#IoT Lora LPWAN

Explore tagged Tumblr posts

Text

2G/3G/4G Combo Screw Mount Antenna with RG174 Cable (L-3MTR) + SMA (M) St. Connector

A 2G/3G/4G combo screw mount antenna is a type of antenna designed to support multiple generations of cellular technology, namely 2G (GSM), 3G (UMTS), and 4G (LTE). These antennas are typically used in applications where there's a need for reliable cellular communication across different generations of networks.

The "screw mount" aspect refers to how the antenna is installed; it typically involves screwing the antenna onto a suitable surface, such as the roof of a vehicle or a fixed structure. This type of mounting provides stability and durability, making it suitable for outdoor and rugged environments.

#rf antenna#RF Antenna#celluler antenna#5g antenna#5G Internal Antenna#5G External Antenna#5G Outdoor Antenna#4G LTE Antenna#4G Internal Antenna#4G External Antenna#4G Outdoor Antenna#3G Antenna#3G Internal Antenna#3G External Antenna#3G Outdoor Antenna#2G/GSM Antenna#2G Internal Antenna#2G External Antenna#2G Outdoor Antenna#IoT Lora LPWAN#868MHz Antenna#433MHz Antenna#915MHz Antenna#925MHz Antenna

0 notes

Text

4G 5dBi #AdhesiveAntenna With RG174 (L-3Mtr) Cable + SMA (M) St. Connector

SKU: ET-LTS-1L3-SMS

-SPECS:-

• Product Antenna

• Type-External Antenna

• Frequency-698~2700MHz

• Gain- SdBi

• Technology-4G

• Mounting Adhesive Mount

• Dimension-117x22mm

• Cable-RG174

• Connector- SMA Male

Know More At - https://eteily.com/3-rf-antenna

#eteily#technologies#eteilyindia#rfantenna#5g#4g#external#telecom#telecomunication#india

#5G Outdoor Antenna#4G LTE Antenna#4G Internal Antenna#4G External Antenna#4G Outdoor Antenna#3G Antenna#3G Internal Antenna#3G External Antenna#3G Outdoor Antenna#2G/GSM Antenna#2G Internal Antenna#2G External Antenna#2G Outdoor Antenna#IoT Lora LPWAN#868MHz Antenna#433MHz Antenna#915MHz Antenna#925MHz Antenna#865MHz Antenna#GPS-GNSS ANTENNA

0 notes

Text

Low Power Wireless IoT Sensors Market : Analysis by Product Types, Application, Region and Country, Trends and Forecast

Global Low Power Wireless IoT Sensors Market��Research Report 2025(Status and Outlook)

The global Low Power Wireless IoT Sensors Market size was valued at US$ 2.96 billion in 2024 and is projected to reach US$ 8.47 billion by 2032, at a CAGR of 14.03% during the forecast period 2025-2032.

Low Power Wireless IoT Sensors are energy-efficient sensing devices that utilize wireless communication protocols to transmit data across IoT networks. These sensors play a pivotal role in enabling smart connectivity across industries by monitoring environmental parameters such as temperature, humidity, pressure, motion, and air quality while optimizing power consumption. Major wireless technologies employed include LoRa, SigFox, NB-IoT, Zigbee, and Bluetooth Low Energy (BLE).

The market growth is primarily driven by the rapid adoption of IoT solutions across smart cities, industrial automation, and healthcare applications. While the deployment of 5G networks and edge computing infrastructure is accelerating market expansion, challenges such as interoperability issues and security concerns persist. Key industry players including Bosch Sensortec, Texas Instruments, and STMicroelectronics are actively investing in advanced sensor technologies with enhanced energy harvesting capabilities to strengthen their market position.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis.https://semiconductorinsight.com/download-sample-report/?product_id=95898

Segment Analysis:

By Technology

LoRa Technology Leads the Market Due to its Long-Range Communication Capabilities for IoT Applications

The market is segmented based on technology into:

LoRa Technology

Subtypes: LoRaWAN, Point-to-Point LoRa

SigFox Technology

NB-IoT Technology

Wi-Fi

Others

By Application

Smart Cities Segment Dominates with Growing Demand for Connected Infrastructure Solutions

The market is segmented based on application into:

Smart Cities

Smart Industrial

Smart Building

Smart Connected Vehicles

Smart Healthcare

By Sensor Type

Environmental Sensors Capture Significant Market Share Due to Climate Monitoring Needs

The market is segmented based on sensor type into:

Temperature Sensors

Humidity Sensors

Pressure Sensors

Motion Sensors

Others

By End-User Industry

Industrial Sector Holds Major Share with Increasing Adoption of Predictive Maintenance Solutions

The market is segmented based on end-user industry into:

Manufacturing

Healthcare

Automotive

Energy & Utilities

Agriculture

Regional Analysis: Global Low Power Wireless IoT Sensors Market

North America North America dominates the low power wireless IoT sensors market, driven by rapid adoption across smart cities, industrial automation, and connected healthcare. The U.S. accounts for over 60% of regional demand due to strong 5G rollout and federal initiatives like the Infrastructure Investment and Jobs Act, which allocates $550 million for IoT integration in critical infrastructure. Canada follows suit with smart building projects in Toronto and Vancouver leveraging LoRa and NB-IoT technologies. The presence of major players like Honeywell and Texas Instruments further strengthens the ecosystem. However, high deployment costs and interoperability challenges between legacy systems remain key restraints.

Europe Europe showcases robust growth, particularly in Germany and France, where EU directives on energy efficiency are accelerating adoption. The region’s share of LPWAN-based sensors grew 28% YoY in 2023, propelled by smart meter deployments under the Clean Energy Package. SigFox and LoRaWAN networks now cover 95% of Western Europe. Stringent data privacy regulations like GDPR initially slowed implementations but now provide standardized frameworks. The Nordic countries lead in smart cold chain logistics applications due to their extensive pharmaceutical exports. Eastern Europe lags in adoption but presents opportunities through EU-funded digital transformation programs.

