#Invoice Financing

Explore tagged Tumblr posts

Text

Types of Business Loans and Their Uses | Capifina

Looking for the right business loan to support your growth? Securing the right financing is essential for businesses aiming to expand operations, manage cash flow effectively, or invest in new opportunities. With a wide range of loan options available, understanding the key differences between them is crucial to making an informed choice. Capifina offers customized financing solutions designed to meet your specific business needs—whether you're looking for equipment financing, working capital, or a flexible business line of credit to help you grow with confidence.

Why Choose Capifina for Your Business Loan Needs?

Finding the right loan provider is just as important as choosing the loan itself. We offers flexible loan options tailored to various business needs, ensuring you get the right financing solution. With a fast approval process and minimal paperwork, securing funds is quick and hassle-free. Our customized financing solutions are designed to match your specific growth strategy, all with competitive interest rates and transparent pricing. Plus, our team provides guidance to help you find the best loan to scale your business efficiently and sustainably.

What Are the Different Types of Business Loans?

Business loans come in various forms to meet specific financial needs:

Business Line of Credit – A flexible funding option that lets businesses access funds as needed, paying interest only on the amount used. Ideal for managing cash flow, covering unexpected expenses, or seizing growth opportunities.

Equipment Financing – A loan designed to purchase machinery, tools, vehicles, or technology. The equipment serves as collateral, making it a cost-effective way to upgrade or expand without straining cash reserves.

Benefits of Business Loans

Business loans offer vital financial support, helping companies thrive in competitive markets by enabling them to:

Improve Cash Flow – Cover daily operational expenses and maintain consistent financial stability.

Invest in Growth – Expand into new locations, upgrade equipment, or increase production capacity.

Build Business Credit – Establish a strong credit profile for easier access to future financing.

Seize Opportunities – Act quickly on time-sensitive investments or strategic deals.

Stabilize Operations – Provide a financial cushion during off-seasons or economic downturns.

How to Use a Business Loan Effectively

Choosing the right business loan is just the first step—knowing how to use it wisely maximizes its benefits. Here are some key applications:

Expanding the Business Locations – Open new branches or offices.

Upgrading Equipment – Invest in the latest technology and machinery.

Enhancing Marketing Efforts – Boost online and offline advertising strategies.

Managing Inventory – Stock up on products to meet customer demand.

Hiring and Training Staff – Strengthen your workforce with skilled employees.

Secure the Right Loan for Your Business Today!

Finding the right loan solution shouldn’t be overwhelming. At Capifina, we simplify financing with fast, flexible, and tailored options to meet your business needs. Whether you need working capital, equipment financing, or a business line of credit, we provide customized solutions to help you grow. Our seamless process ensures quick approvals so you can focus on expanding your business. Apply now at Capifina and take the next step toward success!

#capifina#Small business loans#Business financing options#Equipment financing#Working capital loans#Business line of credit#SBA loan options#Invoice financing#Merchant cash advance#Business loan approval#Business expansion loans#Commercial financing solutions#Fast business funding#Low-interest business loans#Alternative business funding#Financial support for businesses

0 notes

Text

Types of Business Loans and Their Uses | Capifina

Looking for the right business loan to support your growth? Securing the right financing is essential for businesses aiming to expand operations, manage cash flow effectively, or invest in new opportunities. With a wide range of loan options available, understanding the key differences between them is crucial to making an informed choice. Capifina offers customized financing solutions designed to meet your specific business needs—whether you're looking for equipment financing, working capital, or a flexible business line of credit to help you grow with confidence.

Why Choose Capifina for Your Business Loan Needs?

Finding the right loan provider is just as important as choosing the loan itself. We offers flexible loan options tailored to various business needs, ensuring you get the right financing solution. With a fast approval process and minimal paperwork, securing funds is quick and hassle-free. Our customized financing solutions are designed to match your specific growth strategy, all with competitive interest rates and transparent pricing. Plus, our team provides guidance to help you find the best loan to scale your business efficiently and sustainably.

What Are the Different Types of Business Loans?

