largest striped bass farm, the largest free-range egg company, an avocado oil maker that controls 60% of the market, and a large whey protein manufacturer.

Water Rights

Bolthouse and Grimmway started working with each other in a way that competitors rarely do. They filed a lawsuit together in 2021 in Kern County, California to ask a court to decide how to split up the water of New Cuyama, where they farm.

What’s happening in Cuyama Valley is an example of the kinds of water fights that are surfacing across California. Farmers of a variety of crops there have depended on irrigation for decades. Those years of pumping water and spraying it over crops through sprinklers or complex drip irrigation systems have had drastic implications, including threats of land sinking, a receding water table that makes it tougher to dig wells and the threat of some of them drying out.

That’s why water use around New Cuyama could get reduced by two-thirds over the next two decades. To bring the region back to a sustainable level by 2040, water cuts of 5% started this year and will continue each year going forward. The Cuyama basin currently has an annual water deficit of more than 8 billion gallons, and much of the area’s carrot farmland may have to be taken out of production. Some experts say Bolthouse and Grimmway would have to reduce their water consumption by about double what the city of Santa Barbara, California uses annually.

But water-efficient sprinklers can only save so much. The carrot companies’ lawsuit has forced area farmers, ranchers, residents and even the area’s public school to rack up legal bills. In response, a coalition of locals launched a boycott of carrots in July. The boycott’s goals: for the companies to drop the lawsuit, pay all legal fees and to reduce the amount of water they pump. One flyer the boycotters distributed suggests a Thanksgiving recipe for brussels sprouts instead.

Both Bolthouse and Grimmway lease farmland rather than own it. They recently withdrew from the lawsuit, though the companies that own the farmland are still in it, and what the judge decides will dictate how much the companies are able to farm there in the future.

Expanding Elsewhere

Huckaby said the carrot boycott has taken aim at Grimmway and Bolthouse because they’re easy targets. Only 3,700 of the 13,000 acres that Grimmway leases in the Cuyama Valley are being farmed, according to Huckaby. “We cut way back and we cut way back and we cut back and no one else did,” he said.

The companies may have to find new farmland to grow carrots. The average American now eats roughly seven pounds of the fresh vegetable every year, with consumption up 2% so far in 2023, according to NielsenIQ.

Grimmway has already expanded its farming operations outside of California with facilities in Florida, Washington and other states.

Butterfly’s Waglay doesn’t deny that water is one of the biggest barriers that his investment in Bolthouse faces. “Water challenges,” he said with a sigh. “This asset has great access to water, but it’s going to get worse and worse, and you need to be planning for that and trying to work on ways to minimize that. That’ll be a long-term challenge.”

California water fights often result in residents and smaller business owners getting “outgunned in the courts by large commercial actors,” Pomona College environmental analysis and politics professor Heather Williams, an expert on water issues, told Forbes. The lawsuit is among the first of many, she said.

“It’s put into motion a race to the basin — pumping as much as you can, and putting that into production,” Williams said. “Water is property in California. It’s what a rational actor acting on behalf of investors is going to do. If they’re playing this game, they’ve got to play hard.”

Grimmway and Bolthouse can move on, said Williams, unlike most of the residents in New Cuyama. “These are their homes, their small farms. If the well goes dry, it’s worth basically nothing,” she said. “They can’t pay lawyers for ten years of litigation.”

#article#forbes#private equity#boycott#farms#california#water rights#carrots#recall#grimmway farms#bolthouse farms

14 notes

·

View notes

Text

As he vowed to do on X, Rep. Kevin Kiley, R-Roseville, on Wednesday announced he is introducing legislation to eliminate federal funding for the California High-Speed Rail Authority, which seeks to build a high-speed rail line from Los Angeles to San Francisco.

The line would start with the much more modest route of Merced to Bakersfield.

The project has already spent around $6.8 billion in federal dollars and is seeking an additional $8 billion from the U.S. government. Kiley’s bill would make the California high-speed rail project ineligible for any further federal funding.

Kiley is working in tandem with billionaires Elon Musk and Vivek Ramaswamy, both of whom were tapped by President-elect Donald Trump to co-chair a Department of Government Efficiency.

The DOGE, as they are calling it, isn’t really a department, and any recommendations they make would have to be approved by both Trump and the GOP-controlled Congress, but it does have a goal to eliminate vast swaths of federal spending and bureaucracy.

In a statement Wednesday, Kiley called the California high-speed rail project a failure due to “political ineptitude,” and added that “there is no plausible scenario where the cost to federal or state taxpayers can be justified.”

“Our share of federal transportation funding should go towards real infrastructure needs, such as improving roads that rank among the worst in the country,” he said.

Kiley sits on the House Transportation and Infrastructure Committee, which is controlled by Republicans who long have been critical of the project. Should Kiley’s bill pass the House, it would also need to be approved by the Senate, where Republicans hold a 53-seat majority, and be signed by Trump.

That’s likely to be difficult, though, because it would probably take 60 votes to limit debate and both of California’s U.S. senators are Democrats.

The Bee has reached out to the California High-Speed Rail Authority for comment.

In a previous statement to The Bee, authority spokesperson Toni Tinoco said that the agency “continues to make significant progress.”

Tinoco pointed out that the project has been environmentally cleared for all but 31 miles between L.A. and San Francisco, making the project “shovel-ready for future phases of investment.”

Tinoco also pushed back against statements by Kiley and the DOGE about how the project has been beset by both delays (it was initially estimated to be complete by 2020) and massive cost overruns (ballooning from an initial cost estimate of $45 billion to as much as $127.9 billion).

“It did not account for inflation or any unknown scope, a lesson learned as our estimates now account for inflation and project scope, helping explain cost difference,” Tinoco wrote.

7 notes

·

View notes

Text

WhatMatters

Your guide to California policy and politics

By Lynn La

May 15, 2025

Presented by Child Care Providers UNITED, California Alliance of Family-Owned Businesses, California Strawberry Commission and Climate-Smart Agricultural Partnership

Good morning, California.