Asia-Pacific As the fastest-growing region, APAC benefits from China’s massive IoT infrastructure spending ($290 billion in 2023) and India’s 100 Smart Cities Mission. Japan and South Korea excel in precision manufacturing sensors, while Southeast Asia focuses on agricultural IoT. Unlicensed spectrum availability has fueled LoRa adoption, though NB-IoT gains traction through telecom partnerships. The region faces fragmentation – tier-1 cities deploy cutting-edge systems while rural areas still use legacy monitoring. Cost sensitivity drives localization, with regional players like Panasonic and Omron capturing 40% of the market through tailored solutions.

South America Brazil and Argentina lead regional adoption, primarily in smart energy and industrial assets monitoring. The market remains nascent but grew 19% in 2023 as mining and oil/gas operators modernize facilities. Limited spectrum harmonization and economic instability have slowed large-scale deployments. Most projects involve multinational corporations rather than domestic initiatives. Chile’s smart grid projects and Colombia’s urban IoT pilots show promise, though political uncertainty in some countries deters long-term investments. Network coverage gaps in remote areas further hinder growth potential despite improving 4G/LTE infrastructure.

Middle East & Africa The GCC nations drive regional demand through smart city megaprojects like NEOM and Masdar City. UAE’s nationwide LoRaWAN network demonstrated successful smart utility deployments, reducing water losses by 25% in Dubai. Saudi Arabia’s Vision 2030 allocates $24 billion for IoT infrastructure. Sub-Saharan Africa shows patchy adoption, with South Africa and Kenya leading in agricultural and healthcare applications using solar-powered sensors. While 5G rollouts will accelerate growth, the region faces challenges including limited technical expertise, high device import costs, and unreliable power infrastructure in rural areas. Strategic partnerships with Chinese tech firms are helping bridge these gaps.

List of Major Low Power Wireless IoT Sensor Manufacturers

Texas Instruments Incorporated (U.S.)

NXP Semiconductors N.V. (Netherlands)

STMicroelectronics N.V. (Switzerland)

Infineon Technologies AG (Germany)

Analog Devices, Inc. (U.S.)

Silicon Laboratories Inc. (U.S.)

Robert Bosch GmbH (Germany)

Honeywell International Inc. (U.S.)

Sensirion AG (Switzerland)

Omron Corporation (Japan)

TE Connectivity Ltd. (Switzerland)

Sensata Technologies Holding plc (U.S.)

The global push towards smart city development is creating sustained demand for low power wireless IoT sensors. Governments worldwide are investing heavily in urban infrastructure digitization, with wireless sensor networks forming the backbone of these initiatives. Applications range from traffic monitoring and waste management to environmental sensing and public safety systems. The smart city sector accounted for over 30% of total IoT sensor deployments in 2023, demonstrating the crucial role these devices play in modern urban planning. As municipalities continue to prioritize sustainability and operational efficiency, sensor deployments are projected to grow at a compound annual rate exceeding 18% through 2028.

Industry 4.0 transformation across manufacturing and logistics sectors is significantly boosting the low power wireless sensor market. The ability of these devices to operate for years on small batteries while providing real-time equipment monitoring makes them ideal for predictive maintenance applications. In industrial environments, wireless vibration, temperature and pressure sensors help prevent equipment failures while reducing maintenance costs by an average of 25-30%. The manufacturing sector’s embrace of digitization, combined with the falling cost of sensor hardware, has led to a 40% year-over-year increase in industrial IoT sensor shipments.

Energy efficiency requirements continue to push adoption rates higher across all applications. Modern low power wide area network (LPWAN) technologies enable sensor nodes to operate for 5-10 years without battery replacement, eliminating maintenance concerns that previously hindered deployment scalability.

The convergence of AI analytics with wireless sensor networks represents a significant growth opportunity. Cloud-based machine learning platforms can now extract actionable insights from distributed sensor data at unprecedented scale. This technological synergy transforms simple monitoring devices into intelligent systems capable of predictive analytics and automated decision-making. Early adopters in manufacturing and utilities sectors have reported efficiency improvements of 15-20% through AI-enhanced sensor implementations.

The healthcare sector presents particularly promising opportunities for growth. Remote patient monitoring systems leveraging low power biomedical sensors enable continuous health tracking while maintaining extended battery life. With chronic disease management transitioning to outpatient models, the medical IoT sensor market is projected to exceed market growth rates by at least 25% annually through 2030.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=95898

Key Questions Answered by the Outsourced Low Power Wireless IoT Sensors Market Report:

What is the current market size of Global Low Power Wireless IoT Sensors Market?

Which key companies operate in this market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Browse More Reports:

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

U.S. Internet of Things (IoT) Market Size to Hit USD 118.24 Bn by 2030

The U.S. Internet of Things (IoT) market share remains one of the most mature and dynamic ecosystems globally. Valued at USD 98.09 billion in 2022, the market is projected to grow from USD 118.24 billion in 2023 to USD 553.92 billion by 2030, registering a compound annual growth rate (CAGR) of 24.7% during the forecast period. The U.S. Internet of Things (IoT) market refers to the ecosystem of interconnected physical devices, sensors, software, and network infrastructure that enables the collection, exchange, and analysis of data across a wide range of industries. These devices are embedded with computing technology that allows them to monitor environments, automate processes, and communicate with other systems and users in real-time.