Business loans come in various forms to meet specific financial needs:

Benefits of Business Loans

Business loans offer vital financial support, helping companies thrive in competitive markets by enabling them to:

Improve Cash Flow – Cover daily operational expenses and maintain consistent financial stability.

Invest in Growth – Expand into new locations, upgrade equipment, or increase production capacity.

Build Business Credit – Establish a strong credit profile for easier access to future financing.

Seize Opportunities – Act quickly on time-sensitive investments or strategic deals.

Stabilize Operations – Provide a financial cushion during off-seasons or economic downturns.

How to Use a Business Loan Effectively

Choosing the right business loan is just the first step—knowing how to use it wisely maximizes its benefits. Here are some key applications:

Expanding the Business Locations – Open new branches or offices.

Upgrading Equipment – Invest in the latest technology and machinery.

Enhancing Marketing Efforts – Boost online and offline advertising strategies.

Managing Inventory – Stock up on products to meet customer demand.

Hiring and Training Staff – Strengthen your workforce with skilled employees.

Secure the Right Loan for Your Business Today!

Finding the right loan solution shouldn’t be overwhelming. At Capifina, we simplify financing with fast, flexible, and tailored options to meet your business needs. Whether you need working capital, equipment financing, or a business line of credit, we provide customized solutions to help you grow. Our seamless process ensures quick approvals so you can focus on expanding your business. Apply now at Capifina and take the next step toward success!

#Small business loans#Business financing options#Equipment financing#Working capital loans#Business line of credit#SBA loan options#Invoice financing#Merchant cash advance#Business loan approval#Business expansion loans#Commercial financing solutions#Fast business funding#Low-interest business loans#Alternative business funding#Financial support for businesses#capifina

0 notes

Text

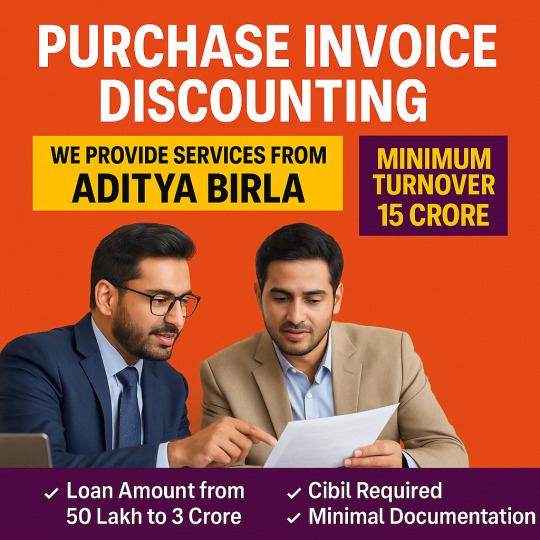

How Purchase Invoice Discounting Enhances Business Efficiency in Delhi

Efficiency in financial operations is a critical determinant of business success, especially in a competitive market like Delhi. Purchase invoice discounting emerges as a strategic solution to streamline cash flow management and operational efficiency.

By converting purchase invoices into immediate cash, businesses can ensure uninterrupted operations, timely procurement of raw materials, and adherence to production schedules. This financial flexibility allows companies to respond swiftly to market demands and customer needs, thereby gaining a competitive edge.

Moreover, purchase invoice discounting reduces the dependency on traditional credit lines, which often involve lengthy approval processes and stringent collateral requirements. The agility offered by this financing method aligns well with the dynamic nature of Delhi's business environment, where quick decision-making and adaptability are essential.

0 notes

Text

Know about loan alternatives for your business: - https://shorturl.at/fwzqI

0 notes

Text

Invoice Financing vs Factoring: Key Differences Explained

Invoice financing vs factoring: What’s the difference? Learn how each solution helps manage unpaid invoices, improve cash flow, and support business growth. Find out which fits your needs best.