Health care, prisons and more cut in Newsom’s new budget plan

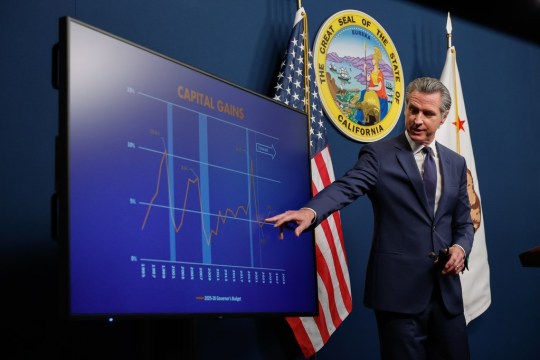

Gov. Newsom addresses the media during a press conference unveiling his revised 2025-26 budget proposal at the Capitol Annex Swing Space in Sacramento on May 14, 2025. Photo by Fred Greaves for CalMatters

When Gov. Gavin Newsom released his preliminary $322 billion state budget plan in January, he projected a “modest surplus.” But many things have changed since then: A general economic slowdown in the U.S. economy; an estimated decline in income tax revenue due to the stock market fallout from President Donald Trump’s tariffs; and an unprecedented Medi-Cal budget shortfall to name a few.

Now — as Newsom on Wednesday unveiled his updated budget plan — California is facing a $12 billion budget deficit, writes CalMatters’ Alexei Koseff.

Newsom’s budget proposal paints an economic outlook that, at best, is unclear, and at worst, is grim. For instance, Trump’s ongoing tariff policies (which Newsom described in the plan as “remarkably inconsistent”) could have “broad-reaching impacts” on nearly all of the state’s imports and could worsen inflation in California. The state’s job growth is also expected to slow through 2026.

In light of the current and upcoming challenges, Newsom plans to close the gap in a few ways. He still needs legislative approval.

Walking back Medi-Cal: To save more than $5 billion, Newsom wants to pause new Medi-Cal enrollments for adult immigrants without legal status beginning in 2026 — a rollback Republican legislators have called for. He is also proposing that adults with “certain statuses” (which could still include those with lawful status) pay a $100 monthly premium starting in 2027. Weight loss drugs, such as Ozempic, would no longer be covered as well, which is estimated to save $85 million this year. Read more from CalMatters’ Kristen Hwang and Ana B. Ibarra.

Closing prisons: California has closed four prisons in recent years, a trend that was enabled by falling numbers of incarcerated people. Newsom wants to close another yet-to-be-determined prison by October 2026, which would save roughly $150 million annually. One big question mark, however: In November, voters passed Proposition 36 to increase penalties for drug- and theft-related crimes. The measure is expected to increase the prison population, though, “we just don’t know how much,” said Newsom on Wednesday. Read more from CalMatters’ Nigel Duara.

Shifting cap-and-trade funds: California’s landmark cap and trade program — which enables companies to buy and trade climate credits — has provided billions of dollars for projects aimed at combating climate change and other environmental issues for more than a decade. Newsom wants to shift some of that money to pay for Cal Fire operations, as well as at least $1 billion a year to fund the High-Speed Rail project.

Join CalMatters and Evident in Bakersfield on May 21 for a screening of Operation: Return to Sender, a short documentary uncovering what really happened during a three-day Border Patrol raid in Bakersfield. After the film, CalMatters’ Sergio Olmos and others will discuss what the team uncovered and what it means for immigration enforcement. Register today or attend our Los Angeles screening on May 22.

Other Stories You Should Know

Bad news on CA housing

Construction on Casa Sueños, an affordable housing complex in Oakland, on Aug 7, 2023. Photo by Semantha Norris, CalMatters

From CalMatters housing reporter Ben Christopher:

For all the optimistic legislation, gubernatorial edicts and state-led lawsuits that the state has aimed at boosting the construction of desperately needed homes, California’s housing market stubbornly refuses to cooperate.

As part of the governor’s revised budget, the administration noted that permits for residential construction are at a decade-long low. Fewer than 100,000 new units were permitted in 2024 — a 10% decline from the prior year. The 2025 numbers so far are coming in even lower than expected.

The future doesn’t look much different. Blaming high interest rates, tariffs and tight labor markets for construction workers, Newsom’s budget wonks projected low permits through mid-2027.

The figures were dragged down by a collapse in proposed apartment projects specifically. That’s despite a bevy of prior bills aimed at promoting dense “infill” urban development.

Will two more bills make a difference? Newsom is counting on it. In Wednesday’s presentation he endorsed two of this year’s most controversial bills (Senate Bill 607 and Assembly Bill 609) that would exempt most urban housing projects from the state’s signature environmental law.

Read more here.

Will freezing building codes make housing more affordable?

Assembly Speaker Robert Rivas during session at the state Capitol in Sacramento on April 29, 2024. Photo by Miguel Gutierrez Jr., CalMatters

Speaking of housing, Ben also takes a look at a bill that seeks to make housing more affordable by putting a multi-year pause on building standards — a proposal critics say is misguided.

If passed, the bill wouldn’t negate any of the current building standards, which dictate a building’s plumbing, safety features, electrical wiring and more. Rather, the measure would freeze the rules in place starting on June 1 through at least 2031. That means that California’s 2025 code, which is set to kick in January 2026, wouldn’t go into effect.

The bill has breezed through the Assembly, likely because its co-author is Assembly Speaker Robert Rivas of Salinas. Proponents say the measure would bring down the cost of construction: Major building standard updates over the last 15 years have added as much as $117,000 to construction costs on each single-family home, according to the California Building Industry Association.

But bill opponents, which include environmental advocates, construction unions and code enforcement officials, argue that the approach is too dramatic of a departure from how the state typically regulates buildings, and that building codes are not the primary cause of high housing costs.

Read more here.

And lastly: Curbing threats to CA schools and churches

State Sen. Susan Rubio addresses lawmakers during the Senate floor session at the state Capitol in Sacramento on May 16, 2024. Photo by Fred Greaves for CalMatters

California’s Legislature is considering a bill to increase penalties for threats made against schools and places of worship. CalMatters’ Denise Amos and video strategy director Robert Meeks have a video segment on the proposal, which proponents say would help reduce trauma as part of our partnership with PBS SoCal. Watch it here.