Key Market Highlights: • Market Size (2022): USD 98.09 billion • Projected Size (2030): USD 553.92 billion • CAGR (2023–2030): 24.7% • Growth Drivers: Technological maturity, innovation leadership, and extensive IoT adoption across industries.

Leading U.S. Companies in the IoT Space: • Cisco Systems, Inc. • Amazon Web Services (AWS) • Microsoft Corporation • Intel Corporation • Qualcomm Technologies, Inc. • Hewlett Packard Enterprise (HPE) • IBM Corporation • Google LLC • Oracle Corporation • PTC Inc.

Request For Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/u-s-internet-of-things-iot-market-107392

Market Dynamics:

Strategic Market Drivers: • Expansion of smart city infrastructure supported by federal and state governments. • Increasing deployment of industrial IoT (IIoT) for manufacturing automation and predictive maintenance. • Growth in consumer IoT, including connected homes, wearables, and personal health tracking devices. • Advancements in 5G, AI, and edge computing fueling real-time, decentralized data processing.

Major Opportunities: • Healthcare IoT for remote patient monitoring, smart diagnostics, and hospital asset management. • Smart grid and energy optimization systems led by clean energy policies. • Transportation and mobility solutions such as connected vehicles and V2X communication. • Federal funding for infrastructure modernization and cybersecurity in IoT environments.

Market Applications: • Smart manufacturing • Connected healthcare and telemedicine • Smart homes and consumer IoT • Fleet and supply chain management • Environmental and agricultural monitoring • Retail automation and customer behavior tracking

Deployment Models & Connectivity: • Deployment Types: Cloud-based, on-premises, hybrid, and edge-enabled solutions • Connectivity: 5G, Wi-Fi 6, LPWAN (LoRa, NB-IoT), Bluetooth, Zigbee, and satellite IoT

Key Market Trends: • Surging interest in cybersecure IoT ecosystems and zero-trust architecture. • Integration of artificial intelligence (AI) with IoT for autonomous decision-making. • Proliferation of IoT-as-a-Service (IoTaaS) and managed IoT platforms. • Increased focus on sustainability and green IoT solutions for emissions tracking and resource efficiency.

Speak to Analyst: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/u-s-internet-of-things-iot-market-107392

Recent Industry Developments: May 2023 – Amazon Web Services (AWS) expanded its IoT TwinMaker platform, enabling faster digital twin deployment for industrial and logistics enterprises across the U.S.

August 2023 – Cisco launched its U.S.-focused IoT Operations Dashboard for real-time device tracking, configuration management, and anomaly detection at enterprise scale.

About Us: Fortune Business Insights delivers powerful data-driven insights to help businesses navigate disruption and capitalize on emerging trends. We specialize in delivering sector-specific intelligence, customized research, and strategic consulting across a wide range of industries. Our team empowers organizations with clarity, foresight, and a competitive edge in a fast-moving technological landscape.

Contact Us: US: +1 833 909 2966 UK: +44 808 502 0280 APAC: +91 744 740 1245 Email: [email protected]

#U.S. Internet of Things Market Share#U.S. Internet of Things Market Size#U.S. Internet of Things Market Industry#U.S. Internet of Things Market Driver#U.S. Internet of Things Market Growth#U.S. Internet of Things Market Analysis#U.S. Internet of Things Market Trends

0 notes

Text

[IOTE Expo 2025 Shanghai] The Key Takeaways from This Seminar: Deepening Technology, Expanding the Ecosystem, and Advancing Intelligent Sensing towards Multi-Dimensional Breakthroughs!

On June 19, the summer in Shanghai was filled with the heat of science and technology, and the IOTE 2025 Shanghai Intelligent Sensing Ecosystem Seminar was held as scheduled amid much anticipation.

This industry event focusing on the intelligent sensing ecosystem attracted representatives and technical experts from multiple fields such as chip research and development, module manufacturing, IoT solution provision, and industry applications to gather together to conduct in-depth exchanges around the innovative application and ecological construction of intelligent sensing technology, injecting new momentum into the development of the IoT industry, especially the intelligent sensing field.

At the seminar, Qiao Lei, deputy manager of the artificial intelligence division of Beijing Zhixin Microelectronics Technology Co., Ltd., introduced that the AIoT digital twin architecture is becoming popular. Zhixin has launched a full range of artificial intelligence terminal products and solutions covering cloud, edge, and end, which can fully support artificial intelligence businesses in various industries.

LoRa Alliance CEO Alper Yegin shared that LoRaWAN has the performance characteristics of low power consumption and wide area network, supports the construction of public networks, private networks and community networks, and its application scenarios include smart metering, smart buildings, asset tracking, smart agriculture, smart industry, etc.

Li Changlin, business cooperation manager of Xiamen Xingzong IoT Technology Co., Ltd., said that Xingzong IoT has been committed to the construction of digital sensing ecological products and promoting low-carbon ecological development with wireless low-power technology.

Robert Comanescu, General Manager of Semtech IoT Chips, introduced LoRa as a leading technology in the LPWAN field. As of May 2025, there are more than 450 million terminal nodes equipped with LoRa chips deployed worldwide. According to research data, LoRa is maintaining a strong growth momentum.

Liu Lei, founder and CEO of Jiaxing Bogan Technology Co., Ltd., summarized that industrial sensors will develop in the direction of miniaturization, integration (multimodal perception), high precision, high reliability, networking, wireless, passive, and intelligent.

Hu Hao, senior market development manager at Avnet Electronic Technology Co., Ltd., analyzed four reasons why the Internet of Things is important for edge AI, namely, it is conducive to: large-scale data collection, continuous model optimization, life cycle and security updates, and unified system intelligence.

Hu Ren, an IoT solutions expert at Shenzhen Jurui Cloud Control Technology Co., Ltd., talked about the application of smart sensing technology in disease control.

