#Money Transfer Software

Explore tagged Tumblr posts

Text

Do you want to start your own b2b fintech business and looking for best solution then this is for you?

Ezulix software is a leading b2b fintech software development company in India. We offer multipls software solutions in a singel b2b admin portal. Here we have mulitple packages with multiple features.

By choosing our b2b software silver package, you can get all multi recharge, aeps, bbps, pancard and money transfer services into your admin panel with integrated mobile app and your brand website.

You can offer all services to your agents and can earn highest commission in the market.

For more details visit our website now or request a free live demo. www.ezulix.com or call at (+91)7230001612

#b2b fintech software#b2b software silver package#mobile recharge software#aeps software#bill payment software#money transfer software#pancard software#b2b fintech business#fintech startup

3 notes

·

View notes

Text

Mobile Top-Up API

Revolutionizing Mobile Recharge: Introducing RC Panel's Mobile Top-Up API Service

In today's fast-paced digital world, staying connected is more crucial than ever. Whether it's for work, communication, or entertainment, mobile phones have become indispensable tools. But what happens when you run out of mobile balance just when you need it the most? This is where RC Panel’s Mobile Top-Up API service comes in.

What is RC Panel’s Mobile Top-Up API?

RC Panel offers an easy-to-integrate Mobile Top-Up API service that enables businesses, app developers, and service providers to offer seamless mobile recharge services to their customers. With our API, your users can instantly top up their mobile phones without the need for third-party apps or websites.

Why Choose RC Panel’s Mobile Top-Up API?

Global Coverage Our Mobile Top-Up API supports a wide range of mobile network providers from across the globe. Whether your customers are in Asia, Africa, or Europe, you can provide them with reliable and secure recharge options.

Instant Transactions Forget waiting for hours to get your mobile recharge done. Our API ensures that the top-up is processed in real-time, meaning that your customers can enjoy their new balance immediately.

Multiple Payment Methods RC Panel's API supports various payment methods such as credit/debit cards, e-wallets, and bank transfers, making the process easier for users to complete transactions through their preferred channels.

Simple Integration Integrating our Mobile Top-Up API into your platform is straightforward. With comprehensive documentation and a developer-friendly interface, you can get started in no time, saving both time and resources.

Security and Reliability We understand that security is paramount when it comes to financial transactions. Our Mobile Top-Up API uses the latest encryption standards to ensure that your users' personal and financial data are always secure.

Customizable Features RC Panel’s API allows for easy customization to meet the specific needs of your business. Whether you want to offer discounts, loyalty points, or promotional services, we provide flexibility for businesses to create their unique offerings.

Use Cases for Mobile Top-Up API

Mobile Service Providers: Offer a value-added service to your subscribers by allowing them to recharge their phones through your website or app.

E-commerce Platforms: Add mobile top-up as an additional service to your customers, increasing their satisfaction and keeping them coming back for more.

Financial Institutions: Enable your users to perform mobile top-ups through your mobile banking app or online banking platform.

Travel Agencies: Travelers can recharge their phones remotely when they are abroad, making it a convenient service for them.

How the RC Panel Mobile Top-Up API Works

Customer Request: The user requests a top-up for their mobile phone by selecting the desired amount and provider.

API Call: Your platform makes an API call to RC Panel’s server with the user’s details and transaction request.

Payment Processing: The user selects their preferred payment method, and the payment is processed securely.

Recharge Completion: Once payment is successful, RC Panel sends a confirmation message, and the top-up is instantly credited to the user’s mobile account.

Key Benefits for Your Business

Increase User Engagement: Offering mobile top-up services on your platform can attract more users, enhance retention, and boost user satisfaction.

Revenue Generation: By integrating mobile top-up services, you can generate additional revenue through transaction fees or offering premium services.

Expand Your Market Reach: With a global network, your service can cater to international users, helping you tap into new markets.

Get Started with RC Panel’s Mobile Top-Up API

Ready to integrate mobile recharge services into your platform? RC Panel’s Mobile Top-Up API is your gateway to providing a seamless, user-friendly experience for your customers.

For more information or to get started, contact us today or check out our API documentation.

