#KIRIN BREWERY COMPANY

Explore tagged Tumblr posts

Text

Beer Events 4.1

Events

Guinness brewed their last batch of ale, deciding instead to concentrate on stout (1799)

Christian Moerlein arrived in Cincinnati (1842)

Missouri Brewers Association founded (1900)

Manitowoc County Brewers Association founded (1901)

Prohibition enacted in Alberta and Saskatchewan, Canada (1918)

Robert Owens patented a Wild-Oat and Barley Separator (1919)

NYC Beer Strike began with 7,000 members of International Union of Brewery Workers out on strike (1949; it ended June 20)

Grace Brothers Brewing re-opened, after being closed since 1953 (California; 1958)

Thin Layer Steam Distillation of Hop Oil Extract patented (1969)

Interbrew Betriebs und Beteilig patented a Preparation of Beer (1975)

Stephen Morris’ The Great Beer Trek published (1984)

Jennifer Guinness kidnapped & held for 2 million pounds ransom (1986)

1st keg of Alaskan Amber was officially tapped by Steve Cowper, then Governor of Alaska (1987)

Leinenkugel became a wholly owned subsidiary of Miller Brewing (1988)

Kirin Beer patented a Flow Passage Closing Mechanism of Beverage Pouring Apparatus (1997)

Tabernash & Left Hand Brewing merged (Colorado; 1998)

1st American restaurant certified organic (Restaurant Now, DC; 1999)

Heineken released their keg-shaped can (2000)

Brewery Openings

Als Aldaris / Pripps & Hartwell (Latvia; 1865)

Anthracite Brewing (Pennsylvania; 1897)

Gund Brewing (1897)

Keystone Brewing (Pennsylvania; 1902)

Genessee Brewing (New York; 1933)

Frog & Parrot brewery (England; 1982)

Granite Brewery (Nova Scotia, Canada; 1985)

Horseshoe Bay Brewing (British Columbia, Canada; 1988)

Old City Brewing (Texas; 1988)

Rochester Brewpub (New York; 1988)

Dilworth Brewing (North Carolina; 1989)

Frankton Bagby Brewery (England; 1989)

Marin Brewing (California; 1989)

Old Colorado Brewing (Colorado; 1989)

Swans Brewpub / Buckerfield Brewery (British Columbia, Canada; 1989)

Dubuque Brewing (Washington; 1991)

Nelson Brewing (British Columbia, Canada; 1991)

Oasis Brewing (Colorado; 1991)

Captain Tony's Pizza & Pasta Emporium brewery (Ohio; 1993)

Lonetree Brewing Ltd (Colorado; 1993)

Murphys Creek Brewing (California; 1993)

Old Peconic Brewing (New York; 1993)

Star Brewing (Oregon; 1993)

Highlands Brewery (Florida; 1994)

Maui Beer Company (Hawaii; 1994)

Black River Brewhouse (Vermont; 1995)

Brazos Brewing (Texas; 1995)

Chuckanut Bay Brewing (Washington; 1995)

Coophouse Brewery (Colorado; 1995)

Drytown Brewing (New York; 1995)

Engine House #9 brewery (Washington; 1995)

Old World Pub & Brewery (Oregon; 1995)

River Market Brewing (Missouri; 1995)

Southend Brewery & Smokehouse (North Carolina; 1995)

Thunder Bay Brewing (California; 1995)

American Brewers Guild Brewery (California; 1996)

Blue Anchor Pub brewery (Florida; 1996)

Champion Billiards & Cafe (Maryland; 1996)

Climax Brewing (New Jersey; 1996)

Gem State Brewing (Idaho; 1996)

Kaw River Brewery (Kansas; 1996)

Mt. Begbie Brewing (Canada; 1996)

O'Hooley's Pub & Brewery (Ohio; 1996)

Osprey Ale Brewing (Colorado; 1996)

Paradise Brewing / Pagosa Springs Brewing (Colorado; 1996)

Railway Brewing (Alaska; 1996)

Rixdorfer Brauhaus (Germany; 1996)

A-Z Brewing (Arizona; 1997)

Ambleside Brewing (Minnesota; 1997)

Arizona Brewing (Arizona; 1997)

Barley Brothers Brewery & Grill (Arizona; 1997)

Barney's Brewery (California; 1997)

Borealis Brewery (Alaska; 1997)

Cottonwood Brewery (North Carolina; 1997)

Great Beer Co. (California; 1997)

High Mountain Brewing (Canada; 1997)

Irons Brewing (Colorado; 1997)

Manitou Brewery (Colorado; 1997)

Maui Kine Brewery (Hawaii; 1997)

Olde Wyndham Brewery (Connecticut; 1997)

Reckless Abandon Brewery (California; 1997)

Red Tomato Brewery (California; 1997)

Sierra Blanca Brewing (New Mexico; 1997)

Willimantic brewing (Connecticut; 1997)

Dragonmead Microbrewery (Michigan; 1998)

Knucklehead Brewing (Canada; 1998)

Newport Brewing (Rhode Island; 1998)

Captain Cook Brewery (England; 1999)

Freedom Brewing (England; 1999)

MIIG Brewery (Jordan; 1999)

Titanic Brewery & Restaurant (Florida; 1999)

Two Rivers Brewing (Canada; 1999)

Clay Pipe Brewing (Maryland; 2000)

Conshohocken Brewing (Pennsylvania; 2014)

0 notes

Text

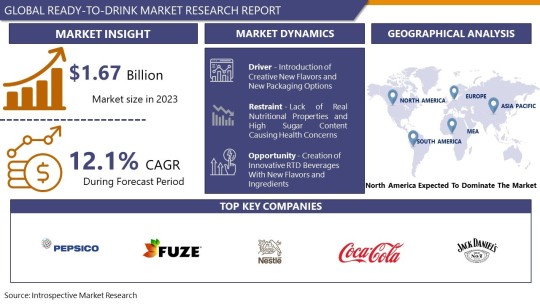

Ready-To-Drink Market Size Was Projected to Reach USD 4.67 Billion by 2032

Ready-To-Drink Market Size Was Valued at USD 1.67 Billion in 2023 and is Projected to Reach USD 4.67 Billion by 2032, Growing at a CAGR of 12.1 % From 2024-2032.

Ready-To-Drink liquids additionally referred to as RTDs are single-use packaged drinks which can be packaged and bought in a organized form equipped for immediate consumption upon buy. Such Beverages do not need any further processing and can be ate up without delay through the package. Ready-to-drink (RTD) liquids have received a whole lot of popularity due to their functionality, specifically in the summer season. Consumers’ leisure of the fortified drinks and alcohols and the easiness of the product is the precise feature provided by the RTDs.

The Major Players Covered in this Report:

PepsiCo Inc.(US)

Fuze Beverage (US)

Nestle S.A. (Switzerland)

The Coca-Cola Company(US)

Jack Daniel's (US)

Suntory Beverages & Food Ltd. (Japan)

Kirin Brewery Company, Limited (Japan)

Red Bull GmbH (Austria)

Monster Beverage Corporation (US)

NZMP (New Zealand)

Zevia (US)

White Claw Hard Seltzer (US)

Southeast Bottling & Beverage (US)

Gehl Foods LLC (US)

Tropical Bottling Corporation (US) and Other Major Players

Get more Information About the Ready-To-Drink Market here & Take a Sample Copy:

https://introspectivemarketresearch.com/request/16553

"Kindly use your official email ID for all correspondence to ensure seamless engagement and access to exclusive benefits, along with prioritized support from our sales team."

Introspective Market Research specializes in delivering comprehensive market research studies that offer valuable insights and strategic guidance to businesses worldwide. With a focus on reliability and accuracy, our reports empower informed decision-making. An in-depth examination of the overall Ready-To-Drink Market is done to provide this report encompassing all essential market fundamentals.

The Report Will Include A Major Chapter

Patent Analysis

Regulatory Framework

Technology Roadmap

BCG Matrix

Heat Map Analysis

Price Trend Analysis

Investment Analysis

Grab your exclusive discount here before the offer ends:

https://introspectivemarketresearch.com/discount/16553

The Ready-To-Drink Market Trend Analysis

Introduction of Creative New Flavors and New Packaging Options

Consumer motivation to buy the product is the number one component that acts efficiently at the back of the sales of RTD Beverages. Many manufacturers today are transferring toward greater natural, botanical, and natural flavors that create the taste of herbal substances at the side of a few health blessings. Such Creative New Flavors with colorful geared up-to-drink drinks are becoming perfect to satisfy the desire that is widespread in the adventure society for brand spanking new and interesting flavor reports.