As the IOTE 2025 Shanghai Smart Sensing Ecosystem Seminar came to an end, this exchange feast that brought together industry wisdom and innovative vitality outlined a development blueprint full of opportunities for the smart sensing and Internet of Things industries. In the future, we will continue to expect that smart sensing technology will continue to break boundaries and unleash potential in more segmented scenarios!

This paper is from Ulink Media, Shenzhen, China, the organizer of IOTE EXPO (IoT Expo in China)

0 notes

Text

📡 𝐋𝐨𝐑𝐚 𝐚𝐧𝐝 𝐋𝐨𝐑𝐚𝐖𝐀𝐍 𝐃𝐞𝐯𝐢𝐜𝐞𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 (𝟐𝟎𝟐𝟒–𝟐𝟎𝟑𝟏) 📡

📌 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐮𝐭𝐥𝐨𝐨𝐤

The LoRa and LoRaWAN Devices Market is projected to skyrocket from $9.3B in 2024 to $32.7B by 2031, registering a phenomenal CAGR of 32.4%. As the backbone of long-range, low-power IoT connectivity, LoRa is enabling smart ecosystems across agriculture, cities, and industry — all without the need for cellular or Wi-Fi.

🔗 𝐆𝐞𝐭 𝐑𝐎𝐈-𝐟𝐨𝐜𝐮𝐬𝐞𝐝 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝟐𝟎𝟐𝟓-𝟐𝟎𝟑𝟏 → 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐍𝐨𝐰

📊 𝐓𝐨𝐩 𝐆𝐫𝐨𝐰𝐭𝐡 𝐕𝐞𝐫𝐭𝐢𝐜𝐚𝐥𝐬

• Smart Agriculture — Precision farming, irrigation monitoring, and livestock tracking

• Smart Cities — Parking, waste, street lighting, and air quality management

• Industrial IoT — Asset tracking and predictive maintenance

• Utilities — Smart metering for water, electricity, and gas

💡 𝐖𝐡𝐚𝐭’𝐬 𝐏𝐨𝐰𝐞𝐫𝐢𝐧𝐠 𝐭𝐡𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

• Explosive growth in IoT-connected devices

• Demand for low-power, wide-area connectivity (LPWAN)

• Cost-efficiency over traditional networks

• Government-backed smart infrastructure initiatives

🛑 𝐂𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞𝐬 𝐭𝐨 𝐖𝐚𝐭𝐜𝐡

• Spectrum interference risks in unlicensed bands

• Interoperability and standardization issues

• Security concerns in remote, low-data-rate deployments

🔬 𝐄𝐦𝐞𝐫𝐠𝐢𝐧𝐠 𝐓𝐫𝐞𝐧𝐝𝐬

• Satellite-LoRaWAN convergence for global coverage

• AI-based network optimization and anomaly detection

• Private LoRaWAN networks for enterprise-grade use

• Integration with blockchain for secure IoT transactions

🏆 𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬 𝐭𝐨 𝐖𝐚𝐭𝐜𝐡

• Leaders: Semtech, Kerlink, MultiTech Systems, SENET, Actility

• Emerging: WATTECO, TEKTELIC, Browan Communications, Inc.

• Innovators: OrbiWise | IoT | LoRaWAN, LORIOT, The Things Industries

📈 𝐖𝐡𝐲 𝐈𝐭 𝐌𝐚𝐭𝐭𝐞𝐫𝐬

LoRa is democratizing the IoT revolution — connecting sensors where other networks can’t reach. From rural farms to urban infrastructure, it’s driving digital transformation at the edge with minimal cost and power.

#LoRa #LoRaWAN #IoT #SmartCities #AgriTech #IIoT #LPWAN #ConnectivitySolutions #EdgeComputing #IoTDevices #FutureOfTech #MarketInsights #IndustryARC

0 notes

Text

Evolution of Roaming Services: Market Dynamics and Future Prospects

The global roaming tariff market size is expected to reach USD 113.41 billion by 2030, expanding at 6.0% CAGR from 2023 to 2030, according to a new study by Grand View Research, Inc. The increasing adoption of high-end mobile devices enabled with 3G, and 4G networking capabilities are expected to drive market growth. Similarly, the emergence of 5G is also anticipated to power the growth of the roaming tariff industry.

High competition among key players in the roaming tariff industry has resulted in companies introducing international roaming packages to maintain their customer base. The companies are doing this to restrict customers from switching from one service provider to another due to price differentiation. These factors are expected to fuel market growth.

Roaming enables users to use their mobile devices outside the pre-defined geographical coverage. Roaming tariffs are the extra charges roamers pay when they utilize a foreign network. These additional charges are paid for various roaming services, such as SMS, data, and voice. Multiple factors are anticipated to fuel the growth of the roaming tariff industry.

The rising growth of mobile phone users, the growing popularity of 3G and 4G-enabled smartphones, the increasing number of unique subscribers, and global penetration of mobile internet among others. These factors are anticipated to positively impact the roaming tariff industry growth over the forecast period.

Companies in the roaming tariff industry have launched various strategic initiatives aimed at reducing operational costs for roaming services. For instance, CELL C (South African mobile network provider) announced 61% of its network had migrated to partner towers, as a part of its network migration strategy.

The strategy involves eliminating spending money on infrastructure, and a telecom provider operating as a wholesale buyer of capacity and services. This strategy enables telecom providers to permanently offer roaming services via other networks. The company has achieved tremendous success in implementing this strategy which has enabled 100% migration in six provinces.

Companies in the roaming tariff industry are also undertaking various mutually beneficial initiatives for themselves and the market alike. Major mobile network operators formed a non-profit association in 2015, named LoRa Alliance, aimed at collaborating and promoting LoRaWAN standard as the major open global standard for secure IoT LPWAN connectivity.