#invoice factoring#invoice factoring For small business#invoice financing#invoice financing for small business#invoice financing vs factoring#pros of invoice factoring#cpros of invoice financing

0 notes

Text

Best Invoice Financing Companies For Small Businesses

Keep A Count offers the best invoice financing solutions for small businesses, helping you unlock cash flow by turning unpaid invoices into working capital. Fast, flexible, and hassle-free financing. For more information visit:- https://keepacount.com/

0 notes

Text

Australian Finance Group

Australian Finance Group Ltd provides mortgage brokerage, personal loans, commercial finance, and insurance services. The Company is an aggregator and offers products through its broker network. Australian Finance Group serves customers in Australia.

Get a clear picture of Finance Group Australia Ltd's performance with key financial ratios and data on financial growth. Compare against peers.

Mortgage Brokerage

Mortgage brokers provide a service to their clients, allowing them to secure financing from lenders. They collect documents such as credit reports, proof of income and asset details to help a client find the most suitable loan. They also act as a liaison between the lender and borrower throughout the application process.

In Australia, mortgage brokers are paid a commission for arranging loans. This may be paid by the mortgage lender or by the client. A mortgage broker should disclose all fees before they arrange a loan. This allows a borrower to compare the cost of loans and choose the most appropriate one for them.

Get detailed financial information on Australian Finance Group Ltd including historical security price data, important key dates, ASX announcements, financial reports and presentations. View and analyze company performance with

benchmarking insights comparing the Company to its peers. IBISWorld’s Enterprise Profiles give you a comprehensive understanding of the company’s business operations, strategic positioning and growth opportunities.

Personal Loans

The company offers personal loans to individuals. It also provides mortgage brokerage, insurance, and commercial finance services. It serves customers throughout Australia. The company's services include unsecured and secured loans, bridging loans, and home loan refinance. Its unsecured loans offer fixed and variable interest rates. Its bridging loans help foreign nationals in need of short-term funds.

Its personal loans are available for a variety of purposes, including paying for study costs, buying furniture, renovating your house, or going on holiday. Its unsecured personal loan is suitable for people who have poor credit histories. Its low credit score personal loans are available for those who are residing in Australia on an approved visa and earning steady income.

Get a full financial picture of Australian Finance Group Ltd with detailed revenue and asset information. Compare relative performance to peers and industry benchmarks. Understand the key drivers of Australian Finance Group Ltd's growth and profitability. Obtain key contact details and analyse the competitive environment for your business.

Commercial Finance

Whether it's for purchasing equipment, expanding your business, or buying land and buildings, commercial loans are available to help you reach your goals. But the terms, rates, and fees can make a huge difference in your bottom line.

The company's business lines include mortgage aggregation, consumer asset finance and commercial finance. It operates its aggregation segment in the form of a securitisation program that packages mortgages into trusts and sells them on. The trusts are backed by non-recourse debt, meaning that AFG will not be liable for defaults within the trust.

Get detailed financial information on 3M+ companies with PitchBook Pro. Compare financial ratios and growth across segments, industries and geographic locations for a clearer picture of performance.

Insurance

There are several large insurance companies in Australia that offer a wide variety of products and services. Some provide general insurance while others specialize in specific types of coverage. Some of these companies include Steadfast, which operates the largest network of insurance brokers in Australia and New Zealand with more than 417 brokerages. Other insurers include nib, which offers health and travel policies, and GIO, which provides car, home, business, and caravan insurance.

Some of these insurance companies also offer specialty commercial products. These products can cover financial risk exposures such as agribusiness and manufacturing. They can also cover the costs of business interruption and cyber crime.

Some of these companies have a market capitalization of more than $10 billion, making them one of the world’s top insurance companies. Their market cap can help customers and investors decide whether they’re a safe investment. In addition, their market share can indicate whether the company is financially stable enough to meet its future obligations.

0 notes

Text

Innovative Approaches to Invoice Financing: Beyond the Basics

The landscape of invoice financing is evolving with the advent of new technologies and innovative models. From dynamic discounting to blockchain integration, AI-driven analytics, and sustainability-focused strategies, businesses have a plethora of options to enhance their cash flow management. As these innovative approaches continue to develop, they promise to make invoice financing more efficient, transparent, and accessible for businesses of all sizes.