Creation of Innovative RTD Beverages With New Flavors and Ingredients

The RTD beverage category for the previous few years is developing very fast. To make the most out of the fashion the manufacturers are going to want to paintings successfully on their improvement and marketing to stand out of others and establish a robust experience of Meaningful to gain big profits.

Segmentation of The Ready-To-Drink Market

By Type

Tea & Coffee

Sports & Energy Drinks

Dairy-Based Beverages

Juices & Nectars

Fortified Water

Alcopops

Others

By Packaging Type

Bottles

Cans

Cartons

Other

By Sales Channel

Supermarkets & Hypermarkets

Specialty Stores

Convenience Stores

Online Stores

By Region

North America (U.S., Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Through meticulous segmentation analysis and extensive geographical coverage, we offer a deep understanding of regional trends. A key aspect of our Accounting Software report is the thorough examination of company profiles and competitive landscapes. This provides detailed insights into market players' roles, overviews, operating business segments, products, and financial performance. By meticulously evaluating critical metrics like production volume, sales volume, and sales margin, we offer a comprehensive understanding of their market position.

Inquiry of this Research Report:

https://introspectivemarketresearch.com/inquiry/16553

The following points were extensively researched:

Key Players: Here, the Travel and Expense Ready-To-Drink Market research focuses on mergers and acquisitions, expansions, analyses of important players, company founding dates, markets served, manufacturing infrastructure, and revenue of key players.

Breakdown by Product and Application: Information on market size by product and application is provided in this section.

Regional Analysis: The report examines each area and nation based on market size by product and application, major players, and market forecast.

Profiles of International Players: On the basis of their gross margin, pricing, sales, revenue, business, products, and other firm information, participants are rated in this game.

Market Dynamics: It includes supply chain analysis, analysis of regional marketing, challenges, opportunities, and drivers analysed in the report.

Key Findings of the Research Study. Appendix: It includes information about the research methodology, data sources, and authors of the study, as well as a disclaimer.

The latest research on the Ready-To-Drink Market provides a comprehensive overview of the market for the years 2024 to 2032. It gives a comprehensive picture of the global Automotive Wrap Films industry, considering all significant industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the Automotive Damper Market. Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years. The report is designed to help readers find information and make decisions that will help them grow their businesses.

Unlock Insights and Make Informed Decisions – Purchase Our Research Report

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16553

About us:

At Introspective Market Research Private Limited, we are a forward-thinking research consulting firm committed to driving our clients' growth and market dominance. Leveraging cutting-edge technology, big data, and advanced analytics, we provide deep insights and strategic solutions that enable our clients to stay ahead in a competitive landscape. Our expertise spans across comprehensive Market Research Reports, Holistic Market Insights, Macro-Economic Analysis, and tailored Go-to-Market (GTM) Strategies. Through our Consulting Services and AI-Driven Solutions, we empower businesses to navigate challenges and achieve their objectives. Additionally, we offer Product Design and Prototyping support and Flexible Staffing Solutions to meet evolving industry demands. Our IMR Knowledge Cluster ensures continuous learning and innovation, guiding our clients toward sustainable success.

Contact us:

Canada Office

Introspective Market Research Private Limited, 138 Downes Street Unit 6203- M5E 0E4, Toronto, Canada.

APAC Office

Introspective Market Research Private Limited, Office No. 401, Saudamini Commercial Complex, Chandani Chowk, Kothrud, Pune India 411038

Ph no: + +91-81800-96367 / +91-7410103736

Email: [email protected]

#Global Ready-To-Drink Market#Ready-To-Drink Market Size#Ready-To-Drink Market Share#Ready-To-Drink Market Growth#Ready-To-Drink Market Trend#Ready-To-Drink Market segment#Ready-To-Drink Market Opportunity#Ready-To-Drink Market Analysis 2024#Global Ready-To-Drink Market Industry Size

0 notes

Text

Ethanol Market to Hit $130.33 Billion by 2032

The global Ethanol Market was valued at USD 93.78 Billion in 2024 and it is estimated to garner USD 130.33 Billion by 2032 with a registered CAGR of 4.2% during the forecast period 2024 to 2032.

The report throws light on the competitive scenario of the global Ethanol Market to know the competition at global levels. Market experts also provided the outline of each leading player of the global Ethanol Market for the market, considering the key aspects such as the areas of operation, production, and product portfolio. In addition, the companies in the report are studied based on vital factors such as company size, market share, market growth, revenue, production volume, and profit.

The global Ethanol Market is fragmented with various key players. Some of the key players identified across the value chain of the global Ethanol Market include United Breweries, Aventine Renewable Energy, AB Miller, Archer Daniels Midland Company, Kirin, Pure Energy Inc., British Petroleum, Cargill Corp. and others. etc. Considering the increasing demand from global markets various new entries are expected in the Ethanol Market at regional as well as global levels.

Download Ethanol Market Sample Report PDF: https://www.vantagemarketresearch.com/ethanol-market-1659/request-sample

Top Competitors:

United Breweries, Aventine Renewable Energy, AB Miller, Archer Daniels Midland Company, Kirin, Pure Energy Inc., British Petroleum, Cargill Corp. and others.

Understanding the Industry's Growth, has released an Updated report on the Ethanol Market. The report is mixed with crucial market insights that will support the clients to make the right business decisions. This research will help new players in the global Ethanol Market to sort out and study market needs, market size, and competition. The report provides information on the supply and market situation, the competitive situation and the challenges to the market growth, the market opportunities, and the threats faced by the major players.

Regional Analysis

-North America [United States, Canada, Mexico]

-South America [Brazil, Argentina, Columbia, Chile, Peru]

-Europe [Germany, UK, France, Italy, Russia, Spain, Netherlands, Turkey, Switzerland]

-Middle East & Africa [GCC, North Africa, South Africa]

-Asia-Pacific [China, Southeast Asia, India, Japan, Korea, Western Asia]

You Can Buy This Report From Here: https://www.vantagemarketresearch.com/buy-now/ethanol-market-1659/0

Full Analysis Of The Ethanol Market:

Key findings and recommendations point to vital progressive industry trends in the global Ethanol Market, empowering players to improve effective long-term policies.

The report makes a full analysis of the factors driving the development of the market.

Analyzing the market opportunities for stakeholders by categorizing the high-growth divisions of the market.

Questions answered in the report

-Who are the top five players in the global Ethanol Market?

-How will the global Ethanol Market change in the next five years?

-Which product and application will take the lion's share of the global Ethanol Market?

-What are the drivers and restraints of the global Ethanol Market?

-Which regional market will show the highest growth?

-What will be the CAGR and size of the global Ethanol Market during the forecast period?

Read Full Research Report with [TOC] @ https://www.vantagemarketresearch.com/industry-report/ethanol-market-1659

Reasons to Purchase this Ethanol Market Report:

-Analysis of the market outlook on current trends and SWOT analysis.

-The geographic and country level is designed to integrate the supply and demand organizations that drive industry growth.

-Ethanol Industry dynamics along with market growth opportunities in the coming years.

-Ethanol Market value (million USD) and volume (million units) data for each segment and sub-segment.

1 year consulting for analysts along with development data support in Excel. Competitive landscape including market share of major players along with various projects and strategies adopted by players in the last five years.

Market segmentation analysis including qualitative and quantitative analysis including the impact on financial and non-economic aspects.

Complete company profiles that include performance presentations, key financial overviews, current developments, SWOT analyzes and strategies used by major Ethanol Market players.

Check Out More Reports

Global Feed Antioxidants Market : Report Forecast by 2032

Global Agricultural Fumigants Market: Report Forecast by 2032

Global Marché de la bière: Report Forecast by 2032

Global Air Transportation Market: Report Forecast by 2032

Global Mechanical Control Cables Market: Report Forecast by 2032

#Ethanol Market#Ethanol Market 2024#Global Ethanol Market#Ethanol Market outlook#Ethanol Market Trend#Ethanol Market Size & Share#Ethanol Market Forecast#Ethanol Market Demand#Ethanol Market sales & price

0 notes

Text

Raise a Glass at New Belgium Brewing Company in Fort Collins, CO!