Curious about the Roaming Tariff Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Roaming Tariff Market Report Highlights

The national roaming type segment dominated the market in 2022 and is expected to continue leading over the forecast period. The market is expected to witness growth in developed and developing countries. For instance, in the U.S., national and international roaming share similarities owing to the presence of key players. These key players must sign national roaming agreements to offer international roaming services globally

Retail roaming emerged as the most significant distribution channel in 2022. The segment is also expected to grow substantially during the forecast period. Retail roaming services are when several Mobile Virtual Network Operators (MVNOs) and Mobile Network Operators (MNOs) offer their roaming services directly to individual customers

Europe is anticipated to grow at a significant CAGR over the forecast period. The growth can be accredited to the rising disposable income among the upper- & middle-class population. Additionally, the European Commission introduced the ‘Roam like at Home’ policy to avoid additional roaming charges and reduce bill-related consumer anxiety

Roaming Tariff Market Segmentation

Grand View Research has segmented the global roaming tariff market based on roaming type, distribution channel, service, and region:

Roaming Tariff Type Outlook (Revenue, USD Million, 2018 - 2030)

National

International

Roaming Tariff Distribution Channel Type Outlook (Revenue, USD Million, 2018 - 2030)

Retail Roaming

Wholesale Roaming

Roaming Tariff Service Outlook (Revenue, USD Million, 2018 - 2030)

Voice

SMS

Data

Roaming Tariff Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Rest of Europe

Asia Pacific

China

India

Japan

Rest of Asia Pacific

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa (MEA)

Key Players in the Roaming Tariff Market

America Movil

AT&T Inc.

Bharti Airtel Ltd.

China Mobile Ltd.

Deutsche Telekom AG

Digicel Group

T-Mobile (Sprint Communication)

Telefonica SA

Verizon Communications Inc.

Vodafone Group plc

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Text

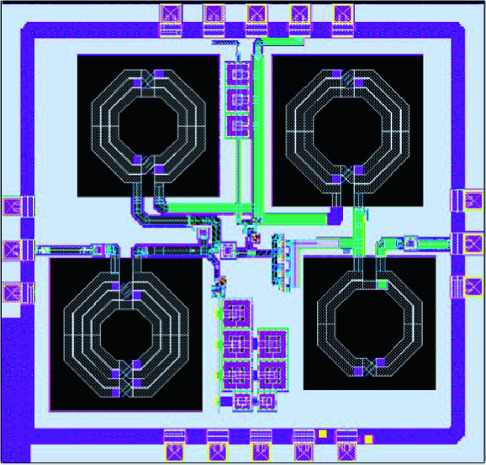

CMOS Power Amplifiers Market Future Trends Driven by 5G, IoT, and Power Efficiency Demands

The global electronics industry is undergoing a transformative shift, and one of the most dynamic segments leading this evolution is the CMOS power amplifiers market. These compact yet powerful components are becoming essential in a variety of applications, especially in wireless communication and low-power electronics. With emerging technologies like 5G, IoT, and AI shaping future connectivity, CMOS power amplifiers are positioned to play a pivotal role in enabling high-efficiency, low-cost, and scalable solutions for signal amplification.

Rising Demand for 5G Integration

One of the most significant drivers influencing the CMOS power amplifiers market is the widespread rollout of 5G networks. Unlike its predecessors, 5G demands much higher data transmission rates and supports a broader range of frequencies, including millimeter-wave bands. CMOS-based power amplifiers, known for their ability to integrate seamlessly with digital baseband and RF circuits, are ideal for these new requirements.

Traditional compound semiconductor technologies like GaAs have been dominant in RF power amplification. However, CMOS technology is increasingly preferred due to its lower cost, scalability, and compatibility with digital ICs. As the demand for 5G-enabled smartphones and network infrastructure rises, so too does the need for efficient, high-frequency CMOS power amplifiers.

The Growth of IoT and Low-Power Applications

Another key trend driving the market is the exponential growth of the Internet of Things (IoT). Billions of connected devices—from smart sensors to wearables—rely on low-power wireless communication systems. CMOS power amplifiers are well-suited for such applications due to their energy efficiency, compact size, and cost-effectiveness.

The proliferation of low-power wide-area networks (LPWANs), such as NB-IoT and LoRa, further accelerates this trend. These networks demand long battery life and reliable RF performance, both of which are achievable through CMOS-based solutions. As IoT ecosystems expand in sectors like smart homes, healthcare, and industrial automation, the demand for optimized CMOS power amplifiers will continue to surge.

Advances in CMOS Technology and Design

Technological advancements in CMOS fabrication and circuit design are unlocking new capabilities for power amplifiers. Modern design techniques, such as envelope tracking and digital predistortion, are being implemented within CMOS architectures to improve linearity and reduce power consumption.

Furthermore, the integration of advanced packaging methods, such as system-in-package (SiP) and 3D packaging, allows manufacturers to build highly compact modules without compromising on performance. These innovations make CMOS power amplifiers even more appealing for applications with stringent size and power requirements.

Consumer Electronics and Mobile Devices

The widespread use of smartphones, tablets, and wearable devices has always influenced the demand for RF components, including power amplifiers. With consumer expectations leaning toward sleeker designs, longer battery life, and faster connectivity, the shift toward CMOS solutions is a natural progression.

In addition, the rise of AI-driven features in mobile devices requires more efficient and integrated circuit designs. CMOS technology, which enables both analog and digital functionalities on a single chip, offers a compelling advantage in meeting these evolving consumer demands.

