#InvestmentTracking

Explore tagged Tumblr posts

Text

Monarch Money Review: Why It's Replacing YNAB for Many

If you’re hunting for a modern alternative to traditional envelope-style budgeting, Monarch Money might just be your new sidekick. With everything from automated tracking to investment overviews, it’s wooing users who felt YNAB was missing the bigger picture. In this review, we’ll explore why Monarch Money is increasingly being chosen over YNAB, hitting on intuitive design, goal-setting…

0 notes

Text

How to Track Your AI Investments: See What the AI is Doing Behind the Scenes 🚀🤖

youtube

Want to know what the AI is doing with your investments? 🤔 Lee explains exactly how to track your AI-driven portfolio and see what’s happening behind the scenes. From smart folios to tracking AI activity, we've got you covered! 💡

In this video, we go over the Activity tab in the platform, where you can see all the recent AI transactions and what the AI is up to. Whether it's staying out of the market or making strategic buys, the AI is working behind the scenes with a lot of calculations. We dive deep into how the AI makes decisions and why it might feel like it's doing "nothing" when in reality, it’s staying patient and calculating.

💥 Key Topics: ✅ How to view AI activity in your portfolio ✅ Why the AI sometimes stays out of the market ✅ Behind-the-scenes AI calculations and strategies ✅ How to stay informed with your smartfolio ✅ The power of patience in investing with AI

Don’t forget to LIKE 👍, COMMENT 💬, and SUBSCRIBE 🔔 for more AI investment insights! Need help or have questions? Reach out to us via email at [email protected] or drop a comment below. Let's dive in! 🚀

#AIInvesting#Smartfolio#StockMarket#InvestingTips#AITrading#InvestmentStrategies#AIStocks#FinancialPlanning#PassiveInvesting#MarketStrategy#InvestingWithAI#AIportfolio#InvestmentTracking#Youtube

0 notes

Text

#WealthManagement#InvestmentSoftware#FinancialTechnology#InvestmentManagement#SoftwareDevelopment#InvestmentTools#CustomFinancialSoftware#InvestmentApps#DigitalWealthManagement#InvestmentTracking#FinancialManagementTools

0 notes

Link

Ziggma provides you the Best Portfolio Tracker where you can set alerts for risk metrics, diversification, valuation metrics, price and technical. When your threshold is exceeded you will receive an email alert. Provides a modern and intuitive user interface so that you can take in a maximum of information in a very short amount of time. We provide you with relevant analytics on risk, asset allocation, diversification, financial and technical data.

#bestportfoliotracker portfoliotracker#freeportfoliotracker#investmentportfoliotracker#stockportfoliotracker#investmenttracking