Surrounded by the scenic beauty of Fort Collins, Colorado, New Belgium Brewing Company stands as a beacon of craft beer excellence and community spirit. Founded in 1991 by Kim Jordan and Jeff Lebesch, New Belgium Brewing Company has grown from a local favorite to a nationally renowned brewery, celebrated for its innovative brews and commitment to sustainability.

Crafting Excellence: A Taste of New Belgium Brewing Company's Brews

At the heart of New Belgium Brewing Company's offerings are its iconic beers, each crafted with precision and passion. Among the lineup, Fat Tire Ale reigns supreme, its recipe inspired by co-founder Jeff Lebesch's bicycle journey through Belgium. This amber ale has become a staple in the craft beer scene, known for its balanced flavors and smooth finish. For hop enthusiasts, the Voodoo Ranger IPA offers a bold and vibrant experience, showcasing New Belgium's expertise in brewing adventurous and full-bodied IPAs. Meanwhile, the Mural Agua Fresca Cerveza and La Folie Sour Brown Ale add diversity to the portfolio, blending traditional brewing techniques with innovative flavors that delight beer aficionados worldwide.

A Journey Through History: From Local Roots to Global Presence

New Belgium Brewing Company's story is one of remarkable growth and innovation. Beginning in Fort Collins, the brewery quickly gained popularity for its distinctive beers and commitment to environmental stewardship. In 1999, New Belgium became the first wind-powered brewery in the United States, a testament to its dedication to sustainability. By 2002, its beers were distributed in 16 states, and today, they're enjoyed in all 50 states and across international borders, including Canada, Australia, Japan, South Korea, Sweden, and Norway.

Sustainability and Innovation: Leading the Way in Brewery Practices

Beyond its brewing excellence, New Belgium Brewing Company is a pioneer in sustainable practices within the brewing industry. The integration of an industrial heat pump in 2023 underscores its commitment to reducing greenhouse gases and minimizing its carbon footprint—a crucial step towards environmental responsibility. This commitment resonates through every aspect of its operations, ensuring that each sip of New Belgium Brewing Company beer is not only flavorful but also contributes to a healthier planet.

Embracing Collaboration and Creativity: New Ventures and Innovations

In 2019, New Belgium Brewing Company entered a new chapter with its acquisition by Lion, the Australian subsidiary of Japan's Kirin Beverage Group, marking a strategic move to expand its global reach while preserving its core values. Recent developments include the acquisition of a production brewery in Daleville, Virginia, focusing on brewing Voodoo Ranger's Juice Force IPA and Fruit Force IPA, showcasing New Belgium Brewing Company's continued dedication to innovation and quality.

Celebrating Community and Culture: Engaging with Fort Collins and Beyond

In Fort Collins, New Belgium Brewing Company isn't just a brewery—it's a cornerstone of community engagement and cultural celebration. The brewery's location adjacent to the Cache La Poudre River bike path invites locals and visitors alike to explore the scenic beauty of the area while enjoying a pint of their favorite brew. Colorful vintage bicycles outside the brewery pay homage to its origins and invite patrons to embrace Fort Collins' vibrant cycling culture.

Looking Ahead: Innovation in Every Pour

As New Belgium Brewing Company continues to evolve and innovate, its commitment to brewing excellence, sustainability, and community remains steadfast. Whether you're a craft beer connoisseur, a sustainability advocate, or simply seeking a memorable brewery experience, New Belgium Brewing Company invites you to raise a glass and join them in celebrating craftsmanship, creativity, and the joy of good beer.

New Belgium Brewing Company Videos

New Belgium Brewing Company Location

Featured Member

Jacques Family Construction

3500 Swanstone Dr UNIT 57, Fort Collins, CO 80525

(970) 556-5503

If you are Looking for Basement Finishing Fort Collins CO Welcome to Jacques Family Construction, where they specialize in crafting dream homes with meticulous attention to detail and a commitment to personalized service. Whether clients envision a modern masterpiece or a cozy retreat, Jacques Family Construction is dedicated to exceeding expectations. As a family-owned business, they pride themselves on integrity, utilizing quality materials, innovative design, and reliable construction practices. Clients are invited to discover the difference of working with a team that collaborates closely to create homes reflecting unique visions, standing as testaments to their craftsmanship and commitment to excellence. Jacques Family Construction: Turning dreams into reality, one home at a time. REVIEWS POSTS FAQS

Featured Member Location

1 note

·

View note

Text

Non-Alcoholic Beer Market Share: Trends, Players, and Growth Opportunities

The non-alcoholic beer market has experienced significant growth over the past few years, driven by increasing consumer demand for healthier and more responsible beverage options. In this blog, we will explore the current state of the non-alcoholic beer market, including its size, share, and growth prospects, as well as the key players and trends shaping the industry.

Non-Alcoholic Beer Market Size and Share

The global non-alcoholic beer market size is expected to reach USD 28.7 billion by 2031, growing at a CAGR of 5.5% from 2022 to 2031. The market is driven by the increasing demand for healthier beverage options, growing awareness about the negative effects of excessive alcohol consumption, and the expansion of the global beer market.

Market Players

The non-alcoholic beer market is dominated by a few large players, including:

Anheuser-Busch InBev: Anheuser-Busch InBev is the largest player in the non-alcoholic beer market, controlling around 25% of the market share. The company operates a range of brands, including Budweiser, Stella Artois, and Corona.

Heineken: Heineken is the second-largest player in the non-alcoholic beer market, controlling around 20% of the market share. The company operates a range of brands, including Heineken, Desperados, and Amstel.

Carlsberg: Carlsberg is another major player in the non-alcoholic beer market, controlling around 15% of the market share. The company operates a range of brands, including Carlsberg, Tuborg, and Baltika.

Suntory Beer: Suntory Beer is a Japanese brewing company that controls around 10% of the non-alcoholic beer market share. The company operates a range of brands, including Suntory, Asahi, and Kirin.

Asahi Breweries: Asahi Breweries is a Japanese brewing company that controls around 5% of the non-alcoholic beer market share. The company operates a range of brands, including Asahi, Suntory, and Kirin.

Non-Alcoholic Beer Market Trends

Several trends are shaping the non-alcoholic beer market, including:

Health and Wellness: Consumers are increasingly seeking healthier beverage options, driving demand for non-alcoholic beers.

Responsible Drinking: Growing awareness about the negative effects of excessive alcohol consumption is driving demand for non-alcoholic beers.

Expansion of the Global Beer Market: The global beer market is expanding, driving demand for non-alcoholic beers.

Product Innovation: Companies are innovating their products to cater to changing consumer preferences, such as the launch of zero-alcohol beers.

Market Growth

The non-alcoholic beer market is expected to grow at a CAGR of 5.5% from 2022 to 2031, driven by increasing consumer demand for healthier and more responsible beverage options. The market is expected to reach USD 28.7 billion by 2031, up from USD 20.2 billion in 2022.

Conclusion

The non-alcoholic beer market is a growing and dynamic industry, driven by increasing consumer demand for healthier and more responsible beverage options. The market is dominated by a few large players, including Anheuser-Busch InBev, Heineken, and Carlsberg, but is also home to a growing number of smaller players. By understanding these trends and players, companies can develop effective strategies to capitalize on the growth opportunities in the non-alcoholic beer market.

0 notes

Text

Ready-To-Drink Market Analysis, Key Trends, Growth Opportunities, Challenges and Key Players by 2032

Ready-To-Drink Market Size Was Valued at USD 1.67 Billion in 2023 and is Projected to Reach USD 4.67 Billion by 2032, Growing at a CAGR of 12.1 % From 2024-2032.

Single-use packaged beverages that are packaged and marketed in a prepared form intended for immediate consumption upon purchase are known as ready-to-drink (RTD) beverages. These beverages can be drank straight from the package without the need for additional preparation. Because of its practicality, ready-to-drink (RTD) beverages have become increasingly popular, particularly during the summer. The distinctive feature provided by RTDs is the ease of use and enjoyment of the fortified beverages and alcohols by consumers.