0 notes

Text

Cash Advances and Loans for Gig Workers No Credit Check

Overcoming Financial Challenges: A Comprehensive Guide to Securing Loans and Cash Advances for Gig Workers and Self-Employed Individuals Introduction The gig economy has revolutionized the way we work, offering flexibility and autonomy to pursue our passions and entrepreneurial dreams. However, gig workers and self-employed individuals often face unique challenges when seeking financial…

View On WordPress

#1099 contractors#alternative funding options#bank brezzy#BankBreezy#Breezy ConnectCash#business lines of credit#cash advances#cash flow management#co-signed loans#credit unions#direct deposits#emergency funds#employee retention tax credits#financial challenges#financial planning#financial solutions#freelance job marketplaces#gig economy platforms#gig workers#government-backed loans#invoice factoring#invoice financing#loans#no credit check loans#online lending platforms#point-of-sale loans#SBA loans#secured credit cards#Self-Employed#Self-Employed Tax Credit

1 note

·

View note

Text

#printing business#printing industry USA#invoice financing#invoice#USA accounting#USA bookkeeping#bookkeeperlive

0 notes

Text

Facts About Factoring That Could Cost You Money

Photo by Mikhail Nilov on Pexels.com Factoring, a financial transaction where a business sells its accounts receivable to a third party (the factor) at a discount, can be a lifeline for businesses in need of immediate cash flow. However, while factoring can provide crucial short-term financial relief, there are aspects of it that could end up costing your business more money than anticipated.…

View On WordPress

#accounts receivable#business finance#business funding#business growth#cash flow#cash flow management#cost assessment#factoring#factoring benefits#factoring costs#factoring fees#financial decision-making#financial management#financial solution#Financial stability#financial strategy#financial tools#Freight#freight industry#Freight Revenue Consultants#interest rates#Invoice factoring#invoice financing#liquidity#non-recourse factoring#recourse factoring#small carriers#small-business#Transportation#Trucking

0 notes

Text

Unlocking Working Capital: An Introduction to Purchase Invoice Discounting in Delhi

In the bustling business landscape of Delhi, maintaining a healthy cash flow is paramount for enterprises of all sizes. One financial tool gaining traction among businesses is purchase invoice discounting. This mechanism allows companies to convert their outstanding purchase invoices into immediate working capital, thereby bridging the gap between payment obligations and cash availability.

Purchase invoice discounting involves a third-party financier advancing funds against the invoices a company has issued to its buyers. This arrangement enables businesses to meet their supplier payments promptly without waiting for the buyers to settle their dues. The process not only ensures timely payments to suppliers but also strengthens the supply chain by fostering trust and reliability.

Delhi's diverse economy, encompassing sectors like manufacturing, retail, and services, presents ample opportunities for businesses to leverage purchase invoice discounting. By adopting this financial strategy, companies can enhance their liquidity, negotiate better terms with suppliers, and seize growth opportunities without the constraints of delayed receivables.

0 notes

Text

Understanding different loan options that suits your loan type is crucial especially, when Loan applications can be time-consuming, and eligibility requirements are often strict. Therefore, loan alternatives can be lifesavers for businesses that don’t qualify for traditional loans. These options widen access to credit and keep operations running even when the cash is tight.

0 notes

Text

How Technology is Revolutionizing Accounts Receivable Financing Companies

Discover how digital solutions are reshaping accounts receivable financing, optimizing efficiency, and helping businesses unlock growth potential in today’s dynamic market.

#ar factoring companies#accounts receivable factoring companies#accounts receivable financing company#invoice financing#accounts receivable financing companies

0 notes

Text

Export Made Easy: Get Paid, Fast, with FinPrestige Invoice Financing

Partner with FinPrestige for a trusted alliance grounded in a proven track record, customer-centric approach, global expertise, and cutting-edge technology. Their commitment to your success is reflected in tailored financial solutions designed for your business's unique needs. Visit https://finprestige.com.sg/ to embark on a journey of financial empowerment, propelling your business to new heights in the global market.

#finprestigeconsultancy#bank loans for startups#finprestige#singaporeproperty#Invoice Financing#export invoice

0 notes