SoCalMatters airs at 5:58 p.m. weekdays on PBS SoCal.

California Voices

CalMatters columnist Dan Walters: There’s a good chance that Newsom’s governorship will end with the state’s finances still unbalanced, which will be an immediate problem for his successor.

CalMatters contributor Jim Newton: A unanimous vote earlier this week on an Inland Empire warehouse project signals a sea change in the statewide approach to building more warehouses.

Other things worth your time:

Some stories may require a subscription to read.

Newsom asks lawmakers to fast-track Delta tunnel project // Politico

No cuts for schools, more funding for early literacy, in Newsom’s budget revision // EdSource

How a funding pause and renewed controversies could tank CA’s ethnic studies mandate // Los Angeles Times

This CA county has the highest death rate for climate change-driven wildfire smoke // San Francisco Chronicle

Mystery of ‘exploding birds’ deepens in Richmond as necropsies suggest foul play // ABC 7

Politics watchdog opens probe into contentious election mailer in Fresno // Fresnoland

Officers are winning massive payouts in ‘LAPD lottery’ lawsuits // Los Angeles Times

LA County wildfire alert mistakenly sent to millions due to tech glitch // AP News

This OC Assembly race is already one of the most expensive 2026 legislative contests // The Orange County Register

CA US Rep. asks for surveillance towers along San Diego coast to prevent maritime smuggling // The San Diego Union-Tribune

See you next time!

Tips, insight or feedback? Email [email protected]. Subscribe to CalMatters newsletters here. Follow CalMatters on Facebook and Twitter.

About Us· How We're Funded· Subscribe· Donate

CalMatters 1017 L Street #261 Sacramento, CA 95814 United States

3 notes

·

View notes

Text

The Importance of Regular Maintenance at an Auto Repair Service in Bakersfield

Owning a vehicle comes with its fair share of responsibilities, one of the most important being regular maintenance. For residents of Bakersfield, where hot summers and unpredictable weather conditions are typical, ensuring your vehicle runs smoothly is crucial. Regular visits to an auto repair service in Bakersfield can save you time, money, and hassle in the long run. But why exactly is maintenance so essential? Let's explore the benefits and why you should prioritize this aspect of car ownership.

Preventing Major Repairs

One primary reason for regular vehicle maintenance is to prevent costly and time-consuming major repairs. Small issues like a worn-out brake pad or a slight oil leak can turn into significant problems if left unaddressed. Regular maintenance allows skilled technicians at an auto repair service in Bakersfield to spot potential issues before they escalate, preventing a minor problem from turning into a significant repair or even a breakdown on the road.

For example, ignoring routine oil changes can lead to engine damage that may require a costly overhaul. Regular maintenance, such as oil changes and brake inspections, ensures your vehicle is in top working condition, reducing the chances of sudden and expensive repairs.

Improving Vehicle Safety

Your safety is paramount, and regular maintenance plays a crucial role in keeping your vehicle safe to drive. Auto repair service providers in Bakersfield can inspect key safety components like brakes, tires, and steering to ensure they are functioning correctly. Worn-out brake pads, bald tires, or faulty steering can pose serious risks, especially on Bakersfield's busy roads or during inclement weather conditions.

By maintaining routine maintenance, you can ensure that these vital components are always in good condition, reducing the likelihood of accidents caused by vehicle failure.

Enhancing Fuel Efficiency

Another significant benefit of regular maintenance is improved fuel efficiency. Simple tasks like keeping the tires properly inflated, changing air filters, and using the right oil can help your vehicle run more efficiently. In Bakersfield, where residents often drive long distances for work or leisure, fuel efficiency can have a direct impact on your monthly expenses.

An auto repair service in Bakersfield can help optimize your car's fuel efficiency, saving you money at the pump while contributing to a more environmentally friendly driving experience.

Extending the Life of Your Vehicle

A well-maintained car lasts longer. Routine checks, including fluid levels, tire health, and engine performance, ensure that your vehicle runs smoothly over the years. Bakersfield residents who rely on their cars for daily commuting or long road trips will appreciate the added reliability that comes with regular maintenance.

By addressing wear and tear early on, your vehicle is less likely to experience sudden breakdowns, giving you peace of mind and saving you from the inconvenience of being stranded or needing to replace your car sooner than expected.

Maintaining Resale Value

If you plan to sell or trade-in your vehicle in the future, regular maintenance will help preserve its value. A car that has been regularly serviced and well-maintained is more likely to fetch a higher price than one with a questionable service history. Whether you're in Bakersfield for the long haul or planning to move, maintaining your vehicle's condition will make it more attractive to prospective buyers.

Conclusion

Regular maintenance at an auto repair service in Bakersfield is not just about keeping your vehicle running; it's about ensuring your safety, preventing significant repair costs, enhancing fuel efficiency, and extending the lifespan of your car. By staying proactive with routine checks and services, you can enjoy a smoother, more reliable driving experience. Whether you're tackling Bakersfield's hot summers or winding roads, regular maintenance is key to keeping your vehicle in optimal condition. Don't wait for a breakdown—schedule your maintenance today and keep your car in the best shape possible for years to come.

If you have any questions or would like to schedule your next maintenance service, feel free to contact us at Mechamedix. Our team of experts is here to ensure your vehicle stays in top condition. Reach out today and experience the best auto repair service in Bakersfield!

0 notes

Link

Book your outdoor movie screen rental services with Mega Outdoor Movies. Full-service outdoor movies, inflatable movie screen rentals, projector rentals and movie equipment rentals provider. Enjoy the excitement and wonder of a movie under the stars at your next event or backyard party!

Inflatable Movie Screen Rentals in Bakersfield

At Mega Outdoor Movies, we aim to make events, gatherings and functions more memorable, fun-filled and a truly different experience.

Visit: https://megaoutdoormovies.com or call us today on (310) 873-3248 to experience the Mega Outdoor Movies difference.