Ready-to-drink beverages are designed to give users immunity and enjoyable benefits; some of these items have even stimulated the demand for alcoholic beverages. There is an endless variety of flavors available today that are created by combining or using many substances separately. Several businesses have a variety of options, such as bottled mojitos, lemonades, and craft beer. Future growth in the potential market for finished drinks and ready-to-drink beverages will allow the newer firms to experiment with their productions.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://introspectivemarketresearch.com/request/16553

Updated Version 2024 is available our Sample Report May Includes the:

Scope For 2024

Brief Introduction to the research report.

Table of Contents (Scope covered as a part of the study)

Top players in the market

Research framework (structure of the report)

Research methodology adopted by Worldwide Market Reports

Leading players involved in the Ready-To-Drink Market include:

PepsiCo Inc.(US), Fuze Beverage (US), Nestle S.A. (Switzerland), The Coca-Cola Company(US), Jack Daniel's (US), Suntory Beverages & Food Ltd. (Japan), Kirin Brewery Company, Limited (Japan), Red Bull GmbH (Austria)

Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years.

If You Have Any Query Ready-To-Drink Market Report, Visit:

https://introspectivemarketresearch.com/inquiry/16553

Segmentation of Ready-To-Drink Market:

By Type

Tea & Coffee

Sports & Energy Drinks

Dairy-Based Beverages

Juices & Nectars

Fortified Water

Alcopops

Others

By Packaging Type

Bottles

Cans

Cartons

Other

By Sales Channel

Supermarkets & Hypermarkets

Specialty Stores

Convenience Stores

Online Stores

Market Segment by Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Highlights from the report:

Market Study: It includes key market segments, key manufacturers covered, product range offered in the years considered, Global Ready-To-Drink Market, and research objectives. It also covers segmentation study provided in the report based on product type and application.

Market Executive Summary: This section highlights key studies, market growth rates, competitive landscape, market drivers, trends, and issues in addition to macro indicators.

Market Production by Region: The report provides data related to imports and exports, revenue, production and key players of all the studied regional markets are covered in this section.

Ready-To-Drink Market Profiles of Top Key Competitors: Analysis of each profiled Roll Hardness Tester market player is detailed in this section. This segment also provides SWOT analysis of individual players, products, production, value, capacity, and other important factors.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16553

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to helping our clients grow and successfully impact the marketplace. Our team at IMR is ready to help our clients grow their businesses by offering strategies to achieve success and monopoly in their respective fields. We are a global market research company, specializing in the use of big data and advanced analytics to gain a broader picture of market trends. We help our customers to think differently and build a better tomorrow for all of us. As a technology-driven research company, we consider extremely large data sets to uncover deeper insights and provide conclusive consulting. We don't just provide intelligence solutions, we help our clients achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1049

Email: [email protected]

#Ready-To-Drink#Ready-To-Drink Market#Ready-To-Drink Market Size#Ready-To-Drink Market Share#Ready-To-Drink Market Growth#Ready-To-Drink Market Trend#Ready-To-Drink Market segment#Ready-To-Drink Market Opportunity#Ready-To-Drink Market Analysis 2024

0 notes

Text

Phenomenal Bira Share Price Surge

Introduction

In the dynamic landscape of the beverage industry, one company's journey has captured the attention of investors and enthusiasts alike. Bira 91, known for its innovative craft beers and strategic market approach, has witnessed a remarkable surge in Bira Share Price, igniting discussions and analyses across the financial world about this phenomenal rise in the Bira 91 Share Price. Bira 91, the brainchild of B9 Beverages Pvt. Ltd., stands as a prominent craft beer brand celebrated for its diverse offerings and bold flavors. Originating from the Flanders region of Belgium, the company initially utilized a craft distillery to contract manufacture its beer, sourcing ingredients from renowned regions such as France, Belgium, the Himalayas, and Bavarian Farms, before importing it to India. However, spurred by its initial success and driven by a commitment to quality, Bira 91 transitioned to manufacturing its beer within India, maintaining the same high standards and utilizing premium ingredients including wheat, barley, and hops.

Available in a variety of formats including draft, 330ml, 650ml bottles, and 500ml cans, Bira 91 has curated a diverse portfolio comprising essential beers aimed at catering to evolving consumer preferences. With a focus on infusing more color and flavor into the global beer landscape, the brand has resonated particularly well with urban millennials, capturing their attention with its delectable brews, distinctive identity, and widespread draft network.

Expanding its horizons beyond Indian shores, Bira 91 embarked on a journey to conquer international markets, marking its presence in iconic cities like New York City and venturing into the dynamic Asia Pacific market, starting with Singapore in 2018. Bolstered by the backing of notable investors such as Sequoia Capital, Belgium’s Sofina Capital, and Japan’s Kirin Holdings, Bira 91 has established itself as a force to be reckoned with in the global beer industry.

Presently, the company operates five breweries within India and maintains offices in key strategic locations, including New York City, underscoring its commitment to both local and international markets. With a market share ranging from 5% to 7% in pivotal regions like New Delhi, Mumbai, and Bengaluru, Bira 91 continues to solidify its position as a frontrunner in the craft beer segment.

The journey of B9 Beverages Pvt. Ltd. traces back to its inception on May 28, 2012, in New Delhi, initially operating under the name Divya Jyoti Coaching Institute Private Limited before rebranding to its current identity on September 9, 2015. Notably, the company acquired the business related to 'Bira 91' beer from Cerana Beverages Private Limited on October 17, 2015, through a slump sale arrangement. With its headquarters situated in Connaught Place, New Delhi, B9 Beverages Pvt. Ltd. remains steadfast in its mission to redefine the beer landscape, both domestically and globally.

The Rise of Bira 91

Founded by B9 Beverages Pvt. Ltd., Bira 91 has rapidly emerged as a leading player in the craft beer segment, redefining consumer preferences with its unique blends and contemporary branding. Since its inception, the company has focused on delivering quality products tailored to the evolving tastes of consumers, paving the way for its extraordinary growth trajectory.

Market Disruption and Innovation

Bira 91's success can be attributed to its disruptive approach to the market. By introducing craft beers that resonate with the millennial demographic, the company has carved a niche for itself in an industry dominated by traditional players. Moreover, its emphasis on innovation, manifested through new flavor profiles and packaging designs, has kept the brand fresh and relevant in the eyes of consumers.

Strategic Expansion and Partnerships

Another key factor driving Bira 91's share price surge is its strategic expansion initiatives and partnerships. The company has leveraged its strong brand equity to enter new markets both domestically and internationally, capitalizing on the growing demand for craft beer worldwide. Additionally, collaborations with distributors, retailers, and e-commerce platforms have enabled Bira 91 to enhance its reach and accessibility, further fueling its growth momentum.

Financial Performance and Investor Confidence

Bira 91's robust financial performance has bolstered investor confidence and contributed to its soaring share price. With impressive revenue figures and consistent profitability, the company has demonstrated its ability to generate value for shareholders amidst a competitive landscape. Moreover, its forward-looking strategies and proactive approach to addressing market challenges have instilled optimism among investors regarding its long-term prospects.

Challenges and Opportunities Ahead

Despite its phenomenal success, Bira 91 faces a set of challenges as it continues to navigate the complexities of the beverage industry. Competition from established players, evolving consumer preferences, and regulatory hurdles pose potential obstacles to its growth trajectory. However, with its innovative spirit and agile business model, the company is well-positioned to capitalize on emerging opportunities and overcome these challenges in the years to come.

Conclusion

The remarkable surge in Bira 91's share price reflects not only the company's exceptional performance but also its ability to disrupt the beverage industry and capture the imagination of consumers and investors alike. As it continues to expand its presence and innovate in the market, Bira 91 is poised to maintain its upward trajectory, solidifying its status as a pioneering force in the world of craft beer.

0 notes

Text

Ready-To-Drink Market Professional Survey and In-depth Analysis Research Report

Ready-To-Drink Market Overview and Insights:

According to Introspective Market Research, The Ready-To-Drink Market size is expected to grow from USD 1.22 Billion in 2022 to USD 2.85 Billion by 2030, at a CAGR of 11.19% during the forecast period.