Competitive Landscape and Market Outlook

The CMOS power amplifiers market is highly competitive, with key players including Qorvo, Skyworks Solutions, Broadcom, and Texas Instruments. Many companies are investing heavily in R&D to improve performance parameters such as gain, efficiency, linearity, and thermal management.

Emerging players and startups are also contributing to innovation, especially in the development of ultra-low-power amplifiers for niche applications. Strategic collaborations, mergers, and acquisitions are further shaping the competitive dynamics of the industry.

According to market analysts, the global CMOS power amplifiers market is expected to witness strong growth over the next decade. Key factors contributing to this outlook include the global expansion of 5G networks, increasing adoption of IoT devices, and the constant push toward energy-efficient consumer electronics.

Challenges and Considerations

Despite the promising future, there are challenges that need addressing. CMOS power amplifiers have traditionally struggled with performance limitations at higher frequencies compared to GaAs-based counterparts. While ongoing research is closing this gap, achieving optimal efficiency and thermal stability across all use cases remains a key focus.

Furthermore, global supply chain issues and semiconductor shortages can impact the availability and pricing of CMOS components. Manufacturers must invest in resilient supply networks and agile production processes to navigate these challenges effectively.

Conclusion

The future of the CMOS power amplifiers market looks bright, propelled by the convergence of next-generation wireless technologies, increasing demand for low-power devices, and rapid advancements in semiconductor design. As the digital world becomes more interconnected and power-conscious, CMOS power amplifiers will continue to serve as a foundational element in supporting efficient, scalable, and innovative communication solutions across industries.

0 notes

Text

The GPS PCB Active Patch Antenna is specifically engineered for L1 band applications at 1575.42 MHz. It incorporates a high-performance ceramic patch mounted on a PCB, complete with an integrated low-noise amplifier (LNA) to enhance signal strength. The antenna is supplied with a 1.13mm cable (10cm) and a UFL connector, facilitating seamless integration into compact GPS devices. Its dimensions are 15×15×4mm.

#rf antenna#rf antenna manufacture#telecom#rf antenna india#eteily technology manufactures#manufacturing

0 notes

Text

#2G External Antenna#2G Outdoor Antenna#IoT Lora LPWAN#868MHz Antenna#433MHz Antenna#915MHz Antenna#925MHz Antenna#865MHz Antenna#GPS-GNSS ANTENNA#External GNSS GPS#Magnetic Antenna#Screw Mount Antenna#Adhesive Mount Antenna#GNSS GPS Marine Antenna#Internal GNSS GPS

0 notes

Text

GSM-4G 5dBi Screw Mount Antenna With RG316 Cable (L - 1MTR) + SMA (M) St. Connector

The "#screwmount" indicates that the antenna can be attached to a surface using screws. This type of mount is common for easy installation on various #devices or structures.

SKU : ET-LT5S-4L1-SMS46M

For More Info - https://eteily.com/

#eteily#technologies#eteilyindia#telecom#telecomunication#screwmount#rfantenna#5G#4G#5GTechnology#India

#5g antenna#5G Internal Antenna#5G External Antenna#5G Outdoor Antenna#4G LTE Antenna#4G Internal Antenna#4G External Antenna#4G Outdoor Antenna#3G Antenna#3G Internal Antenna#3G External Antenna#3G Outdoor Antenna#2G/GSM Antenna#2G Internal Antenna#2G External Antenna#2G Outdoor Antenna#IoT Lora LPWAN#868MHz Antenna#433MHz Antenna#915MHz Antenna#925MHz Antenna#865MHz Antenna#GPS-GNSS ANTENNA#External GNSS GPS#Magnetic Antenna#Screw Mount Antenna#Adhesive Mount Antenna#GNSS GPS Marine Antenna

0 notes

Text

Exploring the Future of Connectivity Connected IoT Devices Market Size Outlook

The rise of interconnected technologies is reshaping industries, businesses, and consumer lifestyles. The Connected IoT Devices Market Size is at the core of this digital transformation, enabling smarter cities, intelligent supply chains, and enhanced user experiences. As organizations and consumers increasingly adopt Internet of Things (IoT) solutions, the market continues to grow at a significant pace.

Overview

According to Market Size Research Future, the Connected IoT Devices Market Size size was valued at USD 158.0 Billion in 2023 and is projected to reach USD 442.5 Billion by 2032, growing at a compound annual growth rate (CAGR) of 12.15% during the forecast period (2024–2032). The growth is fueled by factors such as increasing deployment of smart devices, advancements in wireless communication, and demand for real-time data across various sectors.

The proliferation of 5G networks, integration of AI with IoT, and growing interest in edge computing are further propelling the demand for connected devices, driving innovation and fostering digital transformation across industries.

Market Size Segmentation

The Connected IoT Devices Market Size is segmented based on Component, Device Type, Connectivity Technology, and End User.

By Component:

Hardware

Software

Services

By Device Type:

Wearables

Smart Appliances

Smart Meters

Connected Vehicles

Smart Cameras

Industrial Sensors

By Connectivity Technology:

Wi-Fi

Bluetooth

Zigbee

NFC

Cellular (3G, 4G, 5G)

LPWAN (LoRa, NB-IoT, Sigfox)

By End User:

Consumer Electronics

Healthcare

Automotive

Industrial

Retail

Smart Cities

Agriculture

Trends Shaping the Connected IoT Devices Market Size

1. Edge Computing Adoption

Organizations are increasingly shifting towards edge computing to minimize latency, enhance data processing speed, and reduce bandwidth usage. This decentralization is driving innovation in IoT device capabilities.

2. Integration of AI and ML

The incorporation of artificial intelligence and machine learning into IoT devices enhances automation, predictive maintenance, and intelligent decision-making, especially in industrial and healthcare sectors.