#multi recharge company#mobile recharge#pan card agency#money transfer software#rc panel#mobile recharge software#advertising#business#cars#biology#Fast#Easy#and Reliable Mobile Recharge – Enhance Your Platform with RC Panel’s API#MobileTopUp#APIIntegration#RechargeAPI#InstantRecharge#GlobalTopUp#MobileRecharge#TechSolutions#SeamlessTransactions#RCPanel#apiforbusiness#PaymentSolutions#MobilePayments#BusinessGrowth#RechargeMadeEasy#digitalservices#MoneyTransferSoftware

0 notes

Text

B2B Fintech Software - Get Software for Recharge, Banking, Bill Payment and Travel Booking

Do you want to start fintech business and looking for a comprehensive solution then this is for you?

Ezulix software is a leading b2b fintech software development company in India. We offer b2b fintech admin portal that integrated with mobile recharge software, aeps software, bill payment software, pan card software, money transfer software and travel booking software.

For more details visit our website or request a free live demo. (+91)7230001612

#mobile recharge software#aeps software#money transfer software#pan card software#bill payment software#travel booking software

0 notes

Text

Boost Your Business with Custom B2B Software

Empower your business with custom B2B software solutions from Beta Byte Technologies. Our expert team crafts tailored software to optimize operations and drive growth.

Get in touch with us today to kickstart your journey towards digital transformation!

#software development#custom erp software#custom software development#best software development company in mohali#software development agency#mobile app development#android app development#web app development#b2b software development#b2b software service#AEPS Software#BBPS Software service#Money Transfer Software#Billing Payment Service

0 notes

Text

Welcome To Man in Black Market!

We Sell Real Digital Money with a Cheap price Buy Paypal Balance transfers CashApp Balance Transfers Bank to bank transfers and more…

invite Link : Join Man in Black

pay 100$ Get 1000$ pay 200$ Get 2000$ pay 300$ Get 3000$

invite Link : Join Man in Black

#bitcoin#usdt#flash usdt binance#flash usdt sender#flash usdt transaction#flash usdt software#cryptotrading#cryptocurrency#btc#paypal#venmo#cashapp#bank#transfer#money#make money online#earn money online#money problems#wealth#lifestyle#finances#energy

10 notes

·

View notes

Text

In high-stakes finance, control isn’t optional — it’s everything.

Bank Optimizer by ITIO Innovex is built for businesses that don’t just want data — they want foresight, automation, and total command of their financial operations.

From real-time KPIs to risk mitigation and fraud detection, this isn’t just a platform — it’s your digital control room.

Run your systems like the stakes are real. Because they are.

#crypto#cybersecurity#digitalbanking#digital banking licenses#fintech#investors#white label crypto exchange software#bitcoin#digital marketing#financial advisor#digital banking#neo banks#serena banks#outer banks#money in the bank#bank#transfer money#west bank#money transfer#money#cash#paypal#digital finance#personal finance#finance#financial#investing#investments#itioinnovex#bankoptimizer

2 notes

·

View notes

Text

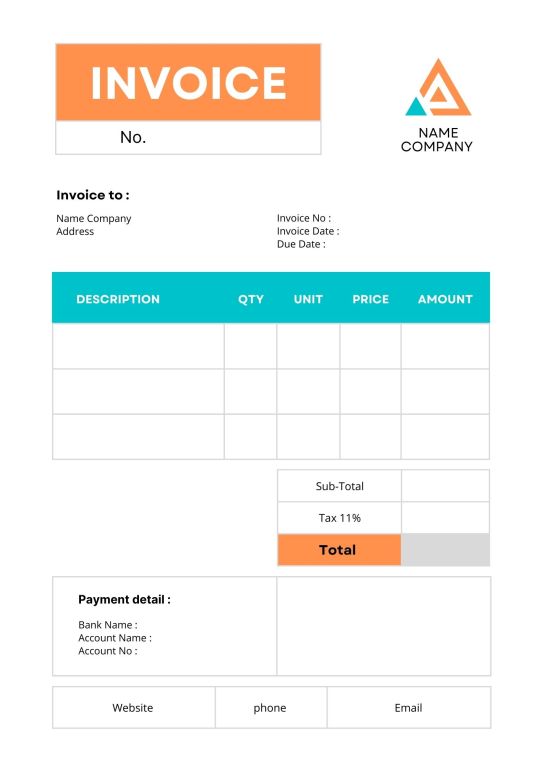

Orange Blue Minimalist Business Invoice A4 Document

Orange Blue Minimalist Business Invoice A4 Document is a vibrant and modern template designed for businesses that value clarity and style. Featuring a clean layout with orange and blue accents, it balances professionalism with a touch of creativity.