#Inflatable Movie Screen Rentals Bakersfield#Bakersfield Projector Screen Rental#popcorn machine rental#inflatable movie screen rental#rent a movie theater los angeles#backyard movie screen rentals#backyard movie night los angeles#inflatable projector screen rental#outdoor movie theater rental#outdoor projector screen rentals

0 notes

Text

When the Biden Administration announced Wednesday that it would cancel $10,000 of federal student loans for Americans making under $125,000 per year, and $20,000 for Pell Grant recipients at the same income level, the backlash was predictable. Critics, often older people who had gone to college before the 1980s, called the policy a giveaway to the college educated, and unfair to those who had paid their way through school.

While I was reporting my book, The Ones We’ve Been Waiting For, I spent months researching why the student debt crisis has hit younger generations so hard— and why many older Americans don’t seem to understand the unique financial predicament of millennials and Gen Z. One key reason is that college affordability has radically transformed over the last 50 years. Many of the older conservatives who are angry at the idea that taxpayers might pay for student loan forgiveness went to school at a time when the government was heavily subsidizing higher education, and therefore tuition was far less expensive. For them, working their way through school without debt was feasible; for modern millennials and Gen Z, it’s often financially impossible.

Senate Minority leader Mitch McConnell called Biden’s loan forgiveness plan “student loan socialism” and said it was a “slap in the face to every family who sacrificed to save for college.” But when McConnell graduated from the University of Louisville in 1964, annual tuition cost $330 (or roughly $2,500 when adjusted for inflation); today, it costs more than $12,000, a 380% increase. When House Minority Leader Kevin McCarthy, who called the policy a “debt transfer scam,” graduated from California State University, Bakersfield in 1989, tuition was less than $800; today, it’s more than $7,500, a 400% increase when adjusted for inflation. Nevada Senator Catherine Cortez Masto, a moderate Democrat who is running for re-election this year, told Axios she disagreed with the policy because “it doesn’t address the root problems” of college affordability; when Cortez Masto graduated from the University of Nevada in 1986, tuition was a little more than $1,000— today, it’s roughly three times as expensive.

And don’t forget Republican Senator Chuck Grassley, who called the policy “UNFAIR” on Twitter. He graduated from the University of Northern Iowa in 1955, when annual tuition cost roughly $159, or between $40 and $53 per quarter. Today, it costs more than $8,300, a nearly 500% increase even when adjusted for inflation.

Younger generations might say what’s really “unfair” is that many Baby Boomers and the Silent Generation had access to highly subsidized higher education with affordable tuition, while some millennials and Gen Z get just $10,000 of student loan forgiveness. Those calling Biden’s new policy “socialism” would do well to remember this: In 1987, a student at the University of Kansas could pay her tuition with a part-time minimum wage job and still have some left over for books and food. In 2016, a student working a minimum wage job would come up $38,000 short.

👉🏿 https://time.com/6208484/biden-student-loan-critics-college/

#politics#republicans#education#college should be free#cancel student loan debt#student loan debt#college#mitch mcconnell#kevin mccarthy#chuck grassley#catherine cortez masto

349 notes

·

View notes

Text

Water Guns | Carnival & Water Games | Slip n Slides in Bakersfield

Slip n Slides, Water Guns Rental, Inflatable Rentals, Carnival Games, and Water Games in Bakersfield. We offer a variety of inflatable water slide rentals

#Water Guns in Bakersfield#Water Games in Bakersfield#Carnival Games in Bakersfield#Slip n Slides in Bakersfield

1 note

·

View note

Quote

Governor Gavin Newsom has canceled the bulk of the state's high-speed line between Los Angeles and San Francisco, leaving only a tail of the once-grand project between the Central Valley's Merced and Bakersfield, not exactly major metropolitan areas . "Let's be real," Newsom said in his first State of the State address. "The project, as currently planned, would cost too much and take too long. The project's cost, originally pegged at $ 33 billion, ballooned over the last decade to an estimated $77 billion (or maybe as high as $98 billion) with little reason to assume that the cost inflation would end there.

Joel Kotkin, Wendell Cox

https://www.city-journal.org/high-speed-rail-projects

1 note

·

View note

Text

Community Voices: Bakersfield's businesses are the heart of our economy | Community Voices

Community Voices: Bakersfield’s businesses are the heart of our economy | Community Voices

This holiday season, rising interest rates and persistent inflation are fueling a new level of uncertainty and a recession seems imminent. Amid rising prices for almost all goods and services, consumers face tough decisions about how and where to spend their money. We usually turn to big retailers for holiday shopping and often dismiss local businesses when deciding to find something to wrap.…

View On WordPress

0 notes

Text

WhatMatters

Your guide to California policy and politics

By Lynn La

April 25, 2025

Presented by Dairy Cares; Californians for a Connected Future, a Project of USTelecom; TURN - The Utility Reform Network and Californians for Energy Independence

Good morning, California.

CA tenants, landlords, Democrats all fight over rent caps

Supporters of Assembly Bill 1157, a housing bill that would strengthen tenant protections, listen during a committee hearing at the state Capitol in Sacramento on April 24, 2025. Photo by Fred Greaves for CalMatters

One of the fiercest legislative fights of 2019 was over a bill limiting the amount that many California landlords can hike rent.

Six years later, legislators were back at it again as the Assembly’s housing committee took up a bill Thursday, authored by Democratic Assemblymember Ash Kalra of San Jose, which would:

Reduce the cap from 10% to 5% (or 2% plus the current inflation rate, whichever is lower);

Extend the law to single-family homes (currently exempt);

Make the law permanent (current law sunsets in 2030).

If crowd size at a mid-morning weekday committee hearing is any indication, Assembly Bill 1157 is among the most contentious bills of the year. Advocates on both sides crowded into the hearing room and blocked the hallway outside in color-coded droves. Tenant advocates with the nonprofit Alliance of Californians for Community Empowerment sported yellow; landlords allied with the California Apartment Association made up a sea of red.

Supporters of the bill argue that the current statutory cap is far too high for low-income renters, especially given the punishing inflation of the last few years, and that the carve-out for single-family homes is unfair.

Tammy Alvarado, a San Diego County renter and bill proponent: “Most people’s American dream is to buy a house and ours is just to remain in our house. Unless something changes, becoming homeless is a reality for my family.”

The bill passed the committee, but narrowly, 7 to 5.