3. 5G Rollout

With the global rollout of 5G, connected devices can leverage ultra-low latency and faster transmission rates, significantly improving performance and expanding use cases such as autonomous vehicles and smart infrastructure.

4. IoT Cybersecurity

As the number of connected devices increases, so does the surface area for cyber threats. Security-focused hardware and encrypted communication protocols are becoming standard requirements in modern IoT ecosystems.

Segment Insights

Consumer Electronics

This segment leads in market share due to high consumer adoption of smart wearables, home assistants, and connected entertainment devices. Demand for seamless integration and personalization is driving innovation.

Industrial

Industrial IoT (IIoT) devices are transforming manufacturing, energy, and logistics. Smart sensors and automation systems enable real-time monitoring, predictive maintenance, and increased operational efficiency.

Healthcare

Connected medical devices—such as wearable monitors, smart insulin pumps, and remote diagnostic tools—are revolutionizing patient care by enabling real-time health tracking and telemedicine.

Automotive

The automotive segment is rapidly advancing with connected vehicle technologies. Features such as V2X communication, smart infotainment systems, and predictive diagnostics are becoming essential.

End-User Insights

Smart Cities

Governments worldwide are investing in smart infrastructure to enhance energy management, traffic control, and public safety. Connected streetlights, surveillance systems, and environmental sensors are key components.

Retail

IoT is enhancing the retail experience through smart shelves, inventory management systems, and personalized marketing. Retailers benefit from real-time analytics that improve customer engagement and supply chain efficiency.

Agriculture

Smart farming using IoT devices enables precision agriculture, remote monitoring of crops, and automation of irrigation systems, leading to improved yields and sustainable practices.

Key Players

Prominent players in the Connected IoT Devices industry include:

Cisco Systems Inc.

Samsung Electronics Co., Ltd.

IBM Corporation

Google LLC (Alphabet Inc.)

Huawei Technologies Co., Ltd.

Microsoft Corporation

Qualcomm Technologies Inc.

Intel Corporation

Amazon Web Services (AWS)

Texas Instruments Incorporated

These companies are focusing on strategic partnerships, mergers, and product innovations to strengthen their market presence and address emerging opportunities in diverse industries.

Conclusion

The Connected IoT Devices Market Size is a cornerstone of the digital economy, transforming how individuals interact with technology and how industries function. With strong growth forecasts and widespread adoption across sectors, the future of connected devices is poised to redefine innovation, connectivity, and efficiency on a global scale.

As connectivity becomes the new currency of competitiveness, enterprises and governments investing in IoT solutions will gain a strategic edge in shaping smarter and more sustainable ecosystems.

Trending Report Highlights

Explore more industry insights with these trending research reports:

Wafer Level Packaging Market Size

Bitcoin ATM Machine Market Size

Japan High Precision GNSS Module Market Size

Semiconductor Capital Equipment Market Size

North America 4 Inches Semi-Insulating Silicon Carbide Wafer Market Size

Wafer Process Control Equipment Market Size

3D Snapshot Sensor Market Size

Thyristor Rectifier Electric Locomotive Market Size

Microelectronics Material Market Size

Piezoelectric Materials Market Size

China Reconfigurable Intelligent Surfaces (RIS) Hardware Market Size

Structural Components Market Size

3D Laser Scanner Market Size

0 notes

Text

New Product Pre-Launch: High Power LR1121 Communication Solution - Sub-GHz Band + Satellite Channel High-Power Communication Module

With the rapid development of IoT (Internet of Things) technology, Low Power Wide Area Networks (LPWAN) have become a core technology in fields such as smart cities, industrial automation, remote monitoring, and environmental data collection. Driven by diverse application scenarios and complex environmental demands, the stability of device communication, transmission range, and frequency band compatibility have garnered unprecedented attention. To enhance the configuration flexibility of IoT communication modules, our company launched the LoRa1121, a cross-frequency compatible module based on the LR1121 chip, in August this year.

To further explore IoT applications across frequency bands, we have developed the LoRa1121F33-1G9, a high-power module supporting Sub-GHz and satellite channels. With high-power output, this module significantly enhances long-distance communication performance while offering greater flexibility for stable connectivity in complex scenarios through its support for both the Sub-GHz and S-band (satellite channels).

The LoRa1121F33-1G9, like the LoRa1121, utilizes SEMTECH's LR1121 chip, a low-power, long-range LoRa transceiver. It supports LoRa, (G)FSK modulation, the Sigfox protocol, and LR-FHSS technology with strong anti-interference capabilities. Additionally, it is compatible with the LoRaWAN communication protocol, enabling its use as a LoRaWAN node.

The key difference between the LoRa1121F33-1G9 and the LoRa1121 lies in its enhanced power for the Sub-GHz and S-band (satellite frequency). Details are shown in the table below:

Application Scenarios for the High-Power LR1121 Solution:

Environmental Monitoring in Remote Mountain Areas: Traditional communication modules often struggle with signal coverage in complex terrains. Leveraging high-power output and outstanding sensitivity, the LoRa1121F33-1G9 can penetrate mountainous obstacles to deliver stable data transmission, ensuring reliable monitoring of weather, air quality, and hydrology in remote regions.

Large-Scale Farmland Irrigation Systems: With its ultra-long transmission range and low-power design, the LoRa1121F33-1G9 can cover extensive farmland spanning several square kilometers. This eliminates the need for frequent relay deployments, reducing costs and improving efficiency in smart agriculture.

Port and Logistics Hub Monitoring: In open yet complex environments, the high-power output enhances signal transmission's resistance to interference, enabling real-time monitoring of port equipment and cargo conditions.

More details will be unveiled in the official release. Stay tuned to learn more about its features and performance specifications!