Ready-to-drink (RTD) beverages are pre-packaged beverages that are ready for consumption without any additional preparation. These beverages have gained popularity due to their convenience, portability, and wide range of available flavors and options. One of the primary appeals of RTD beverages is their convenience. They can be consumed on-the-go, at work, during travel, or at leisure, without the need for any additional preparation or equipment. Current trends in the RTD beverage market include the growing popularity of plant-based and functional beverages, premiumization and artisanal offerings, sustainability and eco-friendly packaging, and the introduction of innovative flavors and formulations.

Who are the key players operating in the industry?

PepsiCo Inc.(US),Fuze Beverage (US),Nestle S.A. (Switzerland),The Coca-Cola Company(US),Jack Daniel's (US),Suntory Beverages & Food Ltd. (Japan),Kirin Brewery Company, Limited (Japan),Red Bull GmbH (Austria),Monster Beverage Corporation (US),NZMP (New Zealand),Zevia (US),White Claw Hard Seltzer (US),Southeast Bottling & Beverage (US),Gehl Foods LLC (US),Tropical Bottling Corporation (US) and Other Major Players

Ready-To-Drink Market research is an ongoing process. Regularly monitor and evaluate market dynamics to stay informed and adapt your strategies accordingly. As market research and consulting firm we offer market research report which is focusing on major parameters including Target Market Identification, Customer Needs and Preferences, Thorough Competitor Analysis, Market Size & Market Analysis, and other major factors. At the end we do provide meaningful insights and actionable recommendations that inform decision-making and strategy development.

Get Sample PDF of Ready-To-Drink Market with Complete TOC, Tables & Figures @

https://introspectivemarketresearch.com/request/16553

Our study encompasses the complete market ecosystem of the Ready-To-Drink market, studying the functions and interdependencies of various market stakeholders. Employing industry-standard tools such as Porter's Five Forces Analysis, SWOT Analysis, and Price Trend Analysis further enhances the comprehensiveness of our evaluation. By employing comprehensive segmentation analysis and offering extensive geographical coverage, we enable a profound understanding of regional trends. Furthermore, we explore external factors that significantly impact the market.

Competitive Analysis of the market in the report identifies various key manufacturers of the market. We do company profiling for major key players. The research report includes Competitive Positioning, Investment Analysis, BCG Matrix, Heat Map Analysis, and Mergers & Acquisitions. It helps the reader understand the strategies and collaborations that players are targeting to combat competition in the market. The comprehensive report offers a significant microscopic look at the market. The reader can identify the footprints of the manufacturers by knowing about the product portfolio, the global price of manufacturers, and production by producers during the forecast period.

As market research and consulting firm we offer market research report which is focusing on major parameters including Target Market Identification, Customer Needs and Preferences, Thorough Competitor Analysis, Market Size & Market Analysis, and other major factors.

Why Choose Introspective Market Research?

A smart dashboard that provides updated details on industry trends.

Data input from various network entities such as suppliers, suppliers, service providers etc.

Strict quality inspection standards: data collection, triangulation and verification.

We provide service 24 hours a day, 365 days a year.

The Ready-To-Drink market research study ensures the highest level of accuracy and reliability as we precisely examine the overall industry, covering all the market fundamentals. By leveraging a wide range of primary and secondary sources, we establish a strong foundation for our findings. Industry-standard tools like Porter's Five Forces Analysis, SWOT Analysis, and Price Trend Analysis further enhance the comprehensiveness of our evaluation.

Research Methodology:

Introspective Market Research inculcated modern methodologies to obtain, summarize and analyze authentic data to produce a highly relevant report which helps to make sound decision making. Primarily, we are working based on research methodologies, including primary and secondary research. We gather data for the secondary research from an assortment of sources, including published official articles, annual reports, official corporate websites, private company journals, and paid databases such as Statista, Factiva, Euromonitor, D&B, and IMR's Data Repository, among others. In the primary research, we contact the key companies in the market, gather the necessary data, and have it analyzed by experts in the industry.

Discount on the Research Report @

https://introspectivemarketresearch.com/discount/16553

What is included in Ready-To-Drink market segmentation?

The report has segmented the market into the following categories:

By Type

Tea & Coffee

Sports & Energy Drinks

Dairy-Based Beverages

Juices & Nectars

Fortified Water

Alcopops

Others

By Packaging Type

Bottles

Cans

Cartons

Other

By Region:

North America (U.S., Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, U.K., France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Saudi Arabia, Bahrain, Kuwait, Qatar, UAE, Israel, South Africa)

Importance of the Report :

• Qualitative and quantitative analysis of current trends, dynamics and estimates;

• Provides additional highlights and key points on various Ready-To-Drink market segments and their impact in the coming years.

• The sample report includes the latest drivers and trends in the Ready-To-Drink market.

• The report analyzes the market competitive environment and provides information about several market vendors.

• The report provides forecasts of future trends and changes in consumer behavior.

• Comprehensive fragmentation by product type, end use and geography.

• The study identifies many growth opportunities in the global Ready-To-Drink market.

• The market study also highlights the expected revenue growth of the Ready-To-Drink market.

Our study encompasses major growth determinants and drivers, along with extensive segmentation areas. Through in-depth analysis of supply and sales channels, including upstream and downstream fundamentals, we present a complete market ecosystem.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assist our clients grow and have a successful impact on the market. Our team at IMR is ready to assist our clients flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, specialized in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1 773 382 1049

Email : [email protected]

LinkedIn | Twitter | Facebook

0 notes

Text

Beer Events 4.1

Events

Guinness brewed their last batch of ale, deciding instead to concentrate on stout (1799)

Christian Moerlein arrived in Cincinnati (1842)

Missouri Brewers Association founded (1900)

Manitowoc County Brewers Association founded (1901)

Prohibition enacted in Alberta and Saskatchewan, Canada (1918)

Robert Owens patented a Wild-Oat and Barley Separator (1919)

NYC Beer Strike began with 7,000 members of International Union of Brewery Workers out on strike (1949; it ended June 20)

Grace Brothers Brewing re-opened, after being closed since 1953 (California; 1958)

Thin Layer Steam Distillation of Hop Oil Extract patented (1969)

Interbrew Betriebs und Beteilig patented a Preparation of Beer (1975)

Stephen Morris’ The Great Beer Trek published (1984)

Jennifer Guinness kidnapped & held for 2 million pounds ransom (1986)

1st keg of Alaskan Amber was officially tapped by Steve Cowper, then Governor of Alaska (1987)

Leinenkugel became a wholly owned subsidiary of Miller Brewing (1988)

Kirin Beer patented a Flow Passage Closing Mechanism of Beverage Pouring Apparatus (1997)

Tabernash & Left Hand Brewing merged (Colorado; 1998)

1st American restaurant certified organic (Restaurant Now, DC; 1999)

Heineken released their keg-shaped can (2000)

Brewery Openings

Als Aldaris / Pripps & Hartwell (Latvia; 1865)

Anthracite Brewing (Pennsylvania; 1897)

Gund Brewing (1897)

Keystone Brewing (Pennsylvania; 1902)

Genessee Brewing (New York; 1933)

Frog & Parrot brewery (England; 1982)

Granite Brewery (Nova Scotia, Canada; 1985)

Horseshoe Bay Brewing (British Columbia, Canada; 1988)

Old City Brewing (Texas; 1988)

Rochester Brewpub (New York; 1988)

Dilworth Brewing (North Carolina; 1989)

Frankton Bagby Brewery (England; 1989)

Marin Brewing (California; 1989)

Old Colorado Brewing (Colorado; 1989)

Swans Brewpub / Buckerfield Brewery (British Columbia, Canada; 1989)

Dubuque Brewing (Washington; 1991)

Nelson Brewing (British Columbia, Canada; 1991)

Oasis Brewing (Colorado; 1991)

Captain Tony's Pizza & Pasta Emporium brewery (Ohio; 1993)

Lonetree Brewing Ltd (Colorado; 1993)

Murphys Creek Brewing (California; 1993)

Old Peconic Brewing (New York; 1993)

Star Brewing (Oregon; 1993)

Highlands Brewery (Florida; 1994)

Maui Beer Company (Hawaii; 1994)

Black River Brewhouse (Vermont; 1995)

Brazos Brewing (Texas; 1995)