Many Democrats, particularly in the Assembly, have trained their legislative focus this year on making it easier, cheaper and more enticing to build new housing. Even some of the lawmakers who voted for the bill Thursday did so half-heartedly, lamenting the cooling effect the policy might have on the construction of new homes at a time when the state is desperate for more overall supply.

As with current law, the bill would not apply to homes that are 15 years old or newer. Most economists agree that rent control measures do tend to discourage the construction of new homes and the upkeep of old ones, while providing financial stability to long-time renters. And as with any policy, the details matter.

The tension between supply boosters and skeptics is likely to become a dominant theme in this year’s legislative session. On Monday, a major housing production bill stalled and another only barely skated by in the Senate Housing Committee, when the chairperson called the bills’ lack of hardcoded affordability requirements a “non-starter.”

Two days later, over in the Assembly, Speaker Robert Rivas, a Salinas Democrat, issued his list of priority housing legislation. Notably, AB 1157 did not make the cut.

Our CalMatters Spring Member Drive ends this weekend and with it a dollar-for-dollar match. We’re here to connect the dots, uncover what others won’t and explain how state and federal decisions directly impact your life — from housing and education to climate and the economy. Support our independent, trusted journalism, please give now.

Join CalMatters and Evident in San Francisco on May 1 for a screening of Operation: Return to Sender, a short documentary uncovering what really happened during a three-day Border Patrol raid in Bakersfield. After the film, CalMatters’ Sergio Olmos and others will discuss what the team uncovered and what it means for immigration enforcement. Register today.

Other Stories You Should Know

San Mateo could make history

San Mateo County Sheriff Christina Corpus enters a San Mateo County Board of Supervisors meeting in Redwood City on Nov. 13, 2024. Photo by Nhat V. Meyer, Bay Area News Group

Last month, voters in San Mateo County overwhelmingly approved a measure to grant its board of supervisors the authority to remove the county sheriff by a four-fifths vote.

This result, as CalMatters’ Nigel Duara explains, follows a gripping saga that includes a 408-page report, commissioned by the county, which accuses San Mateo County Sheriff Christina Corpus of nepotism and conflicting relationships.

After being elected to office in 2022, Corpus appointed one of her campaign consultants, Victor Aenlle, to the executive director of administration. But Aenlle’s relationship with Corpus was more than a “mere friendship,” according to the November report by a retired Santa Clara superior court judge, and included a trip to Hawaii and lavish gifts. During this time Corpus made at least four requests to raise Aenlle’s salary. One was granted, raising his pay to $246,979.

Aenelle told CalMatters the claims are “fabricated,” and that there is a campaign to remove Corpus from office because she threatened the overtime pay that deputies were expecting.

The San Mateo County Executive is suing the embattled county sheriff, who is refusing to resign, and Corpus is suing the county. If the board is successful at removing her — a process expected to take at least three months — it would be the first time in California’s history a county sheriff is removed from office.

Read more here.

Cities, law enforcement force concession on homelessness bill

Fresno police and city workers conduct a homeless encampment sweep under a highway overpass in downtown Fresno on Feb. 3, 2025. Photo by Larry Valenzuela, CalMatters/CatchLight Local

From CalMatters homelessness reporter Marisa Kendall:

State Sen. Sasha Renée Pérez’s effort to stop cities from arresting homeless people for camping in public places fell flat this week in the face of opposition from cities and law enforcement agencies.

With visible tears, the Democrat from Pasadena opted to cut the most controversial part of her bill.

Pérez: “I understand that cities still want the ability to be able to provide clean communities for residents. But at the same time, we need to recognize that these are people with humanity, too.”

Pérez agreed to amend Senate Bill 634 to instead prohibit cities from punishing outreach workers for providing aid to unhoused people (Fremont recently criminalized “aiding” and “abetting” homeless camps, but later walked back that language). The bill also would prevent cities from passing ordinances that ban shelters and supportive housing (as Norwalk did last year).

San Francisco Mayor Daniel Lurie was among those who opposed Pérez’s effort to limit how cities crack down on homeless camps. The original bill “threatens the city’s progress” on homelessness and would make it difficult to connect people to services, he said in a letter read aloud by a representative during the hearing.

And lastly: Judge halts Trump’s anti-DEI school directive

Students play during recess at Loma Vista Elementary School in Salinas on Aug. 8, 2023. Photo by Semantha Norris, CalMatters

A federal judge Thursday blocked President Donald Trump’s directive to cut funding for public schools that did not eliminate their diversity, equity and inclusion programs. Find out how much California’s K-12 schools could lose in federal funding from CalMatters’ Carolyn Jones.

California Voices

CalMatters columnist Dan Walters: California is a complex state with many issues — being its next governor will be a daunting task and should not be viewed as a mere “next step” for former Vice President Kamala Harris.

Other things worth your time:

Some stories may require a subscription to read.

Biden let CA get creative with Medicaid spending. Trump is signaling that may end // CalMatters

Fraud in CA community colleges triggers call for Trump investigation // CalMatters

CA is now fourth-largest economy in world, surpassing Japan // San Francisco Chronicle

Echoing Big Tech, Newsom warns privacy watchdog on AI // Politico

Fight intensifies over bill by former Edison exec to gut rooftop solar credits // Los Angeles Times

UC faculty rejects imposing its own ethnic studies course on high schools // EdSource

Why Trump’s DOJ targeted LA County over gun permits — and who might be next // Los Angeles Times

Two years after Half Moon Bay shooting, new housing for farmers take shape // KQED

Ninth Circuit reinstates SF sheriff program that allows warrantless searches // San Francisco Chronicle

See you next time!

Tips, insight or feedback? Email [email protected]. Subscribe to CalMatters newsletters here. Follow CalMatters on Facebook and Twitter.

About Us· How We're Funded· Subscribe· Donate

CalMatters 1017 L Street #261 Sacramento, CA 95814 United States

3 notes

·

View notes

Text

One of those earliest and biggest South Carolina mortgage fraud prosecutions happened from the Charleston Division in the 1990's.