Buy this

#free invoice software#invoice software development bd#money transfer#finance#money#invoice discounting#invoice management system#invoice maker#invoice processing#invoice

2 notes

·

View notes

Photo

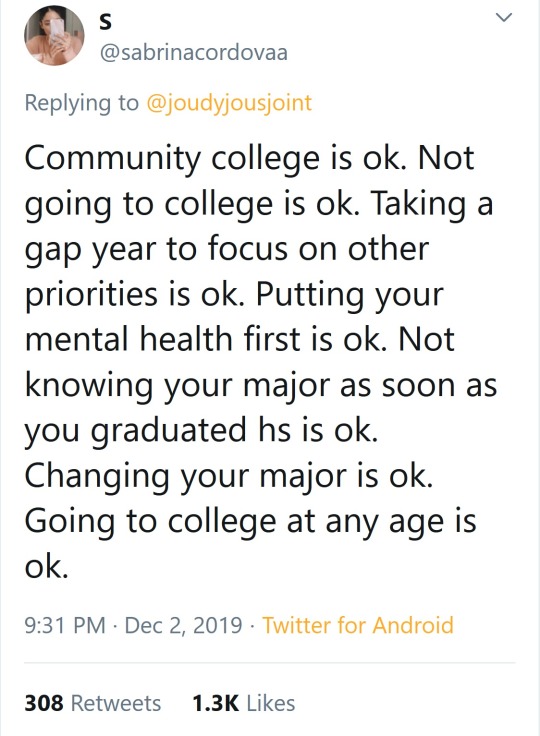

Piggybacking off the 10% of jobs that care what school you went to. Those jobs only care if you went to an elite university. They see some no name state school as equal prestige as your community college. The people considering community college aren't also looking at Harvard.

Community college is not lesser, you can still get a good job, and you can transfer to a 4-year school with significantly less debt than the people who started as a freshman. Heck I know someone who started at community college and got their PhD at Stanford so community college doesn't necessarily lock out the fancy schools.

every year we have to say it

#community college#trade school#gap year#undeclared#transfer#high school senior#college applications#also you can make money with a hyper specific degree that you got out of passion if#you are open to more jobs than just the obvious ones#and you make as many friends as you can while in school#you can call that networking if you like#you need to pick up skills that your professors cant teach you#i know someone who got a philosophy degree and is making $300k as a software developer#he swears the philosophy degree is what makes him so good at programming#you might not be able to get a job youre passionate about if you go the passion route for your major#but youre not doomed to be unemployed/underemployed just because you majored in art history

144K notes

·

View notes

Text

Payment Kiosks Explained: How They’re Enhancing Customer Convenience

In an age of digital transformation and automation, businesses are continuously exploring innovative methods to streamline transactions and enhance customer satisfaction. Among the most effective tools emerging in recent years is the payment kiosk — a self-service solution designed to process transactions without the need for human assistance. From retail shops to healthcare facilities, payment kiosks are revolutionizing how customers pay for goods and services by offering speed, accessibility, and convenience. This blog delves into the technology behind payment kiosks, their benefits, the industries leveraging them, the challenges of implementation, and future trends that will shape their evolution.

Understanding Payment Kiosks: Technology and Functionality

What Are Payment Kiosks?

Payment kiosks are standalone, interactive terminals that allow users to conduct financial transactions quickly and securely. They enable customers to pay bills, purchase products or services, print receipts, or recharge accounts — without waiting in line or dealing with staff. These kiosks are often strategically placed in high-traffic areas to maximize accessibility and reduce service bottlenecks.

Key Technologies Used in Payment Kiosks

To function effectively, payment kiosks integrate several core technologies:

Touchscreens — These form the primary user interface, allowing intuitive navigation.

NFC (Near Field Communication) — Enables contactless payments via smartphones or smart cards.

Card Readers — Accept debit and credit card payments, supporting EMV chip and magnetic stripe transactions.

Cash Acceptors & Dispensers — In some regions, especially where cash is still prevalent.

Receipt Printers — Provide users with physical proof of transactions.

Mobile Payment Integration — Seamlessly connects with e-wallets like Google Pay, Apple Pay, and others.