Chuckanut Bay Brewing (Washington; 1995)

Coophouse Brewery (Colorado; 1995)

Drytown Brewing (New York; 1995)

Engine House #9 brewery (Washington; 1995)

Old World Pub & Brewery (Oregon; 1995)

River Market Brewing (Missouri; 1995)

Southend Brewery & Smokehouse (North Carolina; 1995)

Thunder Bay Brewing (California; 1995)

American Brewers Guild Brewery (California; 1996)

Blue Anchor Pub brewery (Florida; 1996)

Champion Billiards & Cafe (Maryland; 1996)

Climax Brewing (New Jersey; 1996)

Gem State Brewing (Idaho; 1996)

Kaw River Brewery (Kansas; 1996)

Mt. Begbie Brewing (Canada; 1996)

O'Hooley's Pub & Brewery (Ohio; 1996)

Osprey Ale Brewing (Colorado; 1996)

Paradise Brewing / Pagosa Springs Brewing (Colorado; 1996)

Railway Brewing (Alaska; 1996)

Rixdorfer Brauhaus (Germany; 1996)

A-Z Brewing (Arizona; 1997)

Ambleside Brewing (Minnesota; 1997)

Arizona Brewing (Arizona; 1997)

Barley Brothers Brewery & Grill (Arizona; 1997)

Barney's Brewery (California; 1997)

Borealis Brewery (Alaska; 1997)

Cottonwood Brewery (North Carolina; 1997)

Great Beer Co. (California; 1997)

High Mountain Brewing (Canada; 1997)

Irons Brewing (Colorado; 1997)

Manitou Brewery (Colorado; 1997)

Maui Kine Brewery (Hawaii; 1997)

Olde Wyndham Brewery (Connecticut; 1997)

Reckless Abandon Brewery (California; 1997)

Red Tomato Brewery (California; 1997)

Sierra Blanca Brewing (New Mexico; 1997)

Willimantic brewing (Connecticut; 1997)

Dragonmead Microbrewery (Michigan; 1998)

Knucklehead Brewing (Canada; 1998)

Newport Brewing (Rhode Island; 1998)

Captain Cook Brewery (England; 1999)

Freedom Brewing (England; 1999)

MIIG Brewery (Jordan; 1999)

Titanic Brewery & Restaurant (Florida; 1999)

Two Rivers Brewing (Canada; 1999)

Clay Pipe Brewing (Maryland; 2000)

Conshohocken Brewing (Pennsylvania; 2014)

0 notes

Photo

【ブログ更新しました!】ビール キリンビール株式会社/スプリングバレー豊潤496 https://ift.tt/3tPXEGr

1 note

·

View note

Text

Stout Market Is Projected To Reach USD 15.04 Billion By 2027

The global stout market size is expected to reach USD 15.04 billion by 2027, according to a new report by Grand View Research, Inc., expanding at a CAGR of 4.4% from 2020 to 2027. Shifting consumer inclination towards alcoholic drinks with richer taste and texture is boosting the market growth. Moreover, increasing preferences among consumers for premium drinks with nutritional benefits, such as significant amounts of antioxidants, for a healthy lifestyle are expected to offer new avenues for the market over the forecast period.

Over the past few years, the young generation and working-class population have increasingly adopted the partying culture in pubs, bars, casinos, and even house parties across the globe. The U.S. is one of the countries with a vast bar and nightclub industry in the world. According to the statistics provided by the American Nightlife Association (ANA), in 2018, the U.S. bar and nightclub industry was valued at USD 26 billion and is witnessing a 2.9% Year on Year (YoY) growth. These statistics are opening new avenues for stout.

Europe was the largest regional market for stouts, accounting for more than 35.0% in 2019. Stout was first introduced in the U.K. and it is still widely consumed as a traditional and premium beer in the region. North America is expected to witness significant growth in the years to come due to the increasing adoption of the product among millennials, young customers, and working-class people.

Request a free sample copy or view report summary: Stout Market Report

Stout Market Report Highlights

The growing culture of pubbing, house party, outings, clubbing, and other various social gathering is propelling the demand for stouts across the globe

The on-trade segment was the largest distribution channel with a share of more than 60.0% in 2019 owing to the growing pubbing and partying culture among the youngsters across the globe. Young generation customers and the working-class population are propelling the demand for the on-trade sales of premium products, like stouts, across the globe

The off-trade distribution channel is anticipated to be the fastest-growing segment with a CAGR of 4.7% from 2020 to 2027. Due to the pandemic, the online sales channel has witnessed a surge in the sales of alcoholic drinks. Customers were increasingly ordering their drinks through online portals as all the clubs, pubs, and bars were closed due to the pandemic across the globe

North America is anticipated to be the fastest-growing regional market with a CAGR of 5.0% from 2020 to 2027 owing to increasing demand for the premium beers with enhanced flavors, textures, and aroma in the U.S. and Canada.

Stout Market Segmentation

Grand View Research has segmented the global stout market on the basis of distribution channel and region:

Stout Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

On-trade

Off-trade

Stout Regional Outlook (Revenue, USD Million, 2016 - 2027)

North America

Europe

Asia Pacific

Central & South America

Middle East & Africa

The U.S.

The U.K.

Germany

Italy

China

Japan

Brazil

List of Key Players of Stout Market

Carlsberg Breweries A/S

Asahi Group Holdings Ltd.

Heineken N.V.

Anheuser-Busch InBev SA/NV

Kirin Brewery Co. Ltd.

Diageo plc

Molson Coors Beverage Co.

The Boston Beer Co. Inc.

Stone Brewing Co.

Port Brewing Co.

About Grand View Research

Grand View Research, Inc. is a U.S. based market research and consulting company, registered in the State of California and headquartered in San Francisco. The company provides syndicated research reports, customized research reports, and consulting services. To help clients make informed business decisions, we offer market intelligence studies ensuring relevant and fact-based research across a range of industries, from technology to chemicals, materials and healthcare.

1 note

·

View note

Photo

Ch 249′s Shiraishi is cosplaying as the Geisha from early Sapporo Beer Ad Posters!

Diffrences:-

Decor, flowers, headgear, ring

The original poster had several Dainippon brewery brands beer bottles: Yebisu, Sapporo and Asahi(in forefront), Tokio(in back) while Shiraishi only has Sapporo Beer bottles and the poster reads Sapporo Beer.

The star pattern by Shiraishi’s head looks like Akai Hoshi(The Red Star Symbol of Sapporo Beer) but is probably the hairpin from another such poster:-

When Sapporo beer started sale in Meiji Era, it was supposed to be exorbitantly expensive, 1 bottle costing upto 16 sen(16銭) which in todays value has been approximated as 5000 yen(of whichever year the estimation was made). Another figure during Meiji era states beer(brand unspecified) cost 18 sen for one bottle which equals 3800 yen in current day. Another states that the price range would be 3000-5000 yen with inflation in today’s times. Currently the normal rates for a bottle range about 250-800 yen.

Ergo, back then, it was usually served in high end establishments.

And the series of these old posters feature geisha!

Geisha also featured on other beer brand posters and posters for stores such as clothing stores. And during the Russo-Japanese war Geisha postcards(for soldiers) were very popular. Geisha postcards and “Geisha Bromides” became popular therafter too. Even Takuboku is associated with some Geisha postcard he either sent or received.

……………………………………

Two Geishas are very popular as models for many postcards and kimono and cosmetic shop posters-

Manryuu[萬龍] was the most popular girl on postcards and posters of the Meiji Era. She was a Akasaka(Minato ward) geisha. Real name Tamukai Shizu(田向静, 1894-1973), born in Ibaraki, lived in Tokyo.

Teruha(照葉)/Chiyoha(千代葉)- geisha name. Formal name: Takaoka Chishō(高岡 智照). She was a Shimbashi Tokyo geisha. Her postcards were very popular especially because of her unusual beauty and she herself cherished them all through her life and wasstrict about ‘illegal copies’(she wouldn’t have liked us lot). She was known as the nine-fingered Geisha because she cut off her pinky. She had a colorful but troubled life rocked with scandals. She later became a writer and a prominent nun. Real name Takaoka Tatsuko(高岡たつ子, 1896-1994), born in Nara or Osaka.

Many posters promoted beer of different brands in one go or were reused for promotion of different brands.