1 note

·

View note

Text

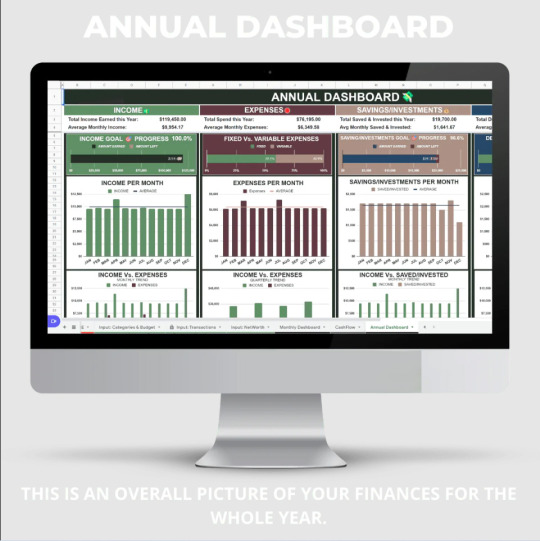

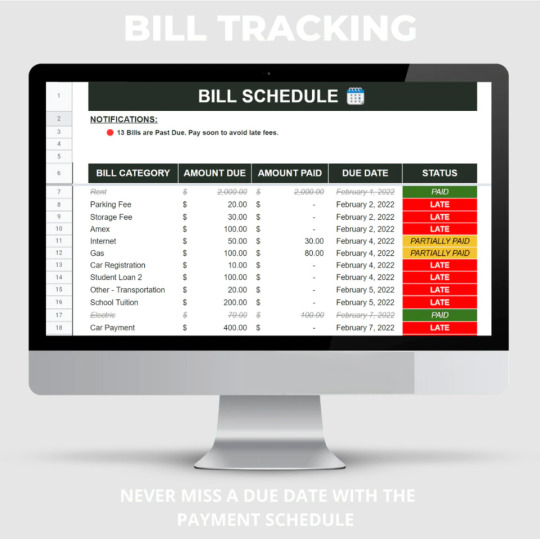

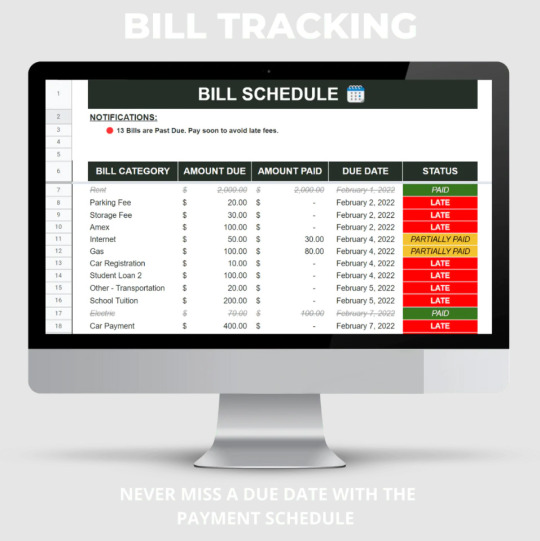

Monthly Budget Spreadsheet Template for Google Sheets, Budget Planner, Financial Planner, Budget Template, Expense Tracker, Savings

#2022spreadsheet#expensebookkeeping#expenseoverview#expensetracker#financialdashboard#googlespreadsheet#incometracker#instantdownload#investmenttracker

1 note

·

View note

Text

Self-directed IRA tracker - post 2

Date: 11/18/2014 IRA: SELL 271 shares AAPL @ $114.95 / share Roth IRA: SELL 103 shares AAPL @ $114.96 / share

Motivation: Approx 16.7% gain in just over 2 months makes me happy, and given the market cap of AAPL and my gut feeling, I decided to take my winnings off the table for the moment. A 16% gain is nice for a year, let alone a few months, so I am choosing not to be greedy here. I will take a break for a few days and collect my thoughts about what to do next. I will most likely identify another company out there that I consider very solid and likely to gain 10-15% in the near term to double down this year, but we'll see.

0 notes

Text

Self-directed IRA tracker - post 1

So, I've decided to start tracking some of my investment decisions on this blog for all the world to see. This series of posts will only cover the activity in my self-directed IRA. I started this IRA in 2014 as an account to roll my various old 401(k)'s from previous employers into. I am excited about having full control over this account, and have decided to take a lot more risk on in the early years, and taper it down as I get closer to retirement. I currently have no plans to contribute more money to this account unless it's from future 401(k)'s that I roll into it.

To begin, I am going to backfill my first and currently only transaction so far, and going forward I'll detail all of them around the time I make them. The IRA is actually 2 accounts, a traditional IRA and a Roth (I only have the Roth because of the tax status of contributions from one of my previous employers).

Date: 9/04/2014 IRA: BUY 271 shares AAPL @ $98.43 / share Roth IRA: BUY 103 shares AAPL @ $98.48 / share

Motivation: I like Apple for a number of reasons. First, compared to other popular tech companies right now, the P/E is very reasonable. Second, Apple is launching Apple Pay this year as well as the larger screen iPhones and the Apple Watch. Apple as a company is very good at getting implementation right where others have failed, and I have high hopes for Apple Pay. The simplicity of being able to wave a device like the watch or your phone by a reader and pay for something should be very compelling, and hopefully secure :P. Apple also has a very zealous fan base, and the brand has a good reputation for quality. Finally, interest rates are still terrible and the stock market remains pretty much the only place a person can grow his or her wealth, so strong brands with good leadership like Apple should act as a safe haven for smart money in the event the market gets jittery.

0 notes