Types of Payment Kiosks

Self-Service Kiosks — General-purpose kiosks that allow various payments like purchases, service subscriptions, etc.

Bill Payment Kiosks — Designed to facilitate payments for utility bills, rent, insurance premiums, and more.

Ticket Kiosks — Common in public transport and entertainment venues for purchasing or printing tickets.

Store Checkout Kiosks — Widely used in retail to expedite checkouts, reducing queues and dependency on cashiers.

Benefits of Payment Kiosks for Customers

Speed and Efficiency in Transactions

Customers appreciate the fast and efficient nature of payment kiosks. Unlike traditional counters, kiosks eliminate wait times and streamline the checkout process. A transaction that may take several minutes at a manned counter can often be completed in less than a minute using a kiosk.

24/7 Availability and Accessibility

Payment kiosks operate around the clock, making them ideal for businesses that want to offer services beyond standard working hours. This convenience is especially valuable in hospitals, airports, and transport hubs, where services are needed at all times.

Reducing Human Error and Improving Accuracy

By automating the payment process, kiosks reduce the risk of human error. There’s no miscalculation in change, incorrect data entry, or miscommunication between staff and customers, ensuring more accurate and reliable transactions.

Enhancing Privacy and Security for Users

Many customers value the privacy of using a kiosk, especially when dealing with personal or sensitive transactions such as medical bill payments or fine settlements. Advanced encryption and secure payment gateways ensure that transactions remain protected from fraud or misuse.

Multi-language Support and User-Friendly Interfaces

Industries Leveraging Payment Kiosks for Customer Convenience

Retail and Grocery Stores

Retailers are deploying checkout kiosks to reduce labor costs and improve customer flow. Self-checkout kiosks in grocery stores are increasingly common, empowering customers to scan and pay for items independently.

Transportation and Ticketing

Airports, train stations, and bus depots use ticket kiosks to streamline ticket purchasing and check-ins. Metro stations often install kiosks for recharging smart cards or purchasing travel passes.

Hospitality and Food Service

Hotels offer kiosks for room check-ins and bill payments, reducing front desk congestion. Similarly, fast food chains like McDonald’s and KFC use kiosks for ordering and paying, significantly cutting wait times and boosting order accuracy.

Healthcare and Utility Bill Payments

Hospitals and clinics utilize kiosks for outpatient billing, appointment confirmations, and even medical report collections. Utility companies, on the other hand, benefit from bill payment kiosks placed in public spaces for easy access by customers.

Challenges and Considerations in Payment Kiosk Deployment

Initial Setup Costs and Maintenance

One of the primary barriers to adopting kiosk technology is the upfront investment. Kiosk terminals, software licenses, networking, and installation can be costly, particularly for small and medium-sized enterprises. Additionally, regular maintenance, hardware repairs, and software updates add to the ongoing expenses.

Mitigation: Leasing options, partnerships with kiosk service providers, and calculating ROI through reduced labor and improved customer retention can justify the investment.

Security Concerns and Fraud Prevention

Because they handle financial data, payment kiosks are potential targets for cyber-attacks or skimming devices.

Mitigation: Implementing advanced encryption protocols, anti-skimming technology, secure payment gateways, and routine system audits are crucial for maintaining customer trust.

User Adoption and Accessibility Issues

Some customers — especially those unfamiliar with digital interfaces — may find kiosks intimidating or difficult to use.

Mitigation: Providing step-by-step guides, training staff to assist during the transition, and designing user-friendly, multilingual UIs can bridge this gap.

Integration with Existing Systems

Ensuring that the payment kiosk integrates with the company’s existing ERP, CRM, or POS systems is crucial for seamless operations.

Mitigation: Working with kiosk solution providers who offer custom API development and compatibility testing ensures smooth system integration.

Future Trends in Payment Kiosk Technology

AI and Machine Learning for Personalized Experiences

Future kiosks will leverage AI to analyze customer behavior and preferences. For instance, a returning customer could be greeted with tailored product suggestions, loyalty rewards, or transaction history.

Biometric Authentication and Enhanced Security

Fingerprint scanners, facial recognition, and even iris scanning are being tested and implemented to secure transactions, particularly in high-security environments such as government and healthcare.

Mobile Wallet and Contactless Payment Expansion

With the growing adoption of digital wallets, payment kiosks will increasingly support contactless transactions, promoting hygiene and convenience — especially in a post-pandemic world.