These posters as can be seen are designed paintings. Some used the same poster for different brands with the artist changing the brand names, bottle design, etc.:-

Left is a postcard with Sapporo beer, the right is a Union(yunion) beer poster

……………………………………

These posters have art of that time’s artists most of which are type of Bijin-ga(beautiful woman). Two such artists who are well known and even associated with the Beer ad posters are:-

Kitano Tsunetomi(北野恒富, 1880-1947) was a famous painter who is credited with drawing several posters for Sakura Beer.

Tada Hoku(多田北烏, 1889-1948) was famous for his exquisite posters for Kirin Beer. (most of these are shown on kirin beer’s official site)

……………………………………

On the Text front,

As can be seen on the cover even the chapter number is running from R to L:-

This font is like the Sapporo Beer poster font:-

The title and lettering that are horizontal are all reverse, i.e. written from right to left(like arabic or urdu) since in those times horizontal japanese was written like that as can be seen in photographs that show shop signs, on postcard descriptions, ad posters like these, etc.

Another Eg:- Kabuto Beer

Nowadays, other than the vertical writing being R to L, the horizontal text is L to R as known.

…………

Note on the Red Star Logo: the Akahoshi(���星)

The star is red on the logo of the bottles(as below) and a popular name associated with the brand is Akahoshi.

The logo on that note is from 1893 edition ater the company changed name to Sapporo Brewery(after abolishment of Kaitakushi):-

The Red Star can be seen in almost everywhere over the Sapporo Beer factory museum:-

The iconic old Sapporo Beer logo of a red star which is also seen on the factory chimney and window, is based on the Kaitakushi’s red star(赤い星). It was derived from a previously existing ship flag. Nothing to do with china or communism(many blogs write that as the first line), the Red Star stands for the north star/polar star.

Other than the Beer Museum, many old buildings in Hokkaido especiallly in Sapporo have either a red star on the building or a five-point star engraved on the building surface. Hakodate’s Goroyaku being a five-point star fort is not related.

Kaitakushi(Hokkaido Development Commission/Hokkaido Colonizing Office) Flag, called Hokushinki[北辰旗]:-

Kuroda Kiyotaka wanted to change the Hokkaido flag to a seven pointed star with darker color scheme. The current prefecature flag of Hokkaido has a similar seven pointed star(though slimmer and designed with white outline standing for snow).

On that note,

Even though none of the other photographs match, this one of Kuroda Kiyotaka reminds me of Kadokura tanuki(maybe because of the hairstyle??):-

At least the military guy Kikuta randomly resembled was a truly well-respected one. But Kuroda…

Kuroda Kiyotaka(died 1900) was one of the first governor of Hokkaido, vice-chairman of the Kaitakushi, and one of the most controversial men during his times either being implicated for scams or corruption, murder, etc and losing his positions very often and yet he climbed the ladder all the way up. He was the Prime Minister of Japan though for only a year. He once again had to resign. And most notoriously he was also accused of murdering his wife in a dunken fury(he was an alcoholic with many stories of his messes under influence) which remained a mystery since he was officially cleared on account of his wife’s lung-disease being unerthed as the cause in autopsy. Further he married his alleged mistress too soon.

Kadokura’s born with bad luck which usually turns good. This man had bad-karma-last-life and collects-more-bad-karma-this-life stamped all over him!

Even upto his death, even his clan was divided about him. He and Takeaki Enomoto however had a good relation throughout. At the end of the Boshin War Kuroda negotiated on behalf of Takeaki Enomoto to prevent his execution and his subsequent entry in Meiji politics.

On that note, if GK is still before October 1908, Takeaki Enomoto(the original architect of the ‘republic of ezo’ idea) will still be alive…

31 notes

·

View notes

Text

This is boycott products & brands from Burma Campaign UK article

We boycott the military coup brands & products according to CDM & we don't support their products. Please do not use their products to help us. Thank you.

Banking and finance

Aung Myint Moh Min Insurance

Aung Thitsar Oo Insurance

Innwa Bank

Myanmar Mobile Money

Myawaddy Bank

Mytel Pay

Cigarettes

Premium Gold

Red Ruby

Communications

MECtel

Mytel

Construction

Berger Paint

Elephant King Cement (Sin Minn Cement)

Myin Pyan Cement (Flying Horse Cement)

Rhino Cement

Rhinoceros Cemec (Cement)

Sigma Cable

Tristar Steel

Entertainment/Tourism

Central Hotel Yangon

Diamond White Restaurant Yangon

Hanthawaddy Golf Course

Indoor Skydiving

Myawaddy Tours and Travel

Myawaddy Travels and Tours

Nan Myaing Café (Pwin Oo Lwin)

Okkala Golf Resort

Royal Sportainment Bowling Alley

Royal Sportainment Complex

Royal Sportainment Ice Skating

Shwe Gandamar Ballroom (Pathein)

Shwe Gandamar Grand Ballroom (Yangon)

Food and drink

Adipati Rice (AAPT Rice)

Akasi Long Grain Rice

Andaman Gold Blue

Andaman Gold Special

Black Shield Stout

Dagon Beverages

Dagon Dairy Plant

Dagon Extra Strong Beer

Dagon Fresh Lemon Sparkling

Dagon Fresh Soda

Dagon Gin

Dagon Lager Beer

Dagon Light Lager Beer

Dagon Malta Fresh

Dagon Rum

Dagon Single Malt Lager Beer

Dagon Super Lager Beer

Fleur Marguerite Sunflower Rice

Kirin Ichiban

Mandalay Beer

Mandalay Brewery

Mandalay Spirulina Anti-aging Beer

Mandalay Strong Beer

Mandalay Super Fresh Lager

MEC Myanmar Rice

Moon Dairy Creamer

Myanmar Beer

Myanmar Brewery

Myanmar Premium Beer

Nan Myaing Coffee

Nay Pyi Taw Water

Ngwe Pin Lei Premium Marine Products

Pyin Oo Lwin Coffee

Royal Karaweik Sugar

Seven7 Condensed Milk

Shwe Phe Oo Teamix

Sugarmec

Sun Condensed Milk

Health and Beauty Products

Dentomec Toothbrushes

Dentomec Toothpaste

Life Coconut Oil (moisturiser)

Padonma Soap

Health Servcies

Defence Services General Hospital

Defence Services Liver Hospital

Defence Services Medical Research Centre

Defence Services Obstetrics, Gynaecology and Child Health Hospital

Defence Services Orthopaedics Hospital

Kan Thar Yar Hospital

Military Institute of Nursing and Paramedical Science

No.2 Military Hospital

Thamadaw Special Clinic

Industrial Estates/Offices

Indagaw Industrial Zone

Myawaddy Bank Luxury Complex

Ngwe Pinlae Industrial Estate

Pyinmabin Industrial Estate

International Trade

Ahlone International Port Terminal 1, Yangon

Container Transport and Port Clearance Yard (Ywama)

Five Star Shipping Company – ships owned: Chindwin, Coco Gyun, Sawei, Ha-Kha, Han Thar, Hpa-an, Htone-Ywa, Kengtung, Kyaukpyu, Lashio, Loikaw, Maan Aung, Mawlamyine, Myit Kyi Na, Pagan, Pha Shwe Gyaw Ywa, Shweli, Sittwe, Taung Gyi, Thanlwin, U Thar, Yaan Byae.