It involved nominee borrowers and subprime loans produced from Citadel Federal Saving and Loan. Over 10 straw purchasers were enticed in to the real estate loans by getting paid fees for registering to the loans. They failed to put up any of their money included in the deal and when the loans went sour the bank had been left with properties which were up side down, in other words, the actual estate was worth less the amount of the mortgage. Some bank insiders were a portion of the scheme and got convicted for their various roles. The array of defendants that a SC Criminal-Lawyer will represent in an ordinary mortgage fraud instance could include straw borrowers or nominee creditors, realtors, developers, appraisers, mortgage brokers, and sometimes even closing bankers and attorneys. Bankers often get involved with mortgage fraud scams as they're receiving kickbacks from the creditors or are paid bonuses for the volume of loans made and thus ignore appropriate banking loan requirements and protocols in order to make more cash. Close scrutiny should be awarded to bank applications, appraisals, HUD-1 closing invoices, debtor's W-2 and taxation yields when assessing a possible mortgage fraud case to get a prospective client. Nominee Loans/Straw buyers. One of the most frequent kinds of mortgage fraud occurs when a"straw buyer" can be used to cover the identity of their real borrower who would not be eligible for that mortgage. The scam artist usually fills the application for the loan to get the brand new buyer, also falsifies the income and net worth of the straw buyer in order to be eligible for the mortgage. These fraud scams were popularized with the advent of this"stated income" loans that did not require a borrower to show his real earnings and net worth - the bank simply believed the income and net worth which was"stated" on the loan application. Straw buyers are often duped into thinking that they're investing in real estate that will be rented out, even with the leasing obligations paying the mortgageand are paid a nominal fee outside of closing. In most case, no payments are made along with the creditor forecloses on the loan. Some times straw buyers are in reality in on the scam and are receiving a cut of the profits. Appraisal fraud. Appraisal fraud is often an integral part of the majority of mortgage fraud scams and also does occur when a dishonest appraiser fraudulently appraises home by inflating its value. In most cases, following owner receives the final proceeds, he will pay a kickback into the appraiser like a quid pro quo for its fake evaluation. Typically, the borrower will not make any loan obligations and your house or property goes into foreclosure. An important practice tip for South Carolina lawyers representing clients that decided to testify before the grand jury would be to accompany your client to the grand jury court room. While not allowed in the grand jury proceeding itself, the attorney can wait just outside of the court room and the client is allowed to check with the attorney for virtually any question which is posed to the client by prosecutors or grand jurors. This is an efficient means to help minimize any possible harmful bills by the client, and also a great way to learn about the focus of the prosecutor's case. This method makes it easier to gain insights from your customer as to the questions asked during the grand jury proceeding rather than debriefing the client Reverse Mortgage Bakersfield CA after a sometimes long and grueling question and answer session which can last all day. Flipping. A flipping scheme occurs when the seller intentionally misrepresents the price of home so as to induce a buyer's purchase. Flipping mortgage fraud approaches usually demand a fraudulent appraisal and also a grossly inflated sales price. There are always a huge variety of approaches, artifices and conspiracies to perpetrate mortgage frauds and band frauds together with which the South Carolina white collar criminal defense lawyer and consumers must be familiar. Frequently targets of a mortgage fraud prosecution have been invited by the prosecution to avail themselves from the grand jury procedure and to testify in the front of the grand jury. Generally, a South Carolina criminal defense attorney should not permit a termed target of a federal criminal mortgage-fraud evaluation to testify before the grand jury. Subjects and witnesses at a mortgage fraud prosecution would be often subpoenaed by the prosecutors to testify before the grand jury. A criminal defense lawyer should additionally generally advise a witness or subject to never testify whether any portion of the testimony could possibly incriminate the client. With respect to a federal mortgage fraud investigation, when a citizen receives a target letter, subject correspondence, or perhaps a subpoena to testify before the grand jury, or is contacted personally by a police officer like an FBI special agent, a sc criminal lawyer who is experienced in national prosecutions should be consulted immediately. Certainly one of the main mistakes that a mortgage fraud objective, topic or opinion can make is to testify before the grand jury or talk with criminal researchers prior to consulting with a legal defense attorney. The 5th Amendment to the Constitution allows any individual, for example a target, subject or witness at a mortgage fraud prosecution, so never to incriminate himself or herself. Interestingly, there's absolutely no 5th Amendment coverage for a corporation. Evidently, if a defendant was detained or imprisoned for a national mortgage-fraud offense in sc, a seasoned SC mortgage-fraud lawyer should be consulted immediately. Air Loans. The atmosphere loan mortgage fraud strategy is a loan obtained within a non existent property or for a non refundable debtor. Skilled scam artists often work together to produce a bogus debtor and a bogus chain of title on a nonexistent property. They then obtain a name and property insurance policy adjuster to present to the financial institution. The scam artists often set up bogus telephone banks and mail boxes in order to create fake employment verifications and W-2s, home addresses and borrower telephone amounts. Phone banks are used to portray an employer, an appraiser, a credit agency, a lawyer, an accountant, etc.. . , for bank verification purposes. The air loan scam artists obtain the loan profits without a land has been purchased or sold, and the lender is left with an outstanding loan which never needed some security. Even the FBI has identified a number of indications of mortgage fraud where the South Carolina criminal white collar lawyer needs to be aware. These include inflated evaluations or even the exclusive usage of one employee, raised commissions or bonuses for both brokers and appraisers, bonuses paid (out or at settlement) for fee-based services, more than standard fees, falsifications on loan applications, grounds to buyers about the best way to falsify the mortgage program, asks for borrowers to register a blank loan application, fake supporting loan documentation, asks to sign blank employee forms, credit forms or alternative styles, purchase loans that are disguised as refinance loans, investors that are guaranteed a repurchase of the property, investors who are paid a fixed percentage to offer or flip home, so when multiple"Holding Companies" are utilised to increase real estate values. Some of the relevant national criminal statutes which may be charged in mortgage fraud indictments include, but are not limited to, the following: A mortgage fraud is usually reported on the FBI by the lender upon which the fraud has been committed. A bank must file a SAR no later than 30 calendar days after the date of initial detection by the financial institution of facts that could constitute a basis for filing a SAR, unless no suspect was identified on the date of this detection, in which event the bank gets up to 60 days to file the SAR. See 3 1 C.F.R. § 103.18(b). Once FinCEN has examined the data contained in the SAR, in the event the criminal activity is found to have occurred, then your situation is turned over to the FBI and the DOJ or AUSO for investigation and prosecution. The development in FBI SARs accounts between mortgage-fraud went from approximately 2000 in 1996 to over 25,000 in 2005. Of the 2005 SARs reports, 20,000 of involved borrower fraud, approximately 7,000 involved brokerage fraud, and approximately 2000 involved appraiser fraud. Quiet Secondly. From the silent 2nd mortgage