Remote Monitoring and Predictive Maintenance

Kiosk providers are embracing IoT and remote diagnostics to detect and fix issues before they affect functionality. Predictive maintenance reduces downtime and prolongs the life of the machines.

Conclusion

As businesses aim to deliver faster, safer, and more satisfying customer experiences, payment kiosks stand out as a practical, forward-looking solution. With their ability to reduce queues, eliminate errors, and operate around the clock, kiosks not only serve customers better but also help businesses reduce costs and improve efficiency. While implementation does come with certain challenges, the long-term benefits — especially when backed by evolving technologies like AI, biometrics, and IoT — make them a worthwhile investment.

#technology#kiosk#selfservicekiosk#kioskmachine#innovation#paymentoptions#bill payment#payment kiosk#payments#money transfer#software#software development#programming#productivity

0 notes

Text

Earn Money By Clicks ..See More

#Earn Money By Clicks#earn money fast#genuine#eurovision#artists on tumblr#youll#cats of tumblr#earn money easily#techniques#earn preeyaphat#earn money from home#earn money online#shiraha#loverlike#money in the bank#conclave#invest#income#financial#investments#money transfer#money management#money heist#money slave#companies#development#online#app#software#technology

0 notes

Text

oh my god i don't speak to my dad anymore cuz hes nutty but i know what he does for a living

and musk is currently pulling a "the software govs use is 50 years old which means there can be no advances"

and that's..... that's what my dad does for a living, he gets paid 500-1k an hour to make software that specifically communicates with old legacy software cause he's a 90s dev who knows the old languages still and it's more efficient to hire a freak who knows how to make something to bridge between the old and new programs than to fully trash the old system

like there's literally consultants that get hired for that specific purpose and as a software guy musk KNOWS this

#personal#im losing a LOT of money and decent work connections cause its less stressful than dealing with the crazy man#who literally called my professors at their personal art studios =_=#but ummm???? um??? hes like a low level linkedin influencer lmfao ._.#for software and THIS specific subject matter#the thing ive been getting raises on at work is making scripts to communicate between adobe software with the spreadsheets our#PLM system at work spits out....to automate a bunch of artwork thru libraries.........????#the way my boss gets me to not leave is by giving me /coolmathgames.com/ as a treat basically#and more money for being able to solve /coolmathgames.com/#i work in corporate and one of our order management systems specifically gets routed thru a windows vista virtual machine#cause they dont feel the need to fix....cuz if its not broke#just make the new things that bridge between the two systems?????#instead of having to transfer over decades of a database it makes 0 sense#idk man im rlly frustrated online cuz one of my dads patents is for a legacy speech to text software#(and the other is for a logistics/shipment thing)#like he wasnt the lead on either project but the speech to text specifically is irritating cuz theres#things ppl call 'AI' and im like....thats a buzzword this is litcherally 90s/00s tech and ive been in the office it was made lol

1 note

·

View note

Text

Get EzulixB2b Software - Recharge, Aeps, BBPS

Are you planning to start your own b2b fintech admin portal and looking for best opportunity then this is for you?

Ezulix Software's, Year End Sale is live now.

You can start b2b fintech business with your own brand name and logo and can make it a handsome source of Income.

For more details, Click on below Image.

#aeps software#aeps software provider#aeps software developer#mobile recharge software#multi recharge software#money transfer software#bharat bill payment system#pancard software#b2b fintech admin portal#ezulix software

2 notes

·

View notes

Text

Mobile Recharge Application

In today’s fast-paced world, mobile phones have become an integral part of our daily lives. From staying connected with loved ones to managing work emails, mobile phones are indispensable. With the increasing dependence on mobile devices, one of the most important features is the ability to recharge them quickly and effortlessly. This is where mobile recharge applications powered by RC panels come into play, offering convenience at the touch of a button.

What is RC Panel?

An RC (Recharge) Panel is a technology-driven platform that enables businesses to offer mobile recharge services to customers. It serves as the backend interface that handles recharges for various mobile network operators (MNOs), allowing users to top-up their phone balances directly from an app or website. Essentially, an RC Panel acts as a central hub, linking mobile users to multiple telecom operators via an integrated system.

How Does an RC Panel Work?

Mobile recharge applications powered by RC panels work seamlessly to process recharge requests. Here’s how:

Recharge Request: The user selects the amount of recharge they wish to apply, enters their mobile number, and submits the request through the app.