Hlaing Dry Port, Inland Container Depot (IDC) and Logistics Centre

Hteedan International Port Terminal, Yangon

Inland Container Depot (IDC) Hlaing Thar Yar

Lann Pyi Marine

MEC Container Transport

Thilawa Shipbreaking Yard

TMT Port Terminal, Yangon

Manufacturing

Life Coconut Charcoal Briquettes

Ngwe Pinlae Fishmeal

Silver Sea Paper Carton Box Production

Thunder Sulphuric Acid

Tristar Tyres

Media

Knowledge Light Magazine

MWD Books

MWD Documentary TV Channel

MWD Family TV Channel

MWD Media

MWD Movies TV Channel

MWD Music TV Channel

MWD Series TV Channel

MWD Shopping TV Channel

MWD Variety TV Channel

Myawaddy (MWD) TV Channel

Myawaddy Television

Myawady Daily

Myawady Magazine

Ngwe Tar Yi Magazine

Tayza (children’s cartoon magazine)

Thazin FM Radio

The Union Daily

Yandanarpon Daily

Retail

547 Minimarts

Adipati Rice Mill Shops

Golden Land Duty Free Shops

Myawaddy Petrol Shop (Station)

Ruby Mart (Yangon & Pyin Oo Lwin)

Satake Showroom

Shwe Gandamar

Starmart Nine Mile Showroom

Trading companies

Adipati Agricultural Produce Trading

Myawaddy Trading Ltd

Ngwe Pinlae Cold Store

Ngwe Pinlae Fisheries Company Ltd

Ngwe Pinlae Livestock Breeding and Fisheries Company

Shwe Gandamar International Trading

Shwe Innwa Gems

Transport

Adipati (AAPT) Waterway Transport

Bandoola Taxi

Bandoola Transportation

City Liner Bus Services

Parami CNG Station

Parami Express

Parami Taxi

Pathein Thu Express

Sales and Service Centre, Mingalardon Township, Yangon (vehicle repairs and spare parts)

Shan Ma Lay Express

Shwe Man Thu Highway Bus Station

Shwe Mann Thu Express (also spelt Shwe Man Thu)

Shwe Myaing Thu Express

Than Myan Thu Express

2 notes

·

View notes

Link

excerpt:

Moreover, Amnesty International has revealed that Kirin’s subsidiary in Myanmar (Burma) actually made three donations to the Burmese military during the army’s offensive in 2017 that forced over 700,000 Rohingya civilians to flee to neighboring Bangladesh. The head of the Burmese military who directed the atrocities against the Rohingya was filmed receiving one of these donations from Kirin's affiliate and explicitly noted that it was for the security forces.

The United Nations-mandated International Independent Fact-Finding Mission urged the international community to "sever ties with Myanmar's military and the vast web of companies it controls and relies on" as "any foreign business activity involving the Tatmadaw (military) and its conglomerates MEHL and MEC poses a high risk of contributing to, or being linked to, violations of international human rights law and international humanitarian law. At a minimum, these foreign companies are contributing to supporting the Tatmadaw's financial capacity."

Kirin is a Japanese conglomerate, best known for its flagship Kirin Ichiban beer and its ownership of many other beer, spirit, and beverage brands worldwide. Through its Lion Beverages subsidiary, Kirin has been expanding through its acquisition of craft breweries in North America, Europe, and Australasia. Its investment in global brands make Kirin highly vulnerable to our consumer boycotts and social media pressure.

It’s time to send a message to Kirin Holdings that will reverberate to other Japanese companies and indeed corporations worldwide: by doing business with Burma's genocidal generals, corporations are risking their brands, their shareholders, and their customers. There can be no "business as usual" with genocide.

For more information:

"How we can pressure Kirin every day from our homes," International Campaign for the Rohingya blog, April 30, 2020

"Military Ltd," Amnesty International, September 2020

“Dirty List: Kirin Holdings,” Burma Campaign UK

Kirin Holdings: Group Companies List

Justice for Myanmar - Justice For Myanmar is a campaign to provide a platform for those unjustly persecuted by the Myanmar military – regardless of class, religion, gender or ethnic identity in their efforts to seek justice and end military impunity in Myanmar. The campaign works to expose the Myanmar military’s businesses’ link to human rights violations across the country.

“The economic interests of the Myanmar military,” United Nations Independent International Fact-Finding Mission, September 2019

“Japan: Investigate brewer Kirin over payment to Myanmar military amid ethnic cleansing of Rohingya,” Amnesty International, 14 June 2018

“Kirin restructures donation policy after Amnesty report,” Myanmar Times, 11 January 2019

“Japan continues to help Myanmar whitewash the Rohingya crisis,” Teppei Kasai, Japan Times, 25 August 2019

"Japan and Myanmar’s Toxic Friendship," Yuzuki Nagakoshi, The Diplomat, 15 January 2020

"Resetting Myanmar Policy," Global Witness, September 2019

2 notes

·

View notes

Video

youtube

‘Kirin Lemon - ‘Super Mario World’‘

[MISC] [JAPAN] [VIDEO, COMMERCIAL] [1991]

Kirin Lemon was created by Kirin Brewery in Yokohama in 1928. Originally the company also produced Kirin Cider, Kirin Citron, and soda water, but the lemon flavor proved most popular. The drink is flavored by extracts from the zest or lemon peel.

The recipe for the drink has been changed several times since 2006, with adjustments to the amount of sugar, amount of lemon juice added, as well as coloring or lack of coloring. ~Delicious Sparkling Temperance Drinks

Source: YouTube; The Unknown

#gaming#advertising#kirin lemon#kirin#super mario#licensed#food and drink#claymation#1991#japan#videos#commercials

14 notes

·

View notes

Text

Flat Tire

I remember back to 2000. I had always enjoyed beer, but finding ones that were actually enjoyable--meaning they tasted good--was hard. Beer was and is still plentiful. Good beer was hard to come by back then, when craft beer was still in its infancy.

But somewhere along the way I met Fat Tire Beer from New Belgium Brewing Company. It was my gateway beer into the craft scene, and set the stage for my inquisitiveness into the brewer’s art. From amber ales such as Fat Tire I went on to explore a large number of very diverse beers, from stouts and porters to pilseners, kolschs, and lagers, and ultimately finding my way to the many sub-varieties of IPAs.

I never lost my love for Fat Tire and its brewer, and have visited their Fort Collins Colorado location many times. Each visit was like a pilgrimage. Hell, I even own one of their neon signs so I could have my own shrine at home.

Yesterday, though, New Belgium Brewing announced the unspeakable among craft beer snobs: They had sold out to Lion Little World Beverages of Australia, which is owned by Kirin Brewing of Japan. And all the craft beer snobs cried.

Among folks who promote craft brewing, being a sell-out is a bad thing. Never mind that it usually involves millions of dollars for the owners, thereby ensuring a happy retirement and maybe an island in the Caribbean. Once a large corporate brewer takes possession, the quality of the beer is perceived (and often truthfully) goes downhill, such as at Karbach (now owned by AB InBev) and Revolver Brewing (where Miller Coors is now majority owner).

New Belgium is rather unique among craft brewers in that it is an ESOP (employee stock ownership program), which means the employees own the company. Each employee will thus receive $100,000 or more from this transaction, which amounts to a buy-out of their accrued retirement. The company has also been proactive in sustainability measures, buying its electricity from a Wyoming wind farm, and processing all of its waste water. They have been exceedingly good citizens.

But New Belgium? This one hurt, although I am actually not a bit surprised. They were actively seeking a buyer in 2015. In 2016, they opened a second brewery in North Carolina. But from 2017 to 2018, their barrelage slipped by 11%. That’s a startling amount for a brewery that had just expanded and gained nationwide distribution.

The fact of the matter is, the craft beer segment has become crowded, even though it still only amounts to about 25% of beer revenues. There are about 7500 craft brewers in the US, and we--yes, I am including myself in this discussion--tend to be very brand-unloyal when we drink. We are promiscuous drinkers, meaning we like to drink around, trying all of the many breweries and their varieties much like bees will fly from flower to flower.

Here’s the free market advocate inside of me: If there is a buyer and seller able to agree upon terms, than who am I to stand in the way or condemn? To be honest, I would do the same, even if my craft-beer-loving customers felt like I took the money and ran. Hell yes, I would run. If you waved $5 million or more at me, I would be busy booking tickets to the Caribbean in a heartbeat.

So while a part of me is saddened that New Belgium will never be allowed to call itself a craft brewer again, I am OK with it. Craft beer as a segment has been maturing the last five to ten years, and industry consolidations are the norm. Look around you. How many cell phone providers do you see these days? It’s nothing like it was 20 years ago. AT&T and Verizon have gobbled up the majority of the small regionals.

In other words, this is normal. And if you think the quality has slipped or will in the future (actually, I think New Belgium started slipping a few years ago), then don’t drink it. There are thousands of other good beers available.

And in the end, don’t you wish you had something successful that you could sell to a large corporation with virtually unlimited cash resources? I”ll wait.

Dr “Here’s To Ya“ Gerlich

Audio Blog

1 note

·

View note