fraud strategy, the buyer borrows the down payment for buying the property by the seller throughout the implementation of another mortgage which is not disclosed to the lending bank. The lending bank is led to believe that the debtor has spent their or her own money for the down payment, when in reality, it's borrowed. The next mortgage is generally not listed to conceal its status from the primary financing lender. There are some essential strategic decisions that need to be created for the defendant who was charged or indicted for fraud. The defendant and his attorney needs to seriously look at the consequences of pleading guilty when he's actually committed the offense. A mortgage fraud defendant can receive up to a 3 degree downward departure for begging. An legal lawyer representing a mortgage-fraud defendant may also file a motion for a downward death and/or a motion for a variance and argue facets to the court in support of an additional reduction at a defendant's sentence. The mortgage fraud suspect's criminal attorney should closely scrutinize the circumstances of the claim and the suspect's background and criminal history so as to greatly reduce the period of time for you to be served. A valuable tip for a lawyer representing a legal mortgage fraud defendant in sc is to consider mitigating factors such as disparate paragraphs, 5-k departures such as cooperation, aberrant behaviour, property values, family ties, outstanding rehabilitation, diminished mental capacity, extraordinary restitution should be thought to be potential justifications to get a smaller sentence. Foreclosure schemes. Foreclosure plot scam artists prey on people who have mounting financial problems that that place them in peril of losing their home. Homeowners in early phases of foreclosure may be reached with a fraudster who symbolizes to the homeowner that he will eliminate his debt and rescue his house for an upfront fee, which the scam artist chooses and subsequently disappears. At a similar foreclosure scheme, Homeowners are approached with a scam artist who offers to help them re finance the mortgage. The homeowners are fraudulently induced to sign alleged"refinance" documents just to later determine they actually transferred title to the home to the fraudster and face eviction. Sc white collar criminal attorneys will need to know about the kinds of mortgage fraud that are commonplace from the nation so as to effectively identify and represent customers who are involved in mortgage fraud pursuits. Consumers need to be aware of the variations of loan fraud that they do not unknowingly be a part of a scheme to defraud a bank or federally backed lending institution. Federal mortgage fraud crimes in sc are punishable by as much as 30 years imprisonment in federal prison or $1,000,000 fine, or both. It is unlawful and deceptive to get a individual to make a false statement about his or her income, debt, assets, or matters of investigation, or even to overvalue any land or property, at a credit or loan application with the aim of affecting in any way the actions of a backed financial institution. Back in South Carolina, a disproportionate quantity of mortgage fraud cases have occurred in the coastal region. The reason for the higher number of mortgage fraud and bank fraud criminal prosecutions in these areas is due to large number of condo, condotels, town house and similar real estate projects that proliferated in these areas. These property improvements were widely popular in areas near the shore and bank creditors were willing to loan money at a furious pace due to a perceived tremendous need. Reverse Mortgage Bakersfield 1709 16th St #38, Bakersfield, CA 93301, USA 661-210-3080 Mortgage-fraud is problem that's now already reached epidemic proportions within the USA (US) in general and in South Carolina (SC) particularly. The white collar specialist should click for more bear in mind that mortgage fraud is generally researched by the United States Federal Bureau of Investigation (FBI), but other bureaus routinely assist the FBI and/or simply take the lead in exploring a case. In South Carolina, mortgage fraud is generally prosecuted by federal prosecutors. At the investigation stage, a individual with potential knowledge or participation in a mortgage fraud may be considered a witness, subject or purpose of this investigation. An issue is generally a man the prosecutor believes might have committed a mortgage fraud crime, where as a target can be an individual the prosecutor believes has committed a crime like mortgage fraud and the prosecutor has substantial evidence to support a legal prosecution. Criminal prosecutions of mortgage fraud felony cases usually are initiated throughout the entire national grand jury process. A federal grand jury includes between 16 and 23 grand jurors who are presented signs of alleged criminal activity by the federal prosecutors with the aid of police representatives, usually FBI special agents. Sc criminal defense attorneys aren't allowed entry into the grand jury at any time, and prosecutors rarely don't obtain an indictment after presentment of these case to the jury. The FBI works extensively using the Financial Crimes Enforcement Network (FinCEN). FinCEN is currently a bureau of the United States Department of the Treasury, established in 1990, which gathers and analyzes information about financial transactions to be able to fight financial crimes, for example mortgage fraud, money laundering and terrorist financing. Sc attorneys may keep a breast of mortgage fraud developments by visiting the respective websites of the FBI and FinCEN. Federal judges that enforce sentences for mortgage-fraud normally are based upon the United States Sentencing Guidelines, which can be now advisory because of their U.S. v. Booker case, when determining a sentence. A national court calculates a specific principle vary by checking a suspect's criminal history, the applicable base offense level, and the amount of the actual or intended loss. Section 2B1.1 of those USSG sets forth a loss table which advances the base offense level according to the amount of money involved in the mortgage fraud. Generally, the additional money which is lost in a mortgage fraud scam, the greater the sentence the defendant receives. Sometimes, a defendant could be exposed to sentencing enhancements which means the defendant receives a larger sentence. A defendant could get an enhancement for the part from the crime if the court determines that the defendant was an organizer, supervisor, or even a recruiter, or even used a sophisticated ways to facilitate a crime, abused a situation an trust, or even targeted a vulnerable victim such as a disabled or elderly person. Equity Skimming. In an equity skimming mortgage fraud scheme, an investor often uses a brand new buyer, false income records, and false credit file to get a home mortgage from the straw purchaser's name. Subsequent to the final, the property buyer signs the property to the investor in a quit claim deed that relinquishes all rights to the property and provides no guaranty to title. The investor doesn't make any mortgage payments, and rents the property until foreclosure happens several months after. Equity skimming also happens when a scam-artist purchases a residential property that the owner is in default on his mortgage or his property taxation, after which diverts rental income against the house for private profit and will not enforce this leasing income toward mortgage payments, the payment of taxes and other property-related expenses. A white collar criminal defense attorney in South Carolina must get an awareness of the basics of the mortgage fraud so as to adequately represent clients that were charged or charged with mortgage fraud violations. Recognizing the gap between your status of being a target, subject or witness can have crucial consequences in the way the situation is managed. A white-collar bank fraud or mortgage-fraud criminal conviction can have life changing consequences for those defendants convicted of the same. A suspect who is charged or indicted with the federal offense of mortgage fraud should consult a SC criminal lawyer who's knowledgeable regarding different types of these scams, and how the scams have been carried out, the law enforcement investigatory process, the grand jury procedure, substantive law regarding mortgage fraud, and the most pertinent federal sentencing recommendations and procedures available to minmise a defendant's potential sentence.