For details, please click:https://www.nicerf.com/products/ Or click:https://nicerf.en.alibaba.com/productlist.html?spm=a2700.shop_index.88.4.1fec2b006JKUsd For consultation, please contact NiceRF (Email: [email protected]).

0 notes

Text

The comprehensive guide to the Internet of Things and remote control

The Comprehensive Guide to the Internet of Things and Remote Control

Table of Contents Chapter 1: Introduction to the Internet of Things (IoT) Definition of the Internet of Things. The evolution of the concept of the Internet of Things. How does the Internet of Things work? IoT applications in daily life. Chapter 2: Components of the Internet of Things Smart devices (sensors, actuators, and controllers). Communication and networking in the Internet of Things (Wi-Fi, Bluetooth, LoRa, 5G). Software and cloud platforms (artificial intelligence and data analysis). Protocols used in the Internet of Things (MQTT, CoAP). Chapter 3: Communication technologies in the Internet of Things Overview of communication technologies. The difference between local and wide area networks (LAN vs WAN). Low-power communication networks (LPWAN). Challenges of communication and reliability in the Internet of Things. Chapter 4: Smart home automation using the Internet of Things Definition of the smart home. Smart home appliances (smart lights, smart locks, thermostats). Virtual assistant systems (such as Alexa and Google Assistant). Smart home security and monitoring solutions. Chapter 5: Internet of Things in industrial sectors Smart manufacturing (predictive maintenance, smart robots). Smart agriculture (agricultural sensors, smart irrigation systems). Smart cities (traffic management, smart ecosystems). Smart healthcare (remote monitoring, wearable devices). Chapter 6: Security and privacy in the Internet of Things Potential security risks in the Internet of Things. Privacy and data protection challenges. Security protocols and technologies (encryption, identity management). How to address security threats in smart systems. Chapter 7: Artificial intelligence and the Internet of Things How does artificial intelligence complement the Internet of Things? Predictive analysis and intelligent decision making. Machine learning applications in the Internet of Things. Examples of artificial intelligence in smart systems. Chapter 8: The future of the Internet of Things Future market developments and trends. 5G Internet of Things and its role in supporting developments. Future challenges and new opportunities. How will the Internet of Things change our daily lives? Chapter 9: Examples and Case Studies Practical examples of the use of IoT in various fields. Case studies of the most popular IoT applications (eg: Nest, Tesla, Philips Hue). Utilizing the Internet of Things to improve efficiency and productivity. Chapter 10: How to get started with the Internet of Things? Available tools and platforms for developing IoT solutions (Raspberry Pi, Arduino). Building simple projects using the Internet of Things.

#Internet of Things (IoT) guide - دليل إنترنت الأشياء#Smart home automation - أتمتة المنازل الذكية#IoT for remote control - إنترنت الأشياء للتحكم عن بعد#Connected devices - الأجهزة المتصلة#IoT applications - تطبيقات إنترنت الأشياء#Smart home technology - تقنية المنازل الذكية#Home automation solutions - حلول أتمتة المنازل#Remote monitoring - المراقبة عن بعد#IoT security - أمان إنترنت الأشياء#IoT and smart devices - إنترنت الأشياء والأجهزة الذكية#Future of IoT - مستقبل إنترنت الأشياء#Smart home gadgets - أدوات المنزل الذكي#Wireless control systems - أنظمة التحكم اللاسلكي#IoT for energy efficiency - إنترنت الأشياء لكفاءة الطاقة#IoT in everyday life - إنترنت الأشياء في الحياة اليومية

0 notes

Text

Things to Know about LoRaWAN Sensors

The Internet of Things (IoT) is rapidly transforming the world around us, connecting everyday objects to the digital realm and enabling a new wave of data-driven applications. In any case, for these applications to flourish, a reliable and efficient way to collect data from a vast network of devices is crucial. This is where LoRaWAN sensors come in, offering a compelling solution for long-range, low-power communication in IoT deployments.

LoRaWAN sensors are tiny, battery-powered devices equipped with LoRa technology, a low-power, wide-area networking (LPWAN) protocol. Dissimilar to traditional Wi-Fi or Bluetooth connections, LoRaWAN focuses on long-range communication and minimal power consumption. This makes them ideal for situations where sensors should be deployed in remote locations or where frequent battery changes are impractical.

The advantages of LoRaWAN sensors are numerous and contribute significantly to the success of various IoT applications. The main advantage is their extended range. LoRaWAN sensors can transmit data over several kilometers, even in challenging environments with obstacles or deep indoor penetration. This vast range eliminates the requirement for dense network infrastructure, making deployment in remote areas like farms, industrial sites, or sparsely populated cities considerably more feasible.

Another key advantage is the deficient power consumption of LoRaWAN sensors. Slowly transmitting little data packets allows these sensors to operate on a single battery for a really long time. This translates to significant expense savings on maintenance and battery replacements, particularly for large-scale deployments with hundreds or thousands of sensors. Additionally, reduced power consumption contributes to a more sustainable IoT ecosystem by minimizing battery waste.

LoRaWAN likewise boasts scalability, allowing a network to grow seamlessly as new sensors are added. This scalability makes it suitable for applications where the number of connected devices could fluctuate or expand over time. Innovative city initiatives, for example, can leverage LoRaWAN sensors for various purposes, starting with a few dozen sensors for air quality monitoring and gradually scaling up to include hundreds of sensors for traffic the board, waste collection, and noise monitoring.

LoRaWAN sensors are a game-changer for the IoT landscape. Their extended range, low power consumption, scalability, security, and two-way communication capabilities make them ideal for various applications. As the world continues to embrace the power of the IoT, LoRaWAN sensors are poised to play a vital role in connecting the physical world to the digital realm, enabling more innovative, more efficient, and data-driven operations across various industries.

0 notes