RC Panel Interface: The app communicates with the RC panel, which processes the recharge request. The panel connects with various MNOs to confirm the transaction.

Transaction Confirmation: Once the recharge is processed, a confirmation is sent to the user, and the mobile account is updated instantly with the chosen recharge amount.

Payment Gateway Integration: Payments are securely handled through an integrated payment gateway, ensuring that customers can make payments using different options such as credit/debit cards, mobile wallets, or UPI.

Benefits of Using a Mobile Recharge Application Powered by RC Panel

1. Instant Recharges

The most attractive feature of RC panel-based recharge applications is the speed. Whether it’s a prepaid or postpaid recharge, transactions are processed instantly, allowing users to get back to their tasks without delay.

2. Multiple Payment Methods

With the integration of various payment gateways, users can choose from multiple payment options such as credit cards, mobile wallets, and bank transfers. This provides flexibility for users and makes the process more accessible.

3. Support for Multiple Operators

RC Panels typically support a wide range of telecom operators, enabling users to recharge mobile numbers across different networks. This is particularly useful for people who manage multiple phone lines or operate across different regions.

4. User-Friendly Interface

Mobile recharge apps powered by RC panels are designed to be easy to navigate, ensuring a smooth user experience. Customers can quickly locate their desired recharge plans, check the available balance, and top-up their accounts in just a few clicks.

5. 24/7 Availability

Unlike traditional methods of recharging, which may require visits to physical stores, mobile recharge applications are available round-the-clock. Whether you’re recharging at midnight or early in the morning, the app is always available to fulfill your recharge needs.

6. Security and Reliability

RC Panels are designed with advanced encryption technologies to ensure secure transactions. With robust security features, users can confidently recharge their mobile numbers without worrying about fraud or data breaches.

How Businesses Benefit from RC Panel Recharge Systems

For businesses, integrating an RC panel into their mobile recharge application opens up multiple revenue opportunities:

Monetization: Recharge applications can generate commissions or service fees on every recharge transaction made through the platform.

User Retention: Offering fast and reliable recharge services keeps users coming back, improving customer loyalty and retention.

Scalability: RC Panels allow businesses to scale their offerings easily. As new telecom operators or payment methods emerge, they can be quickly integrated into the system.

Conclusion

In conclusion, mobile recharge applications powered by RC panels are reshaping the way users approach phone recharges. With faster transactions, multiple payment options, and reliable service, these apps provide a seamless recharge experience. Whether you’re an individual looking for convenience or a business aiming to reach a larger audience, investing in an RC panel-powered recharge app can make a significant difference.

Embrace the power of technology and make mobile recharging effortless with an RC panel solution today!

#multi recharge company#mobile recharge#advertising#pan card agency#money transfer software#rc panel#mobile recharge software#business#cars#biology#MobileRecharge#RCPanel#RechargeApp#MobileTopUp#InstantRecharge#SecureRecharge#RechargeMadeEasy#TechForBusiness#PaymentGateway#TelecomTech#MobileServices#RechargeSolutions#AppDevelopment#DigitalPayments#TechInnovation

0 notes

Text

Ezulix B2B Fintech Admin Portal - Start Fintech Business

Do you want to invest in fintech industry then this is for you? Here we will discuss, how you can start your own brand b2b fintech business with India's top fintech software development company.

In this I have explained about Ezulix b2b fintech admin portal, this is a web and app based portal that allows a business owner to offer all recharge, Aeps, Bbps, Pan card, DMT and Travel Booking Services to customers and earn commission.

Check out how you can start with small investment and can setup a successful b2b admin business in 2024-25.

#aeps software#mobile recharge software#money transfer software#bbps bill payment software#pancard software#travel booking software#fintech software development#fintech app development

0 notes

Text

B2B fintech software development services are offering tailored solutions to meet the evolving needs of businesses. By partnering with a Beta Byte Technologies, businesses can harness the power of fintech solutions to drive success and thrive in the digital age.

#b2b software development#b2b software#b2b fintach software#b2b software service#aeps software development#bbps software development service#mobile recharge software#money transfer software#custom software development#software development service in Mohali

0 notes

Text

if you want to income online money

#online#online income#online insurance#online internship#online invoicing software#online international money transfer from iran

0 notes