1 note

·

View note

Text

Wasn’t He Recently Elected As President?

RAT problem… please help my family and i recently moved to Bakersfield CA. we have recently noticed rats demolishing my moms garden we have tried mint. This particular mixture has been proven to actually kill rats for good, canadian pharmaceuticals online once they ingest your mixture. Consume tonic slowly either two hours after or before eating, and taking any supplements or medications. Taking a quick trip to the mountains on the weekend means preparing for hours of delays. That’s nearly 10 hours of extra time we could be spending with our friends and families per month if we reprioritized our efforts and fixed it. The federal health IT program will provide a valuable boost to all of these efforts. This increased demand for medical care is one reason for the high rate of inflation for health care costs that soon developed. When you visit our online drugstore, it’s easy to make informed decisions about your health. Living with Illness: How well does the plan help people manage chronic illnesses? We will help rural and coal communities find meaningful work in their field retrain for a new career if they choose, and become entrepreneurs by establishing Workforce Development Commissions across the state. Something like dry corn or sunflower seed, or even chook food and bird seed will work. Second, it will be more difficult for employers to estimate the economic impacts of lost time. The financing of the benefits under this program comes from three sources: government revenue, premiums of Medicare beneficiaries, and the FICA taxes paid by most working persons and their employers. It simply works for everyone the same way that Medicare works for our seniors. It really works cause they hate the smell. Most defined benefit pension plans (those that provide a fixed monthly benefit at retirement) are required to participate in the program and pay premiums to the PBGC. Here are our recommended top 5 rat repelling products either 100% or partially based on peppermint oil and their producers, currently available on Amazon. I looked on the UK cannabis forum, which had 30,000 postings, and a vendor called JesusOfRave was recommended. Do not provide credit card or personal information online unless the e-commerce website is secure. I never use a credit card to shop online because fraud is just so prevalent. For the first time, the burden of plan asset protection was placed upon the government, rather than on the individual participants. Companies wanting to offer the best drug coverage will select a "high" coverage plan for their employees. HSA plans will only provide drug coverage when the policy deductible has been met. One sad prescription drug addiction statistic reported by the U.S. Some cases occur in one calendar year and then result in days away from work in the next year. I did not get any work done but I become obsessed with finding watches on Ebay. As Mr. Miyagi said in the movie Karate Kid, “best block, no be there.” In internet scams, the best defense is to simply not get tricked in the first place. There are two small dogs and a cat who have thus far not been good mousers; I have SEVERAL KITTENS. Are there any other lifestyle requirements I need to know about? The Labor Ministry serves as conciliator in labor disputes, and the Industrial Court, to which disputes are referred when collective bargaining fails, has a record of fair, but slow, adjudication. They are extremely prolific breeders… that would be how. Ensure that students with disabilities are granted equal access to a quality physical education. In addition, the interest rate applied to an amount of the cash value equal to the policy loan is reduced. Increasing malpractice suits. The providers of care are much more likely to be sued than in the past, and malpractice awards have outpaced the general rate of inflation. Section 1904.7 General recording criteria. The same is true of retirement benefits. You don't have a prescription? Canada Drugs include prescription drugs as well as over the counters. If you are a young adult covered on your parents policy you might lose that coverage. If you are not active, the carbs can fill up the muscles for you exceed the capacity to hold more so the blood glucose goes up. To control diabetes and prediabetes, eat healthy and move more. Emails typically promise large rewards for helping “government officials” move money to a US financial institution, with upfront fees required. Scammers can be clever, though, and it can be hard to spot the fake phishing emails sometimes. You see you can still be physically fit even when you’re overweight. Our head pharmacist Dr Graham Stretch IP PhD MRPharms trained at The Royal Liverpool Hospital. A concussion occurs after a blow to the head. Keeping up the fight for universal coverage will take tremendous advocacy and effort from our next governor. Closed Christmas Day, Boxing Day, New Year's Day, Good Friday. Evaluate the current system of state and local resources for delivery of care and treatment for Coloradans with intellectual, developmental, physical, and acquired disabilities and identify areas of improvement in services, agencies, and state departments. Besides the increased muscle mass makes one’s baseline metabolism higher.

2 notes

·

View notes

Text

Endorsement of Congressman Kevin McCarthy

Endorsement of Congressman Kevin McCarthy

Congressman Kevin McCarthy is an outstanding Representative for the people of California, and a strong and fearless Leader of the House Republican Conference. In Congress, Kevin is a tireless advocate for the people of Bakersfield and the Central Valley. He is working incredibly hard to Stop Inflation, Deliver Water Solutions, and Hold Joe Biden and Nancy Pelosi Accountable for their catastrophic…

View On WordPress

0 notes

Text

No Republican should be surprised Trump endorsed Kevin McCarthy

No Republican should be surprised Trump endorsed Kevin McCarthy

Former President Donald Trump endorsed the re-election of House Minority Leader Kevin McCarthy on Saturday, and no Republican should be surprised. “In Congress, Kevin is a tireless advocate for the people of Bakersfield and the Central Valley. He is working incredibly hard to stop inflation, provide water solutions, and hold Joe Biden and Nancy Pelosi accountable for their catastrophic failures…

View On WordPress

1 note

·

View note